- Search Search Please fill out this field.

What Is an Annual Report?

Understanding annual reports, special considerations, mutual fund annual reports, the bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Annual Report Explained: How to Read and Write Them

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

An annual report is a document that public corporations must provide annually to shareholders that describes their operations and financial conditions. The front part of the report often contains an impressive combination of graphics, photos, and an accompanying narrative, all of which chronicle the company's activities over the past year and may also make forecasts about the future of the company. The back part of the report contains detailed financial and operational information.

Key Takeaways

- An annual report is a corporate document disseminated to shareholders that spells out the company's financial condition and operations over the previous year.

- It was not until legislation was enacted after the stock market crash of 1929 that the annual report became a regular component of corporate financial reporting.

- Registered mutual funds must also distribute a full annual report to their shareholders each year.

Investopedia / Jake Shi

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm's financial performance and to make investment decisions.

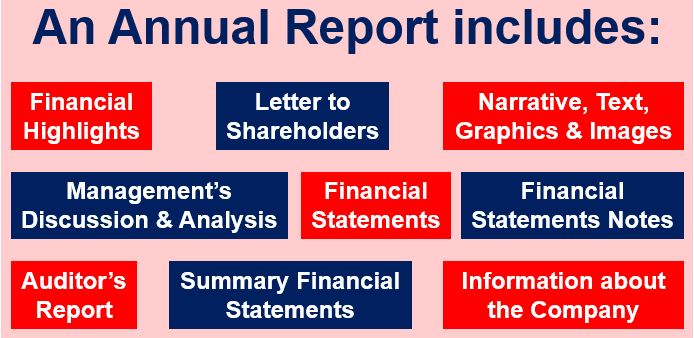

Typically, an annual report will contain the following sections:

- General corporate information

- Operating and financial highlights

- Letter to the shareholders from the CEO

- Narrative text, graphics, and photos

- Management's discussion and analysis (MD&A)

- Financial statements, including the balance sheet, income statement, and cash flow statement

- Notes to the financial statements

- Auditor's report

- Summary of financial data

- Accounting policies

Current and prospective investors, employees, creditors, analysts, and any other interested party will analyze a company using its annual report.

In the U.S., a more detailed version of the annual report is referred to as Form 10-K and is submitted to the U.S. Securities and Exchange Commission (SEC). Companies may submit their annual reports electronically through the SEC's EDGAR database . Reporting companies must send annual reports to their shareholders when they hold annual meetings to elect directors. Under the proxy rules, reporting companies are required to post their proxy materials, including their annual reports, on their company websites.

The annual report contains key information on a company's financial position that can be used to measure:

- A company's ability to pay its debts as they come due

- Whether a company made a profit or loss in its previous fiscal year

- A company's growth over a number of years

- How much of earnings are retained by a company to grow its operations

- The proportion of operational expenses to revenue generated

The annual report also determines whether the information conforms to the generally accepted accounting principles (GAAP). This confirmation will be highlighted as an " unqualified opinion " in the auditor's report section.

Fundamental analysts also attempt to understand a company's future direction by analyzing the details provided in its annual report.

In the case of mutual funds, the annual report is a required document that is made available to a fund's shareholders on a fiscal-year basis. It discloses certain aspects of a mutual fund's operations and financial condition. In contrast to corporate annual reports, mutual fund annual reports are best described as "plain vanilla" in terms of their presentation.

A mutual fund annual report, along with a fund's prospectus and statement of additional information, is a source of multi-year fund data and performance, which is made available to fund shareholders as well as to prospective fund investors. Unfortunately, most of the information is quantitative rather than qualitative, which addresses the mandatory accounting disclosures required of mutual funds.

All mutual funds that are registered with the SEC are required to send a full report to all shareholders every year. The report shows how well the fund fared over the fiscal year. Information that can be found in the annual report includes:

- Table, chart, or graph of holdings by category (e.g., type of security, industry sector, geographic region, credit quality, or maturity)

- Audited financial statements, including a complete or summary (top 50) list of holdings

- Condensed financial statements

- Table showing the fund’s returns for one-, five- and 10-year periods

- Management’s discussion of fund performance

- Management information about directors and officers, such as name, age, and tenure

- Remuneration or compensation paid to directors, officers, and others

How Do You Write an Annual Report?

An annual report has a few sections and steps that must convey a certain amount of information, much of which is legally required for public companies. Most public companies hire auditing companies to write their annual reports. An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows. The last part will typically be notes to the financial statements, explaining certain facts and figures.

Is an Annual Report the Same As a 10-K Filing?

In general, an annual report is similar to the 10-K filing in that both report on the company's performance for the year. Both are considered to be the last financial filing of the year and summarize how the company did for that period. Annual reports are much more visually friendly. They are designed well and contain images and graphics. The 10-K filing only reports numbers and other qualitative information without any design elements or additional flair.

What Is a 10-Q Filing?

A 10-Q filing is a form that is filed with the Securities and Exchange Commission (SEC) that reports the quarterly earnings of a company. Most public companies have to file a 10-Q with the SEC to report their financial position for the quarter.

Public companies must produce annual reports to show their current financial conditions and operations. Annual reports can be used to examine a company's financial position and, possibly, understand what direction it will move in the future. These reports function differently for mutual funds; in this case, they are made available each fiscal year and are typically simpler.

U.S. Securities and Exchange Commission. " Speech By SEC Commissioner: Remarks Before the Securities Traders Association ."

U.S. Securities and Exchange Commission. " Annual Report ."

U.S. Securities and Exchange Commission. " How to Read a 10-K/10-Q ."

U.S. Securities and Exchange Commission. " Final Rule: Shareholder Reports and Quarterly Portfolio Disclosure of Registered Management Investment Companies ."

U.S. Securities and Exchange Commission. " Mutual Funds - The Next 75 Years ."

:max_bytes(150000):strip_icc():format(webp)/10-K--f7185a10d5d342c68235646bd3ceefcd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Annual Report

The annual report to shareholders is a document used by most public companies to disclose corporate information to their shareholders. It is usually a state-of-the-company report, including an opening letter from the Chief Executive Officer, financial data, results of operations, market segment information, new product plans, subsidiary activities, and research and development activities on future programs. Reporting companies must send annual reports to their shareholders when they hold annual meetings to elect directors. Under the proxy rules, reporting companies are required to post their proxy materials, including their annual reports, on their company websites.

The annual report on Form 10-K , which must be filed with the SEC, may contain more detailed information about the company’s financial condition than the annual report and will include the annual financial statements of the company. Companies sometimes elect to send their annual report on Form 10-K to their shareholders in lieu of, or in addition to, providing shareholders with a separate annual report to shareholders.

