Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

A Literature Review of Financial Performance Measures and Value Relevance

In: the impact of globalization on international finance and accounting.

- Author & abstract

- Related works & more

Corrections

(University of Economic, Prague)

Suggested Citation

Download full text from publisher.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

- A literature review of financi...

- More details

A literature review of financial performance measures and value relevance

| Year of publication: | |

|---|---|

| Authors: | |

| Published in: | . - Cham, Switzerland : Springer, ISBN 978-3-319-88655-8. - 2018, p. 385-393 |

| Subject: | | | | | | | | | | | | |

- Report error

| Type of publication: | Article |

|---|---|

| Type of publication (narrower categories): | Aufsatz im Buch ; Book section ; Konferenzbeitrag ; Conference paper |

| Language: | English |

| Other identifiers: | |

| Source: |

- EndNote - Citavi, Endnote, RefWorks, ...

- Zotero, Mendeley, RefWorks, ...

Does EVA beat earnings? : a literature review of the evidence since Biddle et al. (1997)

Toft, Jon Svennesen, (2015)

An empirical study of impact of EVA Momentum on the shareholders value creation as compared to traditional financial performance measures : with special reference to the UAE

Fayed, Ahmed Magdy, (2016)

Competing performance measures in predicting shareholder return of Indian pharmaceutical firms : an empirical evidence

Venugopal, Merugu, (2019)

The IFRS 8 segment reporting disclosure: Evidence on the Czech listed companies

Kopecká, Nattarinee, (2016)

The IFRS 8 segment reporting disclosure : evidence on the Czech listed companies

LITERATURE REVIEW OF FINANCIAL PERFORMANCE AND FINANCIAL DISTRESS: LIQUIDITY AND PROFITABILITY ANALYSIS (FINANCIAL MANAGEMENT LITERATURE REVIEW)

- Sukenti Student of Master of Financial Management Program, University Terbuka, Indonesia

Literature article Reviewing the Effect of Liquidity and Profitability in the context of financial management, a scientific study titled Financial Performance and Financial Distress tries to provide a research hypothesis on the interaction between factors. This literature review was written using the library research approach, including information from online academic databases like Google Scholar, Mendeley, and others. The outcomes of this article's literature review are:1) Liquidity affects Financial Performance; 2) Profitability has an effect on Financial Performance; 3) Liquidity affects Financial Distress; 4) Profitability has an effect on Financial Distress; and 5) Financial Performance Affects Financial Distress; In addition to these 2 external factors that influence the endogenous variables Financial Performance and Financial Distress there are still other additional elements, like as Leverage, Solvency and Activity variables.

Agussalim, M., Ayu Rezkiana Putri, M., & Ali, H. (2016). Analysis work discipline and work spirit toward performance of employees (case study tax office Pratama two Padang). International Journal of Economic Research.

Agussalim, M., Ndraha, H. E. M., & Ali, H. (2020). The implementation quality of corporate governance with corporate values: Earning quality, investment opportunity set, and ownership concentration analysis. Talent Development and Excellence.

Aletheari, I. A. M., & Jati, I. K. (2016). Pengaruh Earning Per Share, Price Earning Ratio, Dan Book Value Per Share Pada Harga Saham. E-Jurnal Akuntansi Universitas Udayana, 17(2), 1254–1282.

Ali, H. (1926). Evolution of Tank Cascade Studies of Sri Lanka. Saudi Journal of Humanities and Social Sciences. https://doi.org/10.21276/sjhss

Ali, H., Mukhtar, & Sofwan. (2016). Work ethos and effectiveness of management transformative leadership boarding school in the Jambi Province. International Journal of Applied Business and Economic Research.

Ansori, A., & Ali, H. (2017). Analisis Pengaruh Kompetensi Dan Promosi Terhadap Kinerja Pegawai Negeri Sipil Pada Sekretariat Daerah Kabupaten Bungo. Jurnal Ilmiah Universitas Batanghari Jambi. https://doi.org/10.33087/jiubj.v15i1.198

Anwar, K., Muspawi, M., Sakdiyah, S. I., & Ali, H. (2020). The effect of principal’s leadership style on teachers’ discipline. Talent Development and Excellence.

Assagaf, A., & Ali, H. (2017). International Journal of Economics and Financial Issues Determinants of Financial Performance of State-owned Enterprises with Government Subsidy as Moderator. International Journal of Economics and Financial Issues

Bastari, A., -, H., & Ali, H. (2020). DETERMINANT SERVICE PERFORMANCE THROUGH MOTIVATION ANALYSIS AND TRANSFORMATIONAL LEADERSHIP. International Journal of Psychosocial Rehabilitation. https://doi.org/10.37200/ijpr/v24i4/pr201108

Chauhan, R., Ali, H., & Munawar, N. A. (2019). BUILDING PERFORMANCE SERVICE THROUGH TRANSFORMATIONAL LEADERSHIP ANALYSIS, WORK STRESS AND WORK MOTIVATION (EMPIRICAL CASE STUDY IN STATIONERY DISTRIBUTOR COMPANIES). Dinasti International Journal of Education Management And Social Science. https://doi.org/10.31933/dijemss.v1i1.42

Desfiandi, A., Fionita, I., & Ali, H. (2017). Implementation of the information systems and the creative economy for the competitive advantages on tourism in the province of Lampung. International Journal of Economic Research.

Djoko Setyo Widodo, P. Eddy Sanusi Silitonga, & H. A. (2017). Organizational Performance : Analysis of Transformational Leadership Style and Organizational Learning. Saudi Journal of Humanities and Social Sciences. https://doi.org/10.21276/sjhss.2017.2.3.9

Elmi, F., Setyadi, A., Regiana, L., & Ali, H. (2016). Effect of leadership style, organizational culture and emotional intelligence to learning organization: On the Human Resources Development Agency of Law and Human Rights, Ministry of Law and Human Rights. International Journal of Economic Research.

Harini, S., Hamidah, Luddin, M. R., & Ali, H. (2020). Analysis supply chain management factors of lecturer’s turnover phenomenon. International Journal of Supply Chain Management.

Hairiyah, S., & Ali, H. (2017). Customer Decision Analysis in Taking Multipurpose Loan : Promotions , Locations and Credit Procedures ( A Case of the Bank " PQR Jakarta "). Saudi Journal of Business and Management Studies. https://doi.org/10.21276/sjbms.2017.2.3.6

Haitao, N., & Ali, H. (2022). THE ROLE OF BANKING AND GOVERNMENT POLICY ON THE ECONOMIC SECTOR DURING THE COVID-19 PANDEMIC. Dinasti International Journal of Digital Business Management, 3(2), 161–169.

Limakrisna, N., Noor, Z. Z., & Ali, H. (2016). Model of employee performance: The empirical study at civil servants in government of west java province. International Journal of Economic Research.

Masydzulhak, P. D., Ali, P. D. H., & Anggraeni, L. D. (2016). The Influence of work Motivationand Job Satisfaction on Employee Performance and Organizational Commitment Satisfaction as an Intervening Variable in PT. Asian Isuzu Casting Center. In Journal of Research in Business and Management.

Munawar, N. A., & Saputra, F. (2021). Application Of Business Ethics And Business Law On Economic Democracy That Impacts Business Sustainability. Journal of Law Politic and Humanities, 1(3), 115–125.

Munawar, N. A., & Saputra, F. (2022). Determination of Public Purchasing Power and Brand Image of Cooking Oil Scarcity and Price Increases of Essential Commodities. International Journal of Advanced Multidisciplinary, 1(1), 34–44. No, P., Sanusi, A., Desfiandi, A., Ali, H., St, A. B., & Ct, R. A. (2017). PERFORMANCE-BASED ON THE HIGHER EDUCATION QUALITY IN PRIVATE COLLEGES. Proeeding MICIMA.

Pitri, A., Ali, H., & Us, K. A. (2022). Faktor-Faktor Yang Mempengaruhi Pendidikan Islam : Paradigma , Berpikir Kesisteman Dan Kebijakan Pemerintah ( Literature Review Manajemen Pendidikan ). 2(1), 23–40.

Prayetno, S., & Ali, H. (2017). Analysis of advocates organizational commitment and advocates work motivation to advocates performance and its impact on performance advocates office. International Journal of Economic Research.

Prayetno, S., & Ali, H. (2020). The influence of work motivation, entrepreneurship knowledge and advocate independence on advocate performance. International Journal of Innovation, Creativity and Change, 12(3), 147–164.

Prihartono, & Ali, H. (2020). The promises ethics and marketing concept strategy as a competitive advantage on private higher education (A survey on perception of product attributes and promotion mix in Indonesia). Talent Development and Excellence.

Richardo, Hussin, M., Bin Norman, M. H., & Ali, H. (2020). A student loyalty model: Promotion, products, and registration decision analysis-Case study of griya english fun learning at the tutoring institute in wonosobo central Java. International Journal of Innovation, Creativity and Change.

Riyanto, S., B, S., & Ali, H. (2017). The Influence of Workplace Spirituality and Oganizational Culture on Employee Engagement of Y Generation in PT. Krama Yudha Tiga Berlian Motors (KTB). The International Journal of Social Sciences and Humanities Invention. https://doi.org/10.18535/ijsshi/v4i7.05

Riyanto, S., Pratomo, A., & Ali, H. (2017). EFFECT OF COMPENSATION AND JOB INSECURITY ON EMPLOYEE ENGAGEMENT (STUDY ON EMPLOYEE OF BUSINESS COMPETITION SUPERVISORY COMMISSION SECRETARIAT). International Journal of Advanced Research. https://doi.org/10.21474/ijar01/4139

Riyanto, S., Yanti, R. R., & Ali, H. (2017). The Effect of Training and Organizational Commitment on Performance of State University of Jakarta Student Cooperative (KOPMA UNJ) Management. Saudi Journal of Humanities and Social Sciences. https://doi.org/10.21276/sjhss

Saputra, F. (2022a). Analysis Effect Return on Assets (ROA), Return on Equity (ROE) and Price Earning Ratio (PER) on Stock Prices of Coal Companies in the Indonesia Stock Exchange (IDX) Period 2018-2021. Dinasti International Journal of Economics, Finance and Accounting, 3(1), 82–94. http://repository.uph.edu/41805/%0Ahttp://repository.uph.edu/41805/4/Chapter1.pdf

Saputra, F. (2022b). The Role of Human Resources , Hardware , and Databases in Mass Media Companies. International Journal of Advanced Multidisciplinary, 1(1), 45–52.

