- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The home depot, inc. (nyse:hd) q4 2023 earnings call transcript.

The Home Depot, Inc. (NYSE: HD ) Q4 2023 Earnings Call Transcript February 20, 2024

The Home Depot, Inc. beats earnings expectations. Reported EPS is $2.82, expectations were $2.77. The Home Depot, Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter ( see the details here ).

Operator: Greetings, and welcome to the Home Depot Fourth Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Isabel Janci. Please go ahead.

Isabel Janci : Thank you, Christine, and good morning, everyone. Welcome to Home Depot's fourth quarter and fiscal year 2023 earnings call. Joining us on our call today are Ted Decker, Chair, President and CEO; Ann-Marie Campbell, Senior Executive Vice President; Billy Bastek, Executive Vice President of Merchandising; and Richard McPhail, Executive Vice President and Chief Financial Officer. Following our prepared remarks, the call will be open for questions. Questions will be limited to analysts and investors. [Operator Instructions] If we are unable to get to your question during the call, please call our Investor Relations department at 770-384-2387. Before I turn the call over to Ted, let me remind you that today's press release and the presentations made by our executives include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations and projections. These risks and uncertainties include but are not limited to the factors identified in the release and in our filings with the Securities and Exchange Commission. Today's presentation will also include certain non-GAAP measures. Reconciliation of these measures is provided on our website. Now, let me turn the call over to Ted.

Edward Decker : Thank you, Isabel, and good morning, everyone. As you'll hear from the team shortly, the fourth quarter of fiscal 2023 was largely in line with our expectations. For fiscal 2023, sales were $152.7 billion, down 3% from the prior year. Comp sales declined 3.2% versus last year, and our U.S. stores had negative comps of 3.5%. Diluted earnings per share were $15.11 compared to $16.69 in the prior year. After three years of exceptional growth for our business, 2023 was a year of moderation. It was also a year of opportunity. We focused on several operational improvements to strengthen the business, while also staying true to the growth opportunities detailed at our Investor Conference in June. As we reflect on 2023, we are better positioned in four key areas.

We invested in our associates, the heartbeat of our company and the storage of customer service, effectively manage disinflation, while maintaining a strong value proposition for our customers, right sized our inventory position in increased in-stock and on-shelf availability levels, and we reduced fixed costs in the business that were introduced during the pandemic. As you know, at the beginning of 2023, we announced an approximately $1 billion investment in increased annualized compensation for our frontline hourly associates. This allowed us to improve customer service, position ourselves favorably in the market, attract and retain the most qualified talent, drive greater efficiency and productivity across the business, and improve safely broadly.

We also navigated a unique disinflationary environment. We did this by leveraging our best-in-class cost finance team in merchants to effectively manage cost movements, while also being our customers advocate for value. And we believe prices have essentially settled in the marketplace. After several years of unprecedented sales growth, we entered 2023 with more inventory than we would've preferred. While the products we sell have low obsolescence, our teams work throughout the year to improve inventory productivity while delivering the highest in-stock and on-shelf availability rates since the pandemic. Today, we feel very good about our inventory position heading into 2024. Productivity and efficiency are hallmarks of the Home Depot, and as you heard at our Investor Conference in June, we announced our commitment to reduce fixed costs by approximately $500 million to be fully realized in 2024.

We've now taken the necessary actions to achieve this cost benefit, which Richard will detail in a moment. As we look forward to 2024, we remain focused on our strategic opportunities of creating the best interconnected experience, growing our Pro wallet share through our unique ecosystem of capabilities and building new stores. In December 2023, we made a strategic acquisition of Construction Resources, a leading distributor of design-oriented surfaces, appliances, and architectural specialty products for Pro contractors focused on renovation, remodeling, and residential home building. This acquisition adds to our robust product offering of products and services. It allows our complex Pro’s to easily shop across aesthetic product categories in a showroom setting, which is how they're accustomed to shopping for these types of goods.

We are excited to welcome Construction Resources into the Home Depot family. In 2024, we will continue learning and building out new capabilities for the complex Pro. We are expanding our assortments, fulfillment options and our outside sales force and just recently began piloting trade credit options. In addition, we continue to work on new order management capabilities to better manage complex Pro orders. For the complex Pro opportunity, this means that by the end of 2024, we will have 17 of our top Pro markets equipped with new fulfillment options, localized product assortment and expanded sales force and enhanced digital capabilities with trade credit and order management in pilot for development. What I hope you take away today is how great we feel about our business and how well we are positioning the business for the future.

We remain excited about the opportunity to grow our share of a fragmented $950 billion-plus market. Our associates and supplier partners have continually demonstrated agility and resilience, and I want to thank them for their hard work and dedication to serving our customers and communities. And with that, I'd like to turn the call over to Ann.

