Year in Search 2022: All about new possibilities

Dec 08, 2022

[[read-time]] min read

For the past 22 years, Year in Search has provided a unique look into what we all cared about, what inspired us and intrigued us, all over the world. This year was no different.

2022 was defined by our collective search for change and new possibilities. After two years of uncertainty we re-emerged stronger, empowered and sought out ways to become better versions of ourselves. We challenged ourselves and asked personal questions like, “can i change?”

Global search interest in “how to change myself” and “how to be better” reached an all-time high this year. Trending searches ranged from changing jobs to ways to improve ourselves and our relationships. For the first time in Google Trends history, the world searched for “happiest jobs” more than “happiest cities.” And people searched “how to be more present” and “how to be a better friend” more than ever. We sought changes big and small: more than ever before we searched for tips on how to speak up more, and we also looked for tips on evolving our personal style.

But in the midst of this personal growth we faced global conflict and natural disasters that tested our resolve. In these moments we came together as a global community and looked for ways to support each other by searching for “how to help Ukraine'' or “how to help Puerto Rico.” Seeing the strength and determination that we had in these moments inspired us to ask questions like “how to be fearless” and “can i create change.”

As the year comes to a close, take a moment to look back, reflect and celebrate all the moments this year that challenged, inspired and enabled us to grow. To watch the film and see all the trends that defined 2022, check out our Year in Search website .

Related Article

Year in Search 2022: See the top trendi…

Join us in looking back at the moments and trends that defined 2022 with Year in Search.

Related stories

Ai overviews: about last week.

Here’s what happened with AI Overviews, the feedback we've received, and the steps we’ve taken.

Doodle for Google’s top 55 artists share their wishes for the future

Generative AI in Search: Let Google do the searching for you

A new Mother's Day gift experience on Google Search

Celebrate spring with floral illustrations on Google Books

Find more sustainable ways to get around, with new Maps and Search updates

Let’s stay in touch. Get the latest news from Google in your inbox.

This year’s roundup of the top Google searches includes super local trends

If you’re in the us, google can tell you what the biggest search terms were in your specific area..

By Jon Porter , a reporter with five years of experience covering consumer tech releases, EU tech policy, online platforms, and mechanical keyboards.

Share this story

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24273058/local_lists_keyword_post_02.jpg)

Let’s jump straight to the chase: “Wordle” was Google’s most searched term globally in 2022. The stat was revealed as part of Google’s annual Year in Search report, which highlights the top trending search terms in both individual countries as well as globally. This year, Google is offering an even more granular look at searches in the USA with a new hub that lets you type in your city or ZIP code and see what people in your area specifically are searching for.

As you might expect, the year’s top searches were dominated by terms relating to 2022’s big news events, with “Ukraine” and “Queen Elizabeth” both featuring in the top five. But there were also a surprising amount of searches for specifically Indian (and presumably cricket) sporting fixtures, with “India vs England,” “Ind vs SA,” and “India vs West Indies” all featuring in the top 10. Remember, these are global search rankings, which makes it all the more impressive that Indian-related searches are so highly represented.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24273072/Screen_Shot_2022_12_07_at_2.57.42_PM.jpg)

Another couple of interesting tidbits: Will Smith, Chris Rock, and Jada Pinkett Smith take up three of the five top five searches for actors after the events at the Oscars this year. And interestingly, when it comes to films, DC took two spots out of the top five (thanks to Black Adam and The Batman ) compared to just one Marvel movie ( Thor: Love and Thunder). That said, Thor still took the top spot.

Also, shout out to the UK, where Google’s search data suggests people were absolutely obsessed with the Queen’s death, with “Is the Queen dead?” “When is the Queen’s funeral?” and “Where will the Queen be buried?” making up three of the top five most Googled questions. In case you’re interested, “How old is Diana Ross?” came in fifth, presumably after the ex-Supremes singer performed at both Glastonbury and the Queen’s Platinum Jubilee celebrations (she’s 78, in case you were wondering).

Anyway, I thoroughly recommend having a poke around the results, both globally as well as locally in the US . If nothing else, it’s a fun reminder of the frankly obscene amount of stuff that’s happened in 2022, which I feel confident in dubbing the longest year that has ever existed.

This is Lunar Lake — Intel’s utterly overhauled AI laptop chip that ditches memory sticks

Here’s jensen huang signing a woman’s chest, palmer luckey is now selling pixel-perfect ultrabright magnesium game boys for $199, x has new rules that officially allow porn now, the at&t and verizon outage that cut off phone calls is over.

More from this stream Wednesday’s Top Tech News: Chips born in the USA

Your home security system may now be a little smarter, now telegram users don’t need a phone number — they can buy a fake one with crypto, former theranos executive sunny balwani is sentenced to almost 13 years in prison, indiana sues tiktok for misleading users on child safety and data security.

Bobbie Thomas shares her summer must-haves — all for 50% off

- Share this —

- Watch Full Episodes

- Read With Jenna

- Inspirational

- Relationships

- TODAY Table

- Newsletters

- Start TODAY

- Shop TODAY Awards

- Citi Concert Series

- Listen All Day

Follow today

More Brands

- On The Show

- TODAY Plaza

Google just released its top searches for 2022

It's that time of the year when everybody is looking back on the past 12 months, and Google is doing just that with its 2022 Year in Search report.

The tech company on Dec. 7 released the list that highlights the top trending searches on Google in the United States over the last year.

Americans took to the search engine to learn about high-profile pop culture stories (like the Johnny Depp/Amber Heard defamation trial) and celebrity deaths (including Betty White , Bob Saget , Queen Elizabeth II and Anne Heche ). Google users were also eager to hear about product shortages , Roe v. Wade , gas prices and COVID-19.

In addition to its top 10 most-searched items, Google also released top searches in 8 specific categories, like athletes and TV shows. Check out the full lists below!

- Election results

- Betty White

- Queen Elizabeth

- Mega Millions

- Powerball numbers

- Jeffrey Dahmer

- Queen Elizabeth passing

- Hurricane Ian

- Texas school shooting

- Will Smith Oscars

- Johnny Depp verdict

- Johnny Depp

- Amber Heard

- Antonio Brown

- Anna Sorokin (Delvey)

- Andrew Tate

- Adam Levine

- Serena Williams

- Joseph Quinn

- Jada Pinkett Smith

- Ezra Miller

- Miles Teller

- Ashley Judd

- Aaron Judge

- Brittney Griner

- Shaun White

- Baker Mayfield

- Kamila Valieva

- Aaron Carter

- Olivia Newton John

- Leslie Jordan

- Taylor Hawkins

- Thor: Love and Thunder

- Top Gun: Maverick

- Everything Everywhere All at Once

- Jurassic World Dominion

- Black Panther: Wakanda Forever

- Turning Red

Musicians and Bands

- Mary J. Blige

- Kendrick Lamar

- Ricky Martin

- Foo Fighters

- Stranger Things

- The Watcher

- Inventing Anna

- House of the Dragon

- Moon Knight

- Yellowstone

- The Summer I Turned Pretty

- Obi-Wan Kenobi

- She-Hulk: Attorney at Law

- We Don’t Talk About Bruno —Encanto

- Surface Pressure — Encanto

- Jiggle Jiggle — Duke & Jones and Louis Theroux

- Unholy — Sam Smith and Kim Petras

- As It Was — Harry Styles

- Running Up That Hill — Kate Bush

- Glimpse of Us — Joji

- About Damn Time — Lizzo

- Anti-Hero — Taylor Swift

- What Else Can I do — Encanto

Sports Teams

- Philadelphia Phillies

- Boston Celtics

- Golden State Warriors

- Cincinnati Bengals

- Los Angeles Rams

- New York Rangers

- San Diego Padres

- San Francisco 49ers

- Cleveland Guardians

- Calgary Flames

- God of War Ragnarök

- Overwatch 2

- Cincinnati Chili

- Marry Me Chicken

- Quick pancake

- Green goddess salad

- Jennifer Aniston salad

- Grinder sandwich

- Bella Hadid sandwich

- The Bear spaghetti

- Gas prices near me

- At home COVID test near me

- Voting near me

- Early voting near me

- PCR test near me

- COVID booster near me

- Easter egg hunt near me

- Where to vote near me

- Concerts near me

- n95 masks near me

Definitions

- Who is Andrew Tate?

