- Contributors

Corporate Governance Case Study: Tesla, Twitter, and the Good Weed

Justin Slane, Sharon Makower and Joe Green are editors for the Capital Markets & Corporate Governance Service at Thomson Reuters Practical Law. This post is based on a Practical Law article by Mr. Slane, Ms. Makower and Mr. Green.

Perhaps no company in the world has the perception of its brand being tied to one person more than Tesla Inc. (Tesla) and its CEO and now former chairman of the board, Elon Musk. As at least one journalist phrased it, “ Elon Musk is Tesla. Tesla is Elon Musk .” And Musk is not just the face of Tesla, but a co-founder of PayPal and Solar City, the founder and current CEO of SpaceX and founder of its subsidiary, The Boring Company. He has crafted a “real-life Iron Man” persona, including all the eccentricity, and is undoubtedly one of the most recognizable and polarizing CEOs in the world.

But 2018 has not been the best year for Elon Musk. In what Musk would call negative propaganda pushed by short sellers, Tesla has faced heightened scrutiny and increasingly negative media attention related to a litany of issues, including cash burn , vehicle safety , production capabilities , and a string of employment-related lawsuits and executive exits ( only made worse recently ). Analysts and investors began to publicly cool on Tesla and question its long-term value, which Musk also attributed to short sellers .

In May, citing independence concerns and questioning whether Musk may be stretched too thin, proxy advisory giants Glass, Lewis & Company (Glass Lewis) and Institutional Shareholder Services, Inc. (ISS) opposed the re-election of current Tesla board members and supported splitting Musk’s roles as CEO and chairman.

As the pressure mounted, Musk became increasingly combative, especially on Twitter, lashing out at short sellers and anyone criticizing Tesla or him. Musk’s erratic behavior and obsession with short sellers and critics drew more criticism of his leadership and that of Tesla’s board of directors .

But it all came to a head on August 7, when in the middle of the trading day, without notice or warning to anyone (including other executives and directors at Tesla or contacts at Nasdaq, the exchange on which Tesla’s common stock is listed), Musk tweeted:

Then, for reasons still unknown, nobody took his phone away, and Musk continued tweeting and interacting with shareholders throughout the day:

The public reaction to Musk’s tweets was strong and immediate. Tesla’s stock soared before Nasdaq eventually halted trading for several hours later in the day, and there was instant speculation about whether Musk actually had the funding to take Tesla private (spoiler: he did not).

Musk’s drastic departure from normal public disclosure standards and the subsequent media circus arising from it unsurprisingly captured the attention of the Securities and Exchange Commission (SEC), which ultimately resulted in an enforcement action and settlement with Elon Musk over the tweets. Tesla also settled with the SEC. The end results of the settlements include the following:

- Musk must step down as chairman of the board and be replaced by an independent chairman, but Musk will be allowed to remain as CEO. On November 7, 2018, Tesla appointed an independent chairman.

- Musk and Tesla must each pay $20 million in fines.

- Tesla must add two independent directors and create a formal disclosure committee to oversee communications from Musk.

- Tesla must hire an experienced securities lawyer, subject to approval by the SEC Division of Enforcement (Tesla’s current general counsel was Elon Musk’s divorce attorney and worked primarily in family law before joining Tesla).

This post examines this corporate governance cautionary tale, focusing primarily on the Regulation FD (Reg FD) issues raised by Musk’s tweets and public statements. The full article from which this post is excerpted also examines a host of other issues including disclosure controls and procedures, stock exchange requirements, conflicts of interest, board independence, and more, highlighting for each issue where things went wrong and identifying resources that perhaps could have helped avoid this type of mess. To learn more about these issues, the full article can be accessed here .

Complying with Regulation FD

Much of the initial reporting surrounding Musk’s tweets questioned whether the use of his personal Twitter account violated Reg FD. Reg FD, which took effect in 2000, prohibits selective disclosure by requiring that material nonpublic information disclosed to securityholders or market professionals (including research analysts) must also be disclosed to the public in a broad, non-exclusionary manner. And in fact, in finally answering why he tweeted about taking Tesla private, Musk explained in an August 13 blog post that he wanted to have discussions with key shareholders and he felt it “wouldn’t be right to share information about going private with just [Tesla’s] largest investors.” While Musk’s intentions are noble and in line with the basic principle of nearly 20-year-old federal securities law, the reports were correct that Reg FD generally requires more than tweets.

SEC guidance issued in 2008 and 2013 regarding the use of company websites and social media for disclosure suggests that companies can still satisfy Reg FD requirements if they notify investors of where they can expect material information to be disclosed online, making it a “recognized channel of distribution.” In particular, the 2013 guidance dealt with the Netflix CEO disclosing monthly viewing hours on his personal Facebook page.

The SEC stated that disclosing material nonpublic information on the personal social media site of an individual corporate officer, without advance notice to investors that the site may be used for this purpose, is unlikely to satisfy Regulation FD because it is not likely a method “reasonably designed to provide broad, non-exclusionary distribution of the information to the public” that Reg FD requires. The SEC stated this is true even if “the individual in question has a large number of subscribers, friends or other social media contacts, so that the information is likely to reach a broader audience over time.”

The SEC used its 2013 guidance to highlight the concept that whether a Regulation FD violation occurred will turn on whether the investing public was alerted to the channels of distribution a company will use to disseminate material information. The SEC’s 2008 guidance on the use of company websites outlines the factors that indicate whether a particular channel (whether it be a corporate website or a corporate executive’s social media account) is a recognized channel of distribution for communicating with investors.

In this case, Tesla and Musk had a few factors in their favor:

- A Form 8-K filed on November 5, 2013 , encourages investors to follow Elon Musk’s personal Twitter account for material information being disclosed to the public. Ideally the notice would be repeated, including in Tesla’s annual reports on Form 10-K or additional Form 8-K reports, but at least some form of notice was provided to shareholders.

