Hacking the Case Interview

If you have an upcoming private equity case interview and are feeling stressed, overwhelmed, or unsure of what to do, we have you covered.

Private equity case interviews are a common type of case given in consulting interviews in addition to market entry case interviews , growth strategy case interviews , M&A case interviews , pricing case interviews , operations case interviews , and marketing case interviews .

Fortunately, private equity case interviews are fairly straight forward. They are very predictable and all cases generally follow the same steps to solve.

In this comprehensive article we’ll cover:

- What is a private equity case interview?

- Why do consulting firms give private equity case interviews?

- How to solve a private equity case interview

- Private equity case interview framework

- Private equity case interview examples

- Private equity case interview vs. M&A case interview

- Recommended private equity case interview resources

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What is a Private Equity Case Interview?

A private equity case interview situates you in a business situation where you are helping a private equity firm decide whether or not to acquire a company to add to their portfolio.

For those that are unfamiliar with what private equity is, private equity firms are investment management companies that specialize in making investments in privately held companies or in public companies that they plan to take private.

This type of investment is called private equity because it involves investments made in privately held companies in contrast to publicly traded companies, which have shares that can be traded on public stock exchanges. However, private equity firms can also buy out a public company and take that company private.

Private equity firms raise capital from investors, including pension funds, endowments, and high-net worth individuals.

These private equity firms then identify potential companies to acquire or invest in, performing a thorough due diligence to ensure that the investments they make are attractive and will generate a high return on investment for their investors.

In a private equity case interview, you will be conducting a due diligence on a company that has been identified as a potential acquisition target.

The value that private equity firms provide include:

- Providing capital to companies that need funding for growth and expansion

- Bringing expertise and resources to help improve operational efficiency

- Providing strategic guidance and advice for business strategy and market positioning

- Providing access to an extensive network of industry contacts, potential customers, suppliers, distributers, retailers, and other stakeholders

- Using financial engineering techniques to optimize capital structure, including restructuring debt, recapitalizing the company, or implementing tax-efficient strategies

Why do Consulting Firms Give Private Equity Case Interviews?

Consulting firms give private equity case interviews because they closely simulate what private equity work at the firm looks like. If candidates can do well on a private equity case interview, they’ll likely succeed doing private equity due diligences for actual clients.

Case interviews in general are a way for consulting firms to assess whether candidates have the skills and capabilities to succeed in consulting.

In just a 30 to 45-minute case interview, interviewers can assess a variety of different skills that are critical to management consulting. Skills assessed in a case interview include:

Logical and structured thinking : Consultants need to be organized and methodical in order to work efficiently.

- Can you structure complex problems in a clear, simple way?

- Can you take tremendous amounts of information and data and identify the most important points?

- Can you use logic and reason to make appropriate conclusions?

Analytical problem solving : Consultants work with a tremendous amount of data and information in order to develop recommendations to complex problems.

- Can you read and interpret data well?

- Can you perform math computations smoothly and accurately?

- Can you conduct the right analyses to draw the right conclusions?

Business acumen : A strong business instinct helps consultants make the right decisions and develop the right recommendations.

- Do you have a basic understanding of fundamental business concepts?

- Do your conclusions and recommendations make sense from a business perspective?

Communication skills : Consultants need strong communication skills to collaborate with teammates and clients effectively.

- Can you communicate in a clear, concise way?

- Are you articulate in what you are saying?

Personality and cultural fit : Consultants spend a lot of time working closely in small teams. Having a personality and attitude that fits with the team makes the whole team work better together.

- Are you coachable and easy to work with?

- Are you pleasant to be around?

Consulting firms typically charge anywhere from 20-50% higher rates for private equity work compared to other types of consulting work. Therefore, consulting firms are always trying to sell more private equity work and really value candidates that show the potential to do private equity diligences.

Showing competency during a private equity case interview will make you a highly attractive candidate.

How to Solve a Private Equity Case interview

Although the exact industry or company that you will do a due diligence on during a private equity case interview will vary, all private equity cases typically follow the same five steps.

Once you have done a few private equity cases, you’ll quickly notice this pattern and be able to take your learnings from your previous cases and apply them to future private equity case interviews.

1. Understand the goal of the acquisition

The first step of any private equity case interview is to understand what is the goal of the acquisition. Only once you understand the goal or objective can you start to evaluate whether the acquisition or investment makes sense.

There are a number of different reasons why a private equity firm may want to acquire or invest in a company:

- Potential for growth : Private equity firms may target companies that have strong growth potential, including the potential to expand into new markets, introduce new products or services, or for increasing market share in existing markets

- Operational improvement : Private equity firms often specialize in operational optimization and efficiency. They may target companies with underperforming operations or inefficient processes to implement changes to improve profitability and performance

- Strategic fit : Private equity firms may pursue investments that align with their overall investment thesis or strategic objectives. This includes investing in companies that complement their existing portfolio holdings or fill a gap in industry coverage

- Turnaround opportunities : Private equity firms may also specialize in turning around distressed companies that are facing significant financial challenges or difficulties. They may see an opportunity to acquire a distressed company at a heavily discounted price

- Market timing : Private equity firms may also opportunistically invest in companies based on market conditions, lower than average valuation multiples, or industry trends. They may see attractive opportunities during periods of economic downturns or industry consolidation

2. Create a framework

The next step to solving a private equity case interview is to create a framework to guide your due diligence.

A case interview framework is a tool that helps you structure and break down complex problems into smaller, simpler components. You can think of a framework as brainstorming different ideas and organizing them into different, neat categories.

Instead of answering the overall question of whether the acquisition should be made, a framework can break up this large question into a few smaller, more manageable ones:

- Is the market that the acquisition target in attractive?

- How does the company perform relative to its competitors?

- Does the private equity firm have the skills or expertise to improve or turn around this company?

- Are there synergies that can be realized from this acquisition with other companies in the private equity firm’s portfolio?

- What are the major risks of this investment?

- What is the expected return on investment?

As you can see, using a framework helps you break down an ambiguous and daunting due diligence task into several more manageable steps.

3. Develop a hypothesis

Once you have developed a great framework to help you solve the private equity case, the next step is to develop a case interview hypothesis .

Based on the limited information that you have, what is your preliminary hypothesis on whether the company should be acquired?

Hypotheses are used in case interviews, as well as in consulting, because they are a very efficient way to solve problems. A hypothesis helps you focus your attention on the issues that matter most in developing a recommendation.

Many candidates find it challenging and intimidating to develop an initial hypothesis with very limited information. However, don’t be discouraged from this.

Know that it is completely acceptable for your initial hypothesis to be wrong.

Remember, the goal of coming up with an initial hypothesis is to help guide your analysis and discussion towards the right direction. You can think of your hypothesis as a strawman that you will either build support for or reject.

Your hypothesis will help you decide on an area of your framework to tackle first.

4. Build support for a recommendation

Now that you have a hypothesis for your private equity case interview, it is time to start building support for it or rejecting it.

As with any other type of case interview, you’ll likely need to do both case math as well as have qualitative discussions with the interviewer to discover more information and uncover key insights.

It is important that throughout the case, you are keeping track of all of the new information presented to you. It will be especially important to keep track of the major insights or key takeaways from each question that the interviewer asks you.

Keeping track of the major insights or key takeaways will make it significantly easier to develop a final recommendation at the end of the private equity case interview.

5. Deliver a recommendation

The last step in a private equity case interview is to develop a recommendation and present it to the interviewer.

Developing an ultimate recommendation is difficult because it requires you to review all of the work that you have done so far in the case interview and synthesize and distill all of it into just the most important points or takeaways.

You’ll also likely need to exercise business judgment to determine whether you should recommend acquiring the company or passing on the investment opportunity.

It is completely acceptable to ask the interviewer for a few minutes of silence so that you can collect your thoughts and deliver your recommendation in a clear, concise, and confident way.

