- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Private equity

- Entrepreneurial financing

- Entrepreneurship

- Finance and investing

- Investment management

To Make Deals in the Middle Market, Private Equity Needs Cultural Literacy

- Nancy Langer

- Sharon B Heaton

- March 11, 2022

Corporate Governance Should Combine the Best of Private Equity and Family Firms

- Dominic Houlder

- Nandu Nandkishore

- December 22, 2016

Private Equity's New Phase

- Dave Ulrich

- Justin Allen

- August 09, 2016

The Strategic Secret of Private Equity

- Felix Barber

- Michael Goold

- From the September 2007 Issue

The Role of Private Equity in Driving Up Health Care Prices

- Lovisa Gustafsson

- Shanoor Seervai

- David Blumenthal

- October 29, 2019

Lessons from Private Equity Any Company Can Use

- Orit Gadiesh & Hugh MacArthur

- March 07, 2008

Truth About Private Equity Performance

- Oliver Gottschalg

- Ludovic Phalippou

- From the December 2007 Issue

Private Equity’s Lessons for the Rest of Us

- Paul Michelman

- July 23, 2007

Managing Shareholders in the Age of Stakeholder Capitalism

- Mark DesJardine

- August 28, 2022

Establish a Productive Private Equity Partnership

- Katherine Alexander

- Richard Davis

- November 08, 2021

Private Equity's Long View

- Walter Kiechel

- From the July–August 2007 Issue

How to Attract the Right Shareholders

- August 08, 2023

How to Compete for Talent like a Private Equity Firm

- March 31, 2008

Does Business Need a New Model?

- Roger L. Martin

- Lucian A. Bebchuk

- From the January–February 2021 Issue

Why Private Equity Still Makes Us a Little Queasy

- January 17, 2012

Private Equity Should Take the Lead in Sustainability

- Robert G. Eccles

- Vinay Shandal

- David Young

- Benedicte Montgomery

- From the July–August 2022 Issue

Private Equity Needs a New Talent Strategy

- Ted Bililies

- From the November–December 2023 Issue

What Private Equity Investors Think They Do for the Companies They Buy

- Paul A. Gompers

- Paul Gompers

- Steven Kaplan

- Vladimir Mukharlyamov

- June 18, 2015

Do Politics Shape Buyout Performance?

- Oliver F. Gottschalg

- Aviad A. Pe'er

- From the November 2008 Issue

Private Equity Can Make Firms More Innovative

- Nicole Torres

- June 29, 2015

To Buy or Not To Buy - The Agony of Choice: A Day in the Life of a Private Equity Partner

- Claudia Zeisberger

- Graham Oldroyd

- Alexandra von Stauffenberg

- August 30, 2021

StreetShares, Inc.: Fintech Platform Lending Business

- Susan Chaplinsky

- December 17, 2019

Taking Private Equity Public: The Blackstone Group

- Mary Margaret Frank

- Elena Loutskina

- Kristin Milone

- November 04, 2011

Arcano Partners: Scaling Impact With a Fund of Funds (A)

- Nicolas Mo Umpierre

- Fabrizio Ferraro

- April 28, 2022

Antoine Leboyer and GSX

- Richard S. Ruback

- Royce Yudkoff

- September 22, 2013

Investindustrial Exits Ducati

- Francois Brochet

- Karol Misztal

- February 06, 2013

Rufus Rivers and Career Choices in Private Equity and Venture Capital Finance

- Steven S. Rogers

- Pat Vaccaro

- Scott T. Whitaker

- October 01, 2010

Blackstone at Age 30

- Josh Lerner

- John D. Dionne

- Amram Migdal

- January 06, 2016

Foreign vs. Local Funds: A Note on the Dynamics of the Private Equity Industry in China

- Benjamin Y. Lee

- June 07, 2012

Spyder Active Sports--2004

- Belen Villalonga

- Dwight B. Crane

- September 07, 2005

Israel Secondary Fund (ISF): Completing venture capital in the start-up nation

- Benoit F. Leleux

- Ilya Altukhov

- Elfie Bogaerts

- Madalina Manoiu

- Jorg Schuttrumpf

- Norman Wijeyratne

- October 12, 2022

Summit Partners--The FleetCor Investment (C)

- Michael J. Roberts

- October 11, 2006

Altoona State Investment Board: July 2012

- Nathaniel Burbank

- October 17, 2012

Project Bravo - Target Information

Note on valuation in private equity settings.

- John Willinge

- October 31, 1996

Globant: Going Public

- Natee Amornsiripanitch

- October 21, 2014

Sula Vineyards

- Armand Gilinsky Jr.

- Raymond H. Lopez

- July 15, 2008

Cumberland Entertainment (B): The Revised Offer

- Abigail Leland

- Christoph Zott

- December 01, 2004

Redhill Capital: Strategy in a Pandemic

- Hugh Thomas

- November 04, 2021

Shenzhen Development Bank

- X.B. (Xiao-Bing) Bai

- August 21, 2009

Durian - Process Management for Professional Services (Executive education), PowerPoint

- Sameer Hasija

- Harry Groenevelt

- Chinmay Bhatt

- March 29, 2017

Vignettes on Professional Service Firm Governance, Teaching Note

- David G. Fubini

- Suraj Srinivasan

- September 29, 2021

To Buy or Not To Buy - The Agony of Choice: A Day in the Life of a Private Equity Partner, Teaching Note

Lind equipment, teaching note.

- Ahron Rosenfeld

- May 01, 2018

Popular Topics

Partner center.