- Who is winning the election?

- Who is the king of England?

- Who is the watcher?

- Who is Alex Jones?

- Who is Jeffrey Dahmer?

- Who is next in line for the throne?

- Who is Amber Heard?

- Who is Aaron Carter?

- Who is in NATO?

How to help...

- How to help Ukraine?

- How to help Ukrainian refugees?

- How to help abortion rights?

- How to help Ukraine army?

- How to help Uvalde?

- How to help Hurricane Ian?

- How to help Puerto Rico, Hurricane Fiona?

- How to help a dry cough?

- How to help restless leg syndrome during pregnancy?

- How to help toddler with cough?

How to pronounce...

- Diesel shortage

- Baby formula shortage

- Tampon shortage

- Adderall shortage

- Sriracha shortage

- Food shortage

- Cream cheese shortage

- Avocado shortage

- Lettuce shortage

- Epidural shortage

- Disneyland tickets

- Bad Bunny tickets

- Taylor Swift tickets

- Phillies tickets

- Blink 182 tickets

- Black Panther: Wakanda Forever tickets

- Paul McCartney tickets

- San Diego Padres tickets

- Coachella tickets

- Steve Lacy tickets

Hum to Search: Top hummed songs

- Everybody (Backstreets Back), Backstreet Boys

- Never Gonna Give You Up, Rick Astley

- We Don’t Talk About Bruno, Encanto

- Enemy, Imagine Dragons

- Seven Nation Army, The White Stripes

- World’s Smallest Violin, AJR

- Toxic, BoyWithUke

- Heat Waves, Glass Animals

- abcdefu, Gayle

- Industry Baby, Lil Nas X

Google Maps: Top searched cultural landmarks

- Skinwalker Ranch, Gusher, Utah

- Public Art “Urban Light”, Los Angeles, California

- Korean Friendship Bell, San Pedro, California

- Tree of Life, Forks, Washington

- Chinatown Gate, Boston, Massachusetts

- Duke Paoa Kahanamoku Statue, Honolulu, Hawaii

- Japantown Peace Plaza, San Francisco, California

- Mrs. Doubtfire’s House, San Francisco, California

- Dignity Statue, Chamberlain, South Dakota

- Mill Mountain Star, Roanoke, Virginia

Google Maps: Top searched exhibits

- Van Gogh: The Immersive Experience — Washington DC, Washington D.C.

- Illuminarium Atlanta, Atlanta, Georgia

- Van Gogh: The Immersive Experience — Seattle, Seattle, Washington

- Dinos Alive Los Angeles, Los Angeles, California

- Titanic: The Artifact Exhibition, Las Vegas, Nevada

- Van Gogh Raleigh: The Immersive Experience, Raleigh, North Carolina

- Van Gogh: The Immersive Experience — Boston, Boston, Massachusetts

- Van Gogh New Orleans: The Immersive Experience, New Orleans, Louisiana

- Jean-Michel Basquiat: King Pleasure, New York, New York

- Van Gogh Albany: The Immersive Experience, Albany, New York

Google Maps: Top searched scenic spots

- Dumbo — Manhattan Bridge View, Brooklyn, New York

- Golden Gate View Point, Mill Valley, California

- Bellagio Fountain, Las Vegas, Nevada

- Statue of Liberty View Point, New York, New York

- Horseshoe Bend, Page, Arizona

- Great Smoky Mountains Railroad, Bryson City, North Carolina

- Gatlinburg SkyBridge, Gatlinburg, Tennessee

- PA Grand Canyon, Wellsboro, Pennsylvania

- Beverly Hills Sign, Beverly Hills, California

- Glacier Point, Yosemite, Valley, California

Chrissy Callahan covers a range of topics for TODAY.com, including fashion, beauty, pop culture and food. In her free time, she enjoys traveling, watching bad reality TV and consuming copious amounts of cookie dough.

‘Real Housewives’ star Dina Manzo’s ex convicted in mob assault on her new husband

Lady Gaga shuts down pregnancy rumors

‘When Calls the Heart’ actor Mamie Laverock opens her eyes after falling 5 stories, family says

Evangeline Lilly explains why she's stepping away from acting in new message

Pop culture.

‘Peaky Blinders’ film starring Cillian Murphy officially in the works

Alec and Hilaria Baldwin announce new TLC reality series

Michael Richards reveals his son’s favorite ‘Seinfeld’ character

Sean ‘Diddy’ Combs sells stake in Revolt, the media company he founded in 2013

TODAY's 'youngest viewer' returns to the show 30 years after TV debut

Brooke Shields is done working for ‘everybody else.’ Her hair care line aims to help women ‘over a certain age’

- global">Global

- indonesia">Indonesia

- united_kingdom">United Kingdom

We got you covered. Don’t miss out on the latest news by signing up for our newsletters.

By subscribing, you agree to our Terms of Use and Privacy Policy .

Download Our App

- dark_mode" data-event-name="menu_navigation" data-custom-event="null" class="dark-mode icon-type d-none d-lg-flex nav-item">

- login">Login

- sign_up">Sign Up

- search" data-event-name="menu_navigation" data-custom-event="null">

- Food & Beverage

- Movies & TV

- Tech & Gadgets

- Brand Ranking

- Brand Directory

- Hypebeast100

What the World Searched is Highlighted in Google’s Year in Search 2022

Led by “wordle,” “ukraine,” “queen elizabeth,” and “jeffrey dahmer.”.

As the time nears to ring in the new year, Google is looking to wrap up the year with its annual Year in Search list. Google’s Year in Search 2022 is a global look at what was trending this year and can be further broken down into what was trending in different countries and regions. Topping the list this year was “ Wordle ” which saw a sharp increase in queries following the fiver-letter word game’s acquirement by The New York Times at the start of the year.

Trailing shortly after was “India vs. England,” showing the amount of interest in the two nation’s faceoff at this year’s Cricket World Cup. Rounding up the top five searches of the year is “Ukraine,” “Queen Elizabeth,” and “India vs. Saudi Arabia,” another one of India’s Cricket World Cup matchups. Some interesting searches to wrap up the top 10 list were for Apple ‘s iPhone 14 , Jeffrey Dahmer , and the Indian Premier League.