Sudiantini, D. (2020). Empirical Testing of Climate Work as Moderating at Regional Public Service. 151(Icmae), 47–49. https://doi.org/10.2991/aebmr.k.200915.012

Sudiantini, D., & Dewi Shinta, N. (2018). Pengaruh Media Pembelajaran Terhadap Kemampuan Berpikir Kreatif dan Penalaran Matematis Siswa. Sintesa, 11(1), 177–186. http://ojs.umsida.ac.id/index.php/pedagogia/article/view/69/75

Sutiksno, SDU, Rufaidah, P., Ali, H., & Souisa, W. (2017). Tinjauan Literatur Pemasaran Strategis dan Pandangan Berbasis Sumber Daya Perusahaan. Int. J. Ekonomi. Res, 14(8), 59–73.

Widayati, C. C., Ali, H., Permana, D., & Nugroho, A. (2020). The role of destination image on visiting decisions through word of mouth in urban tourism in Yogyakarta. International Journal of Innovation, Creativity and Change.

Wangsih, D. (2021). Influence Of Leverage, Firm Size, And Sales Growth On Financial Distress (Empirical Study on Retail Trade Sub-Sector Companies Listed in Indonesia Stock Exchange Period 2016-2020). International Journal of Economics, Business and Accounting Research (IJEBAR), 5(4).

Widodo, D. S., Silitonga, P. E. S., & Ali, H. (2020). The influence of good governance, culture, and performance in increasing public satisfaction and implication to public trust: Study in Indonesian government. Talent Development and Excellence.

Yacob, S., Sucherly, Sari, D., Mulyana, A., & Ali, H. (2020). An Optimising strategy for minimarket modern retail business performance in Indonesia. International Journal of Innovation, Creativity and Change.

- DOWNLOAD ARTICLE FULL PDF

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Dinasti International Journal of Digital Business Management (DIJDBM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Dinasti International Journal of Digital Business Management (DIJDBM).

- Peer Reviewers

- Peer Review Process

- Aim and Scope

- Publication Ethics

- Online Submission Guidelines

- Article Processing Charge

- Open Access Statement

- License Term

- Histori Jurnal

- Plagiarisme Policy

- Archive Policy

- Author Guidelines

E-ISSN: 2715-4203

P-ISSN: 2715-419X

EDITORIAL OFFICE

Casa Amira Prive Jl. H. Risin No. 64D Pondok Jagung Timur, Serpong Utara, Tangerang Selatan, Indonesia

Unipark Condominium, Block D 3-9 Selangor, Malaysia

Singapore 655B Jurong West ST 61#12-542 Singapore 642655

Dinasti International Journal of Digital Business Management (DIJDBM) is managed and published by Dinasti Publisher under the auspices of the Yayasan Dharma Indonesia Tercinta (DINASTI) and in collaboration with several institutions, the Faculty of Education, the National University of Malaysia, Faculty of Economics, Krisnadwipayana University, Faculty of Economics and Business, Winaya Mukti University, Bandung, Faculty of Economics, Muhammadiyah University Cirebon, Corruption Supervisory Commission (KPK Tipikor), Ekasakti University, Padang Indonesian Academy of Accountancy, Piksi Ganesha Polytechnic, Bandung, Bogor Academy of Technology, Bogor Telecommunication Academy, Indonesian National Tourism Academy, Bandung, Indonesian Polytechnic Piksi Ganesha, Kebumen, STIES Indonesia Purwakarta, STMIK Farewell, Kerawang and STIE Mahaputra Riau.

CONTACT INFO

https://dinastipub.org/DIJDBM

DIJDBM INDEX

- DOI: 10.61656/sbamr.v6i2.213

- Corpus ID: 270843051

A Literature Review of Corporate Social Responsibility Implementation in the Manufacturing Industry: Impact on Financial and Environmental Performance

- Bella Monica , Putri Rima Nirwana , +1 author Hwihanus Hwihanus

- Published in Sustainable Business… 30 June 2024

- Business, Environmental Science

Tables from this paper

19 References

Corporate social responsibility, corporate financial performance and the confounding effects of economic fluctuations, understanding corporate green competitive advantage through green technology adoption and green dynamic capabilities: does green product innovation matter, corporate social responsibility (csr): the role of government in promoting csr, mergers and acquisitions: does performance depend on managerial ability, the impact of corporate social responsibility and environmental performance to improve return on asset in manufacturing company, corporate social responsibility decoupling in developing countries: current research and a future agenda, implementation of corporate social responsibility on financial performance of manufacturing companies in indonesia, analysis of the influence of fundamental macro and fundamental micro to discolure of corporate social responsibility, ownership structure, financial performance, going concern audit opinion and value of the firm at state-owned enterprises in indonesia, the effect of csr on financial performance: a study of plantation companies in indonesia and malaysia, making sustainability work : best practices in managing and measuring corporate social, environmental and economic impacts, related papers.

Showing 1 through 3 of 0 Related Papers

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 27 June 2024

Optimization of electric charging infrastructure: integrated model for routing and charging coordination with power-aware operations

- Hamid R. Sayarshad 1

npj Sustainable Mobility and Transport volume 1 , Article number: 4 ( 2024 ) Cite this article

196 Accesses

Metrics details

- Energy and society

- Energy science and technology

- Engineering

With the increasing adoption of electric vehicles (EVs), optimizing charging operations has become imperative to ensure efficient and sustainable mobility. This study proposes an optimization model for the charging and routing of electric vehicles between Origin-Destination (OD) demands. The objective is to develop an efficient and reliable charging plan that ensures the successful completion of trips while considering the limited range and charging requirements of electric vehicles. This paper presents an integrated model for optimizing electric vehicle (EV) charging operations, considering additional factors of setup time, charging time, bidding price estimation, and power availability from three sources: the electricity grid, solar energy, and wind energy. One crucial aspect addressed by the model is the estimation of bidding prices for both day-ahead and intra-day electricity markets. The model also considers the total power availability from the electricity grid, solar energy, and wind energy. The alignment of charging operations with the capacity of the grid and prevailing bidding prices is essential.This ensures that the charging process is optimized and can effectively adapt to the available grid capacity and market conditions. The utilization of renewable energies led to a 42% decrease in the electricity storage capacity available in batteries at charging stations. Furthermore, this integration leads to a substantial cost reduction of approximately 69% compared to scenarios where renewable energy is not utilized. Hence, the proposed model can design renewable energy systems based on the required electricity capacity at charging stations. These findings highlight the compelling financial advantages associated with the adoption of sustainable power sources.

Similar content being viewed by others

Strategies and sustainability in fast charging station deployment for electric vehicles

Hybrid genetic algorithm-simulated annealing based electric vehicle charging station placement for optimizing distribution network resilience

Renewable-based charging in green ride-sharing

Introduction.

The widespread adoption of electric vehicles (EVs) has ushered in a new era of sustainable transportation, addressing concerns about environmental impact and reducing dependence on fossil fuels. However, the transition to electric mobility brings with it the need for efficient and reliable charging infrastructure. By the end of 2022, the global number of public charging points reached 2.7 million, with over 900,000 installations taking place during that year. This signifies a notable growth of approximately 55% compared to the charging point stock in 2021 1 . While this represents a significant increase, it still falls short of meeting the growing demand for EV charging. The limited availability of charging stations poses a significant obstacle, leading to long waiting times and inconvenience for EV owners 2 . As EVs travel across a transportation network, the allocation of charging resources among multiple charging stations becomes crucial to ensure seamless charging accessibility.

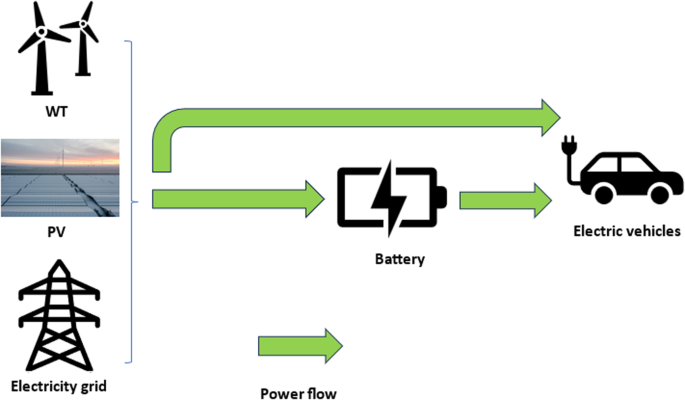

EVs are gaining popularity as a sustainable and eco-friendly transportation option. The coupling of transportation and energy markets captures the interconnectedness between EV charging infrastructure and the energy market. Power-aware operations, on the other hand, involve managing power constraints to optimize the use of available electrical resources and provide efficient charging services for EVs. In the context of charging infrastructure, power-aware operations ensure that charging stations maximize the utilization of electricity resources while delivering reliable charging services. This involves considering factors such as power capacity, load balancing, and dynamic power scheduling to efficiently manage the charging process. Figure 1 depicts a charging station with battery storage, charging equipment, and EVs, all powered by the grid for sustainable and efficient charging.

Electric charging station.

Charging stations equipped with batteries offer a transformative solution to enhance grid efficiency and optimize EV charging operations. By participating in demand response programs, these stations can assist grid operators and utility companies in managing electricity demand during peak periods. The integrated batteries allow for load shifting, storing excess electricity during low-demand periods and releasing it during high-demand hours, reducing strain on the grid. Furthermore, by leveraging time-of-use (TOU) rates, charging stations can strategically charge their batteries during times of lower electricity prices and utilize the stored energy to charge EVs when rates are higher. This combination of demand response programs and TOU rates empowers charging stations to minimize costs and contribute to a more resilient, cost-effective, and sustainable electrical grid.

Renewable energy sources are often decentralized and can be integrated into the charging station infrastructure itself. This localization of generation reduces the need for long-distance power transmission and associated energy losses. By generating electricity closer to the point of consumption, charging stations powered by renewable energy can minimize transmission constraints and enhance overall system efficiency. The integration of renewable energy into charging operations allows for efficient utilization of available resources. During periods of high renewable energy generation, excess electricity can be directed towards charging electric vehicle batteries, effectively using surplus power that might otherwise go unused. Furthermore, renewable energy sources generally have lower operating costs compared to conventional fossil fuel-based generation. In this study, we investigate the influence of renewable energy sources, specifically wind turbines (WT) and photovoltaic (PV) systems, on the power grid. Our analysis focuses on examining the behavior and characteristics of WT and PV systems to gain insights into their impact on grid stability and charging operations at EV charging stations. By studying these factors, we aim to enhance our understanding of the implications associated with integrating renewable energy sources into the power grid. However, the widespread adoption of EVs faces several challenges, including the optimization and improvement of EV charging operations.

