Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Mini-Case study: The downfall of Blackberry

Related Papers

Ramzi Dziri

International Journal of Business Ecosystem & Strategy (2687-2293)

The aim of the paper to investigates the reason for business failure using Nokia as a case study. The paper applies the explanatory conclusive research design since there are cause and effect relations that seek to provide a better understanding of the reasons for the market failure. The mobile manufacturing sector is the most interesting and innovative of all in the “Information & Communications Technology” sector (ICT). Nokia was once known as the market’s dominant company, leader, and pacesetter until it underwent a tremendous market failure. The aim of this research is to shed light on Nokia’s failure in the market due to its complacency & fear of change, lack of innovation moving too slowly in terms of being too late in making decisions & inventing of the iPhone. Paper elaborately discusses and analyses the failure reasons supported by a literature review in addition to the characteristics of this industry and its market structure. Finally provide advice for business makers

International Journal of Technology Management

Patrick Van Der Duin

Lee Chia Tian

Denis Lescop

Telecommunications Policy

Grazia Cecere

Mario Coccia

The purpose of this study is to analyze the driving technical characteristics in product innovation to predict technological trajectories. The analysis is based on hedonic price method and other approaches using empirical data of smartphone technology (N=738 models over 2008-2018). Results show technological trajectories supporting the evolution of smartphone technology. In particular, critical characteristics of technological evolution in smartphone technology are: RAM in Gb, 1 st and 2 nd camera in Mpx, memory in Gb and resolution in total pixels. Implications of innovation product management are discussed.

Mateus B O L D R I N E Abrita

The mobile phone devices industry, whose structure is an oligopolistic technological frontier, suffered a structural change in the 2000s, with firms once leaders giving way to emerging ones. This study's hypothesis is that this chance happened due to different innovation strategies adopted by the firms. The objective is to analyze innovation strategies' influence on business performance of the industry's firms in general, with Apple, Nokia and Samsung cases in particular-considered representative firms of the industry for the period. The methodology used was the game theory, comparatively analyzing two games with Nash-Bayesian equilibrium. The results show that, in the face of an aggressive strategy of innovation by products of the first firm (Apple), there is a worse outcome for the company that competes by innovations by product (Nokia) than by markets (Samsung). It is concluded that companies should pay attention to their innovative strategies to remain operative in dynamic markets. Resumo: A indústria de dispositivos de telefonia móvel, cuja estrutura é de fronteira tecnológica oligopolista, sofreu uma mudança estrutural na década de 2000, com firmas antes líderes perdendo espaço para firmas emergentes. A hipótese do trabalho é que as diferentes estratégias de inovação adotadas pelas firmas foram responsáveis por essa mudança estrutural. O objetivo do trabalho é analisar a influência dos tipos de inovação no desempenho das empresas da indústria em geral, e da Apple, Nokia e Samsung em particular, firmas tidas como representativas. Para tanto, utiliza-se como metodologia um modelo com base na teoria de jogos, analisando dois casos. Os resultados, sob equilíbrio Nash-Bayesiano, evidenciam que, em face a uma estratégia agressiva em inovações via produtos por parte da Apple, há um pior resultado para a empresa competidora que decide competir com inovações via produtos (caso da Nokia) do que a que compete em inovações via mercados (caso da Samsung).

International Journal of Accounting and Financial Reporting Vol 4, No 2 (2014)

Zohaib Babar , Jawwad Jaskani , Tehreem Ilyas

Purpose: This case suggests the development of financial reporting of Apple Inc. in comparison with the industry over the period of 2004 to 2013. This study is helpful for different field of researchers e.g., management, technology, etc. Apple Inc. was found in 1976 by Steve Jobs. In 2007, Apple introduced smartphones and iOS and was the pioneer in this industry. But after the rising competition in this industry Androids snatched the market share from the Apple. Methodology: This study illustrates the reasons and the current performance of the company in the industry. The performance has been measured through actual financial data and through various financial techniques. Findings: This study has found that the company is losing share in the market because of the features in its products whereas the features offered by other competitors are relative consumer friendly and according to their demand. Suggestions: To retain the market share Apple should offer more products that are more affordable for the consumers. DOI: http://dx.doi.org/10.5296/ijafr.v4i2.6079

Business History

RELATED PAPERS

Christina Dounia

European Scientific Journal ESJ

Physics Letters

Paul Linsay

Operative Techniques in Orthopaedics

robert karpman

Novelty Jounals

Tashin Azad

Anesthesiology

axel rodriguez

Ted Parkinson

原版制作ual毕业证书 英国伦敦艺术大学毕业证硕士学位文凭学历认证原版一模一样

FERRAN OLUCHA MONTINS

Social Indicators Research

Håkan Stattin

Eman Alamri

Ovidius University Annals of Constanta - Series Civil Engineering

Dumitriu Stefan

Didier Fouarge

sunaina khan

Clinical Orthopaedics and Related Research

Nabil Ebraheim

Physical Review A

Riccardo Zanasi

Manuel Reyes Suárez

Polymer Degradation and Stability

Maria J . Melo

Fuentes del derecho del trabajo

Elihu Francisco Hernández Rivero

The Mathematical Gazette

Angel Plaza

Rommel Angeles Falcon

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Search Search Please fill out this field.

History of BlackBerry

The game changer, corporate comeback, will blackberry survive, the bottom line.

- Company Profiles

- Tech Companies

BlackBerry: A Story of Constant Success and Failure

:max_bytes(150000):strip_icc():format(webp)/Top100FinancialAdvisors_MargueritaCheng_2-54d1bcc14e3042818cb44df9456919f2.jpg)

BlackBerry Limited ( BB ), known as Research in Motion (RIM) until January 2013, has a long history of extreme success and failure. It’s credited by many as creating the first smartphone. And at its peak in September 2011, there were 85 million BlackBerry subscribers worldwide.

But the rise of Google’s Android platform and Apple’s iOS caused it to decline in popularity by nearly three-quarters. BlackBerry’s stock price effectively tanked from highs of $147 to around $3 as of April 2024.

How did a high-flying revolutionary tech company get eclipsed so badly? A movie, released in Canada in May 2023, told the tale.

Key Takeaways

- BlackBerry pioneered handheld devices but has lost market share to larger rivals like Apple.

- The company, formerly known as Research in Motion, grew by leaps and bounds from 1999 to 2007, as its innovative product lines were well received.

- The launch of the touchscreen iPhone in 2007 triggered a dramatic shift away from BlackBerry handheld devices.

- Hopes for a turnaround have been dashed as the company grapples with intense competition from larger technology companies.

- BlackBerry has lost more than half of its market value in two years.

- “BlackBerry,” a movie about the company’s founders, premiered in Canada on May 12, 2023.

The pioneer in bringing email services to handheld mobiles, with its trademark QWERTY keyboard, BlackBerry became an instant darling of world leaders, corporate honchos, and the rich and famous alike. Indeed, owning a BlackBerry device was once a status symbol , and BlackBerry addiction was a prevalent condition.

The always-on, always-connected wireless world that allowed secure and reliable access to emails turned out to be very useful for businesses. The first prominent release from BlackBerry, the Inter@ctive Pager 950, was in 1998. It had a small-sized screen, keyboard buttons, and the iconic trackball that allowed seamless syncing and continuous access to corporate emails. It became an instant hit, and then there was no looking back.

In 1999, the company introduced the 850 pager, which supported “push email” from the Microsoft Corp. ( MSFT ) exchange server, and in 2000, BlackBerry launched the first smartphone, called the BlackBerry 957.

Attributed to increased use by enterprises and governments, RIM’s revenues grew by leaps and bounds from 1999 to 2001. The company continued to expand functionality in the BlackBerry Enterprise Server (BES) and BlackBerry OS. The golden period of 2001 to 2007 saw BlackBerry’s global expansion and the addition of new products to its portfolio. After successfully gaining a foothold in the enterprise market, BlackBerry expanded into the consumer market. The BlackBerry Pearl series was very successful, and subsequent releases of the Curve and Bold product lines were well received.

