- Search Search Please fill out this field.

How To Get Out of Debt

1. understand your debt, 2. plan a repayment strategy, 3. understand your credit history, 4. make adjustments to debt, 5. increase payments, 6. reduce expenses, 7. consult a professional financial advisor, 8. negotiate with lenders, the bottom line.

- Credit & Debt

- Debt Management

How To Get Out of Debt in 8 Steps

:max_bytes(150000):strip_icc():format(webp)/andy__andrew_beattie-5bfc262946e0fb005143d642.jpg)

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

- The Ultimate Guide to Financial Literacy for Adults

- How to Go from Unbanked to Banked

- How to Open a Checking Account Online

- Where Can You Cash Checks?

- Money Orders: When, Where, and How

- How to Read a Consumer Credit Report

- How to Establish Credit with No Credit History

- Credit Cards vs. Debit Cards

- Buy Now, Pay Later vs. Credit Cards

- How to Get Out of Debt in 8 Steps CURRENT ARTICLE

- Student Debt

- Pros and Cons of Debt Management Plans

- How to Pay Back Taxes

- What You Should Know About Debt Relief

- To Save or Invest?

- How to Save Money for Your Big Financial Goals

- Simple Interest vs. Compound Interest

- Building Generational Wealth

- 10 Investing Concepts Beginners Need to Learn

- How to Invest on a Shoestring Budget

- What You Must Know Before Investing in Cryptocurrency

- Digital Wallet

- Apple Pay vs. Google Wallet

- How Safe is Venmo and Is It Free?

- What Can You Buy with Bitcoin?

- Best Resources for Improving Financial Literacy

- Financial Influencer Red Flags

- Top 10 Personal Finance Podcasts

- How 211 Can Help With Your Finances

Holding too much debt can cause financial hardship in several ways. You may struggle to pay your bills, or your credit score could suffer, making it more difficult to qualify for future loans like mortgages or auto loans.

If you're carrying a significant amount of debt, you can take several steps to reduce it quickly and get on a healthy financial path.

Key Takeaways

- High debt levels can lead to lower credit scores, which can make it more difficult to get financial products.

- Consider paying down your credit cards with the highest interest rates first or paying off your smallest debt first.

- Look for ways to reduce your expenses and put the money you save toward your debt.

- Student loan forgiveness programs and income-based repayment programs can help with student loans.

- Consult with a professional credit counselor about your options for your situation.

Debt can include mortgages, student loans, credit cards , and other types of personal debt. Carrying too much debt can be stressful. Getting out of debt can put you in better financial health and open more opportunities.

Review all your loan statements and bills and fully understand how much debt you owe each month as well as how much interest you are paying on the different debts.

Ensure that your monthly debt obligations and necessary expenses are below your income. If you can't afford to pay your essential bills, you will need to take steps like negotiating with lenders or securing more income.

Instead of just putting extra money toward any of your debt, think about which debt you want to pay down first.

Targeting high-interest debt first using the avalanche method will save you the most money in the long run. However, some people find tackling the smallest amount of debt first works better for them because it keeps them motivated.

Check your credit rating and review your credit report for inaccuracies. You can get one from each of the three credit bureaus (Experian, Equifax, and TransUnion) or from AnnualCreditReport.com . You are entitled to your credit report at least once per year.

Your credit report can help you understand how your debt is affecting your credit score. You can see if you have a significant number of late payments or if you have a high credit utilization ratio, meaning you use a large amount of the debt available to you.

If your credit rating allows for it, try to get a larger, lower-interest loan and consolidate your debts into this loan. This can speed up the process of paying off your debt by minimizing the interest.

You may consider a balance transfer offer of 0% interest from one of your credit cards. This way, you can get grace period from that could last anywhere from six to 18 months, depending on the offer. Be aware that if you don't pay the balance off in full before the offer term ends, you will pay the credit card's interest rate on the balance.

If you own a home and have equity, you may be able to use a home equity line of credit (HELOC) to pay off higher-interest debt. Lines of credit have significantly lower rates than credit cards.

Whenever possible, double the amount of payments you make to your debt, especially for high-interest debt. Paying more than the minimum can speed up the time it takes to get out of debt.

By increasing your payment amount , you will be increasing the overall rate at which your debt declines and reducing the total interest you pay.

Cutting back on unnecessary expenses is a key part of getting out of debt. Review your regular expenses and identify which are necessary, such as food, housing, and utilities, and which are unnecessary, such as entertainment or clothing.

Reducing your unnecessary expenses can give you extra money to put toward getting out of debt.

Try to avoid closing your credit cards. Closing cards reduces the overall amount of credit available to you and increases your credit utilization ratio , both of which can hurt your credit score.

Meeting with a credit counselor or financial advisor can help you understand all your options for getting out of debt. Professional advisors can guide you through the best strategies for your particular situation.

A credit counselor also may provide support when you meet with your creditors. However, be wary of credit specialists that charge high fees.

If you are still struggling to pay your debt with your income, you can take other measures. If you are behind on your payments, you can try debt settlement with the help of a reputable debt relief company .

With this strategy, you negotiate with lenders to reduce the amount of debt you owe in exchange for agreeing to pay a portion of your balance. However, one drawback to turning to debt settlement is that it can negatively affect your credit score for several years.

Investopedia / Ellen Lindner

How Can You Get Out of Debt and Save Money?

You can get out of debt and save at the same time, but you must budget and plan. First, always pay at least the minimum required payments on your credit cards and loans. Then allot extra money toward paying down more debt and saving, according to your goals. A debt consolidation loan or a balance transfer credit card can also help lower overall interest payments.

How Can You Get Out of Real Estate Debt?

If your mortgage debt is too high, there are a few steps you can take to help lower it. First, you may be able to refinance your mortgage for a lower percentage rate, depending on market conditions and what you can get approved for. You can also make extra payments toward the principal on your mortgage loan, which will reduce the length of your loan and lower your interest costs.

How Can You Get Out of Student Debt?

If you have multiple student loans, consider refinancing your loans into one payment with a lower interest rate. Research loan forgiveness programs if you have a federal student loan. It is difficult to include student debt in a bankruptcy filing.

If you can't get out of debt, you may have to declare bankruptcy , which can ruin your credit rating and make you ineligible for loans or credit for years. Consider all your options carefully and weigh their pros and cons. Consult a professional financial advisor for more specific guidance on your options for getting out of debt for your situation.

Federal Trade Commission. " Free Credit Reports ."

Consumer Financial Protection Bureau. " How To Understand Promotional Financing ."

MyFICO. " What Is a FICO Score ?"

Consumer Financial Protection Bureau. " What Is a Debt Relief Program and How Do I Know if I Should Use One ?"

U.S. Department of Education. Federal Student Loans. " Student Loan Forgiveness Programs ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1305866005-f039519b519242b7a8c62f1c90968a85.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Take control of your debt

Our nonprofit helps you get out of debt with free debt relief tools and education.

Join 350,000 members

who have eliminated $600+ million in debt since 2017 with Upsolve's help.

