- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

How to Write a Survey Report

Last Updated: February 16, 2024 Approved

This article was reviewed by Anne Schmidt . Anne Schmidt is a Chemistry Instructor in Wisconsin. Anne has been teaching high school chemistry for over 20 years and is passionate about providing accessible and educational chemistry content. She has over 9,000 subscribers to her educational chemistry YouTube channel. She has presented at the American Association of Chemistry Teachers (AATC) and was an Adjunct General Chemistry Instructor at Northeast Wisconsin Technical College. Anne was published in the Journal of Chemical Education as a Co-Author, has an article in ChemEdX, and has presented twice and was published with the AACT. Anne has a BS in Chemistry from the University of Wisconsin, Oshkosh, and an MA in Secondary Education and Teaching from Viterbo University. wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 403,874 times.

Once you have finished conducting a survey, all that is left to do is write the survey report. A survey report describes a survey, its results, and any patterns or trends found in the survey. Most survey reports follow a standard organization, broken up under certain headings. Each section has a specific purpose. Fill out each section correctly and proofread the paper to create a polished and professional report.

Writing the Summary and Background Info

- Table of Contents

- Executive Summary

- Background and Objectives

- Methodology

- Conclusion and Recommendations

- Methodology of the survey.

- Key results of the survey.

- Conclusions drawn from the results of the survey.

- Recommendations based on the results of the survey.

- Study or target population: Who is being studied? Do they belong to a certain age group, cultural group, religion, political belief, or other common practice?

- Variables of the study: What is the survey trying to study? Is the study looking for the association or relationship between two things?

- Purpose of the study: How will this information be used? What new information can this survey help us realize?

- Look for surveys done by researchers in peer-viewed academic journals. In addition to these, consult reports produced by similar companies, organizations, newspapers, or think tanks.

- Compare their results to yours. Do your results support or conflict with their claims? What new information does your report provide on the matter?

- Provide a description of the issue backed with peer-reviewed evidence. Define what it is you're trying to learn and explain why other studies haven't found this information.

Explaining the Method and Results

- Who did you ask? How can you define the gender, age, and other characteristics of these groups?

- Did you do the survey over email, telephone, website, or 1-on-1 interviews?

- Were participants randomly chosen or selected for a certain reason?

- How large was the sample size? In other words, how many people answered the results of the survey?

- Were participants offered anything in exchange for filling out the survey?

- For example, you might sum up the general theme of your questions by saying, "Participants were asked to answer questions about their daily routine and dietary practices."

- Don't put all of the questions in this section. Instead, include your questionnaire in the first appendix (Appendix A).

- If your survey interviewed people, choose a few relevant responses and type them up in this section. Refer the reader to the full questionnaire, which will be in the appendix.

- If your survey was broken up into multiple sections, report the results of each section separately, with a subheading for each section.

- Avoid making any claims about the results in this section. Just report the data, using statistics, sample answers, and quantitative data.

- Include graphs, charts, and other visual representations of your data in this section.

- For example, do people from a similar age group response to a certain question in a similar way?

- Look at questions that received the highest number of similar responses. This means that most people answer the question in similar ways. What do you think that means?

Analyzing Your Results

- Here you may break away from the objective tone of the rest of the paper. You might state if readers should be alarmed, concerned, or intrigued by something.

- For example, you might highlight how current policy is failing or state how the survey demonstrates that current practices are succeeding.

- More research needs to be done on this topic.

- Current guidelines or policy need to be changed.

- The company or institution needs to take action.

- Appendices are typically labeled with letters, such as Appendix A, Appendix B, Appendix C, and so on.

- You may refer to appendices throughout your paper. For example, you can say, “Refer to Appendix A for the questionnaire” or “Participants were asked 20 questions (Appendix A)”.

Polishing Your Report

- The table of contents should list the page numbers for each section (or heading) of the report.

- Typically, you will cite information using in-text parenthetical citations. Put the name of the author and other information, such as the page number or year of publication, in parentheses at the end of a sentence.

- Some professional organizations may have their own separate guidelines. Consult these for more information.

- If you don’t need a specific style, make sure that the formatting for the paper is consistent throughout. Use the same spacing, font, font size, and citations throughout the paper.

- Try not to editorialize the results as you report them. For example, don’t say, “The study shows an alarming trend of increasing drug use that must be stopped.” Instead, just say, “The results show an increase in drug use.”

- If you have a choice between a simple word and a complex word, choose the simpler term. For example, instead of “1 out of 10 civilians testify to imbibing alcoholic drinks thrice daily,” just say “1 out of 10 people report drinking alcohol 3 times a day.”

- Remove any unnecessary phrases or words. For example, instead of “In order to determine the frequency of the adoption of dogs,” just say “To determine the frequency of dog adoption.”

- Make sure you have page numbers on the bottom of the page. Check that the table of contents contains the right page numbers.

- Remember, spell check on word processors doesn’t always catch every mistake. Ask someone else to proofread for you to help you catch errors.

Survey Report Template

Community Q&A

- Always represent the data accurately in your report. Do not lie or misrepresent information. Thanks Helpful 0 Not Helpful 0

You Might Also Like

- ↑ https://survey.umn.edu/best-practices/survey-analysis-reporting-your-findings

- ↑ https://www.poynter.org/news/beware-sloppiness-when-reporting-surveys

- ↑ https://ctb.ku.edu/en/table-of-contents/assessment/assessing-community-needs-and-resources/conduct-surveys/main

About This Article

To write a survey report, you’ll need to include an executive summary, your background and objectives, the methodology, results, and a conclusion with recommendations. In the executive summary, write out the main points of your report in a brief 1-2 page explanation. After the summary, state the objective of the summary, or why the survey was conducted. You should also include the hypothesis and goals of the survey. Once you’ve written this, provide some background information, such as similar studies that have been conducted, that add to your research. Then, explain how your study was conducted in the methodology section. Make sure to include the size of your sample and what your survey contained. Finally, include the results of your study and what implications they present. To learn how to polish your report with a title page and table of contents, read on! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Vickey Zhao

Nov 21, 2021

Did this article help you?

Fotima Mamatkulova

Jan 4, 2021

Jul 15, 2019

Geraldine Robertson

Dec 4, 2018

Moniba Fatima

Oct 1, 2019

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Level up your tech skills and stay ahead of the curve

How to make a survey report: A guide to analyzing and detailing insights

- March 8, 2024

The survey report: Meaning and importance

Survey findings, analysis and interpretation, recommendations, use clear and accessible language, structure a report for clarity, provide context, include visual aids, cite sources, proofread and edit, introduction, create a survey with surveyplanet.

In today’s data-driven world, surveys are indispensable tools for gathering valuable intelligence and making informed decisions. Whether conducting market research, gauging customer satisfaction, or gathering employee feedback, the key to unlocking a survey’s true potential lies in the subsequent analysis and reporting of the collected data.

Whether you’re new to surveys or a seasoned researcher, mastering analysis and reporting is essential. To unlock the full potential of surveys one must learn how to make a survey report.

Before diving into the process, let’s clarify what a survey report is and why it’s crucial. It is a structured document that presents the findings, analysis, and conclusions derived from survey data. It serves as a means to communicate the insights obtained from the survey to stakeholders, enabling them to make informed decisions.

The importance of a survey report cannot be overstated. It provides a comprehensive overview of collected data, allowing stakeholders to gain a deeper understanding of the subject matter. Additionally, it serves as a reference point for future decision-making and strategy development, ensuring that actions are based on sound evidence rather than assumptions.

Key components of a survey report

Start a survey report with a brief overview of the purpose of the survey, its objectives, and the methodology used for data collection. This sets the context for the rest of the report and helps readers understand the scope of the survey.

The introduction serves as the roadmap that guides readers through the document and provides essential background information. It should answer questions such as why the survey was conducted, who the target audience was, and how the data was collected . By setting clear expectations upfront, the groundwork is laid for a coherent and compelling report.

Present the key findings of the survey in a clear and organized manner. Use charts, graphs, and tables to visualize the data effectively. Ensure that the findings are presented in a logical sequence, making it easy for readers to follow the narrative.

The survey findings section is the heart of the report, where the raw data collected during the survey is presented. It’s essential to organize the findings in a way that is easy to understand and digest. Visual aids such as charts, graphs, and tables can help illustrate trends and patterns in the data, making it easier for readers to grasp the key insights.

Dive deeper into the survey data by analyzing trends, patterns, and correlations. Provide insights into what the data means and why certain trends may be occurring. The findings must be interpreted in the context of the survey’s objectives and any relevant background information.

Analysis and interpretation are where the real value of the survey report lies. This is where surface-level findings are moved beyond to uncover the underlying meaning behind the data. By digging deeper to provide meaningful insights, stakeholders gain a deeper understanding of the issues at hand and identify potential opportunities for action.

Based on the analysis, offer actionable recommendations or suggestions that address the issues identified in the survey. These recommendations should be practical, feasible, and tied directly to the survey findings.

The recommendations section is where insights are translated into action. It’s not enough to simply present the findings—clear guidance on what steps should be taken next must be provided. Recommendations should be specific, actionable, and backed by evidence from the survey data. Such practical guidance empowers stakeholders to make informed decisions that drive positive change.

Don’t forget to summarize the key findings, insights, and recommendations presented in the report. Reinforce the importance of the survey results and emphasize how they can be used to drive decision-making.

The conclusion serves as a final wrap-up, summarizing the key takeaways and reinforcing the importance of the findings. It’s an opportunity to remind stakeholders of the survey’s value and how the results can be used to inform decision-making and drive positive change. By ending on a strong note, readers have a clear understanding of the significance of the survey and the actions that need to be taken moving forward.

Best practices for survey report writing

In addition to understanding the key components of a survey report, it’s essential to follow best practices when writing and presenting findings. Here are some tips to ensure that a survey report is clear, concise, and impactful.

Avoid technical jargon or overly complex language that may confuse readers. Instead, use clear and straightforward wording that is easily understood by the target audience.

Organize a survey report into clearly defined sections:

- Conclusion.

This helps readers navigate the document and find needed information quickly.

Always provide the background of findings by explaining the significance of the survey objectives and how the data relates to the broader goals of the organization or project.

Charts, graphs, and tables can help illustrate key findings and trends in the data. Use them sparingly and ensure they are properly labeled and explained in the text.

When referencing external sources or previous research, be sure to cite them properly. This adds credibility to the findings and allows readers to explore the topic further if they wish.

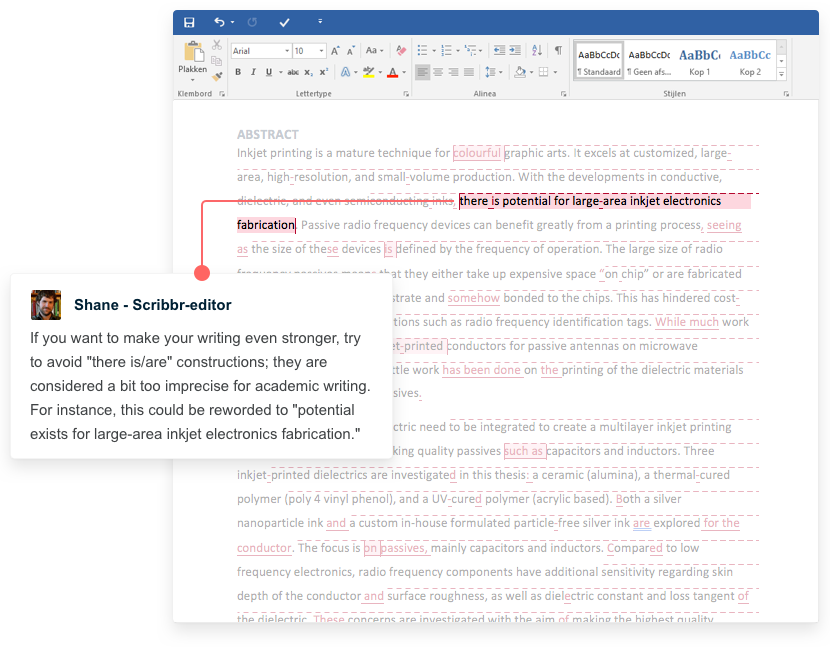

Before finalizing a survey report, take the time to proofread and edit it for grammar, spelling, and formatting errors. A polished and professional-looking report reflects positively on your work and enhances its credibility.

By following these best practices, it is ensured that a survey report effectively communicates findings and insights to stakeholders, empowering them to make informed decisions based on the data collected.

Short survey report example

To illustrate the process, let’s consider a hypothetical short survey report example:

The purpose of this survey was to gather feedback from customers regarding their satisfaction with our products and services. The survey was conducted online and received responses from 300 participants over a two-week period.

- 85% of respondents reported being satisfied with the quality of our products.

- 70% indicated that they found our customer service to be responsive and helpful.

- The majority of respondents cited price as the primary factor influencing their purchasing decisions.

The high satisfaction ratings suggest that our products meet the expectations of our customers. However, the feedback regarding pricing indicates a potential area for improvement. By analyzing the data further, we can identify opportunities to adjust pricing strategies or offer discounts to better meet customer needs.

Based on the survey findings, we recommend conducting further market research to better understand pricing dynamics and competitive positioning. Additionally, we propose exploring initiatives to enhance the overall value proposition for our products and services.

The survey results provide valuable insights into customer perceptions and preferences. By acting on these findings, we can strengthen our competitive position and drive greater customer satisfaction and loyalty .

