- What's Your Exit Number?

- Free Report

Business Strategy

M&A Management Presentation: 5 Ways to Prepare

By Jack

Selling your business is a monumental decision, and if you’ve made the decision to sell, you want to ensure you do everything in your power to maximize the value you receive.

Your management presentation can make or break a deal and is a key part of the bidding process. But what is it exactly? And how can you create a presentation that will make a prospective buyer clamor to acquire your company?

In this post, I’ll walk through everything you need to know for a successful M&A management presentation.

What is an M&A management presentation?

An M&A management presentation is a comprehensive, engaging, and persuasive pitch that provides potential buyers with an in-depth understanding of your business. It showcases your company’s strengths, opportunities, and the management team’s expertise, demonstrating why your business is an attractive acquisition target .

Why is it called a “management” presentation? Because your management team is your company’s backbone. This presentation will highlight their prowess, proving they have the skills, knowledge, and passion to drive your business to new heights.

Keep in mind some of this info will have already been created in your Confidential Information Memorandum .

Why is a management presentation critical when selling your business?

Imagine you’re a potential buyer, sifting through dozens of acquisition opportunities. What would make a business stand out ? You guessed it – a compelling management presentation! It’s not only about the numbers; it’s about telling the story of your business, emphasizing the value you’ve created and the potential that awaits.

A well-crafted management presentation:

- Sets your business apart from the competition

- Showcases your company’s unique strengths and opportunities

- Provides an opportunity for your management team to shine

- Builds credibility and trust with potential buyers

- Opens the door for productive negotiation and higher valuations

What should be included in your management presentation?

Creating a persuasive management presentation requires a delicate balance of storytelling, data analysis, and showcasing your management team’s expertise. Here are the key points to include:

- Company overview : Introduce your business, its history, vision, mission, and core values. Paint a vivid picture of your company’s unique identity and culture. Include your product / service offerings, organization structure, target customers, and geographic reach.

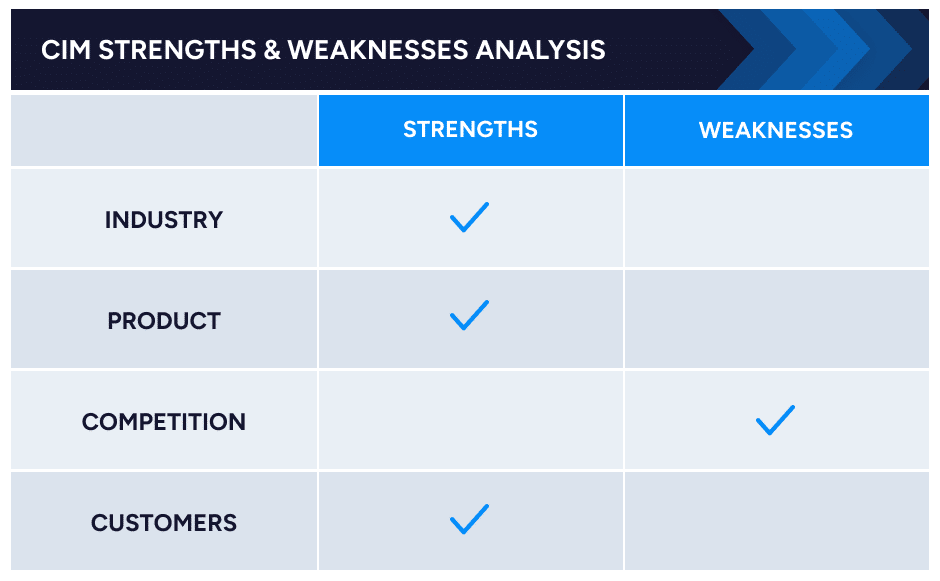

- Market and industry analysis : Demonstrate your understanding of the market, including trends, opportunities, and threats. Establish your company’s position within the industry, and outline your competitive advantages . Include a SWOT analysis to further emphasize your company’s strengths and opportunities.

- Financial performance : Present historical and projected financial information, emphasizing growth, operating expenses, profitability , and value creation. Include key performance indicators, milestones, and any other relevant financial data. Be transparent about your financial performance to build credibility.

- Operations and processes : Describe your company’s core operations, processes, and systems , showcasing their efficiency and scalability. Detail your supply chain , manufacturing capabilities, and any intellectual property or proprietary technology you possess.

- Management team : Highlight the experience, skills, and achievements of your management team, proving they have the ability to lead and grow the business. Include their background, areas of expertise, and any industry recognition or awards they have received.

- Growth strategy and opportunities: Present a clear and achievable growth strategy, detailing specific initiatives, timelines, and expected results. Include market expansion plans, new product development, or potential mergers and acquisitions.

How do you prepare for a management presentation?

The key to a successful management presentation is preparation. Here’s how to get started:

The best management presentations all have these pieces:

- Gather data and insights : Collect all relevant financial, operational, and market data to analyze and present in a compelling manner. This includes conducting thorough market research and competitive analysis to showcase your company’s position in the industry.

- Assemble your team : Involve your management team in the process, ensuring they are comfortable with the presentation’s content and can speak confidently about their areas of expertise. Encourage collaboration and open communication to create a cohesive and engaging presentation.

- Tell your story: Craft a narrative that captures your company’s unique value proposition, weaving it throughout the presentation to create a memorable and persuasive document. Use anecdotes, examples, and case studies to illustrate your points and bring your story to life.

- Design an appealing presentation: Prioritize visual appeal by using a clean and professional design, incorporating visuals like graphs, charts, and images to enhance your presentation. Keep text to a minimum, using bullet points and concise language to convey your message effectively.

- Practice, practice, practice : Conduct rehearsals with your management team to refine the presentation and ensure everyone is confident in their delivery. Encourage feedback and make any necessary adjustments to improve the overall impact of the presentation.

Biggest mistakes in management presentations

- Overloading with information : While it’s important to provide a comprehensive view of your business, avoid overwhelming potential buyers with excessive detail. Focus on the most relevant and persuasive information to keep your audience engaged.

- Neglecting storytelling : Data alone won’t win the hearts of potential buyers. Weave a compelling narrative that brings your business to life, demonstrating its unique value proposition and potential for growth.

- Underestimating the importance of visuals : A picture is worth a thousand words. Use visuals like graphs, charts, and images to enhance your presentation, making it more memorable and impactful.

- Ignoring your management team : Your management team is a key selling point. Make sure they are involved in the process, well-prepared, and ready to shine in front of potential buyers.

- Failing to address potential concerns : Anticipate the questions and concerns potential buyers may have, and address them proactively in your presentation.

Frequently asked questions

How long should a management presentation be.

Aim for 30-40 slides, striking a balance between providing comprehensive information and maintaining your audience’s attention. Remember, less is often more.

Should I customize the presentation for each potential buyer?

Absolutely! Tailoring your presentation to the interests and priorities of each potential buyer can make a significant difference in the perceived value of your business .

Consider conducting research on each buyer’s past acquisitions, investment criteria, and strategic objectives to tailor your presentation accordingly.

How can I make my presentation stand out from the competition?

Focus on storytelling, create visually engaging slides, and showcase the unique aspects of your business, such as your management team, innovative processes, or untapped growth opportunities. It should look professionally designed.

Additionally, consider incorporating multimedia elements like video testimonials, customer success stories, or product demonstrations to further engage potential buyers. If possible, I’d say an in person meeting is far preferable to a Zoom equivalent.

Should I seek professional help in creating a management presentation?

If you’re unsure about your ability to create a persuasive and comprehensive presentation, consider engaging the services of an M&A advisor, consultant, or even a professional designer to guide you through the process and ensure your presentation effectively communicates your business’s value.

When should I start preparing my management presentation?

Ideally, begin preparing your management presentation several months before you plan to engage with potential buyers. This will give you ample time to gather data at a detailed level, involve your management team, and craft a compelling narrative that showcases your business’s strengths and opportunities.

How do I handle confidential information in my management presentation?