“BlackBerry,” the movie, tells the story of the founders who created the world’s first smartphone. The satirical history is loosely based on the book “Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry,” by Sean Silcoff and Jacquie McNish. It premiered in Canada on May 12, 2023.

BlackBerry’s stock price peaked at an all-time high of $147 in mid-2008. A year earlier, Apple Inc. ( AAPL ) introduced its iPhone—the first prominent touchscreen phone. BlackBerry ignored it initially, perceiving it to be an enhanced mobile phone with playful features targeted at younger consumers. However, iPhone was a huge hit—and this was the start of BlackBerry’s demise.

Not just aimed at individuals, the iPhone managed to attract business leaders, penetrating BlackBerry’s core market, which was soon flooded with many similar email-enabled smartphones from other manufacturers. Yet, BlackBerry managed to maintain its status as a “business email device.” People used to carry two phones: a BlackBerry for business and another personal phone.

BlackBerry introduced Storm in 2008, its first touchscreen phone to compete with the iPhone. But after high initial sales, complaints started pouring in about the device’s performance. This was the first time that investors, analysts , and the media started to worry about the business prospects of BlackBerry.

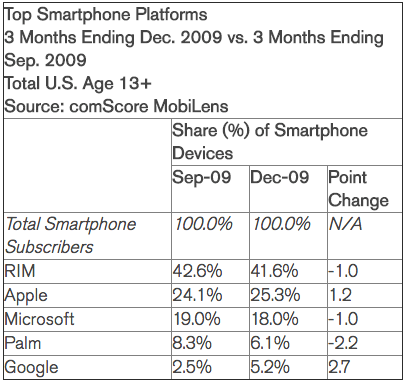

In 2009, RIM secured first place in Fortune’s 100 fastest-growing companies. In September 2010, Comscore reported RIM having the largest market share (37.3%) in the U.S. smartphone market. Its global user base stood at 41 million subscribers. Unfortunately, that was the peak of market penetration for RIM in the United States. After that, the company continued to lose ground to rival operating systems—the Apple iOS and Google’s ( GOOG ) Android —and was never able to make it back.

By November 2012, BlackBerry’s U.S. market share had dropped to just 7.3%, with Google and Apple claiming 53.7% and 35%, respectively. Despite declining U.S. sales, BlackBerry continued to have success globally. It reported 77 million users globally during the last quarter of 2012, demonstrating its success in global expansion.

Owing to these local losses vs. global success, the stock displayed high volatility . The worst year was 2011, as BlackBerry’s stock price tanked around 80% amid declining market share. Continued earnings losses resulted in further declines—most prominently the first-quarter loss in 2014 of $84 million, which led to a roughly 30% decline in the share price on the day after the announcement.

The high volatility in the stock is attributed to several comeback attempts, corporate developments, associated recommendations by analysts, and competitor developments. In April 2010, RIM acquired the real-time operating system QNX, which formed the basis of the BlackBerry Tablet OS. The BlackBerry Playbook tablet was introduced on the QNX platform. Unfortunately, it turned out to be a total failure due to its high price, limited features, and poor performance.

The next generation of BlackBerry phones were announced in 2011, but the eventual product—the BlackBerry 10— failed to catch on . Nonetheless, based on interim forecasts that the BlackBerry 10 would surpass sales predictions, the company’s stock saw an upswing of 14% in November 2012. By January 2013, the stock had risen around 50%, and the volatility continued.

Wide positive swings to the tune of +35% were observed a couple of times during the first half of 2014. Those were based on announcements of BlackBerry transforming from mobile devices to a mobile solutions company. Those plans yielded less-than-meaningful results.

Another swing came in January 2015, when it was reported that Samsung was interested in buying BlackBerry. This led to a 30% spike in the latter’s share price . However, the jump proved to be a short-term blip, as the stock resumed a downtrend through 2015 and 2016.

Enterprise software sales represent almost half of BlackBerry’s revenue in 2020.

Hopes for a dramatic turnaround at BlackBerry have been dashed repeatedly. The stock rallied to a closing high of $12.66 in early 2018—almost doubling value after two years of gains. Since then, however, the stock has lost more than half of its market value , as the company’s mobile business has been decimated by the competition and it has been forced to shift its focus its efforts toward other segments like enterprise software.

In its current iteration, BlackBerry Limited is a provider of cybersecurity and Internet of Things (IoT) services, having effectively given up on smartphones as a business. On April 3, 2024, the company issued fiscal year (FY) 2024 total revenue of $853 million, with IoT revenue of $815 million and cybersecurity revenue of $280 million. Q4 fiscal 2024 revenue for the company’s IoT business showed 25% year-over-year (YOY) revenue growth, according to BlackBerry.

It is possible, often even necessary, for a technology company to change its stripes. Google and Meta (formerly Facebook) ( META ) have blazed trails in that arena. BlackBerry, however, will not only have to morph but will also have to overcome its reputation as a failed smartphone maker. Time, as they say, will tell whether BlackBerry is up to these tasks. Stay tuned.

What Business Is BlackBerry in Now That It Has Stopped Making Smartphones?

Currently, BlackBerry Limited is primarily a provider of cybersecurity and Internet of Things (IoT) services. The company recently reported FY2024 total revenue of $853 million.

Why Did BlackBerry Smartphones Fail?

Competition, in a nutshell. The introduction of the Apple iPhone, which BlackBerry didn’t take seriously, caused a loss of market share that BlackBerry couldn’t recover from. More competitors entered the smartphone space, eventually crowding BlackBerry out.

When Was the BlackBerry Movie Out?

“BlackBerry,” which premiered across Canada on May 12, 2023, told the story of the three men who took an idea and turned it into the world’s first smartphone. The movie, described as more satire than history, is loosely based on the 2015 book “Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry.”

BlackBerry is an example of the big risks associated with the highly dynamic technology sector . None of the industry rankings, predictions, or recommendations seems to fit the BlackBerry stock play. Long-term investors have been burned, while only a few traders may have made money on the wide swings. Unless confirmed news of solid acquisition or partnership comes in, this stock will likely remain a pure trader ’s play.

BGR. “ BlackBerry Lost 4 Million Subscribers in Q1 Despite New Launches .”

Yahoo! Finance. “ BlackBerry Limited (BB): Summary .”

The Canadian Encyclopedia. “ Blackberry Limited .”

York University Computer Museum. “ Research in Motion Inter@ctive 950 Pager .”

National Museum of American History. “ Blackberry .”

Global News. “ ‘BlackBerry’ Filmmakers Toe the Line Between Fact and Fiction .”

Macrotrends. “ BlackBerry—25-Year Stock Price History | BB .”

Comscore. “ Comscore Reports September 2010 U.S. Mobile Subscriber Market Share .”

AnnualReports.com. “ RIM 2010 ,” Page 4 of PDF.

Comscore. “ Comscore Reports February 2013 U.S. Smartphone Subscriber Market Share .”

AnnualReports.com. “ Research in Motion Limited, Form 40-F ,” Page 7 (Page 14 of PDF).

Yahoo! Finance. “ BlackBerry Limited (BB): Historical Data .”

BlackBerry, via Internet Archive Wayback Machine. “ BlackBerry Reports First Quarter Fiscal 2014 Results ,” Page 1.

BlackBerry. “ BlackBerry Reports Fourth Quarter and Full Fiscal Year 2024 Results .”