How can Upsolve help you?

We are a 501(c)3 nonprofit organization that helps Americans struggling with debt in two ways:

Debt Relief Tools

Use one of our free tools to dispute your debt, negotiate your debt, or file Chapter 7 bankruptcy. 13,000 members have used our tools to eliminate $600+ million in debt. Always 100% free.

Learn More >

Our writers and editors also have your back, with diligently researched and unbiased content that answers all your questions about getting out of debt and building credit.

Total debt relieved by Upsolve members since 2017:

$ 633,163,010, hear from our members.

This is an awesome service...I would recommend this to anyone who is in need of filing for bankruptcy but can not afford an attorney.

Helped me to feel able. Nothing but relief and thankfulness in my heart.

simple. straightforward. informative

Upsolve is the absolute best. I will recommend this to anyone that needs help. You guys are the absolute the best. i have another chance at life financially because of your help and guidance. Sincerely Sonya e.

The best way to put it is amazing people

Great option for those who cant afford an attorney.

They changed my life I was out of options and needed help step by step process I filed and as I wait I’m confident

Upsolve is a very organized organization that helped walk me through all the steps of filing for bankruptcy. Thank you for making a difficult situation (having to file for bankruptcy) go so smoothly.

Lawyers quoted thousands of dollars for this service. The website makes everything clear and simple. once finished, the paperwork was perfectly laid out and accepted without any? s or corrections.

Upsolve was so easy to navigate and explained everything! They don't rush through things and they make sure you understand the process.

Awesome tool. Very thankful for Upsolve. I highly recommend using their services.

A lot but I got through it! Im thankful for them frfr they saved me so much money!

Very helpful!

I filed this morning (without an attorney that was going to charge me $1,000), my 341 meeting will be in early June and will be by phone, not in person. The court clerk was extremely helpful and courteous, she checked all my d ... Read More

Upsolve tool is very helpful with the filing requirements. The check list and step by step process makes filling out the forms a breeze. The bankruptcy clerk was please that I had use Upsolve making the filing process simple. I ... Read More

Very efficient and easy process. The bankruptcy court clerk accepted the packet with no problems.

Easy so far

This was easier than filing Taxes with Turbo Tax. The set up is much the same. You are led a long with questions and prompts. The Utah Court told me they love people filling using Upsolve. The papers are in order and thoroug ... Read More

It was very reliable and far definitely recommend

Upsolve has been such an easy and informed process. I'm so glad I didn't pay for a lawyer. My case was pretty straight forward.

Easy to use and answered all my questions

Upsolve makes the process so easy!

Thank you for assisting with the paperwork! It was easy!

IT was a seamless experience and I got it all done alot faster than expected.

Very easy process extremely self-explanatory I really appreciated all of the help!

Experience from start to finish was easy to understand. I felt confident the entire way. Thank you for helping me with my fresh start. I’m grateful for what you all do here at UpSolve.

Upsolve provides an almost seamless experience in filing for a bankruptcy. There is a great amount of work and signing to be done, but Upsolve takes it step by step, providing numerous videos and explanations of some of the tri ... Read More

Upsolve really made this process better. I was feeling overwhelmed at first, but the Upsolve software guided me through it. I really enjoyed the side notes about successful people who filed bankruptcy, but still created a succe ... Read More

Upsolve literally walked me through every step in the process! The guy at the courthouse says Upsolve makes their job so much easier! What a wonderful thing to do for people for free!

Amazing and simple. Highly recommend

The online forms were so simple to fill out. So far this has been a great experience. Definitely recommend.

The whole process and questionnaire are very user friendly and Upsolve's help is very thorough. I would recommend them to anyone who is filing pro se.

Easy, Free, Non-Profit Bankruptcy Service dedicated to helping those file for bankruptcy without the need for an attorney. Organizes the paperwork and walks you through the process. The software is top-tier and I was impressed ... Read More

great job and free

Upsolve guided me through the process for my Chapter 7 bankruptcy. I couldn't have done it without them. Thanks Upsolve!!!!!!!!!!

I'm grateful for Upsolve!

Easy to use every step of the way ! So thankful it was recommended to me. It took a little bit of time but it saved me bc I didn’t have money for an attorney.

Upsolve lessened the emotional stress and pressure during the process. It was easy to read and flow through the paperwork without confusion.

Too easy! I filled out the questionnaire and received my packet in such a timely matter. I delivered it to the courthouse and now its just a matter of time. Thanks upsolve.

Super easy platform to use and it made this process feel very doable. Thank you!

so far everything was good and straight to the point. I filed today with a waiver and now its in gods hands lol thanks upsolve it was a very easy process

It took a long time to complete all of the paperwork. I was thankful that i had to insure all of my past bills were included in all of the information needed to accomplish my Bankruptcy journey

This is what I was looking when I decided to file my petition. It is a very helpful tool. No charge. You just need to be honest with yourself and realistic about your situation to start. Make a list of your assets, your debts a ... Read More

Great service! Very easy to use!

I had an easy time understanding what i was doing and I felt comfortable with everything that I read as well.

Excellent, You Just need to be through when answering questions.

Upsolve is easy straightforward convenient they walk you through the paperwork that you need and when it's time to print out they make that easy as well I want to thank up solve for helping me with my bankruptcy and it's dress free.

Very user friendly, explanatory and straight forward!

They do a amazing and free service. I appreciate it highly. Thanks so much!

The process was very easy and informational. Upsolve healped with every step so far. When I went to go file at the courthouse the clerk asked if i had help and I told them I had a non profit help generate the papers. Once I s ... Read More

A great help!

This has been a ton of work, but it was made easy by the upsolve app.

I am very happy to have found out about upsolve to help me file for bankruptcy. Yes it takes some time but you are guided with plenty of information if you have questions. I would recommend if you can not afford a lawyer.

There are clear instructions and help in every step of the process. I have had no issues using UpSolve.

very easy website to navigate and all the steps are given as you move along the process

Made a potential stressful and complicated process much more easy and far less terrifying. Thank you!!!!

Upsolve has changed the way I think about dealing with legal matters. They give you the support you need to strike out on your own. I hope for the best that this goes well, I will keep you posted.

Upsolve is a highly respected organization, recognized at the courts. Although this is a dreaded experience, it was reassuring that all of my paperwork was meticulously prepared with no errors. I was in and out in less than 30 ... Read More

Upsolve is a great and efficient service . This tool was very explanatory and made our process smooth. I would recommend this service to anyone. I also encourage all users to take your time when using this application and follo ... Read More

Upsolve has come through for me in a really tough and tight situation for me. It's been super hard and overwhelming just carrying the mental budren of filing pro se, but Upsolve has helped me rest a little better at night. Th ... Read More

Upsolve really made my filing painless. I filed today in court hoping all goes well. Thank you Upsolve

Easy to use, great content, everything was easy to do and explain.