Creating a survey report involves more than just presenting data; it requires careful analysis, interpretation, and meaningful recommendations. By following the steps outlined in this guide and utilizing the survey report example like the one provided, you can effectively communicate survey findings and empower decision-makers to take action based on valuable insights.

Ready to turn survey insights into actionable results? Try SurveyPlanet, our powerful survey tool designed to streamline survey creation, data collection, and analysis. Sign up now for a free trial and experience the ease and efficiency of gathering valuable feedback with SurveyPlanet. Your journey to informed decision-making starts here!

Photo by Kaleidico on Unsplash

How to Create a Survey Results Report (+7 Examples to Steal)

Do you need to write a survey results report?

A great report will increase the impact of your survey results and encourage more readers to engage with the content.

Create Your Survey Now

In This Article

1. Use Data Visualization

2. write the key facts first, 3. write a short survey summary, 4. explain the motivation for your survey, 5. put survey statistics in context, 6. tell the reader what the outcome should be, 7. export your survey results in other formats, bonus tip: export data for survey analysis, faqs on writing survey summaries, how to write a survey results report.

Let’s walk through some tricks and techniques with real examples.

The most important thing about a survey report is that it allows readers to make sense of data. Visualizations are a key component of any survey summary.

Examples of Survey Visualizations

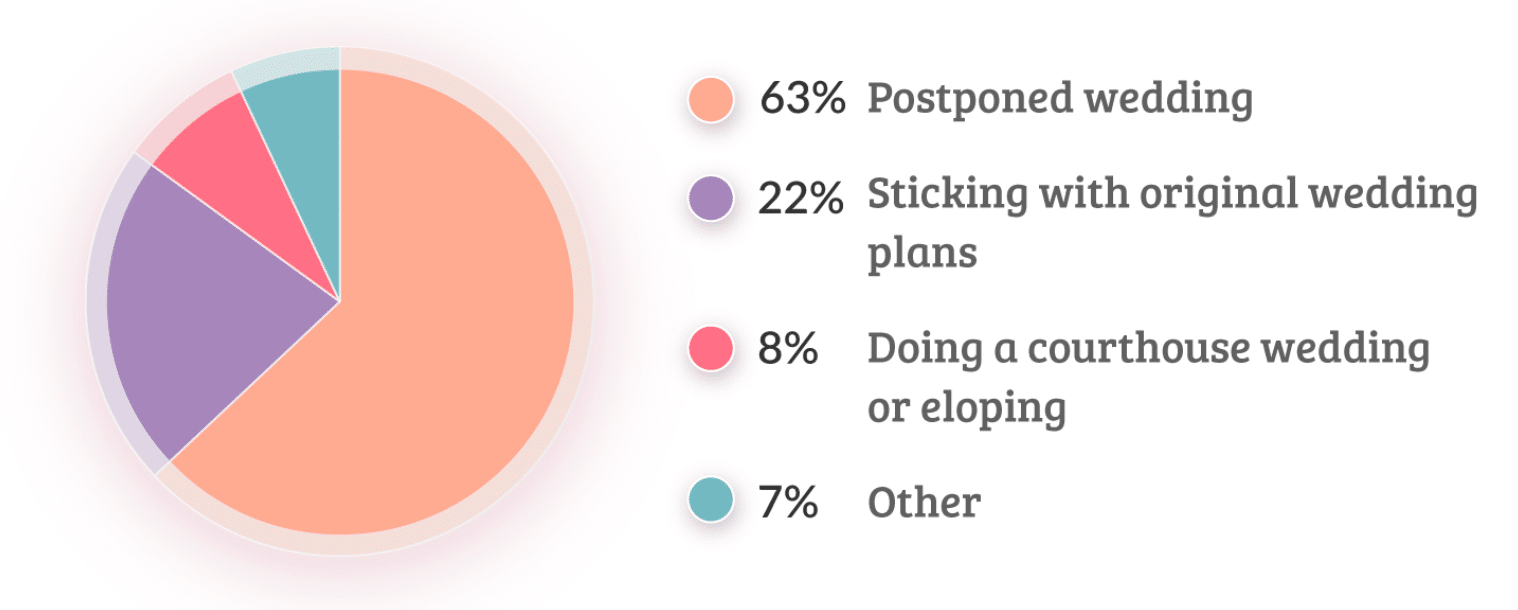

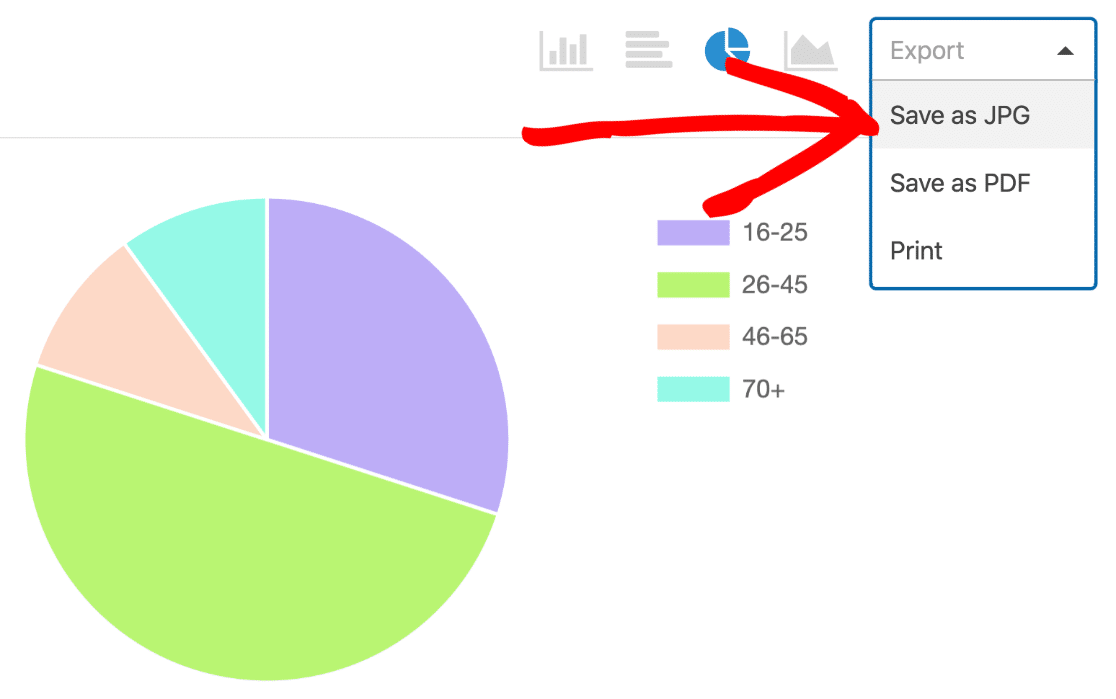

Pie charts are perfect when you want to bring statistics to life. Here’s a great example from a wedding survey:

Pie charts can be simple and still get the message across. A well-designed chart will also add impact and reinforce the story you want to tell.

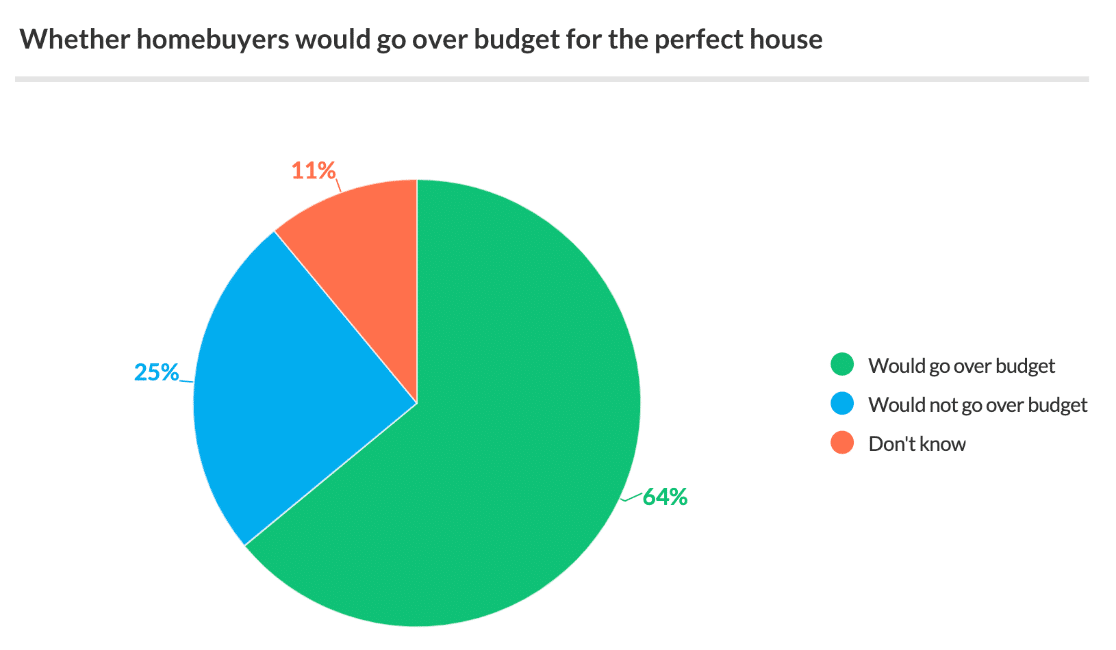

Here’s another great example from a homebuyer survey introduction:

If your survey is made up of open-ended questions, it might be more challenging to produce charts. If that’s the case, you can write up your findings instead. We’ll look at that next.

When you’re thinking about how to write a summary of survey results, remember that the introduction needs to get the reader’s attention.

Focusing on key facts helps you to do that right at the start.

This is why it’s usually best to write the survey introduction at the end once the rest of the survey report has been compiled. That way, you know what the big takeaways are.

This is an easy and powerful way to write a survey introduction that encourages the reader to investigate.

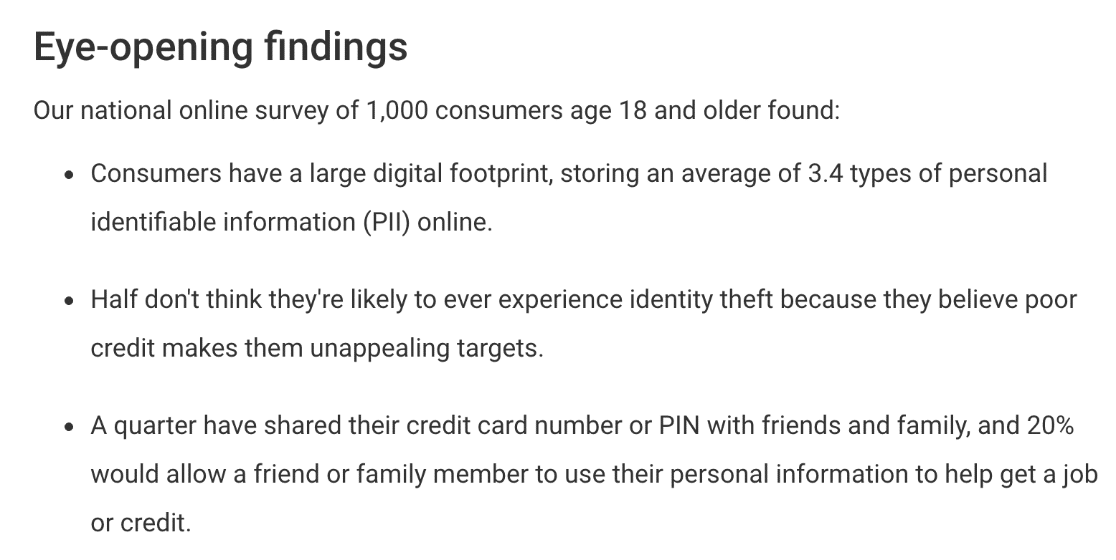

Examples of Survey Summaries With Key Facts

Here’s an awesome example of a survey summary that immediately draws the eye.

The key finding is presented first, and then we see a fact about half the group immediately after:

Using this order lets us see the impactful survey responses right up top.

If you need help deciding which questions to ask in your survey, check out this article on the best survey questions to include.

Your survey summary should give the reader a complete overview of the content. But you don’t want to take up too much space.

Survey summaries are sometimes called executive summaries because they’re designed to be quickly digested by decision-makers.

You’ll want to filter out the less important findings and focus on what matters. A 1-page summary is enough to get this information across. You might want to leave space for a table of contents on this page too.

Examples of Short Survey Introductions

One way to keep a survey summary short is to use a teaser at the start.

