Apple Inc. (AAPL) SEC Filing 10-K Annual Report for the fiscal year ending Saturday, September 24, 2022

Sec filings, aapl valuations.

- Select PDF Feature:

- Include Exhibits

- Highlight YoY Changes

- Highlight Sentiment

February 2024

November 2023

August 2023

February 2023

Last10K.com | 10-K Annual Report Fri Oct 28 2022

Please wait while we load the requested 10-K report or click the link below:

https://last10k.com/sec-filings/report/320193/000032019322000108/aapl-20220924.htm

View differences made from one year to another to evaluate Apple Inc's financial trajectory

Compare this 10-K Annual Report to its predecessor by reading our highlights to see what text and tables were removed , added and changed by Apple Inc.

Assess how Apple Inc's management team is paid from their Annual Proxy

- Voting Procedures

- Board Members

- Executive Team

- Salaries, Bonuses, Perks

- Peers / Competitors

SEC Filing Tools

Read 10-K Annual Reports Better Last10K.com and Stocksnips.net computationally analyzes management discussions inside annual and quarterly reports to determine if they are bullish , bearish or neutral on the company's finances and operations. View Rating for FREE "> Rating Learn More

We provide 5 of these remarks for FREE. To see all the remarks without having to find them in the 10-K Annual Report, become a member of Last10K.com

Services Gross Margin Services gross margin increased during 2022 compared to 2021 due primarily to higher Services net sales, partially offset by the weakness in foreign currencies relative to the U.S. dollar.

Apple Inc. | 2022 Form 10-K | 22 Gross Margin Products and Services gross margin and gross margin percentage for 2022, 2021 and 2020 were as follows (dollars in millions): Products Gross Margin Products gross margin increased during 2022 compared to 2021 due primarily to a different Products mix and higher Products volume, partially offset by the weakness in foreign currencies relative to the U.S. dollar.

In April 2022, the Company announced an increase to its Program authorization from $315 billion to $405 billion and raised its quarterly dividend from $0.22 to $0.23 per share beginning in May 2022.

Services gross margin percentage increased during 2022 compared to 2021 due primarily to improved leverage and a different Services mix, partially offset by the weakness in foreign currencies relative to the U.S. dollar.

Fiscal Year Highlights Fiscal 2022 Highlights Total net sales increased 8% or $28.5 billion during 2022 compared to 2021, driven primarily by higher net sales of iPhone, Services and Mac.

Japan Japan net sales decreased... Read more

Resolution of legal matters in... Read more

The following table shows net... Read more

Europe Europe net sales increased... Read more

Greater China Greater China net... Read more

Rest of Asia Pacific Rest... Read more

The strength of the renminbi... Read more

As of September 24, 2022,... Read more

Services Services net sales increased... Read more

Mac Mac net sales increased... Read more

Wearables, Home and Accessories Wearables,... Read more

iPhone iPhone net sales increased... Read more

Operating Expenses Operating expenses for... Read more

Products gross margin percentage increased... Read more

Debt As of September 24,... Read more

Resolution of these uncertainties in... Read more

Apple Inc. | 2022 Form... Read more

iPad iPad net sales decreased... Read more

Financial Statements, Disclosures and Schedules Inside this 10-K Annual Report

Material Contracts, Statements, Certifications & more Apple Inc provided additional information to their SEC Filing as exhibits

Ticker: AAPL CIK: 320193 Form Type: 10-K Annual Report Accession Number: 0000320193-22-000108 Submitted to the SEC: Thu Oct 27 2022 6:01:14 PM EST Accepted by the SEC: Fri Oct 28 2022 Period: Saturday, September 24, 2022 Industry: Electronic Computers

Intrinsic Value Calculator

Our Intrinsic Value calculator estimates what an entire company is worth using up to 10 years of financial ratios to determine if a stock is overvalued or not

Never Miss A New SEC Filing Again

Receive an e-mail as soon as a company files an Annual Report, Quarterly Report or has new 8-K corporate news

We Highlighted This SEC Filing For You

Read positive and negative remarks made by management in their entirety without having to find them in a 10-K/Q