What to Read Next

OpenAI Is Reportedly Building a Search Engine to Compete With Google

Microsoft CTO Was “Very Worried” About Google’s AI Progress, Emails Sent to Satya Nadella and Bill Gates Reveal

"Barbie" and "The Roman Empire" Lead Google's Top Search Terms of 2023

'The New York Times' Sued OpenAI, Microsoft and Google Revealed 2023's Top Searches in This Week's Tech Roundup

Hundreds of Unreleased Songs From A$AP Rocky, 21 Savage, Future and More Have Leaked

DC and Warner Bros. Reportedly Cancel 'Wonder Woman 3' as Gal Gadot Teases "Next Chapter" of Character

Martell Previews Amos Ananda Streetwear Capsule at Culture Cartel 2022

Nike Air Force 1 High Utility 2.0 Joins the "Leap High" Pack

Rainbow Apple Logo Sign Appears at Sotheby's Auction

LeBron James Spotted in FaZe Clan x Nike LeBron 20 NXXT

HBO Max and Warner Bros. Discovery Combined Streaming Service Set To Be Named "Max"

Calvin Klein Goes Back to Basics with its Latest Footwear Range

New 'The Flash' Poster and Promotional Artwork Surfaces

Death Grips Announce North American Tour for 2023

- Rooftop Solar

- Utility-Scale Solar

- Community Solar

- Regulatory Policy

- Climate Change

- Diversity & Inclusion

- Low-Income Solar

- Environmental Justice

- Workforce Development

- Land Use & Solar Development

- Circular Economy

- Consumer Protection

- Health & Safety

- Domestic Manufacturing

- International Trade

- About Solar Energy

- Solar + Storage

- Cybersecurity

- News Center

- Upcoming Events

- Take Action

- Connect With Peers

- State-By-State Map

Solar Market Insight Report 2022 Year in Review

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released March 9, 2023.

1. Key Figures

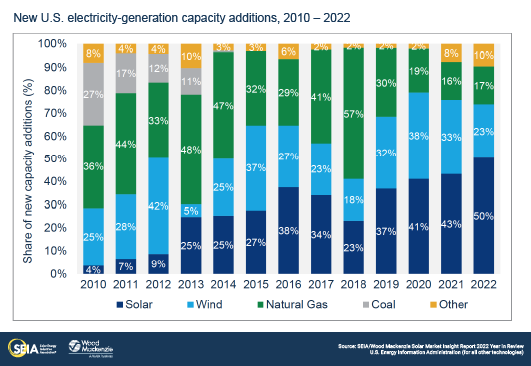

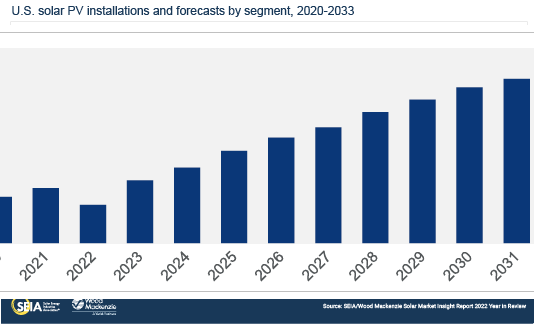

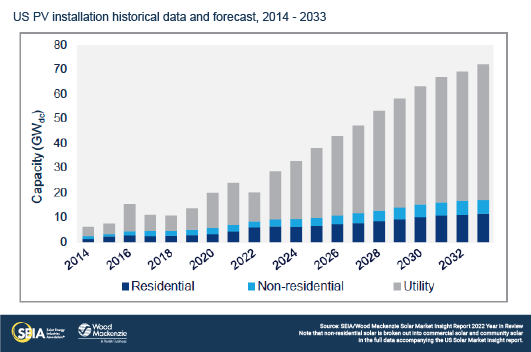

- In 2022, the US solar market installed 20.2 GW dc of capacity, a 16% decrease from 2021. The uncertainty surrounding the anticircumvention investigation and numerous solar equipment detentions by Customs and Border Protection (CBP) constrained industry growth.

- Solar accounted for 50% of all new electricity-generating capacity added to the US grid in 2022, the fourth consecutive year that solar was the top technology for new additions.

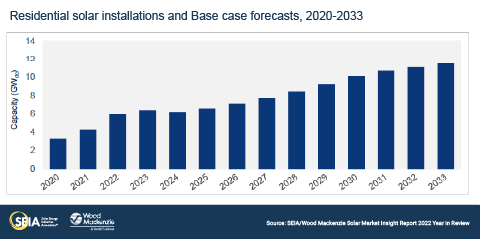

- California was once again the top-ranked solar market in 2022. – Texas had briefly held the position in 2021. California’s annual residential solar installations have doubled to over 2 GW dc since 2020. However, recent changes to residential solar compensation are likely to cut the market by nearly 40% by 2024.

- Nationwide, the residential segment installed just shy of 6 GW dc in 2022, growing by a staggering 40% over 2021. A record 700,000 homeowners installed solar in 2022.

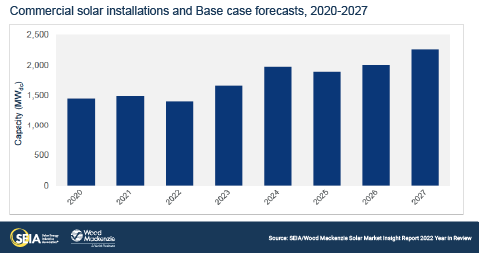

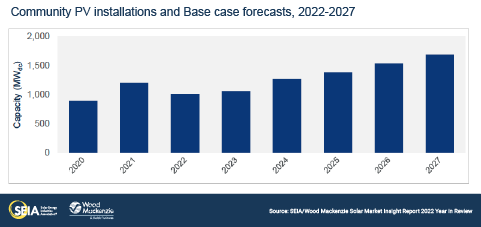

- The commercial solar segment installed 1.4 GW dc , shrinking 6% compared to 2021. The community solar segment installed 1 GW dc , 16% less than in 2021. Project delays from 2022 are expected to prop up installation volumes in 2023 in both segments.

- The utility-scale segment was most heavily impacted by uncertainty from the anticircumvention investigation and solar module detainments caused by CBP’s Withhold Release Order (WRO) and enforcement of the Uyghur Forced Labor Prevention Act (UFLPA). Installations came in at 11.8 GW dc for the year, 31% below 2021 and the segment’s lowest total since 2019.

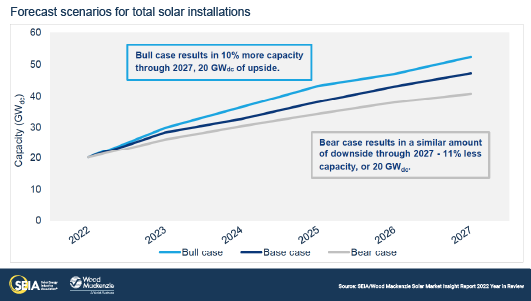

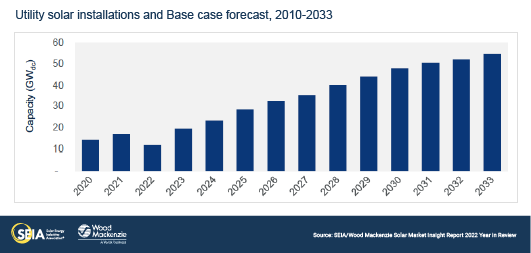

- For this Year in Review report, Wood Mackenzie has included 10-year outlooks for each market segment. The total installed US solar fleet is expected to grow five times larger than it is today, from 141 GW dc at the end of 2022 to more than 700 GW dc by 2033. This growth is due in large part to the long-term policy certainty created by the IRA.

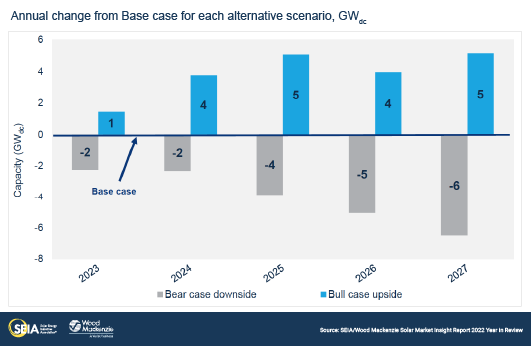

- Wood Mackenzie has also included two alternative forecast scenarios in this report for the first time – a Bull case and a Bear case. These scenarios consider different outcomes related to supply chain dynamics, tax credit qualification, labor availability, and retail rate price trends. More details and data can be found in the full report.