- Elon Musk also has nearly 23 million Twitter followers. His original tweet was widely picked up and further broadcast by major news sources within minutes, and within hours, former SEC Chairman Harvey Pitt was on major cable news networks discussing whether Musk committed securities fraud.

While it was far from a safe use of social media for Reg FD purposes, Musk and Tesla appear to have a decent argument that shareholders had notice that information could be disclosed through Musk’s personal Twitter account and his account was reasonably designed to provide broad, non-exclusionary disclosure of the information.

Most public companies typically adopt formal policies regarding compliance with Reg FD (as well as the use of social media by their employees and executives). A strong Reg FD policy should contain:

- A complete outline of the procedures and practices of the company concerning disclosure of information to the public.

- A formal limitation on which company personnel are permitted to communicate with analysts and securityholders on behalf of the company. These people should be well-versed in Reg FD and familiar with the company’s public disclosures. Ideally these people should also understand the concept of materiality and what may constitute securities fraud under Rule 10b-5.

- A restatement of the company’s policy on confidentiality of information.

- A guide to disclosing material information.

Companies should also address the use of social media by their employees and executives, whether in their Reg FD policies or in separate social media guidelines that cover both personal social media use and social media use as an authorized company spokesperson.

While a Tesla Reg FD policy, set of social media guidelines, or other corporate communications policy addressing these concerns does not seem to be publicly available, the Tesla Code of Business Conduct and Ethics (last revised in December 2017) refers to a “Communication Policy … [that covers] Tesla’s social media guidelines, media relations and marketing guidelines, and the circumstances and the extent to which individuals are allowed to speak on Tesla’s behalf.” Musk should have been aware of Tesla’s communications policy, ideally having been reminded frequently through regular training for Tesla officers regarding the company’s policy and their obligations under Regulation FD, and never tweeted to begin with.

Twitter Was Always a Bad Choice

Musk’s tweets are also an extreme, yet useful, example of why casual social media use and disclosure of material nonpublic information should not be mixed. Section 10(b) of the Exchange Act prohibits material misstatements and omissions of fact, and companies must always avoid making disclosures in informal social media posts that lack material information or the context necessary for investors to be fully informed. If a company decides that there is material information that should be disclosed to the public, it must then determine when that information must be disclosed. Information should only be disclosed when it is definitive, accurate, clear, and specific.

Twitter can be an excellent tool for supplementing more formal corporate disclosure, such as linking to SEC filings, the company’s website, or attaching a press release as an image. However, individual Twitter posts as the sole medium of disclosure might be the worst form of social media use for disclosing material nonpublic information. The primary differentiating factor between Twitter and other social media platforms is it limits user posts to just 280 characters. Musk used 61 characters in his original going private tweet (if you pro rate his $20 million SEC fine to the characters in that tweet, Musk spent over $2.6 million on spaces alone). While some may applaud his succinctness, Musk’s August 7 tweets and blog post are textbook examples of public disclosures that lack context and completeness.

What does “funding secured” and “investor support is confirmed” mean? Who is/are the buyer(s)? How was the $420 per share price calculated? Has the board received or approved a proposal? None of these basic questions had answers. We later learned in the SEC’s civil complaint against Musk:

- A Tesla investor texted Musk’s chief of staff “What’s Elon’s tweet about? Can’t make any sense of it….”

- A reporter emailed Musk to ask if his tweet was a 420 joke and whether “an actual explanation” was coming.

- The following investor relations exchange happened in real life seven hours, ten tweets, and one blog post after Musk’s initial “going private” tweet:

“After Tesla’s head of Investor Relations received another inquiry from another investment bank research analyst at approximately 7:20 PM EDT, he asked whether the analyst had read Tesla’s ‘official blog post on this topic.’ The analyst responded, ‘I did. Nothing on funding though?’ The head of Investor Relations replied, ‘The very first tweet simply mentioned ‘Funding secured’ which means there is a firm offer. Elon did not disclose details of who the buyer is.’ The analyst then asked, ‘Firm offer means there is a commitment letter or is this a verbal agreement?’ The head of Investor Relations responded, ‘I actually don’t know, but I would assume that given we went full-on public with this, the offer is as firm as it gets.'” (see SEC Complaint, par. 52 .)

It took six full days before Musk or Tesla provided any clarification about what Musk meant by “funding secured” and the rest of his going private tweets on August 7.

Corporate Disclosure or Personal Statements?

Musk’s claim he was making statements in his personal capacity as a potential buyer of Tesla as opposed to on Tesla’s behalf as CEO and Chairman adds another element to this case illustrating why disclosure of material nonpublic information requires full context. If his personal Twitter account is both a recognized channel for corporate communications and a means for him to make disclosures as a private individual, how are investors supposed to know what is corporate information and what is personal?

Nothing in the August 7 tweets or blog post definitively stated Musk was not speaking on behalf of Tesla as its CEO and Chairman. In fact, in the investor relations exchange mentioned above, Tesla’s head of Investor Relations says “… I would assume that given we went full-on public with this…” (emphasis added), phrasing that certainly implies he thought the statements were made on Tesla’s behalf.

It is generally good corporate governance practice that if a company discovers a Reg FD violation, to minimize risks, it should promptly disclose the information by a Reg FD-compliant method. For example, if an executive officer selectively discloses material nonpublic information, the company can correct the situation by filing a Form 8-K to disclose the information.

Given the potential confusion for investors resulting from Musk’s initial tweets and his claim that he made the statements in his “personal capacity,” Tesla should have immediately filed a Form 8-K (which also happens to allow for more than 280 characters) to correct any potentially selective or misleading disclosure made by Musk and provide any additional context necessary. No Form 8-K was filed though. Again, it was six days before Musk or Tesla provided any clarification or additional explanation for his statements on August 7.

The SEC Settlement and Ongoing Fallout

The ultimate fallout from Musk’s brief foray into a possible going private transaction is still ongoing:

- Class action lawsuits are still pending.

- The Department of Justice is still investigating Musk’s tweets.