When delivering your recommendation, make sure that you start with your recommendation first. Then, present the reasons or evidence that supports your recommendation. Finally, end by discussing potential next steps that you would look into if you had more time.

You don’t want to start your recommendation by summarizing all of your work and then stating a recommendation at the very end of your presentation.

This makes your recommendation excessively long and potentially unclear and confusing because the interviewer won’t know which way you are leaning towards until the very end.

Private Equity Case Interview Framework

The framework that you develop for your private equity case interview is the most important step of solving a private equity case interview.

Having a comprehensive and robust framework will make solving any private equity case interview easier. On the other hand, having an incomplete and poorly thought out framework will make solving the case significantly more challenging.

While you should not resort to purely memorizing frameworks for case interviews, there is a single framework that we recommend all candidates become familiar with. Many of the components of this private equity case interview framework can be applied to nearly any private equity case interview.

The major components of a private equity framework could include: market attractiveness, company attractiveness, private equity firm capabilities, synergies, financial implications, and risks.

- Market attractiveness : What is the market size of the market that the acquisition target is in? What is the growth rate of that market? How competitive is the market?

- Company attractiveness : What is the financial performance of the acquisition target? What are their key strengths or competitive advantages? What are their weaknesses?

- Private equity firm capabilities : Does the private equity firm have expertise in the industry or market that the acquisition target is in? Does the private equity firm have the capabilities or resources to improve the company’s performance?

- Synergies : Are there potential revenue synergies that can be realized with other companies in the private equity firm’s portfolio? Are there potential cost synergies that can be realized?

- Financial implications : Is the acquisition price fair? What is the potential return on investment? How long will it take the private equity firm to recoup their initial investment?

- Risks : What are the major risks of this investment? Can these risks be mitigated? What is the likelihood of these risks materializing?

An outstanding private equity case interview framework should include at least a few of these components, if not all of them.

However, make sure that you are customizing your private equity case interview framework based on the specific pieces of information and nuances of the case that you receive.

Private Equity Case Interview Examples

Below, we’ve provided examples of several different types of private equity case interviews you could see on interview day.

You can find more case interview examples in our articles on case interview examples and practice and MBA casebooks .

Private Equity Case Interview Example #1 : A private equity firm is interested in acquiring a technology startup with innovative products and a strong customer base. The firm sees significant growth potential in expanding the company's offerings to new markets and leveraging its technology to capture market share. Should they make this acquisition?

Private Equity Case Interview Example #2 : A private equity firm is considering acquiring a manufacturing company with inefficient operations and high production costs. The firm believes it can implement operational improvements, streamline processes, and reduce costs to enhance profitability and competitiveness. Should they acquire this manufacturing company?

Private Equity Case Interview Example #3 : A private equity firm that specializes in the healthcare sector is evaluating the acquisition of a pharmaceutical company with a promising drug pipeline. The firm's industry expertise and network could help accelerate the development and commercialization of the company's products. Should they make this acquisition?

Private Equity Case Interview Example #4 : A private equity firm wants to expand its presence in the consumer goods industry and is looking to acquire a well-established retail brand with a loyal customer base. The acquisition would complement the firm's existing portfolio and provide synergies in distribution, marketing, and brand positioning. Should they acquire this retail brand?

Private Equity Case Interview Example #5 : A private equity firm has identified a target company with substantial real estate assets and a strong cash flow from its core business. Should they make this acquisition?

Private Equity Case Interview Example #6 : A private equity firm that specializes in distressed investing is interested in acquiring a struggling automotive supplier facing liquidity challenges. The firm sees an opportunity to stabilize the business, renegotiate contracts, and implement cost-saving measures to return the company to profitability. What price should they bid for this potential acquisition?

Private Equity Case Interview Example #7 : A private equity firm has recognized a favorable market opportunity in the renewable energy sector and is considering the acquisition of a solar power company with a competitive cost structure and strong growth prospects. The firm aims to capitalize on increasing demand for clean energy solutions and government incentives. What is the most the private equity firm should bid on this solar company?

Private Equity Case Interview Example #8 : A private equity firm is evaluating the acquisition of a software company with a differentiated product offering and a growing customer base. The firm plans to invest in scaling the business and increasing market penetration, with the ultimate goal of exiting through a strategic sale or IPO to realize significant returns for its investors. How much should the private equity firm acquire this software company for?

Private Equity Case Interview vs. M&A Case Interview

Although private equity case interviews and M&A case interviews share many similarities, specifically that both are case interviews that involve deciding on whether to make an acquisition, there are some notable differences.

1. Long-term vs. short-term perspective

Private equity case interviews typically have a longer-term investment horizon since private equity firms may hold onto an investment for 5 to 10 or more years before selling. They are not heavily concerned with exactly how well the investment will perform in the first few years because they have a longer time horizon.

In contrast, for M&A case interviews, there is generally an expectation that a merger or acquisition will provide immediate tangible benefits to the company and shareholders.

2. Reasons for the acquisition

For private equity case interviews, candidates are often asked to develop an investment thesis for a potential acquisition. They will need to articulate why the target company represents an attractive investment opportunity and how the private equity firm can create value from the investment.

This may include identifying growth drivers, operational improvement opportunities, and synergies that can be realized with the existing portfolio.

In contrast, for M&A case interviews, candidates mainly focus on understanding the rationale behind a potential acquisition, including strategic fit, synergies, and market dynamics.

3. Different risk factors

In both private equity and M&A case interviews, candidates will need to give thought behind the potential risks of the acquisition. However, the major risks for a private equity firm making an acquisition vs. a company making an acquisition differ slightly.

For private equity acquisitions, major risks include: market risks, competitive threats, and execution risks. In contrast, for a merger or acquisition, major risks include company integration risks, legal risks, and regulatory compliance.

4. Exit strategies

Private equity case interviews often emphasize the importance of exit strategies since private equity firms typically aim to realize returns for their investors within a specific timeframe.

Therefore, for private equity case interviews, candidates may be asked to evaluate potential exit options, such as strategic sales, IPOs, and secondary buyouts. They may be asked to assess the timing and feasibility of each option.

For M&A case interviews, candidates may need to consider potential exit scenarios, such as divestiture or spin-offs, but the focus may be less on maximizing financial returns and more on strategic objectives.

Land Your Dream Consulting Job

Here are the resources we recommend to land your dream consulting job:

For help landing consulting interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple consulting interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing consulting behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Land Multiple Consulting Offers

Complete, step-by-step case interview course. Save yourself hundreds of hours.

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Private Equity Interviews 101: How to Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker; you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than “2 + 2 = 4,” so let’s take a detailed look at the process:

How to Network and Win Private Equity Interviews

The Private Equity recruiting process differs dramatically depending on your current job and location.

Here are the two extremes:

- Investment Banking Analyst at a Bulge Bracket or Elite Boutique in New York: The process will be highly structured, and interviews will finish at warp speed. In some ways, your bank, group, and academic background matter more than your skill set or deal experience. This one is known as the “on-cycle” process.

- Non-Banker in Another Part of the U.S. or World: The process will be far less structured, it may extend over many months, and your skill set and deal/client experience will matter a lot more. This one is known as the “off-cycle” process.

If you’re in between these categories, the process will also be in between these extremes.

For example, if you’re at a smaller bank in NY, you may complete some on-cycle interviews, but you will almost certainly also go through the off-cycle process at smaller firms.

If you’re in London, there will also be a mix of on-cycle and off-cycle processes, but they tend to start later and move more slowly than the ones in NY.

We have covered PE recruiting previously ( overall process and what to expect in the on-cycle process ), so I am not going to repeat everything here.

Interviews in both on-cycle and off-cycle processes test similar topics , but the importance of each topic varies.

The timing of interviews and start dates, assuming you win offers, also differs.

