Capital Budgeting: Important Problems and Solutions

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 30, 2024

Fact Checked

Why Trust Finance Strategists?

Table of Contents

The cost of a project is $50,000 and it generates cash inflows of $20,000, $15,000, $25,000, and $10,000 over four years.

Required: Using the present value index method, appraise the profitability of the proposed investment, assuming a 10% rate of discount.

The first step is to calculate the present value and profitability index.

Total present value = $56,175

Less: initial outlay = $50,000

Net present value = $6,175

Profitability Index (gross) = Present value of cash inflows / Initial cash outflow

= 56,175 / 50,000

Given that the profitability index (PI) is greater than 1.0, we can accept the proposal.

Net Profitability = NPV / Initial cash outlay

= 6,175 / 50,000 = 0.1235

N.P.I. = 1.1235 - 1 = 0.1235

Given that the net profitability index (NPI) is positive, we can accept the proposal.

A company is considering whether to purchase a new machine. Machines A and B are available for $80,000 each. Earnings after taxation are as follows:

Required: Evaluate the two alternatives using the following: (a) payback method, (b) rate of return on investment method, and (c) net present value method. You should use a discount rate of 10%.

(a) Payback method

24,000 of 40,000 = 2 years and 7.2 months

Payback period:

Machine A: (24,000 + 32,000 + 1 3/5 of 40,000) = 2 3/5 years.

Machine B: (8,000 + 24,000 + 32,000 + 1/3 of 48,000) = 3 1/3 years.

According to the payback method, Machine A is preferred.

(b) Rate of return on investment method

According to the rate of return on investment (ROI) method, Machine B is preferred due to the higher ROI rate.

(c) Net present value method

The idea of this method is to calculate the present value of cash flows.

Net Present Value = Present Value - Investment

Net Present Value of Machine A: $1,04,616 - $80,000 = $24,616

Net Present Value of Machine B: $1,03,784 - 80,000 = $23,784

According to the net present value (NPV) method, Machine A is preferred because its NPV is greater than that of Machine B.

At the beginning of 2024, a business enterprise is trying to decide between two potential investments .

Required: Assuming a required rate of return of 10% p.a., evaluate the investment proposals under: (a) return on investment, (b) payback period, (c) discounted payback period, and (d) profitability index.

The forecast details are given below.

It is estimated that each of the alternative projects will require an additional working capital of $2,000, which will be received back in full after the end of each project.

Depreciation is provided using the straight line method . The present value of $1.00 to be received at the end of each year (at 10% p.a.) is shown below:

Calculation of profit after tax

(a) Return on investment

(b) Payback period

Payback period = 2.9 years

Payback period = 3.5 years

(c) Discounted payback period

(d) Profitability index method

Capital Budgeting: Important Problems and Solutions FAQs

What are some examples of capital budgeting.

Examples of capital budgeting include purchasing and installing a new machine tool in an engineering firm, and a proposed investment by the company in a new plant or equipment or increasing its inventories.

What is the process of capital budgeting?

It involves assessing the potential projects at hand and budgeting their projected cash flows. Once in place, the present value of these cash flows is ascertained and compared between each project. Typically, the project that offers the highest total net present value is selected, or prioritized, for investment.

What are the primary capital budgeting techniques?

The primary capital budgeting techniques are the payback period method and the net present value method.

What are the capital budgeting sums?

The capital budgeting sums are the amounts of money involved in capital budgeting.

What are the capital budgeting numericals?

The capital budgeting numericals are the various types of numbers used in applying different capital budgeting techniques.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

404 Not found

BUS202: Principles of Finance

Introduction to Capital Budgeting Exercises

- The decision rule should consider all relevant cash flows

- The decision rule should recognize the riskiness of the relevant cash flows

- The decision rule should recognize the time value of money

- The decision rule should rank the projects so that those projects that increase the firm's value the most are ranked the highest.

Note that rule four can not be shortened to rank projects. Any decision rule will rank the projects, but we want our "optimal" decision rule to rank by value added. Also, a decision rule that does not meet all four criteria is not necessarily worthless. Instead it means that it has some obvious flaws that must be recognized.

The Payback Period

- may not consider all relevant cash flows,

- does not consider TVM,

- does not rank by value added, and

- has an arbitrary decision rule.

Consider each in order. First, consider two projects as follows:

According to PP, we would prefer project A as it has a shorter PP. However, clearly Project B is superior. The problem is that we fail to consider any cash flows that come in after the PP. Now consider another two projects.

According to PP, we would prefer project B as it has a shorter PP. However, Project A is superior (NPV A = $41,681 vs. NPV B = $33,199 when k=12%). The problem is that PP fails to recognize the advantage of getting $98,000 in year 1 as opposed to $99,000 in year 2. Because of TVM, the $98,000 is much more valuable. The third problem does not need an example. Our goal is to maximize value not get our initial investment back as soon as possible. Following PP distracts us from our primary goal and can lead to bad decision making. Finally, consider the arbitrary cutoff point. Lets say management chooses 3 years for the cutoff. What is special about 3 years vs. 2.5 or 3.5? Nothing really. There is no theoretical basis for any specific cutoff level.

The second part of the question is why bother with PP since it has so many flaws? The answer is twofold. First, one recent survey estimates that over 50% of firms (see Ch. 8) use PP either always or often in their capital budgeting process. Since so many firms use this decision rule, it is important to know how to calculate PP and what it is telling us. It is also important to know its flaws so we know its limitations as a decision rule. The second reason to know PP is that there are two specific situations where PP can be useful. One is for extremely risky projects where there is a significant chance that the project life will be shorter than anticipated. Under this scenario a quick payback may be critical. That way even if the firm has to kill the project early it may still be able to recover most (or all) of their costs. Two, firms that are extremely weak financially may pay extra attention to PP. If the project has a high NPV, but will not start generating positive cash flows for several years it may not be appropriate to firms in financial distress. They need projects that pay off quickly in order to stay in business.

Yes, when projects are independent NPV and IRR will make the same accept/reject decision. The reason for this can be thought of mathematically or intuitively. Mathematically, IRR is the discount rate at which NPV is equal to zero. Any higher discount rate causes NPV to be less than zero and any lower discount rate would cause NPV to be positive. Thus at all positive NPVs, the IRR is higher than the required return and at all negative NPVs the IRR is lower than the required return. Intuitively we can consider that the IRR tells us the expected return on our initial investment. If the expected return is greater than the required return we should be adding value (and vice-versa). Thus, whenever the IRR is higher than the required return the NPV will be positive and whenever the IRR is less than the required return the NPV will be negative. Because IRR and NPV make the same accept reject decision, either can be used for independent projects. It is only for mutually exclusive projects where we will have problems due to different rankings of which project is best.

