- Work & Careers

- Life & Arts

Tesco set to close door on South Korean success story

- Tesco set to close door on South Korean success story on x (opens in a new window)

- Tesco set to close door on South Korean success story on facebook (opens in a new window)

- Tesco set to close door on South Korean success story on linkedin (opens in a new window)

- Tesco set to close door on South Korean success story on whatsapp (opens in a new window)

Simon Mundy in Seoul

Simply sign up to the Retail & Consumer industry myFT Digest -- delivered directly to your inbox.

After negotiating aisles dotted with staff noisily promoting foodstuffs in the style of market hawkers, shoppers at many of Tesco’s Homeplus stores in South Korea can head to the attached “cultural centre” to receive lessons in cooking or English.

Such features show a willingness to adapt to the local market that helped Tesco become the only foreign supermarket chain to succeed in South Korea, where Homeplus is the second-biggest company in the industry by sales.

But nine years after it watched rivals Walmart and Carrefour sell out of the country, the UK retailer is doing the same, as it seeks to shore up its balance sheet following a pre-tax loss of £6.4bn in its last financial year.

Tesco is negotiating terms for a sale of Homeplus to investors led by South Korean private equity firm MBK Partners . The deal could be announced as soon as Monday, and is likely to be worth about $6bn, a person close to the process said on Friday.

The sale will end one of South Korea’s biggest inbound investment success stories — but one that also fell victim to the unpredictable regulatory environment widely seen as a key factor holding back further direct investment in the country.

Tesco entered South Korea in 1999 on the heels of France’s Carrefour and Walmart of the US, as the world’s leading mass retailers charged into what had become recognised as one of the most lucrative consumer markets. Both those rivals pulled out of their struggling businesses in 2006, and were criticised by analysts for failing to customise their offerings to the local market.

In contrast, Tesco tried to win over shoppers by making its new business as South Korean as possible from the start. It launched it as a joint venture with Samsung Corporation , a construction-focused unit of the country’s biggest business group. Samsung put most of its small retail operation — two existing Homeplus stores, and the crucial distribution business — into the joint venture, while Tesco invested £130m to take an 81 per cent stake.

MBK’s expected Tesco unit purchase highlights decade of growth

Private equity fund is one of the biggest Asian buyout firms with $8.2bn in assets under management

Until it sold the last of its shares in 2011, Samsung’s name always came first in the Samsung-Tesco joint venture, and could be seen emblazoned on the exterior of stores — something that helped the business to gain traction, according to Na Hong-suk, an analyst at Nomura. “Many people thought this was actually run by Samsung, and many Korean people trust Samsung when they do something,” he said.

The localisation went beyond clever branding. Tesco put the new business under local management led by the charismatic Lee Seung-han, who stayed until last year. Mr Lee followed some of the successful innovations employed by other supermarket chains, such as the cultural centres. In 2011 he unveiled a £30m training academy in the port city of Incheon, where Tesco employees from across Asia came to learn skills from butchery to ecommerce.

But while Homeplus benefited from local branding and know-how, Tesco’s financial firepower enabled it to create the economies of scale needed to compete with its two rivals E-Mart and Lotte Shopping — respectively part of Shinsegae and Lotte, two of the family-controlled chaebol groups that dominate the national economy.

Over the past 16 years Homeplus has built 140 hypermarkets, while E-Mart runs 155 and Lotte has 114. Since 2004 Homeplus has also set up 702 smaller neighbourhood stores, a move that sought to emulate the success of the Tesco Metro initiative in the UK.

But this drive by Homeplus and the other supermarkets prompted a backlash that has crunched their profits in recent years. After small shop owners complained about the impact on their businesses, South Korea’s parliament passed a law that since 2012 has forced big supermarket chains to close their stores every other Sunday — a day when sales were about double those on weekdays, according to Nomura.

Mr Lee reacted angrily , complaining: “Not even communist countries followed this kind of policies.” His alarm was borne out by the severe impact on profitability, which declined sharply across the sector. In the 12 months to the end of February this year, Homeplus recorded an operating margin of 2 per cent, down from 5.1 per cent three years before.

The tougher conditions for big retailers have left analysts questioning how MBK will be able to realise a good return on its investment. Homeplus has already engaged in extensive sale-and-leaseback transactions on its store sites, limiting the room for further such manoeuvres to boost short-term profits. The union representing Homeplus’s employees has been a vocal spectator of the sale process, staging protests against anticipated job cuts.

Their fears are probably justified, says Yu Jeong-hyun, an analyst at Daishin Securities. “The $6bn price seems high given the state of the market . . . the number of hypermarkets in South Korea is excessive compared with the number of people, and consumers are increasingly shopping through their smartphones,” she says. “MBK is likely to close unprofitable stores and restructure — a downsizing looks inevitable.”

Additional reporting by Kang Buseong

Promoted Content

Follow the topics in this article.

- Retail & Consumer industry Add to myFT

- Retail sector Add to myFT

- UK companies Add to myFT

- Asia-Pacific companies Add to myFT

- South Korean business & finance Add to myFT

International Edition

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Election with BT

- Economic Indicators

- BT-TR GCC Listing

How Tesco virtually created a new market on a country's lifestyle

South koreans have amongst the longest working hours in the world. uk's giant retailer sought to turn this to its benefit..

- Print Edition: Feb 15, 2015

Executive Summary

South Koreans have amongst the longest working hours in the world, with young, upwardly mobile executives often too busy to go shopping for grocery at a traditional store. The UK's giant retailer, Tesco, sought to turn this disadvantage to its benefit. It introduced "virtual stores", which are essentially a display of products on walls of metro stations and bus stops. Commuters, especially the tech-savvy, ultra-busy lot, could scan the QR codes of the products on display with their smartphones, and place their orders even as they waited for their trains or buses. This case study looks at how Tesco "virtually" created a new market based on a country's lifestyle.

In 2011, when domestic sales of the UK's retail giant Tesco slumped, it fell back on its second-largest market, Asia, which accounted for 30 per cent of its total profit. Tesco's success in Asia, and specifically in South Korea - currently its largest market outside the UK - is based on its ability to adapt to the local consumer.

Tesco's expansion into Asia has been an important focus for the company since the late 1990s. Following its acquisition of Thailand's Lotus in May 1998, the company announced a 142-million investment in South Korea in March 1999 by partnering with Samsung to develop hypermarkets. Through its tie-up with Samsung, Tesco made a localisation effort to adapt its Homeplus stores to the local consumer.

The latest example of this localisation was the launch in 2011 of its first virtual store, located in a Seoul subway station, an idea based on the observation that the typical Seoul commuter did not have the time to shop at her nearest brick-and-mortar Homeplus store.

The Virtual Store

The virtual stores are set up in public spaces, most often in subways and bus stops with high foot traffic and frequented daily by tech-savvy commuters. This is how such stores work:

- Interested customers download the Homeplus app into their smartphones.

- They then use their smartphones to scan the QR codes of the products they want to purchase. The posters in the virtual stores are designed to resemble the actual aisles and shelves of a regular Tesco store, making the experience very user-friendly.

- The scanned products are stored in the customers' online shopping basket, who pay online once their order is completed. Homeplus reported that the majority of the orders are placed at 10 am and 4 pm, when people are commuting to and from work.

- Customers schedule a time for home delivery. Same-day delivery is the norm, so that customers can get their products by the time they get back home from work.

The virtual store has been a huge success with commuters and drove over 900,000 app downloads in less than one year, making the Homeplus app the most popular shopping app in South Korea. Online sales increased 130 per cent since the introduction of the virtual stores and registered app users increased by 76 per cent. In February 2012, Tesco Homeplus announced it was extending the virtual store concept to 20 new locations across the country. Today, there are 22 Homeplus virtual stores in South Korea, and the brand is the country's No. 1 online retailer.

Understanding the Consumer

South Korea, a country of around 50 million people, is the fourth-largest economy in Asia and the 12th largest in the world. Compared to other Asian countries, South Koreans generally have higher levels of education, higher average household income, and better living standards. Over the past few decades, the country has built itself up with its largest resource - people - and has achieved rapid economic growth through exports of manufactured goods. It is now a major producer of automobiles, electronics, steel and high-technology products such as digital monitors, mobile phones, and semiconductors.

Over the past decade, South Korea has advanced tremendously and has been shaped by constant innovation, technology and westernisation. In today's world, shopping habits and behaviour of South Korean consumers are impacted by several key factors.

Extensive use of technology/connectivity: According to a report by McKinsey & Co., South Korea is one of the most advanced countries in terms of broadband penetration, and has more than 10 million smartphone users. In other words, one in five South Koreans use a smartphone. Additionally, according to Nielsen, households in South Korea are making six per cent fewer shopping trips. When they do shop for products, an increasing number of South Koreans go online.

