How Zara became the undisputed king of fast fashion?

Zara is one of the biggest international apparel brands. Zara invites customers from around 93 markets to its organization of 2000+ stores in upscale markets on the planet’s biggest urban communities. With these stores, Zara generates 18 billion Euros annually.

The brand has been fruitful in keeping up its central goal to give quick and reasonable designs in the world of fashion. Zara’s way to deal with configuration is firmly connected to its clients. This story is about how Zara became the undisputed king of Fast fashion.

Fashion is the imitation of a given example and satisfies the demand for social adaptation. . . . The more an article becomes subject to rapid changes of fashion, the greater the demand for cheap products of its kind. — Georg Simmel, “Fashion” (1904)

History of Zara: The Long Story Cut Short

Amancio Ortega launched the first Zara store in 1975 in Central Street in downtown A Coruna, Galicia, Spain. The main Store included low-value look-a-like designs of famous and better-quality dress styles. The store ended up being a triumph and Ortega Began opening more Zara stores throughout Spain.

During the 1980s, Ortega began changing the plan, assembling and dissemination cycle to diminish lead times and respond to new patterns in a snappier manner in what they called “Moment Fashions”.

In 1980 the company started its international expansion through Porto, Portugal in the 1990s, with Mexico in 1992. Since then Ortega has continued to grow and create brands such as Pull & Bear, Bershka , and Oysho . It has acquired groups like Massimo Dutti and Stradivarius . Even though these brands have been contributors to their parent group Inditex’s success, Zara is still the principal growth driver.

Zara’s Customer-driven Value Chain

Product line-up:.

Unlike other Inditex chains, Zara has focused on manufacturing fashion-sensitive products internally. The latest designs were continuously in production as per changing customer’s preferences. Many competitors were producing just a few thousand SKUs whereas Zara was producing several hundred of thousands of SKUs in a year. These SKUs varied as per color, size, and fabric.

Zara’s designs are not dependent on design maestros. Instead, its designers carefully observe the catwalk trends and try to implement them for the mass market. The design team continuously creates variations in a particular season. Thereafter expanding on successful designs.

Fast Supply Chain:

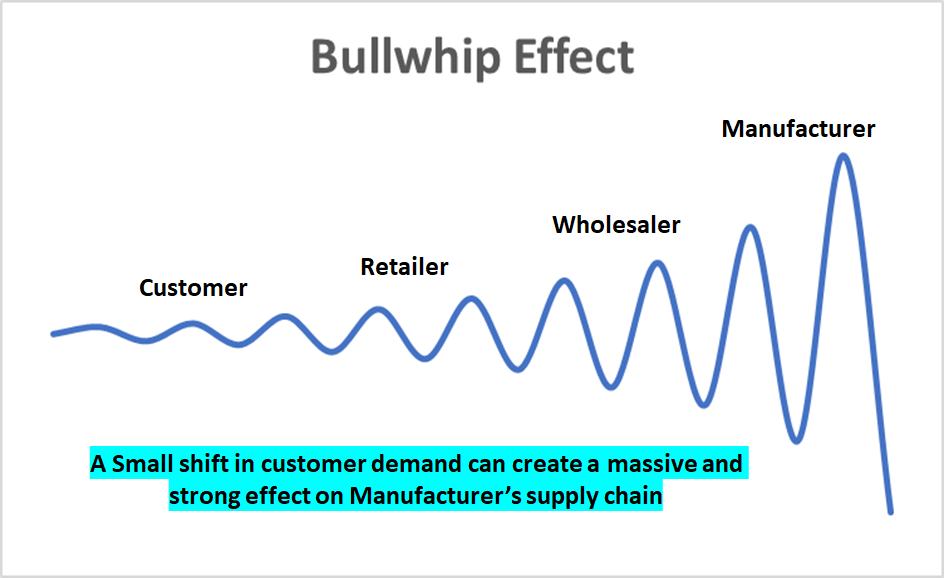

Zara’s flexible supply chain allows it to dispatch new ranges to shops two times per week from its central distribution center that is an approximately 400,000-square-meter facility located in Arteixo, Spain. This kind of business system called vertical integration eliminated the need for local warehouses. The strategy here was to reduce the “bullwhip effect”. Let’s see what the bullwhip effect is:

The bullwhip effect is a distribution channel phenomenon in which demand forecasts yield supply chain inefficiencies. It refers to increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain. Wikipedia

It was a matter of a few weeks and a new design was on the shelf for the customers. Isn’t cool? These designs of clothes and accessories were quickly moved to fancy stores in prime locations but at a cheap price. This strategy has attracted a lot of fashion yet money conscious customers.

We want our customers to understand that if they like something, they must buy it now because it won’t be in the shops the following week. It is all about creating a climate of scarcity and opportunity. Luis Blanc, one of the former Inditex’s international directors

Zara’s Retailing Strategy

Zara instead of focusing on improving its manufacturing efficiency focused on improving its retail strategy. This retailing strategy was about following fashion trends quickly even it means there is an unmet demand. As was previously discussed, this also helped Zara in creating a FOMO for its products. The two components of its retailing strategy were dependent on its upstream operations: Merchandizing and Stores.

Read: The Torchbearers of Sustainable Fashion

Merchandising.

Merchandising is the promotion of goods and/or services that are available for retail sale. It includes the determination of quantities, setting prices for goods and services, creating display designs, developing marketing strategies, and establishing discounts or coupons. Investopedia

- Zara placed emphasis on the freshness of its designs. It wanted to create a sense of exclusivity. It never focused on creating bulk items of one design. Zara had confidence in its fast supply chain of twice a week shipment to the store with the latest designs. Thre quarter of its merchandise gets replaced in just a month. How about that?

The success of your business is based in principle on the idea of offering the latest fashions at low prices, in turn creating a formula for cutting costs: an integrated business in which it is manufactured, distributed, and sold. Amancio Ortega

Fun Fact : An average customer visits a Zara store 17 times in a year where the number is 3-4 times for its competitors.

- Zara understood the importance of store locations very well. Zara prices are not expensive but its store location and design made its products look expensive. The brand wanted its customers to have a premium feel at a reasonable price.

We invest in prime locations. We place great care in the presentation of our storefronts. That is how we project our image. We want our clients to enter a beautiful store, where they are offered the latest fashions. Luis Blanc, one of the former Inditex’s international directors

Store Operations

Zara has stores in most upscale markets and shopping centers in the world. You name it and they have a store there. Champs Elysées in Paris, Regent Street in London, and Fifth Avenue in New York to name a few. As per its latest annual report the value of these properties is valued at almost 8 billion Euros. But the way these stores are managed is a strategy to learn for all retailers.

- We all love grand stores with a lot of variety. Zara has emphasized on creating a grand image of its stores. Imagine a big store at a posh location. How much impressed you would be. The average size of Zara stores has continuously increased over the years. In 2001 the average store size was 910 sq.m whereas in 2018 the size has more than doubled.

Zara’s average store size has increased by 50%: from 1,452m2 in 2012 to 2,184m2 in 2018. That growth has been driven by new store openings – larger flagship stores – as well as the fact that many of the new openings have entailed the absorption of one or more older, smaller units in the same catchment area. Inditex Annual Report

- Zara has tried to standardize the in-store experience with its store window displays and interior presentations. As the season progresses, Zara consistently evolves its interior themes, color schemes, and product placements. All these ideas come from the central team in Spain and regional teams implement with necessary region-based adaptations. So much so that the uniforms of the staff were selected twice in a season by a store manager from the latest collection.

