Home » Explanations » Financial statement analysis » Current ratio

Current ratio

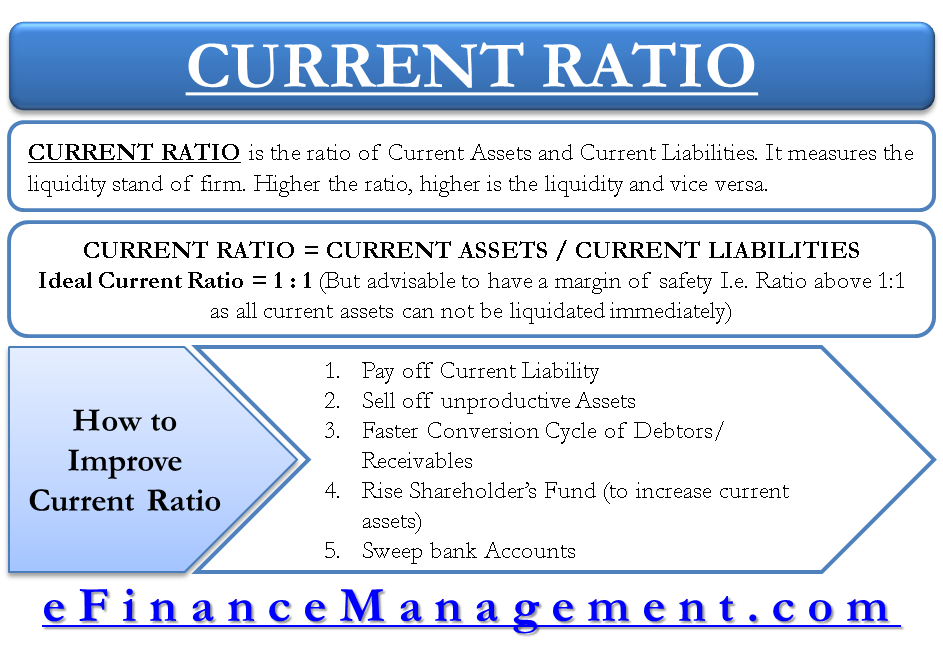

Current ratio (also known as working capital ratio ) is a popular tool to evaluate short-term solvency position of a business. Short-term solvency refers to the ability of a business to pay its short-term obligations when they become due. Short term obligations (also known as current liabilities ) are the liabilities payable within a short period of time, usually one year.

A higher current ratio indicates strong solvency position of the entity in question and is, therefore, considered better.

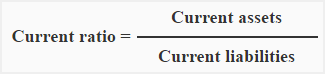

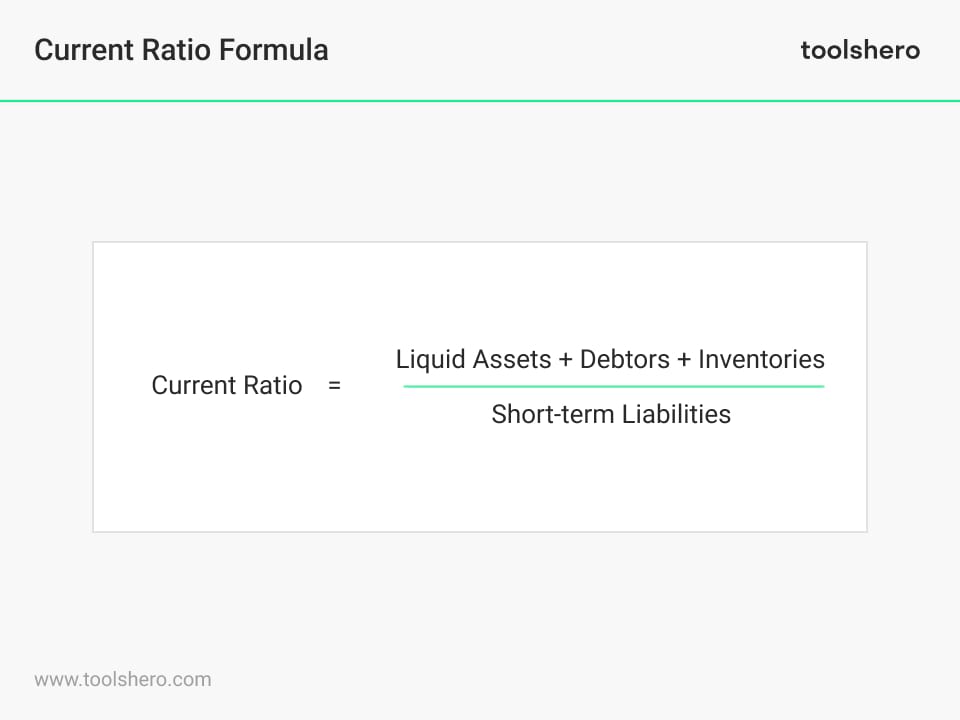

Current ratio is computed by dividing total current assets by total current liabilities of the business. This relationship can be expressed in the form of following formula or equation:

Above formula comprises of two components i.e., current assets and current liabilities. Both of these components should be available from the entity’s balance sheet . Some examples of current assets and current liabilities are listed below:

Some common examples of current assets are given below:

- Marketable securities

- Accounts receivables/debtors

- Inventories/stock

- Bills receivable

- Short-term totes receivable

- Prepaid expenses

Some common examples of current liabilities are given below:

- Accounts payable/creditors

- Bills payable

- Short-term notes payable

- Short term bonds payable

- Interest payable

- Unearned revenues

- current portion of long term debt

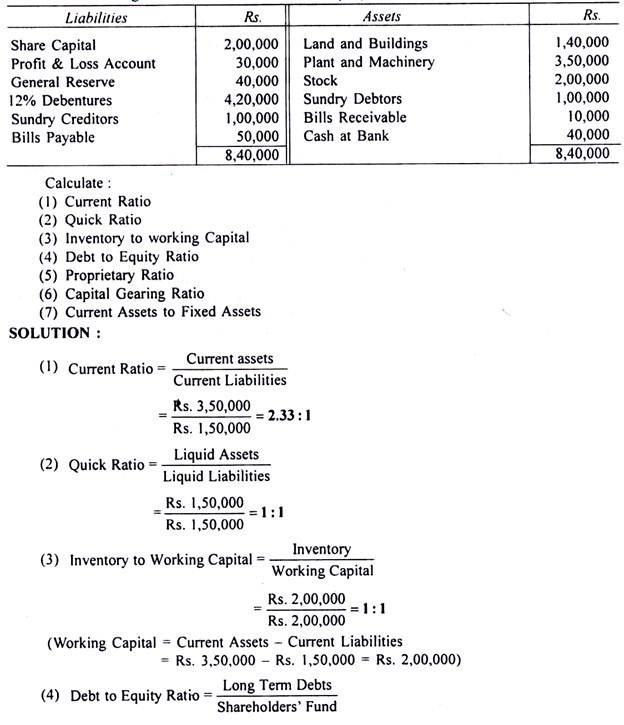

On December 31, 2016, the balance sheet of Marshal company shows the total current assets of $1,100,000 and the total current liabilities of $400,000. Your are required to compute current ratio of the company.

Current ratio = Current assets/Current liabilities = $1,100,000/$400,000 = 2.75 times

The current ratio is 2.75 which means the company’s currents assets are 2.75 times more than its current liabilities.