Some companies may submit their annual reports electronically in the SEC’s EDGAR database. You can learn how to use EDGAR to find annual and other reports filed by companies. If you know that a company has filed its annual report with the SEC, you can enter "ARS" in the type of form box in EDGAR.

If you are looking for the SEC's annual report, please click here .

Featured Content

Investing Quiz – May 2024

Test your knowledge of diversification, individual retirement accounts (IRAs), and more!

Free Financial Planning Tools

Access savings goal, compound interest, and required minimum distribution calculators and other free financial tools.

10 Questions to Consider Before Opening a 529 Account

Are you saving for college or other educational expenses? Read our Investor Bulletin to find answers to your questions about 529 plans.

How to Open a Brokerage Account

Read our Investor Bulletin to learn what to expect when opening a brokerage account.

Sign up for Investor Updates

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, what is an annual report , and how do you file it.

The U.S. Securities and Exchange Commission and many states require businesses to file annual reports. Use this guide to meet your reporting obligations.

Certain business entities must file annual reports (statements of information) with state governments, typically through the State Department. Public companies must give shareholders a yearly report detailing their operational and financial condition.

Additionally, public and certain private organizations may need to file a separate document with the U.S. Securities and Exchange Commission (SEC). So, which reports do you need to file or share with stakeholders? Explore the types of annual reports and learn how (and when) to file them.

What is an annual report for a small business?

A state-required annual report is a short document that explains who owns the company, what products or services it sells, and how to contact the people in charge. Many small businesses file an annual report with their formation state (where they initially registered their company) and any foreign states where they are registered to do business.

Wolters Kluwer said the following statutory business entities might need to file an information report:

- Business corporations .

- Nonprofit corporations.

- Limited liability companies (LLCs).

- Limited partnerships (LPs).

- Limited liability partnerships (LLPs).

The SEC requires publicly traded companies to share yearly reports with shareholders. Unlike state-mandated forms, this annual report is an in-depth accounting of a corporation’s finances and operations. Lastly, federal security laws mandate public corporations to file Form 10-K yearly.

[ Read more: S Corp vs. LLC: What’s the Difference? ]

State-mandated annual report filing

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn’t require an LLC annual report, and if you formed your company in Indiana , you only need to send the report every two years.

Since rules and due dates differ, always check with your state’s business department. States usually send a reporting form to the business address on file. You can return it via postal mail along with any annual registration fees. Many also allow you to file your yearly report online.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health.

SCORE noted that state-mandated annual reports are “relatively short documents” and include:

- Your company’s name and address.

- Purpose of the business.

- Names and addresses of a corporation’s directors and officers.

- Registered agent’s name and address.

- Names and addresses of LLC members or managers.

Annual reports for shareholders

According to Investopedia , “Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.” These documents give a comprehensive view of your organization, allowing shareholders, stakeholders, and investors to understand your corporation’s financial position.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health. Harvard Business School Online said, “Usually, an annual report is split into two halves.” The first section shares “the company’s narrative,” and the second part “presents data” minus the “narrative components.”

Investor.gov stated that businesses must provide shareholders with annual reports when holding yearly meetings to elect the board of directors . Additionally, proxy rules require companies to “post their proxy materials, including their annual reports, on their company websites.”

An annual report template has the following sections:

- Summary of general business information.

- Annual performance highlights.

- CEO’s letter to the shareholders.

- Management’s discussion and analysis (MD&A).

- Financial statements .

- Supporting notes, photos, and graphics.

- Auditor’s report.

- Financial information summary.

- Review of accounting policies.

[ Read more: Which Type of Accounting Service Do You Need? ]

SEC rules for filing annual statements

Organizations required to report to the SEC — including all public and some private companies — must disclose financials yearly to the SEC. Section 12 of the Exchange Act defines a private reporting company as one that has more than $10 million in total assets and a class of equity securities with either 2,000 or more persons or 500 or more individuals who are not accredited investors, or one that “lists the securities on a U.S. Exchange.”

According to Form 10-K instructions

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

What Is an Annual Report? What’s Included & When to File

Running a business can sometimes be exhilarating work, but it can also come with its fair share of tedium—thanks to the long list of tasks associated with compliance. Filing an annual report in your state of incorporation—and any additional states where you’re registered to do business—is one of those tasks. And like many business compliance tasks, the specific requirements to file vary from state to state.

What is an annual report?

An annual report is a brief overview of key facts about your company filed to the Secretary of State in any state where you are registered to do business. Typically, annual reports include business contact information and a record of the company’s activities (such as a merger or a dissolution) during a given reporting period.

States use annual reports to keep information about your company up-to-date and make sure that they are able to deliver routine government correspondence or contact you in the event of a legal action. In some cases, the Secretary of State also uses annual report information to assess your franchise tax obligations in a particular state.

An annual report can also be known as an annual statement, a statement of information , a periodic report , a biennial statement, or a decennial statement. Filing processes, fees, and frequency all vary by state—biennial statements are due every two years, as an example, and decennial statements are due every ten.

Annual report vs. annual shareholder report

Although both are sometimes referred to as annual reports, the annual information reports required of most business entities are distinct from the comprehensive annual shareholder reporting required of public companies. Annual shareholder reports are federally mandated disclosures designed to help stakeholders and potential investors evaluate a company’s performance and financial conditions and make informed investment decisions. They include quantitative and qualitative performance analysis, financial statements (including cash flow statements, income statements, and balance sheets), an auditor’s report, an overview of accounting policies, and details about the company’s operations.

Who’s required to file an annual report? Who isn’t?

Most states require limited liability companies (LLCs) , corporations, limited partnerships, and limited liability partnerships (LLPs) to file annual reports. In most cases, these business entities are required to submit an annual report in every state in which they are registered to do business.

Sole proprietorships and partnerships typically aren’t required to file annual reports, although jurisdictions may require annual renewals for certain types of business licenses.

What’s covered in an annual report?

Although specifics vary by state and business entity, annual reports typically include the following information about the company:

- Business name

- Primary office address

- A brief statement of business purpose

- Your EIN and any other state-issued registration numbers

- Registered agent information (if applicable)

- Addresses of offices in the state (if applicable)

- Fictitious name (if applicable)

- Number of authorized shares (for corporations that issue shares)

- The names and addresses of directors and officers (for a corporation), members and managers (for an LLC), and partners (for a partnership)

Some states will also request financial information, such as liabilities and assets located in the state.

Most states charge an annual reporting fee, which can range from $9 to over $1000 depending on the state, business entity type, and specifics about the company’s operations. Corporation or LLC fees, as an example, may be assessed based on the number of authorized shares or the number of LLC members.

When do you need to file an annual report?