Anti-Marketing Approach of Zara

Zara has able to maintain profitability ~13% whereas its major competitor like H&M is at 6% . This has been possible not only because of its efficient supply chain we discussed above but also because of its no advertising or limited advertising policy.

This is what makes Zara really one of a kind. The organization just spends about 0.3% of deals on promoting and does not have a lot of advertising to discuss. The usual trend in the industry is to spend 3.5% on advertising. Zara never shows its clothes at expensive fashion shows also. It first shows its designs at stores directly. But why does not Zara believe in advertising? There are primarily two reasons:

- First, as we discussed it saves Zara a lot of money. So much so that it has now one of the highest profitability.

- Second, it brings exclusivity and prevents overexposure of a design. Customers feel like if they purchase a shirt at Zara, five others won’t have that equivalent shirt at work or school.

Read: Viral Marketing over the Long-Haul ft. Burger King

Zara is a perfect case study to learn the perfect operations strategy, perfect marketing strategy, perfect pricing strategy, and whatnot. It’s all strategies are so perfect. It is also a perfect example to understand how a traditional brand is evolving itself with time to stay relevant.

As per its annual report , In 2018, Zara launched its global online store, marking a milestone in its commitment to having all of its brands available online worldwide by 2020. Zara continued to earn global accolades for its collections and initiatives, its integrated shopping experience, and its commitment to sustainability, with over 90 million garments put on sale under the Join Life label.

Zara is just not a brand of fast fashion. Its much more than that now. And that’s why it’s actually the true king of fast fashion.

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

Why do some companies succeed consistently while others fail?

What is Adjacency Expansion strategy? How Nike has used it over the decades to outperform its competition and venture into segments other than shoes?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

A marketing aggregator, business story teller, freelancer. I'm pursuing my PGPM, and is a 2nd year marketing student at MDI.

Related Posts

AI is Shattering the Chains of Traditional Procurement

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

- Harvard Business School →

- Faculty & Research →

- April 2003 (Revised December 2006)

- HBS Case Collection

ZARA: Fast Fashion

- Format: Print

- | Pages: 35

Related Work

- Faculty Research

- ZARA: Fast Fashion By: Pankaj Ghemawat and Jose Luis Nueno

How Zara’s strategy made her the queen of fast fashion

Table of contents, here’s what you’ll learn from zara's strategy study:.

- How to come up with disruptive ideas for your industry.

- How finding the right people is more important than developing the best strategy.

- How best to address the sustainability question.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it’s the largest company of the Inditex group.

Amancio Ortega was Inditex’s Chairman until 2011 and Zara’s CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez, daughter of the founder, is the current Chairwoman of Inditex.

Zara's market share and key statistics:

- Brand value of $25,4 billion in 2022

- Net sales of $19,6 billion in 2021

- 1,939 stores worldwide in 2021

- Over 4 billion annual visits to its website

- Inditex employee count of 165,042 in 2021

{{cta('ba277e9c-bdee-47b7-859b-a090f03f4b33')}}

Humble beginnings: How did Zara start?

Most people date Zara’s birth to 1975, when Amancio Ortega and Rosalia Mera, his then-wife, opened the first shop. But, it’s impossible to study the company’s first steps, its initial competitive advantage, and strategic approach by starting at that point in time.

When the first Zara shop opened, Amancio Ortega already had 22 years of industry experience, ten years as a clever and hard-working employee, and 12 years as a business owner. Rosalia Mera also had 20 years of industry experience.

As an employee , Ortega worked in the clothing industry, first as a gofer and then as a delivery boy. He quickly demonstrated great talent for recognizing fabrics, understanding and serving customers, and making sound business suggestions. Soon, he decided to use his insights to develop his own business instead of his boss’s.

As a business owner , he started GOA Confecciones in 1963, along with his siblings, his wife, and a close friend. They started with a humble workshop making women’s quilted dressing gowns, following a trend at the time Amancio had noticed. Within ten years, that workshop had grown to support a workforce of 500 people.

And then, the couple opened the first Zara shop.

Zara’s competitive positioning strategy in its first year

The opening of the first Zara shop in 1975 wasn’t just a new store to sell clothes. It was the final big move of a carefully planned vertical integration strategy.

To understand how the strategy was formulated , we need to understand Amancio’s first steps. His first business, GOA Confecciones, was a manufacturing business. He was supplying small stores and businesses with his products, and he wasn’t in contact with the end customer.

That brought two challenges:

- A lack of insight into market trends and no direct consumer feedback about preferences.

- Very low-profit margins compared to the 70-80% profit margin of retailers.

Amancio developed several ideas to improve distribution and get a direct relationship with the final purchaser. And he was always updating his factories with the latest technological advancements to offer the highest quality of products at the lowest possible price. But he was missing one essential part to reap the benefits of his distribution practices: a store .

So, in 1972 he opened one under the brand name Sprint . An experiment that quickly proved unsuccessful and, seven years later, was shut down. Although it’s unknown the extent to which Amancio put his ideas to the test, Sprint was a private masterclass in the retail world that gave Amancio insights that would later turn Zara into a global success.

Despite Sprint’s failure, Amancio didn’t abandon the idea of opening his own store mainly because he believed that his advanced production model was vulnerable and the rise of a competitor who could replicate and improve his system was imminent.

Adding a store to his vertical integration strategy would have a twofold effect:

- The store would operate as a direct feedback source. The company would be able to test design ideas before going into mass production while simultaneously getting an accurate pulse of the needs, tastes, and fancies of the customers. The store would simultaneously reduce risk and increase opportunity spotting.

- The company would have reduced operating costs as a retailer. Since the group would control all aspects of the process (from manufacturing to distribution to selling), it would solve key retail challenges with stocking. The savings would then be passed on to the customer. The store would have an operational competitive advantage and become a potential cash cow for the company.

The idea was to claim his spot in prime commercial areas (a core and persistent strategic move for Zara) and target the rising middle class. The market conditions were tough, though, with many family-owned businesses losing their customer base, giant players owning a huge market share, and Benetton’s franchising shops stealing great shop locations and competent potential managers.

So the first Zara store had these defining characteristics that made it the successful final piece of Amancio’s strategy:

- It was located near the factory = delivery of products was optimized

- It was in the city’s commercial heart = more expensive, but with access to affluence

- It was located in the city where Ortegas had the most customer experience = knowing thy customer

- It was visibly attractive = expensive, but a great marketing trick

Amancio’s team lacked experience and expertise in one key factor: display window designing . The display window was a massive differentiator and had to be bold and attractive. So, Amancio hired Jordi Bernadó, a designer with innovative ideas whose work transformed display windows and the sales process.

The Zara shop was a success, laying the foundations for the international expansion of the Inditex group.

Key Takeaway #1: Challenge your industry’s conventional wisdom to create a disruptive strategy

Disrupting an industry isn’t an easy task nor a frequent occurrence.

To do it successfully, you need to:

- Understand the prominent business mode of your industry and the forces that contributed to its development.

- Challenge the assumptions behind it and design a radically different business model.

- Develop ample space for experimentation and failures.

The odds of instantly conquering the industry might be low (otherwise, someone would have already done it), but you’ll end up with out-of-the-box ideas and a higher sensitivity to potential disruptors in your competitive arena.

Recommended reading: How To Write A Strategic Plan + Example

How Zara’s supply chain strategy is at the core of its business strategy

According to many analysts, the Zara supply chain strategy is its most important innovative component.