- Significant investors are engaging with Tesla requesting changes to the board of directors (and other corporate governance practices).

Musk doesn’t seem to be fazed by any of this, and could do something tomorrow that turns this all on its head again. But the SEC settlement with Musk has now been approved by the Southern District of New York, and Tesla has settled separately with the SEC without a formal enforcement action. The terms of the settlements bring us full circle to where the year started, with the recognition that Tesla was facing an increasing battle between responsible corporate governance and Elon Musk’s persona. Tesla lost this round. If the added disclosure controls and expanded board continues losing battles, well, who knows? There is always Teslaquilla (or maybe not )!

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

International Cases of Corporate Governance

- © 2022

- Jean Jinghan Chen 0

University of Macao, Macao, China

You can also search for this author in PubMed Google Scholar

- Provides case studies of corporate governance

- Gives guidance for MNCs in an uncertain era

- Explores international legal structures for corporations

29k Accesses

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

About this book

Similar content being viewed by others.

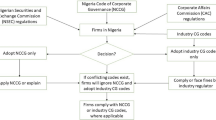

Corporate governance research in Nigeria: a review

Corporate Governance in the EU, the OECD Principles of Corporate Governance and Corporate Governance in Selected Other Jurisdictions

Corporate Governance in Russia

- Corporate governance

- Discusses the case of Carillion, Wells Fargo, & CommInsure

- Addresses the unethical behavior of Volkswagen

- Addresses the financial scandal of Wirecard

- Examines the case of Toshiba, & GOME

Table of contents (14 chapters)

Front matter, introduction.

Jean Jinghan Chen

Carillion PLC

Wells fargo, toshiba (japan), lee kum kee, yunnan baiyao, back matter.

“This book of corporate governance case studies provides a nice complement to existing courses or modules covering the topics of corporate governance, business ethics, and/or corporate social responsibility. There are several well established corporate governance textbooks in existence that included some cases, but this is one of the first stand-alone case books of which I am aware other than Mallin’s casebook published back in 2006. Many of us in the field of comparative corporate governance have our own conceptual framework from which we describe and explain corporate governance behavior and outcomes. This book provides the instructor with quite a bit of freedom to frame the issues around their own personal perspective. Furthermore, in these days of inflated book prices, students should benefit from a text that is fully utilized. I especially liked the relative recency of these cases – all case studies are less than ten years old. Given the turmoil within the global economy and deglobalization trends during the past decade, this book is timely. I also liked that fact that there was a wide range of geographic contexts captured in these cases given the Western bias in previous texts and case studies. Finally, the range of issues is impressive, ranging from dealing with accounting scandals, to ownership and control rights conflicts, to business ethics and corporate social responsibility challenges. If you are looking for a timely casebook on comparative corporate governance, this text should serve you well.” (William Q. Judge, E.V. Williams Professor of Strategic Leadership, Old Dominion University, USA)

“The release of Professor Chen’s new book of international corporate governance cases comes at a time when these new challenges are still defining the new business landscape. Companies are now expected to be more transparent and accountable to their stakeholders. This book not only provides us the insight ofhow and why corporate scandals occur, but also provides insight into the recurrence of corporate governance failures, offers practical guidance for remedying options. Practitioners and policy-makers will certainly learn, share and benefit from the critical thinking this book has provided.” (Qin Zou, Vice President, Stanley Black and Decker, USA)

Authors and Affiliations

About the author, bibliographic information.

Book Title : International Cases of Corporate Governance

Authors : Jean Jinghan Chen

DOI : https://doi.org/10.1007/978-981-19-3238-0

Publisher : Palgrave Macmillan Singapore

eBook Packages : Business and Management , Business and Management (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd. 2022

Hardcover ISBN : 978-981-19-3237-3 Published: 15 September 2022

Softcover ISBN : 978-981-19-3240-3 Published: 16 September 2023

eBook ISBN : 978-981-19-3238-0 Published: 14 September 2022

Edition Number : 1

Number of Pages : XX, 249

Number of Illustrations : 7 b/w illustrations, 18 illustrations in colour

Topics : Accounting/Auditing , Business Finance , Business and Management, general , Performers and Practitioners , Automotive Industry

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Browse All Articles

- Newsletter Sign-Up

Governance →

- 23 Apr 2024

- Cold Call Podcast

Amazon in Seattle: The Role of Business in Causing and Solving a Housing Crisis

In 2020, Amazon partnered with a nonprofit called Mary’s Place and used some of its own resources to build a shelter for women and families experiencing homelessness on its campus in Seattle. Yet critics argued that Amazon’s apparent charity was misplaced and that the company was actually making the problem worse. Paul Healy and Debora Spar explore the role business plays in addressing unhoused communities in the case “Hitting Home: Amazon and Mary’s Place.”

- 18 Mar 2024

- Research & Ideas

When It Comes to Climate Regulation, Energy Companies Take a More Nuanced View

Many assume that major oil and gas companies adamantly oppose climate-friendly regulation, but that's not true. A study of 30 years of corporate advocacy by Jonas Meckling finds that energy companies have backed clean-energy efforts when it aligns with their business interests.

- 04 Mar 2024

Want to Make Diversity Stick? Break the Cycle of Sameness

Whether on judicial benches or in corporate boardrooms, white men are more likely to step into roles that other white men vacate, says research by Edward Chang. But when people from historically marginalized groups land those positions, workforce diversification tends to last. Chang offers three pieces of advice for leaders striving for diversity.

- 27 Feb 2024

Why Companies Should Share Their DEI Data (Even When It’s Unflattering)

Companies that make their workforce demographics public earn consumer goodwill, even if the numbers show limited progress on diversity, says research by Ryan Buell, Maya Balakrishnan, and Jimin Nam. How can brands make transparency a differentiator?

- 17 Jan 2024

Are Companies Getting Away with 'Cheap Talk' on Climate Goals?