Significance and interpretation

Current ratio is a useful test of the short-term-debt paying ability of any business. A ratio of 2:1 or higher is considered satisfactory for most of the companies but analyst should be very careful while interpreting it. Simply computing the ratio does not disclose the true liquidity of the business because a high current ratio may not always be a green signal. It requires a deep analysis of the nature of individual current assets and current liabilities. A company with high current ratio may not always be able to pay its current liabilities as they become due if a large portion of its current assets consists of slow moving or obsolete inventories. On the other hand, a company with low current ratio may be able to pay its current obligations as they become due if a large portion of its current assets consists of highly liquid assets i.e., cash, bank balance, marketable securities and fast moving inventories. Consider the following example to understand how the composition and nature of individual current assets can differentiate the liquidity position of two companies having same current ratio figure.

Liquidity comparison of two or more companies with same current ratio

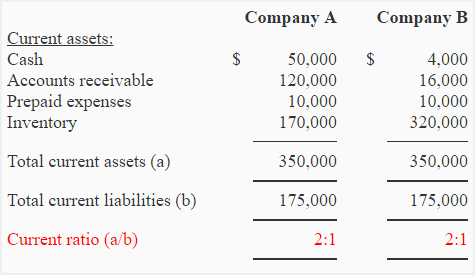

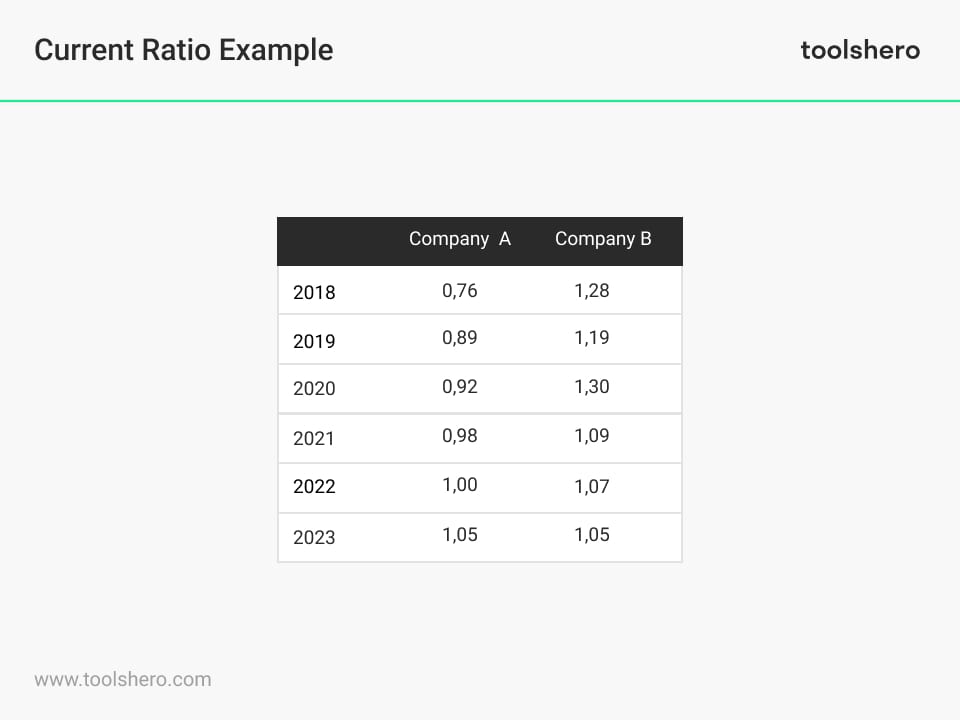

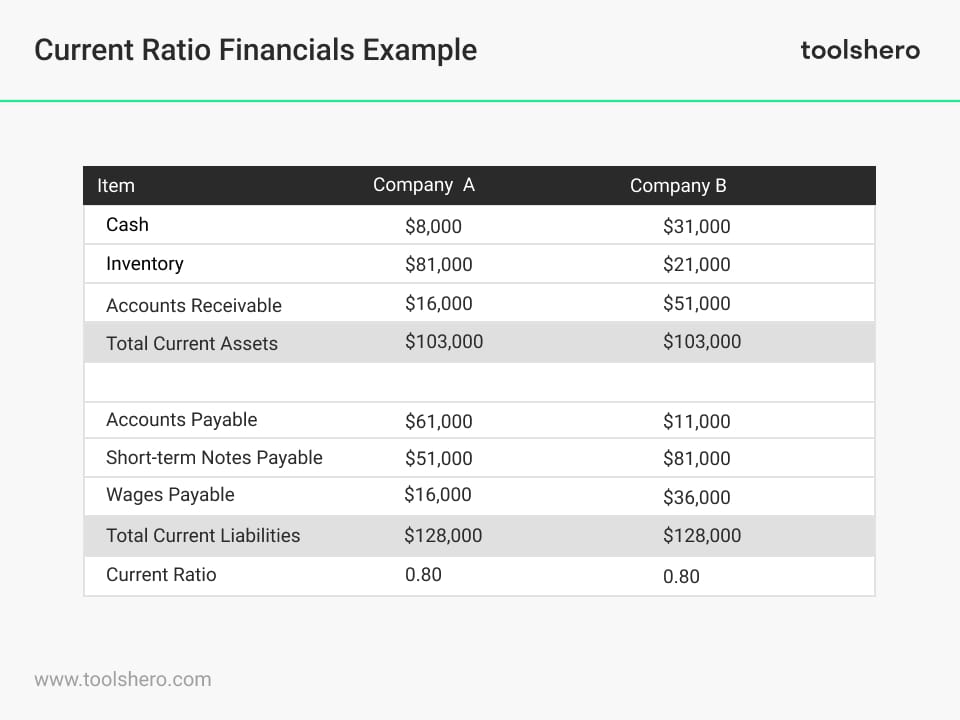

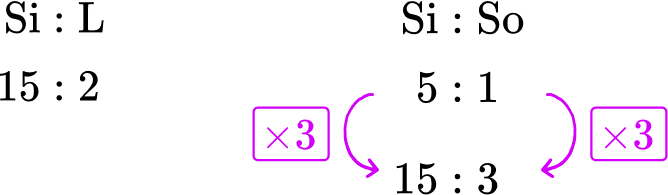

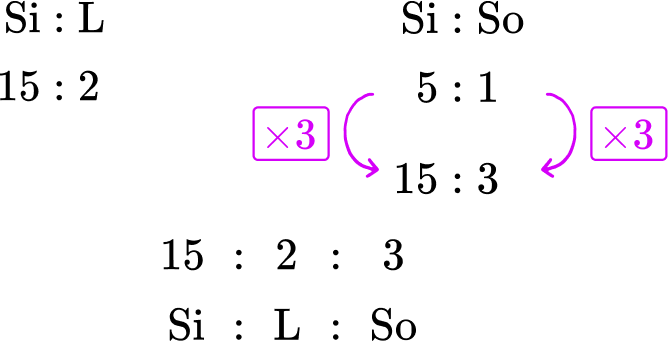

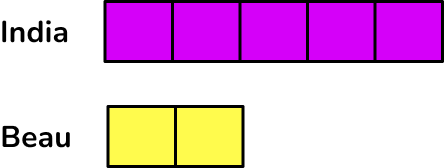

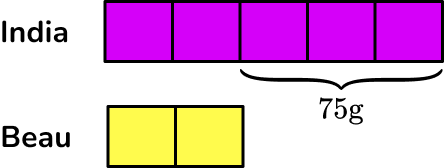

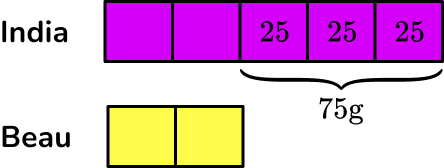

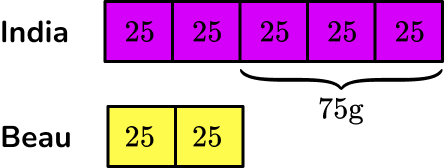

We may find situations where two or more companies have the same current ratio figures but their real liquidity position is far different from each other. It happens because of the quality and nature of individual items that make up the total current assets of the companies. Consider the following example to understand this point in more detail:

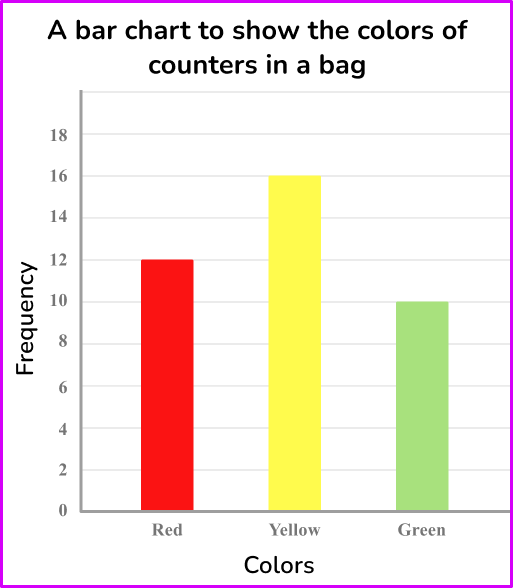

The following data has been extracted from the financial statements of two companies – company A and company B.

Both company A and company B have the same current ratio (2:1). Do both the companies have equal ability to pay its short-term obligations? The answer to this question is a “no” because company B is likely to have difficulties in paying its short-term obligations. Most of its current assets consist of inventory which might not be quickly convertible into cash. The company A, on the other hand, is likely to pay its current obligations as and when they become due because a large portion of its current assets consists of cash and receivables. Accounts receivable are generally considered more liquid assets in nature and thereby have a better chance to be quickly converted into cash than inventories.

The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

Limitations of current ratio

Current ratio suffers from a number of considerable limitations and, therefore, can’t be applied as the sole index of liquidity. Some major limitations are given below:

1. Different ratio in different parts of the year:

The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number. Many entities have varying trading activities throughout the year due to the nature of industry they belong. The current ratio of such entities significantly alters as the volume and frequency of their trade move up and down. In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question.

2. Issues in inter-firm comparison:

Financial ratios are often made part of inter-firm comparison – a comparison of operating performance and financial status of two or more similar commercial entities working in the same industry, primarily conducted to learn and achieve a better business performance. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method. For example, comparing current ratio of two companies would be like comparing apples with oranges if one uses FIFO while other uses LIFO cost flow assumption for costing/valuing their inventories. The analyst would, therefore, not be able to compare the ratio of two companies even in the same industry.

3. Just a test of quantity, not quality:

Current ratio is a number which simply tells us the quantity of current assets a business holds in relation to the quantity of current liabilities it is obliged to pay in near future. Since it reveals nothing in respect of the assets’ quality, it is often regarded as crued ratio. For example, an entity with a favorable current ratio may still be at liquidity risk if it currently lacks on cash to settle its short-term liabilities and a bigger portion of its total current assests is composed of work in process inventories and slow moving stocks which generally require a longer period of time to bring cash in business.

4. Window dressing and manipulation:

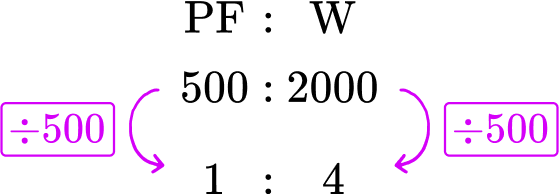

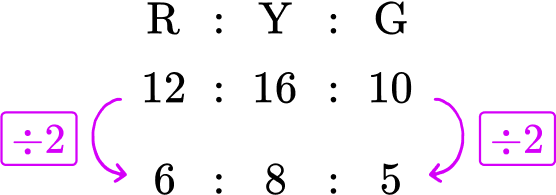

Current ratio can be easily manipulated by equal increase or equal decrease in current assets and current liabilities numbers. For example, if current assets of a company are $10,000 and current liabilities are $5,000, the current ratio would be 2 : 1 as computed below:

$10,000 : $5,000 = 2 : 1

Now If both current assets and current liabilities are reduced by $1,000, the ratio would be increased to 2.25 : 1 as computed below:

$9,000 : $4,000 = 2.25 : 1

Similarly if we increase both the elements by $1,000, the ratio would be decreased to 1.83 : 1 as computed below:

$11,000 : $6,000 = 1.83 : 1

However in order to minimize the impact of above mentioned limitations and to conduct a meaningful and reliable liquidity analysis of a business, the current ratio can be used in conjunction with many other ratios like inventory turnover ratio , receivables turnover ratio , average collection period , current cash debt coverage ratio , and quick ratio etc. These ratios are helpful in testing the quality and liquidity of a number of individual current assets and together with current ratio can provide much better insights into the company’s short-term financial solvency.

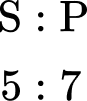

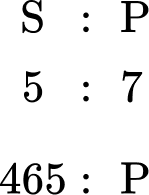

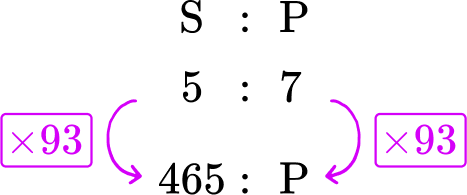

Computating current assets or current liabilities when the ratio number is given

Students may come across examination questions or home work problems in which the examiner or tutor provideds a current ratio number along with some additional information pertaining to a business entity and asks them to work out either total current assets or total current liabilities figure. For example, he may provide current ratio and one of the total current assets or total current liabilities figure and ask the students to calculate the other one. There is no difficulty involved in computations like this, because we can work out either of the two figures just by rearranging the components of formula given above. Consider the two examples given below:

T & D company’s current ratio is 2.5 for the most recent period. If total current assets of the company are $7,500,000, what are total current liabilities?

Current ratio = Current assets/Current liabilities or Current liabilities = Current assets/Current ratio = $7,500,000/2.5 = $3,000,000

If Marbel Inc’s current ratio is 1.4 and total current liabilities are $8,000,000, what are its total current assets?

Current ratio = Current assets/Current liabilities or Current assets = Current liabilities × Current ratio = $8,000,000 × 1.4 = $11,200,000

Need to help for doing my homework about accounting

Leave a comment Cancel reply

.png)

How to Calculate (And Interpret) The Current Ratio

Janet Berry-Johnson, CPA

Reviewed by

March 10, 2022

This article is Tax Professional approved

All businesses have bills to pay. Your ability to pay them is called "liquidity," and liquidity is one of the first things that accountants and investors will look at when assessing the health of your business.

I am the text that will be copied.

The current ratio (also known as the current asset ratio , the current liquidity ratio , or the working capital ratio ) is a financial analysis tool used to determine the short-term liquidity of a business. It takes all of your company’s current assets, compares them to your short-term liabilities, and tells you whether you have enough of the former to pay for the latter.

In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand. It’s one of the ways to measure the solvency and overall financial health of your company.

Here, we’ll go over how to calculate the current ratio and how it compares to some other financial ratios.

How do you calculate the current ratio?

You calculate your business’s overall current ratio by dividing your current assets by your current liabilities .

