- Credits & Deductions

- Income & Investments

- CRA Tax Updates

- Getting Organized

- Family & Children

- Homes & Rental Properties

- Medical & Disability

- Expats & Non-Residents

- Employment & Employees

- Foreign Income & Property

- Self-Employed & Freelance

- Small Business

- Unemployment

- After you File

What Is the 1042-S Form & How Do I Report It in My Canadian Tax Return?

The 1042-S form – Foreign Person’s U.S. Source Income Subject to Withholding is issued to non-residents of the USA that have earned income from the United States such as investment income. The issuer of this slip is usually a financial institution like a bank, they will send out this income slip based on the information they have on file provided by the individual, as a non-resident of the USA. If the individual does not inform the institution of their residency status, then they may be issued a 1099-instead.

Residency Status

Non-residents of Canada are subject to tax on Canadian sourced income only; taxes on your income have likely been withheld at source. You do not need to report a US 1042-s on a Canadian tax return as a Non-resident since you will report your Canadian sourced income only.

However, If you are a Canadian resident, you will report the 1042S as your foreign income such as investment income, as well as taxes withheld on the “Foreign” slip in your Canadian tax return.

File your taxes with confidence

Get your maximum refund, guaranteed*.

How do I input the 1042-S form to my tax return?

Using the boxes reported on the 1042S as a guideline, within TurboTax you will enter them as a type of foreign income (be sure to select the correct type of income such as investment) as well as foreign taxes paid (if any). You also need to indicate the exchange rate to report all amounts into Canadian dollars. Investment income entered will be calculated into Canadian dollars and reported to line 12100 of the Canadian tax return (T1). Foreign taxes paid will be used to calculate a Foreign Tax Credit, on line 40500 .

Make sure you specify the source country (USA) and the exchange rate listed on the Bank of Canada’s website, so the amount can be reported in CDN$.

Example: For 2022 the average US rate was 1.3013. So if your 2022 slip shows $500.00 US dollars it would convert to $650.65 Canadian dollars.

Related Topics:

How does residency status impact your tax return.

- Do You Need to Declare Income Earned From Sources Beyond Canada?

- Foreign Income & Tax Treaties

- Foreign Income Tax Credit

- Common USA Tax Forms Explained & How to enter them on your Canadian Tax Return

Related articles

T657 tax form: calculation of capital gains deduction, taxation for non-residents.

You've got questions. We've got the answers.

I got a Form 1042-S in the mail. What do I do with it?

If you are not a U.S. person (based on the IRS’s Classification of Taxpayers for U.S. Tax Purposes ), but over the past year you received money from U.S. companies or institutes required to withhold tax, you might have received a 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding , an Internal Revenue Service (IRS) form.

You can receive this form if:

- you studied in the United States and received a scholarship that exceeded your tuition

- you undertook contract work for a U.S. company

- you worked in the U.S., but retired in Canada

- you received interest or dividends from a U.S. bank or broker

Whatever the reason, Form 1042-S represents taxable income, so you’ll need to include it on your Canadian tax return and, if the right amount of taxes haven’t been withheld, you might also need to file a U.S. return. We can help!

Choose how you want to meet us :

- Drop-off your tax information at any H&R Block location ( Drop-Off form )

- File online with a Tax Expert

- About Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding (Internal Revenue Service website)

Got feedback? We'd love to hear from you!

Back to Top

©2023, H&R Block Canada, Inc. All rights reserved. Content provided in reference to H&R Block’s 2023 tax software.

www.hrblock.ca | Terms and Conditions | Privacy | DIY Tax Software | Remote Tax Expert | 2024-04-03 5:18 PM

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

CoCounsel: The GenAI assistant for tax and accounting professionals

Save time and effort by reducing long research sessions into simple tasks with AI-assisted research on Checkpoint Edge.

The evolution of artificial intelligence

While AI has evolved dramatically in recent months, the impact of technology on the accounting profession is nothing new.

Related posts

What accountants need to know about Form 1042 filing requirements

Information Reporting on Form 1042-S, A New Challenge for Accounts Payable – Exemption Codes

Why the nature of income paid to foreign vendors matters, more answers.

Are financial advisors filling your tax advisory role?

How to survive tax season with automation, AI, and self-care

New report shows opportunities and risks for tax professionals with GenAI

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- ESTATES, TRUSTS & GIFTS

Reporting Trust and Estate Distributions to Foreign Beneficiaries (Part I)

- Taxation of Estates & Trusts

- Types of Trusts

- International Tax

- Foreign Nationals

T his two-part article explains the procedures and tax compliance issues that fiduciaries face before domestic trust or estate distributions are paid or allocated to foreign beneficiaries. Part I explains how to verify the tax status of foreign beneficiaries for U.S. tax purposes and calculate the net distribution amount after properly withholding tax payments. Part II, in the January issue, will contain a comprehensive example of calculating the net distribution amount and calculating the withholding tax on income items for beneficiaries residing in various foreign countries, as well as the application of certain tax treaty benefits.

The increasing interaction of global economic issues and a mobile society make international tax issues more commonplace, even for smaller practitioner firms. New tax laws, especially the Foreign Account Tax Compliance Act (FATCA) provisions enacted in 2010 that will be effective in 2013 1 and corresponding Treasury regulations and rulings, affect the correct reporting by fiduciaries and practitioners of domestic trust and estate distributions to foreign beneficiaries. What may seem rather straightforward fiduciary administrative and reporting procedures can involve numerous complexities, sometimes with unexpected consequences. The complex rules necessitate early coordination between practitioners and fiduciaries to carefully plan the distribution and accounting procedures before embarking on reporting the results for tax return purposes.

Careful planning and prudent administration should consider a number of factors, including:

- Each beneficiary’s income tax filing status, both in the United States and in the country of residence;

- The potential relevance of tax treaty provisions advantageous to the beneficiaries applicable to each foreign jurisdiction;

- The practical aspects of trust/estate administration, focusing on “flexible” aspects, if possible;

- Being informed on applicable law changes, including the standards for making distributions and reporting them in the beneficiary’s foreign jurisdiction to ensure the proper reporting; and

- Proper allocation of receipts and disbursements between income and principal under local law and the governing instruments. 2

Determination of Tax Status of the Beneficiary

U.S. persons for U.S. tax purposes include U.S. citizens, resident aliens (green card holders), and U.S. residents who meet the “substantial presence” test of Sec. 7701(b) (generally those present in the United States for more than 183 days over a three-year period) or make a first-year election. 3 There are certain exceptions for residents of Canada or Mexico who regularly commute to employment in the United States, foreign-government-related individuals, certain teachers and students, and individuals with medical conditions that arose while present in the United States. 4

An individual who fails the substantial presence test may nevertheless avoid being classified as a U.S. resident if he or she can establish a closer connection to a foreign country. An individual may satisfy the “closer connection test” if the individual can establish that he or she (1) was present in the United States for fewer than 183 days during the current year; (2) maintains a tax home in a foreign country; (3) has a closer connection during the current year to the foreign country where his or her tax home is located than the U.S.; and (4) has not applied or taken affirmative actions to change his or her status to that of a lawful permanent U.S. resident. 5 The determination of whether an individual has maintained a closer connection to a foreign country is determined based on facts and circumstances, including the location of family, personal belongings, and business connections; where the individual holds a driver’s license; and where he or she votes. 6 Form 8840, Closer Connection Exception Statement for Aliens , must be filed to claim the closer connection exception to the substantial presence test (attached to a timely filed Form 1040NR, U.S. Nonresident Alien Income Tax Return ).

A nonresident alien is any individual who is neither a U.S. citizen nor a resident alien. 7 After determining the beneficiary’s tax status, the fiduciary should obtain the nonresident’s identifying tax number and tax withholding certificate (as indicated on Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding ) to withhold the tax required to be withheld on certain items of income distributed to nonresident alien trust or estate beneficiaries.

Withholding Tax for Foreign Beneficiary Distributions of Income

Fiduciaries may be required to withhold tax on distributable net income that is distributed by estates and complex trusts or required to be distributed by simple or complex trusts to a foreign beneficiary. (Foreign beneficiaries can include foreign trusts, but that topic is beyond the scope of this article.) Taxes are withheld when the distributions consist of amounts subject to withholding (i.e., the income portion, not corpus). The withholding requirements apply to foreign persons (i.e., nonresident aliens), but not resident aliens. A grantor trust is subject to tax withholding when a foreign person is treated as its owner and the trust has income subject to withholding.