Long working hours/busy lifestyle: Although the average annual hours worked per person in South Korea is declining, the country still comes out top among OECD countries with 2,193 hours. This is perhaps unsurprising, as the work ethic and lifestyle of South Koreans get shaped at a young age. According to the BBC, South Korean parents spend thousands of pounds a year on after-school tuition on an industrial scale. There are just under 100,000 hagwons or private academies in South Korea and around three-quarters of Korean children attend them.

Travel time on public transportation: South Koreans spend a significant amount of time on public transportation, predominantly between home and work. What has helped is that public transportation is reliable and inexpensive, and is the fastest and most efficient way to get around.

The introduction of Tesco's virtual stores in subways made use of time spent by commuters waiting for public transportation, allowing buyers to use the little time they have available for grocery shopping. Not only did this change the way buyers shopped, it also increased the potential market for Tesco. These buyers may not have otherwise had time to go grocery shopping between their personal and professional lives, opting to buy take-out instead.

All of this implies that grocery customers in South Korea are more time-poor and less price-sensitive. They value convenience and technology to accommodate their busy lifestyle.

Tesco's Value Proposition

Customer segmentation: When you enter a new market/geography, companies need to understand and analyse consumer behaviour trends, including shopping habits and purchasing behaviour, to identify who the valued customers are and how they behave.

Adaptation of value proposition: If the needs, attitudes and lifestyle of the company's "value customer" are different in the new market/geography, the company needs to adapt its value proposition and value network across the entire supply chain.

Power of technology in traditional industries: Technology has a disruptive power in traditional industries, such as retailing. In this case, the predominance of smartphones in Korea allowed Tesco to boost its revenues through an innovative approach.

Innovative marketing: The way marketing can be used innovatively to target captured audiences (such as commuters waiting for the next train in a station).

Brand Extension: One option that Tesco Homeplus may have considered in order to take advantage of is to create a new brand for the virtual stores that would have remained independent from the Homeplus brand and, therefore, limited the risk to the Homeplus brand by increasing prices.

EXPERT VIEW

RETAILERS STRUGGLING TO DEVELOP COMPETENCIES TO SUCCEED GLOBALLY

Despite the popularity of globalisation in retailing, most retailers are still struggling to develop competencies to succeed in global markets. To what extent should the "original" format and merchandise be adapted is a major issue. Walmart learnt this the hard way when its initial entry into China had the wrong merchandise. On the other hand, Mexican customers were disappointed when they did not find enough imported US merchandise in the Walmart stores. Toys R Us has learnt that there are differences in consumption patterns. The Japanese demand electronic toys, other Asian consumers demand educational toys, Europeans favour traditional toys, while American kids prefer television- and movie-endorsed toys.

The Tesco case in South Korea demonstrates that despite the company's many problems, it has been a leader in developing multichannel solutions. With consumers preferring the convenience and selection of e-commerce, traditional brick-and-mortar retailers are challenged to address how to serve this customer profitably. The home-delivery option is much valued by consumers but cannot be as profitable as the traditional store. Therein lies the dilemma.

VIRTUAL STORES COULD SEE ACCEPTANCE LARGELY FOR TOP-UP OR IMPULSE PURCHASES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

Product details

Teaching and learning

tesco virtual supermarket in a subway station

tesco homeplus opened a virtual grocery store in a south korea subway station, where users shop by scanning QR codes on their smartphones

in a campaign designed by the seoul branch of advertising agency cheil , tesco homeplus supermarket opened last fall a virtual grocery store in a south korea subway station, permitting users to shop using their smartphones.

a large, wall-length billboard was installed in the station, designed to look like a series of supermarket shelves and displaying images and prices of a range of common products. each sign also includes a QR code. users scan the code of any product they would like to purchase, thereby adding it to their online shopping cart. after the web transaction is completed, the products are delivered to the user’s home within the day.

the strategy makes productive use of commuters’ waiting time, while simultaneously saving shoppers time spent going to the supermarket.

video footage documenting the concept and actualization of the virtual supermarket

PRODUCT LIBRARY

a diverse digital database that acts as a valuable guide in gaining insight and information about a product directly from the manufacturer, and serves as a rich reference point in developing a project or scheme.

- love hultén (11)

- sound art (63)

- car design (799)

- electric automobiles (642)

- materials (69)

- recycling (333)

- car concept (359)

- space travel design (98)

designboom will always be there for you

Tesco Corporation’s Internationalization Strategy Case Study

Introduction, analysis of the existing strategy, costs and benefits of the strategy, environmental challenges, resources/capabilities, new strategic directions.

Tesco is one of the leading UK retailers that started its international expansion in the 1990s. The company’s focus on internationalization was a successful strategy that led to remarkable growth in many regions and considerable profits that reached $3.8 billion in 2011 (Wrigley, Lowe, & Cudworth, 2013). However, success in some regions was accompanied by major failures in other areas, which led to significant losses, both financial and reputational. This paper includes a brief analysis of the company’s strategy, as well as challenges the company faces and new strategic directions to adapt to address these challenges.

The focus on international expansion was determined by the growing regulatory and competitive pressures Tesco had to handle in the domestic market. The first areas of expansion were countries of Central Europe that were undergoing major transformations in the 1990s after the collapse of the Soviet Union. Regulations in those countries were minimal, and competitors were also quite a few, which enabled the company to earn a significant share of the market (up to 27%) in 2011 (Wrigley et al., 2013). At that, Tesco experienced the most unprecedented growth in Asia, specifically in South Korea. The company is now the second-largest retailer in the country, with revenues of over £5 billion (Butler & Neville, 2013). The company is successfully penetrating the markets of India and China.

Nevertheless, the expansion into the US market that started in 2007 proved to be a failure as the company announced that all the stores would be closed and sold in the near future (Ruddick, 2013). It is noteworthy that Philip Clarke, the company’s CEO, understood the complexity of operating in the USA as the market was saturated, and the competition was rather fierce. However, the decision was to enter the American market with a focus on fresh food (which was quite expensive).

The internationalization of Tesco has a number of peculiarities. First, the company made some partnerships. One of the most successful partnerships was implemented in South Korea (Wrigley et al., 2013). Tesco and Samsung collaboration was successful as Tesco managed to address various issues associated with operating in new markets. First, the retailer managed to learn the peculiarities of the country’s legislation and regulatory policies.

Customers’ needs and characteristic features were also acknowledged. Tesco also managed to establish a retail chain that seemed fully domestic. Another peculiarity of Tesco’s expansion was the focus on its private labels rather than manufacturers’ products. The company also tried to be customer-oriented. However, in many regions, Tesco failed to achieve this goal, which led to failures and losses (Yoder, Visich, & Rustambekov, 2016). The company did not meet the needs of customers in the USA, Japan, and other regions.

It is necessary to note that internationalization is often an effective strategy used when the competition in the domestic market becomes too fierce, or other environmental challenges come into play (Wrigley et al., 2013). The expansion to other markets allows companies to improve profits through the increase in sales. The company can allocate funds wisely and invest in profitable projects. Operating in new markets helps companies become more flexible and innovative.

On the one hand, businesses learn about different regulatory policies and laws. On the other hand, they learn how to adjust to such environments. This flexibility is essential in the contemporary globalized world as regulations and norms existing in some countries tend to be adopted in other regions as well. There are chances that the norms and regulations existing in a foreign market will be used (with some differences) in the domestic market as well.

Nonetheless, the costs associated with the use of this strategy are also substantial. First, any expansion requires significant financial investments (related to acquisitions, alliances, construction of facilities, and so on). For instance, Tesco invested £1.25 billion to enter the American market (Wrigley et al., 2013). Clarke stated that this kind of investment was affordable for the company, and it could become transformational for Tesco in case of success. The CEO also stated that the major reputational loss in case of failure was associated with his name, not the company. Nevertheless, the reputational loss is apparent, and its negative effect can become visible soon. Unsuccessful expansion can come at a high cost, and Tesco’s failures in some regions can be seen as illustrations of these costs.

Tesco’s failures are associated with a number of wrong decisions as well as environmental challenges. First, the company entered the American market a year before the global financial crisis of 2008 (Butler & Neville, 2013). The environmental factor was accompanied by the inability to adjust and the inability to address customer needs (Yoder et al., 2016). For example, Fresh & Easy stores offered high-quality products, but they became unaffordable for price-sensitive Americans.

Furthermore, the focus on private labels was also ineffective in the US market. Martinez-Ruiz, Gonzalez-Gonzalez, Jimenez-Zarco, and Izquierdo-Yusta (2016) stress that American customers often become loyal to particular brands. People’s needs and preferences were not addressed, which resulted in failures. Customers’ peculiarities were not taken into account in other regions as well. For instance, in Poland, people prefer convenience stores to large hypermarkets while Tesco focuses on this type of retail units in that region (Ruddick, 2013). Apart from the inability to identify people’s needs, Tesco also faced issues related to the introduction of new regulations.

