30 Project Financial Analyst Interview Questions and Answers

Common Project Financial Analyst interview questions, how to answer them, and example answers from a certified career coach.

In the world of project management, a Project Financial Analyst plays an integral role in ensuring that projects stay within budget and generate desired profits. Armed with solid financial acumen and strong analytical skills, you’re now ready to ace that all-important interview for this pivotal position.

However, interviews can be daunting, particularly when they involve technical jargon and complex concepts. Fear not, we’ve got you covered. This article will delve into some of the most frequently asked questions during a Project Financial Analyst interview, providing useful insights and suggested responses to help you make your best impression. Let’s demystify the process together – one question at a time.

1. Can you describe a project where you had to analyze financial data and make recommendations?

As a Project Financial Analyst, you’re expected to not only dissect complex financial data but also use this information to make recommendations that will positively impact the company’s bottom line. Interviewers, therefore, ask this question to understand your skills in financial analysis, strategic thinking, and decision-making. They want to hear about your real-world experience turning raw data into strategic suggestions.

Example: “In one project, I was tasked with analyzing the financial viability of a potential new product line.

I started by gathering and scrutinizing data on costs, projected revenues, market trends, and competitor analysis. Using advanced Excel functions and financial modeling techniques, I identified key metrics and performed sensitivity analysis.

The insights from my analysis showed that while the product had strong revenue potential, it also carried significant risk due to high upfront costs and aggressive competition in the market.

Based on these findings, I recommended pursuing a more differentiated strategy to mitigate competitive threats and negotiating better terms with suppliers to reduce initial costs. This approach helped balance potential returns with associated risks, leading to an informed strategic decision.”

2. How have you ensured accuracy when preparing financial reports in the past?

Accuracy and attention to detail are critical when dealing with financial data. A minor error can potentially result in significant losses or decision-making based on inaccurate information. Therefore, interviewers ask this question to assess your ability to maintain precision and your methods for ensuring that the financial reports you prepare are free from mistakes.

Example: “To ensure accuracy in financial reporting, I always adhere to established accounting standards and principles. This includes double-checking all data inputs for errors and inconsistencies.

I also use automated software tools for calculations and reconciliations to minimize manual errors. Regular internal audits are another method I employ to maintain accuracy.

Lastly, continuous learning is key. Keeping up-to-date with changes in financial regulations helps me avoid inaccuracies due to outdated practices.”

3. Can you provide an example of a time you used financial analysis to influence a project’s direction?

Your ability to leverage financial analysis to guide project direction is a key skill that interviewers want to evaluate. Financial analysis is not just about crunching numbers, but also about interpreting these numbers and deriving actionable insights. This question is a way for the interviewer to assess your analytical skills, your decision-making ability, and your capacity to effectively communicate your findings to influence the course of a project.

Example: “In one project, we were developing a new product line. Initial cost projections exceeded our budget and threatened the feasibility of the project. I conducted a thorough financial analysis, identifying areas where costs could be reduced without compromising quality.

I presented my findings to the team, highlighting potential savings from alternative suppliers and production methods. This influenced the project’s direction as it shifted focus towards cost-efficiency. The project eventually launched under budget, validating the importance of detailed financial analysis in decision-making processes.”

4. What methods do you use to assess project profitability?

Employers want to see that you have a systematic approach to analyzing the financial aspects of a project. They want to know that you’re capable of making critical decisions based on your financial findings, which can directly impact the project’s profitability and the company’s bottom line. The methods you use to assess project profitability can reveal your financial acumen, analytical skills, and understanding of the business.

Example: “To assess project profitability, I primarily use two methods: Net Present Value (NPV) and Return on Investment (ROI).

The NPV method helps in understanding the profitability of a project by comparing the present value of cash inflows with the present value of cash outflows. If the NPV is positive, it indicates that the project’s estimated profits exceed its costs, making it a viable option.

On the other hand, ROI measures the gain or loss generated on an investment relative to the amount of money invested. It provides a percentage that can easily be compared across different projects for decision-making purposes.

Both these methods provide valuable insights into the potential profitability of a project and help make informed decisions.”

5. What experience do you have with project budgeting and forecasting?

Employers want to ensure that you have the necessary experience and skills to anticipate costs, manage resources, and keep the project within the set budget. The ability to accurately forecast and budget is key to the financial health of a project, making it a critical skill for a Project Financial Analyst. Hence, this question is posed to understand your proficiency in these areas.

Example: “I have a strong background in project budgeting and forecasting, having worked on numerous projects in my career. I’ve developed financial models to predict project costs, analyzed variances between actuals and forecasts, and made recommendations for adjustments.

In one instance, I was able to identify potential cost overruns early in the project lifecycle, which allowed us to take corrective action and keep the project within budget. This not only saved money but also ensured the project was delivered on time.

My experience with various financial software tools has further enhanced my ability to provide accurate forecasts and manage budgets effectively.”

6. How do you handle discrepancies or inconsistencies in financial data?

The heart of your role as a Project Financial Analyst is to ensure financial accuracy and integrity. When inconsistencies pop up, as they inevitably do, hiring managers want to know that you have the analytical skills to identify the issue and the problem-solving ability to correct it. This question also gives insight into your attention to detail and your commitment to maintaining financial accuracy.

Example: “When I identify discrepancies in financial data, my initial step is to verify the information from its source. It could be a simple clerical error or a misunderstanding of the data input process.

If the inconsistency persists after verification, I would then perform a more detailed analysis using statistical techniques and financial models. This helps me understand the nature and cause of the discrepancy.

In case it’s an issue beyond my expertise, I collaborate with other departments like IT or Audit for further investigation. Transparency and communication are key in these situations.

Ultimately, any significant findings will be documented and reported to management, along with suggestions for preventive measures to avoid such inconsistencies in future.”

7. How would you handle a situation where a project is running over budget?

Money is the lifeblood of any project, and as a project financial analyst, your role is to ensure that every penny is accounted for and used efficiently. Therefore, the interviewer wants to understand your problem-solving skills in situations where the budget is not being adhered to. They want to know how you’ll react, what steps you’ll take to identify the problem, and how you’ll work to rectify the situation and prevent it from happening again.

Example: “In such a situation, I would first conduct a thorough analysis of the project’s financials to identify where and why we are exceeding budget. This could involve reviewing labor costs, material expenses, or unexpected contingencies.

Once identified, I’d prioritize these overruns based on their impact and feasibility for reduction. For instance, if labor costs are high due to overtime, perhaps we can redistribute tasks or hire temporary help.

Then, I would communicate with stakeholders about the issue and propose solutions. Transparency is key in managing expectations and maintaining trust.

Lastly, it’s important to learn from this experience by updating our forecasting models and risk management strategies to avoid similar issues in future projects.”

8. What financial software applications are you most proficient in using?

Financial software applications are integral to the work of a Project Financial Analyst. They help with budgeting, forecasting, performance tracking, and reporting. Therefore, your proficiency in these tools is a major indicator of your ability to handle the financial management tasks associated with the role. This question is a way for hiring managers to gauge your familiarity with these tools and your overall technical competence.

