Accounting | What is

What Is QuickBooks & What Does It Do?

Published January 15, 2024

Published Jan 15, 2024

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Mark Calatrava

This article is part of a larger series on Accounting Software .

- 1 QuickBooks Products

- 2 What Does QuickBooks Do?

- 3 QuickBooks Versions & Pricing

- 5 Bottom Line

With a market share of 81%, QuickBooks is the most popular accounting software suite used by small businesses to manage their financial transactions (12 QuickBooks Statistics You Can Trust ). You can use it to invoice customers, pay bills, generate reports, and print reports to be used to prepare taxes. The QuickBooks product line includes several solutions to support different business needs, including QuickBooks Online, QuickBooks Desktop, QuickBooks Payroll, QuickBooks Time, and QuickBooks Checking.

Visit QuickBooks

QuickBooks Products

Being one of the top accounting software providers in the market today, QuickBooks offers supplementary products to augment your overall QuickBooks experience. These include:

- QuickBooks Checking : You can open a business checking account with QuickBooks Checking for free and enjoy no monthly fees or account minimums. Instant deposit is available at no extra cost.

- QuickBooks Payroll : With this, you can manage payroll easily. What’s more, you can track employee hours and billable time effortlessly with QuickBooks Payroll and QuickBooks Online.

- QuickBooks Payments : Through this product, you can integrate payments seamlessly on QuickBooks Online. Get paid easily and process online payments effortlessly.

- QuickBooks Bill Pay : This new solution allows you to automate your accounts payable (A/P) workflows in QuickBooks Online.

- QuickBooks Time : Formerly known as TSheets, QuickBooks Time offers time-tracking features for employees for tracking client or project billable hours.

- QuickBooks Live : This is an online bookkeeping service wherein you can get a ProAdvisor to work with your bookkeeping needs.

- QuickBooks Capital : You can get additional financing options up to $150,000 with this product.

Check out What’s New in QuickBooks Online for the most recent changes and offerings from QuickBooks.

What Does QuickBooks Do?

- Create, send, and track invoices.

- Add and Track bills and expenses.

- Schedule bill payments with QuickBooks Bill Pay.

- Customize your expense classifications with a chart of accounts (COA).

- Print financial statements for your business.

- Generate consolidated multicompany reports.

- Track employee time and expenses.

- Monitor project profitability.

- Manage payroll.

- Track cost of goods sold (COGS) and inventory.

- Simplify taxes.

- Accept online payments.

- Scan receipts.

- Track mileage.

- Connect your apps.

- Perform accounting tasks on the go.

- Access your data through the QuickBooks Online desktop app.

- Collaborate with a QuickBooks ProAdvisor.

- Manage sales taxes.

- Manage and track fixed assets.

All of the features discussed and images presented below are primarily based on the cloud-based version, QuickBooks Online, which is our overall best small business accounting software . Other versions, such as QuickBooks Desktop, can handle most of these tasks but they may have other features unavailable in QuickBooks Online.

1. Create, Send & Track Invoices

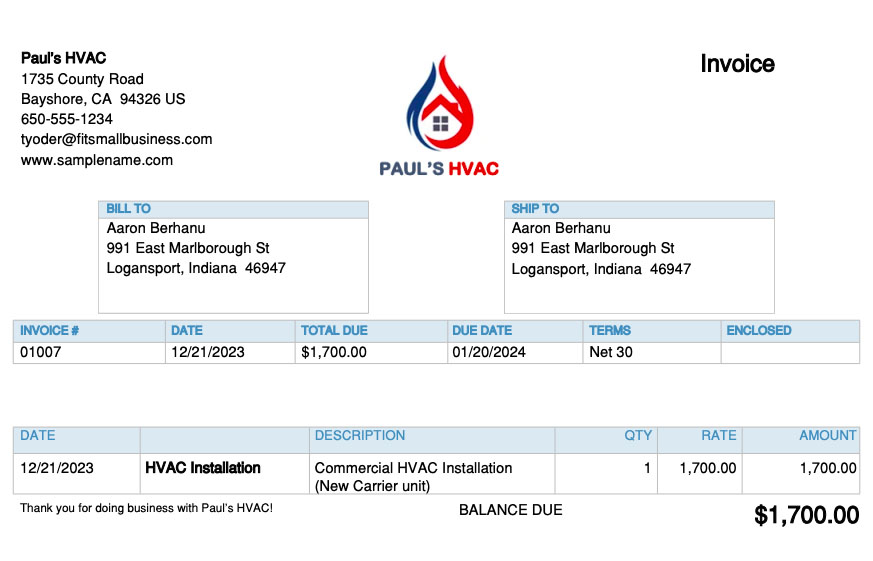

All QuickBooks Online plans allow you to create invoices and either print them or email them to customers—you can learn how to do this through our tutorial on how to create and send invoices in QuickBooks Online . You can create a new invoice from scratch or by converting an existing estimate into an invoice.

QuickBooks Online is known for its professional-looking invoices—making it our overall best invoicing software . To customize your invoice, you can upload your company logo, select from different templates, change the invoice colors, edit invoice fields, and add personalized messages for customers.

Below is a sample invoice created in QuickBooks Online:

Sample invoice in QuickBooks Online

Since our last update: In the new QuickBooks Online version, you can view the final PDF look of your invoice as you input the details. This means you can customize your invoices on the spot without repeatedly clicking the preview button.

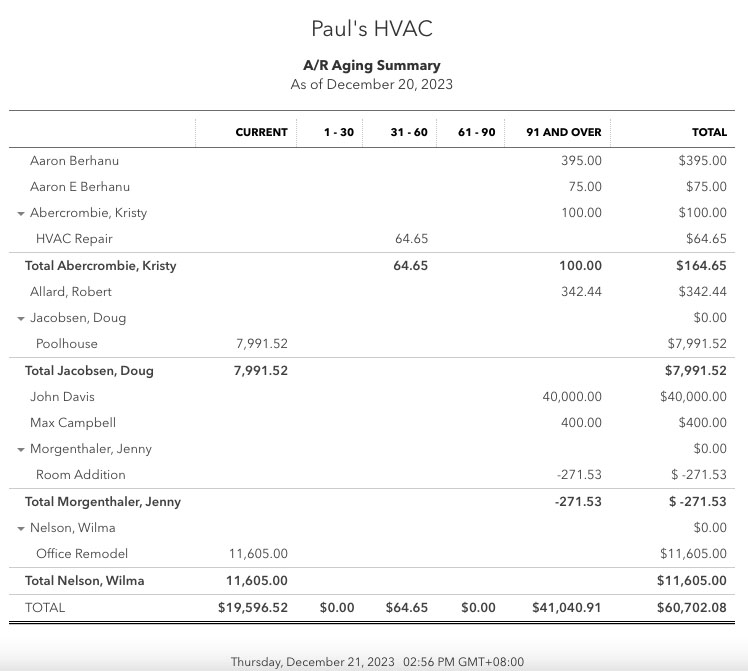

To help you stay on top of your receivables, QuickBooks will record the income and track how much each customer owes you automatically. You can view the number of your outstanding invoices—known as your accounts receivable (A/R)—and how many days they’re overdue by running an A/R aging report.

Sample A/R aging summary report in QuickBooks Online

2. Add and Track Bills & Expenses

QuickBooks allows you to enter new bills and expenses and keep track of them automatically by connecting your bank and credit card accounts to the platform. By doing so, all your expenses are downloaded and categorized automatically. If you need to track a check or cash transaction manually, you can record it directly in QuickBooks in a few minutes. If you need a guide, you can check out our tutorial on how to import transactions into QuickBooks Online .

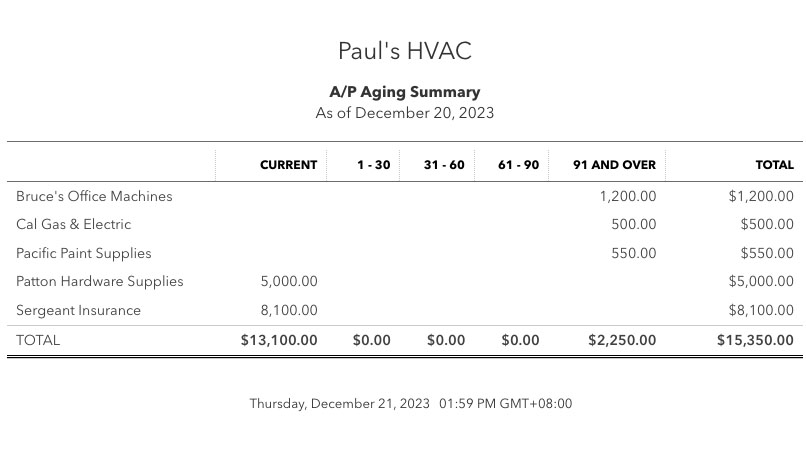

You can also add bills in QuickBooks when you receive them so that QuickBooks can help you track upcoming payments. Our guide on how to enter bills into QuickBooks Online covers this process in detail. Meanwhile, you can ensure that you pay your bills on time by creating an A/P report. This report will provide you with the details of your current and past-due bills. The ability to pay bills and track unpaid bills is available in QuickBooks Online Essentials and higher plans.

Sample A/P Aging Summary report in QuickBooks Online

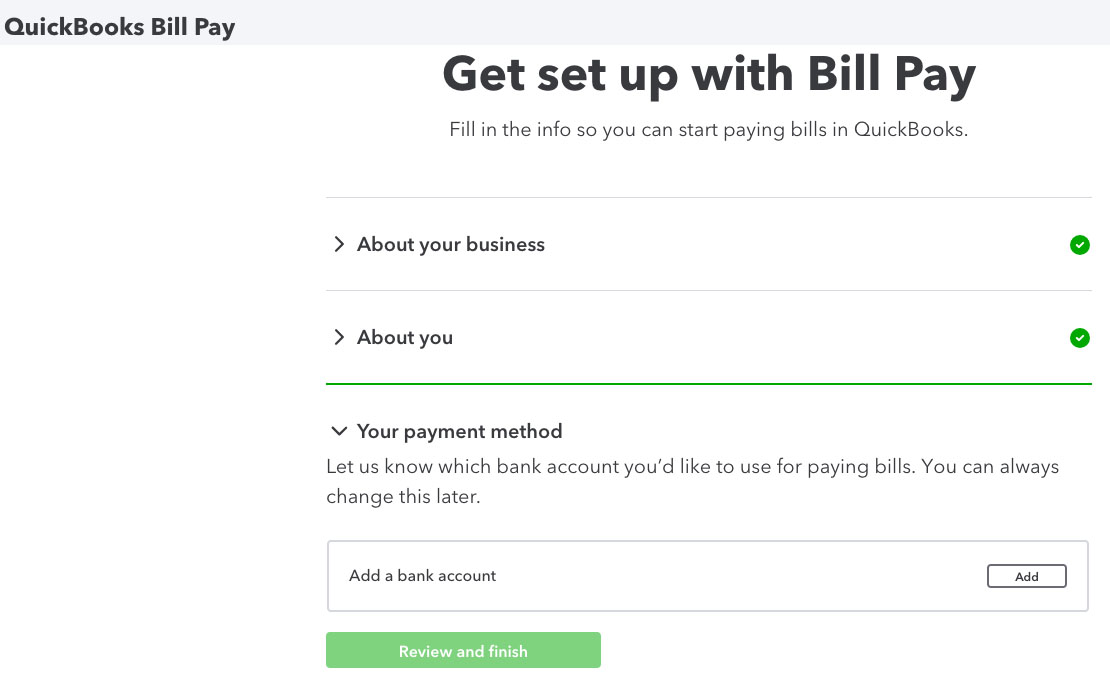

3. Schedule Bill Payments With QuickBooks Bill Pay

You can set up scheduled bill payments in QuickBooks using QuickBooks Bill Pay, a new built-in feature that replaces the Bill Pay powered by Melio integration. Available in QuickBooks Online Essentials and higher plans, QuickBooks Bill Pay allows you to pay bills via bank transfer or check directly from QuickBooks in a few seconds and pay several bills at once.