They make it so easy and through. Had no problems. Would recommend for anyone struggling and needs some help with understanding how to do it yourself

Upsolve has helped me so much!!! They saved me thousands of dollars using their services instead of an over priced attorney

Thank God for this company! It's not easy having to come to terms with filing bankruptcy, and it's safe to say leading on to making this decision that life hasn't been going your way. But with Upsolve this company shines that l ... Read More

easiest thing ive ever had to do with or for the governmet regarding paperwork. i was worried that it was going to take weeks and months and i had it all done within 4 days time from start to finish and filed. it was also a mat ... Read More

This process with Upsolve was SEAMLESS! I’d recommend them to anyone who needs assistance with filing bankruptcy!

I filed bankruptcy 20 years ago, pro se, and it took me 6 months. Upsolve made the process incredibly simple. I was done and had filled within 2 weeks of finding the site.

Great FREE resource for filing your bankruptcy. Easy to navigate. Comprehensive questionnaire to gather all the information required to file

Very easy to use

Is Upsolve Right for You?

A nonprofit you can trust.

As a 501(c)(3) nonprofit dedicated to helping you overcome debt, we value your privacy and dignity. We will never sell your data and our tools will always be free.

- Kreyòl Ayisyen

How to reduce your debt

Getting out of debt is possible when you know what you owe and what you can do to repay it. If you’re ready to begin paying down your debt, start with these three steps.

Step one: Understand debt reduction strategies

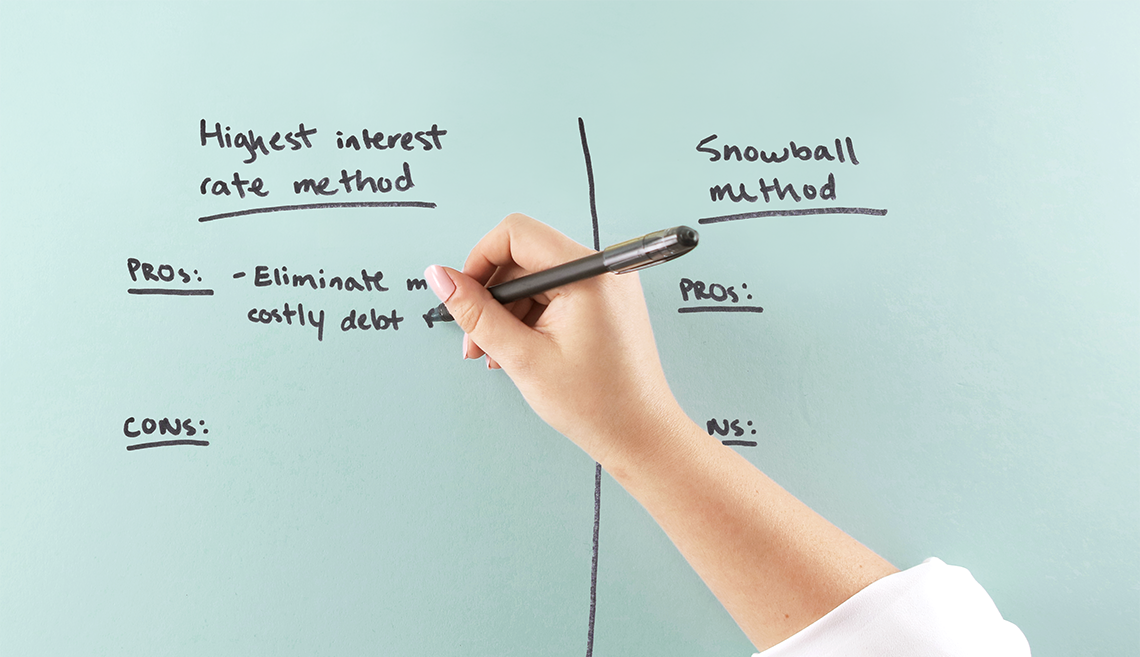

There are two basic strategies that can help you reduce debt: the highest interest rate method and the snowball method.

Highest interest rate method

This approach focuses on your debts like credit card and student loan debts with the highest rate of interest. The goal is to pay off the highest interest rate debt as quickly as possible, because it’s costing you the most. While it may not feel like you’re making progress, this method will help you eliminate your costliest debts first—which can save you money in the long run.

Snowball method

This approach focuses on your smallest debt. The goal is to get rid it as soon as possible. You keep on making the minimum payments on all of your debts, and you put any extra funds you have toward paying off the smallest debt. This will help you pay it off sooner.

Once you’ve paid one smaller debt in full, dedicate that freed up money to the next smallest debt. This way, you create a “snowball” of payments as you eliminate each debt. Unlike the higher interest rate method, you’ll see progress quickly as you pay off smaller debts. However, you may end up paying more in the long run, as you won’t be focusing on the larger or more costly debts.

Step two: Create your debt reduction plan

Download our debt reduction worksheet to put together a strategy that’s right for you. To use the worksheet, you’ll need copies of your bills and interest payment information. If you’re motivated by saving the most money while still paying off your debts, the highest interest rate method might be the right choice for you. However, if you’re motivated by seeing progress quickly, then you may want to consider the snowball method. Choose the strategy that’s best for your situation and put it into action.

Step three: Organize your monthly bills

Understanding what you owe, and when, will help you manage your debt. You can use a bill calendar to keep all your information in one place as you tackle your debt. Use the bill calendar to see all your bills and plan when they’re due. Keeping track of your monthly expenses can help put you one step closer to reaching your goals.

Take control of your finances

The "Get a Handle on Debt" series gives you tools to manage your debt by budgeting smarter , paying your bills on time , tracking your spending , paying down existing debts, and earning extra income . You can also get money management strategies sent directly to your inbox by signing up for our "Get a Handle on Debt" boot camp.

Stay informed

Sign up for the latest financial tips and information right to your inbox.

Join the conversation. Follow CFPB on X (formerly Twitter) and Facebook .

- Search Search Please fill out this field.

- Managing Your Debt

How to Manage Debt of Any Size

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

Know How Much You Owe

Pay your bills on time each month, create a monthly bill payment calendar, make at least the minimum payment, decide which debts to pay off first, pay off collections and charge-offs, build an emergency fund to fall back on, recognize the signs that you need help, frequently asked questions (faqs).

Everyone with even a little bit of debt has to manage their debt. If you just have a little debt, you have to keep up your payments and make sure it doesn’t get out of control. On the other hand, when you have a large amount of debt , you have to put more effort into paying off your debt while juggling payments on the debts you’re not currently paying.

Make a list of your debts, including the creditor, total amount of the debt, monthly payment, interest rate, and due date. You can use your credit report to confirm the debts on your list. Having all the debts in front of you will allow you to see the bigger picture and stay aware of your complete debt picture. Debt reduction software can make this process easier.

Once you have a handle on your debt and your income, you can calculate your Debt to Income ratio (DTI). This ratio tells you how much of your income is going toward debt payments. To find yours, divide your debt payments by your income, and multiply by 100. For example, $1,200 of monthly debt divided by $3,000 of monthly income is 0.4 x 100 = 40%. The lower this number is, the better, and tracking it can help you understand your finances more clearly.