When sharing sensitive information, it’s crucial to maintain a balance between transparency and confidentiality. Consider providing potential buyers with a high-level overview of your business, reserving more detailed confidential information for subsequent discussions or after signing a non-disclosure agreement ( NDA ).

How do I handle questions or concerns during the presentation?

Encourage an open dialogue with potential buyers and address their questions or concerns as they arise. If you don’t have an immediate answer, assure the buyer that you will follow up with the information they need.

Demonstrating your willingness to engage in conversation and address concerns can help build trust and credibility with potential buyers.

What if I have limited experience with public speaking or presenting?

If you or your management team lack experience with public speaking, consider engaging a presentation coach or enrolling in a public speaking course (like Toastmasters ) to improve your skills.

Practice is also essential – rehearse your presentation multiple times to gain confidence in your delivery and become more comfortable with the content.

How can I gauge the effectiveness of my management presentation?

To assess the effectiveness of your management presentation, consider soliciting feedback from trusted M&A advisors or colleagues.

Analyze the level of engagement, interest, and questions from potential buyers during and after your presentation to identify areas that may need improvement or further clarification.

As we wrap, remember that a well-prepared and persuasive management meeting can be the key to unlocking the true value of your business when it’s time to sell.

By showcasing your company’s strengths, opportunities, and the expertise of your management team, you’ll be well on your way to securing the best possible outcome during the final bidding process.

Now, it’s time to tell your company’s story and make potential buyers believe in your vision.

Investor & Mentor

related posts:

SDE vs. EBITDA Adjustments: What Business Owners Should Know

Private sale vs. auction sale: what business owners should know, asset sale vs. share sale: what business owners should know, get in touch.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

- ASEAN Forum

- Digital Agenda

- E-Invoicing

- Alle Kolumnen

- Altersvorsorge

- Antitrust Law

- Artikelserie im OMV Fokus

- Assurance & IT in der Gesundheits- und Sozialwirtschaft

- Aufsichtsrecht

- Außenwirtschaft und Zoll

- BilRUG und weitere Reformen

- International Expert Roundtable

From the Newsletter

- M&A Dialogue

Markus Müller

Associate Partner

Send inquiry

How we can help

Transaction advisory | Mergers & Acquisitions

Experts explain

- Legal notice

- EU representative for data privacy

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in a Confidential Information Memorandum (CIM)?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Do you need strong writing skills to succeed in finance?

Not necessarily, but they certainly help.

But you definitely need strong reading comprehension skills , or you’ll miss crucial information and make the wrong decisions as a result.

Both of these skills intersect in the confidential information memorandum (CIM) that investment banks prepare for clients – the same CIM that you’ll be spending a lot of time reading in private equity, corporate development, and other buy-side roles.

There is surprisingly little information out there on what goes into a CIM, and there’s a lot of confusion over how you write one and how you read and interpret a CIM.

So here’s the full run-down, from how they are used in investment banking to private equity and beyond – along with a bunch of real-life CIMs:

What is a CIM?

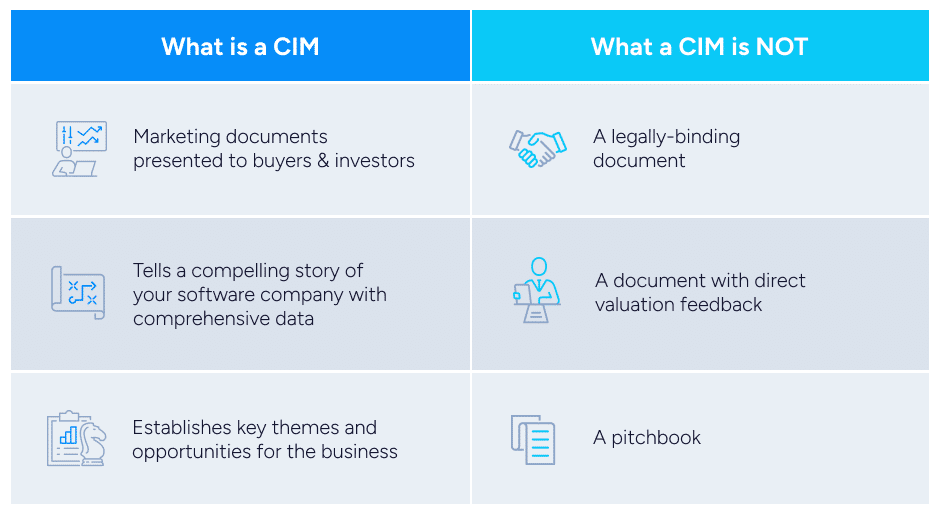

The Confidential Information Memorandum is part of the sell-side M&A process at investment banks . It’s also known as the Offering Memorandum (OM) and Information Memorandum (IM), among other names.

At the beginning of any sell-side M&A process, you’ll gather information on your client (the company that has hired you to sell it), including its products and services, financials, and market.

You turn this information into many documents, including a shorter, 5-10 page “Executive Summary” or “Teaser,” and then a more in-depth, 50+ page “Confidential Information Memorandum.”

You start by sending the Teaser to potential buyers; if someone expresses interest, you’ll have the firm sign an NDA, and then you’ll send more detailed information about your client, including the CIM.

You can write CIMs for debt deals, as well as for distressed M&A and restructuring deals where your bank is advising the debtor .

You might write a short memo for equity deals , but not an entire CIM.

The Order and Contents of a Confidential Information Memorandum

The structure of a CIM varies by firm and group, but it usually contains these sections:

1) Overview and Key Investment Highlights

2) Products and Services

4) Sales & Marketing

5) Management Team

6) Financial Results and Projections

7) Risk Factors (Sometimes omitted)

8) Appendices

Debt-related CIMs will include the proposed terms – interest rates, interest rate floors, maturity, covenants, etc. – and details on how the company plans to use the funding.

What a Confidential Information Memorandum is NOT

First and foremost, a CIM is NOT a legally binding contract.

It is a marketing document intended to make a company look as shiny as possible.

Bankers apply copious makeup to companies, and they can make even the ugliest duckling look like a perfectly shaped swan .

But it’s up to you to go beneath the dress and see what it looks like without the makeup and the plastic surgery.

Second, there is also nothing on valuation in the CIM.

Investment banks don’t want to “set the price” at this stage of the process – they would rather let potential buyers place bids and see where they come in.

Finally, a CIM is NOT a pitch book . Here’s the difference:

Pitch Book : “Hey, if you hire us to sell your company, we could get a great price for you!”

CIM: “You’ve hired us. We’re now in the process of selling your company. Here’s how we’re pitching it to potential buyers and getting you a good price.”

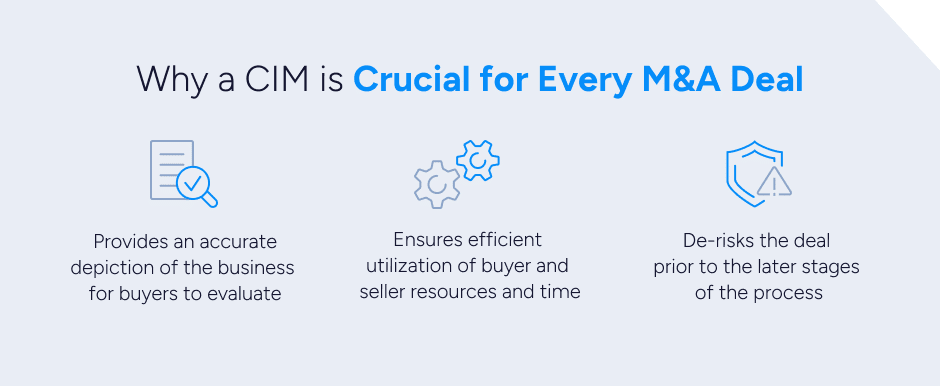

Why Do CIMs Matter in Investment Banking?

You will spend a lot of time writing CIMs as an analyst or associate in investment banking.