Many companies set emissions targets with great fanfare—and never meet them, says research by Shirley Lu and colleagues. But what if investors held businesses accountable for achieving their climate plans?

- 09 Jan 2024

Could Clean Hydrogen Become Affordable at Scale by 2030?

The cost to produce hydrogen could approach the $1-per-kilogram target set by US regulators by 2030, helping this cleaner energy source compete with fossil fuels, says research by Gunther Glenk and colleagues. But planned global investments in hydrogen production would need to come to fruition to reach full potential.

- 02 Jan 2024

- What Do You Think?

Do Boomerang CEOs Get a Bad Rap?

Several companies have brought back formerly successful CEOs in hopes of breathing new life into their organizations—with mixed results. But are we even measuring the boomerang CEOs' performance properly? asks James Heskett. Open for comment; 0 Comments.

- 28 Nov 2023

Economic Growth Draws Companies to Asia. Can They Handle Its Authoritarian Regimes?

The efficiency of one-party governments might seem appealing, but leaders need a deep understanding of a country's power structure and "moral economy," says Meg Rithmire. Her book Precarious Ties: Business and the State in Authoritarian Asia explores the delicate relationship between capitalists and autocrats in the region.

- 07 Nov 2023

How Should Meta Be Governed for the Good of Society?

Julie Owono is executive director of Internet Sans Frontières and a member of the Oversight Board, an outside entity with the authority to make binding decisions on tricky moderation questions for Meta’s companies, including Facebook and Instagram. Harvard Business School visiting professor Jesse Shapiro and Owono break down how the Board governs Meta’s social and political power to ensure that it’s used responsibly, and discuss the Board’s impact, as an alternative to government regulation, in the case, “Independent Governance of Meta’s Social Spaces: The Oversight Board.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 02 May 2023

How Should Artificial Intelligence Be Regulated—if at All?

Some AI pioneers say the technology could be a risk to humanity, and some governments have taken steps to rein it in. But who should set the rules and what details must they consider? asks James Heskett. Open for comment; 0 Comments.

- 24 Apr 2023

What Does It Take to Build as Much Buzz as Booze? Inside the Epic Challenge of Cannabis-Infused Drinks

The market for cannabis products has exploded as more states legalize marijuana. But the path to success is rife with complexity as a case study about the beverage company Cann by Ayelet Israeli illustrates.

- 21 Apr 2023

The $15 Billion Question: Have Loot Boxes Turned Video Gaming into Gambling?

Critics say loot boxes—major revenue streams for video game companies—entice young players to overspend. Can regulators protect consumers without dampening the thrill of the game? Research by Tomomichi Amano and colleague.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 28 Mar 2023

The FDA’s Speedy Drug Approvals Are Safe: A Win-Win for Patients and Pharma Innovation

Expediting so-called breakthrough therapies has saved millions of dollars in research time without compromising drug safety or efficacy, says research by Ariel Stern, Amitabh Chandra, and colleagues. Could policymakers harness the approach to bring life-saving treatments to the market faster?

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

- In Practice

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 14 Feb 2023

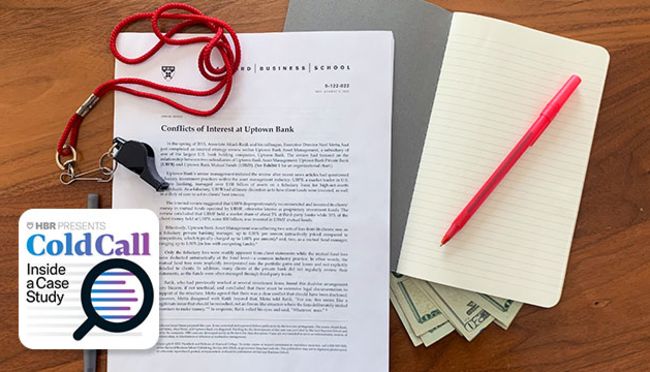

Does It Pay to Be a Whistleblower?

In 2013, soon after the US Securities and Exchange Commission (SEC) had started a massive whistleblowing program with the potential for large monetary rewards, two employees of a US bank’s asset management business debated whether to blow the whistle on their employer after completing an internal review that revealed undisclosed conflicts of interest. The bank’s asset management business disproportionately invested clients’ money in its own mutual funds over funds managed by other banks, letting it collect additional fees—and the bank had not disclosed this conflict of interest to clients. Both employees agreed that failing to disclose the conflict was a problem, but beyond that, they saw the situation very differently. One employee, Neel, perceived the internal review as a good-faith effort by senior management to identify and address the problem. The other, Akash, thought that the entire business model was problematic, even with a disclosure, and believed that the bank may have even broken the law. Should they escalate the issue internally or report their findings to the US Securities and Exchange Commission? Harvard Business School associate professor Jonas Heese discusses the potential risks and rewards of whistleblowing in his case, “Conflicts of Interest at Uptown Bank.”

Is Sweden Still 'Sweden'? A Liberal Utopia Grapples with an Identity Crisis

Changing political views and economic forces have threatened Sweden's image of liberal stability. Is it the end of the Scandinavian business-welfare model as we know it? In a case study, Debora Spar examines recent shifts in Sweden and what they mean for the country's future.

- 17 Jan 2023

Nestlé’s KitKat Diplomacy: Neutrality vs. Shared Value

In February 2022, Russia invaded Ukraine, and multinational companies began pulling out of Russia, in response. At Switzerland-based Nestlé, chief executive Mark Schneider had a difficult decision to make. Nestlé had a long tradition of neutrality that enabled it to operate in countries regardless of their political systems and human rights policies. But more recently the company had embraced Michael Porter’s “shared value” paradigm, which argues that companies have a responsibility to improve the business community and the health of their communities. What should Schneider do? Professor Geoffrey Jones discusses the viability of the shared value concept and the social responsibility of transnational corporations today in the case, “Nestlé, Shared Value and Kit Kat Diplomacy.”