Example: “I am proficient in several financial software applications. My expertise lies primarily with Oracle and SAP, both of which I’ve used extensively for project budgeting, cost tracking, and financial reporting.

I’m also skilled in using Microsoft Excel for data analysis and visualization. This includes advanced functions like pivot tables, VLOOKUPs, and macros.

In addition to these, I have experience with QuickBooks for managing accounts payable and receivable, payroll, and other general accounting tasks.

Overall, my proficiency in these tools enables me to provide accurate financial tracking and insightful analyses.”

9. What strategies do you use to communicate complex financial information to non-financial team members?

In the midst of a project’s hustle and bustle, your ability to distill complex financial information into clear, actionable insights is crucial. Project teams are typically composed of individuals with diverse areas of expertise, all working towards a common goal. However, not everyone on the team will have a financial background. This question is designed to assess your communication skills and your ability to translate intricate financial data into a language that everyone on the team can understand, thereby facilitating informed decision-making.

Example: “I use simple language and analogies to explain complex financial concepts. It’s important to understand the audience’s knowledge level and tailor my communication accordingly. I also utilize visual aids like charts, graphs, or infographics that can help make data more digestible.

Moreover, I focus on key points and their relevance to the project at hand. By linking financial information with practical implications, it becomes easier for non-financial team members to grasp its importance.

Regular training sessions are another strategy I employ. These provide a platform for individuals to ask questions and gain a better understanding of financial aspects related to their work.”

10. How do you balance the financial needs of a project with the operational needs?

Striking a balance between financial and operational needs is a critical skill for a Project Financial Analyst. It demands a deep understanding of the importance of both variables in project success. Interviewers want to see that you are adept at making informed decisions that take into consideration the cost-effectiveness of a project while ensuring it meets its operational objectives. This question helps them gauge your ability to think analytically, make strategic decisions, and manage resources effectively.

Example: “Balancing the financial and operational needs of a project requires strategic planning and constant monitoring. It is essential to start with a robust budget that aligns with the project’s objectives. Regular tracking of expenses against this budget can highlight any potential issues early.

To manage operational needs, it’s crucial to understand the project’s scope thoroughly. This includes knowing the resources required at each stage and ensuring their availability without compromising on quality or timelines.

The key lies in finding an optimal balance between cost efficiency and operational effectiveness. This often involves making informed trade-offs based on real-time data and prioritizing tasks that add maximum value to the project. Effective communication with all stakeholders also plays a vital role in maintaining this balance.”

11. Can you describe a time when your financial analysis led to significant cost savings in a project?

The heart of a Project Financial Analyst’s job is to ensure that the financial aspects of a project are in line and optimized. The question is designed to assess your practical understanding of cost management, and your ability to apply analytical skills to generate cost savings. Essentially, the interviewer wants to gauge if you can think critically, analyze data, and apply your knowledge to positively impact the bottom line of the project.

Example: “In one instance, I was tasked with analyzing the financial viability of a major project that had been experiencing budget overruns. My analysis identified several areas where costs were significantly higher than industry benchmarks.

One key finding was an inflated procurement cost due to a lack of competitive bidding. By initiating a more transparent and competitive bidding process, we managed to reduce these costs by 20%.

Another area was operational inefficiencies leading to high overheads. Implementing lean management techniques resulted in a 15% reduction in overhead costs.

Overall, my financial analysis led to savings of nearly $1 million on this project, highlighting the value of detailed financial scrutiny in project management.”

12. What measures do you take to ensure compliance with financial regulations and standards?

Mastering the intricacies of financial regulations and standards is a must-have skill in a Project Financial Analyst’s toolkit. Employers need assurance that you’re not just familiar with these regulations, but you also have strategies in place to ensure compliance. Your ability to navigate these rules helps the company avoid potential penalties and maintain a positive reputation in the market.

Example: “I ensure compliance with financial regulations and standards by staying updated on the latest changes in laws, policies, and procedures. I regularly attend training sessions and workshops to enhance my knowledge.

In terms of practical application, I use robust financial management systems that have built-in checks and balances. These systems help maintain accuracy and prevent errors or fraud.

Moreover, I conduct regular audits and reviews of financial data. This not only ensures compliance but also helps identify areas for improvement.

Finally, transparency is key. I believe in clear communication with all stakeholders about our financial practices and any regulatory requirements we need to meet.”

13. How have you used financial modeling in your previous roles?

In the role of a Project Financial Analyst, one of your key responsibilities will be to create and interpret financial models. These models are used to predict a project’s financial performance and guide strategic decision-making. By asking this question, hiring managers are trying to gauge your experience and proficiency in creating, using, and analyzing these models, as well as your ability to apply them to real-world situations.

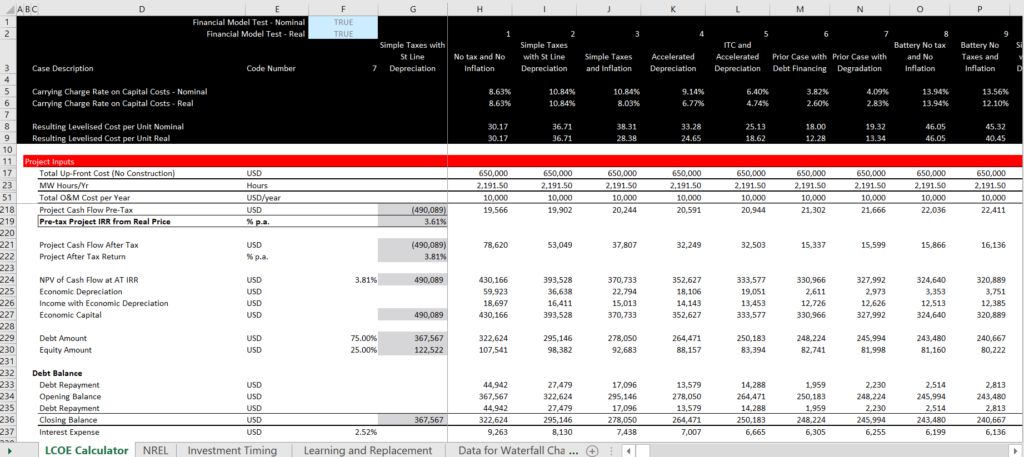

Example: “In the realm of project finance, I have utilized financial modeling to forecast future performance and make strategic decisions. This involved developing comprehensive models that incorporated various scenarios and sensitivity analyses.

For instance, in a renewable energy project, I created a model incorporating capital expenditure, operational costs, revenue projections, and financing structure. It helped us understand the potential return on investment under different scenarios which was crucial for decision-making.

Moreover, I’ve used these models for risk assessment by identifying key drivers that could impact the project’s profitability. This enabled us to develop mitigation strategies proactively.

Overall, financial modeling has been an essential tool in my toolkit for effective project financial management.”

14. Can you explain a situation where you had to make a tough financial decision that was unpopular but necessary for a project?

As a financial analyst, you’re often the one who has to make the hard calls when it comes to budgeting and spending on a project. This question is designed to assess your ability to make those tough decisions, even when they might not be well-received. It’s about demonstrating your financial acumen, your judgement, and your ability to communicate and defend your decisions effectively.

