- Search Search Please fill out this field.

What Is an Annual Report?

Understanding annual reports, special considerations, mutual fund annual reports, the bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Annual Report Explained: How to Read and Write Them

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

An annual report is a document that public corporations must provide annually to shareholders that describes their operations and financial conditions. The front part of the report often contains an impressive combination of graphics, photos, and an accompanying narrative, all of which chronicle the company's activities over the past year and may also make forecasts about the future of the company. The back part of the report contains detailed financial and operational information.

Key Takeaways

- An annual report is a corporate document disseminated to shareholders that spells out the company's financial condition and operations over the previous year.

- It was not until legislation was enacted after the stock market crash of 1929 that the annual report became a regular component of corporate financial reporting.

- Registered mutual funds must also distribute a full annual report to their shareholders each year.

Investopedia / Jake Shi

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm's financial performance and to make investment decisions.

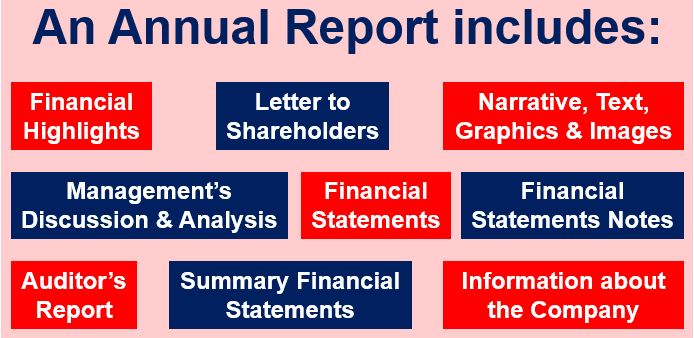

Typically, an annual report will contain the following sections:

- General corporate information

- Operating and financial highlights

- Letter to the shareholders from the CEO

- Narrative text, graphics, and photos

- Management's discussion and analysis (MD&A)

- Financial statements, including the balance sheet, income statement, and cash flow statement

- Notes to the financial statements

- Auditor's report

- Summary of financial data

- Accounting policies

Current and prospective investors, employees, creditors, analysts, and any other interested party will analyze a company using its annual report.

In the U.S., a more detailed version of the annual report is referred to as Form 10-K and is submitted to the U.S. Securities and Exchange Commission (SEC). Companies may submit their annual reports electronically through the SEC's EDGAR database . Reporting companies must send annual reports to their shareholders when they hold annual meetings to elect directors. Under the proxy rules, reporting companies are required to post their proxy materials, including their annual reports, on their company websites.

The annual report contains key information on a company's financial position that can be used to measure:

- A company's ability to pay its debts as they come due

- Whether a company made a profit or loss in its previous fiscal year

- A company's growth over a number of years

- How much of earnings are retained by a company to grow its operations

- The proportion of operational expenses to revenue generated

The annual report also determines whether the information conforms to the generally accepted accounting principles (GAAP). This confirmation will be highlighted as an " unqualified opinion " in the auditor's report section.

Fundamental analysts also attempt to understand a company's future direction by analyzing the details provided in its annual report.

In the case of mutual funds, the annual report is a required document that is made available to a fund's shareholders on a fiscal-year basis. It discloses certain aspects of a mutual fund's operations and financial condition. In contrast to corporate annual reports, mutual fund annual reports are best described as "plain vanilla" in terms of their presentation.

A mutual fund annual report, along with a fund's prospectus and statement of additional information, is a source of multi-year fund data and performance, which is made available to fund shareholders as well as to prospective fund investors. Unfortunately, most of the information is quantitative rather than qualitative, which addresses the mandatory accounting disclosures required of mutual funds.

All mutual funds that are registered with the SEC are required to send a full report to all shareholders every year. The report shows how well the fund fared over the fiscal year. Information that can be found in the annual report includes:

- Table, chart, or graph of holdings by category (e.g., type of security, industry sector, geographic region, credit quality, or maturity)

- Audited financial statements, including a complete or summary (top 50) list of holdings

- Condensed financial statements

- Table showing the fund’s returns for one-, five- and 10-year periods

- Management’s discussion of fund performance

- Management information about directors and officers, such as name, age, and tenure

- Remuneration or compensation paid to directors, officers, and others

How Do You Write an Annual Report?

An annual report has a few sections and steps that must convey a certain amount of information, much of which is legally required for public companies. Most public companies hire auditing companies to write their annual reports. An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows. The last part will typically be notes to the financial statements, explaining certain facts and figures.

Is an Annual Report the Same As a 10-K Filing?

In general, an annual report is similar to the 10-K filing in that both report on the company's performance for the year. Both are considered to be the last financial filing of the year and summarize how the company did for that period. Annual reports are much more visually friendly. They are designed well and contain images and graphics. The 10-K filing only reports numbers and other qualitative information without any design elements or additional flair.

What Is a 10-Q Filing?

A 10-Q filing is a form that is filed with the Securities and Exchange Commission (SEC) that reports the quarterly earnings of a company. Most public companies have to file a 10-Q with the SEC to report their financial position for the quarter.

Public companies must produce annual reports to show their current financial conditions and operations. Annual reports can be used to examine a company's financial position and, possibly, understand what direction it will move in the future. These reports function differently for mutual funds; in this case, they are made available each fiscal year and are typically simpler.

U.S. Securities and Exchange Commission. " Speech By SEC Commissioner: Remarks Before the Securities Traders Association ."

U.S. Securities and Exchange Commission. " Annual Report ."

U.S. Securities and Exchange Commission. " How to Read a 10-K/10-Q ."

U.S. Securities and Exchange Commission. " Final Rule: Shareholder Reports and Quarterly Portfolio Disclosure of Registered Management Investment Companies ."

U.S. Securities and Exchange Commission. " Mutual Funds - The Next 75 Years ."

:max_bytes(150000):strip_icc():format(webp)/10-K--f7185a10d5d342c68235646bd3ceefcd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Learn to Communicate with Data

What is an annual report definitions, requirements and examples.

You want to impress shareholders, attract more investors, highlight your brand, engage your employees, or just file a report with the Securities and Exchange Commission (SEC). You need an annual report - but exactly what is an annual report?

But today, businesses and organizations create many different types of annual reports. Each type of annual report out there is designed with a very specific end goal in mind.

If that’s what you want to learn about - you’re in the right place.

To help you understand the world of annual reports, this post looks at everything you need to know about them - what they are, the different types, what goes into them, who reads them and how to create them. The post is broken down into the following sections. If you’d like to learn about something specific, click on a link to jump ahead.

- What is an annual report?

- What is included in an annual report?

- Who reads an annual report?

- What is the easiest way to create an annual report?

- How do you summarize an annual report?

- How do you create an attractive annual report?

If you want to check out our annual report templates to get a sense of what they look like and get design ideas, just visit our annual report templates page.

see all annual report templates

1. What is an annual report?

A traditional annual report is an in-depth, comprehensive overview of a business’s achievements and financial statements from the preceding year. It is produced on a yearly basis, and provided to shareholders, investors, stakeholders and others to inform them of the organization’s overall performance, financial status, and vision for the future.