The current charging infrastructure for EVs faces several challenges that hinder its optimal performance. Range anxiety, a term used to describe the fear of running out of battery power before reaching a charging station, is a prominent concern among both current EV owners and potential buyers. According to a survey conducted by the American Automobile Association in the United States 3 , 58% of respondents identified range anxiety as a significant deterrent to purchasing an electric vehicle. Similarly, according to a survey by the European Automobile Manufacturers’ Association 4 , 51% of potential EV buyers in Europe are concerned about the driving range and availability of charging infrastructure. This anxiety arises from the perceived limitations in EV driving range when compared to traditional internal combustion engine vehicles, as well as the necessity for accessible and dependable charging infrastructure. The apprehension surrounding range anxiety underscores the importance of expanding charging networks and enhancing EV battery technology to alleviate concerns and promote wider EV adoption.

The time required to charge an electric vehicle is another challenge. While EV charging technology has improved, it still takes significantly longer to charge an EV compared to charging a conventional vehicle with gasoline or diesel. Fast-charging stations can partially alleviate this issue, but their availability is limited. According to a study by the European Commission 5 , 6 , the average charging time for an EV can range from 30 minutes to several hours, depending on the charging station’s power output. However, fast-charging stations can significantly reduce charging time. For example, Tesla’s Supercharger network can provide up to 170 miles of range in just 30 min 7 . In addition to traditional charging methods, there are other faster charging methods, such as swapping, that are also considered in the context of electric vehicle charging. In a study by 8 , the optimization of the charging process at battery swapping stations is explored. The research specifically investigates the significance of a non-myopic routing policy for electric taxis, considering factors such as the limited battery capacity and customer delay.

Charging demands can vary greatly depending on factors such as the time of day, day of the week, and location. This variability makes it difficult for charging infrastructure providers to accurately anticipate and meet the charging needs of EV owners. Consequently, charging stations may experience periods of high demand where they are overwhelmed, leading to long wait times and inconvenience for EV owners. Conversely, during periods of low demand, charging stations may remain underutilized, resulting in wasted resources and inefficient operation. We develop a model that accurately estimates electric charging demands by integrating a charging plan and routing problem. By integrating these two components, the model can effectively determine the charging requirements of electric vehicles.

According to a report by the 9 , the number of EVs in Europe could reach 44 million by 2030, resulting in an additional electricity demand of 15%. The increased demand for electricity from charging stations, including those powered by renewable energy sources such as wind and solar, can strain the existing power grid infrastructure. Simultaneous charging of multiple EVs in a localized area can lead to peak demand that surpasses the grid’s capacity, potentially causing power outages or grid instability. Therefore, the integration of EV charging with smart grid technologies and load management strategies becomes crucial to balance power demand and ensure the stable operation of the electricity grid.

Ensuring an adequate power supply to meet the charging demands of multiple stations simultaneously can be challenging, particularly in areas with inadequate electrical infrastructure. The limited availability of charging resources constrains the charging infrastructure’s capacity to efficiently meet the growing demands of EV owners. However, our innovative approach addresses this challenge by considering the remaining energy between origin-destination (OD) demands, while also taking advantage of renewable energy sources. By precisely calculating and efficiently allocating charging resources, including those from renewable energy such as wind and solar, our approach significantly enhances the effectiveness of the charging infrastructure. This enables electric vehicles to seamlessly meet their energy requirements throughout their journeys, contributing to a sustainable and reliable transportation ecosystem.

The costs associated with electricity procurement and operational expenses further compound the challenges faced by charging stations. Electricity costs can vary depending on market dynamics, and procuring electricity at competitive rates while ensuring a reliable supply can be a complex task. These financial hurdles impact the profitability and long-term sustainability of charging stations, making it crucial to optimize resource allocation and minimize costs. The proposed model enables strategic decision-making through its bidding strategy formulation. By determining the optimal quantity of electricity to bid and the corresponding bidding price in the day-ahead market, charging stations can minimize their costs while meeting the power requirements of the stations. The model also incorporates real-time pricing adjustments in the intra-day market, allowing charging stations to adapt to changing market conditions and optimize their financial outcomes.

In response to these challenges, we develop an optimization model that determines the optimal allocation of charging resources among the charging stations. This model would consider factors such as the estimated power needed for each charging station based on the charging requirements of the EVs at each OD demand, the available battery capacities of the charging stations, and the charge efficiency. The model aims to minimize costs associated with electricity procurement and operational expenses while meeting the estimated power needs of each charging station. The following section outlines our significant contributions to electric charging features.

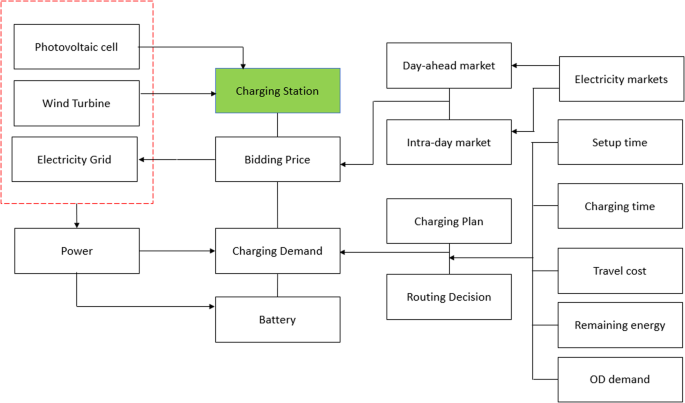

We integrate an optimization model that combines charging and routing plans with the electricity market, aiming to minimize social costs for both users and charging providers.

We concentrate on estimating the charging demands of electric vehicles at charging stations and evaluating the overall power grid requirements necessary to efficiently meet these demands.

We integrate renewable energy sources, such as solar and wind, into the charging infrastructure, optimizing their utilization based on availability and variability to create a more sustainable and environmentally friendly charging ecosystem.

We consider the bidding strategy of charging stations in both the day-ahead and intra-day electricity markets, optimizing the quantity of electricity to bid and corresponding bidding prices based on estimated power needs and real-time pricing. Our goal is to dynamically adjust the bidding prices to optimize financial outcomes while meeting the power needs of the stations.

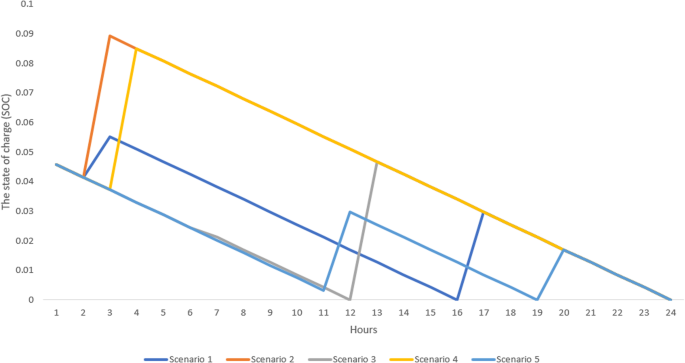

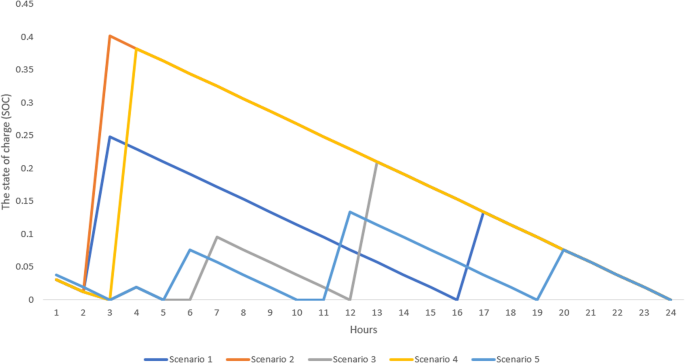

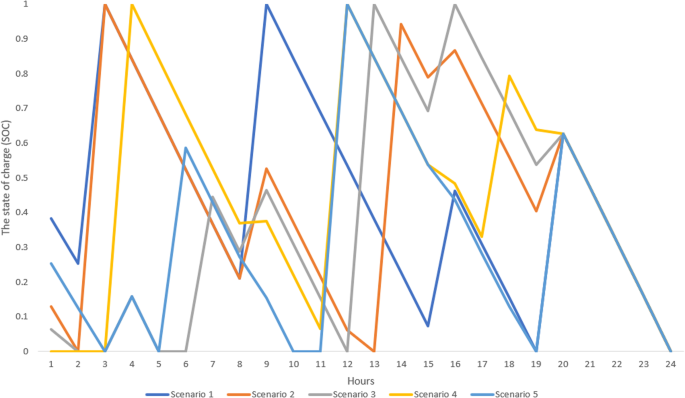

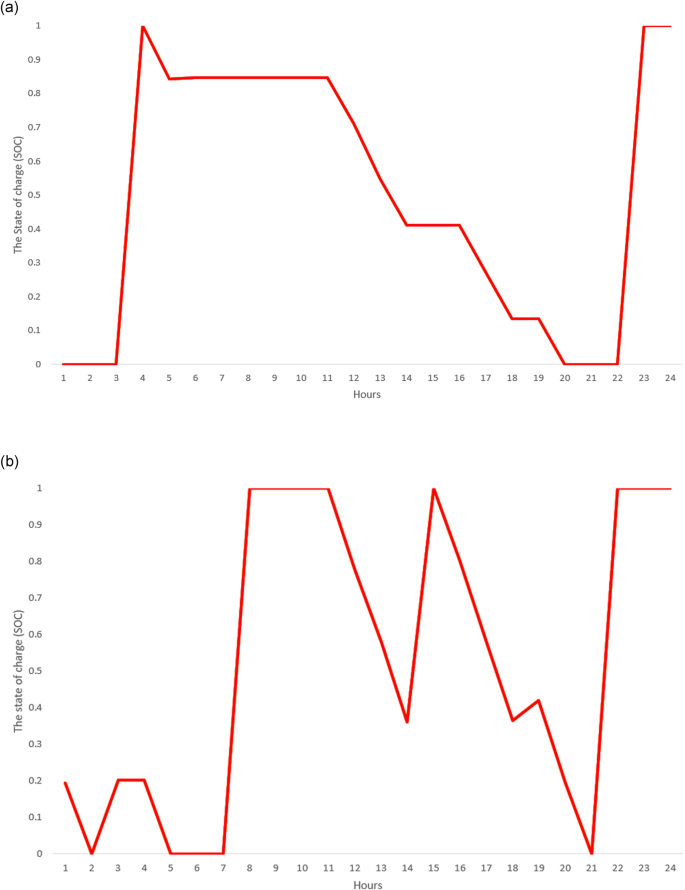

This model actively monitors the state of charge (SOC) of the charging station batteries, optimizing energy storage system utilization and ensuring a reliable power supply for vehicle charging.