The first two IRR problems are both ranking issues. One (the size problem) has to do with the initial investment sizes and the second (the reinvestment rate problem) has to do with cash flow timing issues. Before I go into explaining these problems, it is important to note that both are ONLY problems with mutually exclusive projects. For independent projects, they will alter the ranking of projects, but not the accept/reject decision and are therefore irrelevant. Let's start with the size problem. If we must choose only one project from a list of projects, we want to make sure we select the one that adds the most to firm value. Typically it is easier to do this with a larger project. Consider the following two projects (both with a 15% required return):

Project A looks better according to IRR and has a higher return. However, if we can choose only one, we'd rather earn a little lower percentage return on a lot larger investment. Project B will increase firm value by over $10,000 more than project A would. The difference in sizes for the initial investment leads to different rankings. The second ranking issue with IRR is the reinvestment rate problem. The calculation process of the IRR assumes that all intermediate cash flows will get to be reinvested at the IRR. For projects with high IRRs, this can distort the true return. For instance, in project A above, it assumes that we can reinvest each of the $6000 cash flows and earn over 36% on those investments. It is unlikely that we will be able to do so. This reinvestment rate problem shows up primarily in projects that have significantly different cash flow timing issues. For instance, front-loaded projects (where a large % of cash flows come in early) are more susceptible to the reinvestment rate problem than are back-loaded projects. Again, consider two projects (both with a 13% required return):

According to IRR, Project A looks better but Project B increases firm value by around $7000 more than Project A. This is because the IRR calculation assumes that the $80,000 cash flow in year 1 will be reinvested at 30% for two years which is unlikely. Since most of the cash flows in Project B are at the end of the time, they are not greatly affected by the reinvestment rate assumption. We know that this problem is due to reinvestment and not size as the initial investments are the same, but the timing of cash flows is different.

The third IRR problem is relatively rare. It is referred to as the Multiple IRR (or Crossover) Problem and occurs when the cash flows change signs more than once. For each sign change (from negative to positive or from positive to negative) there will be a unique IRR. Therefore, for a project that has two sign changes (crossovers) there are two IRRs. Three crossovers mean 3 IRRs. When this happens, the IRR is unreliable and shouldn't be used.

The final issue is why know about IRR given its flaws? The answer is that it is commonly used in practice (more than 75% use IRR according to the survey mentioned in the Ch. 8). The reason it is so commonly used is twofold. First, it is easily understood. Since many people involved in capital budgeting may not be finance people it is important to be able to communicate the results in a manner that is easy to follow. Most people are comfortable with rate of return analysis and intuitively understand what a 25% IRR means. On the other hand, without some training fewer people understand a $3567 NPV. This in itself is not enough reason to use IRR – five minutes can explain the basic NPV framework. However, in most cases IRR is sufficient. As long as the projects are not mutually exclusive and there is no crossover problem, IRR and NPV will give the same results. So NPV is only needed when a problem exists.

PP – increase T for low risk projects and decrease T for high risk projects.

IRR, NPV – decrease k for low risk projects and increase k for high risk projects.

No, it does not mean the process is flawed. Capital budgeting analysis gives us a framework for analyzing the value of long-term investment projects. However, two important problems remain. First, the results can only be as good as the inputs into the calculations. If we don't have reasonable forecasts of the cash flows associated with a new project, the expected lifespan, and the risk involved, then the NPV analysis is not helpful. This would be a case of "Garbage In, Garbage Out". Our calculated values are only as good as our inputs. However, we can still have reasonable forecasts and bad results. Anytime we are forecasting future cash flows, we need to remember that they are only forecasts. If we KNEW the outcomes with certainty, life would be a lot easier (but much more boring). Any tool for making decisions about the future (such as NPV analysis) is going to include error. However, it is still useful. If we have a good process, we will be right more often than we are wrong. As an analogy, assume you must pick a basketball player to make one basket. Player A makes 90% of his shots and Player B makes 20%. If you pick Player A and he misses, does that mean you made a bad choice? No! Given the available information, IN THE LONG RUN, you will do far better by choosing Player A. However, in any specific trial, there is a large random factor. Judging your decision process based on short-term results is results-oriented thinking and can lead to a major problem. If we have a good process for estimating cash flows, project life, and risk, then NPV will allow us to accept projects that OVER TIME will add value to our firm. While we may have a few bad outcomes, the process will lead to us being right more than we are wrong.

PP A = 2.89 years PP B = 3.26 years PP C = 2.33 years PP D = 3.39 years

IRR A = 9.99% IRR B = 15.40% IRR C = 17.07% IRR D = 12.94%

NPV A = -$71,051 NPV B = $38,622 NPV C = $28,259 NPV D = -$14,437

If Independent

Choose Projects B and C as both have positive NPVs. While the PP exceeds T for project B, unless the company has significant financial problems and/or is severely concerned about the project lasting the four years. NPV is the best decision rule, so when the decision rules give conflicting results, go with NPV.

If Mutually Exclusive

Choose Project B as it has the highest NPV. The higher IRR for project C is irrelevant and is caused by the different sizes of the projects. Again, when there are conflicts among the rules always follow NPV.

We identify the size problem by looking for different initial investments. Projects AC, AD, BC, and BD all are pairs with different initial investments. However, we also want to find a pair of projects without the reinvestment rate problem. Since A and C are both frontloaded while B and D are both backloaded, they should not suffer from the reinvestment rate problem. Therefore, you could select either AC or BD as an answer for a pair of projects that could suffer from the size problem, but not the reinvestment rate problem.

When looking for pairs of projects that might suffer from the reinvestment rate problem, we have AB, AD, BC, and CD. However, we also want to find a pair of projects without the size problem. Since both AB and CD have the same initial investments, they will not suffer from the size problem. Therefore, you could select either AB or CD as an answer for a pair of projects that could suffer from the reinvestment rate problem, but not the size problem.

- Search Search Please fill out this field.

What Is Capital Budgeting?

How capital budgeting works, discounted cash flow analysis, payback analysis.

- Throughput Analysis

- Capital Budgeting FAQs

The Bottom Line

- Corporate Finance

Capital Budgeting: Definition, Methods, and Examples

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Capital budgeting is a process that businesses use to evaluate potential major projects or investments. Building a new plant or taking a large stake in an outside venture are examples of initiatives that typically require capital budgeting before they are approved or rejected by management.

As part of capital budgeting, a company might assess a prospective project's lifetime cash inflows and outflows to determine whether the potential returns it would generate meet a sufficient target benchmark. The capital budgeting process is also known as investment appraisal.

Key Takeaways

- Capital budgeting is used by companies to evaluate major projects and investments, such as new plants or equipment.

- The process involves analyzing a project's cash inflows and outflows to determine whether the expected return meets a set benchmark.

- The major methods of capital budgeting include discounted cash flow, payback analysis, and throughput analysis.

Investopedia / Lara Antal

Ideally, businesses could pursue any and all projects and opportunities that might enhance shareholder value and profit. However, because the amount of capital any business has available for new projects is limited, management often uses capital budgeting techniques to determine which projects will yield the best return over an applicable period.

Although there are a number of capital budgeting methods , three of the most common ones are discounted cash flow, payback analysis, and throughput analysis.

Discounted cash flow (DCF) analysis looks at the initial cash outflow needed to fund a project, the mix of cash inflows in the form of revenue , and other future outflows in the form of maintenance and other costs.

These cash flows, except for the initial outflow, are discounted back to the present date. The resulting number from the DCF analysis is the net present value (NPV) . The cash flows are discounted since present value assumes that a particular amount of money today is worth more than the same amount in the future, due to inflation.

In any project decision, there is an opportunity cost , meaning the return that the company would have received had it pursued a different project instead. In other words, the cash inflows or revenue from the project need to be enough to account for the costs, both initial and ongoing, but also to exceed any opportunity costs.