Amancio Ortega and other senior members of the group disagree. Nevertheless, the Inditex logistics strategy is extraordinarily efficient and plays a crucial role in sustaining its competitive advantage. Most companies in the clothing retail industry take an average of 4-8 weeks between inception and putting the product on the shelf. The group achieves the same in an average of two weeks. That’s nothing short of extraordinary.

Let’s see how Zara developed its logistics and business strategy.

Innovative logistics: how Zara’s supply chain evolved

The logistics methods developed by companies are highly dependent on external factors.

Take, for example, infrastructure. In the early days of Zara, when it was expanding through Spain, the company considered using trains as a transportation system. However, the schedule couldn’t keep up with Zara’s needs, which had the goal of distributing products twice a week to its shops. So transportation by road was the only way.

However, when efficiency is a high priority, it shapes logistics processes more than anything else.

And for Zara, efficient logistics was – and still is – of the highest priority.

Initially, leadership tried outsourcing logistics, but the experiment failed and the company assigned a member of the house with a thorough knowledge of the company's operating philosophy to take charge of the project. The tactic of entrusting important big projects to employees imbued with the company’s philosophy became a defining characteristic.

So, one of Zara’s early strategic decisions was that each shop would make orders twice a week. Since the first store was opened, the company has had the shortest stock rotation times in the industry. That’s what drove the development of its logistics methods. The whole strategy behind Zara relied on quick production and distribution. And the proximity of manufacturing and distribution was essential for the model to work. So Zara had these two centers in the same place.

Even when the brand was expanding around the world, its logistics center remained in Arteixo, Spain, despite being a less-than-ideal location for international distribution. At some point, the growth of the brand, and Inditex as a whole, outpaced Arteixo’s capacity, and the decentralization question came up.

The debate was tough among leadership, but the arguments were strong. Decentralization was necessary because of:

- Safety and security. If there was a fire or any other crippling disaster there (especially on a distribution day), then the company would face serious troubles on multiple fronts.

- Arteixo’s limitations. The company’s center in Arteixo was reaching its capacity limits.

So the company decided to decentralize the manufacturing and distribution of its brands.

Initially, the group made the decision to place differentiated logistics centers where the management of its chain of stores was based, i.e. Bershka would have a different logistics center than Pull&Bear, although they were both part of the Inditex Group. That idea emerged after Massimo Dutti and Stradivarius became part of Inditex. Those brands already had that geographical structure, and since the group integrated them successfully into its strategy and logistics model, it made sense to follow the same pattern with its other brands.

Besides, the proximity of the distribution centers to the headquarters of each brand allowed them to consolidate them based on the growth strategy and purpose of each brand (more on this later).

But just a few years after that, the group decided to build another production center for Zara that forced specialization between the two Zara centers. The specialization was based on location, i.e. each center would manufacture products that would stock the shelves of stores in specific locations.

Zara’s supply chain strategy is so successful because it’s constantly evolving as the group adapts to external circumstances and its internal needs. And just like its iconic fashion, the company always stays ahead of the logistics curve.

Zara’s business strategy transcends its logistics innovations

Zara’s business strategy relies on four key pillars:

- Flexibility of supply

- Instant absorption of market demand

- Response speed

- Technological innovation

Zara is the only brand in the Inditex group that is concerned with manufacturing. It’s the first brand in the clothing sector with a complete vertical organization. And the production model requires the adoption or development of the latest technological innovations.

This requirement is counterintuitive in the clothing sector.

Most people believe that making big investments in a market as mature as clothing is a bad idea. But the Zara production model is very capital and labor intensive. The technological edge derived from that investment gave the company, in the early days, the capability to manufacture over 50% of its own products while maintaining an extremely high stock rotation frequency.

Zara might be one of the best logistics companies in the world, but that particular excellence is a supporting factor, or at least a highly contributing factor, to its successful business strategy.

Zara’s business strategy is so much more than its supply chain strategy.

The company created the “fast fashion” term and industry. When other companies were manufacturing their collections once per season, Zara was adapting its collection to suit what people asked for on a weekly basis. The idea was to offer fashionable items at a fair price and faster than everybody else.

Part of its cost-cutting strategic priority was its marketing strategy. Zara didn’t – and still doesn’t – advertise like the rest of the clothing industry. Its marketing strategy starts with choosing the location of the stores and ends with advertising that the sales period has started. In the early years of the brand’s expansion, Amancio would visit potential store locations himself and choose the site to build the Zara shop.

The price was never an issue. If the location was in a commercial center, Zara would build its store there no matter how high the cost was because the company expected to recoup it quickly with increased sales.

Zara’s marketing is its own stores.

The strategy of Zara and her Inditex sisters

Despite Zara’s success (or because of it), Amancio Ortega created – or bought – multiple other brands that he included in the Inditex group, each one with a specific purpose.

- Zara was targeting middle-class women.

- Pull&Bear was targeting young people under twenty-five years old with casual clothing.

- Bershka was targeting rebel teens, especially girls, with hip-hop-style clothing.

- Massimo Dutti was targeting both sexes with more affluence.

- Stradivarius was competing with Bershka, giving Inditex two major brands in the teenage market.

- Oysho was concentrating on women's lingerie.

- Zara Home manufactures home textiles and decor.

Pull&Bear was initially targeting young males between the ages of 14 and 28. Later it extended to young females of the same age and focused on selling leisure and sports clothing. It has the slowest stock turnaround time in the group.

Bershka’s target group was girls between 13 and 23 years of age with highly individualized tastes. Prices were low, but the quality average. Almost a fiasco in the beginning, it underwent a successful strategic turnaround becoming today one of the biggest growth opportunities for the group. And out of all the Inditex chains, Bershka has the most creative designs.

Massimo Dutti was the first retail brand Amancio bought and didn’t create himself. Its strategy is very different from Zara, producing high-quality products and selling them at a high price. It’s an extension of the group’s offer to the higher end of the price spectrum in the fashion industry. It’s also the only Inditex chain brand that advertises regularly.

Stradivarius was the second acquired brand, with the purchase being a defensive move. The chain shares the same target group with Bershka, making it, to this day, a direct competitor.

Oysho started as an underwear and lingerie company. Its product lines evolved to include comfortable night and homewear along with swimwear and a very young children’s line. The brand’s strategy was aggressive from its conception, opening 286 stores in its first six years of existence.

Zara Home is the youngest brand in the Group and the only one outside the clothing sector, though still in the fashion industry. It was launched with the least confidence and with immense prior research. An experiment to extend the Zara brand beyond clothing, it was based on the conservative view that Zara could extend its product categories only to textile items for the home. But it turned out that customers were more accepting of Zara Home selling a wide variety of domestic items. So the brand made a successful strategic pivot.

Key Takeaway #2: The right people are more important than the best strategy

It might not be obvious in the story, but a key reason for Zara's and Inditex’s success has been the people behind them.

For example, a vast number of people in various positions from inside the group claim that Inditex cannot be understood without Amancio Ortega. Additionally, major projects like the development of Zara’s logistics systems and the group's international expansion had such a success precisely because of the people in charge of them.

Zara’s radically different model was a breakthrough because:

- Its leadership had a clear vision and a real strategy to execute it.

- People with a deep understanding of the company’s philosophy led Its largest projects.

Sustainability: Zara’s strategy to make fast fashion sustainable

Building a sustainable business in the fast fashion industry is a tough nut to crack.

To achieve it, Inditex has made sustainability a cornerstone of its business model. Its strategy revolves around the values of collaboration , transparency, and innovation . The group’s ambition is to make a positive impact with a vision of prosperity for the planet and its people by transforming its value chain and industry.