Don't just create your list and forget about it. Refer to your debt list periodically, especially as you pay bills. Update your list every few months as the total amount of your debt changes.

Late payments make it harder to pay off your debt since you’ll have to pay a late fee for every payment you miss. If you miss two payments in a row, your interest rate and finance charges will increase.

If you use a calendaring system on your computer or smartphone, enter your payments there and set an alert to remind you several days before your payment is due. If you miss a payment, don’t wait until the next due date to send your payment, by then it could be reported to a credit bureau. Instead, send your payment as soon as you remember that it was missed.

A budget can help you stay out of debt , and it can help you climb out. It allows you to see how much money you earn and where that money is going. Create a bare-bones budget that allows you to pay for necessities like your rent or mortgage and utilities. Set aside everything else to pay off your debt as quickly as possible.

Use a bill payment calendar to help you figure out which bills to pay with which paycheck. On your calendar, write each bill’s payment amount next to the due date. Then, fill in the date of each paycheck. If you get paid on the same days every month—the 1st and 15th—you can use the same calendar from month to month. But, if your paychecks fall on different days of the month, you'll need to create a calendar every month.

If you can’t afford to pay anything more, at least make the minimum payment. Of course, the minimum payment doesn’t help you make real progress in paying off your debt. But, it keeps your account in good standing, which avoids late fees. When you miss payments, it becomes harder to catch up and eventually your accounts could go into default .

While you're working on paying down debt, stop using credit cards. Start carrying cash instead. Stick to the budget you created and only buy what you can pay for with cash.

Paying off credit card debt first is often the best strategy because credit cards have higher interest rates than other debts. Of all your credit cards, the one with the highest interest rate usually gets priority on repayment because it's costing the most money.

Use your debt list to prioritize and rank your debts in the order you want to pay them off. You can also choose to pay off the debt with the lowest balance first. This might cost a little more in the long run, but knocking off small debts first can build confidence.

You can only pay as much on your debt as you can afford . When you have limited funds for repaying debt, focus on keeping your other accounts in good standing. Don’t sacrifice your positive accounts for those that have already affected your credit. Instead, pay those past due accounts when you can afford to do it.

Without access to savings, you’d have to go into debt to cover an emergency expense. Even a small emergency fund will cover little expenses that come up every once in a while.

First, work toward creating a small emergency fund—$1,000 is a good place to start. Once you have that, make it your goal to create a bigger fund, like $2,000. Eventually, you want to build up a reserve of three to six months of living expenses.

Don't Confuse Wants and Needs

It's easy to convince yourself that you "need" to purchase a new tv or that you "need" to go on vacation. The truth is, there aren't that many true needs in life. You need food, shelter, clothing, transportation, and things like that. You want steak, a nice house in the suburbs, designer labels, and a luxury car, for example.

If you find it hard to pay your debt and other bills each month, you may need to seek outside help, like a credit counseling agency . Other options for debt relief are:

- Debt consolidation

- Debt settlement

These each have advantages and disadvantages, so weigh your options carefully.

What is debt consolidation?

Debt consolidation is rolling your debts into a product that offers a single payment and a lower interest rate. Popular debt consolidation tools include personal loans and 0% interest balance-transfer credit cards.

What is debt settlement?

Debt settlement is when you negotiate with a creditor to settle your debt for less than you owe. Creditors will typically only settle debt that isn't current. If you stop making payments in order to settle debt, your credit score will drop due to the missed payments. You can hire debt settlement companies, but they charge fees for resolving your debt. You can settle debt on your own or consider another option like credit counseling.

Investor.gov. “ Pay Off Credit Cards or Other High Interest Debt .”

Get expert insights delivered straight to your inbox.

Debt Help That Actually Works

10 Min Read | Apr 2, 2024

Debt is tricky . It starts out innocent . . . just a few swipes here, and a few payments there—nothing you can’t handle, right? But one day, you realize it’s gotten a little out of control and you’re drowning in debt . The payments are getting harder and harder to make. And your paycheck? Psh, that thing doesn’t go quite as far as it used to.

If that’s you, you’re not alone. And if you’re looking for ways to get help with that debt of yours, you’ve come to the right place.

Why Getting Debt Help Is a Good Idea

66% of Americans say they have consumer debt—and the average total per person is a whopping $34,055. 1 Oof . It’s time for some debt help, don’t you think?

But here’s the thing: True debt help is not instant or easy. And just like any get-rich-quick scheme, you should be suspicious of anyone who promises to solve your money problems with a snap of their fingers. (Debt probably didn’t become your way of life overnight, so it’s going to take some time to get back on your feet.)

Companies that offer debt management or debt reduction services almost never help you actually get out of debt because they don’t solve the one thing keeping you in debt— your spending habits .

Here’s the deal: Personal finance is 80% behavior and only 20% head knowledge. If you truly want to get out of debt and stay out of debt, you have to treat the root of your money issues, not just the symptoms. Even though your choices landed you in a tough spot, you have the ability to fight, kick and claw your way out of debt. You just need a game plan, and it starts with knowing what types of debt relief services will actually help you with your debt.

Debt Relief Services to Watch Out For

We said it before and we’ll say it again: Not all debt help is helpful. Yep—there are companies out there who make money off your desperation. Gross, right?

That’s why it’s so important to know what kind of debt help is actually helpful, which to steer clear of, and how you can demolish debt yourself. (It’s possible.)

1. Debt Consolidation

Debt consolidation is a type of loan that rolls several unsecured debts into one single bill, usually to get a lower interest rate. The intent is to help you slash mounds of debt. But in reality, you end up staying in debt longer because the term of your loan is extended. The longer it takes you to pay off your loan, the more money you pay. That’s why we call it debt CON-solidation (get it?).

2. Debt Settlement

Debt settlement means you hire a company to negotiate a lump-sum payment with your creditors for less than what you owe. Debt settlement companies also charge a fee for their “service.” Most of the time, settlement fees cost between $1,500 to $3,500, which is way more than you would pay if you cut out the middleman and settled the debts yourself.

3. Student Loan Consolidation

We all know student loans are the worst . So, it’s no wonder that most graduates going into their early career are feeling the heavy weight of those payments, especially if they’ve got multiple loans. When you’re eating ramen noodles for the fifth night in a row because you’ve got to pay your bill, any sort of student loan relief seems tempting—including consolidation.

For the record, student loan consolidation is the only kind of consolidation we recommend. It will roll all your federal student loan payments into one, and it can also help you trade in any variable interest rates for a fixed rate.

Pay off debt fast and save more money with Financial Peace University .

But consolidating won’t get you a lower interest rate overall, so you’re not really saving any money. And it tends to extend your loan—which means you’ll end up paying more in interest if you just stick to the minimum payment. It’s more a question of what will motivate you to pay off your loans faster.

So, even if consolidation gives you a little extra breathing room, don’t take your foot off the gas!