With present value , the future cash flows are discounted by the risk-free rate such as the rate on a U.S. Treasury bond , which is guaranteed by the U.S. government, making it as safe as it gets. The future cash flows are discounted by the risk-free rate (or discount rate ) because the project needs to at least earn that amount; otherwise, it wouldn't be worth pursuing.

In addition, a company might borrow money to finance a project and, as a result, must earn at least enough revenue to cover the financing costs, known as the cost of capital . Publicly traded companies might use a combination of debt—such as bonds or a bank credit facility —and equity , by issuing more shares of stock. The cost of capital is usually a weighted average of both equity and debt. The goal is to calculate the hurdle rate or the minimum amount that the project needs to earn from its cash inflows to cover the costs. To proceed with a project, the company will want to have a reasonable expectation that its rate of return will exceed the hurdle rate.

Project managers can use the DCF model to decide which of several competing projects is likely to be more profitable and worth pursuing. Projects with the highest NPV should generally rank over others. However, project managers must also consider any risks involved in pursuing one project versus another.

Payback analysis is the simplest form of capital budgeting analysis, but it's also the least accurate. It is still widely used because it's quick and can give managers a " back of the envelope " understanding of the real value of a proposed project.

Payback analysis calculates how long it will take to recoup the costs of an investment. The payback period is identified by dividing the initial investment in the project by the average yearly cash inflow that the project will generate. For example, if it costs $400,000 for the initial cash outlay, and the project generates $100,000 per year in revenue, it will take four years to recoup the investment.

Payback analysis is usually used when companies have only a limited amount of funds (or liquidity ) to invest in a project, and therefore need to know how quickly they can get back their investment. The project with the shortest payback period would likely be chosen. However, the payback method has some limitations, one of them being that it ignores the opportunity cost.

Also, payback analysis doesn't typically include any cash flows near the end of the project's life. For example, if a project that's being considered involves buying factory equipment, the cash flows or revenue generated from that equipment would be considered but not the equipment's salvage value at the conclusion of the project. As a result, payback analysis is not considered a true measure of how profitable a project is, but instead provides a rough estimate of how quickly an initial investment can be recouped.

Salvage value

Salvage value is the value of an asset, such as equipment, at the end of its useful life .

Throughput Analysis

Throughput analysis is the most complicated method of capital budgeting analysis, but it's also the most accurate in helping managers decide which projects to pursue. Under this method, the entire company is considered as a single profit-generating system. Throughput is measured as an amount of material passing through that system.

The analysis assumes that nearly all costs are operating expenses , that a company needs to maximize the throughput of the entire system to pay for expenses, and that the way to maximize profits is to maximize the throughput passing through a bottleneck operation. A bottleneck is the resource in the system that requires the longest time in operations. This means that managers should always place a higher priority on capital budgeting projects that will increase throughput or flow passing through the bottleneck.

What Is the Primary Purpose of Capital Budgeting?

Capital budgeting's main goal is to identify projects that produce cash flows that exceed the cost of the project for a company.

What Is an Example of a Capital Budgeting Decision?

Capital budgeting decisions are often associated with choosing to undertake a new project that will expand a company's current operations. Opening a new store location, for example, would be one such decision for a fast-food chain or clothing retailer.

What Is the Difference Between Capital Budgeting and Working Capital Management?

Working capital management is a company-wide process that evaluates current projects to determine whether they are adding value to the business, while capital budgeting focuses on expanding the current operations or assets of the business.

Capital budgeting is a useful tool that companies can use to decide whether to devote capital to a particular new project or investment. There are several capital budgeting methods that managers can use, ranging from the crude but quick to the more complex and sophisticated.

U.S. Securities and Exchange Commission. " Treasury Securities ."

:max_bytes(150000):strip_icc():format(webp)/NPV-final-509066b4f3734259a55f52281d155c0b.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

60 Important Capital Budgeting Questions and Answers [With PDF]

The 6th chapter of our finance learning course is “ Capital Budgeting .” In this article, we’ll learn the 60 most important capital budgeting questions and their answers.

It will help you quickly understand the important capital budgeting terms and their explanations.

By reading this post, you may quickly prepare for “finance” courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on.

So let’s get started…

Capital Budgeting Questions and Answers

The 60 important capital budgeting questions and answers are as follows:

Question 01: What is capital budgeting?

Answer: Capital budgeting is the process of finding, analyzing, and choosing investment projects with returns that are expected to last longer than one year.

It is the process by which a company determines whether projects like building a new plant or investing in a long-term venture are worthwhile.

Ideally, companies should pursue all projects and opportunities that increase shareholder value.

Question 02: What is another name for capital budgeting?

Answer: Another name for capital budgeting is “investment appraisal.”

Question 03: What is a project?

Answer: A project is a planned piece of work that has a distinct objective.

Question 04: What are the types of projects?

There are generally three types of projects that businesses will take on:

- Independent Project

- Dependent Project

- Mutually Exclusive Project

Question 05: What are the steps in the capital budgeting process?

Answer: The five steps of capital budgeting are as follows:

- Generating Ideas

- Analyzing individual proposals

- Planning the capital budget

- Implementation

- Monitoring and follow up

Question 06: What are the fundamental principles of capital budgeting?

Answer: The following are the fundamental principles of capital budgeting:

- Cash flows are used to make decisions.

- The timing of cash flow is critical.

- Cash flows are calculated using opportunity costs.

- After-tax cash flows are examined.

- Financing costs (such as interest) are ignored.

- Sunk costs are not considered.

- Only incremental flows are taken into account.

- Inflationary effects are taken into account.

Question 07: What are the objectives of capital budgeting?

Answer: The following are the primary objectives of capital budgeting:

- Select the most profitable project for the business enterprise.

- Assists the business in determining the most rational project for a business venture.

- Aids businesses in forecasting their future revenue, cash flows, present value status of future investments, and net earnings.

- Demonstrate the justification for new investment and abandon older investment projects.

Question 08: What are the benefits or importance of capital budgeting?

Answer: The following are the benefits or importance of capital budgeting:

- Capital budgeting assists in selecting the best project from a pool of potential investments.

- Analyzing capital budgeting techniques allows an investor to forecast future cash flows.

- Capital budgeting allows a company to control costs and other unnecessary expenditures.

- Capital budgeting assists businesses in calculating the venture’s future financial risks. It is cautious steeping to avoid future investment risk.

- It is beneficial to choose a project investment that is not frequently changed.

Question 09: What are the features or characteristics of capital budgeting?

Answer: The following are the five most important features or characteristics of capital budgeting:

- Cash flows are used to make capital budgeting decisions.

- The timing of cash flows is critical in capital budgeting decisions.

- Cash flows are calculated using opportunity costs.

- Capital budgeting ignores financing and sunk costs.

- The cash flows are examined after taxes.

Question 10: What are the constraints or limitations of capital budgeting?

Answer: The top five constraints of capital budgeting are as follows:

- Because major project decisions are based on forecasting, there is a chance that important project information will be overlooked.

- This budgeting technique does not allow for the estimation of probable future risk.

- Sometimes a country’s economic turmoil can have an impact on capital budgeting decisions for a future project.

- Estimating the economic life of an investment is perhaps the most difficult task.

- There are numerous unknown factors that cannot be predicted and cannot be controlled or avoided.

Question 11: What is the application of capital budgeting?