The payer (or a person with control, receipt, or custody or who can disburse or make payments) is responsible for withholding the tax before the “net distribution” is paid. The withholding tax rate is ordinarily 30%. The Sec. 1444 regulations provide detailed rules for when a payer is required to withhold tax, the documentation that can be relied on to establish the status of a payee, and whether an exemption or a reduced rate of withholding should apply. The gross amount of income subject to withholding tax may not be reduced by any deductions, except to the extent that a nonresident alien is allowed a personal exemption for remuneration for personal services rendered in the United States. 8

A fiduciary is not required to withhold tax if a foreign person assumes responsibility for withholding as a qualified intermediary or an authorized foreign agent. 9 A “qualified intermediary” is a foreign financial institution or foreign clearing organization that has entered into a qualified intermediary withholding agreement with the IRS, as represented on Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding . The fiduciary should request a copy of the form from the intermediary.

If the fiduciary, as the withholding agent, makes a payment to a person that can be treated as an intermediary, the payee is the intermediary to the extent that the intermediary assumes primary withholding responsibility for the payment. 10 In that case, the fiduciary is not required to withhold tax on the payment. For a payment to an authorized foreign agent, that agent can fulfill the withholding obligations of the U.S. fiduciary only if (1) there is a written agreement between the withholding agent fiduciary and the foreign person acting as agent; (2) the fiduciary satisfies certain notification procedures; (3) books, records, and relevant personnel of the foreign agent are available (on a continuous basis, even after the termination of the relationship) for IRS examination to evaluate the fiduciary’s withholding and reporting compliance; and (4) the fiduciary remains fully liable for the acts of its agent and does not assert any defenses to avoid any tax liability under the Code. 11

The fiduciary, by appointing an authorized foreign agent, must file notice of the appointment with the Office of Assistant Commissioner (International) before the first payment for which the authorized agent acts as such and acknowledge the withholding liability as described above in (4). 12 The fiduciary, for example, may be compelled to engage an authorized foreign agent to assist an incapacitated or minor foreign beneficiary in order to maintain security for the ultimate distribution to its beneficial owner.

IRS Guidance for Withholding Requirements for Trusts and Estates

Regs. Sec. 1.1441-5 has specific guidance for tax withholding in the case of U.S. simple trusts, complex trusts, and estates. See Exhibit 1 for a summary of the rules for simple trusts. See Exhibit 2 for a summary of rules for complex trusts and estates. The regulation makes specific reference to the “entity” as having the responsibility for withholding and paying the tax in coordination with filing Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons , with the IRS for the applicable calendar tax year. However, for U.S. trusts and estates, the fiduciary has many duties and responsibilities under applicable state laws.

The fiduciary, whether an executor or a trustee (or both), is expected to act prudently in exercising a standard of care that is measured in part by his or her adherence to tax compliance issues in performing his or her duties. Accordingly, this article is written assuming that the fiduciary has the ultimate withholding responsibility, even though he or she may employ agents to satisfy that task.

Importance of the Withholding Certificate

The fiduciary may rely on the information and certifications stated on the Form W-8BEN and/or other documentation without having to inquire into the truthfulness of the information, unless he or she has actual knowledge or reason to know that it is untrue. A withholding certificate may be signed by a person authorized to sign a declaration under penalties of perjury on behalf of the person whose name is on the certificate as provided in Sec. 6061. 13 There are certain presumptions about a payee who is a foreign beneficiary that the fiduciary must be aware of during a grace period to establish foreign tax status. See Exhibit 3 for a summary of these rules.

Form W-8BEN has recently been revised (as of May 31, 2012) in the “Draft W-8BEN Form” (for use by foreign individuals) in anticipation of new Chapter 4 provisions in the Code (i.e., FATCA withholding taxes to enforce reporting on certain foreign accounts, Secs. 1471–1474) effective after Dec. 31, 2012, to accommodate both Chapter 3 (withholding of tax on nonresident aliens and foreign corporations, Secs. 1441–1464) and Chapter 4 withholding taxes, so that withholding agents will not be required to maintain two separate forms. The draft form is expected to be final by December 2012, resulting in the prior version’s being obsolete after six months. The new “Draft W-8BEN-E Form” is for use by entities for purposes of Chapters 3 and 4. Fiduciaries and practitioners should follow these developments closely.

Draft Form W-8BEN requires filers to provide a “foreign tax identification number,” an optional entry in the predecessor form. Such requirement may be an attempt under FATCA procedures to collect non-U.S. taxpayer information that could be transmitted under recently announced intergovernmental agreements between the U.S. and treaty countries. Exhibit 4 summarizes the withholding certificates described in Regs. Sec. 1.1441-1(e)(2).

Income Items Subject to Withholding

Tax must be withheld on payments of interest, dividends, and other fixed or determinable annual or periodic (FDAP) U.S.-source income paid to foreign persons. The Form 1042-S instructions provide detailed instructions and examples for fiduciaries and practitioners to follow. Information required by the foreign beneficiary claiming foreign tax status through a beneficial owner withholding certificate is indicated in Exhibit 4 . The beneficiary may be eligible for a reduced withholding rate (below 30%) or an exemption from withholding, if he or she is entitled to benefits under provisions in a U.S. income tax treaty.