Today, annual reports are often used as marketing tools for organizations to impress shareholders, investors, or donors; attract new ones; and to showcase their brand to employees, clients and others.

This example of an annual report design makes use of friendly, illustrated icons and bright colors to liven up very dry content. Not only is it more engaging to read, the organization’s branding jumps right off the page.

get this annual report template

Companies like Mailchimp regularly publish creative annual year-in-review reports , always outdoing their previous designs.

These types of annual reports are well-designed, fun, and engaging. They share information in a way that’s exciting and easy to understand, and serve as great branding assets. These types of annual reports can also be referred to as ‘year-in-review’ reports, highlighting major milestones for that year. This isn’t just something businesses do, either. Nonprofit organizations consistently promote their cause and the impact of their organizations. Annual reports, year-in-review reports, or impact reports that highlight the past year’s achievements are all staple nonprofit marketing tactics to gain donors and supporters.

Just take a look at this pages out of Novozymes annual report.

This is an annual report you can actually enjoy reading . The visuals are fun, engaging, informative and reflect the uniqueness of the Novozyme brand. The simple and attractive design is super helpful, since it helps us understand pretty complex information.

2. What is included in an annual report?

A typical annual report for a public company must have the following sections:

- A letter from the CEO

- Corporate financial data

- Operations and impact

- Market segment information

- Plans for new products

- Subsidiary activities

- Research and development activities

These are the barebones expectations for an annual report. Of course, depending on the size of your organization or type of organization, your annual report can range anywhere from 20 pages to 200.

Keep in mind, actual human beings read your annual report. It doesn’t just get filed away in a dusty government basement, never to be seen again. Making it easy to read and review is essential in helping people understand your annual report’s findings and how your business is performing.

So on top of those individual sections, it helps to include things like:

- A cover page

- A table of contents

- Mission and vision statement

- Charts, graphs and tables

- CSR initiatives

- An afterword

- A glossary

These are two examples of reader-friendly annual report designs.

Year end annual report template

This year end annual report template uses a color palette that pops, quality stock photos, and organized tables to visualize financial data and performance metrics. It includes a brief introduction and a table of contents.

Get this year end report template

Simple nonprofit annual report template

This nonprofit annual report reduces the use of text, and relies more on visuals, icons and charts to communicate data and figures.

Get this nonprofit annual report template

Ultimately, you decide how much information to include in your annual report, on top of what’s required. The best way to decide what to include, and how you present your annual report, is to consider the audience you’re creating an annual report for.

3. Who reads an annual report?

An annual report’s primary audience is your shareholders. These people have a legal right to know how your company is performing, how it is changing, what it has planned for the future and other facets of its operations.

But shareholders aren’t the only people with an interest in your company’s performance, its products, its projects, and plans for the future. More often, businesses use annual reports to present the organization’s brand as a whole. Your business’s vision for the future, its values and ideals, its social initiatives, its ambitions are all things that shareholders, as well as investors, employees, customers, donors (if you’re a nonprofit) business journalists and many others will take an interest in.

Annual reports for your staff

Annual reports are great ways for employees to learn more about your business and the brand. They can go through an annual report to see what other projects and initiatives the company has invested in. This is helpful for large businesses with hundreds or thousands of employees.

According to the most recent HR trends , employees care more than ever about employer branding and values. Take a look at the information highlighted in the sharply designed Roche Annual Report .

Among other things, this annual report highlights the value placed on the hard work of employees, teams and entire departments that have helped a business succeed.

In many instances, employees are shareholders within the company and they’re just as interested in how the company is performing. It’s another way to reinforce the value of their work, by showing how their team or department has helped the company to grow.

In the case of nonprofit organizations, annual reports help staff understand the impact of their hard work in the community.

Annual reports for your customers

Findings from Accenture Strategy’s global survey found that customers care deeply about the values and behaviors of major brands . Millennials and Gen-Zers in particular care most about brands driven by a purpose other than profit. According to the survey, nearly 40% of respondents stated they would stop purchasing from brands that appear socially irresponsible or ethically questionable.

You can see in this L’Oreal Annual Report , there are sections dedicated to their ethics and values.

Annual reports allow for a brand to present itself in the best light possible. Businesses can demonstrate the values that set them apart from competitors. They can talk about the types of suppliers and manufacturers they work with, how materials are sourced, the quality of their products, the well-being of their employees, their impact on the environment and more.

Nonprofit annual reports for donors

Nonprofit annual reports are testaments to all the money received and hard work that nonprofit organizations have done throughout the year. I’d argue they’re absolutely essential to a nonprofit.

Nonprofit annual reports demonstrate how the support from donors has helped to change people’s lives. After all, donors aren’t purchasing products the way customers do, what they’re “purchasing” is a social good that they want others to receive.

Annual reports highlight exactly how people’s lives are being transformed for the better. Check out the 2018 annual report from Girls Who Code .

Not only do they share the tremendous impact of the organization which donors want to know about - they do it in a visually creative, engaging way.

A nonprofit annual report highlights your organization’s successes, it provides some feel-good fulfillment to your staff who can look back at the fruits of their hard work, and donors know their money is being put to great use.

A nonprofit annual report also helps you make an appeal for more donations, bigger donations, grow your paid staff, and win over more volunteers for the coming year.

4. How do you summarize an annual report?

There are two simple ways to summarize an annual report. You can create an annual report infographic, or an annual report presentation. Both are great ways to share dense data and information in a way that’s manageable for your audience.

Annual report infographics

Let’s start with the annual report infographic. The advantage here is that you let the data tell the story. Rather than provide pages of analysis, visualize your data through charts, graphs, and icons. Take a look at this simple shareholder report infographic:

GET THIS ANNUAL REPORT INFOGRAPHIC TEMPLATE

The infographic focuses on a single data point. There may be layers of information that explain how that figure was determined, but this summary is practical and direct. For a more detailed report, create a long-form infographic report, by adding multiple sections that highlight individual data points.

You can use a layout like this annual report infographic:

get this infographic nonprofit report template

The use of text is minimal. The numbers and data tell the readers everything about the impact of the organization and how it has performed. This is an effective way to share relevant and valuable performance insights with shareholders, investors, or donors.

see all infographic templates

Annual report presentations

An alternate approach to summarizing an annual report is to create annual report presentation slides . You can share the slide deck on its own, or help it guide your presentation on key findings in your company’s complete annual report.

This simple annual report presentation deck dives right into the content. It’s a great example of how to break up data and make information easily digestible.

GET THIS ANNUAL REPORT PRESENTATION

Note how the large headings tell the audience exactly what each slide is focused on. Key findings are also highlighted on each slide, to complement the data the charts/graphs show.

If you expect a lengthier presentation slide, include an agenda or overview of your annual report presentation. This lets people know what you’ll be covering and how far along in your presentation you are.