You can access QuickBooks Bill Pay directly from within your QuickBooks Online account. Select Expenses in the left menu bar and then click on Bills. Next, choose Add bill or select an existing bill to pay. If it’s a new bill, click Save and Schedule Payment ; if it’s an existing one, select Schedule Payment . QuickBooks will take you to the QuickBooks Bill subscription page where you can select a plan.

QuickBooks Bill Pay is available in three subscription options:

- Basic: Free; can process up to five free ACH payments monthly

- Premium: $30 per month; can process up to 40 free automated clearing house (ACH) payments monthly

- Elite: $90 per month; can process unlimited ACH payments

Additional ACH payments for Basic and Premium users cost 50¢ per transaction, and if you need expedited payments (typically the next business day), then you’ll pay $10 per transaction. Additionally, plans include automated bill creation and automatic categorization, but the higher versions include additional features, like unlimited 1099 filing and custom bill approval workflows. You can sign up for Premium and Elite with a 50% discount for three months.

Meanwhile, once you’re subscribed to your selected plan, you’ll be prompted to enter your details, such as business information, payment method, your bank account details, the payment method you’d like to use, and how your vendor would like to receive their payment.

Setting up QuickBooks Bill Pay from within QuickBooks Online

Once QuickBooks Bill Pay is completely set up, select Schedule Payment , and you and your payee will receive email information. You will also be notified once the bill payment is complete.

To learn more about this new feature of QuickBooks Online, read our detailed review of QuickBooks Bill Pay .

4. Customize Your Expense Classifications With a COA

Your COA in QuickBooks provides a complete listing of all the accounts you need to track your financial data. These accounts are useful for tracking income, expenses, assets, liabilities, and equity accounts that might be required on your tax return.

It’ll make tax time easier if your Chart of Accounts includes all the line items required on your tax return. In addition to those line items, create enough detail in your Chart of Accounts to provide whatever information will help you better manage your business. Our tutorial on how to set up a COA in QuickBooks Online walks you through how to add, delete, and customize accounts.

5. Print Financial Statements for Your Business

By managing all of your cash inflow and outflow activities in QuickBooks, you can print financial statements that provide useful information about how your business is performing. Lenders often require financial statements when you apply for a small business loan or line of credit.

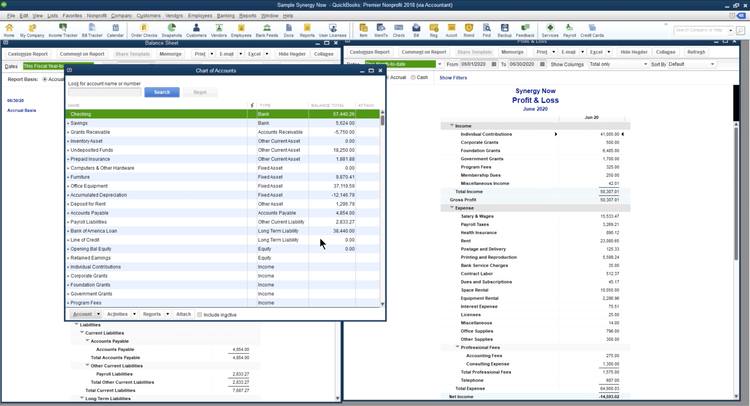

You can produce three primary financial statements in QuickBooks: Profit and Loss report, Balance Sheet report, and Statement of Cash Flows. Below is a brief description of each, along with a snapshot of what they look like in QuickBooks Online.

- Profit and Loss Report

- Balance Sheet Report

- Statement of Cash Flows

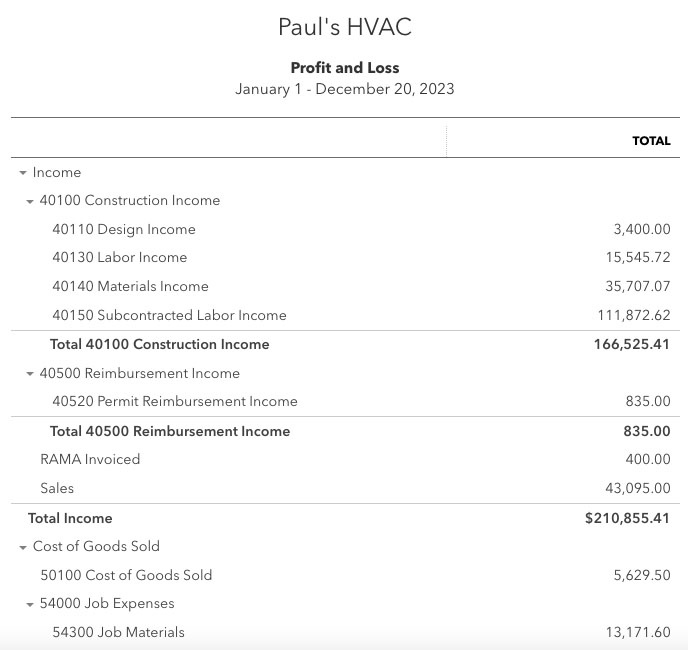

The Profit and Loss report will show you how profitable your business is by summarizing its income minus its expenses. The report shows you the bottom line net income (loss) for a specific time period, such as a week, a month, or a quarter.

Sample profit and loss report in QuickBooks Online

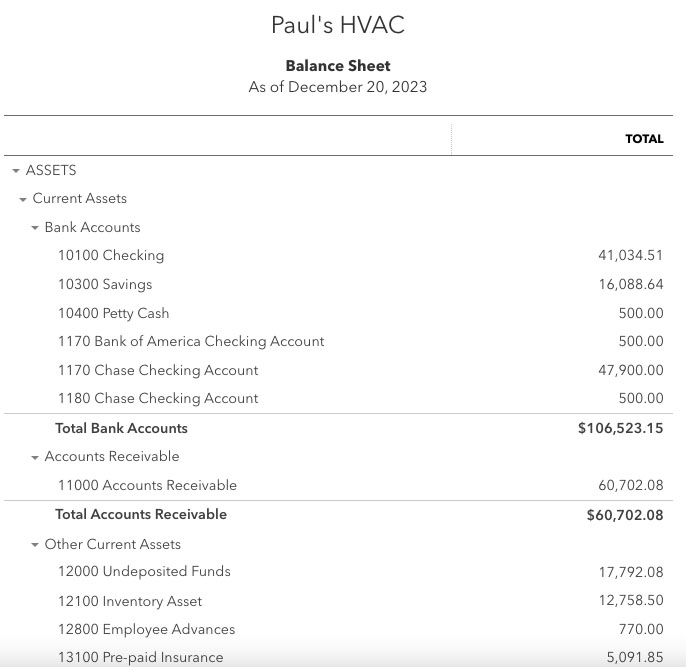

The Balance Sheet report shows what your business owns (assets), what it owes (liabilities), and its net worth (equity) at a particular point in time.

Sample balance sheet report in QuickBooks Online

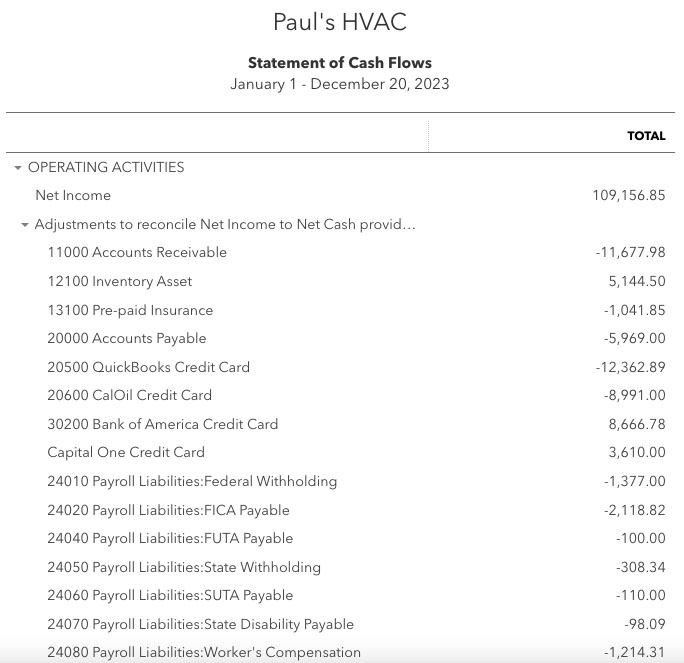

The Statement of Cash Flows in QuickBooks will show you all of the activities that affect the operating, investing, and financing cash inflows and cash outflows for your business.

Sample statement of cash flow in QuickBooks Online

6. Generate Consolidated Multicompany Reports

Using the new Spreadsheet Sync feature, QuickBooks Online extracts financial data automatically and imports them into an Excel spreadsheet. Once the data is edited in Excel, you can send it back to QuickBooks Online easily. This feature is a great tool for companies with multiple QuickBooks Online company files, as it allows them to create consolidated multicompany reports.

Spreadsheet Sync lets you generate customized reports in a single spreadsheet using data from different QuickBooks Online company files. The spreadsheet is updated automatically based on the data from each connected file so that your report is always up-to-date.

7. Track Employee Time & Expenses

Employees or subcontractors can enter their own time as they progress through the day, or a bookkeeper can enter their weekly time if the employee submits a manual timesheet. Time entered and assigned to a customer will be available to add to the customer’s next invoice.

Also, any expense entered can be marked as billable and assigned to a customer. As with time, these billable expenses will be available to add to the customer’s next invoice. You don’t need the payroll add-on to track employee time for billing purposes. You need at least QuickBooks Essentials to track billable hours and Plus to track billable expenses.

You may be interested in our review of QuickBooks Time for details of the platform’s pricing and features.

8. Monitor Project Profitability

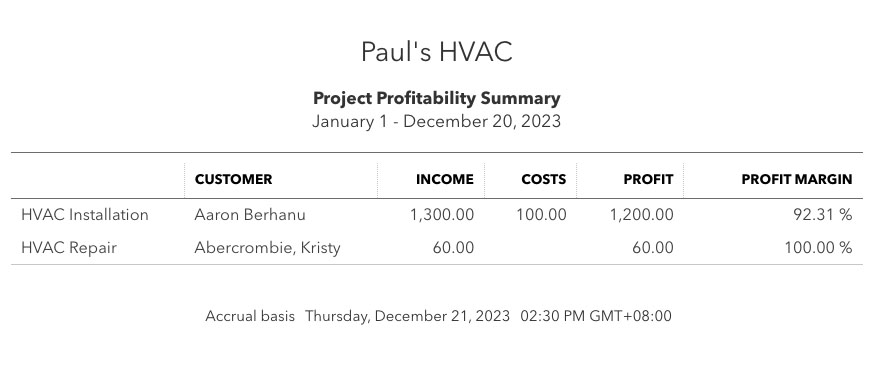

You can use QuickBooks Online Plus or Advanced to create and manage projects, assign income and wages to a project, and track expenses associated with labor and materials. QuickBooks Online’s project accounting module also allows you to generate project estimates and include inventories, labor, and sales taxes. You can monitor the profitability of each project you’re working on by generating a project profitability summary report.