- From the Directors

- Mission & History

- Advisory Council

- Corporate Responsibility Initiative

- Corporations, Government and Public Policy

- Digital Assets Policy Project

- Education Policy Program

- Financial Sector Program

- GrowthPolicy

- Corporate Responsibility and Citizenship Hub

- Harvard Electricity Policy Group

- Harvard Environmental Economics Program

- Harvard Kennedy School Healthcare Policy Program

- Harvard Project on Climate Agreements

- Kansai Keizai Doyukai Program

- Regulatory Policy Program

- Rising Chinese Economic Power

- Sustainability Science Program

- Annual Robert Glauber Lecture

- Working Papers and Reports

- Funding & Prizes

- Other Opportunities

Private Equity: A Casebook

In this section, related publications, transforming the insurance industry to combat climate change-induced poverty and accelerate implementation of the 2030 agenda, lash risk and interest rate, global supply chains undergoing “great reallocation”.

Foundations of Private Equity and Venture Capital

- Upcoming Session

- Previous (1 of 1) Next

- Dates: 02–05 MAR 2025

- Format: In-Person Learning takes place on the HBS campus or a designated location.

- Location: HBS Campus

- Fee: $11,750

The program fee covers tuition, books, case materials, accommodations, and most meals. Application Due: 20 FEB 2025

"HBS is a great place to continue to build relationships and network with other leaders from around the world."

- Teaching Team

- Participant Profile

- Participant Stories

Raising private capital can be a daunting process, especially for new entrants in the sector. Foundations of Private Equity and Venture Capital delves into the fundamental challenges and best practices for successfully raising a new fund or venture. You will explore the full range of industry models, from venture capital to growth equity to buyouts, as well as the key issues related to investment criteria, management strategies, and decision-making processes.

For executives with significant experience in the private equity or venture capital fields, our legacy investment program, Private Equity and Venture Capital , may be more appropriate. The programs are not intended to be taken consecutively and are designed to meet the needs of two distinct groups of investors. Applicants are advised to choose the program that best fits their goals and experience. For more information, connect with a program advisor by emailing [email protected] or by calling +1.617.495.6555.

Key Benefits

- Extend your network by living and working with accomplished executives from various backgrounds, industries, and countries across the globe

- Build relationships with a diverse group of peers who can provide wide-ranging insights into your business challenges and career decisions

Key Benefits Dropdown up

Key benefits dropdown down, who should attend.

- General partners of private equity and venture capital firms responsible for small funds

- Entrepreneurs who are seeking private financing

- Families and institutions in the process of raising their first fund or considering private equity investing

- Angel investors who are looking to formalize their activities

Attendance by multiple company representatives will foster teamwork and amplify the program's impact.

Executives with significant experience in private equity and venture capital are encouraged to explore our advanced investment management program, Private Equity and Venture Capital .