Widen Your SEC Filing Reading Experience

Remove data columns and navigations in order to see much more filing content and tables in one view

Uncover Actionable Information Inside SEC Filings

Read both hidden opportunities and early signs of potential problems without having to find them in a 10-K/Q

Adobe PDF, Microsoft Word, Excel and CSV Downloads

Export Annual and Quarterly Reports to Adobe Acrobat (PDF), Microsoft Word (DOCX), Excel (XLSX) and Comma-Delimited (CSV) files for offline viewing, annotations and analysis

Financial Stability Report

Our Financial Stability reports uses up to 10 years of financial ratios to determine the health of a company's EPS, Dividends, Book Value, Return on Equity, Current Ratio and Debt-to-Equity

Get a Better Picture of a Company's Performance

See how over 70 Growth, Profitability and Financial Ratios perform over 10 Years

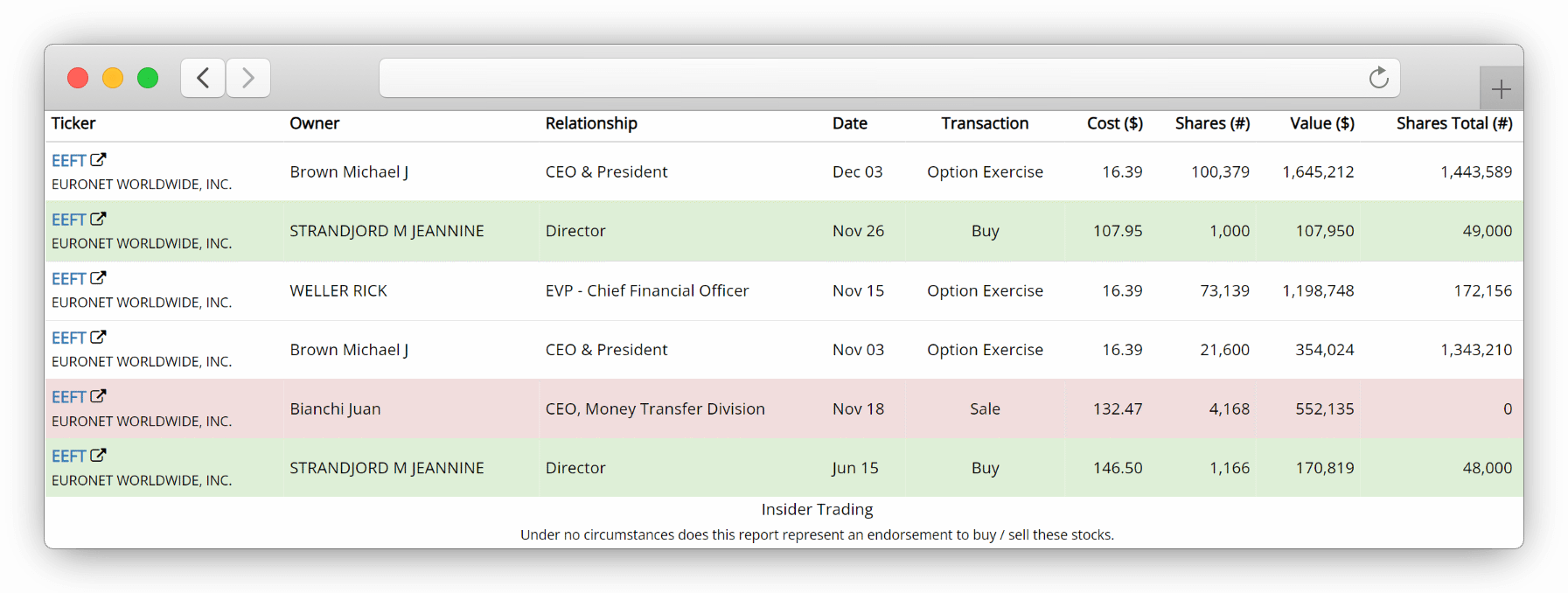

See when company executives buy or sell their own stock

Use our calculated cost dollar values to discover when and how much registered owners BUY , SELL or excercise their company stock OPTIONS aggregated from Form 4 Insider Transactions SEC Filings