Answer: Capital budgeting is used in all aspects of long-term investment decisions. The following are some examples of popular capital budgeting applications:

- Purchase of a fixed asset.

- Business expansion with the goal of increasing production capacity.

- Product differentiation

- Modernization and replacement.

Question 12: What are the factors affecting capital budgeting decisions?

Answer: The following factors influence capital budgeting decisions:

- Maturity of Project

- Cash flows

- Present value factor

Question 13: What are the major cash flow components?

Answer: The following are the major cash flow components:

- Initial cash outflow

- Interim Incremental Net Cash Flows

- Terminal Year Incremental Net Cash Flow

Question 14: What is an initial cash outflow?

Answer: The amount of money paid out or received at the start of a project or investment is referred to as the “initial cash outflow.”

Question 15: How do you calculate the initial cash outflow?

Answer: The initial cash flow is calculated in the following manner:

Initial cash flow = cost of the new asset – capitalized expenditures +/- increased or decreased level of net working capital +/- net proceeds from the sale of old assets +/- taxes (tax savings) from the sale of old assets

Question 16: What are the interim incremental net cash flows?

Answer: Interim incremental net cash flows are the extra operating cash flows that a company gets because it started a new project.

Question 17: How do you calculate the interim incremental net cash flows?

Answer: The interim incremental net cash flows are calculated as follows:

Incremental Net Cash Flow for the Period = Net increase (decrease) in operating revenue -/+ any net increase or decrease in operating expenses, excluding depreciation +/- Net increase or decrease in tax depreciation charges +/- Net increase or decrease in taxes +/- Net increase or decrease in tax depreciation charges

Question 18: How do you calculate the terminal-year incremental net cash flow?

Answer: The terminal year incremental net cash flow is calculated as follows:

Terminal year incremental net cash flow = Net increase or decrease in operating revenue -/+ any net increase or decrease in operating expenses, excluding depreciation +/- Net increase or decrease in tax depreciation charges +/- Net increase or decrease in taxes +/- Net increase or decrease in tax depreciation charges +/- initial salvage value of new assets -/+ Taxes or Tax savings due to sale or disposal of new assets +/- decreased or increased level of net working capital

Question 19: What are the types of capital budgeting decisions?

Answer: The following are the different types of capital budgeting decisions:

- Accept or reject decision

- Mutually exclusive decision

- Capital rationing decision

- Ranking method

- Non-discounted methods of capital budgeting

- Discounted methods of capital budgeting

Question 20: What is an “accept or reject” decision?

Answer: This is an important decision in capital budgeting. The farm would invest in the project if it were accepted, but not if it were rejected.

Most project proposals are accepted if their rates of return are higher than a certain minimum rate of return.

Under the accept or reject decision, all separate products that meet the minimum investment criteria should be put into place.

Question 21: What are mutually exclusive decisions?

Answer: Projects that compete with each other but don’t affect each other’s chances of getting approved are said to be “mutually exclusive.” Only one of the options is allowable because they are mutually exclusive.

Question 22: What is a capital rationing decision?

Answer: If the business has no limits on how much money it can spend, any independent investment proposal with a return higher than a certain level could be accepted.

In reality, a business’s budget for project implementation is limited. There are many investment proposals competing for those limited funds. As a result, the business must ration them.

The business allocates funds to projects in such a way that long-term returns are maximized. Capital rationing is a term for a business’s financial situation in which it only has a small amount of money to spend on capital investments.

Question 23: What is the ranking method?

Answer: Using different capital budgeting techniques, this method starts by figuring out how likely each project is to happen.

The project with the highest return is then ranked first, followed by the project with the lowest return. The project with the highest ranking is chosen, and the investment decision is made.

Question 24: What are the non-discounted methods of capital budgeting?

Answer: The non-discounted methods of capital budgeting are as follows:

- Payback Period (PBP)

- Average Rate of Return (ARR)

- Pay Back Reciprocal (PBR)

Question 25: What are the discounted methods of capital budgeting?

Answer: The discounted methods of capital budgeting are as follows:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Profitability Index (PI)

- Modified Internal Rate of Return (MIRR)

- Discounted Pay Back Period (DPBP)

Question 26: What is a payback period (PBP)?

Answer: The payback period is the number of years it takes to get back the money you put into a project at the beginning.

The payback period is one of the most common and widely accepted ways to judge investment proposals. The PBP figures out how long it will take to get back the initial cash investment based on the expected cash flows.

Question 27: What is the average rate of return (ARR)?

Answer: When you divide the average annual net income after taxes by the average investment, you get the average rate of return. It considers both the amount invested and the profit generated.

Question 28: What is the net present value (VPV)?

Answer: The net present value of a project is the sum of the present values of all expected future cash flows over the project’s life, less the initial cash outlay.

The net present value is the traditional economic method for assessing investment proposals. It is one of the most important ways to discount money that takes into account the value of time.

It makes the right assumption that future cash flows from different time periods have different values and can’t be compared until their equivalent present values are known.

Question 29: What is an internal rate of return (IRR)?

Answer: Another method for discounting is the internal rate of return. A project’s IRR is the discount rate that equals its NPV.

It is the discount rate at which the present value of future cash flows is equal to the initial investment.

Question 30: What is a profitability index (PI)?

Answer: The profitability index is the ratio you get when you divide the present value of all future cash inflows by the present value of all cash outflows.

Question 31: What are the techniques or methods of capital budgeting?

Answer: The following are capital budgeting techniques or methods:

- Discounted Payback Period (DPBP)

Question 32: What is the formula for NPV, and how do you calculate NPV?

Answer: The formula for calculating NPV is as follows:

CFt = After-tax cash flow at time t

R = Required rate of return for the investment

Outlay = Initial cash outflow or investment

Calculation:

Let’s calculate the net present value (NPV) using a straightforward example.

ABC Corporation is thinking about investing $30,000 in a project that will generate after-tax cash flows of $12,000 per year for the next three years and an additional $20,000 in the fourth year. The required rate of return is 13%.

The NPV for ABC Corporation would be as follows, using the above formula:

NPV= 12/1.13+12/(1.13)+12/1.13+20/1.13-30

=10.62+9.4+8.32+12.27-30

=40.61-30

=10.61

Since the NPV is positive, the investment will therefore be accepted.

Question 33: What are the NPV decision criteria?

Answer: The following are the NPV decision criteria:

- Invest: If the NPV is greater than or equal to zero.

- Do not make an investment: If the NPV is less than zero.

Question 34: What are the benefits of using the Net Present Value (NPV) method?

Answer: The net present value (NPV) method has the following benefits:

- It recognizes the time value of money.

- It calculates the project’s worth based on all cash flows that occur over the course of the project’s life.

- The discounting process allows you to calculate cash flows in terms of present value.

- The NPV Method can be modified to account for risk.

- It took into account the risk of future cash flows (through the cost of capital).

- The NPV method is always in line with the goal of maximizing shareholder wealth.

Question 35: What are the disadvantages of using the Net Present Value (NPV) method?

Answer: The following are the disadvantages of the net present value (NPV) method:

- In comparison to PBP or ARR, it is difficult to understand, calculate, and use.

- The problem associated with NPVs involves calculating the required rate of return or cost of capital to discount the cash flows.

- When comparing alternative projects with unequal life, use caution when using the NPV.

Question 36: What is the formula for IRR?

