- Search Search Please fill out this field.

Knowing Your Credit Score

What is a 401(k), causes of inflation, stock market indexes, how to continue your financial literacy journey, the bottom line.

- Personal Finance

- Financial Literacy

Financial Literacy Quiz: Where Are You on Your Journey?

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

There are several benefits to taking a financial literacy quiz. Essential topics ranging from mortgages to inflation are not covered often enough within the traditional education system. And even if you are a financial whiz, there is likely more you have to learn. Our financial literacy quiz is an excellent way to identify gaps in your knowledge and may even put some new concepts on your radar.

Your credit score is calculated based on information in your credit history. Depending on the scoring model, you can have more than one credit score. While FICO 8 is the most commonly used by lenders to judge your fiscal health, some mortgage lenders might use FICO Score 2, 4, or 5. Monitoring your credit score(s) is important, as it can impact your eligibility for loans, car leases, and housing.

There are several ways to check your credit score. Many major credit card companies provide credit scores for their customers; they could be listed on your monthly statement or found by logging into your online account. Additionally, several financial services monitor your spending and credit and can provide you with a score. The U.S. Department of Justice maintains a list of approved non-profit credit counselors , while the U.S. Department of Housing and Urban Development offers the same for HUD-approved housing counselors . These counselors can often provide you with a free credit report and help you review them.

You are entitled to free copies of your credit reports from all three major bureaus at least once a year. You can request them at the official website for that purpose: AnnualCreditReport.com . If you find any errors, you have a right to challenge them, and the credit bureau is required to investigate.

A 401(k) is a retirement savings plan offered to many U.S. employees The person who enrolls in a 401(k) plan agrees to have a percentage of each paycheck paid directly into an investment account. Sometimes, the employer may match part of that contribution, typically pre-tax. From there, the employee can choose from some investment options, typically mutual funds. By understanding the different kinds of retirement savings options, you can assess what is the best move for you at this time. Generally, it’s better to begin saving as soon as possible.

Inflation is a rise in prices, which can also be described as the decline of purchasing power over time. If inflation rises too quickly, it can have a negative impact on the overall economy. It can occur in nearly any product or service, especially need-based expenses such as food, housing, medical care, and consumer goods like cosmetics and cars. Once inflation extends to most sectors of an economy, it becomes a concern for both businesses and consumers. The Federal Reserve has an inflation target of approximately 2% and adjusts monetary policy to combat inflation if prices spike too quickly.

By knowing what inflation is and how it snowballs, you can adjust your lifestyle accordingly–limiting expenses, shifting your savings to a high-yield account, or investing.

There are three major stock indexes for tracking the performance of the U.S. market: the Dow Jones Industrial Average (DJIA), the S&P 500 Index, and the Nasdaq Composite Index. They provide a broad representative portfolio of investment holdings, so people follow different indexes to gauge market movements.

Once you begin to explore and follow these indexes, you’ll have a better idea of what to do with your own investments.

Annual percentage rate , or APR, is the yearly interest rate charged for a loan or earned by an investment. It calculates what percentage of the principal you’ll pay each year by taking things such as monthly payments and fees into account. It is also the annual rate of interest paid on investments without accounting for the compounding of interest within that year.

You’re most likely to come across APR on your credit card. It can either be fixed or variable. A fixed APR loan has an interest rate that is guaranteed to stay the same during the life of the loan, line, or lease. A variable APR, on the other hand, has an interest rate that may change. Rates for people with excellent credit are significantly lower than the rates offered to people with bad credit.

It’s crucial to understand APRs so that you can make safe decisions when borrowing money, whether it's through a simple credit card or taking out a loan. If you have a variable APR, it’s important to monitor your rate actively and make payments on time, or else a high APR may mean a higher payment that could thrust you into debt if you aren't ready to pay it.

Annual percentage yield , or APY, is the interest rate earned on an investment in one year, including compound interest. The more often interest is compounded, the higher the APY will be. A higher APY is better because your return will be higher. You can compare APYs at different financial institutions to ensure you open an account with the biggest possible return. Similar to APR, APYs can have either fixed or variable rates. Generally, higher APYs are associated with less liquid accounts.