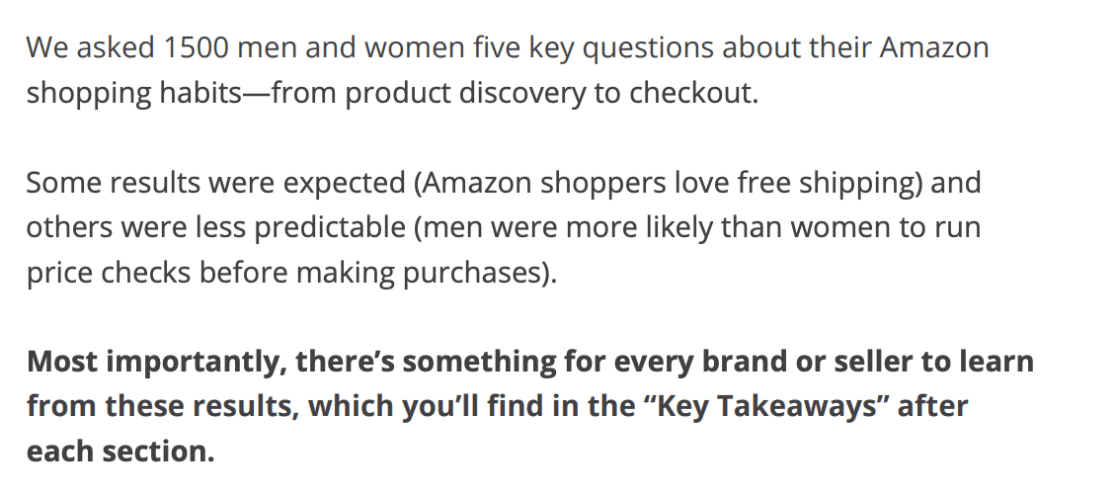

Here’s an example introduction that doesn’t state all of its findings but gives us the incentive to keep reading:

And here’s a great survey introduction that summarizes the findings in just one sentence:

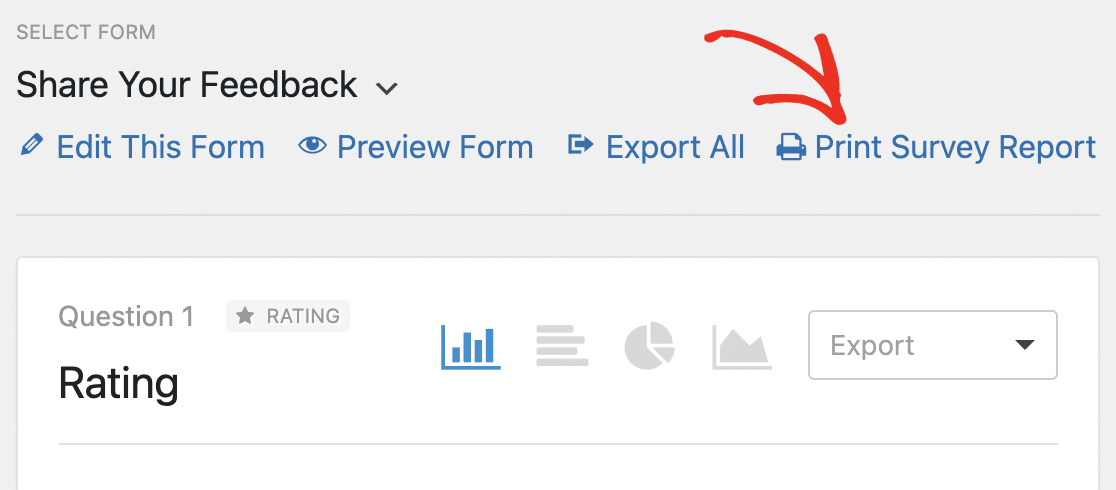

In WPForms, you can reduce the size of your survey report by excluding questions you don’t need. We decided to remove this question from the report PDF because it has no answers. Just click the arrow at the top, and it won’t appear in the final printout:

This is a great way to quickly build a PDF summary of your survey that only includes the most important questions. You can also briefly explain your methodology.

When you create a survey in WordPress, you probably have a good idea of your reasons for doing so.

Make your purpose clear in the intro. For example, if you’re running a demographic survey , you might want to clarify that you’ll use this information to target your audience more effectively.

The reader must know exactly what you want to find out. Ideally, you should also explain why you wanted to create the survey in the first place. This can help you to reach the correct target audience for your survey.

Examples of Intros that Explain Motivation

This vehicle survey was carried out to help with future planning, so the introduction makes the purpose clear to the reader:

Having focused questions can help to give your survey a clear purpose. We have some questionnaire examples and templates that can help with that.

Explaining why you ran the survey helps to give context, which we’ll talk about more next.

Including numbers in a survey summary is important. But your survey summary should tell a story too.

Adding numbers to your introduction will help draw the eye, but you’ll also want to explain what the numbers tell you.

Otherwise, you’ll have a list of statistics that don’t mean much to the reader.

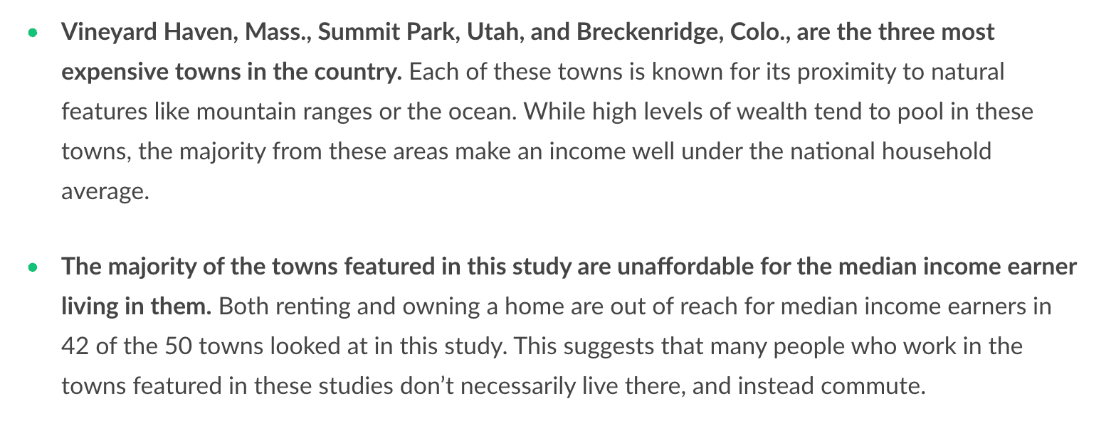

Examples of Survey Statistics in Context

Here’s a great example of a survey introduction that uses the results from the survey to tell a story.

Another way to put numbers in context is to present the results visually.

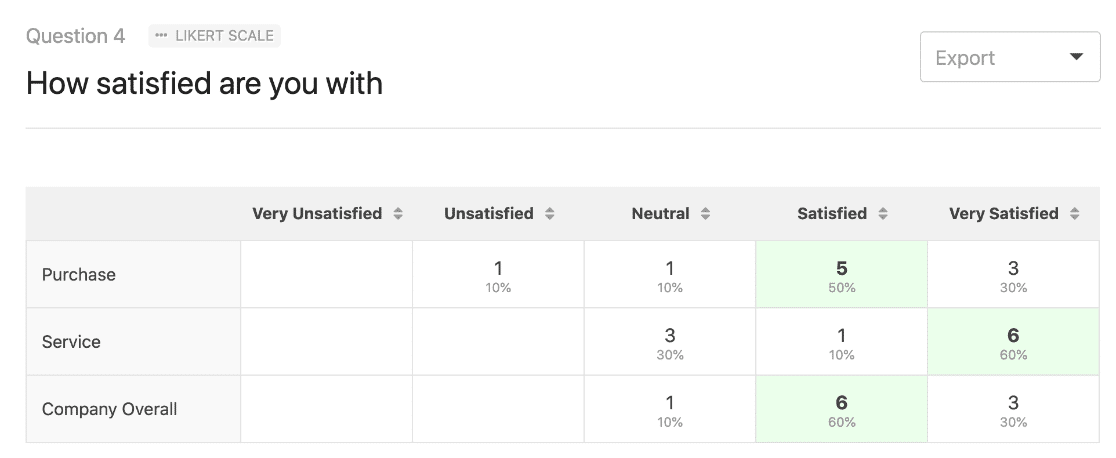

Here, WPForms has automatically created a table from our Likert Scale question that makes it easy to see a positive trend in the survey data:

If you’d like to use a Likert scale to produce a chart like this, check out this article on the best Likert scale questions for survey forms .

Now that your survey report is done, you’ll likely want action to be taken based on your findings.

That’s why it’s a good idea to make a recommendation.

If you already explained your reasons for creating the survey, you can naturally add a few sentences on the outcomes you want to see.

Examples of Survey Introductions with Recommendations

Here’s a nice example of a survey introduction that clearly states the outcomes that the organization would like to happen now that the survey is published:

This helps to focus the reader on the content and helps them to understand why the survey is important. Respondents are more likely to give honest answers if they believe that a positive outcome will come from the survey.

You can also cite related research here to give your reasoning more weight.

You can easily create pie charts in the WPForms Surveys and Polls addon. It allows you to change the way your charts look without being overwhelmed by design options.

This handy feature will save tons of time when you’re composing your survey results.

Once you have your charts, exporting them allows you to use them in other ways. You may want to embed them in marketing materials like:

- Presentation slides

- Infographics

- Press releases

WPForms makes it easy to export any graphic from your survey results so you can use it on your website or in slides.

Just use the dropdown to export your survey pie chart as a JPG or PDF:

And that’s it! You now know how to create an impactful summary of survey results and add these to your marketing material or reports.

WPForms is the best form builder plugin for WordPress. As well as having the best survey tools, it also has the best data export options.

Often, you’ll want to export form entries to analyze them in other tools. You can do exactly the same thing with your survey data.

For example, you can:

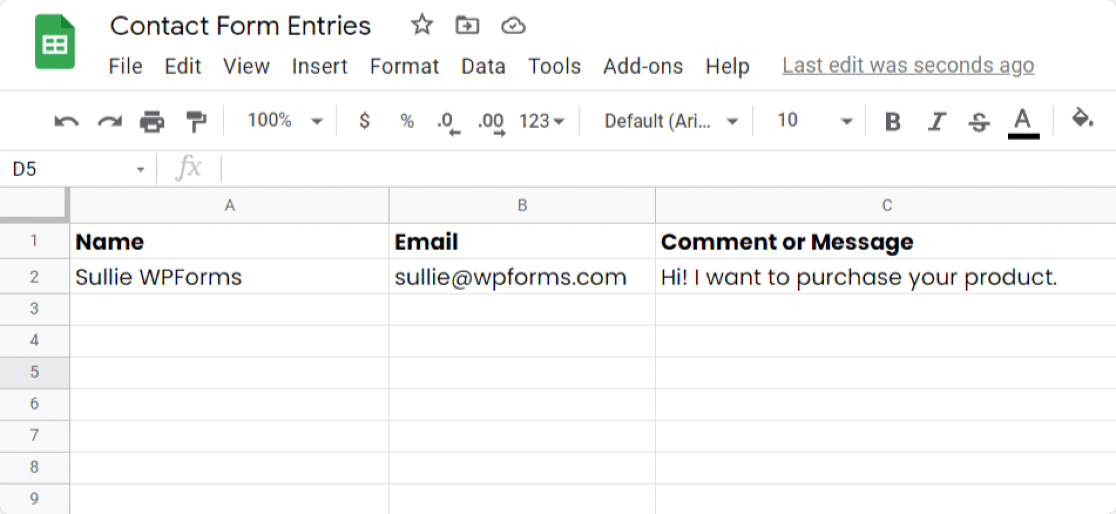

- Export your form entries or survey data to Excel

- Automatically send survey responses to a Google Sheet

We really like the Google Sheets addon in WPForms because it sends your entries to a Google Sheet as soon as they’re submitted. And you can connect any form or survey to a Sheet without writing any code.

The Google Sheets integration is powerful enough to send all of your metrics. You can add columns to your Sheet and map the data points right from your WordPress form.

This is an ideal solution if you want to give someone else access to your survey data so they can crunch the numbers in spreadsheet format.

We’ll finish up with a few questions we’ve been asked about survey reporting.

What Is a Survey Report and What Should It Include?

A survey report compiles all data collected during a survey and presents it objectively. The report often summarizes pages of data from all responses received and makes it easier for the audience to process and digest.

How Do You Present Survey Results in an Impactful Way?

The best way to present survey results is to use visualizations. Charts, graphs, and infographics will make your survey outcomes easier to interpret.

For online surveys, WPForms has an awesome Surveys and Polls addon that makes it easy to publish many types of surveys and collect data using special survey fields:

- Likert Scale (sometimes called a matrix question )

- Net Promoter Score (sometimes called an NPS Survey)

- Star Rating

- Single Line Text

- Multiple Choice (sometimes called radio buttons )

You can turn on survey reporting at any time, even if the form expiry date has passed.

To present your results, create a beautiful PDF by clicking Print Survey Report right from the WordPress dashboard:

Next Step: Make Your Survey Form

To create a great survey summary, you’ll want to start out with a great survey form. Check out this article on how to create a survey form online to learn how to create and customize your surveys in WordPress.

You can also:

- Learn how to create a popup WordPress survey

- Read some rating scale question examples

- Get started easily with a customer survey template from the WPForms template library.

Ready to build your survey? Get started today with the easiest WordPress form builder plugin. WPForms Pro includes free survey form templates and offers a 14-day money-back guarantee.

If this article helped you out, please follow us on Facebook and Twitter for more free WordPress tutorials and guides.

Using WordPress and want to get WPForms for free?

Enter the URL to your WordPress website to install.

This is really good

Hi Jocasta! Glad to hear that you enjoyed our article! Please check back often as we’re always adding new content as well as updating old ones!

Hi, I need to write an opinion poll report would you help with a sample I could use

Hi Thuku, I’m sorry but we don’t have any such examples available as it’s a bit outside our purview. A quick Google search does show some sites with information and examples regarding this though. I hope that helps!

With the Likert Scale what visualisation options are available? For example if there were 30 questions… I would like to be able to total up for all questions how many said never, or often… etc… and for each ‘x’ option for example if it was chocolate bars down the side and never through to often across the top… for each question… I would like to total for all questions for each chocolate bar… the totals of never through to often…? can you help?