Answer: The internal rate of return (IRR) formula is:

IRR = r = the discount rate that makes the net present value of the investment equal to zero.

Question 37: What are the IRR decision criteria?

Answer: The IRR decision criteria are as follows:

- Invest: If the IRR is greater than or equal to the required rate of return.

- Don’t invest: If the IRR is less than the required rate of return.

Question 38: What are the benefits of using the Internal Rate of Return (IRR) method?

Answer: The following are the benefits of using the Internal Rate of Return (IRR) method:

- It takes into account the time value of money.

- It considers total cash inflows and outflows.

- For business executives, the IRR is simpler to grasp.

- It is consistent with the overall goal of increasing shareholder wealth.

- It takes into account the risks associated with future cash flows.

Question 39: What are the disadvantages of using the Internal Rate of Return (IRR) method?

Answer: The following are the disadvantages of the Internal Rate of Return (IRR) method:

- It entails arduous and time-consuming calculations.

- It may generate multiple rates, which can be perplexing.

- IRR does not account for scale or amount.

- If the project has a long duration, the trial and error process used to calculate the IRR can become unmanageable.

Question 40: What is the PBP formula?

Answer: The following is the formula for calculating the payback period (PBP):

PBP= a+((ICO-c)/d)

a= the year of the cumulative inflow closest to the year of the initial cash outflow

ICO= Initial Cash Outlay

c=Cumulative inflow of a year

d= Inflow of the year of recovery

Question 41: What are the PBP decision criteria?

Answer: The payback period decision criteria are as follows:

- The proposal is accepted if the calculated payback period is less than some maximum acceptable payback period.

- The project is rejected if the payback period exceeds the acceptable payback period.

Question 42: What are the benefits of using the Pay Back Period (PBP) method?

Answer: The Pay Back Period (PBP) method has the following benefits:

- It is very simple to compute.

- The method provides some information about the investment’s risks. When the payback period exceeds an acceptable payback period, the project becomes more uncertain.

- This method does not provide a rough estimate of the project’s liquidity.

Question 43: What are the disadvantages of using the Payback Period (PBP) method?

Answer: The Payback Period (PBP) method has the following disadvantages:

- There are no concrete decision criteria for determining whether an investment increases the firm’s value.

- The method disregards cash flows that occur after the payback period.

- It ignores the concept of the time value of money.

- It also takes no account of the risk of future cash flows.

- This method is an ineffective predictor of profitability.

Question 44: What is the Discounted Pay Back Period (DPBP) formula?

Answer: The following is the formula for calculating the discounted payback period (DPBP):

DPBP= a+((ICO-c)/d)

Question 45: What are the benefits of the Discounted Pay Back Period (DPBP) method?

Answer: The following are the benefits of the discounted payback period (DPBP) method:

- The primary benefit of a discounted payback period is that it takes into account the time value of money.

- It also takes into account the riskiness of the project’s cash flows (through the cost of capital).

Question 46: What are the disadvantages of using the Discounted Payback Period (DPBP) method?

Answer: The following are the disadvantages of the Discounted Pay Back Period (DPBP) method:

- This method, like the payback period method, ignores cash flows after the discounted payback period is reached.

- This method is still not a reliable indicator of profitability.

- The maximum acceptable discounted payback period is entirely arbitrary.

Question 47: What is the formula of an average or accounting rate of return (ARR)?

Answer: The formula for figuring out an average or accounting rate of return (ARR) is as follows:

ARR = Average net income/Average Investment

Average Investment=(Initial Investment +Salvage Value)/2

Question 48: What are the ARR decision criteria?

Answer: The following are the ARR decision criteria:

- Accept: If the actual ARR exceeds or equals the projected ARR.

- Don’t accept: If the actual ARR is less than or equal to the projected ARR.

Question 49: What are the benefits of calculating the average rate of return (ARR)?

Answer: The following are the benefits of using the Average Rate of Return (ARR) method:

- It is simple to comprehend, calculate, and apply.

- The ARR method is easy to figure out from accounting data, and unlike the NPV and IRR methods, it doesn’t require any adjustments to get to the cash flows of the project.

- It considers benefits over the project’s entire life cycle.

- The ARR rule considers the entire income stream when calculating the project’s profitability.

Question 50: What are the disadvantages of using the Average Rate of Return (ARR) method?

Answer: The following are the disadvantages of the Average Rate of Return (ARR) method:

- It is calculated using accounting profit rather than cash flow.

- It does not account for the time value of money.

- The ARR does not account for any benefits that may accrue after the project is completed.

- The ARR makes no distinction between the sizes of the investments needed for each project.

Question 51: What is the PI formula, and how is it calculated?

Answer: The following is the formula for calculating PI:

PI = PV of future cash flows/Initial investment

PI= 1+(NPV/Initial Investment)

The example below will show you how to calculate the Profitability Index (PI).

Assume ABC Corporation is considering a $42,000 investment in a capital project that will generate after-tax cash flows of $14,000 per year for the next five years. The cost of capital is 10%.

The estimated present value of future cash flows is $53,071.

PV of Future cash flows=$53,071

Initial Investment = $42,000

Profitability Index (PI)= (53,071/42000)= 1.26

Question 52: What are the PI Decision Criteria?

Answer: The following are the PI decision criteria:

- If PI is greater than or equal to one, invest.

- If the PI is less than one, do not invest.

Question 53: What are the advantages of the Profitability Index (PI) method?

Answer: In capital budgeting decision-making, the Profitability Index has the following advantages:

- The PI meets almost all of the criteria for a sound investment.

- It assesses all of the project’s cash flows.

- It indicates whether or not an investment increases the firm’s value.

Question 54: What are the disadvantages of using the Profitability Index (PI) method?

Answer: The following are the Profitability Index’s disadvantages:

- The calculation necessitates an estimate of the capital cost.

- When used to compare mutually exclusive projects, it may not provide the correct decision.

Question 55: What is the difference between capital budgeting and capital rationing?

Answer: The three important differences between capital budgeting and capital rationing are as follows:

- Capital budgeting is the process of generating, analyzing, and allocating long-term investments to the capital budget. “Capital rationing,” on the other hand, is a situation in which the amount of funding available is limited to the point where projects cannot be accepted.

- Capital budgeting functions include project evaluation, selection, and implementation. On the other hand, the goal of capital rationing is to choose projects that will make the most money out of the limited amount of money.

- To analyze projects, capital budgeting is used. Capital rationing, on the other hand, is used to accept or reject projects.

Question 56: What is the distinction between Net Present Value (NPV) and Internal Rate of Return (IRR)?

Answer: The following are the three important distinctions between the net present value (NPV) and the internal rate of return (IRR):

- NPV is the present value of future cash flows discounted at the required rate of return minus the project’s initial investment. Whereas IRR is the rate of return that equates the present value of a series of cash inflows with the initial investment.

- The NPV method’s goal is to compute the net value. The goal of the IRR method is to calculate the required rate.

- The project is profitable if the NPV is positive. The project is profitable if the IRR is greater than the cost of capital.

Question 57: What is the distinction between Net Present Value (NPV) and Profitability Index (PI)?

Answer: The following are the three important distinctions between net present value (NPV) and profitability index (PI):

- NPV is the present value of future cash flows discounted at the required rate of return minus the project’s initial investment. Whereas PI is the present value of future cash flows discounted at the required rate of return divided by the project’s initial investment.