See how institutional managers trade a stock

View which hedge funds, pension / retirement funds, endowments, banks and insurance companies have increased or decreased their positions in a particular stock. Includes Ownership Percent, Buy versus Sell comparison, Put-Call ratio and more

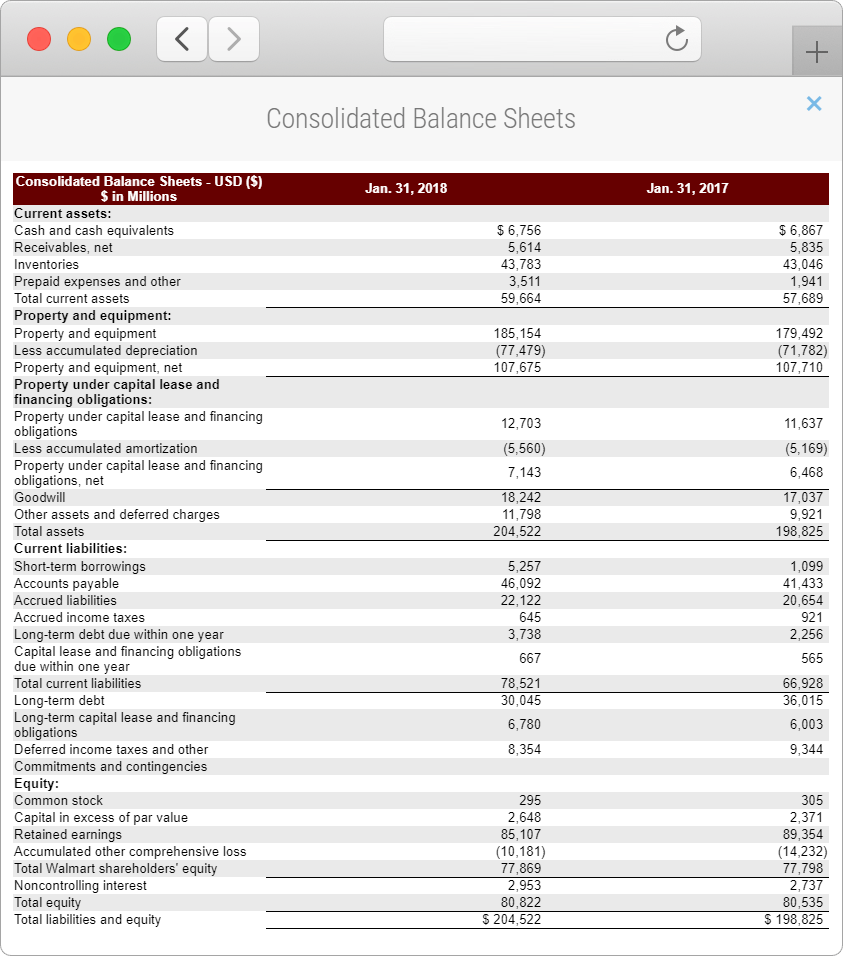

FREE Financial Statements

Get one-click access to balance sheets, income, operations and cash flow statements without having to find them in Annual and Quarterly Reports

SEC Filing Exhibit

Loading SEC Filing Exhibit...

SEC Filing Financial Summary

Loading SEC Filing Financial Summary...

App Store stopped over $7 billion in potentially fraudulent transactions in four years

Account Fraud

Ratings and Reviews

Payment and Credit Card Fraud

Keeping the App Store Safe

Text of this article

May 14, 2024

Since launching the App Store in 2008, Apple has continued to invest in and develop industry-leading technologies designed to provide users with the safest and most secure experience for downloading apps, and a vibrant and innovative platform for developers to distribute their software. Today, the App Store stands at the forefront of app distribution, setting the standard for security, reliability, and user experience.