The Overall Private Equity Interview Process

Regardless of whether you recruit in on-cycle or off-cycle processes, or a combination of both, almost all PE interviews have the following characteristics in common:

- Multiple Rounds: You’ll almost always go through at least 2-3 rounds of interviews (and sometimes many more!) where you speak with junior to senior professionals at the firm.

- Topics Tested: You’ll have to answer fit/background questions, technical questions, deal/client experience questions, questions about the firm’s strategies and portfolio, market/industry questions, and complete case studies and modeling tests.

The differences are as follows:

- Timing and Time Frame: If you’re at a BB/EB bank in NY, and you interview with mega-funds, the process starts and finishes within several months of your start date at the bank (!), and it moves up earlier each year. Interviews at the largest firms start and finish in 24-48 hours, with upper-middle-market and middle-market firms beginning after that.

By contrast, interviews start later at smaller PE firms, and the entire process may last for several weeks up to several months.

- Importance of Topics Tested: At large funds and in the on-cycle process, you need to complete modeling tests quickly and accurately and spin your pitches and early-stage deals into sounding like real deals; at smaller funds and in off-cycle interviews, the reasoning behind your case studies/modeling tests and your real experience with clients and deals matter more.

Firm-specific knowledge and fitting your investment recommendations to the firm’s strategies are also more important.

- Start Date: You interview far in advance if you complete the on-cycle process, and if you win an offer, you might start 1.5 – 2.0 years later. With the off-cycle process, you start right away or soon after you win the offer.

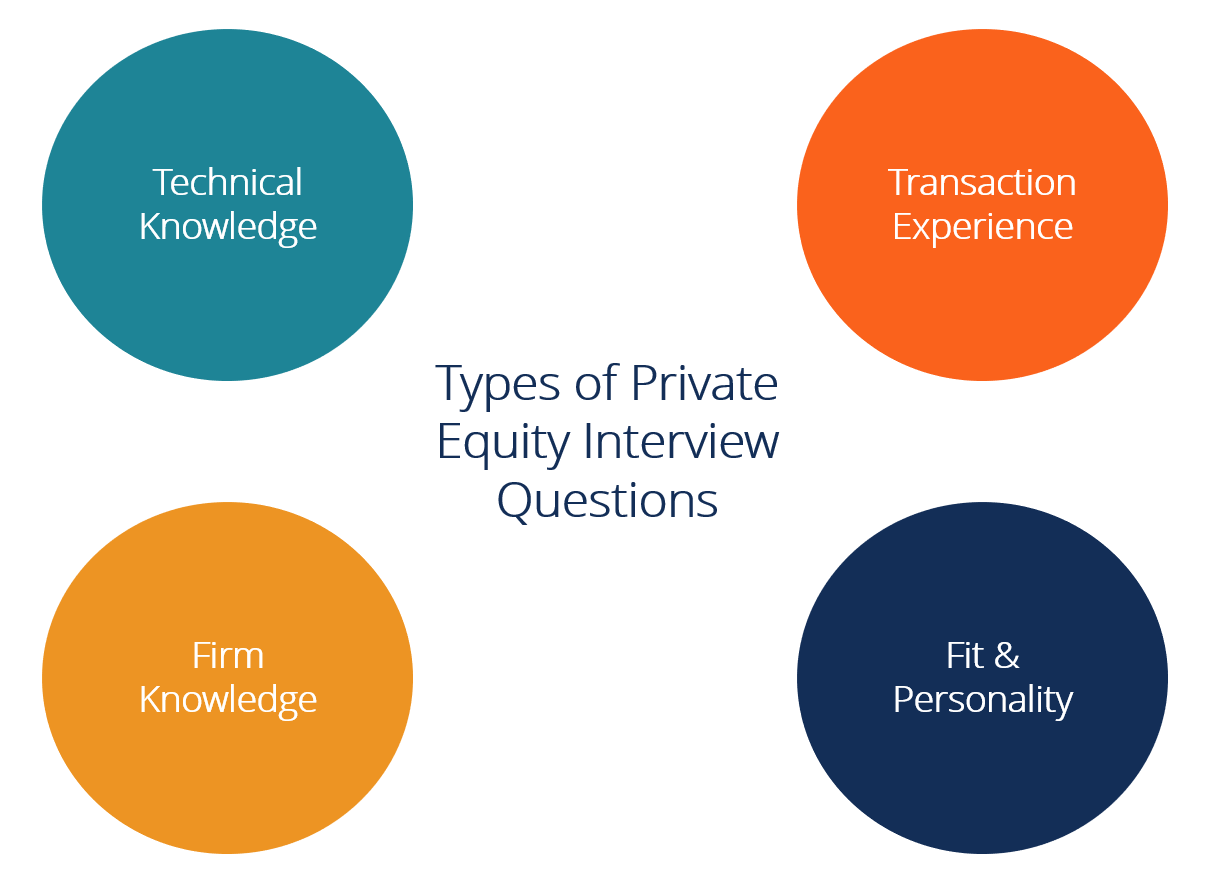

Private Equity Interview Topics

There is not necessarily a correlation between the stage of interviews and the topics that will come up.

You could easily get technical questions early on, and you’ll receive fit/background and deal experience questions throughout the process.

Case studies and modeling tests tend to come up later in the process because PE firms don’t want to spend time administering them until you’ve proven yourself in previous rounds.

However, there are exceptions even to that rule: For example, many funds in London start the process with modeling tests because there’s no point interviewing if you can’t model.

Here’s what to expect on each major topic:

Fit/Background Questions: “Why Private Equity?”

The usual questions about “ Why private equity ,” your story , your strengths/weaknesses , and ability to work in a team will come up, and you need answers for them.

We have covered these in previous articles, so I’ve linked to them above rather than repeating the tips here.

Since on-cycle recruiting takes place at warp speed, you’ll have to draw on your internship experience to come up with stories for these questions, and you’ll have to act as if PE was your goal all along.

By contrast, if you’re interviewing for off-cycle roles, you can use more of your current work experience to answer these questions.

While these questions will always come up, they tend to be less important than in IB interviews because:

- In on-cycle processes, it’s tough to differentiate yourself – everyone else also did multiple finance internships and just started their IB roles.

- They care more about your deal experience, whether real or exaggerated, in both types of interviews.

