Difference Between Report Form and Account Form Balance Sheets

- Small Business

- Accounting & Bookkeeping

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Add Beneficiaries to a Joint Bank Account

Distributions vs. retained earnings, how to adjust the balance on a profit and loss report.

- Creating a Company Financial Analysis Report

- Business Factors Indicating Liquidity Problems

The balance sheet is one of a company’s most important financial statements, because it gives investors a snapshot of the company’s financial health at any given moment in time. Essentially, it is a company’s account ledger, containing information about assets the company possesses, liabilities and obligations it needs to address, and owner equity in the company.

A balance sheet can be presented in account form and report form, but first, it is important to have a basic understanding of the types of financial statements to prepare and why they are important.

Statements of Financial Position Forms

There are four different statement of financial position forms that a company’s accountant prepares, and they each cover a very important piece of the company’s financial health. Statements of financial position forms provide a snapshot of the performance, overall financial position and cash flows of a business. These documents are reviewed by investors, lenders, creditors and management to evaluate a company.

Each of the documents relies on data from other statements, so they are usually prepared in a certain order.

- Income statement . The income statement is the most important of the financial statements, because it reveals basic truths about the financial performance of a company for a given reporting period. Beginning with sales, it subtracts expenses and arrives at a net profit or loss, and, in the case of publicly reported companies, an earnings-per-share figure for investors.

- Statement of retained earnings. If the income statement is a measure of financial health at any given moment, this document — also known as the statement of owner's equity, an equity statement or a statement of shareholders’ equity — offers the information over time. Management and investors want to know if they are making or losing money, so the statement reconciles the beginning and ending retained earnings for the period (for instance, over a year or so) using information such as net income from the other financial statements.

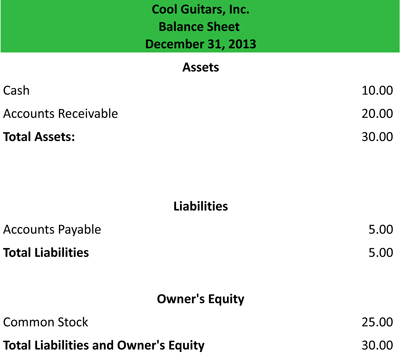

- Balance sheet. This report shows the financial position of a business as of the report date, and like the income statement, it is a snapshot of financial performance at a given moment because it can change daily or hourly, depending on circumstances. The information is divided into the general classifications of assets, liabilities and equity. As a rule, the total amount of the company's assets is equal to the total amount of its liabilities plus the owners' equity in the company. This equation must always balance, with the same amount on each side of the sheet. Unlike the income statement, however, the balance sheet is much more detailed — it lists specific line items of assets and liabilities.

- Statement of cash flows. This report reveals the cash inflows and outflows experienced by a company during a reporting period. These cash flows are broken down into three classifications: operating activities, investing activities and financing activities.

Account Form and Report Form Balance Sheets

A company’s balance sheet can be presented in one of two ways, account form and report form, depending on the preference of those who will review the document.

The account form balance sheet is presented in a horizontal format, with information in two columns beside each other. The left column of the account form balance sheet lists assets, while the right column lists liabilities and equity. Naturally, the last line in each column lists the total value of all assets and liabilities and equity, respectively. The account form balance sheet can be easier to use when information is being presented for multiple periods, and it allows the reader to verify that the ledger is in balance at a glance.

The report form balance sheet is presented in a vertical orientation, and is essentially one column that spans the entire width of a page. Starting with assets, the report form balance sheet provides a total value at the end of the assets section, followed by liabilities and equity, with the final line of the report form balance sheet providing the total combined value of liabilities and equity.

- My Accounting Course: What is a Report Form Balance Sheet?

- Accounting Tools: Types of Financial Statements

- IgniteSpot Accounting: The Four Basic Financial Statements

- WikiAccounting: 5 Main Elements of Financial Statements

John began his 25-year career in the editorial business as a newspaper journalist in his native Connecticut before moving to Boston in 2012. He started fresh out of college as a weekly newspaper reporter and cut his teeth covering news, politics, police, and even a visit from a waterskiing squirrel. He went on to work in the newsrooms of several busy daily newspapers, and developed a love for detailed storytelling, focusing on the lives and diverse tales that all people have to offer. Moving on to the business arena later in his career, John worked as a managing editor for a healthcare publishing company and a technology software firm. He’s used his background in broadcast journalism as a webinar moderator, voice-over specialist, and podcast narrator. John also holds a master’s degree as an elementary school teacher and spent 10 years working with and tutoring students of various ages and backgrounds, including multilingual students and students with special needs of all ages.

Related Articles

How to change the asset account in quickbooks, how to set up a line of credit account in quicken, how to remove a credit card account & all of its transactions from quickbooks, types of statements in accounting, how to e-sign a name online, how to delete an account in outlook 13, a summary of the accounting cycle, how to find your google accounts, how to build data entry forms & reports for mysql, most popular.

- 1 How to Change the Asset Account in QuickBooks

- 2 How to Set Up a Line of Credit Account in Quicken

- 3 How to Remove a Credit Card Account & All of Its Transactions From QuickBooks

- 4 Types of Statements in Accounting

What is a Report Form Balance Sheet?

Home › Accounting › Financial Statements › What is a Report Form Balance Sheet?

Definition: A report form balance sheet is a balance sheet that presents asset, liability , and equity accounts in a vertical format. In financial reporting , there are two general formats for balance sheets: the account format and the report format.

- What Does Report Form Balance Sheet Mean?

The account format presents the asset accounts on the left side and the liabilities and equity accounts on the right. The report format presents all the accounts vertically. Although both balance sheet formats are acceptable, the report form is much more popular.

As the name implies, the report format looks more like a traditional report and is used more often in the general-purpose financial statements . Here is an example of a report form balance sheet.

Download this accounting example in excel.

As you can see, all of the accounts are listed in a vertical fashion. The report form has a traditional balance sheet heading with subtotals for each of the asset, liability, and equity accounts. GAAP offers a lot of flexibility with the accounts that can be listed or not listed on the balance sheet. For example, some companies list cash as one account and cash equivalents as another. Other companies combine these accounts into one cash and cash equivalents account.

In some ways the report format is easier to read than the account format because all the account totals are listed on the right side of the report. This is especially true for multiple comparative balance sheets. Although the balance sheet above is only for one year, it could easily be converted into a two-year comparative report by adding another column of numbers for an additional year.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Search 2,000+ accounting terms and topics.

- Basic Accounting Course

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Financial Ratio

What is Report Writing: Format, Examples, Types & Process

- Table of Contents

Many professionals struggle to create effective reports due to a lack of understanding of the essential elements and organization required. This can lead to frustration and a failure to communicate key information to the intended audience.

In this blog, we’ll explore what is report writing, the types of reports, essential elements, and tips for creating effective reports to help you communicate your message and achieve your goals.

Definition of report writing?

According to Mary Munter and Lynn Hamilton, authors of “Guide to Managerial Communication,” report writing is “the process of selecting, organizing, interpreting, and communicating information to meet a specific objective.”

What is report writing?

Report writing refers to the process of creating a document that represents information in a clear and concise manner. Reports can be written for various purposes, such as providing updates on a project, analyzing data or presenting findings, or making recommendations.

Effective report writing requires careful planning, research, analysis, and organization of information. A well-structured report should be accurate, and objective, and contain a clear introduction, body, and conclusion. It should also be written in a professional and accessible style, with appropriate use of headings, subheadings, tables, graphs, and other visual aids.

Overall, report writing is an important skill for professionals in many fields, as it helps to communicate information and insights in a clear and concise manner.

What is a report?

A report is a formal document that is structured and presented in an organized manner, with the aim of conveying information, analyzing data, and providing recommendations. It is often used to communicate findings and outcomes to a specific audience, such as stakeholders, or managers. Reports can vary in length and format, but they usually contain a clear introduction, body, and conclusion.

Types of report writing

By understanding the different types of report writing, individuals can select the appropriate format and structure to effectively communicate information and achieve their objectives. However, the kind of report used will depend on the purpose, audience, and context of the report.

1/ Informational reports: These reports provide information about a topic, such as a product, service, or process.

Further Reading : What is an information report

2/ Analytical reports: These reports present data or information in a structured and organized manner, often with charts, graphs, or tables, to help the reader understand trends, patterns, or relationships.

3/ Formal Reports: These are detailed and structured reports written for a specific audience, often with a specific objective. In comparison with informal reports , formal reports are typically longer and more complex than other types of reports.

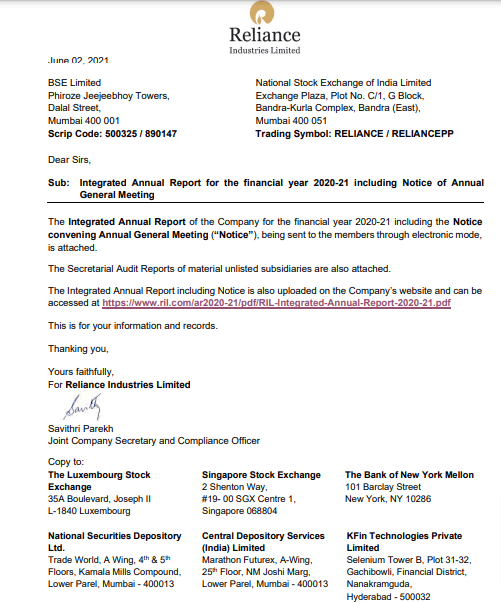

4/ Progress reports: These reports provide updates on a project or initiative, detailing the progress made and any challenges or obstacles encountered.

5/ Technical reports: These reports provide technical information, such as specifications, designs, or performance data, often aimed at a technical audience.

6/ Research reports: These reports present the findings of research conducted on a particular topic or issue, often including a literature review, data analysis, and conclusions.

7/ Feasibility Report: A feasibility report assesses the likelihood of achieving success for a suggested project or initiative.

8/ Business Reports: These reports are used in a business setting to communicate information about a company’s performance, operations, or strategies. Different types of business reports include financial statements, marketing reports, and annual reports.

Structure of report writing

The structure of a report refers to the overall organization and layout of the report, including the sections and subsections that make up the report, their order, and their relationships to each other. A report can we divided into three parts.

Preliminary Parts:

- Acknowledgments (Preface or Foreword)

- List of Tables and Illustrations

- Introduction (clear statement of research objectives, background information, hypotheses, methodology, statistical analysis, scope of study, limitations)

- Statement of findings and recommendations (summarized findings, non-technical language)

- Results (detailed presentation of findings with supporting data in the form of tables and charts, statistical summaries, and reductions of data, presented in a logical sequence)

- Implications of the results (clearly stated implications that flow from the results of the study)

- Summary (brief summary of the research problem, methodology, major findings, and major conclusions)

End Matter:

- Appendices (technical data such as questionnaires, sample information, and mathematical derivations)

- Bibliography of sources consulted.

This structure provides a clear and organized framework for presenting a research report, ensuring that all important information is included and presented in a logical and easy-to-follow manner.

Extra Learnings Role of a report structure in report writing The report structure plays a crucial role in report writing as it provides a clear and organized framework for presenting information in an effective and logical manner. It ensures that the reader can easily understand the purpose and scope of the report, locate and access the relevant information. The preliminary parts of the report, provide an overview of the report and aid navigation. The main text makes it easier for the reader to comprehend and analyze the information. And The end matter provides additional details and sources for reference. An organized report structure also helps the author to communicate their research and ideas effectively to the intended audience.

What is the report writing format?

The format of report writing refers to the structure of a formal document that provides information on a particular topic or issue. The report writing format typically includes the following key components:

8 Essential elements of report writing are:

1/ Title: The title is the first thing that readers will see, and it should be clear and concise. The title should include the report’s subject or topic and the author’s name, date of writing, or who the report is for. Remember to keep the title brief and informative, avoiding vague or ambiguous language.

Example of Business Report Title Page: “Market Analysis and Growth Strategies for XYZ Corporation” Author: Mary Johnson Date: January 2, 2022 Company: Earthcon Corporation Department: Strategy and Planning

In this example, the title page includes the name of the report, ‘Market Analysis 2022,’ the author’s name, ‘John Doe,’ the submission date, ‘January 1, 2024,’ and other details such as the name of the organization, ‘Earthcon Corporation.’

2/ Table of Contents : The table of contents provides an overview of the report’s contents. It should list all sections and subsections with clear headings. It is essential to make the table of contents organized and easy to read, allowing readers to locate specific information quickly.

Example of Table of Contents I. Introduction…… 1 Purpose of the Report…… 2 Methodology Used…… 2 II. Executive Summary…… 3 III. Background and Context…… 3 IV. Analysis and Findings…… 4 Market Trends and Data…… 5 Competitor Analysis…… 6 SWOT Analysis…… 7 V. Recommendations and Conclusion…… 8 VI. References…… 9

3/ Summary : Also known as the executive summary, the summary provides a brief overview of the entire report. It should summarize the report’s main points, including findings, objectives, and recommendations. The summary should be written after the entire report is completed, and it should be concise and summarized in less than one page.

Example of executive summary: The Annual Sales Report for Earthcon Company shows a 10% increase in overall sales compared to the previous year. The report also reveals that the majority of sales came from the Midwest region and the target demographic is primarily males aged 25-40. Based on these findings, recommendations have been made to focus marketing efforts towards this demographic in the upcoming year.

4/ Introduction : The introduction introduces the report’s topic and informs readers what they can expect to find in the report. The introduction should capture readers’ attention and provide relevant background information. It should be clear and concise, including why the report was written and its objectives.

Example of Introduction: This comprehensive report aims to analyze and evaluate the sales performance of EarthCon Corporation throughout 2024. It will look into detailed sales trends observed throughout the year, carefully examining the various factors that have influenced these trends. Additionally, the report will identify and highlight potential areas for growth, offering valuable insights and recommendations to drive future success.

5/ Body: The body is the longest section and includes all the information, data, and analysis. It should present information in an organized manner, often using subheadings and bullet points. The body should include all relevant research findings and data, often accompanied by visuals such as graphs and tables. It is essential to cite all sources correctly and remain objective, avoiding personal opinions or biases.

Example of Background and Context: This report seeks to analyze the influence of technological advancements on business productivity. Previous research has indicated a correlation between the adoption of innovative technologies and increased operational efficiency for Earthcon. The report will examine further into this topic and offer suggestions for maximizing the benefits of these advancements. Example of Analysis and Findings: The market trends and data show a steady increase in demand for innovative products, with a significant rise in sales in the past five years. In comparison, competitor analysis reveals that Earthcon Corporation is well-positioned to take advantage of this trend due to its strong brand reputation and product portfolio. A SWOT analysis also highlights potential areas for improvement and growth.

6/ Conclusion: The conclusion summarizes the findings and conclusions of the report. It should wrap up all the essential information presented in the body and make recommendations based on the report’s findings. The conclusion must be brief and clear, avoiding the introduction of any new information not previously presented in the body.

7/ Recommendations: The recommendation section should provide suggested goals or steps based on the report’s information. It should be realistic and achievable, providing well-crafted solutions. It is often included in the conclusion section.

Example of Recommendations and Conclusion: Based on the analysis, it is recommended that EarthCon Corporation invest in research and development to continue producing innovative products. Additionally, efforts should be made to expand into emerging markets to increase global reach. In conclusion, the Annual Sales Report shows positive outcomes and recommends strategic actions for future growth.

8/ Appendices: The appendices section includes additional technical information or supporting materials, such as research questionnaires or survey data. It should provide supplementary information to the report without disrupting the report’s main content.

It is important to use clear headings and subheadings and to label tables and figures. Also, proofreading and fact-checking are critical before submitting the report. A well-crafted report is concise, informative and free of personal bias or opinions.

What are the features of report writing

There are several key features of effective report writing that can help ensure that the information presented is clear, concise, and useful. Some of these features include:

1/ Clarity: Reports should be written in clear and concise language, avoiding jargon or technical terms that may be confusing to the reader.

2/ Objectivity: A report should be objective, meaning that it should be free from bias or personal opinions. This is particularly important when presenting data or analysis.

3/ Accuracy: Reports should be based on reliable sources and accurate data. Information should be verified and cross-checked to ensure that it is correct and up-to-date.

4/ Structure: A report should be structured in a logical and organized manner, with clear headings, subheadings, and sections.

5/ Visual aids: A report may include visual aids such as charts, tables, and graphs, which can help to illustrate the key points and make the information easier to understand.

6/ Evidence: Reports should include evidence to support any claims or findings, such as statistics, quotes, or references to relevant literature.

7/ Recommendations: Many reports include recommendations or suggestions for future action based on the findings or analysis presented.