As digital threats have evolved in scope and complexity over the years, Apple has expanded its antifraud initiatives to address these challenges and help protect its users. Every day, teams across Apple monitor and investigate fraudulent activity on the App Store, and utilize sophisticated tools and technologies to weed out bad actors and help strengthen the App Store ecosystem.

From 2020 through 2023, Apple prevented a combined total of over $7 billion in potentially fraudulent transactions, including more than $1.8 billion in 2023 alone. In the same period, Apple blocked over 14 million stolen credit cards and more than 3.3 million accounts from transacting again.

As published in its fourth annual fraud prevention analysis released today, Apple found that in 2023, it rejected more than 1.7 million app submissions for failing to meet the App Store’s stringent standards for privacy, security, and content. In addition, Apple’s persistent efforts to stop and reduce fraud on the App Store resulted in the termination of nearly 374 million developer and customer accounts, and removal of close to 152 million ratings and reviews over fraud concerns.

Apple has developed robust systems to root out fraudulent customer and developer accounts quickly and effectively to prevent such actors from defrauding users. In 2023, Apple terminated close to 118,000 developer accounts, a decrease from 428,000 terminations from the prior year, thanks to continued improvements to prevent the creation of potentially fraudulent accounts in the first place. In addition, more than 91,000 developer enrollments were rejected for fraud concerns and prevented from submitting problematic apps to the App Store.

Harmful activity can also occur at the customer account level, and Apple takes a number of measures to protect users and developers from ill-intended parties. These accounts tend to be bots that are created for the purposes of spamming or manipulating ratings and reviews, charts, and search results, which threaten the integrity of the App Store and its users and developers. In 2023, Apple blocked over 153 million fraudulent customer account creations and deactivated nearly 374 million accounts for fraud and abuse.

Apple’s commitment to trust and safety extends beyond the App Store, having detected and blocked more than 47,000 illegitimate apps on pirate storefronts from reaching users over the last 12 months. Blocking apps from pirate storefronts is also beneficial to developers, whose apps could be modified or used to disguise malicious software for distribution on these platforms.

Additionally, in the last month, Apple stopped nearly 3.8 million attempts to install or launch apps distributed illicitly through the Developer Enterprise Program, which allows large organizations to deploy internal apps for use by employees.

Apple’s App Review team of over 500 experts evaluates every single app submission — from developers around the world — before any app ever reaches users. On average, the team reviews approximately 132,500 apps a week, and in 2023, reviewed nearly 6.9 million app submissions while helping more than 192,000 developers publish their first app onto the App Store.

App Review conducts a number of checks before any app makes its way onto the store, and leverages automated processes and human review to detect and take action on apps with the potential to harm or defraud users. In 2023, more than 1.7 million app submissions were rejected for various reasons, including privacy violations and fraudulent activity.

Bad actors employ deceptive tactics to harm users, including the practice of disguising potentially risky apps as innocuous ones. Over the past year, there have been numerous instances where App Review identified apps initially misrepresented as harmless products — such as photo editors or puzzle games — that later transformed postreview into pirate movie streaming platforms, illegal gambling apps, or fraudulent and predatory loan issuers.

In some extreme instances, the team also identified and removed financial service apps involved in complex and malicious social engineering efforts designed to defraud users, including apps impersonating known services to facilitate phishing campaigns and that provided fraudulent financial and investment services. Through its ongoing work to review every app submission and investigate problematic apps on the App Store, App Review, in 2023, removed or rejected 40,000 apps from developers who engaged in bait-and-switch activity.

Malicious actors can also design apps with the intention to trick and scam users. In 2023, more than 248,000 app submissions were rejected from the App Store because they violated Apple’s policies against spam, blatantly copying other apps, or otherwise misleading users. This is in addition to over 38,000 app submissions that were rejected for containing hidden or undocumented features. Apps that are designed to access users’ private, personal data without their permission or knowledge are also prohibited from the App Store. Last year alone, over 375,000 app submissions were rejected for privacy violations.