Technical Questions For PE

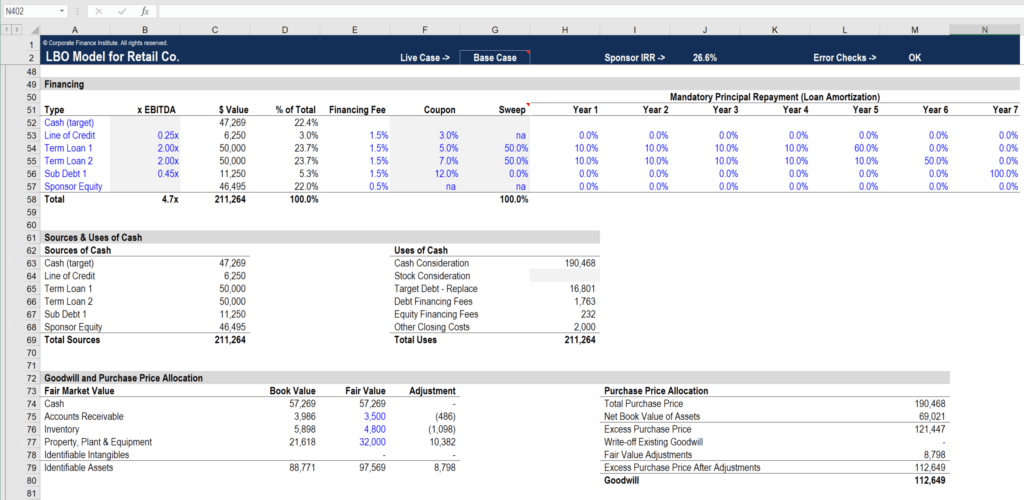

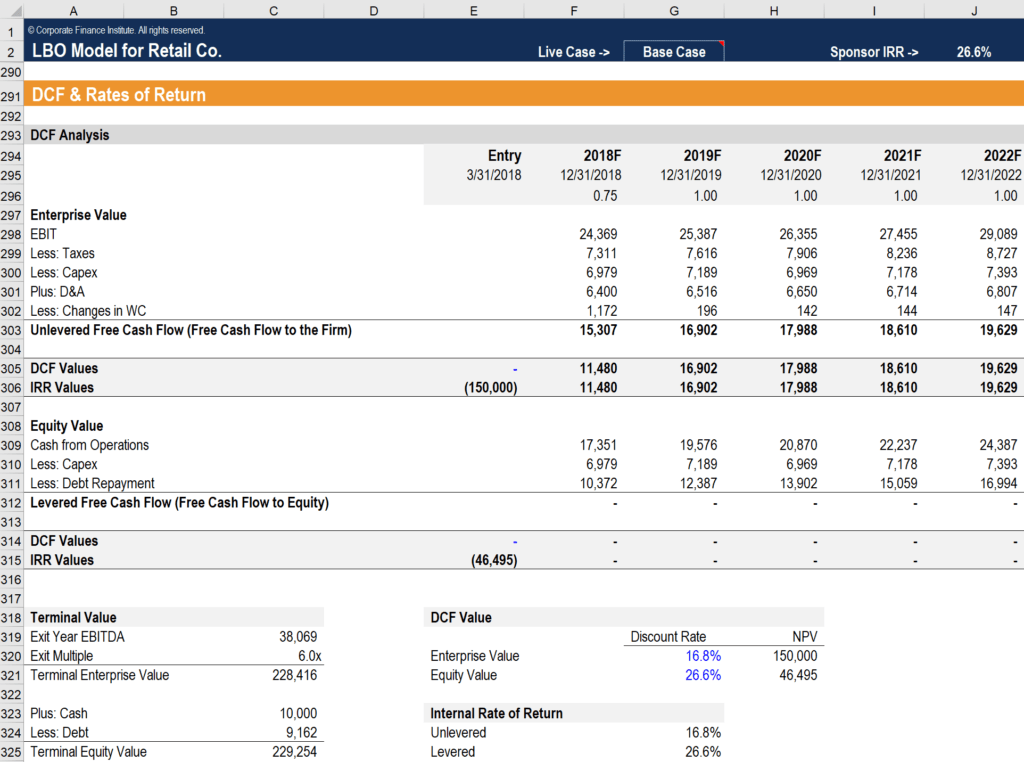

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If you’re in banking, you should know these topics like the back of your hand.

And if you’re not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience – instead of asking generic questions about the WACC formula , they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge won’t necessarily get you an offer.

Talking About Deal/Client Experience

This category is huge, and it presents different challenges depending on your background.

If you’re an Analyst at a large bank in New York, and you’re going through on-cycle recruiting, the key challenge will be spinning your pitches and early-stage deals into sounding like actual deals.

If you’re at a smaller bank, and you’re going through off-cycle recruiting, the key challenge will be demonstrating your ability to lead, manage, and close deals .

And if you’re not in investment banking, the key challenge will be spinning your experience into sounding like IB-style deals.

Regardless of your category, you’ll need to know the numbers for each deal or project you present, and you’ll need a strong “investor’s view” of each one.

That’s quite a bit to memorize, so you should plan to present, at most, 2-3 deals or projects.

You can create an outline for each one with these points:

- The company’s industry, approximate revenue/EBITDA, and multiples (or, for non-deals, estimated costs and benefits).

- Whether or not you would invest in the company’s equity/debt or acquire it (or, for non-deals, whether or not you’d pursue the project).

- The qualitative and quantitative factors that support your view.

- The key risk factors and how you might mitigate them.

If you just started working, pick 1-2 of your pitches and pretend that they have progressed beyond pitches into early-stage deals.

Use Capital IQ or Internet research to generate potential buyers or investors, and use the company-provided pitch materials to come up with your projections for the potential stumbling blocks in the transaction.

For your investment recommendation, imagine that each deal is a potential LBO, and build a quick, simple model to determine the rough numbers, such as the IRR in the baseline and downside cases.

For the risk factors, reverse each model assumption (such as the company’s revenue growth and margins) and explain why your numbers might be wrong.

If you’re in the second or third categories above – you need to show evidence of managing/closing deals or evidence of working on IB-style deals – you should still follow these steps.

But you need to highlight your unique contributions to each deal, such as a mistake you found, a suggestion you made that helped move the financing forward, or a buyer you thought of that ended up making an offer for the seller.

If you’re coming in with non-IB experience, such as internal consulting , still use the same framework but point out how each project you worked on was like a deal.

You had to win buy-in from different parties, get information from groups at the company, and justify your proposals by pointing to the numbers and qualitative factors and addressing the risk factors.

Firm Knowledge

Understanding the firm’s investment strategies, portfolio, and exits is very important at smaller firms and in off-cycle processes, and less important in on-cycle interviews at mega-funds.

If you have Capital IQ access, use it to look up the firm.

If not, go to the firm’s website and do extensive Google searches to find the information.

Finding this information should not be difficult, but the tricky point is that firms won’t necessarily evaluate your knowledge by directly asking about it.

Instead, if they give you a take-home case study, they might judge your responses based on how well your investment thesis lines up with theirs.

For example, if the firm makes offline retailers more efficient via cost cuts and store divestitures, you should not present an investment thesis based on overseas expansion or roll-ups of smaller stores.

If they ask for an investor’s view of one of your deals, they might judge your answer based on your ability to frame the deal from their point of view.

For example, if the firm completes roll-ups in fragmented industries, you should not look at a standard M&A deal you worked on and say that you’d acquire the company because the IRR is between XX% and YY% in all scenarios.

Instead, you should point out that with several roll-ups, the IRR would be between XX% and YY%, and even in a downside case without these roll-ups, the IRR would still be at least ZZ%, so you’d pursue the deal.

Market/Industry

In theory, private equity firms should care about your ability to find promising markets or industries.

In practice, open-ended questions such as “Which industry would you invest in?” are unlikely to come up in traditional PE interviews.

If they do come up, they’ll be in response to your deal discussions, and the interviewer will ask you to explain the upsides and downsides of your company’s industry.

These questions are more likely in growth equity and venture capital interviews, so you shouldn’t spend too much time on them if your goal is traditional PE (for more on these fields, see our coverage of venture capital interview questions and the venture capital case study ).

And even if you are interviewing for growth equity or VC roles, you can save time by linking your industry recommendations to your deal experience.

Case Studies and Modeling Tests

You will almost always have to complete a case study or modeling test in PE interviews, but the types of tests span a wide range.

Here are the six most common ones, ranked by rough frequency:

Type #1: “Mental” Paper LBO

This one is closer to an extended technical question than a traditional case study.

To answer these questions, you need to know how to approximate IRR, and you need practice doing the mental math.

The interviewer might ask something like, “A PE firm acquires a $150 EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA increases to $200 by Year 3, $225 by Year 4, and $250 by Year 5, and it pays off all its Debt by Year 3.

The PE firm sells its stake evenly over Years 3 – 5 at a 10x EBITDA multiple. What’s the approximate IRR?”

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity.

The “average” amount of proceeds is $225 * 10 = $2,250, and the “average” Exit Year is Year 4 (no need to do the full math – think about the numbers – and all the Debt is gone).

So, the PE firm earns $2,250 / $600 = 3.75x over 4 years. Earning 3x in 3 years is a ~45% IRR, so we’d expect the IRR of a 3.75x multiple in 4 years to be a bit less than that.

To approximate a 4x scenario, we could take 300%, divide by 4 years, and multiply by ~55% to account for compounding.

That’s ~41%, and the actual IRR should be a bit lower because it’s a 3.75x multiple rather than a 4.00x multiple.

In Excel, the IRR is just under 40%.