This study considers additional operational factors associated with charging stations, such as the total setup time at each station, the charging time, and the state of charge for the battery.

The proposed study introduced a novel model that simultaneously considers both user-centric and charging provider-centric aspects. This novel approach takes into account the needs and preferences of EV users as well as the operational requirements and constraints of charging providers. By integrating these dual perspectives, the model provides a comprehensive and balanced solution for optimizing charging operations. This unique approach enhances the overall user experience while ensuring the efficiency and sustainability of charging operations. The consideration of both user-centric and charging provider-centric aspects sets this model apart from previous studies, making it a pioneering contribution to the field of EV charging optimization.

The optimization model that was proposed in this study focused on addressing the challenges associated with charging and routing EVs. One of the key considerations was the limited range of EVs and their specific charging requirements. The objective of the model was to optimize the charging plan by strategically planning charging operations to ensure that EVs could successfully complete their trips without running out of battery power. To capture the complexity of EV charging operations, the model took into account various factors. These factors included setup time, which considered the time required to prepare the charging station for the arrival of an EV, and charging time, which reflected the time needed to charge the vehicle’s battery to the desired level.

A critical aspect of the model was the estimation of bidding prices for both day-ahead and intra-day electricity markets. By estimating these prices, the system was able to make informed decisions regarding electricity procurement, optimizing the cost of charging EVs at the charging stations. This estimation also considered the varying prices associated with different energy sources, allowing the model to select the most cost-effective option for charging. Furthermore, the model incorporated the total power availability from three sources: the electricity grid, solar energy, and wind energy. This consideration was essential for aligning the charging operations with the capacity of the grid and the prevailing bidding prices. By incorporating this information, the model ensured that the charging plan optimally utilized the available power resources from all three sources, avoiding overloading the grid and promoting efficient and cost-effective charging operations. The proposed optimization model not only focused on efficiency but also emphasized sustainability. By maximizing the use of renewable energy sources, such as solar and wind energy, the model contributed to the overall goal of reducing carbon emissions and promoting sustainable transportation.

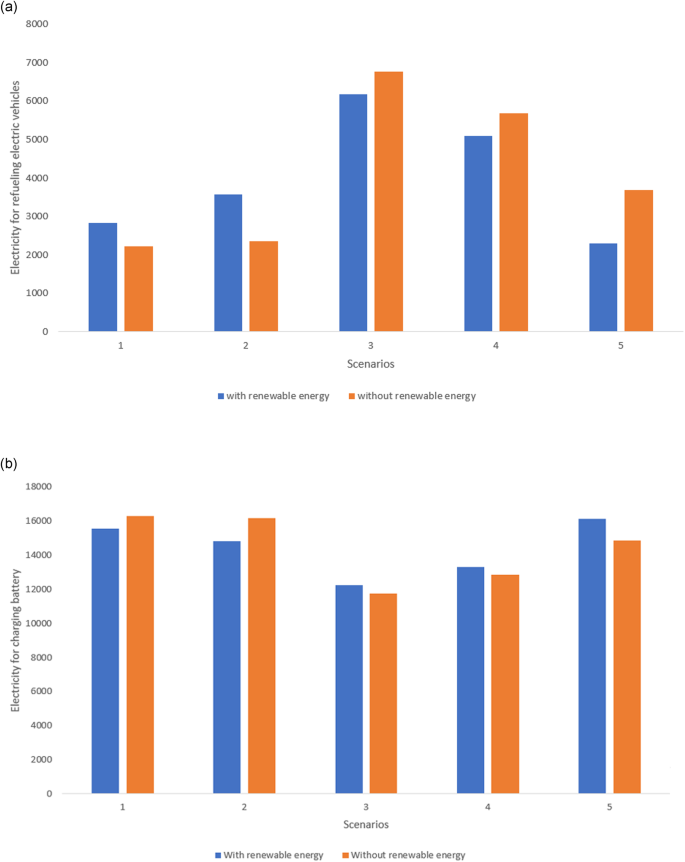

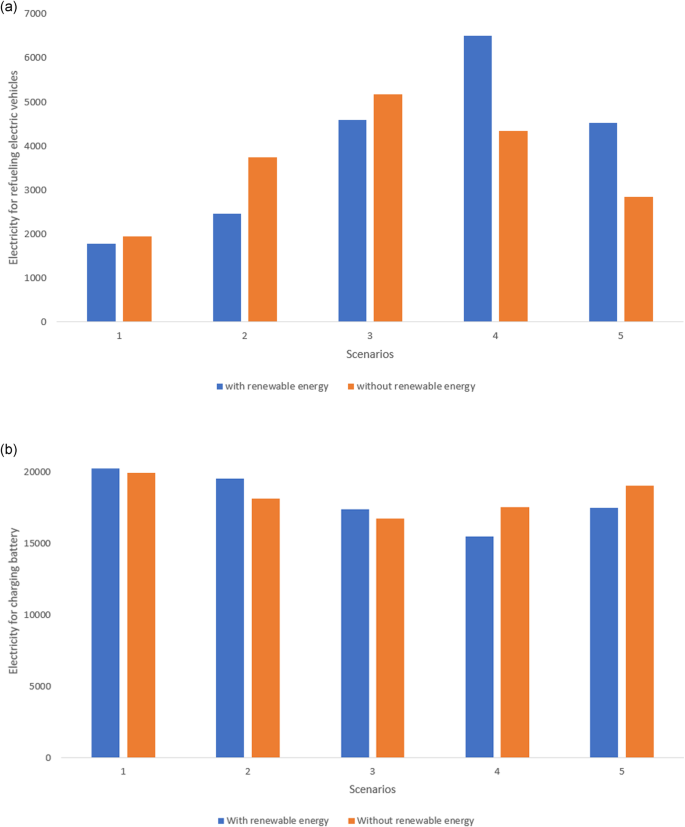

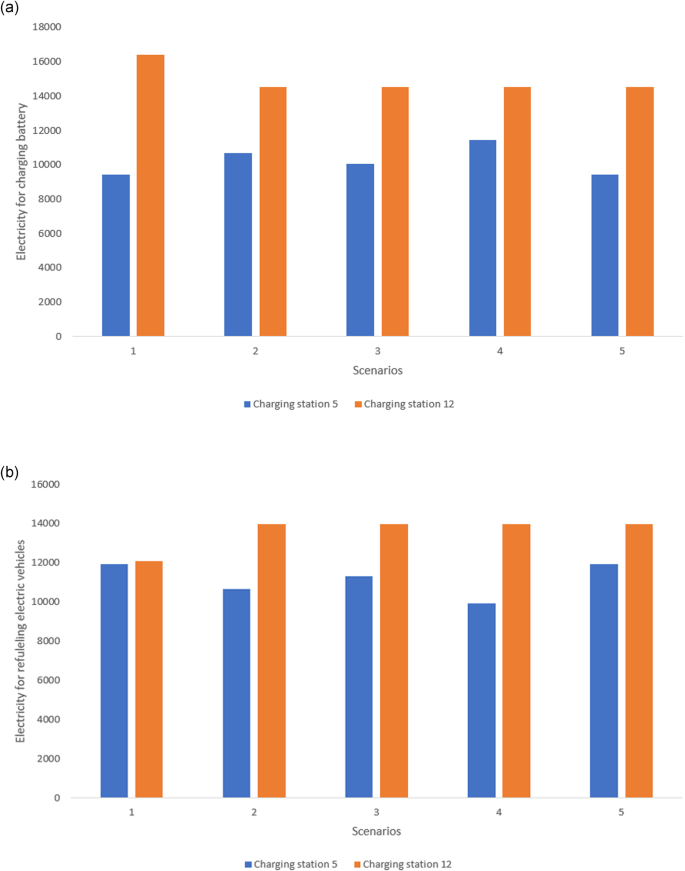

Our analysis showed that integrating renewable energy sources into electric vehicle charging infrastructure brings significant advantages. By leveraging renewable energy, we observed a notable reduction in electricity demand for charging batteries at charging stations, with a substantial decrease of up to 42% at charging stations. Additionally, the integration of renewable energy resulted in a significant cost reduction of approximately 69% compared to scenarios without renewable energy. These findings highlight the tangible benefits of utilizing sustainable power, including reduced reliance on non-renewable energy and substantial cost savings. Furthermore, strategically aligning charging sessions with periods of high renewable energy generation enabled optimal utilization of renewable sources, minimizing the need for energy storage or grid reliance. Overall, these results emphasized the potential of renewable energy integration in advancing sustainable transportation practices and contributing to sector-wide decarbonization.

Literature review

Existing literature in the field of charging infrastructure planning often adopts either a user-centric or charging provider-centric approach. User-centric studies prioritize minimizing the distance traveled or time spent on charging operations from the perspective of electric vehicle users. These studies aim to optimize the charging experience for individual users, focusing on factors such as charging station availability, proximity, and convenience. However, user-centric approaches may not fully consider the impact on infrastructure and overall system efficiency. In contrast, charging provider-centric approaches concentrate on optimizing the operations of charging stations. These studies aim to minimize operational costs and ensure efficient service provision. However, charging provider-centric approaches may overlook user preferences and the overall charging experience.

To bridge this gap, our proposed method aims to consider both user-centric and charging provider-centric aspects simultaneously. By embracing a comprehensive approach, we can optimize the charging infrastructure planning process to benefit both electric vehicle users and charging providers. This approach takes into account user preferences, such as minimizing travel distance and charging time, while also considering the efficient utilization of charging infrastructure resources and the overall system efficiency. By integrating both perspectives, our proposed method can provide a more comprehensive and balanced approach to charging infrastructure planning. It ensures that the needs and preferences of electric vehicle users are met while also optimizing the operations and efficiency of charging stations. This integrated approach contributes to the development of a charging infrastructure network that is user-friendly, cost-effective, and sustainable.

Charging and routing problem

This section aims to explore the existing research on charging plans and routing problems for electric vehicles, highlighting the strategies and solutions proposed in the literature. Efficient routing of EVs involves identifying the most suitable charging stations along the route. Studies have proposed approaches that consider the routing challenges specific to electric vehicles, considering their limited driving range and the need for charging stops. For example 10 , introduced a dynamic routing approach for electric taxis using a Markov decision process (MDP) that considers limited battery capacity, battery swapping stations, customer delay, and system cost 11 . proposed a dynamic routing and pricing problem under a mixed fleet of electric and conventional vehicles. A comprehensive examination of the latest advancements in mathematical modeling-based literature on EV operations management is presented in 12 .