To do this, you’ll need to get familiar with your balance sheet —as one of the three primary financial statements your business produces, your balance sheet helps you get a sense of the big picture and serves as a historical record of a specific moment in time.

Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year . You can find them on the balance sheet, alongside all of your business’s other assets.

The five major types of current assets are:

Cash and cash equivalents . These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds.

Marketable securities . These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market. Examples include common stock, treasury bills, and commercial paper.

Accounts receivable . This account is used to keep track of any money customers owe for products or services already delivered and invoiced for.

Inventory . This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

Prepaid expenses . These are future expenses that have been paid in advance that haven’t yet been used up or expired. Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement.

Your current liabilities (also called short-term obligations or short-term debt) are:

- Any outstanding bill payments

- Short-term loans

- Any other kind of short-term liability that your business must pay back within the next 12 months

You can find them on your company’s balance sheet, alongside all of your other liabilities.

Current liabilities do not include long-term debt, like bonds, lease obligations, and long-term notes payable.

Here are a few common examples of current liabilities:

- Credit card debt

- Notes payable that mature within one year

- Wages payable

- Deferred revenue

- Accounts payable

- Accrued liabilities (also known as accrued expenses) like dividend, income tax, and payroll

What is the current ratio formula?

You calculate the current ratio by dividing your company’s current assets by your current liabilities, i.e.:

Current ratio = total current assets / total current liabilities

Let’s imagine that your fictional company, XYZ Inc., has $15,000 in current assets and $22,000 in current liabilities. Its current ratio would be:

Current ratio = $15,000 / $22,000 = 0.68

That means that the current ratio for your business would be 0.68.

A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. XYZ Inc.’s current ratio is 0.68, which may indicate liquidity problems.

But that’s also not always the case.

A low current ratio could also just mean that you’re in an industry where it’s normal for companies to collect payments from customers quickly but take a long time to pay their suppliers, like the retail and food industries.

Or it could mean that your company is very good at keeping inventory low. (Remember: inventory is included in current assets.)

A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business.

What is a good current ratio?

As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question.

In general, a current ratio between 1.5 and 3 is considered healthy. Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital.

The definition of a “good” current ratio also depends on who’s asking. In many cases, lenders prefer high current ratios, since it indicates that the company won’t have any issues paying the creditor back, while investors may take a high current ratio as a signal of operational inefficiencies.

Current vs. quick ratio

The quick ratio (also sometimes called the acid-test ratio) is a more conservative version of the current ratio.

The quick ratio differs from the current ratio in that it leaves inventory out and keeps the three other major types of current assets: cash equivalents, marketable securities, and accounts receivable.

So the equation for the quick ratio is:

Quick ratio = (cash equivalents + marketable securities + accounts receivable) / current liabilities

Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio. But it’s important to put it in context.

A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.

Similarly, a higher quick ratio doesn’t automatically mean you’re liquid, especially if you encounter unexpected problems collecting receivables

Current vs. cash ratio

Looking for an even purer (in theory) liquidity test? You want the cash ratio.

The cash ratio takes accounts receivable out of the equation, leaving you with only cash equivalents and marketable securities to cover your current liabilities:

Cash ratio = (cash equivalents + marketable securities) / current liabilities

If you have a high cash ratio, you’re sitting pretty. It’s the most conservative measure of liquidity and, therefore, the most reliable, industry-neutral method of calculating it.

Advanced ratios

Financial analysts will often also use two other ratios to calculate the liquidity of a business: the current cash debt coverage ratio and the cash conversion cycle (CCC) .

The current cash debt coverage ratio is an advanced liquidity ratio. It measures how capable a business is of paying its current liabilities using the cash generated by its operating activities (i.e., money your business brings in from its ongoing, regular business activities).

The cash conversion cycle (CCC) is a metric that expresses the time (in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

These calculations are fairly advanced, and you probably won’t need to perform them for your business, but if you’re curious, you can read more about the current cash debt coverage ratio and the CCC .

Related Posts

.png)

Amazon Seller Fees: Everything You Need to Know (Including the Accounting)

Selling products on Amazon? Here’s everything you need to know about Amazon fees to help you make money-saving moves (and avoid any nasty surprises in the future).

What's a Good Profit Margin for Your Small Business?

Wondering if your profit margins are high enough? Here's how to calculate gross, operating, and net profit margins and what they can tell you about your business.

Law Firm Accounting 101

An in-depth guide to setting up the accounting basics for your law firm.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

Current Ratio

Step-by-Step Guide to Understanding Current Ratio

Learn Online Now

What is Current Ratio?

The Current Ratio is a measure of a company’s near-term liquidity position, or more specifically, the short-term obligations coming due within one year.

Often used alongside the quick ratio, the current ratio measures if a company can meet its short-term obligations using its short-term assets on the present date.

- The current ratio is a financial metric that measures the liquidity of a company by comparing the current assets belonging to a company to its current liabilities to determine if the liquid assets are sufficient to meet its short-term obligations coming due within twelve months (or one-year).

- The current ratio formula is the current assets of a company divided by its current liabilities.

- A current ratio of around 1.5x to 3.0x is considered to be healthy, whereas a current ratio below 1.0x is deemed a red flag that implies the near-term liquidity of the company presents risks.

- The current ratio is different from the quick ratio because the metric is less conservative because the formula includes all current assets, rather than only those confirmed to be truly liquid.

Table of Contents

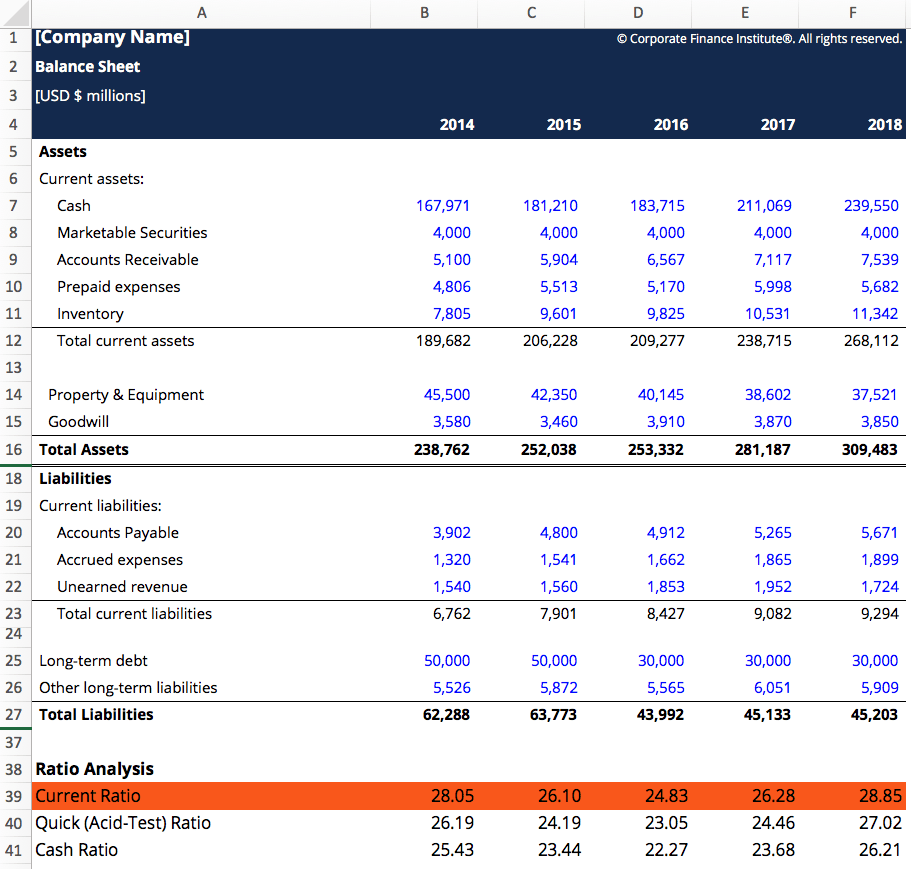

How to Calculate Current Ratio

Current ratio formula, current ratio calculation example, what is a good current ratio, what are the limitations of current ratio, current ratio vs. quick ratio: what is the difference, current ratio calculator, 1. balance sheet assumptions, 2. working capital calculation example, 3. current ratio calculation example.