Ann-Marie Campbell: Thanks, Ted, and good morning, everyone. I couldn’t be more pleased with our operational excellence and the investments we continue to make in the business. As you heard from Ted, we remain focused on three main strategic opportunities of creating the best interconnected experience, growing our Pro wallet share through our unique ecosystem of capabilities and build in new stores. As we continue to create the best interconnected experience and remove friction from our customers shopping journey, one of our biggest areas of opportunity is within our post-sale experience. For the majority of our customers, this process has largely been unchanged for the last 44 years, and we have opportunities to improve this experience.

In 2023, we made significant progress taking friction out of our online order management process. Today, we have enhanced our systems to better allow our customers to both modify orders and self-service online returns. In 2024, we will focus on building more robust capabilities to support an interconnected self-service returns process where customers will have the ability to start a return online and complete that return via mail or in-store. We have just begun all of this work in earnest and are very excited about the friction we will remove through this process while realizing significant productivity benefits over the long term. Through these enhancements and new capabilities in our returns process, we gain efficiencies by reducing transaction time and improving on-shelf availability, enabling better inventory management.

We also improved customer service by allowing the customer to start and complete their return, however they want. As you've heard us say many times, we are focused on making our interconnected experience better and more convenient no matter how our customers choose to engage with us. As we mentioned at our Investor Conference in June, we plan to open approximately 80 new stores over the next five years. Our current network of over 2,300 stores throughout North America makes the Home Depot the most convenient physical destination for customers to shop for their home improvement products. We have a premier real estate footprint that provides convenience for the customer that we believe is nearly impossible to replicate. And we will continue to build out this footprint in a very strategic way by investing in new stores in areas that have experienced significant population growth or where it makes sense to relieve some pressure on existing high-volume stores.

In fiscal 2023, we opened 13 new stores. Eight in the U.S. and five in Mexico. In the U.S., our eight new stores were roughly split between stores relieving pressure from higher volume existing stores and stores where we identified void in new high-growth areas. As an example, we are already seeing great results for many of these new stores and are particularly pleased with our Mapunapuna store in Honolulu, which allows us to better serve the Honolulu market. For fiscal 2024, we plan to open approximately 12 new stores. Beyond our focus on removing friction and growing to new stores, we have a lot of initiatives in 2024 geared at growing our share of wallet with the Pro. My new organization will be focused on better enabling alignment so we can more seamlessly deliver on our unique value proposition for all Pros.

When we invest in new assets and capabilities to better serve the complex Pro, this also improves our Pro experience in our stores. For example, more job site delivery orders fulfilled from our distribution centers means less congestion in our stores and less time dedicated to picking, packing and staging orders for delivery. This gives our in-store Pro sales associates more time to dedicate to our Pros. Additionally, the ability to fulfill large orders through our distribution network also means that we have more product in stock and available for sale for all those Pros shopping in our stores. These improvements benefit our associates and all of our Pros. Our investments in these strategic initiatives as well as the investments in our associates has set us up for success.

Recall that at the beginning of the year, we announced a significant investment of approximately $1 billion in increased annualized compensation for frontline hourly associates. As a result of this investment, we saw what we intended to see meaningful improvement in our attrition rates, particularly among our most tenured associates, which drove improved customer service, productivity and safety. I'm excited to see all of our initiatives gaining traction, and I want to thank our amazing associates for all that they do. With that, let me turn the call over to Billy.

William Bastek: Thank you, Ann, and good morning, everyone. I want to start by also thanking all of our associates and supplier partners for their ongoing commitment to serving our customers and communities. As you heard from Ted, during the fourth quarter, our sales were largely in line with our expectations. However, we did have some unfavorable impacts from weather in January and core commodity deflation. We saw a continuation of the trend that we've been observing throughout the year, with softness in certain big ticket discretionary type purchases. Our customers continue to take on smaller projects while still deferring larger projects. Turning to our department comp performance for the fourth quarter, our building materials and outdoor garden departments posted positive comps and 6 of our remaining 12 merchandising departments posted comps above the company average, including appliances, plumbing, tools, paint, indoor garden, and hardware.

During the fourth quarter, our comp transactions decreased 2.1% and comp average ticket decreased 1.3%. However, we continue to see our customers trading up for new and innovative products. Deflation from core commodity categories negatively impacted our average ticket by 35 basis points during the fourth quarter, driven by deflation in lumber and copper wire. During the fourth quarter, we continued to see, on average, a decline in lumber prices relative to a year ago. However, framing and panel lumber pricing experienced the most stable pricing levels during the quarter in some time. As an example, framing lumber started the quarter at approximately $370 per 1,000 board feet compared to ending the quarter at approximately $395, representing a change of less than 7%.

The big ticket comp transactions or those over $1,000, were down 6.9% compared to the fourth quarter of last year. We continued to see softer engagement in big-ticket discretionary categories like flooring, countertops and cabinets. During the fourth quarter, our Pro and DIY customers performance was relatively in line with one another. While internal and external surveys suggest that Pro backlogs are lower than they were a year ago, they have remained stable and elevated relative to historical norms. Turning to total company online sales. Sales leveraging our digital platforms increased approximately 2% compared to the fourth quarter of last year. We continue to enhance our digital customer experience with a number of new capabilities, including an enhanced browsing experience featuring the best sellers in a local market and new product discovery zones, which highlights what's trending based on new and highly rated products.