Optimally deploying public charging stations plays a vital role in facilitating convenient and efficient travel for EV drivers. This deployment strategy enables drivers to make spontaneous adjustments and interact with their travel and recharging decisions. Additionally, it helps maintain multi-class tour-based network equilibrium conditions, ensuring a balanced and sustainable transportation system for EV users 13 . Real-time traffic conditions and the availability of charging stations can significantly impact route planning for EVs. Researchers have explored techniques that integrate real-time traffic data and charging station availability information into routing algorithms. These approaches aim to optimize the route considering both traffic congestion and charging station availability to minimize travel time and charging delays 14 . proposed routing and charging plans for alternative fuel vehicles that aim to minimize travel time 15 . introduced an adaptive charging and routing strategy that reduces waiting times at charging stations by considering driving, waiting, and charging time 16 . investigated a route planning and charging navigation strategy based on real-time traffic information and grid information, optimizing driving and charging paths to minimize travel time and charging station load 17 . considered an EV route selection and charging navigation optimization model that utilizes crowd sensing for road velocity estimation and addresses waiting time at charging stations.

The optimal location of charging stations is a key research area within the field of electric vehicle infrastructure planning. Many papers and studies specifically address this topic with the aim of determining the most efficient and effective locations for charging stations 18 . determined the optimal number and locations of fast-charging stations for range-limited alternative fuel vehicles, considering both cost minimization and maximum coverage objectives 13 . investigated the optimal placement of public charging stations for electric vehicles within a road network, taking into account the dynamic nature of drivers’ travel and recharging decisions and their spontaneous adjustments and interactions.

Range anxiety refers to the fear of running out of battery power before reaching the destination. Researchers have developed routing algorithms that consider both the available charging infrastructure and the energy consumption characteristics of EVs. These algorithms aim to optimize the route selection to minimize energy consumption while ensuring that the vehicle reaches its destination without depleting the battery 19 . addressed the battery charging station location problem by considering users’ range anxiety and distance deviations, two key barriers to EV mass adoption 20 . focused on the optimal location of charging stations in a specific neighborhood, optimizing demand coverage and station capacity 21 . investigated the optimal locations of wireless charging facilities, incorporating traffic flow patterns and user equilibrium principles. These papers provide insights into the strategic allocation and placement of charging stations to alleviate range anxiety and optimize EV infrastructure planning.

Electricity market

A range of studies have explored the use of stochastic operational models for controlling EV charging to provide frequency regulation 22 . and 23 proposed two-stage stochastic problems to optimize the charging of EVs. They also co-optimized the utilization of distributed energy resources 24 . further enhanced this approach by applying stochastic dynamic programming to the optimization of charging and frequency regulation capacity bids 25 . extended this work by considering the management of EV loads to mitigate renewable generation intermittency and distribution network congestion, using a hierarchical decision-making methodology. These studies collectively highlight the potential of stochastic operational models in improving the efficiency and effectiveness of EV charging for frequency regulation.

In the electricity market, charging station operators can participate in bidding processes to procure electricity at competitive prices. A range of studies have explored the optimization of bidding strategies for charging station operators in the electricity market. These studies emphasize the importance of considering factors such as electricity prices, charging demand, and station capacity in these strategies. Specifically, probabilistic estimates of demand and competitor behavior have been highlighted as crucial aspects 26 , 27 . The role of Electric Vehicle Aggregators (EVAs) has also been investigated in this context 28 . proposed a power price control strategy for the charging of electric vehicles, which involves centrally managing the batteries of electric vehicles and adjusting the demand for charging through electricity price control. Effective bidding strategies can help charging station operators secure electricity supply at favorable prices, reducing operational costs and maximizing revenue 29 . introduced a stochastic linear programming model to construct piecewise linear bidding curves. This model aimed to address the uncertainty and variability present in bidding scenarios by incorporating stochastic elements into the bidding curve construction process. The study conducted by 30 proposes a grid-connected charging station that operates as a price-taker and provides multiple products. To facilitate coordinated bidding for this station, a two-stage stochastic program is developed.

The optimal bidding strategy for EV aggregators in day-ahead markets is a key area of research, with various studies exploring different aspects of this strategy 31 . introduced the concept of two agent modes, the centralized protocol management mode (CPMM) and the decentralized demand response mode (DDRM), and developed a stochastic optimization model to maximize the expected profits of the EV aggregator 32 . focused on the problem of an aggregator bidding into the day-ahead electricity market, with the former proposing a strategy to minimize charging costs while satisfying the flexible demand for plug-in electric vehicles (PEVs). Both studies highlight the potential cost reductions and the importance of flexible charging.

This study proposes a novel approach that combines charging plans, routing optimization, and the electricity market to determine the optimal charging demand for EVs while minimizing social costs for both users and charging providers. Traditional studies in the literature have predominantly focused on either user preferences, such as minimizing distance or minimizing charging operations at charging stations. However, our approach takes a comprehensive perspective by integrating these two objectives into a unified framework. By leveraging the electricity market, we enable the purchase of the total power grid capacity necessary to fulfill the charging demands of EVs, resulting in a more efficient and cost-effective solution. We optimize the routing and charging plans for electric vehicles considering the remaining energy levels between origin-destination (OD) demands. By taking into account the current energy levels of electric vehicles, the proposed model can plan efficient routes and determine when and where charging is necessary. This approach helps minimize unnecessary charging stops and ensures that vehicles reach their destinations without running out of charge. Bidding prices for EV charging stations can be estimated by incorporating actual charging demands at charging stations and estimating the power needed for charging stations based on the power requirements for charging vehicles. Accurately predicting bidding prices through market analysis enables charging infrastructure operators to set competitive prices, efficiently allocate energy resources, and minimize costs.

The proposed optimization model for EV charging operations had significant impacts on real charging stations, benefiting both users and charging providers. By integrating charging and routing plans with the electricity market, the model aimed to minimize social costs, resulting in more efficient and sustainable mobility. One notable contribution was the accurate estimation of charging demands at stations and evaluation of power grid requirements, ensuring successful trip completion and an optimized charging plan considering EV range and requirements.

The model also considered the total power availability from the electricity grid, aligning charging operations with the grid capacity to prevent overloading and maintain stability. Load balancing was also addressed by optimizing the distribution of charging loads across different stations, reducing peak demand periods, and avoiding strain on the grid. The model actively monitored the state of charge (SOC) of charging station batteries, optimizing the utilization of energy storage systems to ensure a reliable power supply for vehicle charging. Effective battery SOC management helped mitigate the impact of fluctuating power demands and provided a stable charging experience for EV users.

The model was enhanced by incorporating renewable energy sources such as wind turbines and photovoltaic cells into the charging stations, thereby promoting environmentally friendly charging operations and reducing dependence on fossil fuels. This integration of renewable energy aligns to establish a sustainable and low-carbon transportation system. Additionally, when estimating the PV and wind energy, capacity factors are taken into account. Capacity factors assess the actual energy output of a renewable energy system relative to its maximum potential output, accounting for factors such as weather conditions and system efficiency. By considering these capacity factors, a more precise estimation of energy production from PV and wind systems can be achieved, facilitating improved planning and utilization of renewable energy resources at electric charging stations.

The model incorporated a dynamic bidding strategy for charging stations in both the day-ahead and intra-day electricity markets. This allowed charging providers to adjust their bidding prices based on real-time pricing and estimated power needs, minimizing costs while meeting station power demands. By integrating bidding prices and optimizing charging plans, the model promoted cost-effective charging operations. It considered estimated power needs, real-time pricing, and available power resources, enabling charging providers to make informed decisions on electricity procurement. This optimization made charging EVs at stations economically viable and cost-effective for providers and users alike.

This model offers capabilities for analyzing factors such as remaining battery charge, distance to be traveled, and the availability of charging infrastructure, making it useful for both autonomous vehicles (AVs) and AV charging stations. It can provide recommendations for the most suitable charging station based on proximity, charging speed, and compatible connectors, as well as estimate the required charging duration or energy capacity considering variables such as battery capacity, energy consumption rate, and planned routes. By utilizing these features, the model can contribute to efficient AV charging and operation, ensuring optimal access to charging infrastructure and enhancing the overall charging experience.

Future research directions in electric vehicle charging infrastructure can explore an integrated model that accommodates both electric and hydrogen vehicles, considering the unique requirements of hydrogen fueling stations. This research should focus on hydrogen storage, dispensing technologies, and safety considerations. Advancements in vehicle-to-grid (V2G) technology, coupled with the ability to sell surplus energy to the grid during high-demand hours, offer numerous benefits to electric vehicle (EV) users, charging stations, and grid stability. Furthermore, as the frequency of disaster events such as wildfires 33 , cyber attacks 34 , and earthquakes 35 has risen in recent years, harnessing surplus energy during these critical periods can significantly enhance overall grid stability and resilience. These research directions have been actively explored in future studies. Moreover, the government’s role in providing incentives for renewable energy integration and electric vehicle adoption, including financial support and streamlined processes, should be further investigated 36 , 37 . Developing efficient algorithms to address variable charging demands for commercial purposes and integrating real-time traffic data into charging infrastructure planning models are also crucial areas for future exploration 38 , 39 . Lastly, in the current model, energy consumption is estimated by converting distance, but it can be enhanced by incorporating an energy consumption function to more accurately estimate the state of charge for electric vehicles between their origin-destination demands.

The proposed framework

Efficient charging infrastructure and operations are crucial to ensure the seamless integration of EVs into the existing transportation system. Figure 2 presents a system designed to improve the optimization of EV charging operations. The proposed model incorporates routing decisions and charging plans for all origin-destination (OD) demands within the transportation network, aiming to enhance the efficiency and convenience of EV charging operations. By considering the remaining energy levels of EVs and accurately estimating the total charging demands of charging stations, the model ensures that EVs are directed to the most suitable charging stations along their routes. This optimization process minimizes travel distance and alleviates anxiety for travelers by providing a reliable and accessible charging infrastructure throughout their journeys. Moreover, the model incorporates setup time and charging time at charging stations to provide a more precise estimation of the overall charging time needed for each EV.

The proposed framework of electric vehicle charging infrastructure planning.