Learning and Living at HBS

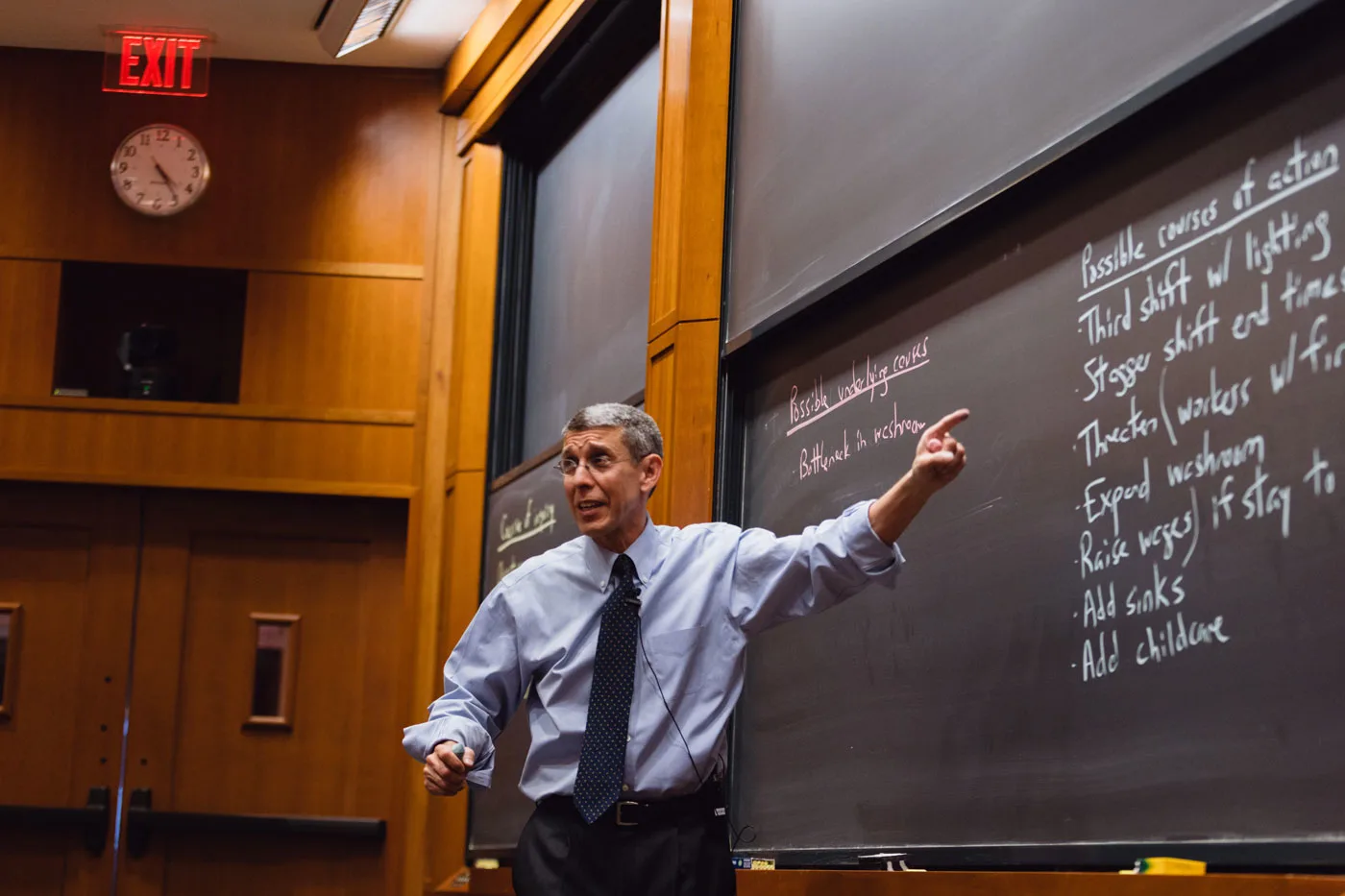

When you participate in an Executive Education program on the HBS campus , you enter an immersive experience where every aspect of the learning model has been carefully designed to facilitate your growth. Your learning will take place on your own, in your living group, and in the larger classroom, driven by the renowned HBS case method .

Review Our Campus Health & Safety Protocols

Admissions Criteria and Process

Answering your questions, application submission, application review, fee, payment, and cancellations, admissions criteria and process dropdown up, admissions criteria and process dropdown down, what you will learn.

Through a rich learning experience that includes faculty presentations, case studies, group discussions, and practical exercises, you will develop a broader understanding of the best practices, core issues, and evolving trends in the private equity and venture capital industry. In the process, you will strengthen your problem-solving and decision-making skills and master new approaches to raising and investing capital.

Participants should expect to spend at least 9-12 hours on self-paced case preparation prior to attending the program. Case materials will be made available approximately two weeks prior to program start.

Key Topics Expand All Collapse All

Private equity and venture capital overview private equity and venture capital overview dropdown down.

- Surveying key limited partners

- Structuring deals and raising funds

- Analyzing term sheets and buyout structures

- Examining the financing structures used by venture capital investors

Establishing and growing a private equity fund Establishing and growing a private equity fund Dropdown down

- Optimizing decision-making and strategies for exiting investments

- Managing the blocking and tackling of capital raising

- Examining the economics and incentives of general partner and limited partner relationships

Navigating an evolving investment industry Navigating an evolving investment industry Dropdown down

- Exploring the impact and future implications of globalization in the investment industry

- Understanding emerging challengers such as crowdfunding, special-purpose acquisition companies, and other alternative investment firms

Key Topics Dropdown up

Key topics dropdown down, private equity and venture capital overview, establishing and growing a private equity fund, navigating an evolving investment industry, the hbs advantage.

Our Executive Education programs are developed and taught by HBS faculty who are widely recognized as skilled educators, groundbreaking researchers, and award-winning authors. Through their board memberships, consulting, and field-based research, they address the complex challenges facing business leaders across the globe.

Victoria Ivashina

Lovett-Learned Professor of Business Administration

Read Full Bio

Josh Lerner

Jacob H. Schiff Professor of Investment Banking

Shai Benjamin Bernstein

Marvin Bower Associate Professor

John D. Dionne

Senior lecturer of Business Administration

Paul A. Gompers

Eugene Holman Professor of Business Administration

Raymond P. Kluender

Assistant Professor of Business Administration

Jim Matheson

Senior Lecturer of Business Administration

Kevin P. Mohan

Your Peers Expand Your Learning

Accepting applications.

View Frequently Asked Questions

Subscribe to Our Emails

- Browse All Articles

- Newsletter Sign-Up

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 May 2020

- Working Paper Summaries

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 31 May 2017

Stock Price Synchronicity and Material Sustainability Information

This paper seeks to understand and provide evidence on the characteristics of emerging accounting standards for sustainability information. Given that a large number of institutional investors seek sustainability data and have committed to using it, it is increasingly important to develop a robust accounting infrastructure for the reporting of such information.

- 15 Aug 2016

Liquidity Transformation in Asset Management: Evidence from the Cash Holdings of Mutual Funds

A key function of many financial intermediaries is liquidity transformation: creating liquid claims backed by illiquid assets. To date it has been difficult to measure liquidity transformation for asset managers. The study proposes a novel measure of liquidity transformation: funds’ cash management strategies. The study validates the measure and shows that liquidity transformation by asset managers is highly dependent on the traditional and shadow banking sectors.

- 15 Feb 2016

Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting

This paper studies the asset selection of private equity investors and the risk and return properties of passive portfolios with similarly selected investments in publicly traded securities. Results indicate that sophisticated institutional investors appear to significantly overpay for the portfolio management services associated with private equity investments.

- 25 Sep 2015

Invest in Information or Wing It? A Model of Dynamic Pricing with Seller Learning

Dealers who need to price idiosyncratic products--like houses, artwork, and used cars--often struggle with a lack of information about the demand for their specific items. Analyzing sales data from the used-car retail market, the authors of this paper develop a model of dynamic pricing for idiosyncratic products, showing that seller learning has an impact on pricing dynamics through a rich set of mechanisms. Overall, findings suggest a potentially high return to taking a more serious information-based approach to pricing idiosyncratic products.