Significance of report writing

Report writing is a critical skill that can have a significant impact on individuals, and organizations. In fact, a report by the National Association of Colleges and Employers found that the ability to communicate effectively, including report writing, was the most important skill sought by employers.

- Reports provide decision-makers with the information they need to make informed decisions.

- Effective report writing demonstrates professionalism and attention to detail, which can help to build trust and credibility with clients.

- Reports can inform planning processes by providing data and insights that can be used to develop strategies and allocate resources.

- Reports often include recommendations or suggestions for future action, which can help to improve processes, procedures, or outcomes.

Further Reading: What is the significance of report writing

Report writing examples and samples

Example of Progress Report

The essential process of report writing

Report writing requires careful planning, organization, and analysis to ensure that the report effectively communicates the intended message to the audience. Here are the general steps involved in the process of report writing:

Plan and prepare:

- Identify the purpose of the report, the target audience, and the scope of the report.

- Collect and examine data from different sources, including research studies, surveys, or interviews.

- Create an outline of the report, including headings and subheadings.

Write the introduction:

- Start with a brief summary of the report and its purpose.

- Provide background information and context for the report.

- Explain the research methodology and approach used.

Write the main body:

- Divide the report into logical sections, each with a clear heading.

- Present the findings and analysis of the research in a clear and organized manner.

- Use appropriate visual aids, such as tables, graphs, or charts to present data and information.

- Utilize a language that is both clear and Brief, and avoid using unnecessary jargon or technical terminology.

- Cite all sources used in the report according to a specified citation style.

Write the conclusion:

- Summarize the main findings and conclusions of the report.

- Restate the purpose of the report and how it was achieved.

- Provide recommendations or suggestions for further action, if applicable.

Edit and revise:

- Review the report for errors in grammar, spelling, and punctuation.

- Check that all information is accurate and up-to-date.

- Revise and improve the report as necessary.

Format and present:

- Use a professional and appropriate format for the report.

- Include a title page, table of contents, and list of references or citations.

- Incorporate headings, subheadings, and bullet points to enhance the report’s readability and facilitate navigation.

- Use appropriate fonts and sizes, and ensure that the report is well-structured and visually appealing.

Important Principles of report writing

To write an effective report, it is important to follow some basic principles. These principles ensure that your report is clear, concise, accurate, and informative. In this regard, here are some of the key principles that you should keep in mind when writing a report:

1/ Clarity: The report should be clear and easy to understand.

2/ Completeness: The report should cover all the relevant information needed to understand the topic

3/ Conciseness: A report should be concise, presenting only the information that is relevant and necessary to the topic.

4/ Formatting: The report should be properly formatted, with consistent fonts, spacing, and margins

5/ Relevance: The information presented in the report should be relevant to the purpose of the report.

6/ Timeliness: The report should be completed and delivered in a timely manner.

7/ Presentation: The report should be visually appealing and well-presented.

Extra Learnings Styles of report writing When it comes to the style of report writing, it’s important to use hard facts and figures, evidence, and justification. Using efficient language is crucial since lengthy reports with too many words are difficult to read. The most effective reports are easy and quick to read since the writer has comprehended the data and formulated practical recommendations. To achieve this, it’s important to write as you speak, avoid empty words, use descending order of importance, use an active voice, and keep sentences short. The goal should be to write to express and not to impress the reader. It’s also important to get facts 100% right and to be unbiased and open. By following these tips, one can create a well-written report that is easy to understand and provides valuable insights.

Differences between a report and other forms of writing

Reports are a specific form of writing that serves a distinct purpose and have unique characteristics. Unlike other forms of writing, such as essays or fiction, reports are typically focused on presenting factual information and making recommendations based on that information. Below we have differentiated report writing with various other forms of writing.

Essay vs report writing

Project writing vs report writing, research methodology vs report writing, article writing vs report writing, content writing vs report writing, business plan vs report writing, latest topics for report writing in 2024.

The possibilities for report topics may depend on the goals and scope of the report. The key is to choose a topic that is relevant and interesting to your audience, and that you can conduct thorough research on in order to provide meaningful insights and recommendations.

- A market analysis for a new product or service.

- An evaluation of employee satisfaction in a company.

- A review of the state of cybersecurity in a particular industry.

- A study of the prevalence and consequences of workplace discrimination.

- Analysis of the environmental impact of a particular industry or company.

- An assessment of the impact of new technology or innovations on a particular industry or sector.

Report writing skills and techniques

Effective report writing requires a combination of skills and techniques to communicate information and recommendations in a clear, and engaging manner.

From organizing information to tailoring the report to the intended audience, there are many factors to consider when writing a report. By mastering these skills and techniques, you can ensure that your report is well-written, informative, and engaging for your audience. Some of the primary ones are:

1/ Organization and structure: Structure your report in a logical and organized manner with headings and subheadings.

2/ Use of data and evidence: Present objective data and evidence to support your findings and recommendations.

3/ Audience awareness: Tailor your report to the needs and interests of your intended audience.

4/ Effective visuals: Use graphs, charts, or other visuals to communicate complex information in a clear and engaging way.

5/ Editing and proofreading: Carefully edit and proofread your report to ensure it is error-free and professional.

6/ Tone: Use a professional and objective tone to communicate your findings and recommendations.

7/ Time management: Manage your time effectively to ensure you have enough time to research, write, and revise your report.

Tips for effective report writing

- Understand your audience before you start writing.

- Start with an outline and cover all the important points.

- Employ clear and concise language.

- Utilize headings and subheadings to organize your report.

- Incorporate evidence and examples to support your points.

- Thoroughly edit and proofread your report before submission.

- Follow formatting guidelines If your report has specific formatting requirements.

- Use visuals to enhance understanding.

What is the ethical consideration involved in report writing

Ethical considerations play a crucial role in report writing. The accuracy of the information presented in the report is of utmost importance, as it forms the basis for any conclusions or recommendations that may be made. In addition, it is essential to avoid plagiarism by giving credit to the original sources of information and ideas.

Another crucial ethical consideration is confidentiality, particularly when the report contains sensitive or confidential information. It is important to safeguard this information and prevent its disclosure to unauthorized individuals.

Avoiding bias in report writing is also crucial, as it is essential to present information in an objective and unbiased manner. In cases where research or data collection is involved, obtaining informed consent from human subjects is a necessary ethical requirement.

By taking these ethical considerations into account, report writers can ensure that their work is fair, accurate, and respectful to all parties involved.

Common mistakes in report writing

There are several common mistakes that students and report writers make in report writing. By avoiding these common mistakes, students as well as report writers can create effective and impactful reports that are clear, accurate, and objective.

1/ Writing in the first person: Often, students and report writers commit an error by writing in the first person and utilizing words such as “I” or “me. In reports, it is recommended to write impersonally, using the passive voice instead.

2/ Using the wrong format: Reports should use numbered headings and subheadings to structure the content, while essays should have a clear line of argument in their content.

3/ Failing to introduce the content: The introduction of the report should introduce the content of the report, not the subject for discussion. It is important to explain the scope of the report and what is to follow, rather than explaining what a certain concept is.

4/ Missing relevant sections: Students and report writers, often miss out on including relevant sections that were specified in the assignment instructions, such as a bibliography or certain types of information. This can result in poor interpretation.

5/ Poor proofreading: Finally, not spending enough time proofreading the reported work can create unwanted mistakes. Therefore, It is important to proofread and correct errors multiple times before submitting the final report to avoid any mistakes that could have been easily corrected.

By avoiding these common mistakes, students and report writers can improve the quality of their reports.

What are some challenges of report writing and how to overcome them

Report writing can be a challenging task for many reasons. Here are some common challenges of report writing and how to overcome them:

1/ Lack of clarity on the purpose of the report: To overcome this challenge, it is important to clearly define the purpose of the report before starting. This can help to focus the content of the report and ensure that it meets the needs of the intended audience.

2/ Difficulty in organizing ideas: Reports often require a significant amount of information to be organized in a logical and coherent manner. To overcome this challenge, it can be helpful to create an outline or flowchart to organize ideas before beginning to write.

3/ Time management: Writing a report can be time-consuming, and it is important to allow sufficient time to complete the task. To overcome this challenge, it can be helpful to create a timeline or schedule for the various stages of the report-writing process.

4/ Writer’s block: Sometimes writers may experience writer’s block, making it difficult to start or continue writing the report. To overcome this challenge, it can be helpful to take a break, engage in other activities or brainstorming sessions to generate new ideas.

5/ Difficulty in citing sources: It is important to properly cite sources used in the report to avoid plagiarism and maintain credibility. To overcome this challenge, it can be helpful to use citation management tools, such as EndNote or Mendeley, to keep track of sources and ensure accurate referencing.

6/ Review and editing: Reviewing and editing a report can be a challenging task, especially when it is one’s own work. To overcome this challenge, it can be helpful to take a break before reviewing the report and seek feedback from others to gain a fresh perspective.

By being aware of these challenges and taking proactive steps to overcome them, report writers can create effective and impactful reports that meet the needs of their intended audience.

Best Software for writing reports

Report writing software has made it easier for writers to produce professional-looking reports with ease. These software tools offer a range of features and functionalities, including data visualization, collaboration, and customization options. In this section, we will explore some of the best report-writing software available:

1/ Tableau : This tool is great for creating interactive and visually appealing reports, as it allows users to easily create charts, graphs, and other data visualizations. It also supports data blending, which means that you can combine data from multiple sources to create more comprehensive reports.

2/ Zoho reporting : This tool is designed to help users create and share professional-looking reports quickly and easily. It offers a variety of customizable templates, as well as a drag-and-drop interface that makes it easy to add data and create charts and graphs.

3/ Bold Reports by Syncfusion : This tool is designed specifically for creating reports in .NET applications. It offers a wide range of features, including interactive dashboards, real-time data connectivity, and customizable themes and templates.

4/ Fast Reports : This tool is a reporting solution for businesses of all sizes. It allows users to create reports quickly and easily using a drag-and-drop interface and offers a variety of templates and customization options. It also supports a wide range of data sources, including databases, spreadsheets, and web services.

Further Reading : 10+ Best Report Writing Software and Tools in 2024

What is the conclusion of report writing

The conclusion of report writing is the final section of the report that summarizes the main findings, conclusions, and recommendations. It should tie together all the different sections of the report and present a clear and concise summary of the key points.

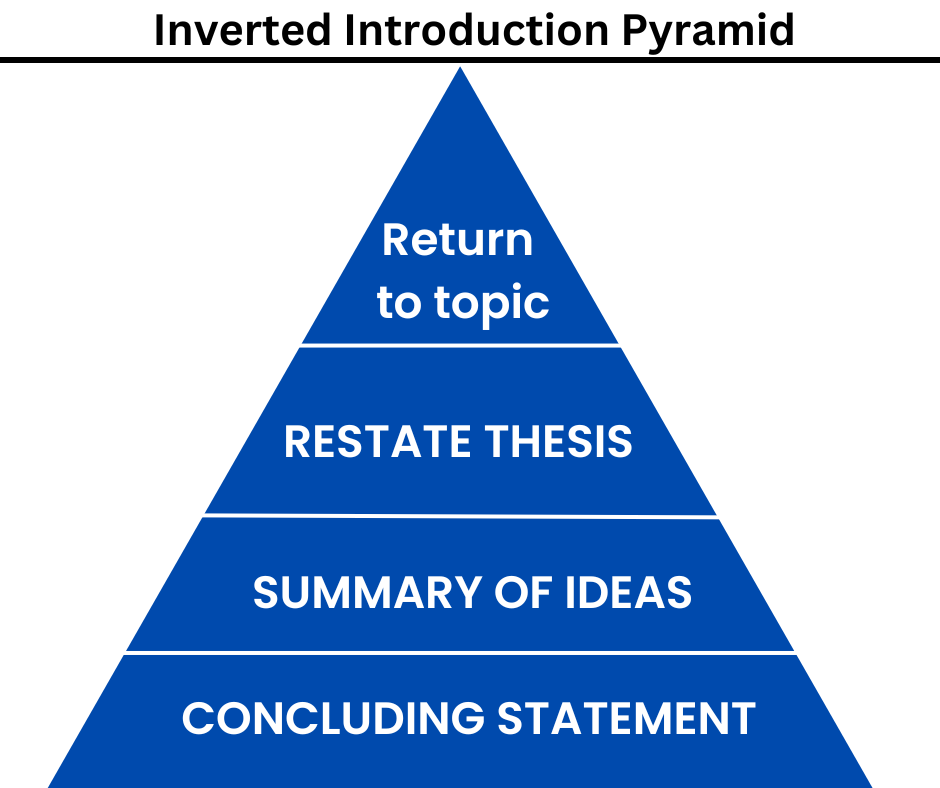

THE UNIVERSITY OF NEWCASTLE has given an inverted introduction framework that can use used for writing effective conclusions for reports.

Example of conclusion in report writing:

The implication of the above diagram can be explained with the following example:

1. RETURN TO TOPIC:

Social media has revolutionized the marketing landscape, providing new opportunities for brands to connect with their target audience.

2. RESTATE THESIS:

However, the complexities and limitations of social media mean that it is unlikely to completely replace traditional marketing methods. The role of the marketing professional remains crucial in ensuring that social media strategies align with the company’s overall goals and effectively reach the desired audience.

3. SUMMARY OF IDEAS DISCUSSED:

Automated tools cannot fully account for the nuances of human communication or provide the level of personalization that consumers crave. Therefore, the most effective marketing strategies will likely blend social media tactics with traditional marketing channels.

4. CONCLUDING STATEMENT [restating thesis]:

In conclusion, while social media presents significant opportunities for brands, the expertise of marketing professionals is still essential to creating successful campaigns that achieve desired outcomes.

Frequently Asked Questions

Q1) what is report writing and example.

Ans: Report writing involves preparing a structured document that delivers information to a particular audience in a clear and systematic manner. An example of a report could be a business report analyzing the financial performance of a company and making recommendations for improvement.

Q2) What is report writing and types of reports?

Ans: The act of presenting information in an orderly and structured format is known as report writing. Reports come in different types, such as analytical reports, research reports, financial reports, progress reports, incident reports, feasibility reports, and recommendation reports.

Q3) What are the 5 steps of report writing

The five steps of report writing, are as follows:

- Planning: This involves defining the purpose of the report, determining the audience, and conducting research to gather the necessary information.

- Structuring: This step involves deciding on the structure of the report, such as the sections and subsections, and creating an outline.

- Writing: This is the stage where the actual writing of the report takes place, including drafting and revising the content.

- Reviewing: In this step, the report is reviewed for accuracy, coherence, and effectiveness, and any necessary changes are made.

- Presenting: This final step involves presenting the report in a clear and professional manner, such as through the use of headings, visuals, and a table of contents.

Q4) What is a report in short answer?

Share your read share this content.

- Opens in a new window

Aditya Soni

You might also like.

10 Differences Between Formal & Informal Reports + Examples

24 Types of Business Reports With Samples & Writing Structure

11 Characteristics of a Good Business Report

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

A Guide To The Top 14 Types Of Reports With Examples Of When To Use Them

Table of Contents

1) What Is The Report Definition?

2) Top 14 Types Of Reports

3) What Does A Report Look Like?

4) What To Look For In A Reporting Tool

Businesses have been producing reports forever. No matter what role or industry you work in, chances are that you have been faced with the task of generating a tedious report to show your progress or performance.

While reporting has been a common practice for many decades, the business world keeps evolving, and with more competitive industries, the need to generate fast and accurate reports becomes critical. This presents a problem for many modern organizations today, as building reports can take from hours to days. In fact, a survey about management reports performed by Deloitte says that 50% of managers are unsatisfied with the speed of delivery and the quality of the reports they receive.

With this issue in mind, several BI tools have been developed to assist businesses in generating interactive reports with just a few clicks, enhancing the way companies make critical decisions and service insights from their most valuable data.

But, with so many types of reports used daily, how can you know when to use them effectively? How can you push yourself ahead of the pack with the power of information? Here, we will explore the 14 most common types of reports in business and provide some examples of when to use them to your brand-boosting advantage. In addition, we will see how online dashboards have overthrown the static nature of classic reports and given way to a much faster, more interactive way of working with data.

Let’s get started with a brief report definition.

What Is The Report Definition?

A report is a document that presents relevant business information in an organized and understandable format. Each report is aimed at a specific audience and business purpose, and it summarizes the development of different activities based on goals and objectives.

That said, there are various types of reports that can be used for different purposes. Whether you want to track the progress of your strategies or stay compliant with financial laws, there is a different report for each task. To help you identify when to use them, we will cover the top 14 most common report formats used for businesses today.

What Are The Different Types Of Reports?