And in buy-side roles, you will spend a lot of time reading CIMs and deciding which opportunities are worth pursuing.

People like to obsess over modeling skills and technical wizardry, but in most finance roles you spend FAR more time on administrative tasks such as writing CIMs (or reading and interpreting CIMs).

In investment banking, you might start marketing your client without creating a complex model first (Why bother if no one wants to buy the company?).

And in buy-side roles, you might look at thousands of potential deals but reject 99% of them early on because they don’t meet your investment criteria, or because the math doesn’t work .

You spend a lot of time reviewing documents and comparatively less time on in-depth modeling until the deal advances quite far.

So you must be familiar with CIMs if your job involves pitching or evaluating deals.

Show Me the Confidential Information Memorandum Example!

To give you a sense of what a CIM looks like, I’m sharing six (6) samples, along with a CIM template and checklist:

- Consolidated Utility Services – Sell-Side M&A Deal

- American Casino – Sell-Side M&A Deal

- BarWash (Fake company) – Sell-Side M&A Deal

- Alcatel-Lucent – Debt Deal

- Arion Banki hf (Icelandic bank) – Debt Deal

- Pizza Hut – Debt Deal

- Sample Deal – CIM Template

- Information Memorandum Checklist

To find more examples, Google “confidential information memorandum” or “offering memorandum” or “CIM” plus the company name, industry name, or geography you are seeking.

Picking an Example CIM to Analyze

To illustrate how you might write a CIM as a banker and how you might interpret a CIM in buy-side roles, let’s take a look at the one above for Consolidated Utility Services (CUS) .

This one has the standard sections, though it omits the Risk Factors and Appendices, resulting in a somewhat shorter (!) length of 58 pages.

This CIM is ancient, so I feel comfortable sharing it and explaining how I would evaluate the company.

CIM Investment Banking: How Do You Create Them?

This CIM creation process is quite tedious for bankers because it consists of a lot of copying and pasting from other sources .

You’ll spend 90% of your “thinking time” on just two sections: the Executive Summary / Investment Highlights in the beginning and the Financial Performance part toward the end.

You may do additional research on the industry and the company’s competitors, but you’ll get much of this information from your client; if you’re working at a large bank, you can also ask someone to pull up IDC or Gartner reports.

Similarly, you won’t write much original content on the company’s products and services or its management team: you get these details from other sources and then tweak them in your document.

The Executive Summary section takes time and energy because you need to think about how to position the company to potential buyers.

You attempt to demonstrate the following points:

- The company’s best days lie ahead of it. There are strong growth opportunities, plenty of ways to improve the business, and right now is the best time to acquire the company.

- The company’s sales are growing at a reasonable clip (an average annual growth rate of at least 5-10%), its EBITDA margins are decent (10-20%), and it has relatively low CapEx and Working Capital requirements, resulting in substantial Free Cash Flow generation and EBITDA to FCF conversion.

- The company is a leader in a fast-growing market and has clear advantages over its competitors. There are high switching costs, network effects, or other “moat” factors that make the company’s business defensible.

- It has an experienced management team that can sail the ship through stormy waters and turn things around before an iceberg strikes.

- There are only small risks associated with the company – a diversified customer base, high recurring revenue, long-term contracts, and so on, all demonstrate this point.

If you turn to “Transaction Considerations” on page 10, you can see these points in action:

“Top-Performing, Geographically Diverse Industry Leader” means “less risk” – hopefully.

Then the bank lists the industry’s attractive growth rates, the company’s blue-chip customers (even lower risk), and its growth opportunities, all in pursuit of the five points above.

The “Financial Performance” Section of the CIM

The “Financial Performance” section also takes up a lot of time because you have to “dress up” a company’s financial statements… without outright lying.

So it’s not as easy as pasting in the company’s historical financial statements and then making simple projections – think “reasonable spin.”

Here are a few examples of “spin” in this CIM:

- Only Two Years of Historical Statements – You normally like to see at least 3-5 years’ worth of performance, so perhaps the bankers showed only two years because the growth rates or margins were lower in the past, or because of acquisitions or divestitures.

- Recurring Revenue / Contract Spin – The bankers repeatedly point to the high renewal rates, but if you look at the details, you’ll see that a good percentage of these contracts were won via “competitive bidding processes,” i.e. the revenue was by no means locked in. They also spin the lost customers in a positive way by claiming that many of those lost accounts were unprofitable.

- Flat EBITDA and Adjusted EBITDA Spin – EBITDA stayed the same at $6.9 million in the past two historical years, but the bankers spin this by saying that it remained “stable” despite significantly higher fuel costs… glossing over the fact that revenue increased by 8%. Figures like “Adjusted EBITDA” also lend themselves to spin since the adjustments are discretionary and are chosen to make a company look better.

- Highly Optimistic Projected Financials – They’re expecting revenue to grow by 7.5% each year, and EBITDA to increase from $8.3 million to $12.6 million over the next five years – despite no EBITDA growth in the last historical year.

As a banker, your job is to create this spin and portray the company favorably without going overboard.

Does Any of This Make a Difference?

Yes and no.

Buyers will always do their due diligence and confirm or refute everything in the CIM before acquiring the company.

But the way bankers position the company makes a difference in terms of which buyers are interested and how far they advance in the process.

Just as with M&A deals, bankers tend to add more value in unusual situations – divestitures, distressed/turnaround deals, sales of family-owned private businesses, and so on.

Example: In a sell-side divestiture deal, the subsidiary being sold is always dependent on the parent company to some extent.

But in the CIM, bankers have to take care with how they describe the subsidiary.

If they say, “It could easily stand on its own, no problem!” then more private equity buyers might show an interest in the deal and submit bids.

But if the PE firms find out that the bankers were exaggerating, they might drop out of the process very quickly.

On the other hand, if the bankers say that it will take significant resources to turn the subsidiary into an independent company, the deal might never happen due to a lack of interest from potential buyers .

So it’s a careful balancing act between hyping up the company and admitting its flaws.

How Do You Read and Interpret the Confidential Information Memorandum in Private Equity and Other Buy-Side Roles?

You will receive A LOT of CIMs in most private equity roles, especially at middle-market and smaller funds.

So you need a way to skim them and make a decision in 10-15 minutes about whether to reject the company upfront or keep reading.

I would recommend these steps:

- Read the first few pages of the Executive Summary to learn what the company does, how big it is in terms of sales, EBITDA, cash flow, etc., and understand its industry. You might be able to reject the company right away if it doesn’t meet your investment criteria.

- Then, skip to the financials at the end . Look at the company’s revenue growth, EBITDA margins, CapEx and Working Capital requirements, and how closely FCF tracks with EBITDA. The financial projections tend to be highly optimistic, so if the math doesn’t work with these numbers, chances are it will never work in real life.

- If the deal math seems plausible, skip to the market/industry overview section and look at the industry growth rates, the company’s competitors, and what this company’s USP (unique selling proposition) Why do customers pick this company over competitors? Does it compete on service, features, specializations, price, or something else?

- If everything so far has checked out, then you can start reading about the management team, the customer base, the suppliers, and the actual products and services. If you make it to this step, you might spend anywhere from one hour to several hours reading those sections of the CIM.

Applying the Analysis in Real Life

Here’s you might apply these steps to this memo for a quick analysis of CUS:

First Few Pages: It’s a utility services company with around $57 million in revenue and $9 million in EBITDA; the asking price is likely between $75 million and $100 million with those stats, though you’d need to look at comparable company analysis to be sure.

There has been solid revenue and EBITDA growth historically, but the company was formed via a combination of smaller companies so it’s hard to separate organic vs. inorganic growth.

At this point, you might be able to reject the company based on your firm’s investment criteria: for example, if you only look at companies with at least $100 million in revenue, or you do not invest in the services sector, or you do not invest in “roll-ups,” you would stop reading the CIM.

There are no real red flags yet, but it does seem like customers are price-sensitive (“…price is generally one of the most important factors to the customer”), which tends to be a negative sign.