- 20 Jan 2009

- Research & Ideas

Risky Business with Structured Finance

How did the process of securitization transform trillions of dollars of risky assets into securities that many considered to be a safe bet? HBS professors Joshua D. Coval and Erik Stafford, with Princeton colleague Jakub Jurek, authors of a new paper, have ideas. Key concepts include: Over the past decade, risks have been repackaged to create triple-A-rated securities. Even modest imprecision in estimating underlying risks is magnified disproportionately when securities are pooled and tranched, as shown in a modeling exercise. Ratings of structured finance products, which make no distinction between the different sources of default risk, are particularly useless for determining prices and fair rates of compensation for these risks. Going forward, it would be best to eliminate any sanction of ratings as a guide to investment policy and capital requirements. It is important to focus on measuring and judging the system's aggregate amount of leverage and to understand the exposures that financial institutions actually have. Closed for comment; 0 Comments.

- 30 Aug 2004

Real Estate: The Most Imperfect Asset

Real estate is the largest asset class in the world—and also the most imperfect, says Harvard Business School professor Arthur Segel. He discusses trends toward institutionalization, environmentalism, and globalization. Closed for comment; 0 Comments.

How do Private Equity Fees Vary Across Public Pensions?

As state and local defined-benefit pensions increasingly shift capital from traditional asset classes to private-market investment vehicles, this analysis shows that public pensions investing in the same private-market fund can experience very different returns.

Real Estate Private Equity and Capital Markets [Module 2]

Through lectures, case studies, and expert panel discussions, this module will explore the evolution of institutional real estate capital markets with a particular focus on market activity over the past seven years. Capital markets embody a complex ecosystem of public and private equity and debt funding for real estate companies, property acquisitions, transformations, and new developments. The business model and investment objectives of capital purveyors depend on a variety of factors. Case studies will be used to highlight key real estate investment concepts such as identifying opportunities, public/private valuations, distressed investing, risk management, asymmetric investments, and alignment of interests. Industry experts will discuss the current macro environment, key market concerns, capital availability, cost of capital, acquisition and development economics, and opportunistic and thematic investment strategies. By the end of the module, students will have gained a functional framework and understanding of how real estate private equity and capital markets work under current and future circumstances.

MRE students who want to take this course should enter the Limited Enrollment Course Lottery and will be automatically enrolled.

- --> Login or Sign Up

- Mergers & Acquisitions

Teaching Guide for Project Merchandise: An Introduction to Private Equity

Holger Spamann and Johnathan Robertson

Share This Article

- Custom Field #1

- Custom Field #2

- Similar Products

Product Description

This Teaching Note provides guidance to instructors for the case study Project Merchandise: An Introduction to Private Equity .

The case study, Project Merchandise: An Introduction to Private Equity , puts students in the role of a private equity firm considering the acquisition of a portfolio company, and later selling that same company. Along the way, the case study introduces private equity and valuation techniques, which students will need to apply in working through the case.

Student Learning Outcomes

By the end of this case students will have an improved understanding of Private Equity, increased familiarity with valuation techniques, and (should students participate in an optional legal exercise) a deepened comprehension of purchase agreements. Specifically, after working through the case materials students should be able to:

1) describe what private equity is, and to summarize the cycle of a private equity transaction from entry to exit,

2) apply valuation concepts in a simplified model and to various entry and exit scenarios,

3) navigate an Excel-based model tracking how changes to input cells flow-through the model and affect valuation outputs,

4) evaluate and weigh both quantitative and qualitative factors when engaging in valuation exercise, and

5) (Optional) recognize key terms in a Purchase Agreement and understand typical Buyer and Seller side arguments while negotiating these terms.

Teaching Approach

The case uses a flipped classroom model. Students watch videos via links provided in the materials prior to coming to class. During class students engage in activities that require them to apply the concepts presented in the pre-class videos.

These materials were taught to Harvard Law School students in an elective corporate finance class. Before engaging with these materials, students need to be familiar with basic valuation techniques (particularly discounted cash flow and comparables analyses).

Student Experience

- Class #1 Entry Case Exercise : Students assume the role of a private equity buyer and use information about a target company presented in the Entry Case materials, concepts from the Private Equity Overview video, points from the deal evaluation framework, and the valuation model to develop a recommendation of whether and how to structure a bid for a target company. The entry case exercise exposes students to examples of uncertainties in enterprise valuation that need to be identified and valued when entering into a new acquisition.

- Class #2 Exit Case Exercise : Students assume the role of a private equity seller and evaluate five competing options to exit the investment. The exit case exercise challenges students to value different exit options not only quantitatively but also qualitatively when considering different deal structures, earn-outs, closing conditions, etc. By the end of these two classes, students will understand the basic issues in valuing an M&A deal from the perspective of a PE sponsor (which largely overlaps with the perspective of other M&A buyers and sellers).

- Class #3 (optional) Purchase Agreement Exercise : Students explore the purchase agreement - the main contract that memorializes a M&A transaction.

Instructors will need to download student materials and either distribute electronically or post in their institution’s Learning Management System (e.g. Canvas etc.). Videos do not need to be downloaded; the materials provide embedded links. The student materials listed below can be downloaded from the Project Merchandise: An Introduction to Private Equity Case Study page .

