The effect of credit risk management and bank-specific factors on the financial performance of the South Asian commercial banks

Asian Journal of Accounting Research

ISSN : 2459-9700

Article publication date: 14 October 2021

Issue publication date: 27 May 2022

Among all of the world's continents, Asia is the most important continent and contributes 60% of world growth but facing the serving issue of high nonperforming loans (NPLs). Therefore, the current study aims to capture the effect of credit risk management and bank-specific factors on South Asian commercial banks' financial performance (FP). The credit risk measures used in this study were NPLs and capital adequacy ratio (CAR), while cost-efficiency ratio (CER), average lending rate (ALR) and liquidity ratio (LR) were used as bank-specific factors. On the other hand, return on equity (ROE) and return on the asset (ROA) were taken as a measure of FP.

Design/methodology/approach

Secondary data were collected from 19 commercial banks (10 commercial banks from Pakistan and 9 commercial banks from India) in the country for a period of 10 years from 2009 to 2018. The generalized method of moment (GMM) is used for the coefficient estimation to overcome the effects of some endogenous variables.

The results indicated that NPLs, CER and LR have significantly negatively related to FP (ROA and ROE), while CAR and ALR have significantly positively related to the FP of the Asian commercial banks.

Practical implications

The current study result recommends that policymakers of Asian countries should create a strong financial environment by implementing that monetary policy that stimulates interest rates in this way that automatically helps to lower down the high ratio of NPLs (tied monitoring system). Liquidity position should be well maintained so that even in a high competition environment, the commercial is able to survive in that environment.

Originality/value

The present paper contributes to the prevailing literature that this is a comparison study between developed and developing countries of Asia that is a unique comparison because the study targets only one region and then on the basis of income, the results of this study are compared. Moreover, the contribution of the study is to include some accounting-based measures and market-based measures of the FP of commercial banks at a time.

- South Asian countries

Credit risk

Bank-specific factors.

- Generalized method of moment

Siddique, A. , Khan, M.A. and Khan, Z. (2022), "The effect of credit risk management and bank-specific factors on the financial performance of the South Asian commercial banks", Asian Journal of Accounting Research , Vol. 7 No. 2, pp. 182-194. https://doi.org/10.1108/AJAR-08-2020-0071

Emerald Publishing Limited

Copyright © 2021, Asima Siddique, Muhammad Asif Khan and Zeeshan Khan

Published in Asian Journal of Accounting Research . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

Introduction

Around the globe, depository institutions perform a crucial job in bringing financial stability and economic growth by mobilizing monetary resources across multiple regions ( Accornero et al. , 2018 ). The commercial plays an intermediary role by collecting the excessive amount from savers and issuing loans to the borrowers. In return, banks can earn a high interest rate ( Khan et al. , 2020 ; Ghosh, 2015 ). Banks tried to increase their financial performance (FP) by issuing loans while playing their intermediary role; banks have a high chance of facing credit risk. Accornero et al. (2018) found that the country's banking industry mostly collapses due to high credit risk. Sometimes, it leads to the failures of the whole financial system. Credit risk is expected to be arises when a borrower cannot meet their obligation about future cash flows. Commercial banks' FP is affected by two factors: one is external and the other is internal. Bank-specific factors are internal and able to control factors of the commercial banks. Ofori-Abebrese et al. (2016) pointed out that adverse selection and moral hazards were created due to mismanagement of internal factors. The abovementioned financial problems are turmoil period in the banking/financial sector.

Among the entire continent of the world, Asia is the most crucial continent and contributing 60% of world growth but facing the serving issue of high nonperforming loans (NPLs). It is well known that a high ratio of NPLs weakens the economy or country's financial position. The growth level in South Asia was the highest in 2015, and the ratio is 9.3%, which is the highest among all continents. According to the Asian Development Bank (2019), the NPLs in the south are approximately $518bn, which is relatively high compared to previous years. The soaring of NPLs in South Asian countries enforces a massive burden on commercial banks' financial position (mainly banks' lending process effected). The massive increase in NPL is observed after the global financial crisis (2007–2008). According to Masood and Ashraf (2012) , the credit risk high ratio of NPLs is the main reason for most of the financial crisis because NPLs alarmingly high during the Asian currency crisis in 1997 and subprime crises in 2007, and some loans are declared bad debts. The alarmingly high ratio of NPL resulted in an increasing depression in the financial market, unemployment and a slowdown of the intermediary process of banks (see Figure 1 ).

The World Bank statistics of different regions show that NPLs exist in almost all regions. Still, the ratio of NPLs is relatively high in the South Asian area compared to other regions. Therefore, the study is conducted in South Asia. Two proxies of credit risk are used in this study: NPLs and capital adequacy ratio (CAR). Moreover, the study also incorporates bank-specific factors to increase FP.

Various studies ( Louzis et al. , 2012 ; Ofori-Abebrese et al. , 2016 ; Hassan et al. , 2019 ) are conducted to address the issue, but literature shows that the results of these studies are inconclusive and also ignore the most important region of South Asia. Therefore, the study objective is to investigate that credit risk and banks specific factors affect FP of commercial banks in Asia or not? We have selected two from South Asia, Pakistan and India, as sample countries. In 2019, the NPLs were 13% and 10% in Pakistan and India, respectively. This ratio is relatively high as compared to the other countries of the world. Due to these reasons, we have mainly selected India and Pakistan from South Asian countries ( Siddique et al. , 2020 ). The present study uses secondary panel data set of 19 commercial banks from 2009 to 2018.

Two serious threats may exist: The first is autocorrelation and the second is endogeneity. If the data do not meet these CLRM assumptions, then the regression results are not best linear unbiased prediction (BLUE) ( Sekaran, 2006 ; Kusietal, 2017 ). And in this situation, apply pooled regression is applied, and then the results were biased because the coefficient results cannot give accurate meaning. After all, pool regression ignores year and cross section-wise variation. Therefore, in this study, an instrumental regression can be used that handle all these issues. Generalized method of moments (GMM) is used to analyze the data to overcome endogeneity. Our study is unique by addressing the autocorrelation and endogeneity issue at a time. Our study results show that credit risk measure NPLs decrease the FP due to having negative relation, while CAR has a positive relation with South Asian banks’ FP. The remainder of the research study is organized as follows: Section 2 consists of a detailed literature review; Section 3 consists of data and methodology. Sections 4 contains information about finding and suggestions. Finally, Section 5 discusses the conclusion.

Literature review

The Literature Review has mainly divided into two crucial sections; First part consists of the literature review related to credit risk and FP. The other part is related to the literature review of bank-specific variables and FP. In the hypothesis development, we have used commercial banks' profitability that represents the FP of commercial banks.

Credit risk and financial performance

While operating in the banking industry, three categories of risks that the bank has to face include environmental, financial and operational risks. Banks generate their incomes by issuing a massive amount of credit to borrowers. Still, this activity involves a significant amount of credit risk. When borrowers of the banking sector default cannot meet their debt obligation on time, it is called credit risk ( Accornero et al. , 2018 ). When there is a large amount of loan defaulter, then it adversely affects the profitability of the banking sector. Berger and DeYoung (1997) pointed out that the absence of effective credit risk management would lead to the incidence of banking turmoil and even the financial crisis. Siddique et al. (2020) explain that NPLs are related to information asymmetric theory, principal agency theory and credit default theory. When asymmetric information unequal distribution of information of high NPLs is spread, there is a chance that banks or financial declared bankrupt. According to Pickson and Opare (2016), the principal agency must separate corporate ownership from managerial interest. Because each management has its interest, they want more prestige, pay increment and want the stock options for management. Effective management of credit risk or nonperformance exposure in the banking sectors increases profitability. It enhances the development of banking sectors by adequate allotment of working capital in the economy ( Ghosh, 2015 ).

There is a growing literature ( Louzis et al. , 2012 ) on credit risk and its empirical relationship with the monetary benefits of the banking sector. Ekinci and Poyra (2019) investigate the relationship between credit risk and profitability of deposit banks in Turkey. The data sample used 26 commercial banks from 2005 to 2017. All data of this study are secondary and collected from annual reports of commercial Turkey banks. The proxies of profitability were taken as return on equity (ROE) and return on the asset (ROA), while NPLs of commercial banks were used as a proxy to measure credit risk. The research paper reveals that credit risk and ROA are negatively correlated as well as the relation between credit risk and ROE is also significantly negative relation. Therefore, the study suggests that the Turkey government tightly monitors and controls the alarmingly soaring ratio of NPLs. Upper management introduced some new measures to trim the credit risk.

There is a negative and significant relationship between NPLs and commercial banks' FP.

There is a positive and significant relationship between capital adequacy ratio and commercial banks' FP.

Bank-specific variables and financial performance

Bank-specific variables or internal factors are the product of business activity. Diversifiable risk is associated with these factors ( Louzis et al. , 2012 ) and can be reduced by efficient management. This risk is controllable compared to an external factor, which cannot be diversified because this risk is market risk ( Ghosh, 2015 ; Rachman et al. , 2018 ). If a firm can manage its internal factor effectively, then the firm can be high profitability, while, on the other hand, these factors are mismanaged. It would adversely affect the firm's balance sheet and income statement ( Ofori-Abebrese et al. , 2016 ). Different authors ( Akhtar et al. , 2011 ; Louzis et al. , 2012 ; Chimkono et al. , 2016 ; Hamza, 2017 ) discuss different bank-specific variables and firm performance in their studies. The bank-specific variables used in this study are cost-efficiency ratio (CER), average lending rate (ALR) and liquidity ratio (LR). Aspal et al. (2019) used two types of factors (macro and bank-specific factors) and inspected their connection with the FP of the commercial bank in India. Gross domestic product (GDP) and inflation are used as proxies of macroeconomic factors.

In contrast, a bank-specific variables’ proxy includes capital adequacy ratio, asset quality, management efficiency, liquidity and earnings quality. Data of 20 private banks have been used from 2008 to 2014. The panel data pointed out that one macroeconomic factor is significant (GDP), and another factor (Inflation) is insignificant. All bank's specific factors (earning quality, asset quality, management efficiency and liquidity) significantly affect the FP except the CAR (insignificant). Hasanov et al. (2018) conducted their study to explore the nature of the interrelation between bank-specific (BS) and macroeconomic determinants with the banking performance of Azerbaijan (oil-dependent economy). The study used the GMM to analyze the panel data set. The results show that bank loans, size, capital and some macro factors (inflation, oil prices) were positive and significantly interconnection with the FP of banks; on the other hand, liquidity risk, deposits and exchange rates are significantly affected negatively bonded with the FP.

There is a negative and significant relationship between the CER and commercial banks' FP.

There is a positive and significant relationship between the ALR and commercial banks' FP.

Francis et al. (2015) define liquidity in their study and, according to the liquidity of an asset, determined by how quickly this asset can be converted or transferred into cash. Liquidity is used to fulfill the short-term liabilities rather than the long term ( Siddique et al. , 2020 ; Raphael, 2013 ). Adebayo et al. (2011) mentioned in their study that when banks are unable to pay the required amount to their customers, it is considered bank failure. Sometimes liquidity risk affects the whole financial system of a country. Different studies are conducted on the issue of liquidity and performance, but different studies show different results. FP and liquidity, on the other hand, a chunk of studies ( Francis et al. , 2015 ; Hamza, 2017 ) revealed significant negative tie-up between liquidity and FP, while some other studies pointed out that there is no significant relationship between liquidity and FP. Therefore, the studies show a contradictory result, so the current study takes the bank-specific measures (LR, ALR study and CER) and checks its interconnection with commercial banks' FP.

There is a positive and significant relationship between the LR and commercial banks' FP.

Data and methodology

Our current study has one problem variable, financial performance (FP), while regressors variables are credit risk and bank-specific variables. Our model is consistent with Chimkono et al. (2016) , where ROA and ROE will be used as a measure of FP, while credit risk will be measured by NPL ratio, CAR and three specific variables: CER, LR and ALR.

Various studies ( Hamza, 2017 ; Belas, 2018 ) emphasize some macro and micro variables that need to be controlled when measuring FP because these factors are the influential factors. Three control variables: size of the bank, age of the banks and Inflation are used in this study and shown as yes in the tables. We have chosen these three control and most relevant variables because these variables represent both micro and economic situations. Data have been collected from two South Asian countries Pakistan and India. The nature of data is panel data and the number of banks from Pakistan (10 commercial banks) and India (9 commercial banks) is 19. The data have been collected from bank financial statements throughout 2009 to 2018, so the data of this study are a panel in nature. The final number of observations is 190 (19*10 = 190) for the analysis of this study (see Table 1 ).

Operational definition

The probability of lenders being the default, high credit risk higher FP of banks ( Louzis et al. , 2012 ).

Bank-specific factors are those which are under the control of the management of commercial banks ( Chimkono et al. , 2016 ).

Nonperforming loans

A loan becomes nonperforming when the duration of the loan has been passed, and after that duration, banks 90 days are passed unable to receive the principal amount of loan and interest payment ( Hamza, 2017 ).

Methodology

The current study investigates the interrelationship between credit risk, bank-specific factors and FP. Panel data set is used in our study, and two serious threats usually faced when using panel data set: (1) autocorrelation and (2) endogeneity. For this purpose, a GMM can be used. GMM model has many advantages on simple ordinary least square regression. And when in any study GMM model applies, it allows by adding the fixed effect model; this model can be able to tackle the problem of heterogeneity, and it also removes the problem of endogeneity by introducing some instrumental variables.

Model specification

The regression model is as follows:.

γ 0 = intercept; γ 1 - γ 8 = estimated coefficient of independent variables and control variables.

ε it represents error terms for those variables that are omitted or added intentionally/unintentionally.

According to Lassoued (2018) , panel data regression has two significant problems: autocorrelation and endogeneity, and this problem is existed due to the fixed effect. Therefore, our study checked the basic two assumptions of ordinary least squares.

Testing for autocorrelation

The fifth assumption of CLRM is that data should be free from autocorrelation. Sekaran (2006) pointed out the relationship between two different error terms should be zero; it means that there is no autocorrelation between error terms. There are different tests for testing autocorrelation, but the Wooldridge test is used in the present paper to test the autocorrelation.

Table 2 shows that the p -value of the Wooldridge test result is zero, so it means that all p -values are less than 0.05. It means that reject the null hypothesis. And the null hypothesis is that our data have no autocorrelation, but the results show that our data have autocorrelation problems.

Testing for endogeneity

The seventh assumption of CLRM is that data have no issue of endogeneity. Sekaran (2006) found that the relationship between the error term and explanatory or independent variable should be zero. If this relationship is not zero, then the problem of endogeneity exists. Brooks (2014) pointed out that Hausman test results probabilities can be used to test the endogeneity, and the null hypothesis of this test is that errors are uncorrelated. He also pointed out that if the probabilities are more than 0.10, then accept the null hypothesis. It means that there is no problem of endogeneity, and if the values are less than 0.1, then our data have the problem of endogeneity. Appendix 1 shows that some values of the Hausman test are less than 0.10, so it means that data have the problem of endogeneity. Our panel data results prove that our data have the problem of autocorrelation and endogeneity. Some CLRM model assumptions are not met, so ordinary least square regression results are not BLUE. And GMM model can be applied to any study because this model can be able to tackle the problem of autocorrelation, and it also removes the problem of endogeneity by introducing some instrumental variables.

Findings and discussion

The present research paper provides empirical evidence on the interconnection between credit risk and bank-specific/internal factors on FP commercial banks. To analyze the data set, first, the study applies the descriptive analysis to identify the big picture of the data, then the correlation section and at the end, regression results are discussed. Table 3 presents the descriptive statistics of the all variables used in the study: credit risk indicator which are the ratio of NPL, CAR; indicators of bank-specific factors (CER, ALR, LR); some control variables SIZE, AGE, INF and the measure of FP: ROA, ROE. The mean value of ROA and ROE is 0.986 and 7.964 with a standard deviation of 1.905 and 39.175, respectively, which shows that ROE has much higher variation than ROA. The standard deviation of NPL is 9.659, which is double that of CAR, whose standard deviation is 4.183 among all bank-specific factors (see Table 4 ).

Factor (CER, ALR, LR) LR has high dispersion (14.177) because there is a remarkable difference between minimum 25.027 and maximum value (107.179) of LR. ROA has 0.986 with a range between 10.408 and −6.234 with a standard deviation of 1.905, and it shows that there is a low level of dispersion in developed countries. The dispersion of ROE 39.175 is highest among all other variables, which means that some outliers exist in the ROE variable.

Correlation analysis is used to check the linear relationship between the two explanatory variables ( Brooks, 2014 ). If the sample size of any approaches to 100, greater than 100 and the correlation coefficient is 0.20, then the correlation is significant at 5% ( Lassoued, 2018 ). Most of the variables in the current study are significant at 5%.NPLs, and CER loans are negatively correlated with almost all independent variables, which supports the literature point that NPLs and CER are negatively associated with FP and bank-specific factors. The negative correlation of NPLs with ROE is loan −0.378, and this correlation is high as compared to other countries. At the same time, all bank-specific factors, CER, ALR and LR are mostly positively correlated with most of the other, almost all dependent and independent variables, while AGE and INF are mostly negatively correlated with the other variables of the study.

Regression results and discussion

Tables 5 and 6 have shown the regression results of pooled regression and GMM models. Tables include all independent, control variable coefficients, t -statistics, standard error and probability values. Additionally, tables have the values of R 2 , adjusted R 2 and Durbin Watson statistics. The adjusted R 2 under pooled regression are 0.250 and 0.231 in both models (ROA and ROE). While adjusted R 2 under the GMM are 0.358 and 0.249 in both models ROA and ROE.

It means the GMM more and better explains our model than pooled regression. Moreover, we also apply a Hausman test on both models. The p -value of both models is less than 0.05, so our data have the problem of endogeneity null hypothesis. To eliminate the endogeneity issue, the GMM coefficient was measured.

NPL has a significant and negative measure of FP: ROA and ROE. In contrast, CAR has significant and positive with all proxies of FP: ROE and ROA, which supports H1 and H2 of the paper. Our finding is consistent with Masood and Ashraf (2012) who conducted their study on credit risk and FP and found a significant negative relationship between NPL and FP, so NPLs hinder banks' profitability. Therefore, NPLs affect the whole financial system of a country especially in developing countries. The findings of CAR matched with Accornero et al. ’s (2018) study and pointed out that CAR has a significantly positive link with FP. CER has a significant negative relationship with ROA and ROE, which is consistent with the study of Francis et al. (2015) who pointed out a significant negative relationship between CER and ROE. Therefore, banks need to adapt strategies to control these costs and tried to increase their profitability. ALR had a significant and positive relationship with both measures of FP. ALR is significant at 1% with ROA and 10% significant with ROE. The result is supported by the study of Chimkono et al. (2016) who found a positive relationship between the ALR and FP of commercial banks.

LR has a significantly negative relationship with ROA and ROE. This finding is consistent with Siddique et al. (2020) who pointed out a significant negative relationship between LR and ROE; the more liquidity is maintained, the lesser the profitability level. In short, most of the independent variables are significant at 5% and 1%, and control variables are also significant in both models size of the bank and inflation except AGE. This result is matched with Ghenimi et al. ’s (2017) findings that prove that total assets or investment increment are directly proportional to the FP. Both variables of credit risk NPL and CAR are significant with the FP of commercial banks in both models. Banks try to reduce bank-specific factors risk, and by doing so, ultimately the amount of bad debt decreased, and another benefit is that it also reduces the amount of loan loss provision.

The current study empirically investigates the causal interrelation between credit risk, bank-specific factors and FP of commercial banks in two South Asian countries (Pakistan and India). The study's finding suggests that managers in South Asian countries should be focused on increasing capital adequacy to enhance the monetary gain (FP) while for the contraction of NPLs by implementing modern techniques and strategies for credit risk (NPLs) management. One indicator of the bank-specific variable (ALR) has a significant and positive interrelation with the FP of commercial banks. In contrast, CER and LR have a significant and positive relationship with the FP of commercial banks of South Asia. Control variables of the study (size of the bank and inflation) are also significant in both models except AGE. There are several policy implications that commercial banks of South Asian countries should be followed. NPLs are soaring due to the following reasons: less supervision and monitoring of customers, the problem of the market and lack of customer knowledge related to loans. Bank management should be efficient in judging that their customers have viable means of repayment or not. Moreover, banks can offer expert opinion to the professional loan take on feasible techniques of efficiently endow the borrowing to secure the required return on total firms investment is acquired. Liquidity position should be well maintained so that even in a high competition environment, the commercial can survive in that environment.

The scope of the study is only limited to commercial banks, but this model can also be applied to Islamic banks. And future researchers can also apply this model to a comparison-based study of commercial and Islamic banks. Data of this study have been collected only from 19 banks; future research can also increase the number of banks and increase the number of years to conduct their study. And if the number of banks and the number of the year increased, the results are a more reliable and accurate representation of the population. The data of this study have been taken only from two countries of South Asia, but this study can be extended by adding more countries in Asia. When we add the number of countries, the results are a better and accurate representation of developing and developed countries of Asia. This model can also be applied to some other continents because the macro environment and bank-specific factors are pretty different from continent to continent Appendix A1 .

NPLs-continent wise

Summary of explanatory variables and dependent variables

Results for autocorrelation for South Asia countries

Descriptive statistics

Correlation figures

ROA model (pooled regression and fixed effect GMM result)

Extra tables and figures in the Google drop box and available at: https://www.dropbox.com/sh/dro0gkowf3t542r/AAC3QQ5lKQTpLdke7UNxRUEea?dl=0

Accornero , M. , Cascarino , G. , Felici , R. , Parlapiano , F. and Sorrentino , A.M. ( 2018 ), “ Credit risk in banks' exposures to non-financial firms ”, European Financial Management , Vol. 24 No. 5 , pp. 775 - 791 .

Adebayo , M. , Adeyanju , D. and Olabode , S. ( 2011 ), “ Liquidity management and commercial banks' profitability in Nigeria ”, Research Journal of Finance and Accounting , Vol. 2 No. 8 .

Akhtar , M.F. , Ali , K. and Sadaqat , S. ( 2011 ), “ Factors influencing the profitability of Islamic banks of Pakistan ”, International Research Journal of Finance and Economics , Vol. 66 , pp. 125 - 132 .

Aspal , P.K. , Dhawan , S. and Nazneen , A. ( 2019 ), “ Significance of bank specific and macroeconomic determinants on performance of Indian private sector banks ”, International Journal of Economics and Financial Issues , Vol. 9 No. 2 , p. 168 .

Belas , J. , Smrcka , L. , Gavurova , B. and Dvorsky , J. ( 2018 ), “ The impact of social and economic factors in the credit risk management of SME ”, Technological and Economic Development of Economy , Vol. 24 No. 3 , pp. 1215 - 1230 .

Berger , A.N. and DeYoung , R. ( 1997 ), “ Problem loans and cost efficiency in commercial banks ”, Journal of Banking and Finance , Vol. 21 , pp. 849 - 870 .

Blum , J. and Hellwig , M. ( 1995 ), “ The macroeconomic implications of capital adequacy requirements for banks ”, European Economic Review , pp. 739 - 749 .

Brooks , C. ( 2014 ), Introductory Econometrics for Finance , Cambridge University Press .

Chimkono , E.E. , Muturi , W. and Njeru , A. ( 2016 ), “ Effect of non-performing loans and other factors on performance of commercial banks in Malawi ”, International Journal of Economics, Commerce and Management , Vol. IV , pp. 1 - 15 .

Ekinci , R. and Poyraz , G. ( 2019 ), “ The effect of credit risk on financial performance of deposit banks in Turkey ”, Procedia Computer Science , Vol. 158 , pp. 979 - 987 .

Francis , B.B. , Hasan , I. , Song , L. and Yeung , B. ( 2015 ), “ What determines bank-specific variations in bank stock returns? Global evidence ”, Journal of Financial Intermediation , Vol. 24 No. 3 , pp. 312 - 324 .

Ghenimi , A. , Chaibi , H. and Omri , M.A.B. ( 2017 ), “ The effects of liquidity risk and credit risk on bank stability: evidence from the MENA region ”, Borsa Istanbul Review , Vol. 17 No. 4 , pp. 238 - 248 .

Ghosh , A. ( 2015 ), “ Banking-industry specific and regional economic determinants of non-performing loans: evidence from US states ”, Journal of Financial Stability , Vol. 20 , pp. 93 - 104 .

Hamza , S.M. ( 2017 ), “ Impact of credit risk management on banks performance: a case study in Pakistan banks ”, European Journal of Business and Management , Vol. 9 No. 1 , pp. 57 - 64 .

Hasanov , F. , Bayramli , N. and Al-Musehel , N. ( 2018 ), “ Bank-specific and macroeconomic determinants of bank profitability: evidence from an oil-dependent economy ”, International Journal of Financial Studies , Vol. 6 No. 3 , p. 78 .

Hassan , M.K. , Khan , A. and Paltrinieri , A. ( 2019 ), “ Liquidity risk, credit risk and stability in Islamic and conventional banks ”, Research in International Business and Finance , Vol. 48 , pp. 17 - 31 .

Khan , M.A. , Siddique , A. and Sarwar , Z. ( 2020 ), “ Determinants of non-performing loans in the banking sector in developing state ”, Asian Journal of Accounting Research .

Kusi , B.A. , Agbloyor , E.K. , Ansah-Adu , K. and Gyeke-Dako , A. ( 2017 ), “ Bank credit risk and credit information sharing in Africa: does credit information sharing institutions and context matter? ”, Research in International Business and Finance , Vol. 42 , pp. 1123 - 1136 .

Lassoued , M. ( 2018 ), “ Comparative study on credit risk in Islamic banking institutions: the case of Malaysia ”, The Quarterly Review of Economics and Finance , Vol. 70 , pp. 267 - 278 .

Louzis , D.P. , Vouldis , A.T. and Metaxas , V.L. ( 2012 ), “ Macroeconomic and bank-specific determinants of non-performing loans in Greece: a comparative study of mortgage, business and consumer loan portfolios ”, Journal of Banking and Finance , Vol. 36 No. 4 , pp. 1012 - 1027 .

Masood , O. and Ashraf , M. ( 2012 ), “ Bank-specific and macroeconomic profitability determinants of Islamic banks: the case of different countries ”, Qualitative Research in Financial Markets , Vol. 4 Nos 2/3 , pp. 255 - 268 .

Ofori-Abebrese , G. , Pickson , R.B. and Opare , E. ( 2016 ), “ The effect of bank specific factors on loan performance of HFC bank in Ghana ”, International Journal of Economics and Finance , Vol. 8 No. 7 , p. 185 .

Oluwafemi , A.S. , Adebisi , A.N.S. , Simeon , O. and Olawale , O. ( 2013 ), “ Risk management and financial performance of banks in Nigeria ”, Journal of Business and Management , Vol. 14 No. 6 , pp. 52 - 56 .

Rachman , R.A. , Kadarusman , Y.B. , Anggriono , K. and Setiadi , R. ( 2018 ), “ bank-specific factors affecting non-performing loans in developing countries: case study of Indonesia ”, The Journal of Asian Finance, Economics and Business (JAFEB) , Vol. 5 No. 2 , pp. 35 - 42 .

Raphael , G. ( 2013 ), “ Bank-specific, industry-specific and macroeconomic determinants of bank efficiency in Tanzania: a two stage analysis ”, European Journal of Business and Management , Vol. 5 No. 2 , pp. 142 - 154 .

Sekaran , U. ( 2006 ), Research Methods for Business: A Skill Building Approach , John Wiley & Sons .

Siddique , A. , Masood , O. , Javaria , K. and Huy , D.T.N. ( 2020 ), “ A comparative study of performance of commercial banks in ASIAN developing and developed countries ”, Insights Into Regional Development .

Corresponding author

Related articles, we’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Open access

- Published: 09 December 2016

An empirical research on evaluating banks’ credit assessment of corporate customers

- Sang-Bing Tsai 1 , 2 , 3 , 4 , 5 ,

- Guodong Li 6 ,

- Chia-Huei Wu 7 ,

- Yuxiang Zheng 1 , 2 &

- Jiangtao Wang 3

SpringerPlus volume 5 , Article number: 2088 ( 2016 ) Cite this article

15 Citations

Metrics details

Under the rapid change of the global financial environment, the risk control of the credit granting is viewed as the foremost task to each bank. With the impact one by one from financial crisis and European debt crisis, the steady bank business is also facing the severe challenge. Banks approve the credits for their customers and then make money from the interest.

Case presentation

Credit granting is not only the primary job but also the main source of income. The quality of credit granting concerns not just the reclaims of creditor’s rights; it also affects the successful running of banks.

Discussion and Evaluation

To enhance the reliability and usefulness of bank credit risk assessment, we first will delve in the facets and indexes in the bank credit risk assessment. Then, we will examine the different dimensions of cause–effect relationships and correlations in the assessment process. Finally, the study focuses on how to raise the functions and benefits of the bank credit risk assessment.

Conclusions

In those five credit risk evaluation dimensions, A “optional capability” and D “competitiveness” are of high relation and high prominence among those dimensions, influencing other items obviously. By actively focusing on these two dimensions and improving their credit risk assessment ability will solve the foremost problems and also solve other facets of credit risk assessment problems at the same time.

Introduction

The so-called bank credit risk management is through the establishment of credit granting policies, instructions, and coordination between the different sections in the bank, such as the full supervision and control of customers’ credit investigation, choices of payment methods, confirmation of the credit limit, and reclaims of the sum of money, banks are guaranteed to retrieve the receivables back in time safely (Aebi et al. 2012 ; Benjamin and Charles 2014 ; Swami 2014 ).

However, there exists the phenomenon of “credit paradox” in the practice of credit risk management. This so called “credit paradox” is, on one hand, the risk management theory demands banks follow principles of the investment decentralization and diversification in bank credit risk management, to prevent the concentration of the credit authorization. Diversification is even more important and the golden rule to obey since particularly the traditional credit risk management model is lacking the effective credit risk hedge. On the other hand, in real practice, the bank loan business often shows that the diversification principle is not easy to put into practice because many banks do not abide by the diversification rule a lot on their loan business (Berger et al. 2009 ; Nuno and Manuela 2014 ; Mora 2014 ). There are several main reasons to cause “credit paradox” phenomenon, stated blow. (1) For most small–medium sized corporations without credit ratings, the credit situation is reveled by the long-term business partnership between the firms and banks. This way of partnership and information gained tends to make the banks execute loan business with the acquainted business clients. (2) Some banks would limit their loan business companies. Those firms whom the banks are familiar with in certain industry or in certain expertise are banks’ priorities. (3) Diversification of loan business tends to minimize the loan business to small-sized business, unfavorable to attain to the scale of benefits for banks on their loan business. (4) Sometimes the investment on the market would force banks to develop their loan business on certain limited sections or areas.

As to the credit risk assessment of banks, the accurate measurement of the risk is the basic premise. For the reasons stated above, it is extremely difficult to measure the credit risk accurately (Shipra and Yash 2014 ). So far some credit risk calculation models developed by JP Morgan and other institutes, such as Creditmetrics, CreditRlsk+, KMV models, are still disputable on their effectiveness and reliability. For the time being, there is still lacking effective measurement on credit risk (Aebi et al. 2012 ; Benjamin and Charles 2014 ; Shipra and Yash 2014 ).

Besides, for the related studies about the credit risk index in the past, there are two insufficient points. First, most studies are based on the hypothesis that indexes are independent, with no influences and cause–effect relationships on others. Second, some studies hold the same weight and hypothesis towards the assessment indexes. For solving the insufficiency in the previous studies and upgrading reliability and usefulness of the bank credit risk, this study adopts Decision Making Trial and Evaluation Laboratory (DEMATEL) to develop its theorizing. We first delve in the evaluation facets and indexes in the bank credit risk assessment. Then, we will examine the different dimensions of cause–effect relationships and correlations in the assessment process. Finally, the study focuses on how to raise the functions and benefits of the bank credit risk assessment.

Literature review

Bank credit risk and risk management.

The credit risk has been the most important management issue to banks. The quality of credit risk management, good or bad, matters a lot to banks which absorb the financial risks in exchange of benefits as their essence of business. The credit risk is like as follows: the borrower or the business counterparties are unable to fulfill the duty of their contracts out of the deterioration and other factors from the entrepreneurs (such as entanglement between firms); therefore this causes the risk of agreement violation and the loss of money. Generally, from different objects and behaviors, the credit risk could be further divided into two types: (1) lending risk, also called, issuer risk. This type of risk is duo to the violation of agreement when borrowers or bond issuers do not repay their debts or their credits get deteriorated, causing the money loss. Lending risk or issuer risk are often correlated to borrowers and bond issuers’ debt credit situations, and correlated to the risk sensitiveness degree of the financial products. (2) The second credit risk is counterparty risk; it could be further divided into two risks: settlement risk and pre-settlement risk. Settlement risk is the risk that counterparties do not fulfill their contract duties in the due settlement time and cause the loss of the equality principal to the bank. Pre-settlement risk is the risk that counterparties violate the agreement before the final settlement day and cause the risk of contract violation to the bank.

The bank credit risk management organizations and functions may appear in different forms. However, the bank should ensure the official positions and related authorities work independently and attributably, not just focusing on the superficial independency, to reach the goal of credit risk management and supervision, such as (Aebi et al. 2012 ; Jiang and Lo 2014 ; Nuno and Manuela 2014 ; Swami 2014 ):

Business functions should be independent from credit granting/verification functions to avoid the interest conflict.

Credit verification functions should be independent from credit granting functions to make sure the credit result report objective and just.

Accounting functions should be independent from credit granting/verification functions and business functions to avoid fraud and malpractice.

The unit responsible for designing, establishing, or executing the credit risk measurement system should be independent from the credit granting functions to keep this unit free of other interruptions.

The office worker in charge of verifying the credit risk measurement system should be different from the office worker responsible for designing or choosing the credit risk measurement system to lower the possibility of making errors from the credit risk measurement system.

The authorities should obey the regulations to restrict the interested parties in the bank.

Re-check the credit granting workers of interest in the bank, such as the credit granting of the general manager and the high-ranked officer.

Regularly (at least per year) check the strategies and related policies of the bank credit risk management to confirm that the high-ranked managers carry out the regulations successfully and to make sure the credit granting in accordance with those strategies and related policies. This is then to make the high-ranked managers ultimately responsible for establishing and maintaining the appropriate and effective credit risk management mechanism.

Make regular inspection on the bank management information and reflect on the correct credit risk strategies to guarantee the suitability and sufficiency of the bank capital.

The bank credit risk evaluation methods

For the past 20 years, the development of international bank credit risk management and evaluation has been through the several phases as follows:

Influenced by the debt crisis at 1980s, banks mostly began to focus on the preventative measures and management against the credit risk. Thus came out the result of the birth of “Basel Accord” which was a kind of vague analysis of the bank credit risk; through the adopting of different weights on different assets, this agreement quantified the risks.

Since 1990s some major banks acknowledged the fact that the credit risk was still the key factor in financial risks and they began to concern about the problems of the credit risk measurement, trying to establish the internal method and model for measuring the credit risk. Among those models, the credit risk management system “Credit Metrics” by J.P. Morgan obtained the widest attention.

After the outbreak of Asia financial crisis in 1997, some new phenomenon appeared in the global financial risk. The loss was not necessarily caused by single risk but by the mixture of the credit risk and the market risk etc. Financial crisis motivated people in the banking industry to value the mixture model of the market risk with the credit risk and to focus on the quantification problems of the operation risk. From this phase on, the comprehensive risk management model attained to people’s heed.

Within the traditional credit risk management, the main methods include the Expert System, Internal Ratings Grading Model for Loans, and Z Rating Model. Nevertheless, the modern development of banking makes those methods obsolete and inaccurate. With the advance of modern science and technology and with the enhancement of the management of the market risks plus other risks, modern credit risk management has also been lifted to the certain level. Therefore there appear some credit risk quantification management models such as “Creditmetrics”, “KMV”, “Creditrisk+” models. These models measuring the credit risk still arouse disputes over their effectiveness and reliability. Hence, in all respects, it is still lacking an effective calculating measure to assess the credit risk (Jiang and Lo 2014 ; Nuno and Manuela 2014 ; Swami 2014 ).

According to Dinh and Kleimeier ( 2007 ), the determination of loans does not depend on the borrower’s income or the amount of collateral, but rather on the qualitative analysis (of, for example, the borrower’s personality, reputation, or social status). Because the maintenance of social credit relationships is expensive, banks typically adopt the credit scoring model to quantitatively analyze a borrower’s credit situation to determine loans and identify whether a borrower can obey the contract. Banks’ credit assessment of corporate customers is a multiple-criteria decision-making problem in which various elements are comprehensively assessed. The construction of an effective credit assessment model requires that credit staff possess sufficient professional knowledge and practical experience. Previous credit assessment studies have mostly analyzed the opinion of a group of credit staff by using a single precise value, which cannot fully describe the actual distribution of credit staff opinions and tends to diminish minority and peculiar opinions. Therefore, precise values are inapplicable in actual decision environments and constructed credit assessment models do not possess the features of anti-catastrophism and sensitivity, which are the criteria of a superior assessment system (Hsieh 2003 ). Srinivasan and Kim ( 1988 ) stated that credit assessment can be conducted using theory-based scientific and objective methods. The experience of credit decision managers and senior credit staff responsible for credit assessment can be applied to credit assessment models for determining credit categorization and rating weights (Chiou and Shen 2011 ; Lee et al. 2016 ).

Research method

Based on the literature regarding the banks’ approaches and principles of corporate customer credit rating, this study developed five assessment dimensions and 25 criteria, with the definitions listed in Table 1 .

DEMATEL model

This study adopted the DEMATEL, which was proposed by Gabus and Fontela who were employed in the Battelle Memorial Institute of Geneva (Gabus and Fontela 1973 ; Fontela and Gabus 1976 ; Lee et al. 2014a , b ; Guo and Tsai 2015 ; Guo et al. 2015 ; Gandhi et al. 2016 ). At the initial stage, the DEMATEL was used to solve difficult and complex problems such as racial, hunger-related, environmental, and energy-related problems (Hu 2003 ; Huang 2013 ; Tsai and Xue 2013 ; Tsai et al. 2014 , 2015 , 2016a ; Qu et al. 2015 ). In this study, the DEMATEL was adopted to establish a relationship structure comprising elements used for banks’ credit assessment of corporate customers. When a bank assesses corporate customers, the relationship and degree of influence among the assessment elements are problems common to bank managers. In other words, when a bank manager intends to improve numerous decision-making elements, the optimal approach is to search for the most critical element that influences all other elements.

The DEMATEL structure and calculation steps are summarized and explained in the following sections (Yang and Tzeng 2011 ; Wu et al. 2013 ; Liu et al. 2015 ; Zhang et al. 2015 ; Tsai 2016 ; Tsai et al 2016b ; Zhou et al. 2016 ).

The six steps of DEMATEL analysis were implemented in this study:

Understanding and defining elements

Problems were thoroughly understood, and elements were determined and defined in a complex system through in-depth interviews, a literature review, brainstorming, or the collection of expert opinions.

Determining the correlation among elements and establishing measurement scales

Based on the relationship among elements, a scale of influence degree was developed for pair-wise comparisons. Specifically, each interviewee’s cognition of each aspect’s influence degree was assessed through the pair-wise comparison of aspects (elements). In the assessment scale, 0, 1, 2, 3, and 4 denoted no influence , low influence , moderate influence , high influence , and excessively high influence among the aspects (elements), respectively.

Constructing a direct-relation matrix

The number of elements was denoted as n . Expert opinions were collected by conducting a questionnaire survey. Elements were compared in pairs based on their relationship and degree of influence. Therefore, an n × n direct-relation matrix (denoted as X ) was obtained, in which x ij indicated the influence degree of element i on element j , and the diagonal elements x ii were set as 0.

Direct-relation matrix X

The symbolic matrix S was established, representing the positive and negative influences (denoted as + and −, respectively).

Calculating a normalized direct-relation matrix

Through the calculation of Eqs. ( 2 ) and ( 3 ), the direct-relation matrix was multiplied by λ to generate the normalized direct-relation matrix N .

In addition, DEMATEL analysis assumes that the sum of at least one row of i must meet the requirement presented in Eq. ( 4 ).

Therefore, the substochastic matrix was computed using the normalized direct-relation matrix N .

where O represented a null matrix and I an identity matrix.

Calculating a direct/indirect relation matrix

When normalized direct-relation matrix N met the requirement of Eq. ( 5 ), the direct/ indirect relation matrix T , also named the total-relation matrix, was obtained using Eq. ( 6 ). The indirect relation matrix H , also called the total-indirect-relation matrix, was obtained using Eq. ( 7 ).

Let t ij be the assessment element in the direct/indirect relation matrix T , and i , \(j = 1,2, \ldots ,n\) . The sum of rows and that of columns of T were calculated using Eqs. ( 8 ) and ( 9 ). The sum of row i was denoted as D i , signifying that the assessment element i was the factor that influenced other assessment elements; R j represented the sum of column j , indicating that the assessment element i was the result influenced by other assessment elements. Both D i and R j , which were obtained using the direct/indirect relation matrix T , involved direct and indirect influences.

Illustrating the causal diagram

In the causal diagram, ( D k + R k , D k − R k ) represented the horizontal and vertical axes. The mean value and 0.0 were used as the dividing points on the horizontal axis ( D k + R k ) and vertical axis ( D k − R k ), respectively, dividing the causal diagram into four quadrants. The values of ( D k + R k ) on the horizontal axis were defined as prominence , and \(k = i = j = 1,2, \ldots ,n\) , indicated the total degree to which an element exerted influence on and was influenced by other elements. Therefore, ( D k + R k ) showed the degree to which element k was at the core of all problems. In addition, the values of ( D k − R k ) on the vertical axis were defined as relation , representing the difference in the degree to which an element exerted influence on and was influenced by other elements. Thus, ( D k − R k ) showed the causal degree of element k in all problems. If the value of ( D k − R k ) was positive, the element tended to be a cause; if the value was negative, the element tended to be a result (Hung 2011 ; Hsu et al. 2013 ; Ren et al. 2013 ; Gandhi et al. 2015 ).

Results and discussion

Questionnaires.

The five dimensions and 25 elements for banks’ credit assessment of corporate customers were used as items in the DEMATEL expert questionnaire. The questionnaire survey was administered to bank managers in Taiwan. The details are described as follows.

Questionnaires were distributed to 18 Taiwan bank credit managers with more than 20 years of work experience. The DEMATEL questionnaires were distributed between March 16, 2015, and April 30, 2015. The measurement scale was a 5-point scale, with 4 representing maximal influence and 0 representing no influence. The scores between these two values were sequential ratings based on value. The author visited each expert in person, explained the content of the questionnaire, and requested each expert to complete the questionnaire. Overall, 18 questionnaires were distributed and returned. The valid return rate was 100%.

This study used Matlab software to calculate. The scores from the 18 experts were averaged and rounded to one decimal place to create a table of five criteria, as shown in Table 2 .

Next, the normalized direct-relation matrix was calculated using column vectors and maximums as benchmarks for normalization. The reciprocal of the maximum value within the sum of each column was the λ value. Using Eqs. ( 2 ) and ( 3 ), the direct-relation matrix X was multiplied by the λ value to obtain the normalized direct-relation matrix N. The influence coefficient was rounded to two decimal places (Table 3 ).

Equations ( 4 ), ( 5 ), ( 6 ), ( 7 ) were then used to calculate the total-relation matrix T, as shown in Table 4 .

Equations ( 8 ) and ( 9 ) were used to calculate value Di of each column and value Rj of each row to obtain prominence (D + R) and relation (D − R), as shown in Table 4 . In addition, the five dimensions were drawn into a figure with prominence as the horizontal axis and relation as the vertical axis, as shown in Fig. 1 .

DEMATEL distribution diagram for the five dimensions

From the results of Table 5 and Fig. 1 , the cause–effect relationships and correlations among five evaluation dimensions are interpreted as follows.

High relation and high prominence: This category contained A “Operational capability” and D “Competitiveness”. These two dimensions were properties in the cause category and were core influences on the other dimensions. This indicates that these were driving factors and critical problem-solving factors.

Low relation and high prominence: This category contained B “Repayment ability” and C “Financing capacity”. These two dimensions were in the effect category and were influenced by the other properties. Although B, C were a property that required improvement, it could not be directly improved because it was in the effect class. Therefore, B, C was relatively irrelevant.

Low relation and low prominence: This category contained E “Response ability”. This dimension was influenced by other properties. However, the influences were small. This dimension that these properties were relatively independent.

All in all, in those five credit risk evaluation dimensions above, A “optional capability” and D “competitiveness” are of high relation and high prominence among those dimensions, influencing other items obviously. By actively focusing on these two dimensions and improving their credit risk assessment ability will solve the foremost problems and also solve other facets of credit risk assessment problems at the same time. Thus we suggest the bank corporations pay huge efforts to improve the credit risk assessment and censorship of these two facets, to upgrade the results of the credit risk assessment immediately.

What we will explain is A “optional capability” and D “competitiveness” are two base dimensions for corporation’s competitive ability, competitive advance, and profit gaining ability. If the corporations’ operational capability and competitive ability are the priority to get upgraded, then the corporation’s repayment ability and financing capacity would also arise naturally.

With the liberalization and globalization of financial development, innovative financial activities flourishing, and the banking business more and more complicated, the financial system risks also gradually increase with time. To effectively adjust to the rapid change of the financial environment, main countries in the world all devote to carrying out financial reforms. Through reflections on financial supervision system and financial regulations, through the improvement of financial credit risk assessment techniques, the banks are urged to sharpen their risk management and corporation administration, to derive a robust financial system and to enhance the country’s financial competitive advantage.

For resolving the insufficiency of the former studies, this study is developed with DEMATEL Model, to increase the reliability and usefulness of the bank credit risk. To enhance the reliability and usefulness of bank credit risk assessment, we first will delve in the facets and indexes in the bank credit risk assessment. Then, we will examine the different dimensions of cause–effect relationships and correlations in the assessment process. Finally, the study focuses on how to raise the functions and benefits of the bank credit risk assessment.

In those five credit risk evaluation dimensions above, A “optional capability” and D “competitiveness” are of high relation and high prominence among those dimensions, influencing other items obviously. By actively focusing on these two dimensions and improving their credit risk assessment ability will solve the foremost problems and also solve other facets of credit risk assessment problems at the same time. Thus we suggest the bank corporations pay huge efforts to improve the credit risk assessment and censorship of these two facets, to upgrade the results of the credit risk assessment immediately.

We suggest the follow-up studies could adopt DEMATEL model and study the cases from other different countries and areas, to discuss the bank credit risk assessment problems and make a comparative study over miscellaneous areas. Other research methods are also recommended to develop other evaluation index system and to make comparisons.

Aebi V, Sabato G, Schmid M (2012) Risk management, corporate governance, and bank performance in the financial crisis. J Bank Finance 36(12):3213–3226

Article Google Scholar

Benjamin C, Charles C (2014) Bank panics, government guarantees, and the long-run size of the financial sector: evidence from free-banking America. J Money Credit Bank 46(5):961–997

Berger AN, Hasan I, Zhou M (2009) Bank ownership and efficiency in China: what will happen in the world’s largest nation? J Bank Finance 33(1):113–130

Chiou JS, Shen CC (2011) The antecedents of online financial service adoption: the impact of physical banking services on Internet banking acceptance. Behav Inf Technol 31(9):859–871

Dinh THT, Kleimeier S (2007) A credit scoring model for Vietnam’s retail banking market. Int Rev Financ Anal 16:471–495

Fontela E, Gabus A (1976) The DEMATEL observer DEMATEL 1976 report. Battelle Geneva Research Center, Geneva

Google Scholar

Gabus A, Fontela E (1973) Perceptions of the world problematique: communication procedure, communicating with those bearing collective responsibility, DEMATEL report no. 1. Battelle Geneva Research Center, Geneva

Gandhi S, Mangla SK, Kumar P, Kumar D (2015) Evaluating factors in implementation of successful green supply chain management using DEMATEL: a case study. Int Strateg Manag Rev 3(1):96–109

Gandhi S, Mangla SK, Kumar P, Kumar D (2016) A combined approach using AHP and DEMATEL for evaluating success factors in implementation of green supply chain management in Indian manufacturing industries. Int J Logist Res Appl 19(6):537–561

Guo JJ, Tsai SB (2015) Discussing and evaluating green supply chain suppliers: a case study of the printed circuit board industry in China. S Afr J Ind Eng 26(2):56–67

Guo WF, Zhou J, Yu CL, Tsai SB et al (2015) Evaluating the green corporate social responsibility of manufacturing corporations from a green industry law perspective. Int J Prod Res 53(2):665–674

Hsieh WC (2003) The study of multiple criteria evaluation model on business loan process by the bank. Master’s thesis, Chaoyang University of Technology, Taichung, Taiwan

Hsu CW, Kuo TC, Chen SH, Hu AH (2013) Using DEMATEL to develop a carbon management model of supplier selection in green supply chain management. J Clean Prod 56(10):164–172

Hu DQ (2003) Financial supervision and financial inspection practices. Taiwan Academy of Banking and Finance, Taipei

Huang SR (2013) Consumer finance and risk management. Taiwan Academy of Banking and Finance, Taipei

Hung SJ (2011) Activity-based divergent supply chain planning for competitive advantage in the risky global environment: a DEMATEL-ANP fuzzy goal programming approach. Expert Syst Appl 38(8):9053–9062

Jiang GJ, Lo I (2014) Private information flow and price discovery in the U.S. treasury market. J Bank Finance 47(10):118–133

Lee YC, Wu CH, Tsai SB (2014a) Grey system theory and fuzzy time series forecasting for the growth of green electronic materials. Int J Prod Res 299(8):1395–1406

Lee YC, Chen CY, Tsai SB, Wang CT (2014b) Discussing green environmental performance and competitive strategies. Pensee 76(7):190–198

Lee YC, Chu WH, Chen Q, Tsai SB et al (2016) Integrating DEMATEL model and failure mode and effects analysis to determine the priority in solving production problems. Adv Mech Eng 8(4):1–12

Liu J, Li Y, Ruan Z, Fu G, Chen X, Sadiq R, Deng Y (2015) A new method to construct co-author networks. Phys A 419:29–39

Mora N (2014) Reason for reserve? Reserve requirements and credit. J Money Credit Bank 46(2):469–501

Nuno F, Manuela MO (2014) An analysis of equity markets cointegration in the European sovereign debt crisis. Open J Finance 6:11–19

Qu Q, Chen KY, Wei YM et al (2015) Using hybrid model to evaluate performance of innovation and technology professionals in marine logistics industry. Math Probl Eng. doi: 10.1155/2015/361275

Ren J, Manzardo A, Toniolo S, Scipioni A (2013) Sustainability of hydrogen supply chain. Part I: identification of critical criteria and cause–effect analysis for enhancing the sustainability using DEMATEL. Int J Hydrog Energy 38(33):14159–14171

Shipra B, Yash PT (2014) Comparative study on performance evaluation of large cap equity and debt mutual fund schemes. Open J Finance 3:1–13

Srinivasan V, Kim YH (1988) Designing expert financial systems—a case study of corporate credit management. Financ Manag 17(3):32–43

Swami MB (2014) The impact of liberalization of regulation in banking sector: case study of Botswana banking sector. Open J Finance 6:1–10

Tsai SB (2016) Using grey models for forecasting China’s growth trends in renewable energy consumption. Clean Technol Environ Policy 18:563–571

Tsai SB, Xue YZ (2013) Corporate social responsibility research among manufacturing enterprises: Taiwanese electronic material manufacturing enterprises. Appl Mech Mater 437:1012–1016

Tsai SB, Lee YC, Guo JJ (2014) Using modified grey forecasting models to forecast the growth trends of green materials. Proc Inst Mech Eng B J Eng Manuf 228(6):931–940

Tsai SB, Saito R, Lin YC, Chen Q et al (2015) Discussing measurement criteria and competitive strategies of green suppliers from a green law perspective. Proc Inst Mech Eng B J Eng Manuf 229(S1):135–145

Tsai SB, Huang CY, Wang CK, Chen Q et al (2016a) Using a mixed model to evaluate job satisfaction in high-tech industries. PLoS ONE 11(5):e0154071. doi: 10.1371/journal.pone.0154071

Tsai SB, Xue Y, Zhang J, Chen Q et al (2016b) Models for forecasting growth trends in renewable energy. Renew Sustain Energy Rev. doi: 10.1016/j.rser.2016.06.001

Wu WW, Lan LW, Lee YT (2013) Factors hindering acceptance of using cloud services in university: a case study. Electron Libr 31(1):84–98

Yang JL, Tzeng GH (2011) An integrated MCDM technique combined with DEMATEL for a novel cluster-weighted with ANP method. Expert Syst Appl 38(3):1417–1427

Zhang Q, Luo C, Li M, Deng Y, Mahadevan S (2015) Tsallis information dimension of complex networks. Phys A 419:707–717

Zhou J, Wang Q, Tsai SB et al (2016) How to evaluate the job satisfaction of development personnel. IEEE Trans Syst Man Cybern Syst. doi: 10.1109/TSMC.2016.2519860

Download references

Authors’ contributions

Writing: S-BT; providing case and idea: C-HW, S-BT; providing revised advice: GL, C-HW, YZ, JW. All authors read and approved the final manuscript.

Acknowledgements

This work was supported by National Social Science Fund of China (No. 12BYJ125), Provincial Nature Science Foundation of Guangdong (Nos. 2015A030310271 and 2015A030313679), Academic Scientific Research Foundation for High-level Researcher, University of Electronic Science Technology of China, Zhongshan Institute (No. 415YKQ08), Tianjin philosophy and social science planning project (No. TJGL-028), The Fundamental Research Funds for the Central Universities (No. ZXH2012N002).

Competing interests

The authors declare that they have no competing interests.

Author information

Authors and affiliations.

School of Economics and Management, Shanghai Maritime University, Shanghai, 201306, China

Sang-Bing Tsai & Yuxiang Zheng

Law School, Nankai University, Tianjin, 300071, China

Zhongshan Institute, University of Electronic Science and Technology of China, Zhongshan, 528400, Guangdong, China

Sang-Bing Tsai & Jiangtao Wang

Sang-Bing Tsai

School of Business, Dalian University of Technology, Panjin, 124221, China

Economics and Management College, Civil Aviation University of China, Tianjin, 300300, China

Institute of Service Industries and Management, Minghsin University of Science Technology, Hsinchu, 304, Taiwan

Chia-Huei Wu

You can also search for this author in PubMed Google Scholar

Corresponding authors

Correspondence to Sang-Bing Tsai , Guodong Li or Yuxiang Zheng .

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License ( http://creativecommons.org/licenses/by/4.0/ ), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

Reprints and permissions

About this article

Cite this article.

Tsai, SB., Li, G., Wu, CH. et al. An empirical research on evaluating banks’ credit assessment of corporate customers. SpringerPlus 5 , 2088 (2016). https://doi.org/10.1186/s40064-016-3774-0

Download citation

Received : 16 December 2015

Accepted : 01 December 2016

Published : 09 December 2016

DOI : https://doi.org/10.1186/s40064-016-3774-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Decision-Making Trial and Evaluation Laboratory (DEMATEL)

- Bank credit

- Credit assessment

- Decision making

- Bank credit risk

- Banking supervision law

- Open access

- Published: 03 September 2022

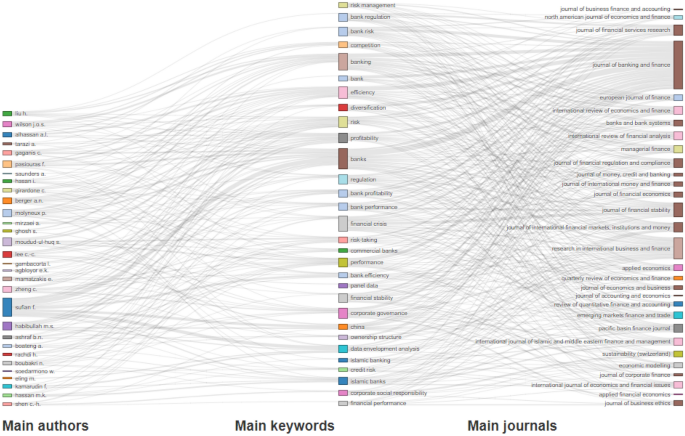

A literature review of risk, regulation, and profitability of banks using a scientometric study

- Shailesh Rastogi 1 ,

- Arpita Sharma 1 ,

- Geetanjali Pinto 2 &

- Venkata Mrudula Bhimavarapu ORCID: orcid.org/0000-0002-9757-1904 1 , 3

Future Business Journal volume 8 , Article number: 28 ( 2022 ) Cite this article

1 Citations

Metrics details

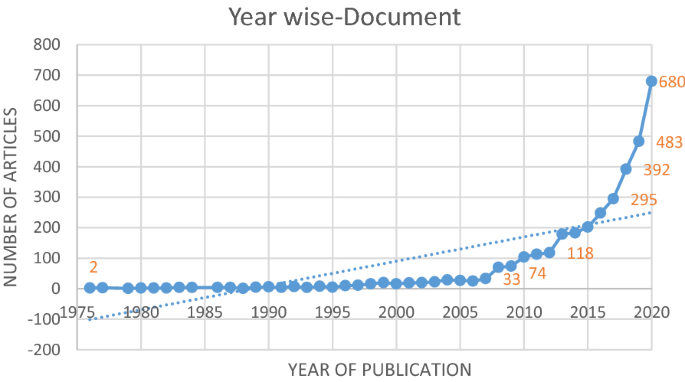

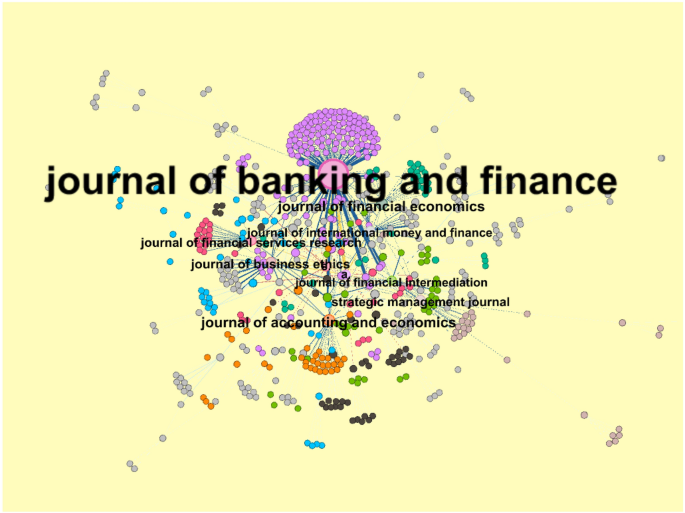

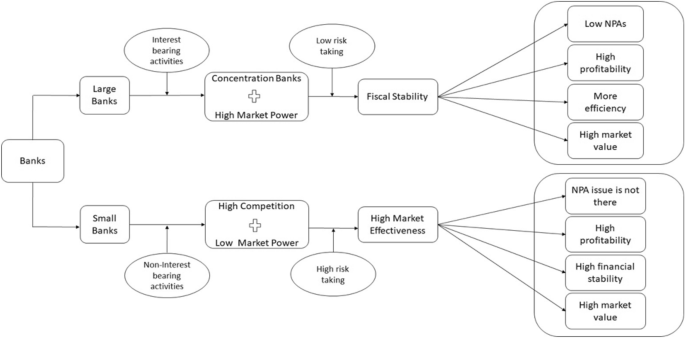

This study presents a systematic literature review of regulation, profitability, and risk in the banking industry and explores the relationship between them. It proposes a policy initiative using a model that offers guidelines to establish the right mix among these variables. This is a systematic literature review study. Firstly, the necessary data are extracted using the relevant keywords from the Scopus database. The initial search results are then narrowed down, and the refined results are stored in a file. This file is finally used for data analysis. Data analysis is done using scientometrics tools, such as Table2net and Sciences cape software, and Gephi to conduct network, citation analysis, and page rank analysis. Additionally, content analysis of the relevant literature is done to construct a theoretical framework. The study identifies the prominent authors, keywords, and journals that researchers can use to understand the publication pattern in banking and the link between bank regulation, performance, and risk. It also finds that concentration banking, market power, large banks, and less competition significantly affect banks’ financial stability, profitability, and risk. Ownership structure and its impact on the performance of banks need to be investigated but have been inadequately explored in this study. This is an organized literature review exploring the relationship between regulation and bank performance. The limitations of the regulations and the importance of concentration banking are part of the findings.

Introduction

Globally, banks are under extreme pressure to enhance their performance and risk management. The financial industry still recalls the ignoble 2008 World Financial Crisis (WFC) as the worst economic disaster after the Great Depression of 1929. The regulatory mechanism before 2008 (mainly Basel II) was strongly criticized for its failure to address banks’ risks [ 47 , 87 ]. Thus, it is essential to investigate the regulation of banks [ 75 ]. This study systematically reviews the relevant literature on banks’ performance and risk management and proposes a probable solution.

Issues of performance and risk management of banks

Banks have always been hailed as engines of economic growth and have been the axis of the development of financial systems [ 70 , 85 ]. A vital parameter of a bank’s financial health is the volume of its non-performing assets (NPAs) on its balance sheet. NPAs are advances that delay in payment of interest or principal beyond a few quarters [ 108 , 118 ]. According to Ghosh [ 51 ], NPAs negatively affect the liquidity and profitability of banks, thus affecting credit growth and leading to financial instability in the economy. Hence, healthy banks translate into a healthy economy.

Despite regulations, such as high capital buffers and liquidity ratio requirements, during the second decade of the twenty-first century, the Indian banking sector still witnessed a substantial increase in NPAs. A recent report by the Indian central bank indicates that the gross NPA ratio reached an all-time peak of 11% in March 2018 and 12.2% in March 2019 [ 49 ]. Basel II has been criticized for several reasons [ 98 ]. Schwerter [ 116 ] and Pakravan [ 98 ] highlighted the systemic risk and gaps in Basel II, which could not address the systemic risk of WFC 2008. Basel III was designed to close the gaps in Basel II. However, Schwerter [ 116 ] criticized Basel III and suggested that more focus should have been on active risk management practices to avoid any impending financial crisis. Basel III was proposed to solve these issues, but it could not [ 3 , 116 ]. Samitas and Polyzos [ 113 ] found that Basel III had made banking challenging since it had reduced liquidity and failed to shield the contagion effect. Therefore, exploring some solutions to establish the right balance between regulation, performance, and risk management of banks is vital.

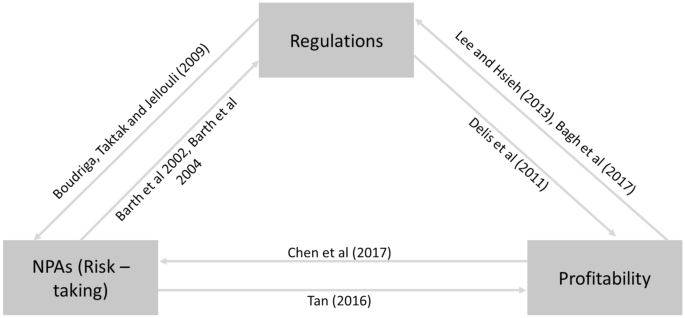

Keeley [ 67 ] introduced the idea of a balance among banks’ profitability, regulation, and NPA (risk-taking). This study presents the balancing act of profitability, regulation, and NPA (risk-taking) of banks as a probable solution to the issues of bank performance and risk management and calls it a triad . Figure 1 illustrates the concept of a triad. Several authors have discussed the triad in parts [ 32 , 96 , 110 , 112 ]. Triad was empirically tested in different countries by Agoraki et al. [ 1 ]. Though the idea of a triad is quite old, it is relevant in the current scenario. The spirit of the triad strongly and collectively admonishes the Basel Accord and exhibits new and exhaustive measures to take up and solve the issue of performance and risk management in banks [ 16 , 98 ]. The 2008 WFC may have caused an imbalance among profitability, regulation, and risk-taking of banks [ 57 ]. Less regulation , more competition (less profitability ), and incentive to take the risk were the cornerstones of the 2008 WFC [ 56 ]. Achieving a balance among the three elements of a triad is a real challenge for banks’ performance and risk management, which this study addresses.

Triad of Profitability, regulation, and NPA (risk-taking). Note The triad [ 131 ] of profitability, regulation, and NPA (risk-taking) is shown in Fig. 1

Triki et al. [ 130 ] revealed that a bank’s performance is a trade-off between the elements of the triad. Reduction in competition increases the profitability of banks. However, in the long run, reduction in competition leads to either the success or failure of banks. Flexible but well-expressed regulation and less competition add value to a bank’s performance. The current review paper is an attempt to explore the literature on this triad of bank performance, regulation, and risk management. This paper has the following objectives:

To systematically explore the existing literature on the triad: performance, regulation, and risk management of banks; and

To propose a model for effective bank performance and risk management of banks.

Literature is replete with discussion across the world on the triad. However, there is a lack of acceptance of the triad as a solution to the woes of bank performance and risk management. Therefore, the findings of the current papers significantly contribute to this regard. This paper collates all the previous studies on the triad systematically and presents a curated view to facilitate the policy makers and stakeholders to make more informed decisions on the issue of bank performance and risk management. This paper also contributes significantly by proposing a DBS (differential banking system) model to solve the problem of banks (Fig. 7 ). This paper examines studies worldwide and therefore ensures the wider applicability of its findings. Applicability of the DBS model is not only limited to one nation but can also be implemented worldwide. To the best of the authors’ knowledge, this is the first study to systematically evaluate the publication pattern in banking using a blend of scientometrics analysis tools, network analysis tools, and content analysis to understand the link between bank regulation, performance, and risk.

This paper is divided into five sections. “ Data and research methods ” section discusses the research methodology used for the study. The data analysis for this study is presented in two parts. “ Bibliometric and network analysis ” section presents the results obtained using bibliometric and network analysis tools, followed by “ Content Analysis ” section, which presents the content analysis of the selected literature. “ Discussion of the findings ” section discusses the results and explains the study’s conclusion, followed by limitations and scope for further research.

Data and research methods

A literature review is a systematic, reproducible, and explicit way of identifying, evaluating, and synthesizing relevant research produced and published by researchers [ 50 , 100 ]. Analyzing existing literature helps researchers generate new themes and ideas to justify the contribution made to literature. The knowledge obtained through evidence-based research also improves decision-making leading to better practical implementation in the real corporate world [ 100 , 129 ].

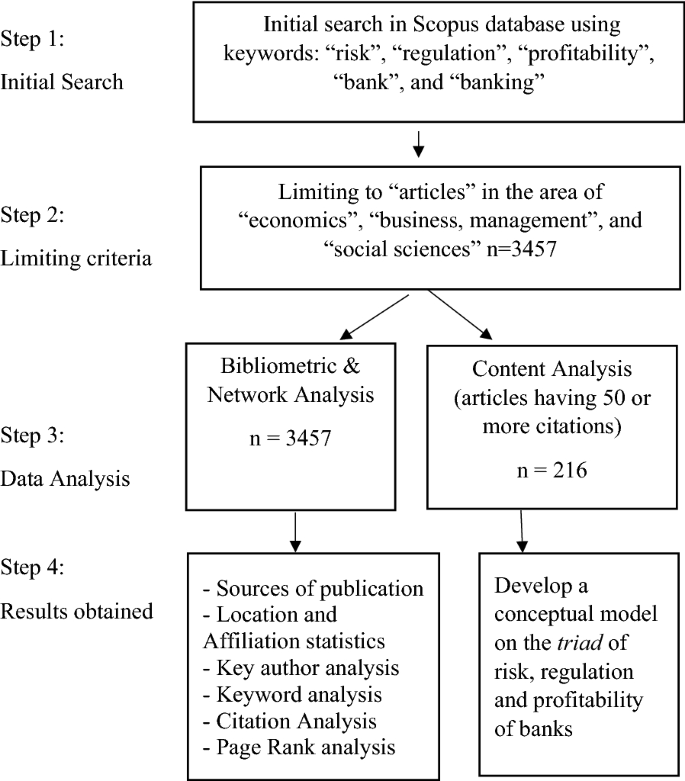

As Kumar et al. [ 77 , 78 ] and Rowley and Slack [ 111 ] recommended conducting an SLR, this study also employs a three-step approach to understand the publication pattern in the banking area and establish a link between bank performance, regulation, and risk.

Determining the appropriate keywords for exploring the data

Many databases such as Google Scholar, Web of Science, and Scopus are available to extract the relevant data. The quality of a publication is associated with listing a journal in a database. Scopus is a quality database as it has a wider coverage of data [ 100 , 137 ]. Hence, this study uses the Scopus database to extract the relevant data.

For conducting an SLR, there is a need to determine the most appropriate keywords to be used in the database search engine [ 26 ]. Since this study seeks to explore a link between regulation, performance, and risk management of banks, the keywords used were “risk,” “regulation,” “profitability,” “bank,” and “banking.”

Initial search results and limiting criteria

Using the keywords identified in step 1, the search for relevant literature was conducted in December 2020 in the Scopus database. This resulted in the search of 4525 documents from inception till December 2020. Further, we limited our search to include “article” publications only and included subject areas: “Economics, Econometrics and Finance,” “Business, Management and Accounting,” and “Social sciences” only. This resulted in a final search result of 3457 articles. These results were stored in a.csv file which is then used as an input to conduct the SLR.

Data analysis tools and techniques