1. Informational Reports

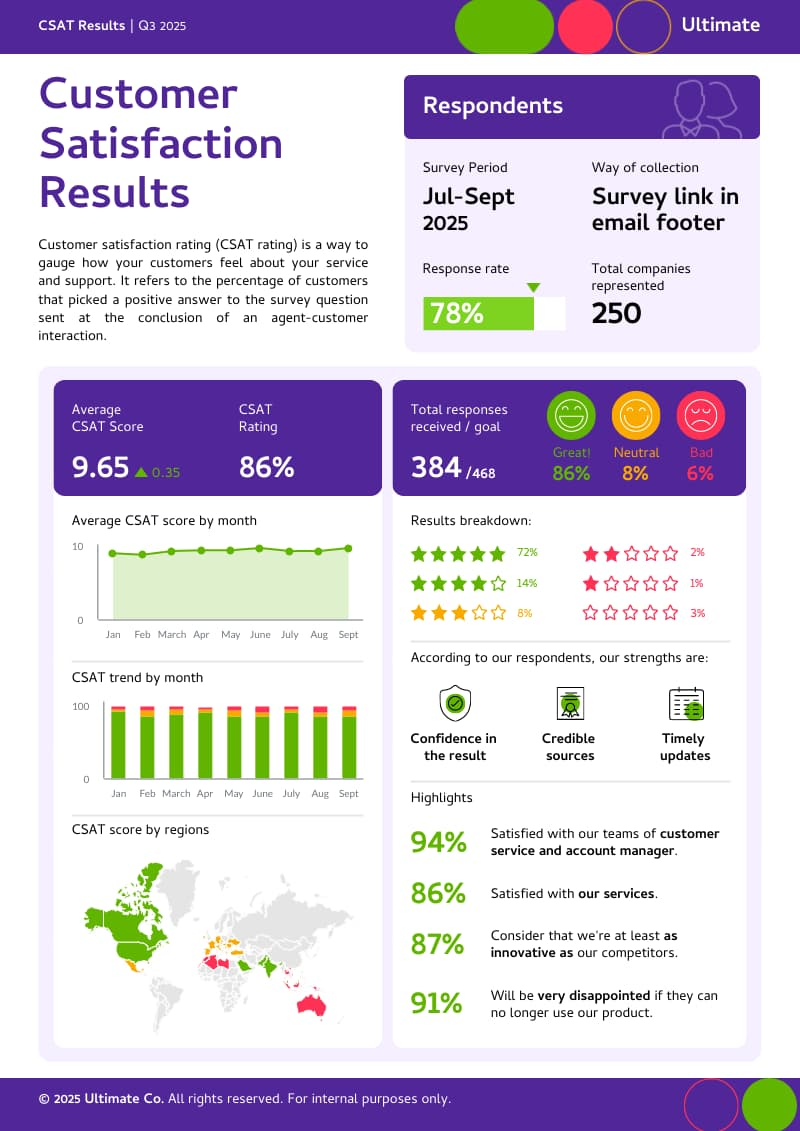

The first in our list of reporting types is informational reports. As their name suggests, this report type aims to give factual insights about a specific topic. This can include performance reports, expense reports, and justification reports, among others. A differentiating characteristic of these reports is their objectivity; they are only meant to inform but not propose solutions or hypotheses. Common informational reports examples are for performance tracking, such as annual, monthly, or weekly reports .

2. Analytical Reports

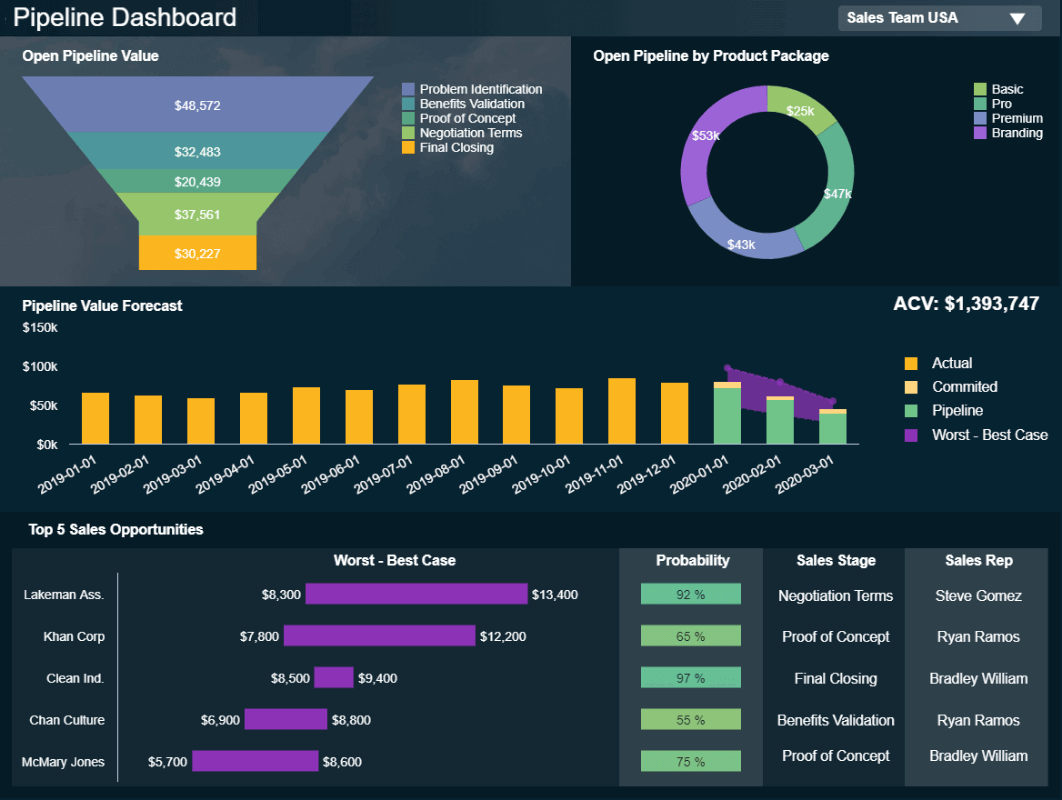

This report type contains a mix of useful information to facilitate the decision-making process through a mix of qualitative and quantitative insights as well as real-time and historical insights. Unlike informational reports that purely inform users about a topic, this report type also aims to provide recommendations about the next steps and help with problem-solving. With this information in hand, businesses can build strategies based on analytical evidence and not simple intuition. With the use of the right BI reporting tool , businesses can generate various types of analytical reports that include accurate forecasts via predictive analytics technologies. Let's look at it with an analytical report example.

**click to enlarge**

The example above is the perfect representation of how analytical reports can boost a business’s performance. By getting detailed information such as sales opportunities, a probability rate, as well as an accurate pipeline value forecast based on historical data, sales teams can prepare their strategies in advance, tackle any inefficiencies, and make informed decisions for increased efficiency.

3. Operational Reports

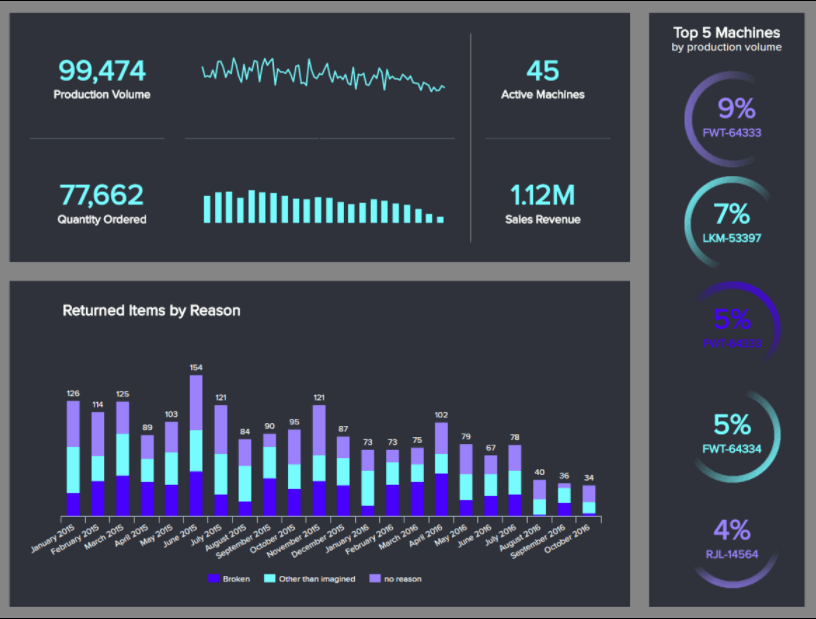

These reports track every pertinent detail of the company's operational tasks, such as its production processes. They are typically short-term reports as they aim to paint a picture of the present. Businesses use this type of report to spot any issues and define their solutions or to identify improvement opportunities to optimize their operational efficiency. Operational reports are commonly used in manufacturing, logistics, and retail as they help keep track of inventory, production, and costs, among others.

4. Product Reports

As its name suggests, this report type is used to monitor several aspects related to product development. Businesses often use them to track which of their products or subscriptions are selling the most within a given time period, calculate inventories, or see what kind of product the client values the most. Another common use case of these reports is to research the implementation of new products or develop existing ones. Let’s see it in more detail with a visual example.

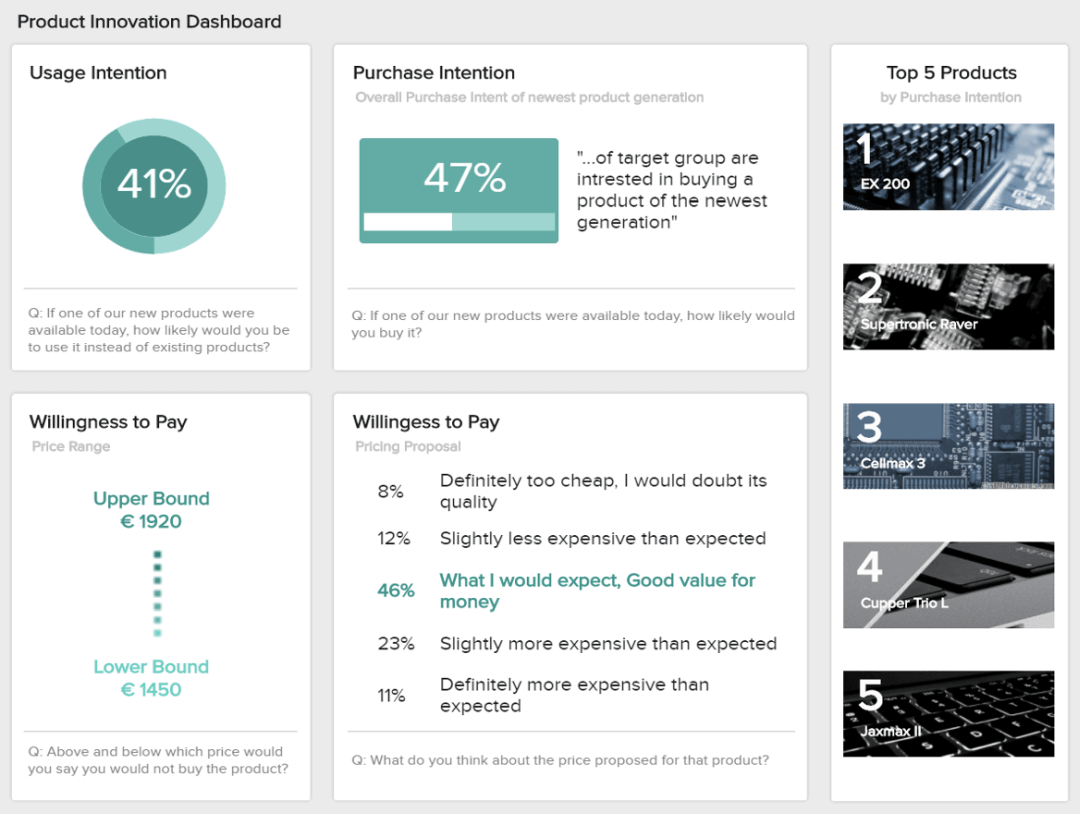

The image above is a product report that shows valuable insights regarding usage intention, purchase intention, willingness to pay, and more. In this case, the report is based on the answers from a survey that aimed to understand how the target customer would receive a new product. Getting this level of insights through this report type is very useful for businesses as it allows them to make smart investments when it comes to new products as well as set realistic pricing based on their client’s willingness to pay.

5. Industry Reports

Next in our list of the most common kinds of reports, we have industry-specific reports. Typically, these reports provide an overview of a particular industry, market, or sector with definitions, key trends, leading companies, and industry size, among others. They are particularly useful for businesses that want to enter a specific industry and want to learn how competitive it is or for companies who are looking to set performance benchmarks based on average industry values.

6. Department Reports

These reports are specific to each department or business function. They serve as a communication tool between managers and team members who must stay connected and work together for common goals. Whether it is the sales department, customer service, logistics, or finances, this specific report type helps track and optimize strategies on a deeper level. Let’s look at it with an example of a team performance report .

The image above is a department report created with an online data analysis tool , and it tracks the performance of a support team. This insightful report displays relevant metrics such as the top-performing agents, net promoter score, and first contact resolution rate, among others. Having this information in hand not only helps each team member to keep track of their individual progress but also allows managers to understand who needs more training and who is performing at their best.

7. Progress Reports

From the brunch of informational reports, progress reports provide critical information about the status of a project. These reports can be produced on a daily, weekly, or monthly basis by employees or managers to track performance and fine-tune tasks for the better development of the project. Progress reports are often used as visual materials to support meetings and discussions. A good example is a KPI scorecard .

8. Internal Reports

A type of report that encompasses many others on this list, internal reports refer to any type of report that is used internally in a business. They convey information between team members and departments to keep communication flowing regarding goals and business objectives.

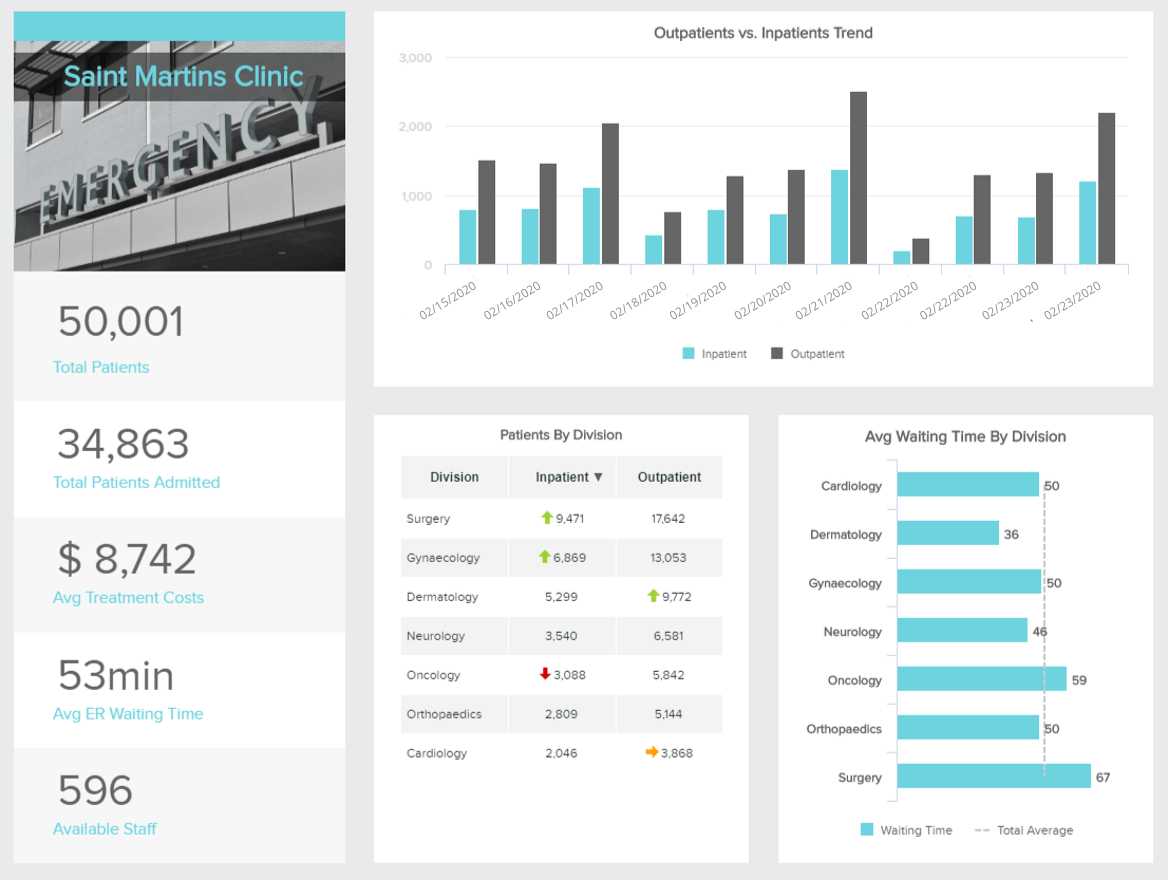

As mentioned above, internal reports are useful communication tools to keep every relevant person in the organization informed and engaged. This healthcare report aims to do just that. By providing insights into the performance of different departments and areas of a hospital, such as in and outpatients, average waiting times, treatment costs, and more, healthcare managers can allocate resources and plan the schedule accurately, as well as monitor any changes or issues in real-time.