App Review is diligent in investigating and taking action against apps reported as fraudulent or malicious through Apple’s Report a Problem tool. Fraudulent apps are immediately removed from the App Store, and the developer faces the risk of termination from the Apple Developer Program, which would also result in any unapproved apps under their account being blocked from the store. In 2023, App Review took action to prevent nearly 98,000 potentially fraudulent apps from reaching users on the App Store.

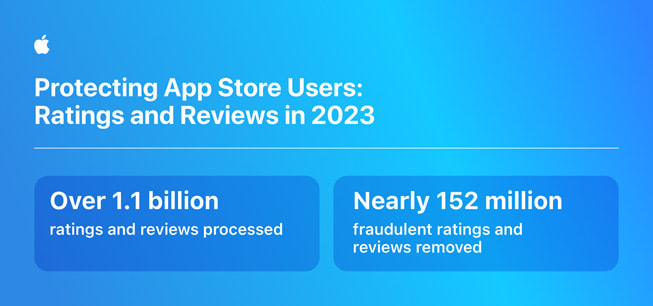

Ratings and reviews are an essential resource for users looking for their next app and a valuable tool for developers to receive meaningful user feedback about their products. In 2023, with over 1.1 billion ratings and reviews processed, Apple removed nearly 152 million fraudulent ratings and reviews from the App Store.

From household goods to entertainment services, apps have become a mainstream way for users to make purchases. Apple is diligent in its efforts to protect users’ financial information through its secure payment technologies like Apple Pay and StoreKit, which nearly 1 million apps use to sell goods and services on the App Store. And as fraud losses globally reach new highs, Apple helped prevent more than $1.8 billion in potentially fraudulent transactions on its platform in 2023.

Apple takes credit card fraud extremely seriously and remains committed to protecting the App Store and its users. For example, when consumers make a purchase with Apple Pay, it uses a device-specific number and unique transaction code so a card number is never stored on a consumer’s device or on Apple servers. Additionally, credit and debit card numbers are never shared with developers, thus eliminating another risk factor in the payment transaction process.

When consumers use Apple Pay to make a purchase online or in-app, cards with certain enhanced fraud prevention will enable a consumer’s device to evaluate information — such as their Apple ID, device, and location if they have Location Services for Wallet turned on — in order to develop on-device fraud prevention assessments.

Apple also leverages a combination of advanced technology and human review to detect when a stolen credit card is being used for illicit purposes. In 2023 alone, Apple prevented more than 3.5 million stolen credit cards from being used to make fraudulent purchases and banned over 1.1 million accounts from transacting again.

Apple has dedicated an advanced suite of tools and resources to ensure the App Store is a safe and trusted place for users and developers. By thwarting the fraudulent efforts of bad actors, Apple ensures users can install software onto their personal devices knowing there are a number of safeguards in place to protect them, and developers have a reliable store with a strong reputation to distribute their apps and games.

Apple will continue to invest in its long-standing commitment to protect the quality and security of the App Store in the best interests of all users and developers.

Press Contacts

Archelle Thelemaque

Apple Media Helpline

Images in this article

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Nasdaq announces 2024 annual meeting of shareholders.

NEW YORK, May 14, 2024 (GLOBE NEWSWIRE) -- Nasdaq, Inc. (Nasdaq: NDAQ) has scheduled its 2024 Annual Meeting of Shareholders for June 11, 2024, at 8:00 AM ET. The virtual meeting website can be accessed 15 minutes prior to the meeting start by visiting: www.virtualshareholdermeeting.com/NDAQ2024 .

Shareholders of record as of April 15, 2024 will be eligible to vote and participate in the Annual Meeting. Nasdaq’s 2024 Proxy Statement and 2023 Annual Report on Form 10-K are available at www.nasdaq.com/annual-meeting . The Proxy Statement contains information on voting and virtual attendance procedures.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn , on X @Nasdaq , or at www.nasdaq.com .

