Vodafone Case Study

Introduction.

Vodafone Case study describes the situation when Idea Cellular and Vodafone after the entrance of JIO. So, here is the Vodafone case study which describes the position of Vodafone and Idea Cellular before and post-merger, reasons for the merger, how did merger take place and critical analyses of the merger.

About Vodafone

Vodafone company came from the UK based Vodafone Group plc. It is a multinational service provider of telecommunications in 22 different countries as of 20th November 2020. And, in India Vodafone has its headquarter in Mumbai, Maharashtra. Vodafone is the third largest telecommunication provider in the country. Vodafone

At the beginning of the year, 1992 Vodafone started its company in India from Bombay(now Mumbai). After the entry of JIO in the year 2016. Afterwards, our Vodafone case study begins, Vodafone and Idea announced their merger in March 2017. And as of 31st August 2018, it is known as Vodafone Idea Limited.

Vodafone Idea Merger Case Study

Vodafone case study explains the reason and the situation of the merger of Vodafone and Idea. This merger was first announced in March 2017. Afterwards, in July 2018, the department of telecommunication gave the approval for the merger. Finally, on 31st Aug 2018, the merger was completed and it is announced as Vodafone Idea Limited.

And this merger was the largest telecom merger in India. As per this merger, Vodafone holds a 45.2% stake, Aditya Birla Group holds 26% and the remaining stakes were held public. So, to understand the Vodafone case study, let’s understand the reasons for the Vodafone Idea merger case study.

Reasons For Vodafone Idea Merger

So, while understanding the Vodafone case study lets us understand the reason for the Vodafone Idea merger.

- The main reason for the Vodafone-Idea merger is to Handel the rising dominance of Reliance Jio in the Telecom industry. As Jio announced to provide free services in the first 6 months. As a result, it started to capture the maximum part of the market.

- Secondly, the free services from the Jio started the price war between the companies in the telecom sector( as it in an oligopoly market structure ).

- As a result in case of a price war merger brings confidence in companies with synergy benefits.

- At last, the combined entity of Vodafone and Idea was expected to hold a strong position in the industry . Such as in some circles it became the largest cellular service provider and in some circle, it was the second-largest after Bharti Airtel. So, a joined company can focus on being the service provider in pan India.

So, these were the reasons in Vodafone case study for the merger of Vodafone and Idea.

Vodafone Idea Integration

According to the past in the telecom industry, major telephone operators believes the merger is a strong tool to be in the lead position. As Airtel acquires the Telenor, it acquires the scope and business from other small telecommunication companies like Augere Wireless, Videcon, Tikona(4G Spectrum) etc.

Also, Reliance Communication (R Com) merged with Aircel and acquire MTC. Plus the Tata Telecom also started the process of merging with R Com. As a result in a period of seven months telephone operators numbers went down to seven from twelve.

However, the announcement of the merger creates a negative image in the public, when the Vodafone and Idea merger was announced the Idea prices started to drop . And the share price of Idea declines from Rs. 97.70 on 20th March 2017 to Rs. 81.81 on 6th Sep 2017.

But the merger was important it gave support to the two companies, which were struggling to survive in the industry. Combined resources will help to compete with only the two biggest brands(Jio and Airtel).

So, these were the challenges of Vodafone and Idea merger in case of Vodafone case study.

Critical Analysis Of Vodafone Case

The merger of Vodafone and Idea in Vodafone case study gave higher stakes to the Idea promoters as compared to Vodafone. So, in long run, both companies can gain access to equal shares in the future.

Here are the few takeaways from the Vodafone Idea merger in Vodafone case study:

- The very first thing was the acquisition of 4.9 per cent shares of Vodafone by Aditya Birla . This would amount to a total of Rs. 3874 crore wherein each share is worth Rs. 108 . This would be helpful in increasing the shareholding capacity of Idea to 26 per cent .

- While in the case of Vodafone case study, Vodafone holds 45.1 per cent of the shares in the merger, Idea would be allowed to buy another 9.6 per cent but at a cost of Rs. 130 per share in the period spread over the next four years. However, if Idea is unable to come up equal to the shareholding percentage of Vodafone, it can go forward and buy the number of shares required further but at the price prevailing in the market.

- And, the chairperson of the newly formed enterprise would be Kumar Mangalam Birla . On the other hand, Vodafone had appointed the Chief financial officer . As, after that new CEO was named under both the companies.

- Lastly, the promotors of both entities have the right to nominate three members for the board . Also, there are 12 members out of which 6 are independent on the board in the Vodafone case study of Vodafone and Idea merger.

Idea Positioning Before Merger

In Vodafone case study of Vodafone and Idea merger, now lets understand the Idea Cellular Limited is an Aditya Birla Group company. Founded in 1995, the company was incorporated as Birla Communications Limited and had a license of GSM-based services in Gujarat and Maharashtra Circle. In the following years, the organization started to expand its business with Tata Group, Birla and AT&T group of the US in joint venture form.

In August 2015, Idea announced the rollout of its 4G services. It was now competing with Airtel and Vodafone – in a non-monopolistic market. The company relaunched its “What an Idea” campaign taking 4G to the rural areas and empowering people through the usage of 4G services.

But in the year 2016 sudden announcement from Mukesh Ambani about Reliance Jio disrupted the Indian telecom sector. Below pie chart shows the market share of different telecom players before the entry of Jio.

As the Indian market is very sensitive towards price and Jio used it to make most of the profits. So, Jio started to make its all services free for the first six months. Afterwards, they made the services of voice calls, data extremely cheap. As a result, JIO captured a significant share of the telecom industry. Here is the pie chart of the post-Jio market share of various telecom players.

Vodafone Idea Merger

This transaction required various approvals from government authorities including SEBI, dept. of Telecom and Reserve Bank of India among others. The Department of Telecommunications (DoT) has given the green signal for the merger of Vodafone India and Idea in our Vodafone case study, the largest Merger and Acquisition agreement in the sector, which has displaced Bharti Airtel from top position after over 15 years. The approval conditions, which were given over a year after the agreement, were announced in March 2017 which included an advance payment of Rs 7,268 crore.

Idea Contributon

Promoters Aditya Birla Group infused Rs 3,250 crore in Idea Cellular , which separately raised Rs 3,000 crore ahead of a planned merger with Vodafone India. Following the equity infusion by Idea’s promoters, their stake in India’s third-largest telecom operator rose to 47.2% from 42.4% now. Idea contributed its assets which included standalone towers with 15,400 tenancies and a stake in Indus towers Ltd of 11.5%.

The entry of Reliance Jio Infocomm Ltd in September 2016, with free services for almost seven months and cheap tariffs, had eroded margins and impacted the revenue of rivals. The contribution of Vodafone will be Vodafone India along with standalone towers with 15,400 tenancies without including an 11.5% stake in Indus Towers. According to the agreement between Idea and Vodafone.

Vodafone will contribute more amount of net debt, about Rs 2,480 crore than Idea at the completion of the merger. Post-termination of both companies, the combined entity will be a joint venture between Vodafone and Idea in the Vodafone case study. Which will account for the under the equity method, controlled by both Aditya Birla Group and Vodafone.

Idea promoters hold the rights to acquire a 9.5% additional stake from Vodafone under the agreed deal to equalize shareholdings over time as per the following proposition

Vodafone: 45.1% – 9.5% = 35.6%

Idea: 26% + 9.5% = 35.6%

Impact of Merger on Telecom Industry

There are also several other implications that this merger of Vodafone case study will bring forth on the telecom industry.

1. Firstly, there can be initiatives based on the renewal of price discipline for the disruptive entry by Jio has caused some serious misbalance

2. Secondly, the poor financial health of the telecom sector can be observed. And through such mergers, there will be an infusion of health and life. Since India is the fastest-growing market in terms of subscriber base .

3. Through the merger, Vodafone and Idea will overcome their debts and a large sum of credit will be infused into the system

4. The deal has also saved both the telecom companies from selling off their business . As was being planned by them initially and this would directly impact the quality of services being provided by different players in the industry

The merger in the Vodafone case study will surely boost the pace of the telecom sector. It has also been found that the savings, synergies and also the spectrum will have a substantial impact on the escalating growth.