9. External Reports

Although most of the reports types listed here are used for internal purposes, not all reporting is meant to be used behind closed doors. External reports are created to share information with external stakeholders such as clients or investors for budget or progress accountability, as well as to governmental bodies to stay compliant with the law requirements.

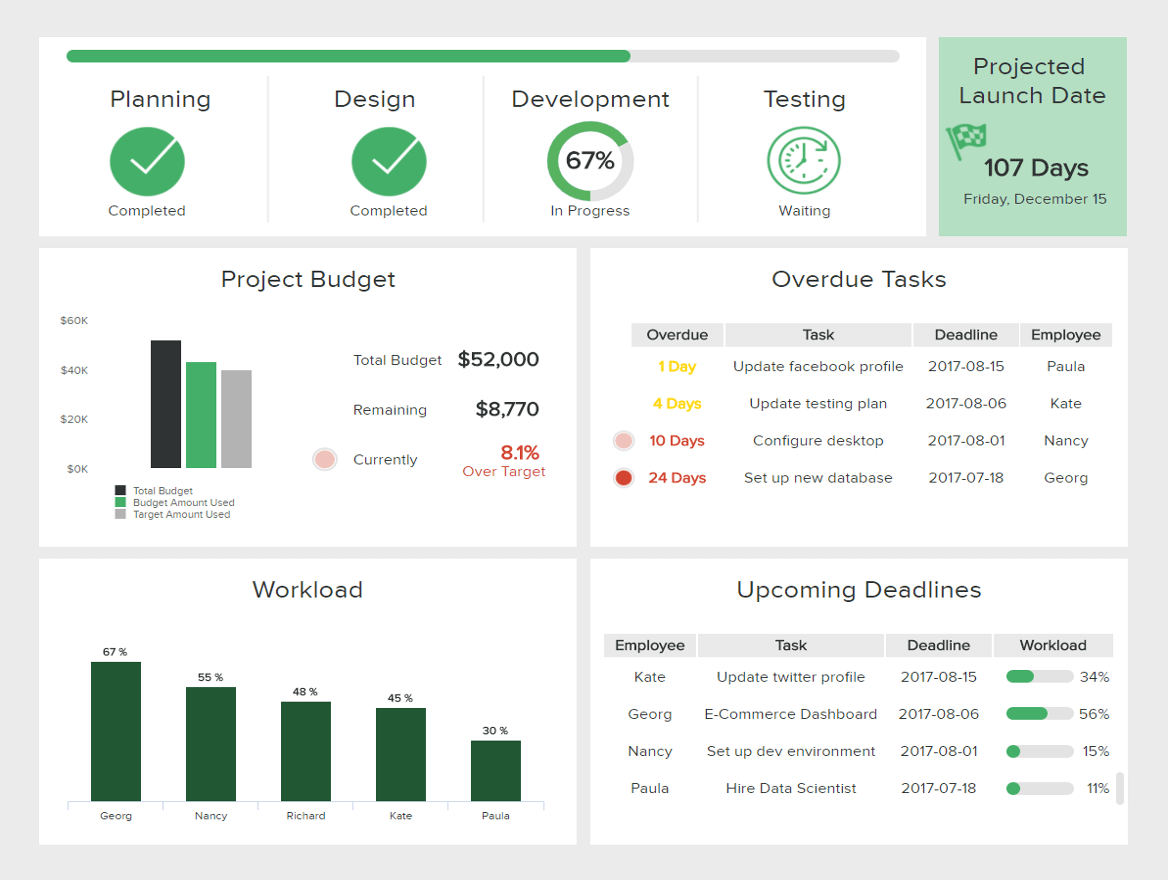

The image above is the perfect example of an external client report from an IT project. This insightful report provides a visual overview of every relevant aspect of the project's development. From deadlines, budget usage, completion stage, and task breakdown, clients can be fully informed and involved in the project.

10. Vertical & Lateral Reports

Next, in our rundown of types of reports, we have vertical and lateral reports. This reporting type refers to the direction in which a report travels. A vertical report is meant to go upward or downward the hierarchy, for example, a management report. A lateral report assists in organization and communication between groups that are at the same level of the hierarchy, such as the financial and marketing departments.

11. Research Reports

Without a doubt, one of the most vital reporting types for any modern business is centered on research. Being able to collect, collate, and drill down into insights based on key pockets of your customer base or industry will give you the tools to drive innovation while meeting your audience’s needs head-on.

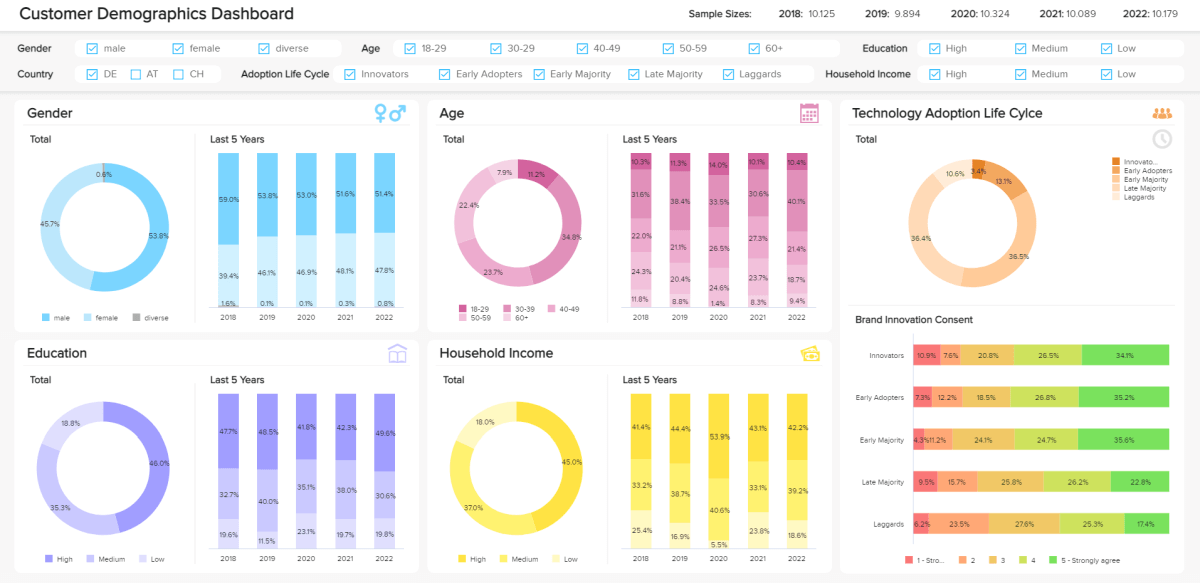

The image above is a market research analytics report example for customer demographics. It serves up a balanced blend of metrics that will empower you to boost engagement as well as retention rates. Here, you can drill down into your audience’s behaviors, interests, gender, educational levels, and tech adoption life cycles with a simple glance.

What’s particularly striking about this dashboard is the fact that you can explore key trends in brand innovation with ease, gaining a working insight into how your audience perceives your business. This invaluable type of report will help you get under the skin of your consumers, driving growth and loyalty in the process.

12. Strategic Reports

Strategy is a vital component of every business, big or small. Strategic analytics tools are perhaps the broadest and most universal of all the different types of business reports imaginable.

These particular tools exist to help you understand, meet, and exceed your most pressing organizational goals consistently by serving up top-level metrics on a variety of initiatives or functions.

By working with strategic-style tools, you will:

- Improve internal motivation and engagement

- Refine your plans and strategies for the best possible return on investment (ROI)

- Enhance internal communication and optimize the way your various departments run

- Create more room for innovation and creative thinking

13. Project Reports

Projects are key to keeping a business moving in the right direction while keeping innovation and evolution at the forefront of every plan, communication, or campaign. But without the right management tools, a potentially groundbreaking project can become a resource-sapping disaster.

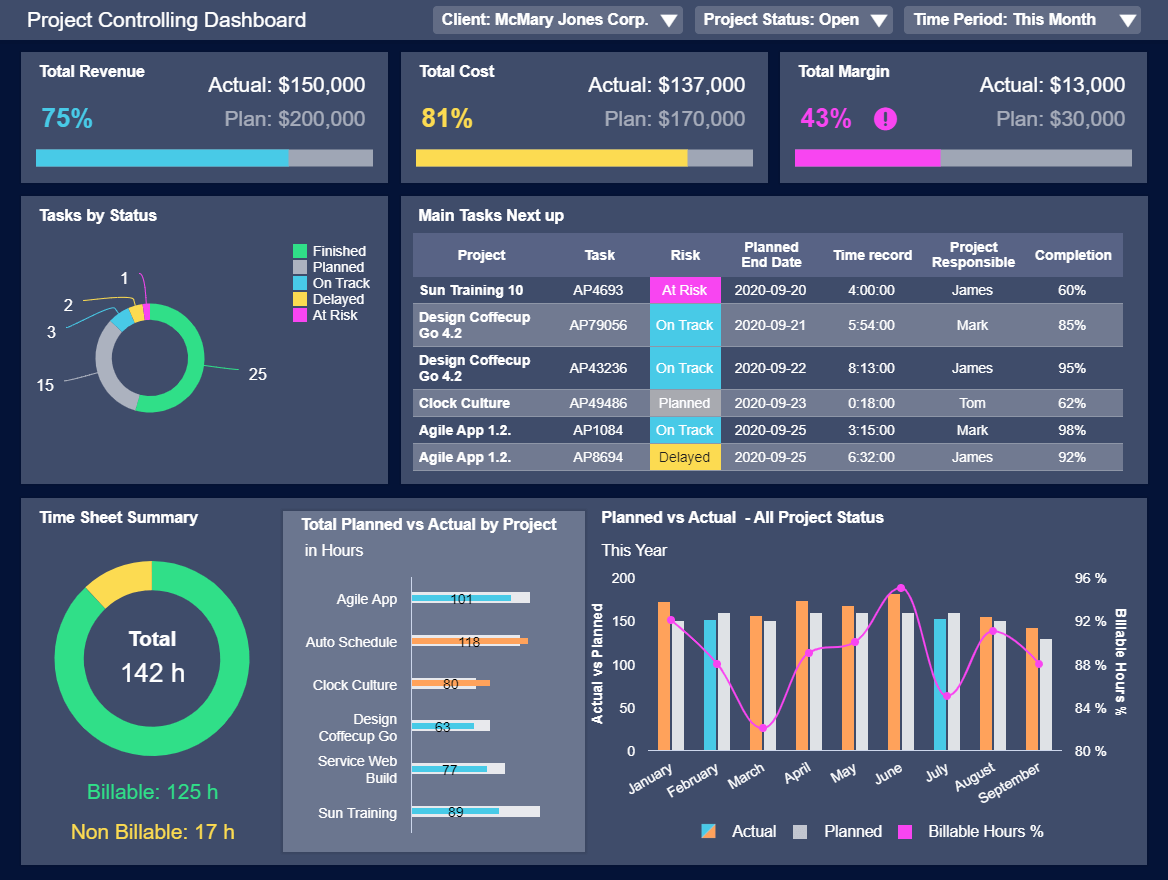

A project management report serves as a summary of a particular project's status and its various components. It's a visual tool that you can share with partners, colleagues, clients, and stakeholders to showcase your project's progress at multiple stages. Let’s look at our example and dig a little deeper.

To ensure consistent success across the board, the kinds of reports you must work with are based on project management.

Our example is a project management dashboard equipped with a melting pot of metrics designed to improve the decision-making process while keeping every facet of your company’s most important initiatives under control. Here, you can spot pivotal trends based on costs, task statuses, margins, costs, and overall project revenue. With this cohesive visual information at your fingertips, not only can you ensure the smooth end-to-end running of any key project, but you can also drive increased operational efficiency as you move through every significant milestone.

14. Statutory Reports

It may not seem exciting or glamorous, but keeping your business's statutory affairs in order is vital to your ongoing commercial health and success.

When it comes to submitting such vital financial and non-financial information to official bodies, one small error can result in serious repercussions. As such, working with statutory types of report formats is a water-tight way of keeping track of your affairs and records while significantly reducing the risk of human error.

Armed with interactive insights and dynamic visuals, you will keep your records clean and compliant while gaining the ability to nip any potential errors or issues in the bud.

What Does A Report Look Like?

Now that we’ve covered the most relevant types of reports, we will answer the question: what does a report look like?

As mentioned at the beginning of this insightful guide, static reporting is a thing of the past. With the rise of modern technologies like self-service BI tools , the use of interactive reports in the shape of business dashboards has become more and more popular among companies.

Unlike static reports that take time to be generated and are difficult to understand, modern reporting tools are intuitive. Their visual nature makes them easy to understand for any type of user, and they provide businesses with a central view of their most important performance indicators for an improved decision-making process. Here, we will cover 20 useful dashboard examples from different industries, functions, and platforms to put the value of dashboard reporting into perspective.

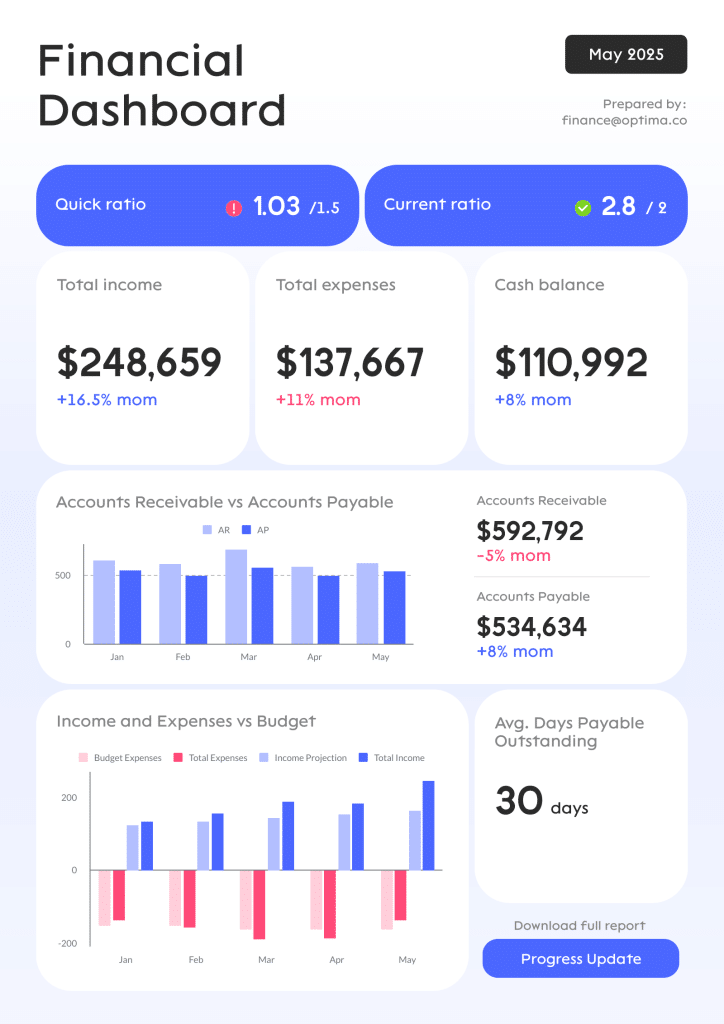

1. Financial Report

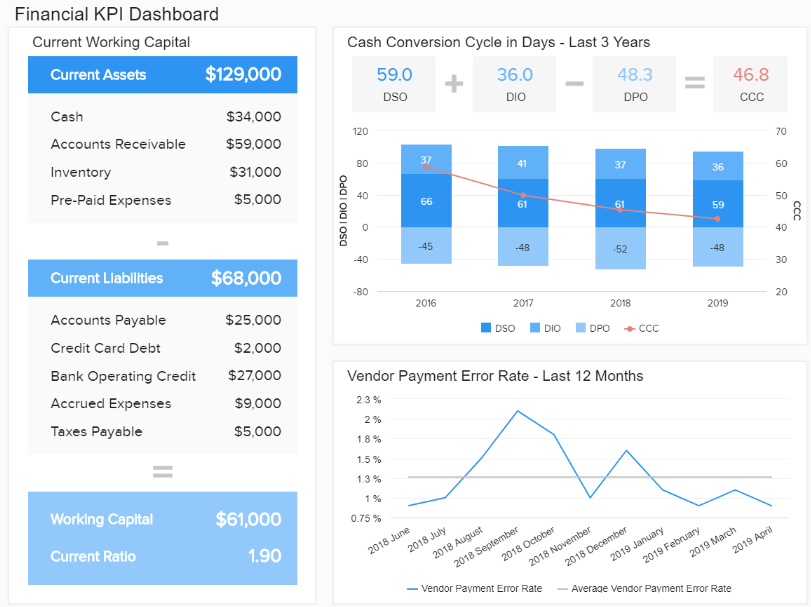

Keeping finances in check is critical for success. This financial report offers an overview of the most important financial metrics that a business needs to monitor its economic activities and answer vital questions to ensure healthy finances.