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

- Disclosures

- Insights & Reports

Owned by 186 member countries and consistently rated AAA/Aaa. IFC aims to achieve our mission of promoting development by providing debt and equity to the private sector, through a range of benchmark and bespoke products.

- Governments

- Apply for Financing

- IFC Careers

- General Inquiries

Case Studies of Good Corporate Governance

This second fully revised edition of "Case Studies of Good Corporate Governance Practices" presents the experiences of a set of leading companies in Latin America in reforming and improving how their firms are governed, and the results these changes have achieved. Each chapter's contents reflect the views of one company's management and directors of the motivations, challenges, solutions and rewards for devising and putting in place better governance rules and practices.

The full publication download also includes the case studies translated into Spanish and Portuguese.

DOWNLOAD PDF

Get full access to Case Studies in Business Ethics and Corporate Governance and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

Case Studies in Business Ethics and Corporate Governance

Read it now on the O’Reilly learning platform with a 10-day free trial.

O’Reilly members get unlimited access to books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Book description

Table of contents.

- Content (1/2)

- Content (2/2)

- APPLE’S CULTURE

- ENVIRONMENTAL RECORD

- LABOR PRACTICES

- CORPORATE GOVERNANCE ISSUES

- PRICE CUT STRATEGY

- ANNA HAZARE’S BACKGROUND

- ANNA HAZARE: THE SECOND GANDHI

- MOVEMENT: “INDIA AGAINST CORRUPTION (IAC)”

- ANNA’S MOVEMENT

- THE DARK SIDE OF INDIA

- IMPACT OF ANNA HAZARE’S MOVEMENT

- WHAT WENT WRONG?

- WE ALL ARE ANNA!!

- EVOLUTION OF APPLE

- EVOLUTION OF SAMSUNG

- INDUSTRY ANALYSIS

- PORTER’S FIVE FORCE MODEL TO ANALYZETHE SMARTPHONE MARKET

- INTELLECTUAL PROPERTY INFRINGEMENT

- IMPACT ON SUPPLIER RELATIONSHIP

- STRATEGIES APPLE MAY ADOPT TO PROTECT ITSELF FROMPATENT INFRINGEMENT

- CORPORATE GOVERNANCE

- CORPORATE GOVERNANCE IN INDIA

- CORPORATE GOVERNANCE AT WIPRO

- MANAGEMENT’S RESPONSIBILITIES

- THE INDIAN SOFTWARE SERVICES INDUSTRY

- HISTORICAL BACKGROUND

- ETHICAL ISSUES AND CHALLENGES

- US ENERGY INDUSTRY ANALYSIS

- ENERGY MARKET DEREGULATION AND ENRON

- BUSINESS DIVERSIFICATION AND GROWTH

- ENRON’S CODE OF CONDUCT

- RISE IN THE STOCK PRICES OF ENRON

- THE ALARM SET OFF BY BETHANY McCLEAN: “IS ENRON OVERPRICED?”

- ISSUES AT ENRON

- QUESTIONABLE PRACTICES

- TOP EXECUTIVES AND THEIR ROLES

- SHERRON WATKINS “THE WHISTLEBLOWER”

- FALL OF ENRON

- ETHICAL DILEMMA

- ITC PVT LTD. (1/2)

- ITC PVT LTD. (2/2)

- ABOUT JOHNSON & JOHNSON

- 1998–2006, TURBULENCE STARTED

- TURBULENCE WORSENS (1/2)

- TURBULENCE WORSENS (2/2)

- INTRODUCTION

- INDUSTRY CHARACTERISTICS

- INTO THE SPOTLIGHT

- ETHICAL ISSUES – WHERE TO DRAW THE LINE? (1/2)

- ETHICAL ISSUES – WHERE TO DRAW THE LINE? (2/2)

- ABOUT ANIL DHIRUBHAI AMBANI GROUP (ADAG)

- CORPORATE GOVERNANCE AT RELIANCE GROUP

- INDIAN OIL INDUSTRY

- BACKGROUND OF COMPANIES

- FUEL BEHIND THE FIRE

- JUDGMENT OF THE APEX COURT

- RIL REACTS SWIFTLY

- COMPANY BACKGROUND

- THE SUBHIKSHA SAGA

- BUSINESS VISION AND MISSION OF SUBHIKSHA

- INDIAN RETAIL INDUSTRY: A STORY OF TRANSITION

- BUSINESS MODEL OF SUBHIKSHA

- OPERATIONS MANAGEMENT AT SUBHIKSHA RETAIL

- FAILURE OF SUBHIKSHA – WHAT ACTUALLY WENT WRONG?

- FINANCIAL HEALTH OF SUBHIKSHA

- ETHICAL ISSUES

- TATA MOTORS COMPANY BACKGROUND

- AUTOMOBILE INDUSTRY CHARACTERISTICS

- TATA NANO LAND ACQUISITION ISSUE

- COSTS OF CONFLICT

- THE TATA GROUP

- ABOUT THE COMPANY – TATA CHEMICALS LIMITED

- VISION, MISSION AND VALUES

- COMPANY’S PHILOSOPHY ON THE CODE OF GOVERNANCE

- CORPORATE SOCIAL RESPONSIBILITY BY TATA CHEMICALSLIMITED

- SOME IMPORTANT CSR INITIATIVES BY TATA AT MITHAPUR

- THE UNION’S TUSSLE AT TATA CHEMICALS LIMITED

- Index (1/2)

- Index (2/2)

Product information

- Title: Case Studies in Business Ethics and Corporate Governance

- Author(s): Sreejesh, Mohapatra

- Release date: January 2012

- Publisher(s): Pearson Education India

You might also like

Business ethics and rational corporate policies.

by Konstantinos Mantzaris

This book is about providing a comprehensive framework for understanding business ethics and corporate governance. As …

Business Ethics and Corporate Governance

by A.C. Fernando

usiness Ethics and Corporate Governance offers readers a comprehensive coverage of the theories of business ethics …

Business Sustainability, Corporate Governance, and Organizational Ethics

by Zabihollah Rezaee, Timothy Fogarty

A comprehensive framework for understanding the most important issues in global business This is the e-book …

Corporate Governance and Ethics

by Zabihollah Rezaee

Colleges and universities play an important role in training competent and ethical future academic and business …

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

What Corporate Boards Can Learn from Boeing’s Mistakes

- Sandra J. Sucher

- Shalene Gupta

Five lessons from the 737 MAX shareholder lawsuit.