Financials at the End: You can skip to page 58 now because if the deal math doesn’t work with management’s highly optimistic numbers, it definitely won’t work with realistic numbers.

Let’s say your fund targets a 5-year IRR of 20% and expects to use a 5x leverage ratio for deals in this size range.

The company is already levered at ~2x Debt / EBITDA, so you can only add 3x Debt / EBITDA.

If you do the rough math for this scenario and assume a $75 million purchase price:

A $75 million purchase enterprise value represents a ~9x EV / EBITDA multiple, with 3x of additional debt and 2x for existing debt, which implies an equity contribution of 4x EBITDA (~$33 million).

If you re-sell the company in five years for the same 9x EBITDA multiple, that’s an Enterprise Value of ~$113 million (9x * $12.6 million)… but how much debt will need to be repaid at that point?

To answer that, we need the company’s Free Cash Flow projections… which are not shown anywhere.

However, we can estimate its Free Cash Flow with Net Income + D&A – CapEx and then assume the working capital requirements are low (i.e., that the Change in Working Capital as a percentage of the Change in Revenue is relatively low).

If you do that, you’ll get figures of $3.9, $3.6, $3.8, $4.5, and $5.1 million from 2007 through 2011, which adds up to $21 million of cumulative FCF.

But remember that the interest expense will be significantly higher with 5x leverage rather than 2x leverage, so we should probably reduce the sum of the cumulative FCFs to $10-$15 million to account for that.

Initially, the company will have around $42 million in debt.

By Year 5, it will have repaid $10-15 million of that debt with its cumulative FCF generation. We’ll split the difference and call it $12.5 million.

At a 9x EV / EBITDA exit multiple, the PE firm gets proceeds of $113 million – ($42 million – $12.5 million), or ~$84 million, upon exit, which equates to a 5-year IRR of 20% and a 2.5x cash-on-cash multiple.

I would reject the company at this point.

- Even with optimistic assumptions – the same EBITDA exit multiple and revenue and EBITDA growth above historical numbers – the IRR looks to be around 20%, which is just barely within your firm’s desired range. And with a lower exit multiple or more moderate growth, the IRR drops below 20%.

- The EBITDA growth looks fine, but FCF generation is weak due to the company’s relatively high CapEx, which limits debt repayment capacity.

- It seems like the company doesn’t have much pricing power, since quite a few contracts were renewed via a “competitive bid cycle process.” Low pricing power means it will be harder to maintain or improve margins.

On the other hand, you might look at this document and interpret it completely differently.

The numbers don’t seem spectacular for a standalone investment, but this company could represent an excellent “roll-up” opportunity because there are tons of smaller companies offering similar utility services in different regions (see “Pursue Additional Add-on Acquisitions” on page 14) (for more, see our tutorial to bolt-on acquisitions ).

So if your firm focuses on roll-ups, then perhaps this deal would look more compelling.

And then you would read the rest of the confidential information memorandum, including the sections on the industry, competitors, management team, and more.

You would also do a lot of research on how many smaller competitors could be acquired, and how much it would cost to do so.

These examples should give you a flavor of what to expect when you write a confidential information memorandum in investment banking, or when you read and interpret CIMs in private equity.

I’m not going to say, “Now write a 100-page CIM for practice!” because I don’t think such an exercise is helpful – at least, not unless you want to practice the Ctrl + C and Ctrl + V commands.

So here’s what I’ll recommend instead:

- Pick an example CIM from the list above, or Google your way into a CIM for a different company.

- Then, look at the Executive Summary and Financial Performance sections and find the 5-10 key areas where the bankers have “dressed up the company” and spun it in a positive light.

- Finally, pretend you’re at a private equity firm and follow the decision-making process I outlined above. Take 20 minutes to scan the document and either reject the company or keep reading the CIM.

Bonus points if you can locate typos, grammatical errors, or other attention-to-detail failures in the memo you pick.

Any questions?

You might be interested in a detailed tutorial on investment banking PowerPoint shortcuts .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

45 thoughts on “ What’s in a Confidential Information Memorandum (CIM)? ”

Hi Brian. I notice that the Debt IMs barely have any financial forecasts/projections (the vast majority of financials are historical), while all the M&A ones have them. Perhaps it reflects the fact that M&A involves much more modeling than DCM, isn’t it?

I don’t really think that’s it. The style of debt IMs is just different, and while DCM has far less modeling work than M&A, that’s mostly because DCM is a markets role that mostly consists of updating slides and interacting with other groups at the bank. There may be some requirement that debt IMs do not show projections as well (not sure about that).

Great article.

I’m in the process of applying to PE and LevFin/Credit firms (Ireland).

I was informed that the final recruitment stage in these often includes a CIM analysis.

I was wondering how would you alter the analysis steps that you outlined above for a LevFin/Credit firm? I’m assuming it would be quite different since you’re looking much more at the chances of the company surviving if you leverage it up.

Focus more on the downside and extreme downside cases and see if the company can survive even if revenue drops by 50%+, or some other very high level. The base and upside cases don’t really matter because there’s no additional benefit to creditors in those.

Hey Brian, great article as always- I really appreciate it.

Do you happen to have access to other old CIMs you could link? Thanks!

Everything we have is linked to here.

OMG this website, and the articles are great! Concrete and detailed:)

Thanks for reading!

FYI: Was interested in your free 57 pager, but the link is not working for me even after inputting my name, valid email address and checking the box..others may be experiencing a similar problem, just a heads-up, cheers.

I am not sure about that one – the link seemed to work when I just tried it. You can email us to download it if the form is still not working.

The Article was very helpful. Thanks for putting it up. I am a CPA from India and trying my hand at a very small equity cum debt infusion in a company. Thanks once again.

For the assumption of 75-100 mil, how do we know if the assumption makes sense or not. Is there a reference range for that if we are given different revenue or EBITDA figures?

Just our own estimate based on average multiples in the sector.

Great article. However just wanted to make a small correction. At the end you used $21 million of FCF generated over 5 years to pay down $12.5 million of debt, which is fine, but you didn’t add the remaining FCF of $8.5 million in calculation of the ending equity value. The Ending Equity will then be $113mn – ($42.5 mn – $12.5mn) + $8.5mn = $91.5mn instead of the mentioned $84mn. This would bump up the multiple to 2.77x and IRR of 23%. Your point still stands though.

Thank you so much Brian for this article.

I have learned a lot about investment banking from your articles.

I would urge you to please share one more video for writing an industry report/power point presentation skills on how to create the attractive diagrams (However, I have seen two of your videos on ppt skills).

Also is there any video/article on competitive benchmarking, trading & transaction comps and market sizing.

Once again thank you so much for your contribution towards learning.

We have a full course on PowerPoint if you want to learn more. Our modeling courses cover some of the other topics. Beyond that, we may create more YouTube videos, but there is only so much we’ll give away for free (why would anyone ever sign up for the paid courses if we just gave away everything?).

Thanks so much Brian. You are very generous and humble.

Hello Brian: I’m in greater Boston (to the south) I’m currently seeking assistance creating a CIM for a low-end mid-market business, very well-established and growing fast, 2016 revenue $15.5MM, 2017 ~$20MM. Ideally, I want to have some actual interaction with the person. Can you suggest the best way to find such a person. I’m seeking to find a person with talent who reads stuff your for enjoyment. Thank you kindly. W,

We do not advise on the creation of CIMs. I would recommend contacting boutique banks in your area and requesting the services of one who creates CIMs for small businesses.

Hi Warren, feel free to touch base with me at MidCap Advisors. I’d be happy to help any way I can.

Thanks Brian, another great insider perspective on the important financial documents – as a marketer helping clients to sell deals or launch new offerings it’s been hard making sense of some of the investment terminology – your site has been a big help, and I’ve just signed up for the powerpoint course which looks fantastic – again I used powerpoint all day but mostly for webinars and video presentations, so getting the more formal and structured elements right for a pitch deck was something I needed some expert insight on and I came to the right place. Great work!