Hey Nigel- to achieve what you’ve mentioned, I’d recommend you to make use of the Survey and Poll addon that has the ability to display the number of polls count. Here is a complete guide on this addon

If you’ve any questions, please get in touch with the support team and we’d be happy to assist you further!

Thanks, and have a good one 🙂

I am looking for someone to roll-up survey responses and prepare presentations/graphs. I have 58 responses. Does this company offer this as an option? If so, what are the cost?

Hi Ivory! I apologize for any misunderstanding, but we do not provide such services.

Hi! Can you make survey report.

Hi Umay! I apologize as I’m not entirely certain about your question, or what you’re looking to do. In case it helps though, our Survey and Polls addon does have some features to generate survey reports. You can find out more about that in this article .

I hope this helps to clarify 🙂 If you have any further questions about this, please contact us if you have an active subscription. If you do not, don’t hesitate to drop us some questions in our support forums .

Super helpful..

Hi Shaz! We’re glad to hear that you found this article helpful. Please check back often as we’re always adding new content and making updates to old ones 🙂

Hi , can you help meon how to present the questionnaire answer on my report writing

Hi Elida – Yes, we will be happy to help!

If you have a WPForms license, you have access to our email support, so please submit a support ticket . Otherwise, we provide limited complimentary support in the WPForms Lite WordPress.org support forum .

Add a Comment Cancel reply

We're glad you have chosen to leave a comment. Please keep in mind that all comments are moderated according to our privacy policy , and all links are nofollow. Do NOT use keywords in the name field. Let's have a personal and meaningful conversation.

Your Comment

Your Real Name

Your Email Address

Save my name, email, and website in this browser for the next time I comment.

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Add Your Comment

- Testimonials

- FTC Disclosure

- Online Form Builder

- Conditional Logic

- Conversational Forms

- Form Landing Pages

- Entry Management

- Form Abandonment

- Form Notifications

- Form Templates

- File Uploads

- Calculation Forms

- Geolocation Forms

- Multi-Page Forms

- Newsletter Forms

- Payment Forms

- Post Submissions

- Signature Forms

- Spam Protection

- Surveys and Polls

- User Registration

- HubSpot Forms

- Mailchimp Forms

- Brevo Forms

- Salesforce Forms

- Authorize.Net

- PayPal Forms

- Square Forms

- Stripe Forms

- Documentation

- Plans & Pricing

- WordPress Hosting

- Start a Blog

- Make a Website

- Learn WordPress

- WordPress Forms for Nonprofits

- Student Program

- Sign Up for Free

How to Create a Survey

How to write a survey report

Tips for an effective survey report.

- Start with an introduction

- Use visualizations

- Focus on key facts first

- Categorize results

- Summarize your findings

- Integrate company branding

Conducting a survey is a great way to gather insights from your target demographic. But you’ll limit the effectiveness of the results if you don’t have the right strategy to analyze and report the information.

Once you’ve published and collected data from an online survey, it’s time to analyze the information and format it in a presentable way. Let’s dive into the ins and outs of how to write a survey report.

Survey report basics

You conduct research because you want to answer a question. Do your customers like your product? Why or why not? Did your customers get good service from the support team? If not, how could you improve? One way to find out is to conduct a survey.

The survey report presents the results of the survey objectively, summarizing the responses. Most survey reports show the results in visually appealing ways by including graphs and charts.

It’s important to make the report easy to follow — for example, creating different sections for various survey question categories and using headings and subheadings to call out those categories. Your survey report should be interesting, but always focus on summarizing the information accurately.

Create and share customizable surveys with Jotform.

Survey administration and data collection

Before drafting a survey, consider what you want to achieve, then shape the questions to gather the kind of information that will help you reach those goals. You’ll likely want to include two types of questions :

- Quantitative. These are questions that yield a numerical response. Some of the most common quantitative questions ask respondents how satisfied they are with a product or service or how likely they would be to recommend a service to someone else. Respondents then have a scale of numbers to choose from. This numerical data can measure variables, and the results fit easily into graphs and charts.

- Qualitative. These questions gather more details from respondents about their experiences and opinions. As an example, if you were an online retailer, you might ask respondents to describe how you could improve their shopping experience.

Quantitative results are a little easier to present in a report because the numbers can quickly translate into easy-to-understand graphics. When you include qualitative questions, you’ll need to analyze and interpret the responses in text to share the results effectively with others.

Here are a few best practices for creating a quality survey report:

- Start with an introduction. Set the tone by explaining the purpose of the survey. Provide context for the information you’re presenting.

- Use visualizations. Images and graphs are an effective way to tell a story. Keep it interesting with different visuals, such as pie charts, bar graphs, and other formats. But make sure to use the type of visual that best demonstrates the results.

- Focus on key facts first. What are the most critical data points you want to share? Include those at the beginning of the survey report.

- Categorize results. Group similar data together to show relationships. Consider using headings and subheadings to break up the information.

- Summarize your findings. At the end of the survey report, give the reader an overview of the information. Include takeaways that you can use to make improvements.

- Integrate company branding. Look for ways to infuse your brand in the survey report — at minimum, make sure you include your logo at the top of the document and a footer with your company’s information. And don’t forget to select presentation colors that align with your branding guidelines.

The aesthetics of your report matter. Even the smallest details can communicate volumes about your organization. So make sure the survey report is professional and concise while sharing accurate information.

Sharable survey reports

Now that you’ve created your survey report, how will you share it with others ? Here are a few options to consider:

- Send a URL to a cloud-based report

- Embed the report on a website

- Download the report to distribute as a PDF

- Print a copy of the report for in-person meetings

You may also want to use multiple report-sharing features to accommodate the varying needs of your audience.

Built-in reporting features

If you don’t want to write a survey report from scratch, don’t worry! The simplest solution is to use a survey tool with built-in reporting features. You can pair a Jotform survey template with the Jotform Report Builder to visualize and present data in just a few clicks.

Jotform Report Builder makes it easy to convert collected survey data into beautiful visuals and charts. You can use auto-generated reports , but you also have the ability to customize the report layout to match the unique needs of your organization. You can share these survey reports in seconds, and they are updated automatically whenever new responses are submitted.

Student Survey Example Report

Additionally, the Report Builder allows you to filter the data in many ways, which is a huge help when it comes to analyzing the information you’ve collected. You can use these powerful insights to improve your business and meet the needs of your customers more effectively.

Thank you for helping improve the Jotform Blog. 🎉

- Data Collection

- Data Collection Tools

- Form Templates

- Jotform Report Builder

- Report Builder

RECOMMENDED ARTICLES

Multiple-choice survey questions: Examples and tips

SurveyMonkey vs SurveySparrow

15 of the best Refiner.io alternatives in 2024

How to create an NPS® survey email that gets results

Top 14 demographic survey questions to ask

How to make Google Forms anonymous

Ordinal Scale Questions: Definition and Examples

5 tips for creating great qualitative surveys

Qualtrics vs SurveyMonkey: Which should you choose?

14 best SurveyMonkey alternatives in 2024

Top 3 SurveySparrow alternatives in 2024

How is public opinion measured with surveys?

How to send Mailchimp surveys easily

25 post-training survey questions to ask employees

How to write a survey reminder email

The 3 best Checkbox Survey alternatives

Basic product survey questions to ask customers

14 political survey questions to gauge public opinion

Top 6 advantages of open-ended questions

Survey report examples with informative visuals

11 top survey incentive ideas

How to close a survey on SurveyMonkey

What are ambiguous survey questions, and how do you avoid asking them?

10 questions to ask in your membership survey

47 excellent customer service survey questions

The 5 most powerful Bucket.io alternatives for 2024

How to embed a survey in an email

Top diversity and inclusion questions to ask employees

How to embed a survey in a website

How to set up and send a Constant Contact survey

21 website usability survey questions to ask your user

Top 8 QuestionPro alternatives in 2024

Closed-ended questions: Definition and examples

28 examples of leading questions to avoid in surveys

Survey vs questionnaire: Which one should you use for your next project?

How to add a signature in SurveyMonkey

Creating a fun survey: Topics and best practices

How to turn survey results into a great presentation

How to conduct a pricing survey: Questions to ask

20 religion survey questions to ask your church community

4 types of survey questions to engage your audience

Top survey questions to ask kids

What you need to know about SurveyMonkey pricing

80 survey question examples and when to use them

5 UX survey tools to help you create a winning user experience

Top 20 team collaboration survey questions

9 examples of ranking survey questions

Survey data collection: 5 best practices

How to ask someone to take a survey via email

Top 3 Key Survey alternatives in 2024

How to create a survey in Google Forms

8 of the best WordPress survey plug-ins

10 of the best StrawPoll alternatives

Social media survey questions: Examples and best practices

CRM survey benefits, best practices, and example questions

How to measure customer experience: Key metrics and KPIs

Webinar: How to use surveys and email marketing to gain key insights

How to create an inviting welcome screen for online forms

Top 15 employee pulse survey tools

Top 21 brand survey questions

How to create an anonymous survey for employees

4 tips for creating effective quantitative surveys

Types of survey bias and ways to avoid them

Using survey logic to elicit better survey responses

How to write a research question

10 AidaForm alternatives that make data collection a breeze in 2024

Top podcast survey questions to ask guests and listeners

50 mental health survey questions to ask employees

SurveyMonkey vs Alchemer (Formerly SurveyGizmo)

How to get the most out of Peakon surveys

Top 7 KwikSurveys alternatives in 2024

How to send a survey to your email list on AWeber

Top 5 Qualtrics alternatives for 2024

What is a good survey response rate?

What are the best website survey questions?

The 28 best post-purchase survey questions to ask your customers

A Guide to Creating the Perfect Survey Form

65+ e-commerce survey questions for valuable business insights

6 best survey tools for research

16 best survey tools worth checking out

20 business survey questions to ask your customers

One question at a time: The best strategy for a survey

20 essential human resources (HR) survey questions

How to write a survey introduction (plus examples)

30 insightful hotel survey questions

5 ways to improve your online surveys

Top survey topics and ideas

How to calculate the Net Promoter Score® (NPS®)

20 pre-training survey questions for a professional development course

How to use a survey dashboard effectively

The best newsletter survey questions to ask

The leadership survey questions every company should ask

How to analyze survey data

Announcing Jotform’s free Student Survey Program

How to create a survey on Facebook

How to create an employee pulse survey

Peakon alternatives in 2024

How to send surveys: 7 survey distribution methods

SurveyLegend alternatives in 2024

Send Comment :

4 Comments:

साक्षरता पर सर्वे रिपोर्ट कैसे बनेगी साक्षरता पर

More than a year ago

Choice of the question and answer

Can you please provide a draft of a survey report?

Can you please provide me demo of a survey

Summer is here, and so is the sale. Get a yearly plan with up to 65% off today! 🌴🌞

- Form Builder

- Survey Maker

- AI Form Generator

- AI Survey Tool

- AI Quiz Maker

- Store Builder

- WordPress Plugin

HubSpot CRM

Google Sheets

Google Analytics

Microsoft Excel

- Popular Forms

- Job Application Form Template

- Rental Application Form Template

- Hotel Accommodation Form Template

- Online Registration Form Template

- Employment Application Form Template

- Application Forms

- Booking Forms

- Consent Forms

- Contact Forms

- Donation Forms

- Customer Satisfaction Surveys

- Employee Satisfaction Surveys

- Evaluation Surveys

- Feedback Surveys

- Market Research Surveys

- Personality Quiz Template

- Geography Quiz Template

- Math Quiz Template

- Science Quiz Template

- Vocabulary Quiz Template

Try without registration Quick Start

Read engaging stories, how-to guides, learn about forms.app features.

Inspirational ready-to-use templates for getting started fast and powerful.

Spot-on guides on how to use forms.app and make the most out of it.

See the technical measures we take and learn how we keep your data safe and secure.

- Integrations

- Help Center

- Sign In Sign Up Free

- An ultimate guide to survey report: Best practices & tools

Surveys are designed to obtain information and opinions from respondents by asking questions about a topic. Surveyors care about the participants' views and follow a path according to survey results.

Even if you manage to receive a high number of replies, a survey is not over. Simply put, responses are the data you collect. The survey report is a way to present and interpret this data, apply the findings to your study, and turn them into knowledge.

This article will explain the definition of a survey report, best practices to follow when creating a survey report, how to create graphics for a survey report and examples with all details.

- What is a survey report?

You can find out if your customers like your product or services, whether your customers get good service from the support team, or how you can improve the service and your product by conducting a survey.

A survey report is a document that objectively , precisely , and factually presents all the pertinent facts about the survey . The survey report summarizes the replies and objectively presents the survey results.