:max_bytes(150000):strip_icc():format(webp)/004-how-to-delete-photos-from-iphone-but-not-icloud-5219768-485283945b02421ba45d373eae5e2a3a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Brought to you by:

The Rise and Fall of BlackBerry

By: Deborah Himsel, Andrew C. Inkpen

The launch of BlackBerry by Research in Motion (RIM) in 1999 laid the foundation for the development of smartphones. The next decade was a period of spectacular growth for RIM, making its two co-CEOs…

- Length: 10 page(s)

- Publication Date: Jun 1, 2017

- Discipline: Strategy

- Product #: TB0485-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The launch of BlackBerry by Research in Motion (RIM) in 1999 laid the foundation for the development of smartphones. The next decade was a period of spectacular growth for RIM, making its two co-CEOs billionaires. At the end of 2007 the company had a market capitalization of more than $60 billion. Sales peaked at almost $20 billion in 2011. In 2016, sales were $2.2 billion and the company had lost money for four straight years. With the market capitalization having fallen to $4 billion by August 2016, the survival of BlackBerry (the company changed its name from RIM to BlackBerry) was uncertain.

Learning Objectives

This case can be used for several teaching purposes. The case can be used to illustrate the process of innovation and the linkages between strategy, competitive advantage, and innovation. BlackBerry created a unique product and for a few years occupied a competitive position with no rivals. The company established a competitive advantage based on product differentiation and saw BlackBerry become one of the most recognizable and valuable global brands. Unfortunately, the initial success could not be sustained once competitors, and particularly Apple, entered the smartphone market. After many attempts to change its strategy, BlackBerry eventually was forced to exit the hardware market. In a marketing class the case could be used to illustrate the challenges of being a pioneer versus a follower. The case can also be used to focus on leadership and building a culture of adaptability and change, especially in a successful organization. Initially the yin and yang of Lazaridis and Balsillie's complementary approaches led to innovation and growth. Rapid growth, distraction from lawsuits and increased competition, highlighted a fundamental lack of strategy, vision, reactive leadership and hierarchical, undisciplined, siloed, arrogant organization culture. The case can also highlight some of the fundamental leadership differences between Lazaradis/Balsillie and Steve Jobs, especially as it relates to vision, customer focus and simplicity of message.

Jun 1, 2017

Discipline:

Thunderbird School of Global Management

TB0485-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Mini-Case study: The downfall of Blackberry

Related documents

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

A business journal from the Wharton School of the University of Pennsylvania

Knowledge at Wharton Podcast

Victim of success: the rise and fall of blackberry, december 15, 2015 • 18 min listen.

A new book by Jacquie McNish and Sean Silcoff looks at what went wrong with the iconic device that was once so beloved and addictive it was nicknamed “Crackberry.”

Though BlackBerry has less than 1% of the smartphone market share today, it once had more than 50%. The question is how such a successful company could fall so far. Journalists Jacquie McNish and Sean Silcoff provide many of the answers in their book, Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry.

Wharton marketing professor Americus Reed recently had an opportunity to talk with McNish about what we can learn from the rise and fall of BlackBerry.

An edited transcript of the conversation follows.

Americus Reed: I want to start off with some questions about what drew you to this topic. Tell us a little bit about why you wrote this book, Jacquie.

Jacquie McNish: It started with an investigation I did when I worked at The Globe and Mail here in Canada with my colleague Sean Silcoff. The great untold story in Canada in the technology sector globally was how the maker of something that we loved so much and that we were so addicted to — the BlackBerry – could fail so quickly. It was an enduring mystery that was very hard for any business journalist to crack: [Research in Motion (RIM), was a] very, very insular company based in Waterloo, Ontario, outside of Toronto, [with] a very small business feel to it despite its global reach. We spent a lot of time trying to crack it.

We were finally able to talk to some of the principals and did an investigation for the Globe and Mail that led to a wonderful agent in Washington, Howard Yoon, calling up and saying, “You guys should write a book,” and that’s how it all began.

Reed: What do you think sets this book apart?… Tell us a little bit about why this particular book should be on people’s must-read lists.

McNish: We live in an era of constant disruption. No matter where you are, there’s an algorithm or a new way of doing something that’s more efficient, that challenges the old way of doing things. We will look back on this period as being as significant socially and economically as the industrial revolution.

“In this era of disruption, the mother of disruption stories is the BlackBerry story.”

In this era of disruption, the mother of disruption stories is the BlackBerry story. A company that introduced the BlackBerry in 1998 became a $20 billion company from nothing in less than a decade. Then four or five years later, it was back down to a $3 billion company, gasping for breath. It’s not only a disruption story; it is a story of the speed of the technology race today. There has not been a technology that has so quickly penetrated the consumer market as the smartphones did with the BlackBerry being the innovator. Not since the television in the 1950s. We’ve never gone from zero to more than 50% of the consumer market so quickly.

Reed: When I look back on the heyday of the BlackBerry brand, I’m reminded of those images of how deeply it was connected to the business community. In other words, it was seen as a symbol as those who had made it professionally. I remember very vividly our President at the time holding up his BlackBerry and saying, “I cannot live without my BlackBerry,” very much in line with what you were describing with respect to this iconic rise of such a great brand. Tell us a little bit about the genesis of this rise. What were the key business moments that precipitated this rise to greatness for that particular brand?

McNish: Timing is everything, and coming from an outside perspective is very important in innovation. At the time, in the 1990s, a lot of people were racing in the handheld device space. I remember when the Palm was the “It” thing. That only synced your calendars and your contacts with your desktop, but it was the hot thing then. The other hot thing was Motorola’s Tango, the one-way pager that you could [use to] send a few messages … but they were very distant and very unreliable because of their big network.

You had IBM trying to do stuff. You had Ericsson as well strapping … a very successful cell phone onto a very tiny keyboard. If you had fingers the size of a squirrel, you might be able to tap onto it. So all these people were racing to get into that space, essentially with products they already had. Even Apple tried with the Apple Newton with the stylus; that was a disaster because the software just wasn’t right.

BlackBerry looked at this market and came at it from a very different point of view, and this is the key thing about successful innovation. You’re not only offering new innovation, you’re changing the rules of the game. What none of the competitors, the big players, understood was that at that time in the 1990s, bandwidth was very limited for data transmissions. Mike Lazaridis, the founder of Research in Motion, which was BlackBerry’s founding name, understood … how limited the bandwidth was at that time. So he created an instrument that parceled out bits of data communications … so that it would not overtax the networks, whereas everyone else wanted to charge you $4,000 for something that the networks could barely function to transmit. They had that simplicity of design [and] the conservation of the data being transmitted.

The final wonderful thing was that everyone was using their little squirrel keyboards. He said, “What if we create this kind of arched keyboard where you could use opposable thumbs?” That was just one of those breakthrough moments he had one night. That’s the innovation side of the story.

The other side of the story is staying alive because then you’re a small company from Waterloo, Ontario, that’s struggling to make it. You get something right like the BlackBerry, and the big players want it. Some of the big players were there from the beginning. Palm tried to buy them. US Robotics, when it was making modems for mobile data communications, placed a big order and then withdrew it, nearly killing the company because they took on debt to meet that order…. That was managed by Jim Balsillie, a Canadian businessman who went to Harvard, who came back and decided that technology was going to be the key to his success. The two of them were a powerful combination in the early days….

Reed: Can you speak a little bit about the particular strategies that were being pursued at that time by the company?…

McNish: [RIM] did something very innovative. They created these guerilla marketing teams…. They threw boxes of BlackBerrys in the back of their cars, and they went to conferences, they went to airports. They specifically looked at airports for people who were carrying back then the big, heavy laptop computers with the large modems that may or may not have worked, and said “Here, try this.”

“Everyone was using their little squirrel keyboards. He said, ‘What if we create this kind of arched keyboard where you could use opposable thumbs?’”

They called it the Puppy Dog Routine. They said, “Give us your card. You can have this free for a month. Let us know what you think of it.” They were so successful at it, and they had such a small back office that for years, people were using their BlackBerrys for free because they couldn’t figure out who their clients were because they were handing so many of them out spontaneously.

Reed: They had that much faith in the power of the technology that they were literally willing to let people just try it to form an impression.