Inditex’s sustainability commitments and strategy to achieve them

Inditex has developed a sustainability roadmap that extends up to 2040 with ambitious goals. Specifically, it has committed to

- 100% consumption of renewable energy in all of its facilities by 2022 (report pending).

- 100% of its cotton to originate from more sustainable sources by 2023.

- 100% of its man-made cellulosic fibers to originate from more sustainable sources by 2023.

- Zero waste from its facilities by 2023.

- 100% elimination of single-use plastic for customers by 2023.

- 100% collection of packaging material for recycling or reuse by 2023.

- 100% of its polyester to originate from more sustainable sources by 2025.

- 100% of its linen to originate from sustainable sources by 2025.

- 25% reduction of water consumption in its supply chain by 2025.

- Net zero emissions by 2040.

The group’s commitments extend beyond environmental issues to how its manufacturing and supplying partners conduct their business . To bring its strategy to fruition, it has set up a new governance and management structure.

The Board of Directors is responsible for approving Inditex’s sustainability strategy. The Sustainability Committee oversees and controls all the proposals around the social, environmental, health, and safety impact of the group’s products, while the Ethics Committee makes sure operations are compliant with the rules of conduct. There is also a Social Advisory Board that includes external independent experts that advises Inditex on sustainability issues.

Finally, Javier Losada, previously the group’s Chief Sustainability Officer and now promoted to Chief Operations Officer, will be leading the sustainability transformation of the group. Javier Losada first joined Inditex back in 1993 and ascended its rank to reach the C-suite.

Inditex is dedicated to its commitment to reducing its environmental impact and seems to be headed in the right direction. The only question is whether it’s fast enough.

Key Takeaway #3: Integrating sustainability with business strategy is a present-day necessity

Governments and international bodies around the world are implementing more stringent environmental regulations, forcing companies to commit to ambitious goals and developing a realistic strategy to achieve them.

The companies that are impacted the least are those that always had sustainability as a high priority .

From the companies that require significant changes in their operations to comply with the new regulations, only those who integrate sustainability into their business strategy and model will succeed.

Why is Zara so successful?

Zara is the biggest Spanish clothing retailer in the world based on sales value. Its success is due to its fast fashion strategy that is based on a strong supply chain and quick market feedback loops.

Zara's customer-centric approach places a strong emphasis on understanding and responding to customer needs and preferences. This is reflected in the company's product design, marketing, and customer service strategies.

Zara made fashionable clothes accessible to the middle class.

Zara’s vision guides its future

Zara's vision, as part of the Inditex Group, is to create a sustainable fashion industry by promoting responsible consumption and production, respecting the environment and people, and contributing to the communities in which it operates.

The company aims to offer the latest fashion trends to its customers at accessible prices while continuously innovating and improving its operations and processes.

Growth by numbers (Inditex)

Digital Innovation and Transformation

Mba student perspectives.

- Assignments

- Assignment: Data and Analytics as…

ZARA: Achieving the “Fast” in Fast Fashion through Analytics

How does fast fashion make any business sense? Zara uses intensive data and analytics to manage a tight supply chain and give customers exactly what they want.

Introduction

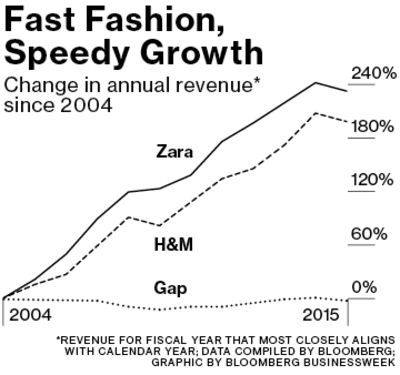

Zara’s parent company Inditex has managed to thrive in the last decade while several other fashion retailers have faced declining sales or stagnant growth. Inditex has grown over 220% in annual revenue since 2004, more than its key competitors like H&M, Gap, or Banana Republic (1).

The value of a fast fashion brand is to bring the latest designs and “trendiest trends” into the market as quickly as possible, preferably as soon as they became hot on the catwalk, and to provide these at a reasonable price. The traditional fashion industry is not well equipped to provide such value as it operates on a bi-annual or seasonal basis, with long production lead times due to outsourced manufacturing to low cost-centers. Zara has turned the industry on its head by using data and analytics to track demand on a real-time, localized basis and push new inventory in response to customer pull. This enables them to manage one of the most efficient supply chains in the fashion industry, and to create the fast fashion category as a market leader.

Pathways to a Just Digital Future

How Zara Uses Data

Inditex is a mammoth retailer, producing over 840 million garments in a year, the majority of which are sold by Zara (2). Every item of clothing is tagged with an RFID microchip before it leaves a centralized warehouse, which enables them to track that piece of inventory until it is sold to a customer (3). The data about the sale of each SKU, inventory levels in each store, and the speed at which a particular SKU moves from the shelf to the POS is sent on a real time basis to Inditex’s central data processing center (see picture below). This center is open 24 hours a day and collects information from all 6000+ Inditex stores across 80+ countries and is used by teams for inventory management, distribution, design and customer service improvements (4).

Zara’s Data Processing Center receives real-time data from around the world (4).

When the apparel arrives in store, RFID enables the stockist to determine which items need replenishing and where they are located, which has made their inventory and stock takes 80% faster than before (3). If a customer needs a particular SKU, salespeople are able to serve them better by locating it immediately in store or at a nearby location. Moreover, every Zara location receives inventory replenishments twice a week, which is tailored to that stores real-time updates on SKU-level inventory data.

The sales tracking data is critical in enabling Zara to serve its customers with trends that they actually want, and eliminate designs that don’t have customer pull. Zara’s design team is an egalitarian team of over 350 designers that use inspiration from the catwalk to design apparel on daily basis. Every morning, they dive through the sales data from stores across the world to determine what items are selling and accordingly tailor their designs that day. They also receive qualitative feedback from empowered sales employees that send in feedback and customer sentiment on a daily basis to the central HQ e.g., “customers don’t like the zipper” or “she wishes it was longer” (1).

At the start of the planning process, Zara orders very small batches of any given design from their manufacturers (even just 4-6 of a shirt per store). The majority of Zara’s factories are located proximally in Europe and North Africa, enabling them to manufacture new designs close to home and ship them to their stores within 2-3 weeks. They then test these designs in store, and if the data suggests the designs take off, Zara can quickly order more inventory in the right sizes, in the locations that demanded it. Such store-level data allows Zara to be hyper-local in serving their customer’s needs – as tastes can vary on a neighborhood level. As Inditex’s communication director told the New York Times,

“ Neighborhoods share trends more than countries do. For example, the store on Fifth Avenue in Midtown New York is more similar to the store in Ginza, Tokyo, which is an elegant area that’s also touristic. And SoHo is closer to Shibuya, which is very trendy and young.” (5)

Unlike other retailers that may order inventory based on their hypotheses about tastes at a regional level, Zara is tailors its collections based on the exact zip code and demographic that a given location serves (5).

Zara’s Results vs. Competitors

Zara sells over 11,000 distinct items per year versus its competitors that carry 2,000 to 4,000. However Zara also boasts the lowest year-end inventory levels in the fashion industry. This lean working capital management offsets their higher production costs and enables them to boast rapid sales turnover rates.