2. Introduction

The US solar industry installed 20.2 gigawatts-direct current (GWdc) of capacity in 2022, a 16% decrease from 2021. Between the anticircumvention investigation, equipment detainments by Customs and Border Protection (CBP), and passage of the historic Inflation Reduction Act (IRA), it was one of the most tumultuous years in the industry’s history.

Throughout the year, commercial, community, and utility-scale solar were all down compared to 2021. The utility-scale segment had its best quarter of 2022 in Q4, installing 4.3 GW dc . But this was still the segment’s lowest fourth quarter since 2018. Utility-scale volumes were down 31% for the year – the last time utility solar shrank that much was in 2017, when the industry had been expecting the expiration of the investment tax credit (ITC).

Counter to the other segments, the residential segment grew 40% over 2021, the highest level of annual growth since 2015. Residential solar has been more insulated from the impacts of trade issues since half the segment utilizes domestically-sourced modules. As of year-end 2022, 6% of single-family owner-occupied homes have solar installed.

Overall, solar PV accounted for 50% of all new electricity-generating capacity additions in 2022, the fourth consecutive year that solar was the top technology for new additions.

The solar industry hopes for supply chain relief in 2023

After another year of trade policy turmoil, the US solar industry is hoping for supply chain relief in 2023. Our expectations for the industry shifted throughout the year as the anticircumvention investigation was initiated in March, President Biden paused potential anticircumvention tariffs in June, and the Uyghur Forced Labor Prevention Act (UFLPA) resulted in hundreds of equipment detentions in the second half of the year. Between all of this and the historic passage of the Inflation Reduction Act (IRA) in August, 2022 was one of the most volatile policy years in industry history.

We expect a robust return to growth in 2023. While there is still uncertainty around the CBP’s requirements to release detained equipment under the UFLPA, some manufacturers have had small releases in the last several months. (For more details and context on this issue, see the US Solar Market Insight Q4 2022 report.) It will likely take several more months, and the timing is far from certain, but we expect shipments to accelerate in the second half of the year. This will help 2023 installations grow 41% over 2022 to 28.4 GW dc , assuming no further disruptions.

Alternative scenarios help to benchmark current market uncertainty

In addition to current supply chain constraints, the US solar industry faces several near-term uncertainties. To help characterize the potential impacts of those uncertainties, Wood Mackenzie has created two alternative forecast scenarios for the first time. These two scenarios – a Bull case and a Bear case to accompany our standard Base case – will help the industry benchmark industry impacts based on various outcomes (see table below for more details).

First, our alternative scenarios consider various outcomes related to the future supply/demand balance of PV modules. This will be heavily impacted by new anticircumvention tariffs that could go into effect by June 2024, pending a final decision by the Department of Commerce. These new tariffs could apply to some suppliers shipping cells and modules from the four Southeast Asian countries named in the investigation – the region where the US solar industry currently sources most of its PV module imports. The industry is already working to diversify supply chains, but new tariffs will create immense pressure to procure non-tariffed supply.

The availability of domestically-produced equipment will also impact this supply/demand balance. Our Bull case generally assumes more availability of non-tariffed supply as well as a more optimistic view on how much, and how quickly, domestic manufacturing capacity comes online and supplies the US market. The Bear case assumes a less favorable supply environment.

Second, the alternative scenarios consider various outcomes related to the anticipated guidance from the US Department of Treasury on qualifying for tax credits and associated adders. Some Treasury guidance has already been published (on prevailing wage and apprenticeship requirements, as well as the low-income communities bonus credit program). But given that much more guidance is yet to be published, it’s too early to tell how the various adders will impact solar installations. Our Bull case considers more favorable guidance where a higher proportion of projects can utilize the adders. The Bear case generally assumes the opposite.

Lastly, there are several other factors incorporated into our alternative scenarios, some of which are sector specific. For utility-scale solar, labor availability and tax equity availability are considered across the scenarios as important factors for that segment’s growth. For distributed solar, trends in retail rates that impact project economics vary between the scenarios. More details on the assumptions for each segment can be found within the full report.

Our Bull case puts cumulative US solar installations 10% higher than our Base case and our Bear case puts cumulative installations 11% lower through 2027 – about 20 GWdc in either direction. Put another way, depending on what assumptions become reality, there is roughly 20 GW dc of upside or downside risk for the US solar industry over the next five years.

US solar industry to multiply by five times over the next decade

Looking longer-term, our Base case outlook puts cumulative solar installations by 2033 at over 700 GW dc , compared to 141 GW dc installed as of year-end 2022. In other words, the total base of installed solar will be five times larger in 2033 than it is today. Growth is faster in the near-term, averaging 19% until 2027 before slowing to an average annual growth rate of 7% from 2028-2033. Growth slows as market penetration increases and grid capacity becomes more limited. Eventually growing to a 60-70 GWdc annual market toward the end of the outlook, the US solar industry is clearly a key pillar of the energy transition.

3. Market segment outlooks

3.1. residential pv.

- 5.9 GW dc and nearly 700,000 systems installed in 2022, 1,687 MW dc in Q4 2022

- Up 40% from 2021

Last year was a record-breaking but chaotic year for the residential solar industry. While supply chain constraints consumed the first half of the year, recovery from module shortages, rising interest rates, and excitement for the IRA characterized the second half. The residential segment installed 1,687 MW dc in Q4 to reach 5.9 GW dc of annual installed capacity, a remarkable 40% increase over 2021. Last year also marked the first year the segment exceeded 5 GW dc of annual installations.

Installers continued to work through backlogs in Q4, contributing to strong installation numbers to end the year. But the fourth quarter challenged installers’ sales activity, with many seeing a more pronounced seasonal drop in sales compared to past years. This can be partially attributed to customer expectations of a recession and a lower urgency to go solar due to the ITC extension. Shifts in financial product offerings and price increases are also slowing residential growth.

Wood Mackenzie forecasts 7% growth for the residential solar market in 2023, as demand pull-in continues in California before NEM 3.0 takes effect on April 14th. After a robust 2022 for California, the subsequent drop in installations will lead to minimal growth in 2023 and a contraction of 38% in 2024 for the state, resulting in a 3% reduction in installations nationwide. In the long term, the residential segment will grow steadily as it feels the full impacts from the IRA and third-party-owned projects qualify for the adders. The residential solar market will quadruple in size over the next decade, adding 95 GW dc of installed capacity between 2023 and 2033.

3.2. Commercial PV

- 1,402 MW dc installed in 2022, 354 MW dc in Q4 2022

- Down 6% from 2021

Note on market segmentation: Commercial solar encompasses distributed solar projects with commercial, industrial, agricultural, school, government or nonprofit offtakers, including remotely net-metered projects. This excludes community solar (covered in the following section).

Commercial solar volumes in 2022 came in 6% below 2021 volumes – in line with our expectations from the prior report. The year was riddled with project delays due to supply chain constraints. As a result, we expect 2023 installations to grow by 19%. This is driven by a combination of delayed projects coming online as well as the beginning of a two-year installation rush in California before new net metering rules take effect.

The commercial solar industry continues to be highly concentrated. In 2022, 62% of capacity was installed in the top four markets: California, Illinois, New Jersey, and New York. And this hasn’t changed much in the last few years, demonstrating the reliance of commercial solar markets on state-level incentive programs. We do expect commercial solar markets to diversify over the course of our outlook, but these states will continue to be the most important markets for this sector.