4. Credit Counseling

A credit counselor is someone who “helps” you come up with a debt management plan . They essentially become the middleman between you and your creditors, paying your bills for you, negotiating smaller rates on your loans, and combining your bills into one lump payment. Sounds nice right? Not so fast— credit counseling only works on certain types of loans. And you’ll want to watch out for those hidden “maintenance fees” too. Oh and P.S. . . . while the name implies counseling, the only one getting counseled is your debt!

5. Credit Repair and Debt Elimination Scams

In a world that revolves around the almighty FICO , it’s easy to come across companies that are ready to “fix” your credit report—for a fee. But the truth is, most of these repair companies are scams. They offer to take the negative information from your report (even if it’s accurate). 2 Psst. That’s illegal.

And debt elimination scams are similar. They offer to eliminate or drastically lower your debt for a large up-front cost. But all you’re paying for is falsified loan documents that aren’t tricking anybody. Yikes .

6. Bankruptcy

Sometimes your situation feels so desperate that bankruptcy seems like the answer. But it is not your only option. Bankruptcy is a gut-wrenching, life-changing event that causes lifelong damage. It also doesn’t guarantee that all your debts will be canceled. Bankruptcy falls into the same category as divorce—sometimes it’s necessary, but as a general rule, you should do everything in your power to avoid it.

7. Balance Transfers

Think a simple balance transfer from one credit card to another will help? Think again! It may seem like you did something to help your debt when you transfer it to a credit card with lower interest. But all it really did was trick you into thinking you’re better off than you were before. The only way to really help your debt is to get rid of it!

8. Personal Loans

Borrowing money to pay off debt is like trying to dig yourself out of a hole. A personal loan won’t solve your problem because it’s just moving your debt from one place to another. Even cash advance apps like the Dave app won't help you break the paycheck to paycheck cycle.

It’s time to stop thinking of debt as the solution and end the cycle of borrowing money for good. And if you’re thinking about borrowing money from family, don’t. The borrower is slave to the lender (see Proverbs 22:7), and you change the dynamic of a relationship when a loved one loans you money. Trust us on this—it’s not worth the trouble.

Debt Help That Really Works

Don’t let debt back you into a corner. You can be debt-free! It’s time to defend yourself from the phonies selling false hope and learn how to knock out debt once and for all. Here’s a rule of thumb: If it seems too good to be true, it usually is. There’s no easy button when it comes to dealing with debt.

Your best bet is hard work, strong bootstraps (so you can pull yourself up), and the right person or plan to come alongside you as you walk toward freedom from debt once and for all.

If you’re fed up with the debt cycle and other debt relief services that bring nothing but stress (and even more debt), it’s time for a change . But in order to get a different outcome, you’ve got to do something you’ve never done before.

Here are three ways to start changing your money behaviors that will completely change your life (if you stick with it):

Use the debt snowball method.

The debt snowball method is a plan that’s proven to help you defeat debt—for good.

By listing your debts smallest to largest (regardless of interest rate) and attacking the smallest with a vengeance while making minimum payments on the rest, you will start to knock out more debt than you ever thought possible!

The debt snowball is the fastest way to get out of debt because it addresses behavior, not just math. It forces you to be more intentional with your money and gives you small wins that motivate you to keep going.

This method changes lives ! And it can change yours too.

Find a good financial coach.

Unlike a counselor—who serves primarily as a mediator—a financial coach gets into the trenches with you. They’ll help you develop a plan to get out of debt and achieve your big money goals . . . all while encouraging you along the way.

Maybe asking for debt help is uncomfortable for you. Maybe your pride is as big as the state of Montana and you can’t imagine showing your bank statements to someone else. We get it. But if you really want to demolish your debt, it’s time to bring in a helpful third party that knows how to help you get out of the hole you’re in. We’re talking about a financial coach .

Sure, it may be awkward at first letting a stranger in on your spending habits. But it’s one of the best decisions you’ll make. Why? Because a financial coach is trained to get you from the deep end of debt to standing on the dry land of stability. Not only that, but they’ll also help you reach your financial goals and get to places you never thought you could go with your money.

Don't Go It Alone: Connect With a Financial Coach

A trained financial coach helps you navigate your money problems and make real money progress.

Change your life with Financial Peace University .

Think a money course will be boring? Think again. Financial Peace University is the debt help you need that will change your life for good. In nine lessons, you’ll learn how to save for emergencies, dump debt, invest for your future, build wealth, and give like no one else.

Listen, nearly 10 million people have gone through Financial Peace University and come out on the other side . . . winning with money. You're next.

You Have the Power to Get Out of Debt!

Attacking your debt with gazelle intensity will get you on the road to financial peace and allow you to build wealth faster than any debt reduction company ever will. No, it’s not easy. And it’s not quick. But it is worth it!

You are ultimately the only one responsible for your debt. It’s up to you to roll up your sleeves, change your spending habits, make a plan for your money , and take action!

If you’re really serious about learning how to pay off debt fast and save for the future, Financial Peace University will show you how. Get this: The average household pays off $5,300 in the first 90 days on the plan. We aren't joking.

Pulling yourself up by your bootstraps will only get you so far. Start Financial Peace University and learn how to get out of debt (and stay out of debt)—forever.

Did you find this article helpful? Share it!

About the author

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How the Debt Snowball Method Works

The debt snowball method is the fastest way to pay off your debt. You'll pay off the smallest debt while making the minimum payment on all your other debts, and gain momentum as each one gets paid off.

What Is Debt Consolidation?

Juggling multiple payments got you feeling like you’re in a circus? See why consolidating your debts can actually set you back even more.

How to consolidate debt without hurting your credit

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit repair

- • Real estate

- • Personal finance

- • Debt relief

- Connect with Aylea Wilkins on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Debt consolidation puts multiple debts into a single account to make your payments easier.

- Debt consolidation can lower your credit score temporarily, but your score will improve if you make payments on time.

- Other tools like debt management plans and bankruptcy can help you manage debt.

You’re not alone if you’re carrying large amounts of debt across multiple credit cards and loans. According to the Federal Reserve Bank of New York , total household debt reached $17.5 trillion in Q4 2023. Credit card balances stood at $1.13 trillion. TransUnion reported that the average debt per borrower was $6,360 as of Q3 2023.

If you owe a lot of money on multiple credit cards and loans, debt consolidation can provide a way out. Unsurprisingly, there’s also a lot of misinformation and confusion about the process. What is the best way to consolidate debt? Is debt consolidation bad for your credit? Does the process really work? What are the possible drawbacks?

Debt consolidation doesn’t get rid of your debt, but it can help you pay it off efficiently. You should weigh the pros and cons and know how it will affect your credit score to decide if debt consolidation is right for you.

What is debt consolidation?

Debt consolidation lets you to roll debts into a single account. This process can make your life easier. You can merge multiple monthly payments to different creditors and lenders into one payment to a single source. Depending on the method used, debt consolidation can also help lower your overall interest rate.

You can consolidate your debt in a few ways. How you decide to consolidate your debt can change how your credit score is impacted.