At Zara, only 15% to 25% of a line is designed ahead of the season, and over 50% of items are designed and manufactured in the middle of a season based on what becomes popular (2). This is in direct contrast to a close competitor like H&M where 80% of designs are made ahead of the season, and 20% is done in real-time during the season (6). Most other retailers commit 100% of their designs ahead of a season, and are often left with excess inventory that they then have to discount heavily at season-end. Instead, Zara’s quick replenishment cycles create a sense of scarcity which might actually generate more demand:

“With Zara, you know that if you don’t buy it, right then and there, within 11 days the entire stock will change. You buy it now or never.” (5)

- https://www.bloomberg.com/news/articles/2016-11-23/zara-s-recipe-for-success-more-data-fewer-bosses

- http://www.digitalistmag.com/digital-supply-networks/2016/03/30/zaras-agile-supply-chain-is-source-of-competitive-advantage-04083335

- http://static.inditex.com/annual_report_2015/en/our-priorities/innovation-in-customer-services.php

- http://www.refinery29.com/2016/02/102423/zara-facts?utm_campaign=160322-zara-secrets&utm_content=everywhere&utm_medium=editorial&utm_source=email#slide-11

- http://www.nytimes.com/2012/11/11/magazine/how-zara-grew-into-the-worlds-largest-fashion-retailer.html?pagewanted=all

- https://erply.com/in-the-success-stories-of-hm-zara-ikea-and-walmart-luck-is-not-a-key-factor/

Student comments on ZARA: Achieving the “Fast” in Fast Fashion through Analytics

Great post Ravneet – I had never read about Zara’s extremely quick supply chain or hyper-local testing. I have a question for you about fast fashion in general, but especially for Zara since it produces and sells more distinct items than its competitors: it seems that many designers are not fond of the “runway-inspired” fashions sold at these stores and some have even sued stores for copying their designs. Do you think Zara and other brands like it are doing anything wrong, and if not, what recourse do designers have for “imitations” of their work?

Thanks for the post Ravneet. Zara and H&M are beacons of hope for a mostly distressed industry. Do you think Zara’s advantage could be sustained in the event of a full-on assault by the Amazons of the world?

Leave a comment Cancel reply

You must be logged in to post a comment.

Zara's Secret for Fast Fashion

by Kasra Ferdows, Michael A. Lewis and Jose A.D. Machuca

Editor's note: With some 650 stores in 50 countries, Spanish clothing retailer Zara has hit on a formula for supply chain success that works by defying conventional wisdom. This excerpt from a recent Harvard Business Review profile zeros in on how Zara's supply chain communicates, allowing it to design, produce, and deliver a garment in fifteen days.

In Zara stores, customers can always find new products—but they're in limited supply. There is a sense of tantalizing exclusivity, since only a few items are on display even though stores are spacious (the average size is around 1,000 square meters). A customer thinks, "This green shirt fits me, and there is one on the rack. If I don't buy it now, I'll lose my chance."

Such a retail concept depends on the regular creation and rapid replenishment of small batches of new goods. Zara's designers create approximately 40,000 new designs annually, from which 10,000 are selected for production. Some of them resemble the latest couture creations. But Zara often beats the high-fashion houses to the market and offers almost the same products, made with less expensive fabric, at much lower prices. Since most garments come in five to six colors and five to seven sizes, Zara's system has to deal with something in the realm of 300,000 new stock-keeping units (SKUs), on average, every year.

This "fast fashion" system depends on a constant exchange of information throughout every part of Zara's supply chain—from customers to store managers, from store managers to market specialists and designers, from designers to production staff, from buyers to subcontractors, from warehouse managers to distributors, and so on. Most companies insert layers of bureaucracy that can bog down communication between departments. But Zara's organization, operational procedures, performance measures, and even its office layouts are all designed to make information transfer easy.

Zara's single, centralized design and production center is attached to Inditex (Zara's parent company) headquarters in La Coruña. It consists of three spacious halls—one for women's clothing lines, one for men's, and one for children's. Unlike most companies, which try to excise redundant labor to cut costs, Zara makes a point of running three parallel, but operationally distinct, product families. Accordingly, separate design, sales, and procurement and production-planning staffs are dedicated to each clothing line. A store may receive three different calls from La Coruña in one week from a market specialist in each channel; a factory making shirts may deal simultaneously with two Zara managers, one for men's shirts and another for children's shirts. Though it's more expensive to operate three channels, the information flow for each channel is fast, direct, and unencumbered by problems in other channels—making the overall supply chain more responsive.

In each hall, floor to ceiling windows overlooking the Spanish countryside reinforce a sense of cheery informality and openness. Unlike companies that sequester their design staffs, Zara's cadre of 200 designers sits right in the midst of the production process. Split among the three lines, these mostly twentysomething designers—hired because of their enthusiasm and talent, no prima donnas allowed—work next to the market specialists and procurement and production planners. Large circular tables play host to impromptu meetings. Racks of the latest fashion magazines and catalogs fill the walls. A small prototype shop has been set up in the corner of each hall, which encourages everyone to comment on new garments as they evolve.

The physical and organizational proximity of the three groups increases both the speed and the quality of the design process. Designers can quickly and informally check initial sketches with colleagues. Market specialists, who are in constant touch with store managers (and many of whom have been store managers themselves), provide quick feedback about the look of the new designs (style, color, fabric, and so on) and suggest possible market price points. Procurement and production planners make preliminary, but crucial, estimates of manufacturing costs and available capacity. The cross-functional teams can examine prototypes in the hall, choose a design, and commit resources for its production and introduction in a few hours, if necessary.

Zara is careful about the way it deploys the latest information technology tools to facilitate these informal exchanges. Customized handheld computers support the connection between the retail stores and La Coruña. These PDAs augment regular (often weekly) phone conversations between the store managers and the market specialists assigned to them. Through the PDAs and telephone conversations, stores transmit all kinds of information to La Coruña—such hard data as orders and sales trends and such soft data as customer reactions and the "buzz" around a new style. While any company can use PDAs to communicate, Zara's flat organization ensures that important conversations don't fall through the bureaucratic cracks.

Once the team selects a prototype for production, the designers refine colors and textures on a computer-aided design system. If the item is to be made in one of Zara's factories, they transmit the specs directly to the relevant cutting machines and other systems in that factory. Bar codes track the cut pieces as they are converted into garments through the various steps involved in production (including sewing operations usually done by subcontractors), distribution, and delivery to the stores, where the communication cycle began.

The constant flow of updated data mitigates the so-called bullwhip effect—the tendency of supply chains (and all open-loop information systems) to amplify small disturbances. A small change in retail orders, for example, can result in wide fluctuations in factory orders after it's transmitted through wholesalers and distributors. In an industry that traditionally allows retailers to change a maximum of 20 percent of their orders once the season has started, Zara lets them adjust 40 percent to 50 percent. In this way, Zara avoids costly overproduction and the subsequent sales and discounting prevalent in the industry.

Excerpted with permission from "Rapid-Fire Fulfillment," Harvard Business Review , Vol. 82, No.11, November 2004.

[ Order the full article ]

Kasra Ferdows is the Heisley Family Professor of Global Manufacturing at Georgetown University's McDonough School of Business in Washington DC.

Michael A. Lewis is a professor of operations and supply management at the University of Bath School of Management in the UK.

Jose A.D. Machuca is a professor of operations management at the University of Seville in Spain.

For Fast Response, Have Extra Capacity on Hand

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

A Case Study on Zara's Digital Transformation

This case study examines Zara’s current retail strategy and digital transformation. It details Zara’s current in-store and eCommerce retail strategy, the impact of digital on the retail environment and customer experience, and the growth opportunity provided by eCommerce. By providing a competitive analysis of the current market, this paper presents key opportunities, strategic questions, and possible solutions for retail brands to improve their digital strategy. This paper received First Class Honors in the Digital Marketing Strategy course at Trinity Business School.