The current ratio is categorized as a liquidity ratio , since the financial metric assesses how financially sound the company is in relation to its near-term liabilities .

Liquidity ratios generally have a near-term focus, hence the two main inputs are current assets and current liabilities.

- Current Assets → Cash and Cash Equivalents, Marketable Securities, Accounts Receivable (A/R), Inventory

- Current Liabilities → Accounts Payable (A/P), Accrued Expense, Deferred Revenue (D/R), Short-Term Debt (<12 Month)

The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now.

The formula to calculate the current ratio divides a company’s current assets by its current liabilities.

Since the current ratio compares a company’s current assets to its current liabilities, the required inputs can be found on the balance sheet .

Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management.

Suppose a company has the following balance sheet data:

Current Assets:

- Cash = $25 million

- Marketable Securities = $20 million

- Accounts Receivable (A/R) = $10 million

- Inventory = $60 million

Current Liabilities:

- Accounts Payable (A/P) = $55 million

- Short-Term Debt = $60 million

With that said, the required inputs can be calculated using the following formulas.

- Current Assets = $25 million + $20 million + $10 million + $60 million = $115 million

- Current Liabilities = $55 million + $60 million = $115 million

For the last step, we’ll divide the current assets by the current liabilities.

- Current Ratio = $115 million ÷ $115 million = 1.0x

The current ratio of 1.0x is right on the cusp of an acceptable value, since if the ratio dips below 1.0x, that means the company’s current assets cannot cover its current liabilities.

If the ratio were to drop below the 1.0x “floor”, raising external financing would become urgent.

The range used to gauge the financial health of a company using the current ratio metric varies on the specific industry.

For instance, supermarket retailers typically have low current ratios considering their business model (and free cash flows) are essentially a function of their ability to raise more debt to fund asset purchases (i.e. increases debt on B/S ), as well as pushing back supplier/vendor payments (i.e. increasing accounts payable )

As a general rule of thumb, a current ratio in the range of 1.5 to 3.0 is considered healthy.

- Current Ratio >1.5x → The company has sufficient current assets to pay off its current liabilities

- Current Ratio = 1.0x → The company has sufficient current assets to meet its current liabilities, however, there is no margin for error (i.e. no “cushion”)

- Current Ratio <1.0x → The company has insufficient current assets to pay off its current liabilities

However, a current ratio <1.0 could be a sign of underlying liquidity problems, which increases the risk to the company (and lenders if applicable).

Tracking the current ratio can be viewed as “worst-case” scenario planning (i.e. liquidation scenario) — albeit, the company’s business model may just require fewer current assets and comparatively more current liabilities.

Here, the company could withstand a liquidity shortfall if providers of debt financing see the core operations are intact and still capable of generating consistent cash flows at high margins.

But a higher current ratio is NOT necessarily always a positive sign — instead, a ratio in excess of 3.0x can result from a company accumulating current assets on its balance sheet (e.g. cannot sell inventory to customers).

While under a liquidation scenario, a higher amount of asset collateral is perceived positively, most companies focus on forward-looking performance like free cash flow (FCF) generation and profit margins , although everything is linked to one another in some ways.

The limitations of the current ratio – which must be understood to properly use the financial metric – are as follows.

- Minimum Cash Balance → One shortcoming of the metric is that the cash balance includes the minimum cash amount required for working capital needs. Without the minimum cash on hand for operations to continue, as usual, the business cannot continue to run if its cash were to dip below this level — e.g. the company is struggling to collect owed cash payments from customers that paid on credit.

- Restricted Cash → Likewise, the cash balance could contain restricted cash, which is not freely available for use by the business and is instead held for a specific purpose.

- Illiquid Short-Term Investments → Next, the inclusion of short-term investments that cannot be liquidated in the markets easily could also have been included — i.e. low liquidity and cannot sell without selling at a loss at a substantial discount.

- Bad A/R (Uncollectible) → The last drawback to the current ratio that we’ll discuss is the accounts receivable amount can include “Bad A/R”, which is uncollectible customer payments, but management refuses to recognize it as such.

Another practical measure of a company’s liquidity is the quick ratio , otherwise known as the “acid-test” ratio.

The formula to compute the quick ratio is as follows.

In comparison to the current ratio, the quick ratio is considered a more strict variation due to filtering out current assets that are not actually liquid — i.e. cannot be sold for cash immediately.

By adjusting the numerator to include solely highly liquid assets that can truly be converted into cash in <90 days with a high degree of certainty, the quick ratio is a more conservative measure of liquidity.

We’ll now move to a modeling exercise, which you can access by filling out the form below.

By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1.

- Cash and Cash Equivalents = $20 million

- Marketable Securities = $15 million

- Accounts Receivable (A/R) = $25 million

- Inventory = $65 million

- Accounts Payable: $45 million

- Short-Term Debt: $80 million

Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected.

The company has just enough current assets to pay off its liabilities on its balance sheet.

As for the projection period – from Year 2 to Year 4 – we’ll use a step function for each B/S line item, with the Year 1 figures serving as the starting point.

Our assumptions for the changes in working capital line items are as follows.

- Cash and Cash Equivalents = +$5 million/Year

- Marketable Securities = +$5 million/Year

- Accounts Receivable (A/R) = +$3 million/Year

- Inventory = +$2 million/Year

- Accounts Payable (A/P) = –$3 million/Year

- Short-Term Debt = –$2 million/Year

Clearly, the company’s operations are becoming more efficient, as implied by the increasing cash balance and marketable securities (i.e. highly liquid, short-term investments), accounts receivable , and inventory.

By dividing the current assets balance of the company by the current liabilities balance in the coinciding period, we can determine the current ratio for each year.

From Year 1 to Year 4, the current ratio increases from 1.0x to 1.5x.

- Current Ratio – Year 1 = $125 million ÷ $125 million = 1.0x

- Current Ratio – Year 2 = $140 million ÷ $120 million = 1.2x

- Current Ratio – Year 3 = $155 million ÷ $115 million = 1.3x

- Current Ratio – Year 4 = $170 million ÷ $110 million = 1.5x

Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales .

The increase in inventory could stem from reduced customer demand, which directly causes the inventory on hand to increase — which can be good for raising debt financing (i.e. more collateral), but a potential red flag.

Therefore, applicable to all measures of liquidity, solvency , and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package : Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

- Google+

- Working Capital

- Cash Conversion Cycle

- Cash Flow Drivers

- Liquidation Value

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

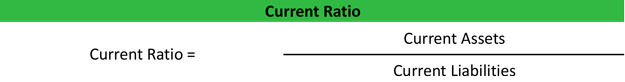

What is the Current Ratio?

Current ratio formula, example of the current ratio formula, download the free current ratio formula template.

- Current Ratio Formula - What are Current Assets?