Media Relations Contacts:

Nick Jannuzzi +1.973.760.1741 [email protected]

Nick Eghtessad +1.929.996.8894 [email protected]

Investor Relations Contact:

Ato Garrett +1.212.401.8737 [email protected]

More From Forbes

Berkshire hathaway’s first quarter 2024 portfolio moves.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Warren Buffett unveiled his "secret" stock purchase in a regulatory filing yesterday. (Photo credit ... [+] should read NICHOLAS ROBERTS/AFP via Getty Images)

Berkshire Hathaway’s (BRK/A, BRK/B) first-quarter 13F was filed after the market close on May 15. This filing gives us a quarterly opportunity to observe what Warren Buffett and his investment team are doing within Berkshire’s publicly traded equity portfolio. Berkshire has a large stable of wholly-owned entities, so this is just a slice of their investments. Berkshire’s first-quarter earnings were reported at the annual meeting, containing significant information about the extensive portfolio of wholly-owned operating companies. A summary of the first-quarter earnings report is available here .

Berkshire’s $332 billion very concentrated investment portfolio consists of 41 companies, unchanged from last quarter. Berkshire was a net seller of over $17 billion in publicly traded stocks during the quarter. The top five holdings, in order of the size of holding, are Apple Apple (AAPL), Bank of America Bank of America (BAC), American Express American Express (AXP), Coca-Cola Coca-Cola (KO), and Chevron Chevron (CVX). The top 5 holdings account for over 76% of the total portfolio, down from 80% last quarter due to the large sale of Apple stock.

Percent Of Berkshire Hathaway 13F Portfolio

The most substantial disclosure in the 13F was the unveiling of Berkshire’s purchase of Chubb (CB), which had been concealed since the third quarter of 2023. The Securities and Exchange Commission allowed Buffett to keep the holding confidential while amassing the position. Other previous regulatory filings pointed to the secret holding being a financial company, but the suspense surrounding which company finally ended. The new $6.7 billion Chubb position makes it the ninth largest holding in the publicly traded portfolio at 2% of the total. Berkshire is the third largest shareholder at 6.4% of Chubb’s outstanding shares.

At the recent annual meeting , one of the most significant disclosures was that Berkshire Hathaway sold close to $20 billion of its massive stake in Apple (AAPL) in the first quarter. Before this sale, Apple stock comprised over 50% of its publicly traded portfolio, but Berkshire remains Apple’s largest shareholder aside from index funds. Despite selling about 13% of its stake, Buffett said it’s likely that Apple will remain the largest common stock holding at the end of the year. Buffett said that noted Berkshire holdings of American Express (AXP) and Coca-Cola (KO) were “wonderful” businesses but said Apple is an even better one.

‘Ghost Of Tsushima’ Is Already Flooded With Negative Reviews On Steam

This is a big deal congress suddenly hurtling toward a crucial crypto vote that could blow up the price of bitcoin ethereum and xrp, netflix s best new overlooked action movie is a must watch.

Due to its top five holdings, plus Occidental Petroleum Occidental Petroleum (OXY) and Kraft Heinz (KHC), the portfolio remains considerably overweight technology, energy, consumer staples, and financials relative to the S&P 500. Berkshire now controls almost 28% of the outstanding shares in Occidental. A deeper analysis of the probable reasons behind the Occidental purchase can be found here . Berkshire has no holdings in the industrial sector and no real estate companies or utilities. However, Berkshire’s wholly-owned entities include a large railroad, Burlington Northern Santa Fe, and multiple regulated utilities and pipelines.

Berkshire Hathaway 13F Portfolio By Sector

Because the 13F does not include international stocks, Berkshire Hathaway initially announced the acquisition of about 5% of five Japanese trading companies at the end of August 2020. These holdings are Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp. Buffett revealed in April 2023 that Berkshire increased its stakes in these companies to 7.4%. Buffett indicated that these were intended to be long-term holdings, and Berkshire may still increase its stake to 9.9%.

This analysis looks at the Berkshire portfolio across a host of measures, including 12-month forward estimated: price-to-earnings (P/E), price-to-sales (P/S), return-on-equity (ROE), enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA), price-to-book (P/B), dividend yield, current debt-to-EBITDA , current free cash flow yield , current operating margin , and long-term earnings-per-share growth consensus estimates.