A mortgage is a loan used to purchase a home, plot of land, or other type of real estate. The home serves as collateral to secure the loan. To get approved for a mortgage loan, you’ll likely need good credit and enough money for a down payment (this is where knowing your credit scores, APRs, and APYs comes in handy).

Our financial literacy quiz is a great step to take to identify and understand what you don’t know and can help guide your continued learning of financial topics.

To those who got perfect scores, congratulations. You’re ready to move forward to more long-term financial education. Since you have a solid understanding of personal finance, now is a great time to begin educating yourself on retirement planning and wealth-building topics. With your present financial situation under control, learning more about your options for the future will allow you to live comfortably later in life, too.

For those who got passing scores, you’re on the right track. We recommend looking into debt management and investing to ensure you’re making responsible financial decisions. You seem to have some money put away or have begun building credit. Now, you can focus on staying on top of monthly payments and saving.

For those who still have room for improvement, don’t worry. Start with the basics: open a bank account and track your monthly spending. From there, you can begin budgeting and saving.

What Are the Benefits of Taking a Financial Literacy Quiz?

Our financial literacy quiz is a great way to identify benchmarks in your personal finance journey. Maybe you know more than you realize, or maybe you’ll learn that you’ve misunderstood a concept. They are designed to help identify gaps in your understanding so that you know how to move forward or what to prioritize in your personal finance journey.

How Can I Prepare Effectively for a Financial Literacy Quiz?

You don’t need to prepare for a financial literacy quiz. They are used mainly to help you reflect on your own financial journey, so studying for them would produce an inaccurate representation of your experience. Answer the questions to the best of your ability with the knowledge you already have, and from there, you can identify topics to continue learning about.

What Resources Can Help Me Improve My Financial Literacy Knowledge?

Investopedia has educational information to answer any of your financial questions, covering anything from mortgages and airline points to broader economic theories.

It’s important to know your level of financial literacy. Navigating the world of personal finance is a tricky undertaking, but by eliminating topics you already have a good grasp of, you can identify the areas that require more attention. Sometimes, the mere scope of one’s understanding can change by taking this quiz, and others like it, as they can expose you to new topics.

When it comes to financial literacy and preparedness , it’s called a journey for a reason. People who walk away with both low or perfect scores will still have something new on their radar to learn about. Focus on one step at a time.

myFICO. " FICO Scores Versions ."

Consumer Financial Protection Bureau. " Where Can I Get My Credit Scores? "

Federal Trade Commission. " Disputing Errors on Your Credit Reports ."

Financial Industry Regulatory Authority. " Retirement Accounts: Types ."

The Board of Governors of the Federal Reserve System. " Why Does the Federal Reserve Aim for Inflation of 2% Over the Longer Run? "

Experian. " What Is a Good Credit Score? "

Consumer Financial Protection Bureau. " Appendix A to Part 1030 — Annual Percentage Yield Calculation ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1480323436-6a71cece6b774afb8048709abdbe5b60.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Personal Finance Quiz

Test your financial literacy with this multiple-choice quiz! Read each question carefully and select the one correct answer below it. Once you’ve answered each question, click the “Submit” button at the bottom of the screen to see how you did.

If you are a teacher, please visit CEE’s educational tool, ReadyAssessments , to access ready-made economics and personal finance tests and quizzes for K-12 learning. It’s simple to use and it’s FREE!

- Show all results for " "

Test Your Financial Literacy

Study Flashcards

10 Questions

What is globalization.

The interaction and integration between people, businesses, governments, and cultures from other nations.

What are the effects of globalization?

Economic and political dependence, expanded flow of culture and people among societies.

What is multicultural literacy?

The ability to understand and participate in the customs and activities of other cultures.

What is financial literacy?

The ability to understand and apply different financial skills effectively.

What does the Economic and Financial Literacy Act ensure?

That economic and financial education becomes a part of formal learning.

What does financial literacy enable people to achieve?

A financially balanced, sustainable, ethical, and responsible lifestyle

How many major characteristic types of how people view money are there?

What are spending patterns.

Habits or impulsive actions.

What are goals?

Short-term, medium-term, or long-term objectives.

Why is saving important?

For emergency situations, retirement, and future events.