Board members have an incredibly difficult job. On average they spend between 250 to 350 hours a year advising the company, and they must understand the manifold issues management is dealing with, as well as the industry and global context. When they fail at these duties, the consequences, including public outrage, can be immense, as we’re seeing in a shareholder lawsuit against Boeing. The suit offers five main lessons for companies and board members: 1) Hire board members for competence and objectivity; 2) Ensure that the board structure aligns with industry needs; 3) Prepare for the worst case; 4) Manage for truth and realism; and 5) Practice accountability and punish wrongdoing.

In February, Boeing shareholders filed a lawsuit against the company’s board of directors. They argued that the board had neglected their oversight duty, failing to hold Boeing accountable for safety before and after the crashes of two 737 MAX airplanes that killed 346 people in 2018 and 2019. “Safety was no longer a subject of Board discussion, and there was no mechanism within Boeing by which safety concerns respecting the 737 MAX were elevated to the Board or to any Board committee,” they wrote in the 120-page filing .

- Sandra J. Sucher is a professor of management practice at Harvard Business School. She is the coauthor of The Power of Trust: How Companies Build It, Lose It, and Regain It (PublicAffairs 2021).

- Shalene Gupta is a journalist and writer. She is co-author of The Power of Trust: How Companies Build It, Lose It, and Regain It (PublicAffairs, 2021), and the author of The Cycle: Confronting the Pain of Periods and PMDD (Flatiron, 2024).

Partner Center

- Author Biography

- Case Studies

Select Page

Corporate Governance Case Studies Volume 11: The Final Volume

Posted by Mak Yuen Teen | Oct 20, 2022 | Articles , Case Studies

By Mak Yuen Teen

Thank you to CPA Australia for honouring me with a formal launch of Volume 11 of the Corporate Governance Case Studies last night at the Singapore Division President’s Dinner, and to the many CPA Australia members who congratulated me.

When I worked on the first volume with CPA Australia, which was published in 2012, I did not expect that we would end up with one volume every year until 2022. This latest volume, Volume 11, will be the final volume in this series.

In all, the 11 volumes contain 237 cases – 84 Singapore, 54 Asia-Pacific (ex-Singapore), and 99 from the rest of the world. In 2020, I also co-edited a special financial services edition with my colleague, Richard Tan, also published by CPA Australia. That special edition contains 22 cases, with 17 cases re-edited and updated, and 5 new cases (2 Asia-Pacific and 3 rest of the world) that did not appear in the regular series. Therefore, in total, there have been 242 different cases.

38 cases have been translated to Chinese for the HK, PRC and Taiwan markets. The first 3 volumes containing 58 cases have been translated to Vietnamese in collaboration with the stock exchanges and other professional bodies there.

The cases were written from public information – except for a small number where the views of company management or institutional investors were sought and included (in which case, they were made clear). They were written to facilitate discussion of issues – not as analyses of a company’s situation.

I put in place a very thorough process to ensure that they are accurate, objective and well-written. The cases may cite comments reported in public sources which reflect the views of certain individuals or organisations but it is for the reader to make their own assessment of the situations described in the cases. After students in my course have submitted the cases as part of their coursework, I selected the best or most interesting cases. Students whose cases were selected are acknowledged as the original authors of these cases. An editorial assistant would check, rewrite, add content and update for recent developments, often with the help of other student assistants. I reviewed and approved every case, often doing more rewriting and adding more content. They were then sent to CPA Australia and I personally went through the proofs for the entire volume before its publication. It was a time-consuming exercise that took up a considerable amount of my time during the break between the two semesters from May to August each year. As recent cases have become more in-depth, I have also been spending an increasing amount of time on them. It is really my passion for corporate governance that has kept this going for so long.

All the cases are available online for free use. Over the years, many professors, universities and organisations have asked for permission to use many of the cases. I have used them in my own courses and in professional development programs for directors, senior executives and regulators that I conduct, and some of my colleagues have also used some cases for their courses. Many individuals have written to me or commented on social media about how much they like the cases and look forward to them.

I appreciate the partnership with CPA Australia. However, it is time for me to move on.

Corporate governance cases often raise issues that are controversial or sensitive. Those who follow my work know that I speak and write about corporate governance issues without fear or favour. I believe the final decision as to whether a case study should be published should rest with me, but this may not always be possible under the current arrangement.

Many have told me that they will miss the case studies. I hope that the series can be rebooted fairly quickly under a different arrangement. It may be that a new series will include more cases that deal with the “E” and “S” issues in ESG, as some of the cases already do. However, corporate governance will continue to provide the foundation for future cases, including cases covering broader sustainability issues.

I have also been talking to some stakeholders in the region about the possibility of partnering to write more cases of companies in other ASEAN markets – possibly including about companies which have been substantively improving their ESG practices.

In the meantime, I have some unedited and unpublished cases which I hope to edit and publish in due course.

As a Marvel fan, I think of this as just the end of Phase 1. Some may wonder why end at volume 11 and not volume 12. It’s a bit like asking why there are 23 and not 24 movies in Marvel Phase 1. Marvel Phase 1 started in 2008 with Ironman and ended in 2018 with Avengers: Endgame. Mine ran from 2012 to 2022 so the gap is the same.

More seriously, thank you to everyone who have given me support and encouragement for this series of corporate governance case studies over the years. For ease of access, I have also included the earlier volumes, including the financial services edition, for download below.