Sample Project Profitability Summary report in QuickBooks Online

If you need to compare actual and estimated project costs, then you will need to upgrade to QuickBooks Online Advanced. It’s a new feature that allows you to compare your projected expenses for a project and the actual costs incurred during its completion. This helps you better track whether each project is profitable or not.

9. Manage Payroll

Payroll is an area that you don’t want to skimp on and try to do manually. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees. QuickBooks has its own payroll function that can calculate and run payroll as often as you need automatically.

When you enter employee time as discussed above, the hours not only flow to your invoices but also to the payroll module. This way, you can be confident that every hour you pay your employee is also considered for billing to a customer.

The best thing about using QuickBooks Payroll is that it’s integrated with QuickBooks, so your financial statements are always up to date as of the latest payroll run. You have to purchase a QuickBooks Payroll subscription to run payroll, but you have several levels of service to choose from to fit your needs.

Running your payroll through QuickBooks will allow you to:

- Pay employees with a check or direct deposit

- Calculate federal and state payroll taxes automatically

- Have QuickBooks fill in the payroll tax forms for you

- E-pay your payroll taxes directly from QuickBooks

Here’s a video link from Intuit on how small businesses use QuickBooks Payroll:

10. Track COGS and Inventory

Available in Plus and Advanced, the inventory management feature helps you track the quantity and cost of your inventory. As you sell inventory, QuickBooks will allocate a portion of your inventory to the cost of goods sold (COGS) automatically, which is an expense account that reduces your income. This allocation is a requirement for calculating taxable income and very cumbersome to do by hand. QuickBooks can also remind you to order inventory automatically when quantities are low.

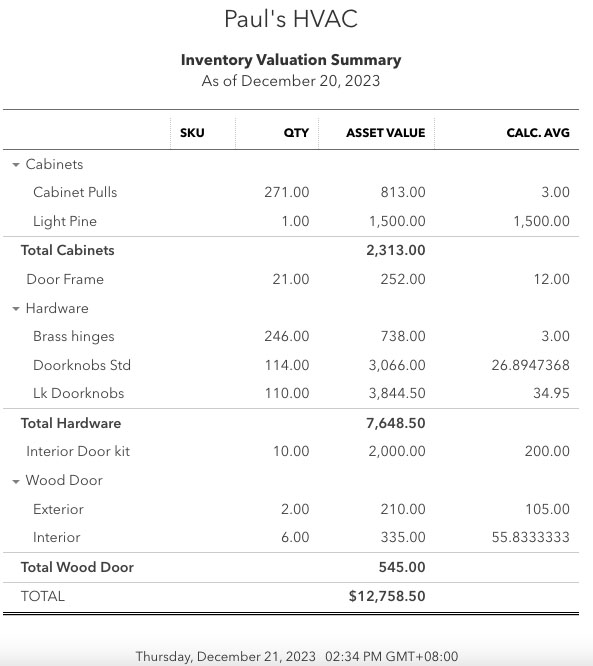

Below is a sample Inventory Valuation Summary report from QuickBooks Online. This report shows a list of your inventory products, quantity on hand, average cost, and their total value:

Inventory Valuation Summary report in QuickBooks Online

11. Simplify Taxes

Perhaps the most important thing QuickBooks can do for your small business is to simplify tax time. By far, the largest headache in preparing a tax return is compiling your income and expenses.

If you use QuickBooks during the year, all you need to do at tax time is print your financial statements. Better yet, with QuickBooks Online, you can invite your tax preparer to access your account directly so that they can review your numbers and print whatever information they need to prepare your return.

12. Accept Online Payments

One of the best ways to improve your cash flow is to offer customers the option to pay their invoices online. You can add QuickBooks Payments (formerly known as Intuit Merchant Services) so that customers can pay online directly from their emailed invoice.

QuickBooks Payments is similar to other merchant services. However, because it’s integrated completely within QuickBooks, the sale, credit card fee, and cash deposit are all recorded automatically as they occur.

You can learn more about this solution through our QuickBooks Payments review .

13. Scan Receipts

Another key to making tax time a breeze is being able to organize your receipts in QuickBooks. All QuickBooks Online subscribers can download the QuickBooks app to their mobile devices for free, take a picture of a receipt, and upload it to QuickBooks Online in a few minutes.

QuickBooks allows you to attach a receipt to the corresponding banking transaction. You can upload an unlimited number of receipts to QuickBooks Online as the receipts are stored in the cloud along with your data.

14. Track Mileage

Many self-employed individuals and employees use their personal vehicles for business purposes. This provides a generous tax deduction of 58.5 cents per mile for 2022. However, to receive the deduction, you must keep a record of the date, miles, and purpose of your trip.

QuickBooks Online makes this incredibly easy. Its mobile app will use the GPS in your phone to sense every time you’re in a moving vehicle automatically. Then, you can review your trips, classify them as personal or business, and mark them as billable to a customer. Billable mileage expenses will then be available to add to the next invoice you create for that customer automatically.

15. Connect Your Apps

QuickBooks Online integrates with hundreds of business applications available in the QuickBooks App Store. These integrated apps are designed to help you simplify the various aspects of your business, from bill management and payment acceptance to cash flow forecasting.

In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps. These include PayPal, Melio, HubSpot, Expensify, LeanLaw, Square Payroll, and Expensify.

While QuickBooks Online has hundreds of integrations available, we believe there are a few that stand out. For this, we recommend the best QuickBooks Online integrations for small businesses . You should also look into integrations for industry-specific uses, such as our best QuickBooks Online construction integrations and best Shopify integrations for QuickBooks .

16. Perform Accounting on the Go

The QuickBooks Online mobile app allows you to execute various accounting tasks from your mobile devices. Available for Android and iOS devices, it lets you create and send invoices, accept payments online, and assign expenses to projects or customers.

You can also track your business mileage and view financial reports from your smartphone. The QuickBooks Online mobile app is available for download on Google Play and App Store, but you need an active subscription to use its features.

17. Access Your Data Through the QuickBooks Online Desktop App

The QuickBooks Online desktop app is a standalone application that you can install on your Mac or Windows app. The app offers all of the core features of the browser-based version, but it has additional features that you may find useful, including the ability to stay logged in for six months, switch to an interface similar to QuickBooks Desktop Pro or Premier, and open multiple tabs or windows easily.

Note that the QuickBooks Online Desktop app is different from the QuickBooks Online mobile app. The desktop app runs on your desktop computer or laptop while the mobile app is accessible on mobile devices. For more information, read our article on what the QuickBooks Online desktop app is .

18. Collaborate With a QuickBooks ProAdvisor

Collaborating with a QuickBooks ProAdvisor can be a valuable experience that optimizes your accounting and financial management processes for efficiency and accuracy. QuickBooks ProAdvisors are certified in QuickBooks, and they have extensive knowledge of the software’s features and capabilities.

This expertise can be helpful with setting up your accounting processes, troubleshooting issues, and maximizing the software’s capabilities. QuickBooks users can invite an accountant to view their books, and QuickBooks Desktop users are able to export an accountant copy and import any changes the accountant has made to their file.

The best way to find a QuickBooks ProAdvisor is to visit Intuit’s Find a ProAdvisor website . We suggest reading our article on how to find a QuickBooks ProAdvisor for step-by-step guidance—and we also include a list of other places to find ProAdvisors.

You could also choose to hire a QuickBooks ProAdvisor through QuickBooks Live, an add-on to QuickBooks Online. While QuickBooks Live charges a set monthly fee that is based on your company’s average monthly expenses, you have more flexibility to arrange a payment schedule and customize services with an independent ProAdvisor.

Read our review of QuickBooks Live for more information on the product.

19. Manage Sales Taxes

QuickBooks can help small businesses manage their sales tax obligations by calculating sales tax, preparing sales tax returns, and generating reports on sales tax liability. It can calculate sales tax for transactions automatically based on the tax rates and rules for the customer’s location. This can help ensure that the correct tax amount is charged on each sale. It can also track the sales tax collected on transactions and the sales tax owed to the various tax authorities.

The platform integrates with popular sales tax software providers, such as Avalara and TaxJar, to streamline the sales tax management process and ensure compliance with local and state tax regulations. It can also support businesses that sell products or services in multiple jurisdictions, with the ability to calculate and track sales tax rates and rules for each jurisdiction.

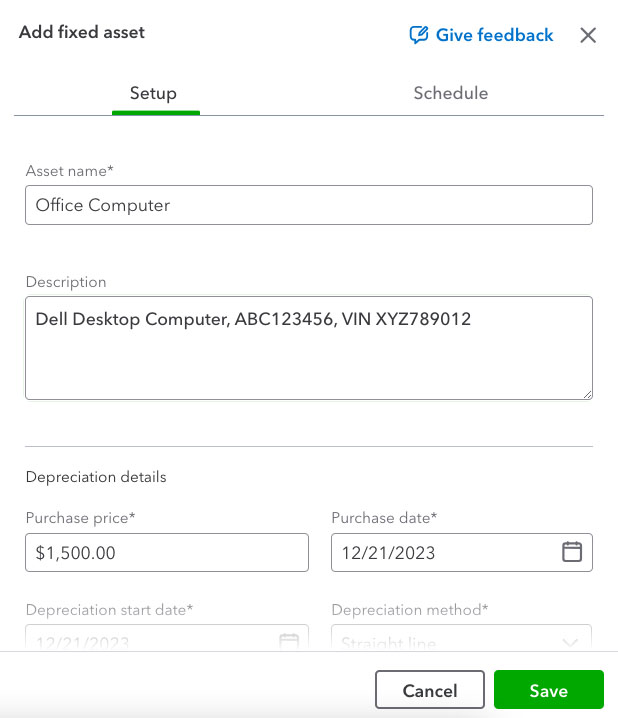

20. Manage and Track Fixed Assets

A new feature in QuickBooks Online Advanced, the fixed asset accounting tool allows you to add, manage, and track fixed assets, like buildings, vehicles, machinery, and equipment. Instead of computing depreciation expenses manually, QuickBooks Online does it for you automatically based on the depreciation method you choose, such as straight line and double declining. Advanced also creates schedules outlining the depreciation expenses over time.

To access fixed asset accounting in QuickBooks, select Advanced accounting in the left menu bar and then click Fixed Asset Accounting. Click the Add an asset button, and then enter the required details, such as the asset name and description and depreciation details.

Setting up a new fixed asset in QuickBooks Online

You an learn more in our complete guide on How to Use the QuickBooks Online Fixed Asset Manager .

QuickBooks Options & Pricing

QuickBooks comes in both a cloud-based online platform and a traditional desktop program. You can read about the pros and cons of each in our comparison of QuickBooks Online vs Desktop .

QuickBooks Online

QuickBooks Online is a cloud-based product that doesn’t require software installation, allowing you to access your data from any computer with an internet connection by using your secure login. It is available in four subscription levels, Simple Start, Essentials, Plus, and Advanced, and is ideal for any business without complicated job-costing requirements.