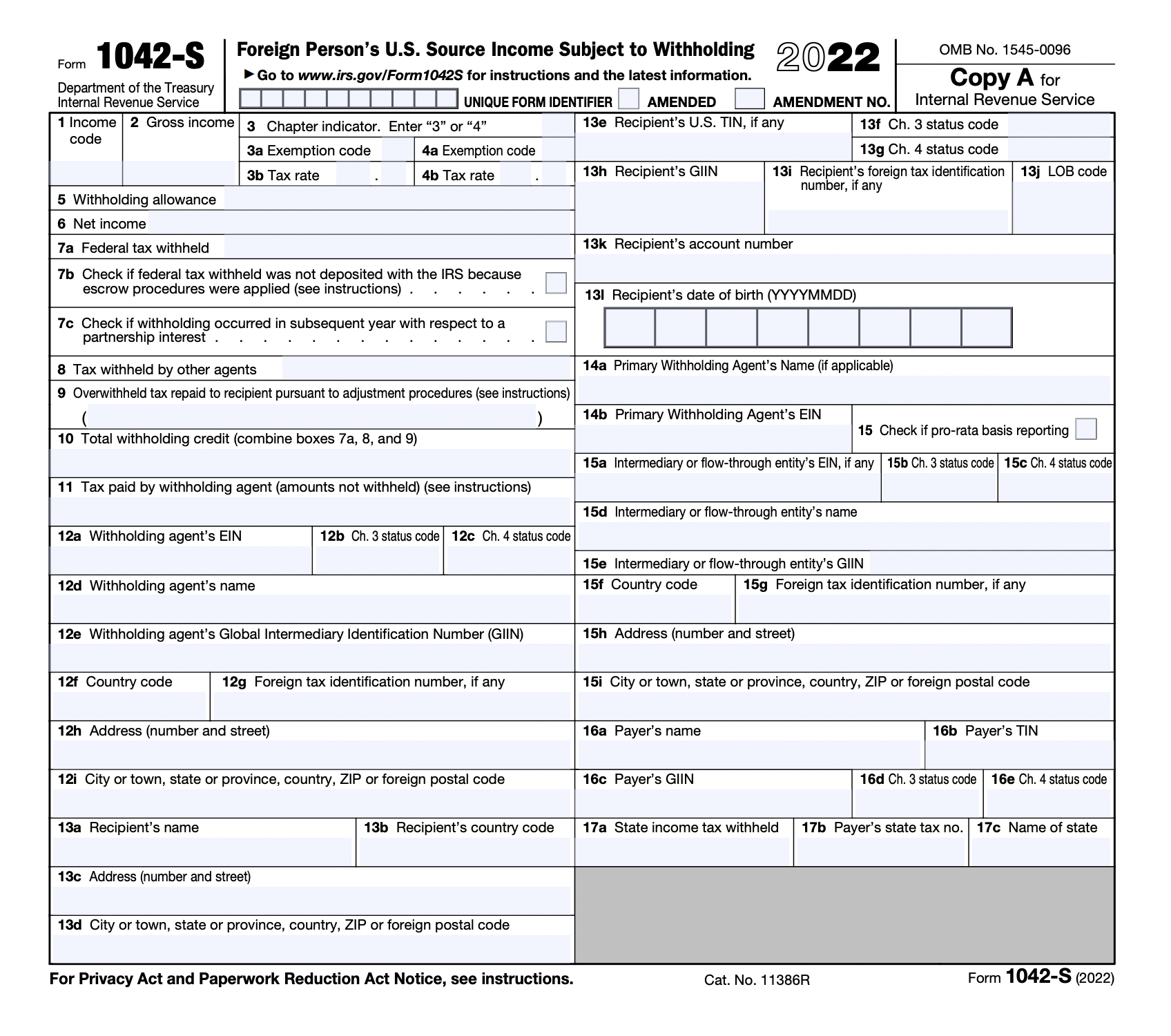

Reporting of Withholding Tax on Forms 1042-S and 1042-T

The various categories of income subject to withholding and the applicable tax rates are reported on Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding . The payer must complete a separate Form 1042-S for each withholding rate pool (i.e., a payment of a single type of income), as determined by the “income codes” of Form 1042-S (according to the IRS instructions) that is subject to a single rate of withholding. 14 Other requirements in filing Forms 1042-S and 1042-T, Annual Summary and Transmittal of Forms 1042-S , are reported in Exhibit 5 . Payment (e.g., “deposit requirements”) of the withholding taxes to the IRS is reported on Form 1042. Further guidance and explanation will be provided in a comprehensive example in Part II of this article, in the January issue.

The fiduciary is indemnified against the claims and demands of any person for the amount of any tax it deducts and withholds in accordance with the Sec. 1441 provisions. However, this indemnity does not relieve the fiduciary from tax liability under the Sec. 1441 requirements. Thus, the fiduciary can be personally liable, even if the payer reasonably believed that correct action was taken. 15

Reporting of Specific Income Items on Form 1042-S

If distributions are made to a foreign beneficiary, tax withholding is required on amounts from U.S. sources, and those amounts are reported on Form 1042-S, including:

- FDAP income (fixed or determinable annual or periodic income (e.g., rents and royalties)).

- Certain gains from the disposal of timber, coal, or domestic iron ore with a retained economic interest.

- Gains related to contingent payments received from the sale or exchange of patents, copyrights, and similar intangible property.

- Distributions of effectively connected income from a publicly traded partnership.

Capital gains, other than those listed above and gains on the sale of U.S. real estate or real property interest or gains from effectively connected income property, are not subject to withholding tax on distributions to foreign beneficiaries.

Income that might be included in the distributable net income of a U.S. trust or estate, subject to Form 1042-S reporting, includes, but is not limited to, the following U.S.-source amounts:

- Rents and royalties (gross amounts, if not effectively connected income);

- Annuity income;

- Pension and other deferred income, including IRAs;

- Most gambling winnings;

- Cancellation of debt income;

- Effectively connected income, including bank deposit interest that is effectively connected income (see below);

- Original issue discount (OID) from the redemption of an OID obligation; and

- Amounts, whether or not subject to withholding, that are paid to a foreign payee and have been withheld on, including backup withholding under Sec. 3406, by another withholding agent under the “presumption rules” (see Exhibit 3 ).

Items Not Subject to Withholding on Form 1042-S Reporting

The following income items are exempt from Sec. 1441 tax withholding but should be reported by category and code identification (as described in the Form 1042-S instructions):

- Interest on bank deposits, provided that the income is not effectively connected, including bank deposit interest (and OID) from foreign branches of U.S. banks or savings and loans. 16 The exemption also applies to interest paid to Canadian residents who are not U.S. citizens, but only if less than $10 per calendar year.

- Interest and OID from short-term obligations (i.e., those payable 183 days or less from the date of original issue).

- Accrued interest and OID.

When the normal conduit rules of trust and estate taxation apply, the interest income is ultimately received by the nonresident alien beneficiary. Otherwise, the bank interest income would be taxable to the U.S. trust or estate. As the interest income is not taxable to the nonresident under Secs. 871(h)(1) and (2), the fiduciary should not have to withhold tax on that income item.

In Isidro Martin-Montis Trust , 17 the IRS agreed with the court’s decision that, since the interest income was ultimately received by the nonresident alien, the fact that it was received in the first instance by the trust does not prevent the operation of the exclusion from U.S. sources as to that income item in the hands of the trust beneficiaries. 18 The IRS reached the same conclusion under similar facts and circumstances in Letter Ruling 8608013 (specific conclusion as to no withholding required under Sec. 1441) and Letter Ruling 8530051 (also no Sec. 1441 withholding required). 19

This exemption from tax and reporting has been in the Code for more than 50 years. On April 17, 2012, Treasury issued final regulations (T.D. 9584) that require U.S. financial institutions to annually report bank deposit interest income of all nonresident individuals to the IRS. These new rules only affect reporting requirements and do not affect the taxation of the interest income. The final 2012 regulations are effective for payments made on or after Jan. 1, 2013.

Reporting the Foreign Beneficiary’s Share of Distributable Net Income on Form 1042-S

The fiduciary does not attach any documentation, such as withholding certificates, when filing Forms 1042-S with the IRS. As previously discussed, a separate Form 1042-S is filed for each type of income for each beneficiary. For example, a trust that distributed distributable net income consisting of dividends and rental income to two foreign beneficiaries is required to file four Forms 1042-S. Such reporting is required even if withholding was not made because of a treaty provision or an exception in the Code.

Special Reporting Rules

Box 1 of Form 1042-S requires a two-digit income code found in the form’s IRS instructions. Box 2 requires reporting the gross amount of the income item type that was distributed or required to be distributed to the nonresident alien beneficiary. The withholding tax rate, typically 30%, unless a lower treaty rate or exemption applies, is reported in Box 5 (e.g., 30.00). If withholding tax is not required, a “-0-” is reported, and the proper corresponding code (as designated in IRS instructions) should be reported in Box 6.

The distributable net income of the estate or trust is typically determined for each beneficiary’s Schedule K-1 in a three-step process: Step One (gross income by type), Step Two (allowable deductions allocated to each gross income item), and Step Three (the distributable net income as calculated in Steps One and Two is then compared to the distributions to each of the entity’s beneficiaries).

The method of allocating amounts found in Step Two among trust beneficiaries depends on whether the trust is a simple or a complex trust. For the purposes of satisfying the Form 1042-S reporting and withholding requirements, the foreign beneficiary faces a higher effective tax rate than the U.S. beneficiary of the same trust or estate on some income items. However, by filing a Form 1040NR for the tax year, the foreign beneficiary may be able to file for a refund on a portion of the Sec. 1441 tax withheld on his or her Forms 1042-S because the 30% withholding tax is based on each beneficiary’s distributable share of “gross income” from the entity. Part II of this article in the January issue will illustrate these requirements in a comprehensive example.

Effect of Treaty Provisions to Reduce Withholding on Foreign Beneficiary Distributions

The withholding rate can be less than 30%, under certain provisions in U.S. tax treaties. When a foreign beneficiary has an income type subject to a reduced withholding rate (based on his or her Form W-8BEN and his or her applicable foreign country’s tax treaty provision), a separate Form 1042-S must be prepared to report that rate. As previously discussed, Part II of the beneficiary’s Form W-8BEN, “Claim of Tax Treaty Benefits,” contains information that the beneficiary must certify (under penalties of perjury, as attested by his or her signature in Part IV). The fiduciary, or a designated withholding agent, will determine the beneficiary’s eligibility for a reduced rate according to the form’s content and other documentation necessary to satisfy the responsible withholding party.

To prevent double taxation in an international context, the U.S. tax treaty system with many foreign countries protects foreign persons from U.S. tax in certain cases. Although there may be identical provisions in certain U.S. tax treaties, each treaty should be carefully interpreted in its own context. IRS Publication 901, U.S. Tax Treaties , is helpful in determining whether a particular tax treaty country provides for a reduced rate of (or a possible exemption from) U.S. income tax for residents of that particular country.