- Current Ratio Formula - What are Current Liabilities?

Why Use the Current Ratio Formula?

Additional resources.

Current Assets / Current Liabilities

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities .

It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

The Current Ratio formula is:

Current Ratio = Current Assets / Current Liabilities

If a business holds:

- Cash = $15 million

- Marketable securities = $20 million

- Inventory = $25 million

- Short-term debt = $15 million

- Accounts payables = $15 million

Current assets = 15 + 20 + 25 = 60 million

Current liabilities = 15 + 15 = 30 million

Current ratio = 60 million / 30 million = 2.0x

The business currently has a current ratio of 2, meaning it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. There is no upper end on what is “too much,” as it can be very dependent on the industry, however, a very high current ratio may indicate that a company is leaving excess cash unused rather than investing in growing its business.

Image: CFI’s Financial Analysis Fundamentals Course

Enter your name and email in the form below and download the free template now! You can browse All Free Excel Templates to find more ways to help your financial analysis.

Current Ratio Template

Download the free Excel template now to advance your finance knowledge!

- First Name *

Current Ratio Formula – What are Current Assets?

Current assets are resources that can quickly be converted into cash within a year’s time or less. They include the following:

- Cash – Legal tender bills, coins, undeposited checks from customers, checking and savings accounts, petty cash

- Cash equivalents – Corporate or government securities with 90 days or less maturity

- Marketable securities – Common stock, preferred stock, government and corporate bonds with a maturity date of 1 year or less

- Accounts receivable – Money owed to the company by customers and that is due within a year – This net value should be after deducting an allowance for doubtful accounts (bad credit)

- Notes receivable – Debt that is maturing within a year

- Other receivables – Insurance claims, employee cash advances, income tax refunds

- Inventory – Raw materials, work-in-process, finished goods, manufacturing/packaging supplies

- Office supplies – Office resources such as paper, pens, and equipment expected to be consumed within a year

- Prepaid expenses – Unexpired insurance premiums, advance payments on future purchases

Current Ratio Formula – What are Current Liabilities?

Current liabilities are business obligations owed to suppliers and creditors, and other payments that are due within a year’s time. This includes:

- Notes payable – Interest and the principal portion of loans that will become due within one year

- Accounts payable or Trade payable – Credit resulting from the purchase of merchandise, raw materials, supplies, or usage of services and utilities

- Accrued expenses – Payroll taxes payable, income taxes payable, interest payable, and anything else that has been accrued for but an invoice is not received

- Deferred revenue – Revenue that the company has been paid for that will be earned in the future when the company satisfies revenue recognition requirements

This current ratio is classed with several other financial metrics known as liquidity ratios. These ratios all assess the operations of a company in terms of how financially solid the company is in relation to its outstanding debt. Knowing the current ratio is vital in decision-making for investors, creditors, and suppliers of a company. The current ratio is an important tool in assessing the viability of their business interest.

Other important liquidity ratios include:

- Acid-Test Ratio

- Quick Ratio

Below is a video explanation of how to calculate the current ratio and why it matters when performing an analysis of financial statements .

Video: CFI’s Financial Analysis Courses

Thank you for reading this guide to understanding the Current Ratio Formula. To keep educating yourself and advancing your finance career, these CFI resources will be helpful:

- Quick Ratio Template

- Current Ratio Calculator

- Net Asset Liquidation

- Liquidation Value Template

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Current Ratio

Home › Finance › Financial Ratio Analysis › Current Ratio

The current ratio is a liquidity and efficiency ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year.

This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets.

The current ratio is calculated by dividing current assets by current liabilities. This ratio is stated in numeric format rather than in decimal format. Here is the calculation:

GAAP requires that companies separate current and long-term assets and liabilities on the balance sheet . This split allows investors and creditors to calculate important ratios like the current ratio. On U.S. financial statements, current accounts are always reported before long-term accounts.

The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm’s current debt in terms of current assets. So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities.

A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments.

If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. In other words, the company is losing money. Sometimes this is the result of poor collections of accounts receivable.

The current ratio also sheds light on the overall debt burden of the company. If a company is weighted down with a current debt, its cash flow will suffer.

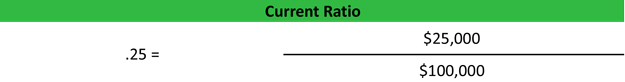

Charlie’s Skate Shop sells ice-skating equipment to local hockey teams. Charlie is applying for loans to help fund his dream of building an indoor skate rink. Charlie’s bank asks for his balance sheet so they can analysis his current debt levels. According to Charlie’s balance sheet he reported $100,000 of current liabilities and only $25,000 of current assets. Charlie’s current ratio would be calculated like this:

As you can see, Charlie only has enough current assets to pay off 25 percent of his current liabilities. This shows that Charlie is highly leveraged and highly risky. Banks would prefer a current ratio of at least 1 or 2, so that all the current liabilities would be covered by the current assets. Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

Financial Ratios

- Financial Ratio

- Receivables Turnover Ratio

- Accumulated Depreciation Ratio

- Asset Coverage Ratio

- Asset Turnover Ratio

- Average Inventory Period

- Average Payment Period

- Break-Even Analysis

- Capitalization Ratio

- Cash Conversion Cycle

- Cash Earnings/Share

- Cash Flow Coverage Ratio

- Contribution Margin

- Correlation Coefficient

- Cost of Goods Sold

- Days Payable Outstanding

- Days Sales in Inventory

- Days Sales Outstanding

- Debt Service Coverage Ratio

- Debt to Asset

- Debt to Capital

- Debt to Equity Ratio

- Debt to Income

- Defensive Interval

- Dividend Payout

- Dividend Yield

- DuPont Analysis

- Earnings Per Share

- Enterprise Value

- Equity Multiplier

- Equity Ratio

- Expense Ratio

- Fixed Asset Turnover Ratio

- Fixed Charge Coverage Ratio

- Free Cash Flow

- Goodwill to Assets

- Gross Margin Ratio

- Gross Profit

- Gross vs Net

- Interest Coverage Ratio

- Internal Rate of Return

- Inventory Turnover Ratio

- Loan to Value

- Long Term Debt to Assets

- Margin of Safety

- Marginal Revenue

- Net Fixed Assets

- Net Interest Margin

- Net Operating Income

- Net Present Value (NPV)

- Net Profit Margin

- Net Working Capital

- Operating Cash Flow

- Operating Income

- Operating Leverage

- Operating Margin Ratio

- Payables Turnover Ratio

- Payback Period

- Preferred Dividend Coverage

- Present Value

- Price Earnings P/E Ratio

- Price to Book

- Price to Cash Flow

- Price to Sales

- Profit Margin Ratio

- Quick Ratio – Acid Test

- Residual Income

- Retention Ratio

- Return on Assets

- Return on Capital Employed

- Return on Equity

- Return on Invested Capital

- Return on Investment

- Return on Net Assets

- Return on Operating Assets

- Return on Retained Earnings

- Return on Sales

- Sales to Admin Expenses

- Sharpe Ratio

- Sortino Ratio

- Times Interest Earned Ratio

- Treynor Ratio

- Working Capital Ratio

Current Ratio Calculation

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on April 16, 2023

Are You Retirement Ready?

Table of contents, current ratio definition.

The current ratio is a liquidity ratio that is used to calculate a company's ability to meet its short-term debt and obligations, or those due in a single year, using assets available on its balance sheet .

It is also known as working capital ratio. A current ratio of one or more is preferred by investors.

A current ratio less than one is an indicator that the company may not be able to service its short-term debt.