It is essential to prepare a survey report when you complete survey research. Most reports include graphs and charts to present the findings in a visually pleasing manner. The report should be simple to read and understand. A survey report usually contains the following:

- Completion rate

- Total number of responses

- Survey views

- The date range of responses

- Distribution of survey respondents' responses

- Closed-ended question analysis

- The thoughts and interpretations of the researcher/survey owner

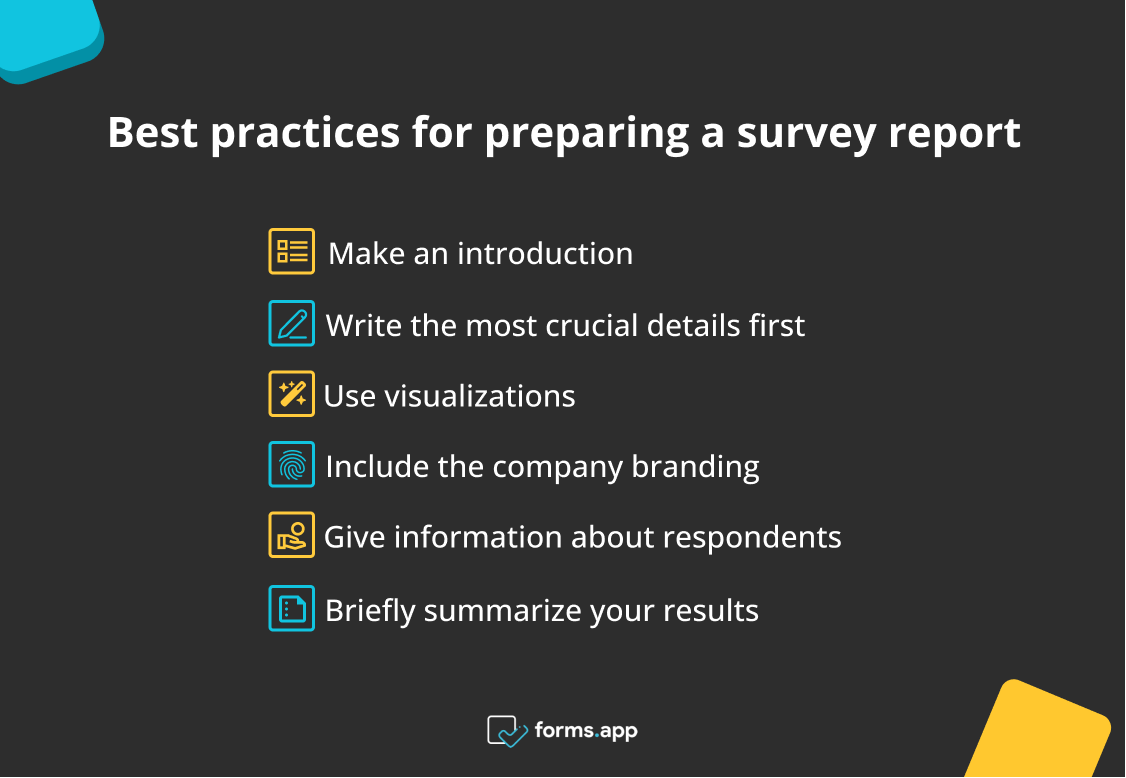

- Best practices to follow when creating a survey report

The survey report aims to accurately and comprehensively communicate the information gathered during the survey. Here are the guidelines to remember while building a survey report:

- Make an introduction: At the start of the report, specify what the main aim of this survey was when you were starting off. Explaining the survey's purpose will help establish the mood. Give the facts you are delivering context.

- Write the most crucial details first: You need to grab the attention of your audience and readers to make your point. Emphasize crucial points at the beginning and make sure the report is logically arranged with distinct headings and subheadings.

- Use visualizations: A survey report can be effectively presented using graphs and images . Use a variety of visualizations, such as bar graphs, pie charts, and other formats , to keep it interesting.

- Include the company branding: Incorporate your brand as much as possible within the survey report. Make sure to add your company’s details in a footer or at the top of the page, along with your logo. You can customize your report with colors suitable for your brand principles.

- Give information about respondents: Providing information about the respondents in the survey report makes it more reliable and effective. In your survey report, you can include information about the age , education leve l, and gender of the participants.

- Briefly summarize your results: Give the reader an overview of the data points at the conclusion of the survey report . Provide a succinct and straightforward description of the survey's results.

Best practices for preparing a survey report

- How to create graphics for your survey report

The survey reports are a crucial study component; thus, you must continually offer correct data. Making a survey report is one thing, but making a good survey report is quite another. Therefore, we have shared how to create graphics for your survey report.

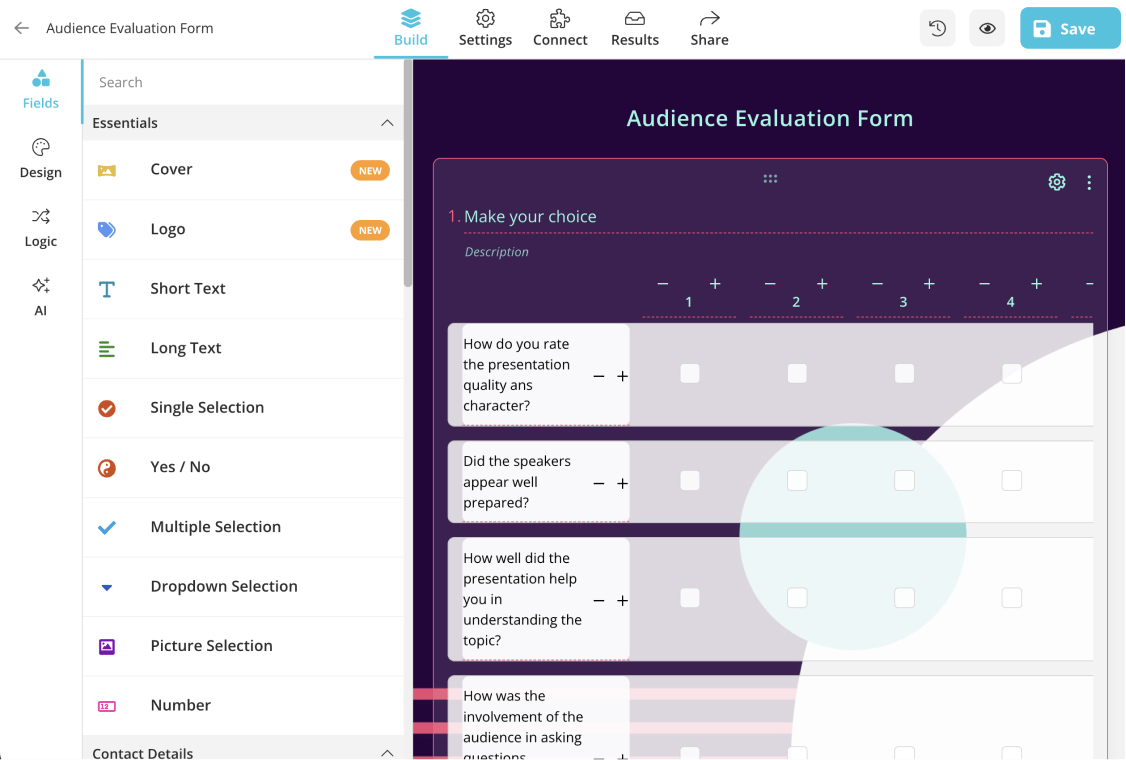

forms.app’s statistics page

You can generate an effective survey report through online survey tools. forms.app is one of the best survey maker tool . You can get the survey reports you created on forms.app easily from the statistics page. Here is how to create the graphics for your survey report on forms.app.

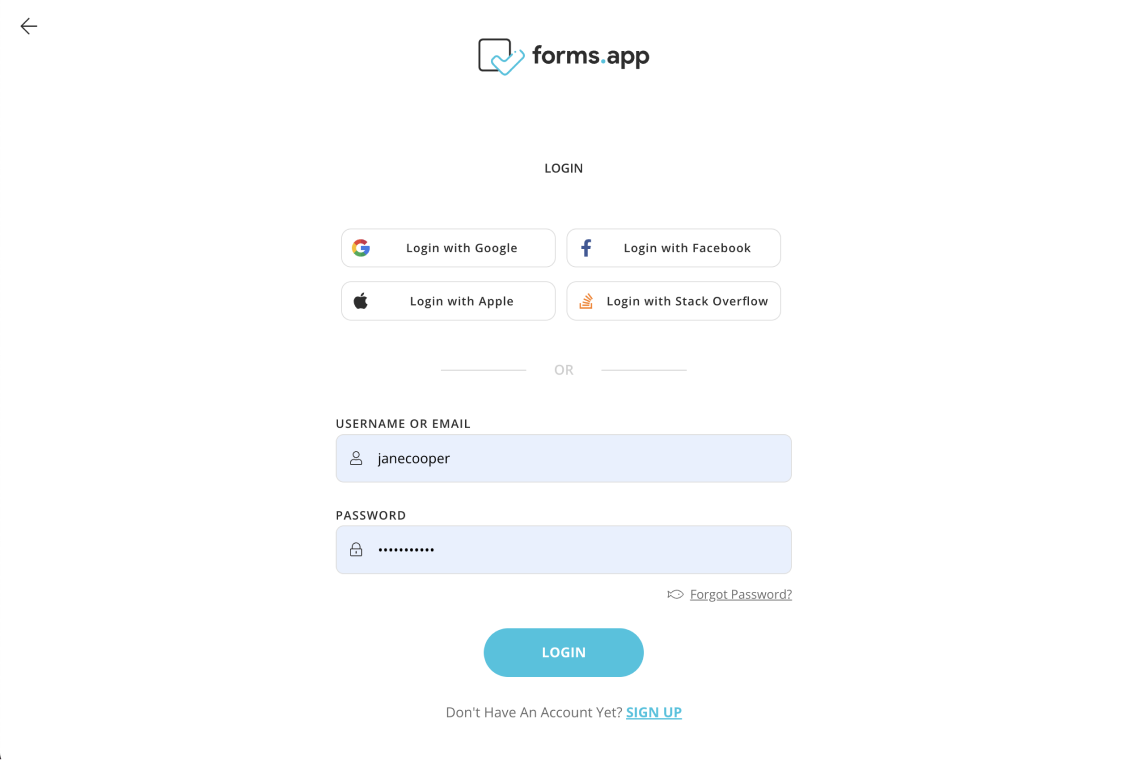

1 - Sign in or create a forms.app account: You can get the report graph of your survey that you created with just a few clicks, without writing code on forms.app. First, you can log into your existing account. If you do not have an account, you can create an account in seconds and become a free member.

Sign in or create a forms.app account

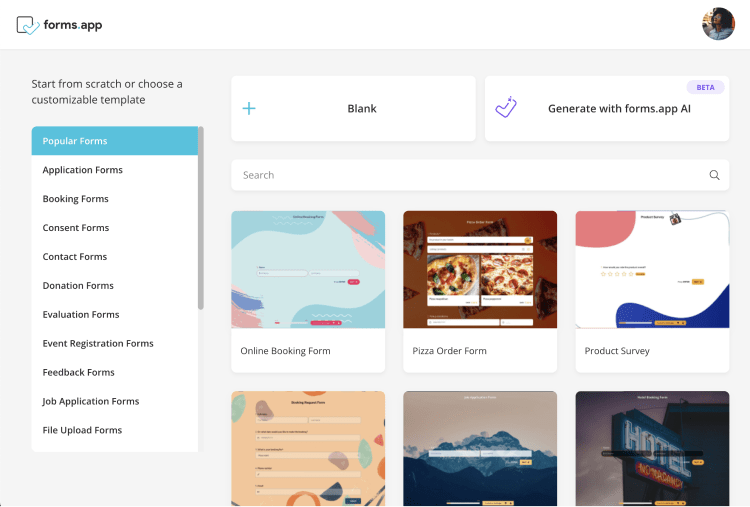

2 - Choose ready-to-use templates or begin to form from scratch: You can choose templates for many topics on forms.app. You can easily design your survey by selecting ready-to-use survey templates . Additionally, you have the option of starting from scratch with your survey.

Choose ready-to-use templates or begin to form from scratch

3 - Edit the questions and customize the survey design: You can edit the pre-made questions according to your needs. The questions can be changed, added, or removed. In addition, forms.app gives its customers access to hundreds of colorful themes. You can select one of the ready-made themes for your survey.

Edit the questions and customize the survey design

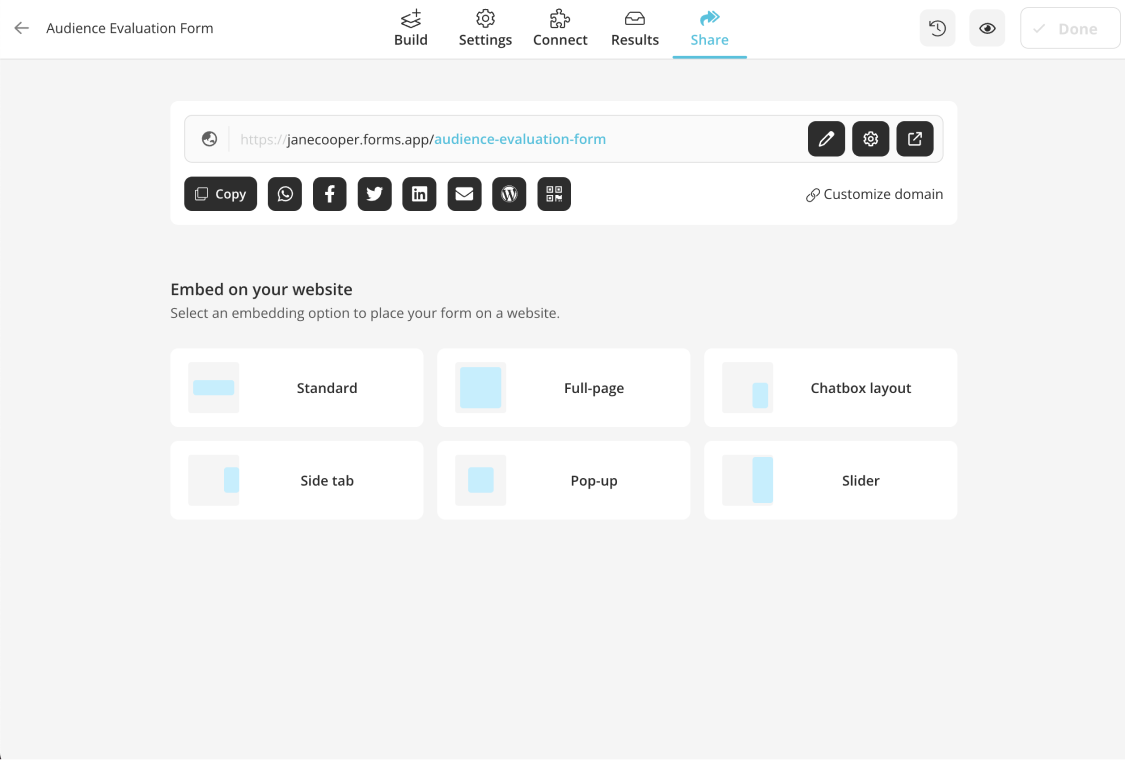

4 - Adjust the settings and share your survey: After you finish your survey settings, you can save and share it with respondents. You can send a link to participants or embed your survey on your website.