Determining Eligibility for U.S. Tax Treaty Benefits

The tax benefits incorporated in a U.S. tax treaty are generally available only to persons who are residents of one or both of the contracting states. Under Article 4 of the U.S. Model Income Tax Convention, a “resident of a Contracting State” is a person who is liable for tax under that state’s laws by reason of his or her domicile, residence, or citizenship. The withholding agent will be required to analyze the facts and circumstances in each foreign beneficiary’s case to determine if he or she is entitled to income tax treaty benefits in his or her resident foreign country under Sec. 894. 20

Generally U.S. tax treaties negotiated after 1963 contain provisions that establish that certain types of income are taxed only to the beneficiary (by a distribution of distributable net income under Secs. 652(b) and 662(b)) as determined by the beneficiary’s country of residence. There are also specific exemptions or exceptions to tax withholding under the Code, as previously discussed. For example, the exceptions for U.S. bank debt or “portfolio interest” are common income items. 21 An example of a “reduced withholding rate” is the provision in recent U.S. tax treaties for a limit on the rate of tax (15%) that may be imposed on its resident by the other country (i.e., the United States) on dividends. 22

In another example, in the United States treaty with Germany, most of the types of income likely to be earned by a U.S. domestic trust would not be treated as fixed, determinable, annual, or periodic income if earned by the German beneficiary directly (Germany is a civil law jurisdiction that does not recognize the trust entity concept), such as dividends received from a U.S. corporation. Thus, the dividend income would be taxable in the United States at 15% (15% withholding tax on the dividends in the distributable net income portion distributed to the German beneficiary). In Germany the beneficiary would be subject to both German income tax (but allowed a tax credit for the U.S. 15% withholding tax against the German income tax liability), as well as a gift tax, which is levied on distributions to recipients, even from a trust settled by a foreign resident settlor. However, the German beneficiary would escape the liability of an inheritance tax in this case. 23 Prudent withholding agents should give proper attention to measures available to alleviate double taxation under the domestic laws of each jurisdiction and to the terms of any double taxation treaty between the contracting states. A careful and cautious analysis is required to achieve such objectives for the foreign beneficiary, but also to avoid underwithholding claims that might transpire at a later date.

Other U.S. Tax Treaty Operative Provisions

One area of growing importance is the “other income” provision (a residual or default category) in U.S. bilateral income tax treaties. 24 In this provision—Article 21 of the model convention—the contracting states (the United States and the other signatory country) agree that any item of income that is not covered in one of the preceding articles (e.g., Business Profits, Dividends, Interest, Royalties, etc.) is taxable only in the jurisdiction of the recipient’s residence. The tax exemption under Article 21 requires that (1) the recipient have beneficial ownership of the income item (i.e., the recipient cannot be an agent or nominee), (2) the taxpayer is a resident of the contracting state (to the treaty), and (3) the particular income item is not covered in another article. In addition, all recent U.S. treaties in force require that the limitation-on-benefits (LOB) article (which prohibits residents of third countries from obtaining treaty benefits) be satisfied (e.g., the recipient is not merely a resident, but a “qualified resident” of the contracting state). 25

The “other income” provision in treaties has become much more important with the significant increase in the types of assets and income. At the same time, the IRS defines broadly what it considers to be U.S.-source income subject to Sec. 1441 withholding. Examples include viatical settlement contract income from life settlement contracts, income items from payments under a notional principal contract, and punitive (but not compensatory) damages. The statutory definition of a “specified notional principal contract” (found in Sec. 871(m)(3)(A)) is effective for payments after March 18, 2012. 26

In Rev. Rul. 2009-14, 27 the IRS takes a broad view of what income should be subject to Sec. 1441 withholding. The ruling takes the position that if there is no specific guidance on the source of a particular type of income, the appropriate action is to compare and analyze the income item “to classes of income that are specified within the statute.” 28 Practitioners and fiduciaries need to be aware of the IRS’s lack of guidance in the “other income” category for Sec. 1441 purposes. 29

Reporting Under Special Circumstances

Distributions to covered expatriates from nongrantor trusts.

Whether a nongrantor trust makes a direct or indirect distribution to a covered expatriate, the trustee may be required to withhold 30% of the “taxable portion” of the distribution. 30 The Heroes Earnings Assistance and Relief Tax Act of 2008 31 designates a “covered expatriate” 32 as those U.S. citizens (or a U.S. resident for not more than 10 of the prior 15 years before expatriation) seeking expatriation who have (1) a net worth of at least $2 million on the expatriation date or (2) an average annual net income tax for the five tax years prior to expatriation greater than $124,000, adjusted periodically for inflation. 33 Under Rev. Proc. 2011-52, the inflation-adjusted amount for 2012 is $151,000. This withholding obligation on the U.S. trustee arises only if the covered expatriate was a beneficiary of the nongrantor trust on the day before the expatriation date. 34 Form W-8CE, Notice of Expatriation and Waiver of Treaty Benefits , filed within 30 days of expatriation, notifies the trustee that the person is a covered expatriate.

The covered expatriate is deemed to have made an irrevocable waiver of any rights to treaty benefits (which might otherwise reduce the tax), but he or she may preserve the right to claim a treaty benefit with respect to a distribution to which Sec. 877A(f)(1)(A) applies by electing on Form 8854 to be treated as having received the value of his or her interest in the trust on the day before the expatriation date. 35 To make such an election, the expatriate must obtain a letter ruling from the IRS as to the value of his or her interest in the trust as of the day before the expatriation date (requested as set forth in Rev. Proc 2010-4). 36 Until the trustee receives a copy of such letter ruling and a certification that the tax due on the value of the trust interest has been paid, the trustee must withhold the 30% tax on any distributions to the covered expatriate beneficiary. 37 The election is invalid if the IRS determines that the interest does not have an ascertainable value.

The amount of tax due on the value of the trust interest will be adjusted by the amount of tax withholding on or after the expatriation date and prior to receipt of the letter ruling. If the nongrantor trust distributes appreciated property to the covered expatriate, the trust must recognize gain as if the property was sold to the expatriate at its fair market value. 38 Subsequent to the expatriation date, if the covered expatriate is deemed to become the owner of the nongrantor trust, it is treated as a conversion under Sec. 877A(f)(1) (as a distribution in an amount equal to the value of the property he or she is deemed to own under the grantor trust rules, as set forth in Sec. 671 et seq. ). 39

Distributions in Foreign Currency

The typical foreign beneficiary would expect or desire a cash distribution be paid in his or her functional currency. To do so requires that the prudent fiduciary be knowledgeable of the applicable federal tax reporting issues, as well as future foreign currency conversion amounts, to maximize potential gains and minimize potential losses before making such distribution conversions. If the amount subject to withholding tax is paid in a currency other than U.S. dollars, the amount of withholding is determined by applying the applicable rate of withholding to the foreign currency amount and converting the amount withheld into U.S. dollars on the date of payment at the spot rate in effect on that date. 40 A withholding agent making regular or frequent payments in foreign currency may use a month-end spot rate or monthly average spot rate (but the method must be applied consistently from year to year). 41 The spot rate may also be used on the day that the withholding tax is deposited, if the deposit is made within seven days of the date of the payment that causes the withholding obligation.

Alternatively, the fiduciary could elect to calculate the withholding tax and withhold the tax before making the currency conversion for the distribution payment to the foreign beneficiary. However, in that case, if the currency conversion transaction results in a gain to the beneficiary, additional withholding tax may be due. If the fiduciary satisfies the additional withholding tax liability associated with the distribution, this payment may represent additional income attributed to the foreign distribution, for which additional withholding tax would be required. 42 The Code, through the mechanism of the “Sec. 988 transaction,” sets forth rules governing the tax treatment of “exchange gain or loss” arising from a number of specific transaction types.

Family Governance Benefits Family Trusts

In many global high-wealth trust administrations, practitioners see that family governance provides positive benefits for family trusts. Such trust governance, in the case of a U.S. trust, can include family members, such as subgroups, to assist the fiduciary with distributions to the foreign beneficiaries and keep them informed on administrative issues. For example, the trust agreement could provide that the family council members maximize the after-tax distribution amounts to the beneficiaries by acting in their role to benefit the larger family. As discussed previously in this article, nonresident beneficiaries may be faced with more challenging technical issues before enjoying their net distribution benefits from a U.S. trust, compared to their fellow U.S. beneficiaries. Successful family governance systems succeed because they are based on the initial and ongoing participation of all the affected family members (“taxation with representation”). Such policies and procedures tend to maintain family harmony and avoid litigation. 43

Best Practice Guidelines

The following best practice procedures and strategies will facilitate sound U.S. estate and trust administration for distributions to foreign beneficiaries.