Personal loans

A personal loan gives you a lump sum, which you can use to pay off your multiple creditors and lenders. You then repay that loan in monthly installments over months or years.

Personal loans generally have a fixed interest rate. The interest rate you owe (and the amount of money you can borrow) depends on your credit score and the lender you choose.

Home equity loans or HELOCs

Home equity loans and home equity lines of credit (HELOCs) are secured loans that use your home as collateral:

- A home equity loan is a second mortgage (at a fixed or variable interest rate). It gives you cash equal to a portion of the equity in your home.

- A HELOC is a revolving line of credit similar to a credit card or credit line. You borrow what you need from the line of credit, repay it and use it again when needed. How much you can receive is tied to your home’s equity.

Balance transfer credit cards

A balance transfer credit card lets you move existing debt from various credit cards to a single card. These specialized credit cards can offer a low or zero-introductory annual percentage rate (APR).

Does debt consolidation hurt your credit?

Debt consolidation can negatively impact your credit score. Any debt consolidation method you use will have the creditor or lender pulling your credit score, leading to a hard inquiry on your credit report. This inquiry will decrease your credit score by a few points.

However, this credit score decline is temporary. Making consistent, on-time payments on your HELOC, personal loan or balance transfer credit card will help boost your overall credit score over time. Credit bureaus like to see an on-time payment history. Those payments make up 35% of your overall credit score with FICO.

On the other hand, making off-and-on payments or completely missing payments are good ways to make a mess of your credit score.

Pros of debt consolidation

Managing your payments through debt consolidation can offer plenty of benefits , including:

- Faster debt repayment: The main advantage of consolidating debt is combining multiple monthly payments into a single monthly payment. This allows you to direct your payments to a single source. You won’t be paying many minimum payments. This process can help reduce your debt more quickly.

- Lower interest rates : Depending on your credit score, you could find yourself paying a lower interest rate through a debt consolidation loan or credit card transfer . A lower interest rate means more money stays in your pocket. That extra cash could help you pay off your debt faster.

Cons of debt consolidation

It’s also important to understand the downsides:

- Upfront costs : That personal loan or HELOC doesn’t come for free. You’ll have loan origination, application fees or closing costs if you’re using home equity. Balance transfer credit cards might also charge fees. These costs are either fixed or a percentage of the loan.

- Longer payoff terms : You could pay less per month with a debt consolidation plan. However, you might be paying this off over a longer time. If so, you might pay more in interest.

- Fees if you can’t make payments : If you miss even one payment on a debt consolidation loan, you could be dinged with a late fee. If your payment doesn’t go through because of insufficient funds, you might get a return payment fee.

- Damage to your credit score if you can’t pay : Once your payment is more than 30 days past its due date, your creditor or lender might report the omission to the credit bureaus.

How do you decide when debt consolidation is a good idea?

When considering a debt consolidation plan, it’s a good idea to consider a few important factors to decide if it’s going to work for you:

- Your credit score : One goal of debt consolidation is to reduce the interest rate on your debt. The idea here is to pay a lower interest rate on a consolidation loan or balance transfer credit card than you currently have. This is doable with a “good” credit score, which is at least 670 (FICO) or 661 (VantageScore).

- Your budget and financial goals : Debt consolidation could make your payment period longer. It can also provide a route to a specific, fixed monthly payment. This might be ideal if you’re working within a specific budget.

- Your ability to repay : Don’t get a debt consolidation loan unless you’re 100% sure you can repay it. Missing payments could drive you deeper into debt, and missed payments drag down your credit score.

What are the alternatives to debt consolidation?

If you’ve realized you might not be a good candidate for debt consolidation, there are other options to help pay down your debt.

Debt management plans

Debt management plans are offered by nonprofit agencies that work with creditors and lenders to negotiate more favorable terms for you. You make one monthly payment to the agency, which then pays your creditors. These agencies also help you formulate and follow a reasonable budget.

Debt settlement plans

Through debt settlement procedures , you negotiate directly with your creditors to reduce your interest rates, monthly payments or both. You can take the reins and do this on your own, or you can have a debt relief company do much of the work for you.

However, be careful when considering working with a debt settlement company, which can be an expensive option. Furthermore, if you work with a scam company, you could also have more debt problems than you started.

If all else fails, bankruptcy can help with your debt problems.

On the upside, bankruptcy can cancel what you owe, helping rid you of overwhelming balances and calls from creditors. On the downside, bankruptcy means attorney fees and remains on your credit report for a long time, anywhere from seven to 10 years.

Bankruptcy should be considered as a tool of last resort, only to be considered if all other attempts to reduce your debt have been exhausted.

The bottom line

It’s important to understand that debt consolidation doesn’t get you out of what you owe. You still need to pay your creditors and debtors. However, debt consolidation can help you redirect your financial resources and pay debt down more efficiently.

The key is determining the best way to consolidate debt for your specific financial situation. Then, dedicate yourself to making on-time payments and sticking with the process. When used correctly, this process can help you successfully pay off lenders and credit card companies while improving your credit score over time.

Related Articles

How to consolidate business debt

How to stick to your debt repayment plan

Alternative ways to pay down credit card debt

What are credit repair companies and how do they work?

What are your financial priorities?

Answer a few simple questions, and we’ll direct you to the right resources for every stage of life.

Welcome back. Your personalized solutions are waiting.

Welcome back. Here's where you left off.

You might also be interested in:

Debt and budgeting articles

Read more , 2 minutes

View infographic , 3 minutes

Read more , 4 minutes

6 ways to tackle financial stress

Read, 4 minutes

For many Americans, financial concerns are ever present, especially given the uncertainties of today’s economy. While worrying doesn’t solve much, having a plan to manage financial challenges can help ease some of the stress. Plus, the monetary benefits of dealing with financial problems—paying off bills, saving more and reducing debt—can help improve your overall outlook. Here are some suggestions for tackling your money stress and taking control of your finances.

Identify top sources of financial stress

If financial anxiety is weighing on you, start by identifying the specific issues keeping you up at night. Whether the problem is credit card debt or upcoming bill payments, pinpointing the source of your stress will help you determine your next move .

Write down your biggest money challenges. | ||

Keep the list short to help you feel less overwhelmed. | ||

Revisit your list every three to six months or as your circumstances change. |

Create a monthly budget

A budget is a powerful tool for taking control of—and understanding—your finances. It can help you avoid spending more than you have as well as save for future goals. Once you have a full picture of where your money is going every month, you can look for opportunities to redirect some of it to the areas causing your financial stress.

Start with your net income, the amount you take home every month after taxes. | ||

Write down all your expenses—from your rent or mortgage to your daily cup of coffee. | ||

Set up automatic payments for recurring bills and savings. | ||

Sign up to get alerts if your balance falls below a certain level. |

There are lots of apps and online tools to help you track spending or set up a budget. If you have an account with Bank of America, consider using the Spending & Budgeting tool .

Make the most of your income

When money is tight, you may think you don’t have enough to deal with your financial problems. However, it’s important to make the most of the income you do have. Know that small steps add up. You may not be able to cut any one expense by $500 a month, but you may be able to identify five that you can cut by $100 each.