The power sources in the electric charging station are depicted in Fig. 2 by the dashed red line, representing the combination of power grid and renewable energy. Combining renewable energy sources like solar and wind power in electric vehicle charging stations offers a holistic solution. By integrating wind turbines and photovoltaic (PV) cells, these stations can access a reliable and steady energy supply, capitalizing on the synergistic generation profiles of wind and solar power. This synergistic approach optimizes energy generation, effectively utilizing available space, ensuring resilience in diverse weather conditions, enabling load balancing, and facilitating the storage or sale of surplus energy. Incorporating both wind and solar power not only promotes sustainability and decreases carbon emissions but also enhances the public perception of the charging station as a pioneering entity that embraces clean energy for transportation systems.

In the electricity market, suppliers, such as power plants, submit bids indicating the amount of electricity they are willing to supply at various price levels. These bids are typically based on the production costs of the suppliers. The proposed model incorporates an economic perspective by addressing the cost aspect of EV charging operations. It achieves this by considering bidding prices in day-ahead and intra-day electricity markets. By accurately estimating the prices for purchasing electricity at charging stations, the model enables the optimization of charging costs and enhances the efficient utilization of available resources. This advanced approach empowers charging station operators to make well-informed decisions regarding the procurement of electricity. By considering market dynamics and pricing fluctuations, the model assists operators in balancing the cost-effectiveness of charging operations. By providing accurate estimations of bidding prices, the model contributes to the overall cost optimization of EV charging, delivering advantages to both charging station operators and EV owners. With the utilization of these economic insights, stakeholders can enhance the efficiency of their charging operations, minimize expenses, and advance sustainable transportation practices. The model not only supports the growth of the EV market but also facilitates the integration of electric vehicles into the existing energy market ecosystem.

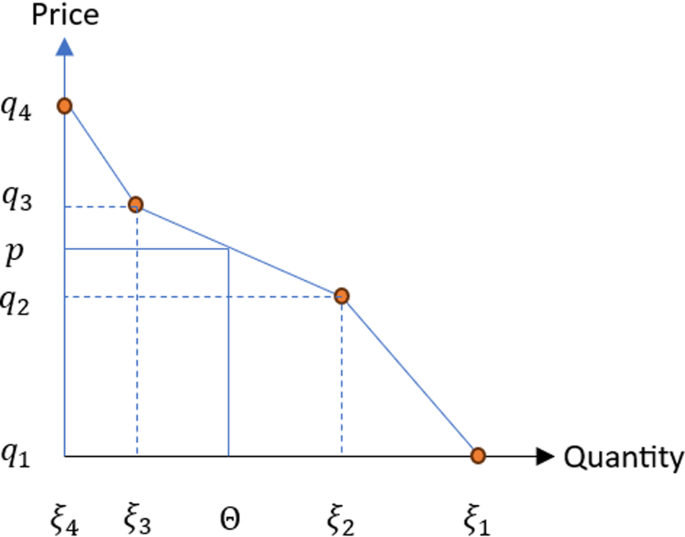

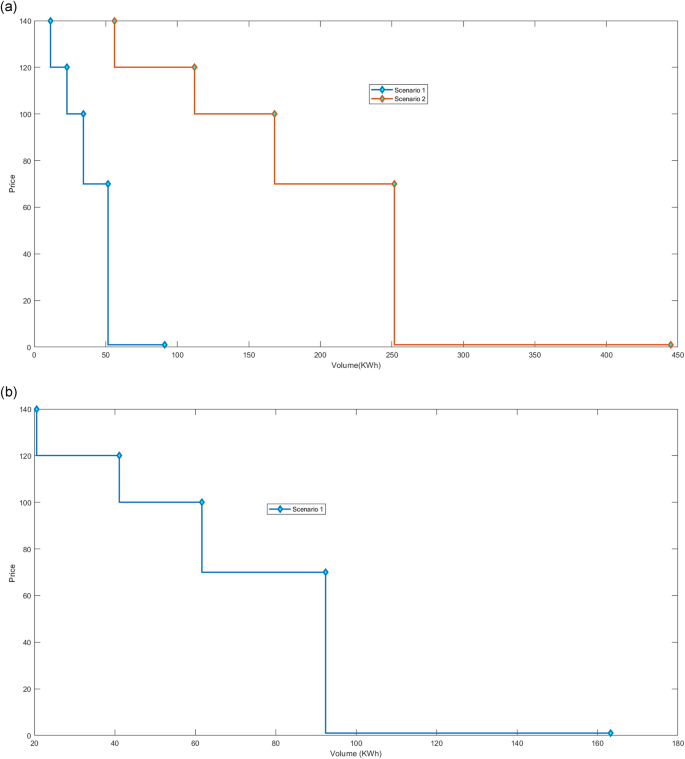

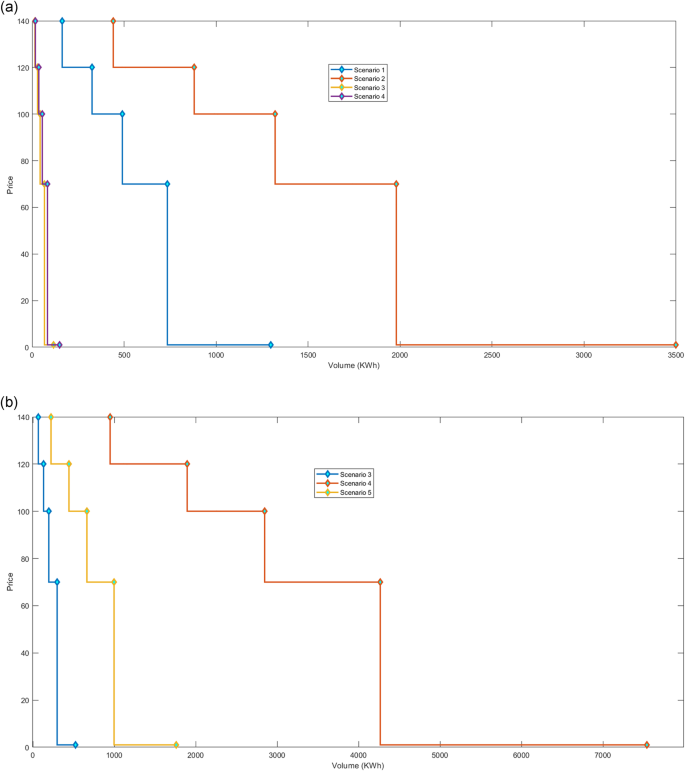

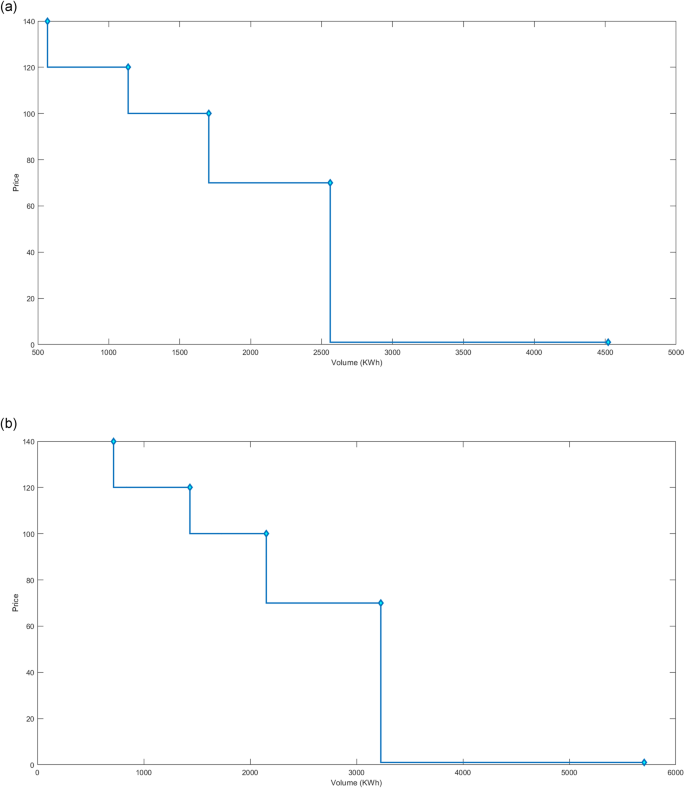

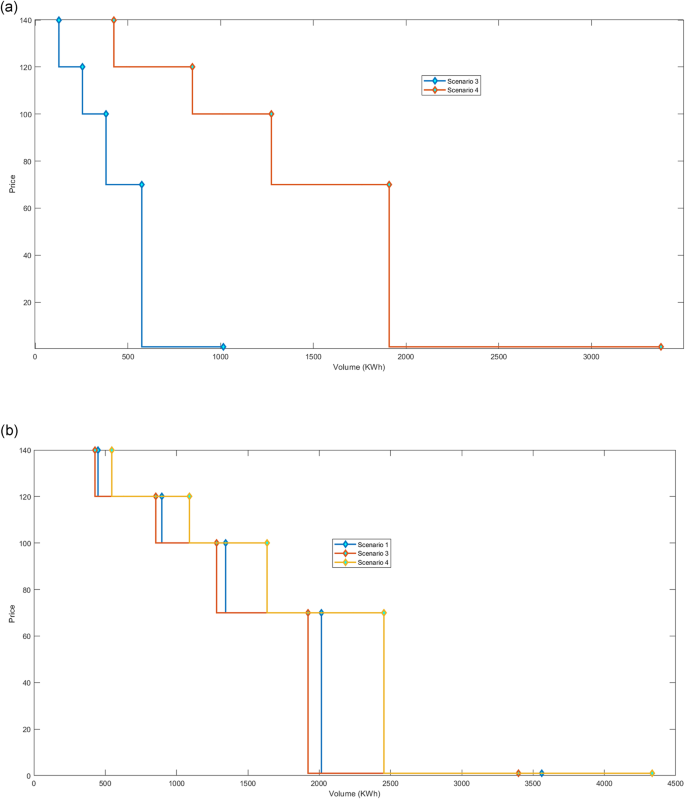

During the bidding process for each hour, a collection of points known as scenarios is utilized on a bidding curve. These scenarios correspond to specific bid prices and bid volumes, providing a comprehensive representation of the various pricing and quantity options offered by suppliers. However, due to the non-linear nature of the formulation resulting from selecting both bid prices and volumes, an approach is taken to linearize the problem. To achieve linearity, the bid prices are treated as fixed exogenous parameters, while the bid volumes are modeled as decision variables. The bidding curve is constructed by interpolating linearly between adjacent price-volume pairs, resulting in a piece-wise linear curve that represents the bids. This linearization simplifies the problem while still capturing the essential characteristics of the bidding process.