Although there’s a lot of overlap in annual report content across states, due dates vary widely.

States require different filing frequencies and use different methods to establish filing deadlines. Depending on the state, you may be required to file annually, biannually, or once a decade. Your due dates might fall in a state-determined month (e.g. every January) or be based on when you originally registered to do business in the state.

These differences can make it tedious to track deadlines—especially if you have reporting obligations in multiple states. If you formed your business in New York in 2020 and registered to do business in ten other states after hiring remote employees , you might end up with six annual reports due in January, one each in June and July, one due every other December, and one due every tenth December.

Mosey ’s compliance platform can help you stay on top of these deadlines. With Mosey, you can automate filing annual reports in supported states, track requirements and recurring deadlines, receive alerts for key tasks, and manage state mail all in one place.

Penalties for not filing an annual report or filing late

Most states impose fees for filing a late annual report—and if you don’t file at all, consequences can be severe.

Failing to file an annual report in your state of incorporation can result in loss of good standing, affecting your ability to open business bank accounts or obtain financing. In some cases, it can even cause your business to be dissolved entirely.

If you don’t file a report in a state in which you are registered as a foreign entity, that state can revoke your ability to do business in the state.

Mosey features active monitoring and notifications to help you stay on top of annual report filing for your company. Import your incorporation date or foreign qualification date for each state and Mosey will calculate your annual report filing requirements and deadlines automatically. They will be added to your account for easy management and Mosey will alert you when they become upcoming tasks to complete. Mosey keeps it all organized by showing you the requirements, when they are due, and who is doing what. Mosey will even automate filing the annual report for you—just click a button and we’re on it.

Read more from Mosey:

- Certificate of Good Standing: The Business Owner’s Guide to How and Why

- What Is Tax Nexus? Nexus Types & Determining Tax Nexus

- What Is Foreign Qualification? Considerations & How to Qualify

- What Is Workers Compensation & How Does It Work?

- Exiting a PEO: Reasons, Considerations, and Checklist

- Hiring Remote Employees: Everything You Need to Know

- LLC Annual Report: What It Is, What’s Included & How to File

- These 5 States Require Short-Term Disability Insurance (2023)

- What Is an LLC (Limited Liability Company)?

Review your compliance risks, free.

Use our compliance checkup to learn more about what to do to be compliant in any state! It's free and takes less than five minutes.

Ready to get started?

Sign up now or schedule a free consultation to see how Mosey transforms business compliance.

Mosey has everything you need to get compliant in all 50 states in one, easy to use, platform.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Quickly & Effectively Read an Annual Report

- 04 Jun 2020

Intelligent investing requires analyzing a vast amount of information about a company to determine its financial health. Armed with this information, an investor can better understand how much risk might be involved with backing a company based on how well it’s performed historically, in recent quarters, and toward its financial targets.

Exactly where this information comes from depends on the specific company that’s being invested in, but typically requires several financial statements, including a balance sheet, cash flow statement, and income statement.

In addition to these documents, most investors look forward to reviewing a company’s annual report—a collection of financial information and analysis that can prove invaluable in evaluating the health of a company.

If you’re not an investor, but an employee working within a corporation, the annual report can impart valuable information pertinent to your career. Understanding how your company is performing and the impact your actions have had on its business objectives can help you advocate for a promotion or other form of career advancement .

If you’re unfamiliar with what goes into an annual report, there’s some good news: You don’t need to be a financial expert to get value out of the document or understand the messaging in it.

Here’s an overview of the different information you’ll find in an annual report and how you can put it to use.

Access your free e-book today.

What Is an Annual Report?

An annual report is a publication that a public corporation is required by law to publish annually. It describes the company’s operations and financial conditions so that current and potential shareholders can make informed decisions about investing in it.

The annual report is often split into two sections, or halves.

The first section typically includes a narrative of the company’s performance over the previous year, as well as forward-looking statements: Letters to shareholders from the chief executive officer, chief financial officer, and other key figures, as well as graphics, photos, and charts.

The second section strips the narrative out of the picture and presents a variety of financial documents and statements.

Unlike other pieces of financial data—and because they include editorial and storytelling—annual reports are typically professionally designed and used as marketing collateral. Annual reports are sent to shareholders every year before an annual shareholder meeting and election of the board of directors, and often accessible to the public via the company’s website.

Annual Report vs. 10-K Report

Annual reports aren’t the only documents public companies are required to publish yearly. The US Securities and Exchange Commission (SEC) requires public firms also to produce a 10-K report , which informs investors of a business’s financial status before they buy or sell shares.

While there’s similar data in both an annual and 10-K report, the two documents are separate.

10-K reports are organized per SEC guidelines and include full descriptions of a company’s fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. You can also find detailed discussions of operations for the year, as well as a full analysis of the industry and marketplace.

Because of this, 10-K reports are longer and denser than annual reports, and have strict filing requirements—they must be filed with the SEC between 60 to 90 days after the end of a company’s fiscal year.

If you need to review a 10-K report, you can find it on the SEC website .

What Information Is Contained In An Annual Report?

An annual report typically consists of:

- Letters to shareholders: These documents provide a broad overview of the company’s activities and performance over the course of the year, as well as a reflection on its general business environment. An annual report usually includes a shareholder letter from the CEO or president, and may also contain letters from other key figures, such as the CFO.

- Management’s discussion and analysis (MD&A): This is a detailed analysis of the company’s performance, as conducted by its executives.

- Audited financial statements: These are financial documents that detail the company’s financial performance. Commonly included statements include balance sheets, cash flow statements, income statements, and equity statements.

- A summary of financial data: This refers to any notes or discussions that are pertinent to the financial statements listed above.

- Auditor’s report: This report describes whether the company has complied with generally accepted accounting principles (GAAP) in preparing its financial statements.

- Accounting policies: This is an overview of the policies the company’s leadership team relied upon in preparing the annual report and financial statements.

What to Look for in an Annual Report

While all the information found in an annual report can be useful to potential investors, the financial statements are particularly valuable, as they provide data that isn’t obscured by any sort of narrative or opinion. Three of the most important financial statements you should evaluate are the balance sheet, cash flow statement, and income statement.

The balance sheet shows a company’s assets, liabilities, and owners’ equity accounts as of a specific date, illustrating its financial position and health.

The income statement shows a company’s revenue and expense accounts for a set period, allowing you to gauge its financial performance. Using trial balances from any two points in time, a business can create an income statement that tells the financial story of the activities for that period.

Cash flow statements provide a detailed picture of what happened to a business’s cash during an accounting period. A cash flow statement shows the different areas in which a company used or received cash, and reconciles the beginning and ending cash balances. Cash flows are important for valuing a business and managing liquidity, and essential to understanding where actual cash is being generated and used. The statement of cash flows gives more detail about the sources of cash inflows and the uses of cash outflows.