Student Materials :

Class Sessions #1 & #2 (required materials)

- Project Merchandise - Student Guide: Provides learning outcomes, exercise overviews, and preparation materials including links to pre- and post-class videos

- Project Merchandise - Valuation Model: Provides student-ready Excel template to test assumptions

- Project Merchandise - Exit Case Exercise: Provides a summary of five competing exit alternatives students can reference while working through the Exit Case

Class Session #3 (additional materials included in the download but for optional class)

- Project Merchandise - Form Securities Purchase Agreement (SPA) (23 pages)

- Project Merchandise - Disclosure Schedule Sample (4 pages)

- Project Merchandise - Negotiation Issues List (2 pages)

- Project Merchandise - Market Outcomes Matrix (3 pages)

Product Videos

Custom field, product reviews, write a review.

Find Similar Products by Category

- Share full article

What Do Students at Elite Colleges Really Want?

Many of Harvard’s Generation Z say “sellout” is not an insult.

Credit... Jeff Hinchee

Supported by

By Francesca Mari

- Published May 22, 2024 Updated May 24, 2024

The meme was an image of a head with “I need to get rich” slapped across it. “Freshmen after spending 0.02 seconds on campus,” read the caption, posted in 2023 to the anonymous messaging app Sidechat.

The campus in question was Harvard, where, at a wood-paneled dining hall last year, two juniors explained how to assess a fellow undergraduate’s earning potential. It’s easy, they said, as we ate mussels, beets and sautéed chard: You can tell by who’s getting a bulge bracket internship.

“What?” Benny Goldman, a then-28-year-old economics P.h.D. student and their residential tutor, was confused.

One of the students paused, surprised that he was unfamiliar with the term: A bulge bracket bank, like Goldman Sachs , JPMorgan Chase or Citi. The biggest, most prestigious global investment banks. A B.B., her friend explained. Not to be confused with M.B.B. , which stands for three of the most prestigious management consulting firms: McKinsey, Bain and Boston Consulting Group.

While the main image of elite campuses during this commencement season might be activists in kaffiyehs pitching tents on electric green lawns, most students on campus are focused not on protesting the war in Gaza, but on what will come after graduation.

Despite the popular image of this generation — that of Greta Thunberg and the Parkland activists — as one driven by idealism, GenZ students at these schools appear to be strikingly corporate-minded. Even when they arrive at college wanting something very different, an increasing number of students at elite universities seek the imprimatur of employment by a powerful firm and “making a bag” (slang for a sack of money) as quickly as possible.

Elite universities have always been major feeders into finance and consulting, and students have always wanted to make money. According to the annual American Freshman Survey , the biggest increase in students wanting to become “very well off financially” happened between the 1970s and 1980s, and it’s been creeping up since then.

But in the last five years, faculty and administrators say, the pull of these industries has become supercharged. In an age of astronomical housing costs, high tuition and inequality, students and their parents increasingly see college as a means to a lucrative job, more than a place to explore.

A ‘Herd Mentality’

At Harvard, a graduating senior, who passed on a full scholarship to another school, told me that he felt immense pressure to show his parents that their $400,000 investment in his Harvard education would allow him to get the sort of job where he could make a million dollars a year. Upon graduation, he will join the private equity firm Blackstone, where, he believes, he will learn and achieve more in six years than 30 years in a public-service-oriented organization.

Another student, from Uruguay, who spent his second summer in a row practicing case studies in preparation for management consulting internship interviews, told me that everyone arrived on campus hoping to change the world. But what they learn at Harvard, he said, is that actually doing anything meaningful is too hard. People give up on their dreams, he told me, and decide they might as well make money. Someone else told me it was common at parties to hear their peers say they just want to sell out.

“There’s definitely a herd mentality,” Joshua Parker, a 21-year-old Harvard junior from Oahu, said. “If you’re not doing finance or tech, it can feel like you’re doing something wrong.”

As a freshman, he planned to major in environmental engineering. As a sophomore, he switched to economics, joining five of his six roommates. One of those roommates told me that he hoped to run a hedge fund by the time he was in his 30s. Before that, he wanted to earn a good salary, which he defined as $500,000 a year.

According to a Harvard Crimson survey of Harvard Seniors, the share of 2024 graduates going into finance and consulting is 34 percent. (In 2022 and 2023 it exceeded 40 percent. The official Harvard Institutional Research survey yields lower percentages for those fields than the Crimson survey, because it includes students who aren’t entering the work force.)

These statistics approach the previous highs in 2007, after which the global financial crisis drove the share down to a recent low of 20 percent in 2009, from which it’s been regaining ground since.

Fifteen years ago, fewer students went into tech. Adding in that sector, the share of graduates starting what some students non-disparagingly refer to as “sellout jobs” is more than half. (It was a record-shattering 60 percent in 2022 and nearly 54 percent in 2023.)

“When people say ‘selling out,’ I mean, obviously, there’s some implicit judgment there,” said Aden Barton, a 23-year-old Harvard senior who wrote an opinion column for the student newspaper headlined, “How Harvard Careerism Killed the Classroom.”

“But it really is just almost a descriptive term at this point for people pursuing certain career paths,” he continued. “I’m not trying to denigrate anybody’s career path nor my own.” (He interned at a hedge fund last summer.)

David Halek, director of employer relations at Yale’s Office of Career Strategy, thinks students may use the term “sell out” because of the perceived certainty: “It’s the easy path to follow. It is well defined,” he said.

“It’s hard to conceptualize other things,” said Andy Wang, a social studies concentrator at Harvard who recently graduated.

Some students talk about turning to a different career later on, after they’ve made enough money. “Nowadays, English concentrators often say they’re going into finance or management consulting for a couple of years before writing their novel,” said James Wood, a Harvard professor of the practice of literary criticism.

And a surprising number of students explain their desire for a corporate job by drawing on the ethos of effective altruism : Whether they are conscious of the movement or not, they believe they can have greater impact by maximizing earnings to donate to a cause than working for that cause.