McNish: That’s right…. Word of mouth was very key. Early adopters were Michael Dell and Jack Welch. Just as you described, the CEO of your company says, “Wow, I love this thing, I’m addicted to it,” and everyone wants to have it … and it ripples down the organization….

Reed: Talk a little bit about the BlackBerry brand and how it was part of this calculus associated with the business strategy.

McNish: This company grew so fast that I don’t think they even thought about brand. That’s the amazing thing, and they could do that as long as they had the technology…. Their main clients, and the people who mattered the most, were the carriers. They had to convince the carriers to sell it, and then they entered this new world where they’d be offering discounts on the smartphones, which really sort of juiced sales and put them in the hands of a lot of consumers.

That was an advantage in the early days, and then later as things started to fall apart, a lot of people believed that one of their biggest problems was they didn’t fully understand who their consumers were because they had to spend so much time making the carriers happy.

It was a very limiting relationship because, again, back in the days of limited bandwidth on the networks, the carriers were very rigorous about what they would allow, and Steve Jobs said for years, “I will never make a smartphone.” He called the carriers the “four orifices”; you couldn’t get anything down their pipeline without their permission. Only when he saw the success of BlackBerry, which leapt to control right away, 58% of the smartphone market, did they set their sights on that market, and then they reinvented it on their terms….

Reed: You talked to some extent about this notion of this rise to greatness and its equally iconic fall, if you will. Can you talk a little bit about that? What was it that was behind this kind of deceleration? Was it a series of events? Was it death by a thousand cuts? Was it something foreseeable? Give us some insight into that.

McNish: The pivotal moment is January 2007 when Steve Jobs walks onto the stage in San Francisco and holds up that shiny glass object that we all [now] know and love so much, and says, “This is an iPhone.” It brings you computing, it brings you the Internet and it brings you email — three things. The interesting thing is that he not only brought on the prototype for the iPhone, and said “I’m going to change the world,” he also brought on stage the head of AT&T Mobility. This is where he changed the rules of the game because really the iPhone is just an iteration of the smartphone that BlackBerry started, only they added more.

“The race is faster than ever. It never ends, and the people who are the leaders today will most likely be the followers tomorrow because it’s very, very difficult to stay ahead.”

They brought the AT&T executive onstage, announced a five-year exclusive contract, and that did two things. It gave AT&T the incentive to spend billions of dollars on upgrading its network, and it made every other carrier nuts because they wanted to have the same thing, and they all went out looking for an antidote to the iPhone. The really compelling part of the BlackBerry story is how they reacted that day. Over in Mountain View, California, you had the folks at Google under a secret project. One was for a new keyboard phone and the other was for a touch screen phone that was going to be run on Android. The minute they watched that live, streaming on the internet, they realized that their project keyboard was dead, and they immediately shifted everything to the touch screen phone….

Mike Lazaridis looked at this announcement, looked at what Steve Jobs was offering, and said, “This is an impossibility.” Again, the conservative engineer brought up on conservation said, “The networks won’t be able to carry this. It’s an impossibility. It’s illogical that anyone would even propose this.” He was right for the first two years. Remember all the dropped calls, all the frustrations, all the lawsuits against Apple and the carriers. It didn’t work….

But then it did, and RIM got it wrong. Two years is a lifetime at a technology rate, and by the time they realized what a serious threat it was, they were at that point followers.

Reed: What do you think is the public’s greatest misconception about the BlackBerry story?

McNish: A lot of people think that Mike and Jim and the folks at the senior offices in BlackBerry were arrogant and didn’t understand iPhone and just focused only on BlackBerry. There is an element of truth to all of that. Yes, they missed the turn, but they were missing the turn at a time when they were going from zero to $20 billion. They were growing at a rate of 25% every quarter. You talk to any business person, that’s an impossibility.

They were expanding in Indonesia and India, in other parts of the world. They were huge. They couldn’t keep up with the demand, and they were coproducing new factories everywhere to keep up with it. So imagine going to your board of directors or your shareholders because you’re a publicly traded company and saying, “You know this BlackBerry thing? It’s probably going to be history in a couple of years. We’re going to stop making it, and we’re going to regroup and move into something we know nothing about.” When you have that kind of momentum, it’s really hard.

Reed: It’s hard. You become a victim of your own success in some senses.

McNish: Exactly, exactly…. When you’re a publicly traded company, your options are pretty limited. What I would layer on top of that is they had a series of really unfortunate events. Everything from a horrific and badly managed patent battle in the United States [to] the three-day outage of 2009, which made everyone question their faith in the BlackBerry. We all remember where we were for those three days….

Then there was the Playbook, and then there were other phones. There was just one disaster after another, and this is how businesses fail. At first it’s slow, and then it’s very fast.

Reed: John Chen is now charged with the difficult task of turning this thing around. What are some of the broader takeaways and learnings that you think are critical from having written the book?

McNish: The thing that I take away, and we conclude with, is that the race is faster than ever. It never ends, and the people who are the leaders today will most likely be the followers tomorrow because it’s very, very difficult to stay ahead. It is so easy today to innovate…. In the old days when you were a GE factory or an auto factory or a parts supplier, there were huge barriers to entry because you were spending hundreds of millions of dollars on plants. You were pretty well assured that there wouldn’t be an excess of competitors.

Today, that’s disappeared. There are groups of kids coming out of Stanford, out of Waterloo University, all these technology companies. All they have to do if they’ve got a Visa card is rent server time, set up an office, get some people with code experience…. Those barriers don’t exist anymore….

These days you’re an algorithm away from some pretty serious competition. Look at what Apple is trying to do with payment system. I wouldn’t want to be a bank right now. It’s a lot of disruption, and the worst mistake you can make is think that we’re better, we can out-muscle them or we can buy them or handle that competition. I don’t think you can.

More From Knowledge at Wharton

Who Will Survive a Shakeout in the Electric Vehicle Market?

Why Do So Many EV Startups Fail?

Five Myths About Generative AI That Leaders Should Know

Looking for more insights.

Sign up to stay informed about our latest article releases.

Find anything you save across the site in your account

How BlackBerry Fell

By Vauhini Vara

Shares in the Canadian maker of BlackBerry smartphones peaked in August of 2007, at two hundred and thirty-six dollars. In retrospect, the company was facing an inflection point and was completely unaware. Seven months earlier, in January, Apple had introduced the iPhone at San Francisco’s Moscone Center. Executives at BlackBerry, then called Research in Motion, decided to let Apple focus on the general-use smartphone market, while it would continue selling BlackBerry products to business and government customers that bought the devices for employees. “In terms of a sort of a sea change for BlackBerry,” the company’s co-C.E.O Jim Balsillie said at the time , referring to the iPhone’s impact on the industry, “I would think that’s overstating it.”

Six years later, BlackBerry’s stock is worth just over ten dollars a share , and on Monday it announced that it has formed a “special committee” to explore ways to sell the company or form a joint venture with another business, among other options. This was a striking declaration: although BlackBerry has been in trouble for some time—it underwent a public “strategy review” of its business plan a year ago—its decision to put up a giant, blinking for-sale sign suggests it has become especially desperate. If BlackBerry sells itself, the buyer’s biggest gains will be a pile of cash, a big portfolio of patents, and some security technology. In other words, one of the companies that pioneered the smartphone market may soon end up selling itself as scrap.

BlackBerry, founded in 1984 by a pair of engineering students, Mike Lazaridis and Douglas Fregin, was for years one of the world’s most innovative builders of communications products like two-way pagers and e-mail devices. But the story of its past six years has been one of missed opportunities. First, the company failed to recognize that the iPhone could hurt it. Then it overlooked the threat of low-cost competitors in Asia. Finally, and most recently, executives threw the company’s little remaining energy into a new line of high-end smartphones that failed to resonate with consumers, having arrived far too late with too little to offer.