These three documents can help you understand the financial health and status of a company, and they’re all included in the annual report. When you read the annual report—including the editorial information—you can gain a better understanding of the business as a whole.

An annual report can help you learn more details about what type of company you work for and how it operates, including:

- Whether it’s able to pay debts as they come due

- Its profits and/or losses year over year

- If and how it’s grown over time

- What it requires to maintain or expand its business

- Operational expenses compared to generated revenues

All of these insights can help you excel in your role, be privy to conversations surrounding the future of the company, and develop into an effective leader .

Critical Information for Investors and Employees Alike

Being able to analyze annual reports can help you gain a clearer picture of where a company sits within its industry and the broader economy, illuminating opportunities and threats.

The best part about learning to read and understand financial information is that you don’t need to be a certified accountant to do so. Start by analyzing financial documents over a set period. Then, when the annual and 10-K reports are published, you can review and understand what leadership is saying about the operational and financial health of your company.

If you’re an investor, knowing how to read an annual report can give you more information from which to base your decision on whether to invest in a company. If you’re an employee within an organization, learning how to read and apply the information contained in an annual report is an essential financial accounting skill that can help you understand your company’s goals and capabilities and, ultimately, further your career.

Do you want to take your career to the next level? Explore Financial Accounting and our other online finance and accounting courses , which can teach you the key financial topics you need to understand business performance and potential. Download our free course flowchart to determine which best aligns with your goals.

About the Author

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Microsoft Annual Report 2023

Annual report 2023, satya nadella.

Chief Executive Officer

Dear shareholders, colleagues, customers, and partners:

We are living through a time of historic challenge and opportunity. As I write this, the world faces ongoing economic, social, and geopolitical volatility. At the same time, we have entered a new age of AI that will fundamentally transform productivity for every individual, organization, and industry on earth, and help us address some of our most pressing challenges.

This next generation of AI will reshape every software category and every business, including our own. Forty-eight years after its founding, Microsoft remains a consequential company because time and time again—from PC/Server, to Web/Internet, to Cloud/Mobile—we have adapted to technological paradigm shifts. Today, we are doing so once again, as we lead this new era.

Amid this transformation, our mission to empower every person and every organization on the planet to achieve more remains constant. As a company, we believe we can be the democratizing force for this new generation of technology and the opportunity it will help unlock for every country, community, and individual, while mitigating its risks.

Here are just a few examples of how we are already doing this:

- Leading electronic health records vendor Epic is addressing some of the biggest challenges facing the healthcare industry today—including physician burnout—by deploying a wide range of copilot solutions built on Azure OpenAI Service and Dragon Ambient eXperience Copilot.

- Mercado Libre is reducing the time its developers spend writing code by more than 50 percent with GitHub Copilot, as the company works to democratize e-commerce across Latin America.

- Mercedes-Benz is making its in-car voice assistant more intuitive for hundreds of thousands of drivers using ChatGPT via the Azure OpenAI Service.

- Lumen Technologies is helping its employees be more productive, enabling them to focus on higher value-added activities, by deploying Microsoft 365 Copilot.

- Nonprofit The Contingent is matching foster families with children in need using Dynamics 365, Power BI, and Azure, with an eye on using AI to amplify its work across the US.

- And, Taiwan’s Ministry of Education has built an online platform to help elementary and high school students learn English using Azure AI.

To build on this progress, we remain convicted on three things: First, we will maintain our lead as the top commercial cloud while innovating in consumer categories, from gaming to professional social networks. Second, because we know that maximum enterprise value gets created during platform shifts like this one, we will invest to accelerate our lead in AI by infusing this technology across every layer of the tech stack. And, finally, we will continue to drive operating leverage, aligning our cost structure with our revenue growth.

As we make progress on these priorities, we delivered strong results in fiscal year 2023, including a record $211 billion in revenue and over $88 billion in operating income.

A NEW ERA OF AI

There are two breakthroughs coming together to define this new era of AI. The first is the most universal interface: natural language. The long arc of computing has, in many ways, been shaped by the pursuit of increasingly intuitive human-computer interfaces—keyboards, mice, touch screens. We believe we have now arrived at the next big step forward—natural language—and will quickly go beyond, to see, hear, interpret, and make sense of our intent and the world around us.

The second is the emergence of a powerful new reasoning engine. For years, we’ve digitized daily life, places, and things and organized them into databases. But in a world rich with data, what has been most scarce is our ability to reason over it. This generation of AI helps us interact with data in powerful new ways—from completing or summarizing text, to detecting anomalies and recognizing images—to help us identify patterns and surface insights faster than ever.

Together, these two breakthroughs will unlock massive new opportunity. And, in fact, just last month we announced our vision for Copilot , an everyday AI companion. We are building Copilot into all our most used products and experiences and allowing people to summon its power as a standalone app as well. Just like you boot up an OS to access applications or use a browser to visit websites today, our belief is that you will invoke a Copilot to do all those activities and more: to shop, to code, to analyze, to learn, to create.

As a company, any time we approach a transition like this, we do so responsibly. We believe AI should be as empowering across communities as it is powerful, and we’re committed to ensuring it is responsibly built and designed, with safety in mind from the outset.

OUR OPPORTUNITY

Every customer solution area and every layer of our tech stack will be reimagined for the AI era. And that’s exactly what we’ve already begun to do:

Infrastructure

Four years ago, we first invested in our AI supercomputer, with a goal of building the best cloud for training and inference. Today, it’s being used by our partner OpenAI to power its best-in-class foundation models and services, including one of the fastest-growing consumer apps ever—ChatGPT. NVIDIA, as well as leading AI startups like Adept and Inflection, is also using our infrastructure to build its own breakthrough models.

More broadly, organizations continue to choose our ubiquitous computing fabric—from cloud to edge—to run their mission-critical applications. We continued to see more cloud migrations to Azure this past fiscal year, as it remains early when it comes to the long-term cloud opportunity. And we also continue to lead in hybrid computing with Azure Arc, which now has 18,000 customers.

Data and AI

Every AI app starts with data, and having a comprehensive data and analytics platform is more important than ever. Our Intelligent Data Platform brings together operational databases, analytics, and governance so organizations can spend more time creating value and less time integrating their data estate. We also introduced Microsoft Fabric this year, which unifies compute, storage, and governance with a disruptive business model.