- Consider opportunities for reducing the Sec. 1441 withholding tax, in compliance with IRS regulations, provided adequate documentation is obtained from foreign beneficiaries.

- Collect and maintain all necessary tax forms (W-8BEN, W-8CE, W-8IMY, and W-9, Request for Taxpayer Identification Number and Certification ) and other documentation from beneficiaries needed to verify residence and to compute the correct withholding tax annually.

- Review applicable U.S. treaty provisions with each applicable beneficiary’s foreign country. Seek professional advice to ensure a proper understanding of the provisions as they affect the current year’s Sec. 1441 tax amount(s).

- Compute the correct Sec. 1441 tax before each applicable distribution, after performing procedures 1 through 3 above, using the appropriate rates. Be sure to consider (a) documentation indicating that a treaty provision allows a reduced income item withholding rate or an exemption from withholding; (b) proper handling, timing, and reporting of any foreign currency conversion to facilitate payment in the beneficiary’s home country currency; (c) the strategic timing of the distributions based upon tax law changes, U.S. tax treaty changes or revisions, foreign currency exchange rates, and changes in beneficiary residences.

- Reconsider any “reduced withholding tax” by analyzing any risks whereby the withholding agent can be held accountable for underwithholding.

- File Forms 1042, 1042-T, and 1042-S in a timely manner each applicable tax year. Provide copies of Forms 1042-S to the applicable beneficiaries. Counsel each to seek professional advice in the tax filing in his or her home country as well as filing Form 1040NR in the United States

Part II of this article, in the January issue, will illustrate the technical issues analyzed and explained in Part I of estate and trust distributions to foreign beneficiaries in a comprehensive example. The example will encompass fiduciary accounting concepts and their determination of distributable net income to illustrate how to maximize net distributions to foreign beneficiaries. The example will also illustrate the application of certain U.S. tax treaty provisions in determining the correct withholding rates. Prudent fiduciaries will seek the advice of practitioners who are knowledgeable and experienced with these complicated issues to guide them in their estate and trust administrations.

1 Enacted as part of the Hiring Incentives to Restore Employment Act, P.L. 111-147.

2 See Robinson, “U.S. Trusts With Foreign Beneficiaries: Issues and Observations,” 35-8 Estate Planning 25 (August 2008).

3 Sec. 7701(b)(1)(A).

4 Regs. Secs. 301.7701(b)-3(b) and (c).

5 Regs. Secs. 301.7701(b)-2(a) and (f).

6 Regs. Sec. 301.7701(b)-2(d).

7 Sec. 7701(b)(1)(B).

8 Reg. Secs. 1.1441-4(b)(6) and 1.1441-3(a).

9 Regs. Sec. 1.1441-1(b)(1).

10 Regs. Sec. 1.1441-1(b)(2)(v)(B).

11 Regs. Sec. 1.1441-7(c)(2).

12 Regs. Sec. 1.1441-7(c)(3).

13 See Regs. Secs. 1.1441-1(e)(4)(i) and (viii).

14 Regs. Sec. 1.1461-1(c)(4)(i)(B).

15 Regs. Sec. 1.1461-1(e).

16 Sec. 1441(c)(10); Regs. Sec. 1.1441-1(b)(4)(ii).

17 Isidro Martin-Montis Trust , 75 T.C. 381 (1980), acq . 1981-2 C.B. 2.

18 Rev. Rul. 81-244, 1981-2 C.B. 151.

19 IRS Letter Ruling 8608013 (2/31/86); IRS Letter Ruling 8530051 (7/26/85).

20 Rev. Proc. 2012-7, 2012-1 I.R.B. 232, stipulates that the IRS will not issue a ruling or determination letter on this issue.

21 See Sec. 871(h) providing for exempt status for nonresident alien taxpayers.

22 The dividend provision has been added to several treaties, including those with Australia, Germany, and the Netherlands. See Bissell, BNA Tax Management Foreign Income Portfolios 907-2d, U.S. Income Taxation of Nonresident Alien Individuals , at VI.C.1.b (2005).

23 See detailed discussion in Lehmann, “Balancing Act,” 20-4 STEP Journal 27 (May 2012).

24 The “other income” provision is found in Article 21 of both the 2006 U.S. model income tax treaty and 2010 OECD model income tax treaty. Every U.S. treaty in force has been separately negotiated, which results in a diversity of language in each treaty, as well as a diversity of interpretations.

25 See Lorence, “Why ‘Other Income’ Tax Treaty Provisions Are Important,” 22-4 J. Int’l Tax 44 (April 2011).

26 Temp. Regs. Sec. 1.871-16T.

27 Rev. Rul. 2009-14, 2009-1 C.B. 1031.

28 Rev. Rul. 2009-14 does not analyze the exemption of Chapter 3, Sec. 1441 withholding; it is subject to criticism as poorly consummated and lacks proposed regulation criteria, including comment period and hearing.

29 See Lorence, “Why ‘Other Income’ Tax Treaty Provisions Are Important.”

30 Sec. 877A(f)(1)(A).

31 Heroes Earnings Assistance and Relief Tax Act of 2008, P.L. 110-245, 6-17-08. The HEART legislation created new Sec. 877A for expatriates. The manner in which the new statute applies, as well as exceptions to those rules, differs for expats who expatriated prior to June 17, 2008 (Sec. 877 rules apply), based on the identity of the expat (i.e., whether the expat is a current U.S. citizen or green card holder).

32 Sec. 877A(g)(1)(A).

33 Even if the U.S. citizen does not have the specified net worth or income tax liability, if the citizen fails to certify under penalties of perjury (by filing Form 8854) that he or she has complied with U.S. tax laws for the five-year period prior to expatriation, the U.S. citizen will also be treated as a covered expatriate, subject to the rules (Notice 2009-85, 2009-2 C.B. 598, §8.C).

34 Sec. 877A(f)(5).

35 Notice 2009-85, §7.D.

36 Rev. Proc. 2012-4, 2012-1 I.R.B. 125.

38 Sec. 877A(f)(1)(B).

39 See Joint Committee on Taxation, Technical Explanation of H.R. 6081 (JCX-44-08) (May 20, 2008); Notice 2009-85, §7.A.

40 Regs. Sec. 1.1441-3(e)(2); Notice 2001-43, 2001-2 C.B. 72, §3.

41 The term “spot rate” means a rate that reflects a fair market rate of exchange available to the public for currency under a spot contract in a free market and involving representative amounts. For example, the spot rate may be determined by reference to exchange rates published in the pertinent monthly issue of International Financial Statistics or a successor publication of the International Monetary Fund; exchange rates published in newspapers, financial journals, or other daily financial news sources; or exchange rates quoted by electronic financial news services (Regs. Sec. 1.988-1(d)(1)).

42 Regs. Sec. 1.1441-3(e)(1).

43 See Hauser, “International Family Governance: Integration With Family Trusts,” in Trusts in Prime Jurisdictions , p. 585 (Globe Business Pub. Ltd. 2010).

Sale of clean-energy credits: Traps for the unwary

Tax consequences of employer gifts to employees, top 8 estate planning factors for real estate, success-based fees safe harbor: a ruling raises concerns, pond muddies the waters of the mailbox rule.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

Understanding Critical Elements of Nonresident Withholding Form 1042-S

Understanding when U.S. tax must be withheld from a payment made to a non-U.S. person and understanding when a payment made to a non-U.S. person must be reported on a Form 1042-S are critical elements in preparing complete and accurate forms.

U.S. persons are subject to tax on their worldwide income. The IRS relies on billions of information returns filed each year—primarily 1099 and W-2 forms filed by payers and employers—to know that a U.S. person has income that should be reported on an income tax return. So long as the IRS receives an information return with a payee’s correct name and taxpayer identification number, or TIN, it can confirm that the income reported on that information return is properly reported on the payee’s income tax return and any requisite income tax is paid. Payors generally require U.S. payees to furnish a W-9 to certify their U.S. tax status and their TINs. It is very unusual for a payer to be required to impose withholding on a payee who has furnished a W-9.

Non-U.S. persons and nonresident aliens—NRAs—are subject to U.S. tax on income they earn in the U.S., also known as U.S. source fixed or determinable, annual, or periodical (FDAP) income. U.S. source FDAP income includes interest paid by U.S. borrowers, dividends paid by U.S. corporations, rent paid for the use of U.S. real property, royalties, licensing fees paid for use inside the U.S. of a non-U.S. person’s intangible property, and payments for services rendered in the U.S. U.S. source income paid to a non-U.S. person is generally subject to 30% withholding and 1042-S reporting.