For instance, the changes in the Indian legislature has a negative effect on the development of the company and its further expansion in the region (Butler & Neville, 2013). Finally, many countries are trying to address serious financial issues and introduce new taxes, which also has an adverse impact on the company’s growth.

When discussing the resources and capabilities of the international retailer, it is necessary to note that Tesco has substantial funds to invest in numerous projects. The company’s billion profits show that significant funds can be allocated to innovate and expand. Apart from the obvious financial resources, the company also has other resources and capabilities. For instance, Tesco has a positive experience associated with the collaboration with companies operating in new (for Tesco) regions (Wrigley et al., 2013).

This experience can be helpful when expanding to new markets (in India and China). Tesco’s experience in collaborating with other companies can generate value as the company will be able to employ it in other regions (collaborating with other companies). The use of this strategy can help the company reduce costs, understand new markets better, and develop a proper image in the new market.

The company also tries to innovate and come up with new products and services. The development of private labels is one of the areas where Tesco has succeeded in many regions. For example, its tablets have acquired significant popularity (Warman, 2013). Hence, the development of private labels can help the company meet the existing and potential customers’ needs in a more efficient way.

The company is also expanding its e-commerce operations. Tesco’s management claims that being online is one of the major competitive advantages in the retailing industry (Warman, 2013). The company has quite effective information systems that can be used to implement marketing research, share knowledge within the company, and so on. The data obtained can help the company create value-added products and services that can attract more customers and meet the needs of the existing customers.

It may seem that the most appropriate strategy for Tesco is the focus on the domestic market and the most successful foreign markets (such as South Korea). However, the UK market is saturated, and the competition is very serious. The company needs to expand, but the expansion strategy should be based on the lessons learned from previous years. First, Tesco should launch large-scale market research with a focus on customers’ characteristic features (profile).

It is essential to understand what people need and want. One of the successful methods to learn more about new customers is the development of partnerships and alliances. Tesco can collaborate with local businesses to develop a successful marketing strategy.

Yoder et al. (2016) note that ineffective supply chain management contributed to Tesco’s failures. The company should implement research concerning the most efficient locations of stores and other facilities. This task is closely connected with another area of concern. The company should analyze the existing competition in new markets. Tesco should properly evaluate the existing competition and (based on this analysis) decide whether new Tesco stores can be set or other locations should be chosen. It is also important to identify Tesco’s competitive advantage to be able to win the competition or, at least, remain a successful player in the market.

Finally, Tesco should focus on innovation as this strategy has proved to be effective in South Korea and many other countries. The use of technology is instrumental in achieving this goal. For example, South Korean customers enjoy so-called virtual stores (Wrigley et al., 2013). These advances can be equally successful in western countries as well. The use of mobile technologies is also on the rise. E-commerce is another area to develop.

In conclusion, it is possible to state that Tesco has chosen an effective strategy that implies internationalization. This strategy is associated with numerous opportunities, including larger profits, growth, flexibility, organizational learning, etc. However, it is vital to avoid the mistakes the company has made. For instance, Tesco should reconsider its supply chain management, especially when it comes to the choice of location. The company should implement extensive research concerning customers’ needs and preferences.

It is also critical to evaluate properly the existing competition in different markets as well as environmental issues as macro and micro-economic factors affecting the development of countries and regions. Tesco should maintain its focus on innovation, but the use of advanced technologies and marketing strategies should be based on extensive market research. Although the company is still facing numerous internal and external issues, Tesco can still retain its leading position and improve its operations in different markets.

Butler, S., & Neville, S. (2013). Tesco’s empire: Expansion checked in UK and beyond . The Guardian . Web.

Martinez-Ruiz, M. P., Gonzalez-Gonzalez, I., Jimenez-Zarco, A. I., & Izquierdo-Yusta, A. (2016). Private labels at the service of retailers’ image and competitive positioning: The case of Tesco. In M. Gomez-Suarez & M. Martinez Ruiz (Eds.), Handbook of research on strategic retailing of private label products in a recovering economy (pp. 104-126). Hershey, PA: IGI Global.

Ruddick, G. (2013). Is Tesco’s dream of building an international empire unravelling? The Telegraph . Web.

Warman, M. (2013). Tesco Hudl tablet takes on Kindle and iPad . The Telegraph . Web.

Wrigley, N., Lowe, M., & Cudworth, K. (2013). The internationalization of Tesco: New frontiers and new problems. In G. Johnson, R. Whittington, D. Angwin, K. Scholes, & P. Regner (Eds.), Exploring strategy: Text and cases (pp. 657-661). Harlow, UK: Pearson.

Yoder, S., Visich, J., & Rustambekov, E. (2016). Lessons learned from international expansion failures and successes. Business Horizons , 59 (2), 233-243.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, July 21). Tesco Corporation's Internationalization Strategy. https://ivypanda.com/essays/tesco-corporations-internationalization-strategy/

"Tesco Corporation's Internationalization Strategy." IvyPanda , 21 July 2021, ivypanda.com/essays/tesco-corporations-internationalization-strategy/.

IvyPanda . (2021) 'Tesco Corporation's Internationalization Strategy'. 21 July.

IvyPanda . 2021. "Tesco Corporation's Internationalization Strategy." July 21, 2021. https://ivypanda.com/essays/tesco-corporations-internationalization-strategy/.

1. IvyPanda . "Tesco Corporation's Internationalization Strategy." July 21, 2021. https://ivypanda.com/essays/tesco-corporations-internationalization-strategy/.

Bibliography

IvyPanda . "Tesco Corporation's Internationalization Strategy." July 21, 2021. https://ivypanda.com/essays/tesco-corporations-internationalization-strategy/.

- British Trading Giant Tesco: Impact of Globalization

- Organisational Change at Tesco Revised

- Tesco Operations Management: Report

- Dubai Electricity and Water Authority's Tech Innovations

- The Lawn Care Company's Strategy Transformation

- Mylan's EpiPen Pricing and Marketing Strategies

- Quay International Convention Centre's Organizational Change

- Quay International Convention Centre's Organizational Development

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Business news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Business Resources

Resource Selections

Currated lists of resources

Tesco in Korea - a classic case study in international expansion

6th September 2009

- Share on Facebook

- Share on Twitter

- Share by Email

A great article in The Sunday Times today examines the strategy behind the success of Tesco’s expansion in South Korea…

International expansion is a key topic in the new A2 specs and the case study of Tesco’s approach to building market share in Korea is a great example to use.

The Sunday Times article is here

Some of the key points I noted down are:

- Tesco’s investment in Korea was set up as a joint venture partnership with Samsung - the leading Korean conglomerate

- Tesco will soon achieve market leadership, with more than a third of the market

- Tesco’s share of the Korean business’ profits is forecast to rise to almost £0.5bn by 2014

- Of the 23,000 staff, just 4 are from the UK!

- The success of the business is all about Tesco operating it as a local business, taking full account of the Korean way of life

- The Korean stores also double-up as community centres, even including schools!

- 25% (13million) Koreans are signed up to the Tesco customer loyalty scheme

Students can learn more about Tesco’s international strategy here

Jim co-founded tutor2u alongside his twin brother Geoff! Jim is a well-known Business writer and presenter as well as being one of the UK's leading educational technology entrepreneurs.

You might also like

Our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Best place to find and share your notes

- Arts and Humanities

- Design and Engineering

- Electronics

- Law & Jurisprudence

- Mathematics

- Medicine & Health

- Other languages

- Other subjects

- Philosophy and ethics

- Physical Education

- Psychology and Sociology

- Social sciences

- Teaching & Education

- Training and Employment Advise

- Visual arts

Tesco’s Success in South Korea: A Case Study in Strategic Localization

Posted on Apr 30, 2024 in Economy

Tesco’s Entry into the South Korean Market

Joint venture with samsung.

Tesco’s successful entry into South Korea was marked by a strategic joint venture with Samsung, operating under the established “Homeplus” brand. This move proved crucial in overcoming negative perceptions associated with foreign companies and provided Tesco with several advantages, including prime locations, government support, and local market expertise.

Leveraging Global and Local Best Practices

By early 2006, Tesco emerged as the second-largest retailer in South Korea. This success can be attributed to its ability to combine global best practices in supply chain management, customer service, and private label products with local expertise and manpower.

Location and Product Strategies

Focus on fresh food and local preferences.

Tesco stores in Korea prioritized fresh food products, catering to local preferences. They offered a wide range of products, including food and non-food items, with a focus on private label products tailored to Korean customers. Additionally, they strategically placed ready-to-eat foods at store entrances for convenience.

Adapting Store Layouts and Locations

Tesco deviated from international display standards by lowering product stands for easier customer access. Recognizing the preference for local shopping, Tesco initially opened stores in city centers but later shifted to locations with convenient public transport access, even establishing “subway stops” for some stores. To further expand its reach, Tesco implemented virtual supermarkets, allowing customers to shop online using QR codes.