Read our review of QuickBooks Online to learn more about the tool. We compared its four options in our QuickBooks Online plans comparison .

QuickBooks Desktop

QuickBooks Desktop comes in four versions and offers a specialized edition for Mac users, QuickBooks Desktop for Mac Plus.

Each requires you to install the software on your computer.

- QuickBooks Pro Plus is sufficient for businesses with up to three users and those with minimal inventory.

- QuickBooks Premier Manufacturing review

- QuickBooks Premier Contractor review

- QuickBooks Premier Professional Services review

- QuickBooks Premier Retail review

- QuickBooks Premier Nonprofit review

- QuickBooks Enterprise is for large enterprises with complicated pricing and heavy inventory.

- QuickBooks Accountant Desktop is optimal if you’re a bookkeeper serving a client using QuickBooks.

- QuickBooks Desktop for Mac Plus: QuickBooks for Mac is the only QuickBooks desktop product available for Mac users. This edition is very similar to QuickBooks Desktop Pro, and it works well for most small businesses that don’t manufacture products. Read our QuickBooks for Mac review to learn more.

In the know: QuickBooks Desktop Pro, Premier, and Mac Plus will no longer be available for new users starting July 31, 2024. Existing users, however, can still renew their subscriptions even after the said date.

If you want to learn more about the four QuickBooks Desktop versions, read our:

- QuickBooks Pro review

- QuickBooks Premier review

- QuickBooks Enterprise review

- QuickBooks Accountant Desktop review

In our QuickBooks Desktop comparison article, we break down each of these to help you understand the various versions.

On a tangent, you can be more productive with QuickBooks Desktop by getting a hosting provider. QuickBooks hosting lets you access your desktop software anywhere through a remote server, and a good place to start would be our list of the best QuickBooks hosting providers . You may also want to switch completely to cloud-based software. Our guide on how to convert QuickBooks Desktop to Online walks you through the simple process.

QuickBooks Self-Employed

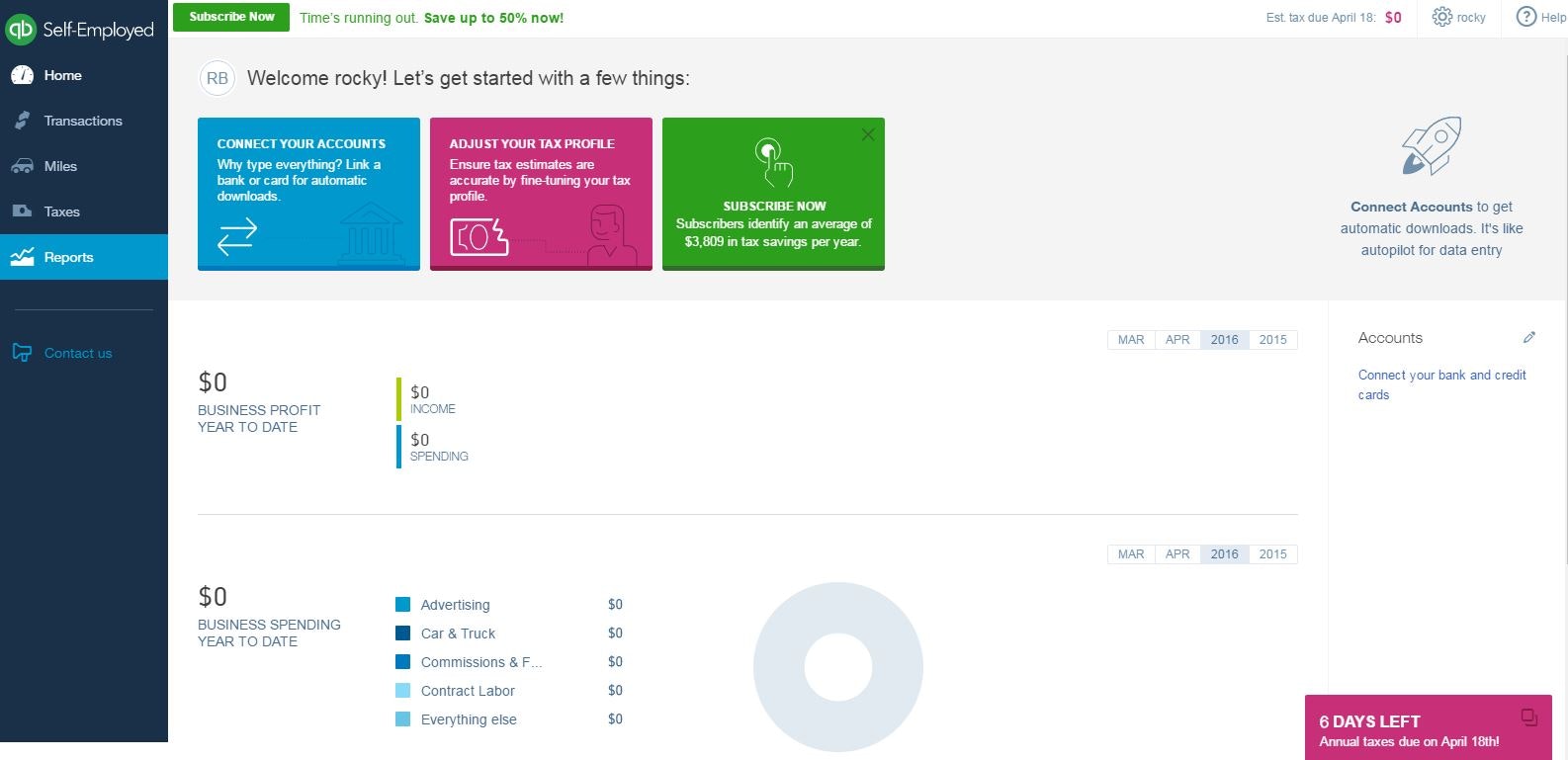

QuickBooks Self-Employed is ideal for freelancers, real estate agents, and independent contractors, like Uber and Lyft drivers. Similar to QuickBooks Online, it’s a cloud-based product that can be accessed with your secure login from any computer with an internet connection.

It includes unique features that are unavailable in QuickBooks Online and QuickBooks Desktop, like the ability to track business and personal expenses from the same bank account and transfer data to TurboTax. It will even calculate your estimated quarterly tax payments and remind you when they’re due.

If you’re a startup with plans of expanding your workforce, QuickBooks Self-Employed won’t be the best fit as it cannot be upgraded to other QuickBooks versions.

There are three QuickBooks Self-Employed pricing plans: Self-Employed, Self-Employed Tax Bundle, and Self-Employed Live Tax Bundle. To learn more about it, read our review of QuickBooks Self-Employed .

Frequently Asked Questions (FAQs)

What is quickbooks used for.

Depending on your QuickBooks product and plan, you can use QuickBooks to create and send invoices, manage and track unpaid bills, handle inventory, keep track of project profitability, view financial reports, and more.

What is the difference between QuickBooks Online and QuickBooks Desktop?

QuickBooks Online is a cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. Meanwhile, QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you’ll use it and is available as an annual subscription. For more information about the differences between the two programs, read our comparison of QuickBooks Online vs QuickBooks Desktop .

Is there a free version of QuickBooks for businesses?

No, there’s no free version of QuickBooks for businesses, but there’s a 30-day free trial for new users. Meanwhile, QuickBooks Online Accountant is free for professional bookkeepers. For accounting software with free options check out our top-recommended free accounting software .

How is QuickBooks different from Microsoft Excel?

Excel and QuickBooks are drastically different programs. QuickBooks is by far the most popular small business bookkeeping program in the United States, whereas Excel is a spreadsheet program that advanced users may be able to use to create their own custom bookkeeping program. While we don’t recommend using Excel as your base bookkeeping program, Excel has many great accounting uses . Our comparison of QuickBooks Online vs Excel will help you better understand the differences between the two programs.

What is the best QuickBooks product for me?

The best QuickBooks product depends on your needs and the size of your business. SMBs needing remote access to their account files should choose QuickBooks Online. If you want the speed and usability of desktop software, then QuickBooks Desktop is preferable. If you’re a freelancer, consider QuickBooks Self-Employed.

How easy is it to learn QuickBooks?

One of the best things about QuickBooks is that it has a user-friendly interface. All QuickBooks Online products have the same interface, and so do all the QuickBooks Desktop products. There are also available free online training resources that you can use to get up to speed quickly. To get started, check out our free QuickBooks Online tutorials .

Bottom Line

QuickBooks is the most popular small business accounting software suite. It comes in a variety of editions and has web-based and desktop programs. QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes.

About the Author

Find Mark On LinkedIn

Mark Calatrava

Mark Calatrava is an accounting expert for Fit Small Business. He has covered more than 50 accounting software for small businesses and niche industries and has developed an in-depth knowledge of the important features of accounting software, including how the importance of these features vary by business. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- What is QuickBooks?

QuickBooks, the popular accounting software by Intuit, often has small business owners wondering if it is the right solution for their financial needs.

Learn more about what QuickBooks has to offer:

- Benefits and Features

- Popular Versions

Deployment Options

QuickBooks by Intuit is a well-known accounting software designed to help small to medium-sized businesses manage their finances. This easy-to-use software streamlines business tasks by offering templates for spreadsheets, invoices, and financial reports. These features help you save precious time and money, making it one of the most popular software products on the market.

Who Uses QuickBooks?

QuickBooks Online is an ideal solution for small business owners across every industry. In particular, this product is popular with those who need a cloud-based solution accessible on any device with internet access. QuickBooks also offers multiple products capable of serving mid and enterprise-level corporations.

QuickBooks’ base products primarily focus on accounting only, lacking the industry-specific functionality some businesses require. To discover a few apps to add to your QuickBooks accounting software, explore the 7 Best QuickBooks apps for complete integration .

Benefits and Features of QuickBooks

Every company has its own accounting processes, and QuickBooks boasts multiple features to help satisfy those specific needs without the higher price of a full accounting or ERP software. Specific modules with additional functionality can be added and removed as your company grows and changes. The following are just a few of the many ways that QuickBooks helps business owners stay financially organized:

- Income, cashflow, and expenses

- Tax deductions and sales tax

- Receipt capture

- Estimates and budgeting

- General reports

With these features, base-level QuickBooks software allows a single user to manage most business-related income and expenses. All QuickBooks plans include free mobile apps, customer support, and integration with over 750 business apps. Other key benefits include:

General Ledger and Accounts Receivable and Payable

The most important part of a business is undeniably the cash flow. QuickBooks automates this process by directly connecting credit card and bank accounts so you can download and categorize your expenses in real-time.

Manage your invoices in one place where you can create, send, and track all of your invoices. Enter bills into QuickBooks as you receive them, then simply pay those bills online via bank transfer or check. You will never miss another payment to your vendors and contractors.

With your cash flow and chart of accounts managed through Quickbooks, it is easy to monitor and audit your business performance by printing financial statements such as your Statement of Cash Flows, Balance Sheet Report, and Profit and Loss Report.

Easy Employee Payroll

To ensure you pay your employees accurately and on time, QuickBooks Payroll tracks employee time, then calculates and runs payroll automatically with the option for direct deposit. With your bank and credit card accounts connected, easily E-pay payroll taxes through QuickBooks. Payroll is available as standalone software or an add-on module to other products.