Download (PDF, 3.95MB)

Download (PDF, 3.27MB)

Download (PDF, 2.84MB)

Download (PDF, 2.47MB)

Download (PDF, 4.16MB)

Download (PDF, 1.91MB)

Download (PDF, 1.54MB)

Download (PDF, 1.99MB)

Download (PDF, 3.42MB)

Download (PDF, 3.14MB)

Download (PDF, 1.12MB)

Download (PDF, 1.66MB)

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

About The Author

Mak Yuen Teen

This is a personal website of Mak Yuen Teen intended to convey his personal views on current developments in corporate governance and to share thought leadership publications. He sees himself as a corporate governance advocate, taking an independent and objective view of corporate governance situations with the goal of improving corporate governance for the public interest. Yuen Teen has been involved in many key corporate governance developments in Singapore and the region. He was the founder of the first corporate governance centre in Singapore and developed the first corporate governance index in Singapore; has served on various corporate governance committees set up by the Singapore authorities; has served on boards and committees in various not-for-profit and international organisations; regularly conducts training for directors, regulators and other professionals; edits an annual collection of case studies published by CPA Australia; and has been recognised by both investor and director bodies with awards and citations for his contributions to corporate governance.

Related Posts

Will datapulse shareholders be haunted by the seoul hotel.

March 7, 2019

A truly extraordinary meeting that raises many issues

March 29, 2016

Why do companies make attending AGMs so tough?

April 1, 2015

Vietnam Independent Directors Association (VNIDA): Independent Directors Competency Framework

December 29, 2023

Receive Notifications of New Posts by Email

Your email here...

Yes, I'm In!

Recent Posts

Top posts & pages.

- Practising lawyers serving as independent directors should be closely scrutinised

- BEST WORLD: UGLY TIME FOR MINORITY SHAREHOLDERS

- Seatrium’s Settlements with Brazilian Authorities

- Interview on Gender Diversity with Money FM 98.3

Yes, I'm in!

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

Models of Corporate Governance. Who's the Fairest of Them All?

In 2007, corporate governance became a well-discussed topic in the business press. Newspapers produced detailed accounts of corporate fraud, accounting scandals, excessive compensation, and other perceived organizational failures—many of which culminated in lawsuits, resignations, and bankruptcy. Central to these stories was the assumption that somehow corporate governance was to blame. That is, there was a functional failure in the system of checks and balances established to prevent abuse by executives. This case explores the various corporate governance systems that have been adopted in the United States and in various countries in Europe and Asia. The issues of control, director independence, auditor independence, dual-board versus unitary-board structure, comply-or-explain, and legislative versus market-driven solutions are explored. Readers are asked to evaluate what governance systems or elements they consider to be most effective. Plentiful examples—including Johnson & Johnson, BMW Group, Michelin, Heineken, Toyota, Samsung, Posco, PetroChina, Infosys, and many others—are used throughout as illustration.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Trends shaping corporate governance in 2023 – Four areas to watch

04 January, 2023

Looking back on 2022

2022 saw upheaval with rising inflation, the war in Ukraine, energy price disruptions, and continued supply chain problems. There was action on the legislative and regulatory fronts too. Billed as the largest climate legislation in US history, President Biden signed into law the Inflation Reduction Act that includes tax credits and incentives to help companies tackle climate change. The pace of regulations from the SEC increased, and the EU finalized regulation of ESG topics that will impact US and other non-EU companies and their EU subsidiaries.

After the midterm elections, the new Congress returns to a divided government. Divided government is often viewed by businesses as a positive development as they believe it makes it difficult for comprehensive legislation favored by only one political party to become law. According to PwC’s latest Pulse Survey , 52% of respondents view a flip of the House of Representatives to Republican control as a positive change for business, compared to only 8% who believe it will have a negative impact and 34% who believe it will have no impact. But traditional policy paradigms have shifted in recent years, creating unlikely bedfellows on issues that have historically been favored by one political party or the other. So, businesses will need to remain vigilant.

Here are the four trends I’m watching for in 2023:

Trend 1: responding to macroeconomic uncertainty.

We face an unusual and uncertain economic situation—the potential for a recession with an odd confluence of factors—rising inflation, higher interest rates, low unemployment, and, for the moment, growth and high consumer spending. I see this uncertainty intensifying in 2023. It has been a decade since the last major recession. Given the potential risks, companies should leverage their longer-tenured directors while maintaining a balanced approach to board refreshment.

Last year, some companies began to focus on their enterprise risk management (ERM) process to identify priority areas and risks and developed strategies to respond. This year, when considering changes in strategy in response to the downturn, companies are more focused on long-term strategic initiatives necessary for growth. According to a recent PwC survey , despite the macroeconomic uncertainty, 83% of executives are focusing business strategy on growth as they confront today’s economic challenges. I agree—employing efforts focused on cost-cutting measures, like hiring freezes, for example, may have unintended consequences. Opportunistic competitors could attract great talent as others temporarily stop hiring or make reductions to their headcount.

Potential blind spots:

- Focusing on short-term uncertainty at the expense of long-term sustainability; balance is important

- Instituting a hiring freeze or headcount reduction without accounting for existing shortages in key business areas

Trend 2: Enhanced transparency in light of increasing responsibilities and pressures

Shareholders and regulators have shown increasing interest in understanding how boards execute their oversight responsibilities. In 2023, I expect boards to continue responding with increased transparency.

In preparation, boards are looking to collectively elevate their knowledge. Board education programs that focus on discrete topics, like cybersecurity and climate, will support this goal. But the most effective boards will use a multi-faceted approach, leveraging internal and external resources tailored for their needs, as well as continuing education.

Boards will also need to re-evaluate the allocation of responsibilities to maximize their effectiveness. The allocation matrix and reporting structure between management, committees, and the full board should be clear. This is especially true if the SEC’s final climate and cybersecurity rules include detailed governance disclosures as written in the initial proposals.