BlackBerry, of course, wasn’t the only company that made the mistake of ignoring the iPhone and the revolution it portended: engineers at Nokia, which, years earlier, had introduced a one-pound smartphone, dismissed the iPhone because, among other reasons, it failed to pass a test in which phones were dropped five feet onto concrete over and over again, the Wall Street Journal reported last year. Microsoft C.E.O. Steve Ballmer actually laughed at the iPhone. “It doesn’t appeal to business customers because it doesn’t have a keyboard,” he said. Nokia and Microsoft, which are now building smartphones in partnership with each other, have, like BlackBerry, seen their share of the market shrink.

As early as 2009, BlackBerry’s share price had fallen to less than fifty dollars, from its high of two hundred and thirty-six dollars in the summer of 2007. The “consumerization” of business technology was already underway, and the company had failed to come to grips with it: when BlackBerry users returned home and pulled off their ties, they picked up iPhones, which were a lot more fun to use. Soon, they wanted to use iPhones at work. Simultaneously, companies realized that workers would be happier and more productive buying the device of their choice, and the firms themselves, spared the expense of providing their employees with phones, would save money.

By the time BlackBerry realized it needed to reach consumers directly, it was too late. In November, 2008, the company released its first touchscreen phone, the Storm, to middling reviews. BlackBerry then turned its focus to Asia and Latin America, where the smartphone market continued to explode. For several months, the strategy worked. In Indonesia, where the company made a special push , its products held forty-seven per cent of the market by the first half of 2011, up from only nine per cent in the first half of 2009, according to the research firm Canalys. The decline in the company’s stock price finally started to level off. But the plateau was short-lived: soon, a new crop of Asian companies started to build cheaper smartphones.

Around the time that BlackBerry deepened its efforts in emerging markets, it also bought QNX Software Systems, whose operating systems powered technology ranging from medical devices to computerized automobile interfaces. BlackBerry hoped to augment its own operating-system expertise—but in April of 2011, when the company introduced a tablet powered by a QNX-based operating system, the PlayBook, it flopped.

Then BlackBerry appointed a new C.E.O., Thorsten Heins, at the start of 2012. It would take a year for the firm to throw what David Pogue, the Times technology critic, called “BlackBerry’s Hail Mary pass”: this January, the company launched the Q10 and Z10, its most serious attempts at high-end phones that would actually be attractive to everyday consumers. While some critics praised the phones—Pogue called the Z10 “lovely, fast and efficient, bristling with fresh, useful ideas”—they have failed to sell as well as the company had hoped. In its most recent quarter, BlackBerry shipped only 6.8 million smartphones—roughly a fifth of what Apple sold during the same period.

Coming six years after the iPhone’s introduction, the Hail Mary hardly stood a chance. BlackBerry had lost the game long ago.

Photograph by Lucas Jackson/Reuters.

By signing up, you agree to our User Agreement and Privacy Policy & Cookie Statement . This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By Bill McKibben

By Anthony Lane

Mini-Case Study: the Downfall of Blackberry Ali Moussi Universteit Van Amsterdam 6068324 [email protected]

Mini-Case study: The downfall of Blackberry Ali Moussi Universteit van Amsterdam 6068324 [email protected]

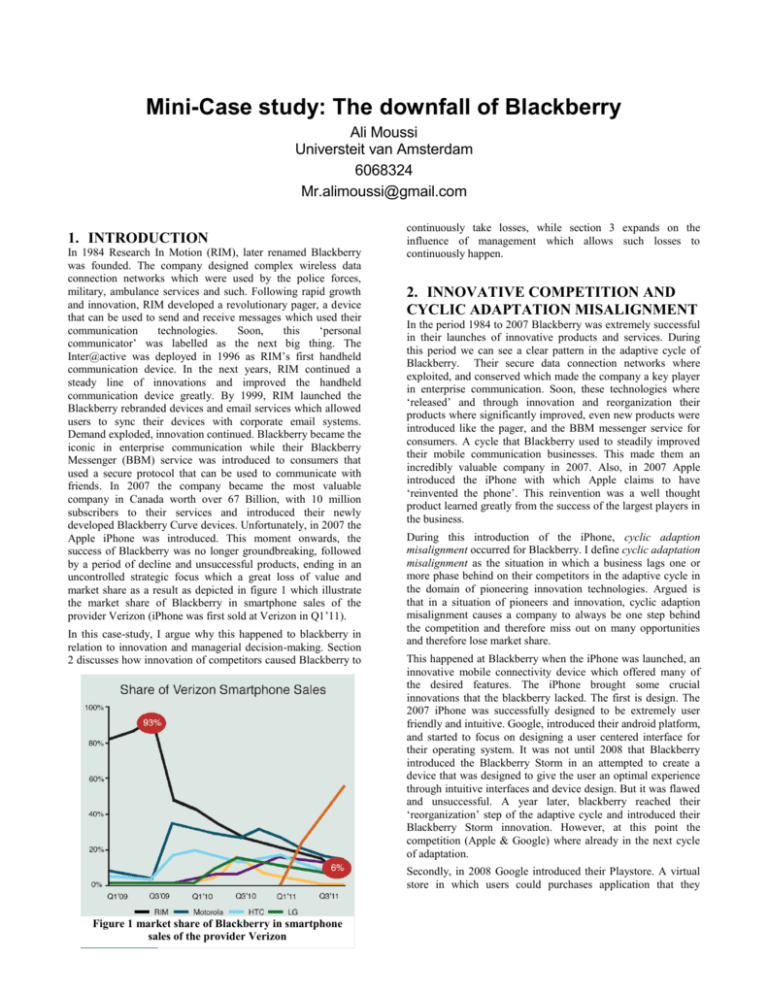

continuously take losses, while section 3 expands on the 1. INTRODUCTION influence of management which allows such losses to In 1984 Research In Motion (RIM), later renamed Blackberry continuously happen. was founded. The company designed complex wireless data connection networks which were used by the police forces, military, ambulance services and such. Following rapid growth 2. INNOVATIVE COMPETITION AND and innovation, RIM developed a revolutionary pager, a device CYCLIC ADAPTATION MISALIGNMENT that can be used to send and receive messages which used their In the period 1984 to 2007 Blackberry was extremely successful communication technologies. Soon, this ‘personal in their launches of innovative products and services. During communicator’ was labelled as the next big thing. The this period we can see a clear pattern in the adaptive cycle of Inter@active was deployed in 1996 as RIM’s first handheld Blackberry. Their secure data connection networks where communication device. In the next years, RIM continued a exploited, and conserved which made the company a key player steady line of innovations and improved the handheld in enterprise communication. Soon, these technologies where communication device greatly. By 1999, RIM launched the ‘released’ and through innovation and reorganization their Blackberry rebranded devices and email services which allowed products where significantly improved, even new products were users to sync their devices with corporate email systems. introduced like the pager, and the BBM messenger service for Demand exploded, innovation continued. Blackberry became the consumers. A cycle that Blackberry used to steadily improved iconic in enterprise communication while their Blackberry their mobile communication businesses. This made them an Messenger (BBM) service was introduced to consumers that incredibly valuable company in 2007. Also, in 2007 Apple used a secure protocol that can be used to communicate with introduced the iPhone with which Apple claims to have friends. In 2007 the company became the most valuable ‘reinvented the phone’. This reinvention was a well thought company in Canada worth over 67 Billion, with 10 million product learned greatly from the success of the largest players in subscribers to their services and introduced their newly the business. developed Blackberry Curve devices. Unfortunately, in 2007 the Apple iPhone was introduced. This moment onwards, the During this introduction of the iPhone, cyclic adaption success of Blackberry was no longer groundbreaking, followed misalignment occurred for Blackberry. I define cyclic adaptation by a period of decline and unsuccessful products, ending in an misalignment as the situation in which a business lags one or uncontrolled strategic focus which a great loss of value and more phase behind on their competitors in the adaptive cycle in market share as a result as depicted in figure 1 which illustrate the domain of pioneering innovation technologies. Argued is the market share of Blackberry in smartphone sales of the that in a situation of pioneers and innovation, cyclic adaption provider Verizon (iPhone was first sold at Verizon in Q1’11). misalignment causes a company to always be one step behind the competition and therefore miss out on many opportunities In this case-study, I argue why this happened to blackberry in and therefore lose market share. relation to innovation and managerial decision-making. Section 2 discusses how innovation of competitors caused Blackberry to This happened at Blackberry when the iPhone was launched, an innovative mobile connectivity device which offered many of the desired features. The iPhone brought some crucial innovations that the blackberry lacked. The first is design. The 2007 iPhone was successfully designed to be extremely user friendly and intuitive. Google, introduced their android platform, and started to focus on designing a user centered interface for their operating system. It was not until 2008 that Blackberry introduced the Blackberry Storm in an attempted to create a device that was designed to give the user an optimal experience through intuitive interfaces and device design. But it was flawed and unsuccessful. A year later, blackberry reached their ‘reorganization’ step of the adaptive cycle and introduced their Blackberry Storm innovation. However, at this point the competition (Apple & Google) where already in the next cycle of adaptation. Secondly, in 2008 Google introduced their Playstore. A virtual store in which users could purchases application that they