Tax Automation and Compliance

With QuickBooks, federal and state payroll taxes are automatically calculated, instantly filling in your payroll tax forms. Simply print your company’s financial statements from your account to share with bookkeepers and CPAs. Through QuickBooks Online, professional tax preparers can access your account directly to prepare your tax returns. For additional help with your business’s accounting needs, enlist the services of a certified QuickBooks ProAdvisor .

Popular QuickBooks Software Versions

The bulk of QuickBooks products can be divided into two deployment categories: Online and Desktop. A few notable products include:

QuickBooks Point of Sale

QuickBooks Point of Sale is a locally installed solution built for small retail businesses looking for the features of an ERP without the higher price tag. This tablet POS-compatible software will process credit cards and even manage your customer loyalty program. It’s more than just a cash register: This all-in-one software allows for inventory management, customer management, merchandise planning, time tracking, bill payment, and more. Pair QuickBooks Point of Sale with QuickBooks Online or QuickBooks Pro to integrate your POS with your accounting system.

QuickBooks for Mac

In addition to the desktop solutions for Windows, QuickBooks offers a solution for Mac users similar to QuickBooks Desktop Pro. This software works best for non-manufacturing small businesses.

QuickBooks Self-Employed

This cloud-based product is perfect for freelancers seeking a simplified accounting solution.

Software Integration

Your business may already be using a legacy software system you know and love yet lacks the additional tools necessary to keep up with growth. These QuickBooks products can easily integrate with new and existing software, such as TurboTax, PayPal, and Amazon Business.

QuickBooks offers cloud-based software (Online) and on-premise solutions (Desktop). Which is best suited for your company depends on several factors.

QuickBooks Online

QuickBooks Online is a Cloud-based service that does not require a software download and can is accessible from any computer or mobile device with an internet connection. Four subscription levels are available: Simple Start, Essentials, Plus, and Advanced. In addition, you can add a wide variety of modules to your base program to customize your QuickBooks experience.

QuickBooks Desktop

Quickbooks Desktop offers several software solutions: Enterprise, Premier, Pro, and Accountant. These scalable solutions are best for businesses with high inventory needs. However, QuickBooks now recommends that companies move to their cloud-based products.

QuickBooks Online vs. QuickBooks Desktop

By now, you’re probably wondering which deployment is best for your business, cloud-based or on-premise. There are a few main differences between QuickBooks Online and QuickBooks Desktop.

QuickBooks Online is the preferred product for most small businesses because of its ability to connect to any device with an internet connection. The Online version also has several features that Desktop does not have, including a multicurrency tool for international businesses. In recent years, QuickBooks has been focusing on expanding its cloud-based products. Any business looking for long-term support and growth should consider Online plans over Desktop.

While there are many benefits to using QuickBooks Online, QuickBooks Desktop is the better solution for companies needing heightened security measures to protect data, particularly if you have your own in-house servers. Since the software is locally installed on your company’s computers, you will have the safety of your own secure network. It features advanced reporting and inventory tracking tools for businesses that require it. New software versions are released yearly, and full support for each version remains for up to 3 years.

QuickBooks Mobile App

The free QuickBooks mobile app allows you to access your business’s accounting reports from anywhere. Additionally, you can scan unlimited receipts to QuickBooks Online and attach the image of the receipt to the transaction.

How Much Does QuickBooks Cost?

QuickBooks is known for being an affordable product that meets the budget requirements of small to medium-sized businesses. The total price will depend on how many users you have, the add-ons you want, and the key functionality you need.

QuickBooks Online’s base software is on a monthly subscription and starts as low as $30.

The Desktop versions of QuickBooks have products that are on a monthly and yearly basis. They start from $37 per month , depending on the number of users needed to access the software.

Visit the Quickbooks website for pricing options.

Free 30-day Trial

QuickBooks is currently offering a free 30-day trial, so you can decide if this software is the best solution for your business. QuickBooks also regularly offers discounts on their products, such as 30% off for the first three months of use. These offers frequently change, so be sure to check their website for the latest information.

If you aren’t ready to buy the software, QuickBooks Desktop Enterprise offers a commitment-free and interactive online product tour. Choose the software edition that best matches your business, and review the software’s features with the sample data provided.

Additionally, small business owners can utilize YouTube tutorials on QuickBooks for help with their growing companies.

If you are a small business looking for other accounting solutions, read our article on 8 Best QuickBooks Alternatives For Small Business Accounting to find the best option for your company.

While QuickBooks is the favorite of many small businesses, it may not have all the tools and industry-specific features you need to grow your business. If you are looking for a more robust accounting solution, check out our list of the top accounting software products .

What Is QuickBooks Software? A Guide to Choosing the Right Solution

When you hear “small-business accounting software,” you probably think of QuickBooks. Since Intuit launched its flagship product over 25 years ago, the financial management platform has dominated the accounting software marketplace , resulting in an impressive 11 consecutive years of stock gains

Currently, QuickBooks software holds more than 80% of the small-business market share. If you’re researching small-business accounting solutions, QuickBooks is on your list.

But which version is right for you? On-premise or cloud? With payroll or without?

QuickBooks has a product for nearly all of your accounting needs, but sorting through the options can feel like an insurmountable task.

To simplify your search, we’ve created this QuickBooks comparison report, which outlines the different versions and who/what type of business they’re best suited for.

Are you a solo entrepreneur seeking cloud-based accounting?

Jump to: QuickBooks Self-Employed

Are you a small business seeking cloud-based accounting?

Jump to: QuickBooks Online

Are you a small or midsize business seeking desktop accounting?

Jump to: QuickBooks Desktop

Looking to enhance whichever version of QuickBooks you already use?

Jump to: QuickBooks Apps

QuickBooks Self-Employed

The newest edition of the QuickBooks product line is a cloud-based financial management service designed for self-employed and/or freelance individuals.

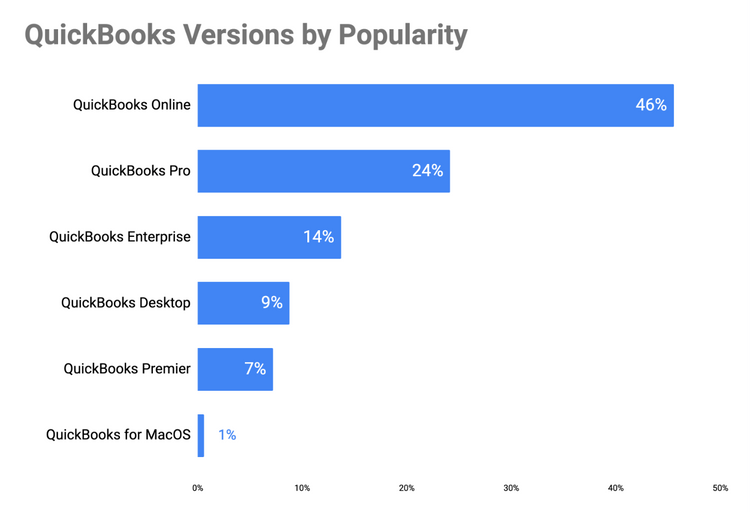

Reports in QuickBooks Self-Employed ( Source )

Pricing: Available through a monthly subscription that includes the cost for phone support, data backups, and system maintenance.

The solution comes in three packages:

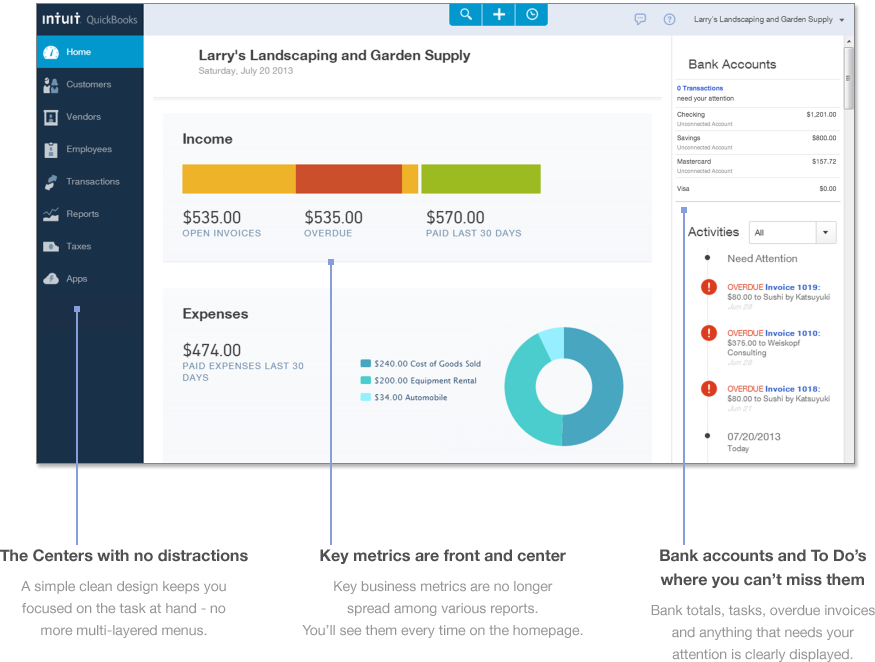

QuickBooks Online

In 2014, Intuit reported a major turning point for QuickBooks products. For the first time, more new customers chose QuickBooks Online over desktop versions.

Since then, QuickBooks Online has grown to over 1 million subscribers, signaling that small businesses are growing more confident hosting their accounting solutions in the cloud .

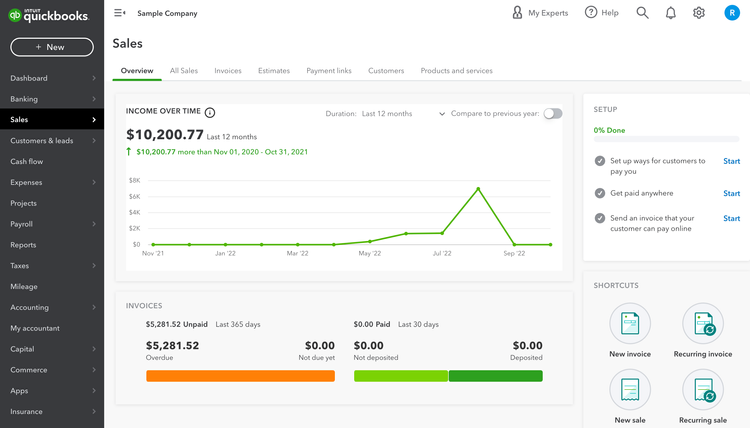

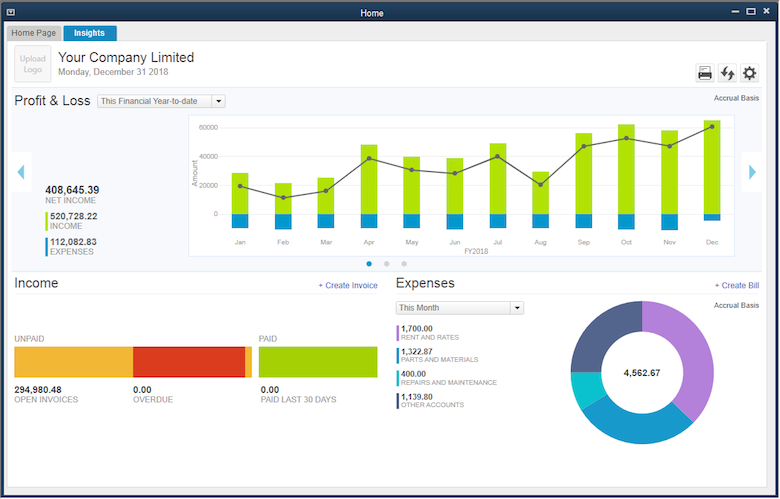

Dashboard in QuickBooks Online ( Source )

Pricing: Available through a monthly subscription that includes the cost for support, automatic data backups, and upgrades.