The key to presenting is letting your audience know where they are in your presentation. Are you only halfway through or three quarters of the way done? Even with a summary, preparing your audience helps to keep them engaged, rather than distracted.

Our templates library has an attractive range of annual report presentation templates. Interested in designing your own? Check out our annual report presentation templates page.

SEE ALL BUSINESS PRESENTATION TEMPLATES

5. What is the easiest way to create an annual report?

As you’ve seen from the actual annual report examples I shared, and our annual report templates, annual reports are packed with a ton of content - text, visuals, charts, financial figures and more.

Hiring a design agency to design your annual report is one option. The cost for a professionally-designed annual report ranges anywhere from $5,000 to $12,000, and then depending on the types of visuals you need, even more.

Keep in mind, you’ll still need to pull all the content and data together yourself.

To save your organization time and money, without compromising on design, a professional annual report template is the way to go . You can visit Venngage’s annual report templates page today, browse hundreds of unique designs for a number of industries, and use preset layouts and design styles to format your content.

Customizing the templates is straightforward and doesn’t require any design experience. The Venngage editor is a drag-and-drop tool that’s simple to use. With it you can do a number of things like:

- Apply your branding through Venngage’s My Brand Kit , which includes your organization logo, brand colors and brand fonts

- Use chart and graph widgets to visualize financial data, trends, statistics and more

- Add beautiful icons that really elevate your annual report design

- Apply high-quality stock photos directly from Pixabay and Unsplash (or upload your own professional images).

6. How do you create an attractive annual report?

Why does the design of an annual report matter? Those who are interested in the information will take the time to read it, won’t they?

Sure, but they might not understand everything you’ve tried to communicate. Keep in mind, you’re sharing tons of data and ideas. If it’s boring and dry, investors might just take a nap instead.

I also mentioned that annual reports are a way to present your brand, and that employees and customers alike would be potential readers. How you present your organization influences their opinion of you, your values, what you’re all about and all the data you’ve packed in.

Captivating, engaging design provides your many different readers with an enjoyable experience, and helps them walk away with your annual report’s key takeaways. So below, I'll share a handful of annual report design best practices for you to keep in mind.

- Create a high-impact annual report cover page with large images

The cover of your annual report should grab, and hold, the attention of your readers. This can be hard to achieve without the help of a professional designer.

The workaround?

Use large, high quality images as the focal point of your cover page for a bold, eye-catching effect.

In this annual report example, bright blocks of color are combined with a full-page image to create a simple, yet striking design.

GET THIS TEMPLATE

Cover images should not be used purely for decoration. They should tell your customers, stakeholders, and employees something about the culture or values of your organization.

Use cover photos to set the tone for the report and to convey the company spirit that you’d like to project to your readers.

Does your company focus on positive customer experiences?

On company culture?

On high quality, professional products?

Take a look at how each of the companies below uses cover images to project their own, unique narrative focus. Nestle is focused on customer experiences, GE is focused on their employees, and Thermo Fischer Scientific is all about the product:

Source high quality images for a professional touch.

Using low quality or pixelated images can make the report look amateur and reflect poorly on your company or organization.

If you’re going to go with a full-page cover image, it’s worth investing in a professional photographer to take photos of real employees or customers, like L’Oreal has done for their annual report:

Otherwise, try to source high-resolution images from respected sites like Unsplash or Pixabay . You can access Unsplash and Pixabay's complete stock photo library in Venngage's editor as well.

- Choose the right charts for your annual report metrics

Annual reports are all about the numbers, meaning that a key ingredient of creating an effective annual report is choosing the right chart for each metric .

There are a few types metrics found in most annual reports, including:

- Financial highlights (revenue, earnings per share, growth, profit margin)

- Month by month financial trends

- Sales breakdown by market and by product

- Year over year financial performance

The type of data you are visualizing should determine what type of chart you use. Let’s review the best visualization types for each type of metric.

Use “big number” charts to summarize financial highlights.

The financial highlights section of an annual report should summarize the most important facts and figures of the year simply and concisely.

The easiest way to show this assortment of different metrics in a small space is to simply write out those numbers in big, bold text. We call this type of visualization a “big number” chart.

In a big number chart, the size of each number should vary based on its importance, as shown in Concho Resources’ 2017 annual report :

As you can see in the example below, big number charts communicate key metrics quickly, clearly, and with impact.

CREATE THIS REPORT TEMPLATE

Use line charts to display monthly trends.

Line charts are the standard display for tracking changes over time, which is essential in an annual report. Investors and shareholders will want to see month by month trends for all sorts of financial metrics, including sales, profits, margins, and share earnings.

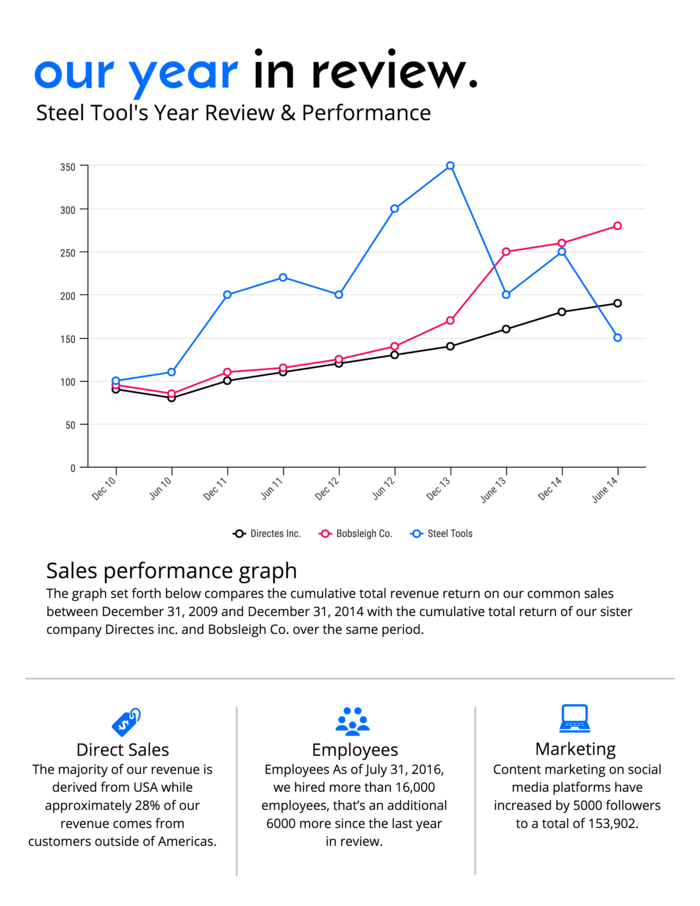

Line charts are perfect for comparing and contrasting sales trends across competitors, as seen in this annual report example:

As seen in Adidas’ 2016 annual report, line charts are particularly useful for tracking the growth of share prices over time (compared to market indices):

Use stacked bar or donut charts to show market composition.

Another core component of the finances section of an annual report is market segmentation, which shows the breakdown of annual sales into different categories.