Figure 1 market share of Blackberry in smartphone sales of the provider Verizon desired on their mobile device. In that same year, Apple also successful enterprise communication architectures, and widely introduced the similar App store. Both focused in on increasing used mobile devices equipped with BBM Messenger for the number and quality of the available apps a user and consumers through innovation of their pager. No radical download to ensure a good user experience with their devices. innovations were introduced, which gives me reason to believe Again clear trend is visible in which these companies introduce the management remained too focused on improve the business radical new innovations which they continue to exploit. and too little with research and development. This managerial Blackberry did not. It was not until 2009 that RIM’s APP world approach of adaptation cycles that are conservative and focused was introduced. As a result the amount of apps available was on improving their products was developed pre-iPhone and significantly lesser than that of the Apple Appstore and the worked well. But after this era the competitors brought radical Google Playstore. A problem that remained and again, the as well as disruptive innovations to the market. An example of competitors were one cycle ahead, and left Blackberry one step this is the cross-platform Whatsapp messenger which behind. In an attempt to keep up, in 2010 blackberry purchased undermined the BBM in a fast pace. Here the blackberry the company Ottawa-based QNX Software Systems which management still maintained in refining their own products would help improve the design of the blackberry operating which was a waste of effort as they were replaced. I argue that system to compete with what Apple and Google have been post-iPhone, Blackberry should have installed new managers doing for years. who used more radical adaptation cycles to stay in a market with Thirdly, and again in the same year, 2010 where Blackberry was fierce competition. still finding their way of catching up, Apple introduced their revolutionary iPad tablet. In order to not miss out again, this 4. CONCLUSION time only a few months later Blackberry announced their RIM started with groundbreaking products and using relatively Playbook tablet which would not be available till next year. In small adaptive cycles, Blackberry continuously improved their that next year, Blackberry delivered an unpolished product products leading to an incredibly successful and valuable which was not received well by the consumers. I believe that in company in 2007. However these conservative adaptation cycles an attempt to make sure they do not lag behind too long again, that continuously improved the products of Blackberry they speeded up their adaptive cycle process and announced eventually lead to their downfall. As the management learned their innovative products to maintain market share. However this behavior in the years pre-iPhone, it is unlikely they will this rush caused them to deliver products of lower quality which change this successful approach post-iPhone. This managerial proved fatal as the Playbook was very unsuccessful. approach also caused Blackberry to remain in cyclic adaptation These three examples show how Blackberry suffered from misalignment as the competitors used more radical adaptive cyclic adaptation misalignment which caused the company to cycles which left Blackberry following a year behind. I conclude stay behind on their competition which makes it a matter of time with arguing that Blackberry should have appointed a new until Blackberry succumbs to the success of the competition. management with a fresh perspective managing Blackberry in the new technological era with fierce competition. It is not until 2013 that the CEO and other managers stepped down, and 3. MANGERIAL EFFECT ON ADAPTIVE blackberry became desperate for a new strategic course. Even considering tragically splitting the company and selling the CYLE remaining parts to companies who are luring for Blackberry’s It is only logical consider why an organization would remain patents and technologies. November 4 2013, the sale plan is behind in a state of cyclic adaptation misalignment and not make aborted and Blackberry receives an investment for one last try an effort to catch up or redesign to match their competitors as under leadership of the new CEO John Chen. Is the new the adaptive cycle is merely a model and also adaptive in nature management a good choice? I believe so. As long as which means everything is possible. Continuing the analysis of Blackberry’s adaptive cycle will become more radical and Blackberry, an explanation for the fact Blackberry continuously innovative, in order to push the company out of cyclic remained in cyclic adaptation misalignment is given in this adaptation misalignment. But time will tell. section. One reason Blackberry found itself trapped behind is that speeding up their adaptive cycles did not yield desired results. Recall, after Apple introduced the iPad, Blackberry responded quickly with their playbook in an attempt to match up. I argue that speeding up the adaptive cycles in a business is not the right methodology to get an organization out of the cyclic adaptation misalignment. Speeding up your adaption cycles leads to rushing which results in quality loss as demonstrated by the failure of Blackberry’s fast responsive with the Playbook tablet.

Another reason why blackberry remain behind is from the managerial perspective. Pre-iPhone, or before 2007, Blackberry had little competition in their field of secure data communication networks like BBM, email services, and even some of their mobile devices where state of the art. What is noticeable from the complete duration of the existence of Blackberry is that their innovation consisted of refining their existing technologies. This they did successfully leading to their

- BlackBerry /

BlackBerry's success led to its failure

With a little help from apple and google.

By Vlad Savov

Share this story

:format(webp)/cdn.vox-cdn.com/assets/766007/9900Bold_blk_BottomAngle.jpg)

It’s mobile prehistory at this point, but there was once a time when the ultimate smartphone you could get was a BlackBerry. Before Apple’s iPhone arrived, Google’s first Android prototypes were basically BlackBerry clones . It’s easy to think of the stratospheric rise of Android and the iPhone over the past few years as inevitable, but we sometimes forget just what outsiders both of these platforms once were. Back in 2006, neither Apple nor Google had established relationships with carriers. Neither had a loyal following of business users to bolster its consumer proposition. And neither had the best text-input method ever devised for a pocketable device. BlackBerry, then known as Research In Motion, did. And it’s partially because of those advantages that BlackBerry is this week shuttering its phone design and manufacturing for good.

The story of BlackBerry’s mobile demise stretches so far back that we wrote a forensic dissection of it back in early 2012. It’s actually to the company’s credit that it managed its crash landing as well and for as long as it has done. BlackBerry persists today and has refashioned itself around its enterprise and software services, which have been propping it up for a while, and doesn’t look to be in danger of following in Nokia or Palm’s ill-fated footsteps.

Android manufacturers came in with nothing to lose at the time of greatest innovation

But the reason why BlackBerry is interesting today is that it provides a prime example of an incumbent business being disrupted by sprightlier newcomers. Success, as BlackBerry had a decade ago , breeds two interrelated negatives: conservatism and complacency.

At the time of the iPhone and Android’s arrival, the whole mobile industry was on the precipice of moving to bigger touchscreen displays. That was the destination that technology was evolving toward, and it was a trend that Apple jumped on with perfect timing, and later companies like HTC and Samsung exploited to the fullest. HTC was never influential enough to unilaterally dictate that screen manufacturers build bigger, and the prime reason for its repeated success at the start of this decade was that it had nothing to lose and just kept moving to the latest spec with the greatest speed. Most Android OEMs, in fact — companies like LG and Sony along with Samsung and HTC — essentially functioned as dumb conduits for the latest specs. Dual-core processors become available and LG was so fast to implement them that it got a Guinness World Record for it (and a bunch of dissatisfied users owing to its buggy performance ).