Example: “In a previous project, we were significantly over budget due to unforeseen complications. After thorough analysis, I identified that the only viable solution was to cut costs in certain areas which could potentially affect the quality of our output.

This decision wasn’t popular among the team as it meant compromising on some features initially planned. However, I explained the financial implications and potential risks if we continued overspending.

We eventually agreed on a revised plan, focusing on core functionalities while postponing less critical features. It was a tough call, but it ensured the project’s financial health without jeopardizing its overall success.”

15. How do you determine the financial risks involved in a project and what steps do you take to mitigate them?

Assessing and mitigating risks is a critical part of any financial role. In project-based roles, where budgets and timelines are closely intertwined, understanding how to balance the financial risks with the potential rewards is especially important. This question is designed to see if you’re comfortable with this balancing act, and if you have strategies in place to ensure that your projects stay on track financially.

Example: “To determine financial risks in a project, I conduct a thorough risk assessment that includes identifying potential risks, analyzing their impact and probability, and prioritizing them. This process involves scrutinizing every aspect of the project – from market conditions to resource availability.

Mitigation strategies depend on the nature of the risk. For instance, for risks related to cost overruns, we could implement strict budget controls or contingency planning. If the risk is due to fluctuating exchange rates, hedging might be an option. It’s crucial to monitor these risks continuously throughout the project lifecycle, adjusting mitigation strategies as necessary.”

16. What is your approach to project cost control and monitoring?

Maintaining control over a project’s finances is vital for a project’s success. By asking this question, recruiters want to ensure that you not only understand the importance of budget management, but also have a strategic approach to monitor and control costs. This includes skills such as forecasting, risk assessment, and an ability to make data-driven adjustments as needed. It’s all about ensuring that the project stays financially viable while still meeting its objectives.

Example: “My approach to project cost control and monitoring involves a blend of proactive planning, continuous tracking, and regular reporting.

In the initial stages, I ensure accurate budget development by understanding project scope and potential risks. This helps in setting realistic financial expectations.

Throughout the project, I track actual costs against the budget using financial management tools. This allows me to identify any variances promptly and take corrective action if necessary.

Regular reporting is key to keeping stakeholders informed about the project’s financial status. It also aids in making data-driven decisions for future projects.

Overall, my objective is to maximize efficiency while ensuring that the project stays within its allocated budget.”

17. How do you handle financial reporting deadlines and pressure?

This question is asked because the role of a Project Financial Analyst often involves handling a high volume of work under tight deadlines. It’s important to demonstrate your ability to manage stress, prioritize tasks, and remain detail-oriented even when the pressure is on. It’s a chance to show your potential employer how you maintain your cool and ensure accuracy in a fast-paced environment.

Example: “I handle financial reporting deadlines by prioritizing tasks and planning ahead. I use project management tools to track progress and ensure all requirements are met in a timely manner.

Under pressure, I stay focused and maintain accuracy in my work. I believe that clear communication with the team is key during these times. By sharing updates and potential challenges, we can collectively find solutions and meet our goals.

In terms of handling pressure, I practice stress management techniques such as taking short breaks or deep breathing exercises. This helps me keep a clear mind and deliver quality results despite tight deadlines.”

18. Can you describe your experience with variance analysis and how it has influenced project outcomes?

Financial vigilance is key in project management. Variance analysis is a fundamental tool that helps in understanding the financial performance of your project and any deviations from the budget. By asking this question, prospective employers are keen to understand your proficiency in variance analysis, and how you have used it to influence decision-making and project outcomes. They want to see if you can identify, analyze, and adapt to financial discrepancies in real-time to ensure the project stays on track.

Example: “In my experience, variance analysis is a vital tool for effective project management. It allows us to identify discrepancies between planned and actual outcomes, thus enabling corrective actions.

I’ve used it extensively in financial forecasting and budgeting processes. For instance, on one project we noted significant variances in our labor costs. Upon analysis, we discovered inefficiencies in resource allocation which were promptly addressed.

This not only brought the project back on track financially but also improved overall operational efficiency. Thus, variance analysis has been instrumental in steering projects towards successful completion within budget constraints.”

19. What is your process for conducting a project post-mortem from a financial perspective?

This question digs into your analytical skills and understanding of financial project management. Post-project analysis is a critical component of financial management, as it provides insights into the financial efficiency of the project. By asking this question, the interviewer wants to understand how you evaluate the financial performance of a project, learn from any discrepancies, and use this information to improve future projects.

Example: “A project post-mortem from a financial perspective involves evaluating the budgetary performance of the project. This process begins with comparing actual costs against the initial budget to identify any variances and their causes.

Next, I analyze the return on investment (ROI) to understand if the project was financially successful or not. It’s also important to review the cost-benefit analysis to see if the benefits realized were worth the costs incurred.

Then, I assess how effectively resources were utilized and whether there were any inefficiencies that led to unnecessary expenditures.

Lastly, I compile these findings into a report with recommendations for future projects. This helps in improving financial planning and management in subsequent projects.”

20. How do you balance the need for financial rigor with the realities of a project’s timeline?

Being able to find the balance between fiscal responsibility and time efficiency is a key part of being a successful Project Financial Analyst. Employers want to ensure that you have the ability to maintain strict financial control, while also understanding that projects have deadlines that need to be met. They want to know that you can make sound financial decisions without letting the timeline of the project suffer.

Example: “Balancing financial rigor with project timelines involves a mix of proactive planning and flexible adaptation.

In the initial stages, it’s crucial to develop a detailed budget and timeline, ensuring costs align with project milestones. Regular monitoring helps identify any deviations early on.

However, projects often encounter unforeseen challenges that can impact both finances and timelines. In such cases, I believe in maintaining a level of flexibility within the framework of financial discipline. This could mean reallocating resources or adjusting certain aspects of the project to keep it on track financially without compromising the timeline.

Communication is also key – keeping all stakeholders informed about any changes ensures transparency and builds trust. It’s about finding the right balance between sticking to the plan and adapting when necessary.”

21. What strategies do you use to ensure that project stakeholders understand the financial implications of their decisions?

In the realm of project finance, it’s essential to remember that not everyone speaks the same financial language. As an analyst, your role isn’t just to crunch numbers, but to translate them into understandable information for stakeholders. This question is designed to test your ability to communicate complex economic concepts to non-financial experts, helping them make informed decisions that positively impact the project’s financial health.

Example: “To ensure stakeholders understand the financial implications of their decisions, I use clear and concise communication. This involves translating complex financial data into layman’s terms that are easily understandable.

I also utilize visual aids such as graphs, charts, and presentations to illustrate the potential outcomes of various scenarios.

Moreover, I encourage active participation in discussions about project finances. By asking questions and seeking clarification, stakeholders can gain a deeper understanding of the financial aspects involved.

Lastly, I provide regular updates on financial status and progress, ensuring transparency and keeping everyone informed.”

22. Can you discuss your experience with capital budgeting techniques?

This question is designed to assess your ability to plan, evaluate, and control investments. The hiring manager wants to know if you have the necessary skills to analyze a project’s profitability and make recommendations that align with the company’s financial goals. Your response will provide insight into your understanding of concepts like net present value (NPV), internal rate of return (IRR), and payback period, which are all critical in capital budgeting decisions.