Study Notes

- Globalization is the interaction and integration between people, businesses, governments, and cultures from other nations.

- The effects of globalization include economic and political dependence, expanded flow of culture and people among societies.

- Multicultural literacy refers to the ability to understand and participate in the customs and activities of other cultures.

- Social literacy concerns the development of social skills, knowledge, and positive human values.

- Financial literacy refers to the ability to understand and apply different financial skills effectively.

- The Economic and Financial Literacy Act ensures that economic and financial education becomes a part of formal learning.

- Financial literacy enables people to achieve a financially balanced, sustainable, ethical, and responsible lifestyle.

- There are six major characteristic types of how people view money, including frugal, pleasure, status, indifference, powerful, and self-worth.

- Spending patterns can be habitual or impulsive, and expenses can be fixed or variable.

- Goals can be short-term, medium-term, or long-term.

- Record, review, and take action on your spending plan.

- Saving is important for emergency situations, retirement, and future events.

- Social Security should only be a supplementary source of income.

- Two ways to save: save before you spend or save wisely after spending.

- Develop a saving habit by committing to a month, finding an accountability partner, and a saving role model.

- Write down your goals and avoid tempting situations.

Are you financially literate? Test your knowledge and skills with our quiz! From understanding the effects of globalization to developing saving habits, this quiz covers a range of topics related to financial literacy. Discover your strengths and areas for improvement in areas such as record-keeping, spending patterns, and goal-setting. Whether you're just starting to learn about financial literacy or looking to sharpen your skills, this quiz is perfect for you. So, get ready to take charge of your finances and achieve a balanced, sustainable

Make Your Own Quizzes and Flashcards

Convert your notes into interactive study material.

More Quizzes Like This

Test Your Financial Management Knowledge

Test Your Financial Knowledge

Test Your Financial Know-How

Test Your Financial Management Skills with Certinia Accounting Quiz!

Upgrade to continue

Today's Special Offer

Save an additional 20% with coupon: SAVE20

Upgrade to a paid plan to continue

Trusted by students, educators, and businesses worldwide.

We are constantly improving Quizgecko and would love to hear your feedback. You can also submit feature requests here: feature requests.

Create your free account

By continuing, you agree to Quizgecko's Terms of Service and Privacy Policy .

be finlightened

Financial Literacy Quiz With Answers [2024] – Super Easy?

Financial literacy quiz.

Take the FREE financial literacy quiz here and see how many of the 7 basic questions you get right. The main motive of this website is to make financial literacy easily accessible to everyone. Evaluating the current state of knowledge with the financial literacy quiz is a good starting point.

The average American can score 3.2 on this quiz of 7 questions (that’s less than 50%!!!).

Can you beat that score? Don’t worry if you get a few questions wrong, we have also compiled complete and detailed solutions to the financial literacy quiz below.

In case something is unclear, we are here to help without any judgments. Simply drop an email to [email protected] with the subject “Help on Financial Literacy Quiz” , and we’ll get back to you soon!

- Financial Literacy Quiz (Slider Version)

Which of the following indicates the highest probability of getting a particular disease?

Imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. After one year, would the money in the account buy more than it does today, exactly the same or less than today?

Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn't pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much would you have?

True or false: Buying a single company's stock usually provides a safer return than a stock mutual fund.