Figure 3 depicts a bidding curve characterized by three line segments, serving as an illustrative example. The bidding curve is typically depicted graphically, with the price plotted on the vertical axis and the quantity on the horizontal axis. Each point on the curve represents a specific price-quantity combination that a supplier is willing to offer. The shape of the curve reflects the supply-side behavior and competitiveness of the market. Equation ( 1 ) and Equation ( 2 ) represent the bidding curve using different variables. Equation ( 1 ) expresses the curve in terms of prices, while Equation ( 2 ) expresses it in terms of volumes.

Electricity market bidding curve.

Furthermore, the proposed model takes into account the state of charging for batteries at the charging stations through the consideration of charging and discharging functions. Installing backup power systems, such as batteries, can enable charging stations to continue operating during power outages. These systems can provide electricity to the charging infrastructure, ensuring that electric vehicles can still be charged even when the grid is down. It’s important to properly size and maintain backup power systems to ensure they have sufficient capacity and reliability. By continuously monitoring the charging levels and managing the flow of electricity, the model ensures that the charging stations operate within their capacity limits and prioritize the needs of EVs. This functionality optimizes the charging process, avoiding overloading of the charging infrastructure and maintaining a reliable and stable charging experience for EV owners. The model’s ability to regulate the state of charging at charging stations contributes to the overall efficiency and effectiveness of EV charging operations, enhancing the charging experience and promoting widespread EV adoption. The proposed model aims to generate a set of outputs that collectively contribute to the optimization and improvement of EV charging operations. The outputs derived from the proposed model encompass:

The model provides optimized routing decisions for EVs, considering factors such as travel costs, charging station availability, and energy consumption. By optimizing the routes, EVs can reach their destinations efficiently while minimizing energy consumption and charging requirements.

The model generates charging plans that determine when and where EVs should charge along their travel routes. By considering the OD demands, the model ensures that there are sufficient charging stations available to meet the charging needs of EVs throughout their journeys.

The model takes into account the remaining energy levels of EVs and considers them in the routing and charging decisions. By factoring in the remaining energy, the model aims to reduce traveler anxiety by ensuring that EVs have adequate energy reserves to reach their destinations and avoid running out of charge.

The model optimizes the charging demands for charging stations by considering factors such as charging station capacities, electricity grid constraints, and EV charging requirements. This optimization helps in efficiently utilizing the charging infrastructure and minimizing charging congestion.

The model considers the availability and variability of renewable energy sources. By optimizing the utilization of these sources, it helps stabilize the power grid. The intermittent nature of renewable energy can be managed by smart charging systems that can adjust charging rates based on the availability of renewable energy, reducing grid stress and balancing electricity supply and demand.

Efficient battery management is crucial for optimizing the operation of charging stations. The proposed model facilitates the effective utilization of battery resources by optimizing the charging and discharging functions at charging stations. It considers factors such as station capacity, battery state monitoring, grid integration, energy pricing, and battery health to ensure the efficient utilization of resources, support grid stability, minimize operational costs, and promote the longevity of batteries.

The model considers bidding prices for electricity markets to make informed procurement decisions regarding the purchase of electricity for charging operations. By considering market prices, the model aims to optimize the cost-effectiveness of EV charging while ensuring reliable and sustainable energy supply.

By generating these outputs, the proposed model aims to contribute to the optimization and improvement of EV charging operations. This, in turn, promotes the adoption of electric vehicles, fosters the transition to a sustainable transportation system, and helps overcome the challenges associated with the integration of EVs into the existing infrastructure.

Optimal integration model for electric charging stations

In this section, we present an optimization model for electric vehicle charging stations that takes into account renewable energy sources such as photovoltaic (PV) cells and wind turbines. Then, we explore incorporating these renewable energy sources into the proposed model, allowing for a more sustainable and efficient charging infrastructure for electric vehicles. Integrating an optimization model that combines charging and routing plans with the electricity market can indeed help minimize social costs for both users and charging providers. This integrated model can effectively optimize charging and routing plans by considering various factors such as vehicle range, charging infrastructure availability, electricity prices, and user preferences, leading to cost savings and improved efficiency. The model incorporates several factors associated with the value of time, such as travel cost, setup time at the station, and charging duration. By considering these factors, the model provides an accurate assessment of the overall time-related costs involved in charging at a charging station.

The first element of the objective function incorporates the expenditure associated with purchasing electricity from both the day-ahead and intra-day electricity markets. We incorporate scenarios that are generated using probability distributions for bid prices. This approach allows us to explore a range of potential situations that could occur during a bidding process. Rather than relying on a singular fixed bid price, we consider the probabilities associated with different bid prices, thereby taking into account the likelihood of various bid prices arising. The second component denotes the travel time from point O to point D, assuming a consistent speed. The third component of the objective function accounts for the cumulative time spent on setup at each station. The last component corresponds to the duration of charging at the station. The notations used in the proposed framework are provided in Table 1 .

Constraints ( 4 ) and ( 5 ) in this context serve as a condition related to the inclusion of a specific arc (i, j) in the path. When the decision variable x i j t k v (representing the inclusion of arc ( i , j ) in the path) is equal to 1, it means that the arc is indeed included in the path. In this scenario, constraint ( 4 ) becomes active and imposes a requirement on the variables a j t k v , a i t k v , b i t k v , and d i j 14 .

On the other hand, if x i j t k v is equal to 0, indicating that the arc ( i , j ) is not included in the path, constraints ( 4 ) and ( 5 ) become redundant. In this case, it does not contribute any additional information or place any additional constraints on the variables. It effectively becomes inactive and does not affect the optimization problem 14 .

Constraints ( 6 ), ( 7 ), and ( 8 ) play a vital role in maintaining the flow balance equation within the transportation network problem. Constraint ( 6 ) ensures that the flow of electric vehicles into the set of source nodes \(O\left(k\right)\) is equal to the flow out of it, while

Constraint ( 7 ) extends this requirement to all intermediate nodes, ensuring that the flow into and out of each intermediate node is balanced.

Constraint ( 8 ) ensures a similar balance for the set of destination nodes \(D\left(k\right)\) , enabling the network to maintain flow balance and integrity while designating the set \(O\left(k\right)\) as source nodes, nodes in \(D\left(k\right)\) as destination nodes, and the remaining nodes as intermediaries. This structural enforcement preserves the network’s functionality and integrity.

Constraint ( 9 ) specifies that the charging amount at node i should not exceed the charging capacity ( δ ) minus the remaining charge level at that node.

Constraint ( 10 ) states that the charging amount at node i is the difference between the charging capacity and the charge adjustment at that node. To prevent overcharging beyond the available capacity of the battery, a parameter r i t k v is used to calibrate the amount of charge replenished at a site. This is achieved by satisfying the inequality δ y i t k v − r i t k v ≤ δ − a i t k v (where b i t k v in Constraint ( 9 ) is replaced by δ y i t k v − r i t k v in Constraint ( 10 )). Ideally, the desired formula would be δ y i t k v L ≤ δ − a i t k v , where L is a recharging coefficient ranging of 0-1, based on the available capacity of the battery at each stop. The recharging coefficient regulates the amount of charge replenished at a specific site. However, solving this nonlinear equation is currently challenging. Therefore, we introduce a linear formula with an adjustment variable r i t k v to approximate the desired behavior 18 .

Constraint ( 11 ) establishes a direct relationship between the inclusion of a node in the path and the possibility of charging at that node. It stipulates that charging at a particular node can occur if and only if that node is included in the travel path 14 .

Constraint ( 12 ) implies that the EV is fully charged at the starting point 18 .

The bidding curves enable the efficient allocation of electricity resources by facilitating the matching of supply and demand at equilibrium prices. Equation ( 13 ) formulates the bidding curve for the day-ahead market. This curve describes the relationship between the bid price and the corresponding quantity of electricity that market participants are willing to supply or demand in the day-ahead market. It helps determine the market clearing price and quantity for the day-ahead market 29 , 30 .

Equation ( 14 ) formulates the bidding curve for the intra-day market. This curve represents the price-quantity relationship for electricity bids in the intra-day market. It reflects the willingness of market participants to buy or sell electricity at different prices in the intra-day market, allowing the determination of the market clearing price and quantity for intra-day transactions. By formulating these bidding curves, market participants can express their preferences and strategies for buying or selling electricity at different price levels 29 , 30 .

Constraint ( 15 ) in the day-ahead market ensures that the bidding curve submitted by market participants follows a non-increasing pattern. This means that as the quantity of electricity increases, the corresponding bid prices must decrease or remain the same. This rule helps maintain fairness and efficiency in the day-ahead market by discouraging participants from artificially inflating prices as the quantity increases.

In the intra-day market, Constraint ( 16 ) serves a similar purpose but with a slight difference. The bidding curves in the intra-day market are based on the realized scenario from the day-ahead market. This means that the bidding volume in the intra-day market is influenced by the specific conditions and outcomes observed in the day-ahead market. The scenario index is introduced to reflect these conditions and ensure that the bidding curve remains non-increasing within the context of the realized scenario.

Equation ( 17 ) is a critical component in maintaining power balance within the sequential markets. It establishes the requirement that the combined power purchased from both the day-ahead and intra-day markets must equal the dedicated power allocation designated for charging electric vehicles and charging the battery. This equation ensures that the total power procured from the markets aligns precisely with the power demand necessary for the specific tasks of electric vehicle charging and battery charging.

Constraint ( 18 ) effectively meets the power demand of the charging station by considering both the purchased power and the power discharged from the battery for electric vehicle charging. The equation accounts for the combined power from these sources to ensure that the station’s charging requirements are adequately fulfilled.

where ρ e is the energy consumption rate per kilometer, which converts the distance to energy.

The charging equation establishes a relationship between the charge current, \({I}_{its}^{c}\) (measured in amperes, A), the charge power, \({\Theta }_{its}^{C}\) , and the state of charge (SOC) of the battery. In this equation, V i represents the battery voltage, which is a measure of the electrical potential difference across the battery terminals. The term \({\eta }_{i}^{C}\) denotes the charging efficiency, which accounts for any energy losses that occur during the charging process. Hence, it can be represented as:

By dividing the charge power, \({\Theta }_{its}^{C}\) , by the product of the battery voltage, V, and the charging efficiency, \({\eta }_{i}^{C}\) , the charging equation determines the charge current required to deliver the specified charge power to the battery.

During the discharging process, the battery releases stored energy to power an external load. The discharge current, denoted as \({I}_{its}^{D}\) , represents the rate at which electrical charge flows out of the battery and is typically measured in amperes (A). This equation shows that the discharge current is equal to the discharge power divided by the product of the battery voltage and the efficiency of the discharge process.