Type #2: Written Paper LBO

The idea is similar, but the numbers are more involved because you can write them down, and you might have 30 minutes to come up with an answer.

You can get a full example of a paper LBO test, including the detailed solutions, here .

You can also check out our simple LBO model tutorial to understand the ropes.

With these case studies, you need to start with the end in mind (i.e., what multiple do you need for an IRR of XX%) and round heavily so you can do the math.

Type #3: 1-3-Hour On-Site or Emailed LBO Model

These case studies are the most common in on-cycle interviews because PE firms want to finish quickly.

And the best way to do that is to give all the candidates the same partially-completed template and ask them to finish it.

You may have to build the model from scratch, but it’s not that likely because doing so defeats the purpose of this test: efficiency.

You’ll almost always receive several pages of instructions and an Excel file, and you’ll have to answer a few questions at the end.

The complexity varies; if it’s a 1-hour test, you probably won’t even build a full 3-statement model .

They might also ask you to use a cash-free debt-free basis or a working capital adjustment to tweak the Sources & Uses slightly.

If it is a 3-hour test, a 3-statement model is more likely (the other parts of the model will be simpler in this case).

Here’s a free example of a timed LBO modeling test ; we have many other examples in the IB Interview Guide and Core Financial Modeling course .

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Type #4: Take-Home LBO Model and Presentation

These case studies are open-ended, and in most cases, you will not get a template to complete.

The most common prompts are:

- Build a model and make an investment recommendation for Portfolio Company X, Former Portfolio Company Y, or Potential Portfolio Company Z.

- Pick any company you’re interested in, build a model, and make an investment recommendation.

With these case studies, you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model.

You might have 3-7 days to complete this type of case study and present your findings.

You might be tempted to use that time to build a complex LBO model, but that’s a mistake for three reasons:

- The smaller firms that give open-ended case studies tend not to use that much financial engineering.

- No one will have time to review or appreciate your work.

- Your time would be better spent on industry research and coming up with a sold investment thesis, risk factors, and mitigants.

If you want an example of an open-ended exam like this, see our private equity case study article and follow the video walkthrough or article text.

Your model could be shorter, and your presentation could certainly be shorter, but this is a good example of what to target if you have more time/resources.

Type #5: 3-Statement/Growth Equity Model

At operationally-focused PE firms, growth equity firms, and PE firms in emerging markets such as Brazil , 3-statement projection modeling tests are more common.

The Atlassian case study is a good example of this one, but I would change a few parts of it (we ignored Equity Value vs. Enterprise Value for simplicity, but that was a poor decision).

Also, you’ll never have to answer as many detailed questions as we did in that example.

If you think about it, a 3-statement model is just an LBO model without debt repayment – and the returns are based on multiple expansion, EBITDA growth, and cash generation rather than debt paydown .

You can easily practice these case studies by picking companies you’re interested in, downloading their statements, projecting them, and calculating the IRR and multiples.

Type #6: Consulting-Style Case Study

Finally, at some operationally-focused PE firms, you could also get management consulting-style case studies, where the goal is to advise a company on an expansion strategy, a cost-cutting initiative, or pricing for a new product.

We do not teach this type of case study, so check out consulting-related sites for examples and exercises.

And keep in mind that this one is only relevant at certain types of firms; you’re highly unlikely to receive a consulting-style case study in standard PE interviews.

A Final Word On Case Studies

I’ve devoted a lot of space to case studies, but they are not as important as you might think.

In on-cycle processes, they tend to be a “check the checkbox” item: Interviewers use them to verify that you can model, but you won’t stand out by using fancy Excel tricks.

Arguably, they matter more in off-cycle interviews since you can present unique ideas more easily and demonstrate your communication skills in the process .

What NOT to Worry About In PE Interviews

The topics above may seem overwhelming, so it’s worth pointing out what you do not need to know for interviews.

First, skip super-complex models.

As a specific example, the LBO models on Macabacus are overkill; they’re way too complicated for interviews or even the job itself.

You should aim for Excel files with 100-300 rows, not 1,000+ rows, and skip points like circular references unless they specifically ask for them (for more, see our tutorial on how to remove circular references in Excel )

Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm.

Finally, you don’t need to know about the history of the private equity industry or much about PE fund economics beyond the basics.

Your time is better spent learning about a firm’s specific strategy and portfolio.

PE Interview X-Factor(s)

Besides the topics above, competitive tension can make a huge difference in interviews.

If you tell Firm X that you’ve already received an offer from Firm Y, Firm X will immediately become far more likely to give you an offer as well.

Even at the networking stage, competitive tension helps because you always want to tell recruiters that you’re also speaking with Similar Firms A, B, and C.

Also, leverage your group alumni and the 2 nd and 3 rd -year Analysts.

You can read endless articles online about interview prep, but nothing beats real-life conversations with others who have been through the process.

These alumni and older Analysts will also have example case studies they completed, and they can explain how to spin your deal experience effectively.

PE Interview Preparation

The #1 mistake in PE interviews is to focus excessively on modeling tests and technical questions and neglect your deal discussions.

You can avoid this, or at least resist the temptation, by turning your deals into case studies.

If you follow my advice to create simplified LBO models for your deals, you can combine the two topics and get modeling practice while you’re preparing your “investor’s views.”

If you’re working full-time in banking, use your downtime in between tasks to do this , outline your story , and review technical questions.

If you only have 10-15-minute intervals of downtime, break case studies into smaller chunks and aim to finish a specific part in each period.

Finally, start preparing before your full-time job begins .

You’ll have far more time before you start working, and you should use that time to tip the odds in your favor.

The Ugly Truth About PE Interviews

You can read articles like this one, memorize PE interview guides, and get help from dozens of bank/group alumni, but much of the process is still outside of your control.

For example, if you’re in a group like ECM or DCM , it will be tough to win on-cycle interviews at large firms and convert them into offers no matter what you do.

If the mega-funds decide to kick off recruiting one day after you start your full-time job in August, and you’re not prepared, too bad.

If you went to a non-target school and earned a 3.5 GPA, you’ll be at a disadvantage next to candidates from Princeton with 3.9 GPAs no matter what you do.

So, start early and prepare as much as you can… but if you don’t receive an offer, don’t assume it’s because you made a major mistake.

So You Get An Offer: What Next?

If you do receive an offer, you could accept it on the spot, or, if you’re speaking with other firms, you could shop it around and use it to win offers elsewhere.

If you’re not in active discussions with other firms, you’re crazy if you do not accept the offer right away.

If You Get No Offer: What Next?

If you don’t get an offer, follow up with your interviewers, ask for feedback, and ask for referrals to other firms that might be hiring.

If you did reasonably well but came up short in a few areas, you could easily get referrals elsewhere .

If you did not receive an offer because of something that you cannot fix, such as your undergraduate GPA or your previous work experience, you might have to consider other options, such as a Master’s, MBA, or another job first.

But if it was something fixable, you could take another pass at recruiting or keep networking with smaller firms.

To PE Or Not to PE?

That is the question.

And the answer is that if you have the right background, you understand the process, and you start preparing far in advance, you can get into the industry and win a private equity career .

And if not, there are other options, even if you’re an older candidate .

You may not reach the promised land, but at least you can blame it on someone else.

Additional Reading

You might be interested in:

- The Search Fund Internship: Perfect Pathway into Investment Banking and Private Equity Roles?

- Private Equity Analyst Roles: The Best Way to Skip Investment Banking?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ Private Equity Interviews 101: How to Win Offers ”

Brian, What about personality tests? What is their importance in the overall hiring process eg if you get them as the last stage?

They’re not that important, and even if you do get them, you can’t really “prepare” in any reasonable way (barring a brain transplant to replace your personality and make it more suitable for the firm). It’s also highly unusual to get one in the final stage – a firm doing that is probably just paranoid that you are secretly a serial killer and they want to rule out that possibility.