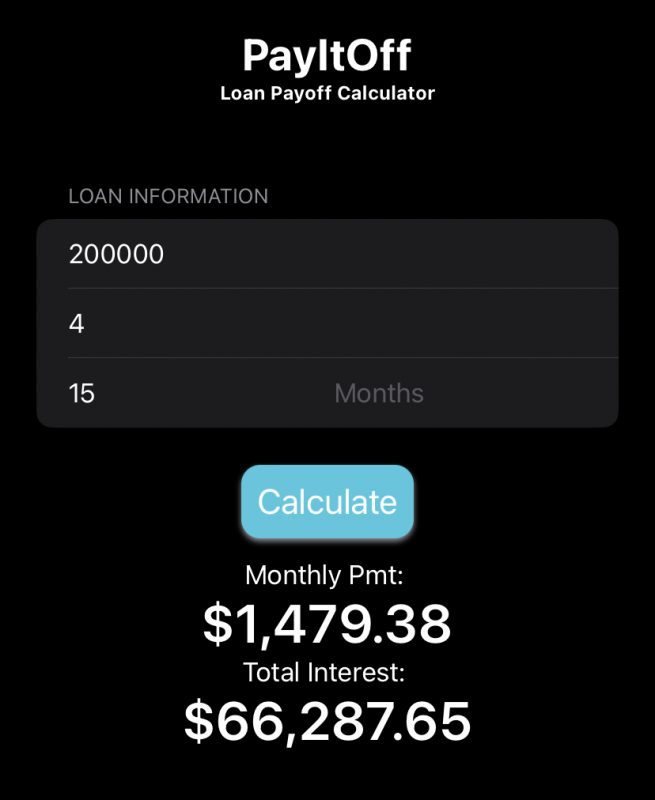

True or false: A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less.

If interest rates rise, what will typically happen to bond prices? Rise, fall, stay the same, or is there no relationship?

Share your Results:

Download FREE Financial Literacy Quiz PDF

Are you smarter than the average American? Can you prove that by scoring 4 or more on the financial literacy quiz ?

You will get an email with a link to download the Financial Literacy Quiz PDF instantly. Don’t forget to check your spam.

Add [email protected] to your contact WHITELIST to prevent misdirecting emails to spam.

Take the quiz and for complete solutions to the financial literacy quiz, see below.

Page Contents

Financial Literacy Quiz (Simple Version)

Suppose you have $100 in a savings account earning 2 percent interest a year. after five years, how much money would you have, imagine that the interest rate on your savings account is 1% per year and inflation is 2% per year. after one year, would the money in account buy more than it does today, exactly the same or less than today, if interest rates rise, what will typically happen to bond prices, a 15-year mortgage typically requires higher monthly payment than a 30-year mortgage but total interest over the life of loan will be less. true or false, true or false: buying a single company’s stock usually provides a safer return than a stock mutual fund..

- Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

That’s less than a 50% score.

There’s room for improvement, you can kickstart your journey toward financial enlightenment right from here!

#1. Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much would you have?

#2. imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. after one year, would the money in the account buy more than it does today, exactly the same or less than today, #3. if interest rates rise, what will typically happen to bond prices rise, fall, stay the same, or is there no relationship, #4. true or false: a 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less., #5. true or false: buying a single company’s stock usually provides a safer return than a stock mutual fund., #6. suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. if you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double, #7. which of the following indicates the highest probability of getting a particular disease, solutions to financial literacy quiz, assuming simple interest is being discussed here.

- In the first year the $100 will earn an interest of 2/100 * $100 = $2

- In the second year, the $100 will earn another $2.

- Likewise, in years 3, 4, and 5 also the $100 will earn $2 each year.

- After five years, the total amount in the savings account will be $100 + 5 * $2 =$110

Assuming compound interest is being discussed here (when interest earned in a previous period also earns interest in subsequent periods)

- In the first year, the $100 will earn $2 interest.

- At the beginning of year 2, $102 is available in the savings account. This entire $102 will earn 2% interest. 2/100 * $102 = $2.04

- At the beginning of year 3, $104.04 is available in savings account. This can be calculated as (1 + 0.02) ^ 2 * $100 = $104.04

- Likewise, at the end of year five, (1 + 0.02) ^ 5 * $100 = $110.41 is available in the savings account.

For the purpose of this quiz, it doesn’t matter whether you compute using the simple interest or compound interest formula, the correct answer is More than $102

Inflation is a term that describes a general increase in the price of something. Effectively, it tells us that if there is positive inflation in the economy, the value of money is going down.

Related Posts:

Starting with $100 in a savings account today, the amount next year will be $101 (1% interest rate on $100).

A 2% inflation means that something that can be purchased for $100 today, will cost $102 next year.

Since the cost, next year will be $102 for the same quality and quantity of a product and we will have $101 available at that time, we will have to compromise on either quality or quantity.

Hence, for a similar quality product, the money will buy LESS than what it buys today.

There is an inverse relationship between bond price and interest rates (yield). So, as interest rates rise, the bond prices will FALL .

Bestseller Personal Finance Books

Read more here for a comprehensive understanding of the topic.