With insights about liquidity, invoicing, budgeting, and general financial stability, managers can extract long and short-term conclusions to reduce inefficiencies, make accurate forecasts about future performance, and keep the overall financial efficiency of the business flowing. For instance, getting a detailed calculation of the business's working capital can allow you to understand how liquid your company is. If it's higher than expected, it means you have the potential to invest and grow—definitely, one of the most valuable types of finance reports.

2. Marketing Report

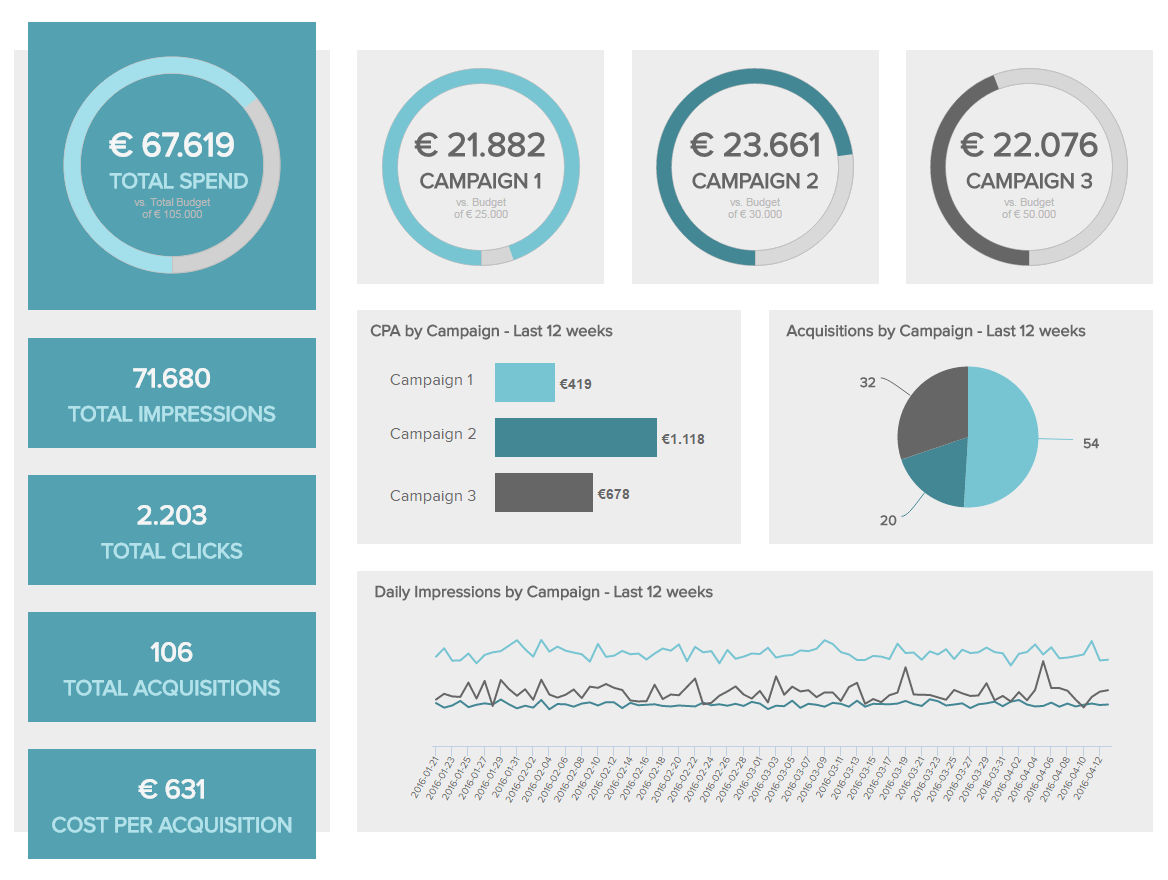

Our following example is a marketing report that ensures a healthy return on investment from your marketing efforts. This type of report offers a detailed overview of campaign performance over the last 12 weeks. Having access to this information enables you to maximize the value of your promotional actions, keeping your audience engaged by providing a targeted experience.

For instance, you can implement different campaign formats as a test and then compare which one is most successful for your business. This is possible thanks to the monitoring of important marketing metrics such as the click-through rate (CTR), cost per click (CPC), cost per acquisition (CPA), and more.

The visual nature of this report makes it easy to understand important insights at a glance. For example, the four gauge charts at the top show the total spending from all campaigns and how much of the total budget of each campaign has been used. In just seconds, you can see if you are on target to meet your marketing budgets for every single campaign.

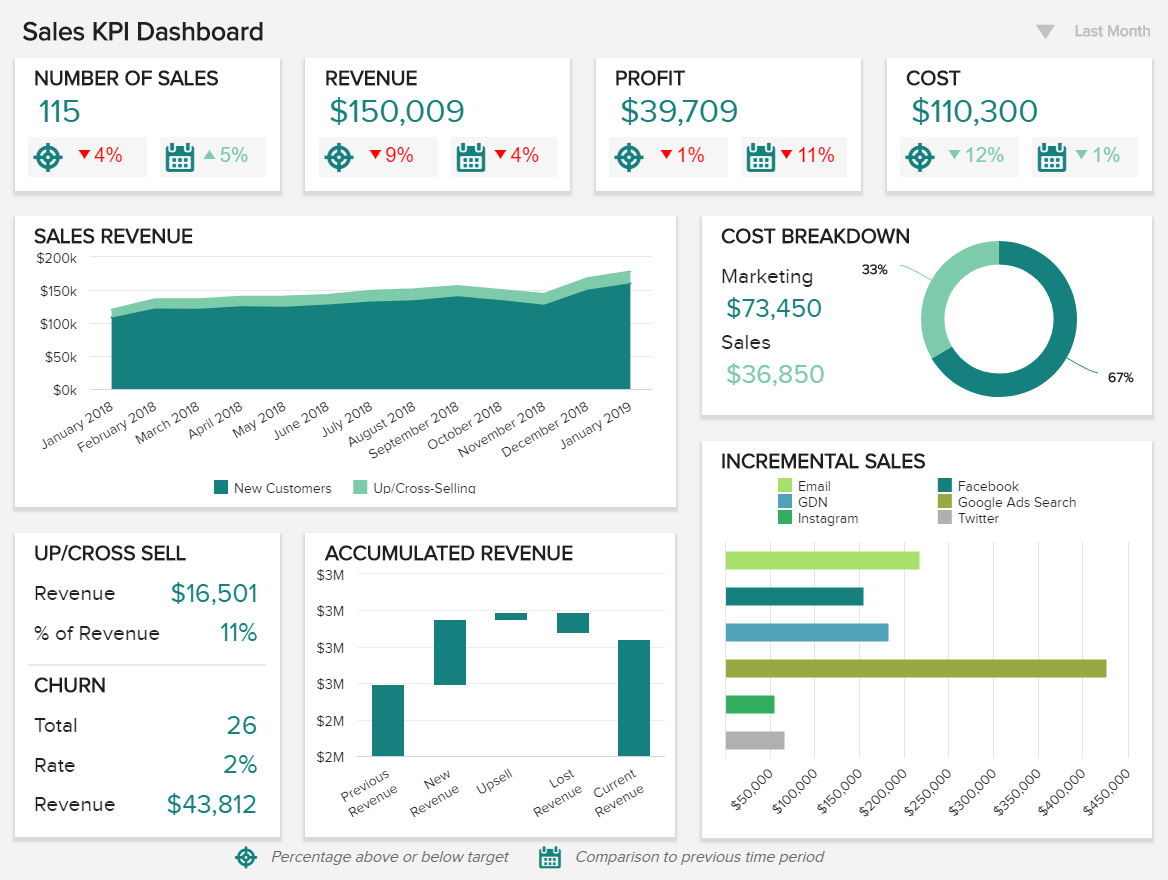

3. Sales Report

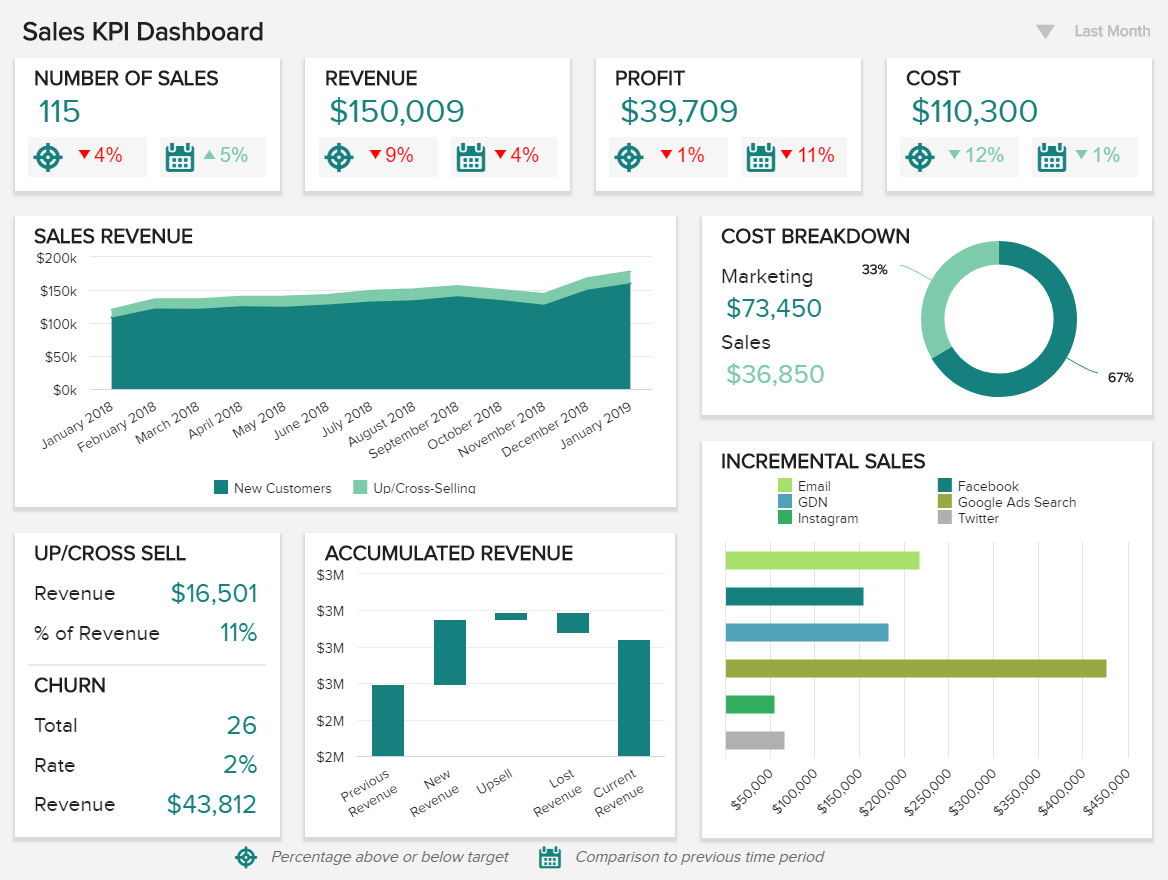

An intuitive sales dashboard like the one above is the perfect analytical tool to monitor and optimize sales performance. Armed with powerful high-level metrics, this report type is especially interesting for managers, executives, and sales VPs as it provides relevant information to ensure strategic and operational success.

The value of this sales report lies in the fact that it offers a complete and comprehensive overview of relevant insights needed to make smart sales decisions. For instance, at the top of an analysis tool, you get important metrics such as the number of sales, revenue, profit, and costs, all compared to a set target and to the previous time period. The use of historical data is fundamental when building successful sales strategies as they provide a picture of what could happen in the future. Being able to filter the key metrics all in one screen is a key benefit of modern reporting.

4. HR Report

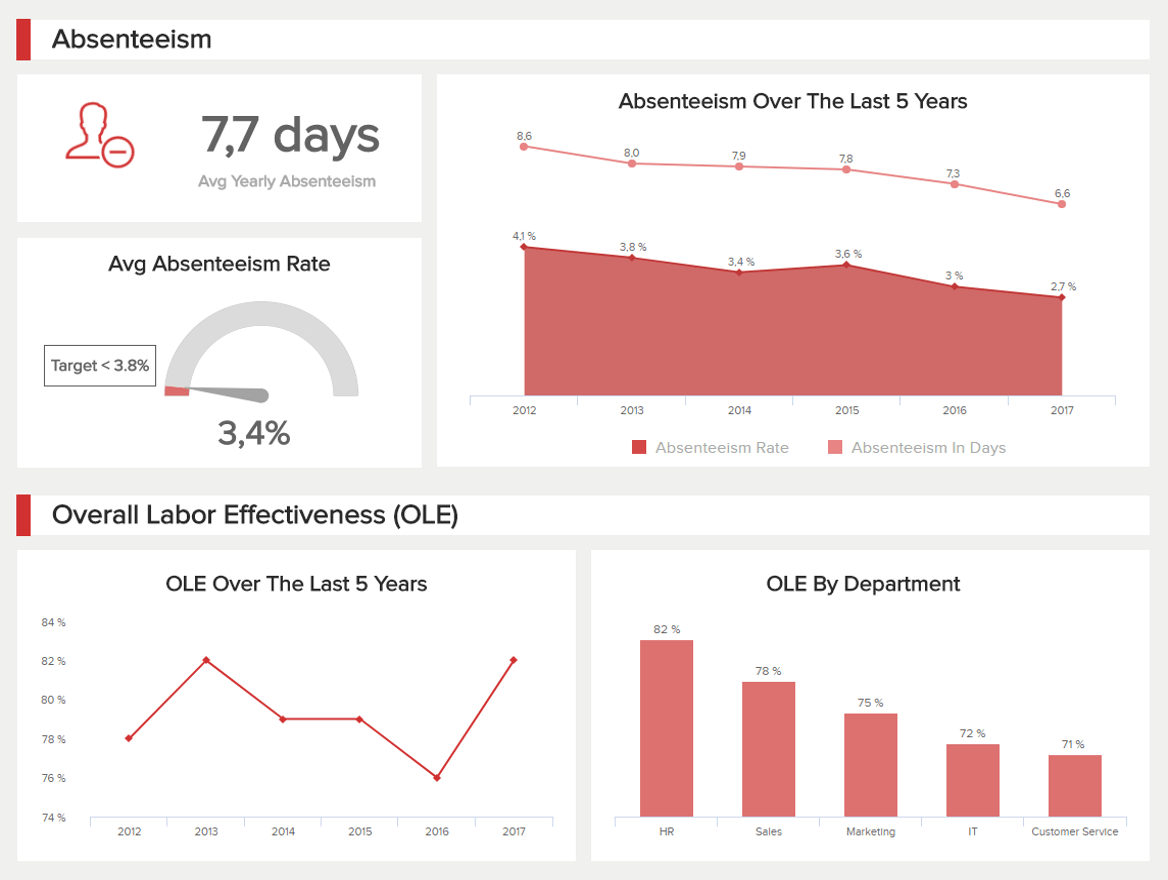

Our next example of a report is about human resources analytics . The HR department needs to track various KPIs for employee performance and effectiveness. But overall, they have to ensure that employees are happy and working in a healthy environment since an unhappy workforce can significantly damage an organization. This is all possible with the help of this intuitive dashboard.

Providing a comprehensive mix of metrics, this employee-centric report drills down into every major element needed to ensure successful workforce management. For example, the top portion of the dashboard covers absenteeism in 3 different ways: yearly average, absenteeism rate with a target of 3.8%, and absenteeism over the last five years. Tracking absenteeism rates in detail is helpful as it can tell you if your employees are skipping work days. If the rate is over the expected target, then you have to dig deeper into the reasons and find sustainable solutions.

On the other hand, the second part of the dashboard covers the overall labor effectiveness (OLE). This can be tracked based on specific criteria that HR predefined, and it helps them understand if workers are achieving their targets or if they need extra training or help.