Important things to note:

- For tax purposes, a person includes anyone and any entity. Individuals, corporations, partnerships, and limited-liability companies are all persons for U.S. tax purposes.

- Someone who makes a payment to a non-U.S. person is generally known as a withholding agent.

- While corporations and tax-exempt entities are typically exempt recipients and do not receive 1099 forms other than Form 1099-K, there are no NRAs who are exempt recipients for 1042-S purposes.

Non-U.S. persons generally document their tax status on one of several types of W-8 forms. Unfortunately, many withholding agents believe that if they collect a W-8 from a non-U.S. person, they are not required to withhold on or report payments to that person. That is simply not true. Instead, when a withholding agent makes a payment to a non-U.S. person, they must consider four additional steps:

- First, determine whether the payment is FDAP income. FDAP income includes interest, dividends, rents, royalties, licensing fees, and payments for services rendered. For payments made by an accounts payable group, a good rule of thumb is to ask whether the payment would be reportable on a 1099 if it was paid to a U.S. nonexempt recipient. If the answer is yes, it is most likely FDAP income. Likewise, if it is a payment for merchandise, equipment, raw materials, or inventory, it is not FDAP income and is not subject to U.S. reporting or withholding. However, beware of hidden charges for shipping, repairs, assembly, etc.

- Second, if the payment is FDAP income, determine where it was earned by the non-U.S. person. Rental payments are earned in the U.S. if the rented property is located in the U.S. Royalties and licensing fees are earned in the U.S. if the intangible property, e.g., software, is used in the U.S. Finally, payments for services are U.S. source if the services were rendered in the U.S., i.e., if the NRA came to the U.S. to perform services. This includes payments to board members who travel to the U.S. to attend board meetings and payments to professional services firms that send personnel to the U.S. Where a withholding agent does not know whether income is U.S. or foreign source, the tax rules presume the income to be from a U.S. source.

- Third, if the payment is U.S. source FDAP income, withholding at a rate of 30% is generally required. However, if the beneficial owner of the income provides a valid treaty claim on either a Form W-8BEN or W-8BEN-E, a reduced withholding rate will most likely apply. Although uncommon, the beneficial owner may also claim that the income is effectively connected with their conduct of a trade or business in the U.S. via Form W-8ECI or is otherwise exempt from withholding on a W-8EXP. It is the responsibility of a withholding agent to ensure that any claim for reduced withholding is valid, and a withholding agent is always liable for any tax they should have withheld but did not.

- Fourth, if the payment is U.S. source FDAP income, it is reportable on a 1042-S regardless of whether it was subject to withholding. Completing a 1042-S is not a simple task. The form contains numerous fields that require codes to report such things as income type, reason for exemption, the withholding agent’s chapter 3 and chapter 4 status, and the recipient’s chapter 3 and chapter 4 status. Chapter 3 refers to the general NRA withholding and reporting rules, while chapter 4 is a reference to FATCA, which applies an additional layer of information reporting and withholding compliance applicable to “financial payments.”

A few tips for completing Forms 1042 and 1042-S correctly:

- As stated above, Form 1042-S requires codes for several items. These codes are updated annually, and processes need to be refreshed to make sure the correct updated codes are being captured on each 1042-S. The instructions to the form provide ordering rules to address instances in which more than one code could be applied.

- The 1042-S instructions provide a list of required fields. A withholding agent must ensure that all required fields are completed.

- A 1042 is required even if no tax was withheld. The aggregate amount of gross income paid and the tax withheld as reported on the 1042-S forms filed must match the aggregate amounts reported.

- The IRS has developed an online tool for 1042-S validation that can be used before a file is submitted to the IRS to identify certain errors. The agency is also using data analytics to identify withholding agents for audit and to receive inquiries to reconcile certain amounts reported on Forms 1042 and 1042-S.

This article does not necessarily reflect the opinion of The Bureau of National Affairs, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Debbie Pflieger is a Principal in EY’s Financial Services Organization. Debbie is EY Americas’ Tax Information Reporting and Withholding Services leader and consults with clients in the information reporting and withholding arena, assisting them to understand and comply with their many obligations in this area.

Tara Ferris is a principal in the financial services office of EY Americas. In this role, Ferris advises multinational financial institutions and asset managers on customer tax reporting and withholding.

We’d love to hear your smart, original take: Write for Us

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

- Contact Trolley

Global payouts & compliance

Send payouts worldwide and comply with local regulations

Developer tools

Embed payouts and compliance directly in your platform

Access resources to help you use Trolley to its full potential

Content Spotlight

A Customer-Driven Triumph: Trolley Ranks on Deloitte's Fast 50 & Fast 500

Read the full article →

Discover how we help our customers pay out their contractors and stay tax compliant.

So, How Exactly Do Streaming Services Calculate Royalties in 2024? Read the full article →

IRS Form 1042-S: Reporting & withholding for foreign contractors

- Myles Carter

- Published: March 10, 2022

- Last updated: February 23, 2024

When your company engages foreign (non-U.S.) contractors and freelancers, you take on an obligation to report their earnings to the IRS and withhold the appropriate amount of taxes on each payment. This is recorded and reported each tax year via IRS Form 1042-S. Simply put, if a company based in the United States pays non-US citizens for their services, the company must provide them with a Form 1042-S and file this document with the IRS.

As organizations expand their recruitment efforts outside borders, being prepared to manage the tax withholding requirements when paying freelancers who aren’t U.S. citizens is critical to attracting (and paying) skilled workers from the global talent pool.

In our article “ Working with foreign contractors: What is IRS Form W-8 BEN? ” we discussed gathering the information required to establish a tax-compliant relationship with foreign contractors. In this article, we dive into Form 1042-s, the key document needed to report earnings paid to non-U.S. workers.

This article covers

What is form 1042-s, types of income reportable on form 1042-s, who receives a 1042-s, penalties for late 1042-s submission, differences between forms 1042s and 1099 (nec, k, misc), summing it all up, simplify contractor tax compliance with trolley.

Even though they are non-citizens, foreigners who earn income in the U.S. or from a U.S. company need to report and pay taxes on those payments.

The company or person making the payment is required to withhold an appropriate amount—based on the tax treaties in place.

- If there is no tax treaty between the US and the country of residence, the general withholding tax rate is 30%.

- Then the payee manages taxes with their government instead of with the IRS.

This reporting is done via form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, is an IRS form that belongs to the 1042 series of forms.

No matter their taxable status, Form 1042-S is an IRS form that individuals, corporations, and institutions in the United States must complete at the end of the year to record and report to the IRS the amounts they paid to—and withheld from—their non-citizen, nonresident workers.

The affected parties include,

- Nonresident aliens,

- foreign partnerships,

- foreign businesses,

- foreign estates,

- and foreign trusts.

For example, if a company is situated in the United States and hires a graphic designer in India and a content writer in London, it needs to file Form 1042-S for each employee at the end of the year.

Unlike the 1099 series of forms used when paying a U.S. contractor, each related to particular types of income, a separate 1042-S form is required for each type of income paid as there may be different withholding amounts dependent on the kind of income.

The following are some of the different types of revenue that are reported on 1042-S forms:

- Royalties

- Services conducted in the United States

- Scholarships

- Corporations in the United States pay dividends to their shareholders.

- Real estate earnings

- Income from a pension

- Winnings from gambling

- Interest paid on deposits.

- Premiums for insurance

Form 1042-S does not have a minimum payment threshold. Whether a foreign freelancer is paid $100 per year or $10,000 per year, the IRS still expects a report.

In contrast, only when a company pays a U.S.-based freelancer over $600 must it provide them with a Form 1099-NEC . This is a significant distinction to be aware of if a company hires freelancers both in the United States and abroad.

Even if a company’s payments to their contractors were eventually exempt from withholding tax due to a tax treaty or taxation exception, any U.S. person, corporation, or institution that provides income to non-citizen individuals must file a Form 1042-S.

Nonresidents of the United States who receive money from any source in the United States, including passive sources like interest, should receive and then file a 1042-S for each type of income. The 1042-S form is typically used by:

- foreign-based freelancers & contractors,

- International artists & creatives offering services in the United States,

- international students & postdoctoral fellows at American colleges,

- and employees who are nonresident aliens under a tax treaty.