But once students board the prestige escalator and become accustomed to a certain salary, walking away can feel funny. Like, well, walking off an escalator.

Financial Pressures

The change is striking to those who have been in academia for years, and not just at Harvard.

Roger Woolsey, executive director of the career center at Union College, a private liberal arts college in Schenectady, N.Y, said he first noticed a change around 2015, with students who had been in high school during the Great Recession and who therefore prioritized financial security.

“The students saw what their parents went through, and the parents saw what happened to themselves,” he said. “You couple that with college tuition continuing to rise,” he continued, and students started looking for monetary payoffs right after graduation.

Sara Lazenby, an institutional policy analyst for the University of Wisconsin-Madison, said that might be why students and their parents were much more focused on professional outcomes than they used to be. “In the past few years,” she said, “I’ve seen a higher level of interest in this first-destination data” — stats on what jobs graduates are getting out of college.

“Twenty years ago, an ‘introduction to investment banking’ event was held at the undergraduate library at Harvard,” said Howard Gardner, a professor at the Harvard Graduate School of Education. “Forty students showed up, all men, and when asked to define ‘investment banking,’ none raised their hands.”

Now, according to Goldman Sachs, the bank had six times as many applicants this year for summer internships as it did 10 years ago, and was 20 percent more selective for this summer’s class than it was last year. JPMorgan also saw a record number of undergraduate applications for internships and full-time positions this year.

The director of the Mignone Center for Career Success at Harvard, Manny Contomanolis, also chalked up the change, in part, to financial pressure. “Harvard is more diverse than ever before,” Mr. Contomanolis said, with nearly one in five students eligible for a low-income Pell Grant . Those students, he said, weigh whether to, for instance, “take a job back in my border town community in Texas and make a big impact in a kind of public service sense” or get a job with “a salary that would be life changing for my family.”

However, according to The Harvard Crimson’s senior survey, as Mr. Barton noted in his opinion column, “The aggregate rate of ‘selling out’ is about the same — around 60 percent — for all income brackets.” The main distinction is that students from low-income families are comparatively more likely to go into technology than finance.

In other words, there is something additional at play, which Mr. Barton argues has to do with the nature of prestige. “If you tell me you’re working at Goldman Sachs or McKinsey, that’s amazing , their eyes are going to light up,” Mr. Barton said. “If you tell somebody, ‘Oh, I took this random nonprofit job,’ or even a journalism job, even if you’re going to a huge name, it’s going to be a little bit of a question mark.”

Maibritt Henkel, a 21-year-old junior at Harvard, is an economics major with moral reservations about banking and consulting. Ms. Henkel sometimes worries that others might misread her decision not to go into those industries as evidence that she couldn’t hack it.

“Even if you don’t want to do it for the rest of your life, it’s seen kind of as the golden standard of a smart, hardworking person,” she said.

Some students have also become skeptical about traditional avenues of social change, like government and nonprofits, which have attracted fewer Harvard students since the pandemic, according to the Harvard Office of Institutional Research.

Matine Khalighi, 22, founded a nonprofit to award scholarships to homeless youth when he was in eighth grade. When he began studying economics at Harvard, his nonprofit, EEqual, was granting 50 scholarships a year. But some of the corporations that funded EEqual were contributing to inequality that created homelessness, he said. Philanthropy wasn’t the solution for systemic change, he decided. Instead, he turned to finance, with the idea that the sector could marshal capital quickly for social impact.

Employers encourage this way of thinking. “We often talk about the fact that we work with some of the biggest emitters on the planet because we believe that’s how we actually affect climate change,” said Blair Ciesil, the global leader of talent attraction at McKinsey.

The Recruitment Ratchet

Princeton’s senior survey results are nearly identical to The Crimson’s Senior Survey: about 38 percent of 2023 graduates who were employed took jobs in finance and consulting; adding tech and engineering, the rate is close to 60 percent, compared with 53 percent in 2016, the earliest year for which the data is available.

This isn’t solely an Ivy League phenomenon. Schools slice their data differently, but at many colleges, a large percentage of students pursue these fields. At Amherst , in 2022, 32 percent of employed undergrads went into finance and consulting, and 11 percent went into internet and software, for a total of about 43 percent. Between 2017 and 2019, the University of California, Los Angeles, sent about 21 percent of employed students into engineering and computer science, 9 percent into consulting and nearly 10 percent into finance, for a total of roughly 40 percent

Part of that has to do with recruitment; the most prestigious banks and consulting firms do so only at certain colleges, and they have intensified their presence on those campuses in recent years. Over the last five years or so, “the idea of thinking about your professional path has moved much earlier in the undergraduate experience,” Ms. Ciesil said. She said the banks first began talking to students earlier, and it was the entrance of Big Tech onto the scene, asking for junior summer applications by the end of sophomore year, that accelerated recruitment timelines.

“At first, we tried to fight back by saying, ‘No, no, no, no, no, sophomores aren’t ready, and what does a sophomore know about financial modeling?’” said Mr. Woolsey at Union College. But, he added, schools “don’t want to push back too much, because then you’re going to lose revenue,” since firms often pay to recruit on campus.

The Effective Altruist Influence

The marker that really distinguishes Gen Z is how pessimistic its members are, and how much they feel like life is beyond their control, according to Jean Twenge, a psychologist who analyzed data from national surveys of high school students and first-year college students in her book “Generations.”

Money, of course, helps give people a sense of control. And because of income inequality, “there’s this idea that you either make it or you don’t, so you better make it,” Ms. Twenge said.