Hey- for the Fromageries Bel case study, can’t quite make sense of the Tier 4 management incentive returns, what’s the calculation for each tier? Would think it’s Tier 2 less tier 1 * tier 1 marginal profit

Tier 4 is based on a percentage of all profits *above* a 2.5x equity multiple. Each tier below it is based on a percentage of profits between specific multiples, which correspond to specific EUR proceeds amounts.

I have an accounting background (CPA & several years removed from school) and a small amount of finance experience through internships. I’m interviewing for a PE analyst position and managed to get through the first round of interviews. The firm itself doesnt just hire guys with a few years of banking, their team is very diverse with some backgrounds similar to mine.

The first round interview was a mix of technical questions plus a lot about myself and my experience. No behavioral questions. The first round was with an associate for 30 minutes, the second round is an hour with a partner. I managed to answer a lot of the questions about LBO models and what types of companies are good LBO candidates. Thanks to your website for that.

Any advice for a second round interview for a guy like me who doesnt have deal making experience or much experience in finance? Will the subsequent interviews after the first round be more technical-based questions? Or do they lean more on technical questions in round 1 to weed out candidates?

They will usually become more fit-based if they’ve already asked a lot of technical questions in earlier rounds. I would focus on your story and answers to the Why PE / Why This Firm / Are you sure you want to switch?-type questions.

Is it likely too difficult to access the on-cycle process from the CLT office of an In-Between-a-Bank that it would make more sense to focus one’s energy on the MM/LMM? Is the new era of Zoom making geography/distance less of a factor or is the perceived prestige of NY still an obstacle?

Location is somewhat less of a factor now, but it still matters, and working from home will not continue indefinitely into the future. It will be very difficult to participate in on-cycle recruiting at the mega-funds if you’re working in Charlotte at Wells Fargo if that’s your question, but plenty of MM funds are realistic.

What are some of the larger funds that you would consider realistic?

There are dozens of funds out there (it’s not like bulge bracket banks or mega-fund PE firms where there’s only a defined set of 5-10), so I can’t really give you a specific answer. My recommendation would be to look up people who worked at WF on LinkedIn and see the types of funds they are now working at.

I remember I saw a video of yours (might have been YouTube) where you explained the PE process. You talked about do pe firms really add value and then you went over how when a pe firm buys a company, they do a little “trick” where they create a shell company to acquire the target so the debt isn’t on the pe firms books. I’ve been looking all over for this video. Do you know which video I’m referring to?

Yes, that is no longer in video form. It’s still in the written LBO guide but the video from the old course was removed because it was way too long and boring for a video and was better explained in text.

Hi Brian, can you elaborate more on ‘Understanding the firm’s investment strategies, portfolio, and exits’ when you talk about smaller firm and off-cycle processes, simliar point came up under *Type 5*: you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model. What exactly should I pay attention on? I felt funds I checked their investment strategy descirption are pretty broad, and they invest in various type of deals, say even in one industry, they do different purchase range. Also, when talking about growth equity, you mentioned you can practice case by picking companies you’re interested in, downloading their statements, projecting them. What if they are not public companies, how can I get those information? Are you recommending only those companies with 20F available? Or can you just elaborate more on how can I follow your instruction? Thanks

All you can do is go off their website and possibly a Capital IQ description if you have access. See if they focus on growth, leverage for mature companies, operational improvements, or add-on acquisitions and pick something that fits one of those.

You can pick public companies for growth equity or find a public company that is similar to a private one the firm has.

Hey Brian! I have an interview with a family office for a private equity analyst position. The firm is small and not much about it online. I haven’t had much time to prepare as it was not an interview I was expecting. What would you say the most important elements to focus on are for the interview considering the time constraint? I am an undergrad, third year, second internship. (first internship was for a large construction/developer as project coordinator, not finance based)

Focus on your story, the firm’s portfolio companies and strategies, and a few investment ideas you have for specific sectors. Technical questions are fine, but you probably won’t have much time to prepare at the last minute.

How would PE interviews / Technical questions look like for straight out of undergrad PE role look like

e.g Blackstone internships, Goldman Merchant Banking internships etc

Similar to IB ones, with a focus on LBOs?

Largely the same, but less emphasis on deal experience and deal-related questions at the undergraduate level. They may ask slightly more questions on LBOs, but at the undergrad level, they assume you know very little, so questions will span a wide range of topics.

Have you written or seen similar articles on PE operating partner interviews?

No, sorry. There’s hardly any information on that level of interview online because you can’t really make an interview guide or other product to prepare for it, and most people at that level would need 1-on-1 coaching more than a guide. My guess is that they will focus almost exclusively on your past experience turning around and growing businesses and assess how well you can do it for their portfolio companies. They’re not going to give you LBO modeling tests or case studies.

“Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm”

Could you please elaborate on this? Almost every IB interview includes brain teasers so I am wondering why a PE interview shouldn’t?

Brain teasers are not that common in IB interviews in most regions unless you count any math/accounting/finance question as a brain teaser. They are far more common in S&T, quant fund, and prop trading interviews.

The point of this statement is that it’s OK if an occasional brain teaser comes up, but if the interviewer asks you brain teasers for 30 minutes, which have exactly 0% correlation to the real work in PE, you should leave because it’s a sign that the people working at the firm are idiots who don’t know how to conduct proper interviews or test candidates.

This is helpful. I find myself at a fix, I do not think I have had the right exposure, although in a BB I support teams with standard materials in a particular industry group in M&A. However I have interviews with a top global PE next month. Any guidance on how should I prepare for it ?

Thanks in advance

Follow everything in this article… practice spinning/discussing your deals… practice LBO questions and simple case studies.

Brian – thank you for your concise and candid remarks. do you have any insights or advice for someone with 5yrs of BB ECM & DCM experience now at a top full-time MBA program looking to break in?

It’s going to be very difficult if you just have capital markets experience and you’re already in business school. You should probably move to an M&A or strong industry team at a large bank (BB or EB) after business school and then go into private equity from there. It’s tough, but still easier than trying to move into PE directly out of an MBA program with only capital markets experience.

My next interview will highly likely involve a statement/growth equity modeling case. I tried to find the Atlassian Case interview but i am unable to open the link.

Would it be possible to share an example case or more information on that topic?

Many thanks,

The Atlassian case study is all we have. I don’t know why you can’t open the files, but I just tried and they seemed to work. Maybe try again or use a different browser.

Hi M&I team,

I have an opportunity to interview for an Analyst level opening at a boutique PE fund. This is a shop that has just started operations so I am directly communicating with the Partner. I doubt they have any structured recruitment process at this stage of their existence. He asked me to send some written work (memos and spreadsheets) on any public listed co that demonstrates my understanding of investing (basic balance sheet analysis, ratio analysis, valuation multiples).

So I am just wondering what to do? Should I work on projections and prepare a DCF model or do something simpler? I’d really appreciate your guidance on this.

Thanks again for the amazing work you’ll have been doing!

Yes, just create simple projections, a simple valuation/DCF, and maybe a simple LBO model since it is a PE fund that intends to buy and sell companies.

Could you provide some advice for preparing interviews for principal investing role ?

Thank you in advance Laura

We don’t really focus on that, but the articles on private equity and funds of funds on this site might be helpful.

Just wanted to say thank you! After reading everything on this site including all the CV and interview material I have managed to transition from a second year engineering undergrad with no prior experience/spring weeks/insight days, into an intern at Aviva Investors (UK buy side) within the space of one year.

The information you have posted is invaluable and “breaking in” is definitely doable with the right mindset and appetite for rejections!

Thanks again.

Thanks! Congrats on your internship offer.