Example: “In my experience, capital budgeting techniques are crucial for making strategic investment decisions. I’ve frequently used methods like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period.

With NPV, I assess the profitability of a project by calculating the present value of cash inflows and outflows. If the NPV is positive, it indicates that the project will generate profit in terms of present value.

The IRR method helps me determine the break-even point of a project. It’s the discount rate at which the NPV becomes zero. A higher IRR usually means a more profitable project.

Finally, the Payback Period helps gauge how quickly an investment can be recovered. This is particularly useful when liquidity is a concern.

These techniques have been instrumental in helping me make informed financial decisions on projects.”

23. How have you used key performance indicators (KPIs) to monitor a project’s financial health?

Utilizing KPIs to monitor financial health is vital in any project. It gives you a snapshot of where you stand and helps you make informed decisions. This question, therefore, is a way for the interviewer to gauge your understanding of financial metrics, your analytical skills and your ability to use data in managing a project’s budget. Your response will give them an insight into your financial acumen and decision-making process.

Example: “In my experience, KPIs are crucial for monitoring a project’s financial health. They provide quantifiable metrics that can be used to assess progress and performance.

One way I’ve utilized KPIs is by tracking actual expenditure against budgeted costs. This helps identify any discrepancies early on and allows for timely corrective measures.

Another important KPI is the return on investment (ROI). It evaluates the profitability of a project and aids in decision-making processes.

I’ve also monitored cash flow forecasts as a KPI. It ensures sufficient funds are available at each stage of the project, preventing delays or disruptions due to lack of finances.

Overall, using these KPIs has allowed me to keep a close eye on a project’s financial status and make informed decisions to ensure its success.”

24. What methods do you use for cost allocation in a project?

Financial acumen is a key part of project management, and hiring managers want to ensure that you can effectively manage and allocate resources. By asking this question, they aim to gauge your understanding of cost allocation strategies and your ability to apply them in a real-world setting. This could involve knowledge of direct and indirect costs, understanding of activity-based costing, or experience with other cost allocation methods.

Example: “In cost allocation, I typically use the Direct Allocation method for direct costs that can be easily traced to a specific project. For indirect costs, I employ the Step-Down Method which allocates costs from supportive departments to operational ones iteratively until all costs are allocated.

Moreover, I leverage Activity-Based Costing (ABC) for more complex projects. This approach assigns overhead costs based on the activities driving these costs, providing a more accurate picture of resource usage.

I also utilize software tools and Excel for tracking and allocating costs effectively. It’s crucial to review and update allocations regularly to ensure they reflect current operations and project requirements.”

25. Can you describe a time when you had to negotiate project finances with suppliers or contractors?

Money matters, particularly when it comes to project management. As a project financial analyst, your role involves a lot of negotiation with suppliers and contractors to ensure that the project gets done within budget. This question is designed to test your negotiation skills, financial acumen, and your ability to manage relationships with external parties. It also helps the interviewer to understand how you make decisions that could impact the financial success of a project.

Example: “In a previous project, we had a supplier who increased their prices midway through the contract. I initiated a meeting to discuss this change and understand their perspective. After evaluating their reasons, I presented our budget constraints and emphasized the importance of maintaining our agreed-upon costs.

We reached a compromise where they maintained the original pricing for the current project, but we would consider a slight increase for future contracts. This negotiation not only preserved our relationship with the supplier but also kept the project within budget. It was a challenging situation that required diplomacy and financial acumen.”

26. How do you ensure that your financial projections align with the strategic goals of a project?

Navigating the complex world of financial project analysis calls for a nuanced understanding of the strategic objectives behind each project. When employers ask this question, they’re looking to gauge whether you have the ability to think beyond the numbers and align your financial forecasts with the larger goals of the project. This is an essential skill in ensuring the financial viability and success of any project.

Example: “To ensure financial projections align with strategic goals, I start by understanding the project’s objectives and key performance indicators. This helps to define the financial metrics that are most relevant.

I then develop a detailed financial model, incorporating variables such as costs, revenues, and risks. Regular reviews of these projections against actual results allow for adjustments as needed.

Communication is also crucial. By maintaining an open dialogue with project managers and stakeholders, I can better understand their expectations and make necessary changes to the financial plan.

In essence, it’s about blending accurate data analysis with effective communication and flexibility to keep financial projections in line with strategic project goals.”

27. Can you discuss an instance where you identified a financial issue before it became a major problem for the project?

This question is aimed at understanding your proactive nature and your ability to identify and mitigate potential risks in the financial landscape of a project. It demonstrates your analytical skills, foresight, and ability to take appropriate action in time to avert a crisis. This is vital in the role of a Project Financial Analyst, where you’re often the front line defense against financial discrepancies that could derail a project’s success.

Example: “In one project, I noticed discrepancies in our projected and actual expenses during a routine financial review. Our material costs were consistently exceeding the budget.

I immediately alerted the team and we discovered that a key supplier had increased prices without prior notice. We renegotiated terms with them to mitigate further losses and also sought alternative suppliers for future needs.

This proactive approach prevented significant cost overruns and ensured the project remained financially viable.”

28. How do you handle financial data confidentiality in your role?

Confidentiality is the cornerstone of any financial role. As a Project Financial Analyst, you’ll likely deal with sensitive data that, if mishandled, could lead to significant consequences for the company. Therefore, employers want to know that you are trustworthy and have concrete strategies for safeguarding confidential information.

Example: “In my role, maintaining financial data confidentiality is paramount. I adhere strictly to the company’s policies and guidelines regarding data protection. This includes only accessing information necessary for my tasks, not sharing sensitive information with unauthorized individuals, and ensuring secure storage and disposal of documents.

I also understand the importance of using encrypted systems and secure networks when dealing with financial data. Regular password updates and two-factor authentication are practices I follow diligently.

Moreover, I stay updated on any changes in legal regulations related to financial data handling to ensure compliance at all times. Breaches can have serious implications, so it’s crucial to be vigilant and proactive in preventing them.”

29. Can you describe your experience with financial audits in relation to projects?

The essence of a financial analyst’s role is to ensure the financial health of projects. Part of this role involves navigating financial audits. The ability to handle audits shows that you understand the financial landscape of a project, you’re able to maintain accurate records, interpret financial data, and can ensure compliance with financial regulations. This question tests your experience in those areas and your ability to mitigate risk.

Example: “In my experience with financial audits, I have been responsible for preparing and presenting detailed reports on project expenditures. This involves ensuring all costs are accurately recorded and allocated to the correct budget lines.

I’ve also liaised with auditors by providing necessary documentation and clarifications. My focus has always been on maintaining transparency and compliance with financial regulations.

Through these experiences, I’ve developed a keen eye for discrepancies, which helps in identifying potential issues before they escalate. Understanding the importance of accuracy and timely reporting is crucial in this role.

Overall, my audit experiences have strengthened my skills in financial management, particularly in relation to project budgets.”

30. What is your approach to continuous improvement in the area of project financial management?

The focus here is on your capacity for growth and development in the realm of project financial management. The financial landscape is always changing, with new software, procedures, and best practices emerging regularly. Employers want to know that you’re not just going to rest on your laurels, but are proactive about staying up-to-date and always looking for ways to improve efficiency and accuracy in your work.