Thanks for signing up!

From buyside’s perspective, what’s a relatively low CapEx and Working Capital requirements that’s good for possible investment? Does it depend on the industry? If so, what are those numbers for various industries?

Also when you mentioned watch “how closely FCF tracks with EBITDA” what do you mean by that? Can you show an example?

Your questions are beyond the scope of what we can answer here, but, broadly speaking, lower capital requirements are better because they make the company’s cash flow higher, meaning it can pay off more debt and generate more cash. The exact numbers differ greatly based on industry and company stage. If FCF follows EBITDA closely it’s easier to estimate the investment returns because you can use EBITDA as a proxy for debt pay-down/cash generation.

Would you advise to write the Executive Summary of the CIM as early as possible or would you wait until all sections of the CIM are covered to extract the Exec Summary?

Write a draft of the summary section, then the rest of the CIM, and then come back and revise the summary.

Being a former banker and a recent PE joinee, this hits bang on the spot. Brings back my memories of the CIM prep (we generally refer to it as IM in India) with other fellow associates, sitting late into the night, chatting, fighting (even on points like font sizes) and positioning the company, taking pride in our work till the next day the VP turns and asks to completely re-draft the whole thing.. to the stage where it satisfies the VP.. but the Partner then turning back and requesting you to again change the IM with the final version resembling close to the one that you had originally prepared. Man.. those were the days..

Thanks! Yes, CIM prep is always fun… until you find out you have to re-do the whole thing, and then re-do it again when someone else gets pissed off. And then you realize it doesn’t matter since no one reads it anyway.

What documents are significant for IB/PE/Corp Dev?

CIMs, Pitch Books, Letters of Intents, Definitive Agreements, Business Plans, Term Sheets, Private Placement Memos, Prospectus, Credit Memos, etc…?

Did I leave out anything?

Those are the main ones. Management Presentations are also important (condensed and more visual/impactful version of a CIM that’s intended for management teams to use when pitching their company).

Brian, great article with valuable Information. Yep all-niters are not very uncommon when drafting CIMs and the work with the right version is even more challenging (with a lot of remarks). Back in my days when I started in IB word was the dominating source for making CIMs, in recent years it has shifted to ppt (at least in Europe).

Thanks! Yes, it seems like PowerPoint is more common for CIMs in Europe. Not sure why – maybe just higher design standards?

Guess that would be one of the reasons.

Also, IMO, i guess that PPT features such as headers and the possibility to split extensive topics in more slides (still following the same rationale, of course) make the reading so much easier than in MS Word…guess that a more dynamic and straight to the point CIM is always the best option when you’re looking for a specific data

Great text, btw

Great post as always Brian! I have followed the site since I first entered university 3 years ago. Very valuable source of information! It contributed greatly to me breaking into IB as an M&A Associate. And with the stuff I read now becomes one I practice..having a Déjà vu reading this.

Thank you for your generosity in sharing these information Brian, keep up the good work.

Thanks, glad to hear it! Yes, after a while you start dreaming about CIMs..

Funny to notice that all CIMs are in word format. Correct me if I’m wrong, but I think this is more common in the US. In my short 1 year experience in Europe (London), I’ve only seen CIMs on powerpoint. Have to agree with KG, in ppt you can make more visually appealing and especially spend less time on wording and rephrasing.

Great article again, learning lots of stuff reading M&I as a student and still now as an analyst!

Thanks! Yes, you’re right that CIMs in Word format are more common in the US. But even in other countries, Word is still quite common (see the example above fore that bank in Iceland). PowerPoint-formatted CIMs do likely take up a greater percentage of the total, though.

It’s interesting how CIMs in the U.S. seem dull, and are rather ugly. In Canada, IPO CIMs in particular, are rather slim and colourful, and make us push the boundaries of what you can achieve with PowerPoint and Excel charts. They are mostly targeted at retail and HNW financial advisors with short attention spans, but, by law, they can’t state anything that is not in the prospectus.

I can think of 2-3 bulge bracket banks that take good care in making these marketing documents appealing, and in some groups at my bank, they have become bona fide masterpieces in Microsoft Office graphic design and the ability to distill the essence of entire paragraphs of information into single bullet points.

Since I started making them I realized that obsessing over presentation and clarity in writing my own resume was perfect training for this type of work, and that investors and/or their advisors look at new deals similarly to how recruiters look at resumes.

Yup that is true, but I think you pinpointed the reason why right there: IPOs are often aimed at retail and HNW advisers, not private equity firms or corporate development teams at Fortune 500 companies. So inevitably there will be more attention-grabbing features and the design will look better.

Also, for IPOs often the nitty-gritty details matter a bit less because no one is buying 100% of the company… so there may be more focus on the design instead of detailed financial analysis.

Thanks for pointing this out – I’ve been surprised at how boring these are because it seems like an easy place to differentiate and get attention – although obviously you need to be taken seriously too. Can you point to some example Canadian CIMs to compare KG?

Great read. Keep it going

This is a great read. As a a former IB guy, this hits so close to home I am getting flashbacks to the CIM drafting sessions I had for the deals I worked on (for deals closes and those that stalled out). Would recommend other people interested in going into the field to read this article (or even exiting the field to buyside)….

Thanks! Glad to hear it. Yes, late-night CIM sessions are always a good time…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Perfect Your PowerPoint Skills

The BIWS PowerPoint Pro course gives you everything you need to complete pitch books and presentations in half the time and move straight to the front of the "top tier bonus" line.

[email protected]

How to Prepare an M&A Management Presentation

Merger and acquisition (M&A) management presentations provide critical pieces of information to prospective investors who are considering either investing or buying your SaaS business and or SaaS product. Depending on the size of the potential deal, a SaaS company may engage an investment bank to help put this together, or it may lay solely on the shoulders of a founder. In any event, creating an M&A management presentation that paints a SaaS business in the best possible light is a heavy lift for everyone involved.

The article will review the role of M&A management presentations and its key elements, such as financial information, value proposition, crafting an engaging narrative, and ways to build trust with potential investors and buyers.

The Role of Management Presentations

Management presentations are essential components of the M&A process, giving potential investors and buyers a chance to hear from management and get insights into a company’s current performance, future plans, and projected performance. The management presentation will typically be the first step in a potential M&A transaction and is commonly called a Confidential Information Memorandum (CIM). The idea is to give prospective investors and buyers enough detail to allow them to determine if the SaaS business or product is something they may be interested in.

By presenting an informative and well-prepared management presentation, a SaaS business helps create trust and credibility with prospective bidders, which will benefit the eventual deal to be negotiated.

Key Elements in a Successful Presentation

M&A management presentations will commonly include the following information, but not limited to:

- Overview of the SaaS company and market

- Current strategy and opportunities for growth

- Current SaaS products and services

- Leadership team and organization structure

- Past financial performance, forecast and SaaS specific metrics.

While each section of the management presentation is important and serves a purpose, it goes without saying it will be of keen interest to all potential investors or buyers.

Preparing Your Financial Information

Even the most seasoned SaaS may not have their bookkeeping and financial records up to date. Well before a SaaS is considering selling, an effort should be made to clean up its financial house. With the financial house in order with prepared financial statements, a SaaS business can focus on the most important part of the M&A process, getting the best bid and sale price possible.

Historical Financial Performance

Potential investors and buyers need to see how well a SaaS business has financially performed in the past and how the financial performance is trending. This information should be provided in an easy-to-consume fashion in the management presentation; however, this information will be pulled from prior period financial statements. Common financial statement ratios such as liquidity and leverage ratios will provide greater insight into the financial performance of the company. SaaS businesses should also consider including SaaS-specific metrics such as the Rule of 40 and SaaS Magic Number . These industry-specific metrics provide valuable insight into the SaaS business and allow prospective investors or buyers to be able to compare the results with industry peers.