5. Management Report

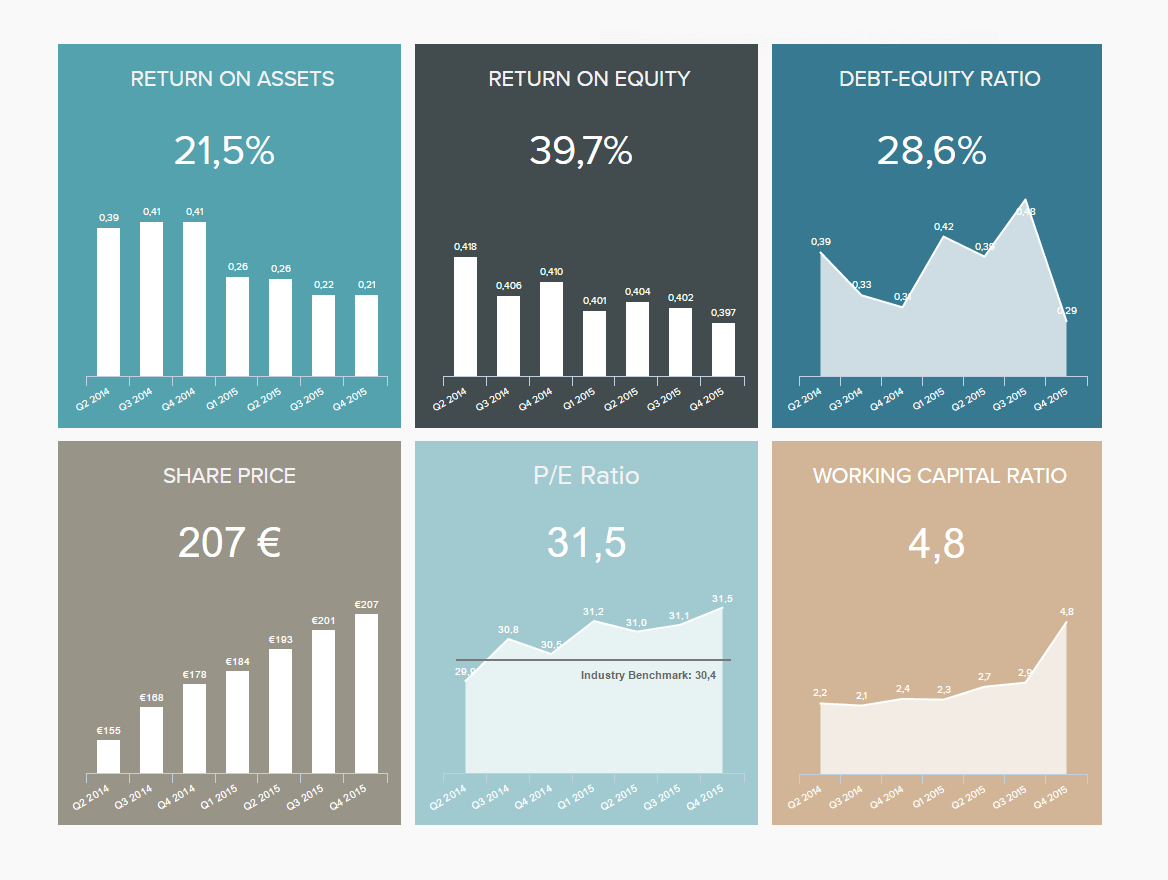

Managers must monitor big amounts of information to ensure that the business is running smoothly. One of them being investor relationships. This management dashboard focuses on high-level metrics that shareholders need to look at before investing, such as the return on assets, return on equity, debt-equity ratio, and share price, among others.

By getting an overview of these important metrics, investors can easily extract the needed information to make an informed decision regarding an investment in your business. For instance, the return on assets measures how efficiently are the company's assets being used to generate profit. With this information, investors can understand how effectively your company deploys available resources compared to others in the market. Another great indicator is the share price; the higher the increase in your share price, the more money your shareholders are making from their investment.

6. IT Report

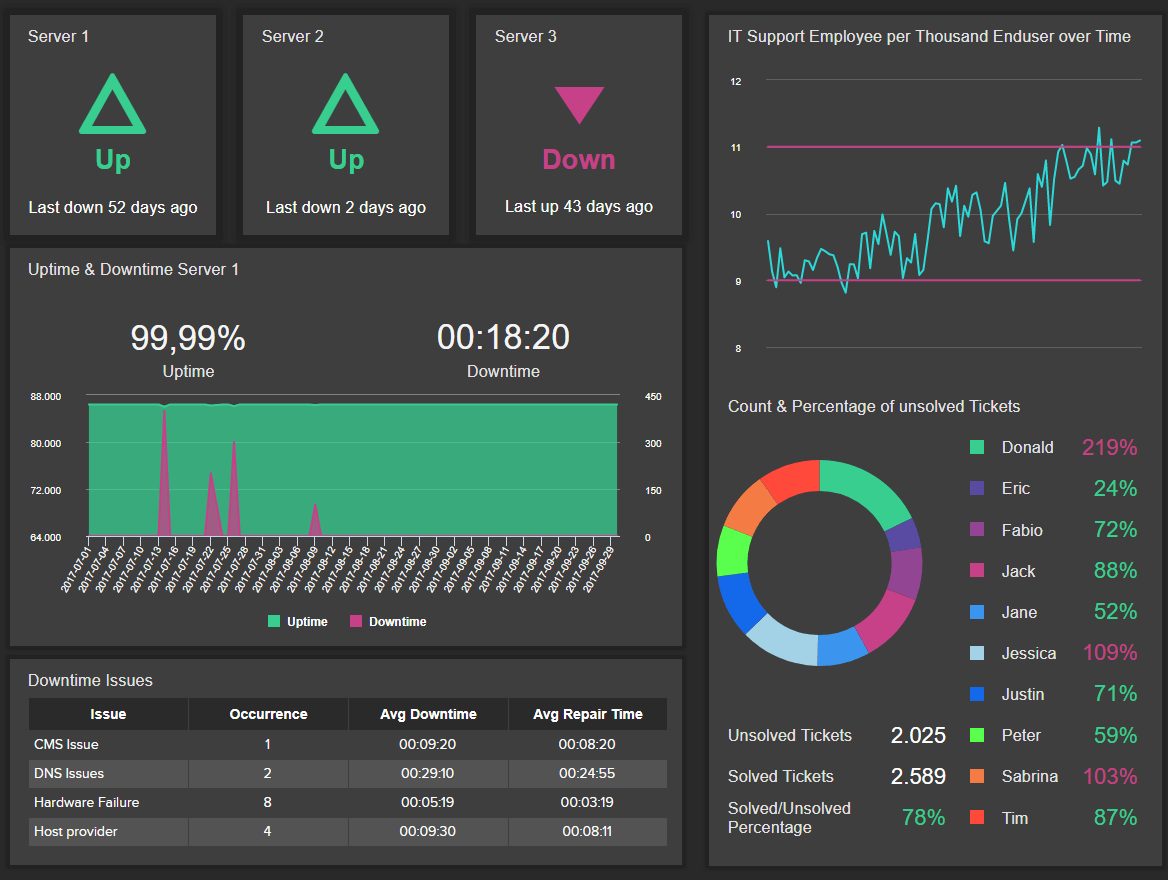

Just like all the other departments and sections covered in this list, the IT department is one that can especially benefit from these types of reports. With so many technical issues to solve, the need for a visual tool to help IT specialists stay on track with their workload becomes critical.

As seen in the image above, this IT dashboard offers detailed information about different system indicators. For starters, we get a visual overview of the status of each server, followed by a detailed graph displaying the uptime & downtime of each week. This is complemented by the most common downtown issues and some ticket management information. Getting this level of insight helps your IT staff to know what is happening and when it is happening and find proper solutions to prevent these issues from repeating themselves. Keeping constant track of these metrics will ensure robust system performance.

7. Procurement Report

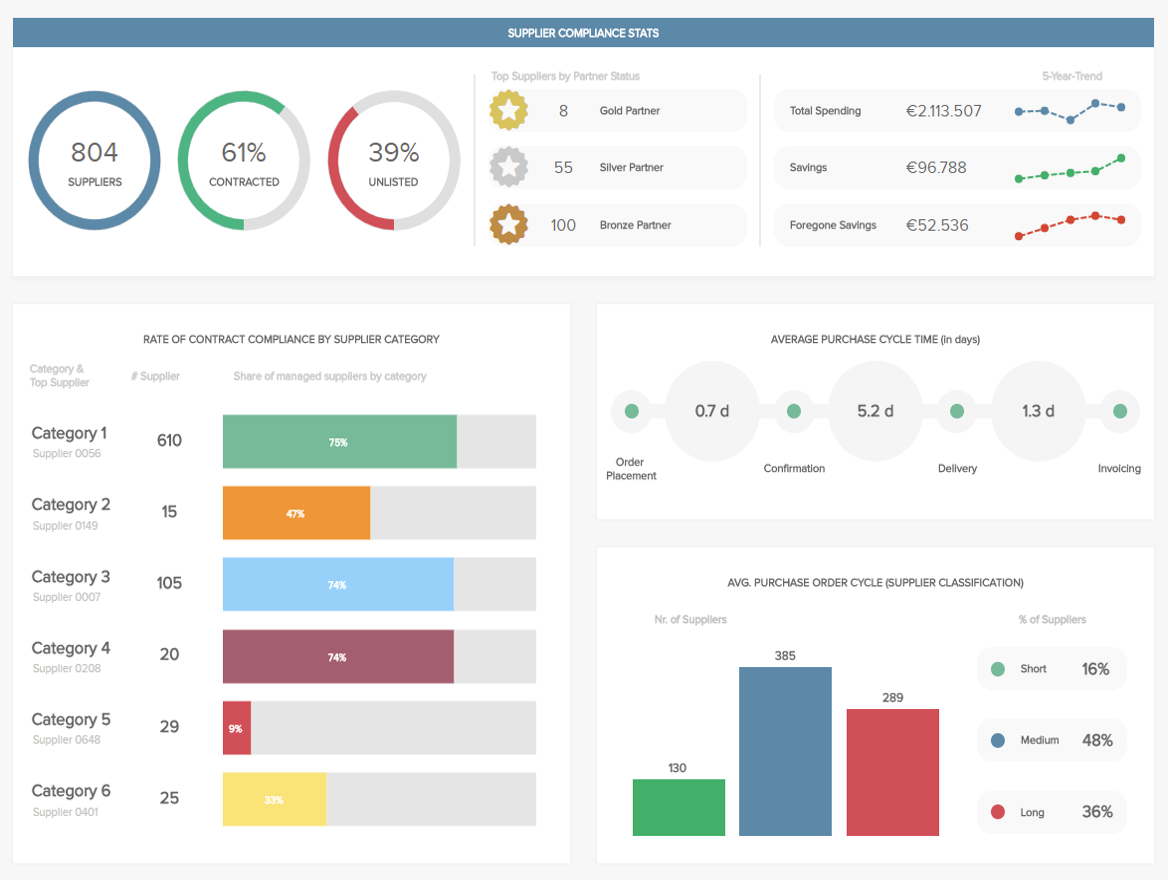

The following example of a report was built with intuitive procurement analytics software , and it gives a general view of various metrics that the procurement department needs to work with regularly.

With the possibility to filter, drill down, and interact with KPIs, this intuitive procurement dashboard offers key information to ensure a healthy supplier relationship. With metrics such as compliance rate, the number of suppliers, or the purchase order cycle time, the procurement team can classify the different suppliers, define the relationship each of them has with the company, and optimize processes to ensure it stays profitable.

8. Customer Service Report

Following our list of examples of reports is one from the support area. Armed with powerful customer service KPIs , this dashboard is a useful tool to monitor performance, spot trends, identify strengths and weaknesses, and improve the overall effectiveness of the customer support department.

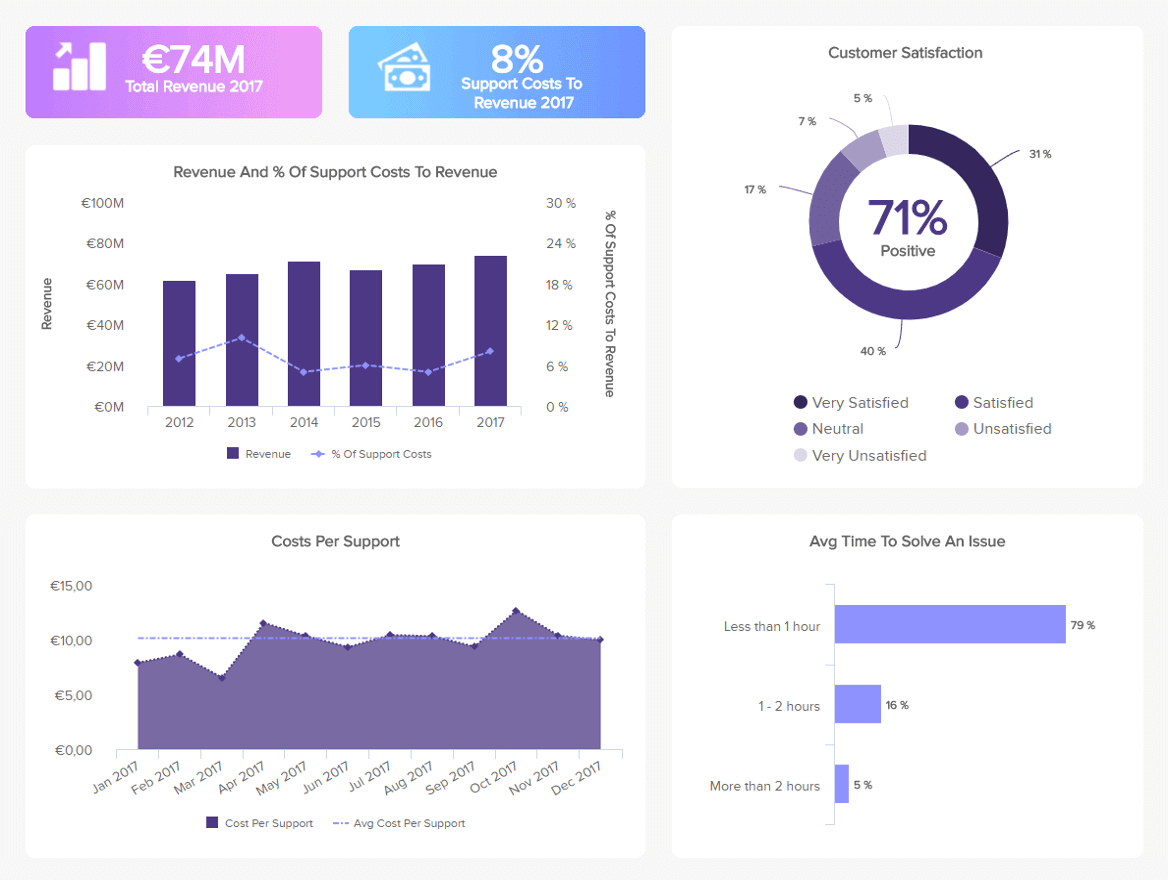

Covering aspects such as revenue and costs from customer support as well as customer satisfaction, this complete analysis tool is the perfect tool for managers who have to keep an eye on every little detail from a performance and operational perspective. For example, by monitoring your customer service costs and comparing them to the revenue, you can understand if you are investing the right amount into your support processes. This can be directly related to your agent’s average time to solve issues; the longer it takes to solve a support ticket, the more money it will cost and the less revenue it will bring. If you see that your agents are taking too long to solve an issue, you can think of some training instances to help them reduce this number.

9. Market Research Report

This list of report types examples would not be complete without a market research report . Market research agencies deal with a large amount of information coming from surveys and other research sources. Taking all this into account, the need for reports that can be filtered for deeper interaction becomes more necessary for this industry than any other.