Example: “My approach to continuous improvement in project financial management is threefold.

First, I believe in utilizing the latest technology and software for accurate tracking and analysis of financial data. This allows for real-time monitoring and adjustments as needed.

Next, I focus on regular training and updates on best practices and regulations in financial management. This ensures that my skills and knowledge are always up-to-date.

Lastly, I advocate for open communication within the team. By fostering a culture of transparency and collaboration, we can identify any issues early and work together to find solutions.”

30 Investment Officer Interview Questions and Answers

30 data entry representative interview questions and answers, you may also be interested in..., 20 interview questions every data analyst must be able to answer, 30 screen printer interview questions and answers, 20 most common client service analyst interview questions and answers, 30 benefits consultant interview questions and answers.

Project Finance

Looking for Interview questions in Project Finance, here are the list of top interview questions to prepare for your next Finance interview.

Get Govt. Certified

Certified Project Finance Analyst

Are you an expert ?

Report this question.

47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Digital transformation case with ex-Bain consultant

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

- Browse All Articles

- Newsletter Sign-Up

ProjectFinance →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Private Equity Forum PE

Interviewing For Infrastructure Investment Roles

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

There seems to be a growing interest in infrastructure on WSO and I've seen a number of posts inquiring about the recruitment / interview process for infrastructure specific funds. I've had a number of people help me out in this area so I thought I'd summarize what I've learned with the hope that someone finds it useful. For those who are thinking about recruiting for a buyside seat in the infrastructure space, you've probably realized that there aren't a lot of infra specific prep resources out there. I'm going to try and cover the broad strokes and hit on things that I think are particularly important, but happy to address more specific questions to the extent that I can. Most of what I will focus on is specific to 'why infra' and the case study as I believe these aspects are really what separate an infrastructure process from a more traditional PE interview .

The intention of this thread is not to provide an overview of infrastructure, but I would encourage anyone who hasn't already to take a look these threads:

https://www.wallstreetoasis.com/forums/overview-of-infrastructure-private-equity

https://www.wallstreetoasis.com/forums/renewable-energy-pe-overview

https://www.wallstreetoasis.com/forums/qa-infrastructure-pe-ibd

Know What You're Looking For

The great thing about infrastructure is that its definition has become so broad. Power & renewables, utilities, airports, toll roads, hospitals, data centres. All infrastructure. As a junior you can get a breadth of industry experience without siloing yourself. However, this can be a bit overwhelming especially if you've never worked your analyst years in infra. My advice for anyone looking to jump into the recruitment process is to have conviction in your story and what strategy you're targeting. There are a ton of large cap players who have generalist programs, but there are also a lot of MM /UMM shops who are refining their strategy into more specific segments of the infrastructure space. As you can imagine, if a shop is running lean it can be fairly challenging to be effective in all areas of the infrastructure spectrum and so these places are choosing to get really smart on 2-3 subsectors. The reason I bring this up is because a lot of the household name megafund infrastructure programs still put a big emphasis on pedigree. There are quite a few MM shops that I've seen hire individuals from less traditional backgrounds and if you can demonstrate your interest in a particular industry / strategy, you can probably position yourself favorably in a process where you're not competing against the BB / EB analyst who went to H/S/W. Of course landing a role at Blackstone Infrastructure would be phenomenal, but there is only a small subset of us here who would get their foot in the door. That being said, the learning opportunities at some of the smaller funds is just as good and these should not be overlooked.

Show Interest

If you're interviewing for an investment role, your interviewer is going to want to see that you can put your investor cap on and speaking intelligently about infrastructure. For those who spent their analyst years in infrastructure, expect to get grilled on the specifics of your deals. This is no different than the expectations that would be set in a more traditional buyout shop interview. If you've spent time in the infra already, you also know the lingo. This is where I think people who haven't worked in the space are behind the 8-ball. If you are really interested in infrastructure but haven't worked in the space before, the bar is naturally going to be set lower heading into a conversation. If you spend the time getting to understand the industry and demonstrate genuine interest in a subset of the space you will stand out. I can't tell you how many people I've seen stumble through a response to 'Why are you interested in infrastructure?' or 'Can you tell me what trends you're following in the infrastructure space?'. You'd think this would be a no brainer, but apparently not. If you haven't worked in infra and can't demonstrate that you've spent any time reading up on the industries that interest you, what reason do I have to push you forward over someone else who can probably hit the ground running? If I see an analyst from a non-related industry group who can talk passionately about infrastructure I'll generally walk away feeling good about that interaction. It's no secret that ambition and curiosity go a long way.

Modelling Test / Case Study

This is where I think the interview process really starts to diverge from your traditional buyout process and where I see most candidates struggle. There are a few different mutations of these case studies, but they generally aim to test the same skills. Before I jump into the specifics, I want to highlight that some infrastructure funds will administer a case study that is akin to what you'd receive at a buyout shop (i.e. your LBO modelling test ). The purpose for doing this is that they can assess one's excel capabilities / financing knowledge and not handicap anyone for not having worked in infrastructure before. For those of you who spent your analyst years grinding through project finance and tax equity models, it is worth mentioning that you may want to practice a few of the more traditional LBO-style case studies. While the modelling isn't hard, it is a bit different than what you're used to doing, and under a time crunch you want to be sure that you aren't putting yourself at a disadvantage.

Case Study Type 1: Traditional LBO

As mentioned above, some of the bigger funds have been known to administer the LBO style modelling test. Typically you are provided with 3-4 hours to complete this test where you would be asked to build a 3 statement LBO model accompanied by a powerpoint deck. There are a ton of guides out there on how to complete these and numerous threads with individuals trading old cases.

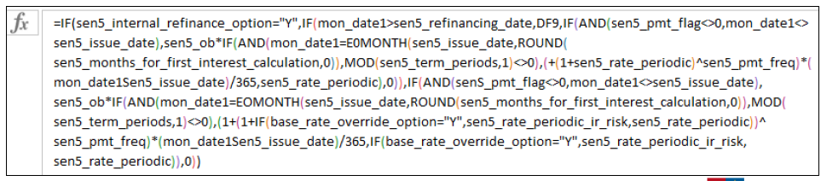

If you've never built an infrastructure model a lot of what I'm about to say isn't going to make any sense. Totally normal, but you have some work to do. Ed Bodmer has a video for basically everything project finance / infrastructure modelling related. You can find his resources here: https://edbodmer.com/project-finance-exercises/