Related Papers

Lea Valentine F Steinlein

Dinh Nam Nguyen

The successful implementation of an integrated supply chain strategy enhances total control over the operations and thus enhances speed and flexibility. The objective of this study is twofold: first to identify the constituents that mold the fast fashion retailing business model, and second to discuss how global leader of fast fashion retailing Inditex-Zara's product offering is strongly supported by integration of various supply chain operations. The findings suggest that vertical integration through ownership of various operational stages including product design and development, production operation, logistics and distribution channel; appropriate sourcing strategy to meet product needs; application of process/product modularity practices in product design, material procurement and manufacturing to ensure manufacturing flexibility; flexible logistics capability; and all of these seamlessly integrated and coordinated by a centralized IT infrastructure can significantly raise overall supply chain flexibility and responsiveness. Inditex-Zara's super-responsive supply chain reduces 'bullwhip effect', order-to-delivery lead time to stores, ensures lean inventory and high level of responsiveness to adapt and deliver products to stores with latest fashion trends and customer feedbacks at a rapid speed. Thus Inditex-Zara is able to successfully counter the negative effects of short product life cycles, high product variety, demand uncertainty and thus able to closely match product supply to the stores with market demand. This contributes to lower inventory backlogs; avoid mark-down losses and/or inventory stock out.

josep valor

Florida Tax Review

Rifat Azam , Orly Mazur

The growth of the digital economy, and, in particular, cloud computing, has put a significant strain on sales taxation and other consumption tax systems. The borderless, anonymous, and digital nature of cloud computing raises questions about the paradigm used to determine the character of the transaction and the location where consumption, and therefore, taxation occurs. From an American perspective, the effective resolution of these issues continues to grow in importance in light of the recent U.S. Supreme Court decision in South Dakota v. Wayfair and the growing number of U.S. businesses transacting overseas in jurisdictions that impose value-added taxes (VATs). The cloud magnifies difficulties with VAT compliance and enforcement, as businesses increasingly are subject to VAT laws in multiple jurisdictions. Tax authorities therefore have to collect from remote vendors who have numerous opportunities for VAT avoidance and evasion. The outcome of these challenges is unfair competition, a burden on international trade, and a huge gap in VAT revenues. In this important article, we closely analyze these cutting-edge challenges and contribute to the debate on how to tax the digital economy. We argue that while the approaches taken by both the Organisation for Economic Cooperation and Development, of which the United States is a member, and the European Union introduce some noteworthy improvements to the current system, more substantial measures are necessary. Thus, we propose a range of fundamental changes that include improving the existing registration-based VAT system through the enhanced use of new technologies, replacing the current system with a blockchain real-time basis VAT system, and shifting the VAT collection burden from suppliers to payment intermediaries. As the digital transformation of the economy accelerates, each of these changes will help adapt consumption taxation to the modern realities of our digital era.

Theodora A Christou

This report is prepared for the World Bank Legal Department’s Thematic Working Group on Technology and Innovation in Development. The research paper explores the legal issues and considerations the World Bank should take into account when considering financing projects with components that involve disruptive technologies. The report highlights legal and regulatory issues which may either enable or which may impede the adoption or creation of disruptive technologies, particularly in emerging market economies. The authors of the report are Professor Ian Walden and Dr Theodora A Christou, members of the Cloud Legal Project at the Centre for Commercial Law Studies, Queen Mary University London

Administrative Sciences

Dag Øivind Madsen

The Industry 4.0 (I4.0) concept is concerned with the fourth industrial revolution in manufacturing, in which technological trends such as digitalization, automation and artificial intelligence are transforming production processes. Since the concept's introduction at the Hannover Fair in Germany in 2011, I4.0 has enjoyed a meteoric rise in popularity and is currently high on the agenda of governments, politicians and business elites. In light of these observations, some commentators have asked the question of whether I4.0 is a concept that is hyped up and possibly just the latest in a long line of fashionable management concepts introduced over the course of the last few decades. Therefore, the aim of this paper is to provide a critical outside-in look at the emergence and rise of I4.0. Theoretically, these processes are viewed through the lens of management fashion, a theoretical perspective well suited to examinations of evolutionary trajectories of management concepts and ideas. The findings indicate that the I4.0 concept has quickly become highly popular and is dominating much of the popular management discourse. The concept has migrated out of the specialized manufacturing discourse to become a more general concept with mainstream appeal and applicability, evidenced by a multitude of neologisms such as Work 4.0 and Innovation 4.0. The numbers 4.0 have spread in a meme-like fashion, evidenced by the fact that the combination of a noun and the numbers 4.0 are used to signal and usher in discussions about the future of business and society. While there is much evidence that clearly shows that the concept has had a wide-ranging impact at the discursive level, the currently available research is less clear about what impact the concept has had so far on industries and organizations worldwide.

Heart (British Cardiac Society)

Reme Revista Mineira de Enfermagem

Silvia Bocchi

RELATED PAPERS

Journal of Korean Tunnelling and Underground Space Association

Current issues of scientific support for the state anti-corruption policy in the Russian Federation

Telelbachillerato Caracheo Cortazar

CERN European Organization for Nuclear Research - Zenodo

Yamandú Acosta

American journal of medical genetics. Part A

Deborah Wenkert

Journal of Materials Science

Arpita tiwari

Analytica Chimica Acta

Journal of Molecular Structure: THEOCHEM

HAMBATAN DAN PERENCANAAN PEMBANGUNAN DAERAH EFEKTIVITAS PEMBERDAYAAN MASYARAKAT 0LEH KELOMPOK SADAR WISATA (POKDARWIS) DALAM MENGEMBANGKAN PARIWISATA BERKELANJUTAN

Anggun Selfi Febriyani

Jimmy Robot

Sai Lakshmi 1430

Ovidius University Annals: Economic Sciences Series

Alina Elena Ionascu

Dunia keperawatan: Jurnal Keperawatan dan Kesehatan

Arif Imam Hidayat

New England Journal of Medicine

Márcia Boechat

NMIMS Assignments Solutions

IFAC Proceedings Volumes

B. Castillo-toledo

Journal of Communications Technology and Electronics

Đorđe Grozdić

INTERNATIONAL CONFERENCE on eGOVERNMENT & eGOVERNANCE (ICEBEG-2013)

Sosyal Bilimler Araştırmaları Derneği (Social Sciences Research Society)

Abdulla Hassan Hamad

Materials Advances

Neeleshwar Sonnathi

riyana rajput

Scientific Research Journal

saidu yakubu

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Zara Case Study: How Zara Lead The Fast Fashion Market?

Supti Nandi

Updated on: April 8, 2024

You asked, and we listened! Get ready to dive into the fascinating world of Zara with our highly requested Zara Case Study.

Recently, Zara has been trending in Instagram reels and YouTube shorts for its funky model poses. You must have seen it too! Have you wondered what made this Spanish brand so famous?

You may say that Zara works on the concept of fast fashion, which makes it win in the competitive market.

Well, that’s true but it is not the only reason. Let’s uncover the secrets behind Zara’s success through the Zara Case Study.

Let’s begin!

(A) Zara: A Brief Overview

Zara, a notable name in the fashion industry, is a Spanish retailer known for its distinctive approach to clothing and accessories. Operating on a fast fashion model, Zara excels in swiftly adapting to evolving fashion trends, setting it apart in the market. With a vertically integrated process, the brand manages everything from design to production in-house, allowing for efficient and responsive operations.