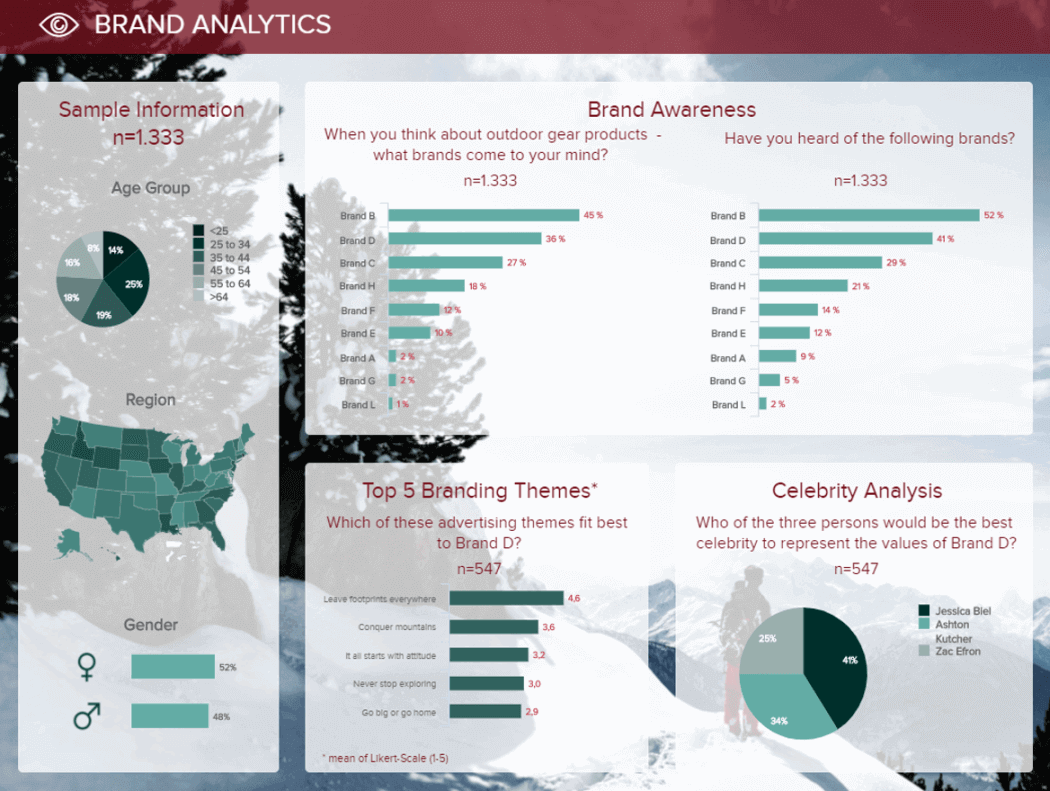

The image above is a brand analytics dashboard that displays the survey results about how the public perceives a brand. This savvy tool contains different charts that make it easy to understand the information visually. For instance, the map chart with the different colors lets you quickly understand in which regions each age range is located. The charts can be filtered further to see the detailed answers from each group for a deeper analysis.

10. Social Media Report

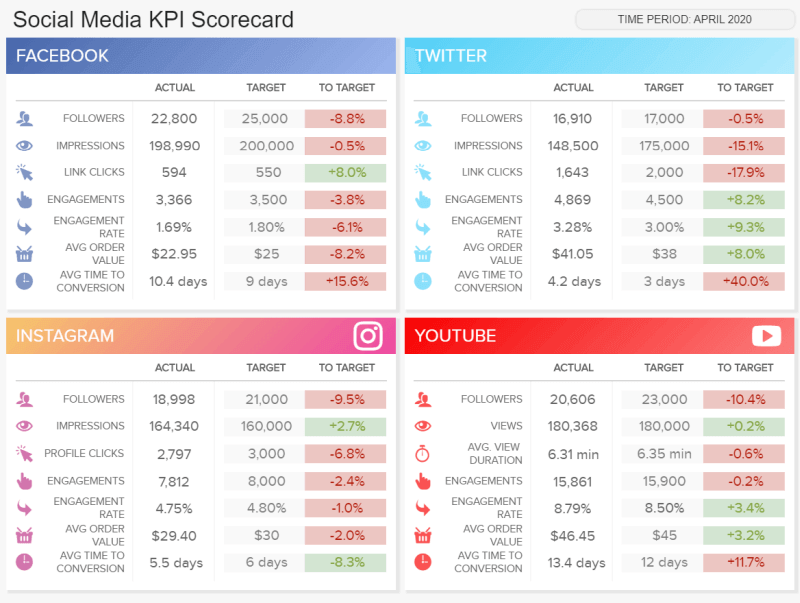

Last but not least, we have a social media report . This scorecard format dashboard monitors the performance of 4 main social media channels: Facebook, Twitter, Instagram, and YouTube, and it serves as a perfect visual overview to track the performance of different social media efforts and achievements.

Tracking relevant metrics such as followers, impressions, clicks, engagement rates, and conversions, this report type serves as a perfect progress report to show to managers or clients who need to see the status of their social channels. Each metric is shown in its actual value and compared to a set target. The colors green and red from the fourth column let you quickly understand if a metric is over or under its expected target.

11. Logistics Report

Logistics are the cornerstone of an operationally fluent and progressive business. If you deal with large quantities of goods and tangible items, in particular, maintaining a solid logistical strategy is vital to ensuring you maintain your brand reputation while keeping things flowing in the right direction.

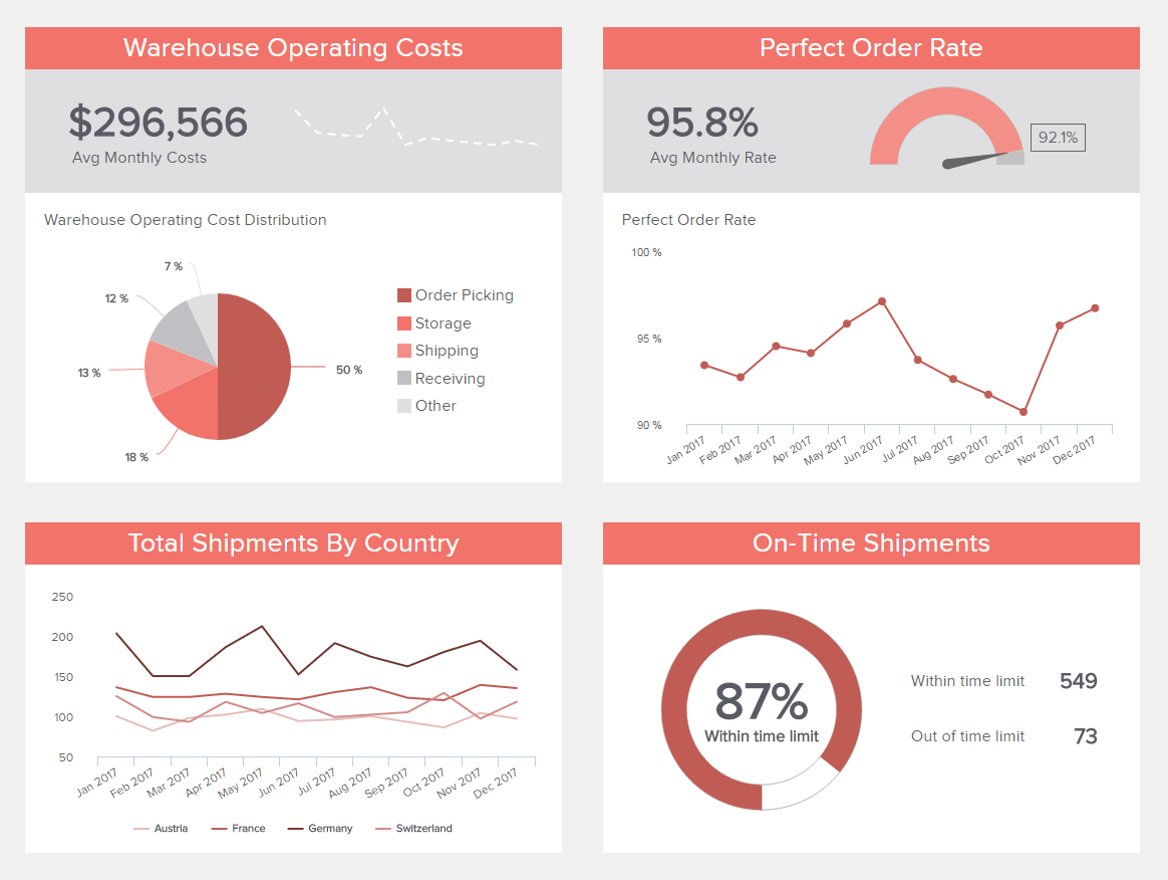

A prime example of the types of data reporting tool designed to improve logistical management, our warehouse KPI dashboard is equipped with metrics required to maintain strategic movement while eliminating any unnecessary costs or redundant processes. Here, you can dig into your shipping success rates across regions while accessing warehouse costs and perfect order rates in real-time. If you spot any potential inefficiencies, you can track them here and take the correct course of action to refine your strategy. This is an essential tool for any business with a busy or scaling warehouse.

12. Manufacturing Report

Next, in our essential types of business reports examples, we’re looking at tools made to improve your business’s various manufacturing processes.

Our clean and concise production tool is a sight to behold and serves up key manufacturing KPIs that improve the decision-making process regarding costs, volume, and machinery.

Here, you can hone in on historical patterns and trends while connecting with priceless real-time insights that will not only help you make the right calls concerning your manufacturing process at the moment but will also help you formulate predictive strategies that will ultimately save money, boost productivity, and result in top-quality products across the board.

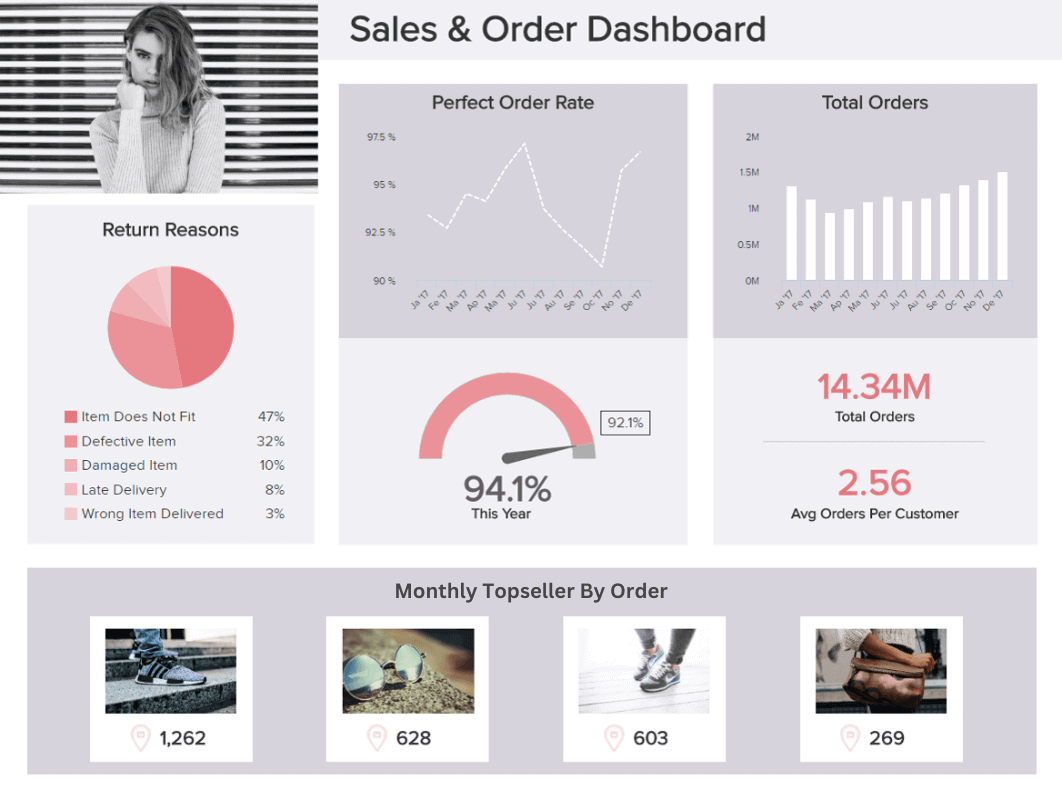

13. Retail Report

As a retailer with so many channels to consider and so many important choices to make, working with the right metrics and visuals is absolutely essential. Fortunately, we live in an age where there are different types of reporting designed for this very reason.

Our sales and order example, generated with retail analytics software , is a dream come true for retailers as it offers the visual insights needed to understand your product range in greater detail while keeping a firm grip on your order volumes, perfect order rates, and reasons for returns.

Gaining access to these invaluable insights in one visually presentable space will allow you to track increases or decreases in orders over a set timeframe (and understand whether you’re doing the right things to drive engagement) while plowing your promotional resources into the products that are likely to offer the best returns.

Plus, by gaining an accurate overview of why people are returning your products, you can omit problem items or processes from your retail strategy, improving your brand reputation as well as revenue in the process.

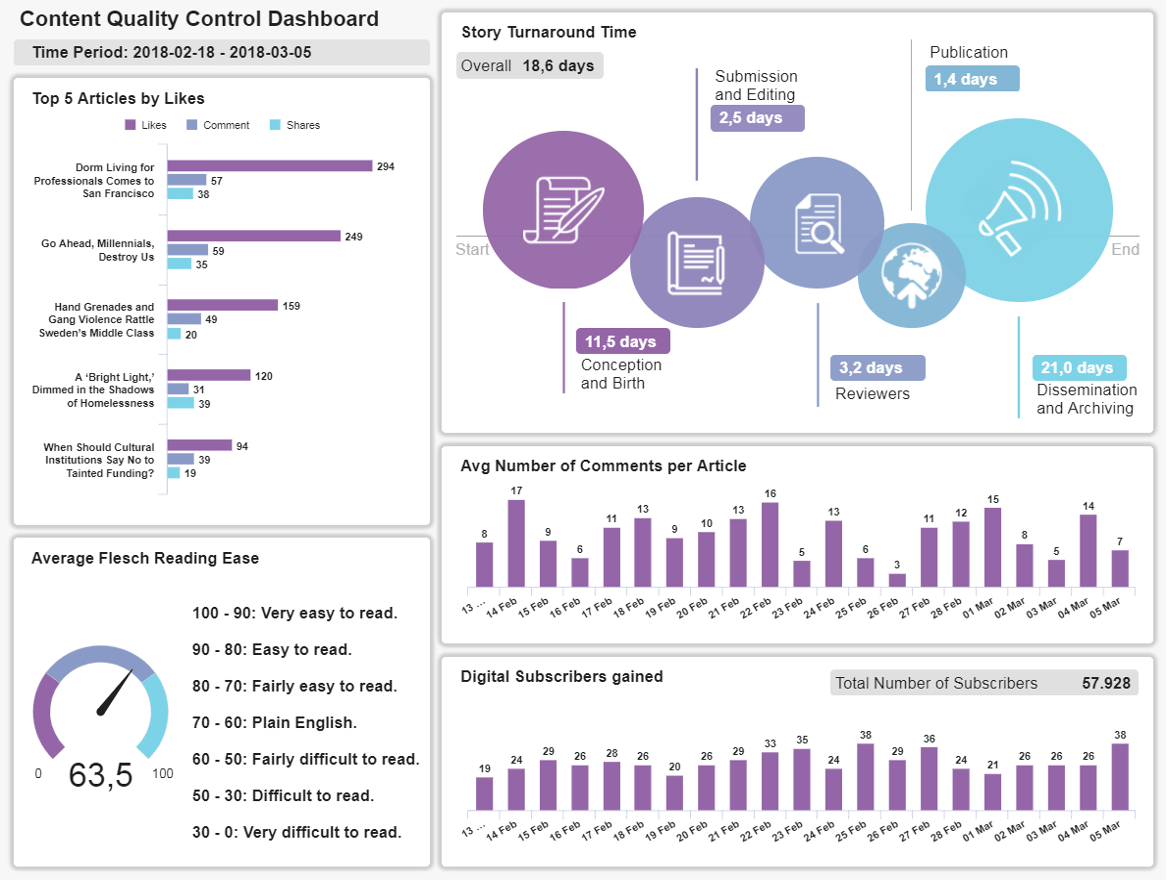

14. Digital Media Report

The content and communications you publish are critical to your ongoing success, regardless of your sector, niche, or specialty. Without putting out communications that speak directly to the right segments of your audience at the right times in their journey, your brand will swiftly fade into the background.

To ensure your brand remains inspiring, engaging, and thought-leading across channels, working with media types of a business report is essential. You must ensure your communications cut through the noise and scream ‘quality’ from start to finish—no ifs, no buts, no exceptions.

Our content quality control tool is designed with a logical hierarchy that will tell you if your content sparks readership, if the language you’re using is inclusive and conversational, and how much engagement-specific communications earn. You can also check your most engaged articles with a quick glance to understand what your users value most. Armed with this information, you can keep creating content that your audience loves and ultimately drives true value to the business.

