Ethical Concerns

Local sourcing - getting food, resources locally (from an area close by)

Sustainability - meeting the needs for now, without compromising the needs for the future.

food miles - the distance from crop to plate that a food takes.

Transition town - towns that aim to reduce their carbon emissions and increase independence.

Fair trade- ensuring that a fair price is paid for goods that are produced so that producers and workers get a fairer share of the money and are better protected (rights. Tends to support small scale, democratic organisations in LICs.

Ethical shopping A deliberate choice of buying goods for ethical reasons considering the ethical and social costs of purchasing them.

Like most HICs, the UK is living well beyond its ‘environmental means’. To supply resources for every country at the UK’s current level of consumption it would take 3.1 Earths. At the current rates of growth and global consumption, researchers believe that we would need two planets by 2050.

What can be done?

Responding locally – transition towns

Some local groups and non-governmental organisations (NGOs) promote local sourcing of goods to increase sustainability (relocalisation).

Totnes in Devon (pop 8000) was the world’s first ‘Transition Town’. Now a global network exists using the internet and social media to spread the idea of ‘transition’. By 2016 transition has become a movement of up to 50 countries attempting to reduce their carbon footprints and increase their independence.

Transition towns promote:

• Reducing consumption by repairing or reusing items

• Reducing waste, pollution and environmental damage

• Meeting local needs through local production where possible (farmers market)

Evaluate Ethical Consumption

Ethical Consumerism:

The UK’s retail sector is becoming increasingly aware of ethical issues associated with shopping. M&S now only sells Fairtrade teas and coffees, plus naturally died fabrics (to reduce carbon emissions). All supermarket chains now display ethical shopping credentials for those who want to buy ethical.

Local produce such as meat and milk have named suppliers on the product. This shows a shift back towards farmers markets e.g. Lidl adverts proving where they source their produce (Mussels, Scottish Beef, and Turkeys).

The issues with ethical shopping:

· Buying organic destroys more forests – less use of fertilisers and pesticides mean that more land is needed to produce the same amount.

· Fairtrade does raise farmers’ incomes but it also increases potential overproduction – causing prices to fall, which leaves farmers no better off.

· Growing cash crops even under Fairtrade can mean some farmers end up not growing enough food to feed themselves and their families.

· Buying local food minimises ‘food miles’ and helps the local economy – but most consumers still use cars to go shopping and as a result more energy is used.

Example: Bristol Pound

In 2012 Bristol introduced the ‘Bristol Pound’ (a community currency) to encourage people to spend locally rather than chain stores. However strategies like this also threaten global economic growth because they reduce the demand for items overseas.

Every £10 spent in local businesses is actually worth £23 for the local economy – through what economist call the ‘Multiplier Effect’ (Employees and suppliers are paid). In contrast to £10 in a chain supermarket is worth only £13 locally because it will return to its head office (e.g. Aldi and Lidl are German).

Some services are coordinated centrally (e.g. transport) so it’s hard to influence them. It’s also been argued that doing transition in a large city e.g. London can be difficult.

Due to TNC exploitation of poorer countries many fair trade companies and campaigners began to appear. They want simple things such as fair pay, better working conditions and improvements in infrastructures. The Fairtrade mark is a guarantee that the product is ethically produced and that a fair price has been paid to by the producers.

In 2015 Ethical Consumer gave coffee retailers a rank of out 20 for using ethical products. The marks received were not generally high.

Degradation

Waste and recycling:

In 2012 the UK generated 200 million tonnes of waste! (That’s around 32 fully loaded container ships). We need to do something about how we dispose of our waste. The UK has a long way to go in order to improve it waste management. Many efficient European countries recycle more than half of their waste!

Actions for the Future

The circular economy is an approach to sustainable development calling for careful management of materials. The ultimate idea is to ‘design out’ waste all together.

Could this concept be used into the future to create a more sustainable world?

welcome to the geography portal!

Become a member and discover where geography can take you.

- Global trade

- Investigating ...

Investigating fairtrade

This lesson highlights the positive impact that buying fairtrade products has on communities in other countries

In this lesson pupils investigate the fairtrade approach to global trade. Pupils learn the geographical terms ‘more developed’ (developed) and ‘less developed’ (developing) countries and how these relate to fairtrade. Pupils learn about the positive impact that people buying fairtrade has on communities of farmers and manufacturers in less developed countries, for example through better working conditions and a fair working wage. In the main activity pupils create a poster ‘Why Pay More?’, outlining the benefits of fairtrade and link different types of fairtrade products such as flowers and jewellery to their source location on a map.

Ideally, this lesson should take place after a Mathematics data handling lesson in the morning, when pupils create a bar chart of the price of a range of fairtrade and non-fairtrade items.

Pupils use the Price Data and Bar chart resource provided (table only, bar chart is only used if pupils do not complete the linked Maths lesson) which displays images of a range of popular items (chocolate, brown sugar, black tea, mango smoothie, cotton wool, gold jewellery, beauty products, cotton, coffee, flowers, Balasport footballs) and their fair and non-fairtrade retail prices.

They record the data on the fair and non-fairtrade price of these products in table format with clear column labels and title before creating a bar chart on graph paper. Pupils conclude that fairtrade products do cost more to buy. Explain that in the afternoon geography lesson we will learn the reasons why pay more for fairtrade.

Linked Maths Lesson

Mathematics: National Curriculum KS2 Ma 4 (Data Handling) Pupils to select and use handling data skills to discover trends in global trade and identify data needed to solve word problems related to trade. Ma 4 (2a) Solve problems involving data; b) interpret tables, lists and charts involving data on global trade, construct tables and charts; d) Use the terms ‘mode’ and ‘range’ to describe data sets; e) recognise whether data is discrete or continuous; f) draw conclusions from statistics and graphs) If the pupils do not carry out the linked maths lesson, they use the table and bar chart included in the resources Price Data and Bar chart resource and Price comparison resources to support lesson four.

Key questions

What is fairtrade?

Do fairtrade products cost more to produce and purchase than non-fairtrade products?

Why might fairtrade products cost the consumer more?

Why should we pay more for fairtrade products? What is the benefit?

Additional resources needed

Additional links.

Go to the Balasport website to find out about fairtrade football

Go to the HK jewellery website to find out about fairtrade gold

Go to YouTube to watch a video about roses from Ecuador Fairtrade Association

Recap that trade is global (imports, exports, and global supply chain).

Explain there are huge benefits to global trade, however it needs to be done in a way that benefits the workers in the early stages of the supply chain (farmers, miners etc).

Introduce the terms ‘less developed’ and ‘more developed’ countries on the Investigating Faritrade PPT and link this to stages of the supply chain (primary, secondary, tertiary). Often the primary stage is in less economically developed countries and the tertiary in the more economically developed). Show the table of the wealth of different continents on Investigating Faritrade PPT and discuss.

Main Activity

Define the ‘fairtrade’ approach to global trade: “Trade between companies in developed countries and producers in developing countries in which fair prices are paid to the producers”. Go to YouTube website to play an introductory video on Fairtrade

Ask a pupil to volunteer to read the Fairtrade Foundation statement on the Investigating Faritrade PPT. Go through the benefits to fairtrade on the following slide and discuss as a whole class or in small groups.

Examine the pie chart of fairtrade products by volume and ask pupils whether they can remember any other products you can buy fairtrade from the homework research task set last week.

Go to the Fairtrade foundation website to see an interactive world map of Fairtrade producers on the Interactive Whiteboard.

Revisit the morning findings in Mathematics and bar charts created (if did optional maths lesson), otherwise look at example bar chart on Investigating Fairtrade PPT/ downloadable resource Price Data and Bar Chart) showing difference in price of fair and non-fairtrade items. Conclude fairtrade items are more expensive to buy. Encourage the pupils to think about why this may be (Fairtrade minimum price, Fairtrade premium).

Pupils create a poster using the template provided Why Pay More? (Enlarge to A3).

They write the reasons why people should pay more for fairtrade products and the positive impact of buying fairtrade products on people in developing countries. They illustrate their poster with pictures of different fairtrade products (five from the price comparison table- football, chocolate, gold ring, roses, face cream) linking their source location the correct location on the world map.

Success criteria:

Pupils show five products and link these to five places they have located using their atlas.