Creating a Comprehensive Forecast

It’s critical to include thorough forecasts in the management presentation, which should be taken from a very detailed and accurate financial model that is typically created and managed in Microsoft Excel. This comprehensive forecast needs to include forecasted revenue by product line with assumptions about customer churn rates , upsells and cross-sells , etc., along with Cost of Goods Sold (COGS) and OpEx/overhead expenses such as General and administrative (G&A)

Showcasing Your Company’s Unique Value Proposition

In an M&A management presentation, it is critical to articulate the company’s distinct value and show prospective investors why they should be interested in either investing or buying the business.

Identifying the Competitive Advantage

Identifying what sets the SaaS business or product apart from others in the industry helps reinforce the company’s unique value proposition. To identify and showcase this competitive advantage, the management presentation should clearly state where the business stands in the market, customer demographics, and how it prices products or services offered compared with rival firms.

Crafting a Compelling Narrative

For a management presentation to be successful, it is essential for its overall narrative to be informative and captivating. To achieve this goal and create an impact on potential buyers, both intellectually and emotionally, management can voice over certain slides and information with storytelling techniques in combination with visual aids. This may include a short story on how the SaaS received recognition or awards for providing excellent customer service.

In order to craft memorable presentations that influence investors, we will explore different ways of narrating stories along with illustrating the importance of visuals/designs in M&A management presentations.

Storytelling Techniques

The importance of using storytelling tools, such as metaphors and anecdotes, in management presentations should not be underestimated. These techniques can help simplify concepts for potential buyers and help create an emotional impact whereby the information and presentation will be more easily remembered.

Visual Aids and Design

When creating a management presentation for investors, incorporating visual aids and professional design elements can be beneficial. These could include charts, graphs, diagrams, photographs, or videos to help communicate complex concepts and information more effectively. They may also emphasize important points while captivating the audience’s attention at an in-person meeting. For optimal results, it is key to maintain simplicity and clarity when utilizing these visual aids, such as using easy-to-read and consistent fonts.

Building Trust and Credibility

Successful M&A management presentations must help establish trust and credibility with prospective buyers. To help achieve this aim, when delivering a presentation, it is important to address any known reservations or doubts held by potential investors and how the business believes these apprehensions can be remedied. By addressing this head-on, the business will convey assurance these concerns can be addressed and continue to build trust through openness and transparency.

Demonstrating Integrity and Commitment

Another effective method to demonstrate integrity and commitment is through the emphasis on ethical and integrity-based practices. Revealing that management is reliable, moral, faithful, and committed continues to build trust with prospective investors or buyers. Now, this wouldn’t typically be a slide that says the business has these values but rather shown through the review of the management presentation. This may include not using confusing notes to financial or other information presented that clouds the information provided, using realistic forecast assumptions such as growth estimates, and being able to answer questions directly and succinctly.

To create a successful M&A management presentation that stands out to potential buyers and investors, careful planning, drafting, and review are essential. A thorough understanding of the company’s financials is required, as well as an appealing value proposition and narrative. Lastly, demonstrating trustworthiness is essential to make any potential transaction as smooth as possible, and to create an environment where investors and buyers can confidently bid for the SaaS business – ideally, at the higher end of internal valuations.

Frequently Asked Questions

What is a management presentation in m&a.

An M&A management presentation is where the sell side presents relevant high-level information to potential investors and buyers, the buy side. The presentation answers commonly asked questions and portrays the business in the best possible light.

What are some storytelling techniques that can enhance my management presentation?

Employing analogies, similes, metaphors, and stories can assist in rendering a complex management presentation easier for the audience to comprehend and relate to. It also helps make it more accessible by providing relatable comparisons.

How can I address concerns and doubts during the M&A management presentation?

For the management presentation, it is essential to demonstrate openness and truthfulness while providing current and accurate information.

Access average EBITDA and revenue purchase multiples for private middle market companies across 11 industries. Learn More.

What is a cim.

- Mergers & Acquisitions

- Aerospace, Defense, Government & Security

- Building Products & Construction Services

- Business Services

- Education & Training

- Energy, Power & Infrastructure

- FinTech & Financial Services

- Industrial Technology

- Industrials

- Technology, Media & Telecom

- Transportation & Logistics

What is a CIM and how is it used in the Mergers and Acquisitions (M&A) Process?

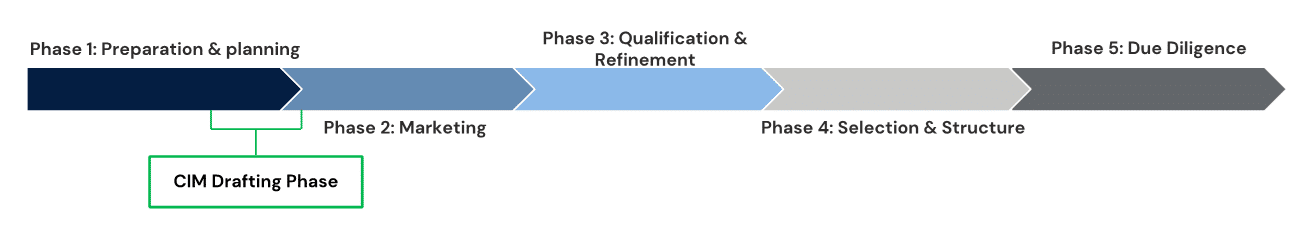

If you’re considering a sale of your business, it’s helpful to first understand the merger and acquisition (M&A) process and how an investment bank can help you navigate through the complicated buyer universe. One essential document in this process is the Confidential Information Memorandum (CIM) or increasingly a Confidential Information Presentation (CIP). For background on the M&A process and where the CIM falls on the deal timeline, check out this article: Step-by-Step Guide to the M&A Process .

Simply put, a CIM is a comprehensive presentation that serves as a marketing document during an M&A process . It is crafted by your advisor, in close conjunction with you and your management team, and outlines nearly everything a potential buyer would need to know before submitting an initial offer. In summary, the CIM should answer the question: “Why should a buyer be interested in your company?”

CIM Preparation as Part of the M&A Process

Source: Capstone Partners Research

Who creates the cim.

Creating a thoughtful, well-organized, and detailed CIM is a critical element of a successful sell-side effort. While time-consuming to create, the CIM engages and educates buyers and limits the need for detailed, individual discussions at the beginning of the process. A trusted M&A advisor with industry experience can be a significant asset and can help streamline the CIM writing process. Part of the investment banker’s role is to be in tune with the unique subsector trends of your business. The deal team can make or break a transaction in many cases, so you’ll want to surround yourself with experts that have a successful track record in your sector.

Part due diligence document, and part marketing collateral, the CIM is central to positioning the client for maximum market receptiveness. John Ferrara Founder & President, Capstone Partners

Why are CIM’s Important?

Your advisor will know how to optimally position your company to drive up the valuation through experience and knowledge of the buyer universe. Additionally, a veteran banker has the skills to effectively market your business to their vast network of qualified buyers in the space, further increasing your chances of receiving a competitive offer through a bidding war.

The investment banker prepares the CIM not just to sell, but to maximize value for their client by generating qualified interest from as many potential buyers as possible. An offer is only valuable if it comes from a buyer who truly understands your business and is willing to close on their proposed terms. A comprehensive CIM ensures that the buyer understands everything from the relevant experience of the management team, the company’s business model, the product or service differentiation, and the competitive dynamics of the sector. In addition to the granular detail and financial data that appears in a CIM, it also depicts the growth story of the company. The presentation provides details on the company’s history and ongoing initiatives.

What is Included in a CIM?

Every CIM is uniquely tailored to the unique differentiators that make the company a valuable and attractive asset. The CIM is custom-built to highlight the strengths and growth opportunities for the company. That said, there are a few common elements of a CIM that will help provide an all-encompassing presentation to effectively market your company:

- Executive Summary: Similar to an executive summary in a financial statement, this section provides a high-level sample of what’s to come. The executive summary includes the transaction overview, which showcases the target company’s transaction goals, management’s forward-looking plans, and most importantly the rationale for selling.