Hi Brian/Nicole – Im an Economics student from the UK in 3rd year out of a 4 year course at a semi-target college, with 2 finance internships done up until now(not FO). I plan on doing a Msc Finance when I finish and eventually break into IB or Sales/Trading (I know I still haven’t decided which one I really want more). Through a family friend I have an offer to do a short internship this summer in NY in a post-trade regulatory commission. As this isn’t actually sitting at a trading desk experience, or anything related to IB should I decide to go down that road, would this add genuine value to my CV ? How are internships in regulatory commissions looked at for students looking to break into sales/trading? Surely even having any NY Finance experience on the CV will add more substance over here in London when going for internships compared to the majority of UK students who don’t? Appreciate any advice on this matter, Thanks!

I don’t think it would help much because you already have 2 non-FO internships, and a regulatory internship would be yet another non-FO internship. If it’s your best option, you can take it, but you would be better off getting something closer to a real front-office role.

Hey Brian. I am graduating after this semester going into Management consulting (Deliote, AT Kearny, Accenture)but I’m hoping to make a switch into either IB or PE after a couple years. I have one search fund internship which was enough to get me a few 1st and second round ib/pe FT interviews but no offers.My plan is to get into the best online MSF program I can and switch into Finance once I’m done. Do you think, given how close I was to getting in my 1st try, a high GPA from a reputable MSF and good experience in consulting will be enough or should I try to somehow get an IB internship before I apply?

I think you will probably need another internship just before the MSF starts or while it is in progress, not necessarily in IB, but something closer to it. Otherwise you’ll get a lot of questions about why you went from the search fund to consulting.

Thanks. As far as my story is concerned, is it better to do another finance internship before consulting so it’s search fund->ib->consulting->MSF (or MBA not sure)? I only ask because I may be able to get on some m&a projects with the consulting firm and my story could be when exposed to those deals, I realized how big my passion for finance was and that’s when I decided to get my MSF and switch to IB.

No, I think that would make less sense because then you would have to explain why you went from IB to consulting… and are now trying to go back to IB. Saying that you got exposed to M&A deals during the consulting experience would be a better story (and you would still ideally pair it with a transaction-related internship before/during the MSF).

Got it, thanks!

Probably missing something here, but for the first example, where does the 300% and 55% come from?

300% = 4x multiple. If compounding did not exist, we could just say 300% / 4 = 75% annual return. Because of compounding, however, the actual return does not need to be 75% per year in order for us to earn 300% by the end of 4 years. Instead, it can be a fair amount less than that, and we’ll still end up with 300% at the end.

To estimate the impact of compounding, you can multiply this 300% / 4 figure by a “compounding factor,” which varies based on the multiple and time period, but which is around 55% for a 4x return over a standard holding period.

Do you mind explaining how you can estimate a “compounding factor” such as with the 55% here?

There’s no easy-to-calculate-using-mental-math way to get this for all scenarios, but you can memorize quick rules of thumb (based on actual numbers and looking at the ratios) for 3 and 5-year periods and extrapolate from there. I don’t really think it’s worth doing that in-depth, though, because you just have to be roughly correct with these answers.

Do you think you will do a hedge fund interview guide similar to the one you have here?

Potentially, yes, but it’s much harder to give general guidelines for HF interviews because they’re completely dependent on your investment pitches. Also, interest in HFs has declined over the years (we no longer receive as many questions about them).

On that mental paper LBO question, how is the company able to pay off 900 of debt by year 3? It sounds like proceeds from the sale will have to be used in order to fully pay off the debt because EBITDA alone only adds up to 525, and that’s assuming there’s no interest.

Favorable working capital… NOLs… asset sales… the Konami code or other cheat codes. The point is not the numbers but the thought process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ace Your Private Equity Interviews

Our Interview Guide has 120+ pages of LBO instruction, deal discussions, LBO practice tests, personal pitch templates, and more.

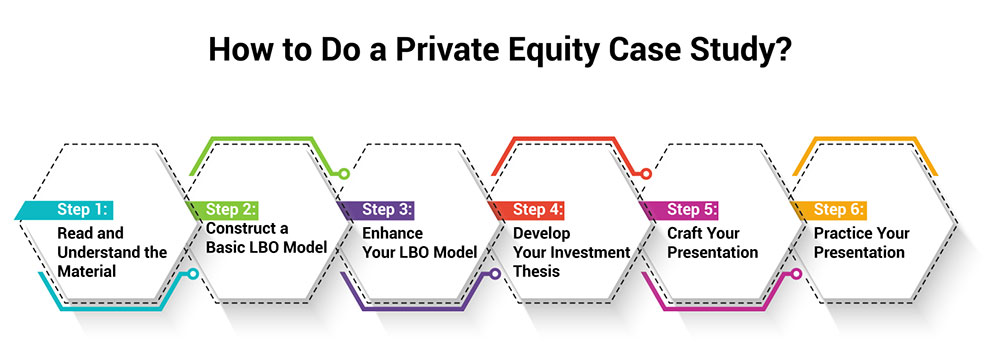

How to prepare for the case study in a private equity interview

If you're interviewing for a job in a private equity firm , then you will almost certainly come across a case study. Be warned: recruiters say this is the hardest part of the private equity interview process and how you handle it will decide whether you land the job.

Get Morning Coffee ☕ in your inbox. Sign up here.

“The case study is the most decisive part of the interview process because it’s the closest you get to doing the job," says Gail McManus of Private Equity Recruitment. It's purpose is to make you answer one question: 'Would you invest in this company?'

When the case study interview starts, you usually be given a 'Confidential Information Memorandum' (CIM) relating to a company the private equity fund could invest in. You'll be expected to a) value this company, and b) put together an investment proposal - or not. Often, you'll be allowed to take the CIM away to prepare your proposal at home.

“The case study is still the most decisive element of the recruitment process because it’s the closest you get to actually doing the job. Candidates can win or lose based on how they perform on case study. People who are OK in the interview can land the job by showing the quality of their thinking, ” says McManus. “You need to show that you can think, and think like an investor.”

"The end decision [on whether to invest] is not important," says one private equity professional who's been through the process. "The important thing is to show your thinking/logic behind answer."

Preparing for a PE case study has distinctive challenges for consultants and bankers. If you're a consultant, you need to, "make a big effort to mix your strategic toolkit with financial analysis. You need to prove that you can go from a strategic conclusion to a finance conclusion," says one PE professional. Make sure you're totally familiar with the way an LBO model works.

If you're a banker, you need to, "make a big effort to develop your strategic thinking," says the same PE associate. The fund you're interviewing with will want to see that you can think like an investor, not just a financier. "Reaching financial conclusions is not enough. You need to argue why certain industry is good, and why you have a competitive advantage or not. Things can look good on paper, but things can change from a day to another. As a PE investor, hence as a case solver, you need to highlight and discuss risks, and whether you are ready or not to underwrite them."

Kadeem Houson, partner at KEA consultants, which specialises in hiring junior to mid-level PE professionals, says: “If you’re a banker you’re expected to have great technical skills so you need to demonstrate you can think commercially about the numbers you plugged in. Conversely, a consultant who is good at blue sky thinking might be pressed more on their understanding of the model. Neither is better or worse – just be conscious of your blank spots.”

Felix Beuttler, a former Goldman Sachs associate and founder of FinEx Academy, says bankers and consultants have different strengths and weaknesses when it comes to the case study interview. "Consultants are often too focused on the qualitiative elements and bankers are too focused on getting the numbers right," he says. Both need to prepare with a view to overcoming their weaknesses.

A good business or a good investment?

For McManus, one of the most important things to consider when looking at the case study is to understand the difference between a good business and a good investment. The difference between a good business and a good investment is the price. So you might have a great business but if you have to pay hugely for it it might not be a great business. Conversely you can have a so-so business but if you get it a good price it might make a great investment. “

McManus says as well as understanding the difference between a good business and a good investment, it’s important to focus on where the added value lies. This has become a critical element for private equity firms to consider now that rates are higher, prices are still comparatively high, and adding value is more difficult. "In the case study it’s really important you think about where the value creation opportunity lies in this business and what the exit would be,” says McManus.