There will be a saving of over 60 per cent of the cost of the operation and this will aid in improving the quality and performance of the service through investments from the saved money.

Enhancement in network infrastructure will be observed while the operational efficiencies have a chance to reach excellence. Moreover, the revenue market share is expected to rise for all the locations and the spectrum of the entity would exceed the initial caps.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

MAKING LAW SIMPLE!

Mergers and Acquisitions: Case Study of Vodafone Idea Merger

By: Vaidehi Sharma

Introduction to mergers and acquisition

‘Mergers and acquisitions’ is a technical term used to define the consolidation of two or more companies. When two companies are combined to form one unit, it is known as a merger, while an acquisition refers to the buying of one company by another one, which means that no new company is formed, only one company has been absorbed into another. Mergers and Acquisitions are an important component of strategic management, which comes under the head of corporate finance. The subject concerns buying, selling, dividing, and combining various companies. It is a type of restructuring to have rapid growth and increase profitability.

Mergers and acquisitions are part of the strategic working of any business or working group. It involves the joining of two businesses with the object to increase market share and profits and to have an influential impact on the industry. Mergers and Acquisitions are complicated processes that require preparation, analysis, and deliberation. There are a lot of parties who might be affected by a merger or an acquisition but before a deal is finalized, all parties need to be taken into consideration, their concerns should be addressed, and all possible hurdles that can be avoided must be avoided.

The term ‘Merger’ has not been defined under the Companies Act, 2013 or Income Tax Act, 1961 , but as a concept ‘merger’ is a combination of two or more entities into one; with the accumulation of their assets and liabilities, and coming together of the entities into one business.

The other word for Merger is ‘Amalgamation’. Under The Income Tax Act, 1961 (ITA) ‘amalgamation’ is defined as the merger of one or more entities with another company, or the merger of two or more entities forming one company. It also mentions other conditions to be satisfied for an ‘Amalgamation’ to benefit from the beneficial tax treatment.

For example -A company called and a company called B merge to form a new company called C . This is called a merger.

The effect of the merger is that the assets and liabilities of both companies will now be shared and they will cease to exist as independent companies .

Benefits of Mergers

⮚ Profit and resource sharing – The resources of both companies are pooled together which increases the profit outcome.

⮚ Access to New Markets – Entering into new markets can be challenging for any company even for established companies. While setting up a subsidiary or branch is always an option, a merger or acquisition can save companies a significant amount of time, effort, and money compared to starting from scratch

⮚ More Economic Strength and Competitive Edge – mergers and acquisitions mean financial strength for both companies. It can help them to become more powerful in the market, attract more customers and create more resources.

⮚ Powerful Human Resource -The biggest asset any company can hold is its employees. A skilled and effective stall generates a lot of profit for the company. Therefore in mergers and acquisitions, the human resources of both companies are pooled together.

⮚ Better infrastructure and Fixed Capital -In mergers and acquisitions the resources of both companies are shared which means access to better infrastructure for the poor company. Big machines and other resources can also be used up for better production.

Mergers and acquisitions in the telecom industry in India

Introduction .

India is currently ranked as the world’s second-largest telecommunications market with more than 1.20 billion subscribers and has shown strong growth in the past one and a half decades.

The Indian telecom industry is growing at a rapid pace. In 2020-2021 the telecom industry contributed 6% to India’s Gross Domestic Product (GDP). The telecom sector is set to grow at a Compound Annual Growth Rate (CAGR) of 9.4% from

2020 to 2025. However, with a CAGR of 15.9% throughout the forecast period, the smartphone industry in India will have the fastest growth. By 2025, India’s digital economy will be worth $ 1 trillion.

The industry has increased primarily due to favorable regulatory conditions, low prices, increased accessibility, and the introduction of Mobile Number Portability (MNP), expanding 3G and 4G coverage, and changing subscriber consumption patterns. The deregulation of Foreign Direct Investment (FDI) rules has made the telecom sector one of the fastest-growing sectors in the country and a huge means of employment opportunity generator in the country too.

The subsectors of the telecommunication sector include infrastructure, equipment, Mobile Virtual Network Operators (MNVO), white space spectrum, 5G, telephone service providers, and broadband.

It is predicted that 5G technology will boost the Indian economy by $ 450 Bn between 2023 and 2040. According to the Global System for Mobile Communications (GSMA), there is an excellent opportunity for investment in this sector as India will have almost one billion installed smartphones by 2025 and 920 million unique mobile customers, including 88 million 5G connections.

Importance of the telecom industry

The importance of the telecommunication industry is highlighted by the fact that it enables global communication. The relevance of this industry has increased significantly after the pandemic. Services offered by this industry are more frequently used since it allows for a continued virtual connection. The smartphone market will continue to increase as more people are expected to purchase them in the coming years. Given that government reforms have eliminated ambiguity and risks and established a stable investment environment, India’s telecom sector is projected to receive investments totaling $ 25.2 Bn over the next two years.

Mergers and acquisitions in the telecom industry

The recent trend of mergers and acquisitions can be widely seen in the telecom sector too. This recent trend in the world of the telecommunications market has been caused by the ongoing regulatory liberalization and privatization of the industry. These changes have brought about fierce competition and ensuing decreases in profit in both the domestic and international telecommunications service markets.

Mergers and acquisitions in the telecom sector are considered to be horizontal mergers because both companies deal in the same line of business. In the majority of developed and developing countries, mergers and acquisitions in the telecommunications sector have increased which also resulted in the creation of jobs.

The legal Framework of Mergers and Acquisitions in the telecom sector

- ⮚ National Telecom Policy formed in 2012 hasimplifiedde M&A in Telecom Service Sect, ensuring adequate competition and allowing 100% FDI.

- ⮚ The merger in the case of licenses shall be done for the respective service category. Access to service license allows the provision of internet service and so the merger of ISP license with services license shall also be

- permitted.

- ⮚ In a service area, the market share of the merged entity should not be more than 50%. If it is more, it has to reduce it below 50% in an annum.

- ⮚ The total spectrum held by the merged entity should not be more than 50% in a service area. If it is excess, it has to be surrendered within an annum.

- ⮚ The corporation which acquires will have to pay the difference between the market price determined in the auction & the administrative price if an acquired company has got spectrum after paying the administrative price.

- ⮚ If due to a merger or transfer of license in any service area business, corporation or entity becomes an important market power, then TRAI’s Telecommunication Act of the year 2002 will come into place.

Case study – Merger of Vodafone and Idea

History of both the companies .

| It was formed in the year 1995. | It was a UK-based company. |

| The Vodafone Group had 534.5 million mobile customers and 19.9 million fixed broadband customers as of 2018. | It was an Indian company. |

| Earlier owned by Max group. | Earlier owned by Birla group. |

| ∙ Idea Cellular was the third-largest telecom company in India, with a market share of 15.9%. | ∙ Idea Cellular was the third-largest telecom company in India, with a market share of 15.9%. |

History of the merger

In March 2017, it was announced that Idea Cellular and Vodafone India would merge. The merger got approval from the Department of Telecommunications in July 2018. On 30 August 2018, National Company Law Tribunal gave the final nod to the Vodafone-Idea merger. It was completed on 31 August 2018, and the new entity was named Vodafone Idea Limited. Under the terms of the deal, the

Vodafone Group held a 45.2% stake in the combined entity, the Aditya Birla Group held 26% and the remaining shares were to be held by the public.

Reasons for Merger of Vodafone and Idea

Dominance over the market by JIO- The main reason for the merger of Vodafone and the idea was the dominance of the Jio company. The companies saw a major downfall as Jio announced free internet services for the first 6 months. As a result price war began between companies. the companies began to see losses, and as a result, a merger between Vodafone and Idea happened.

Key takeaways

- ⮚ Under the plan submitted to Indian regulators, Vodafone will initially hold a 50 0% stake in the combined entity, while the Aditya Birla Group and public shareholders will hold 21.1% and 28.9%, respectively. Vodafone will then divest a 4.9% stake to the Aditya Birla Group, which would increase the latter’s stake from 21.1% to 26%, thus crossing the threshold for an open offer.

- ⮚ Vodafone and Idea had individual spectrum holdings of 411 MHz and 316 MHz respectively. The amalgamation of the companies would give, it was expected, the merged company a hold of 728 Mhz increasing the chances of the merged company to rank number one or two in India.

- ⮚ The merger ratio was 1:1. This ratio was based on the price of Idea at 72.5 per unit. Implied enterprise value for Idea and Vodafone was INR 72 thousand crores and INR 82 thousand and 8 hundred crores respectively. The agreement had a break fee of Rs 3,300 crore payable upon certain conditions.

- ⮚ Aditya Birla also has the right to acquire up to 9.5% additional shareholding from Vodafone Group throughout three years post-closure of the deal for an agreed price of INR 130 per share. But these rights by Aditya Group will be exercised based on the growth achieved and the market price of the combined entity .

- ⮚ Idea and Vodafone will have joint control over the appointment of CEO and COO, the exclusive rights to appoint a CFO is with Vodafone. So Vodafone is not just a major shareholder but also has more financial rights.

- ⮚ If at the end of 3 years, Aditya Birla Group fails to purchase any stakeout of the additional stake of 9.5%, then they will be given the last opportunity to purchase the stake at the prevailing market price for share equalization.

- ⮚ Vodafone contributed net debt of Rs 55,200 crore to the merged entity, whereas Idea contributed Rs. 52,700 crore. Vodafone contributed net debt of Rs. 2,500 crore more than Idea .

- ⮚ In September 2020, Vodafone – Idea rebranded itself. The company used the initials to rebrand itself as ‘Vi’. The rebranding took place after almost two years of the merger, however, it shows the spirit of integration.

- ⮚ In the financial year 2022, Vodafone Idea Limited earned revenue of 386.5 billion Indian rupees.

Related Posts

Critical view to the reasons and effects of the manipur violence.

There was contention about whether or not the Meitei community would be included in the list of Scheduled Tribes even at that time, which did not happen. Until 18th century indigenous faith known as sanamahism was followed by the king and people.

The YES BANK SCAM: Analysis

INTRODUCTION Over various decades, financial crimes and multifarious criminal activities within the corporate sector have been witnessed, the very first being the Mundhra Scam, which came to light in 1957 and is considered to be the first big financial scam of independent India to the present day Yes Bank crisis….

PHARMACEUTICAL SOCIETY OF GREAT BRITAIN V BOOTS CASH CHEMISTS (1953)

INTRODUCTION The two-person joe mama and ma balls go to the boots chemists shop on April 13, 1951, to purchase PERCCC 30s from the pharmacy shelf. The boots cash chemists introduce the new method for selling medicine. He introduced the self-service system. What kind of medicine do you want to…

Leave a Reply

You must be logged in to post a comment.

- 232 Share on Instagram

- 215 Share on Facebook

- 205 Share on LinkedIn

A Post-Merger Analysis of Vodafone-Idea Ltd.

Paper Presented and Published at TWO DAY NATIONAL CONFBRENCE ON "OVER THE HORIZON: INTROSPECTING THE SELF IN FLUX" ON 15-16 November 2019, Organized by KALINGA UNIVERSITY, RAIPUR. ISBN- 978-93-88867-88-7

11 Pages Posted: 15 Jan 2020 Last revised: 30 Mar 2023

CMA(Dr.) Ashok Panigrahi

SVKM's Narsee Monjee Institute of Management Studies (NMIMS)

Date Written: November 16, 2019

Vodafone and Idea announced their merger in 2017, which made a huge impact in the Indian telecom sector. This was a major consequence of Jio’s cruising dominance in the industry which backed other major players to take precarious steps to maintain their stand in the Indian telecom market. Vodafone India was the second-largest player of the Indian Telecom Industry in terms of subscriber base while Idea Cellular Limited has the third largest subscriber base in India. Idea Cellular was a subsidiary of Aditya Birla Group. This merger did not only create a telecom giant but has had wide-ranging implications for the industry, services, the staff, and consumers as well as it pushed more merger moves in the telecom sector. In this paper, the current scenario of the Indian telecom market is also analyzed to understand where Vodafone-Idea stands today.

Keywords: Merger, Vodafone, Idea, Telecom Industry

Suggested Citation: Suggested Citation

Ashok Panigrahi (Contact Author)

Svkm's narsee monjee institute of management studies (nmims) ( email ).

Narsee Monjee Institute of Management Studies Mukesh Patel Technology Park Shirpur, MS 425405 India 8888810975 (Phone)

HOME PAGE: http://nmims.irins.org/profile/149882

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, finance education ejournal.

Subscribe to this fee journal for more curated articles on this topic

IO: Regulation, Antitrust & Privatization eJournal

Communication & technology ejournal.

A Study of Merger and Acquisition and Its Impact on Profitability Performance of Selected Merger (With Reference to Vodafone Idea Merger)

- First Online: 23 August 2022

Cite this chapter

- Suruchi Satsangi 12 &

- Prem Das Saini 12

Part of the book series: Flexible Systems Management ((FLEXSYS))

510 Accesses

Mergers and acquisitions are vital choices taken to boost an endeavor's blast through improving its assembling and promoting tasks. They are adopted to use and gain advantage power, expand the purchaser base, cut competition or enter into a brand new market or product section. When globalization of the Indian financial system was started in 1991, it was believed that it would suggest foreigners were not the handiest doing enterprise in India but additionally taking over Indian organizations. The objectives are to review the case of Vodafone-Idea related to M&As and analyzing its before- & after- performance of the company and its impact on the basis of profitability performance of the selected companies. The study is based on an analytical research. The data are taken from secondary sources from several websites. The time period of the study is two-year pre & two-year post of the selected companies. The base year is considered as zero. To analyze the profitability performance, ratios and t test has been used as a tool for further analysis of the paper.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Bedi, A. (2018). Post acquisition performance of indian telecom companies: An empirical study. Pacific Business Review International , 56–62.

Google Scholar

Jiang, J. (2019 ). An empirical study on M&A performance: evidence from horizontal mergers and acquisitions in the United States. Open Journal of Business and Management , 976–997.

Poddar, N. (2019). A study on mergers and acquisition in india and its impact on operating efficiency of indian acquiring company. Theoretical Economics Letters , 1040–1052.

Satyanarayana, D., Rao, D., & Naidu , D. (2017). The impact of reliance jio on Indian mobile industry a case study on mergers and acquisitions of idea—Vodafone and Airtel—Telenor. International Journal of Applied Research , 209–212.

Download references

Author information

Authors and affiliations.

Department of Accountancy and Law, Faculty of Commerce, Dayalbagh Educational Institute, Agra, Uttar Pradesh, 282005, India

Suruchi Satsangi & Prem Das Saini

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Suruchi Satsangi .

Editor information

Editors and affiliations.

Department of Management Studies, Indian Institute of Technology Roorkee, Roorkee, Uttarakhand, India

Ramesh Anbanandam

Santosh Rangnekar

Rights and permissions

Reprints and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Satsangi, S., Das Saini, P. (2022). A Study of Merger and Acquisition and Its Impact on Profitability Performance of Selected Merger (With Reference to Vodafone Idea Merger). In: Anbanandam, R., Rangnekar, S. (eds) Flexibility, Innovation, and Sustainable Business. Flexible Systems Management. Springer, Singapore. https://doi.org/10.1007/978-981-19-1697-7_12

Download citation

DOI : https://doi.org/10.1007/978-981-19-1697-7_12

Published : 23 August 2022

Publisher Name : Springer, Singapore

Print ISBN : 978-981-19-1696-0

Online ISBN : 978-981-19-1697-7

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

With a population of 1.38 billion people, India has one of the largest telecom markets in the world. Up until 2016, there were more than a dozen telecom service providers operating in the country.

But in 2016, a new provider entered the marketplace, causing major disruption to the telecom market and triggering massive changes, including increased competition and price wars.

To adapt to these changes, two of the top telecom providers in the country—Vodafone India and Idea Cellular—decided to merge to become Vodafone Idea Limited (Vi). According to Vineet Chauhan, Vice President and Head of Digital Technology at Vi, the two businesses decided to embrace the market changes. “It was a great opportunity to serve more and more customers through our ever-improving network, best-in-class data speeds, and great products and services,” he says.

A merger of this size was unprecedented. The two companies needed to consolidate without significantly disrupting operations or service to customers. At the same time, Vi wanted to execute on its vision of becoming a digital-first company.

Rapid growth

A new digital retailer app platform adds 7 million subscribers per month

Revenue management

The digital retailer app is used to manage revenue of USD 200 million each month

Vi had a long history with IBM, so it turned to IBM® Consulting to help plan and execute its massive digital transformation and its consolidation and integration projects. “We partnered with IBM to drive digital transformation at the scale that we needed to,” says Chauhan. “And in this partnership with IBM, our three pillars are trust, transparency and agility.”

A key component for the merger was digital transformation. “We set out to transform ourselves,” says Chauhan. “As a digital-first organization, we wanted to make sure that we delight consumers at every touchpoint, every time. We have the kind of products and offerings that are innovative, personalized, contextual and relevant.”

Working alongside IBM, Vi created a “digital factory” to help transform the various Vi digital properties, including websites, mobile apps and new digital platforms. As it rolled out the new Vi brand, the company launched these new websites and mobile apps during the day with zero downtime. “Our consumers use the website for information, to subscribe or to recharge their prepaid phone,” says Chauhan. “Our postpaid subscribers come and make a bill payment. And we can present exciting offers. So, we turned all these functions around and we were seamlessly able to transition into the new brand.”

The digital transformation enabled new digital platforms for Vi’s channel partners. Vi worked collaboratively with IBM in the digital factory to launch several first-of-a-kind solutions, such as a new digital retailer mobile app platform supporting contactless recharges and contactless UPI-based balance transfers. Using the digital retailer app, customers can recharge their prepaid phone easily while maintaining the social distancing required for COVID-19 safety. In addition, distributors can make contactless UPI-based balance transfers, so retailers can always get the recharges they need without requiring representatives to travel to retail locations.

These initiatives help some 300 million Indian citizens stay connected, without any issues, during the COVID-19 pandemic. With the new digital retailer app, Vi is gaining seven million new subscribers per month and managing monthly revenue of USD 200 million. Plus, the company launched a new digital sales acquisition platform, driving a 100% increase in digital acquisitions in three months.

Nirupmay Kumar, Executive Vice President of Technology at Vi, oversaw integration strategy, solution design and demand management for enterprise and consumer business during the consolidation and integration projects. “We interacted very closely with IBM to identify our business requirements and to determine how to design the systems,” says Kumar. “IBM also helped us detail all of our requirements to make sure that nothing was missed.”

Kumar and his team handled the job of consolidation design of the IT systems from both Vodafone and Idea. “So the challenge was how to identify the right set of applications that can support double the subscriber base, along with future growth and functionalities,” says Kumar. This was no easy task, considering the size and IT landscape maturity of the two companies. “IT Transformation project for a telecom company is like changing the engine while the flight is in the air, you have to upgrade with minimal or no downtime” says Kumar.

As Kumar and his team worked with IBM to determine which enterprise applications could best support the newly merged organization, they found at times that the best choice was to transform an existing system rather than consolidating. And in some cases they created new functionality. In the past, neither company had a digital platform for the enterprise consumer, so Vi and IBM created a new digital platform to provide self-service options to Vi enterprise customers. In fact, the Vi enterprise digital platform won five awards at the prestigious ICMG Architecture Excellence Awards competition. The new enterprise digital platform has delivered a 35% increase in payments, a 60% growth in customer self-servicing and a 70% rise in new customer registrations in one year.

Sanjeev Vadera, Vice President and Head of Integration Program Management at Vi, handled consolidation and operations for the consolidation and integration projects. Part of the consolidation program involved moving many applications and services to a virtualized cloud to reduce the cost of ownership. “In the back of our minds, we were always looking for ways to move to the cloud as much as possible,” says Vadera. “We did a lot of virtualization as well.” The IBM and Vi team successfully executed 32 parallel transformation programs within just 18 months. These projects impacted nearly 300 million customers (or approximately one in every four Indian citizens) and two million channel partners across more than 700 business processes.

Although the consolidation and integration program was originally projected to take three to five years, Vi was able to complete it within 24 months with help from IBM. The company also completed the digital transformation with minimal impact on its consumers. “For the majority of our consolidation projects, we ensured that there was zero customer impact,” says Vadera. “With IBM’s help, we did iterations of mock migrations to create the strategies for how we can reduce downtime.”

In total, Vi and IBM consolidated more than 350 applications down to approximately 200. In addition, the teams migrated 140 applications from three data centers to one data center. Ultimately, the project will result in the consolidation of four data centers into one. Through this consolidation, Vi has saved USD 600 million so far.

In addition, IBM is helping Vi with its network domains. Vi collaborated with IBM to deliver its first major production milestone for core network functions on its open universal hybrid cloud, powered by IBM and Red Hat. The platform enables IT and network applications to run on a common cloud architecture, which is designed to deliver ROI improvements through the optimization of CapEx, OpEx, skills and automation investments across both the network and IT application domains. The hybrid cloud is based on open technology and open standards from IBM and Red Hat, and it delivers a wide range of capabilities, including IBM Watson® AI and the Red Hat® Ansible® Automation Platform (link resides outside ibm.com), which can help strengthen Vi’s capability in network and IT planning.

Vadera and his team also teamed with IBM to implement the Big Data Lake program at Vi. The Big Data Lake program is one of the biggest open-source-based data lakes implemented globally in a telecom company. “The business analytics and intelligence needs for the new company needed to be very different from the existing tools and applications used by Vodafone and Idea, so we decided build a completely new system,” says Vadera.

The launch of the new Big Data Lake data platform has delivered significant value to Vi. “The program has brought immense business benefits to Vi, with close to a 40% cost reduction and a 60% reduction in operational complexity,” says Aditya Ghosh, Associate Vice President of IT for Analytics at Vi. “We’re going to be ahead of the curve with a future-ready, modern and open-source platform.”

The new data platform, which replaced two existing data warehouse platforms, processes over 15 billion records per day, creating more than 2,000 business KPIs daily. The data lake is a massive 10-petabyte platform. It’s helping Vi take the next big step into the AI domain, with the implementation of major AI- and machine-learning-related use cases for network experience improvements, new planning and customer experience improvement.

According to Himanshu Jain, Senior Vice President at Vi, the partnership with IBM was key to the success of the project. “IBM brings robust governance framework, agility to scale up and domain expertise to the table,” he says. “And IBM has really helped us digitize our organization during challenging times due to COVID-19.”

Vi anticipates that it will continue to work with IBM to achieve its goals. “Now we have a very strong platform that we can use as a springboard for more innovation, more features,” says Kumar. “Our relationship with IBM is growing day by day, and I look forward to working with IBM as a trusted partner for many years to come.”

Vi (link resides outside of ibm.com) is one of the leading telecom providers in India. The company serves approximately 300 million subscribers across more than 480,000 towns and villages throughout India. In addition to having the largest telecom network in India, Vi provides pan-India voice and data services across 2G, 3G and 4G platforms. It is headquartered in Mumbai and Gandhinagar and reported revenue of USD 6.4 billion in 2020.

To learn more about the IBM solutions featured in this story, please contact your IBM representative or IBM Business Partner.

© Copyright IBM Corporation 2021. IBM Corporation, IBM Consulting, Orchard Road, Armonk, NY 10504

Produced in the United States of America, June 2021.

IBM, the IBM logo, ibm.com, and IBM Watson are trademarks of International Business Machines Corp., registered in many jurisdictions worldwide. Other product and service names e trademarks of IBM or other companies. A current list of IBM trademarks is available on the web at “Copyright and trademark information” at ibm.com/legal/copyright-trademark .

Red Hat® and Ansible® are trademarks or registered trademarks of Red Hat, Inc. or its subsidiaries in the United States and other countries.

This document is current as of the initial date of publication and may be changed by IBM at any time. Not all offerings are available in every country in which IBM operates.

The performance data and client examples cited are presented for illustrative purposes only. Actual performance results may vary depending on specific configurations and operating conditions. THE INFORMATION IN THIS DOCUMENT IS PROVIDED “AS IS” WITHOUT ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING WITHOUT ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND ANY WARRANTY OR CONDITION OF NON-INFRINGEMENT. IBM products are warranted according to the terms and conditions of the agreements under which they are provided.

- Law of torts – Complete Reading Material

- Weekly Competition – Week 4 – September 2019

- Weekly Competition – Week 1 October 2019

- Weekly Competition – Week 2 – October 2019

- Weekly Competition – Week 3 – October 2019

- Weekly Competition – Week 4 – October 2019

- Weekly Competition – Week 5 October 2019

- Weekly Competition – Week 1 – November 2019

- Weekly Competition – Week 2 – November 2019

- Weekly Competition – Week 3 – November 2019

- Weekly Competition – Week 4 – November 2019

- Weekly Competition – Week 1 – December 2019

- Sign in / Join

Aditya Birla Group

- Telecommunication industry

All about the Vodafone India and Idea merger

This article is written by Bushra Tungekar from the University of Mumbai Law Academy. In his article, the author analyses the merger of the two largest players in the telecom industry in India.

Table of Contents

Introduction

Mergers and acquisitions have been proved to be an effective tool for the purpose of corporate restructuring activities. The telecommunication industry is one of the most profitable and rapidly developing industries. The Indian telecommunications industry is the world’s second-largest telecommunication industry. It has a subscriber base of 1183.51 million users , an internet subscriber base of 604.21 million, and the revenue generated by the telecom sector is around Rs 185,291 crore.

Mergers in the Indian telecom industry are not uncommon. The merger phenomenon has grown in the industry since the past few decades. The famous mergers seen in the industry are Vodafone and Hutchison Essar in 2007 , Idea and Spice Telecom , Telenor and Unitech , Reliance and Aircel , etc.

In the year 2017, Vodafone India and Idea Cellular announced that they had received approvals from their respective Boards for a merger. It was the creation of India’s largest telecom company beating Bharti Airtel and Reliance Jio .

Background of the merger

Vodafone group .

- Vodafone is a British multinational company. It is one of the largest telecommunication groups based in the United Kingdom.

- It provides its services in over 25 countries across the globe, partners with mobile networks in 46 more countries, and has fixed broadband services in 18 markets, majorly in Europe, Africa, the Middle East, and Asia pacific.

- The services provided by the Vodafone group range from voice, messaging, data, and fixed communications.

- The Vodafone Group had 534.5 million mobile customers and 19.9 million fixed broadband customers as of 2018 . This included India and all of the customers of the company including the joint ventures.

- Aditya Birla is an Indian multinational company based in Mumbai.

- It is in the group of Fortune 500 companies . It has its business operations in almost 36 countries.

- It has a workforce of 120,000 employees.

- Globally it is number one in aluminium rolling, viscose staple fibre, and carbon black.

- In India, the Aditya Birla Group leads in several sectors such as fashion, lifestyle, viscose filament yarn, grey, white cement, and concrete. It is the largest producer in the Chlor-alkali sector, as well as in life insurance and asset management.

- Idea Cellular was the first multinational company under the Birla group. It was established in 1995.

- Idea Cellular was the third-largest telecom company in India, with a market share of 15.9% .

Reason for the merger

With this merger, the two companies have gained immensely. It was a horizontal merger amongst the two biggest players in the telecom industry. This merger deal was worth $23 billion .

The rationale behind this merger, when both the companies were doing well individually, is explained below:

Synergy benefits

- Both the companies had said in their statement that the synergy would be extremely cost-effective. The estimated savings annually would go up to 14,000 crores. The savings would be in the form of both capital expenditure as well as operating costs.

- EBITDA (earnings before interest, tax, depreciation, and amortization) of both the companies were around the margin of 30%. It was comparatively lower than that of Bharti Airtel and Reliance Jio Infocomm Ltd.

Domination of the market

- Individually, the market share of Vodafone India and Idea was very low as compared to Bharti Airtel and the recent entry of Reliance Jio. Reliance Jio took the telecom industry by storm.

- The merged company would gain 400 million subscribers , a customer market share of 35%, and a revenue market share of 40%.

Spectrum share

- Vodafone and Idea had individual spectrum holdings of 411 MHz and 316 MHz respectively. However, on the other hand, the spectrum hold of Bharti Airtel and Reliance Jio was 860 MHz and 650 MHz respectively. Therefore, effectively competing in the industry individually was proving to be difficult for Vodafone and Idea.

- The amalgamation of the companies would give, it was expected, the merged company a hold of 728 Mhz increasing the chances of the merged company to rank no one or on number 2 in India.

Deal structure

The merger was an all-share merger, which later moved on to the deconsolidation of Vodafone operations in India. The deal excluded Vodafone’s 42% share in the Indus Towers. The promoters of both companies had equal rights on important matters. Both the companies had joint control over the appointment of the Chief Operating Officer (COO) and the Chief Executive Officer (CEO).

Merger ratio

The merger ratio was 1:1 . This ratio was based on the price of Idea at 72.5 per unit. Implied enterprise value for Idea and Vodafone was INR 72 thousand crores and INR 82 thousand and 8 hundred crores respectively. The agreement had a break fee of Rs 3,300 crore payable upon certain conditions.

Stock transfer

Under the deal, Aditya Birla Group was allotted a stake of 4.9% of the merged company. The stake was given from Vodafone for Rs 109 per share (INR 3900 crores). This brought the shareholding of the Aditya Birla group to 26%, therefore giving Vodafone a stake of 45.2%. 26% stake was given to other promoters of the idea group and the remaining 24% was owned by the public.

Lock-in period

Neither company could purchase or sell any shares from or to any third party for a period of 3 years (lock-in period). Vodafone offered an acquisition of 9.5% additional without any premium, enabling the Aditya Birla Group to acquire an additional 9.5% of the shares within the period of the next 3 years at a predetermined price of Rs. 103 per share.

Sale at market rate

If at the end of 3 years Aditya Birla group fails to purchase any stakeout of the additional stake of 9.5%, then they will be given the last opportunity to purchase the stake at the prevailing market price for the purpose of share equalization.

Sale to third parties

If after four years Aditya Birla Group still hasn’t purchased Vodafone shares for equalization, then the shares may be sold to a third party.

Vodafone contributed net debt of Rs. 55,200 crore to the merged entity, whereas Idea contributed Rs. 52,700 crore. Vodafone contributed net debt of Rs. 2,500 crore more than Idea.

Hurdles faced

The merged entity faced many regulatory challenges such as:

- The entity was exceeding the caps on revenue market share, subscriber market share, and spectrum holdings in at least six circles each.

- In the spectrum holding cap, the combined entity was shooting over 25% in Gujarat, Kerala, Maharashtra, Madhya Pradesh, and western Uttar Pradesh.

Approval from DoT (Directory of Telecommunications)

The DoT provides for M&A guidelines (Guidelines for Transfer/Merger of various categories of Telecommunication Service License/Authorization under Unified Licence on Compromises, Arrangements, and Amalgamation of the Companies) , wherein it lays down certain conditions which are meant to be met in order to receive approval for mergers in the telecom industry.

The guidelines provide that the entity must submit excess spectrum within one year from receiving the permissions. The guidelines permit the entities to sell excess spectrum to different telecom companies.

The merged entity can have up to fifty per cent spectrum holding in each band individually. However, the challenge faced by the merged entity was that they were breaching the spectrum cap 900MHz band . The obstacle, with the excess of market share, was that it had to be reduced to the prescribed limit within one year of receiving the approval.

Effect of the merger

The Vodafone idea merger was embraced by all the stakeholders but had its repercussions as well.

The merger took a toll on the employees of both companies. The employees were met with serious uncertainty. Somewhere, the companies failed to boost or maintain company morale. Vodafone – Idea had to let go of 5000 employees leading up to the merger. The employees who fell in the bottom quartile in the performance assessment were asked to leave the company. Other than that, there was a huge cultural difference that affected the remaining employees. The companies were different with respect to their salary levels and human resource processes. According to a few of the employees, the new structure which was adopted after the merger led to demotions. Many of the Idea employees who were asked to leave were accommodated in different companies under the Aditya Birla Group, but no such resort was given to the employees of Vodafone India.

The merger of Vodafone and Idea is a perfect example of a market that mostly benefits the customers. This deal released the telecom industry from the pressure of fierce prices and tariffs. The entry of Reliance Jio into the telecom industry had a huge impact. It cornered other companies to decrease their prices as Reliance Jio had launched free voice calling and data at discounted rates. The merger meant an increase in competition which means that the consumers will be paying less price. The merger increased their reach. It now collectively provides 4G services to a wider range. The assets were also combined with both the companies which meant better services, airwaves, and workforce. It also benefits the customer with better quality of network and expansion of the same across the country. The company can further invest in R&D to improve its services by providing innovative products. The company is now capable of providing better 4G and 5G network access to its consumers. Vodafone being a market lead in urban circles and Idea being a market lead in the rural circle, the synergy of both the companies will give them a stronghold in both the circles.

Other stakeholders

The merger left the telecom industry with only three players namely Bharti Airtel, Reliance Jio, and Vodafone Idea Ltd. Vodafone Idea Ltd. became the largest player with 35% of the market share worth INR 1.5 lakh crores. The telecom industry was amidst fierce price wars due to the entry of Reliance Jio. The price wars were affecting the revenues and profits of the telecom industry. The cost-cutting would benefit the government. It would also help in controlling the cut-throat competition in the industry, stabilizing the telecom industry in India.

Operations after the acquisition

While Vodafone and Idea had joint control over the appointment of the CEO and COO, Vodafone had exclusive rights to appoint the Chief Financial Officer (CFO). Giving Vodafone more financial rights.

Key management

Vodafone appointed Akshaya Moondra as the CFO. Both the companies jointly appointed Balesh Sharma as the CEO and Ambrish Jain as COO.

Board composition

The Board comprises twelve directors which will include six independent directors along with the chairman. Mr. Kumar Mangalam Birla was appointed as the chairman. The Board has equal representation from both companies.

The current status of Vodafone-Idea merger

In the month of September 2020, Vodafone – Idea rebranded itself. The company used the initials to rebrand itself as ‘ Vi ’. The rebranding took place after almost two years of the merger, however it shows the spirit of integration. The company in its statement said that the name ‘Vi’ is to be pronounced as ‘we’. The long-overdue rebranding was done to commemorate the final lapse of the merger. It marked the consolidation of the two companies after three years of merger talks and execution.

Rebranding created a lot of buzz over social media. The company in a statement said that the pronunciation of ‘Vi’ reflected the origin of the brands and the collective nature. There have been various advertisements of the ‘Vi’ across digital platforms. The announcement of the rebranding was however led by the Hon’ble Supreme Court of India directing Vodafone Idea to pay back government dues . Vodafone Idea owes approximately INR 504 billion. To pay off these debts, the company has to raise 3.41 billion dollars. The company plans to raise capital through a mix of debt and equity. It has received the required Board approval. It also plans to focus on joining the 5G service sector in India.

It can be concluded that the merger was needed in order to fight the competitive pricing policy taken up by Reliance Jio. The consumer is the most beneficial because of this merger as now all the telecom companies will try to bring in the best technology at the best price and with better customer service in order to maintain customer loyalty.

- https://www.vodafoneidea.com/content/dam/vodafone-microsite/docs/pdf/VIL%20Press%20Release%20-%2031st%20August.pdf

- https://www.adityabirla.com/about-us/downloads/Aditya-Birla-Group-Profile.pdf

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

https://t.me/joinchat/J_0YrBa4IBSHdpuTfQO_sA

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

RELATED ARTICLES MORE FROM AUTHOR

Understanding the role of finance law in mergers and acquisitions, mergers and acquisitions in indian banking sector, changing landscape of privacy and data security in m&a, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

How to Pass the Advocate-on-Record (AoR) Exam and Establish Your Supreme Court Practice

Register now

Thank you for registering with us, you made the right choice.

Congratulations! You have successfully registered for the webinar. See you there.

Are you looking for information about offers, devices or your account?

Please choose your local Vodafone website

- Tanzania (EN)

- Republiek van Suid-Afrika

Asia Pacific

- Česká Republika

- United Kingdom

- Deutschland

- Go to About

- Go to Who we are

- Go to Our purpose

- Empowering people

- Protecting the planet

- Maintaining trust

- Together we can

- Go to People and culture

- Workplace equality

- Domestic violence and abuse

- Fair Pay at Vodafone

- UK Gender Pay Gap

- Workplace safety

- Code of Conduct

- Go to Leadership

- Board of Directors

- Executive committee

- Board committees

- Go to What we do

- Go to Innovation

- Digital Transformation

- Artificial Intelligence

- Augmented Virtual Reality

- Go to Technology

- Open RAN – all you need to know

- Network as a Platform (NaaP)

- 5G – all you need to know

- Internet of things (IoT)

- Next Generation Network (NGN)

- Connected drones

- Go to Consumer products and services

- Broadband and Super WiFi

- V by Vodafone

- Devices – technical documentation

- Business products and services

- Go to Where we operate

- Vodafone in the Americas

- Go to Partner markets

- Partner Markets Stories

- Go to Vodafone Voice and Roaming Services

- Roaming Hub

- Travel Mobility

- Maritime Mobility

- Sponsored Roaming

- Managed Services

- IPX Services

- International Voice

- Privacy Policy

- Go to How we operate

- Go to Our strategy

- Europe consumer

- African technology leader

- Vodafone Business

- Go to Public Policy

- Shaping the future of connectivity

- Go to Suppliers

- Suppliers purpose overview

- Supplier ethics

- Policies and requirements

- Vodafone Procurement Company

- Vodafone Pass partner portal

- Supplier management help

- Vodafone Autonomous Procurement Platform

- Vodafone Business Product & Services IoT E2E Solutions

- Go to Consumer privacy and cyber security

- Data principles

- Privacy centre

- Cyber security

- Cost of living

- Go to Reporting centre

- Government assistance demands reporting

- Go to Tax and Economic Contribution

- Vodafone's tax principles and strategy

- Vodafone corporation tax

- Corporate responsibilities and obligations

- Vodafone, Luxembourg and tax havens

- Multinationals, governments and tax

- Tax and emerging markets

- Political and tax policy advocacy

- Sustainability reports

- Go to Sustainable Business

- Go to Empowering people

- Go to Closing the digital divide

- Increasing mobile Broadband Coverage

- Democratising access to connectivity

- Go to Empowering customers

- Supporting small businesses to digitalise

- Connecting people to financial services

- Supporting communities

- Go to Protecting the planet

- Tackling carbon emissions

- Enabling the green transition

- Promoting circularity

- Switch To Green

- Go to Maintaining trust

- Go to Human rights

- Managing human rights

- Our impacts

- Go to Handling government demands

- Challenges for operators

- Managing government demands

- Our principles and policies

- Go to Responsible supply chain

- How we manage our Supply Chain

- Engaging with our suppliers

- Go to Child rights and online safety

- Useful resources for child online safety

- Anti-bribery & corruption

- Go to Mobiles, masts and health

- Is 5G safe to use?

- Our commitments and goals

- Independent research

- How the technology works

- Health: the science and evidence

- Workplace Equality

- Our contribution to UN SDGs

- Sustainability Reporting

- Go to Categories

- Corporate and Financial

- Empowering People

- Protecting the Planet

- Public Policy

- Vodafone Foundation

- For Journalists

- Visual Assets

- Go to Campaigns & Events

- Vodafone’s Digital Enabler Showcase

- Mobile World Congress (MWC)

- Global Citizen: Our 2020 heroes

- Go to Investors

- Annual report 2024

- Go to Vodafone Business

- Large Enterprise

- Small and Medium Business

- Public Sector

- Carrier Services

- Go to Careers

- Go to Vodafone Foundation

- About Vodafone Foundation

- Go to Focus Areas

- Go to Apps against abuse

- SkillsUpload Europe

- Go to DreamLab

- Czech Republic

- Democratic Republic of the Congo

- Netherlands

- South Africa

- Employee Fundraising

- Girls and Mobile

- Instant Network Schools

- Instant Schools

- Vodafone Volunteers

Merger of Vodafone India and Idea: creating the largest telecoms operator in India

Key highlights

Vodafone to combine its subsidiary Vodafone India (excluding its 42% stake in Indus Towers) with Idea, which is listed on the Indian Stock Exchanges.

- Highly complementary combination will create India’s largest telecoms operator1 with the country’s widest mobile network and a strong commitment to deliver the Indian government’s ‘Digital India’ vision.

Sustained investment by the combined entity will accelerate the pan-India expansion of wireless broadband services using 4G/4G+/5G technologies, support the introduction of digital content and ‘Internet of Things’ (IoT) services as well as expand financial inclusion through mobile money services for the benefit of Indian consumers, businesses and society as a whole.

Merger of equals with joint control of the combined company between Vodafone and the Aditya Birla Group, governed by a shareholders’ agreement.

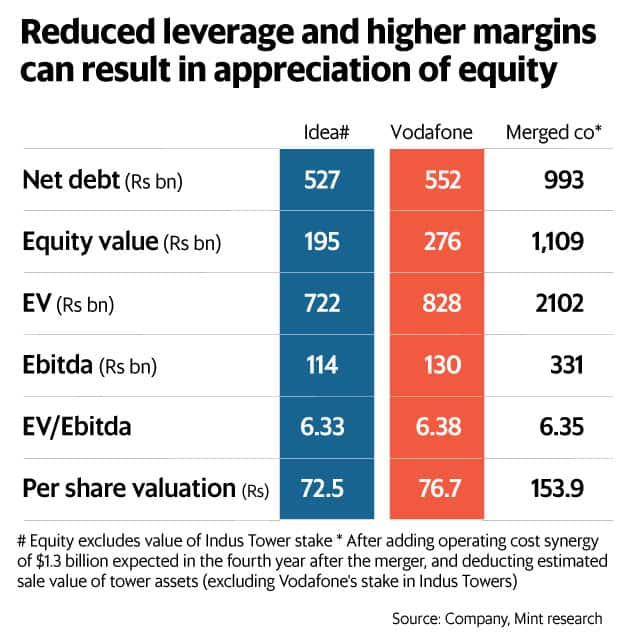

- The merger ratio is consistent with recommendations from the joint independent valuers. The implied enterprise value is INR828 billion (US$12.4 billion) for Vodafone India and INR722 billion (US$10.8 billion) for Idea excluding its stake in Indus Towers, valuing Vodafone India at 6.4x EV/LTM EBITDA and Idea excluding its stake in Indus Towers at 6.3x EV/LTM EBITDA2.

- Substantial cost and capex synergies with an estimated net present value of approximately INR670 billion (US$10.0 billion) after integration costs and spectrum liberalisation payments, with estimated run-rate savings of INR140 billion (US$2.1 billion) on an annual basis by the fourth full year post completion3.

Vodafone will own 45.1% of the combined company after transferring a stake of 4.9% to the Aditya Birla Group for circa INR39 billion (circa US$579 million) in cash concurrent with completion of the merger. The Aditya Birla Group will then own 26.0% and has the right to acquire more shares from Vodafone under an agreed mechanism with a view to equalising the shareholdings over time.

If Vodafone and the Aditya Birla Group’s shareholdings in the combined company are not equal after four years, Vodafone will sell down shares in the combined company to equalise its shareholding to that of the Aditya Birla Group over the following five-year period.

Until equalisation is achieved, the voting rights of the additional shares held by Vodafone will be restricted and votes will be exercised jointly under the terms of the shareholders’ agreement.

- Vodafone India will be deconsolidated by Vodafone on announcement and reported as a joint venture post- closing, reducing Vodafone Group net debt by approximately INR552 billion (US$8.2 billion) and lowering Vodafone Group leverage by around 0.3x Net Debt/EBITDA4. The transaction is expected to be accretive to Vodafone’s cash flow5 from the first full year post-completion.

The transaction is expected to close during calendar year 2018, subject to customary approvals.

Highly complementary combination will create India’s largest telecoms operator 1 with the country’s widest mobile network and a strong commitment to deliver the Indian government’s ‘Digital India’ vision.

The merger ratio is consistent with recommendations from the joint independent valuers. The implied enterprise value is INR828 billion (US$12.4 billion) for Vodafone India and INR722 billion (US$10.8 billion) for Idea excluding its stake in Indus Towers, valuing Vodafone India at 6.4x EV/LTM EBITDA and Idea excluding its stake in Indus Towers at 6.3x EV/LTM EBITDA 2 .

Substantial cost and capex synergies with an estimated net present value of approximately INR670 billion (US$10.0 billion) after integration costs and spectrum liberalisation payments, with estimated run-rate savings of INR140 billion (US$2.1 billion) on an annual basis by the fourth full year post completion 3 .

Vodafone India will be deconsolidated by Vodafone on announcement and reported as a joint venture post- closing, reducing Vodafone Group net debt by approximately INR552 billion (US$8.2 billion) and lowering Vodafone Group leverage by around 0.3x Net Debt/EBITDA 4 . The transaction is expected to be accretive to Vodafone’s cash flow 5 from the first full year post-completion.

Aditya Birla Group Chairman, Kumar Mangalam Birla, said:

“Throughout its history, the Aditya Birla Group has been synonymous with the task of nation building and driving inclusive growth in the country. This landmark combination will enable the Aditya Birla Group to create a high quality digital infrastructure that will transition the Indian population towards a digital lifestyle and make the Government’s Digital India vision a reality. For Idea shareholders and lenders who have supported us thus far, this transaction is highly accretive, and Idea and Vodafone will together create a very valuable company given our complementary strengths.”

Vodafone Group Plc Chief Executive, Vittorio Colao said:

“The combination of Vodafone India and Idea will create a new champion of Digital India founded with a long-term commitment and vision to bring world-class 4G networks to villages, towns and cities across India. The combined company will have the scale required to ensure sustainable consumer choice in a competitive market and to expand new technologies – such as mobile money services – that have the potential to transform daily life for every Indian. We look forward to working with the Aditya Birla Group to create value for all stakeholders.”

For further information

Vodafone Group, Media Relations www.vodafone.com/media/contact

Investor Relations Telephone: +44 (0) 7919 990 230

Idea Cellular Limited Tel: +91 22 95940 03439

Investor Relations email: [email protected]

About Vodafone Group

Vodafone is one of the world’s largest telecommunications companies and provides a range of services including voice, messaging, data and fixed communications. Vodafone has mobile operations in 26 countries, partners with mobile networks in 49 more, and fixed broadband operations in 17 markets. As of 31 December 2016, Vodafone had 470 million mobile customers and 14.3 million fixed broadband customers. For more information, please visit: www.vodafone.com

- Mergers and Acquisitions

- Press Release

More stories

No results found

- Cost of living

- HR Most Influential

- HR Excellence Awards

- Advertising

Search menu

Peter Crush

View articles

Global case study: Vodafone's comms strategy

Vodafone wanted to make its internal communications two-way, less siloed, and more accessible for all employees. On top of this it needed to be at a global level too

The organisation

A decade ago British-based multinational telecoms giant Vodafone was infamously known as the business that issued one of the biggest pre-tax losses in corporate history (£13.5 billon, or £37 million per day). The past 12 months haven’t exactly been easy either. Last Autumn it reported a €7.8 billion loss for the first half of the 2019 financial year due to the merger of Vodafone India with Idea Cellular. Meanwhile Q3 revenues fell £0.8 billion after adopting the new International Financial Reporting Standard IFRS 15.

Having grown to become the world’s fourth largest telco by number of mobile customers (it operates networks in 25 countries, has partner networks in a further 47 and has 100,000-plus staff worldwide), Vodafone’s internal story is ever-changing. Recently, for example, it announced it would extend its existing network-sharing agreement with Telefónica O2 in the UK to include 5G services.

The challenge

“We’re a communications-based business, but what we were increasingly finding was that making connections and increasing engagement with our own people could be significantly improved,” recalls Tahni Morrison, Vodafone’s global digital communications manager. In 2017 she began exploring options for how this could be done at a global level.

She says: “Although we had an existing internal communications infrastructure – notably our intranet where people could see the same information across a given country – we felt it was quite one-way. It was also very siloed, and the real issue was that not everyone was as up to date as each other; especially our retail staff who do not have access to their own desktop PC.

“What was clear was that we needed to bring new technology into play – something that would bring with it a new mindset, where communication could also be two way,” she adds.

The strategy

With Vodafone not wanting to design a solution itself, Morrison decided to canvass the HR technology market. She selected workforce communications platform SocialChorus to be rolled out across 25 markets. Respective internal comms country heads were involved at the start of the process, and as each phase was rolled out.

For HR and internal communications administrators there are dashboards that show open and click-through rates for pushed content. At the employee level the solution exists as an app that staff have on either their work or personal mobile phones/devices (or both). The app carries both local and global content.

“The amount of content we have to push out has always been quite high – we aim for a minimum of three pieces per day, sometimes more. Which can add up to about 300 to 500 pieces per month. But rather than reduce content because we didn’t think people were seeing it, we decided to stick with our comms output but make what we communicated as visible to people as possible.”

So when a piece of content arrives staff see it on the app like a text message, with a number in the corner of the app icon to indicate there is an unread message. This disappears as soon as it’s opened.

“Although it’s a UK-run project, prior to rollout we got all of the heads of internal communications together to consult on it, and come up with a plan to promote it back in their own countries,” says Morrison. “We launched it locally in waves from September 2017. Desk employees also have it as their launch page when they turn their PCs on each day, along with a few other of their work widgets and personalised news feeds.”

According to Morrison, not only are frequency targets of daily, weekly and monthly communications still being met, but there are also a host of background metrics available to gauge the penetration of communications.

“Thanks to what we believe is a more engaging way to hear from us, 65% of our employees globally are consuming our messages each month, although in certain other countries – particularly Greece – it’s much higher, at 95%. The global average for click-through rates on featured content is around 20%,” says Morrison. “This is a significant improvement on before, where the figure was around 2%.”

Thanks to additional behind-the-scenes data-processing and AI modelling, another strength is the ability to use analytics on existing open rates and use this as the basis for predicting the likely response certain topics will generate. Morrison confirms Vodafone is currently looking at how this can be used to plan future communications. “If we start seeing certain trends we can begin pushing more of what people are most interested in,” she says.

So far in the UK distribution of content has been line manager-driven. But the success of more two-way communications in Greece for example (where the rules are different, and user-generated content is allowed) has meant plans are afoot to extend the facility for staff-driven content here too.

“In Greece 20% of content is now user-generated,” explains Morrison. For the time being desktop users still see communications default to their login page. But over time, and as portable devices become more common, Morrison anticipates more interaction with communications on the move.

“We’ve already noticed people engage with content while they’re commuting,” she says. “Interestingly we also see spikes in readership and open rates at the weekend, and early morning and early evening. If this is when people want to read stuff we have to be wise to it. The whole point of good internal communication is keeping it regular and for reading it to be habitual.”

Further reading

International case study: Digitalising L&D at Faurecia

Case study: Mental health support led by the individual

International case study: Unilever's internal project platform

International case study: Building resilient leaders at MVF Global

Case study: Global mobility at Specsavers

International Case Study: GfK SE revamps learning platform

Case study: Engagement on a budget

Case study: Superdrug's Everyone Matters D&I strategy

- Tata Steel share price

- 178.95 4.04%

- Wipro share price

- 484.45 5.09%

- ITC share price

- 439.10 0.76%

- State Bank Of India share price

- 829.90 1.59%

- Power Grid Corporation Of India share price

- 309.35 2.95%

The rationale behind Idea-Vodafone merger in five charts

The merger of idea cellular and vodafone holds the potential for significant cost savings and 3g/4g spectrum gaincrucial in market share battle against reliance jio and airtel.

The success of the mega merger between Idea Cellular Ltd and Vodafone India Ltd depends largely on synergy benefits that can accrue by combining operations. Not surprisingly, the two companies are factoring in huge gains on this count.

Vodafone and Idea said in a statement that annual savings, both in terms of operating costs as well as capital expenditure, will be around Rs14,000 crore annually by the fourth full year of operations as a combined entity. About two-thirds of this will be on account of savings in operating costs. The net present value of total savings (opex and capex) is estimated at Rs70,000 crore ($10.5 billion).

Opex and capex are short for operating expenditure and capital expenditure, respectively.

Reliance Jio not main reason for merger of Idea Cellular, Vodafone: Vittorio Colao

While merging companies are typically quite sanguine about synergy benefits, most analysts agree that the Vodafone-Idea merger holds the potential for significant cost savings. With a larger scale and elimination of duplicate costs, margins can rise substantially. However, with the two companies announcing that Vodafone and Idea will exist as separate brands, some analysts are questioning the expected gains from synergies.

Idea and Vodafone individually operate at an EBITDA margin of around 30%, far lower than Bharti Airtel Ltd’s margin of around 40% and Reliance Jio Infocomm Ltd’s targeted margins of 50%.

Ebitda stands for earnings before interest, tax, depreciation and amortization.

On their own, Vodafone and Idea’s holdings of 3G and 4G spectrum was far lower than that acquired by Airtel and Reliance Jio. This also inhibited their ability to compete effectively, given the shift towards increased data usage by customers. Coming together will enable Idea and Vodafone to operate in the same league, as far as spectrum footprint goes.

The combined entity will also be either the largest cellular services operator in prominent circles, or a very strong No. 2. In a couple of circles, it will upstage Bharti Airtel as the number one operator, while in some other ‘A’ and ‘B’ circles, it will graduate to a strong No. 2. It remains to be seen if the combined entity will retain a half-hearted presence in the relatively smaller ‘C’ circles, or whether it will up the ante and aim for a strong pan-India focus.

Vodafone’s Indian escape act is heavy on the contortions

Nevertheless, a stronger market share in the majority of circles will also result in better efficiency. One of the reasons margins are relatively lower at both Idea and Vodafone is that these companies run EBITDA losses in some circles where market share is sub-optimal.

The merger will also result in a sharp fall in leverage. Idea and Vodafone expect the net debt/Ebitda for the combined entity to fall from around 4.4 times to around 3 times. This will be aided by asset sales—both companies intend to sell their tower assets and reduce debt. Besides, capex synergies will contain debt to some extent in the future. In addition, opex synergies will result in higher profits.

On a standalone basis, analysts at JM Financial Institutional Securities Ltd had forecast Idea’s net Debt/Ebitda ratio to reach around 5.5 times by end March 2017. In contrast, the forecast 3 times net Debt/Ebitda ratio for the combined entity is far lower.

With synergy benefits expected to result in higher profits and leverage expected to reduce, the combined entity’s equity valuation is estimated to soar, as the chart below shows.

For the deal, the two companies have been valued at around 6.35 times enterprise value/Ebitda. Even if we were to assume similar valuations for the combined entity, the estimated increase in Ebitda itself will result in a huge jump in enterprise value. And with debt expected to reduce, equity shareholders are likely to gain.

Merger with Idea Cellular signals Vodafone’s shrinking interest in India