For those customers that transacted with us online during the fourth quarter, nearly half of our online orders were fulfilled through our stores. During the fourth quarter, we hosted our annual decorative holiday, Gift Center and Black Friday events. We saw strong engagement across all these events with our decorative holiday event posting a record sales year. As Ted mentioned, 2023 marked the year of significant progress for our inventory management and on-shelf availability while effectively navigating a disinflationary pricing environment and maintaining our position as the customer's advocate for value. Today, we are in a great position regarding our inventory levels. Our in-stocks are the best they've been in a number of years, and we are delivering a compelling assortment for our customers' home improvement needs.

We are looking forward to the year ahead, particularly with the spring selling season right around the corner, and we have a great lineup of new and innovative products in live goods to outdoor power equipment. We're excited to expand our offering of Pro outdoor tools with the launch of our new cordless battery powered, Milwaukee, M18, backpack blower and straight shaft trimmer, broadening our assortment for the Pro landscaper. And our Spring Gift Center event continues to lean into cordless technology with a wide variety of products from RYOBI, Milwaukee, Makita and DEWALT, many of which are exclusive to the Home Depot and the big box retail channel. We're also excited about our live goods program. Each year, our merchants partner with our national and regional growers to provide our customers with new and improved varieties to enhance the overall garden experience.

We've made significant investments in partnership with our growers to bring new varieties to our customers that are more disease resistant, tolerant to different climates and require less watering. Investing in our relationships with our growers will allow us to continue to drive innovation to meet our customers' needs and improve their shopping experience while building loyalty to the Home Depot. As we look forward to spring, we're excited about continuing to provide a broad assortment of best-in-class products that are in stock and available for our customers when and how they need it. With that, I'd like to turn the call over to Richard.

Richard McPhail: Thank you, Billy, and good morning, everyone. In the fourth quarter, total sales were $34.8 billion, a decrease of 2.9% from last year. During the fourth quarter, our total company comps were negative 3.5% with comps of negative 2.5% in November, positive 1.1% in December and negative 8.5% in January. Comps in the U.S. were negative 4% for the quarter with comps of negative 2.7% in November, positive 0.6% in December and negative 9.1% in January. In local currency, Mexico and Canada posted comps above the company average with Mexico posting positive comps. It is important to note that adjusting for holiday shifts and weather-related impacts in January, monthly comps relatively consistent across the quarter. For the year, our sales totaled $152.7 billion, a decrease of 3% versus fiscal 2022.

For the year, total company comp sales decreased 3.2% and U.S. comp sales decreased 3.5%. In the fourth quarter, our gross margin was approximately 33.1%, a decrease of 20 basis points from last year. For the year, our gross margin was approximately 33.4%, a decrease of 15 basis points from last year, which was in line with our expectations. During the fourth quarter, operating expenses as a percentage of sales increased approximately 115 basis points to 21.2% compared to the fourth quarter of 2022. Our operating expense performance during the fourth quarter reflects our previously executed compensation increases for hourly associates as well as deleverage from our top line results. For the year, operating expenses were approximately 19.2% of sales, representing an increase of approximately 90 basis points from fiscal 2022.

Our operating margin for the fourth quarter was approximately 11.9% and for the year was approximately 14.2%. Interest and other expense for the fourth quarter increased by $50 million to $458 million. In the fourth quarter and for fiscal 2023, our effective tax rate was 24%. Our diluted earnings per share for the fourth quarter were $2.82, a decrease of 14.5% compared to the fourth quarter of 2022. Diluted earnings per share for fiscal 2023 were $15.11, a decrease of 9.5% compared to fiscal 2022. At the end of the quarter, merchandise inventories were $21 billion, down $3.9 billion or approximately 16% versus last year, and inventory turns were 4.3x, up from 4.2x from the second period last year. Moving on to capital allocation. During the fourth quarter, we invested approximately $860 million back into our business in the form of capital expenditures.

This brings total capital expenditures for fiscal 2023 to approximately $3.2 billion. During the year, we opened 13 new stores, bringing our store count to 2,335 at the end of fiscal 2023. Retail selling square footage was approximately 242 million square feet and total sales per retail square foot were approximately $605 in fiscal 2023. Additionally, we invested approximately $1.5 billion on three acquisitions during fiscal 2023, accelerating our strategic initiatives and providing us with better capabilities to serve our customers. During the year, we paid approximately $8.4 billion of dividends to our shareholders. Today, we announced our Board of Directors increased our quarterly dividend by 7.7% to $2.25 per share, which equates to an annual dividend of $9 per share.