- Key Investment Considerations: The key investment considerations outline the unique aspects of a business that a potential buyer would find attractive and how it differentiates from the competition. This section will provide five-to-ten leading characteristics of the target company and will depend solely on the individual company and the industry they operate in. This should be thought of as the positioning portion of the CIM.

- Growth Opportunities: This section communicates major growth opportunities including expanding online presence, geographical expansion, or potential M&A opportunities. These points are derived from management’s input and depend on the individual company’s trajectory and should typically generate the most excitement (and scrutiny) from potential buyers.

- Company Overview: This section provides an opportunity to tell the story of the target company. In addition to the firm’s history, it offers specific details such as the company’s timeline, product differentiation, value-added capabilities, marketing strategy, and an introduction to the management team.

- Industry Overview: The industry overview provides a holistic view of the target company’s industry and highlights the size of the addressable market, industry growth trends, and competitive dynamics. Ideally, this section demonstrates that the industry is profitable and is forecast for substantial growth in the coming years.

- Financial Overview: The final section serves three main purposes:

- To provide the target company’s historical financials which demonstrates the financial health of the company and is presented using Generally Accepted Accounting Principles (GAAP).

- To provide a future forecast, ideally a five-year plan.

- To detail key performance indicators (KPIs) such as an adjusted EBITDA that the business is measured against.

Keep in mind that some sellers will choose to hire an outside financial consultancy firm, such as our Financial Advisory Services (FAS) Group , to make sure all financial statements are in order before they are publicly presented. This is often referred to as a sell-side quality of earnings (QoE) report which can serve as an impactful supplement to a CIM.

Planning Ahead

Although the majority of the workload for a CIM falls on the shoulders of the deal team, it’s important to be ready to fill in the gaps with information specific to your company. Making sure all the information is uploaded to a Data room, a file-sharing software, so that it is readily available for your advisors will save time and headache. Taking these steps earlier rather than later, will not only lead to a more complete CIM, but an expedited M&A process. By combining your personal experience as a business owner with your advisor’s knowledge of the buyer universe, you will be able to create a one-of-a-kind CIM for the buyers and achieve uncommon results.

Related Insights

Packaging market update – may 2024, construction services market update – may 2024.

- Construction Professional Services

Pest Control Market Update – May 2024

- Home & Garden

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.

Write a Winning M&A Management Presentation

February 13, 2023

Are you looking for a new owner, scale-up funding or new financing for your business? If so, you need to invest in creating the best M&A management presentation your prospective investor has seen.

Really effective management presentations are like great cvs. they won’t get you the job, but they make the right impression to get you through the door, into the board room and onto the agenda . great management presentations do this by making your audience want to find out more., every management team and business is different. that means there’s no simple template or formula that you can copy for your management presentation. don’t believe people who tell you there is.

We’ve pulled these seven tips from the 15+ years’ experience of the team at Benjamin Ball Associates. Our management presentation coaching specialists have reviewed thousands of management presentations, and we know that small changes make a big difference . Incorporating these tips can make the difference between getting relegated to the ‘no’ pile, or having an investor take the next step to investing with you.

How to write a winning management presentation Your management presentation should sell the investment, not your product Keep your M&A management presentation simple Be clear what makes you special in your presentation Don’t let your management presentation be boring Appeal to the heart AND the head in your management presentation Be honest in your management presentation Show, don’t tell

Best management presentation tip #1: Sell the investment, not the product

Investors are selfish. Your product may well change the world, but the investor is primarily thinking about their own risk and reward. This means that when they listen to you, they are subconsciously asking the question: ‘what does this mean for me’?

The best management presentations present everything in an investor-first context.

- So instead of slides that talk about your plans and ambitions, frame the information in terms of how those plans and ambitions will impact your investor’s returns.

- Instead of listing your team’s background, demonstrate how that background makes you a safe pair of hands for a new owner.

- Got great sales forecasts? Show how those forecasts will translate into rewards for investors.

Grab and hold their attention by using the language of M&A and investment and focusing on the things that matter most to potential buyers. Read how to create a great pitch document.

Contact us for a free consultation on your coaching needs

Best management presentations tip #2: Keep it simple

Investors don’t put their cash into opportunities they don’t understand. If you present a concept in a difficult or complicated way , the mental exertion feels painful or makes them uneasy. Investors associate this with a negative gut instinct about you or your opportunity. That road leads to a ‘no’.

Instead, make the investment proposition easy to grasp . Clarity and ease of mental digestion feels good – That means investors will associate positive feelings with you and your opportunity .

So how do you transform a complex business into a simple management presentation?

When Steve Jobs was trying in 1990 to explain the impact that computers would have on the world, he spoke about bicycles. He described how humans are inefficient movers compared to many other animals on the planet. A human on a bicycle, though, can move even more efficiently than a condor. And a computer is like a bicycle for the human mind.

This analogy used a familiar concept (bicycles) to make an unfamiliar concept (computers in 1990) relatable. Analogies are one of several tools that help communicate complex ideas more effectively. Others are metaphors, similes and stories. No matter how complicated or abstract your product is, there is a way of presenting it in a simple, visual and engaging way. Use these ideas in your management presentations.

Best M&A management presentations tip #3: Be clear what makes you special

We find senior executives are frequently too close to their business to uncover the red thread that needs to run through their management presentation to make it exciting for investors. This is especially true for people wanting to sell their business . That’s where we help them discover their red thread and turn in into a seam of gold. What is the secret sauce that drives your success? Perhaps it’s your team, your IP, your connections or your track record?

The best M&A management presentations focus relentlessly on their unique advantage. They demonstrate why it will contribute to the business’s success and how the team will leverage it.

One of our clients, a London-based block chain developer, used this idea to their advantage. Their original pitch had confused what they had done, the market, their technology, their products and the potential of the business. In all, it was unclear what the business did and why investors should be excited. For their management presentation, we helped them identify the red thread and then turn it into a few clear messages that ran through the presentation. The result was a compelling investment story that has taken them to the next level.

Learn how to create a powerful equity story.

How to create a killer pitch deck

Best management presentation tip #4: don’t be boring.

- Crowded slides?

- Long blocks of text?

- Lists of bullet points?

- Bland headings?

- Weak design?

If your management presentation pitch deck looks as boring as everyone else’s, then investors will not get excited about meeting you. The best management presentation pitch decks are easy to read . They grab interest from the start, avoid jargon and use engaging language. They arouse interest through compelling headlines .

Investors should be able to flick through your management presentation pitch deck and understand your key points just from reading your slide headings. But those headings should also be different and intriguing enough that investors want to find out more. For example, instead of naming one of your slides ‘ About Us’ or ‘Our Team’ , choose a headline that reinforces your key message.

If your business is about running rock festivals, your headline for the team section of your deck could be ‘Ten Years’ Combined Experience of Running Profitable Events’. If you manufacture widgets that draw on your experience working with the inventor of the leading vacuum cleaner, your headline could be ‘James Dyson’s Protégé’. Finally, the best management presentations are often professionally designed with plenty of white space and relevant visuals. Don’t let amateur design let you down.

Best management presentation tip #5: Appeal to the heart as well as the head

Stories are an incredibly effective way to bypass investors’ heads and reach straight for their hearts. Instead of delivering plain facts in your management presentation (which are quickly forgotten), provide them within the context of a story.

- Identify the problem (the ‘villain’ of your story) and then

- Introduce your solution (the ‘hero’ of your story).

- Show what happens after the hero takes action, and

- Lay out the consequences of that action (or the consequences if that action doesn’t happen).

Perhaps your product is a small security device that alerts friends and family when you need help. Your presentation could focus on the software behind the invention. You could talk about how easy it is to set up. You can list the features and benefits. Or you could share what it’s like to feel safe and connected. You could show a video of someone whose life was saved, and how he or she felt when help came running – thanks to your device. That’s what great management presentations feel like.