Berkshire Hathaway 13F Portfolio Valuation

Overall, the portfolio analysis reflects a cheaper price-to-earnings valuation than the S&P 500 while having better profitability as measured by return on equity and operating margin with lower debt levels. The long-term (next 3 to 5 years) consensus earnings-per-share growth rate is expected to be lower than the S&P 500. Buffett’s preference for high-quality companies that generate significant cash flows is evident from the better profitability metrics combined with a superior free cash flow yield.

In addition to the new position in Chubb, Berkshire added to Occidental Petroleum (OXY), Liberty Media Liberty Media – SiriusXM Class C (LSXMK), and Liberty Media – SiriusXM Class A (LSXMA). HP HP (HPQ) was eliminated from the portfolio in the quarter. HP had been trimmed in the last two quarters.

As noted previously, Berkshire significantly reduced its holdings of Apple (AAPL). In addition, Chevron (CVX), Louisiana-Pacific Louisiana-Pacific (LPX), SiriusXM Holdings (SIRI), and Paramount Paramount Global (PARA) were trimmed. Chevron had been cut in several past quarters as Berkshire built its Occidental stake. Despite the sales, Chevron has remained Berkshire’s fifth-largest publicly traded holding, worth over $19 billion. While the filing does not indicate a complete exit from Paramount Global at the end of the first quarter, Buffett said at the annual meeting that the position has been eliminated. He added that it was one hundred percent his decision to buy the Paramount stock initially and that “we lost quite a bit of money.”

Berkshire was again a net seller of stocks in its portfolio, with net sales of over $17 billion in publicly traded stocks during the quarter. Berkshire continued to add to its various types of SiriusXM stock. Buffett sold a little over 116 million shares of Apple in the first quarter. However, because of price appreciation, Apple remains Berkshire’s most extensive holding, worth over $135 billion and comprising about 41% of Berkshire’s stock portfolio. The biggest news was the disclosure of Chubb (CB) as Berkshire’s secret purchase, which has been ongoing since the third quarter of last year. The purchase will likely be widely emulated due to Buffett’s expertise in managing and acquiring insurance companies. Chubb is up over 30% since the third quarter of 2023, when Buffett began to acquire shares, outperforming the S&P 500 by 12 percentage points.

Disclosure: Glenview Trust holds Berkshire Hathaway, Chubb (CB), and many other stocks mentioned in this article within its recommended investment strategies. I am a long-time shareholder of Berkshire Hathaway and worked for Salomon Brothers when Warren Buffett became Chairman and CEO.

- Editorial Standards

- Reprints & Permissions

IMAGES

COMMENTS

Apple provides its SEC filings details on its investor website, where you can access the latest 10-K filing and other financial reports. Learn more about Apple's performance, governance, and sustainability from its official documents.

Apple Inc. | 2021 Form 10-K | 1. Services. ... The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are filed with the U.S. Securities and Exchange ...

Apple Inc. Form 10-K For the Fiscal Year Ended September 25, 2021 TABLE OF CONTENTS Page Part I Item 1. Business 1 Item 1A. Risk Factors 6 Item 1B. Unresolved Staff Comments 17 Item 2. Properties 17 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation ...

Apple Inc. | 2020 Form 10-K | 1. AppleCare. ... The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are filed with the Securities and Exchange ...

Apple Inc. Form 10-K For the Fiscal Year Ended September 26, 2020 TABLE OF CONTENTS Page Part I Item 1. Business 1 Item 1A. Risk Factors 5 Item 1B. Unresolved Staff Comments 15 Item 2. Properties 15 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation ...

Inside Apple Inc's 10-K Annual Report: Financial - Shares Highlight. In May 2023, the Company announced a new share repurchase program of up to $90 billion and raised its quarterly dividend from $0.23 to $0.24 per share beginning in May 2023. Financial - Earnings Highlight

Apple Inc. Form 10-K For the Fiscal Year Ended September 28, 2019 TABLE OF CONTENTS Page Part I Item 1. Business 1 Item 1A. Risk Factors 5 Item 1B. Unresolved Staff Comments 14 Item 2. Properties 14 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation ...

notes should be read in conjunction with the Company's annual consolidated financial statements and accompanying notes included in its Annual Report on Form 10-K for the fiscal year ended September 25, 2021 (the "2021 Form 10-K"). The Company's fiscal year is the 52- or 53-week period that ends on the last Saturday of September.