Conceptually, a 15-year mortgage will try to spread the principal payment over a shorter period of time as compared to a 30-year mortgage, so the monthly payments will be higher.

Since you pay off the mortgage quickly, the interest payments will also be lower over the life of the loan.

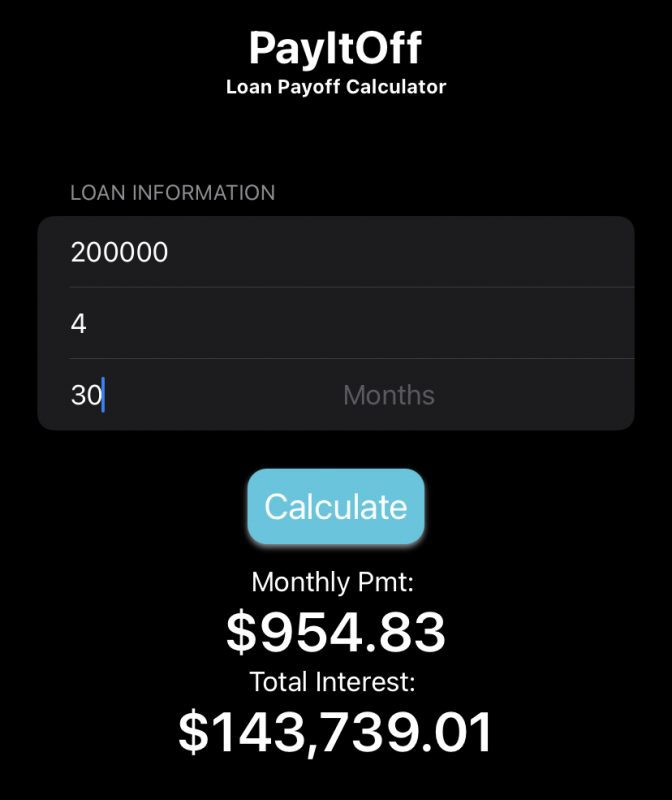

Let’s use the mortgage calculator to confirm our beliefs.

15-year mortgage ($200,000)

- Monthly payment = $1,479

- Total interest over life of loan = $66,288

30-year mortgage ($200,000)

- Monthly payment = $955

- Total interest over life of loan = $143,739

As we can see, the monthly payments are higher ($1,479 > $955), but the interest paid ($66,288 < $ 143,739 ) overall is much lower for the 15-year mortgage. The answer is TRUE.

A single company’s stock tends to be more volatile than a stock mutual fund which is a diversified portfolio. Generally, well-diversified funds are more stable than a single stock.

So, the answer is FALSE .

Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

If you know the rule of 72 (more like a rule of thumb, than an actual mathematical rule), the number of years * interest rate = 72 for the money to double. So, for example, if you have an interest rate of 9% per year, it will take 72 / 9 = 8 years for the money to double.

Using the rule of 72, we can quickly calculate 72/20 = 3.6 years

So, among the options, the correct answer is 2 to 4 years.

This question can throw you off. But the question has nothing to do with the virality of disease in a medical sense, but more with understanding fractions and percentages.

The probability of something happing can be expressed in percentages. The higher the percentage, the higher the probability.

Let’s evaluate the fractions and percentages mentioned in all the options.

- There is a one-in-twenty chance of getting the disease: one-in-twenty means 1/20, which is 5%

- 2% of the population will get the disease: This is a clear percentage, 2%

- 25 out of every 1,000 people will get the disease: 25 out of 1000 is 25/1000 = 2.5/100 or 2.5%

Among the three options, the highest percentage is 5%, so the correct answer is ‘ there is a one-in-twenty chance of getting the disease .’

Popular Topics: Stocks , ETFs , Mutual Funds , Bitcoins , Alternative Investing , Dividends , Stock Options , Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Check out our new venture multipl !

Our Financial Calculator Apps

Have an account?

2nd Grade Financial Literacy

1st - 3rd grade, social studies.

11 questions

Introducing new Paper mode

No student devices needed. Know more

A ___________ buys goods and services.

A _________ makes a good or provides a service.

Carlos owns a donut shop. Is Carlos a producer or consumer?

You get lunch in the cafeteria. Are you a producer or a consumer?