The most significant change in our outlook since last quarter comes from the inclusion of the ITC adders. Improved economics for commercial solar projects, whether through additional federal tax credits or state-level incentive programs, have a significant impact on the sector’s potential. Taking these factors into account, average annual growth for our commercial solar outlook has increased to 10% from 7% last quarter.

3.3. Community solar PV

- 1,014 MW dc installed in 2022, 284 MW dc installed in Q4 2022

- Down 16% from 2021

Note on market segmentation: Community solar projects are part of formal programs where multiple customers can subscribe to the power produced by a local solar project and receive credits on their utility bills.

Community solar installations declined 16% in 2022 compared to 2021, primarily driven by continued interconnection queue delays in key state markets, as well as industry-wide supply chain constraints pushing project timelines into 2023. Despite this market contraction, 2022 was the second consecutive year the national community solar market broke 1 GW dc of new installations. New York, which installed a record-breaking 532 MW dc in 2022, made up 52% of the national market.

By 2027, we expect the community solar market to more than double, growing by an average of 11% annually from 2023-2027. The two main drivers for growth are newly established state markets and the potential of the ITC adders. Newer state markets like Virginia, New Mexico and Delaware will begin to see projects come online in 2023 and have strong capacity pipelines. Additionally, community solar legislation recently signed in California could support nearly 1 GW dc of new capacity between 2024 and 2027, pending the establishment of full program rules.

Community solar developers are well positioned to take advantage of the ITC adders, boosting our five-year outlook. Developers are particularly interested in qualifying projects for the low-income, domestic content, and energy communities adders. These adders – and other incentives like the greenhouse gas reduction fund – will support growth in existing and emerging markets. Additionally, the IRA could positively impact program proposals and the creation of new markets, which we continue to monitor closely.

3.4. Utility PV

- 11.8 GW dc installed in 2022, 4.3 GW dc installed in Q4 2022

- More than 428 GW dc of utility-scale solar will be added over the next 10 years in our Base Case

The trend of utility-scale solar growth came to a halt in 2022. The sector grew 67% quarter-over-quarter in Q4 2022, but 2022 installations decreased by 32% compared to 2021 with 11.8 GW dc installed for the year. This contraction can be attributed almost entirely to supply chain challenges and trade disruptions.

The IRA provided the certainty needed to regain momentum in project development and contract negotiations in late 2022. More than 4.5 GW dc of projects were contracted during Q4, leaving the project pipeline at 90.3 GW dc . While this represents 12% pipeline growth over 2021, short-term uncertainty remains due to continued supply chain challenges.

Tier 1 manufacturers remain confident in their ability to achieve major module shipment releases during the first half of the year. Smaller utility-scale buyers that procure Tier 2 modules may now face challenges as CBP reviews smaller orders and smaller manufacturers with higher scrutiny than in 2022. The Executive Order delaying anticircumvention tariffs allowed buyers to diversify their supply without compromising 2023 and 2024 buildout plans. Still, module supply will remain limited in the short term as Tier 1 suppliers in Southeast Asia are fully booked through 2023.

Despite the complex procurement environment, Wood Mackenzie forecasts that 139 GW dc of total utility-scale installations will be added between 2023 and 2027, and 429 GW dc will be added over the next decade in our Base case. Interest in the segment will remain strong throughout the forecast period, as corporate and utility procurement soar. The different buildout levels presented in the alternative scenarios are mainly driven by labor availability, interconnection reforms, and tax equity availability.

4. US solar PV forecasts

5. National solar PV system pricing

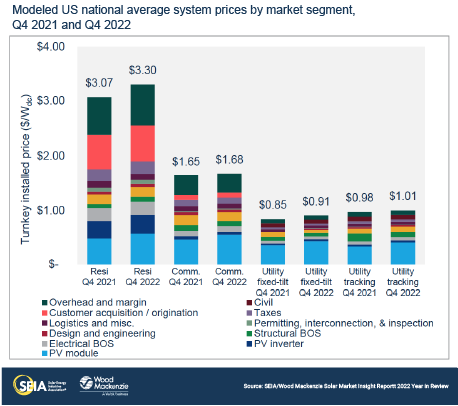

Note: Wood Mackenzie has updated the reporting methodology for modeled prices to be consistent with the US solar system pricing reports. Therefore, figures shown below may not match those published in earlier editions of the US Solar Market Insight report.

Wood Mackenzie employs a bottom-up modeling methodology to capture, track and report national average PV system pricing by segment for systems installed each quarter. The methodology is based on the tracked wholesale pricing of major solar components and data collected from industry interviews. Wood Mackenzie assumes all product is procured and delivered in the same year as the installation except modules for the utility segment, which are procured one year prior to commercial operation.

Last year was a challenging year for solar. We saw price increases across equipment and soft cost categories. High demand, supply constraints, rising inflation, and a harsh policy environment (primarily impacting module and inverter prices) all contributed to rising capex for solar in 2022. In the fourth quarter, system pricing was up by 7% for the residential segment and 2% for the commercial segment compared to Q4 2021. Increases in capex for the utility segment were partially offset by the adoption of large format modules in 2022. System pricing for utility-scale fixed-tilt was up 5% and 3% for tracker systems compared to last year.

About the Report

U.S. solar market insight ® is a quarterly publication of Wood Mackenzie and the Solar Energy Industries Association (SEIA)®. Each quarter, we collect granular data on the U.S. solar market from nearly 200 utilities, state agencies, installers and manufacturers. This data provides the backbone of this U.S. Solar Market Insight® report, in which we identify and analyze trends in U.S. solar demand, manufacturing and pricing by state and market segment over the next five to ten years. All forecasts are from Wood Mackenzie, Limited; SEIA does not predict future pricing, bid terms, costs, deployment or supply. The report includes all 50 states and Washington, D.C. National totals reported also include Puerto Rico and other U.S. territories. Detailed data and forecasts for 50 states and Washington, D.C. are contained within the full version of the report.

References and Contact

References, data, charts and analysis from this executive summary should be attributed to “Wood Mackenzie/SEIA U.S. solar market insight ® .”

Media inquiries should be directed to Wood Mackenzie’s PR team ( [email protected] ) and Morgan Lyons ( [email protected] ) at SEIA.

All figures are sourced from Wood Mackenzie. For more detail on methodology and sources, click here .

About the Authors

Wood mackenzie power & renewables | u.s. research team.

Michelle Davis, Principal Analyst (lead author) Sylvia Leyba Martinez, Senior Analyst Zoe Gaston, Principal Analyst Sagar Chopra, Solar Analyst Caitlin Connelly, Research Associate Matthew Sahd, Research Associate Matt Issokson, Research Analyst Elissa Pierce, Research Associate Chris Seiple, Senior Vice President

Solar Energy Industries Association | SEIA

Shawn Rumery , Senior Director of Research Colin Silver , Chief of Staff and Chief Content Officer Tyler Thompson , Research Analyst Justin Baca , Vice President of Markets & Research

Note on U.S. solar market insight report title: The report title is based on the quarter in which the report is released, not the most recent quarter of installation figures .

Ownership rights

This report ("Report") and all Solar Market Insight ® ("SMI")TM reports are jointly owned by Wood Mackenzie and the Solar Energy Industries Association (SEIA) ® (jointly, "Owners") and are protected by United States copyright and trademark laws and international copyright/intellectual property laws under applicable treaties and/or conventions. Purchaser of Report or other person obtaining a copy legally ("User") agrees not to export Report into a country that does not have copyright/intellectual property laws that will protect rights of Owners therein.