Additional Services and Customer Focus

Tesco enhanced the shopping experience by offering car servicing facilities and play zones for children. The company also recognized the importance of customer satisfaction and loyalty, aiming to improve its ratings compared to competitors.

Strategies for Maximizing Competitiveness and Profitability

Several strategies were identified to enhance Tesco’s competitiveness and profitability:

- Industry Diversification: Expanding into other industries, such as banking, to mitigate risks associated with focusing solely on retail.

- Customer Satisfaction: Prioritizing customer satisfaction and loyalty through improved service and offerings.

- Clubcard Utilization: Leveraging the “Clubcard” to gather customer data for improving convenience, store layouts, and shopping times.

- Dual Delivery Stream: Implementing an effective online retailing system to complement physical stores and broaden the delivery stream.

- Training Programs: Investing in training programs to enhance employee skills and adapt to local market dynamics.

Learning from Competitors’ Mistakes

Tesco learned valuable lessons from the failures of competitors like Wal-Mart and Carrefour in the South Korean market. These competitors made critical mistakes, including:

- Failure to Adapt to Local Tastes: Neglecting to understand and cater to local preferences, assuming Western strategies would suffice.

- Ignoring Customer Acquisition Strategies: Opting for simpler store appearances compared to the more stylish and luxurious designs of competitors.

- Slow Store Expansion: Losing market share and customer base due to a slow pace of store openings.

- Ineffective Sales Techniques: Selling products in bulk rather than creating appealing displays and engaging sales approaches.

- Wrong Market Entry Strategy: Choosing not to pursue joint ventures, which proved crucial for Tesco’s cultural adaptation and success.

Key Takeaways for Success

Tesco’s experience in South Korea highlights several key takeaways for success in international markets:

- Avoid a Know-It-All Attitude: Approach new markets with humility and a willingness to learn.

- Adapt to Local Culture: Understand and respect local customs, preferences, and business practices.

- Implement a Swift Strategy: Act quickly and decisively to gain a competitive edge.

- Consider Joint Ventures: Leverage local partnerships to navigate cultural nuances and gain market insights.

By embracing these principles, Tesco successfully established itself as a major player in the South Korean retail market, demonstrating the importance of strategic localization and cultural adaptation.

Recent Notes

- The Ultimate Motorcycle Safety Guide: Tips for Safe Riding

- Concept and Characteristics of Observation in Research

- Introduction to Computer Science and Programming

- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Tesco's Virtual Store: From South Korea to the United Kingdom

- Sales & Marketing / MBA EMBA Resources

Next Case Study Solutions

- Toyplace Production (Hong Kong) Ltd. Case Study Solution

- Geox: Breathing Innovation into Shoes Case Study Solution

- Himalaya Drug Company: Repositioning an Herbal Soap Case Study Solution

- Black & Decker Corp.: Household Products Group, Brand Transition Case Study Solution

- Autobytel.com, Spanish Version Case Study Solution

Previous Case Solutions

- VerticalNet (www.verticalnet.com) Case Study Solution

- Neiman Marcus (A) Case Study Solution

- Canada Goose Inc.: At a Retail Crossroads Case Study Solution

- Tom Muccio: Negotiating the P&G Relationship with Wal-Mart, (B) Case Study Solution

- Automobile Retailing in the U.S. Case Study Solution

Predictive Analytics

May 13, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Tesco's virtual store: from south korea to the united kingdom description.

After the successful launch of their virtual grocery stores in South Korean metro stations, Tesco UK is trying to determine whether the virtual grocery store concept should be launched in their home market. In order to make this decision, Tesco needs to determine the role of the virtual store(s), the location(s) of the store(s) and the product range. At the same time, Tesco needs to compare the Korean and U.K. markets in order to determine whether the virtual store concept is viable.

Case Description Tesco's Virtual Store: From South Korea to the United Kingdom

Strategic managment tools used in case study analysis of tesco's virtual store: from south korea to the united kingdom, step 1. problem identification in tesco's virtual store: from south korea to the united kingdom case study, step 2. external environment analysis - pestel / pest / step analysis of tesco's virtual store: from south korea to the united kingdom case study, step 3. industry specific / porter five forces analysis of tesco's virtual store: from south korea to the united kingdom case study, step 4. evaluating alternatives / swot analysis of tesco's virtual store: from south korea to the united kingdom case study, step 5. porter value chain analysis / vrio / vrin analysis tesco's virtual store: from south korea to the united kingdom case study, step 6. recommendations tesco's virtual store: from south korea to the united kingdom case study, step 7. basis of recommendations for tesco's virtual store: from south korea to the united kingdom case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Tesco's Virtual Store: From South Korea to the United Kingdom

Tesco's Virtual Store: From South Korea to the United Kingdom is a Harvard Business (HBR) Case Study on Sales & Marketing , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Tesco's Virtual Store: From South Korea to the United Kingdom is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Tesco's Virtual Store: From South Korea to the United Kingdom case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Tesco's Virtual Store: From South Korea to the United Kingdom will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Tesco's Virtual Store: From South Korea to the United Kingdom case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Sales & Marketing, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Tesco's Virtual Store: From South Korea to the United Kingdom, is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Tesco's Virtual Store: From South Korea to the United Kingdom case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Sales & Marketing Solutions

In the Texas Business School, Tesco's Virtual Store: From South Korea to the United Kingdom case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Tesco's Virtual Store: From South Korea to the United Kingdom

Step 1 – Problem Identification of Tesco's Virtual Store: From South Korea to the United Kingdom - Harvard Business School Case Study

The first step to solve HBR Tesco's Virtual Store: From South Korea to the United Kingdom case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Virtual Tesco is facing right now. Even though the problem statement is essentially – “Sales & Marketing” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Virtual Tesco, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Tesco's Virtual Store: From South Korea to the United Kingdom. The external environment analysis of Tesco's Virtual Store: From South Korea to the United Kingdom will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Tesco's Virtual Store: From South Korea to the United Kingdom case study. PESTEL analysis of " Tesco's Virtual Store: From South Korea to the United Kingdom" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Tesco's Virtual Store: From South Korea to the United Kingdom macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Tesco's Virtual Store: From South Korea to the United Kingdom

To do comprehensive PESTEL analysis of case study – Tesco's Virtual Store: From South Korea to the United Kingdom , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Tesco's Virtual Store: From South Korea to the United Kingdom

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Tesco's Virtual Store: From South Korea to the United Kingdom ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Virtual Tesco is operating, firms are required to store customer data within the premises of the country. Virtual Tesco needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Tesco's Virtual Store: From South Korea to the United Kingdom has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Virtual Tesco in case study Tesco's Virtual Store: From South Korea to the United Kingdom" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Virtual Tesco in case study “ Tesco's Virtual Store: From South Korea to the United Kingdom ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Virtual Tesco in case study “ Tesco's Virtual Store: From South Korea to the United Kingdom ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Tesco's Virtual Store: From South Korea to the United Kingdom ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Virtual Tesco can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Tesco's Virtual Store: From South Korea to the United Kingdom case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Virtual Tesco needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Tesco's Virtual Store: From South Korea to the United Kingdom

Social factors that impact tesco's virtual store: from south korea to the united kingdom, technological factors that impact tesco's virtual store: from south korea to the united kingdom, environmental factors that impact tesco's virtual store: from south korea to the united kingdom, legal factors that impact tesco's virtual store: from south korea to the united kingdom, step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: tesco's virtual store: from south korea to the united kingdom case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

All Assignment Experts | Blog

Case study solution – Tesco’s korean venture

I. Introduction

A. Overview of Tesco

Tesco is a UK-based multinational grocery and general merchandise retailer having presence in more than 12 Countries. Founded by Jack Cohen in 1919 as a market stall in London, since then Tesco has grown and become one of the largest retailers in the world having a market capitalization of $24.94B till May 12, 2023. B. Importance of International Expansion for Companies like Tesco International expansion is one of the most crucial aspects for firms like Tesco to tap into new untouched markets to increase their revenue and diversify their business. To expand their business companies needs to adapt to the culture, local market’s culture, laws and regulation, language, and customer preferences to succeed in local markets. Expansion into new markets can help companies to reduce their dependencies on a single market and help them to spread across a large part of the total market of different countries. C. Purpose of the Case Study

The purpose of this case study is to analyze Tesco’s Korean venture, the challenges faced, and the lessons learned from this experience. The case study will examine the reasons behind Tesco’s decision to enter the Korean market, the strategies adopted, the challenges encountered, and the eventual failure of the venture.

II. Background on Tesco’s Korean Venture

A. Founding of Tesco’s Korean Venture

Tesco entered the Korean market in 1999 through a joint venture with Samsung Group, forming Homeplus, which became the second-largest retailer in Korea after Lotte Mart. Tesco saw an opportunity in Korea’s rapidly growing retail market, and Homeplus became the company’s largest overseas venture, with over 400 stores and employing over 30,000 people.