And finally, during fiscal 2023, we returned approximately $8 billion to our shareholders in the form of share repurchases, including $1.5 billion in the fourth quarter. Computed on the average of beginning and ending long-term debt and equity for the trailing 12 months, return on invested capital was 36.7% compared to 44.6% at the end of the fourth quarter of fiscal 2022. Now I'll comment on our outlook for 2024. First, let me point out that fiscal 2024 will include a 53rd week, so the fourth quarter of fiscal 2024 will consist of 14 weeks. We will continue to report comps on a 52-week basis, but we will base our overall guidance on 53 weeks. As you heard from Ted, we feel great about the actions we took in 2023 to position us well heading into 2024.

And while there are signs that the economy is on the way towards normalization, the home improvement market still faces headwinds as we look ahead to fiscal 2024. We considered several factors that informed our outlook for fiscal 2024. On the positive side, we faced a number of pressures in fiscal 2023 that are unlikely to repeat in fiscal 2024. In 2023, we saw four increases in the Fed funds rate, a sharp decline in existing home sales and approximately 110 basis points of comp pressure from lumber deflation. However, we still expect pressures to our business in fiscal 2024. Personal consumption growth as measured by PCE is expected to decelerate compared to 2023. Our share of PCE also remains slightly elevated relative to 2019 and has been on a glide path towards 2019 levels.

Higher interest rates at the beginning of 2024 relative to last year will likely continue to pressure demand for larger projects. And the effects from pull forward of demand during the pandemic as well as some project deferral could impact demand into 2024. As we consider these influences on home improvement demand, we are planning for a year of continued moderation but with slightly less pressure to comp sales than what we faced in fiscal 2023. Our fiscal 2024 outlook is for total sales growth to outpace sales comp with sales growth of approximately positive 1% and comp sales of approximately negative 1% compared to fiscal 2023. Total sales growth will benefit from a 53rd week as well as from the acquisitions we made and the new stores we opened in fiscal 2023 and the stores we plan to open in fiscal 2024.

We expect the 53rd week will contribute approximately $2.3 billion in sales. Our gross margin is expected to be approximately 33.9%, an increase of approximately 50 basis points compared to fiscal 2023. This primarily reflects a lower product and transportation cost environment relative to fiscal 2023 as well as benefits from a portion of the approximately $500 million in reduced fixed costs that we will realize in fiscal 2024. Further, we expect operating margin of approximately 14.1%. This reflects deleverage from sales and pressure from targeted incentive compensation as we are overlapping lower incentive compensation paid than planned in 2023. This will be partially offset by the benefits from the approximately $500 million in fixed costs that we will realize in fiscal 2024 in both cost of goods sold and operating expenses.

Our effective tax rate is targeted at approximately 24.5%. We expect net interest expense of approximately $1.8 billion. Our diluted earnings per share percent growth is targeted to be approximately 1% compared to fiscal 2023, with the extra week contributing approximately $0.30. We plan to continue investing in our business with capital expenditures of approximately 2% of sales on an annual basis. After investing in our business and paying our dividend, it is our intent to return excess cash to shareholders in the form of share repurchases. We believe we have positioned ourselves to meet the needs of our customers in any environment. The investments we've made in our business have enabled agility in our operating model. As we look forward, we will continue to invest to strengthen our position with our customers, leverage our scale and low-cost position to drive growth faster than the market and deliver shareholder value.

Thank you for your participation in today's call. And Christine, we are now ready for questions.

See also 25 Most Popular Email Newsletters in the US in 2024 and 13 High Growth Penny Stocks That Are Profitable .

To continue reading the Q&A session, please click here .

Company News

The home depot announces agreement to acquire hd supply holdings, inc..

The Home Depot, the world's largest home improvement retailer, today announced it has entered into a definitive agreement to acquire HD Supply Holdings, Inc., a leading national distributor of maintenance, repair and operations (MRO) products in the multifamily and hospitality end markets. The acquisition is expected to position The Home Depot as a premier provider in the MRO marketplace.

“The MRO customer is highly valued by The Home Depot, and this acquisition will position the company to accelerate sales growth by better serving both existing and new customers in a highly fragmented $55 billion marketplace,” said Craig Menear, chairman and CEO of The Home Depot. “HD Supply complements our existing MRO business with a robust product offering and value-added service capabilities, an experienced salesforce that enhances the strong team we have in place, as well as an extensive, MRO-specific distribution network throughout the U.S. and Canada.”

"We're thrilled that our associates are joining the Home Depot team and that our customers will be able to benefit from a broader product assortment, expanded delivery options and enhanced services nationally," said Joe DeAngelo, chairman and CEO, HD Supply. "We are confident that this will position both The Home Depot and HD Supply for continued growth and success in the MRO distribution space."

Under the terms of the merger agreement, a subsidiary of The Home Depot will commence a cash tender offer to purchase all outstanding shares of HD Supply common stock for $56 per share, for a total enterprise value (including net cash) of approximately $8 billion. The closing of the tender offer is subject to customary closing conditions, including regulatory approvals and the tender of a majority of the shares of HD Supply common stock then outstanding (on a fully diluted basis) and is expected to be completed during The Home Depot's fiscal fourth quarter, which ends on January 31, 2021. The transaction is expected to be funded through cash on hand and debt.