Grant of license rights

Owners hereby grant user a non-exclusive, non-refundable, non-transferable Enterprise License, which allows you to (i) distribute the report within your organization across multiple locations to its representatives, employees or agents who are authorized by the organization to view the report in support of the organization’s internal business purposes, and (ii) display the report within your organization’s privately hosted internal intranet in support of your organization’s internal business purposes. Your right to distribute the report under an Enterprise License allows distribution among multiple locations or facilities to Authorized Users within your organization.

Owners retain exclusive and sole ownership of this report. User agrees not to permit any unauthorized use, reproduction, distribution, publication or electronic transmission of any report or the information/forecasts therein without the express written permission of Owners.

Disclaimer of warranty and liability

Owners have used their best efforts in collecting and preparing each report.

Owners, their employees, affiliates, agents, and licensors do not warrant the accuracy, completeness, correctness, non-infringement, merchantability, or fitness for a particular purpose of any reports covered by this agreement. Owners, their employees, affiliates, agents, or licensors shall not be liable to user or any third party for losses or injury caused in whole or part by our negligence or contingencies beyond Owners’ control in compiling, preparing or disseminating any report or for any decision made or action taken by user or any third party in reliance on such information or for any consequential, special, indirect or similar damages, even if Owners were advised of the possibility of the same. User agrees that the liability of Owners, their employees, affiliates, agents and licensors, if any, arising out of any kind of legal claim (whether in contract, tort or otherwise) in connection with its goods/services under this agreement shall not exceed the amount you paid to Owners for use of the report in question.

Related Resources

Seia letter to department of energy on transmission approval process, siting and permitting reform company sign-on letter, solar market insight report 2023 q3.

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released September 7, 2023.

Semiconductor shortage: How the automotive industry can succeed

During the earliest days of the COVID-19 crisis, automotive headlines focused on the huge drop in vehicle demand. But for more than a year now, concerns have shifted to the supply side. Although vehicle orders have surged to unexpected heights, a shortage of automotive semiconductors is forcing OEMs to close production lines or remove some popular features, such as heated seats, from their offerings.

We first explored the automotive chip shortage in a May 2021 article , noting that a quick fix was likely impossible. The situation has worsened since then, and the recent drop in automotive revenues is largely occurring because OEMs and Tier 1 suppliers cannot procure sufficient quantities of chips and must delay vehicle production. While manufacturers of laptops, white goods, and other devices have also cut production because of semiconductor shortages, the repercussions in the automotive industry have been more severe. Some premium OEMs were able to safeguard profits with selective manufacturing and sales strategies designed to optimize margins. This strategy, however, may result in a shortage of lower-margin vehicles and could cause extreme fluctuations in demand for automotive chips.

Russia’s invasion of Ukraine has introduced further uncertainties to both the semiconductor supply chain and automotive demand. For instance, Ukraine supplies 25 to 35 percent of the world’s purified neon gas, and Russia supplies 25 to 30 percent of palladium, a rare metal used for semiconductors. 1 Peter Hobson, “London market greenlights Russia’s palladium while blocking its gold,” Mining.com, March 8, 2022; Karvi Rana, “The Russian invasion of Ukraine to further cripple the semiconductor industry,” Logistics Insider, February 16, 2022. Another wrinkle: many semiconductors are transported by air, but transport costs have significantly increased while available shipping volume has dropped. And yet another problem: OEMs have been unable to obtain critical vehicle components, such as wiring harnesses, and have reduced their production volumes in response, which has added even more uncertainty by decreasing demand for some semiconductor-based components.

Given the ongoing instabilities in the semiconductor supply chain, the automotive industry should consider refining its strategy. Companies can start by focusing on the implications of three critical activities that form the foundation for strategic shortage management: the creation of strong technology maps, reliable short-term demand planning, and guidance for long-term demand planning.

Factors behind the escalating challenges in semiconductor supply

More than two years into the pandemic, the gap between chip supply and demand has widened across all semiconductor-enabled products. While sales of all consumer goods plummeted in the first half of 2020, and automotive sales dropped precipitously—up to 80 percent in some locations—demand rebounded more than expected later in the year, continued to grow in 2021, and remains strong today. The high-tech sector, in particular, has seen sales volumes increase, partly because of changes wrought by the COVID-19 pandemic. The growth in working from home, for instance, has contributed to a greater demand for wireless connectivity and PCs. These market shifts have rippled back to affect demand for semiconductors and other components. Across almost all industries, the demand for semiconductors in 2020 and 2021 exceeded prepandemic forecasts (Exhibit 1). And this means automotive OEMs and Tier 1 suppliers are increasingly competing with companies in other industries for chips.

Although the chip shortage is affecting many industries, the automotive sector has some unique characteristics that exacerbate the problem. For instance, many OEMs and Tier 1 suppliers follow a “just in time” manufacturing strategy in which they order semiconductors and other vehicle components close to production to optimize inventory costs. When vehicle sales fell in early 2020, OEMs and Tier 1 suppliers decreased their chip orders, leaving them low on inventory when demand began to recover. Companies in industries that do not follow a just-in-time ordering approach were in a better position, especially since some had secured extra capacity when automotive players canceled or reduced their orders.

On the demand side, automotive companies have much more complex and personalized products than companies in many other industries. In consequence, they may have more difficulty predicting their semiconductor needs, and demand may fluctuate. On top of this, the automotive industry must follow stringent safety requirements that necessitate the use of specifically validated semiconductors and defined production facilities along the complete value chain.

Amid all the uncertainty, demand for automotive chips is growing steadily as vehicle electrification, advanced driver-assistance systems (ADAS), and connected-car features become more popular.

The growing chip shortage is prompting the automotive industry to order surplus semiconductors—about 10 to 20 percent more than needed—to ensure inventory and safeguard production. This “bullwhip effect” has been documented across various industries for many years. In 2022, for instance, OEMs and Tier 1 suppliers are expected to place orders for enough automotive chips to outfit about 120 million new cars, but annual vehicle sales are forecast to be about 83 million. 2 Alternative propulsion forecast, IHS Markit, January 2022. Companies across industries are also placing more ad hoc orders, often at an unusually high average sales price. The new ordering trends do not provide immediate relief, given the long production times for chips, and they introduce additional uncertainty into the semiconductor supply chain.

The need for solutions

As we noted in our earlier article, no short-term solutions exist for the automotive semiconductor crisis. The lead times for chip manufacture average a minimum of four months if capacity is available and no expansion is required; otherwise, it will likely take a minimum of 18 months (Exhibit 2). Increasing production might seem like the obvious answer, but it takes more than three years to build a new fab and ramp up wafer production. Lead times for manufacturing equipment have also increased over the past two years because COVID-19 complicated supply chains, making expansion even more difficult.

The semiconductor supply chain was already under stress before the pandemic. COVID-19, combined with recent challenges related to power outages, natural disasters, and geopolitical uncertainties, has only intensified the problem. After closely examining the industry, including these recent supply and demand trends, we have concluded that the semiconductor shortage will likely persist in selected technology nodes for at least the next three to five years. The ongoing shortage is partly a result of long-standing structural factors, such as insufficient capacity, but the recent behavior of automotive companies—overordering and increasing stock levels—is also contributing to the problem (Exhibit 3).

For nodes greater than 90 nanometers (nm), which are in high demand in the automotive industry, the shortage is likely to persist for two reasons. First, the semiconductor industry is unlikely to address the structural reasons for this shortage, because mature nodes have low profit margins. Second, some end customers appreciate the attractive price point of mature nodes and have a limited incentive to migrate to lower node sizes, because of the additional development and qualification costs, as well as the limited availability of R&D staff.