They list at least three reasons why consumers should pay more for fairtrade products.

Pose the question: which product has the biggest price jump when it is fairtrade?

Pupils present their posters to the class and explain content as a persuasive argument for choosing fairtrade products.

Pupils offer feedback to one other using the teacher’s preferred peer review technique e.g. two stars and a wish.

Discussion questions: What are the positive impacts on the communities when we purchase fairtrade items? When we are purchasing items in our shops should we try to understand why an item may be cheaper or more expensive? (E.g. consider those who have made the items and their working conditions).

If time permits, teacher can also follow the links below so pupils learn more about specific fairtrade products:

Go to the Balasport website to find out about fairtrade football Go to the HK jewellery website to find out about fairtrade gold

Ask pupils to bring in a fairtrade product each for a fairtrade tea party next week.

File name Files

Global Trade Lesson 5 Lesson Plan

Global Trade Lesson 5 Lesson Plan (1)

Global Trade Lesson 5 Investigating Fair Trade

Global Trade Lesson 5 Price Data and Pie Chart

Global Trade Lesson 5 Price Data and Pie Chart (1)

Global Trade Lesson 5 Poster Template 'Why Pay More?'

Global Trade Lesson 5 Poster Template 'Why Pay More?' (1)

Global Trade Lesson 5 Price Comparison

This resource has been developed as part of the Rediscovering London's Geography project, funded by the GLA through the London Schools Excellence Fund. It seeks to improve the quality of teaching and learning of geography in London’s schools, in addition to encouraging more pupils to study geography

Back To Top

Case Study: Fair Trade

- Fair Trade is an organisation that sets standards fro trade with LEDC’s

- It guarantees a fair price for the farmer

- This pays for the product and investment in local community development projects

- In return the farmer must farm in an environmentally friendly way and treat their workers fairly too!

- More than 900 products are labelled fair trade

- Retail trade is growing by 40% a year!

- In Costa Rica coffee growers have formed co-operatives (groups ) and now grow and trade their own coffee

Skip to content

Get Revising

Join get revising, already a member.

Fair Trade and Free Trade

- Globalisation

- Created by: FloraD

- Created on: 01-06-16 16:04

Importance of Trade

- Countries with strong economies have greater influence over international trade

- Many TNCs or MNCs strike hard bargains with the producers of their primary products.

- General Motors, Wal-Mart and Exxon Mobil all have revenues greater than the GDPs of the 48 least developed countries

- A country should aim to have trade surplus - the opposite is trade deficit

- Free Trade assumes that there are no barriers to trade between countries

- A balance is created between how much the producer wants and how much the consumer is prepared to pay

- If a commodity is scarce, the producer has the greatest influence

- If there is a glut, the consumer has greatest influence

- Focuses on trading with poor and marginalized groups

- Pays fair prices that cover production costs and provides living wage

- Provides credit for producers

- A premium can be paid that will provide funds for social development in local communities

- Fair treatment of all workers + safe workplace conditions

- Development of long term trading relationships

Kenya - Disadvantaged

Kenya is classified by the World Bank as a LOW INCOME COUNTRY

- The cost of Kenya's imports is rising more quickly than the value of Kenya's exports

- Most of the exports are primary products: tea, coffee and fresh flowers

- Tourism is a growing industry, but in susceptible to political instability

- Farmers in countries like the EU and USA recieve subsidies - can sell goods at cheap prices

- Countries whose farmers are not given subsidies cannot compete with these subsidised producers

Traidcraft in Kenya

Kenya is ranked 134 out of 177 in HDI - 60% of the population live on less than $2 a day.

AIMS OF TRAIDCRAFT

- Help local businessed develop and enhance their capacities

- Promoteethical trading policies = increased productivity & reduced poverty

- improve skills of businesses

KENYA PLANS

- Craft productts from Bombolulu Workshops for the Handicapped in Mombassa

- Machakos District Co-operative Union - 7000 artisans

- Tea from a range of producers on the FLO register

- Business Linkages Project - small & medium businesses create links in supply chain

- Coastal farmers and wood carver co-operatives to gain access to new markets

- Fair Trade Tourism - promoting people-to-people tours

Role of WTO

The WTO has 162 members (2016). It remits to reduce tariffs and other barriers to trade.

Significant progress has been made; the average rate of import tax has gone down from 40% in the 1940s to 4% today.

- CANCUN WTO MEETING 2003

- Discussing on agricultural and on-agricultural goods, as well as services

- If talks were successful, it was said that global income could be raised by $500 billion a year and over 60% of teh inc. would occur in poorer countries

- The real discussion was centred around LEDCs opening their markets compeltely to free trade, whilst the MEDCs cut subsidies for farmers

- Meeting failed as no one was willing to compromise

There is a growing recognition that it is in everyone's interest to have a system of trade that allows LEDCs and LDCs to develop their industries and compete with MEDCs.

Market realities

Comparisons

- The EU is home to many dairy farmers who are subsidised on average $2 for every cow

- In Burkina Faso, a cotton famrer with a small plot of landwithout fertiliser or irrigation etc. has an average annual income of just $250

- The USA is the world's biggest cotton exporterand gave its cotton farmers $4.7 billion in subsidies in 2005

- This figure is larger than the amount of aid given to sub-Saharn Africa in the same year

Import Levies

- In order to develop their industries, LEDCs may want to move away from producing and exporting raw amterials, and instead export manufactured goods

- This is already difficult as they do not have the same level of knowledge or technologies as MEDCs

- Whats more, richer countries charge higher import levies on manufactured goods than on raw materials

TRIPS (Trade-Related Aspects of Intellectual Prope

- TRIPS is a policy that was agreedon by the WTO

- TRIPS states that the inventors of medical treatments have monopoly rights over their inventiions for 20 years

- During the AIDS epidemic, the standard drug used in MEDCs was too expensive for the LEDCs, so South Africa purchased generic drugs from India and Brazil - this was in breach of the TRIPS agreeement

- LEDCs are unable to treat their patients as they are unable to create their own drugs (limited knowledge).

What is needed to make trade fairer?

LEDCs need help in developing their trade. This comes in the form of...

- Protection of their fledgling industries from cheaper imports

- Rich countries sharing technical expertise and knowledge

- The dismissal of policies which support the protection of such informations

- In terms of the WTO, poorer countries often lack the expertise of the teams of specialist advisers that support trade ministers from richer countries

- All the G7 countries meeting their target of giving 0.7% of GDP in aid

No comments have yet been made

Similar Geography resources:

Fair Trade Vs Free Trade 0.0 / 5

Bananas 0.0 / 5

3.2.1.3 international trade, Global features and trends 0.0 / 5

International Trade Agreements 0.0 / 5

approaches to reducing development Gap 0.0 / 5

Trade or Aid 3.0 / 5 based on 1 rating

AQA Geography-International trade and access to markets 0.0 / 5

GLOBAL INTERDEPENDENCE- TRADE FLOWS AND TRADING PATTERNS 0.0 / 5

Global Systems and Global Governance 4 5.0 / 5 based on 1 rating Teacher recommended

Key players in the development gap 0.0 / 5

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Study Notes

Fair Trade and Development

Last updated 9 Apr 2023

- Share on Facebook

- Share on Twitter

- Share by Email

The Fair Trade movement covers over 650 producer organisations in more than 60 countries

One of the driving forces behind Fair Trade was a desire to correct for market failures in industries for many primary sector commodities. These included the effects of monopsony power among transnational food processors and food manufacturers that often led to farmers in some of the world's poorest countries receiving an inequitably low and unsustainable price for their products.