Mihir Desai, a professor at Harvard’s business and law schools, wrote a 2017 essay in The Crimson titled “ The Trouble With Optionality ,” arguing that students who habitually pursue the security of prestigious employment foreclose the risk-taking and longer-range thinking necessary for more unusual or idealistic achievements. Mr. Desai believes that’s often because they are responding to the bigger picture, like threats to workers from artificial intelligence, and political and financial upheaval.

In recent years, he’s observed two trends among students pursuing wealth. There’s “the option-buyer,” the student who takes a job in finance or consulting to buy more time or to keep options open. Then there’s what he calls “the lottery ticket buyer,” the students who go all-in on a risky venture, like a start-up or new technology, hoping to make a windfall.

“They know people who bought Bitcoin at $2,000. They know people who bought Tesla at $20,” he said.

Some faculty see the influence of effective altruism among this generation: In the last five years, Roosevelt Montás, a senior lecturer at Columbia University and the former director of its Center for the Core Curriculum, has noticed a new trend when he asks students in his American Political Thought classes to consider their future.

“Almost every discussion, someone will come in and say, ‘Well, I can go and make a lot of money and do more good with that money than I could by doing some kind of charitable or service profession,’” Mr. Montás said. “It’s there constantly — a way of justifying a career that is organized around making money.”

Mr. Desai said all of this logic goes, “‘Make the bag so you can do good in the world, make the bag so you can go into retirement, make the bag so you can then go do what you really want to do.’”

But this “really underestimates how important work is to people’s lives,” he said. “What it gets wrong is, you spend 15 years at the hedge fund, you’re going to be a different person. You don’t just go work and make a lot of money, you go work and you become a different person.”

Inside the World of Gen Z

The generation of people born between 1997 and 2012 is changing fashion, culture, politics, the workplace and more..

Many of Harvard’s Generation Z say “sellout” is not an insult, instead it appears to mean something strikingly corporate-minded .

A younger generation of crossword constructors is using an old form to reflect their identities, language and world. Here’s how Gen Z made the puzzle their own .

For many Gen-Zers without much disposable income, Facebook isn’t a place to socialize online — it’s where they can get deals on items they wouldn’t normally be able to afford.

Dating apps are struggling to live up to investors’ expectations . Blame the members of Generation Z, who are often not willing to shell out for paid subscriptions.

Young people tend to lean more liberal on issues pertaining to relationship norms. But when it comes to dating, the idea that men should pay in heterosexual courtships still prevails among Gen Z-ers .

We asked Gen Z-ers to tell us about their living situations and the challenges of keeping a roof over their heads. Here’s what they said .

Advertisement

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Harvard Business School

Dynamic, immersive education for learners at every level

Doctoral programs, executive education.

Rigorous research, rooted in practice

The most pressing challenges and interesting opportunities facing the world today cannot be addressed without business playing a significant role. At HBS, faculty-led initiatives and projects engage practitioners, students and alumni to develop insights that drive impact today.

- Browse All Faculty & Research

- Explore Initiatives & Projects

The research conducted by HBS faculty fuels insights at the intersection of business and today’s most pressing issues.

What makes Harvard Business School distinctive?

At HBS, real-world leadership challenges come to life. Our programs and courses will help you learn how to think expansively, act decisively, and inspire those around you to achieve great things.

Dynamic and immersive learning experiences

Our discussion-based approach to learning brings real world leadership challenges to life.

A tight knit community

The scale of HBS, from large-format classes to intimate sections and curated study groups, is intentionally designed to foster growth and learning.

Global perspectives

The world is profoundly connected, that’s why we pride ourselves on bringing students together from around the world and studying cases with global impact.

A lifetime of connection

It’s not just the people you meet during your time at HBS, but the network of alumni that’s 86,000 strong and ready and willing to support your journey. More about Alumni .

A residential campus

Our campus, in the heart of one of the world’s great cities, is designed with the belief that daily interactions increase the potential for learning.

IMAGES

VIDEO

COMMENTS

Private Equity and COVID-19. by Paul A. Gompers, Steven N. Kaplan, and Vladimir Mukharlyamov. Private equity investors are seeking new investments despite the pandemic. This study shows they are prioritizing revenue growth for value creation, giving larger equity stakes to management teams, and targeting somewhat lower returns.

Paul Michelman. A year ago, most of us couldn't name a single asset in the Cerberus Capital Management portfolio. Today, we know them as the private equity firm that bought controlling interests ...

Abstract. This book is a collection of cases and notes that have been used in Private Equity Finance, an advanced corporate finance course offered in the second year of the Harvard Business School's MBA curriculum, over several years. Our goal is to provide detailed insight into the sources of value creation as well as outline the process of ...

Private Equity and COVID-19. by Paul A. Gompers, Steven N. Kaplan, and Vladimir Mukharlyamov. Private equity investors are seeking new investments despite the pandemic. This study shows they are prioritizing revenue growth for value creation, giving larger equity stakes to management teams, and targeting somewhat lower returns.

This case follows Kaspi.kz, a private equity (Baring Vostok) co-owned retail bank in Central Asia that evolved into a fintech, payments and e-commerce company. It provides insights into private equity financing, portfolio company management, and initial public offering practices. In particular, the case focuses on (i) the bank's journey from ...

New research on venture capital from Harvard Business School faculty on issues including how venture capitalists make decisions, the economics of private equity partnerships, and angel investments. ... Harvard Business School senior lecturer Jo Tango and Johnson discuss which option he should choose in the case, "Kevin D. Johnson: To Be a ...