“We plan to access the debt capital markets to raise incremental indebtedness in support of this acquisition. We also expect the transaction to be accretive to earnings in fiscal 2021, with potential for significant shareholder value creation over the longer term,” said Richard McPhail, executive vice president and CFO.

Keep up with all the latest Home Depot news! Subscribe to our bi-weekly news update and get the top Built from Scratch stories delivered straight to your inbox.

RELATED STORIES & ARTICLES

Home Depot vs. Lowe’s: Home improvement leaders growth to recover next year in $1 trillion market

Bloomberg Intelligence

June 24, 2024

This analysis is by Drew Reading, Lead Analyst, Homebuilding & Home Improvement, US, and Mike Campellone, Contributing Analyst, Credit, US. It appeared first on the Bloomberg Terminal.

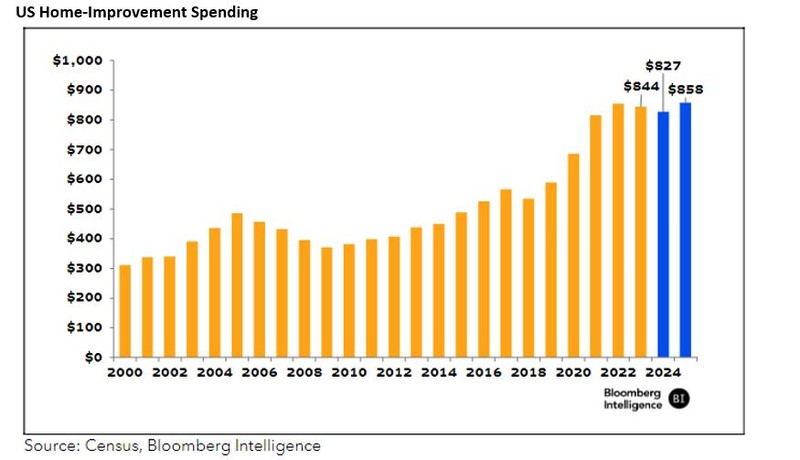

Investments from a position of strength will enable Home Depot and Lowe’s to capitalize on a rebound in-home improvement spending that we think will emerge in 2025, with sales rising mid-single digits. While both retailers stand to benefit, Home Depot’s outsized exposure to pros could fuel stronger growth amid expectations for the segment to outpace DIY customers. Lowe’s has done well to narrow the operational gap with its rival, which is reflected in its relative stock performance and slimmer valuation discount.

Discover more with Bloomberg newsletters

Subscribe now

Key takeaways

• Industry Rebuilds From 2024 Bottom: The $1 trillion North America home-improvement industry may return to growth in 2025, climbing mid-single digits after two years of declines. Our intermediate-term view is underpinned by a rebound in existing home sales from trough levels, $32 trillion in homeowners’ equity and the oldest US housing stock on record.

- Professionals Propel Industry Growth: The $500 billion market for pro contractors is projected to fuel industry growth over the next five years, climbing 4.4% annually vs. 3% for the DIY segment, according to HIRI. This should support higher sales growth at Home Depot given its 50% exposure– vs. 25% for Lowe’s — and $18 billion deal for SRS Distribution, which will accelerate its push among larger pro customers.

- Brick and Mortar Evolution Continues: Home Depot is embarking on its first meaningful store expansion in over a decade — adding 80 new stores through 2027 – to tap underserved markets while relieving pressure in congested locations, supporting sales and productivity. Conversely, Lowe’s has reduced its footprint through the sale of its Canadian operations and is testing new concepts with rural assortments and outlets to drive sales.

- Double-Digit Penetration Hammers Peers: Online penetration of 15% of total sales for Home Depot and 12% for Lowe’s stand far above the industry’s 8%, as the big-box peers leverage merchandising and supply-chain investments to grow channel share faster than smaller names. Lowe’s online penetration may reach the midteens and Home Depot the high teens in the next few years, contributing to above-industry sales growth.

- EPS Accelerates, Depot Leads Long Term: Home Depot and Lowe’s EPS should rebound in 2025, with our analysis suggesting mid-to-high-single-digit growth for both after a challenging 2024. Longer term, Home Depot’s aggressive push into the complex pro market and resumption of buybacks after a period of deleveraging could fuel more robust gains.

Already a customer? Access the full report here .

Not a terminal user? Click here to learn more.

This is a synopsis of the full report. The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg intelligence is a service provided by bloomberg finance l.p. and its affiliates. bloomberg intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. the bloomberg intelligence function, and the information provided by bloomberg intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. you should determine on your own whether you agree with bloomberg intelligence. bloomberg intelligence credit and company research is offered only in certain jurisdictions. bloomberg intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any bloomberg intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. employees involved in bloomberg intelligence may hold positions in the securities analyzed or discussed on bloomberg intelligence., recommended for you, request a demo.

You're reading a free article with opinions that may differ from The Motley Fool's Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

5 Top Stocks to Buy in July

- Okta and Celsius have seen healthy growth and have room to run.