- The NPV method’s goal is to compute the net value. The goal of the PI method is to calculate the ratio.

- The project is profitable if the NPV is positive. The project is profitable if the PI is greater than one.

Question 58: Which technique, NPV or IRR, is preferred and why?

Answer: It is difficult to choose between approaches. It is smart to look at NPV and IRR methods from both a theoretical and a practical point of view.

The theoretical point of view:

Answer: NPV is the superior approach to capital budgeting for the following reasons:

- The NPV user assumes that any intermediate cash inflows from an investment are reinvested at the firm’s cost of capital. whereas the use of IRR assumes that the IRR will reinvest any of these cash inflows. The cost of capital, on the other hand, is the realistic investment rate.

- A project with an unusual cash flow may produce multiple IRR, whereas NPV does not have this issue.

The practical point of view:

Answer: Even though the NPV method is better in theory, financial managers prefer the IRR method for the following reasons:

- Rates of return are preferred by businesspeople over dollar returns. In this regard, IRR is preferable.

- NPV is less intuitive to financial decision-makers because it does not measure benefits in relation to the amount invested.

- There are several methods for avoiding the difficulty of the IRR.

Question 59: When is the profitability index better than the NPV?

Answer: In the following situations, it is thought that the profitability index is better than the net present value (NPV).

- In terms of capital rationing decisions, the profitability index is thought to be better than the NPV.

- If the initial investment is unequal and I am asked to accept or reject a decision, the profitability index will be a better technique than the NPV.

- In the profitability index method, the net present value of the cash flows is calculated first, followed by the profitability index. As a result, the profitability index becomes preferable.

Question 60: What is the best way to figure out how much a capital expenditure or investment is worth?

Answer: There are two types of capital budgeting methods: traditional and discounted cash flow. The discounted cash flow method is the better option of the two.

I hope that by the end of this post, you will have a good understanding of the “ capital budgeting ” chapter.

You will gain a better understanding of the “ capital budgeting ” chapter if you read these “60 important capital budgeting questions and answers” on a regular basis.

You can read the first five chapters of our finance learning course here:

- 25 Important Introduction to Finance Questions and Answers [With PDF]

- 30 Important Time Value of Money Questions and Answers [With PDF]

- 35 Important Short-Term and Mid-Term Financing Questions and Answers [With PDF]

- 35 Important Long-Term Financing Questions and Answers [With PDF]

- 35 Important Cost of Capital Questions and Answers [With PDF]

1 thought on “60 Important Capital Budgeting Questions and Answers [With PDF]”

Well researched and written, short and pricise, straight to the point notes. Very understandable when studying them.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notable Children's Digital Media

To find out about more great digital media for children, visit the page for ALSC's Excellence in Early Learning Digital Media Award .

This list represents the titles selected by the committee for 2023-2024.

GLOBE Observer . App: iOS & Android. Middle, Older. Science, Nature, Environment. https://observer.globe.gov/about/get-the-app

This citizen science app is available in more than 120 countries. It allows users to make environmental observations that complement NASA satellite observations, helping scientists study Earth and the global environment. By using the GLOBE Observer app, you can contribute important scientific data to NASA and GLOBE, your local community, and students and scientists worldwide. (Available in numerous languages. See app for list.)

Goally . App: iOS, Amazon, Android, and tablets. Younger, Middle, Older. Cost : starting at $15/mo. https://getgoally.com/

Provides neurodiverse children with the tools to build life and language skills needed to reach their potential. These include visual schedules, interactive video classes, emotional regulation games, and augmentative and alternative communication. Available in English.

Google Arts and Culture . Website/App: iOS & Android. Older, Educators, Parents. Arts, Visual Arts. https://artsandculture.google.com/explore

Google Arts & Culture is a non-commercial initiative that works with cultural institutions and artists from around the world. There are various topics to aid students in projects with excellent visuals for a heightened experience. Available in English.

Katoa . App: iOS & Android. Middle, Older. Science, Nature, Environment. https://www.sankaristudios.com/

This mobile farm-sim game incorporates strategy and environmental awareness as players build, nurture, and defend virtual ocean habitats from pollution. Players collect fauna and attract flora in a series of biomes, unlocking real photos of and facts about the species and locations depicted in the game's high-quality art. Additional reading and learning components come from short quest storylines and scripted conversations with fish and marine mammals. Game play points count toward real world donations from the developer and their sponsors to conservation organizations; players select their preferred organizations from a curated list. Available in English.

OctoStudio . App: iOS and Android. Elementary, Middle. Coding. https://octostudio.org/en/

This mobile coding app was created by the Lifelong Kindergarten research group at MIT, the same people who created Scratch. Children learn logic and develop programming skills by using block coding to create stories and games. Once it's downloaded, the app is able to function offline, which means that children with limited or no access to internet connectivity can enjoy it. OctoStudio is available in over 20 languages and is compatible with screen readers.

Seek by iNaturalist . App: iOS and Android. Younger, Middle. Nature. https://www.inaturalist.org/pages/seek_app

Citizen scientists, ages four and up, can snap photos of wildlife, plants, and fungi in order to have them identified. App users are able to take on challenges and unlock badges for photographing different organisms and species in their neighborhoods. Available in English, Afrikaans, Arabic, Basque, Bulgarian, Catalan, Croatian, Czech, Danish, Dutch, Finnish, French, German, Greek, Hebrew, Indonesian, Italian, Japanese, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Singhalese, Spanish, Swedish, Traditional Chinese, Turkish, and Ukrainian.

SkySci for Kids . Website. Younger, Middle. Science, Weather, Climate. https://scied.ucar.edu/kids

This website allows children ages 5-10 to explore weather wonders, stuff in the sky, and climate change in fun and interactive ways using short articles, games, storybooks, and videos. The materials are designed to allow kids to explore either independently or with a parent or caregiver. Available in English.

Starfall . Website/App: iOS & Android. Younger, Parents/Caregivers. Language Arts, Math, Music. https://www.starfall.com/h/index.php

This resource, for Prek-Grade 5, provides exploration, play, and positive reinforcement for children as they learn and practice reading and math skills through interactive and multisensory games and music. A Parent-Teacher Center provides additional resources such as worksheets, books, projectables, music, and curriculum to help parents extend learning. Available in English

Notable Children's Digital Media Committee

Melanie A. Lyttle, Chair, Madison Public Library, Madison, OH Dr. Danilo M. Baylen, Co-Chair, University of West Georgia, Carrollton, GA Lauren E. Antolino, Cranford Public Library, Cranford, NJ Kirsten Caldwell, Onalaska, WI Angelica Candelaria, Bloomington, IN Jaclyn C. Fulwood, Allen County Public Library, Fort Wayne, IN Elizabeth M. Gray, Yolo County Library, Woodland, CA Bethni King, Georgetown, TX Trina C. Smith, Saint John the Baptist Parish Library, Laplace, LA Erin Warnick, NCDM Administrative Assistant, Pleasant Grove, UT