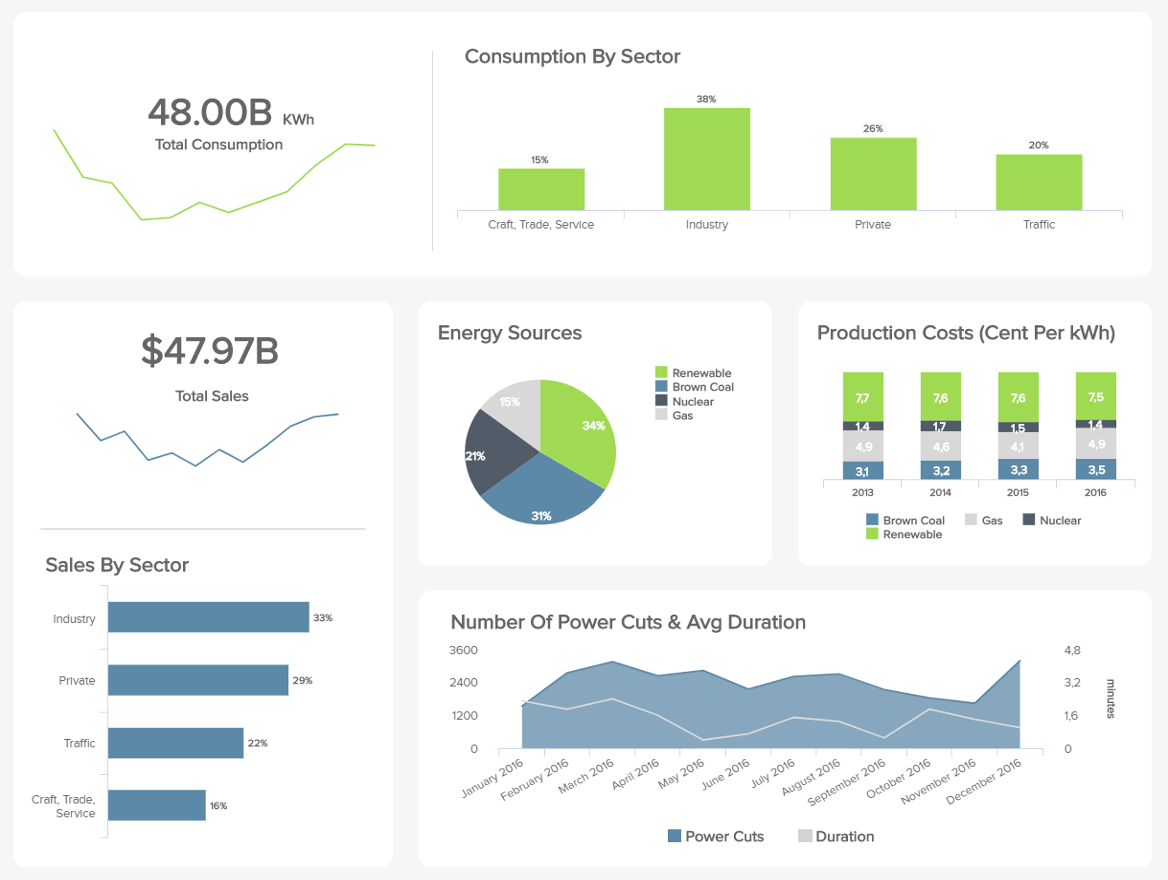

15. Energy Report

In the age of sustainability and in the face of international fuel hikes, managing the energy your business uses effectively is paramount. Here, there is little room for excess or error, and as such, working with the right metrics is the only way to ensure successful energy regulation.

If your company has a big HQ or multiple sites that require power, our energy management analytics tool will help you take the stress out of managing your resources. One of the most striking features of this dashboard is the fact that it empowers you to compare your company’s energy usage against those from other sectors and set an accurate benchmark.

Here, you can also get a digestible breakdown of your various production costs regarding energy consumption and the main sources you use to keep your organization running. Regularly consulting these metrics will not only help you save colossal chunks of your budget, but it will also give you the intelligence to become more sustainable as an organization. This, in turn, is good for the planet and your brand reputation—a real win-win-win.

16. FMCG Report

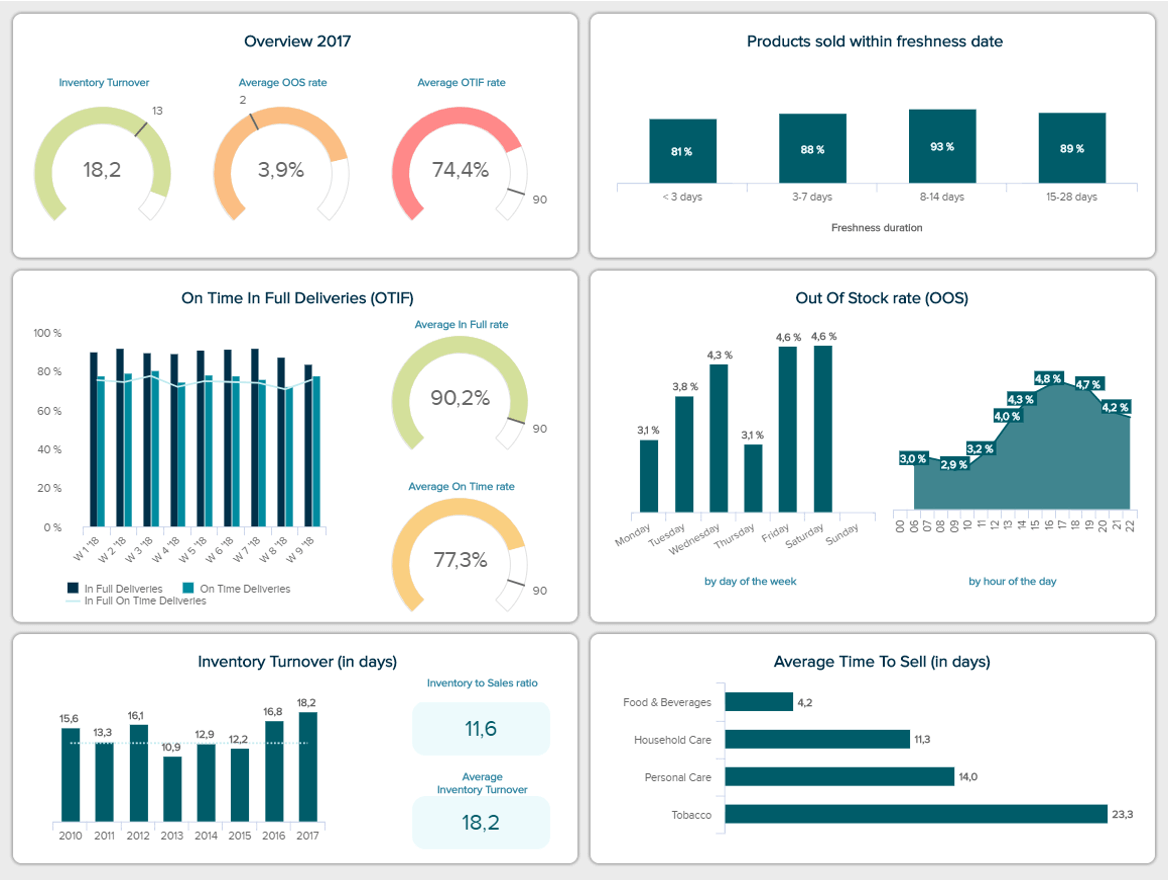

The fast-moving consuming goods (FMCG) industry can highly benefit from a powerful report containing real-time insights. This is because the products handled in this sector which are often food and beverages, don’t last very long. Therefore, having a live overview of all the latest developments can help decision-makers optimize the supply chain to ensure everything runs smoothly and no major issues happen.

Our report format example above aims to do just that by providing an overview of critical performance indicators, such as the percentage of products sold within freshness date, the out-of-stock rate, on-time in full deliveries, inventory turnover, and more. What makes this template so valuable is the fact that it provides a range of periods to get a more recent view of events but also a longer yearly view to extract deeper insights.

The FMCG dashboard also offers an overview of the main KPIs to help users understand if they are on the right track to meet their goals. There, we can observe that the OTIF is far from its target of 90%. Therefore, it should be looked at in more detail to optimize it and prevent it from affecting the entire supply chain.

17. Google Analytics Report

Regardless of the industry you are in, if you have a website then you probably require a Google Analytics report. This powerful tool helps you understand how your audience interacts with your website while helping you reach more people through the Google search engine. The issue is that the reports the tool provides are more or less basic and don’t give you the dynamic and agile view you need to stay on top of your data and competitors.

For that reason, at datapine, we generated a range of Google Analytics dashboards that take your experience one step further by allowing you to explore your most important KPIs in real-time. That way, you’ll be able to spot any potential issues or opportunities to improve as soon as they occur, allowing you to act on them on the spot.

Among some of the most valuable metrics you can find in this sample are the sessions and their daily, weekly, and monthly development, the average session duration, the bounce rate by channel and by top 5 countries, among others.

18. YouTube Report

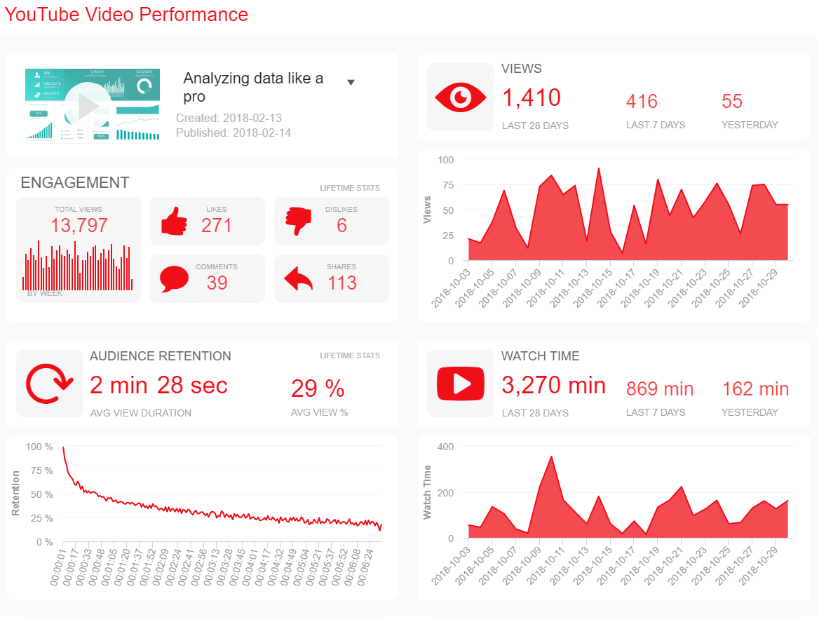

So far, we’ve covered examples for various industries and sectors. Now, we will dive a bit deeper into some templates related to popular platforms businesses use in their daily operations. With the rise in video-related content, we could not leave YouTube outside of the list. This popular platform hides some valuable insights that can help you improve your content for your current audience but also reach new audiences that can be interested in your products or services.

This highly visual and dynamic sample offers an interactive view of relevant KPIs to help you understand every aspect of your video performance. The template can be filtered for different videos to help you understand how each type of content performs. For instance, you get an overview of engagement metrics, such as likes, dislikes, comments, and shares, that way, you can understand how your audience interacts with your content.

Additionally, you also get more detailed charts about the number of views, the average watch time per day, and audience retention. These indicators can help you understand if something needs to be changed. For instance, audience retention goes down a lot after one minute and a half. Therefore you either need to make sure you are making the rest of the video a bit more interesting or offering your product or service or any other relevant information in the first minute.

19. LinkedIn Report

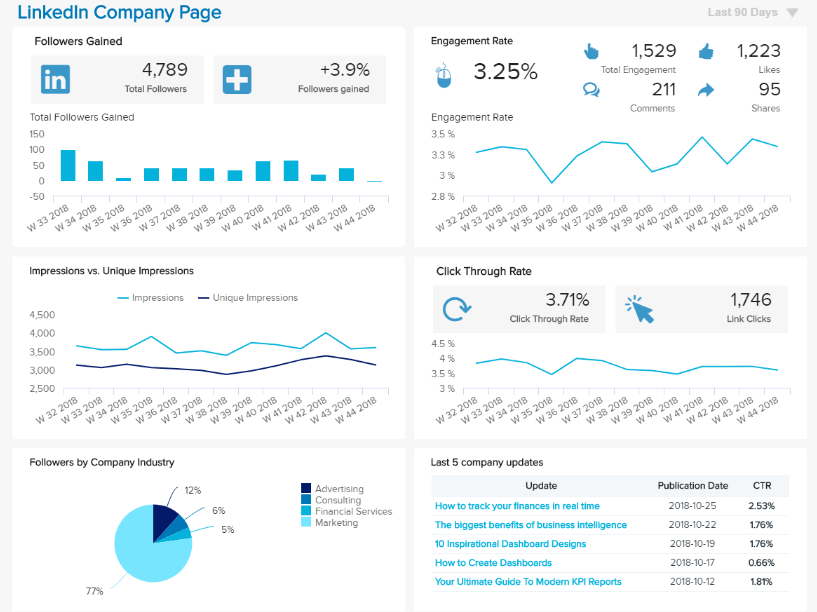

Another very important platform that companies use, no matter their size or industry, is LinkedIn. This platform is the place where companies develop and showcase their corporate image, network with other companies, and tell their clients and audience about the different initiatives they are developing to grow and be better. Some organizations also use LinkedIn to showcase their charity or sustainability initiatives.

The truth is LinkedIn has become an increasingly relevant platform, and just like we discussed with YouTube, organizations need to analyze data to ensure their strategies are on the right path to success.

The template above offers a 360-degree view of a company page's performance. With metrics such as the followers gained, engagement rate, impressions vs unique impressions, CTR, and more. Decision-makers can dive deeper into the performance of their content and understand what their audience enjoys the most. For instance, by looking at the CTR of the last 5 company updates, you can start to get a sense of what topics and content format your audience on the platforms interact with the most. That way, you’ll avoid wasting time and resources producing content without interaction.

20. Healthcare Report

Moving on from platform-related examples, we have one last monthly report template from a very relevant sector, the healthcare industry. For decades now, hospitals and healthcare professionals have benefited from data to develop new treatments and analyze unknown diseases. But, data can also help to ensure daily patient care is of top quality.

Our sample above is a healthcare dashboard report that tracks patient satisfaction stats for a clinic named Saint Martins Clinic. The template provides insights into various aspects of patient care that can affect their satisfaction levels to help spot any weak areas.

Just by looking at the report in a bit more detail, we can already see that the average waiting time for arrival to a bed and time to see a doctor are on the higher side. This is something that needs to be looked into immediately, as waiting times are the most important success factors for patients. Additionally, we can see those lab test turnarounds are also above target. This is another aspect that should be optimized to prevent satisfaction levels from going down.

If you feel inspired by this list and want to see some of the best uses for business reports, then we recommend you take a look at our dashboard examples library, where you will find over 80+ templates from different industries, functions, and platforms for extra inspiration!

What You Should Look For In A Reporting Tool

As you learned from our extensive list of examples, different types of reports are widely used across industries and sectors. Now, you might wonder, how do I get my hands on one of these reports? The answer is a professional online reporting tool. With the right software in hand, you can generate stunning reports to extract the maximum potential out of your data and boost business growth in the process.

But, with so many options in the market, how do make sure you choose the best tool for your needs? Below we cover some of the most relevant features and capabilities you should look for to make the most out of the process.

- Pre-made reporting templates

To ensure successful operations, a business will most likely need to use many types of reports for its internal and external strategies. Manually generating these reports can become a time-consuming task that burdens the business. That is why professional reporting software should offer pre-made reporting templates. At datapine, we offer an extensive template library that allows users to generate reports in a matter of seconds—allowing them to use their time on actually analyzing the information and extracting powerful insights from it.

- Multiple visualization options

If you look for report templates on Google you might run into multiple posts about written ones. This is not a surprise, as written reports have been the norm for decades. That being said, a modern approach to reporting has developed in the past years where visuals have taken over text. The value of visuals lies in the fact that they make the information easier to understand, especially for users who have no technical knowledge. But most importantly, they make the information easier to explore by telling a compelling story. For that reason, the tool you choose to invest in should provide you with multiple visualization options to have the flexibility to tell your data story in the most successful way possible.

- Customization

While pre-made templates are fundamental to generating agile reports, being able to customize them to meet your needs is also of utmost importance. At datapine, we offer our users the possibility to customize their reports to fit their most important KPIs, as well as their logo, business colors, and font. This is an especially valuable feature for external reports that must be shown to clients or other relevant stakeholders, giving your reports a more professional look. Customization can also help from an internal perspective to provide employees who are uncomfortable with data with a familiar environment to work in.

- Real-time insights

In the fast-paced world we live in today, having static reports is not enough. Businesses need to have real-time access to the latest developments in their data to spot any issues or opportunities as soon as they occur and act on them to ensure their resources are spent smartly and their strategies are running as expected. Doing so will allow for agile and efficient decision-making, giving the company a huge competitive advantage.

- Sharing capabilities