Apple Inc. | 2022 Form 10-K | 1. Services. ... The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are filed with the U.S. Securities and Exchange ...

Inside Apple Inc's 10-K Annual Report: Financial - Earnings Highlight. Services Gross Margin Services gross margin increased during 2022 compared to 2021 due primarily to higher Services net sales, partially offset by the weakness in foreign currencies relative to the U.S. dollar.

Apple Annual Report 2022 Form 10-K (NASDAQ:AAPL) Published: October 28th, 2022 PDF generated by stocklight.com . UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of ...

Apple Inc. | 2019 Form 10-K | 2. Supply of Components. ... The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are filed with the Securities and ...

Apple today announced financial results for its fiscal 2024 second quarter ended March 30, 2024. ... reports filed or furnished with the SEC, information on corporate governance, and details related to its annual meeting of shareholders. ... Analysis of Financial Condition and Results of Operations" sections of the Company's most recently ...

Apple (AAPL 0.04%) just hit the earnings tape with one major headline: a $110 billion stock buyback authorization. This is a notable announcement, as it marks the largest share buyback in U.S ...

Recent Inflation Figures. In April 2024, CPI inflation rose 0.3% and remained at 0.3% with food and energy removed. That's lower than the 0.4% headline monthly increases in February and March ...

Apple Inc. Form 10-K For the Fiscal Year Ended September 26, 2020 TABLE OF CONTENTS Page Part I Item 1. Business 1 Item 1A. Risk Factors 5 Item 1B. Unresolved Staff Comments 15 Item 2. Properties 15 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation ...

In 2023 alone, Apple prevented more than 3.5 million stolen credit cards from being used to make fraudulent purchases and banned over 1.1 million accounts from transacting again. Keeping the App Store Safe. Apple has dedicated an advanced suite of tools and resources to ensure the App Store is a safe and trusted place for users and developers.

View the latest SEC filings by Apple, including annual reports, quarterly results, proxy statements, and more.

Shareholders of record as of April 15, 2024 will be eligible to vote and participate in the Annual Meeting. Nasdaq's 2024 Proxy Statement and 2023 Annual Report on Form 10-K are available at www ...

The report examined instances of fraud between fiscal years 2018 and 2022 and concluded that "the federal government could lose between $233 billion and $521 billion annually to fraud."

Apple (AAPL) 10-K Annual Report - Dec 1st 2005: 578kb 2004 Apple (AAPL) 10-K Annual Report - Dec 3rd 2004: 651kb 2003 Apple (AAPL) 10-K Annual Report - Dec 19th 2003: 566kb 2002 Apple (AAPL) 10-K Annual Report - Dec 19th 2002: 520kb See all annual reports in The United States . Who we are. Overview; Team;

Apple Inc. Form 10-K For the Fiscal Year Ended September 30, 2023 TABLE OF CONTENTS Page Part I Item 1. Business 1 Item 1A. Risk Factors 5 Item 1B. Unresolved Staff Comments 16 Item 1C. Cybersecurity 16 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities ...

MINNEAPOLIS, May 14, 2024 (GLOBE NEWSWIRE) -- Today, Jamf (NASDAQ: JAMF), the standard in managing and securing Apple at work, published its 2024 Purpose...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 25, 2021 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to .

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 24, 2022 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to .

At the recent annual meeting, one of the most significant disclosures was that Berkshire Hathaway sold close to $20 billion of its massive stake in Apple (AAPL) in the first quarter.Before this ...

Apple Inc. Form 10-K For the Fiscal Year Ended September 28, 2019 ... This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Many of the forward-looking statements are located in Part II, Item 7 of ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2023 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to .