Boards are under pressure to identify directors with varied expertise (e.g., DEI, cyber). Before looking externally, they should consider whether (1) directors have the credentials and (2) existing disclosures effectively document their existing credentials and processes. Providing visibility into how directors meet their responsibilities—while holding themselves publicly accountable—is paramount in creating trust with all stakeholders.

- Not evaluating if the board’s competencies align with how the business has evolved and oversight of new areas, like cybersecurity

- Relying on a point in time program or certificate to establish expertise in a topical area that is evolving quickly; it can lead to overestimating abilities

- Identifying a single board member as the expert in a topical area instead of collectively elevating the knowledge of all directors

- Limiting the audit committee’s oversight to financial disclosures when their process and controls expertise can be leveraged for disclosures being made in other documents, like the proxy statement and corporate sustainability report

Trend 3: Strain on talent

Companies are overhauling how and where work gets done at the same time that there is a generational shift in who is doing the work. As younger generations advance in the workforce, I see the best boards expanding their human capital oversight deeper into the organization to understand and address this shift. In addition, C-suite succession planning may need an overhaul to identify young leaders ready to succeed. Even against economic headwinds, companies should identify gaps in their talent and have upskilling plans to fill in the gaps. A talent pool that is diverse in many respects addresses this and other needs for different ways of thinking.

Companies can look outside the C-suite for gaps in talent. I have seen a shortage of talent in areas like legal, finance, and internal audit. This poses risks for companies, for example, in ensuring appropriate internal controls are in place. Companies may have to outsource responsibilities in response, but this comes with a price tag. Our paper, A deeper dive into talent management: the new board imperative , outlines how critical it is for boards to provide greater oversight of talent management at multiple levels of the organization and what directors can do.

- Failing to align talent discussions with the ERM process—this could mean companies do not have the right talent for the risks identified

- Misunderstanding what motivates the next generation—flexibility, culture, well-being, reputation, and impact are key decision points for the next set of outperformers

Trend 4: Plain English reporting to the board

It’s clear that the scope of board oversight has expanded. When I meet with clients, I am consistently asked how the board can be confident that they are receiving the right information and asking the right questions. This is a difficult question to answer. Ultimately, it comes down to having a strong relationship and good dialogue with management. That starts with making sure that board materials are clear and designed to support their oversight responsibilities.

ESG is a great example. It would be impossible for the board to oversee every risk and topic that could be attached to the moniker. Further, processes to compile the information to produce a coherent narrative and supporting metrics for the company as a whole are just emerging. Seeking discipline in what information the board receives and its link to strategy will prepare the company to answer questions from a diverse set of stakeholders.

Another example is cybersecurity, where boards tell us they want better information. Less than half of board members (46%) who responded to our survey of corporate directors say they’re receiving consistent, decision-useful chief information security officer reporting to understand progress on key cyber risks. That information is mission critical in preparing for a cyber breach.

Our paper, Get boardroom ready: five ways to improve executive interactions with the board , focuses on preparing best-in-class board materials, knowing your audience, and presenting a clean message.

- Not leaning into the board evaluation process to ensure efficient and effective practices

- Failing to establish a clear process for prioritizing ESG issues and spreading responsibility around the board and committees

- Relying on the SEC as the sole ESG disclosure authority, as our recent survey of corporate directors showed more than half of directors (54%) are either unsure or don’t understand if their company needs to comply with the EU’s Corporate Sustainability Reporting Directive

Finally, I’ll also be watching these emerging trends to see how they develop:

- Technological transformation (e.g., implementing new technologies, such as blockchain)

- Executing against climate commitments, such as net zero

- Investors’ focus on natural capital (i.e., the need to better manage and value natural resources like water, timber, and fisheries)

{{filterContent.facetedTitle}}

Playback of this video is not currently available

{{item.publishDate}}

{{item.title}}

{{item.text}}

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

Your browser is not supported

Sorry but it looks as if your browser is out of date. To get the best experience using our site we recommend that you upgrade or switch browsers.

Find a solution

We use cookies to improve your experience on this website. To learn more, including how to block cookies, read our privacy policy .

- Skip to main content

- Skip to navigation

- Collaboration Platform

- Data Portal

- Reporting Tool

- PRI Academy

- PRI Applications

- Back to parent navigation item

- What are the Principles for Responsible Investment?

- PRI 2021-24 strategy

- A blueprint for responsible investment

- About the PRI

- Annual report

- Public communications policy

- Financial information

- Procurement

- PRI sustainability

- Diversity, Equity & Inclusion for our employees

- Meet the team

- Board members

- Board committees

- 2023 PRI Board annual elections

- Signatory General Meeting (SGM)

- Signatory rights

- Serious violations policy

- Formal consultations

- Signatories

- Signatory resources

- Become a signatory

- Get involved

- Signatory directory

- Quarterly signatory update

- Multi-lingual resources

- Espacio Hispanohablante

- Programme Francophone

- Reporting & assessment

- R&A Updates

- Public signatory reports

- Progression pathways

- Showcasing leadership

- The PRI Awards

- News & events

- The PRI podcast

- News & press

- Upcoming events

- PRI in Person 2024

- All events & webinars

- Industry events

- Past events

- PRI in Person 2023 highlights

- PRI in Person & Online 2022 highlights

- PRI China Conference: Investing for Net-Zero and SDGs

- PRI Digital Forums

- Webinars on demand

- Investment tools

- Introductory guides to responsible investment

- Principles to Practice

- Stewardship

- Collaborative engagements

- Active Ownership 2.0

- Listed equity

- Passive investments

- Fixed income

- Credit risk and ratings

- Private debt

- Securitised debt

- Sovereign debt

- Sub-sovereign debt

- Private markets

- Private equity

- Real estate

- Climate change for private markets

- Infrastructure and other real assets

- Infrastructure

- Hedge funds

- Investing for nature: Resource hub

- Asset owner resources

- Strategy, policy and strategic asset allocation

- Mandate requirements and RfPs

- Manager selection

- Manager appointment