You might break down your sales by geographic region, by product category, by customer profile...whatever helps your business identify opportunities for growth and improvement.

Traditionally, sales breakdowns are visualized with pie or donut charts, a standard method for showing part-to-whole relationships.

Pie charts, while intuitive to read, are notoriously poor data visualization tools. Most people struggle to distinguish between the size of similar pie segments at a glance.

A better choice would be a stacked bar chart, seen in the market segmentation report below.

Use grouped bar charts to compare year-over-year financial performance.

Year over year financial performance is of interest to many potential readers.

Investors, employees, and customers will all want to see how an organization’s current performance compares to that of previous years. It’s arguably the most important metric to be included in an annual report.

The most efficient method for visualizing year-over-year performance is with grouped bar charts, like these ones in GE’s 2017 annual report. The side-by-side bars emphasize the changes from one year to the next.

As seen above, it’s a good idea to use a highlight color to draw extra attention to the year of interest (2017, in this case).

- Use bold color accents to highlight key facts, quotes, and figures

Color should never be used simply for decoration in an annual report.

Although aesthetics should be a consideration, color should primarily be used to enhance communication--to clarify the information on the page.

As I just mentioned for the bar charts above, color can be used to highlight key information. It can be used to draw the reader’s attention to particularly important facts, figures, or data points in information-dense displays of text and data.

Check out how the yellow color is used to create visual contrast in this annual report example:

The contrast between the green background and the yellow highlight color draws attention to the most valuable bits of information: the data! The contrast creates points of visual focus, helping us make sense of the information on the page.

When creating your annual report, try to pick one highlight color and apply it to every key data point that you want your readers to pay attention to. The brighter, the better!

To learn more about using contrasting color schemes, check out this guide on how to use colors in infographics .

- Create a clear type hierarchy to make your annual report skimmable

Annual reports are typically quite information-heavy, with a great deal of technical information on each page.

To prevent your readers from getting lost (or worse: bored), it’s important to create a clear hierarchy of information on each page. This hierarchy will help your reader navigate through the report, allowing them to easily skim through to the most pertinent information.

You can create hierarchy by altering the size, weight, and placement of various elements. Headings should be larger than subheadings, key figures should be bolder than general body text, chart captions should be small and light, etc.

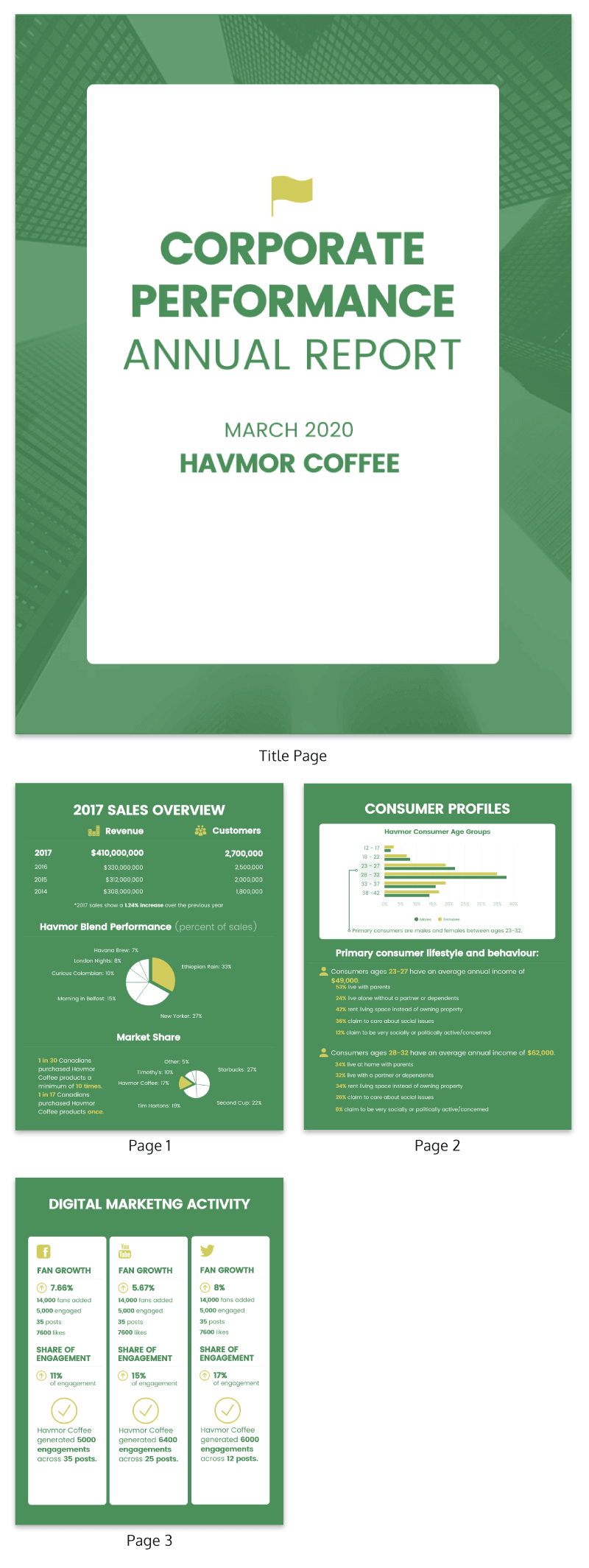

Check out how text hierarchy enhances the readability of the corporate performance annual report below. The titles and key numbers are styled in bold, black, large text, making them stand out from the rest of the page, while less pertinent text, like labels and captions, are smaller and more subtle:

When creating this visual hierarchy, it’s important to be mindful of the principles of typography. You don’t want the typography to distract from the content of the annual report.

Here are a few principles to keep in mind:

- Use a maximum of three different fonts to ensure the text is interesting but not chaotic.

- Use a stylized font for the header text and a minimal font for the body text.

- Use different font weights and styles to create contrast and draw the eye.

Want to learn more about typography for annual reports and infographics? Check out this guide on how to choose fonts .

- Create your annual report on a grid for a balanced page layout

I strongly suggest using a grid to format your annual report design.

Building off of an underlying grid framework will ensure consistency from page to page, while allowing you to experiment with different compositions (to keep your report interesting).

Using a grid can also help you create negative space, which is critical to great design. It gives the viewer time to process what they are seeing before moving on to the next section. Negative space is the core design component of most crisp, modern designs, like the one below:

- Focus on what’s important with a condensed one-pager annual report

Short, one page annual reports (also known as one-pagers) are gaining popularity as an alternative to extensive multi-page annual reports. These reports cover only the most important metrics, making it possible to grasp an organization’s performance at a glance.

One of the keys to a successful one page annual report is a simple color scheme. Pair neutral greys with a single bright highlight color for a sleek, cohesive look.

I hope this guide has answered the question, “what is an annual report”. To wrap up, here are all of the design best practices you should keep in mind when creating your next annual report.

Now you know everything there is to know about annual reports! If you still have burning question, comment and let us know. We'll share our expertise.