B. Expansion and Growth of the Venture

Homeplus saw significant growth in the early 2000s, with an innovative approach to online grocery shopping and home delivery. In 2008, Homeplus became the first Korean retailer to open a virtual store in a subway station, allowing commuters to shop using their smartphones and have their orders delivered to their homes. Homeplus continued to innovate and expand, with plans to open over 200 new stores by 2015.

C. Key Players and Stakeholders in the Venture

The key players in Tesco’s Korean venture were Tesco PLC and Samsung Group, who formed the joint venture, Homeplus. The stakeholders included Tesco’s shareholders, employees, and customers, as well as Samsung Group’s shareholders and employees. The Korean government and regulators were also stakeholders, as they had a role in regulating the retail market and foreign investment in the country.

III. Cultural and Market Differences

A. Cultural Differences between the UK and South Korea

Cultural differences can have a significant impact on the success of a company’s international expansion. Tesco’s Korean venture encountered several cultural differences that affected the company’s operations. In South Korea, relationships and trust play a crucial role in business, and building and maintaining strong relationships with customers and suppliers is vital for success. Korean consumers tend to prefer local products over foreign products, and they are highly selective in their purchases.

B. Market Differences between the UK and South Korea

The market differences between the UK and South Korea are significant. South Korea is a highly competitive and complex market, with a strong domestic retail industry. Tesco faced intense competition from established players such as Lotte Mart, Homeplus, and E-Mart. Korean consumers have high expectations when it comes to product quality and customer service, and companies must meet these expectations to succeed.

C. Impact of Cultural and Market Differences on Tesco’s Korean Venture

Tesco’s Korean venture faced several challenges due to the cultural and market differences between the UK and South Korea. The company struggled to establish strong relationships with local suppliers, which affected its ability to secure the products that Korean consumers preferred. Tesco also faced challenges in developing products that appealed to Korean consumers’ tastes and preferences. Additionally, the company faced intense competition from well-established local players, which affected its ability to gain market share.

IV. Key Components of Tesco’s Korean Venture

A. Product and Services

Tesco’s Korean venture offered a range of products and services, including groceries, fresh produce, household goods, and clothing. The company developed several private label brands to appeal to Korean consumers, such as “Homeplus” and “No Brand.” Tesco also offered online grocery shopping and delivery services, which were popular with Korean consumers.

B. Marketing and Branding

Tesco’s Korean venture developed several marketing and branding campaigns to appeal to Korean consumers. The company focused on offering competitive prices, high-quality products, and excellent customer service. Tesco also developed several private label brands, which were designed to appeal to Korean consumers’ tastes and preferences.

C. Supply Chain and Logistics

Tesco’s Korean venture developed a sophisticated supply chain and logistics system to ensure the efficient delivery of products to its stores. The company operated several distribution centers throughout South Korea and developed partnerships with local suppliers to ensure a steady supply of products. Tesco also implemented a “Scan as You Shop” system, which allowed customers to scan items as they shopped and then pay for their purchases at a self-checkout.

D. Financial Management

Tesco has invested heavily in its Korean venture in South Korea, intending to become the top player in the South Korean retail industry. However the company struggled a lot to achieve profitability and due to intense competition from local markets, other big players, and the challenges posed by differences in culture and market differences the company faced major losses and ended its operation in 2015. The Company sold its Korean operations to a local consortium for $6.1 billion eventually leaving the South Korean market. In conclusion, Tesco’s Korean venture highlights the challenges that companies face when expanding into international markets. Cultural and market differences can have a significant impact on a company’s operations, and companies must adapt to these differences to succeed. Tesco’s experience in South Korea provides valuable insights into the importance of building strong relationships with local suppliers, developing products that appeal to local tastes and preferences, and implementing efficient supply chain and logistics systems.

V. Challenges and Risks

A. Cultural and language barriers : The cultural and language differences between the UK and South Korea posed significant challenges for Tesco’s Korean venture. Korean customers have different preferences, tastes, and habits when it comes to grocery shopping, which Tesco had to take into account. Additionally, the Korean language posed a significant barrier to Tesco’s marketing and communication efforts, as well as its hiring and training of Korean employees.

B. Competition and market risks : Tesco’s Korean venture faced intense competition from well-established domestic competitors like Lotte Mart and E-Mart. Tesco also struggled to differentiate itself in the crowded market, and its initially aggressive pricing strategy ultimately hurt its profitability. Moreover, the Korean grocery retail market had unique features, such as the prevalence of small, independently owned shops that offered personalized services and were located closer to customers’ homes.

C. Regulatory and legal risks: Tesco’s Korean venture had to navigate the complex and constantly changing regulatory and legal environment in South Korea. The government imposed strict regulations on foreign companies, making it difficult for Tesco to establish and operate its stores in the country. Additionally, the company faced legal challenges related to its business practices, including allegations of unfair labor practices and improper sourcing of products.

D. Mitigation strategies: To mitigate the challenges and risks associated with its Korean venture, Tesco adopted several strategies, such as investing heavily in market research to understand the needs and preferences of Korean consumers. The company also implemented an aggressive marketing and advertising campaign, including the use of social media, to build brand awareness and customer loyalty. Additionally, Tesco worked to improve its supply chain and logistics, streamlining its operations and investing in new technologies to improve efficiency and reduce costs.

VI. Future Outlook

A. Key growth opportunities and challenges: Despite its challenges, Tesco’s Korean venture presents significant growth opportunities for the company, particularly in the e-commerce and online retail space. The Korean market has a high penetration of mobile and internet usage, and Tesco’s focus on digital innovation and technology could help the company tap into this growing segment of the market. However, the company also faces challenges related to intense competition, changing customer preferences, and regulatory and legal risks.

B. The role of international expansion in shaping the future of Tesco’s business : International expansion has been a critical part of Tesco’s growth strategy, and the company has entered into several new markets in recent years. The Korean venture provided Tesco with valuable experience in navigating cultural and market differences and developing a successful business model in a foreign market. Going forward, Tesco will likely continue to look for new international opportunities to expand its footprint and reach new customers.

C. Strategies for sustainable growth and success: To achieve sustainable growth and success, Tesco will need to continue to invest in technology and digital innovation, while also building strong relationships with customers and local partners. The company will also need to remain vigilant to changing market conditions and customer preferences and be prepared to adapt its business model accordingly.

VII. Conclusion

A. Summary of the case study and key takeaways : Tesco’s Korean venture provides valuable lessons for companies looking to expand into new markets, particularly those with significant cultural and market differences. Tesco’s experience demonstrates the importance of investing in market research, adapting to local preferences, and building strong partnerships with local stakeholders. Additionally, the case highlights the challenges of navigating complex regulatory and legal environments and intense competition in foreign markets.

B. Implications for other companies in the retail industry: Other companies in the retail industry can learn from Tesco’s experience and apply similar strategies to their own international expansion efforts. In particular, companies should prioritize market research, customer engagement, and digital innovation, while also being prepared to adapt their business models to local conditions.

C. Future outlook for Tesco and the retail industry as a whole.

Tesco has demonstrated the potential benefits and risks associated with international expansion, and its experience in South Korea provides valuable lessons for other retailers looking to expand into new markets. Going forward, the company will need to continue to adapt to changing market conditions and consumer preferences in order to remain competitive.

One key trend that is likely to shape the future of the retail industry is the continued growth of e-commerce and online shopping. Tesco has already made significant investments in its online platform, and will need to continue to do so in order to compete with other retailers in this space. The company will also need to ensure that its supply chain and logistics infrastructure can support the growing demand for online orders.

Another trend that is likely to impact the industry is the increasing emphasis on sustainability and ethical business practices. As consumers become more aware of the environmental and social impacts of their purchasing decisions, retailers will need to adapt in order to meet these changing expectations. Tesco is taking certain steps to reduce food wastage and packaging but they will need constant innovations and improvements to prioritize sustainability to remain a relevant competitor in the market. Overall, Tesco’s experience in the South Korean market is an example of how the importance of local culture is relevant for expansion in new markets. To expand in a new market a company has to learn, adapt and innovate according to the market’s culture and understand the demands of the market to establish a long-term connection with their potential customers. In that way, a company can remain competitive in an increasingly dynamic and competitive industry.

Meet the author of the blog

Ethan T is one of the best experts with an MBA degree from Indiana University, who has years of experience and knowledge in the field of business management. With more than 12+ industry experience Ethan has a lot of practical expertise and great academic excellence making him a leading author and expert in the industry. An Impressive record of solving more than 5551 assignments to date is a testament to his expertise and his potential to deliver great quality work. His dedication has made him earn an outstanding rating of 4.8/5 from our clients for which he has been appreciated and praised several times. We are proud to have Ethan T on our team and we are confident that his experience and vast knowledge of the industry will be a valuable will be a valuable asset to our clients. Ethan’s dedication to his work, combined with his commitment to providing exceptional service, aligns with our company’s values and mission.