An organization must a) provide the completed Form 1042-S to the person who received the payments and b) file it with the IRS.

The most accurate way to determine who should receive 1042-S forms from the organization is to verify if those individuals or merchants have submitted a W-9 or W-8 BEN form. The W-8 BEN is an IRS-mandated form used to collect accurate Nonresident Alien (NRA) taxpayer information and document their status for withholding tax and reporting reasons.

1042-S submission & filing deadlines

In general, form 1042-S must be filed with the IRS by March 15 (March 15, 2022, for tax-year 2021), whether on paper or electronically. By March 15, the company must additionally provide Form 1042-S to the income receiver for their personal filing purposes.

Unless a company can prove that the omission was due to reasonable cause and not intentional negligence, failing to file complete and proper 1042-S forms for each foreign person the firm pays could result in a penalty.

In 2022, the penalty for filing form 1042-S late (between 1 and 30 days late) is expected to be roughly $50 per form. For forms more than 31 days late—until August 1—the penalty increases to $110 per form. The penalty increases to $280 per form if the firm submits the documents after August 1.

If the IRS finds out the firm didn’t file the forms on purpose, the penalty can rise to $560 per form, or 10% of the total amount of items that must be reported, with no maximum penalty.

To avoid paying the penalty, a firm can ask the IRS for an extension if it needs additional time to file Form 1042-S. The firm must file Form 8809 (Application for Extension of Time to File Information Returns) by March 15 to request more time.

The payee’s residence is the critical difference between the 1042 & 1099 series of IRS forms.

The 1099 series is intended to record and report different types of income & payments, such as Nonemployee Compensation (1099-NEC) , Payment Card and Third Party Network Transactions (1099-K) , and Miscellaneous Income (1099-MISC) , made to U.S. citizens and businesses only.

On the other hand, Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, is used to report income paid to a nonresident whether or not the payment is taxable.

To recap, form 1042-S is used to report income earned paid to a foreign contractor by a U.S.-based entity. It is critical for both the employer and the contractor as it is the key record to report and file taxes for all payments made throughout the year. It also details the total that the employer withheld from their foreign payees, including handling of tax exemptions and tax treaties in place.

With numerous different tax treaties between the United States and other nations, it is vital for companies working with foreign contractors to focus on developing robust procedures for W-8 collection and validation . They should also promptly produce and distribute their 1042-S forms to avoid late filing penalties.

Trolley removes the heavy lifting and automates the whole international contractor tax process.

With a built-in recipient onboarding portal, recipients can self-complete their W-8 form online, with the data they enter validated by Trolley. Our system applies the correct withholding tax rates to all payments, and when it’s time to prepare your tax filings, you can review all payments made over the past 12 months and generate all of your 1042-S forms from the Trolley dashboard. As a result, you can expect:

- Less administrative work

- Minimal to no errors

- Peace of mind knowing that withholdings are correct and 1042-S forms will be completed, distributed and filed on time.

We welcome you to come back and refer to this guide on Form 1042-S whenever you need it!

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.

Join The Payouts Pulse

Sign up to have vital insights, industry news, and all things payouts delivered to your inbox monthly.

More to explore

So, How Exactly Do Streaming Services Calculate Royalties in 2024?

Music Royalties Explained: Understanding IRS Taxation for Music Payouts

Print Music Royalties: A Guide for Music Business Professionals

Mastering the Art of Licensing Samples: A How-to Guide

Sync Royalties: A Guide for the Streaming & Social Media Era

Understanding Payouts: How Are Performance Royalties Calculated and Reported?

Ready to get started.

To learn more about Trolley, schedule a demo with one of our team members or start a chat with a product expert by selecting the box on the bottom of your screen.

Subscribe to The Payouts Pulse newsletter

- API, SDK, widget

- App integrations

- Trolley status

- Help center

- Payout network

- Recipient onboarding & management

- Payouts automation

- IRS tax compliance

- DAC7 tax compliance

- DSA compliance

- INFORM compliance

- Risk management & fraud monitoring

- Music & streaming royalties

- Gig economy

- Marketplaces

- Freelance marketplaces

- Influencer marketing

- Ad networks & publishers

- Content creator platforms

- P2P marketplace sellers

- Video games & esports

- Affiliate platform partners

- B2B accounts payable

- Photo royalties

- Learning center

- Customer success stories

- About Trolley

- –Space–

- 2023 Tax Need-to-Knows

- TrolleyBRIEF: 1099-Ks

- TrolleyBRIEF: DAC7 & OECD Rules

- Security policies

- Privacy policy

- Legal agreements

- Developer Tools

- API, SDK, Widget

- App Integrations

- Trolley Status

- Help Center

- Payout Network

- Recipient Onboarding & Management

- Payouts Automation

- IRS Tax Compliance

- DAC7 Tax Compliance

- DSA Compliance

- INFORM Compliance

- Risk Management & Fraud Monitoring

- Music & Streaming Royalties

- Gig Economy

- Freelance Marketplaces

- Influencer Marketing

- Ad networks & Publishers

- Content Creator Platforms

- P2P Marketplace Sellers

- Video Games & eSports

- Affiliate Platform Partners

- B2B Accounts Payable

- Photo Royalties

- Learning Center

- Customer Success Stories

- Careers at Trolley

- TrolleyBRIEF: DAC7 & OECD Rules

- Security Policies

- Privacy Policy

- Legal Agreements

Trolley. All rights reserved.

Trolley payments uk ltd, in the uk, is authorised by the financial conduct authority (the “fca”) under the payment service regulations 2017 (registered reference no. 771016) for the provision of payment services. in australia, trolley payments uk ltd is a designated remittance provider registered with the australian transaction reports and analysis centre (austrac), remittance sector registration number: ind100571450-001. in new zealand, trolley payments uk ltd is registered as an overseas entity and is supervised by the department of internal affairs (dia). in the eu (eea countries), payment services for trolley payments uk ltd are provided by the currency cloud b.v., registered in the netherlands no. 72186178. registered office: nieuwezijds voorburgwal 296-298, 1012rt amsterdam. the currency cloud b.v. is an e-money institution authorised by the dnb (r142701) under the regulations for the issuing of electronic money and the provision of payment services in the netherlands. in canada, trolley ca inc is registered with the financial transactions and reports analysis centre of canada (fintrac), with registration number m18487871. we are also regulated by revenue québec, with license number 904296..

Sprintax - The name for nonresident tax

- Go To Sprintax

On March 11, 2024 by Rory Lynskey 0 comments

I have received a 1042-s – what do i do now.

Are you living in the United States and recently received a Form 1042-S? Don’t worry; you’re not alone.

Many individuals find themselves in this situation each tax season, and understanding what to do next can remove any potential confusion or stress.

In this guide, we’ll break down everything you need to know if you received a 1042-S form.

What is a 1042-S form?

The 1042-S is a tax form used to report various types of income paid to nonresidents in the US.

This form is issued by US payers, which can include universities, employers, and financial institutions, in order to report income that is subject to taxation.

Why am I receiving a 1042-S?

If you received a Form 1042-S, it is more than likely that you received certain types of income from US sources, such as:

- Scholarships or Fellowship : If you are a nonresident alien who received a scholarship or fellowship grant that is subject to tax withholding.

- Tax Treaty exempt income – If any part of your income is exempt from tax under a Tax Treaty Agreement between the US and your home country

- Independent personal services, prizes awards and similar payments

- Taxable Income not connected with a US business : This includes income from dividends, interest, rents, royalties, and other fixed or determinable annual or periodical gains, profits, or income.

When do I receive a form 1042-S?

Form 1042-S is typically issued to recipients by 15 March of each year for the previous tax year’s income.

This allows recipients to include the information on their US tax returns, which are due by 15 April in 2024.

If you did not receive 1042-S form by this date, you should reach out to your payroll office to get them to issue you with one.

1042-S vs 1099 – what’s the difference?

The main difference between the 1042 and 1099 forms are the types of payments they report, who they are filed for, and their respective deadlines.

The 1042-S form is used to document taxes withheld on particular income given to foreign individuals.

Meanwhile, the 1099 form is used to report different types of income, such as gross rent, and is used by US residents and businesses only.

The deadline to file Form 1099 is also different to 1042-S, with 31 January marking the final date to submit it without an extension.