- Ares Capital has a 20-year track record, and the stock is dirt cheap.

- NextEra Energy and Home Depot pay reliable and growing dividends.

- Motley Fool Issues Rare “All In” Buy Alert

NASDAQ: OKTA

The S&P 500 and Nasdaq Composite are hovering around all-time highs, but there are plenty of buying opportunities if you know where to look.

Now that we're officially halfway through 2024, it's time to reflect on where the stock market has been. Although no one knows what the market will do in the short term, we can try to filter out the noise and be aware of what's driving broader themes. A good place to start is by looking at sector performance.

There are 11 sectors in the S&P 500 . And only two of them -- tech and communications -- are outperforming the index. Right off the bat, it tells you that growth-heavy sectors are doing well, and value and income stocks are lagging. Dig deeper, and you'll find that mega-cap growth, more so than smaller growth stocks , are driving the bulk of the gains in the major indexes.

Investors looking for buying opportunities outside of mega caps have come to the right place. Here's why these Motley Fool contributors are particularly excited about Okta ( OKTA 0.19% ) , Celsius Holdings ( CELH 0.49% ) , Ares Capital ( ARCC 0.38% ) , NextEra Energy ( NEE 1.93% ) , and Home Depot ( HD -0.40% ) .

Image source: Getty Images.

Please identify yourself

Demitri Kalogeropoulos (Okta): It's a great time to get excited about Okta stock again. The software-as-a-service specialist, which sells cybersecurity and digital identity management services, is trading at about where it was at the beginning of the year. Yet its prospects are brightening.

Sales in the most recent quarter were up a healthy 19% to $617 million. Almost all of the revenue figures are subscription-based, too, which gives shareholders confidence that sales won't swing wildly during any upcoming industry slowdown.

Okta is not profitable just yet, but that won't be true for long. Operating losses narrowed to 8% of sales last quarter from over 30% a year ago. Meanwhile, cash flow is solidly in positive territory, at nearly 40% of sales.

According to its late May outlook, management is projecting a growth slowdown in the coming months, with second-quarter revenue gains decelerating to about 14%. Sales should rise by about 13% for the full fiscal year, too. But investors should look past that short-term volatility toward Okta's likely impressive earnings growth over the next several fiscal years.

Buying the stock in July and patiently waiting for these benefits to accrue will put you in a great financial position when you reflect on your decision to buy this small but growing tech company.

Get energized with Celsius

Anders Bylund (Celsius Holdings): Known for its fitness-focused energy drinks, Celsius is brewing up impressive growth. Unlike archrivals Monster Beverage (NASDAQ: MNST) or Red Bull, Celsius focuses on providing a fitness-centric boost, with no artificial preservatives or flavors. It has proved to be a recipe for success, especially with the distribution expertise of Celsius partner PepsiCo .

The Pepsi deal is paying off big time, expanding Celsius' reach globally and boosting brand visibility. International growth is only getting started, leaving a ton of overseas opportunities to explore. The health-focused branding message should resonate just as strongly in valuable markets such as Canada, Australia, and Western Europe.

The stock isn't exactly cheap, trading at 61 times earnings and 9.4 times sales. But those valuation ratios are still a bargain compared to Celsius' loftier figures over the last couple of years. A 28.6% price drop in June took the edge off a skyrocketing stock chart, giving Celsius investors a chance to load up on shares at a lower price premium.

The heart of Celsius' idea is that its health-conscious growth story has many chapters left. The Pepsi partnership has proved effective, and the company is expanding its brand around the world. The stock isn't cheap, but it has earned every drop of that premium price tag. Those lofty ratios should calm down as it executes its profitable growth plans over the next few years.

There is room for a third global giant in the booming energy drink industry. Many have tried and failed to fill that role. With soaring sales and robust profit margins already under its belt, Celsius looks primed to get the job done. That's why its stock is a hot buy in July.

An attractive valuation, dividend, and business

Keith Speights (Ares Capital): I have a condition I call investors' acrophobia. The higher the stock market goes, the more afraid I become. With the S&P 500 continuing to rise, my nervousness is increasing. But Ares Capital is the kind of stock I don't have qualms about in a pricey market.

Ares is a leading business development company (BDC) . And its stock is dirt cheap, with shares trading at only 8.7 times forward earnings.

That attractive valuation isn't because the company's business is floundering. Its earnings continue to grow. CEO Kipp deVeer said in the first-quarter earnings press release, "With our competitive advantages, we believe we are well positioned to build upon our nearly 20-year track record of generating attractive investment returns for our shareholders."

Those competitive advantages include a stronger financial position and more investment professionals than its rivals have. Ares Capital has a longer history in the industry than most direct lenders. Unsurprisingly, the company has delivered significantly higher returns on equity (ROE) and total returns than other BDCs.

Income investors should love the forward dividend yield of over 9.3%. Even if you're not an income investor, this hefty yield gives Ares a head start on delivering exceptional returns.