You can also check out more resources on report design examples, templates and tips below.

More report design guides:

55+ customizable annual report templates, examples & tips.

7 Business Report Templates You Need to Make Data-Backed Decisions

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Quickly & Effectively Read an Annual Report

- 04 Jun 2020

Intelligent investing requires analyzing a vast amount of information about a company to determine its financial health. Armed with this information, an investor can better understand how much risk might be involved with backing a company based on how well it’s performed historically, in recent quarters, and toward its financial targets.

Exactly where this information comes from depends on the specific company that’s being invested in, but typically requires several financial statements, including a balance sheet, cash flow statement, and income statement.

In addition to these documents, most investors look forward to reviewing a company’s annual report—a collection of financial information and analysis that can prove invaluable in evaluating the health of a company.

If you’re not an investor, but an employee working within a corporation, the annual report can impart valuable information pertinent to your career. Understanding how your company is performing and the impact your actions have had on its business objectives can help you advocate for a promotion or other form of career advancement .

If you’re unfamiliar with what goes into an annual report, there’s some good news: You don’t need to be a financial expert to get value out of the document or understand the messaging in it.

Here’s an overview of the different information you’ll find in an annual report and how you can put it to use.

Access your free e-book today.

What Is an Annual Report?

An annual report is a publication that a public corporation is required by law to publish annually. It describes the company’s operations and financial conditions so that current and potential shareholders can make informed decisions about investing in it.

The annual report is often split into two sections, or halves.

The first section typically includes a narrative of the company’s performance over the previous year, as well as forward-looking statements: Letters to shareholders from the chief executive officer, chief financial officer, and other key figures, as well as graphics, photos, and charts.

The second section strips the narrative out of the picture and presents a variety of financial documents and statements.

Unlike other pieces of financial data—and because they include editorial and storytelling—annual reports are typically professionally designed and used as marketing collateral. Annual reports are sent to shareholders every year before an annual shareholder meeting and election of the board of directors, and often accessible to the public via the company’s website.

Annual Report vs. 10-K Report

Annual reports aren’t the only documents public companies are required to publish yearly. The US Securities and Exchange Commission (SEC) requires public firms also to produce a 10-K report , which informs investors of a business’s financial status before they buy or sell shares.

While there’s similar data in both an annual and 10-K report, the two documents are separate.

10-K reports are organized per SEC guidelines and include full descriptions of a company’s fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. You can also find detailed discussions of operations for the year, as well as a full analysis of the industry and marketplace.

Because of this, 10-K reports are longer and denser than annual reports, and have strict filing requirements—they must be filed with the SEC between 60 to 90 days after the end of a company’s fiscal year.

If you need to review a 10-K report, you can find it on the SEC website .

What Information Is Contained In An Annual Report?

An annual report typically consists of:

- Letters to shareholders: These documents provide a broad overview of the company’s activities and performance over the course of the year, as well as a reflection on its general business environment. An annual report usually includes a shareholder letter from the CEO or president, and may also contain letters from other key figures, such as the CFO.

- Management’s discussion and analysis (MD&A): This is a detailed analysis of the company’s performance, as conducted by its executives.

- Audited financial statements: These are financial documents that detail the company’s financial performance. Commonly included statements include balance sheets, cash flow statements, income statements, and equity statements.

- A summary of financial data: This refers to any notes or discussions that are pertinent to the financial statements listed above.

- Auditor’s report: This report describes whether the company has complied with generally accepted accounting principles (GAAP) in preparing its financial statements.

- Accounting policies: This is an overview of the policies the company’s leadership team relied upon in preparing the annual report and financial statements.

What to Look for in an Annual Report

While all the information found in an annual report can be useful to potential investors, the financial statements are particularly valuable, as they provide data that isn’t obscured by any sort of narrative or opinion. Three of the most important financial statements you should evaluate are the balance sheet, cash flow statement, and income statement.

The balance sheet shows a company’s assets, liabilities, and owners’ equity accounts as of a specific date, illustrating its financial position and health.

The income statement shows a company’s revenue and expense accounts for a set period, allowing you to gauge its financial performance. Using trial balances from any two points in time, a business can create an income statement that tells the financial story of the activities for that period.

Cash flow statements provide a detailed picture of what happened to a business’s cash during an accounting period. A cash flow statement shows the different areas in which a company used or received cash, and reconciles the beginning and ending cash balances. Cash flows are important for valuing a business and managing liquidity, and essential to understanding where actual cash is being generated and used. The statement of cash flows gives more detail about the sources of cash inflows and the uses of cash outflows.

These three documents can help you understand the financial health and status of a company, and they’re all included in the annual report. When you read the annual report—including the editorial information—you can gain a better understanding of the business as a whole.

An annual report can help you learn more details about what type of company you work for and how it operates, including:

- Whether it’s able to pay debts as they come due

- Its profits and/or losses year over year

- If and how it’s grown over time

- What it requires to maintain or expand its business

- Operational expenses compared to generated revenues

All of these insights can help you excel in your role, be privy to conversations surrounding the future of the company, and develop into an effective leader .

Critical Information for Investors and Employees Alike

Being able to analyze annual reports can help you gain a clearer picture of where a company sits within its industry and the broader economy, illuminating opportunities and threats.

The best part about learning to read and understand financial information is that you don’t need to be a certified accountant to do so. Start by analyzing financial documents over a set period. Then, when the annual and 10-K reports are published, you can review and understand what leadership is saying about the operational and financial health of your company.

If you’re an investor, knowing how to read an annual report can give you more information from which to base your decision on whether to invest in a company. If you’re an employee within an organization, learning how to read and apply the information contained in an annual report is an essential financial accounting skill that can help you understand your company’s goals and capabilities and, ultimately, further your career.

Do you want to take your career to the next level? Explore Financial Accounting and our other online finance and accounting courses , which can teach you the key financial topics you need to understand business performance and potential. Download our free course flowchart to determine which best aligns with your goals.

About the Author

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, what is an annual report , and how do you file it.

The U.S. Securities and Exchange Commission and many states require businesses to file annual reports. Use this guide to meet your reporting obligations.

Certain business entities must file annual reports (statements of information) with state governments, typically through the State Department. Public companies must give shareholders a yearly report detailing their operational and financial condition.

Additionally, public and certain private organizations may need to file a separate document with the U.S. Securities and Exchange Commission (SEC). So, which reports do you need to file or share with stakeholders? Explore the types of annual reports and learn how (and when) to file them.

What is an annual report for a small business?

A state-required annual report is a short document that explains who owns the company, what products or services it sells, and how to contact the people in charge. Many small businesses file an annual report with their formation state (where they initially registered their company) and any foreign states where they are registered to do business.

Wolters Kluwer said the following statutory business entities might need to file an information report:

- Business corporations .

- Nonprofit corporations.

- Limited liability companies (LLCs).

- Limited partnerships (LPs).

- Limited liability partnerships (LLPs).