Tesco exists South Korea Case study Contents

Added on 2020-04-21

End of preview

Want to access all the pages? Upload your documents or become a member.

Critical Issues in Business Management : Report lg ...

Critical issues in business management lsbm303 lg ..., issues in business management assignment lg ..., globalisation issues for woolworths limited lg ..., (pdf) impact of globalization on the growth of economies lg ..., global marketing in tesco: a comparative analysis lg ....

ORIGINAL RESEARCH article

Deconstructing subjective unmet healthcare needs: a south korean case study with policy implications.

- 1 Department of Health Policy and Management, Graduate School of Public Health, Yonsei University, Seoul, Republic of Korea

- 2 Korea Peace Institute, Seoul, Republic of Korea

Background: Despite widespread efforts by many countries to reduce the prevalence of unmet healthcare needs within their populations, there remains a scarcity of research systematically exploring the components of these needs.

Objectives: This study aims to deconstruct subjective unmet healthcare needs into two distinct components: the experience of subjective healthcare needs (the “Needs” component) and the experience of unmet needs contingent on those healthcare needs (the “Unmet” component).

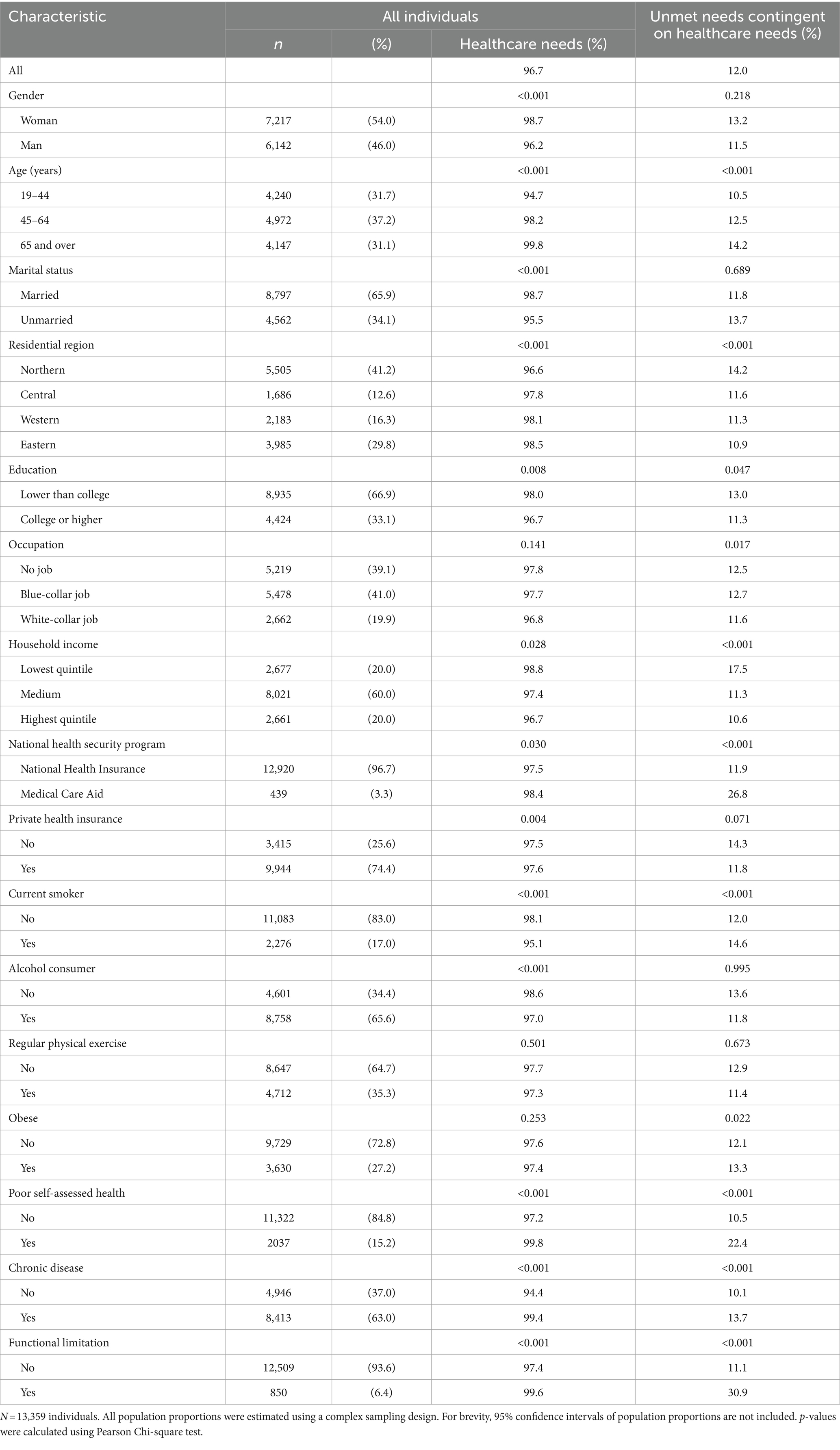

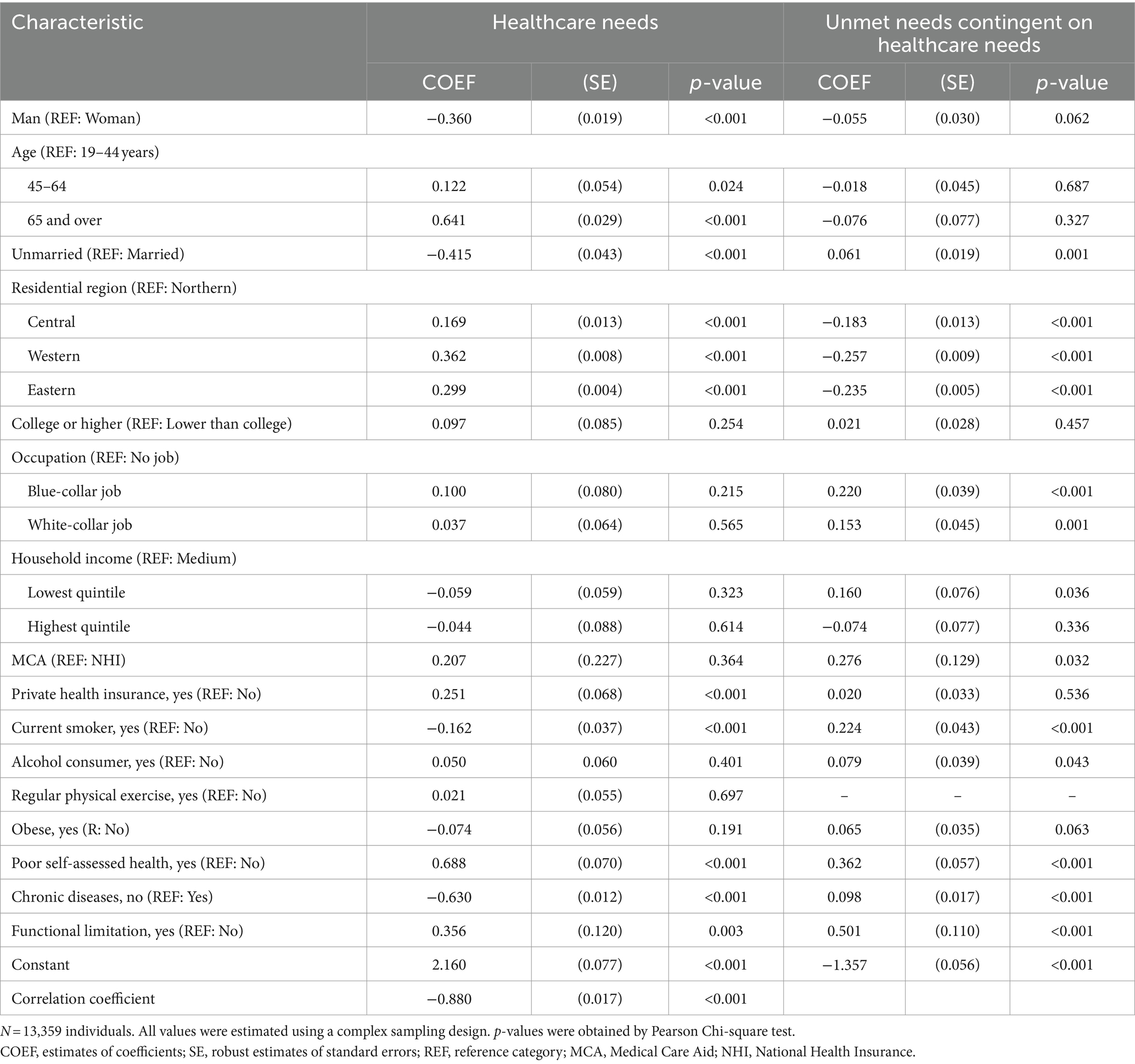

Methods: This analysis utilizes data from 13,359 adults aged 19 or older, collected through the 2018 Korea Health Panel survey, with the aim of minimizing the influence of the coronavirus disease 19 pandemic. The two dependent variables are the experience of subjective healthcare needs and whether these needs have been met. The independent variables include 15 socio-demographic, health, and functional characteristics. The study employs both a population proportion analysis and a multivariable bivariate probit model with sample selection.