QuickBooks’ cloud-based solution is designed for small-business users and comes in four packages: Simple Start, Essentials, Plus, and Advanced.

QuickBooks Online: Common capabilities

Accounts payable and accounts receivable: Monitor and manage income and expenses.

Billing and invoicing: Send unlimited estimates and invoices. Essentials and Plus also offer recurring invoices.

Expense management: Track and process work-related expenses such as travel and supplies.

Financial reporting: Simple Start has over 20 prebuilt reports, Essentials has over 40, and Plus has over 60 (includes sales and tax reports).

QuickBooks Desktop products

It’s important to note: while QuickBooks Online will be the best choice for many small businesses due to ease of use and access, the online version is not identical to the vendor’s desktop products.

They offer similar capabilities, but the breadth and depth of the features differ. For example, with QuickBooks Online, users can automatically schedule and send invoices, a feature absent from the desktop version. QuickBooks Desktop, meanwhile, allows for the calculation of job costs and individual customer discounts.

There are several QuickBooks products under the Desktop umbrella (in this article, we’re discussing the 2019 versions of each. They include:

Mac: Designed for small businesses using macOS (not scalable)

Pro: A good fit for small business just starting out (can scale to Premier and Enterprise)

Premier: Aimed at small businesses with industry-specific needs (can scale to Enterprise)

Enterprise: Designed for small to midsize businesses that need a flexible business and financial management solution

The desktop products have a similar base feature set, with functionalities becoming more advanced as the packages scale.

QuickBooks Desktop: Common capabilities

Core accounting: Accounts receivable, accounts payable, general ledger, and bank reconciliation.

Payroll (limited): Track employee hours and print checks and deposit slips. Enhanced payroll is available for an additional fee (calculates payroll taxes and files tax forms).

Billing and invoicing: Automates invoice creation and sharing, as well as payment collection.

Inventory management: Tracks orders, sales, and deliveries to maintain product supply levels.

Financial reporting: Tracks and visualizes trends, evaluates KPIs, and reports profitability on profit and loss (P&L) statements, balance sheets, etc.

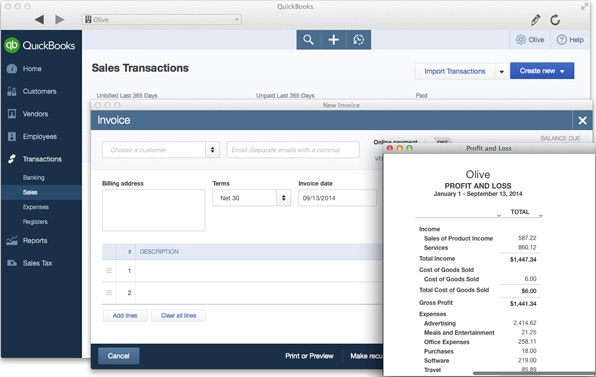

QuickBooks Desktop for Mac

Businesses should note that QuickBooks’ Mac desktop product is not scalable, whereas the Windows versions of Pro, Premier, and Enterprise are.

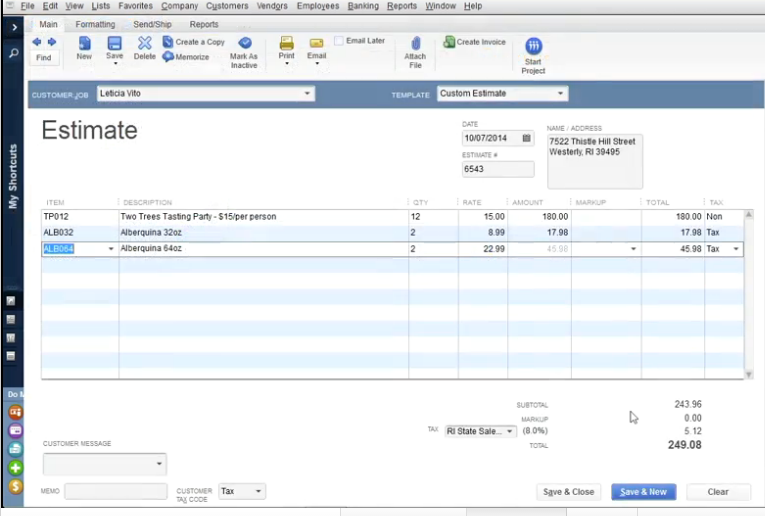

Sales transactions in QuickBooks Desktop for Mac ( Source )

Pricing: User licenses are sold outright for a one-time fee. This package supports up to three concurrent users, but requires a unique user license for each. Phone support is available 24/7 for an additional fee, sold in recurring 90-day support plans.

In addition to the common desktop capabilities listed above, QuickBooks Desktop for Mac includes:

✔ An “Income Tracker” dashboard, which displays unpaid invoices

✔ Project accounting to invoice for projects in phases

✔ Budget management to create fiscal year budgets and track progress

QuickBooks Desktop Pro

QuickBooks Desktop Pro is designed for small businesses that are just getting started. It’s simple enough for business owners who lack advanced accounting knowledge, and makes it easy for them to share files and data with their accountant.

Estimate in QuickBooks Desktop Pro ( Source )

Pricing: Businesses with an existing IT infrastructure can purchase Pro for a one-time payment. Phone support, data backups, and product upgrades are available for an additional fee.

Pro can also be purchased as a “Plus” package. With an active annual subscription, businesses receive new features and upgrades as they become available. This package also includes 24/7 phone support and data backups.

Businesses without an existing IT infrastructure—or those who wish to reduce their overall IT costs—can purchase Pro and opt to use a cloud hosting service (for an additional fee). This allows remote access through a virtual desktop, which provides greater connectivity (anytime, anywhere access on any device).

Pro allows up to three users to work within QuickBooks at the same time (however, this requires separate user licenses). The Pro package offers the common capabilities listed in the table above, as well as the following:

✔ A “Bill Tracker” dashboard that shows unpaid bills, purchase orders, etc., in one place

✔ Tracks sales and expenses in multiple currencies

✔ Easy data import from Excel, Quicken, and older QuickBooks versions

QuickBooks Premier

QuickBooks Desktop Premier targets small-business users that have industry-specific needs. It is especially beneficial for industries such as non-profit, retail, professional services, contractors, and manufacturing.

Homepage in QuickBooks Desktop Premier ( Source )

Pricing: Premier can be purchased outright for a one-time payment. Support, upgrades, and data backups are available for an additional fee.

Businesses can also opt to purchase Premier as a “Plus” package through an annual subscription. The annual subscription includes the cost for phone support and automated data backups.

Customers can also choose to purchase Premier and pay an additional fee for cloud hosting . This allows businesses to access Premier remotely through a virtual desktop.

Premier supports more concurrent users than Pro or Mac; Up to five users can work in QuickBooks Premier at the same time (this also requires separate user licenses).

Premier has all the features of Pro, as well as:

✔ Budgeting and forecasting

✔ Industry-specific reports (including the ability to run a P&L by job or client)

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise is Intuit’s most comprehensive business and financial management solution, because it includes several applications, such as QuickBooks Payroll (see QuickBooks Apps below). Enterprise is designed for both small and midsize businesses, supporting up to 30 user licenses.

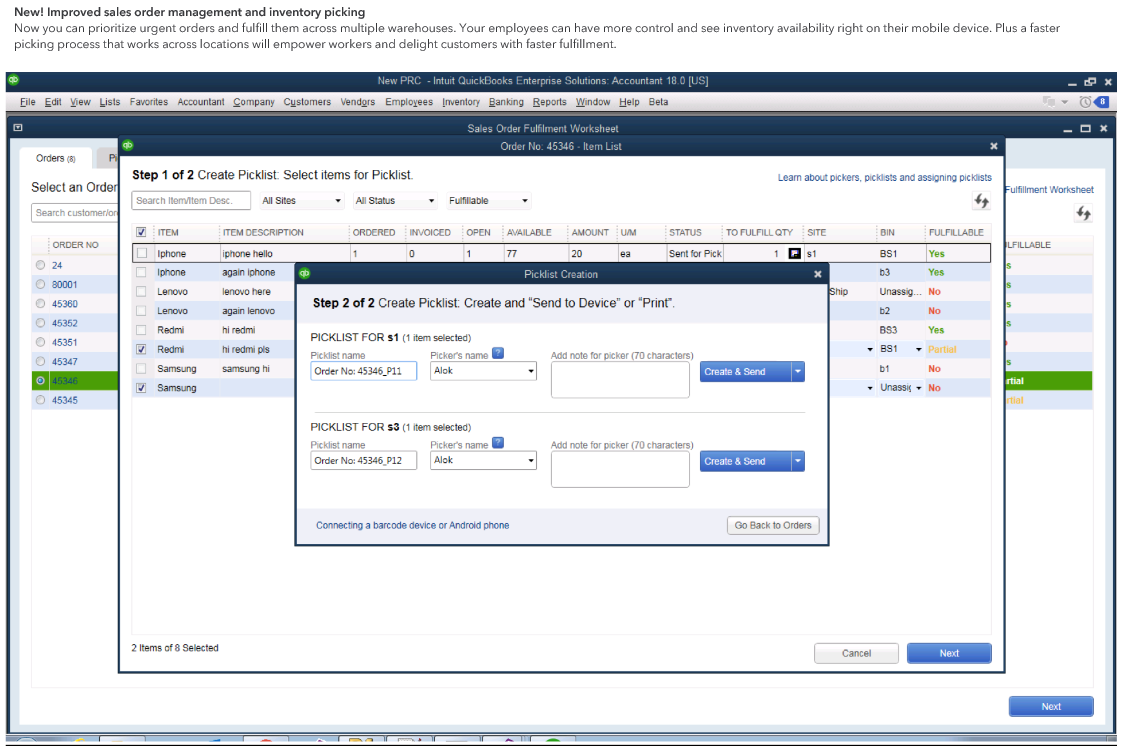

Sales order management in QuickBooks Desktop Enterprise ( Source )

Pricing: Enterprise is available as an annual subscription. Users can opt to pay their annual subscription in equal payments over 12 months. The annual subscription includes the cost for support, upgrades, and data backups.

Businesses can also pay an additional fee for the cloud hosting service . This allows access to Enterprise through a virtual desktop, which provides remote access and greater connectivity (users can connect to Enterprise anytime, anywhere, and on any device).

Enterprise is sold in three packages: Silver , Gold, and Platinum . Each Enterprise package includes the same capabilities as the Pro and Premier packages plus several others, including:

✔ Up to 14 predefined user roles (admin, accountant, etc.)

✔ Access multiple files simultaneously

✔ “Expanded list” allows businesses to track over 1 million employees, customers, vendors, and inventory items (Pro and Premier allow 14,500)

Features unique to the QuickBooks Enterprise packages:

QuickBooks Apps

Intuit has several branded applications designed to enhance the functionality of the above-mentioned platforms. Businesses can purchase these add-ons for an additional fee:

QuickBooks Payments: Available via mobile or as an extension to QuickBooks for desktop, this app allows businesses to email invoices and accept payments online via credit card or ACH transfers.