Adjust the settings and share your survey

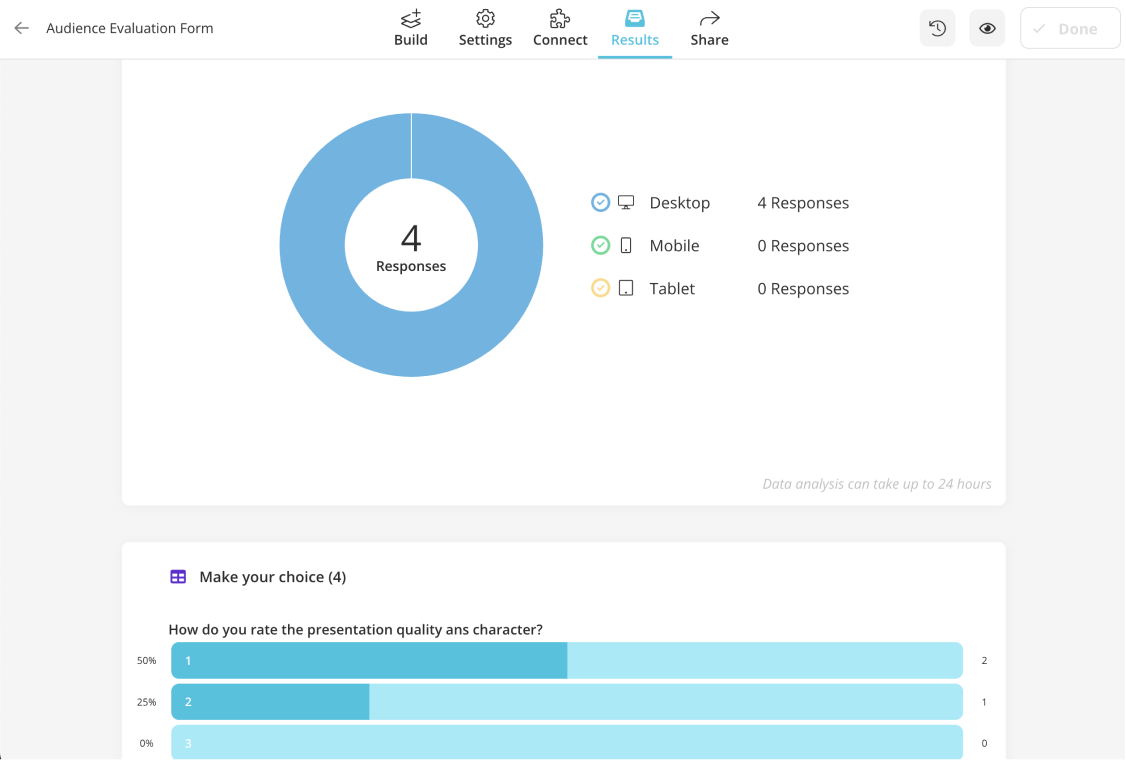

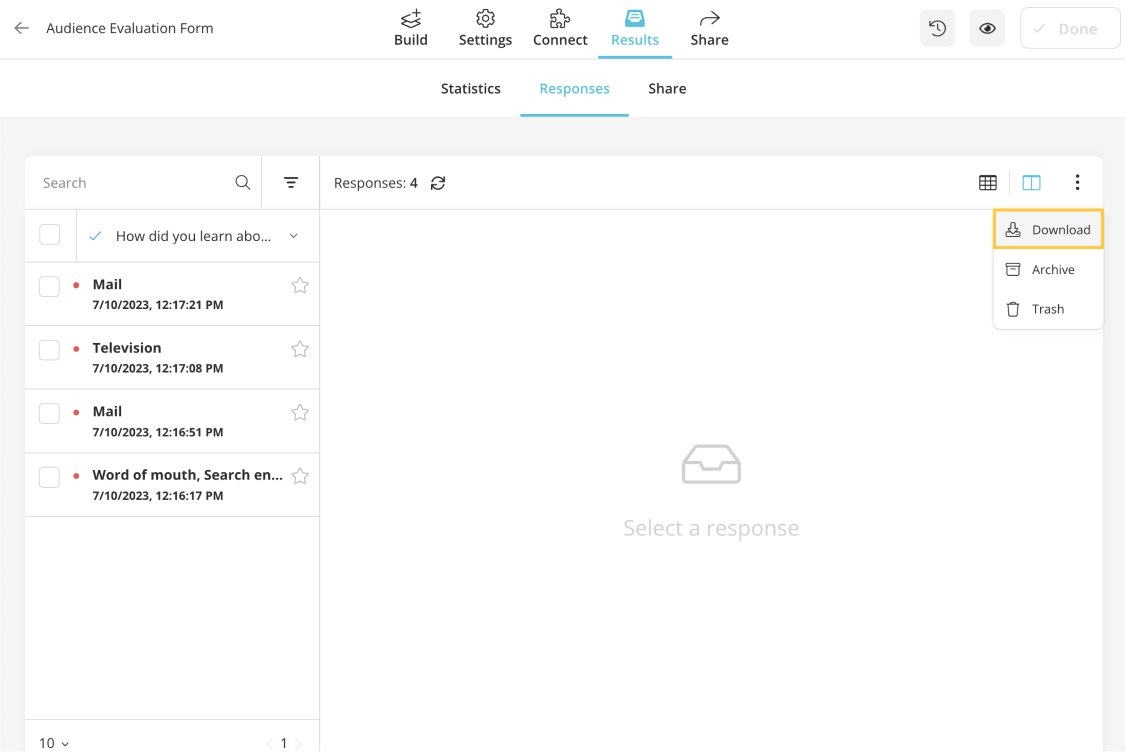

5 - Get a survey report graphic: After sharing your easily prepared survey on forms.app with the participants, you can quickly see the answers. After the survey process is over, click on the "results" button above. You can see the statistics and respondents in the “results” section. Thus, you can reach the report graph of the survey you prepared on forms.app.

Get a survey report graphic

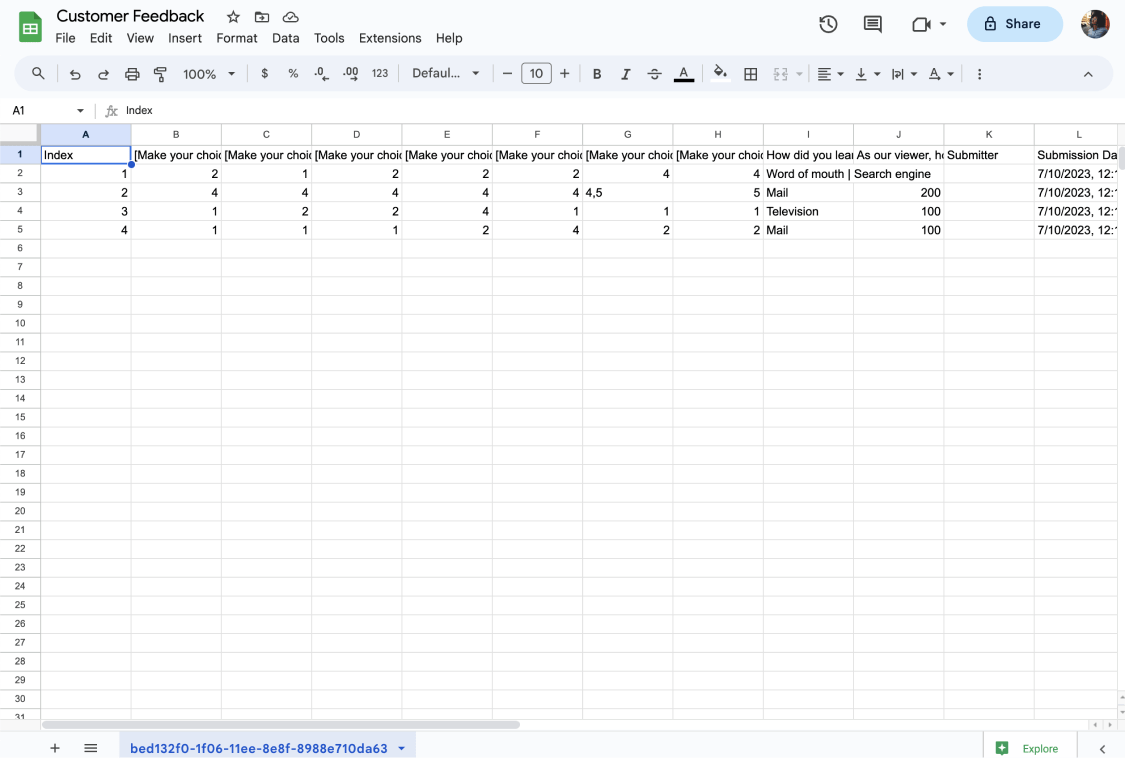

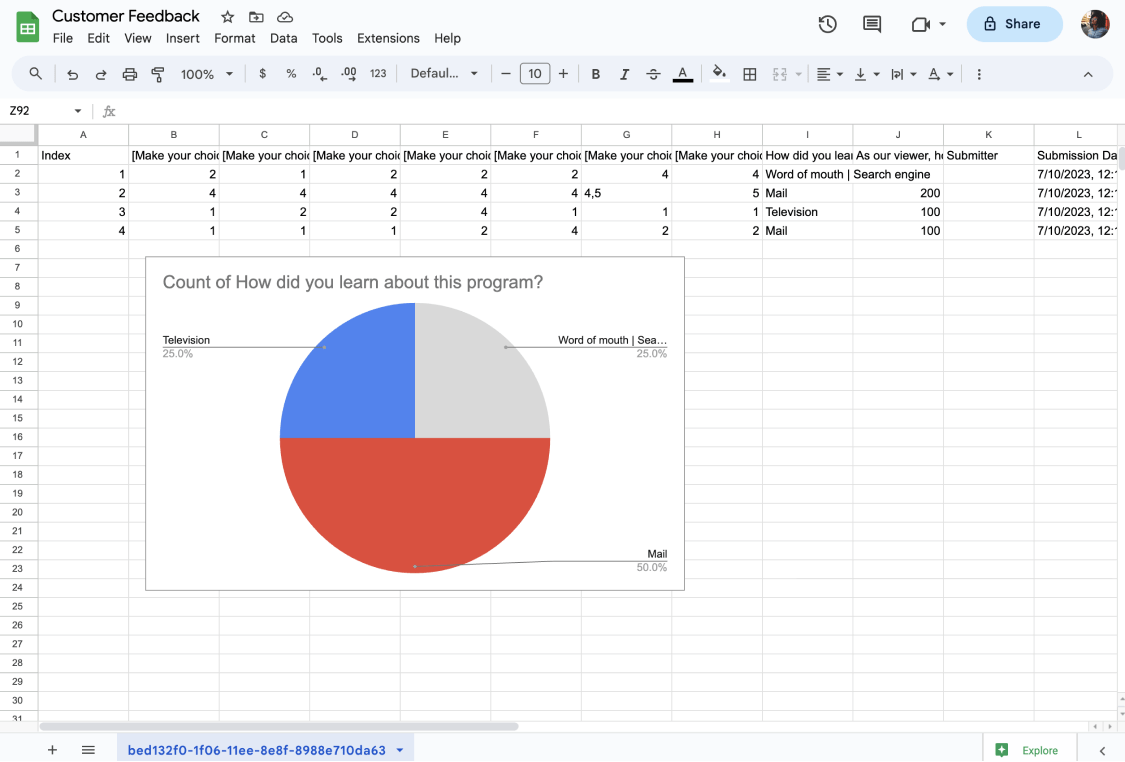

MS Excel or Google Sheets

You can easily create a graph of your survey report on MS Excel or Google Sheets. Here we shared the steps you need to follow.

1 - Open Excel or Google Sheets and create a new spreadsheet. Or simply download your survey data from forms.app.

Open your data on a spreadsheet

2 - Make sure your questions and answers are in different columns.