She advises candidates to be brave and state a specific price, provided you can demonstrate how you’ve arrived at your answer.

Another private equity professional says you shouldn't go out on a limb, though, and you should appear cautious: "Keep all assumptions conservative at all times so as not to raise difficult questions. Always highlight risks, downsides as well as upsides."

Research the fund – find the angle

One private equity professional says that understanding why an investment might suit a particular firm could prove to be a plus. Prior to the case study, check whether the fund favours a particular industry sector, so that when it comes to the case study, you can add that to the investment thesis. “This enables you to showcase you have read up on the firm’s strategy/unique characteristics Something that would make it more likely for the fund you’re interviewing with winning the deal in what’s a very competitive market, said the PE source, who said this knowledge made him stand out.

However, the primary purpose of the case study is to test the quality of your thinking - it is not to test you on your knowledge of the fund. “Knowing about the fund will tick an extra box, but the case study is about focusing on the three most critical things that will drive the investment decision,” says McManus.

You need to think through these questions and issues:

Beuttler advises his students to assemble a deck filled with a particular set of slides, including investment highlights, investment risks, a value creation strategy, returns analysis and a clear conclusion. You will also want to include slides outlining the route to deriving a return on the investment.

We spoke to another private equity professional who's helpfully prepared a checklist of points to think about when you're faced with the case study. "It's a cheat sheet for some of my friends," he says.

When you're faced with a case study, he says you need to think in terms of: the industry, the company, the revenues, the costs, the competition, growth prospects, due dliligence, and the transaction itself.

The questions from his checklist are below. There's some overlap, but they're about as thorough as you can get.

When you're considering the industry, you need to think about:

- What the company does. What are its key products and markets? What's the main source of demand for its products?

- What are the key drivers in that industry?

- Who are the market participants? How intense is the competition?

- Is the industry cyclical? Where are we in the cycle?

- Which outside factors might influence the industry (eg. government, climate, terrorism)?

When you're considering the company, you need to think about:

- Its position in the industry

- Its growth profile

- Its operational leverage (cost structure)

- Its margins (are they sustainable/improvable)?

- Its fixed costs from capex and R&D

- Its working capital requirements

- Its management

- The minimum amount of cash needed to run the business

When you're considering the revenues, you need to think about:

- What's driving them

- Where the growth is coming from

- How diverse the revenues are

- How stable the revenues are (are they cyclical?)

- How much of the revenues are coming from associates and joint ventures

- What's the working capital requirement? - How long before revenues are booked and received?

When you're considering the costs, you need to think about:

- The diversity of suppliers

- The operational gearing (What's the fixed cost vs. the variable cost?)

- The exposure to commodity prices

- The capex/R&D requirements

- The pension funding

- The labour force (is it unionized?)

- The ability of the company to pass on price increases to customers

- The selling, general and administrative expenses (SG&A). - Can they be reduced?

When you're considering the competition, you need to think about:

- Industry concentration

- Buyer power

- Supplier power

- Brand power

- Economies of scale/network economies/minimum efficient scale

- Substitutes

- Input access

When you're considering the growth prospects, you need to think about:

- Scalability

- Change of asset usage (Leasehold vs. freehold, could manufacturing take place in China?)

- Disposals

- How to achieve efficiencies

- Limitations of current management

When you're considering the due diligence, you need to think about:

- Change of control clauses

- Environmental and legal liabilities

- The power of pension schemes and unions

- The effectiveness of IT and operations systems

When you're considering the transaction, you need to think about:

- Your LBO model

- The basis for your valuation (have you used a Sum of The Parts (SOTP) valuation or another method - why?)

- The company's ability to raise debt

- The exit opportunities from the investment

- The synergies with other companies in the PE fund's portfolio

- The best timing for the transaction

BUT: keep things simple.

While this checklist is important as an input and a way to approach the task, when it comes to presenting the information, quality beats quantity. McManus says: “The main reason why people aren’t successful in case studies is that they say too much. What you’ve got to focus on is what’s critical, what makes a difference. It’s not about quantity, it’s about quality of thinking. If you do 30 strengths and weaknesses it might only be three that matter. It’s not the analysis that matters, but what’s important from that analysis. What’s critical to the investment thesis. Most firms tend to use the same case study so they can start to see what a good answer looks like.”

Softer factors such as interpersonal skills are also important because if the case study is the closest thing you’ll get to doing the job, then it’s also a measure of how you might behave in a live situation. McManus says: “This is what it will be like having a conversation at 11am with your boss having been given the information memorandum the day before. Not only are the interviewers looking at how you approach the case study, but they’re also looking at whether they want to have this conversation with you every Tuesday morning at 11am.”

The exercise usually takes around four hours if you include the modelling aspect, so there is time pressure. “Top tips are to practice how to think in a way that is simple, but fit for purpose. Think about how to work quickly. The ability to work under pressure is still important,” says Houson.

But some firms will allow you do complete the CIM over the weekend. In that case on one private equity professional says you should get someone who already works in PE to check it over for you. He also advises getting friends who've been through case study interviews before to put you through some mock questions on your presentation.

Have a confidential story, tip, or comment you’d like to share? Contact: +44 7537 182250 (SMS, WhatsApp or voicemail). Telegram: @SarahButcher. Click here to fill in our anonymous form , or email [email protected]. Signal also available.

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.)

Sign up to Morning Coffee!

The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits.

Boost your career

Associate at US bank said to die after working 120 hour weeks

The man you must never mention in a private equity interview

Morning Coffee: Cause of death of banking associate disclosed. Family offices hiring juniors on $300k

JPMorgan's new top 28-year-old is in product management

Morning Coffee: Goldman Sachs & JPMorgan's 22-year-olds on $100k salaries may go extinct. The banking associate who’s forbidden from playing golf with clients

"My banking team is very lean but we will not be getting any new graduates this year"

How to get an accounting job in banking and finance

Goldman Sachs trading MD who quit last year is training as a firefighter

Revolut's new accounts reveal the huge pay day coming to some employees

Related articles

How to move from banking to private equity, by a former associate at Goldman Sachs

The banks with the best and worst working hours

Private equity pay: where the money has been made

- Education Requirement

- Experience Requirement

- Learning Resources

- CPEP™ Journey

- Register for CPEP™

- Examination

- Careers in Private Equity

Our commitment to fostering the growth of private equity professionals is reflected in the introduction of Private Equity Central, a virtual community that serves as your comprehensive resource and networking platform for success in this ever-evolving industry.

- myUSPEC

- Career in Private Equity

- Private Equity Central

- Help Center

Don't Have an Account?

Start your CPEP™ journey and manage your profile conveniently by creating your myUSPEC Account today.

Sign In to Your my USPEC Account

- Remember Password

- Forgot Password?

Create myUSPEC Account >

Reset Your Password

Please enter the Email ID you use to sign-in to your account:

Private Equity Case Study: Tips, Prompt & Presentation

Private equity case studies serve as a pivotal stage in recruitment. They offer firms a window to assess candidates' analytical, investing, and presentation skills. Understanding the nuances of these case studies can significantly enhance your preparation and success rate.

This comprehensive guide provides insights into the types of case studies, preparation strategies, and key aspects of presentation and analysis. Whether you're new to private equity or a seasoned professional, mastering these case studies is essential for succeeding in a competitive industry.

What Should You Expect in a Private Equity Case Study?

Private equity case studies are a critical component of the recruitment process, offering firms a valuable opportunity to assess candidates' analytical, investing, and presentation skills. Understanding what to expect in a private equity case study can significantly enhance your preparation and improve your chances of success.

What are the Types of Private Equity Case Studies?

Private equity case studies can take various forms, each presenting its unique set of challenges. Candidates can anticipate encountering one of the following formats.

- Candidates are provided with company information and tasked with evaluating the feasibility of an investment. This type of case study typically involves preparing a comprehensive presentation or investment memo, supported by a detailed LBO (leveraged buyout) model, within a specified timeframe.