Share This Page

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

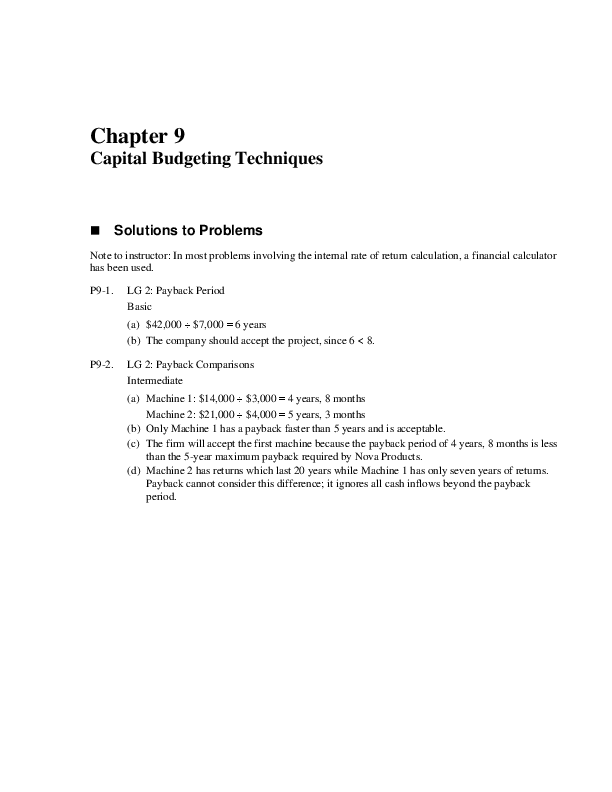

Capital Budgeting Techniques Solutions to Problems

Related Papers

Alessandro Pascale

.La Riscossa, bollettino periodico del Partito Comunista. N° 12 - 10 gennaio 2024. La Riscossa.info è diretto da Alessandro Pascale. SOMMARIO COPERTINA p. 2 SI È ANTIFASCISTI SEMPRE IL PUNTO DEL SEGRETARIO p. 3 2023 UN ANNO DI PASSAGGIO EDITORIALE DEL DIRETTORE p. 5 ITALIA p. 6 CONTINUA LA STRAGE SILENZIOSA 745 MORTI SUL LAVORO NEL 2023 REGALO DI NATALE PER GLI ITALIANI. ANNUNCIATI NUOVI TAGLI STANGATA SULLE BOLLETTE! ANCORA RINCARI PER IL POPOLO! SANITÀ PUBBLICA SMANTELLATA ANCORA PRIVATIZZAZIONI ANCORA AIUTI A ZELENSKIJ DA PARTE DELLA MELONI PD NELLE FABBRICHE DAGLI IMPRENDITORI E NON DAI LAVORATORI ESTERI, GUERRA, IMPERIALISMO p. 9 USA PRONTI A ESPORTARE LA GUERRA GERMANIA PARALIZZATA. I MEDIA PARLANO D’ALTRO L’OCCUPANTE SIONISTA ATTACCA ANCHE LA SIRIA UN NUOVO EUROMAIDAN IN SERBIA TORNANO A MINACCIARE IL VENEZUELA! IL NIGER PROCEDE VERSO IL MULTIPOLARISMO CRONACHE DAL TOTALITARISMO “LIBERALE” p. 12 DEMOCRAZIA? QUALE DEMOCRAZIA? RICCHI SEMPRE PIÙ RICCHI GENOCIDIO E CENSURA. LA STORIA SI RIPETE! SE SOLIDARIZZI CON LA PALESTINA VIENI CONDANNATO PARTITO COMUNISTA p. 15 65° ANNIVERSARIO DELLA RIVOLUZIONE CUBANA ROMA 21 GENNAIO 2024 STORIA E MEMORIA p. 16 25 DICEMBRE 1991 IL SOCIALISMO CHE FU E IL SOCIALISMO CHE SARÀ 28 DICEMBRE 1943 – SANGUE DEL NOSTRO SANGUE, NERVI DEI NOSTRI NERVI COME FU QUELLO DEI FRATELLI CERVI ANNIVERSARIO DELLA NASCITA DI PEPPINO IMPASTATO 101 ANNI FA NASCEVA L’URSS 1° GENNAIO 1959 TRIONFA LA RIVOLUZIONE “SALVAR LA PATRIA, LA REVOLUCION, EL SOCIALISMO Y VENCER” – MIGUEL DIAZ CANEL IL TEMPO DELLA CORRUZIONE GENERALE IN MEMORIA DI FELICE BESOSTRI GLI APPROFONDIMENTI DEL GIORNALE SUL SITO p. 22 VIDEO p. 27 FORMAZIONE E INFORMAZIONE CONTINUA p. 28 ISCRIVITI AL PARTITO, ABBONATI AL GIORNALE p. 32

Sztuka i Dokumentacja

Ewelina Wejbert-Wąsiewicz

Journal of Thermal Analysis and Calorimetry

JOSE ANTONIO RODRIGUEZ CHEDA

Jesus Rivas

Movement ecology is an important tool for understanding animal behaviour toward basic needs, as well as to design conservation and management priorities. Animals usually do not move randomly and may prefer certain types of habitats over others. The yellow anaconda (Eunectes notaeus) is one of the largest snakes in South America. However, little is known about its natural history. Here, we present results from a telemetry study to quantify movement patterns and habitat use of eight yellow anacondas in a protected, seasonally flooded area in Midwestern Brazil. Yellow anacondas were associated to small channels with macrophyte stands and bushy vegetation. They moved relatively little (188 m monthly) and had small home range (mean 6.2 ha); they used native pastures and abandoned farmlands with forest patches more than expected by chance. Our results contribute to the understanding of dispersal patterns, habitat choices, and life history of this large aquatic snake and to the body of knowledge needed for management and conservation of its populations and habitats.

New Biotechnology

Gita Naseri

Sikunder Ali

Journal of the American Chemical Society

Denis Kissounko

Journal of Education and Society JES , theo rosas

This study aimed to determine the sources of stress, factors that affect job satisfaction, and gender differences among public and private secondary teachers in the six identified secondary schools in the municipality of San Isidro and Tabango, Leyte. A quantitative descriptive cross-sectional research design was employed in this study. A self-administered survey questionnaire with 45 items for teacher stress adapted from Borg et al. (2006) and teacher's job satisfaction (TFS, 2001) was distributed to 112 secondary teachers using purposive sampling. The data were statistically analyzed using descriptive statistics and Z-test for statistical differences. Results revealed that the teachers' most occupational stress was the student's misbehavior due to students' poor attitude towards work, noisiness, and impolite behavior. However, secondary teachers were satisfied with their teaching job, particularly on the school's safety, such as the location, security policies,...

Shaheryar Haider

A 68-year-old African American male who presented to the emergency department with back and abdominal pain. Imaging showed a posterior mediastinal mass interposed between the carina, the left mainstem bronchus, and the descending thoracic aorta. Biopsy of the mass favored a metastatic prostate carcinoma, which is an extremely rare presentation.

RELATED PAPERS

International Journal of Innovation and Scientific Research

Eugène Kouakou

2019 International Workshop on Antenna Technology (iWAT)

Muhammad Imran

Environmental pollution (Barking, Essex : 1987)

V. Lecureur

Entre Europa y América: Hacia una historia internacional del socialismo

Daniel Gaido

Clinical Nutrition Supplements

Mohamed Mouhieddine

Brazilian Archives of Biology and Technology

Martin Roberto Del Valle Alvarez

Sleep Science

André Comiran Tonon Tonon AC

Journal of Operational Oceanography

marina lipizer

Falah Journal of Sharia Economic Law

Ahmad Habibi

Journal of pediatric hematology/oncology

Ahmed Elgendy

Andrea Tanevitch

办理兰卡斯特大学毕业证书文凭学位证书 英国大学文凭学历认证

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

IMAGES

VIDEO

COMMENTS

Problem 1. The cost of a project is $50,000 and it generates cash inflows of $20,000, $15,000, $25,000, and $10,000 over four years.. Required: Using the present value index method, appraise the profitability of the proposed investment, assuming a 10% rate of discount. Solution. The first step is to calculate the present value and profitability index.