The SEC requires publicly traded companies to share yearly reports with shareholders. Unlike state-mandated forms, this annual report is an in-depth accounting of a corporation’s finances and operations. Lastly, federal security laws mandate public corporations to file Form 10-K yearly.

[ Read more: S Corp vs. LLC: What’s the Difference? ]

State-mandated annual report filing

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn’t require an LLC annual report, and if you formed your company in Indiana , you only need to send the report every two years.

Since rules and due dates differ, always check with your state’s business department. States usually send a reporting form to the business address on file. You can return it via postal mail along with any annual registration fees. Many also allow you to file your yearly report online.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health.

SCORE noted that state-mandated annual reports are “relatively short documents” and include:

- Your company’s name and address.

- Purpose of the business.

- Names and addresses of a corporation’s directors and officers.

- Registered agent’s name and address.

- Names and addresses of LLC members or managers.

Annual reports for shareholders

According to Investopedia , “Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.” These documents give a comprehensive view of your organization, allowing shareholders, stakeholders, and investors to understand your corporation’s financial position.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health. Harvard Business School Online said, “Usually, an annual report is split into two halves.” The first section shares “the company’s narrative,” and the second part “presents data” minus the “narrative components.”

Investor.gov stated that businesses must provide shareholders with annual reports when holding yearly meetings to elect the board of directors . Additionally, proxy rules require companies to “post their proxy materials, including their annual reports, on their company websites.”

An annual report template has the following sections:

- Summary of general business information.

- Annual performance highlights.

- CEO’s letter to the shareholders.

- Management’s discussion and analysis (MD&A).

- Financial statements .

- Supporting notes, photos, and graphics.

- Auditor’s report.

- Financial information summary.

- Review of accounting policies.

[ Read more: Which Type of Accounting Service Do You Need? ]

SEC rules for filing annual statements

Organizations required to report to the SEC — including all public and some private companies — must disclose financials yearly to the SEC. Section 12 of the Exchange Act defines a private reporting company as one that has more than $10 million in total assets and a class of equity securities with either 2,000 or more persons or 500 or more individuals who are not accredited investors, or one that “lists the securities on a U.S. Exchange.”

According to Form 10-K instructions

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

What Is an Annual Report? What’s Included & When to File

Running a business can sometimes be exhilarating work, but it can also come with its fair share of tedium—thanks to the long list of tasks associated with compliance. Filing an annual report in your state of incorporation—and any additional states where you’re registered to do business—is one of those tasks. And like many business compliance tasks, the specific requirements to file vary from state to state.

What is an annual report?

An annual report is a brief overview of key facts about your company filed to the Secretary of State in any state where you are registered to do business. Typically, annual reports include business contact information and a record of the company’s activities (such as a merger or a dissolution) during a given reporting period.

States use annual reports to keep information about your company up-to-date and make sure that they are able to deliver routine government correspondence or contact you in the event of a legal action. In some cases, the Secretary of State also uses annual report information to assess your franchise tax obligations in a particular state.

An annual report can also be known as an annual statement, a statement of information , a periodic report , a biennial statement, or a decennial statement. Filing processes, fees, and frequency all vary by state—biennial statements are due every two years, as an example, and decennial statements are due every ten.

Annual report vs. annual shareholder report

Although both are sometimes referred to as annual reports, the annual information reports required of most business entities are distinct from the comprehensive annual shareholder reporting required of public companies. Annual shareholder reports are federally mandated disclosures designed to help stakeholders and potential investors evaluate a company’s performance and financial conditions and make informed investment decisions. They include quantitative and qualitative performance analysis, financial statements (including cash flow statements, income statements, and balance sheets), an auditor’s report, an overview of accounting policies, and details about the company’s operations.

Who’s required to file an annual report? Who isn’t?

Most states require limited liability companies (LLCs) , corporations, limited partnerships, and limited liability partnerships (LLPs) to file annual reports. In most cases, these business entities are required to submit an annual report in every state in which they are registered to do business.

Sole proprietorships and partnerships typically aren’t required to file annual reports, although jurisdictions may require annual renewals for certain types of business licenses.

What’s covered in an annual report?

Although specifics vary by state and business entity, annual reports typically include the following information about the company:

- Business name

- Primary office address

- A brief statement of business purpose

- Your EIN and any other state-issued registration numbers

- Registered agent information (if applicable)

- Addresses of offices in the state (if applicable)

- Fictitious name (if applicable)

- Number of authorized shares (for corporations that issue shares)

- The names and addresses of directors and officers (for a corporation), members and managers (for an LLC), and partners (for a partnership)

Some states will also request financial information, such as liabilities and assets located in the state.

Most states charge an annual reporting fee, which can range from $9 to over $1000 depending on the state, business entity type, and specifics about the company’s operations. Corporation or LLC fees, as an example, may be assessed based on the number of authorized shares or the number of LLC members.

When do you need to file an annual report?

Although there’s a lot of overlap in annual report content across states, due dates vary widely.

States require different filing frequencies and use different methods to establish filing deadlines. Depending on the state, you may be required to file annually, biannually, or once a decade. Your due dates might fall in a state-determined month (e.g. every January) or be based on when you originally registered to do business in the state.

These differences can make it tedious to track deadlines—especially if you have reporting obligations in multiple states. If you formed your business in New York in 2020 and registered to do business in ten other states after hiring remote employees , you might end up with six annual reports due in January, one each in June and July, one due every other December, and one due every tenth December.

Mosey ’s compliance platform can help you stay on top of these deadlines. With Mosey, you can automate filing annual reports in supported states, track requirements and recurring deadlines, receive alerts for key tasks, and manage state mail all in one place.

Penalties for not filing an annual report or filing late

Most states impose fees for filing a late annual report—and if you don’t file at all, consequences can be severe.

Failing to file an annual report in your state of incorporation can result in loss of good standing, affecting your ability to open business bank accounts or obtain financing. In some cases, it can even cause your business to be dissolved entirely.

If you don’t file a report in a state in which you are registered as a foreign entity, that state can revoke your ability to do business in the state.

Mosey features active monitoring and notifications to help you stay on top of annual report filing for your company. Import your incorporation date or foreign qualification date for each state and Mosey will calculate your annual report filing requirements and deadlines automatically. They will be added to your account for easy management and Mosey will alert you when they become upcoming tasks to complete. Mosey keeps it all organized by showing you the requirements, when they are due, and who is doing what. Mosey will even automate filing the annual report for you—just click a button and we’re on it.

Read more from Mosey:

- Certificate of Good Standing: The Business Owner’s Guide to How and Why

- What Is Tax Nexus? Nexus Types & Determining Tax Nexus

- What Is Foreign Qualification? Considerations & How to Qualify

- What Is Workers Compensation & How Does It Work?

- Exiting a PEO: Reasons, Considerations, and Checklist

- Hiring Remote Employees: Everything You Need to Know

- LLC Annual Report: What It Is, What’s Included & How to File

- These 5 States Require Short-Term Disability Insurance (2023)

- What Is an LLC (Limited Liability Company)?