Have your questions and answers in separate columns

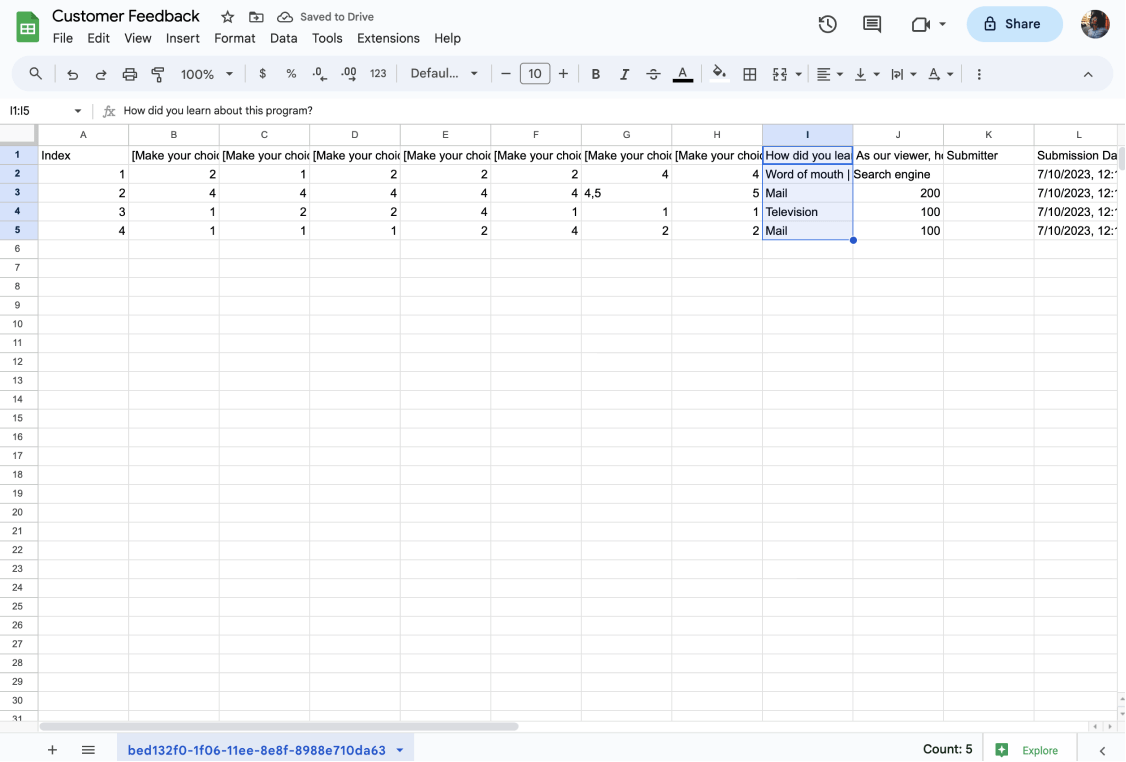

3 - Move your mouse over the cells that hold the answer data and choose them.

Choose related data

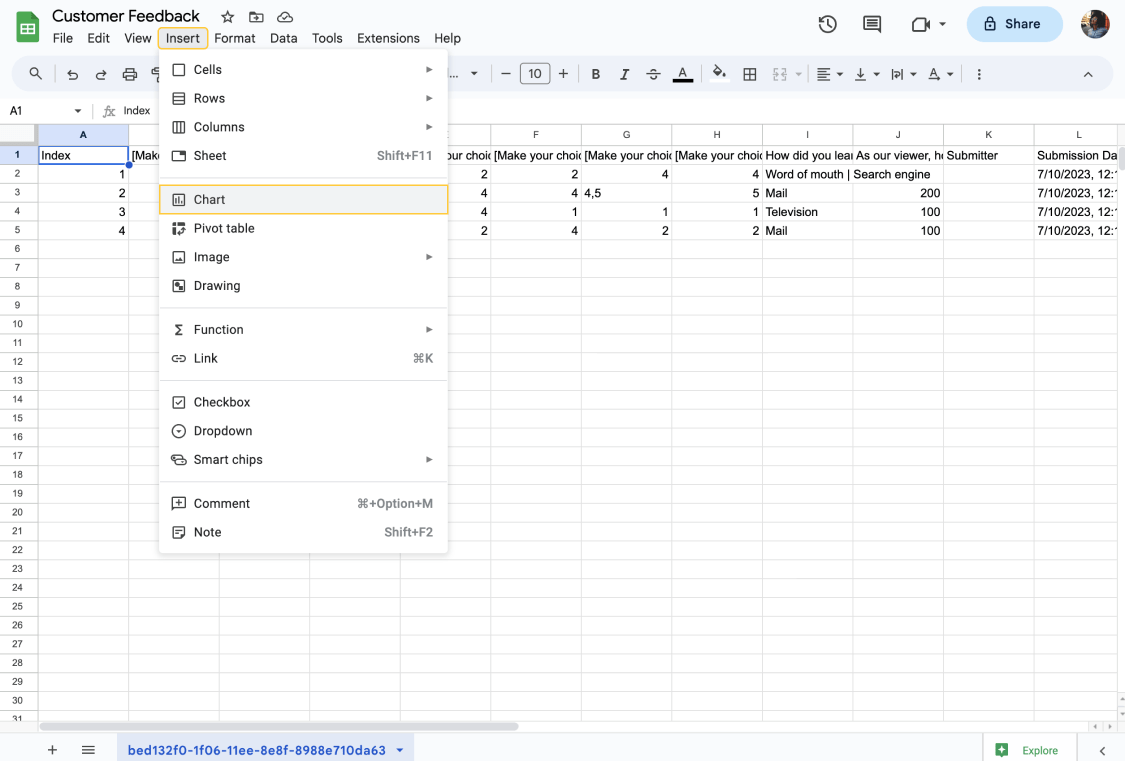

4 - Select the "Column Chart" or "Bar Chart" option from the list of chart types under the "Insert" menu.

Insert a chart

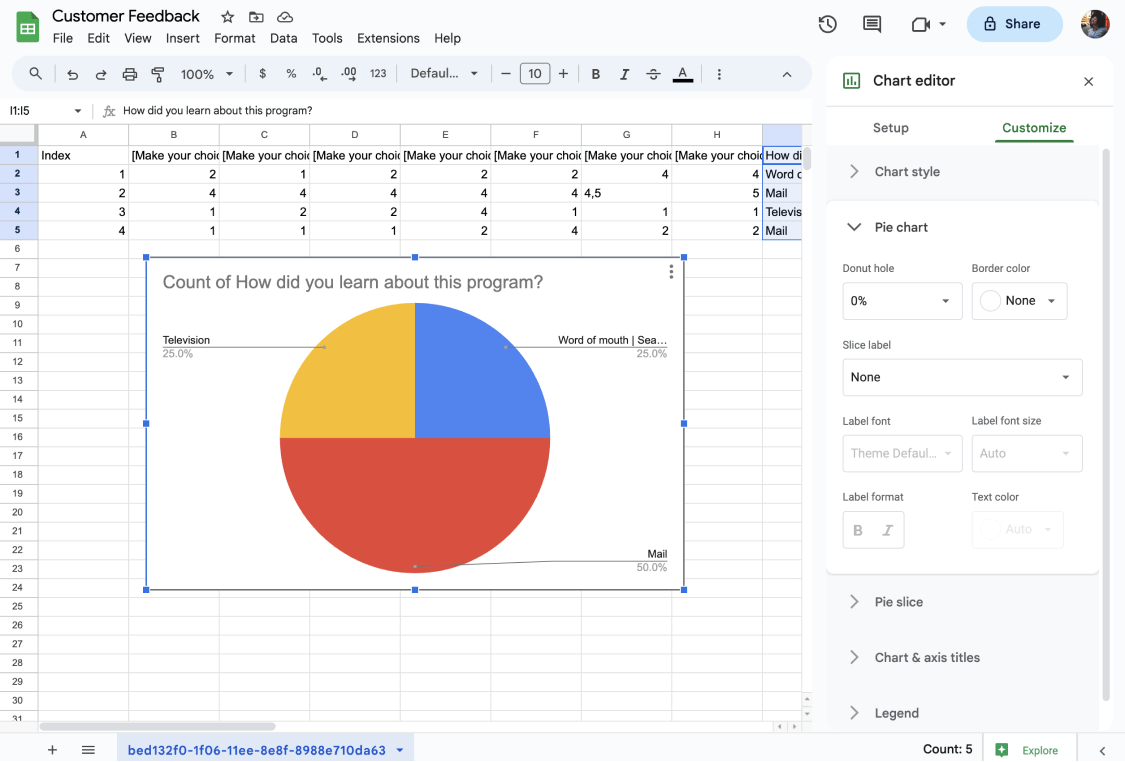

5 - Customize the chart according to your needs.

Customize your chart

6 - Save the chart and use it in your report.

Use it in your survey report

Custom data visualization tools

Data visualization displays data visually, such as graphs and charts. This makes it easier for individuals to draw conclusions from data and make data-driven decisions. You can create your survey report graph using custom data visualization tools like Tableau, Klipfolio , and Qlik Sense .

The list of data visualization tools

- A survey report example

The essential data should be presented in your survey report clearly and understandably so you can reach conclusions fast. Let’s imagine the survey research conducted by a perfume company was conducted from March 7 to March 16 via an online survey, which consisted of 16 questions.

A total of 150 customers participated in the survey. The survey aimed to measure product quality, customer service, and overall customer satisfaction level . Of the 150 customers surveyed, 55% rated the overall survey score as excellent, 36% as good, and only 9% as average or below. You can review the following item created on forms.app.

- Completion rate: The completion rate is calculated by dividing the total number of questions in your survey by the number of questions that were answered. If your survey has 16 questions and respondents answered only 8, the completion rate is 50%.

- Total number of responses: The total number of responses is the total number of respondents you selected to participate in the survey. In our example, the total number of responses is 150.

- Survey views: The total number of views versus the number of different people who viewed the survey, as some people may have viewed the survey more than once.

- The date range of responses: You must provide the date range of the responses in your survey report. In the above example, the response date range is between March 7 and 16.

- Distribution of survey respondents' responses: Survey respondents have different opinions about your products and services. In our example, 55% rated the overall survey score as excellent, 36% as good, and 9% as average or below.

- Closed-ended question analysis: Closed-ended questions are analyzed more quickly in the survey report. The analysis process is complex in open-ended questions as the participants express their opinions directly. You can easily illustrate closed-ended questions with pie charts or bar charts.

- The thoughts and interpretations of the researcher/survey owner: The researcher's thoughts and comments should be included in the survey report. This reflects the survey owner’s insights.

- Key points to take away

In conclusion, a survey report aims to impartially convey the data acquired during the survey. It does it in an easy-to-understand and aesthetically pleasing way by survey summary of all the replies gathered.

The report has a typical structure, with sections, headers, subheadings, and more. Usually, it is produced at the conclusion of a survey. To create an effective survey report, you should:

- Have a clean structure

- Use simple language

- And focus on the key results

Ensure the survey report is accurate and professional, giving only pertinent information. This article has explained the definition of the survey report, the statistical significance of the survey analysis report, and how to create excellent graphics for your survey report.

Sena is a content writer at forms.app. She likes to read and write articles on different topics. Sena also likes to learn about different cultures and travel. She likes to study and learn different languages. Her specialty is linguistics, surveys, survey questions, and sampling methods.

- Form Features

- Data Collection

Table of Contents

Related posts.

SurveySparrow vs. Typeform: Which survey maker to choose?

What is sampling frame: Definition, example & tips

.jpg)

10 Best Jotform alternatives (pros, cons & prices)

- How to Create a Survey Report in 5 Steps

Surveys are usually created as part of a research process, which is aimed at attaining a conclusion. Hence,r to conclude your surveys, you need to create a survey report at the end of your survey.

This describes a survey, its results, and any pattern or trends found in the survey, all to help you conclude your research.

Creating a survey report is usually the next step after you finish conducting your survey. For proper analysis, it usually follows a set-out pattern — including headings, subheadings, etc.

What is a Survey Report?

A survey report is a document whose task is to present the information gathered during the survey in an objective manner. It presents a summary of all the responses that were collected in a simple and visually appealing manner.

The report follows a standard organization, with different sections, headings, subheadings, etc. It is usually created at the end of a survey (i.e. after constructing and gathering responses).

Survey reports are an integral part of the research, and it is very important that you always represent accurate data in your report.

5 Steps to Creating a Survey Report

It is one thing to create a survey report, but another to create a good survey report. Therefore, we have prepared a guide to assist you in writing your next report.

Here are the 5 main steps you need to follow to create a good survey report.

Create a Questionnaire

Every survey report requires a survey Hence, the first thing you need to do is to create a survey or questionnaire that will be used to carry out your survey.

The responses received from the questionnaire will determine the final outlook of the survey report . However, there are a few important things you need to consider before creating a questionnaire for your survey report.

Factors to Consider Before Creating a Questionnaire For a Survey Report

- Define your objectives

The first step to creating a good questionnaire for your survey report is defining the objectives of your research. After which you will create your questionnaire which aligns with your research objectives.

In simple terms, your research objective will guide you in choosing the kind of questionnaire that should be created. For example, if your objective is to sell your products online, then you should create an online order form.

- Who are your audience?

After defining your objectives, the next step is to identify your target audience. Your target audience will determine the kind of questions that would be asked in the questionnaire.

When creating a questionnaire to evaluate job seekers, for instance, the questions that will be asked in the questionnaire will be different from when creating a questionnaire for those seeking a life partner.

- Survey Report Method (Quantitative/Qualitative)

Now that you know the research objective and target audience, the next step is to determine the method that will be used in carrying out this survey. Is it going to be quantitative or qualitative? Or both?

The interesting thing about choosing a method of carrying out your research is that this method is determined by the first two factors. For an online matchmaking questionnaire, a qualitative method will be used.