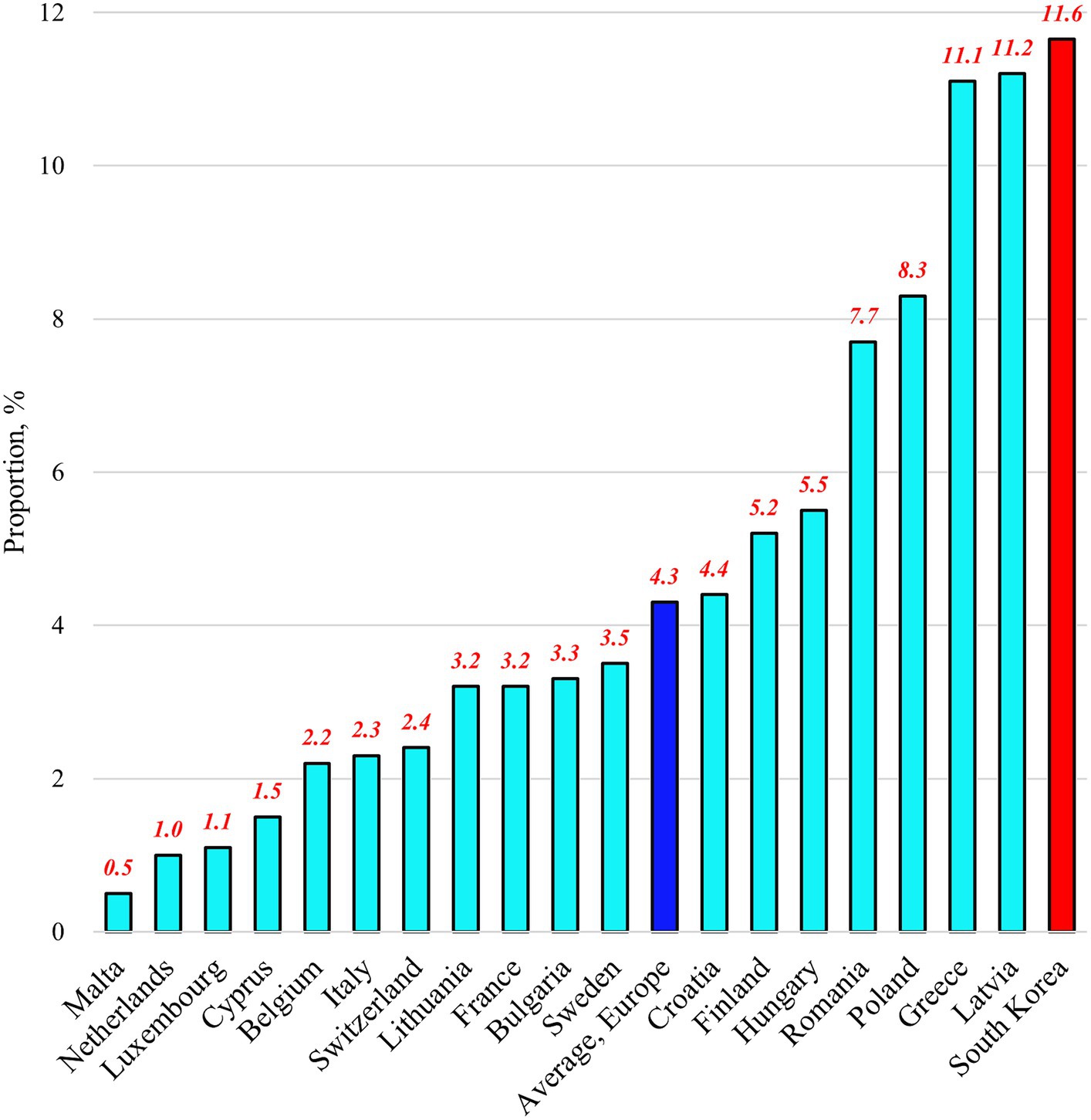

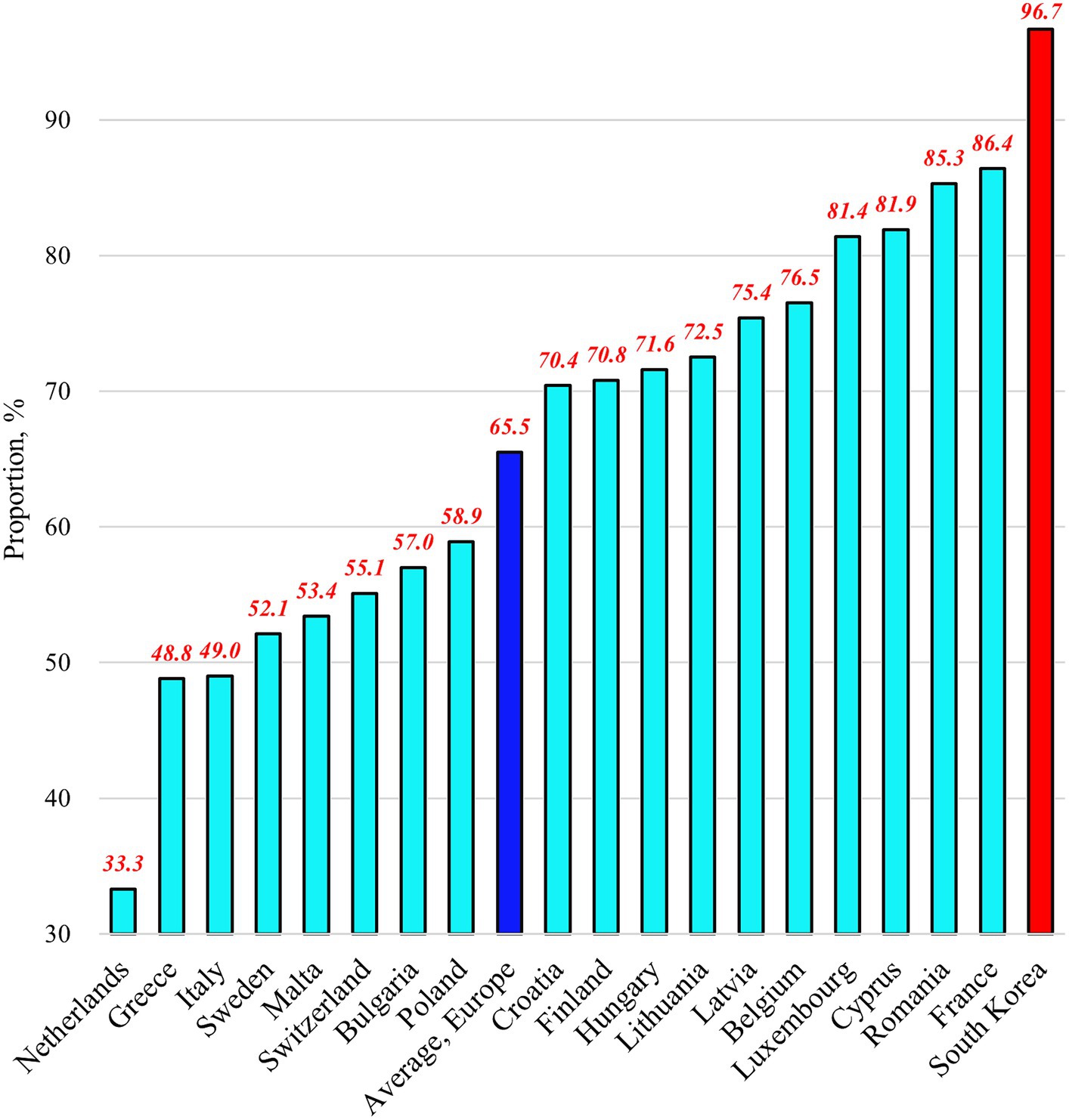

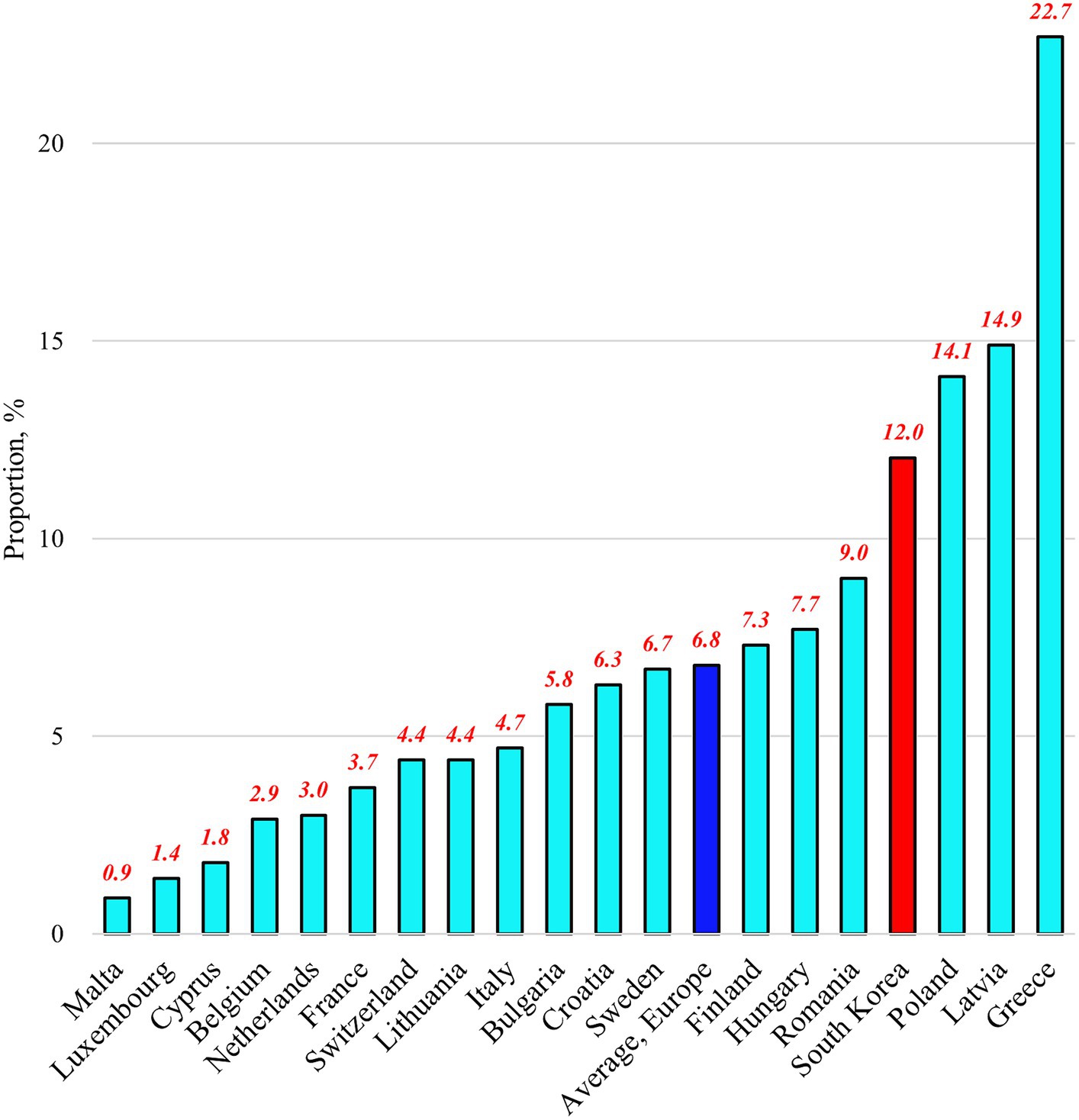

Results: In South Korea, 11.6% (CI [confidence interval] = 11.0–12.3%) of the population experienced subjective unmet healthcare needs. Upon deconstructing these, 96.7% (CI = 96.2–97.1%) of the population exhibited the Needs component, and 12.0% (CI = 11.4–12.7%) displayed the Unmet component. Each independent variable showed different associations between the two components. Furthermore, effective interventions targeting the characteristics associated with each component could reduce the proportion of the population experiencing subjective unmet healthcare needs from 11.6 to 4.0%.

Conclusion: South Korea faces a significant challenge due to the considerable prevalence of subjective unmet healthcare needs. To address this challenge effectively, the universal healthcare coverage system should adapt its approach based on the characteristics associated with both the Needs and Unmet components of subjective unmet healthcare needs. To achieve this goal, it is highly recommended that the government prioritize strengthening community-based primary healthcare, which currently suffers from insufficient resources.

1 Introduction

Universal health coverage (UHC) continues to be a crucial objective in contemporary global health policy. The UHC system aims to provide essential, high-quality healthcare and ensures unrestricted access to safe, effective, and affordable medications and vaccinations, regardless of an individual’s socio-demographic status ( 1 , 2 ). This system is anticipated to improve access to healthcare services for those previously unable to do so, thereby reducing overall unmet healthcare needs in the population ( 3 , 4 ).

The measurement of unmet healthcare needs in a population is often conducted from the perspective of subjective unmet healthcare needs (SUN, hereafter). In this context, SUN is derived from survey responses collected from a diverse cross-section of the population, assessing whether they perceived a need for healthcare in the past 12 months and, subsequently, whether they were unable to access it. The primary rationale for the widespread utilization of SUN data is their ability to gather information on unmet healthcare needs from individuals, regardless of their status as patients or non-patients ( 5 – 9 ).

Despite significant efforts by most countries to address unmet healthcare needs within their populations, data from the Organization for Economic Co-operation and Development (OECD) reveals a wide variation in the prevalence of SUN across countries. For instance, as of 2019, Spain reported a mere 0.2 percent SUN rate. In contrast, Greece and Estonia registered 8.5 percent and 15.5 percent, respectively ( 5 ). Numerous studies conducted in diverse countries have examined the individual characteristics associated with SUN, focusing on gender, age, marital status, education, income, economic activity, health insurance, self-rated health, chronic illnesses, depression, and functional limitations ( 6 – 10 ).