Categorize your spending into needs and wants—and then look for ways to trim from your wants list. | ||

Examine your spending patterns to identify on small daily expenses. | ||

Consider modifying your budget to prioritize goals that will help ease your overall financial stress, such as paying off a high-interest credit card. |

Article continues below

Build an emergency fund.

Having money set aside for an emergency—such as car repairs, job loss or illness—can go a long way towards relieving financial anxiety. However, building an emergency fund can seem overwhelming, especially one with enough to cover three to six months of expenses. Don’t get hung up on the amount—what’s important is that you’re consistently setting money aside.

Use your budget to determine how much you can contribute each month toward savings after accounting for the expenses on your needs list. | ||

Prioritize building up three to six months of living expenses before you start looking at longer-term savings goals. | ||

Set up automatic transfers from your checking to your savings account. |

Bank of America offers a Savings Calculator to help you see how much time it could take to hit your savings goal.

Be strategic about reducing debt.

Credit card debt is a common source of financial stress. Not only is it expensive—it can also get in the way of your savings goals. The anxiety antidote: a plan to pay off the debt . If you have balances on multiple cards, consider using the snowball method (paying off your debts one-by-one, focusing on the smallest first) or the high-rate method (concentrating on the cards with the highest interest rates first).

Make the minimum payment on each of your cards. | ||

Pick a payment strategy and stick with it. | ||

Avoid taking on new credit card debt. |

Consider outside help

If you’re not satisfied with your progress in reducing debt, you may want to seek help from trusted resources, such as the Federal Trade Commission and the National Foundation for Credit Counseling. Or if you want guidance on long-term goals, such as saving for retirement or college, financial advisors can help. Finally, your friends and family may be able to offer support—just make sure to set clear boundaries and expectations to avoid damaging those relationships.

Monitor your progress. | ||

Make adjustments as your income, spending and goals change. | ||

Seek help if you’re struggling to keep up with minimum payments. |

The material provided on this website is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation.

What to read next

More from bank of america, keep better track of your money with online banking.

We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

You're continuing to another website

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Va a ir a una página que podría estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Connect with us

Your Privacy Choices

Some materials and online content may be available in English only.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2023 Bank of America Corporation. All rights reserved.

Investment products:

|

|

|

Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Financial Mentor

Invest smart. build wealth. retire early. live free., how to consolidate debt, the smart way, debt consolidation can save you money by paying off debt sooner — if you avoid certain mistakes..

- Debt consolidation can be a powerful tool to get out of debt faster.

- Even if you're financially secure, debt consolidation may save you thousands.

- Use caution; common mistakes can make your debt problem worse.

Sometimes, debt takes on a life of its own.

Even if you're responsible with money, surprises can catch you off guard and, before you know it, one loan turns into an insurmountable pile of debt.

It’s easy to get in over your head.

If you're paying what you can, but your loan or credit card balances are barely moving, it can feel like you’ll be in debt forever! This is just one of the reasons people find it so difficult to get out of debt .

Get This Article Sent to Your Inbox as a PDF…

Should I Consolidate Debt?

Debt consolidation may be a good option for you if:

- You have the income and credit to qualify for a new loan, and

- You can meaningfully reduce the interest rate on your debt by consolidating.

Consolidating debt can relieve some of the pressure on your budget, or simply reduce the number of creditors you need to pay each month. In many cases, consolidating your outstanding debt into a single loan can lower your monthly payments, save you money on interest, or both.

However, not all consolidation loans are created equally. There are many alternatives, each with their own pros and cons. The option that's right for you will depend on:

- What kind of debt you have

- The total amount of your debt

- Your creditworthiness and income

Read on to get all the information you need to decide which type of debt consolidation is best for you. We'll also cover exactly how to get started and offer some tips for avoiding the most common debt consolidation mistakes.

What is Debt Consolidation?

Debt consolidation is simply the process of taking out a single loan or credit card and using the proceeds to pay off multiple loans or credit card balances.

The two types of debt that are most commonly consolidated are credit card debt and student loan debt. But, you can also use debt consolidation for payday loans, personal loans, or medical bills.

It’s important to note that debt consolidation doesn’t reduce the amount of debt you owe. In fact, if you pay transfer fees or loan origination fees, you may end up owing more than you did when you started. However, in most cases, the benefits of consolidation make the upfront costs worthwhile in the long run.

Benefits of Debt Consolidation

You may wonder why you should bother with the hassle of consolidating your debt, especially when you’ll likely end up paying extra fees? There are actually several very compelling reasons. Let’s look at an example.

Related: Here’s a scientific system to build your wealth now

Imagine that you had five credit cards totaling $20,000 in outstanding debt. For this example, we’ll assume the interest rates averag 18.5% and the minimum monthly payments for all five cards totaled $500. In this case, it would take you five years to pay off your debt.

Now, imagine that you’re able to take out a $20,000 loan with a 5-year repayment schedule and a 10% interest rate. Your new minimum payment would be approximately $425 for the same debt and same repayment period.

The new, lower payment gives you two options to solve your debt problems:

The first is to use the monthly savings of $75 to give yourself a little bit of financial breathing room.

This might be the best option if you didn’t have enough cash flow to keep up with your previous $500 monthly payment.

The second option is to continue paying $500 per month so that you can pay off your loan even sooner.

How would these choices impact you?

In the first scenario, you would have an extra $75 per month to support current lifestyle so that you hopefully don't accumulate additional debt, while still saving $900 per year in interest payments. Over the five-year period, you’ll save $4,503. This is a huge benefit, but what if you went one step further and used the extra money to increase your loan payment? This would put you back at your original $500 per month payment while shaving an additional 0.9 years off your repayment schedule. This would allow you to pay the loan off in just 4.1 years and save $1,067 over the life of the loan.

These numbers will obviously vary for each person's individual scenario, but you can see what a huge difference consolidation can make. If you want to see what your consolidation numbers would look like, check out our debt consolidation calculator .

Another advantage is you’ll enjoy the freedom and convenience of dealing with one single loan instead of trying to juggle five credit card payments. It makes life easier, and it reduces the very real risk that you'll miss a payment, incur late fees, and tarnish your credit.

Depending on your credit history, debt consolidation may also give your credit score a much-needed boost. Once you’ve consolidated to a single loan and establish a track record of on-time payments, you should see a positive improvement in your credit score over time.

Now that you understand the benefits of consolidation, the next step is figuring out exactly how you’re going to consolidate that debt.

There are multiple options so it's important to weigh the pros and cons of each to decide which is best for your situation.

5 Methods for Consolidating Debt

The five most popular debt consolidation options are:

- Home equity

- Personal loans

- Credit card balance transfers

- Student loan refinancing

- Debt consolidation services

1. Home Equity or Mortgage Refinancing

If you're a homeowner then consolidating your debts with a home equity loan or line of credit (HELOC) is likely to be the least expensive option. Home equity loans typically offer lower interest rates than most other loan types because you’re putting your home up as collateral.