On the other hand, a current ratio greater than one can also be a sign that the company has too much unsold inventory or cash on hand.

Current Ratio Formula

Current assets refers to the sum of all assets that will be used or turned to cash in the next year.

This list includes cash, inventory, and accounts receivables . Current liabilities refers to the sum of all liabilities that are due in the next year.

This list includes wages, accounts payable and mortgage payments and loans.

For example, if a company has $100,000 in current assets and $150,000 in current liabilities , then its current ratio is 0.6.

What Does the Current Ratio Measure?

Current ratios can vary depending on industry, size of company, and economic conditions.

Industries with predictable, recurring revenue , such as consumer goods, often have lower current ratios while cyclical industries, such as construction, have high current ratios. Even within an industry, current ratios can differ between companies.

For example, supplier agreements can make a difference to the number of liabilities and assets. A large retailer like Walmart may negotiate favorable terms with suppliers that allow it to keep inventory for longer periods and have generous payment terms or liabilities.

What Is a Good Current Ratio?

During times of economic growth , investors prefer lean companies with low current ratios and ask for dividends from companies with high current ratios.

But, during recessions , they flock to companies with high current ratios because they have current assets that can help weather downturns.

Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. This may not always be the case, especially during economic recessions.

In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.

Current Ratio Calculation FAQs

What is the current ratio.

The current ratio is a liquidity ratio that is used to calculate a company’s ability to meet its short-term debt and obligations, or those due in a single year, using assets available on its balance sheet.

What is the formula for the Current Ratio?

The formula for the current ratio is: Current Ratio = Current Assets / Current Liabilities

What is a good current ratio?

A current ratio of one or more is preferred by investors.

What's an example of current ratio?

For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6.

How reliable is the current ratio?

Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. This may not always be the case, especially during economic recessions. In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- 50/30/20 Budget Rule

- Aggressive Investing

- Behavioral Finance

- Brick and Mortar

- Cash Flow From Operating Activities

- Cash Flow Management

- Debt Reduction Strategies

- Depreciation Recapture

- Divorce Financial Planning

- Education Planning

- Envelope Budgeting

- Farmland Investments

- Financial Planning for Allied Health Professionals

- Financial Planning for Military Families

- Global Macro Hedge Fund

- Inventory Turnover Rate (ITR)

- Long-Term Mutual Funds

- Medicaid Asset Protection Trust

- Medical Lines of Credit

- Military Spouse Financial Planning

- Pension Pillar

- Pension Scheme

- Post-Divorce Debt Management

- Retirement Budgeting

- Retirement Savings Vehicles

- Succession Planning

- Trustee Succession

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Claudia Valladares

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

IDEAL CLIENTS:

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

Taylor Kovar, CFP®

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

- Skip to primary navigation

- Skip to content

Great things in business are never done one. They're done by a team of people.

Email us directly

[email protected]

Call us directly

(123) 567 8901, social network, send a message..

We’re here to answer any question you may have.

Would you like to join our growing team?

Have a project in mind? Send a message.

I am bound by the terms of the Service I accept Privacy Policy

- Blessing Peter Titus

- Bongdap Nansel Nanzip

- Joy Sunday Zaleng

- Obotu Agape Oguche

- Privacy Policy

- Terms and Conditions

Current Ratio Formula, Calculation and Examples

The current ratio formula and calculation is an example of liquidity ratios used to determine a company’s ability to pay off current debt obligations without raising external capital. The current ratio, quick ratio , and operating cash flow ratio are all types of liquidity ratios.

This article will discuss the current ratio formula, interpretation, and calculation with examples. But first of all, let’s look at the definition and how it is used.

What is the current ratio?

Therefore, the current ratio measures a company’s short-term liquidity with respect to its available assets. Current ratios measure the ability of a company to pay its short-term or current liabilities (debts and payables) with its short-term or current assets, such as cash, inventory, and receivables. The ratio is an indication of a firm’s liquidity.

The current ratio in finance compares the company’s current assets to its current liabilities, thus, evaluating whether a company has enough resources to meet its short-term obligations. This ratio is called a current ratio because all current assets and liabilities are included in the current ratio equation. This is different from other liquidity ratios like the quick ratio and cash ratio.

The quick ratio, unlike the current ratio formula, only considers assets that can be converted to cash in a short period of time. So, it excludes inventory and prepaid expense assets in the calculation. While cash ratio as the name implies measures the ability of the company to settle its short-term liabilities using only cash and cash equivalents. Therefore, a simple on how to find current ratio in accounting is to divide the company’s current assets by its current liabilities.

Furthermore, the current ratios that are acceptable will vary from industry to industry. So, the ratio derived from the current ratio calculation is considered acceptable if it is in line with the industry average current ratio or slightly higher.

Conversely, a current ratio may indicate a higher risk of distress or default, if it is lower than the industry average. For investors, a very high current ratio may not be a good sign. This is because a company having a very high current ratio compared to its peer group may mean that the management might not be using the company’s assets or its short-term financing facilities efficiently.

If the current liabilities of a company are more than its current assets, the current ratio will be less than 1. It is interpreted that a current ratio of less than 1 may mean that the company likely has problems meeting its short-term obligations.

Nevertheless, some kinds of businesses function with a current ratio of less than 1. For instance, a company’s current ratio can comfortably remain less than 1, if inventory turns into cash much faster than the accounts payable become due. The sale of inventory will generate substantially more cash than its value on the balance sheet if it is sold for more than the cost of acquiring it. More so, low current ratios are also understandable for businesses that can collect cash from customers long before they need to pay their suppliers.

Interpretation

Interpreting current ratio as good or bad would depend on the industry average current ratio. The current ratio interpretation of a ratio greater than 1 shows that the current assets of the company are greater than its liabilities. This can be seen as a desirable situation for investors and creditors. Furthermore, the current ratio analysis that gives a ratio that is equal to 1 shows that the current assets of the company equate to its current liabilities, indicating that the company has current assets that are just enough to settle short-term obligations.

However, interpreting a current ratio of less than 1 shows that the company’s current assets are less than its current liabilities. This could be a problem as it indicates that the company does not have enough current assets to settle its short-term obligations.

Therefore, in several cases, a current ratio greater than 1 means that the company has the financial resources to remain solvent in the short term, whereas a company with a current ratio less than 1 may not have the capital on hand to pay off its short-term obligations. However, the current ratio analysis is usually not a complete representation of a company’s short-term liquidity or longer-term solvency.

Therefore, it is only when the ratio is placed in the context of what has been historically normal for the company and its peer group that it can be a useful metric of a company’s short-term solvency. Current ratios can also offer more insight when calculated repeatedly over several periods. This is because calculating the current ratio at just one point in time could show that the company can’t pay off all of its current debts, but it doesn’t necessarily mean that the company won’t be able to settle the debts when the payments are due.

Theoretically, we interpret current ratios as the higher the current ratio, the more the ability of the company to pay its obligations because it has a larger amount of short-term asset value compared to the value of its short-term liabilities.

Nevertheless, a company with a very high current ratio, say 3.0 compared to its peer group may not necessarily mean that the company can cover its current liabilities three times. It could mean that the management may not be using the company’s current assets or its short-term financing facilities efficiently. It could be an indication that the company’s working capital is not properly managed and is not securing financing very well.

Current ratio formula

The formula for current ratio in accounting is expressed as:

Current ratio = Current Assets / Current Liabilities

The current assets and current liabilities are listed on the company’s balance sheet. These current assets include items such as accounts receivable, cash, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash within a year. The current liabilities, on the other hand, include wages, accounts payable, short-term debts, taxes payable, and the current portion of long-term debt.