Review your compliance risks, free.

Use our compliance checkup to learn more about what to do to be compliant in any state! It's free and takes less than five minutes.

Ready to get started?

Sign up now or schedule a free consultation to see how Mosey transforms business compliance.

Mosey has everything you need to get compliant in all 50 states in one, easy to use, platform.

Request a Free Vena Demo Today

Learn how Vena reduces budgeting, reporting, and analysis times by 50%.

- Annual Reports

Annual Reports Explained: What They Are And How To Read And Write

An annual report is a document created by companies for stakeholders that outlines important information about an organization's financial and operational health. For publicly traded companies in most countries, providing stakeholders with an annual report is a legal requirement. In the United States, there is a more detailed version of the annual report called Form 10-K , which is submitted to the U.S. Securities and Exchange Commission (SEC).

What Is An Annual Report?

An annual report typically contains in-depth information about the organization’s financial and operational status. The report is usually accompanied by visuals, such as charts and graphs, that highlight accomplishments from the previous year as well as forecasts about future performance. The annual report is also an opportunity to tell all stakeholders the story behind the numbers.

Understanding Annual Reports

The main objective of annual reports is to provide transparency to stakeholders so they can make more informed decisions about their investment in the company. In the United States, annual reports became mandatory for public companies after the Wall Street Crash of 1929. A typical annual report will contain:

General Corporate Information

Companies usually provide a snapshot of their business in the annual report, with information such as:

- Number of employees

- Number of offices

- Founding date

Performance Highlights

The annual report is a great opportunity for a company to showcase performance highlights from the previous year, such as revenue growth, new product launches and improvements in operational efficiency.

Financial Statements

The three financial statements—balance sheet, income statement and cash flow statement—are almost always included in the annual report.

Letter to the Shareholders From the CEO

It is common for a company’s CEO to write a letter to their shareholders that outlines achievements and performance from the previous year.

Management Discussion & Analysis (MD&A)

In addition to the CEO, it is also common for annual reports to include a section written by the other C-level executives discussing performance, achievements and potentially plans for the future.

Outlook for Future Years

The annual report usually contains a section about future outlook for the company. This section may include plans for the future, detailed information about strategy, thoughts on position within the company’s respective market and more.

What Key Information Does an Annual Report Contain?

The annual report includes key financial information about a company such as:

- Profits and loss statements

- Information about a company's ability to pay outstanding debts

- The company’s growth over the years

- Retained earnings

- Revenue compared to expenses

Who Uses Annual Reports

Annual reports are most commonly used by:

- Shareholders

- Potential investors

How Do You Write an Annual Report? (Step-by-Step Guide)

Here are the steps for writing an annual report: 1. Write a shareholder letter. 2. Add basic information about your company, such as your industry, market share and revenue. 3. Include income and expense reports that have been audited. 4. Use business intelligence tools to tell the story of your company’s financial health. 5. Provide details about your cash flow. 6. Ensure your financial statements are easy to understand for a non-finance audience by including explanatory notes.

5 Common Pitfalls To Avoid When Writing Your Annual Report

Try to avoid these five common mistakes when writing your annual report: 1. No personality. Don’t just focus on the numbers—this is your chance to tell your company’s story and showcase your culture. 2. Too much information. Instead of overwhelming your readers with content, try to add some focus and precision to your annual report. 3. Leaving readers confused about your company. Don’t assume your stakeholders know the basics about your company. Make sure you clearly communicate what your company does, how it makes money, what its vision is and what their future goals are. 4. Not enough value for stakeholders. Your annual report will be read by investors, potential investors, employees, board members, partners, suppliers and more. Ensure your report has valuable information for all of those audiences. 5. Too difficult to skim. Nobody is going to read a wall of text. Your report needs to be formatted well and contain visuals so stakeholders can easily skim it to get the information they need.

Vena Can Help You Build Annual Reports

If you’re looking for help in building annual reports, here are a few resources to check out:

- Free Excel templates for balance sheets, income statements, board reports and more

- Easy-to-use solution for creating your financial statements and reports

Recommended Resources

What Is Financial Reporting and Why Is It Important?

Reporting excel templates.

All-in-One Financial Reporting Solution With an Excel Interface

What is an Annual Report?

Home › Finance › Corporate Finance › What is an Annual Report?

Definition: An annual report is a financial summary of a company’s activities during the year along with management’s analysis of the company’s current financial position and future plans. Annual reports are prepared at the end of the fiscal year for external users to gain financial information about the inner workings of the company and what management plans to do in the future.

A typical annual report includes several different sections that help investors and creditors understand the company more than they would by simply looking at a set of general-purpose financial statements . A standard report includes the following sections:

- Letter to Shareholders

- Financial History and Highlights

- Management Discussion and Analysis

- Management’s Report on Financial Statements and on Internal Controls

- Report of Independent Accountants sometimes called the Auditor’s Report including a section on internal controls

- Balance Sheet

- Income Statement

- Statement of Stockholders’ Equity

- Cash Flows Statement

- Notes to Financial Statements

- List of Directors and Officers

As you can see, the full report gives external users a much more holistic view of a company’s financial position, market standings, and ability to improve than a simple set of comparative financial statements .

Although the report is directed at external users , it’s often used as an advertising and marketing tool to show the public that the company is doing well. Management can showcase new products and innovations as well as discuss new markets that they expect to enter in future periods.

This report is typically issued with graphics, photos, illustrations, graphs, and diagrams. It’s for more attractive than a simple set of financial statements. In a sense, this is the report where management can brag about its accomplishments and entice new investors to join the company. Even though there are marketing-type elements in the report, the actual purpose of it is to convey financial information to the outside users.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Search 2,000+ accounting terms and topics.

- Basic Accounting Course

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Financial Ratio

Annual report – definition and meaning

An annual report is a document that public companies issue to provide shareholders with important corporate information. Potential investors, analysts, and financial journalists also read annual reports. In fact, when a major company like Apple Inc. issues its report, a wide range of people examine it.

The majority of jurisdictions instruct companies to prepare and disclose annual reports. Many firms file their annual reports at the company’s registry.

The main aim of the annual report is to provide a summary of how well (or badly) a company has performed over the past 12 months. Additionally, the document provides a glimpse of things to come.

Creating a compelling annual report today is a real art. In fact, some people call it a science. There are even agencies that specialize in preparing annual reports.

Annual report – public companies

In most cases, ** public companies usually have to report at more frequent intervals. However, this also depends on the guidelines of the stock exchange where investors buy and sell the company’s shares.

** You can buy and sell public company shares on a stock exchange , but not the shares of a private company.

An annual report usually begins with an opening letter from the Chief Executive Officer, followed by financial data, results of continuing operations, and information about its market. The report authors also write about products that are in the pipeline, as well as the company’s subsidiary activities.

Additionally, many companies, especially the larger ones, include details on their research and development.