An online order form , on the other hand, will require both, but mostly quantitative methods.

- Best Types of Questions for Surveys

Another important aspect of creating a questionnaire is determining the types of questions that will be most perfect for the survey. Is it dichotomous, close-ended questions , or rating and ranking questions ?

The type of survey questions should be carefully chosen by the questionnaire in order to collect the right data and not affect the response rate on the survey . For example, when requesting the phone number of your respondents, the question shouldn’t be closed-ended.

Collect Data

After determining how to create a questionnaire for your survey, the next thing to do is create the questionnaire and start collecting data . There are points to note in data collection and some of them have been highlighted below:

- Location of your Audience

to create a more detailed survey report, you need to identify your audience’s location when collecting data. Respondents may be reluctant to provide their location in the questionnaire,

Therefore, you need to create a questionnaire that automatically identifies the respondent’s location once they start filling the questionnaire. This can be done using the Formplus Geolocation feature .

- Avoid Survey Bias

One of the best practices of collecting clean data for your questionnaire is by avoiding survey bias . There are different kinds of biases that we can face during data collection, and they all fall under response and non-response biases .

There are a lot of things you need to consider when creating your questionnaire to avoid these biases. These fall under the 4 factors we have highlighted above for you to consider when creating a questionnaire.

- Ways to Create a Questionnaire (Paper or Online Form)

Another thing to consider when choosing a data collection method is the type of questionnaire to use. Is it better to use an online or paper form?

There are a lot of factors that should be considered when making this decision. Some of these include; your target audience, cost of implementation, efficiency, and data security.

The traditional way of data collection is through the paper questionnaire. However, if you consider the factors that were highlighted above, you will realize that it is better to use an online questionnaire .

An online questionnaire is easier to implement, more efficient, cost-effective, helps to reach a larger audience, and even offers more data security. However, if most of your target audience are in remote areas without an internet connection, or are not familiar with how to use a technological device, it is better to use paper forms or both.

Analyze Data

Before writing a report from the data collected during your survey, you need to simplify it for better understanding. This will make it easy to write a survey report for the data collected and for other people to understand the data.

- Export Data

After data collection, you need to export it for data analysis. This can be done using any of the available data analysis software.

Analyzing data on Excel or Google Sheets just became easier with Formplus . With the Formplus – Google Sheets integration, the responses collected from your questionnaire will be automatically added to your Google Sheets worksheet in real-time.

You can also export the data as CSV and work on it using Microsoft Excel, Power BI, or any other data analysis software.

Analyze and Interpret

After exporting the data, you analyze it. Data analysis involves breaking data down into simpler terms, identifying similarities, grouping and interpreting them.

There are different methods of data analysis that can be used in analyzing the data collected from your questionnaire before interpretation . However, each of these methods follows similar processes that have been highlighted below.

- Data Cleaning

Due to some factors during the data collection process, you may have collected inaccurate or corrupt information – making the data “ dirty”. This may include duplicate records, white spaces, or outright errors.

Things like this make the collected data irrelevant to your aim of Analysis and should be cleaned. It is the next step after data collection, so that you may arrive at a conclusion that is closer to your expected outcome.

- Data Analysis

Once the data is collected, cleaned, and processed, it is ready for analysis. At this point, you may realize that you have the exact data you need or still need to collect more data. To make analysis easier, you might use software that will ease understating, interpretation, and conclusion.

- Data Interpretation

After a successful analysis, the next step is interpretation. There are different ways of interpreting the result of data analysis. It can be done using simple words (usually a summary of the result), tables, or charts.

- Data Visualization

This is the most common process involved in data analysis and interpretation. It is the process of displaying data graphically so that it can be easier for everyone to understand and process it. It is often used to analyze relationships and discover trends by comparing t variables in a dataset.

Write Survey Report

After successfully analysing and interpreting your data, it is ready to feature in your survey report. At this stage, all you need to do is plug and play because everything you need has been prepared in the previous steps.

To further make your survey report writing process easier, it is advised that you follow a pre-designed template that is tailored to the type of survey under consideration.

Types of Survey Report

Before embarking on the report writing journey, you need to first identify the type of survey report you want to write. The type of survey report is determined by the nature of the survey that was carried out.

Some of the different kinds of surveys include employee satisfaction surveys, customer feedback surveys, market research surveys, etc.

- Employee Satisfaction Survey

This method is used to gauge whether employees are satisfied with the work environment. Organizations usually do this to ensure that employees are motivated and to build a stronger team spirit.

Employees are asked to give feedback and particularly voice their frustrations with the company.

- Customer Feedback Survey

This is undoubtedly one of the most common types of surveys. Businesses are always seen requesting feedback from customers after selling a product or rendering a service.

As an individual, you must have experienced this at a point in time. Whether after purchasing an item from a grocery store, placing an order online ordering at a restaurant, etc.

- Market Research Survey

It is used to discover customer needs, competitive advantage, how and where products are purchased, etc. This type of survey can be applied when no data is available yet: For example, to measure how your target audience feels about a product you intend to lunch.

In some instances, it’s about building on past data in your market research database. When you are building on past research, you conduct a survey to measure, for example, what people think about the product, say, a year after its launch.

For each of the different types of surveys highlighted above, the structure of the survey report will be slightly different from the other.

Features of a Survey Report/Guidelines

Although the structure of the different types of survey reports may vary slightly, there are some must-have features common to all survey types. The features of a survey report include; a title page, table of contents, executive summary, background and objectives, methodology, results, conclusion and recommendations, and appendices.

The content of the above-listed sections may, however, vary across the different types of survey reports. Asides from following a set structure, there are also guidelines for writing a good survey report.

This includes writing the executive summary and table of contents last, writing in concise, simple sentences, and polishing the report before finalizing it.

- Use Analyzed Data and Infer Conclusion

This is the point where you implement all the research and analysis that was done in previous steps. Note that it is not good practice to write survey reports from memory.

Rather, it should be carefully written using the facts and figures derived from analysis. This is what is used to drive a conclusion on your research, and also make recommendations.

You will notice that this follows consecutively in the survey report. That is results, the conclusion derived from results, and the recommendation after observing the conclusion.

How to Create an Online Survey with Formplus

Follow the following simple steps to create a ranking questionnaire using Formplus:

Step 1- Get Started for Free

- Visit www.formpl.us on your device

- Click on the Start Free Trial button to start creating surveys for free

- Register using your email address or Google account in just 2 seconds.

Step 2- Start Creating Surveys

You can create a Formplus survey in one of the following ways:

Use an Existing Template

Get a head start by using a template designed by a team of market research experts. To do this, go to Templates and choose from any of the available templates.

Start From Scratch

To create a new survey from scratch on Formplus, go to your Dashboard, then click on the Create new form button.

Alternatively, go to the top menu, then click on the Create Form button.

Step 3 – Add Form Fields

The next step is to add questions so you can collect data from your survey. You can do this by going to the left sidebar in the form builder, then choose from any of the available 30+ form fields.

You can simply click or drag and drop the form field into the blank space to preview your progress as you create the survey. Each form field included in your form can be further edited by clicking on the Edit icon.

Once you have edited the form fields to your taste, you should click on the Save button in the top right corner of the form builder.

Step 4 – Beautify Your Survey

After adding the required form field to your survey, the next step is to make it attractive to respondents. Formplus has some built-in customization features that can be used to create a beautiful survey

This option allows you to add colours, fonts, images, backgrounds, etc. There is also a custom built-in CSS feature that gives you more design flexibility.

You even get to preview the survey in real-time as you make further customization.

Step 5 – Share and Start Collecting Responses

Formplus offers various sharing options to choose from. This includes sharing via email, customized links, social media, etc.

You can send personalized email invites to respondents with prefilled respondent details to avoid entry of incorrect data. With prefilled surveys, personal details like respondent’s name, email address, and phone number will be pre-populated.

Conclusion

Survey reports show the results of a research survey and make recommendations based on a careful analysis of these results. They summarize the result of your research in a manner that can be easily understood and interpreted by a layman or third party, who was not involved in the research process.

A good survey report follows a well thought out systematic arrangement that smoothly drives you from a wide summary down to your specific recommendations. How it is being written is what determines how it is seen or understood by other people.

The key to writing a good survey is by mastering the art of using simple words to summarize the results of your research. It should also be created using beautiful designs to encourage readers.

Connect to Formplus, Get Started Now - It's Free!

- how to create a survey report

- types of survey report

- busayo.longe

You may also like:

Cobra Effect & Perverse Survey Incentives: Definition, Implications & Examples

In this post, we will discuss the origin of the Cobra effect, its implication, and some examples

33 Online Shopping Questionnaire + [Template Examples]

Learn how to study users’ behaviors, experiences, and preferences as they shop items from your e-commerce store with this article

Training Survey: Types, Template + [Question Example]

Conducting a training survey, before or after a training session, can help you to gather useful information from training participants....

Job Evaluation: Definition, Methods + [Form Template]

Everything you need to know about job evaluation. Importance, types, methods and question examples

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

How to Write a Survey Report: 10 Expert Tips

- September 28, 2022

- Guest Post , Survey Design

Surveys are how we learn what people think, they’re an essential tool for developing an understanding of public opinion and how to take action based on feedback. However, if you don’t fully understand how to analyze and contextualize your survey report your efforts may have been in vain.

In this article, we’ll show you how to make sense of your data by learning how to write a survey report. Being aware of their structure and recommended content is a sure-fire way for you to make sense of your data and present it in a comprehensible fashion.

What is a survey report?

A survey report is a write-up of the results of a survey. It describes the survey, the results obtained, and the patterns and trends that the data reveals.

Create a survey with Shout

Sign up to our 14-Day Free Trial to start collecting responses and analyzing data in real time.

How to write a survey report

Here are some tips for the best way to write a survey report. The following guidelines were gladly provided by academic essay experts from SmartWritingService.com ; a professional writing service for college and university students.

1. Use headings and subheadings to break up the report

Using headings and subheadings to break up the report will make it easier to follow and also help your audience to find the information they need quickly and efficiently.

While there is no set list of heading standards for a survey report, you will typically want to identify your executive summary, background, methodology, results, and conclusions. Audiences will expect to be able to find these easily.

Then package all these headings together with their page number to create a table of contents. Making it easy for stakeholders to navigate and reference.

2. Begin with an executive summary

Your report should start with an executive summary that summarizes the entire report in 1-2 pages. The executive summary is a brief breakdown of everything you will cover later in the report.

By the time your audience finishes reading the executive summary, they should be able to predict the content of the entire report. Be sure to include a discussion of your methodology, key findings, and conclusions.

Don’t hold important facts back for the full report just because you think it will entice the reader. Be upfront instead.

3. List your objectives in the background section

Be sure to let the reader know why you conducted the survey. Explain what you hoped to find, the hypotheses that you used to answer the question, and how you envision the results being used in the future.

The goal of this section is to explain the purpose, aims, and limitations of your survey.

Why is this important? Well, the context of a student survey, an employee feedback survey and a net promoter score survey are all entirely different. Each type of survey has different goals and purposes. This section prepares your readers for the context of your own research and helps manage their own expectations.

4. Compare your survey to others

Look for other surveys that have touched on similar areas. How are their results similar or different? What accounts for any differences?

What gaps did you find in prior surveys that your own survey fills? Explain to the audience how past work connects to your own work.

5. Explain how you conducted the survey

The methodology section should give a complete overview of how you conducted the survey.

You need to explain in detail how you:

- Developed your questions

- Selected a target audience

- Distributed your survey questions

- Encouraged responses (e.g. offered an incentive)

- Plan to analyze data

The more specific you are about your methodology, the better. Ideally, the reader should be able to recreate your entire method just by reading what you’ve written.

There’s also an opportunity here to discuss any response bias your survey may have been exposed to, what measures you took to avoid it and what bias was unavoidable.

6. Don’t put the questions in the methodology

It can be tempting to simply list all of the questions in the methodology section, but that is not where they belong.

Instead, you should place the questions in an appendix as part of a copy of your survey instrument. Typically, this will be Appendix A of your survey report.

7. Separate the results and the analysis

The results of the survey should be reported in their own section. In that section, you will go through the questions, explain the results, and provide an overview of the data you obtained from the survey. It’s a good idea here to include pie charts (and other chart types ) so your readers can easily visualize your results.

While it is tempting to also use this section to tell the audience what the results mean, your data analysis should be placed in its own section so you can separate the factual information from the inferences and conclusions drawn.

8. Identify trends in the results section

The results section should indicate trends in the data, showing the reader what the survey question responses indicate.

For example, are there demographic trends in the data aligned to age, gender, race, or political affiliation? Did some questions receive more uniform answers than others? What might this mean?

When analyzing survey results with Shout, you’ll have access to advanced filter and comparison tools to help you identify patterns and trends in your data.

9. Include recommendations based on survey results

Be sure to explain to the reader what the survey results suggest should be the next step, whether that is a policy change, a change in marketing strategy, or a change in outreach efforts, etc.

Think about your audience and what they need to do based on what you’ve learned. What needs to change? Why should it change?

10. Consider professional writing services

Writing a survey results paper can be challenging, and having a professional help college students like you to write academic papers can make a major difference.

You can find survey report samples and writing examples on the internet. But help from paper writing services allows you to devote energy to developing and conducting your survey, knowing that you’ll be able to offload the report write-up to an expert custom writing service.

Related Posts

7 Proven Tips to Improve Your Customer Experience

- May 22, 2024