Are there risks associated with investing in a BDC that provides financing to middle-market businesses? Sure. However, Ares Capital has proved to be remarkably resilient, generating strong ROE during the financial crisis of 2008 and 2009 and the pandemic period of 2020 and 2021.

Whether or not you have investors' acrophobia, Ares Capital looks like a great stock to buy in July.

Any drop in this stock's price is an opportunity to buy

Neha Chamaria (NextEra Energy ) : I recommended NextEra Energy in May , and while the stock surged during the month, it has come under a bit of pressure over the past couple of weeks or so. I believe the fall was unwarranted, and with NextEra Energy reminding investors yet again about its growth potential and plans, I am picking it as my top stock to buy now.

Investors were spooked when management announced plans to sell equity units worth $2 billion in mid-June. What they might have overlooked, though, is the reason the company is raising money via a share sale: to fund growth.

At its latest Europe investor presentation, NextEra Energy quoted an industry report projecting fourfold power demand growth in the U.S. over the next couple of decades versus the previous 20 years. As the owner and operator of the largest utility in the U.S., Florida Power & Light, NextEra is primed to benefit from any surge in power demand.

To top that, the company is also the world's largest producer of wind and solar energy and a leader in battery storage. It announced plans to invest $65 billion to $70 billion over the next four years with a potential to develop 36.5 to 46.5 gigawatts (GW) of new renewable and storage capacity through 2027.

That brings us back to why the fall of NextEra Energy stock after the company announced an equity sale was an overreaction. With its utility and renewables businesses, it could spend around $100 billion between 2024 and 2027. But equity issues are expected to be only about 5% of the company's total projected spending. It expects to fund the bulk of its growth through cash generated from operations and will rely more on debt than equity to fund the remaining portion.

With NextEra Energy further reiterating its adjusted earnings-per-share growth projection of 6% to 8% through 2027 and increases in dividends of around 10% through 2026, I believe any drop in the stock's price is an opportunity to buy and hold for the long term.

Home Depot knows how to navigate a cyclical slowdown

Daniel Foelber (Home Depot): In the long term, stock market winners are companies that can grow earnings over time through innovation, staying flexible, and savvy acquisitions. But in the short term, the market is often driven by narratives.

Right now, the market is marching higher to the beat of the mega-cap growth drum . But behind the scenes, many industry-leading consumer-facing companies like Home Depot have seen their stock prices get left behind. The home-improvement retailer's stock is down year to date and up less than 10% over the last three years compared to a 24.3% gain in the S&P 500.

At least part of the sell-off is justified. Home Depot and its peer Lowe's Companies are facing a difficult housing market. Management commentary hasn't shied away from its impact on results.

High volume in home sales is great for Home Depot and Lowe's because homebuying coincides with home improvement. But if homebuying is low or so expensive that consumers have little left over for home improvement, then they might be less inclined to pair pricey projects with a home purchase.

The economic indicators point to relatively expensive housing, record-high credit card debt, and some of the highest mortgage interest rates in the last decade -- all bad news for Home Depot .

Despite these challenges, the company has continued investing through the cycle with new store openings and expansions. On June 18, it completed its $18.3 billion acquisition of SRS Distribution -- which boosts its building products and roofing materials offerings. Management has been targeting professional contractors as a key growth area that can help diversify the business to be less dependent on consumer sales.

On the surface, this strategy looks fairly aggressive, considering all the near-term challenges. But the company has historically been an excellent capital allocator and has the balance sheet needed to take market share during a slowdown rather than be passive.

Home Depot is also a reliable dividend stock. In February, it announced a 7.7% increase to its dividend, bringing it to $2.25 per share per quarter, or $9 per year. The dividend is up 379% over the last decade and 65% over the last five years. With a yield of 2.6%, it's an excellent dividend stock to buy for patient investors who believe in the company's ability to navigate cyclical ebbs and flows.

Anders Bylund has no position in any of the stocks mentioned. Daniel Foelber has no position in any of the stocks mentioned. Demitri Kalogeropoulos has positions in Home Depot and Okta. Keith Speights has positions in Ares Capital and PepsiCo. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius, Home Depot, Monster Beverage, NextEra Energy, and Okta. The Motley Fool has a disclosure policy .

Related Articles

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

COMMENTS

Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688.

Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688. Founded in 1978, The Home Depot, Inc. is the world's largest home improvement specialty retailer with fiscal 2023 net sales ...

Founded in 1978, The Home Depot, Inc. is the world's largest home improvement specialty retailer with fiscal 2018 retail sales of $108.3 billion and earnings of $11.1 billion.

Contact Us. Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688. Document Format Press Release PDF Forward Looking Statement PDF Ted Decker PDF Ann-Marie Campbell PDF Billy ...