Typically, the cover and first few pages of the report contain graphics, photos, and accompanying narrative. The annual report’s first few pages detail what the company has achieved over the past year.

Comprehensive financial and operational information appears in the latter half of the report.

Every year, companies send their annual reports to shareholders. They send the reports when the companies hold their AGMs to elect directors and discuss strategy. AGM stands for A nnual G eneral M eeting.

According to the dictionary Merriam-Webster , an annual report is:

“A usually lengthy report issued yearly by an organization giving an account of its internal workings and especially its finances.”

The Wall Street Crash

The Wall Street Crash , which occurred in 1929, was the greatest stock market collapse in US history. After the crash, the US Government passed legislation forcing public companies to publish an annual report.

In the US, companies submit a more comprehensive report, a Form 10-K , to the SEC. SEC stands for the S ecurities and E xchange C ommission.

American companies must file the Form 10-K no more than ninety days after the fiscal year. Additionally, public companies must file a Form 10-Q every quarter.

US companies can submit their annual reports electronically via the SEC’s EDGAR database. This database is also a useful tool, especially when you are researching public companies.

Share this:

- Renewable Energy

- Artificial Intelligence

- 3D Printing

- Financial Glossary

What is an annual report?

Annual reports inform all interested parties about the financial success (or failure) of a public entity, private corporation, non-profit organization, or other business formation.

Ready to start your business? Plans start at $0 + filing fees.

by Jonathan Layton, J.D.

Jonathan Layton is a graduate of The College of William and Mary, where he majored in English literature. While...

Read more...

Updated on: February 1, 2024 · 4 min read

What is the purpose of an annual report?

What is included in an annual report, who files the annual report, when should annual reports be filed, do small businesses or llcs need to file an annual report, what is the annual report requirement for large corporations.

An annual report is a document that contains comprehensive financial information about public companies, small and large corporations, non-profit organizations, partnerships, and other businesses. It includes their financial performance and activities over the prior fiscal year.

Some types of businesses must prepare and file an annual report by law with the Secretary of State where the company operates. Other companies prepare annual reports to keep shareholders, employees, and the community informed regarding the company's financial health.

In general, most states require corporations and other businesses with shareholders to file annual reports. If they fail to do so, they may lose their corporate designation and the tax advantages that go with that designation.

Annual reports can also be known as "business annual reports," "statements of information," or "yearly statements."

Beyond the legal requirements, they also:

- Help to attract new investors

- Retain the confidence of current stakeholders

- Provide business analysts and creditors with insight into the company's financial status

Depending on the size of the corporation (500 or more shareholders) and amount of annual profit (at least $10 million or more in assets), and whether it is publicly traded, in addition to filing an annual report, a separate filing with the U.S. Securities and Exchange Commission may also be required.

The requirements for filing an annual report vary in each state. In the states that require annual reports to be filed, the Secretary of State (or similar governmental entity) will normally prescribe the filing requirements.

In many instances, for ease of operation, the Secretary of State will forward—via electronic mail or United States mail—the annual report forms to the companies (or to their registered agent) that are expected to file them. The forms are relatively easy to complete and contain the requisite information to be included.

Alternatively, the forms can be located online, downloaded, completed, and filed electronically.

The annual report forms generally require the following information to be included:

- Information regarding the name of the company, business type, and registered agent

- Information concerning corporate officers and directors and the corporation's physical location

- A report from the CEO to update current and potential investors on the company's economic status, key events, activities and achievements, yearly highlights, details regarding new products or services, and future needs, wants, and goals, as well as the desired direction of the company

- The company's financial breakdown (including balance sheet summaries, a cash flow statement, capital investment data, an auditor's report, anticipated revenues, and expenses, changes in equity report, income statement, and other profit and loss details)

- A restatement of the company's core values, mission statement, and future objectives

There are normally annual report fees involved when you file the annual report, including, but not limited to, franchise taxes.

A business entity's size will typically determine whether an in-house staff member will prepare an annual report or if an outside firm will be retained.

Larger organizations often have employees within the company who are designated to complete this essential undertaking.

To the extent your state requires an annual report to be filed, it's always best to timely file required annual reports and financial statements with the Secretary of State, and pay any requisite fees.

A review of a state-by-state list of the annual report filing deadlines reveals that the filing date, the type of filing required, and the fees involved vary greatly depending upon the state in which your business was formed or is currently operating.

Be aware that the failure to promptly file the annual report and remit any fees due and owing could result in severe penalties or the complete dissolution of the business.

The annual reporting requirements for a small business or limited liability company (LLC) tend to be less rigorous than they are for larger corporations. Nevertheless, the majority of states require small businesses and LLCs to file some form of report to comply with state regulations and to maintain their good standing .

Although less comprehensive in size and scope, annual reports for small businesses and LLCs serve to generally inform the employees or members about how the company is performing and to share the management's vision for the future.

Depending upon the state in which the LLC is formed and operated, the yearly report may be called an "annual report," a "statement of information," an "annual statement," or something very similar.

Annual reports prepared by larger corporations normally have the most onerous filing requirements. The reports usually begin with a letter from the CEO or the president regaling the history of the company, recapping the previous year's activities, revealing the company's profit and loss outlook, discussing the short- and long-term objectives of the company, and touting the prognosis for future growth and prosperity.

The report may also include a mission statement, the names of the executive officers or board members, and a listing of the services and/or products the company offers .

Although designed to disclose the important aspects of a company's current financial position, an annual report often includes some "style point" elements as well, such as visually appealing graphics, photos and brand storytelling to enhance the company's corporate identity.

If you need assistance completing and filing an annual report, you can seek help from attorneys in your state.

You may also like

How to get an LLC and start a limited liability company

Considering an LLC for your business? The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first.

March 21, 2024 · 11min read

What is a power of attorney (POA)? A comprehensive guide

Setting up a power of attorney to make your decisions when you can't is a smart thing to do because you never know when you'll need help from someone you trust.

May 7, 2024 · 15min read

How to start an LLC in 7 easy steps

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 6, 2024 · 22min read

What is an annual report?

Annual report (definition).

An annual report is a detailed report that shows a company’s operations and financial performance in the preceding 12 months. This information is of interest to shareholders and potential investors.

Publicly traded companies have to produce annual reports as part of their responsibilities to stock market regulators and their shareholders. Companies that aren’t publicly traded may still have to produce annual reports for government regulators and tax offices.

What goes in an annual report?

An annual report for a publicly traded company typically contains highlights of the company’s activities and performance during the previous year, future goals and objectives, a letter to shareholders from the CEO or company president, an auditor’s report, and detailed financial statements. Financial information is often visually presented in graphs and tables. The annual report for a small business will be much more simple.

The financial statements – balance sheet, income statement, and cash flow statement – provide information about the company’s:

- current financial state

- profit or loss in its previous fiscal year

- cash availability to pay its debts as they come due

- earnings retained to grow its operations

- operating ratio (OR) ratio of operational expenses to revenue generated

See related terms

Financial statements

Financial reporting

Handy resources, advisor directory.