You’ll find Zara stores globally, each offering a diverse range of trendy and affordable clothing for men, women, and children. The brand’s commitment to delivering fashion-forward pieces at accessible prices caters to a broad audience, reflecting its significance in the industry.

Do you know what is fast fashion?

Fast fashion is a business model characterized by quickly producing affordable, trendy clothing items to meet rapidly changing consumer demands.

Zara works in the same way. We will look into its details in the upcoming section. Before that, let’s go through the profile of Zara-

What makes Zara stand out is its ability to balance responsiveness in manufacturing, a well-structured supply chain, and a keen understanding of consumer preferences. This combination has established Zara as a trendsetting and influential player in the fashion landscape. Its adaptability and dedication to making fashion trends accessible have solidified Zara’s place as a recognizable and influential name in the fashion industry.

(B) Zara Case Study: History & Evolution

Zara’s journey began with a dress-making factory called Inditex, established by Ortega in 1963. Over the years, Zara expanded its presence from Spain to Portugal and eventually to other European countries, the United States, and France.

Today, Zara boasts nearly 6,500 stores across 88 countries worldwide.

Let’s dive into the history of Zara in detail-

Zara is the flagship brand of the Inditex group, which is one of the world’s largest fashion retail conglomerates.

The head office of Zara is located in Arteixo, in the province of A Coruña, Galicia, Spain. Inditex also owns other popular brands like Massimo Dutti, Pull&Bear, Bershka, and Stradivarius.

(C) Brand Philosophy of Zara

Do you know why Zara stands out among its competitors? Due to its brand philosophy! Sara’s success hinges on several key principles-

Zara’s strategy is strikingly different from traditional fashion retailers. Reason? Fast fashion concept and in-house production of clothes! Go through the next section for detailed information.

(D) Zara Business Model: Effective Working Strategies

In this section, we will dive into the business model of Zara to determine its working strategies that played a huge role in its success-

Let’s dive into the details-

(D.1) Fast Fashion Model

Zara is known for its “ Fast Fashion ” approach. It releases new collections frequently, sometimes launching over 22 new product lines per year. This agility allows Zara to respond swiftly to changing trends and customer preferences.

- Rapid Trend Replication: Harnessing cutting-edge information technology, Zara excels at swiftly replicating prevailing fashion trends. This enables the brand to stay ahead of the curve, delivering the latest styles to customers promptly.

- Group Design Approach: Departing from the conventional individual designer model, Zara adopts a collaborative approach. Teams of designers work in synergy, fostering enhanced creativity and efficiency in product development. This collective effort ensures a diverse range of products aligned with dynamic market demands.

- Cost-Effective Materials: Zara strategically utilizes affordable materials without compromising on quality. This approach allows the brand to maintain competitive pricing while delivering products that meet or exceed industry standards. The focus on cost-effective yet quality materials contributes to Zara’s accessibility and broad customer appeal.

- Competitive Pricing: Zara optimizes its production costs by outsourcing to countries with cost-effective labor. This global approach not only supports competitive pricing but also facilitates the brand’s ability to swiftly adapt to market demands. The combination of efficient production and competitive pricing reinforces Zara’s position as a leader in the fast fashion landscape.

(D.2) Product Range

Let’s briefly look at its product range too-

- Clothing: From chic dresses and tailored suits to casual wear and activewear.

- Accessories: Including bags, shoes, belts, and jewelry.

- Beauty Products: Fragrances and cosmetics.

- Perfumes: Zara has its line of fragrances.

(D.3) Vertical Integration: In-House Operations & Logistics

Zara’s way of doing business centers on something called vertical integration. Here is how it works-

- Design: Zara takes charge of creating its designs, meaning it controls how its clothes look and stay on-trend. This ensures that what you find in Zara stores reflects the latest fashion trends.

- Manufacturing: Zara doesn’t just design; it also makes its clothes in-house. This is a big deal because it lets Zara make changes to its products fast. If there’s a new trend or customer feedback, Zara can respond quickly, which is pretty cool.

- Shipping and Distribution: Zara doesn’t stop at making the clothes; it handles everything from getting them to the store to making sure they’re sent to the right places. This full control of the supply chain ensures that the clothes you see in Zara are not only stylish but also reach the stores efficiently.

In short, the fast fashion concept, vertical integration, and supply chain efficiency helped Zara to achieve impressive milestones.

(E) Revenue Model of Zara: How does Zara make money?

Do you know Zara earned Rs.2,562.50 crore in India? That’s not all. It earned over 23 billion euros from its stores worldwide.

That’s quite amazing! Isn’t it?

But how does Zara earn such a whopping amount of money? Due to its impressive revenue model.

Let’s go through them one by one-

Let’s briefly dive into Zara’s finances for the years 2022 & 2021-

That’s how Zara is going through its purple patch in terms of revenues!

(F) Zara Marketing Strategies

Zara, the renowned Spanish fashion retailer, has crafted a distinctive marketing strategy that contributes to its global success. In this section, we will delve into the key elements of Zara’s marketing approach-

(F.1) Fast Fashion Strategy

The fast fashion model functions as a highly effective marketing strategy for Zara in several ways. First and foremost, the rapid turnover of collections, with over twenty product lines per year, creates a sense of urgency and novelty for customers. This continual introduction of fresh styles not only keeps Zara top-of-mind but also fosters a dynamic shopping experience, encouraging frequent visits to discover the latest trends.

Moreover, the quick response to changing trends and customer preferences positions Zara as a trendsetter, appealing to fashion-conscious consumers. The ability to swiftly translate runway trends into accessible and affordable pieces reinforces Zara’s image as a go-to destination for staying in vogue.

Additionally, the limited production batches contribute to an atmosphere of exclusivity, prompting customers to make timely purchases to secure unique and in-demand items. This scarcity-driven approach enhances the perceived value of Zara’s offerings.

In essence, the fast fashion model serves as a powerful marketing tool for Zara by creating a sense of immediacy, exclusivity, and trend relevance, fostering customer loyalty and consistently attracting a diverse audience seeking the latest in fashion.

(F.2) In-Store Experience

Zara places a strong emphasis on crafting an exceptional in-store experience, carefully curating showrooms to exude an atmosphere that is both exclusive and professional. The meticulous design choices contribute to an ambiance that goes beyond a mere shopping space, creating an environment where customers feel engaged and inspired.

The meticulous attention to detail is aimed at ensuring that every aspect of the in-store setting is carefully considered, from layout to lighting.

This focus on the in-store ambiance goes beyond aesthetics—it becomes a vital part of Zara’s marketing strategy. The thoughtfully designed physical stores act as powerful marketing tools in themselves, drawing in customers by providing a memorable and immersive shopping environment.

By enticing shoppers to explore the latest trends in this carefully curated setting, Zara not only enhances the overall customer experience but also reinforces its brand image as a trendsetting and sophisticated fashion destination!

(F.3) Affordability & Differentiation

Zara strategically positions itself by prioritizing affordable pricing while maintaining a commitment to quality. This dual emphasis allows the brand to resonate with a wide range of customers. By providing stylish clothing at reasonable prices, Zara ensures accessibility, making fashion-forward designs attainable for a diverse audience.

The effectiveness of this marketing strategy lies in Zara’s ability to differentiate itself in the market. The brand stands out not only for its trendsetting designs but also for its adept balance of fashion-forward aesthetics and accessible costs.

This unique blend positions Zara as a go-to destination for those seeking both style and value, enhancing the brand’s appeal and solidifying its market presence. The affordability and differentiation strategy contribute to Zara’s ability to capture a broad customer base and maintain its status as a leading player in the competitive fashion landscape.