When you trigger your buyer’s emotions, they become invested in your business and in you. Your management presentation becomes memorable and shareable. Remember: “People will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

Best M&A management presentation tip #6: Be honest

The best management presentations are from senior executives who don’t pretend to be perfect. Teams admit their mistakes, but also what they’ve learnt from them. They don’t hide their strategy changes, but instead share why and how they changed their approach, and the impact this has had. They have the confidence and self-awareness to be honest. As a result, investors see them as being trustworthy and having integrity and credibility.

Investors know there’s no perfect opportunity, there’s no perfect team, there’s no risk-free reward . So they are – rightly – wary of management teams that claim to offer any of these. Equally, if it appears that you’re trying to hide or mislead them, the investor will start to question everything else about you. To avoid this, be explicit about the data backing up your track record and the methodology used for your forecasts. Address doubts in your management presentation instead of creating them.

How to prepare an investor pitch deck

Best management presentation tip #7: show, don’t tell.

In your management presentation, Instead of describing how your product works, embed (or link to) a short film or screen-capture showing how it works. Instead of stating that your product changes people’s lives, include screenshots of customer reviews in which people say they will never be the same again. You could say that your product or service is different, but it’s much more powerful to show it, with mock-ups, testimonials and clippings from your industry’s trade press.

A few years ago we helped a diamond mining company raise money from investors in London. To back up the powerful pitch deck that we helped them create, for their management presentation we suggested they bring a raw diamond into their meeting. Why? Firstly, few investors will have ever handled a raw diamond. Secondly, it allowed the management team to bring the business to life with stories: How often a diamond of that size was found, How many tons of rock they had to move to find that diamond, At what depth they found it, and What they did about safely and security. This one small prop transformed the quality of their presentation and made it much easier for the team to raise the money they needed to expand the business.

Transform your M&A management presentation

Call us, you’ll get practical, easy-to-implement advice that will help you to grab investors’ attention , impress them and get you invited in for that vital face-to-face management presentation. we can write your investor pitch deck and help with presentation training ., you’ll benefit from our 15+ years experience transforming management presentations. then, ahead of the meeting, we help you rehearse the management meeting so that you come across as just the right team to help the investors achieve their investment objectives., we do this every day for scale-ups, quoted companies and private equity firms. , call louise today on +44 (0)20 7018 0922 or email [email protected] to discuss how we can best help you., transform your presentation skills with tailored coaching.

We can help you present brilliantly. Thousands of people have benefitted from our tailored in-house coaching and advice – and we can help you too .

“I honestly thought it was the most valuable 3 hours I’ve spent with anyone in a long time.” Mick May, CEO, Blue Sky

For 15+ years we’ve been the trusted choice of leading businesses and executives throughout the UK, Europe and the Middle East to improve presentation skills and presentations through coaching, training and expert advice.

Unlock your full potential and take your presentations to the next level with Benjamin Ball Associates.

Speak to Louise on +44 20 7018 0922 or email [email protected] to find out more and discuss transforming your speeches, pitches and presentations.

Or read another article..., how to make a compelling financial presentation.

Writing financial presentations is not easy. Typically, You have a lot of information…

How to Create a Winning Elevator Pitch – Top 11 tips

If you need to give a short pitch – an elevator pitch –…

Master the Art of a Persuasive Investor Pitch: Use Cognitive Biases

If you want to write a persuasive investor pitch or a compelling M&A…

9 Speed Networking Tips – when pitching to investors

How do you handle an Investor Speed Dating or Business Speed Networking event?…

Contact us for a chat about how we can help you with your presenting.

What leaders say about Benjamin Ball Associates

Ceo, plunkett uk.

"Thank you so much for an absolutely brilliant session yesterday! It was exactly what we were hoping for, and you did an incredibly job covering such a range of issues with 4 very different people in such short a session. It really was fantastic - thank you!"

James Alcock, Chief Executive, Plunkett UK

Manager, ubs.

"Essential if you are going to be a spokesperson for your business"

Senior Analyst, Sloane Robinson

"Being an effective communicator is essential to get your stock ideas across. This course is exactly what's needed to help you do just that!"

CEO, Blast! Films

“Our investment in the coaching has paid for itself many times over.”

Ed Coulthard

Corporate finance house.

“You address 95% of the issues in a quarter of the time of your competitor.”

Partner International

“Good insight and a great toolbox to improve on my presentations and delivery of messages to not only boards, analysts and shareholders but to all audiences”

CEO, Eurocamp

“We had a good story to tell, but you helped us deliver it more coherently and more positively.”

Steve Whitfield

Ceo, ipso ventures.

“Ben did a great job on our presentation. He transformed an ordinary set of slides into a great presentation with a clear message. Would definitely use him again and recommend him highly.”

Nick Rogers

“Moved our presentation into a different league and undoubtedly improved the outcome and offer we received.”

Let's talk about your presentation training needs

+44 20 7018 0922, [email protected], our bespoke presentation coaching services, investor pitch coaching, executive presentation coaching, public speaking training, executive media training, new business pitch coaching, privacy overview.

- Client Login

Preparing a Confidential Information Memorandum: What You Need to Know

January 17 2023 | 3 Min Read Time

Share this article:

Mike Rosendahl

Follow me: LinkedIn

Once you've decided to sell your company—no matter what type, how large, or in which industry sector—presenting it in the best possible light is essential to getting the highest possible price. To provide a detailed depiction of your business and help potential buyers determine whether to pursue an acquisition, your investment banker will prepare a confidential information memorandum (CIM).

Also known as an offering memorandum or an information memorandum, this confidential document is a typical part of the M&A sell-side process and an important tool for buyers to evaluate your business. But what exactly goes into preparing a CIM? And how can an investment bank help you accurately portray your company’s past performance, present standing, and future promise?

What Should You Consider When Preparing a CIM?

A CIM for an M&A deal must effectively communicate the current and potential value of your business. Here are some things to keep in mind as you begin:

- Consider who the document is being prepared for, and tailor the content accordingly. Your CIM should be customized to the specific needs and interests of impending buyers for your particular business.

- Your CIM will contain sensitive information about your business, so maintaining confidentiality throughout its preparation and distribution is vital. To maximize privacy, ensure that proper nondisclosure agreements are in place before sharing the CIM with qualified buyers.

- Your company’s CIM should be concise and easy to understand. Avoid using overly technical language and jargon that may confuse or overwhelm interested parties.

What Information Should Your CIM Include?

The CIM should report the facts and figures that a future owner would want to know—starting with a clear and detailed description of the company, your products/services, your history, and your mission and core values. In addition, your CIM should communicate the following:

- Growth opportunities. How will the company grow in the future? What is necessary to achieve this growth?

- Financial information. Your CIM should provide detailed financial information about the business, such as revenue and profit margins, EBITDA, cash flow, projections for future growth, CapEx, and balance sheets.

- Competitive landscape. Interested parties will appreciate a thorough analysis of your industry as a whole—and the competitive landscape in which your company operates.

- Management team. Take the time to highlight key members of your management team, their experience, and their qualifications. Your top people have contributed to your company’s success—and would-be buyers will want to hear all about it.

- Marketing and sales strategy. What is your company's marketing and sales strategy? Explain your target market, your channels of distribution, and your approach to customer acquisition.

- Risks and challenges. Be transparent in your CIM about the risks and potential challenges that your company faces, including legal and regulatory issues, market trends, and other factors that could impact future performance.

- Other key items. Your CIM should also provide any supporting documents and appendices, such as legal agreements, a description of any patents and other intellectual property your company owns, and any other relevant information that can help potential buyers evaluate the business.

How Can an Investment Banker Help You in Preparing the CIM?

Investment banks play a critical role in preparing a CIM for an upcoming M&A deal, identifying and gathering the key information required to help secure the most advantageous deal for you. Furthermore, your investment banker can work with your management team and financial advisors to compile financial statements, market research reports, and other relevant documents. An experienced investment banker can help you do the following: