Book Aid International

Generation Reader

Join us as we use the power of books to help 10 million children and young people in Africa unlock their potential.

Books give people power

They provide the information and the inspiration that people need to build a more equal future. So we work for a world where everyone has access to books.

Veronica in Liberia

I would say to somebody who says books are not important, don’t fool yourself. If you can read, you can lead.

Emilina Palasido in Malawi

“I believe that books are very important. When the children read books they open up their minds.”

Dalitso in Malawi

My school performance is changing because of the library and if the books were not there it would decline.

Rogers in Uganda

Thanks to our mountain bike library, I’ve seen how books give people power

Davidson in Malawi

Now, when my daughter comes home from school, she reads to me things that I cannot read.

Ahmed Makkour in Syria

The cost of a book could be $100. That $100 could be a month’s worth of food for a whole family.

Mr. Musa Mansaray in Sierra Leone

If we hadn’t received books from Book Aid International, it would have been so challenging for us to serve the public.

Habiba in Greece

I think the books are very good for me – for my heart.

Eletina in Malawi

If I never had access to books, things would be different

Justin in Kenya

If I had no access to books life would be very bad. I would not be able to reach the place where I want to be.

Ugbaad Abdillahi Mohamed in Somaliland

You fall in love with the books when you read today. Then tomorrow you will have the appetite to read again.

Ridwan Mahamoud Ahmed in Somaliland

“If I didn’t have the books provided by Book Aid international, my knowledge wouldn’t be at this level.”

Get to know us

- Mission and vision

- Where we work

- How we select books

- The books we provide

- Annual report

Calculate your impact

Publishers donate books to us, but we can’t send them without you. See how many books you could send *

Learn more about our finances

Based on the average value of a book sent since 2017, £13.

Our latest shipment

Destination

Books on shipment

Books sent in 2024

From our team

We can only share the power of books because of our generous supporters, our inspiring partners and our many friends. You can meet a few of them on our blog.

Hay Festival 2024

Find out more about our event at Hay Festival this month, where our Vice Patron, Lord Paul Boateng will be joined in conversation by writers Elif Shafak and Priscilla Morris

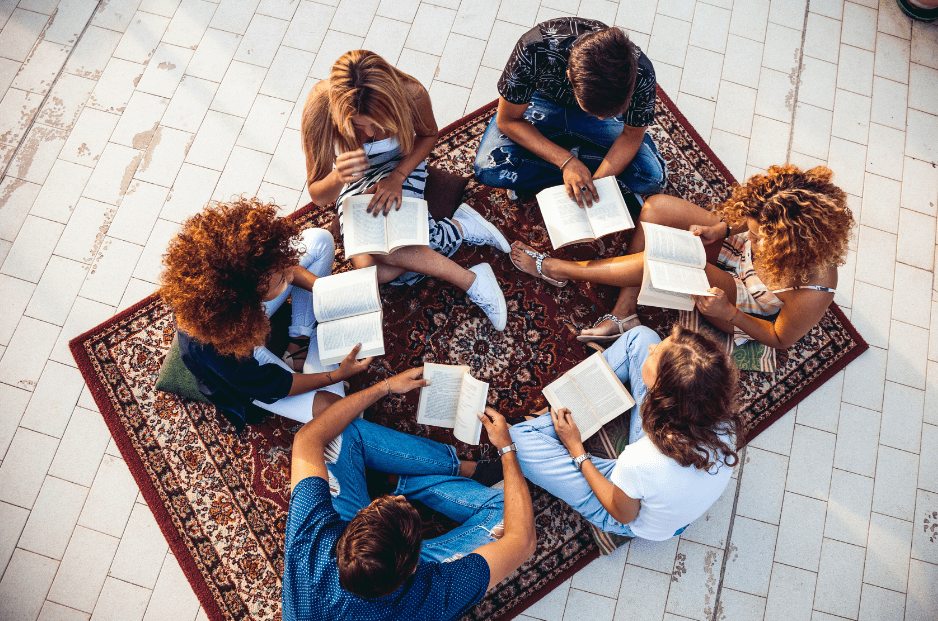

Attracting new readers

Hear from our Head of Programmes, Samantha Sokoya, about our 2023/24 Community Reading Award Winners!

‘A school without books is just a shell.’

Sayid Aden Ali works for IFED, an organisation which has set up over 16 schools in Somalia, giving thousands of children an opportunity to learn. This is his story.

Quick links

- Our supporter promise

- Send us feedback

- Change how you hear from us

- Join our team

- Protecting the environment

- Press centre

- Privacy and cookies

Sign up now

Hear from readers and be kept updated on our work, fundraising activities and events

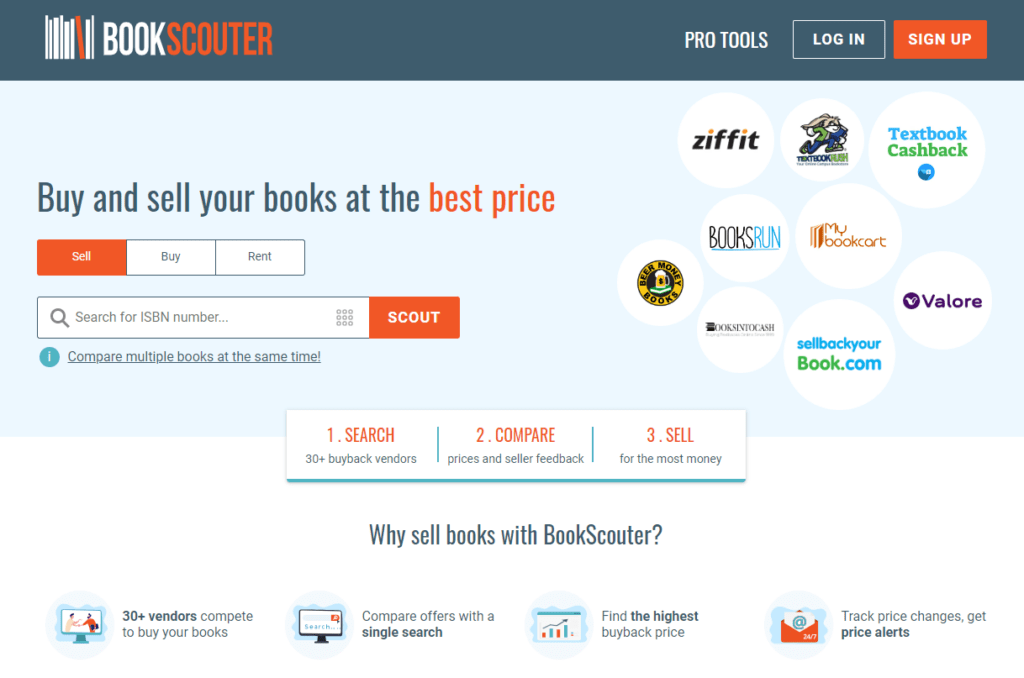

Buy and sell your books at the best price

Where to donate used books: 14 great places to make a positive impact.

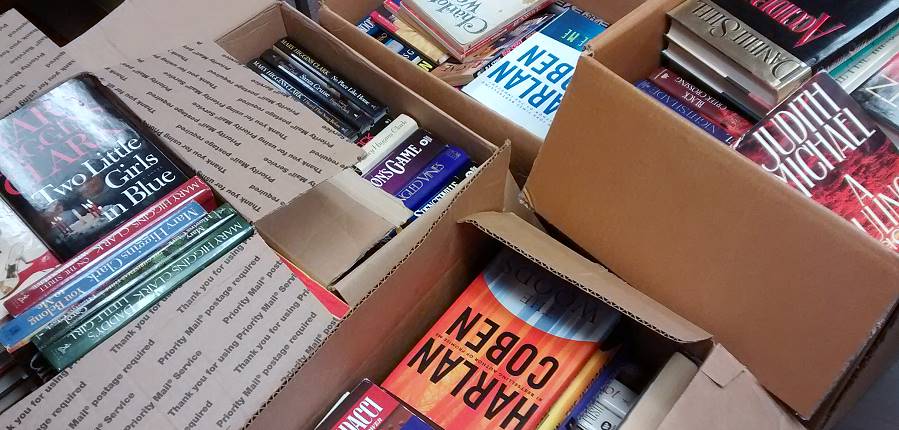

Image Source

Picture this: You find yourself surrounded by an impressive collection of books, unsure of your next steps as you simply have no clue what to do with old books .

You can be a voracious bibliophile, a habitual book collector, or you can be just looking to declutter your room and make room for new reads, it’s apparent that donating your used books can be immensely rewarding.

In addition, donating books reduces waste and promotes sustainability by giving them a second life. As a result, instead of letting your books collect dust on shelves or, worse, become debris in a landfill, you’re extending their lifespan.

If you’re wondering what to do with all those gently used books that have brought you so much joy, then you’re in the right place. In this blog, we’ll explore some fantastic options for donating your pre-loved books, so stay tuned for some great insights and ideas!

1. Local Libraries

Commonly, local libraries warmly accept book donations, as they rely on community support to maintain their collections. Libraries are always in need of new materials to add to their collection, and your donated books can provide countless hours of discovery, knowledge, and inspiration to fellow book lovers. Before donating to a library, it’s helpful to ensure that the books are in good condition and to check if there are any specific requirements for donations. It’s prudent to reach out to your local library for details about their donation policies and any specific genres or types of books they are currently seeking.

2. Nonprofit Organizations

Nonprofit organizations are truly the unsung heroes when it comes to accepting book donations and ensuring that they reach communities in need. These book charities actively seek book donations to support literary initiatives and promote education. By donating your books to these organizations, you can truly make a global impact on literacy and education. If you’re eager to give your books a new home and contribute to a positive cause, be sure to explore our article featuring the top book charities in the US where you can make a meaningful donation.

Organize your books beforehand, sorting them by categories, to assist both yourself and the receiving nonprofit. While perfection isn’t mandatory, tidying up your books can go a long way. If your books have been sitting on the shelf for a while, consider giving them a quick dusting and wipe down before donating them. This shows that you value the donation and want to provide quality books to the organization.

3. Theaters

Have ever thought that many theaters actually welcome book donations? Whether it’s for their lobby displays or for actors to use as part of their character research, your donated books can find a new home in the creative world of theater. Imagine the joy of seeing your favorite stories inspire the next big performance! Besides, many theaters also have programs or partnerships with local libraries and schools to provide books for children and adults. That’s why donating your used books to theaters not only helps to champion literacy and education but also bolsters the performing arts. Should you find books awaiting new purpose, why not approach local theaters to see if they accept book donations?

4. Hospitals and Care Facilities

Books donated to hospitals and care institutions serve as balm and leisure for patients during their stay. Many patients and residents spend a significant amount of time within these establishments, so having some books at their disposal can help mitigate boredom and provide a sense of normalcy during challenging times. From glossy magazines, uplifting novels to an inspiring memoir and other reading materials, such content can provide a peaceful distraction and promote a sense of relaxation and comfort. Donations to these facilities should be thoughtfully chosen to cater to a vast audience and must be in favorable condition.

5. Schools and Educational Institutions

Schools and educational institutions, constantly aiming to enrich their student’s learning experiences, are yet another splendid go-to place for your previously enjoyed books. Children’s storybooks, educational resources, and age-appropriate literature are typically welcomed by schools. The act of donating used books to schools and educational institutions goes beyond simply getting rid of old books—it gifts the treasure of knowledge, sparking boundless imagination in students. When you donate books, you nurture the intellectual growth of young minds. Additionally, many schools often operate on constrained budgets, making it challenging for them to acquire a diverse range of reading materials. Your book donation can significantly enhance their literary collections that may otherwise be out of reach.

Literary works are potent: they can educate, entertain, and provide solace. Thus, donating books to prisons can have a profound effect. Access to diverse reading content is a rarity in prisons, and your books could become a priceless font of education and escapism for inmates. If you desire to aid prisons with your literature, it’s crucial to first check with the specific prison or correctional facility to understand their guidelines and restrictions. Many prisons have specific rules about the types of books they can accept, so it’s best to reach out to them directly or visit their website for more information. Some common guidelines include only accepting paperback books, no hardcover or spiral-bound books, and restrictions on certain genres or topics.

7. Online Platforms and Book Drives

Modern technology has birthed virtual platforms and book drives that offer convenient ways to donate used books. Websites such as BookMooch , BookCrossing , and PaperBackSwap streamline the book donation process, book exchanges, and online book swaps, connecting bookworms across the globe. Participating in or organizing local book drives can also rally community support and create a collective impact through book donations.

8. Churches

Churches often incorporate libraries or reading nooks where congregants and the community can borrow books. Offering your used books to a church supports educational enrichment and personal growth within a community context. Before donating, it’s advisable to reach out to the church office or library to understand their specific donation process and any applicable guidelines they may have.

Museums are not just about visual art and historical artifacts; they also house libraries and educational resources. Your donated books can enhance the research and learning potential for visitors delving into various subjects during their time at a museum.

10. Retirement Homes

Many retirees enjoy reading as a cherished pastime that animates the imagination and keeps the intellect engaged. Your book donations could serve as a source of pleasure and mental stimulation, ranging from fiction and non-fiction to biographies and more. Donating your books to retirement homes not only provides entertainment but also promotes cognitive stimulation and fostering social interaction among the residents.

11. Sell Books for Cash

If you have gently used books that you no longer need, consider selling them for cash. This not only helps you declutter your space but also puts some extra money in your pocket. Plus, it gives someone else the opportunity to enjoy the books you’ve cherished. There are various online platforms and local bookstores that buy back books.

In fact, BookScouter.com is the perfect solution for selling your used books. Simply enter the ISBN of the books you no longer need, and BookScouter will compare buyback prices from over 40 vendors, making sure you get the best deal possible. It’s super easy and convenient, allowing you to clear out your old books while also making a little money on the side. So, why not give it a try and turn your unwanted books into cash today?

12. Recycling

When books have fulfilled their readable lives and are no longer in a condition to be donated, consider recycling as the next step. Paper recycling centers can process the paper from your books and turn them into new paper products. This environmentally friendly approach ensures that your books are put to good use even after they’ve been read and loved. If you choose this option, learn how to recycle books or where to recycle textbooks .

13. Upcycling

Another great option is to get creative and repurpose your old books through upcycling. You can transform worn books into unique home decor items such as book art, book sculptures, or even furniture. Upcycling not only gives your books a new purpose but also adds a touch of personality to your living space. Additionally, you can explore upcycling options by donating to art centers or craft stores that use old books for creative projects.

14. Ask your family and friends

When it comes to finding the perfect home for your used books, why not start with the people closest to you? Asking your friends and family if they’d like to take any of your books off your hands can be a great way to share the love of reading within your circle and enrich your relationship. Plus, it’s a wonderful feeling to know that your beloved books are going to someone you care about. You might even spark some interesting conversations about your favorite reads! So, don’t hesitate to reach out and see if your loved ones would appreciate the opportunity to give your books a new home.

By the way, you can organize a book swap with friends, family, or your local community. This allows everyone to exchange books they’ve already read for new ones, fostering community spirit and sharing literary treasures. It’s a real win-win for every bookworm!

Where to Donate Used Books: Final Thoughts

Every book donation counts! By finding the right donation location, you can ensure that your books will be put to good use. From community libraries to educational centers — wherever you choose to donate — your kindness and generosity have a broad impact.

Remember, the impact of donating books goes beyond the pages themselves – it’s about delivering happiness, inspiration, and a sense of connection to those who may benefit from the power of storytelling and knowledge.

So, now is the time to gather up your gently loved books so they may enlighten and engage readers anew.

Alison Bailey

Alison is a recent college graduate. Since college, she’s especially been interested in creating interesting stories and exploring different topics to write about. Writing for BookScouter gives her incredible pleasure and satisfaction. Alison considers content creation as an addictive hobby she puts her whole soul into. She’s also passionate about traveling, reading fiction, stretching, and playing the piano. The greatest stress-reliever for Alison is to pet her cat named Cupcake and listen to his soothing purring.

You may also like

Used Books are Good for the Planet

Tips for Packaging Books

International Standard Book Number (ISBN)

Copy and paste this code to display the image on your site

Last Updated on February 5, 2024 by Sammy Wilson

- APPLICATION

Copyright © The Tokyo Foundation for Policy Research.

- Report on Book Donations (April 2020-August 2021)

◆ Donation record The READ JAPAN PROJECT donated 8,537 books to 92 institutions between April 2020 and August 2021. The biggest recipient by region was Asia/Oceania, where 36 institutions received a total of 3,701 books. Since its launch in 2008, the READ JAPAN PROJECT has donated a total of 74,313 books to 1,130 institutions in 138 countries/territories.

◆Reasons for applying for a donation Many applicants said they wanted to enrich their Japan-related library materials. Many of the applicants were universities. The schools not only had Japanese language and studies departments, they also taught international relations, Asian studies, business and economics, as well as the liberal arts. Some universities had staff who had studied in Japan. Others were located where the Japan International Cooperation Agency (JICA) had provided technical cooperation and Japanese education as part of its developmental assistance projects. Moreover, given that the books cover a wide range of fields in English, some universities saw the donation as an opportunity to expand their efforts to explore global diversity and different cultures. In addition, we received much interest from institutions dedicated to fostering international civil servants, think tanks, Japanese culture centers and communities of people of Japanese descent. There was interest from public libraries in areas of economic activity thanks to Japanese tourists and others. Some applicant institutions were in countries or regions where very few books on Japan are available, where it is difficult to obtain useful books, where information technology is underdeveloped, where people find it difficult to visit Japan due to geographical or economic reasons, and where there are no Japan-related research or cultural facilities. Thus, we received many avid requests for books on Japan from both applicant and recommending institutions.

◆Applications and book donations amid the Covid-19 pandemic The global Covid-19 pandemic, which began in early 2020, has seriously affected the READ JAPAN PROJECT in various ways. For example, some applicant institutions such as universities and libraries have closed. Staff at some recommending institutions such as embassies and other overseas diplomatic establishments have returned to Japan. And there have been delays in book deliveries. These difficulties continue. Nevertheless, the PROJECT received many applications from universities and libraries in various countries that wished to receive book donations from Japan. As a result, we have been able to donate over 8,500 books to 92 institutions. One of the universities that applied for books employs a professor who studied in Japan on a grant from Japan’s Ministry of Education, Culture, Sports, Science and Technology. The professor expressed the wish that graduate students majoring in Japanese studies will use the donated books. Another applicant was a scholarship institution affiliated with a public interest incorporated foundation. There were also universities that have exchange programs with Japanese universities. Thus, it can be said the PROJECT is a good example of how multiple ventures to promote an understanding of Japan, both public and private, have steadily grown and their impact has been felt around the world. Some applicant institutions had to overcome the disadvantages of weak infrastructure. They were forced to retype their application forms again and again due to sudden power outages. Many applications came from countries and regions that lack basic infrastructure such as electricity and the Internet. Other areas lack educational institutions or cultural facilities related to the Japanese language or Japan. This unfortunate situation reminds us that our book donations are a valuable source of information for people in those places who are seeking to learn about Japan.

Impact Reports

Read our 2023 impact report, check out our ten years of impact.

Read the timeline below to see Book Harvest's journey from 2011-2021!

Read Past Impact Reports

You can click on the covers below to access each of our complete annual reports from 2013 – 2022. If you would like to receive a hard copy of the latest report, email your request with a postal address to [email protected].

- Our Mission

- Board Members

- Authors and Publishers

- Our Sponsors

- Become A Sponsor

- In Memoriam

- Testimonials

- Upcoming Events

- Financial Statements

- Donation Recipients

- Request a Book Donation

- From Our Shelves to Yours

- The Page Coach

- Grow Your Library

- Storybook Adventures

- Community Presentations

- Current Needs

- Donate Your Vehicle

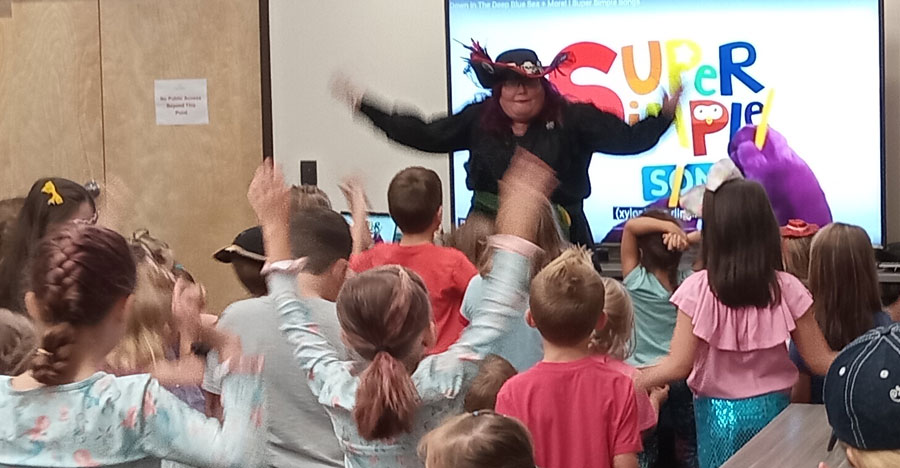

Kids Need to Read works to create a culture of reading for children by providing inspiring books to underfunded schools, libraries, and literacy programs across the United States, especially those serving disadvantaged children.

Helping children discover the joy of reading and the power of a literate mind

We Need Your Help:

Upcoming events:.

Founded with a passion to improve the lives of disadvantaged children by providing inspiring book collections and engaging literacy programs to underfunded schools, libraries, and organizations across the nation, Kids Need to Read aspires to empower and embolden every last child through a culture of reading. For many of the children it serves, Kids Need to Read represents a crucial link to a strong literacy education, and its programs help build and nurture support systems for the development of literate minds. By immersing children in an integrated world of literary experiences that teaches them, firsthand, the impact of reading on every aspect of life, imagination is ignited and confidence is built for a prosperous future, regardless of race, economic status, or personal capabilities.

By providing thousands of books to children lacking adequate access to reading resources, Kids Need to Read encourages kids to discover the joy of reading and the power of a literate mind.

The Page Coach provides a unique mobile outreach program to children living in low socioeconomic areas, delivering books and interactive events directly where literacy support is needed most.

Steven Riley's interactive Story Quest workshops walk children through every step of the creative process, planting the seed of a simple idea and then watching it grow as young minds collaborate toward their own literary masterpiece.

Grow Your Library donates new book collections to selected libraries, while providing personal story time visits in which participating children are encouraged to turn their own love of reading into even more literary gifts for their community.

There is nothing better than simply getting a chance to read with kids and give them books! There is a beautiful connection between reader and child, and to get a moment in their lives to help inspire them to read is magical!

The most significant factor influencing a child�s early success in school is being introduced to reading at home at an early age. Kids Need to Read's group presentations encourage caregivers to prioritize literacy within their homes.

- 05/23/2023 – Kids Need to Read: Doing our part to Stop the Summer Slide

- 03/19/2023 – Kids Need to Read: Our future is so bright, we gotta wear shades

- 12/30/2022 – Kids Need to Read: Consider a gift to Kids Need to Read in 2022

- 11/29/2022 – The readers we help to create today create future generations of readers.

- 10/30/2022 – Kids Need to Read: Getting ready for Winter Literacy fun

- 09/01/2022 – Kids Need to Read: Falling in love with reading again

- 08/07/2022 – It's our birthday!

- 07/10/2022 – Kids Need to Read: Summer Reading, Summer Fun

- 03/09/2022 – Kids Need to Read: Planting Seeds for the Future

- 01/26/2022 – Kids Need to Read: Celebrating Our Goals

- 12/29/2021 – Kids Need to Read: Consider a gift to Kids Need to Read in 2021

- 12/06/2021 – The excitement of receiving a new book will never grow old

- 11/11/2021 – To our communities with love

- 09/01/2021 – Remember when a book could make you feel good?

- 08/01/2021 – The World is a Book, Come Travel With Us

- 07/20/2021 – Kids Need to Read provided over a million dollars in reading resources this past year!

- 05/23/2021 – Truly a Stellar Year!

- 03/07/2021 – Necessity Is the Mother of Invention.

- 01/05/2021 – Executive Director Denise Gary Retiring

- 12/27/2020 – We Were Created For This Need

- 12/20/2020 – Caution: Books Taking Over the Country!

- 12/08/2020 – All Things Good and Right

- 12/01/2020 – Please Join Our #GivingTuesday Drive

- 11/29/2020 – Fun Ways to Support Kids Need to Read This Holiday Season

- 11/08/2020 – The Page Coach Has New Clothes!

- 09/22/2020 – A Greater Urgency for KNTR's Books

- 09/08/2020 – Kids Need to Read's Summer of Covid-19 Relief

Sign Up for KNTR News!

Privacy Policy

Major Contributors

Copyright © 2023 Kids Need to Read, all rights reserved. Kids Need to Read ® and the Kids Need to Read Inspiring Imagination logo are registered service marks of Kids Need to Read.

Donor Impact Report: How To Write One and Win Over Donors

You and your team have put in the hard work of growing a donor network, collecting donations and championing your nonprofit’s mission. With those donations helping your nonprofit transform the world for the better, how can you shout it from the mountains? Create a donor impact report!

A donor impact report shows donors that their gifts are making a meaningful difference for your nonprofit and the community that you serve. They can also draw in more supporters!

Summing up every hard-earn donation and accomplishment into one report can feel like a big undertaking. But don’t worry—we’ve got you covered.

We’ll show you everything that you need to know about creating a high-quality donor report that’ll help you build a closer relationship with donors and inspire them to keep contributing .

What’s a donor impact report?

A donor impact report is an account of all the donations that a nonprofit received over a period of time and what was accomplished with these funds.

Donors want to know that they can trust your organization to use their financial gifts to further your mission. That’s where donor impact reports come in! By creating this report, you can reassure donors that their donations are being used thoughtfully and are making a difference.

These nonprofit reports can include:

- Total amount of donations you received

- Number of people helped

- Month by month breakdown of where contributions went

- Graphs and visuals

Donor reports let contributors see the impact of their donations while promoting accountability and transparency for your nonprofit.

How often should you send a donor impact report?

Typically, nonprofits send donor impact reports quarterly or yearly. The rate you send out your reports depends on the scale and pace of your organization.

By sending more frequent nonprofit impact reports you can sooner share your nonprofit’s wins and keep your donors in the loop. With an annual report , you can summarize every donation received over the year and break down how they were used in one convenient document.

Not sure which option is best for your nonprofit? You can reach out to your donors and ask what they’d prefer.

What format should your donor impact report be?

Choosing a format for your donor report is a perfect opportunity to show off your nonprofit’s creativity, success and gratitude for your donors.

Let’s look at the most popular formatting options.

Keep things traditional with a printed donor impact report. This is a great option if your nonprofit has a great deal of donors who write and mail in checks. An eye-catching printed report can be a keepsake for your donors which they can also easily share with others.

The best part? That means more people can see the great work that your nonprofit does and become inspired to donate!

2. Digital

If you want to go digital you have plenty of formatting options. Whether it’s a dedicated webpage, PDF or attachment in an email from the CEO, digital donor impact reports are a flexible choice.

With digital reports, you can include as much text and colorful visuals as you’d like without ever having to worry about printing costs. Plus, digital reports are easy to share widely!

A video donor impact report may sound intensive but it can leave a major impression. Don’t worry about making high-scale production. A heartfelt message from your CEO about your nonprofit’s progress can move donors. Video reports also let you include visuals to help break down financials.

Just like with digital reports, the video version can be shared with a click of a button.

Bonus: Social media

Compliment your donor impact report by repurposing snippets of it on social media. Whatever reporting format you chose, you’ll have tons of great stats and visuals that can become thumb-stopping social media posts.

Not only does this let you announce that your report is ready and drum up excitement for it, but you’ll also have great content to share on your social media channels!

Why donor impact reports matter

You already have plenty on your plate with attracting donors, keeping contributors engaged and running your nonprofit, so creating a donor impact report might feel like too big of a time commitment. But these reports are about so much more than just sharing how much in donations you’ve received. Donor impact reports help grow your nonprofit in several ways.

Transparency

Above all else, donors want to make sure that they can trust your nonprofit with their gifts. This report gives you the opportunity to break down exactly how donations were used and what was accomplished with them. By seeing how responsibly their donations are used and the difference they’re making, contributors can feel inspired to keep giving .

Share impact

This report is your chance to celebrate all the good that your nonprofit has done thanks to donors. Use this report to show every achievement made and number of lives touched by your nonprofit. After you have years of reporting under your belt, you’ll also have a convenient record of your nonprofit’s progress.

Engage donors

Donor impact reports help you show even more appreciation for your donors. Every report lets your contributors see how they’re making a difference in the world by donating. Reporting makes donors feel engaged with your nonprofit and increases their likelihood of donating again.

Attract new donors

Any chance to attract new donors is a win for nonprofits. Whether they found your report on your website or it was shared with them from a friend, it can teach people about all the great work your nonprofit does. This can make all the difference for someone that’s considering donating and wants more information before contributing.

What to include in a donor impact report

Your nonprofit does so much good during the year that figuring out what to include in your report can feel daunting. You’ll want to highlight all of your wins while making sure not to overwhelm your readers.

While there’s no strict donor impact report template, here’s a list of what donors would appreciate and expect to see in a report:

- Introduction

- Letter from the CEO

- Appreciation and personalization

- Financial information

- Stories from donors, recipients and volunteers

- How to stay involved

1. Introduction summarizing your mission

While your donors likely are familiar with your nonprofit’s mission, this report is another opportunity to share your mission, why it matters and how donations will help you succeed. This section is also helpful for people who haven’t already donated to your cause and are checking out your donor impact report before making a decision.

2. Letter from the CEO

As the head of your nonprofit, a message from your CEO is a perfect way to kick off the donor impact report. Your CEO can craft a letter that shows the nonprofit’s gratitude for every donor , a snapshot of the nonprofit’s achievements and upcoming plans. Hearing from your CEO can make donors feel appreciated for their contributions.

3. Appreciation and personalization

Nonprofits can never thank donors enough for their gifts! Donors will appreciate all the gratitude you send their way. Make your thanks even more special by personalizing it in the stewardship report . Include stats like number of donors, largest contributors and record amount collected in a day.

4. Financial information

There’s no doubt that you have plenty of financial information you can include in your report. But make sure that the information you share makes sense for your readers. Instead of minute details, include the total amount of donations you received and how these funds helped progress your mission.

5. Stories from donors, recipients and volunteers

One of the best ways to touch the heart of readers is to include stories from donors, recipients and volunteers. By reading firsthand accounts of how your nonprofit is changing lives, readers can feel more connected with your mission by seeing the difference that their donations are making.

6. Visuals

Break up long blocks of text and keep your readers engaged by including a variety of visuals in your report—like graphs and pie charts! These are a great way to showcase data while making it interesting and easy to understand (and are perfect to reuse for social media posts!). Also include pictures of your team and community to help readers feel more involved with your nonprofit.

7. How to stay involved

Remind your readers of how they can stay involved with your nonprofit at the end of your report. In addition to asking for donations , let your readers know that they can stay up to date with your nonprofit through your social media channels and newsletters as well as how they can get in touch with you.

3 Examples of donor impact reports

Need some inspiration before you kickstart your report? Here are 3 donor impact report examples from nonprofits and what we love about them.

1. New Energy Nexus

New Energy Nexus is a global nonprofit that’s driving clean energy innovation and adoption. Here’s what we liked in their 2021 impact report :

- Opens with a letter from their Chief Energy Officer that shares their program, team and upcoming plans

- Features an illustrated snapshot of their impact over the year with powerful stats on one easy to read page

- Explains their strategy and solution behind decarbonizing the global economy

- Spotlights several organizations across the world that they’ve helped transform and their impact on local communities

- Shares pictures of their team who make the nonprofit’s work possible

- Lists ways for readers to get involved with the nonprofit like donating and following them on social media

2. CAMH Foundation

The CAMH Foundation is Canada’s leading hospital for mental health and is working to transform the treatment of mental illness. Here’s what we liked about their donor impact report webpage :

- Opens with a video of gratitude for donors from several people

- Features a message of appreciation for donors and highlights that their gifts have helped change thousands of lives over a year

- Shares several stories from people and families who’ve benefited from CAMH’s care as well as stories from donors and what inspired them to contribute

- Details the progress that was made through donations like number of patients supported and visits made possible

- Highlights several of their accomplishments from 2021 that progressed the mental health movement

- Lists initiatives for the upcoming year to help even more communities

- Includes ways donors can get involved with the nonprofit and a form for sharing the donor’s reason for supporting the nonprofit for a chance to be featured on their social media

3. Power Poetry

Power Poetry is the first and largest mobile poetry community for young people. Here’s what we liked about their data-focused impact webpage :

- Begins with a number of their current poets and their membership goal

- Details stats like number of poems written and lifetime scholarship amount

- Explains their goal of increasing the number of young people writing and reading poetry

- Features an interactive heatmap of the amount of poems written in an area

- Lists the nonprofit’s major milestones like its first scholarship for young poets and the day that they reached 100,000 members

- Encourages readers to sponsor a poetry slam where they can pick the topic and cause or donate $1 to support the poems of 1 poet for a year

Propel your nonprofit with a donor impact report

Creating your donor impact report can feel like a big undertaking, but it’ll help you connect with your contributors on a whole new level. By reassuring donors that their gifts were properly used and encouraging people who haven’t yet donated, your report will resonate with readers and inspire them to stay invested in your nonprofit.

Looking for an easy way to store donor data and send them important messages? Try a 60-day free trial of WildApricot .

Related Fundraising Articles

Donor Engagement Strategies to Level Up Your Nonprofit + Donor Engagement Plan Checklist!

How to Get Funding for a Nonprofit: Tips on Tapping into 12 Top Funding Sources

How to Step Up Your Donor Cultivation Strategy: 14 Useful Ideas

The Membership Growth Report:

Benchmarks & insights for growing revenue and constituents.

Book Donation Programs: Seeking Book Donations

- Seeking Book Donations

- International Donations

- Ebook Donations

- Donating to Prison Libraries

- Selling or Valuing Your Books

Please be aware that the American Library Association does not accept or distribute donations of books or any other materials. This Guide provides information on some of the groups and organizations that do handle book donations.

Who can we contact?

We need book donations! What can we do?

You may be eligible to apply for donations from the groups listed on the other tabs in this resource. Contact the groups directly for application information and eligibility criteria.

Resources for Getting Magazines

- Magazine Harvest - Get magazines Provides new and “gently read” recycled magazines and comics via food pantries, homeless and domestic violence shelters, youth mentoring and job training programs, foster care, and teachers reaching at-risk readers.

Resources for Getting Books donated

- Amazon Wish Lists Wish Lists are a great way to keep track of what you want, and sometimes get great gifts. You can create many lists both for yourself and to remember gift ideas for others.

- Association of American Publishers Book Donation Initiative Many publishing houses donate books to non-profit organizations. To encourage book donations, AAP maintains a list of 501(c)3 and international organizations that wish to receive donated books from American publishers.

- Better World Books - Request Books NEED BOOKS? Request a book donation through our online form.

- Distribution to Underserved Communities Library Program The Distribution to Underserved Communities Library Program (D.U.C.) distributes books on contemporary art and culture to public schools, libraries, prisons, and alternative education centers nationwide, free of charge.

- Domestic and International Book Donations - SUNY at Buffalo This list prvides a place for institutions and programs that have little or no money to post their need for educational materials. We do not include private colleges (especially those that charge high tuition fees), foundations of corporate firms, individuals, or other well off entities. Our donors wish to send their materials to those most desperately in need.

- International Book Bank - request books The International Book Bank aims to increase global literacy by donating brand new books to charities in developing countries.

- Local Donation Program - International Book Project, Inc. The Local Donation program of the International Book Project is always looking to expand and provide literacy to those in need. If you have an organization and would like to be considered for a local book donation please fill out our local donations application. Once you have submitted your application, our Local Donations Coordinator will review your application and contact you.

- Pilcrow Rural Library Disaster Relief Grant Special non-matching grants through our Children’s Book Project program to libraries serving rural communities in the United States affected by recent tornadoes, hurricanes, flooding, or other natural disasters. Libraries qualified to receive a Children’s Book Project: Disaster Relief grant can select $800 worth of new, quality, hardcover children’s books from The Pilcrow Foundation’s booklist. Locally sponsored matching funds are not required for the disaster relief grants.

- Pilcrow Rural Library Grants The Pilcrow Foundation, a national non-profit public charity, provides a 2-to-1 match to rural public libraries that receive a grant through its Children’s Book Project and contribute $200-$400 through a local sponsors for the purchase of up to $1200 worth (at retail value) of new, quality, hardcover children’s books.

ALA Grants and Resources for Obtaining Books

- Beyond Words: the Dollar General School Library Relief Fund The fund will provide grants to public schools whose school library program has been affected by a natural disaster. Grants are to replace or supplement books, media and/or library equipment in the school library setting.

- Bookapalooza Program The Bookapalooza Program offers select libraries a collection of materials that will help transform their collection and provide the opportunity for these materials to be used in their community in creative and innovative ways.

- Eisner Graphic Novel Grants for Libraries Two Will Eisner Graphic Novel Grants for Libraries are given annually - the Will Eisner Graphic Novel Growth Grant will provide support to a library that would like to expand its existing graphic novel services and programs and the Will Eisner Graphic Novel Innovation Grant will provides support to a library for the initiation of a graphic novel service, program or initiative.

- Great Books Giveaway Competition Each year the YALSA office receives approximately 3,000 newly published books, videos, CD's and audiocassettes, materials that have been targeted primarily towards young adults.

- Romance Writers of America Library Grant The Romance Writers of America Library Grant is designed to provide a public library the opportunity to build or expand its romance fiction collection and/or host romance fiction programming.

Sources for Books

- Library of Congress Surplus Book Program The Library of Congress has available at all times, for donation to eligible organizations and institutions, surplus books which are not needed for the Library's own uses. Receiving organizations must apply, as well as pick up the materials at the Library.

- << Previous: Home

- Next: International Donations >>

- Last Updated: Jun 23, 2022 4:27 PM

- URL: https://libguides.ala.org/book-donations

Important COVID-19 information: Our Programs | FAQs | Resources for families

- Join our Team

- Resource Hub

Lead a Fundraiser or Book Drive

Lead a fundraiser, you can help raise critical funds needed to sustain the reading partners program..

Some of the most impactful fundraisers are campaigns created by community members like you. That’s because when individuals share a fundraiser with their network, they reach more people than the organization can alone. And most importantly, people are more inclined to donate when someone they know and trust shares a campaign.

Fundraising campaigns can be done at any time, and many people choose to fundraise to mark special times of the year, including:

- Birthdays, holidays, w eddings, “giving season”, and o ther special occasions (graduations, in memory of a loved one, to honor a personal milestone, etc.)

Interested in starting your own fundraiser for Reading Partners?

There are two ways to easily start a fundraiser for Reading Partners, either through the Classy online giving platform or Facebook. A Classy fundraiser is more adaptable for sharing across any communication channel while a Facebook fundraiser is optimized to engage your friends on Facebook.

Download the Reading Partners Volunteer Fundraiser Guide for more tips and inspiration on everything you need to know to run a successful fundraiser.

Classy Fundraiser Facebook Fundraiser

Lead a book drive or donate books

“Take reading with you” is a cornerstone of the Reading Partners program. We encourage our students to build their personal libraries by offering books from our take reading with you library.

Local businesses and organizations can help Reading Partners build the take reading with you library with donations of new or very gently used children’s books ranging in level from kindergarten to fourth grade, of varying topics and genres. These books go directly to students in the community, enabling them to enjoy their own reading library.

Before you begin: book donation guidelines

In order to provide our students with the most high-quality, desirable texts, we set specific guidelines for book drive donations. At this time, we are seeking the following:

- Multicultural books and books featuring diverse characters (ages 5-9)

- Books for beginning readers

- Award winning books (Caldecott Medal & Honor, Newbery, New York Times Best, Sibert Informational Book Medal, Coretta Scott King Book Award, etc.)

- Graphic novels for grades 3 and 4 such as Dogman/Diary of a Wimpy Kid/Dork Diaries

- Non-fiction texts focused on animals, sports, science, Black History, etc.

- For additional recommendations, check out Reading Partn ers’ Diverse Book Wishlist !

If you have books you’d like to donate that do not fit these criteria, we recommend checking about making a donation to another local elementary school, library, or a thrift/second hand store. At this time, we are not accepting the following:

- Dirty, dusty, ripped, written in, bent, moldering, or mildewed books.

- Non-fiction texts written over 10 years ago

- Library discards

- Books with television/cartoon characters

- Chapter books that do not have illustrations such as Nancy Drew, Boxcar Children, Babysitter’s Club, etc.

- Religious texts, including holiday books

- Adult/Young Adult texts

- Encyclopedias, thesauruses, or dictionaries

- Board books

- Audio/Video books

- Instructional materials for teachers

Steps to lead a successful book drive

Step 1: reach out to reading partners.

Contact the Reading Partners location nearest you or reach out to our national office and let us know that you’re interested in hosting a book drive for Reading Partners. We can provide some pointers and give you more information about how to make your donation.

STEP 2: Determine dates and a goal for the book drive

Most groups conduct efforts for two to four weeks. It is also helpful to set a goal for the number of books to be collected, as this inspires many donors and helps you gauge success.

STEP 3: Promote the book drive to your network

Flyer link (PDF) Editable flyer file (Microsoft Word Document) Editable flyer file (Canva)

STEP 4: If running an in-person book drive, provide “donation bins” at selected drop-off locations and collect books.

Bins should be placed where they are most visible and should be strong enough to hold large numbers of books. In some regions, Reading Partners can loan these to your company. Remember to put a Reading Partners logo and instructions on the bins.

If running a virtual book drive, provide participants with information on how to make a donation (this may include the link to an online Booklist wishlist).

STEP 5: Make and celebrate your donation

As you near the conclusion of the book drive, contact your local Reading Partners team to arrange drop off (either in person or confirm your local office’s address to have books shipped). Don’t forget to celebrate and promote your success by sharing results with local media, employees, customers, and other stakeholders.

Engaging communities. Empowering students.

Thanks to our partners

Scholastic Book Donations

Our Philanthropic Network

Scholastic's national network includes the following strategic partners, as well as many dedicated local organizations and nonprofits that help distribute donated books throughout the country.

Disaster Response

Scholastic is committed to supporting children in communities experiencing crisis or natural disaster whenever possible. Please reach out: CLICK HERE

More information on the full range of Scholastic's Corporate Social Responsibility and Impact initiatives can be found in our Philanthropic Impact Report .

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Date of contribution.

Terms of the purchase or sale.

Rate of increase or decrease in value.

Arm's-length offer.

Sales of Comparable Properties

Replacement cost, opinions of professional appraisers, unusual market conditions, selection of comparable sales, future events, using past events to predict the future, household items, used clothing.

Art valued at $20,000 or more.

Art valued at $50,000 or more.

Authenticity.

Physical condition.

Collectibles.

Reference material.

Gems and jewelry.

Stamp collections.

Coin collections.

Modest value of collection.

Condition of book.

Other factors.

Manuscripts, autographs, diaries, and similar items.

More information.

Selling prices on valuation date.

No sales on valuation date.

Listings on more than one stock exchange.

Bid and asked prices on valuation date.

No prices on valuation date.

Prices only before or after valuation date, but not both.

Large blocks of stock.

Unavailable prices.

Restricted securities.

1. Comparable Sales

2. capitalization of income, 3. replacement cost new or reproduction cost minus observed depreciation, interest in a business.

Interest rate.

Actuarial tables.

Special factors.

Certain Life Insurance and Annuity Contracts

Remainder interest in real property, undivided part of your entire interest.

Qualified organization.

Conservation purposes.

Certified historic structures.

Qualified real property interest.

Disallowance of deductions for certain conservation contributions by pass-through entities.

Cost of appraisals.

Donation less than $5,000.

Deduction over $500 for certain clothing or household items.

Publicly traded securities.

Deductions of More Than $500,000

Prohibited appraisal fee.

Information included in qualified appraisal.

Art objects.

Number of qualified appraisals.

Qualified appraiser.

Excluded individuals.

Appraiser penalties.

Responsibility of the IRS.

The IRS does not accept appraisals without question.

Timing of IRS action.

20% penalty.

40% penalty.

Preparing and filing your tax return.

Free options for tax preparation.

Using online tools to help prepare your return.

Need someone to prepare your tax return?

Employers can register to use Business Services Online.

IRS social media.

Watching IRS videos.

Online tax information in other languages.

Free Over-the-Phone Interpreter (OPI) Service.

Accessibility Helpline available for taxpayers with disabilities.

Getting tax forms and publications.

Getting tax publications and instructions in eBook format.

Access your online account (individual taxpayers only).

Get a transcript of your return.

Tax Pro Account.

Using direct deposit.

Reporting and resolving your tax-related identity theft issues.

Ways to check on the status of your refund.

Making a tax payment.

What if I can’t pay now?

Filing an amended return.

Checking the status of your amended return.

Understanding an IRS notice or letter you’ve received.

Responding to an IRS notice or letter.

Contacting your local TAC.

What Is TAS?

How can you learn about your taxpayer rights, what can tas do for you, how can you reach tas, how else does tas help taxpayers, low income taxpayer clinics (litcs), publication 561 - additional material, publication 561 (02/2024), determining the value of donated property.

Revised: February 2024

Publication 561 - Introductory Material

New actuarial tables. New actuarial tables used to determine the present value of a charitable interest donated to a charitable organization have been published. These new actuarial tables were effective June 1, 2023. However, for a period prior to June 1, 2023, there is a transitional rule allowing filers to elect to use either the former or the new actuarial tables. The transitional rule applies for donations with valuation dates from May 1, 2019, through June 1, 2023. See Actuarial tables , later.

For the latest information about developments related to Pub. 561, such as legislation enacted after it was published, go to IRS.gov/Pub561 .

Introduction

This publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. It also explains what kind of information you must have to support the charitable contribution deduction you claim on your return.

This publication does not discuss how to figure the amount of your deduction for charitable contributions or written records and substantiation required. See Pub. 526, Charitable Contributions, for this information.

We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRS.gov/FormComments . Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Useful Items

Publication

526 Charitable Contributions

Forms (and Instructions)

8282 Donee Information Return

8283 Noncash Charitable Contributions

8283-V Payment Voucher for Filing Fee Under Section 170(f)(13)

See How To Get Tax Help near the end of this publication for information about getting these publications and forms.

Publication 561 - Main Contents

What is fair market value (fmv).

To figure how much you may deduct for property that you contribute, you must first determine its FMV on the date of the contribution. This publication focuses the valuation of noncash property being contributed after January 1, 2019, to a charity that qualifies under section 170(c) for an income tax charitable contribution deduction.

FMV is the price that property would sell for on the open market. It is the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts. In addition to this general rule, there are special rules used to value certain types of property such as remainder interests, annuities, interests for life or for a term of years, and reversions, discussed below.

If you give an item of used clothing that is in good used condition or better to the Salvation Army, the FMV would be the price that typical buyers actually pay for clothing of this age, condition, style, and use. Usually, such items are worth far less than what you paid for them.

If you donate land and restrict its use to agricultural purposes, you must value the land at its value for agricultural purposes, even if it would have a higher FMV if it were not restricted.

In making and supporting the valuation of property, all factors affecting value are relevant and must be considered. These include, but are not limited to:

The cost or selling price of the item,

Sales of comparable properties,

Replacement cost, and

Opinions of professional appraisers.

These factors are discussed later. Also, see Table 1 for a summary of questions to ask as you consider each factor.

Ordinarily, the date of a contribution is the date on which the property is delivered to the charity or the title transfer date, provided you do not retain any right to or interest in the property that would limit the charity's use of the property.

If you deliver, without any conditions, a properly endorsed stock certificate to a qualified organization or to an agent of the organization, the date of the contribution is the date of delivery. If the certificate is mailed and received through the regular mail, it is the date of mailing. If you deliver the certificate to a bank or broker acting as your agent or to the issuing corporation or its agent, for transfer into the name of the organization, the date of the contribution is the date the stock is transferred on the books of the corporation.

If you grant an option to a qualified organization to buy real property, you have not made a charitable contribution until the organization exercises the option. The amount of the contribution is the FMV of the property on the date the option is exercised minus the exercise price.

You grant an option to a local university, which is a qualified organization, to buy real property. Under the option, the university could buy the property at any time during a 2-year period for $40,000. The FMV of the property on the date the option is granted is $50,000.

In the following tax year, the university exercises the option. The FMV of the property on the date the option is exercised is $55,000. Therefore, you have made a charitable contribution of $15,000 ($55,000, the FMV, minus $40,000, the exercise price) in the tax year the option is exercised.

Determining FMV

Determining the value of donated property depends upon many factors. You should consider all the facts and circumstances connected with the property, including any recent transactions, in determining value. Value may also be based on desirability, use, condition, scarcity, and market demand for that property. Depending on the type of property, there may be other characteristics that are relevant in determining its value.

Cost or Selling Price of the Donated Property

The cost of the property to you or the actual selling price received by the qualified organization may be the best indication of its FMV. However, because conditions in the market change, the cost or selling price of property may have less weight if the property was not bought or sold at a time that is reasonably close to the date of contribution.

The cost or selling price is a good indication of the property's value if:

The purchase or sale took place close to the valuation date in an open market,

The purchase or sale was at “arm's-length,”

The buyer and seller knew all relevant facts,

The buyer and seller did not have to act, and

The market did not change between the date of purchase or sale and the valuation date.

Bailey Morgan, who is not a dealer in gems, bought an assortment of gems for $5,000 from a promoter. The promoter claimed that the price was “wholesale” even though this dealer and other dealers made similar sales at similar prices to other persons who were not dealers. The promoter said that if Bailey kept the gems for more than 1 year and then gave them to charity, Bailey could claim a charitable deduction of $15,000, which, according to the promoter, would be the value of the gems at the time of contribution. Bailey gave the gems to a qualified charity 13 months after buying them.

The selling price for these gems had not changed from the date of purchase to the date Bailey donated them to charity. The best evidence of FMV depends on actual transactions and not on some artificial estimate. The $5,000 paid by Bailey and others is, therefore, the best evidence of the maximum FMV of the gems.

The terms of the purchase or sale should be considered in determining FMV if they influenced the price. These terms include any restrictions, understandings, or covenants limiting the use or disposition of the property.

Unless you can show that there were unusual circumstances, it is assumed that the increase or decrease in the value of your donated property from your cost has been at a reasonable rate. For time adjustments, an appraiser may consider published price indexes for information on general price trends, building costs, commodity costs, securities, and works of art sold at auction in arm's-length sales.

Corey Brown bought a painting for $10,000. Thirteen months later, Corey gave it to an art museum, claiming a charitable deduction of $15,000 on their tax return. The appraisal of the painting should include information showing that there were unusual circumstances that justify a 50% increase in value for the 13 months Corey held the property.

An arm's-length offer to buy the property close to the valuation date may help to prove its value if the person making the offer was willing and able to complete the transaction. To rely on an offer, you should be able to show proof of the offer and the specific amount to be paid. Offers to buy property other than the donated item will help to determine value if the other property is reasonably similar to the donated property.

The sales prices of properties similar to the donated property are often important in determining the FMV. The weight to be given to each sale depends on the following.

The degree of similarity between the property sold and the donated property.

The time of the sale—whether it was close to the valuation date.

The circumstances of the sale—whether it was at arm's-length with a knowledgeable buyer and seller, with neither having to act.

The conditions of the market in which the sale was made—whether unusually inflated or deflated.

Quinn Black, who is not a book dealer, paid a promoter $10,000 for 500 copies of a single edition of a modern translation of a religious book. The promoter had claimed that the price was considerably less than the “retail” price and gave Quinn a statement that the books had a total retail value of $30,000. The promoter advised that if Quinn kept the books for more than 1 year and then gave them to a qualified organization, Quinn could claim a charitable deduction for the “retail” price of $30,000. Thirteen months later, all the books were given to a house of worship from a list provided by the promoter. At the time of the donation, wholesale dealers were selling similar quantities of books to the general public for $10,000.

The FMV of the books is $10,000, the price at which similar quantities of books were being sold to others at the time of the contribution.

The facts are the same as in Example 1 , except that the promoter gave Quinn Black a second option. The promoter said that if Quinn wanted a charitable deduction within 1 year of the purchase, Quinn could buy the 500 books at the “retail” price of $30,000, paying only $10,000 in cash and giving a promissory note for the remaining $20,000. The principal and interest on the note would not be due for 12 years. According to the promoter, Quinn could then, within 1 year of the purchase, give the books to a qualified organization and claim the full $30,000 retail price as a charitable contribution. Quinn purchased the books under the second option and, 3 months later, gave them to a house of worship, which will use the books for religious purposes.

At the time of the gift, the promoter was selling similar lots of books for either $10,000 or $30,000. The difference between the two prices was solely at the discretion of the buyer. The promoter was a willing seller for $10,000. Therefore, the value of Quinn’s contribution of the books is $10,000, the amount at which similar lots of books could be purchased from the promoter by members of the general public.

The cost of buying, building, or manufacturing property similar to the donated item may be considered in determining FMV. However, there must be a reasonable relationship between the replacement cost and the FMV.

The replacement cost is the amount it would cost to replace the donated item on the valuation date. Often, there is no relationship between the replacement cost and the FMV. If the supply of the donated property is more or less than the demand for it, the replacement cost becomes less important.

To determine the replacement cost of the donated property, find the “estimated replacement cost new.” Then subtract from this figure an amount for depreciation due to the physical condition and obsolescence of the donated property. You should be able to show the relationship between the depreciated replacement cost and the FMV, as well as how you arrived at the “estimated replacement cost new.”

Generally, the weight given to a professional appraiser’s opinion on matters such as the authenticity of a coin or a work of art, or the most profitable and best use of a piece of real estate, depends on the knowledge and competence of the professional appraiser and the thoroughness with which the opinion is supported by experience and facts. For a professional appraiser’s opinion to deserve much weight, the facts must support the opinion. For additional information, see Appraisal , later.

Table 1. Factors That Affect FMV

Problems in determining fmv.

There are a number of problems in determining the FMV of donated property.

The sale price of the property itself in an arm's-length transaction in an open market is often the best evidence of its value. When you rely on sales of comparable property, the sales must have been made in an open market. If those sales were made in a market that was artificially supported or stimulated so as not to be truly representative, the prices at which the sales were made will not indicate the FMV.

For example, liquidation sale prices usually do not indicate the FMV. Also, sales of stock under unusual circumstances, such as sales of small lots, forced sales, and sales in a restricted market, may not represent the FMV.

Using sales of comparable property is an important method for determining the FMV of donated property. However, the amount of weight given to a sale depends on the degree of similarity between the comparable and the donated properties. The degree of similarity must be close enough so that this selling price would have been given consideration by reasonably well-informed buyers or sellers of the property.

You give a rare, old book to your former college. The book is a third edition and is in poor condition because of a missing back cover. You discover that there was a sale for $300, near the valuation date, of a first edition of the book that was in good condition. Although the contents are the same, the books are not at all similar because of the different editions and their physical condition. Little consideration would be given to the selling price of the $300 property by knowledgeable buyers or sellers.

You may not consider unexpected events happening after your donation of property in making the valuation. You may consider only the facts known at the time of the gift, and those that could reasonably be expected at the time of the gift.

You give farmland to a qualified charity. The transfer provides that your mother will have the right to all income and full use of the property for her life. Even though your mother dies 1 week after the transfer, the value of the property on the date it is given is its present value, subject to the life interest as estimated from actuarial tables. You may not take a higher deduction because the charity received full use and possession of the land only 1 week after the transfer.

A common error is to rely too much on past events that do not fairly reflect the probable future earnings and FMV.

You give all your rights in a successful patent to your favorite charity. Your records show that before the valuation date there were three stages in the patent's history of earnings. First, there was rapid growth in earnings when the invention was introduced. Then, there was a period of high earnings when the invention was being exploited. Finally, there was a decline in earnings when competing inventions were introduced. The entire history of earnings may be relevant in estimating the future earnings. However, the appraiser must not rely too much on the stage of rapid growth in earnings or of high earnings. The market conditions at those times do not represent the condition of the market at the valuation date. What is most significant is the trend of decline in earnings up to the valuation date. For more information about donations of patents, see Patents , later.

Valuation of Various Kinds of Property

This section contains information on determining the FMV of ordinary kinds of donated property. For information on appraisals, see Appraisal , later.

The FMV of used household items is usually much lower than the price paid when new. Household items include furniture, furnishings, electronics, appliances, linens, and similar items. Household items do not include paintings, antiques, objects of art, jewelry, gems, and collections like stamp and coin collections. Such used property may have little or no market value because it may be out of style.

You cannot take an income tax charitable contribution deduction for household items unless they are in good used condition or better. The one exception to this is a household item that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500. In this case, you must obtain a qualified appraisal valuing the item and complete a Form 8283. See Deduction over $500 for certain clothing or household items , later.

If the property is valuable because it is old or unique, see Art and Collectibles , later.

Used clothing and other personal items are usually worth far less than the price you paid for them. Valuation of items of clothing does not lend itself to fixed formulas or methods.

The price that buyers of used items actually pay in used clothing stores, such as consignment or thrift shops, is an indication of the value.

You cannot take an income tax charitable contribution deduction for an item of clothing unless it is in good used condition or better. An item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires a qualified appraisal and a completed Form 8283. See Deduction over $500 for certain clothing or household items , later.

Art and Collectibles

Your income tax charitable contribution donation of art and collectibles, for which you claim a deduction of more than $5,000 must be supported by a qualified appraisal and a Form 8283. See Qualified Appraisal , later.

If you claim a deduction of $20,000 or more for an income tax charitable contribution donation of art, you must attach the qualified appraisal for the art. A photograph of a size and quality fully showing the object, preferably a high-resolution digital image, must be provided if requested.

If you donate an item of art that has been appraised at $50,000 or more, you can request a Statement of Value for that item from the IRS. You must request the statement before filing the tax return that reports the donation. Your request must include the following.

A copy of a qualified appraisal of the item. See Qualified Appraisal , later.

A user fee of $7,500 for one to three items and $400 for each additional item paid through Pay.gov . A payment confirmation will be provided to you through the Pay.gov portal and you should submit the payment confirmation with your Statement of Value request.

A completed Form 8283, Section B.

The location of the IRS territory that has examination responsibility for your return.

Send your request to:

You can withdraw your request for a Statement of Value at any time before it is issued. However, the IRS will not refund the user fee if you do.

If the IRS declines to issue a Statement of Value in the interest of efficient tax administration, the IRS will refund the user fee.

Because many kinds of art may be the subject of a charitable donation, it is not possible to discuss all of the possible types in this publication. Most common are paintings, sculptures, watercolors, prints, drawings, ceramics, antiques, decorative arts, textiles, carpets, silver, rare manuscripts, and historical memorabilia.

The professional appraiser should use reasonable due diligence to determine or confirm the authenticity of a donated art work. This due diligence may include verifying whether the art work is included in the relevant catalogue raisonné (a scholarly listing of all known works by a specific artist), has an assigned foundation number when relevant, is included in a comprehensive on-line archive, or whether the art work has an accompanying certificate of authenticity from a recognized authority or expert on the artist.

The physical condition and extent of restoration are both relevant in determining the valuation of art and antiques. These factors should be addressed in the appraisal. An antique in damaged condition lacking the "original brasses," may be worth much less than a similar piece in excellent condition.

Because many kinds of collectibles may be the subject of a charitable donation, it is not possible to discuss all of the possible types in this publication. Most common are rare books, autographs, sports memorabilia, dolls, manuscripts, stamps, coins, guns, gems, jewelry, music and entertainment memorabilia, comics, toys, and natural history items.

Publications available to help you determine the value of many kinds of collections include catalogs, dealers' price lists, and specialized hobby periodicals. When using one of these price guides, you must use the current edition at the date of contribution.

For example, a dealer may sell an item for much less than is shown on a price list, particularly after the item has remained unsold for a long time. The price an item sold for in an auction may have been the result of a rigged sale or a mere bidding duel. The appraiser must analyze the reference material, and recognize and make adjustments for misleading entries. If you are claiming an income tax charitable contribution deduction for the donation of a collection valued at more than $5,000, you must obtain a qualified appraisal and complete a Form 8283.

Gems and jewelry are of such a specialized nature that it is almost always necessary to get an appraisal by a specialized jewelry appraiser. The appraisal should describe, among other things, the style of the jewelry, the cut and setting of the gem, and whether it is now in fashion. The stone's coloring, weight, cut, brilliance, and flaws should be reported and analyzed. Sentimental personal value has no effect on FMV. But if the jewelry was owned by a famous person, its value might increase. GIA certificates and color photos should be included in jewelry appraisals.

Most libraries have catalogs or other books that report the publisher's estimate of values. Generally, two price levels are shown for each stamp: the price postmarked and the price not postmarked. Contact an appraiser for assistance with properly valuing stamp collections.

Many catalogs and other reference materials show the writer's or publisher's opinion of the value of coins on or near the date of the publication. Like many other collectors' items, the value of a coin depends on the demand for it, its age, and its rarity. Another important factor is the coin's condition. For example, there is a great difference in the value of a coin that is in mint condition and a similar coin that is only in good condition.

Use caution when consulting price guides for coins as only a trained grader can distinguish the difference between various Mint State grades and circulated grades including extremely fine, very fine, fine, very good, good, fair, or poor. The difference in value between one grade and another could be vast.