Focusing on the tens of millions of customers it already had, BlackBerry missed out on the billions that were to come

While all the tumult and furious evolution was happening on the Android front, BlackBerry was more concerned with protecting what it already had instead of conquering new lands. It’s understandable. The majority of big businesses and government organizations relied on BlackBerry’s superb security, reliable email, and utilitarian functionality to keep their workers productive on the move. BlackBerry Messenger had even accomplished the unlikely feat of making a business device popular among young users as well. Nokia’s Symbian might have had the biggest share of the global market, but BlackBerry dominated in the United States, which has been the tastemaker for new technology products since forever. It was just a comfortable place to be in.

It’s hard to argue that BlackBerry should have thrown away all the goodwill and loyalty it had accrued with customers and thrown itself into the large-screen smartphone race. The BlackBerry keyboard will remain an iconic part of mobile history precisely because of how effective and popular it was. It’s just that the mobile industry went through a uniquely transformative period of rapid evolution at a time when BlackBerry was best served by making iterative improvements.

BlackBerry thought it had more time and room for error than it actually did

But being conservative and seeking to appease existing customers was only half of the problem. BlackBerry also exhibited hubris with disturbing regularity. It launched the PlayBook tablet without an email client on board. It insisted, along with Adobe, that Flash would be the future of rich mobile content , and it delayed the release of a spec-competitive smartphone until it had a chip powerful enough to handle the requirements of Flash. BlackBerry believed people would wait for its superior product or would put up with limitations, because, well, it’s BlackBerry. If that sounds like Apple’s approach with things like the recent headphone jack removal , the big difference is that BlackBerry was selling tens of millions of devices per year at its zenith, whereas Apple now does close to double BlackBerry’s annual tallies each quarter. The latter simply has more latitude to act haughty.

It’s the very definition of complacency to think that you have more room for error than you actually do. And that was BlackBerry, a company that knew it had a lot of assets and advantages, and therefore exhibited a reluctance to embrace change and a consistent smugness about what it had already accomplished. To be fair, most of BlackBerry’s biggest mistakes — things like keeping BBM locked down to its own hardware in a world where the cross-platform WhatsApp grew into a $19 billion business — are historic, but it was as recently as last year that the company’s CEO was showing off a new device without actually being familiar with what it could do, or even what its peculiar name, Priv, is supposed to stand for.

So now, with a quiet whimper of irrelevance, BlackBerry departs the smartphone market that it once helped to shape and define. It's an instructive lesson to any company with less than a billion users of its products or services: no matter how good you may already be, there's always the potential to do better, and if you're not willing to change and do the scary new thing, someone else will. Adapt or die.

Tesla CEO Elon Musk could leave if $56 billion pay package not approved, shareholders warned

Netflix’s latest redesign aims to simplify your homepage, what’s next for xbox and halo, google makes its note-taking ai notebooklm more useful, rivian’s r1 vehicles are getting a gut overhaul — here’s what’s new.

More from Mobile

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/19336098/cwelch_191031_3763_0002.jpg)

The best Presidents Day deals you can already get

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25289658/vic_green_1024x1024.jpg)

Android 15’s first developer preview has arrived

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25287583/DSC06615.jpg)

The OnePlus 12R is a $500 phone with flagship tendencies

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24931969/236794_iPhone_15_pro_pro_Max_VPavic_0011.jpg)

Yep, Apple’s breaking iPhone web apps in the EU

The New York Times

Bits | behind the downfall at blackberry, behind the downfall at blackberry.

Ever since Jim Balsillie and Mike Lazaridis stepped down as co-chairmen and co-chief executives of BlackBerry, neither has spoken much in public about the once-dominant smartphone maker’s fall into near market obscurity. The two and many others have opened up, however, to two reporters from The Globe and Mail in Toronto: Jacquie McNish, a senior business writer and author of several books and Sean Silcoff, who reports about the company. The resulting book, “ Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry ,” which will be published in the United States on Tuesday, fills in some details of the early history of BlackBerry. And its later chapters offer gripping details about the emotional and business turmoil surrounding its near collapse.

How did you gain what seems like extensive access to Mr. Lazardis and Mr. Balsillie?

Ms. McNish: Sean opened the door in 2013 when we were doing a long-simmering investigation into the company. Up until that point, Jim Balsillie and Mike Lazaridis were very frustrated with the common narrative and they were willing to tell a much more complex story.

At times, Sean and I felt like we were therapists. We interviewed 120 people and I think the vast majority of them have some form of post-traumatic stress syndrome.

What was their initial reaction to the iPhone?

Mr. Silcoff: It was an interesting contrast to the team at Google, which was working on smartphones at the time. Google seemed to realize immediately that the world had changed and scrapped its keyboard plans.

At BlackBerry, they sort of dismissed the need to do anything about it in the short term.

Ms. McNish: One thing that they misunderstood is how the game had changed when AT&T announced its deal with Apple. BlackBerry had built its whole business model on offering carriers products that worked efficiently on their networks.

The first thing Mike Lazaridis said when he saw an iPhone at home is that this will never work, the network can’t sustain it. What they misunderstood is that the consumer demand would make carriers invest in their networks.

Verizon’s need for an alternative to the iPhone, which was sold exclusively by AT&T at first, forced BlackBerry into the touchscreen business. Why was the result, the BlackBerry Storm, a technical and sales disaster?

Mr. Silcoff: Verizon presented them with a very tight deadline to deliver a touch screen. It was very early times for touchscreens and it wasn’t clear that the iPhone would end up as the model for the market.

Mike Lazaridis hated typing on glass, so he came up with a new vision for glass that required users to push on it. That combined with the deadline and an inadequate operating system meant that there were a lot of long odds going against BlackBerry.

It was their biggest order ever. But when the Storm came out late and buggy for Thanksgiving 2008, what they hoped would be the next big move was disaster for the company.

Ms. McNish: One of the big reveals for us in the book was the enormous power wielded by carriers in the smartphone race. Verizon pushed BlackBerry to deliver its touchscreen Storm phone in little more than a year and when the rushed product failed, Verizon demanded $500 million to recover its losses. BlackBerry balked at the big ask, but in the end shouldered more than $100 million in repairs and other benefits.

In the wake of Apple’s ascendency, carriers have seen their clout and economic value significantly diminished as customers spend more of their smartphone money on Apple phones, apps and other content than they do on carrier bills. It is one of the greatest wealth transfers in our generation.

Although it was phone purchases by consumers that brought BlackBerry to its peak, did the company ever understand that segment of its business?

Ms. McNish: David Yach, the former chief technology officer, said that he learned in retrospect that beauty mattered, fun mattered. That was so antithetical to BlackBerry. It was aimed at efficiency, security and all the practical things people in the biz world want.

What do you see for the company they left behind for John Chen, the company’s current chief executive?

Ms. McNish: Their biggest investor is a long term player — they are not looking for a quick fix.

And they have time, in part because of BlackBerry’s legacy of very prudent fiscal management.

Mr. Silcoff: John Chen has a tall order on his hands. Their revenues are still falling there’s no clear indication yet that the world needs more BlackBerry phones. He has an ambitious plan but he has yet to show that his software will start delivering hundreds of millions of dollars in in new revenues.

This was a company that had $20 billion in revenue and changed the way we communicated. It’s not likely we’ll see that lightning strike again.

What's Next

The Rise and Fall of BlackBerry: A Lesson in Technological Evolution

Rishi Mundra , Subham Kumar

The story of BlackBerry is a cautionary tale of a once-dominant player in the smartphone industry who ultimately fell from grace. At its peak, BlackBerry was a trailblazer, pioneering on-the-go communication and email with its iconic keyboard-enabled phones. However, the company's slow adaptation to changing market trends, lack of consumer focus, and missed opportunities ultimately led to its downfall. In this article, we shall shed light on the key factors that contributed to BlackBerry's decline and examine the lessons that can be learned from its spectacular failure.