However, prior research has not extensively explored the two key components of SUN: the experience of subjective healthcare needs (the “Needs” component, hereafter) and the experience of unmet needs contingent on those healthcare needs (the “Unmet” component, hereafter). While one study delved into the role of social capital in addressing SUN across the entire population of 20 European countries ( 11 ), a more nuanced understanding of the associations between different characteristics and SUN continues to elude us, especially at the country-specific level. To effectively reduce SUN within a country’s population, governments must undertake comprehensive efforts to address either the Needs component, the Unmet component, or both, considering the intricate associations between these components and individuals’ characteristics. Therefore, this study aims to bridge the gap between previous research and the requirements for policies to reduce SUN across various countries. This study utilized a nationally representative survey dataset focused on healthcare utilization in South Korea (Korea, hereafter) to achieve this goal. Additionally, it employs a multivariable bivariate probit model with sample selection to analyze the study sample. Furthermore, based on the resulting findings, this study compares the proportions of population individuals experiencing SUN, the Needs component, and the Unmet component between European countries and Korea.

The anticipated outcomes of this study include guiding researchers in formulating and evaluating novel theories related to healthcare access by dissecting SUN into its Needs and Unmet components. Additionally, these findings are expected to provide policymakers in each country with insights to assist their populations in reducing SUN compared to that in the previous initiatives. This study is part of a research series aimed at contributing to the development of each country’s UHC systems by addressing the challenges posed by rapid demographic and social changes ( 7 , 8 , 12 ).

2 Overview of South Korea’s universal health coverage system

Korea introduced its social health insurance program following a Bismarck-type model with multiple payers, similar to the systems used in Germany, France, and Japan. The National Health Insurance (NHI) system, established in 1989, plays a pivotal role in achieving UHC. Complementing this, the Medical Care Aid (MCA) program, designed to assist the economically disadvantaged, covers approximately 3% of the population. In 2000, a transition occurred, consolidating the NHI into a single-payer system, and the NHI and the MCA are now overseen by the National Health Insurance Service (NHIS). This centralization of governance ensures uniformity in contribution and benefit packages nationwide ( 7 , 13 ).

In Korea, approximately 90% of medical facilities are privately owned, and physicians and hospitals are primarily reimbursed through a fee-for-service payment model. The government refrained from regulating the number of hospital beds nationwide ( 13 ). These factors contribute to high rates of healthcare utilization. In 2019, the annual doctor consultations per capita stood at 17.2, the highest among 34 OECD member countries (average 6.8). The average length of hospital stays was 18.0 days, which was the highest among 38 OECD member countries (with an average of 7.6 days). Additionally, the consumption of second-line antibiotics (measured in terms of the defined daily dose per 1,000 people) reached 9.4 in 2019, second only to Greece’s 10.6 among 30 OECD member countries (with an average of 3.3) ( 5 ).

While Korea’s UHC system excels in objective measures of physical health status, it falls short of assessing citizens’ emotional and mental well-being. In 2019, life expectancy at birth reached 83.3 years, surpassing the OECD member countries (with an average of 81.0 years). However, 15.2% of adults rated their health as “bad” or “very bad,” the second-highest among 36 OECD member countries (with an average of 8.5%). Similarly, the suicide rate per 100,000 people (age-standardized) was 24.6, the highest among the 38 OECD member countries (with an average of 11.0) ( 5 ).