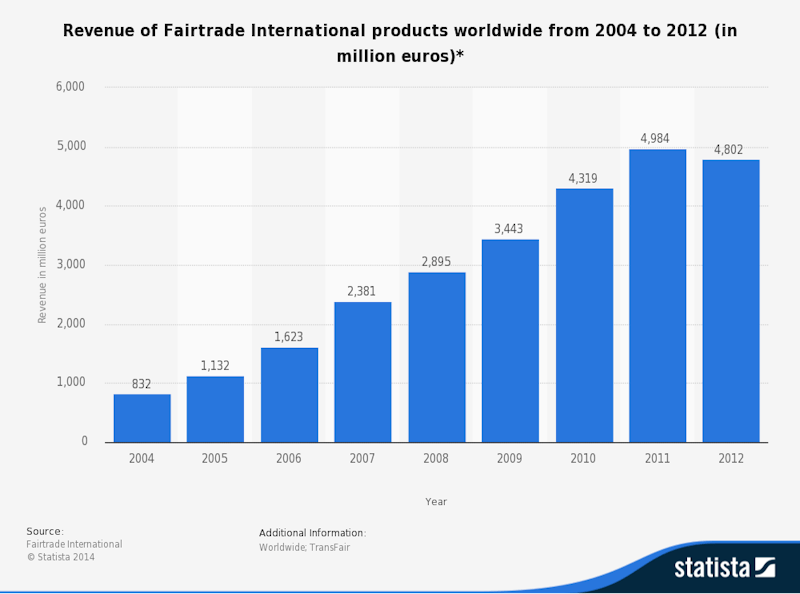

Sales of fair-trade labels have risen from an estimated Euro 830m in 2004 to Euro 4.9bn in 2011

The Fair Trade Foundation web site explains fair trade as follows:

"Fairtrade is about better prices, decent working conditions, local sustainability, and fair terms of trade for farmers and workers in the developing world. By requiring companies to pay sustainable prices (which must never fall lower than the market price), Fairtrade addresses the injustices of conventional trade, which traditionally discriminates against the poorest, weakest producers. It enables them to improve their position and have more control over their lives."

Key aims of Fair Trade

- Guarantee a higher / premium price to certified producers

- Achieve greater price stability for growers

- Improve production standards . A grower will be able to receive a Fair Trade licence if it can improve working conditions , better pay and guarantees of environmental sustainability

- A premium price can be offered - for direct investment in improving businesses and communities

Criticisms of Fair Trade

- Impact on non-participating farmers: Some claim that by encouraging consumers to buy their products from Fairtrade sources, this cuts demand and revenues for farmers in poorer nations not covered by the Fairtrade label thereby worsening the risk of extreme poverty

- Who captures the gains (producer surplus) from Fair-Trade coffee ? There is some evidence that a large part of the premium price goes to processors and distributors rather than the farmers themselves.

- The fundamental causes of poverty are not addressed by Fairtrade. Greater investment needs to be made in raising farm productivity , reducing vulnerability to climate change, and reaching multi-lateral trade agreements between countries to reduce import tariffs and improve access for poor countries into the markets of rich advanced nations. Other investment might be better targeted at encouraging farmers to establish producer co-operatives of their own and create their own branded products selling direct to consumers.

- Some free market think-tanks believe that the fair trade movement has resulted for example in excess production of coffee, which has driven down world coffee prices.

- Many producers certified to use the fair trade label come from richer more diversified advanced and middle income countries rather than poorer one

- Producer surplus

- Terms of Trade

You might also like

Australia lags in Commitment to Development Index

7th February 2015

UK & the European Union

Topic Videos

Causes and Effects of China's Growth Slowdown - Views from Economists

27th November 2015

Why Can’t Economists Sell Free Trade?

28th May 2017

EU agrees biggest free trade deal with Japan

10th December 2017

African Free Trade Agreement (Chain of Analysis)

Practice Exam Questions

Welfare Loss - Applying The Concept in Exams

Our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Jack Williams Geography

Case Study: The Banana Trade

The banana market is dominated by one species of banana, the Cavendish banana. There are other types of bananas that do not fit the specified description of one and so are excluded from trade. (e.g red bananas)

Quick Facts

Facts about bananas

- Staple food (commonly eaten) for over 400 million people

- One of the 5 most eaten fruits worldwide

- 90 calories per 100g

- 2013 16.5 million tons exported. (Latin America and the Caribbean)

- Grown mainly in India, Philippines

- 30kg of active ingredients (pesticides, fungicides, insecticides, herbicides) added per hectare of bananas.

- Mass production in developing countries is bad for the environments

- WTO will support free trade at all cost

- TNCs have a large influence

- Supermarket price wars decide on the price

- Power and control has moved to supermarkets

Negatives of banana farms

- Deforestation to build (greenfield)

- Chemicals added to farms to increase yield can cause eutrophication

- Kill biomass decreasing biodiversity

- Decreased soil fertility due to contaminants

Positives of banana farms

Four main TNCs

TNCs used to own 80% of the banana trade. This has changed as TNCs have released direct control of farms and as of 2002 TNCs only control 60% of the trade. They are, however, large influences in the labour standards. Recently retailers have been gaining power and due to the large number of up-coming banana companies exporting. This allows for retailers to demand low prices from suppliers as they can threaten to stop imports from that company.

- ACP – Africa, the Caribbean and Pacific

- ‘ dollar producers’ (so called due to the heavy investment from US TNCs) – Central American Republics, mainly Ecuador. and Colombia.

- EU (4.5 million tonnes)

- USA (4.5 million tonnes)

Banana Trade War

- Lasted 20 years (1992 – 2012)

- Geneva Banana Agreement

- Between US and EU

- EU negotiated trade agreements with 71 African, Caribbean and Pacific former European colonies ( Lomé Convention ) . They were given special and differential treatment (SDT) when supplying to EU to allow them to develop without European aid.

- The deal was extended to include Cameroon, Dominican Republic, Belize, Ivory Coast, Jamaica, Ghana, Suriname and the Windward Isles.

- The idea of the convention was to protect the smaller, family run business to develop as around 75% of crop supplied to the EU were from large mechanised South American TNCs plantations.

- In 1997 the WTO ruled against the EU

- EU proposals did not satisfy TNCs and were put under pressure and so imposed a number of WTO sanctions on various EU products.

- A compromise was reached in 2009 between the EU and 11 Latin American countries. The Geneva Banana Agreement was ratified in 2012

Race to the Bottom

Supermarkets are paying low prices to suppliers and so TNCs are looking for cheaper places to produce bananas. They are settling in West Africa where there is weaker legislation and low labour costs. This has lead to some very bad social impacts, such as the long, hot hours for workers.

Fair trade bananas help smaller-scale producers in the Caribbean. Fair trade gives consumers organic products that are at a slightly higher price and help developing small suppliers.

Further Reading

http://www.fao.org/economic/est/est-commodities/bananas/en/

Summary: Global exports of bananas in 2017 were expected to reach 18.1 million tonnes which is good as in 2015 export fell to 16.7 million.

https://www.express.co.uk/news/world/1003246/Brexit-news-Africa-banana-trade-wiped-out-fear-Latin-America-European-Union-UK

Summary: UK import 20% of all bananas that are imported to the EU. Brexit threatens food quotas and suppliers that rely on UK imports

Share this:

One thought on “ case study: the banana trade ”.

So cool. do you need any more or not atm?

Leave a comment Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- Media centre

- Resources library

- Campaign materials

Fairtrade case studies

Choose Fairtrade and you’ll be joining a strong and growing Fairtrade market. Over 400 businesses already choose us and work with us in many different ways.

Whether you are interested in sustainable sourcing on Fairtrade terms, tackling supply chain challenges with a Fairtrade Programme, or are simply intrigued to see how the FAIRTRADE Mark might benefit your marketing, read our case studies from businesses and brands below.

- Jump down to sharing expertise and innovative ways of working with Fairtrade

- Jump down to Fairtrade partnerships for long-term impact

Sourcing with Fairtrade

Greggs: building back better with fairtrade commitments.

Why Greggs are continuing to grow their Fairtrade range despite today’s tough climate.

Despite the challenges faced by the out-of-home sector as a result of the pandemic, Greggs announced in 2021 that they would be using Fairtrade cocoa across their supply chain. Fairtrade cocoa will be in all chocolate products sold through their shops by the end of 2023.

We caught up with them to find out more about why they’re continuing to grow their Fairtrade range despite today’s tough climate.

Cru Kafe: Fighting climate change with Fairtrade

The standout reason CRU Kafe chooses Fairtrade is to fight back against climate change.

Hear from Katie Colvin, Head of Marketing and Communications at CRU Kafe, about how Fairtrade equips the coffee farmers they work with, to deal with climate-related diseases like La Roya. What are the kinds of support Fairtrade coffee farmers in CRU Kafe’s supply chain choose? ‘Certain tools or certain new seed varieties to overcome climate change and get the best from their crop.’

Fyffes: Empowering communities with Fairtrade

Empowering communities is the best reason Fyffes can think of to explain why they are proud to work with Fairtrade.

The combination of the Fairtrade Minimum Price, a safety net that farmers receive when the market price drops, and the Fairtrade Premium, a fund that the community can choose to spend wherever it needs, is unbeatable for farmers to take control of their lives. ‘We work in some of the poorest communities in the world and are proud to see the changes this creates.’ John Hopkins, Procurement Director, Fyffes Group Limited.

Dip & Doze: Secure livelihoods and sustainable incomes

Dip & Doze feel that not knowing where your next pay is coming from, or even how much it might be, can be really stressful and unsustainable for families and communities. They explain why Fairtrade helps them support farmers with more financial security.

Why do businesses choose Fairtrade? Jennie Blake, Head of Brand & Content at Dip & Doze answers ‘with Fairtrade we can support secure livelihoods and sustainable incomes.’ They know that everyone deserves a good night’s sleep, without worrying about having enough money to put food on the table, for school books or for healthcare. We couldn’t have put it better ourselves, Jennie.

Grumpy Mule: Farmers invest in quality

The quality of Grumpy Mule’s coffee is down to the ability of their coffee farmers to invest in their business.

We asked Dave Jameson, Coffee Programme Manager from Grumpy Mule why do they choose Fairtrade coffee? Here’s Dave’s response, including how Fairtrade coffee farmers are using the Fairtrade Premium to invest in sorting machines to produce the best, ripest coffee beans. ‘I know that Fairtrade coffee farmers will invest their Premium in improving the coffee that they grow for us.’

Cafédirect: Direct trade and Fairtrade

Cafédirect was set up as a mission-led business to deliver impact for smallholder farmers worldwide, and working alongside Fairtrade they have created a brilliant model incorporating both direct trade, and Fairtrade.

Cafédirect has a holistic, grower led approach, that is facilitated through direct relationships with growers, and the framework of Standards and pricing that Fairtrade provides.

LEON Fairtrade coffee: Protecting the rainforest and regenerating land in one beautiful blend

LEON buys their 100% Arabica beans from Puro, who are trailblazers in sustainable coffee production. For years, Puro has helped LEON source the best beans from Peru and Honduras , picked at high altitude to give them natural sweetness, then roast them to bring out their full flavours.

The beans are organic, Fairtrade certified, and support the World Land Trust. Puro’s efforts to protect biodiversity have earned them the honour of having not one, but three new rainforest species named after them.

Sharing expertise

Tate & lyle: fighting child labour with fairtrade.

Tate & Lyle know any labour issues in their supply chain can be tackled in a timely, responsible and ethical way.

Tate & Lyle Sugars buys raw sugar from Belize, where sugar supports the livelihoods of more than 40,000 people, and their communities. Farmers in Belize are dealing with the worldwide Covid-19 pandemic, the climate crisis, and since 2015 they have been addressing the social, cultural and economic factors that drive child labour. And Tate & Lyle Sugars have been by their side.

A programme partnership to create more resilient flower supply chains

This case study demonstrates how partnering with Fairtrade can generate industry-wide innovation.

The project aimed to provide vital support to Kenyan flower farms and workers to ensure they could operate safely and bridge income gaps during the pandemic. It also aimed to carry out research and hold forums to lead discussions on how to create a more sustainable future for the floriculture sector. These two approaches were highly complementary since the pandemic had highlighted systemic issues within these supply chains.

Fairtrade Partnerships

Divine: empowering farmers and consumers.

Divine is driven by its social mission to empower farmers and consumers through creating a supply chain that shares value more equitably; a mission aligned closely to Fairtrade.

Sophi Tranchell, CEO of Divine Chocolate ‘I hope that we have demonstrated that there really is a different way of doing business, putting the cocoa farmer at the heart of it.’

Clipper: Fairtrade means education, health and an empowered future

Clipper believe that small things like a cup of tea can make a big difference. That’s why they’re proudly organic and have supported Fairtrade for the last 25 years.

Clipper don’t just make tea, they make every cup count. And being FAIR is a vital part of that. FAIR stands for Fairness and education for the workers’ children. For Aid and healthcare for all. For Influencing the future and for Rights and empowerment for the workers. And the added bonus for Clipper? Campaigning for act-TEA-vism! The tastiest way to change the world.

Read more about the Clipper Fairtrade campaign

Waitrose & Partners and Fairtrade: Partnering on sourcing and producer voice

Waitrose & Partners are a long-standing partner of Fairtrade, helping to provide stability to producers in the global south since 1994 when they were one of the first retailers to stock Fairtrade products.

This case study demonstrates the huge impact of their sourcing commitments, which benefit Fairtrade farmers and workers, and how we’ve worked together to amplify their voices.

Get in touch

This page is currently under maintenance.

We apologise for any inconvenience caused.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to them allow us to process data such as browsing behaviour on this site.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 28 June 2024

The limits of fair medical imaging AI in real-world generalization

- Yuzhe Yang ORCID: orcid.org/0000-0002-7634-8295 1 na1 ,

- Haoran Zhang 1 na1 ,

- Judy W. Gichoya ORCID: orcid.org/0000-0002-1097-316X 2 ,

- Dina Katabi 1 &

- Marzyeh Ghassemi ORCID: orcid.org/0000-0001-6349-7251 1 , 3

Nature Medicine ( 2024 ) Cite this article

1644 Accesses

126 Altmetric

Metrics details

- Radiography

As artificial intelligence (AI) rapidly approaches human-level performance in medical imaging, it is crucial that it does not exacerbate or propagate healthcare disparities. Previous research established AI’s capacity to infer demographic data from chest X-rays, leading to a key concern: do models using demographic shortcuts have unfair predictions across subpopulations? In this study, we conducted a thorough investigation into the extent to which medical AI uses demographic encodings, focusing on potential fairness discrepancies within both in-distribution training sets and external test sets. Our analysis covers three key medical imaging disciplines—radiology, dermatology and ophthalmology—and incorporates data from six global chest X-ray datasets. We confirm that medical imaging AI leverages demographic shortcuts in disease classification. Although correcting shortcuts algorithmically effectively addresses fairness gaps to create ‘locally optimal’ models within the original data distribution, this optimality is not true in new test settings. Surprisingly, we found that models with less encoding of demographic attributes are often most ‘globally optimal’, exhibiting better fairness during model evaluation in new test environments. Our work establishes best practices for medical imaging models that maintain their performance and fairness in deployments beyond their initial training contexts, underscoring critical considerations for AI clinical deployments across populations and sites.

Similar content being viewed by others

Generative models improve fairness of medical classifiers under distribution shifts

AI in health and medicine

Physical imaging parameter variation drives domain shift

As artificial intelligence (AI) models are increasingly deployed in real-world clinical settings 1 , 2 , it is crucial to evaluate not only model performance but also potential biases toward specific demographic groups 3 , 4 . Although deep learning has achieved human-level performance in numerous medical imaging tasks 5 , 6 , existing literature indicates a tendency for these models to manifest existing biases in the data, causing performance disparities between protected subgroups 7 , 8 , 9 , 10 , 11 . For instance, chest X-ray (CXR) classifiers trained to predict the presence of disease systematically underdiagnose Black patients 12 , potentially leading to delays in care. To ensure the responsible and equitable deployment of such models, it is essential to understand the source of such biases and, where feasible, take actions to correct them 13 , 14 .

Recent studies have unveiled the surprising ability of deep models to predict demographic information, such as self-reported race 15 , sex and age 16 , from medical images, achieving performance far beyond that of radiologists. These insights raise the concern of disease prediction models leveraging demographic features as heuristic ‘shortcuts’ 17 , 18 —correlations that are present in the data but have no real clinical basis 18 , for instance deep models using the hospital as a shortcut for disease prediction 19 , 20 .

In this work, we investigated four questions. First, we consider whether disease classification models also use demographic information as shortcuts and whether such demographic shortcuts result in biased predictions. Second, we evaluate the extent to which state-of-the-art methods can remove such shortcuts and create ‘locally optimal’ models that are also fair. Third, we consider real-world clinical deployment settings where shortcuts may not be valid in the out-of-distribution (OOD) data, to dissect the interplay between algorithmic fairness and shortcuts when data shift. Finally, we explore which algorithms and model selection criteria can lead to ‘globally optimal’ models that maintain fairness when deployed in an OOD setting.

We performed a systematic investigation into how medical AI leverages demographic shortcuts through these questions, with an emphasis on fairness disparities across both in-distribution (ID) training and external test sets. Our primary focus is on CXR prediction models, with further validation in dermatology (Extended Data Fig. 1 ) and ophthalmology (Extended Data Fig. 2 ). Our X-ray analysis draws upon six extensive, international radiology datasets: MIMIC-CXR 21 , CheXpert 22 , NIH 23 , SIIM 24 , PadChest 25 and VinDr 26 . We explored fairness within both individual and intersectional subgroups spanning race, sex and age 12 . Our assessment uncovers compelling new insights into how medical AI encodes demographics and the impact that this has on various fairness considerations, especially when models are applied outside their training context during real-world domain shifts, with actionable insights on what models to select for fairness under distribution shift.

Datasets and model training

We used six publicly available CXR datasets, as described in Table 1 . We focused on four binary classification tasks that have been shown to have disparate performance between protected groups 7 , 27 : ‘No Finding’, ‘Effusion’, ‘Pneumothorax’ and ‘Cardiomegaly’. The detailed prevalence rates of the diseases for each demographic subgroup are shown in Extended Data Table 1 .

We also examined medical AI applications in dermatology and ophthalmology. Specifically, we used the ISIC dataset 28 with ‘No Finding’ as the task for dermatological imaging (Extended Data Fig. 1a ) and the ODIR dataset 29 with ‘Retinopathy’ as the task for ophthalmology images (Extended Data Fig. 2a ).

To evaluate fairness, we examined the class-conditioned error rate that is likely to lead to worse patient outcomes for a screening model. For ‘No Finding’, a false positive indicates falsely predicting that a patient is healthy when they are ill, which could lead to delays in treatment 12 ; we, therefore, evaluated the differences in false-positive rate (FPR) between demographic groups. For all other diseases, we evaluated the false-negative rate (FNR) for the same reason. Equality in these metrics is equivalent to equality of opportunity 30 . We choose to study fairness through the notion of equalized odds, as it has been widely used in previous work in the CXR and fairness literature 7 , 12 . In addition, shortcut learning using a particular demographic attribute leads to differences in class-conditioned error rates (that is, FPR and FNR gaps) across attributes 31 , 32 , and so studying these gaps allows us to glean insight into the severity of shortcut learning. Finally, FPR and FNR (as enforced to be equal by equalized odds) are meaningful metrics in the clinical setting, as they correspond to error rates of decision-making at the individual level 12 .

To understand and quantify the types and degrees of distribution shifts in our study, we examined whether there are significant statistical differences in distributions between demographic groups in the ID settings as well as across different datasets in the OOD settings. Specifically, we analyzed prevalence shifts P(Y|A) and representation shifts P(X|A) across different subgroups for ID scenarios and added label shifts P(Y) and covariate shifts P(X) for OOD scenarios ( Methods ). Our analyses indicate that all the distributions that we examined show statistically significant shifts, affecting most demographic groups in the ID context (Extended Data Table 2 ) and across various sites in the OOD context (Extended Data Table 3 ). We note that our analysis does not presuppose specific types of distribution shifts; instead, we simulated real-world deployment conditions where any of these shifts might occur, aiming for results that are generalizable to complex, real-world scenarios.

We trained a grid of deep convolutional neural networks 33 on MIMIC-CXR (radiology), CheXpert (radiology), ODIR (ophthalmology) and ISIC (dermatology), varying the classification task. Our approach follows previous work that achieves state-of-the-art performance in these tasks 8 , 12 using empirical risk minimization (ERM) 34 . We also evaluated algorithms designed to remove spurious correlations or increase model fairness during training. We categorized these algorithms into those that (1) reweight samples based on their group to combat underrepresentation (ReSample 35 and GroupDRO 36 ); (2) adversarially remove group information from model representations (DANN 37 and CDANN 38 ); and (3) more generically attempt to improve model generalization—that is, exponential moving average (MA 39 ). In total, our analysis encompassed a total of 3,456 models trained on MIMIC-CXR, corresponding to the cartesian product of four tasks, four demographic attributes, six algorithms, 12 hyperparameter settings and three random seeds. We summarized our experimental pipeline in Fig. 1 .

a , We trained a grid of deep learning models on medical images from a variety of modalities on several clinical tasks. We applied a variety of state-of-the-art algorithms to mitigate shortcuts, for up to four demographic attributes (where available). b , We evaluated each model ID (that is, on the same dataset where it is trained), along the axis of performance, fairness, amount of demographic encoded and calibration. c , We evaluated the performance and fairness of CXR classification models on OOD domains. To mimic a realistic deployment setting where OOD samples are not observed, we chose the ‘best’ model based on several ID selection criteria.

Algorithmic encoding of attributes leads to fairness gaps

We separately trained deep learning models for our four distinct CXR prediction tasks (‘No Finding’, ‘Cardiomegaly’, ‘Effusion’ and ‘Pneumothorax’) as well as ‘Retinopathy’ in ophthalmology and ‘No Finding’ in dermatology. Each model consists of a feature extractor followed by a disease prediction head. We then employed a transfer learning approach, wherein we kept the weights of the feature extractor frozen and retrained the model to predict sensitive attributes (for example, race). This allowed us to assess the amount of attribute-related information present in the features learned by each model as measured by the area under the receiver operating characteristic curve (AUROC) for attribute prediction ( Methods ). Previous work 15 , 40 demonstrated that deep models trained for disease classification encode demographic attributes, and such encoding could lead to algorithmic bias 41 . We extend the investigation to a broader array of datasets, attributes and imaging modalities. As Fig. 2a,c,e confirms, the penultimate layer of different disease models contains significant information about four demographic attributes (age, race, sex and the intersection of sex and race), and that is consistent across different tasks and medical imaging modalities.

a , The AUROC of demographic attribute prediction from frozen representations for the best ERM model. We trained ERM models on MIMIC-CXR to predict four different binary tasks. ERM representations encode demographic attributes to a high degree. b , The fairness gap, as defined by the FPR gap for ‘No Finding’, and the FNR gap for all other tasks for the best ERM model. ERM models exhibit high fairness gaps, especially between age groups. c , The AUROC of demographic attribute prediction from frozen representations for the best ERM model on the ODIR dataset (ophthalmology), following the same experimental setup. d , The fairness gap for the best ERM model on the ODIR dataset (ophthalmology). e , The AUROC of demographic attribute prediction from frozen representations for the best ERM model on the ISIC dataset (dermatology), following the same experimental setup. f , The fairness gap for the best ERM model on the ISIC dataset (dermatology). a – f , Each bar and its error bar indicate the mean and standard deviation across three independent runs. g , The correlation between attribute prediction performance and fairness for all learned models. We excluded models with suboptimal performance—that is, with an overall validation AUROC below 0.7. The attribute prediction AUROC shows a high correlation with the fairness gap (‘No Finding’, age: R = 0.82, P = 4.7 × 10 −8 ; ‘No Finding’, sex and race: R = 0.81, P = 8.4 × 10 −9 ; ‘Cardiomegaly’, age: R = 0.81, P = 1.9 × 10 −7 ; ‘Effusion’, race: R = 0.71, P = 6.4 × 10 −6 ; ‘Pneumothorax’, sex: R = 0.59, P = 2.3 × 10 −3 ; all using two-sided t -test). The center line and the shadow denote the mean and 95% CI, respectively.

We then assessed the fairness of these models across demographic subgroups as defined by equal opportunity 30 —that is, discrepancies in the model’s FNR or FPR for demographic attributes. We focused on underdiagnosis 12 —that is, discrepancies in FPR for ‘No Finding’ and discrepancies in FNR for other diseases. For each demographic attribute, we identified two key subgroups with sufficient sample sizes: age groups ‘80–100’ ( n = 8,063) and ‘18–40’ ( n = 7,319); race groups ‘White’ ( n = 32,732) and ‘Black’ ( n = 8,279); sex groups ‘female’ ( n = 25,782) and ‘male’ ( n = 27,794); and sex and race groups ‘White male’ ( n = 18,032) and ‘Black female’ ( n = 5,027). In all tasks, we observed that the models displayed biased performance within the four demographic attributes, as evidenced by the FNR disparities (Fig. 2b ). The observed gaps can be as large as 30% for age. The same results hold for the other two imaging modalities (Fig. 2d,f ). Similar results for overdiagnosis (FNR of ‘No Finding’ and FPR for disease prediction) can be found in Extended Data Fig. 3 .

We further investigated the degree to which demographic attribute encoding ‘shortcuts’ may impact model fairness. When models use demographic variables as shortcuts, previous work showed that they can exhibit gaps in subgroup FPR and FNR 31 , 40 . We note that a model encoding demographic information does not necessarily imply a fairness violation, as the model may not necessarily use this information for its prediction. For each task and attribute combination, we trained different models with varying hyperparameters ( Methods ). We focused on the correlation between the degree of encoding of different attributes and the fairness gaps as assessed by underdiagnosis. Figure 2g shows that a stronger encoding of demographic information is significantly correlated with stronger model unfairness (‘No Finding’, age: R = 0.82, P = 4.7 × 10 −8 ; ‘No Finding’, sex and race: R = 0.81, P = 8.4 × 10 −9 ; ‘Cardiomegaly’, age: R = 0.81, P = 1.9 × 10 −7 ; ‘Effusion’, race: R = 0.71, P = 6.4 × 10 −6 ; ‘Pneumothorax’, sex: R = 0.59, P = 2.3 × 10 −3 ; all using two-sided t -test). Such consistent observations indicate that models using demographic encodings as heuristic shortcuts also have larger fairness disparities, as measured by discrepancies in FPR and FNR.

Mitigating shortcuts creates locally optimal models

We performed model evaluations first in the ID setting, where ERM models trained and tested on data from the same source performed well. We compared ERM to state-of-the-art robustness methods that were designed to effectively address fairness gaps while maintaining overall performance. As shown in Fig. 3a , ERM models exhibited large fairness gaps across age groups when predicting ‘Cardiomegaly’ (that is, models centered in the top right corner, FNR gap of 20% between groups ‘80–100’ and ‘18–40’). By applying data rebalancing methods to address prevalence shifts during training (for example, ReSample), we observed reduced fairness gaps in certain contexts. By applying debiasing robustness methods that correct demographic shortcuts, such as GroupDRO and DANN, the resulting models were able to close the FNR gap while achieving similar AUROCs (for example, the bottom right corner). Our results hold when using the worst group AUROC as the performance metric (Extended Data Fig. 4 ) and across different combinations of diseases and attributes (Fig. 3b and Extended Data Fig. 4 ).

a , Tradeoff between the fairness gap and overall AUROC for all trained models, for ‘Cardiomegaly’ prediction using ‘age’ as the attribute. We plotted the Pareto front—the best achievable fairness gap with a minimum constraint on the performance. b , Tradeoff between the fairness gap and overall AUROC for all trained models, with more disease prediction tasks and attributes. c , Tradeoff between the fairness gap and the overall AUROC on the ODIR dataset (ophthalmology). d , Tradeoff between the fairness gap and the overall AUROC on the ISIC dataset (dermatology).

To demonstrate the value of model debiasing, we further plotted the set of ‘locally optimal models’—those on the Pareto front 42 that balance the performance–fairness tradeoff most optimally on ID data (Fig. 3a ). Those models that lie on this front are ‘locally optimal’, as they have the smallest fairness gap that can be achieved for a fixed performance constraint (for example, AUROC > 0.8). In the ID setting, we found several existing algorithms that consistently achieve high ID fairness without losing notable overall performance for disease prediction (Fig. 3a,b and Extended Data Fig. 4 ).

Similar to our observations in radiology, we identified fairness gaps within subgroups based on age and sex in dermatology and ophthalmology, respectively (Fig. 2d,f ). We further verified the Pareto front for both attributes, where similar observations hold that algorithms for fixing demographic shortcuts could improve ID fairness while incurring minimal detriments to performance (Fig. 3c,d ). The steepness of the Pareto front suggests that small sacrifices in performance could yield substantial gains in fairness.

Locally optimal models exhibit tradeoffs in other metrics

We examined how locally optimal models that balance fairness and AUROC impact other metrics, as previous work showed that it is a theoretical impossibility to balance fairness measured by probabilistic equalized odds and calibration by group 43 . We found that optimizing fairness alone leads to worse results for other clinically meaningful metrics in some cases, indicating an inherent tradeoff between fairness and other metrics. First, for the ‘No Finding’ prediction task, enforcing fair predictions across groups results in worse expected calibration error gap (ECE Gap; Extended Data Fig. 5a ) between groups. Across different demographic attributes, we found a consistent statistically significant negative correlation between ECE Gap and Fairness Gap (age: R = −0.85, P = 7.5 × 10 −42 ; race: R = −0.64, P = 6.1 × 10 −15 ; sex: R = −0.73, P = 4.4 × 10 −28 ; sex and race: R = −0.45, P = 1.9 × 10 −8 ; all using two-sided t -test).

We explored the relationship between fairness and other metrics, including average precision and average F1 score. For ‘No Finding’ prediction, fairer models lead to both worse average precision and F1 score (Extended Data Fig. 5a ). The same trend holds across different diseases—for example, for ‘Effusion’ (Extended Data Fig. 5b ). These findings stress that these models, although being locally optimal, exhibit worse results on other important and clinically relevant performance metrics. This uncovers the limitation of blindly optimizing fairness, emphasizing the necessity for more comprehensive evaluations to ensure the reliability of medical AI models.

Local fairness does not transfer under distribution shift

When deploying AI models in real settings, it is crucial to ensure that models can generalize to data from unseen institutions or environments. We directly tested all trained models in the OOD setting, where we report results on external test datasets that are unseen during model development. Figure 4 illustrates that the correlation between ID and OOD performance is high across different settings, which was observed in previous work 44 . However, we found that there was no consistent correlation between ID and OOD fairness. For example, Fig. 4b shows an instance where the correlation between ID fairness and OOD fairness is strongly positive (‘Effusion’ with ‘age’ as the attribute; R = 0.98, P = 3.0 × 10 −36 , two-sided t -test), whereas Fig. 4c shows an instance where the correlation between these metrics is actually significantly negative (‘Pneumothorax’ with ‘sex and race’ as the attribute; R = −0.50, P = 4.4 × 10 −3 , two-sided t -test). Across 16 combinations of task and attribute, we found that five such settings exhibited this negative correlation, and three additional settings exhibited only a weak ( R < 0.5) positive correlation (see Extended Data Fig. 6a,b for additional correlation plots). Thus, improving ID fairness may not lead to improvements in OOD fairness, highlighting the complex interplay between fairness and distribution shift 45 , 46 .

a , We plotted the Pearson correlation coefficient of ID versus OOD performance versus the Pearson correlation coefficient of ID versus OOD fairness. Here, each point was derived from a grid of models trained on a particular combination of task and attribute. We found that there was a high correlation between ID and OOD performance in all cases, but the correlation between ID and OOD fairness was tenuous. b , One particular point where fairness transfers between ID and OOD datasets (‘Effusion’ with ‘age’ as the attribute; R = 0.98, P = 3.0 × 10 − 36 , two-sided t -test). The center line and the shadow denote the mean and 95% CI, respectively. c , One particular point where fairness does not transfer between ID and OOD datasets (‘Pneumothorax’ with ‘sex and race’ as the attribute; R = −0.50, P = 4.4 × 10 − 3 , two-sided t -test). The center line and the shadow denote the mean and 95% CI, respectively. d , The ID Pareto front for ‘Cardiomegaly’ prediction using ‘race’ as the attribute. e , The transformation of the ID Pareto front to the OOD Pareto front, for ‘Cardiomegaly’ prediction using ‘race’ as the attribute. Models that are Pareto optimal ID often do not maintain Pareto optimality OOD.

In addition, we investigated whether models achieving ID Pareto optimality between fairness and performance will maintain in OOD settings. As shown for ‘Cardiomegaly’ prediction using race as the attribute, models originally on the Pareto front ID (Fig. 4d ) do not guarantee to maintain Pareto optimality when deployed in a different OOD setting (Fig. 4e ). We show additional examples of this phenomenon in Extended Data Fig. 6c .

Dissecting model fairness under distribution shift

To disentangle the OOD fairness gap, we present a way to decompose model fairness under distribution shift. Specifically, we decompose and attribute the change in fairness between ID and OOD to be the difference in performance change for each of the groups—that is, the change in fairness is determined by how differently the distribution shift affects each group ( Methods ).

In Extended Data Fig. 7 , we show examples of transferring a trained model from ID setting to OOD setting. For example, Extended Data Fig. 7d illustrates an ERM model trained to predict ‘No Finding’ on CheXpert (ID) and transferred to MIMIC-CXR (OOD) while evaluating fairness across sex. We found that the model was fair with respect to the FPR gap in the ID setting (−0.1% gap, not significant) but had a significant FPR gap when deployed in the OOD setting (3.2%), with females being underdiagnosed at a higher rate (Extended Data Fig. 7e ). We then segmented this FPR gap by sex and found that females experienced an increase in FPR of 3.9%, whereas males experienced an increase in FPR of 0.8% (Extended Data Fig. 7f ). In other words, the model becomes worse for both groups in an OOD setting but to a much larger extent for female patients. This decomposition suggests that mitigation strategies that reduce the impact of the distribution shift on females could be effective in reducing the OOD fairness gap in this instance.

We further extended this study to a larger set of tasks and protected attributes (Extended Data Fig. 7 ). Across all settings, the disparate impact of distribution shift on each group was a significant component, indicating that mitigating the impact of distribution shift is as important as mitigating ID fairness, if the goal is to achieve a fair model OOD.

Globally optimal model selection for OOD fairness

Figure 4 shows that selecting a model based on ID fairness may not lead to a model with optimal OOD fairness. Here, we examined alternate model selection criteria that may lead to better OOD fairness, when we have access only to ID data. Our goal is to find ‘globally optimal’ models that maintain their performance and fairness in new domains. First, we subsetted our selection only to models that had satisfactory ID overall performance (defined as those with overall validation AUROC no less than 5% of the best ERM model). This set of models also had satisfactory OOD performance (Supplementary Fig. 1 ).

Next, we proposed eight candidate model selection criteria (Fig. 5a ), corresponding to selecting the model from this set that minimizes or maximizes some ID metric. We evaluated the selected model by its OOD fairness across five external datasets, each containing up to four attributes and up to four tasks, corresponding to a total of 42 settings. We compared the OOD fairness of the selected model to the OOD fairness of an ‘oracle’, which observes samples from the OOD dataset and directly chooses the model with the smallest OOD fairness gap. For each setting, we computed the increase in fairness gap of each selection criteria relative to the oracle. In Fig. 5a , we report the mean across the 42 settings as well as the 95% confidence interval (CI) computed from 1,000 bootstrap iterations. We found that, surprisingly, selecting the model with the minimum ID fairness gap may not be optimal. Instead, two other criteria based on selecting models where the embedding contains the least attribute information lead to a lower average OOD fairness gap. For instance, we observed a significantly lower increase in OOD fairness gap by selecting models with the ‘Minimum Attribute Prediction Accuracy’ as compared to ‘Minimum Fairness Gap’ ( P = 9.60 × 10 −94 , one-tailed Wilcoxon rank-sum test). The result echoes our finding in Fig. 2 that the encoding of demographic attributes is positively correlated with ID fairness.

a , We varied the ID model selection criteria and compared the selected model against the oracle that chooses the model that is most fair OOD. We plotted the increase in OOD fairness gap of the selected model over the oracle, averaged across 42 combinations of OOD dataset, task and attribute. We used non-parametric bootstrap sampling ( n = 1,000) to define the bootstrap distribution for the metric. We found that selection criteria based on choosing models with minimum attribute encoding achieve better OOD fairness than naively selecting based on ID fairness or other aggregate performance metrics (‘Minimum Attribute Prediction Accuracy’ versus ‘Minimum Fairness Gap’: P = 9.60 × 10 −94 , one-tailed Wilcoxon rank-sum test; ‘Minimum Attribute Prediction AUROC’ versus ‘Minimum Fairness Gap’: P = 1.95 × 10 −12 , one-tailed Wilcoxon rank-sum test). b , We selected the model for each algorithm with the minimum ID fairness gap. We evaluated its OOD fairness against the oracle on the same 42 settings. We found that removing demographic encoding (that is, DANN) leads to the best OOD fairness (‘DANN’ versus ‘ERM’: P = 1.86 × 10 −117 , one-tailed Wilcoxon rank-sum test). On each box, the central line indicates the median, and the bottom and top edges of the box indicate the 25th and 75th percentiles, respectively. The whiskers extend to 1.5 times the interquartile range. Points beyond the whiskers are plotted individually using the ‘+’ symbol.

Finally, we studied the fairness of each algorithm in the OOD setting. We maintained the performance cutoff described above and selected the model for each algorithm with the lowest ID fairness gap. In Fig. 5b , we report the mean increase in OOD fairness gap relative to the oracle across the same 42 settings. We found that methods that remove demographic information from embeddings (specifically, DANN) lead to the lowest average OOD fairness gap (‘DANN’ versus ‘ERM’: P = 1.86 × 10 −117 , one-tailed Wilcoxon rank-sum test). Our findings demonstrate that evaluating and removing demographic information encoded by the model ID may be the key to ‘globally optimal’ models that transfer both performance and fairness to external domains.

We demonstrated the interplays between the demographic encoding of attributes as ‘shortcuts’ in medical imaging AI models and how they change under distribution shifts. Notably, we validated our findings across global-scale datasets in radiology (Table 1 ) and across multiple medical imaging modalities (Extended Data Figs. 1 and 2 ). The results show that algorithmic encoding of protected attributes leads to unfairness (Fig. 2 ) and mitigating shortcuts can reduce ID fairness gaps and maintain performance (Fig. 3 ). However, our results also show that there exists an inherent tradeoff for clinically meaningful metrics beyond fairness (Extended Data Fig. 5 ), and such fairness does not transfer under distribution shift (Fig. 4 ). We provide initial strategies to dissect and explain the model fairness under distribution shifts (Extended Data Fig. 7 ). Our results further reveal actionable algorithm and model selection strategies for OOD fairness (Fig. 5 ).

Our results have multiple implications. First, they offer a cautionary tale on the efficacy and consequences of eliminating demographic shortcuts in disease classification models. On the one hand, removing shortcuts addresses ID fairness, which is a crucial consideration in fair clinical decision-making 12 . On the other hand, the resulting tradeoffs with other metrics and non-transferability to OOD settings raises the question about the long-term utility in removing such shortcuts. This is particularly complex in the healthcare setting, where the relationship between demographics and the disease or outcome label is complex 47 , variables can be mislabeled 48 and distribution shifts between domains are difficult to quantify 1 .

Second, we frame demographic features as potential ‘shortcuts’, which should not be used by the model to make disease predictions. However, some demographic variables could be a direct causal factor in some diseases (for example, sex as a causal factor of breast cancer). In these cases, it would not be desirable to remove all demographic reliance but, instead, match the reliance of the model on the demographic attribute to its true causal effect 49 . In the tasks that we examined here, demographic variables, such as race, may have an indirect effect on disease (for example, through socioeconomic status) 50 , which may vary across geographic location or even time period 51 . Whether demographic variables should serve as proxies for these causal factors is a decision that should rest with the model deployers 14 , 47 , 52 , 53 .

Third, we present a preliminary decomposition for diagnosing OOD model fairness changes, by expressing it as a function of the ID fairness gap and the performance change of each group. We found that the disparate impact of distribution shift on per-group performance is a major contributor to lack of fairness in OOD settings. Our work suggests that, for practitioners trying to achieve fairness in models deployed in a different domain, mitigating ID fairness is at least as important as mitigating the impact of distribution shift for particular groups. However, building models robust to arbitrary domain shifts is, in general, a challenging task 54 , 55 . Having some knowledge or data about how the distributions may shift, or even the ability to actively collect data for particular groups, may be necessary 56 . Developing methods and deriving theoretical characterizations of fairness under distribution shift is an active area of research 45 , 46 .

Fourth, the US Food & Drug Administration (FDA), as the primary regulatory body for medical technologies, does not require external validation of clinical AI models, relying instead on the assessment by the product creator 57 . Our findings underscore the necessity for regular evaluation of model performance under distribution shift 58 , 59 , challenging the popular opinion of a single fair model across different settings 60 . This questions the effectiveness of developer assurances on model fairness at the time of testing and highlights the need for regulatory bodies to consider real-world performance monitoring, including fairness degradation 61 . Finally, when a model is deployed in any clinical environment, both its overall and per-group performance, as well as associated clinical outcomes, should be continuously monitored 62 .

Finally, although we imply that smaller ‘fairness gaps’ are better, enforcing these group fairness definitions can lead to worse utility and performance for all groups 43 , 63 , 64 , 65 , 66 , and other fairness definitions may be better suited to the clinical setting 8 , 67 . We note that these invariant notions of fairness could have drawbacks 66 , as equalized odds are incompatible with calibration by group (Extended Data Fig. 5 ), and enforcing equalized odds often lead to the ‘leveling down’ effect in overall performance 63 , 64 . We present the Pareto curve showing the tradeoff between fairness and accuracy, allowing the practitioner to select a model that best fits their deployment scenario. In general, we encourage practitioners to choose a fairness definition that is best suited to their use case and carefully consider the performance–equality tradeoff. The impact of minimizing algorithmic bias on real-world health disparities, the ultimate objective, is complex 68 , and there is no guarantee that deploying a fair model will lead to equitable outcomes. In addition, although we constructed several models for clinical risk prediction, we do not advocate for deployment of these models in real-world clinical settings without practitioners carefully testing models on their data and taking other considerations into account (for example, privacy, regulation and interpretability) 1 , 3 .

Datasets and pre-processing

The datasets used in this study are summarized in Extended Data Table 1 . Unless otherwise stated, we trained models on MIMIC-CXR 21 and evaluated on an OOD dataset created by merging CheXpert 22 , NIH 23 , SIIM 24 , PadChest 25 and VinDr 26 . We included all images (both frontal and lateral) and split each dataset into 70% train, 15% validation and 15% test sets. Note that only MIMIC-CXR and CheXpert have patient race information available, and we extracted race (and other attributes) following established protocols 69 . For MIMIC-CXR, demographic information was obtained by merging with MIMIC-IV 70 . For CheXpert, separate race labels were obtained from the Stanford Center for Artificial Intelligence in Medicine & Imaging ( https://aimi.stanford.edu/ ) website. Where applicable, we dropped patients with missing values for any attribute.

For all datasets, we excluded samples where the corresponding patient has missing age or sex. For ODIR and ISIC, we dropped samples from patients younger than 18 years and older than 80 years due to small sample sizes (that is, smaller than 3% of the total dataset).

Owing to computational constraints, we mainly chose four prediction tasks for CXRs (that is, ‘No Finding’, ‘Effusion’, ‘Cardiomegaly’ and ‘Pneumothorax’). We selected these tasks for several reasons: (1) diversity in presentation: ‘Effusion’, ‘Cardiomegaly’ and ‘Pneumothorax’ each present distinctively and occur in different locations on a CXR, allowing for a comprehensive evaluation across varied pathologies and underlying causes; (2) prevalence in clinical and research settings: these labels are not only common in clinical practice but also frequently studied in prior academic work 7 , 12 , 63 and used in commercial diagnostic systems 71 ; and (3) performance and fairness considerations: these labels are among those with both the highest diagnostic accuracy and substantial fairness gaps on MIMIC-CXR, making them particularly relevant for exploring the relationship between model performance and fairness 7 , 12 .

We scaled all images to 224 × 224 for input to the model. We applied the following image augmentations during training only: random flipping of the images along the horizontal axis, random rotation of up to 10° and a crop of a random size (70–100%) and a random aspect ratio (3/4 to 4/3).

Evaluation methods

To evaluate the performance of disease classification in medical imaging, we used the following metrics: AUROC, TPR, TNR and ECE.

The TPR and TNR are calculated as (FN, false negative; FP, false positive; TP, true positive; TN, true negative):

When reporting the sensitivity and specificity, we followed previous work 12 , 72 in selecting the threshold that maximizes the F1 score. This threshold optimization procedure is conducted separately for each dataset, task, algorithm and attribute combination. We followed standard procedures to calculate the 95% CI for sensitivity and specificity.

We also reported AUC, which is the area under the corresponding ROC curves showing an aggregate measure of detection performance. Finally, we report the expected calibration error (ECE) 73 , which we computed using the netcal library 74 .

Assessing the fairness of machine learning models

To assess the fairness of machine learning models, we evaluated the metrics described above for each demographic group as well as the difference in the value of the metric between groups. Equality of TPR and TNR between demographic groups is known in the algorithmic fairness literature as equal odds 75 . As the models that we studied in this work are likely to be used as screening or triage tools, the cost of an FP may be different from the cost of an FN. In particular, for ‘No Finding’ prediction, FPs (corresponding to underdiagnosis 12 ) would be more costly than FNs, and so we focused on the FPR (or TNR) for this task. For all remaining disease prediction tasks, we focused on the FNR (or TPR) for the same reason. Equality in one of the class-conditioned error rates is an instance of equal opportunity 30 .

Finally, we also examined the per-group ECE and ECE gap between groups. Note that zero ECE for both groups (that is, calibration per group) implies the fairness definition known as sufficiency of the risk score 75 . We emphasize that differences in calibration between groups is a significant source of disparity, as consistent under-estimation or over-estimation of risk for a particular group could lead to under-treatment or over-treatment for that group at a fixed operating threshold relative to the true risk 76 .

Quantifying the distribution shifts

We examined and quantified the types and degrees of distribution shifts in both ID and OOD settings in this study. Inspired by previous work 46 , 77 , we performed a series of hypothesis tests to determine if there were significant statistical differences in distributions between demographic groups and across different pairs of datasets. All P values were adjusted for multiple testing using Bonferroni correction 78 .

We studied the following distribution shifts in the ID setting:

Prevalence shift: P(Y|A)

For binary outcomes Y across groups, we calculated the total variational distance between the probability distributions of Y conditioned on different groups and used a two-sample binomial proportion test, where the null hypothesis corresponds to P(Y|A = a 1 ) = P(Y|A = a 2 ):

Representation shift: P(X|A)

When comparing the distribution of the input images X, we first encoded them into representations derived from a frozen foundation model f that is trained in a self-supervised manner on diverse CXR datasets 79 , 80 . We then used the mean maximum discrepancy (MMD) distance and a permutation-based hypothesis test following ref. 81 to test if demographic groups differed statistically in their distribution of representations:

OOD setting

We studied the following distribution shifts in the OOD setting (the null hypothesis is P ID (·) = P OOD (·)):

Label shift: P(Y)

We calculated the total variational distance between the probability distributions of binary outcomes Y across ID and OOD datasets using a two-sample binomial proportion test:

Prevalence shift: P(Y|A = a)

We similarly evaluated the distance between the distributions of Y conditioned on specific demographic subgroups (A) between ID and OOD datasets:

Covariate shift: P(X)

We again encoded X into representations derived from a frozen foundation model f and then used the MMD distance and a permutation-based hypothesis test 81 to examine if ID and OOD datasets differed statistically in their distribution of representations:

Representation shift: P(X|A = a)

Similarly, we calculated the MMD distance conditioned on subgroup A to evaluate shifts in the representation space:

We provide additional results on quantifying various distribution shifts in both ID and OOD settings in the Supplementary Information (Supplementary Tables 1 – 3 ).

Training details

We trained DenseNet-121 (ref. 33 ) models on each task, initializing with ImageNet 82 pre-trained weights. We evaluated six algorithms: ERM 34 , ReSample 35 , GroupDRO 36 , DANN 37 , CDANN 38 and MA 39 .

For each combination of task, algorithm and demographic attribute, we conducted a random hyperparameter search 83 with 12 runs. During training, for a particular attribute, we evaluated the validation set worst-group validation AUROC every 1,000 steps and early stopped if this metric had not improved for five evaluations. We tuned the learning rate and weight decay for all algorithms and also tuned algorithm-specific hyperparameters as mentioned in the original works. We selected the hyperparameter setting that maximized the worst-attribute validation AUROC. CIs were computed as the standard deviation across three different random seeds for each hyperparameter setting.