The Rise of BlackBerry Missed Opportunities and Lack of Adaptation The Rise of the iPhone and Android The Failure to Innovate The Shift to Software and Cybersecurity Lessons Learned from BlackBerry's Downfall

The Rise of BlackBerry

BlackBerry, initially known as Research in Motion (RIM), emerged in the late 1990s and quickly gained traction in the smartphone market. The company's early success was fueled by its innovative products, such as the Interactive Pager 950, which introduced on-the-go communication and email capabilities. With its signature keyboard and secure messaging system , BlackBerry became synonymous with professionalism and efficiency.

Throughout the early 2000s, BlackBerry continued to expand its product portfolio and solidify its position in the market. The introduction of the BlackBerry Pearl series, Curve, and Bold product lines further cemented the company's success. BlackBerry's user base grew rapidly, and by 2011, it boasted more than 50 million units sold worldwide.

Missed Opportunities and Lack of Adaptation

Despite its initial success, BlackBerry failed to anticipate and adapt to key market shifts, leading to its downfall. One of the critical mistakes made by the company was its slow response to the touch screen revolution. While competitors like Apple were going for touch screen technology, BlackBerry remained loyal to its keyboard-enabled devices. This decision proved to be a significant misstep, as consumers increasingly gravitated towards touch screen devices.

Furthermore, BlackBerry's lack of consumer focus played a significant role in its decline. The company primarily catered to corporate and government customers, neglecting the broader consumer market. While BlackBerry's devices offered robust security and email capabilities, they lacked the intuitive user experience and app ecosystem that consumers were seeking.

The Rise of the iPhone and Android

The introduction of the iPhone in 2007 marked a turning point in the smartphone industry . With its sleek design, touch screen interface, and extensive app store, the iPhone changed the way people interacted with their mobile devices. BlackBerry, however, failed to recognize the iPhone as a direct competitor and continued to focus on its core business customers.

At the same time, Android smartphones began to gain traction, offering consumers a wide range of device options and customization capabilities. BlackBerry, with its limited device selection and lacklustre app store, struggled to compete with the growing popularity of iPhones and Android devices.

The Failure to Innovate

Another critical factor in BlackBerry's decline was its failure to innovate and keep up with evolving consumer demands. While BlackBerry Messenger (BBM) gained popularity as a messaging platform, the company missed the opportunity to expand its user base by locking the service exclusively to BlackBerry devices. Competitors like WhatsApp , which offered cross-platform messaging, quickly surpassed BBM in popularity and user adoption.

Additionally, BlackBerry's operating system (OS) faced significant limitations in terms of app availability and user experience. While competitors like Apple and Android devices offered a vast array of applications, BlackBerry struggled to attract developers and provide an appealing app ecosystem for its users. As a result, BlackBerry devices became increasingly outdated and less desirable to consumers.

The Shift to Software and Cybersecurity

Recognising the need for a strategic pivot, BlackBerry decided to shift its focus from hardware to software and cybersecurity . In 2016, the company ceased smartphone manufacturing and transitioned into a software firm. Today, BlackBerry specialises in providing cybersecurity solutions and software services to businesses and governments.

The shift to software has allowed BlackBerry to leverage its expertise in security and build a new business model. The company offers a range of products and services, including endpoint security, threat intelligence, and secure communication solutions. BlackBerry's cybersecurity offerings have gained traction in the market, positioning the company as a key player in the industry.

Lessons Learned from BlackBerry's Downfall

The rise and fall of BlackBerry offer valuable lessons for companies operating in the fast-paced and ever-evolving technology industry. First and foremost, adaptability is crucial. Companies must be willing to embrace change and respond to shifting market dynamics. BlackBerry's failure to recognise the significance of touch screen technology and adapt its devices accordingly proved to be a fatal mistake.

Secondly, consumer focus is essential for long-term success. While BlackBerry initially targeted corporate and government customers, it failed to recognise the growing importance of the consumer market. Companies must understand the needs and preferences of their target audience and prioritise delivering a compelling user experience.

Furthermore, innovation is key to staying competitive. BlackBerry's reluctance to innovate and introduce new features and functionalities limited its ability to attract and retain customers. In today's fast-paced technology landscape, companies must continuously innovate and evolve to meet the ever-changing demands of consumers.

Lastly, strategic pivots can be necessary for survival. BlackBerry's decision to shift its focus from hardware to software and cybersecurity allowed the company to capitalize on its strengths and remain relevant in the industry. Companies must be willing to reassess their business models and make bold decisions to adapt to changing market conditions.

The rise and fall of BlackBerry serve as a powerful reminder of the importance of adaptability, consumer focus, innovation, and strategic pivots in the technology industry. While BlackBerry's dominance in the smartphone market may be a thing of the past, the company's transformation into a software and cybersecurity provider demonstrates its resilience and ability to evolve.

The lessons learned from BlackBerry's downfall can guide other companies in overcoming the challenges and opportunities presented by technological advancements. By inculcating change, understanding customer needs, pushing for innovation, and making strategic shifts when necessary, companies can position themselves for long-term success in an ever-changing market.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

How Does Google Pay Make Money? | Google Pay Business Model

Google Pay is a digital wallet platform and online payment system developed by Google to power in-app and tap-to-pay purchases on mobile devices. Google Pay enables its users to make payments with their Android devices phones, tablets, watches, etc. In addition, the service also supports passes such as coupons, boarding

What Is Distributed Workforce and How to Manage It | Key Features & Benefits

In recent years, many companies have started embracing a new work model known as a distributed workforce. This shift has been further accelerated by the global COVID-19 pandemic, which has forced organisations to adapt and find innovative ways to keep their operations running smoothly. In this comprehensive guide, we will

Making India Greener: How Companies Aim to Improve the Environment This World Environment Day

In celebration of World Environment Day 2024, the largest international event for environmental awareness led by the United Nations Environment Programme (UNEP), we reached out to various companies dedicated to sustainability. We asked them about their future plans for sustainable technology in India and how they envision these plans contributing

World Environment Day Spotlight: How Companies' Sustainable Technologies Are Impacting the Environment

On World Environment Day, celebrated annually on June 5, to encourage global awareness and action for environmental protection, StartupTalky reached out to various companies dedicated to sustainability to understand how their technologies are making a positive impact on the environment. By asking how various companies' technology is making a difference

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access only $1 for 4 weeks.

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, ft professional, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

- Make and share highlights

- FT Workspace

- Markets data widget

- Subscription Manager

- Workflow integrations

- Occasional readers go free

- Volume discount

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Digital Innovation and Transformation

Mba student perspectives.

- Assignments

- Assignment: Digital Winners & Losers

The Rise and Fall (and Rise Again?) of BlackBerry

The roller coaster journey of the world's original smartphone leader.

In many ways, BlackBerry was the producer of the world’s first widely-adopted premium smartphone brand. At its peak, Blackberry owned over 50% of the US and 20% of the global smartphone market, sold over 50 million devices a year, had its device referred to as the “CrackBerry”, and boasted a stock price of over $230. Today, BlackBerry has 0% share of the smartphone market and has a stock price that has hovered in the high single digits for most of the past few years. How did BlackBerry fall from such soaring heights?

First, a little bit of history. BlackBerry was founded in 1984 (as Research in Motion) and was originally a developer of connectivity technology like modems and pagers. In 2000, the company introduced its first mobile phone product in the BlackBerry 957, which came with functionality for push email and internet. Over the ensuing decade, the BlackBerry became the device of choice in corporate America due to its enterprise-level security and business functionality. Even after the competitive entry of the iPhone in 2007 and Google’s Android OS in 2008, BlackBerry was certainly not destined for failure. In fact, BlackBerry continued to dominate the smartphone market through 2010, when it still held over 40% of domestic and nearly 20% of global market share.

Ultimately, however, it was a combination of slow market reactions, focusing on the wrong end market, misunderstanding the smartphone’s value proposition, and poor execution that sealed BlackBerry’s fate.