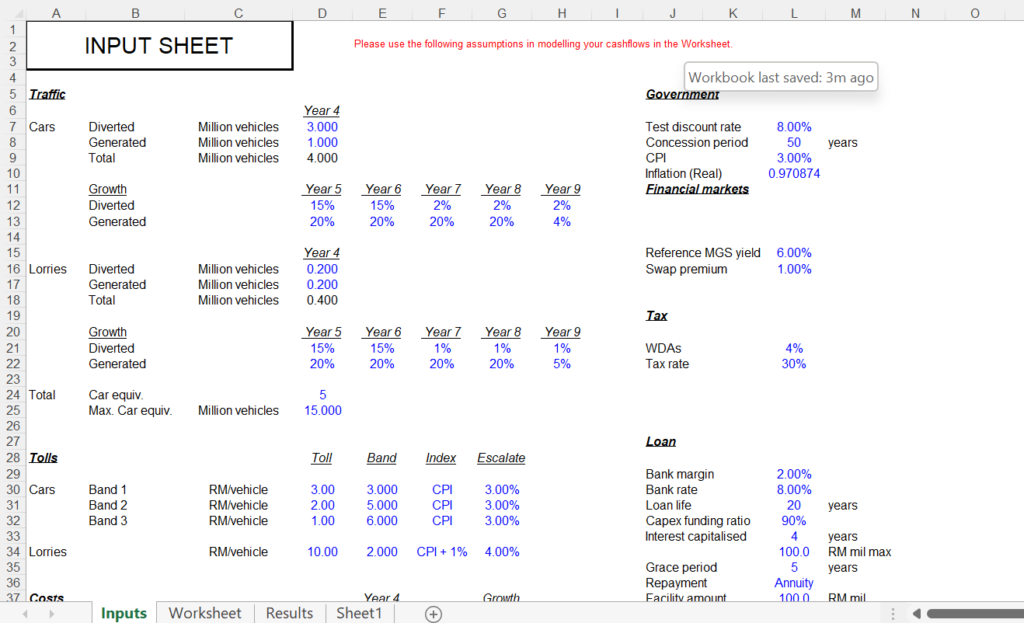

Case Study Type 2A: Short Form Construction Stage Infrastructure Model

This is a fairly common infrastructure modelling test where you will also be provided 3-4 hours to complete a model and presentation. Within this type of case, there are three mutations of a case study that I've seen. The first mutation, what I'll call "Type 2A" is a construction stage, fully/partially contracted infrastructure asset. In this type of case study you will be given some or all of the following assumptions and be asked to model out returns. This is an example of an actual prompt I received for an infrastructure test (I can't remember the exact numbers so I'm using dummy figures to get my point across)

- Assume you are a developer who is constructing a solar asset with a 1 year construction timeline and an asset that will have a 30 year useful life

- The cost to construct this solar asset is $500mm spread evenly over a 12 month period

- The project has a nameplate capacity of 200MW and the asset will expect to produce power at a gross capacity factor of 30%. Assume degradation of 0.25% per year.

- The asset has arranged a 15-year power purchase agreement at $100/MWh without any escalation. Assume the post-contracted pricing for the power produced after the expiry of the PPA is $85 in real 2022 dollars escalated at inflation.

- Opex for the project is contracted under a full wrap EPC at $25mm per year escalated at inflation.

- Assume a tax rate of 25%

- Assume the asset is depreciated on a straight line basis over the useful life

- Assume that you procure a construction facility at 70% gearing, which will be refinanced by a long-term debt facility sculpted to contracted cash flows at 1.30x DSCR (interest rates for the facilities will typically be provided)

Based on this information, you would be asked to build out the construction spend profile, the construction debt draw downs, an operating model consisting of the generation profile, tax & depreciation, sculpt the long term debt that is used to refinance the construction loan, and calculate returns / sensitivities . The amount of time you are allotted will vary based on the complexity of the prompt. This type of test can also be based on a concession based asset with an availability payment (e.g. a toll road concession P3 with a government).

Case Study Type 2B: Short Form Operating Stage Infrastructure Model

This version of the case study is a bit easier. Generally the assumptions are very similar to what you'd get provided above, except you are modelling out the acquisition of an operating asset. In prompts like this that I've seen, you'll typically be given the assumptions required to build out the operating model, and then will get asked to sculpt a back leverage financing to get to some form of a post-tax levered return. Based on the assumptions provided you'll get asked to back into what you would pay to acquire the equity in the project given a return requirement of xyz%.

Case Study 2C: Long Form Infrastructure Model

This version of the case study will typically span over a weekend where you'll have 48 hours to build a model and prepare a more fulsome set of presentation materials. Basically a mock IC presentation. In instances where these prompts have been issued, it's typically the build of a financial model to value a publicly traded name. In order to occupy two days of someone's time, you generally need quite a bit of information and so going with a public name is easier. In this instance you generally won't have to build an infrastructure-like model described in 2A/2B above, and can focus on a more traditional DCF / public comps analysis . Generally the infrastructure names that you'd be given are operating platforms so you are valuing a broader company as opposed to a specific asset. I've actually seen a fund prompt candidates with a 1 week timeline to complete a case with materials comprising of 20+ slides. This is rather excessive and definitely not the norm.

Career Longevity

Not specific to the interview process, but I thought I'd provide some additional color on why I think this space is great to be in from a career longevity perspective. Infrastructure is seeing significant growth right now, and there are various pockets that can expect to benefit from decade long tailwinds, particularly in light of medium-long term carbon reduction targets. From a macro lens, the broader sector that underpins your job is incredibly stable, which is great to hear for us risk-averse PE lemmings. From a micro/job specific lens, because the technical skillset you develop in infrastructure is a bit more niche, it becomes less common for these platforms to develop a two-and-out program. It's a lot more efficient to train up an associate and promote them. You'll also find that a lot of infrastructure funds don't often hire MBA grads for this reason and typically promote from within. I've seen a lot of mid-to-senior level lifers who never pursued the MBA because they were just promoted directly. This is a trend that I think is becoming more common in buyout funds as well, so maybe not an infrastructure thing.

I'll pause here for now, but hopefully some of you who are interested in pursuing an investing career in infrastructure find this useful. Happy to answer any questions or expand on areas which I may have glossed over.

Thank you so much for this write up, very helpful.

This is incredibly helpful thanks for writing. Wondering if there is some overlap between industrial and infrastructure funds and can industrial bankers recruit for infra funds?

Happy it helped. Yes there are certainly some overlaps especially given the broadening of what we define as infrastructure. Funds who invest in core plus opportunities will also get looks at infrastructure-linked businesses which might see overlap in industrials.

Do you think it's possible for someone who works in secondary/co-investing space in infrastructure to go to a more direct role if they have some modeling experience or banking is basically required?

Fantastic writeup, I always try to read everything infra related on WSO .

One question I had, and this is going to be somewhat difficult to answer since infra overall is so broad, but what are some ways to better follow trends about what's going on in the space? Obviously each subsector (healthcare, telecoms, power/utilities, transportation, etc.) is going to be drastically different, but what are some news sources or anything of that nature that you follow to learn more about the way things are going? It's a niche enough space still that articles in WSJ and whatnot are pretty rare.

Thanks, I really appreciate that. I've been spoiled if I'm being honest - I had access to Infrastructure Investor and InframationNews since my analyst days which is where you get a lot of information on deals being closed and funds being raised. I also had access to a lot of proprietary thought leadership through my previous role, and in my current role banks are always pitching ideas and sending industry reports to us. I empathize with the fact that there isn't a lot out there that is free... if I had to try and find trends or something along those lines without my fund's resources at my disposal, I think the first place I would look to are investor presentations from one of the larger funds that are publicly traded (i.e. Brookfield, Macquarie , etc.). Typically these larger funds are first movers and trend setters so they'd be a good starting point outside of scrubbing the generic news outlets as you've mentioned.