Sample Problems—Capital Budgeting—part 1 1. Lloyd Enterprises has a project which has the following cash flows: Year Cash Flow 0 -$200,000 1 50,000 2 100,000 3 150,000 4 40,000 5 25,000 The cost of capital is 10 percent. What is the project's discounted payback? 2.

The company's cost of capital is 16 percent, and its tax rate is 40 percent. Required. a. Calculate the removal costs of the existing equipment net of tax effects. b. Compute the depreciation tax shield. c.Compute the forgone tax benefits of the old equipment. d. Calculate the cash inflow, net of taxes, from the sale of the new equipment in ...

Capital Budgeting Practice Problems And Solutions Richard A. Brealey,Stewart C. Myers Practical Problems In Financial Management - SBPD Publications Dr. F. C. Sharma, ,C S Rachit Mittal,2021-11-18 1.The Time-Value of Money , 2. Risk and Return (Including Capital Asset Pricing Model), 3. Capital Budgeting and Investment Decisions, 4.

Solution. The start tread is in calculate the past value and profitability index. Entire give rate = $56,175. Less: initial outlay = $50,000. Net presented value = $6,175. Profitability Index (gross) = Present value of cash inflows / Original cash outflow. = 56,175 / 50,000. = 1.1235. Given that the profitability index (PI) is greater than 1.0 ...

The problem is that PP fails to recognize the advantage of getting $98,000 in year 1 as opposed to $99,000 in year 2. ... The answer is that it is commonly used in practice (more than 75% use IRR according to the survey mentioned in the Ch. 8). ... Capital budgeting analysis gives us a framework for analyzing the value of long-term investment ...

Capital budgeting is the process in which a business determines and evaluates potential expenses or investments that are large in nature. These expenditures and investments include projects such ...

1. The Investment Problem and Capital Budgeting 3 2. Cash Flow Estimation 13 3. Integrative Examples and Cash Flow Estimation in Practice 33 Case for Section I 47 Questions for Section I 49 Problems for Section I 51. Section II: Capital Budgeting Evaluation Techniques. 57 4. Payback and Discounted Payback Period Techniques 61 5. Net Present ...

Capital Budgeting Practice Problems And Solutions F. M. Wilkes Practical Problems In Financial Management - SBPD Publications Dr. F. C. Sharma, ,C S Rachit Mittal,2021-11-18 ... Treat capital budgeting as a problem of portfolio selection. - The framework for portfolio selection originally presented by Markowitz [10] [11] is now well-known and ...

Capital Budgeting Questions and Answers. The 60 important capital budgeting questions and answers are as follows: Question 01: What is capital budgeting? Answer: Capital budgeting is the process of finding, analyzing, and choosing investment projects with returns that are expected to last longer than one year.

Examples of Capital Budgeting Techniques. Top 5 Examples of Capital Budgeting. Example #1 (Pay Back Period) Example #2. Example #3 (Accounting Rate of Return) Example #4 (Net Present Value) Example #5. Recommended Articles.

Capital Budgeting Practice Problems And Solutions CFA Program Curriculum 2017 Level II, Volumes 1 - 6 CFA Institute.2016-08-01 Master the ... capital-budgeting-practice-problems-and-solutions 2 Downloaded from gws.ala.org on 2021-07-24 by guest Schaum's Outline of Financial Management, Third Edition Jae Shim,Joel Siegel.2007-03-23

Capital Budgeting Practice Problems And Solutions Arthur J. Keown,John D. Martin,J. William Petty Practical Problems In Financial Management - SBPD Publications Dr. F. C. Sharma, ,C S Rachit Mittal,2021-11-18 1.The Time-Value of Money , 2. Risk and Return (Including Capital Asset Pricing Model), 3. Capital Budgeting and Investment Decisions, 4.

Identify the letter of the choice that best completes the statement or answers the question. ____ 1.Sacramento Paper is considering two mutually exclusive projects. Project A has an internal rate of return. (IRR) of 12 percent, while Project B has an IRR of 14 percent. The two projects have the same risk, and.

Solutions to Practice Problem Set #8: Capital budgeting Practice Problems: Payback period is 2 years - recommend project B; y1: 18,000-10,000=8,000.....

Capital Budgeting Practice Problems And Solutions Book Review: Unveiling the Magic of Language In a digital era where connections and knowledge reign supreme, the enchanting power of language has become more apparent than ever. Its capability to stir emotions, provoke thought, and instigate transformation is truly remarkable. This

Capital Budgeting. A. Stockholm Company is considering the sale of a machine with the following characteristics. Book value P120, Remaining useful life 5 years Annual straight-line depreciation P 24, Current market value P 70,

Capital Budgeting Practice Problems And Solutions Dr. R. S. Kulshrestha, ,Rakesh Kulshrestha Practical Problems In Financial Management - SBPD Publications Dr. F. C. Sharma, ,C S Rachit Mittal,2021-11-18 1.The Time-Value of Money , 2. Risk and Return (Including Capital Asset Pricing Model), 3. Capital Budgeting and Investment Decisions, 4.

Carmen Ayuso. Download Free PDF. View PDF. Chapter 9 Capital Budgeting Techniques Solutions to Problems Note to instructor: In most problems involving the internal rate of return calculation, a financial calculator has been used. P9-1. LG 2: Payback Period Basic (a) $42,000 ÷ $7,000 = 6 years (b) The company should accept the project, since 6 < 8.

Capital Budgeting Practice Problems And Solutions F. M. Wilkes Practical Problems In Financial Management-SBPD Publications Dr. R. S. Kulshrestha, ,Rakesh ... Treat capital budgeting as a problem of portfolio selection. - The framework for portfolio selection originally presented by Markowitz [10] [11] is now well-known and widely accepted, ...

Solutions To Capital Budgeting Practice Problems Harold Bierman Practical Problems In Financial Management-SBPD Publications Dr. R. S. Kulshrestha, ,Rakesh ... Treat capital budgeting as a problem of portfolio selection. - The framework for portfolio selection originally presented by Markowitz [10] [11] is now well-known and widely accepted, ...

Solutions To Capital Budgeting Practice Problems ... Management of Working Capital Practical Problems In Financial Management - SBPD Publications Dr. F. C. Sharma, ,C S Rachit Mittal,2021-11-18 1.The Time-Value of Money , 2. Risk and Return (Including Capital Asset Pricing Model), 3. Capital Budgeting and Investment

Annual cost saving 40, Looking at present value table at discount compound discount factor for 4 years is 3 ∴ Cos of capital = 12% Calculation Net Present Value of Project N. V = Present Value of Total Cash Inflows - Cost of Project = 1,21,509 - 1,14,200 = Rs. 7, 17. XYZ Ltd., an infrastructure company is evaluating proposal to build, operate.