QuickBooks Point of Sale : A cloud-based point-of-sale (POS) system that allows businesses to ring up sales, accept credit cards, and keep track of inventory through a POS dashboard.

QuickBooks Payroll : Allows businesses to pay up to 50 employees by check or direct deposit. Available as a self-service or full-service solution, with the latter offering the ability to file year-end W-2 tax forms and automatically calculate federal, state, and local taxes.

Next steps: Finding the right solution for your business

QuickBooks has established itself as a major player in the small to midsize business accounting market . Whether you’re just starting out or you’re expanding and have more advanced accounting needs, QuickBooks has a solution designed to fit your business.

If you’re looking for more information about QuickBooks products or other leading accounting solutions, here’s what you can do next:

Read our product reviews . Browse through hundreds of accounting solutions with reviews from real, verified users. Find out how your peers have rated each platform’s customer support, ease of use, and more.

Take an online questionnaire . If you’re still not sure if QuickBooks is the right solution for you, answer a few questions online and we’ll provide you with a shortlist of vendors whose financial management solutions can help support and drive your business.

Talk to a software expert. If you still need help choosing a specific accounting system, we’re here to help. Our software advisors provide free, fast, and personalized software recommendations, helping companies of all sizes find products that meet their business needs. Schedule an appointment with an advisor here .

- Product Catalog

- Digital Assessment Tool

- Website Services

- Digital Marketing

- TechSoup Courses

- Consultant Connection

- Community Home

- Upcoming Events and Webinars

- Articles & How-Tos

- Events and Webinars Archive

- Impact Stories (495)

- Impact Stories Microsoft (352)

- Marketing and Communications (300)

- Tech Planning (193)

- Donor Management (141)

- Operations (139)

- IT Security (135)

- The Cloud (118)

- Web Development (118)

- TechSoup (114)

- Libraries (108)

- Social Media (101)

- Data Management (90)

- Education (75)

- Graphic Design (55)

- Hardware (49)

- Digital Divide (43)

- Grant Writing (39)

- Impact Stories Cisco (39)

- Accounting (35)

- The Future of Work (35)

- Impact Stories Intuit (34)

- Project Management (23)

- Impact Stories Symantec (22)

- Impact Stories Adobe (21)

- Event Planning (18)

- Disaster Preparedness (13)

- Impact Stories Veritas (13)

- E-Commerce (9)

- Impact Stories Autodesk (2)

- Impact Stories Box (2)

- Impact Stories ClickTime (2)

- Impact Stories NortonLifeLock (2)

- Impact Stories Shopify (2)

- Impact Stories Dell (1)

- Impact Stories Mailshell (1)

- Impact Stories ReadyTalk (1)

- Impact Stories Refurbished Computers (1)

- IT Security

- Donor Management

- Impact Stories

- Marketing and Communications

- Social Media

- Data Management

- The Future of Work

- Web Development

- Tech Planning

- Digital Divide

- Graphic Design

- Event Planning

- Grant Writing

- Project Management

- Disaster Preparedness

- Norton LifeLock

The QuickBooks Product Line Is Changing. Here's What You Need to Know.

2 minute read

If your organization relies on Intuit QuickBooks for its bookkeeping and accounting, we've got some news to share. In late November, Intuit announced that it would no longer offer a number of its QuickBooks Desktop software products to new subscribers.

This change will take place on July 31, 2024 , and it will affect these products:

- QuickBooks Desktop Pro Plus

- QuickBooks Desktop Premier Plus

- QuickBooks Desktop Mac Plus

- QuickBooks Desktop Enhanced Payroll

According to Intuit, the company is not discontinuing these products per se: It simply won't sell new subscriptions of these products to customers. In other words, if you already have subscriptions for any of these QuickBooks products, you will still be able to use them. You'll also be able to renew your existing subscriptions after July 31, 2024, according to the company.

What Does This Mean for the QuickBooks Subscription I Got Through TechSoup?

This upcoming change doesn't affect any of the Intuit QuickBooks products that TechSoup offers to nonprofits and libraries. TechSoup will continue to offer QuickBooks Online Plus and QuickBooks Online Advanced subscriptions to members like you.

Additionally, if you've requested a QuickBooks Desktop product in the past, you can still request QuickBooks Premier 2021 and QuickBooks for Mac through TechSoup. That said, we expect that Intuit will end support for the QuickBooks 2021 product line sometime in 2024 and QuickBooks for Mac in 2025.

The Future Is Clear — and It's in the Cloud

This change reinforces the fact that technology companies are increasingly focusing on cloud-based subscription services. These services, like QuickBooks Online, let you more easily access your data from anywhere and use software across multiple devices more readily.

In particular, QuickBooks Online comes with the ability to perform automatic online backups. You also get access to QuickBooks software that you can install onto your Mac or Windows PC, plus the QuickBooks Online mobile app for iOS and Android.

You do have to pay an ongoing subscription fee to use QuickBooks Online. But you will receive the latest version of QuickBooks Online for as long as you subscribe.

More Resources

To understand how QuickBooks and QuickBooks Online stack up against one another, see our comparison chart . Also, check out our Intuit for Nonprofits program : We offer QuickBooks Online subscriptions with admin fees that start at $75 per year.

Top photo: Shutterstock

Related Content

More TechSoup

- Our Mission

- TechSoup Global Network

- Meet Our Donor Partners

- Meet Our Funders

- Anti-Discrimination Policy

Get in Touch

- Donate and Invest

- Partner with TechSoup

- Digital Resilience Program

- Returns and Refunds

- Media and Press

Subscribe to Our Newsletters

Get technology news and updates on exciting new offers from TechSoup.

Copyright © 2024, TechSoup Global. All Rights Reserved.

- Privacy Policy

- Terms of Use

TechRepublic

Account information.

Share with Your Friends

Quicken vs. QuickBooks (2024): Accounting Software Comparison

Your email has been sent

Although Quicken and QuickBooks sound related, they’re entirely different small-business accounting platforms .

Quicken costs less but lacks power, but it’s undoubtedly better for beginners and simpler operations, though you’ll need a dedicated desktop computer for the task.

Meanwhile, QuickBooks Online is more advanced. It can stick with you through any stage of growth, and since it’s cloud-based, you can use it from any device. But it is more expensive and challenging to learn.

Let’s discover which accounting software brand is right for your business.

Quicken vs. QuickBooks Online: Comparison table

Quicken vs. quickbooks online: pricing.

If you’re worried about saving money, then Quicken is the better bet. It’s much more budget-friendly and boasts a simpler subscription scheme.

But if you’re willing to pay more for richer features, then QuickBooks Online wins.

Quicken’s pricing

- Simplifi : $3.99 per month, billed annually, for a total of $47.88 per year.

- Classic Deluxe : $5.99 per month, billed annually, for a total of $71.88 per year.

- Classic Premier : $7.99 per month, billed annually, for a total of $95.88 per year.

- Classic Business & Personal : $10.99 per month, billed annually, for a total of $131.88 per year.

There is no free trial available for any plan. But all offerings include a 30-day money-back guarantee if you’re unhappy.

QuickBooks Online’s pricing

- Simple Start : $30 per month.

- Essentials : $60 per month.

- Plus : $90 per month.

- Advanced : $200 per month.

Unlike Quicken, QuickBooks Online allows you to snag a month’s free trial on all options. Alternatively, you can get 50% off the first three months, but if you choose the price cut, you can’t get the free trial.

If your budget allows, you can also tack on Intuit’s other offerings, like TurboTax and QuickBooks Payroll. These robust additions make this title a better value in the long run if you have ambitious growth plans.

Quicken vs. QuickBooks Online: Feature comparison

Scalable setup.

Winner: QuickBooks Online

As mentioned above, QuickBooks Online is the clear winner for long-term scalability. Its tiered subscription plans provide tailored solutions for all stages of growth. You can start simple and later expand to the high-end Advanced plan. Compare this to Quicken’s singular Business & Personal version, which lacks this scalability.

Personal finance integration

Winner: Quicken

Quicken shines when it comes to integrating personal financial management with business accounting . Its platform naturally melds the two realms seamlessly under one roof. This all-in-one financial management approach is perfect for sole proprietors and freelancers who need to manage their personal and business expenses in tandem.

With its advanced invoicing features, QuickBooks Online stands out. Users can create custom, professional invoices, set up recurring billing and accept payments online. This comprehensive suite of invoicing and payment tools is ideal for businesses with complex billing needs or those looking to streamline their accounts receivable processes.

Investment tracking

Quicken is the go-to for comprehensive investment tracking. It offers detailed tools for monitoring stocks, certificates of deposit and real estate, among other financial vehicles. Perks include performance tracking, portfolio analysis and access to Morningstar research. Plus, landlords can track occupancy rates, maintenance requests and more from within the software.

User-friendly interface

Quicken wins in terms of user-friendliness. Its beautiful, simple interface is specially designed for individuals without a background in accounting. As a result, you can quickly get started with the title without worrying about jargon-filled complexities. This straightforward approach is particularly convenient if you have multiple people of various skill levels handling accounting.

QuickBooks Online excels in providing deep financial insights through its reporting and analytics. The platform generates boatloads of customizable reports that cover everything from basic profit and loss statements to complex cash flow forecasts. This breadth and depth of reporting capabilities make it invaluable for businesses that rely on data-driven decision-making.

Multiple users

QuickBooks Online also takes the lead in multi-user accessibility. It allows multiple users to use the software with different levels of permissions, facilitating collaboration among team members while ensuring data security. This feature is essential for businesses relying on several employees to tackle finances simultaneously.

Financial analysis

Winner: Tie

Both Quicken and QuickBooks Online offer comprehensive overviews of your financial situation. Quicken specializes in welding personal and business finances under one roof, which is ideal for sole proprietors and freelancers.

On the other hand, QuickBooks Online offers a more detailed business financial perspective. These richer analytics and enterprise-centric focus are great for serious entrepreneurs seeking ambitious growth.

Quicken pros and cons

- Combines personal and business finances seamlessly.

- Investment tracking tools included.

- Beginner-friendly.

- Limited scalability.

- Microsoft Windows-centric (limited Mac edition and no cloud-based option).

- Less customizability.

- Limited analytics.

QuickBooks Online pros and cons

- Strong scalability and broad features.

- Lots of integrations with Intuit and third-party software.

- Advanced analytics included.

- Steeper learning curve than Quicken.

- No desktop option (requires separate QuickBooks Desktop subscription).

Should your Organization use Quicken or QuickBooks Online?

Choose quicken if:.

- You manage personal and business finances together.

- You need detailed investment tracking.

- Ease of use is a priority.

- You have a tighter budget.

Choose QuickBooks Online if:

- Your business is growing (or plans to).

- You rely heavily on invoicing and billing.

- You need comprehensive reporting and analytics.

- Integration with other software is crucial.

- Collaboration with colleagues and others is key.

Methodology

We carefully evaluated each platform’s features, pricing, analytics and suitability for various business sizes. We also studied specific abilities such as financial tracking, invoicing, reporting and scalability. Finally, we analyzed honest customer feedback and investigated the overall value in the long term for both platforms, among other factors.