The change in SOC over time can be calculated based on the charge and discharge currents. Equation ( 21 ) represents the net charge or discharge during the time interval, divided by the battery capacity. Assuming a small time interval Δ t , the change in SOC, Δ S O C , can be expressed as:

To update the State of Charge (SOC) of a battery, the initial SOC is modified based on the change in SOC. The updated SOC ( S O C i t s ) is obtained by adding the change in SOC (Δ S O C ) to the initial SOC. This calculation helps track the battery’s energy level and reflects any charge or discharge that has occurred. By continuously updating the SOC, it becomes possible to monitor the battery’s remaining capacity, estimate runtime, and optimize charging and discharging strategies.

Maintaining the State of Charge within the recommended range of \(SO{C}_{its}^{Min}\) to \(SO{C}_{its}^{Max}\) is essential for optimal battery performance, longevity, and safe operation. \(SO{C}_{its}^{Max}\) defines the maximum allowable level of charge for a battery, beyond which overcharging may occur, leading to potential damage and safety risks. \(SO{C}_{its}^{Min}\) , on the other hand, represents the minimum acceptable level of charge to avoid deep discharge, which can cause irreversible damage and loss of capacity.

Constraints ( 24 ) and ( 25 ) sets the nonnegativity and the binary condition of the variables.

Modeling of wind turbine

To model wind turbines in charging stations for electric vehicles, it is necessary to comprehend the principles of wind energy conversion and its connection to power generation. A widely employed mathematical model for this purpose is the power curve model. This model establishes a relationship between the wind speed and the power output of the turbine. The power output ( \({\Theta }_{it}^{W}\) ) of a wind turbine can be represented using the following equation 40 , 41 :

where ρ i t represents the air density, A i is the swept area of the rotor, \({C}_{i}^{p}\) is the power coefficient that quantifies the turbine’s efficiency, and \({V}_{it}^{w}\) denotes the wind speed. By employing this equation, one can determine the wind turbine’s power output based on the prevailing wind conditions.

Modeling of PV array

To model photovoltaic (PV) arrays in charging stations for electric vehicles, it is essential to utilize mathematical representations that accurately capture the conversion of solar energy into electrical power. One prevalent approach involves employing the single-diode model, which effectively describes the current voltage (I-V) characteristics of the PV array. The single-diode model represents the I-V relationship of a PV module or array using the following equation 41 , 42 :

The mathematical model for a photovoltaic cell involves several parameters that describe its electrical behavior. In this model, the cell’s output current ( \({I}_{it}^{S}\) ) is related to its output voltage ( \({V}_{it}^{s}\) ) through various factors. These factors include the photocurrent generated by the cell under illumination ( \({I}_{it}^{ph}\) ), the reverse saturation current (or dark current) of the cell ( \({I}_{it}^{0}\) ), the series resistance of the cell ( \({R}_{it}^{s}\) ), the diode ideality factor ( n ), and the thermal voltage ( \({V}_{it}^{th}\) ). The thermal voltage is calculated as the product of Boltzmann’s constant ( B k ), the temperature in Kelvin ( T s ), and the elementary charge ( q ). Additionally, the model accounts for the shunt resistance of the cell ( \({R}_{it}^{sh}\) ). Together, these parameters provide insights into the electrical characteristics and performance of the photovoltaic cell.

The power ( \({\Theta }_{it}^{S}\) ) generated by a photovoltaic (PV) cell can be calculated by multiplying the current ( \({I}_{it}^{S}\) ) generated by the cell with the voltage ( \({V}_{it}^{S}\) ) across its terminals. Mathematically, it can be expressed as:

To incorporate renewable energy sources, specifically solar and wind, for charging stations, we modify Equation ( 17 ). Other formulations remain unchanged. The updated equation now reflects the contribution of solar and wind energy to power the charging stations. The equation is as follows:

In equation ( 29 ), the left-hand side represents the combined power purchased from both the day-ahead (DA) and intra-day (ID) markets, as well as the renewable energy provided by solar (S) and wind (W). The right-hand side represents the dedicated power allocation designated for charging electric vehicles (V) and charging the battery (C). This equation ensures that the total power procured from the markets aligns precisely with the power demand necessary for the specific tasks of electric vehicle charging and battery charging.

Findings and Analysis

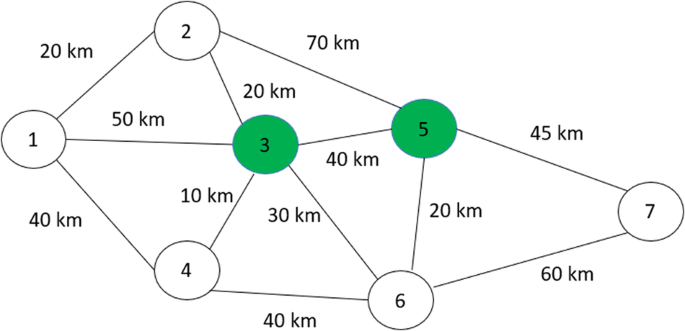

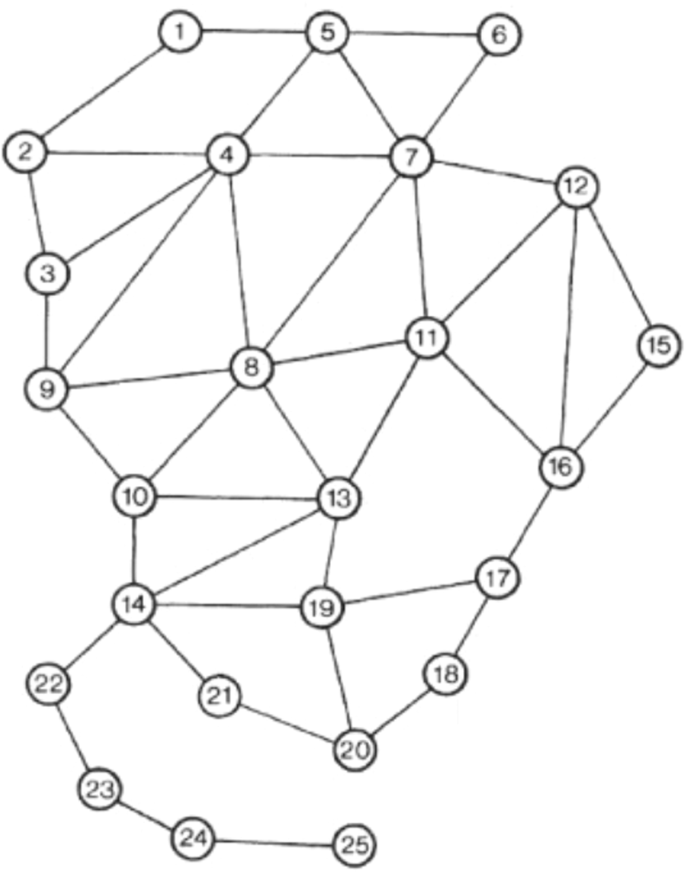

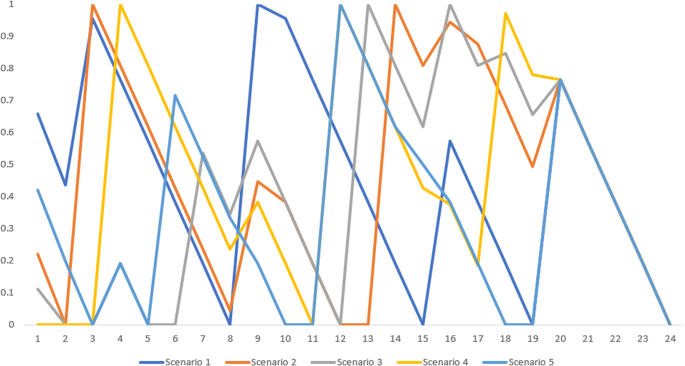

This paper presents two examples that demonstrate the application of an integrated model for optimal charging, routing, and grid-aware operations in the context of EV charging. The first example focuses on a transportation network with seven nodes. It considers two charging stations located at nodes 3 and 5, which rely solely on the electricity grid for charging operations. The nodes within the network represent various locations, such as residential areas, workplaces, and charging stations. EVs travel between these nodes to complete their trips. The model optimizes the charging, routing, and grid-aware operations to ensure efficient EV charging within the network. The second example involves a transportation network consisting of 25 nodes. Simulation tests were conducted to evaluate the effectiveness of the proposed model. Two strategically placed charging stations within the network, located at nodes 5 and 12, accommodate the growing demand for EVs. These stations consider both the electricity grid and renewable energy sources, such as solar panels and wind turbines, to provide sustainable charging options. Both examples highlight the versatility and effectiveness of the integrated model in addressing the challenges of EV charging, including optimal power allocation, renewable energy integration, and grid-aware operations.

The model was implemented in Julia 1.7.1 programming language. To solve the optimization model, we utilized the Jump package 43 in Julia. Additionally, we leveraged the CPLEX software for the optimization process. The CPLEX software, which was utilized in solving the optimization model, is based on the Branch-and-Bound (B&B) algorithm for Mixed Integer Programming (MIP) problems. The proposed model was solved on a laptop computer with the following specifications: a 2.50 GHz processor, 12 GB of RAM, Intel Core i7-2450, and a 64-bit Windows 10 Professional operating system.

An illustration example

In this numerical example, we have a transportation network consisting of seven nodes. The specific layout of this network can be observed in Fig. 4 . We consider two charging stations located at node 3 and node 5, which utilize the electricity grid for charging operations. The seven nodes represent different locations within the transportation network where EVs travel between. The network displays the distances between nodes measured in kilometers. Each node represents a specific point or destination within the network. EVs in this network travel between these nodes to complete their trips. The network includes two origin nodes, node 1 and node 2, marked as O = [2, 1]. These nodes represent residential areas or starting points for EV trips. Conversely, node 6 and node 7 are designated as destination nodes, indicated by D = [7, 6]. These nodes represent the desired endpoints for the EV journeys. We consider a total of 10 electric vehicles for each OD demand in this example. The charging stations located at node 3 and node 5 rely on the electricity grid to cater to the charging needs of the EVs within the network. Let’s consider the following example with the given parameters: u i t = 30 min/stop, π i t = 2 min/km, and v = 1 km/min. Other parameters that will be made publicly available at https://github.com/homase2003/ElectricChargingStations . In this paper, we present a simplified version of the model where we assume a constant travel time. However, the model can be enhanced by incorporating the Bureau of Public Roads (BPR) function. The BPR function allows for a more accurate representation of travel time by considering factors such as traffic congestion and road conditions.

Seven-node test road network.