With Azure AI, we are making foundation models available as platforms to our customers. We offer the best selection of industry-leading frontier and open models. In January, we made the Azure OpenAI Service broadly available, bringing together advanced models, including ChatGPT and GPT-4, with the enterprise capabilities of Azure. More than 11,000 organizations across industries are already using it for advanced scenarios like content and code generation. Meta chose us this summer as its preferred cloud to commercialize its Llama family of models. And, with Azure AI Studio , we provide a full lifecycle toolchain customers can use to ground these models on their own data, create prompt workflows, and help ensure they are deployed and used safely.

Digital and app innovation

GitHub Copilot is fundamentally transforming developer productivity, helping developers complete coding tasks 55 percent faster. More than 27,000 organizations have chosen GitHub Copilot for Business, and to date more than 1 million people have used GitHub Copilot to code faster. We also announced our vision for the future of software development with GitHub Copilot X , which will bring the power of AI throughout the entire software development lifecycle. All up, GitHub surpassed $1 billion in annual recurring revenue for the first time this fiscal year.

We’re also applying AI across our low-code/no-code toolchain to help domain experts across an organization automate workflows, create apps and webpages, build virtual agents, or analyze data, using just natural language with copilots in Power Platform . More than 63,000 organizations have used AI-powered capabilities in Power Platform to date.

Business applications

We are bringing the next generation of AI to employees across every job function and every line of business with Dynamics 365 Copilot , which works across CRM and ERP systems to reduce burdensome tasks like manual data entry, content generation, and notetaking. In fact, our own support agents are using Copilot in Dynamics 365 Customer Service to resolve more cases faster and without having to call on peers to help. With our Supply Chain Platform , we’re helping customers apply AI to predict and mitigate disruptions. And, with our new Microsoft Sales Copilot , sellers can infuse their customer interactions with data from CRM systems—including both Salesforce and Dynamics—to close more deals.

All up, Dynamics surpassed $5 billion in revenue over the past fiscal year, with our customer experience, service, and finance and supply chain businesses each surpassing $1 billion in annual sales.

Across industries, we are rapidly becoming the partner of choice for any organization looking to generate real value from AI. In healthcare, for example, we introduced the world’s first fully automated clinical documentation application, DAX Copilot . The application helps physicians reduce documentation time by half, freeing them to spend more time face to face with patients. And Epic will integrate it directly into its electronic health records system.

And, in retail, we introduced new tools to help companies manage their day-to-day operations and digitize their physical stores.

Modern work

We are rapidly evolving Microsoft 365 into an AI-first platform that enables every individual to amplify their creativity and productivity, with both our established applications like Office and Teams, as well as new apps like Designer, Stream, and Loop. Microsoft 365 is designed for today’s digitally connected, distributed workforce.

This year, we also introduced a new pillar of customer value with Microsoft 365 Copilot , which combines next-generation AI with business data in the Microsoft Graph and Microsoft 365 applications to help people be more productive and unleash their creativity at work. Just last month, I was excited to announce that we will make Microsoft 365 Copilot generally available to our commercial customers later this year.

We continue to build momentum in Microsoft Teams across collaboration, chat, meetings, and calls. We introduced a new version of Teams that delivers up to two times faster performance, while using 50 percent less memory. We also introduced Teams Premium to meet enterprise demand for AI-powered features like intelligent meeting recaps. All up, Teams usage surpassed 300 million monthly active users this year.

With Microsoft Viva, we have created a new category for employee experience. Copilot in Viva offers leaders a new way to build high-performance teams by prioritizing both productivity and employee engagement. This year, Viva surpassed 35 million monthly active users.

As the rate and pace of cyberthreats continue to accelerate, security is a top priority for every organization. Our comprehensive, AI-powered solutions give defenders the advantage. With Security Copilot , we’re combining large language models with a domain-specific model informed by our threat intelligence and 65 trillion daily security signals, to transform every aspect of security operations center productivity.

All up, more than 1 million organizations now count on our comprehensive, AI-powered solutions to protect their digital estates, and our security business surpassed $20 billion in annual revenue, as we help protect customers across clouds and endpoint platforms.

Search, advertising, and news

We are reshaping daily search and web habits with our new Bing and Microsoft Edge browser , which brings together search, browsing, chat, and AI into one unified experience to deliver better search, more complete answers, a new chat experience, and the ability to generate content. We think of these tools as an AI copilot for the web.

We are also bringing these breakthrough capabilities to businesses, with Bing Chat Enterprise , which offers commercial data protection, providing an easy on-ramp for any organization looking to get the benefit of next-generation AI today.

Although it’s early in our journey, Bing users engaged in more than 1 billion chats and created more than 750 million images over the past year as they apply these new tools to get things done. And Edge has taken share for nine consecutive quarters.

More broadly, we continue to expand our opportunity in advertising. This year, Netflix chose us as its exclusive technology and sales partner for its first ad-supported subscription offering, a validation of the differentiated value we provide to any publisher looking for a flexible partner to build and innovate with them.

The excitement around AI is creating new opportunities across every function—from marketing, sales, service, and finance, to software development and security. And LinkedIn is increasingly where people are going to learn, discuss, and uplevel their skills. We are using AI to help our members and customers connect to opportunities and tap into the experiences of experts on the platform. In fact, our AI-powered articles are already the fastest-growing traffic driver to the network.

All up, LinkedIn’s revenue surpassed $15 billion for the first time this fiscal year, a testament to how mission critical the platform has become to help more than 950 million members connect, learn, sell, and get hired.

In gaming, we are rapidly executing on our ambition to be the first choice for people to play great games whenever, wherever, and however they want. With Xbox Game Pass, we are redefining how games are distributed, played, and viewed. Content is the flywheel behind the service’s growth, and our pipeline has never been stronger. It was especially energizing to release Starfield this fall to broad acclaim, with more than 10 million players in the first month post-launch alone.

Earlier this month, we were thrilled to close our acquisition of Activision Blizzard, and we look forward to sharing more in the coming months about how, together , we will bring the joy of gaming to more people around the world.

Devices and creativity

Finally, we’re turning Windows into a powerful new AI canvas with Copilot , which rolled out as part of a Windows 11 update last month. It uniquely incorporates the context and intelligence of the web, your work data, and what you are doing in the moment on your PC to provide better assistance, while keeping your privacy and security at the forefront. Overall, the number of devices running Windows 11 more than doubled in the past year. And we are also transforming how Windows is experienced and managed with Azure Virtual Desktop and Windows 365, which together surpassed $1 billion in annual revenue for the first time.

OUR RESPONSIBILITY

As we pursue our opportunity, we are also working to ensure technology helps us solve problems—not create new ones. To do this, we focus on four enduring commitments that are central to our mission and that take on even greater importance in this new era. For us, these commitments are more than just words. They’re a guide to help us make decisions across everything we do—as we design and develop products, shape business processes and policies, help our customers thrive, build partnerships, and more —always asking ourselves critical questions to ensure our actions are aligned with them.

How can we expand opportunity?

First, we believe access to economic growth and opportunity should reach every person, organization, community, and country. And although AI can serve as a catalyst for opportunity and growth, we must first ensure everyone has access to the technologies, data, and skills they need to benefit.

To achieve this, we are focused on getting technology into the hands of nonprofits, social entrepreneurs, and other civil society organizations to help them digitally transform, so they can help address some of society’s biggest challenges. This year, we provided nonprofits with over $3.8 billion in discounted and donated technology. Nearly 325,000 nonprofits used our cloud. And to help them tap the potential of AI, we’re building new AI capabilities for fundraising, marketing, and program delivery.

AI will displace some jobs, but it will also create new ones. That’s why we aim to train and certify 10 million people by 2025 with the skills for jobs and livelihoods in an increasingly digital economy. Since July 2020, we’ve helped 8.5 million people, including 2.7 million this year. We’ve also focused on skilling women and underrepresented communities in cybersecurity, working across 28 countries and with nearly 400 US community colleges to scale our efforts.

Finally, to help people learn more about AI, we launched the first online Professional Certificate on Generative AI in partnership with LinkedIn Learning, created AI tools for educators, and held our first AI Community Learning event in the US. These events will be replicated around the world and localized in 10 languages over the next year. We also partnered to launch a Generative AI Skills Grant Challenge to explore how nonprofit, social enterprise, and research or academic institutions can empower the workforce to use this new generation of AI.

How can we earn trust?

To create positive impact with technology, people need to be able to trust the technologies they use and the companies behind them. For us, earning trust spans the responsible use of AI, protecting privacy, and advancing digital safety and cybersecurity.

Our commitment to responsible AI is not new. Since 2017, we’ve worked to develop our responsible AI practice, recognizing that trust is never given but earned through action.

We have translated our AI principles into a core set of implementation processes, as well as tools, training, and practices to support compliance. But internal programs aren’t enough. We also enable our customers and partners to develop and deploy AI safely, including through our AI customer commitments and services like Azure AI Studio, with its content safety tooling and access to our Responsible AI dashboard.

Building AI responsibly requires that we work with other industry leaders, civil society, and governments to advocate for AI regulations and governance globally. This year, we released our Governing AI Blueprint , which outlines concrete legal and policy recommendations for AI guardrails. We are signatories to the eight voluntary commitments developed with the US White House, and proud of the six additional commitments we’ve made to further strengthen and operationalize the principles of safety, security, and trust.

The era of AI heightens the importance of cybersecurity, and we deepened our work across the private and public sectors to improve cyber-resilience. We’ve continued to support Ukraine in defending critical infrastructure, detecting and disrupting cyberattacks and cyberinfluence operations, and providing intelligence related to these attacks. Our Microsoft Threat Analysis Center team produced more than 500 intelligence reports to help keep customers and the public informed. And we published our third annual Microsoft Digital Defense Report , sharing our learnings and security recommendations.

We also remain committed to creating safe experiences online and protecting customers from illegal and harmful content and conduct, while respecting human rights. We supported the Christchurch Call Initiative on Algorithmic Outcomes to address terrorist and violent and extremist content online. And through the World Economic Forum’s Global Coalition for Digital Safety, we co-led the development of new global principles for digital safety.

Protecting customers’ privacy and giving them control of their data is more important than ever. We’ve begun our phased rollout of the EU Data Boundary , supporting our commercial and public sector customers’ need for data sovereignty. And each month, more than 3 million people exercise their data protection rights through our privacy dashboard, making meaningful choices about how their data is used.

How can we protect fundamental rights?

In an increasingly digital world, we have a responsibility to promote and protect people’s fundamental rights and address the challenges technology creates. For us, this means upholding responsible business practices, expanding connectivity and accessibility, advancing fair and inclusive societies, and empowering communities.

In 2023, we worked diligently to anticipate harmful uses of our technology and put guardrails on the use of technologies that are consequential to people’s lives or legal status, create risk of harm, or threaten human rights. We will continue to assess the impact of our technologies, engage our stakeholders, and model and adopt responsible practices and respect for human rights—including across our global supply chain.

Today, our lives are more connected than ever. Access to education, employment, healthcare, and other critical services is increasingly dependent on technology. That’s why we’ve expanded our commitment to bring access to affordable high-speed internet to a quarter of a billion people around the world, including 100 million people in Africa, by the end of 2025. Since 2017, we’ve helped bring internet access to 63 million people, a key first step to ensuring communities will have access to AI and other digital technologies.

This year, we also continued working toward our five-year commitment to bridge the disability divide with a focus on helping close the accessibility knowledge gap. Seven hundred and fifty-thousand learners enriched their understanding of disability and accessibility in partnership with LinkedIn Learning , Teach Access , and the Microsoft disability community.

In addition, we’re stepping up efforts to combat online disinformation through new media content provenance technologies—enabling users to verify if an image or video was generated by AI. We continued our efforts to promote racial equity across Microsoft, our ecosystem, and our communities, including our work to advance justice reform through data-driven insights. And we provided support in response to eight humanitarian disasters, including committing $540 million of support to those who have been impacted by the War in Ukraine.

Finally, recognizing AI’s potential to advance human rights and humanitarian action, we worked on several AI for Humanitarian Action projects. Together with our partners, we’re building the capabilities to identify at-risk communities , estimate seasonal hunger, predict malnutrition, and assist in disease identification.

How can we advance sustainability?

Climate change is the defining issue of our generation, and addressing it requires swift, collective action and technological innovation. We are committed to meeting our own goals while enabling others to do the same. That means taking responsibility for our operational footprint and accelerating progress through technology.

We continue to see extreme weather impacting communities globally. To meet the urgent need, this must be a decade of innovation and decisive action—for Microsoft, our customers, and the world.

In our latest Environmental Sustainability Report , we shared our progress toward our 2030 sustainability targets across carbon, water, waste, and ecosystems. In 2022, our overall carbon emissions declined by 0.5 percent while our business grew. Addressing scope 3 emissions, which account for the vast majority of our emissions, is arguably our ultimate challenge—one we’ll continue to tackle through our supply chain, policy advances, and industry-wide knowledge-sharing.

We’ve provided just under 1 million people with access to clean water and sanitation, one of five pillars on our path to becoming water positive. And in our pursuit to be zero waste, we achieved a reuse and recycle rate of 82 percent for all our cloud hardware and diverted over 12,000 metric tons of solid operational waste from landfills and incinerators.

We also continue to take responsibility for the impacts of our direct operations on Earth’s ecosystems. We’ve contracted to protect 17,268 acres of land, over 50 percent more than the land we use to operate. Of that, 12,270 acres—the equivalent of approximately 7,000 soccer fields—were designated as permanently protected.

Technology is a powerful lever to help us avoid the most severe impacts of climate change. That’s why we’re accelerating our investment in more efficient datacenters, clean energy, enhancements to the Microsoft Cloud for Sustainability and Planetary Computer, and green software practices. To date, through our Climate Innovation Fund , we’ve allocated more than $700 million to a global portfolio of 50+ investments spanning sustainable solutions in energy, industrial, and natural systems.

Finally, we believe AI can be a powerful accelerant in addressing the climate crisis. We expanded our AI for Good Lab in Egypt and Kenya to improve climate resilience for the continent. And, together with our partners, we launched Global Renewables Watch , a first-of-its-kind living atlas that aims to map and measure utility-scale solar and wind installations, allowing users to evaluate progress toward a clean energy transition.

Although this new era promises great opportunity, it demands even greater responsibility from companies like ours. As we pursue our four commitments, we focus on transparency—providing clear reporting on how we run our business and how we work with customers and partners. Our annual Impact Summary shares more about our progress and learnings this year, and our Reports Hub provides detailed reports on our environmental data, political activities, workforce demographics, human rights work, and more.

OUR CULTURE

There’s never been a more important time to live our culture. The way we work and the speed at which we work are changing.

In an economy where yesterday’s exceptional is today’s expected, all of us at Microsoft will need to embrace a growth mindset and, more importantly, confront our fixed mindsets as our culture evolves. It will take everyday courage to reformulate what innovation, business models, and sales motions look like in this new era. As a high-performance organization, we aspire to help our employees maximize their economic opportunity, while simultaneously helping them learn and grow professionally and connect their own passion and purpose with their everyday work and the company’s mission.

To be successful, we need to be grounded in what our customers and the world need. We need to innovate and collaborate as One Microsoft. And we need to actively seek diversity and embrace inclusion to best serve our customers and create a culture where everyone can do their best work. To empower the world, we need to represent the world. To that end, we remain focused on increasing representation and strengthening our culture of inclusion. Even as we navigated challenges this year, our company continued to be the most globally diverse it’s ever been.

Giving also remains core to our culture. This year, more than 105,000 employees gave $242 million (including company match) to over 35,000 nonprofits in 116 countries. And our employees volunteered over 930,000 hours to causes they care about.

I am deeply grateful to our employees for their commitment to the company and their communities, and how they are living our mission and culture every day in a changing company and world.

In closing, this is Microsoft’s moment. We have an incredible opportunity to use this new era of AI to deliver meaningful benefits for every person and every organization on the planet.

On New Year’s Day, I saw a tweet from Andrej Karpathy, Tesla’s former director of AI who now works at OpenAI, about how GitHub Copilot was writing about 80 percent of his code, with 80 percent accuracy. Two days later, I saw a stunning example of work we’ve done with the government of India’s Ministry of Electronics and IT, which is applying an AI model so farmers in rural areas can interact with government resources in their native languages.

Think about that: A foundation model that was developed on the West Coast of the United States is already transforming the lives of both elite developers and rural farmers on the other side of the globe. We’ve not seen this speed of diffusion and breadth of impact in the tech industry before.

As a company, this is our moment to show up and responsibly build solutions that drive economic growth and benefit every community, country, industry, and person. If we do it well, the world will do well, and Microsoft will do well too. I’ve never been more confident that we will deliver on this promise together in the days, months, and years to come.

Satya Nadella Chairman and Chief Executive Officer October 16, 2023

Financial Review

Issuer purchases of equity securities, dividends, and stock performance, market and stockholders.

Our common stock is traded on the NASDAQ Stock Market under the symbol MSFT. On July 24, 2023, there were 83,883 registered holders of record of our common stock.

SHARE REPURCHASES AND DIVIDENDS

Share Repurchases

On September 18, 2019, our Board of Directors approved a share repurchase program authorizing up to $40.0 billion in share repurchases. This share repurchase program commenced in February 2020 and was completed in November 2021.

On September 14, 2021, our Board of Directors approved a share repurchase program authorizing up to $60.0 billion in share repurchases. This share repurchase program commenced in November 2021, following completion of the program approved on September 18, 2019, has no expiration date, and may be terminated at any time. As of June 30, 2023, $22.3 billion remained of this $60.0 billion share repurchase program.

We repurchased the following shares of common stock under the share repurchase programs:

All repurchases were made using cash resources. Shares repurchased during fiscal year 2023 and the fourth and third quarters of fiscal year 2022 were under the share repurchase program approved on September 14, 2021. Shares repurchased during the second quarter of fiscal year 2022 were under the share repurchase programs approved on both September 14, 2021 and September 18, 2019. All other shares repurchased were under the share repurchase program approved on September 18, 2019. The above table excludes shares repurchased to settle employee tax withholding related to the vesting of stock awards of $3.8 billion, $4.7 billion, and $4.4 billion for fiscal years 2023, 2022, and 2021, respectively.

Our Board of Directors declared the following dividends:

The dividend declared on June 13, 2023 was included in other current liabilities as of June 30, 2023.

STOCK PERFORMANCE

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among Microsoft Corporation, the S&P 500 Index and the NASDAQ Computer Index

- $100 invested on 6/30/18 in stock or index, including reinvestment of dividends. Fiscal year ending June 30.

Note About Forward-Looking Statements

This report includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report, including the following sections: “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. We describe risks and uncertainties that could cause actual results and events to differ materially in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” in our fiscal year 2023 Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

Embracing Our Future

Microsoft is a technology company whose mission is to empower every person and every organization on the planet to achieve more. We strive to create local opportunity, growth, and impact in every country around the world. We are creating the platforms and tools, powered by artificial intelligence (“AI”), that deliver better, faster, and more effective solutions to support small and large business competitiveness, improve educational and health outcomes, grow public-sector efficiency, and empower human ingenuity. From infrastructure and data, to business applications and collaboration, we provide unique, differentiated value to customers.

In a world of increasing economic complexity, AI has the power to revolutionize many types of work. Microsoft is now innovating and expanding our portfolio with AI capabilities to help people and organizations overcome today’s challenges and emerge stronger. Customers are looking to unlock value from their digital spend and innovate for this next generation of AI, while simplifying security and management. Those leveraging the Microsoft Cloud are best positioned to take advantage of technological advancements and drive innovation. Our investment in AI spans the entire company, from Microsoft Teams and Outlook, to Bing and Xbox, and we are infusing generative AI capability into our consumer and commercial offerings to deliver copilot capability for all services across the Microsoft Cloud.

We’re committed to making the promise of AI real – and doing it responsibly. Our work is guided by a core set of principles: fairness, reliability and safety, privacy and security, inclusiveness, transparency, and accountability.

What We Offer

Founded in 1975, we develop and support software, services, devices, and solutions that deliver new value for customers and help people and businesses realize their full potential.

We offer an array of services, including cloud-based solutions that provide customers with software, services, platforms, and content, and we provide solution support and consulting services. We also deliver relevant online advertising to a global audience.

Our products include operating systems, cross-device productivity and collaboration applications, server applications, business solution applications, desktop and server management tools, software development tools, and video games. We also design and sell devices, including PCs, tablets, gaming and entertainment consoles, other intelligent devices, and related accessories.

The Ambitions That Drive Us

To achieve our vision, our research and development efforts focus on three interconnected ambitions:

- Reinvent productivity and business processes.

- Build the intelligent cloud and intelligent edge platform.

- Create more personal computing.

Reinvent Productivity and Business Processes

At Microsoft, we provide technology and resources to help our customers create a secure, productive work environment. Our family of products plays a key role in the ways the world works, learns, and connects.

Our growth depends on securely delivering continuous innovation and advancing our leading productivity and collaboration tools and services, including Office 365, Dynamics 365, and LinkedIn. Microsoft 365 brings together Office 365, Windows, and Enterprise Mobility + Security to help organizations empower their employees with AI-backed tools that unlock creativity, increase collaboration, and fuel innovation, all the while enabling compliance coverage and data protection. Microsoft Teams is a comprehensive platform for work, with meetings, calls, chat, collaboration, and business process automation. Microsoft Viva is an employee experience platform that brings together communications, knowledge, learning, resources, and insights. Microsoft 365 Copilot combines next-generation AI with business data in the Microsoft Graph and Microsoft 365 applications.

Together with the Microsoft Cloud, Dynamics 365, Microsoft Teams, and our AI offerings bring a new era of collaborative applications that optimize business functions, processes, and applications to better serve customers and employees while creating more business value. Microsoft Power Platform is helping domain experts drive productivity gains with low-code/no-code tools, robotic process automation, virtual agents, and business intelligence. In a dynamic labor market, LinkedIn is helping professionals use the platform to connect, learn, grow, and get hired.

Build the Intelligent Cloud and Intelligent Edge Platform

As digital transformation and adoption of AI accelerates and revolutionizes more business workstreams, organizations in every sector across the globe can address challenges that will have a fundamental impact on their success. For enterprises, digital technology empowers employees, optimizes operations, engages customers, and in some cases, changes the very core of products and services. We continue to invest in high performance and sustainable computing to meet the growing demand for fast access to Microsoft services provided by our network of cloud computing infrastructure and datacenters.

Our cloud business benefits from three economies of scale: datacenters that deploy computational resources at significantly lower cost per unit than smaller ones; datacenters that coordinate and aggregate diverse customer, geographic, and application demand patterns, improving the utilization of computing, storage, and network resources; and multi-tenancy locations that lower application maintenance labor costs.

The Microsoft Cloud provides the best integration across the technology stack while offering openness, improving time to value, reducing costs, and increasing agility. Being a global-scale cloud, Azure uniquely offers hybrid consistency, developer productivity, AI capabilities, and trusted security and compliance. We see more emerging use cases and needs for compute and security at the edge and are accelerating our innovation across the spectrum of intelligent edge devices, from Internet of Things (“IoT”) sensors to gateway devices and edge hardware to build, manage, and secure edge workloads.

Our AI platform, Azure AI, is helping organizations transform, bringing intelligence and insights to the hands of their employees and customers to solve their most pressing challenges. Organizations large and small are deploying Azure AI solutions to achieve more at scale, more easily, with the proper enterprise-level and responsible AI protections.

We have a long-term partnership with OpenAI, a leading AI research and deployment company. We deploy OpenAI’s models across our consumer and enterprise products. As OpenAI’s exclusive cloud provider, Azure powers all of OpenAI’s workloads. We have also increased our investments in the development and deployment of specialized supercomputing systems to accelerate OpenAI’s research.

Our hybrid infrastructure offers integrated, end-to-end security, compliance, identity, and management capabilities to support the real-world needs and evolving regulatory requirements of commercial customers and enterprises. Our industry clouds bring together capabilities across the entire Microsoft Cloud, along with industry-specific customizations. Azure Arc simplifies governance and management by delivering a consistent multi-cloud and on-premises management platform.

Nuance, a leader in conversational AI and ambient intelligence across industries including healthcare, financial services, retail, and telecommunications, joined Microsoft in 2022. Microsoft and Nuance enable organizations to accelerate their business goals with security-focused, cloud-based solutions infused with AI.

We are accelerating our development of mixed reality solutions with new Azure services and devices. Microsoft Mesh enables organizations to create custom, immersive experiences for the workplace to help bring remote and hybrid workers and teams together.

The ability to convert data into AI drives our competitive advantage. The Microsoft Intelligent Data Platform is a leading cloud data platform that fully integrates databases, analytics, and governance. The platform empowers organizations to invest more time creating value rather than integrating and managing their data. Microsoft Fabric is an end-to-end, unified analytics platform that brings together all the data and analytics tools that organizations need.

GitHub Copilot is at the forefront of AI-powered software development, giving developers a new tool to write code easier and faster so they can focus on more creative problem-solving. From GitHub to Visual Studio, we provide a developer tool chain for everyone, no matter the technical experience, across all platforms, whether Azure, Windows, or any other cloud or client platform.

Windows also plays a critical role in fueling our cloud business with Windows 365, a desktop operating system that’s also a cloud service. From another internet-connected device, including Android or macOS devices, users can run Windows 365, just like a virtual machine.

Additionally, we are extending our infrastructure beyond the planet, bringing cloud computing to space. Azure Orbital is a fully managed ground station as a service for fast downlinking of data.

Create More Personal Computing

We strive to make computing more personal, enabling users to interact with technology in more intuitive, engaging, and dynamic ways.

Windows 11 offers innovations focused on enhancing productivity, including Windows Copilot with centralized AI assistance and Dev Home to help developers become more productive. Windows 11 security and privacy features include operating system security, application security, and user and identity security.

Through our Search, News, Mapping, and Browser services, Microsoft delivers unique trust, privacy, and safety features. In February 2023, we launched an all new, AI-powered Microsoft Edge browser and Bing search engine with Bing Chat to deliver better search, more complete answers, and the ability to generate content. Microsoft Edge is our fast and secure browser that helps protect users’ data. Quick access to AI-powered tools, apps, and more within Microsoft Edge’s sidebar enhance browsing capabilities.