Subscribe to the Daily Tech Insider Newsletter

Stay up to date on the latest in technology with Daily Tech Insider. We bring you news on industry-leading companies, products, and people, as well as highlighted articles, downloads, and top resources. You’ll receive primers on hot tech topics that will help you stay ahead of the game. Delivered Weekdays

- 7 Best Accounting Software and Services

- Best Accounting Software for Small Businesses

- QuickBooks Online Review: Features, Pricing and More

- Quick Glossary: Accounting

- Best Software for Businesses and End Users

Create a TechRepublic Account

Get the web's best business technology news, tutorials, reviews, trends, and analysis—in your inbox. Let's start with the basics.

* - indicates required fields

Sign in to TechRepublic

Lost your password? Request a new password

Reset Password

Please enter your email adress. You will receive an email message with instructions on how to reset your password.

Check your email for a password reset link. If you didn't receive an email don't forgot to check your spam folder, otherwise contact support .

Welcome. Tell us a little bit about you.

This will help us provide you with customized content.

Want to receive more TechRepublic news?

You're all set.

Thanks for signing up! Keep an eye out for a confirmation email from our team. To ensure any newsletters you subscribed to hit your inbox, make sure to add [email protected] to your contacts list.

Please contact the site administrator

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

How to make intuit's discontinuation of quickbooks desktop smooth and seamless.

Qvinci can help you make the transition from QuickBooks Desktop to Online easy and affordable. We're your single-source provider of all Intuit products plus Qvinci's full suite of automated reporting (patented) and customizable business intelligence tools.

AUSTIN, Texas , May 10, 2024 /PRNewswire-PRWeb/ -- Intuit is discontinuing QuickBooks Desktop v21 on May 31, 2024 , and after July 31, 2024 , the only version of Desktop that will be available for purchase is Enterprise.

This includes all 2021 versions of QuickBooks Desktop:

QuickBooks Desktop Pro

QuickBooks Desktop Premier

QuickBooks Desktop for Mac

QuickBooks Enterprise Solutions

QuickBooks Premier Accountant (affected)

QuickBooks Enterprise Accountant (affected)

According to Intuit:

"Your access to QuickBooks Desktop Payroll, Desktop Payments, live technical support, Online Backup, Online Banking, and other services through QuickBooks Desktop 2021 software will be discontinued after May 31, 2024 . This also means you won't receive critical security updates protecting your data starting June 1, 2024 ."

Which means the QuickBooks Desktop Pro and Premier 2021 versions or older will be fully discontinued June 1, 2024 , and after August 1, 2024 , Enterprise will be the only version available for purchase.

( CLICK HERE TO LEARN MORE )

Services Affected by QuickBooks Desktop 2021 Discontinuation

Payroll Services

Credit Card Processing

Other Services

But there's great news.

Qvinci can help you make the transition from QuickBooks Desktop to Online easy and affordable.

We're your single-source provider of all Intuit products plus Qvinci's full suite of automated reporting (patented) and customizable business intelligence tools.

Just talk with one of our expert Solution Consultants and we'll get you set up with your favorite accounting software plus our industry-leading financial management solution that provides timely and reliable insights everyone can understand, make sense of, and act on.

If you need QuickBooks or any Intuit product, Qvinci has all the benefits of Intuit and Qvinci in one powerful single-sourced, cost-effective package.

About Qvinci

Qvinci is a cloud-based, patented solution that empowers franchises, multi-unit organizations, dioceses, non-profits, single SMBs, and their accountants and advisors to make better decisions, save time, and increase profitability and net assets by providing financial insights everyone understands, can make sense of, and act on. Qvinci automates the processes and workflows like the collection, consolidation, and mapping of data to a SCoA. Qvinci's color-coded and customizable KPIs and business intelligence track and predict trending, benchmarking, and KPIs, and forecast financial and cashflow positioning. Its Rockstar Customer Success team is always ready to provide personal help. Qvinci is easy to implement, simple to use, and provides immediate results. Qvinci is also an authorized QuickBooks Solution Provider trained to help migrate your businesses from QuickBooks Desktop to Online.

*Intuit and QuickBooks are registered trademarks of Intuit Inc. Used with permission under the QuickBooks Solution Provider Program.

Media Contact

Justin M. Clark , Qvinci Software, 1-844-422-5037, [email protected] , https://qvinci.com

View original content to download multimedia: https://www.prweb.com/releases/how-to-make-intuits-discontinuation-of-quickbooks-desktop-smooth-and-seamless-302141635.html

SOURCE Qvinci Software

- Remember me Not recommended on shared computers

Forgot your password?

- Business of Photography

How Do I Get QuickBooks Enterprise Help: [+1(844)-222-0805]

By Payal Rajput 21 minutes ago in Business of Photography

Recommended Posts

Payal rajput.

Navigating the world of QuickBooks Enterprise can sometimes feel like treading through a maze. But don't fret; help is at your fingertips. Whether you're struggling with technical issues, troubleshooting, or simply have a few questions about the software, QuickBooks Enterprise Support [+1(844)-222-0805] is there for you.

The support team is dedicated to providing solutions to your problems, answering your questions, and guiding you through any hurdles you might encounter. They're just a phone call away, “+1(844)-222-0805”, ready to assist you with any aspect of QuickBooks Enterprise.

So, let's dive into how you can access this valuable resource and get the support you need for a smooth and productive QuickBooks Enterprise experience. Stay tuned as we unravel the process and make your QuickBooks journey a breeze.

How can I get Quickbooks Enterprise help?

Getting QuickBooks Enterprise help couldn't be simpler. For all your technical questions or any other queries related to QuickBooks Enterprise, the first point of contact lies with the support team. The team, dedicated to serving your needs, operates round the clock and can be contacted through the QuickBooks Enterprise Support Number, 1(844) 222-0805.

Offering help for a range of issues, their expertise embodies everything from software installation and configuration to usage problems. Having a problem with the software? They've got it covered. Are you asking yourself how to navigate a specific feature? They've got answers. Facing an unexpected technical issue? They're standing by to troubleshoot swiftly and effectively. Alternatively, you can reach out directly to the QuickBooks support number at 1-844-INTUIT (**1(844)222-0805**) or (844)222-0805) (No Wait) for immediate help

If you're based in Canada, rest assured that comprehensive QuickBooks Enterprise Support is just a call away. Simply use the Toll-Free QuickBooks Enterprise Helpline Canada number, 1(844) 222-0805, to connect with the Canadian support team. No matter your location, QuickBooks Enterprise Support gives you peace of mind, delivers solutions, and consistently ensures that your software experience is as seamless as possible.

For impending urgency related to troubleshooting or any technical issues, QuickBooks Enterprise Phone Support is an available mitigator. By dialing (1-844-222-0805) a competent team member attends to your concerns with immediacy, dispatching technical problems, and ensuring your user experience remains uninterrupted.

Remember, every QuickBooks Enterprise user’s experience matters to the support team. They're not just there for major crises; they're available to help with minor ones too. So, before frustrations morph into significant disruptions, ensure to reach out to them.

In essence, Quickbooks Enterprise Support is instrumental in maintaining the functionality and productivity of your software, granting ease at every step of the way. For all your QuickBooks Enterprise related needs, simply and promptly dial (844) 222-0805.

Get More Out Of QuickBooks Enterprise

As a QuickBooks Enterprise user, there are several ways to maximize the functionality and efficiency of your software. From customizing a support plan tailored to your business to utilizing professional services to enhance your business processes, QuickBooks Enterprise ensures you have everything you need to manage financial transactions seamlessly.

QuickBooks Business Process

The backbone of any financial management system is an efficient business process. By understanding your system's unique requirements and how QuickBooks, along with other systems, can meet them, it's possible to create a process that enhances business operations and increases productivity. This involves analysis and careful workflow design, ensuring that every element interacts optimally with QuickBooks Enterprise.

Here's how you can elevate your QuickBooks Enterprise experience:

Workflow Design : This involves the creation of a strategic approach to how work moves through your system, ensuring a smooth financial management operation. This kind of structure allows QuickBooks Enterprise to integrate easily with other systems, making sure that you get the most value from your investment.

Inventory Cleanup : QuickBooks Enterprise also offers support for inventory cleanup. This feature is all about optimizing your inventory data for easy access and manipulation, giving you more control over your stock management.

Enhanced Features : QuickBooks Enterprise boasts comprehensive financial management features that can help you streamline your company's operations. The software's features extend beyond simple accounting functions; you can track sales, customers, and inventory; manage payroll; monitor expenses; create reports; and more.

Remember, QuickBooks certified ProAdvisors are available to help with any aspect of the software. This team of experts has a deep understanding of the software and how it applies to various industries. By engaging with these professionals, you can ensure that your QuickBooks Enterprise platform is tailor-fit for your business, providing the specific solutions you need. These trained advisors can help with the initial software setup, updating your software, to troubleshooting any issues you may encounter along the way.

QuickBooks Enterprises Support Resources

Navigating through technical roadblocks may sometimes require professional assistance. Have no doubt - QuickBooks Enterprise's dedicated support team stands ready to help at any given moment. To facilitate quick resolutions, there are two avenues of support you can utilize: call-back services and chatting with QuickBooks experts online. Let's dive into these processes in further detail.

How to Get a Call or Chat from Us

You're not alone in your quest to get the most out of QuickBooks Enterprise. QuickBooks provides a fast and convenient callback service that puts you in immediate contact with a professional. Here's your go-to guide for requesting a callback:

Launch QuickBooks.

Navigate to the 'Help' menu and select 'QuickBooks Desktop Help.'

Press the 'Contact Us' button.

State your issue in brief, then hit 'Continue.'

Proceed to log into your Intuit account and press 'Continue.'

If you don’t have an existing account, opt to create a new one.

You'll receive a unique, one-time code via email. Upon receiving it, enter this code and hit 'Continue.'

Finally, opt between 'chat with us' or 'Have us call you.'

It's as easy as that! Now, with a simple process followed, expert assistance is just a matter of moments away.

One important note: Phone support may be impacted due to high volume. If this happens, the 'chat with us' feature serves as an excellent alternative, offering you the opportunity to converse online with a QuickBooks expert. So, whether you prefer to talk or type, professional help is always within your reach.

Contact QuickBooks Desktop (Windows)

If technical glitches with QuickBooks Desktop Enterprise become a strain, relief comes in the form of professional support. Dial (844) 222-0805 to reach the QuickBooks Enterprise Support Team. Offering assistance on the spectrum of issues like installation errors, setup complications, or software configuration, their expertise proves invaluable.

Even if QuickBooks Desktop challenges your understanding, it's got your back. Calling (844) 222-0805 connects you to reliable individuals versed in QuickBooks Desktop usage. They aid in resolving any queries, making your experience with QuickBooks Enterprise seamless.

The QuickBooks Desktop Enterprise Support Team goes the extra mile. Whether it's a challenging question or a pesky problem related to Intuit QuickBooks Enterprise, dial 1(844)222-0805 to receive prompt help. They embody reliability, resolving issues or clearing doubts about Intuit QuickBooks Enterprise Support Number.

Seek answers to make QuickBooks Enterprise work better for you. Contact the support team at 1(844)222-0805 for insights into any feature, function or aspect of QuickBooks Enterprise. Experts are ready to address your concerns, enhancing your usage of this powerful financial software.

For technical challenges that stump even seasoned users, QuickBooks Enterprise phone support brings relief. Dial 1(844)222-0805 for expert advice on issues ranging from system compatibility to complex troubleshooting. Whether it's a software glitch or an operational query, this dedicated team facilitates a smooth QuickBooks experience.