For wafers from 22 to 65 nm, the shortage will not fully resolve over the short- to midterm, but it may lessen if semiconductor companies increase their supply, as expected. Overall, however, it is difficult to predict the size of the demand–supply gap for specific products in this group, given the high heterogeneity of device types and technologies.

An updated approach: Sustainable control rooms and an intensified long-term strategy

As companies contemplate the semiconductor shortage, they are considering both their short- to medium-term needs, as well as their long-term resiliency and survival. Our previous article described some strategies that are appropriate for both periods, and we have refined them to reflect recent experience.

Many OEMs and automotive Tier 1 suppliers have already established control rooms that combine staff from procurement, supply chain management, and sales to help ensure that they have a sufficient supply of semiconductors. While these teams have developed some effective solutions to manage the immediate supply–demand shortage, they often lack the required tools, skills, or capacity to manage it over the midterm and develop strategic solutions. To remedy the most common problems, companies can undertake several actions (Exhibit 4).

Stronger technology road maps

In many cases, companies create unclear technology road maps that do not truly define their semiconductor needs. For instance, the road maps may contain limited insights about the semiconductor content in next-generation products or fail to account for all factors affecting semiconductor supply and demand, such as the impact of custom-vehicle orders.

Creating stronger technology road maps will allow Tier 1 suppliers (or potentially OEMs in the case of certain components, such as central computers) to increase transparency, allowing the companies to steer their product development more strategically. They may decide to reengineer chips, hold discussions jointly with the OEMs to identify opportunities for drop-in components, or collaborate with OEMs to reduce variations in the large-volume discrete and analog devices across different vehicle components (thereby decreasing variations in demand resulting from custom-vehicle orders).

Improved short-term demand planning

In addition to strategically designing products, OEMs and Tier 1 suppliers can provide greater transparency about short-term automotive chip demand to semiconductor suppliers. In other industries, such as electronic equipment, manufacturers and suppliers share information about demand and supply across the full supply chain, which helps surface potential problems before they escalate. If one supplier appears to be having difficulty getting the components necessary for its products, the manufacturers know that this delay will ripple back to affect them. Historically, the automotive industry has not required this end-to-end transparency, because of its market power and steady growth, and OEMs and Tier 1 suppliers have not yet achieved this. To attain the desired level of insight, OEMs and suppliers can use a commonly agreed upon nomenclature, such as a shared definition of chip families and technology nodes, in demand forecasts.

If one supplier appears to be having difficulty getting the components necessary for its products, the manufacturers know that this delay will ripple back to affect them.

OEMs and Tier 1 suppliers that invest in data-driven processes and automated tools will improve the quality of their end-to-end planning process. Some have already taken steps in this direction by providing ready-to-use dashboards for tracking products along the supply chain, but many more opportunities remain across functions. Sales, for example, could use advanced analytics to forecast required demand. And manufacturing could use digital tools that help allocate semiconductors to the right areas, rather than making ad hoc decisions, to keep vehicle production on track. Teams can also use risk cockpits to reduce the chance of unexpected semiconductor shortages. These steps can help address many issues that now interfere with chip supply, such as a lack of insight about the semiconductor content of next-generation products.

Better end-to-end planning along the supply chain, combined with greater use of data-driven processes, will make OEMs and Tier 1 suppliers within the automotive industry more reliable and potentially preferred partners. These actions will also enable strategic contractual levers, such as long-term take-or-pay commitments by Tier 1 suppliers, that will increase the chances for strategic partnerships between semiconductor suppliers and automotive players.

Better short-term planning will also help OEMs and Tier 1 suppliers form more strategic relationships. As they work together, OEMs should remember that demand estimates may be inaccurate and take steps to mitigate risks or share the burden with their Tier 1 suppliers. For instance, a contract might state that an OEM will commit to using a specific chip technology 18 months in advance. It would offer the OEM some limited flexibility to modify the order and the option of switching to a different technology until six months prior to shipment. To make such arrangements work, OEMs must specify the exact components needed (rather than the vehicles being manufactured), since this directly translates into demand for semiconductors.

Improved transparency along the complete supply chain, including supply–demand matching, is a prerequisite for having OEMs and Tier 1 suppliers implement midterm inventory-management strategies that will reduce risk. This inventory management can allow Tier 1 and semiconductor suppliers to confirm that they can fill orders because the supply–demand analysis gives them more transparency and allows them to allocate chips to potential customers earlier.

Improved long-term demand planning

Besides short-term demand planning, OEMs and suppliers could build a long-term perspective on demand. This will allow them to consider jointly investing in projects involving mature nodes. Alternatively, both groups may codevelop semiconductors in advanced or leading-edge nodes. These strategies will allow them to share the financial burden while improving the supply of low-margin or highly innovative technologies.

Even after OEMs and Tier 1 suppliers improve their strategy, control rooms may become semipermanent features in the automotive industry until the semiconductor crisis is resolved; companies should therefore develop some long-term talent strategies for staffing them. Many employees have been juggling multiple priorities and dealing with unexpected challenges since the pandemic began, and asking them to serve on a control room team might seem overwhelming in these circumstances. To reduce the burden, automotive companies can create efficient control room processes and tools that streamline tasks. They can also ensure a stable inflow of talent by asking different employees—either current staff or new hires—to participate on the team, allowing other employees to rotate out.

OEMs and Tier 1 suppliers have quickly moved into firefighting mode to deal with the short-term chip shortage, but even more decisive action is necessary, especially since the situation is likely to persist far into 2023. Taking a hard look at internal processes, contract conventions, and product features will go a long way, as will greater transparency and cooperation with semiconductor suppliers. Those OEMs and Tier 1 suppliers that are willing to experiment and investigate creative solutions may gain the greatest advantages.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office; Johannes Deichmann is a partner in the Stuttgart office, where Philipp Pfingstag is a consultant; and Julia Werra is an associate partner in the Berlin office.

The authors wish to thank Stefan Burghadt, Justin Peters, Larissa Rott, and Fabian Steiner for their contributions to this article.

This article was edited by Eileen Hannigan, a senior editor based in the Waltham, Massachusetts, office.

Explore a career with us

Related articles.

Coping with the auto-semiconductor shortage: Strategies for success

Sustainability in semiconductor operations: Toward net-zero production

Health Spending

- Quality of Care

- Access & Affordability

- Health & Wellbeing

- Price Transparency

- Affordability

- Prescription Drugs

How does medical inflation compare to inflation in the rest of the economy?

By Shameek Rakshit , Emma Wager Twitter , Paul Hughes-Cromwick, Cynthia Cox Twitter , and Krutika Amin

May 17, 2024

Stay Connected

Get the best of the Health System Tracker delivered to your inbox.

Note: This analysis was updated on May 17, 2024 to include new data.

Medical care prices and overall health spending historically outpace growth in the rest of the economy. Health costs usually represent a growing share of gross domestic product and many American families have seen the costs of health services and premiums grow faster than their wages. However, since 2021 prices for many consumer goods and services have increased faster than usual, with overall inflation reaching a 4-decade high in mid-2022.

This brief analyzes prices for medical care compared to other goods and services using consumer price index (CPI) and producer price index (PPI) data from the Bureau of Labor Statistics (BLS) and personal consumption expenditures (PCE) price index data from the Bureau of Economic Analysis (BEA).

Using the CPI, overall prices grew by 3.5% in March 2024 from the previous year, while prices for medical care increased by only 2.2%. As a result, overall prices excluding medical care grew by 3.6%. This is unusual, as growth in health prices historically outpace inflation in the rest of the economy.