Thanks for the write up.

Any thoughts on the challenges and best approach to moving into an Infrastructure Equity Fund from a large international Sponsor/government procurer? Particularly at Director/Senior level?

Not particular to infrastructure, but I think the general rule of thumb is that as you become more senior it becomes increasingly challenging to move roles especially if you are looking transition into something different. It's somewhat difficult for me to opine on your situation because there are a number of different roles within government functions that facilitate the procurement process on infrastructure assets. Without any context I would say that you have to play to your strengths. I've seen a number of individuals at a more senior level move from transaction finance-type roles at advisory firms or government entities to LMM infrastructure funds, albeit taking a haircut on title. Depending on the role I think there is some overlap in skillset when it comes to managing workstreams, marking up legal documents, reviewing P3 financial models , etc. To make a direct lateral move at a director level, I think you'd have to demonstrate your ability to source and lead transactions, which is not realistic coming from, what is my interpretation of, your background.

Great thread and a great space to be in.

You are a king and a beast bro, started process a few days ago and needed EXACTLY this :)

Hi, really appreciate you making this, I have a bit of a unique situation in that I'm not coming from an industrials or infrastructure coverage group, however, from a LatAm group at a BB , I work frequently with infra since this is the main line of business in the region so I understand PPPs and all the related infra jargon and regulations, I also speak the relevant languages for the region, I'm a non-target though, so what do you think would be the best form of entry for someone like me? Thanks again for making this post.

I think you're in a good spot - being in a generalist group isn't a bad thing, especially if you're interested in pursuing infrastructure and have gotten infrastructure experience. You've got a BB brand name on your CV and it sounds like you speak Spanish, which definitely works in your favor. I wouldn't worry about being a "non-target". Sure it might be harder to get an interview at some top MF's, but it isn't impossible and there are a ton of funds who would give you a look based on what you've described.

Hey, thanks for making this! I'm starting a process soon and in one of my initial interviews, was told to prepare paper/pen/calculator. Do you have any idea what kind of math questions might be asked in an infra fund interview as opposed to corporate PE?

Only thing I can think of is a paper LBO , but usually you're asked to do mental math here. Not sure, sorry!

Really appreciate the write-up! It was very insightful. I’m curious if it’s common/ difficult for energy/ Houston IB analysts from top BBs / EBs to pursue an exit into the broader Infra funds that you mentioned. I am interested in the feasibility of transitioning into Infrastructure on the buy-side.

Can't speak to the feasibility or the difficulty of making that move because I haven't gone through it, but I have seen this done on multiple occasions. Anecdotally it's been analysts from top banks in Houston joining large cap infrastructure platforms. There are two factors that come to mind when I think about why this is: 1) there is likely a smaller pool of energy bankers interested in infrastructure and so naturally the pool of energy bankers represented in infrastructure is going to be lower and 2) large cap platforms that recruit on cycle are generally more open to bankers from different industries so long as they check a number of the boxes (top school, grades, brand name bank, etc.). Off the top of my head I can't think of anyone in my circle who has made that move to a MM fund, but nothing is impossible.

Thank you for the response and information! Looking forward to starting off my career in HOU IB and exploring from there.

Have seen this move multiple times (from MM-ish banks so assuming BB / EB move would be simpler). Echoing OP's comments, having that energy (not renewable) skillset is not that common at top infra shops but still there (look at Brookfield/GIP associate classes). Also, funds are still looking at midstream opps given potential dislocation due to ESG -related outflows from the sector and the need to ensure energy resilience in the U.S.

Do infra funds hire MBB if you can model LBOs+demonstrated interest?

This definitely isn't common and I personally only know one person who has moved over from MBB to a mid-market infra shop. I think infrastructure investing generally places less focus on operational strategy, which is where an MBB consultant can probably provide more value. I also just did a quick Linkedin search for anyone living in NYC who currently works at the usual large cap suspects, who has identified that they work on the infra platform, and who was previously employed at McK, BCG and Bain and didn't see anyone who went Consultant/BA > ASO1. Would defer to anyone else who has made different observations. All that to say though I don't think it's an impossible move to make - infrastructure isn't rocket science and with adequate preparation and networking I don't see any reason why you wouldn't be qualified to do the job.

FWIW, I've met several people who are coming from renewable energy consultancies, who dealt directly with buy-side infrastructure shops make the jump. Maybe a case to be made if you worked on that specific niche within MBB /leveraged a client relationship to make that jump

Thanks for the write up. Have you seen people make the jump to infra funds from Public Finance ? My team focuses on P3 projects in the transportation space mostly.

Love seeing infrastructure get some love on this forum. Especially a high-quality and accurate write-up. I work in renewables infra and it's a super cool space.

Good write up. Not to hijack but am joining an MF's infra fund this summer and happy to answer any questions as well. Currently AN2 at a BB in NY in a non-infra coverage group.

Hey, do you mind if I PM you a few questions?

let's keep it public (and my account private), happy to help in this thread!

How do you transfer from a non-infra coverage group to an infra fund? I would think they'd only hire from P&U/Transpo groups. How did you sell them?

many of the MFs hire from all coverage groups since their mandate is so broad, especially with the explosion of digital infra. for example, if you look at team pages you'll see a lot of people with TMT / tech investing ( warburg , silver lake , etc.) backgrounds. i imagine those with narrower mandates (e.g. pension funds) are more focused on traditional infra backgrounds.

in terms of selling them, i think if you show an interest in the macro space, as well as an understanding of what infra is (and isn't) you should be good to go. at the end of the day, a platform is a platform, whether in infra, consumer, healthcare, or any other space.

Thanks for keeping this public. The big question a lot of us will have is what is the general comp structure for infra at the MFs (assuming you interviewed at more than one and can provide some comparisons)?

same as PE at the associate level for MFs (~350k AS1). i don't know how carry compares as im not senior enough, but there are two offsetting factors:

a) returns are structurally lower, which lowers the carry pool

b) AUM per IP tends to be higher (my fund has close to $1bn), which increases your carry allocation

so could go either way.

What have you seen in terms of people transitioning from project finance to infrastructure PE? Are there a lot of people with that background?

I most likely have an interview for a 2022 FT role with for an Infrastructure group coming up. I am currently an undergraduate student with very little/no experience in infrastructure. I was told to be prepared for technicals and a possible case study.

The case prep seems like it is targetted towards experienced hires. Any changes to your advice for an undergrad?

I just went thru an infra PE process (got offer) and can help you out with a mock interview + some general advice.

PM me if you're interested, no pressure.

Hello Lamron,

Will be you able to extend this offer to me. I am in the infra recruiting process

I would say that it would probably be pretty difficult. Typically most post-MBA associate / senior associate roles are given to candidates who have previous infrastructure, PE or relevant M&A experience. Typically on any given mandate, the extent to which we would interact with a group like yours is to lock in a rate hedge on a financing or hedge fx on something cross-border. Someone reviewing your profile at an infrastructure fund is likely going to come to the conclusion that there isn't much overlap between your role and what you would do at an infra fund. Never say never though!