What happens if 30% tax was withheld even though I completed a W-8BEN to claim a tax treaty?

In the rare event in which you are a nonresident who completed a Form W-8BEN to claim a reduced rate of withholding under an income tax treaty, but 30% tax was withheld instead, you may be eligible for a refund of this taxation!

To claim a refund, you would need to file a 1040NR – which is the US nonresident tax return, Form 1040-NR , along with Form 1042-S and any other required documentation.

You can do this with Sprintax Returns !

I received a 1042-S, what do I do?

Upon receiving Form 1042-S, you’ll need to review it carefully to ensure that all the information is accurate.

If you believe there is any incorrect information, contact the payroll team to promptly request any corrections.

The next step is to determine whether you need to report the income shown on the form on your US tax return.

Students receiving a 1042-S Form

Students with a taxable scholarship in the US should usually receive a 1042-S form from the school that issued them with the scholarship.

This form will usually be sent to the student the following February after the year when the scholarship was received.

So, if you received a scholarship in 2023, you should receive the 1042-S form by 15 March 2024.

Does 1042-S need to be reported?

Yes, any income reported on Form 1042-S generally needs to be reported on your US tax return, even if no tax was withheld.

Failure to report this income could result in penalties or other consequences.

Remember, you want to avoid any trouble with the IRS as it could lead to potential future visa issues, as well as the aforementioned penalties.

How to report a 1042-S on my nonresident tax return

If you’re confused about how to report 1042-S on a 1040NR, don’t worry – this is a common issue for nonresidents.

You will need to include the 1042-S along with your US non-resident tax return when you are filing.

Follow the instructions provided with the form to ensure accurate reporting.

How long will it take to get my refund?

If you are eligible for a refund of any excess withholding reported on Form 1042-S , the processing time can vary.

Generally, it takes several weeks to several months for the IRS to process refund claims.

Who can help me with my tax forms?

Sprintax Returns!

At Sprintax Returns, we offer the only online solution for nonresident e-filing of federal and state tax returns.

By using Sprintax Returns, you will guarantee 100% US tax compliance . We will prepare every document that you will need to file as well as ensure you don’t pay any more tax than you need to in The States.

We are also the nonresident partner of choice for TurboTax.

Prepare your nonresident tax return with Sprintax

Get started

Leave a reply.

* Copy This Password *

* Type Or Paste Password Here *

- Portal Login

OPEN ACCOUNT

- Start Application

- Finish an Application

- What You Need

- A Guide to Chosing the Right Account

FOR INDIVIDUALS

- Individual, Joint or IRA

- Family Advisors

FOR INSTITUTIONS

- Institutions Home

- Registered Investment Advisors

- Proprietary Trading Groups

- Hedge Funds

- Introducing Brokers

- Family Offices

- Compliance Officers

- Small Businesses

- Money Managers

- Fund Administrators

- Commissions

- Margin Rates

- Interest Rates

- Short Sale Cost

- Research and News

- Market Data

- Stock Yield Enhancement Program

- Products and Exchange Search

- Order Types

- Securities Financing

- Features in Focus

- Probability Lab

- Sustainable Investing

- RSP and TFSA Information

- IBKR GlobalAnalyst

- PortfolioAnalyst

- Bonds Marketplace

- No Transaction Fee ETFs

- Investors' Marketplace

- Short Securities Availability

- Cash Management

- Third Party Integration

- IBKR Campus

- Traders' Academy

- Traders' Insight

- IBKR Podcasts

- IBKR Quant Blog

- Student Trading Lab

- Traders' Glossary

- Traders' Calendar

- Strength and Security

- Information and History

- News at IBKR

- Press and Media

- Investor Relations

- Sustainability

- Regulatory Reports

- Refer a Friend

- Affiliate Programs

- Fund Your Account

- For Individuals

- For Institutions

- Institutional Sales Contacts

- Browse Our FAQs

- Tax Information

Tax Information and Reporting - Year-End Tax Forms | Interactive Brokers LLC

Tax Information and Reporting

Canada Persons & Entities

Year-end tax forms.

You can expect to receive the tax forms and reports described below. This information is also reported to Revenue Canada (CRA) and the Ministère du Revenu du Québec (Québec Ministry of Revenue).

To access and print your forms and reports, log in to Account Management or Client Portal and then click Reports > Tax > Tax Forms .

Jump to a section:

Form 1042-s.

T5008, Statement of Securities Transactions, reports the proceeds of all disposition on settlements during the year. The information contained on the form will help determine your capital gains (losses) for the year. Realized capital gains (losses) must be reported on your income tax return for dispositions that settle within the calendar year (by December 31). A separate T5008 will be provided for each transaction involving stocks, options or futures. You may review this information also available on your Annual or Monthly Statement.

Box 15 identifies the types of securities as stocks (SHS), options (OPC), futures (FUT) or mutual funds (MFT). Box 16 indicates the number of shares or contracts. Box 21 reports the gross proceeds less commissions and fees, for all your transactions.

When will Form T5008 be available? Your Form T5008 will be available by February 28 for the immediately preceding year.

T5, Statement of Investment Income, reports investment income paid to your account during the year. Investment income includes interest, dividends and certain foreign income. If you received income of $50 or more during the year from stocks, bonds or interest on credit balances you will receive a T5. Your T5 slip generally includes:

- Dividends paid, including the value of stock dividends.

- Interest paid on bonds and cash balances.

- Accrued interest earned during the year (but not yet received)

- Foreign income and foreign withholding taxes paid.

T5 is provided to you for information purposes only to give details about the income indicated on the T5 tax slip. Québec residents also receive a Relevé 3, described below.

T3, Statement of Trust Income Allocations and Designations (slip), reports distributions of trust unit income, capital gains or return of capital (ROC) from Canadian Unit Trusts during the year. The Income can be subdivided into categories that have different characteristics in the way they are treated for tax purpose. If you invest in Canadian Based Real Estate Investment Trusts (REITS), Income Trusts and Royalty Trusts, you will receive a T3 (and Relevé 16, if you are a resident of Quebec) and Statement of Trust Income Allocations which summarizes all distributions received from such securities during the year.

RL-18, Securities Transactions, is equivalent to the T5008 and reports the same information to the Québec Ministry of Revenue.

RL-3, Investment Income, is equivalent to Form T5 described above and reports the same information to the Quebec Ministry of Revenue.

RL-15, Statement of Limited Partnership Units reports the amounts allocated to the Members of a Partnership, reports income, losses and other amounts allocated from a partnership to the Quebec Ministry of Revenue. A separate RL-15 must be filed for each partner and contain all information requested. Partnerships use the RL-15 slip to provide their members with information about operating results (for example, income, losses, and other amounts allocated to the members for the fiscal period).

RL-16, Trust Income, is equivalent to the T3 described above and reports distributions of unit trust income, capital gains and eligible dividends to the Québec Ministry of Revenue.

US Tax Reporting to Non-US Persons and Entities

Form 1042-S reports US source income earned by non-US persons. Generally this income is subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned (paid to and for account managers) on your account for the year. You may receive multiple 1042-S forms reporting as each 1042S form reports a different type of income.

This information is also reported to the IRS. Each type of income is reported on a separate 1042S form using a code in Box 1. Common codes are:

Interest paid by US obligors including the U.S. Treasury 29) Deposit Interest 30) Original issue discount (OID) 06) Dividends paid by U.S. Corporations 13) Royalties paid on certain publicly offered Securities 34) Substitute payment – Dividends 35) Substitute- payment – Other 51) Other Income

Box 2 indicates the amount of income credited to your account of this type, and Box 3b and 4b indicates the rate at which tax was withheld and Box 7, the amount of U.S. Tax withheld.

If the income is exempt from withholding tax a code indicating this appears in Box 6.

Common exemption codes are:

01) Income effectively connected with a US trade or business 02) Exempt under an Internal Revenue Code section (income other than portfolio interest) 03) Income is not from US sources 04) Exempt under tax treaty 05) Portfolio interest exempt under an Internal Revenue Code section 06) Qualified intermediary that assumes primary withholding responsibility 07) Withholding foreign partnership or withholding foreign trust

Box 7a shows the amount of US tax withheld by IBKR.

Box 8 shows US tax withheld by agents other than IBKR. This occurs when foreign securities are held at depositories that do direct withholding.