He had experience as a developer of technical products for Fortune 500 companies, an executive of cutting-edge startups, and a venture capitalist for eight years. This case study also reviews how private equity investment works, the private equity spectrum, the history of venture capital, stages of venture capital funds, and their locations.

Harvard Business School. Executive Education. Programs for Individuals. Topic-Focused Programs ... books, case materials, accommodations, and most meals. Application Due: 23 FEB 2025. Apply. Download Brochure. Apply. Download Brochure. ... but the outlook for private equity remains strong.

Wildcat Capital Investors is a small real estate private equity company. Its MBA intern, Jessica Zaski, is asked to develop a financial model for the purchase of Financial Commons, a 90,000 square foot office building in suburban Chicago. By simple metrics, the property seems to be a good value, but with credit conditions tight, Jessica must consider whether outside investors would be ...

Private Equity: A Casebook. Paul Gompers, Victoria Ivashina, Richard Ruback, 2019, Book, "'Private Equity' is an advanced applied corporate finance book with a mixture of chapters devoted to exploring a range of topics from a private equity investor's perspective. The goal is to understand why and which practices are likely to deliver sustained profitability in the future.

Harvard Business School. Executive Education. Programs for Individuals. Topic-Focused Programs ... books, case materials, accommodations, and most meals. Application Due: 20 FEB 2025. Apply. Download Brochure ... Foundations of Private Equity and Venture Capital delves into the fundamental challenges and best practices for successfully raising ...

The purpose of this case was to determine whether ACE Private Equity Partners, a mid-size private equity fund, should acquire two physical therapy companies in order to develop them for subsequent sale to a larger private equity firm. This situation represented another opportunity for ACE's general partners to implement their "merger consolidation" investment strategy for their fund investors ...

Abstract. This case study puts students in the role of a private equity firm considering the acquisition of a portfolio firm, and later selling that same firm. Along the way, the case study introduces private equity and valuation techniques, which students need to apply in working through the case. The teaching guide for instructors can be ...

Harvard Business Publishing offers case collections from renowned institutions worldwide. Case method teaching immerses students in realistic business ... Register now for our Teaching with Cases Seminar at Harvard Business School, held June 21 ... Case Companion is an engaging and interactive introduction to case study analysis that is ideal ...

In this case study, students will grapple with PE's complex legacy while learning its history. The case will trace PE's two main ingredients (the limited partnership and the LBO), examine the auspicious conditions of the 1980s that brought them together, and discuss the experiences of two very different early players in the PE field—KKR ...

This case study is designed to introduce students to the private equity market and regulators' attempts to safely expand access to it. It provides a background of private equity regulation in the United States, including some of the concerns that motivated the original definition of an accredited investor. Students should finish the case ...

by Laura Alfaro, Ester Faia, Ruth Judson, and Tim Schmidt-Eisenlohr. Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions. 31 May 2017.

Through lectures, case studies, and expert panel discussions, this module will explore the evolution of institutional real estate capital markets with a particular focus on market activity over the past seven years. Capital markets embody a complex ecosystem of public and private equity and debt funding for real estate companies, property ...

Product Description. This Teaching Note provides guidance to instructors for the case study Project Merchandise: An Introduction to Private Equity.. Summary. The case study, Project Merchandise: An Introduction to Private Equity, puts students in the role of a private equity firm considering the acquisition of a portfolio company, and later selling that same company.

The 'Dollar General Going Private' case is intended to improve students' understanding and encourage their use of financial statement analysis. The context is Dollar General Corporation's acquisition by private equity sponsor KKR, which took the company private in 2007. Although the proposed merger generated a 30% premium over the stock price at the time, and the enterprise value to EBITDA ...

The research integrates microhistory with Harvard Business School-style case studies. I selected a group of individuals to interview, and asked them to share ... a large private equity company in Asia Shan provided evidence that many institutional investors have benefited from China's economic growth over the past 30 years. Shan's book,

Viceira, Luis M., John D. Dionne, Soracha Prathanrasnikorn, and Ari Sunshine. "Francisco Partners Private Credit Opportunity Fund." Harvard Business School Case 221-002, October 2020. (Revised June 2021 ...

A Case Study from Massachusetts Harvard Kennedy School Institute of Politics Economics Policy Group July 2020 ... such as equity investment. However, this simplicity comes with drawbacks. The Federal Geographic ... - School of Business at Northeastern University

Many of Harvard's Generation Z say "sellout" is not an insult. The meme was an image of a head with "I need to get rich" slapped across it. "Freshmen after spending 0.02 seconds on ...

Cole, Shawn A., Vikram S. Gandhi, Michael Norris, and John Masko. "Public Equities Impact Investing at BlackRock." Harvard Business School Case 221-066, April 2021. (Revised July 2021 ...

Harvard Business Publishing is an affiliate of Harvard Business School. We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More .

The cases that landed before the court, against Harvard University and University of North Carolina, were the culmination of more than a decade of legal work by the anti-affirmative action ...

Wellington Global Impact (218067) by Shawn Cole and Lynn Schenk. FEBRUARY 2018 (REVISED OCTOBER 2018) In 2016, Wellington launched the first-ever public market impact investing fund. This case explores the process of building a new impact investing product within a leading asset manager.

Rigorous research, rooted in practice. The most pressing challenges and interesting opportunities facing the world today cannot be addressed without business playing a significant role. At HBS, faculty-led initiatives and projects engage practitioners, students and alumni to develop insights that drive impact today. Browse All Faculty & Research.