I have a first round with a secondary infra group and this helps out a lot. Even if I don't get the role this definitely helped me get a better idea of what infra is like so thank you, cheers.

Thanks for the insightful discussion! Do you have any recommendation on good source to learn on infrastructure modelling?

There are quite a few resources out there offered by the training platforms, but they're kind of expensive. F1F9 and Corality are popular ones and I think offer individual seats for in-person group lessons where they'd tour major cities and run 3-4 day programs. This was pre-pandemic though so I'm not sure if they still run these.

Separately, the Ed-Bodmer resource which I've linked in my original post is about as good as it gets when it comes to free modelling resources. Ed covers basically every topic under the sun and is a great place to start.

Ed Bodmer is good with some neat Excel tricks (ALT + EIS being one) but a bit disorganized. When I really wanted to get good at modelling, I remember I just went through a ton of his videos and took notes - treated it like a course (in my first year of banking).

No better practice than actually being in the model with a MD coaxing you on the phone though

Good thread. Biased because I wrote out most of the answers here but would add this as a link in regards to some hopefully helpful discourse on framing valuation with an infra asset: https://www.wallstreetoasis.com/forum/private-equity/exit-multiple-term…

Thanks for the very insightful post! What do you think are the most critical skillsets to develop/have for someone who wants to break into infrastructure?

Also, do you mind to share how's the day to day like for infrastructure investment professional? E.g. what do you don daily basis besides working on financial model?

I would love to know about the WLB across the different types of infra funds.

infra IB tends to be quite sweaty due to the heavy modelling and legal and technical processes involved. Likewise I’ve seen top fund such as KKR /stonepeak to top pension funds just as OTPP and omers working insane hours constantly which is probably not something I find personally sustainable.

however I’ve seen people at lesser known pension funds, smaller PE shops , infrastructure arms of insurance companies, sovereign wealth funds have great hours with less pay. Also potentially in the infrastructure private debt space (although know less about this area)

would love to hear your thoughts

Good question - I would say that some of the reasons you've listed that cause infra IB to be sweaty are also applicable to the buyside. The WLB at any given fund is going to almost always correlated directly to strategy / appetite to deploy capital and there are pros and cons to this. If you work at a fund that is trying to aggressively deploy capital are you going to get a great experience? Yes, mostly likely. Will you get paid a lot? Probably otherwise how will these places attract talent. Are you going to work a lot? You bet. Is it sustainable? Depends, but I would agree with you and say probably not...

Some of the lesser known pension funds likely don't have the capacity to do direct investing and do mostly co-invest/fund investing which is less demanding in comparison to diligencing an actual business. Smaller PE shops tend to look at things with a bit more hair on them and don't necessarily do as many deals which could result in better hours. SWF - depends on the fund, I've heard some groups are sweatier than others. All else equal credit in general tends to have better hours based on my understanding.

Everyone is going to have different career and life objectives - the fact of the matter is if you want a good experience in the infra space you're probably going to have to grind for a few years. My personal view on this is if you want a long term career in infra, I think you should put in 4-6 years and get a solid experience and brand. If you really like what you're doing you can stick it out and make great coin, but if you decide you want more WLB you can take a step back and find another role in the space with a strategy that isn't as demanding on resources.

Thanks for the write-up. Can you speak about exits from MF /UMM infra funds? If the associates find out later they want to do generalist PE or HF instead, how difficult would the transition be?

It really depends on the platform you work in. As an extreme example, if you're working in a sector specific platform that only invests in renewables you may have a hard time moving to a corporate PE / HF role because the way you would evaluate those types of investments is different. If you worked in a generalist role where the definition of infrastructure and private equity are blurred, you likely won't encounter any issues trying to make the switch (I've seen it happen many times).

Any chance you could shed some light on OMERS / OTPP Infra teams / anything you know about them? Would greatly appreciate it.

Happy to provide some high level thoughts based on what I've heard. Anyone with better information please feel free to correct me, and don't quote me on any of this as it could be outdated.

OTPP's infrastructure team is primarily based out of Toronto and London, UK. I would say they are probably the most active out of all of the Canadian pension funds on the direct side, and if I was juggling offers between the Canadians, I'd take it over OMERS or CPPIB. I say this because OTPP are generalists on the infra side whereas CPPIB bifurcated its renewables/energy transition investments and their core infra group, so your sector experience may be handicapped; the latter group also has major toll road concentration which could dictate sector focus in the near-medium term if you joined them. I still think OTPP buckets infra and NR into the same team, but I don't have any purview into the nuances of their team structure to be able to comment on what kind of exposure you'd get. If you plan on being in Toronto they are also moving from North York to downtown if you ascribe any value to that. Based on my understanding, I think OTPP is also more advanced in its approach to managing its portfolio with the advancements they've made in building their value creation team.

OMERS also does a lot of direct investing in the infra space, but their platform isn't as robust as OTPP. They have also had quite a bit of turnover in recent time which probably isn't a good thing. They have a strong presence in NYC as well. I don't believe they have the equivalent of a value creation team and IP's are responsible for asset management to my knowledge. Apparently OMERS also used to offer carried interest on the funds they managed but I've heard through the grapevine that this structure may be changing.

If you have any specific questions I can try to be more direct, but hopefully this gives you something to chew on for now.

Thanks so much - just sent you a DM!

On the topic of the Canadians, do you happen to know anything about PSP's infra practice?

Anyone interested in sharing costs on WSP project finance course? Heard it’s pretty good

Would you be willing to share you answer to the sample model test you outlined above?

Hey, do you have an opinion on infrastructure debt investing at a place like Allianz GI?

Awesome post! Infrastructure PE has always been a dream of mine but for now I’ve been working in DCM commercial real estate. Do you think I could transition to infra PE after completing my MBA ? I’ve heard that real estate modeling is similar to infrastructure modeling. My firm specializes in industrial, large retail, and multi family properties. Would appreciate any advice! Thank u.

Thanks - yes there are similarities to real estate modelling. You don't really see a lot of post- MBA hiring at the low to mid market funds because these places don't have the capacity to train you. Some of the larger mega funds and institutional infrastructure investors have grad programs which would be worth applying to.

losing interest Some of the larger mega funds and institutional infrastructure investors have grad programs which would be worth applying to.

are you referring to post- MBA type roles (i.e., Aso)?

Which valuation method can be used to best value infrastruction assets and how does that method differ from PE

Hi, does anyone have a viewpoint on asset management roles in these infrastructure funds?

This is a solid post for anyone that has an interest in infrastructure and needs a quick 101 on the industry.

One thing I would add in the "Know What You're Looking For" section is knowing the differences between the different infrastructure strategies, namely Core / Core+ / Value-add / Opportunistic, and how investing in those strategies look and change between the mega-funds, UMMs and true MMs .

On top of that, do you want to solely focus on a specific region? Working at a North American-only firm will provide a vastly different experience than a firm that targets investments globally.

Why I like infrastructure:

- Tangible assets that create tangible effects on a population / society (i.e. a waste collection business).

- Potentially complex regulatory factors (i.e. local/state permits, sector-specific permits, government agencies as counterparty)