Current ratio calculation

The current ratio calculation is done by comparing the current assets of the company to its current liabilities. How to find the current ratio is to divide the company’s current assets by the current liabilities of the company.

How do you calculate current ratio?

Example 1: how to calculate current ratio from balance sheet.

Here is an example of how to calculate current ratio from the balance sheet using the excerpt from the Apple balance sheet for the fiscal year of 2020 below:

From the excerpt of Apple, Inc. (AAPL) 2020 balance sheet, we can see that for the fiscal year (FY) ended September 26, 2020, Apple had total current assets of $143,713,000,000 and total current liabilities of $105,392,000,000.

How to compute current ratio in balance sheet

Using the current ratio formula:

Calculating current ratio will be:

Current ratio = $143,713,000,000 / $105,392,000,000 = 1.36

Current ratio interpretation example : Apple Inc. (AAPL) having a current ratio of 1.36 indicates that the company has more than enough to cover its current liabilities if these liabilities were all theoretically due immediately and all its current assets could be converted into cash.

How to calculate current ratio example 2

Company X and Company Y are two leading competitors operating in the consumer electronics manufacturing sector. Calculate the current ratio of Company X and Company Y based on the figures given as appeared on their balance sheets for the fiscal year ending in 2020.

| CURRENT ASSETS: | ||

| Cash and cash equivalents | $30,000 | $50,000 |

| Inventories | $60,000 | $10,000 |

| Accounts receivable | $15,000 | $45,000 |

| CURRENT LIABILITIES: | ||

| Accounts payable | $75,000 | $20,000 |

| Short-term notes payable | $40,000 | $80,000 |

| Wages payable | $15,000 | $30,000 |

How to calculate the current ratio

Using the current ratio equation:

Calculating current ratio for Company X will be:

Current ratio = $105,000 / $130,000 = 0.807

Calculating current ratio for Company Y will be :

Current ratio interpretation example : In the current ratio calculation done for Company X and Company Y, it is seen that the two companies both have a current ratio value of 0.807 which is less than 1, indicating that these companies may not have enough current assets to settle their short-term obligations. However, even though these two companies seem similar, Company Y is likely in a more liquid and solvent position based on the following observations from the balance sheet:

- Company X has much more inventory than Company Y, which may be harder to turn into cash in the short term. It is possible that this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet.

- Company Y has more cash than Company X. Cash is the most liquid asset, and Company X even have more accounts receivable, which could be collected more quickly than liquidating inventory.

- In regard to assets, even though the total value of current assets is the same for both companies, Company Y is in a more liquid, solvent position.

Also, for the liabilities, even though the current liabilities of Company X and Y sums up the same value, they are still very different because Company X has more accounts payable, whereas Company Y has a greater amount in short-term notes payable.

More investigation may be needed because there is a probability that the accounts payable will have to be paid before the entire balance of the notes-payable account. More so, Company X has fewer wages payable, which is the liability most likely to be paid in the short term.

However, an investor can look deeper into the details of a current ratio comparison of these companies by evaluating other liquidity ratios that are more narrowly focused than the current ratio, such as the quick ratio.

How to find current ratio example 3

What will be the current ratio analysis of a tech firm with the following details in its balance sheet:

| CURRENT ASSETS: | |

| Cash and cash equivalents | $37,000,000 |

| Inventories | $30,000,000 |

| Marketable securities | $20,000,000 |

| CURRENT LIABILITIES: | |

| Accounts payable | $15,000,000 |

| Short-term debt | $25,000,000 |

How to calculate the current ratio of tech firm

Using the formula for current ratio:

Calculating the current ratio for the firm will be:

Current ratio = $87,000,000 / $40,000,000 = 2.175

Current ratio interpretation example : It means that this tech firm has a current ratio of 2.1 indicating that it can easily settle $1 of its debts or accounts payable twice. This suggests financial well-being for the firm.

How to increase current ratio

Reconfigure debt, reduce the company’s expenses, enhance asset management.

How to increase current ratio is to repay or restructure debt. Companies can explore ways they can re-amortize existing term loans and change the interest charges from lenders. This can effectively delay debt payments and drop off the current ratio. Companies can also negotiate for longer payment cycles whenever they can. This can enable the company to shift short-term debt into a long-term loan, thus, reducing its impact on liquidity.

One of the ways to increase the current ratio is to reduce expenses. The budget of the company should be reviewed carefully to see where some line items can be reduced. Also, considering limiting personal draws on the business can help in achieving a better current ratio. If possible, the business can finance or delay capital purchases that need a significant outlay of cash. This is because when the business spends operating funds on major expenses, the current ratio will draw below 1.

Enhancing asset management in the company can help increase the current ratio of the company. For instance, with a sweep account, the cash on hand of the company can earn interest while remaining available for operating expenses. These accounts sweep excess cash into an interest-bearing account and then return this excess cash to the operating account when it’s time to pay bills.

The company can also consider selling unused capital assets that don’t produce a return. This cash infusion would increase the short-term assets column, which, in turn, increases the current ratio of the company. There are some liabilities that do not bring funds into the business that can be converted to cash.

Furthermore, if outstanding accounts payable have reduced the liquidity of the company, the company can consider amplifying efforts to collect on these debts. After purchase, the company can issue invoices as quickly as possible, establishing clear payment terms at the outset such as late fees and interest on past-due balances. Companies can conduct a close review of the business’ accounts payable process and look for inefficiencies that delay payments and prevent prompt collections.

Limitations of the current ratio formula

The current ratio formula has its limitations. It is only useful when comparing two companies in the same industry because inter-industrial business operations differ substantially. Hence, comparing the current ratios of companies across different industries may not lead to productive insight. Therefore, the current ratio is not as helpful as the quick ratio in determining liquidity.

Another disadvantage of using the current ratio formula is its lack of specificity. This is because the ratio includes all the assets that may not be easily liquidated such as inventory and prepaid expenses. Moreso, the current ratio can be manipulated by management. For instance, an equal increase in current assets and liabilities will reduce the current ratio while an equal decrease in current assets and liabilities will increase the ratio.

Compared with the quick ratio

The current ratio and quick ratio are both types of liquidity ratios. However, there is a significant difference between the current vs quick ratio. When comparing the quick ratio vs current ratio, the quick ratio is more conservative than the current ratio formula.

The quick ratio evaluates the liquidity of a company and in the calculation, the inventory and other current assets that are more difficult to turn into cash are excluded. The ratio only considers the most liquid assets on the balance sheet of the company. The current ratio formula, on the other hand, considers all current assets including the inventory and prepaid expense assets. Theoretically, the current ratio formula is not as helpful as the quick ratio formula in determining liquidity.

What does the current ratio inform you about a company?

What is a good current ratio?

What is a good current ratio for a company?

Is a high current ratio good?

How is the current ratio calculated?

Is a higher current ratio better?

Is the current ratio a percentage?

You may also like

Tax Implications of Perpetuities

How to Measure Market Efficiency

Adding {{itemName}} to cart

Added {{itemName}} to cart

Current ratio: What it is and how to calculate it

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Personal finance

- • Financial planning

- Connect with Nina Semczuk on LinkedIn Linkedin

- • Investing

- • Stock analysis

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit . Presently, she is the senior investing editor at Bankrate, leading the team’s coverage of all things investments and retirement. Prior to this, Mercedes served as a senior editor at NextAdvisor.

- Connect with Mercedes Barba on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.