In some cases, you may also be able to refinance your mortgage for more than you owe and withdraw the difference as cash to pay off your debts.

However, both of these are options are risky propositions. You’re converting unsecured debt into secured debt.

Related: Why you need a wealth plan, not a financial plan.

If you stop repaying a credit card, personal loan, medical bill, or any other unsecured debt, your creditor will have to sue you to attempt to collect the unpaid balance. They might be successful, they might not. However, even if they're successful, the worst that can happen is a judge will place a lien on your property or garnish a percentage of your wages.

Home equity loans — just like mortgages — are secured by your home, which means if you're unable to make the minimum monthly payments then the lender can foreclose on your home . Until the loan is paid off, the bank has the legal right to the value of your home, and can take it once certain conditions are met.

Therefore, while home equity can be an inexpensive way to consolidate debt, you’ll only want to consider this option if you’re absolutely sure you have sufficient cash flow to easily meet the monthly payment requirements. If not, it's not worth risking the roof over your head.

If you want to explore home equity or refinancing as a debt consolidation option, LendingTree is a convenient website to obtain no-obligation rate quotes for all kinds of mortgage products. Get your personalized rates in 5 minutes here.

2. Personal Loans

Personal loans are the fastest-growing type of unsecured debt. Since these loans aren't backed by collateral, the rate you’ll pay (and whether you’ll get approved at all) will depend in large part on your credit score. They’re an excellent option for consolidating multiple loans, particularly if you already have good credit.

You can get personal loans through banks, credit unions, personal finance companies, peer-to-peer lenders, and through online direct personal loan lenders like these .

If you have excellent credit, direct online lenders often offer great rates, fast approval, and prompt delivery times. In some cases, they can approve and transfer funds in as little as a day or two.

If you have poor credit, direct online lenders will also offer the best chance of approval, but they may be willing to loan less money and will inevitably charge higher interest rates than you're already paying, which defeats the largest benefit to consolidation.

If your credit is somewhere in the middle — okay, but not great — then a local credit union may offer a better chance of approval at a fair interest rate.

If you're curious about whether a personal loan could help you consolidate debt, these websites will show you the best personal loan rates, loan amounts, and monthly payments based on your individual situation. They're free to use, do not affect your credit score, and come with no obligation to apply for a loan.

Learn more about how to use personal loans responsibly in our complete guide.

3. Balance Transfer Credit Cards

If you're looking to consolidate credit card debt and only owe a modest amount, a 0% balance transfer credit card could be the right answer for you. However, approach this option carefully.

Credit card balance transfers are usually best when you owe no more than a few thousand dollars.

The zero-percent rate is offered for a set period of time (usually between 12 and 24 months).

If you haven't paid the balance in full by the time the offer expires, the remaining balance will be subject to the credit card's regular interest rate, which can be quite high.

Most cards also charge a balance transfer fee that amounts to between 3 and 5 percent of the balance transferred.

Before considering using a zero-percent interest rate offer, make sure you read all of the fine print and understand every detail. Then, figure out the payment schedule you’ll need to adhere to in order to ensure you can pay your balances in full before the promotional period ends. If you want to be safe, plan to pay the total off at least one month before the deadline.

Is Your Credit Card Costing You Too Much?

Whether you're paying off existing debt or considering using a credit card to finance a new purchase, you may be able to save hundreds---even thousands---by taking a minute to shop for the best credit card for your situation .

Visit our partner, Cardratings , to compare balance transfer credit cards which offer 0% intro APRs for 18 months or more on transferred balances. Likewise, if you're considering financing a new purchase, see the top 0% intro APR credit cards offering 12 months or more of interest-free financing.

See The List Here →

Need longer than two years to pay off an existing debt or a new purchase? A fixed-payment personal loan may charge less interest than a credit card. See our list of the best personal loans for debt consolidation.

4. Student Loan Consolidation

Most people graduate from college with multiple student loans. These loans often have different interest rates, terms, and repayment periods. Keeping track of them all is a hassle and consolidating them will almost always put you in a better financial position.

Federal Student Loan Consolidation

If you only have federal student loans, you may consider consolidating them using a Direct Consolidation Loan through the U.S. Department of Education. Doing so can also give you access to additional loan repayment plans and certain loan forgiveness programs. In many cases, you’ll also be able to remove the uncertainty of variable rate loans by consolidating them into a fixed-rate product.

Before moving forward with this, however, you’ll want to take a close look at the terms of your current loans and make sure you won’t lose any valuable benefits or credits by transferring your balances to a new loan. It’s also important to note that this option only works for Federal loans. If you have private loans or a mix of the two, then you’ll need to explore working with a private lender.

Private Student Loan Refinancing

Consolidating student loans through private lenders is often referred to as refinancing. This option could help you get a better interest rate, but you may find that it’s also more difficult to qualify.

Since Federal loans offer favorable repayment plans and forgiveness programs that you won't find with a private lender, you’ll want to think twice about rolling them into a private loan. It may still be a good idea if the rate is significantly lower and you don’t need these types of options. Before making a decision, you’ll want to ensure that you understand everything completely and weigh the pros and cons carefully.

If you only have private loans, then consolidating them through a new private lender will work in much the same way as consolidating credit cards using a personal loan. Many banks and credit unions offer student loan consolidations. However, online direct lenders are often the best choice. There are many websites available that allow you to compare offers from various lenders, which is a smart thing to do before you make your final decision.

5. Debt Consolidation Companies

There are various names that “debt consolidation” companies operate under. They may call their product debt consolidation, debt management, credit counseling, or a number of other things.

These companies should be considered an absolute last resort. If your credit is poor enough that you cannot qualify for other kinds of debt consolidation, using one of these firms may keep you out of bankruptcy, but it will cost you.

You should also know that these companies often don’t consolidate your debts into one loan. Rather, they serve as a middle man between you and your creditors. You send the company one monthly payment, and they distribute it among your various loans and credit cards. Sometimes, they can negotiate lower interest rates or minimum payments with your lenders. But, you must pay them a hefty monthly fee for using their services, which can offset any negotiated savings.

Finally, using these companies will almost always have negative consequences for your credit in the short-term. That's because your creditors will report to the credit bureaus that you are repaying your debt under modified terms, which goes on your credit report as a negative remark.

While some debt consolidation companies are reputable, there are also a ton of debt consolidation scams out there. If you decide to pursue this option, be very careful. Do your research, ask a lot of questions, and always trust your gut.

Is Debt Consolidation Always a Good Idea?

Although we’ve discussed the many benefits of debt consolidation, it’s important to note that there are situations when it’s not a good move. Generally, you’ll only want to consolidate your debt if the new loan will give you a lower payment and/or a lower interest rate.

Remember, also, that your new loan may offer you a lower payment simply by extending the amount of time you have to repay your loan. The longer you hold debt, the more total interest you’ll pay. That’s why it’s better to pay more than your minimum payment each month.

Related: How to take back control of your portfolio