(F.4) Word of Mouth and Limited Advertising

Zara strategically leverages the power of word of mouth and customer recommendations as primary drivers of its marketing efforts. In a departure from traditional advertising-heavy approaches, Zara relies on the subtlety of customer satisfaction and positive experiences to promote its brand.

This unique strategy involves cultivating a strong and positive buzz around Zara’s collections, encouraging customers to share their experiences and recommendations. The reliance on word of mouth creates an authentic and organic promotion of the brand, fostering a sense of trust and credibility among potential customers.

The limited advertising approach doesn’t diminish Zara’s impact; rather, it aligns with the brand’s commitment to providing an outstanding in-store experience and quality products. The positive buzz generated by satisfied customers becomes a powerful force, driving foot traffic to Zara’s stores and contributing to the brand’s sustained success in the competitive fashion market.

(F.5) Social Media Marketing

Zara actively embraces social media platforms as a crucial component of its marketing strategy. The brand leverages platforms like Instagram, Facebook, and Twitter to engage directly with its audience, creating a dynamic online presence.

The strategy involves regular updates across these platforms, keeping followers informed about the latest arrivals, ongoing trends, and behind-the-scenes glimpses into Zara’s fashion world. By maintaining an active and visually appealing presence, Zara not only stays connected with its audience but also cultivates a sense of anticipation and excitement around its offerings.

In addition to direct engagement, Zara strategically collaborates with influencers. These collaborations amplify Zara’s reach, tapping into the influencers’ follower base and creating a ripple effect of brand awareness.

Through this multi-faceted approach, Zara effectively utilizes social media not just as a promotional tool but as a means to foster a dynamic and interactive relationship with its audience, contributing to the brand’s overall success in the digital landscape.

(F.6) Personalization & Community Engagement

Zara adopts a customer-centric strategy by customizing its offerings to cater to local tastes and preferences. This personalization ensures that Zara’s collections resonate with diverse communities, creating a more inclusive and relatable shopping experience.

Community engagement takes center stage in Zara’s approach. Events like fashion shows or store openings play a pivotal role in fostering a sense of belonging among customers. By actively involving the community in these events, Zara goes beyond being a retailer and becomes an integral part of the local fabric.

Crucially, Zara prioritizes customer feedback. Actively listening to what customers have to say, the brand adapts and evolves its offerings based on this valuable input. This responsiveness not only enhances the overall customer experience but also reinforces a sense of collaboration between Zara and its community.

In essence, Zara’s commitment to personalization and community engagement contributes to a brand image rooted in customer satisfaction and a genuine connection with the diverse communities it serves.

(G) Sustainability Efforts: Crucial Part of Zara Case Study

Do you know what Zara is famous for apart from fashion? Its sustainability efforts to preserve mother nature! Let’s look at the sustainability efforts of Zara-

Thus, Zara is increasingly conscious of sustainability. The brand aims to reduce its environmental impact by using eco-friendly materials and promoting recycling. Such initiatives resonate with socially aware consumers.

(H) Challenges Faced by Zara

The journey of Zara was not free of challenges. Let’s look at some of the major challenges of Zara-

Zara brilliantly addressed those challenges to produce effective results that ultimately helped them grow their business.

(I) Summing Up: Zara Case Study

Zara’s remarkable success in leading the fashion market can be attributed to its unique blend of rapid fashion cycles, vertical integration, and a customer-centric approach. By staying ahead of trends with its fast fashion model, ensuring control over the entire production process, and tailoring offerings to local tastes, Zara captures a diverse and loyal customer base.

The brand’s commitment to affordability, engaging in-store experiences, and strategic use of social media further solidify its market leadership. Zara’s story showcases the power of adaptability, responsiveness, and a strong connection with customers in navigating the dynamic landscape of the fashion industry!

Related Posts:

Apart from selling clothes and accessories at higher prices, still it is among the favourite ones for many!

Contact Info: Axponent Media Pvt Ltd, 706-707 , 7th Floor Tower A , Iris Tech Park, Sector 48, Sohna Road, Gurugram, India, Pin - 122018

© The Business Rule 2024

Case Flash Forward: Zara: Fast Fashion

By: Baker Library

Each Case Flash Forward provides educators and students with a brief, 2-3 page update of key changes at a particular company covered in a related case study. It is a compilation of…

- Length: 4 page(s)

- Publication Date: Oct 1, 2015

- Discipline: Strategy

- Product #: 8553-PDF-ENG

What's included:

- Educator Copy

$2.62 per student

degree granting course

$4.60 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Each Case Flash Forward provides educators and students with a brief, 2-3 page update of key changes at a particular company covered in a related case study. It is a compilation of publicly-available content prepared by an experienced editor. This Case Flash Forward provides an update on Inditex and Zara, including significant developments, current executives, key readings, and basic financials.

Oct 1, 2015 (Revised: Apr 26, 2023)

Discipline:

Geographies:

Industries:

Apparel accessories, Retail trade

Harvard Business School

8553-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

MBA Knowledge Base

Business • Management • Technology

Home » Information Systems Management » Case Study of Zara : Application of Business Intelligence in Retail Industry

Case Study of Zara : Application of Business Intelligence in Retail Industry

ZARA is a Spanish clothing and accessories retailer based in Arteixo, Galicia. Founded in 24 May ,1975 by Amancio Ortega and RosalÃa Mera, the brand is renowned for it’s ability to deliver new clothes to stores quickly and in small batches. Zara needs just two weeks to develop a new product and get it to stores, compared to the six-month industry average, and launches around 10,000 new designs each year. Zara was described by Louis Vuitton Fashion Director Daniel Piette as “possibly the most innovative and devastating retailer in the world. The company produces about 450 million items a year for its 1,770 stores in 86 countries.

The Zara has made of use of Information Systems (IS) and to advance in many areas. This has resulted in huge success for the company. This included application of Business intelligence (BI) involves technologies, practices for collection, integration and applications to analyze and present business information. The main aim of business intelligence is to promote better business decision making.

BI describes a group of information on concepts and methods to better decision making in business. This is achieved by employing a fact based support systems. The intelligence systems are data-driven and sometimes used in executive information systems. Predictive views on business operations can be provided by use of BI systems. predictive views on business operations can be provided by use of BI systems since historical and current data has been gathered into a data bank performance management benchmarking is done whereby information on other companies in the same industry is gathered.

Since the Zara’s have large network and therefore dealing with large volumes of data, an enterprise information system has been employed in the firm. This is generally a type of computing systems that involves an enterprise class that is, typically offering total quality service handling large volumes of data and able to sustain a big organization. With this system, a technology platform is provided which enables the enterprise is provided to that information can be shared in all useful levels of management enterprise systems are important in removing the problem of fragmentation of information. This happens when there are numerous information systems in an enterprise. The problem is solved by developing a standard data structure.

The Zara being big organization, the enterprise systems is housed in many different data centers, and includes content management system as the main application. The Zara team comprises technology professionals. These include content specialists, network and system engineers, flash developers, database business analysts and administrators, software developers, quality assurance managers and computer and applications support technicians. All these specialists work in tandem to bring about competitive advantage to business by allowing for quick-response capability.

The Zara is devoted to integrating information technology appropriately into all areas of its operations and activities. The range of services and resources available to its clients is attributed to the commitment of integration of IT properly in the organization. The client services group in the Zara partners with staff and clients to identify and meet each group’s technological requirements. This group of technical advisors associates with departments to execute a roadmap for a team’s technological vision and then defines this vision within entity projects.