Anna has a dairy farm. She sells the milk to a dairy factory. Is she a producer or consumer?

A pair of shoes is a good or a service?

Is a dentist a good or a service?

______ are the good things that come from something.

Javi received $13.50 from his grandmother for his birthday. He wants to buy a new toy, but he puts the money in his piggy bank instead. Is he saving or spending his money?

Mrs. Neale goes to Target to buy some tissues and a new coffee cup. She purchases clothes, toothpaste, and a candle while there. Is this an example of planned or unplanned spending?

Martina goes to the grocery store to buy apples, bananas, and a pack of gum. She purchases apples, bananas, and a pack of gum. Is this an example of planned or unplanned spending?

Explore all questions with a free account

Continue with email

Continue with phone

IMAGES

VIDEO

COMMENTS

option 2 because each racquet will only cost $37.50. option 1 because they will save money not going back to the first store. option 1 because each racquet will cost $45. option 2 because each racquet will cost $56.25. Review lesson 7.4 and then re-calculate. Score: 0 of 1. option 1 because each racquet will cost $45.

Vikki Velasquez. There are several benefits to taking a financial literacy quiz. Essential topics ranging from mortgages to inflation are not covered often enough within the traditional education ...

Test your financial literacy with this multiple-choice quiz! Read each question carefully and select the one correct answer below it. Once you've answered each question, click the "Submit" button at the bottom of the screen to see how you did. If you are a teacher, please visit CEE's educational tool, ReadyAssessments, to access ready ...

Looking to help your students prepare for a financial literacy test? Take the National Financial Educators Council's basic financial literacy practice test.

Qualifying accounts can even access their paycheck up to two days early. Better banking is here with SoFi, NerdWallet's 2024 winner for Best Checking Account Overall.*. Enjoy up to 4.60% APY on SoFi Checking and Savings. Open an account. SoFi® Checking and Savings is offered through SoFi Bank, N.A. ©2023 SoFi Bank, N.A.

Financial Literacy Test. This free 20-question test will reveal if your financial knowledge is up to par. Select your answers and click the CHECK ANSWERS button at the bottom of the page to see how you did. If the questions have you stumped, sign up for Consolidated Credit's free online financial education course to improve your financial ...

Further, only 37 percent of respondents were considered to have high financial literacy, meaning they could answer four or more questions correctly on the five-question financial literacy quiz—down from 39 percent in 2012 and 42 percent in 2009. Take the NFCS Financial Literacy Quiz now and see how you fare. The NFCS findings show that all ...

Financial literacy enables people to achieve a financially balanced, sustainable, ethical, and responsible lifestyle. There are six major characteristic types of how people view money, including frugal, pleasure, status, indifference, powerful, and self-worth. Spending patterns can be habitual or impulsive, and expenses can be fixed or variable.

Let's say you get a 30-year mortgage at 6 percent on a $150,000 home. You will pay $899 a month in principal and interest charges. Over 30 years, you will pay $173,757 in interest alone. But a 15-year mortgage at the same rate will cost you less. You will pay $1,266 each month but only $77,841 in total interest—nearly $100,000 less.

Financial Literacy Unit 2 Test Review quiz for 8th grade students. Find other quizzes for Social Studies and more on Quizizz for free!

2019-20 Financial Literacy - Unit 2 Test Review quiz for 11th grade students. Find other quizzes for Life Skills and more on Quizizz for free!

Financial Literacy Quiz (Slider Version) Download FREE Financial Literacy Quiz PDF. Take the quiz and for complete solutions to the financial literacy quiz, see below. Financial Literacy Quiz (Simple Version) Results. #1. Suppose you have $100 in a savings account earning 2 percent interest a year.

1 pt. When money is taken out of a checking account, it decreases the account balance and is called a. Withdrawal. Deposit. 3. Multiple Choice. 2 minutes. 1 pt. Which statement describes why it is important to have a positive credit report?

Multiple Choice. A _________ makes a good or provides a service. 3. Multiple Choice. Carlos owns a donut shop. Is Carlos a producer or consumer? Already have an account? 2nd Grade Financial Literacy quiz for 1st grade students. Find other quizzes for Social Studies and more on Quizizz for free!