PRESENTATION Operator Greetings, and welcome to The Home Depot Fourth Quarter 2023 Earnings Conference Call. At this time, all ... Productivity and efficiency are hallmarks of The Home Depot, and as you heard at our investor conference in June, we announced our commitment to reduce fixed costs by approximately $500 million, to be fully realized

HD - Q4'21 Home Depot Earnings Call EVENT DATE/TIME: February 22, 2022 / 09:00AM ET. t Earnings CallEVENT DATE/TIME: February 22, 2022 / 09. 00AM ETPRESENTATIONOperator Greetings, and welcome to. The Home Depot Earnings Call. At this time, all participants are in a li. ten only mode. A brief question-and-answer session will follow the formal.

HD - Q1'22 Home Depot Earnings Call EVENT DATE/TIME: May 1 7, 2022 / 09:00AM ET . PRESENTATION . Operator . Greetings and welcome to The Home Depot First Quarter 2022 Earnings Call. At this time, all participants are in a listen -only mode. A brief question- and-answer session will follow the formal presentation. [Operator

ATLANTA, May 18, 2021 -- The Home Depot, the world's largest home improvement retailer, today reported sales of $37.5 billion for the first quarter of fiscal 2021, an increase of $9.2 billion, or 32.7 percent from the first quarter of fiscal 2020. Comparable sales for the first quarter of fiscal 2021 increased 31.0 percent, and comparable sales in the U.S. increased 29.9 percent.

Fiscal Year 2021 Results | The Home Depot. Skip to main content. ShopStoresContact. Search. Keywords. Type- Any -NewsPagesDocuments. SortRelevanceNewest firstOldest firstA to ZZ to ARelevance Asc. Customer Service 1 (800) 466-3337.

INFOGRAPHIC: THE HOME DEPOT ANNOUNCES SECOND QUARTER 2022 RESULTS. August 16, 2022. For additional information and transcript from today's call, visit our Quarterly Earnings page. CLICK FOR FULL Q2 2022 INFOGRAPHIC. Keep up with all the latest Home Depot news! Subscribe to our bi-weekly news update and get the top Built from Scratch stories ...

The Home Depot, Inc. ( NYSE: HD) 2023 INVESTOR CONFERENCE June 13, 2023 9:00 AM ET. Company Participants. Isabel Janci - Investor Relations. Ted Decker - Chairman, President, and Chief Executive ...

HD. The Home Depot, Inc. (NYSE: HD) Q3 2023 Earnings Call Transcript November 14, 2023. The Home Depot, Inc. misses on earnings expectations. Reported EPS is $3.81 EPS, expectations were $3.82 ...

The Home Depot, Inc. (NYSE:HD) Q4 2023 Earnings Call Transcript February 20, 2024 The Home Depot, Inc. beats earnings expectations. Reported EPS is $2.82, expectations were $2.77. The Home Depot ...

The following slide deck was published by The Home Depot, Inc. ... Home Depot (HD) Investor Presentation - Slideshow. May 22, 2020 4:03 PM ET The Home Depot, Inc. (HD) Stock 3 Likes.

Home Depot (HD) Investor Presentation - Slideshow SA Transcripts Fri, May 22, 2020 The Home Depot, Inc. (HD) CEO Craig Menear on Q1 2020 Results - Earnings Call Transcript

The Home Depot, the world's largest home improvement retailer, today announced it has entered into a definitive agreement to acquire HD Supply Holdings, Inc., a leading national distributor of maintenance, repair and operations (MRO) products in the multifamily and hospitality end markets. The acquisition is expected to position The Home Depot as a premier provider in the MRO marketplace.

The Home Depot, Inc. (NYSE:HD) Raymond James Associates 42nd Annual Institutional Investors Conference March 2, 2021 12:50 PM ETCompany Participants. Ted Decker - President, Chief Operating ...

Valuation and Conclusion. Home Depot is currently trading at a 22.72x FY24 consensus EPS estimate of $15.34 and a 21.40x FY25 consensus EPS estimate of $16.29. Over the last 5 years, the stock has ...

The Home Depot General Information Description. Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the United States, Canada, and Mexico.

This should support higher sales growth at Home Depot given its 50% exposure- vs. 25% for Lowe's — and $18 billion deal for SRS Distribution, which will accelerate its push among larger pro ...

Finance document from University of Phoenix, 15 pages, Home Depot Investor Presentation Brad Escobar FIN/571 This Photo by Unknown Author is licensed under CC BY Home Depot and it's Ticker Symbol • Home Depot has been a publicly-traded company since April 19, 1984. • The Trading Symbol or "ticker" is represe

Isabel Janci-- Vice President, Investor Relations. Thank you, Christine, and good morning, everyone. Welcome to Home Depot's fourth-quarter and fiscal year 2023 earnings call. Joining us on our ...

Home Depot and it's Ticker Symbol • Home Depot has been a publicly-traded company since April 19, 1984. • The Trading Symbol or "ticker" is represented on the NYSE as "HD". • "The Initial Public Offering of Home Depot Common Stock was on September 22, 1981. The price at that time was $12 per share" (The Home Depot Product Authority, LLC, 2021).

Okta and Celsius have seen healthy growth and have room to run. Ares Capital has a 20-year track record, and the stock is dirt cheap. NextEra Energy and Home Depot pay reliable and growing ...