Medical care prices have generally grown faster than overall consumer prices

Since 2000, the price of medical care, including services provided as well as insurance, drugs, and medical equipment, has increased by 119.2%. By contrast, prices for all consumer goods and services rose by 85.0% in the same period.

Related Content:

Charges for emails with doctors and other healthcare providers

How do health expenditures vary across the population?

The consumer price index for all urban consumers (CPI-U) measures the U.S city average change in prices consumers pay for goods and services. For medical care, CPI measures total price changes, including both the costs consumers pay out-of-pocket and those insurers (public and private payers) pay to providers and pharmacies. While CPI measures total price changes, the index weights spending to match consumers’ out-of-pocket costs, including consumers’ spending at the point of care and on health insurance premiums. For example, physician and hospital services are 47% of the medical care index.

BLS used new expenditure weights to calculate the CPI starting from January 2023 and will continue to update the weights annually. Previously, BLS updated CPI weights once every two years using two consecutive years of consumer spending data. CPI weights are now calculated each year using one year of spending data for greater accuracy.

In March 2024, prices rose 3.5% across the economy from the previous year, compared to 2.2% for medical care

While medical care prices have usually grown faster than prices in the overall economy, they have also grown more consistently year-over-year. Prices in the general economy can be more volatile (particularly for food and energy). Between 2001 and 2020, prices for medical care increased between 1% and 5% each year. Overall prices saw more volatility though generally increased at a slower rate than prices for medical care, until 2020. Still, inflation in healthcare is generally lagged due to administrative price setting and contract negotiations ahead of time. As such, medical care inflation has steadily increased since June 2023, while inflation in the overall economy has remained between 3% and 4%.

Medical care prices increased slower than prices for other consumer goods and services in the past year

While medical care prices increased by 2.2% between March 2023 and March 2024, the prices of many other consumer goods increased by significantly more.

Prices for all goods and services increased by 3.5%. Overall annual price growth excluding medical care was at 3.6% and core inflation (excluding food and energy) was at 3.8%. Many essential goods and services saw similar or larger increases. Food prices grew by 2.2% and electricity costs grew by 5.0%. Many other household items, such as rent, have also seen larger price increases in the past year than medical care. Gasoline was the fastest-growing essential household expense in 2022, reaching a peak inflation rate of 59.9% in June 2022. More recently, as of March 2024, gasoline prices have increased by 1.3% from the same month last year.

Some health prices increased faster than others in the past year

Prices for hospital services and related services (7.7%) – both inpatient (6.9%) and outpatient (8.3%) – as well as for nursing homes (3.9%) rose faster than for prescription drugs and physicians’ services (0.4% and 0.7%, respectively). The medical CPI is generally based on lagged data even more so than other CPI categories. For example, the prescription drug CPI does not immediately reflect the introduction of new, high-priced drugs.

The medical care CPI also includes a price index for health insurance. This index measures retained earnings of health insurers – it is not a reflection of the premiums they set. The health insurance CPI fell from an annual increase of 28.2% in September 2022 (the all-time high) to a decrease of -15.2% in March 2024. However, the health insurance CPI presents data that is almost one-year lagged, so it is not representative of current price changes. In fact, the health insurance CPI through September 2022 reflects insurers’ margins in 2020, as they paid lower medical claims than in a typical year. Nevertheless, insurers likely saw lower margins , on average, in 2021 and 2022 than they had been in the first year of the pandemic due to returning utilization.

Regardless, with a 9% weight of the total medical consumer price index, health insurance brought the overall medical CPI up during most of 2022 and is now exerting downward pressure.

Different measures of medical inflation produce different estimates of price growth

While the CPI covers inflation in prices paid directly by consumers, another measure of inflation, the personal consumption expenditures (PCE) price index, also tracks changes in prices paid on behalf of consumers. For example, the health care services PCE price index covers payments by employers, private insurers, and government programs to providers in addition to premiums and out-of-pocket expenses paid by consumers. The PCE price index also accounts for shifts in consumer spending patterns in response to price changes. CPI, by contrast, assumes consumers buy a similar bundle of goods and services and does not account for trade-offs consumers may be making in response to price changes.

A third measure of inflation, the producer price index (PPI), represents inflation from the producers’ perspective in both the public and private sector. The PPI for health services includes medical services (provided by physicians or other care providers) paid for by third parties, such as employers or the federal government. Unlike the CPI, the PPI considers changes in industry output costs with a focus on the actual transaction prices.

Since June 2009, the CPI for medical care services has risen by 53.4%, while the PPI for health care services has increased by 39.6% and the PCE price index for health care services has increased by 31.8%. Services included in this chart include hospital, physician, and other professional and facility care prices. While drugs and medical equipment are included in previous CPI charts in this analysis, this chart measures CPI of medical care services specifically and excludes drugs and medical equipment in all three medical inflation measures.

Prices paid by private insurance generally outpace those paid by public programs

Generally, prices paid by private insurance are higher and rise more quickly than prices paid by public payers. Prices for private insurers are the result of negotiations between health systems and the insurance companies, while public payer prices are set administratively. In 2024, healthcare prices paid for by private insurance and Medicaid are rising faster than those paid for by Medicare. The private insurance health services PPI has risen by 28.1% since June of 2014, compared to 15.4% for Medicare and 24.7% for Medicaid in the same period. The overall health services PPI increased by 24.7% since June 2014.

During the public health emergency, Medicare provider reimbursement for COVID-19 treatment was boosted by 20.0%, which explains part of the reason for the increase in the Medicare PPI in 2020.

Typically, medical inflation outpaces inflation in the rest of the economy. However, since 2021, medical prices have grown at a similar rate as in past years while prices in some other parts of the economy grew much more rapidly than in the past.

After the onset of the COVID-19 pandemic in 2020, high consumer demand and supply chain disruptions, stemming from production shortages, accelerated inflation for most consumer goods. The Russia-Ukraine War put additional pressure on the global energy market. While inflation has declined in some sectors, particularly gasoline, ongoing labor shortages and sustained demand continue to keep non-medical services inflation high.

As inflation pushes wages upward, health worker wage increases also put upward pressure on medical prices unless hospitals and other providers can find ways to operate with fewer staff or cut other expenses.

Many health prices are set in advance, administratively or via private insurance contracting, so there is a delay in observable price increases. Public payer prices are set by the federal and state governments annually. Medicare uses indexing measures to update payment rates annually, reflecting increases in operating costs and wage growth, among other factors. Some commercial rates are negotiated throughout the year, but most are tied to the plan or calendar year.

For now, inflation in the broader economy continues to outpace medical price increases. It remains to be seen whether, or to what extent, these recent trends will hold moving forward.

About this site

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.

More from Health System Tracker

How do prices of drugs for weight loss in the u.s. compare to peer nations’ prices.

Looking for more data?

Find out more details about U.S. healthcare from our updated dashboard.

A Partnership Of

Share health system tracker.

AT&T says outage affecting customers’ ability to make calls is resolved

(Gray News) - AT&T says it has resolved an outage Tuesday afternoon that affected some mobile customers’ ability to make phone calls to customers of other mobile carriers.

In a statement to CNN , the telecommunications giant said calls between AT&T customers were still going through, but some customers complained on social media that they couldn’t make any calls at all.

“We collaborated with the other carrier to find a solution and appreciate our customers patience during this period,” a company spokesperson told CNN.

DownDetector.com began receiving reports of problems with AT&T mobile service around 1 p.m., eventually reaching more than 3,000 reports. New York City, Chicago, Philadelphia, Dallas, Pittsburgh and Indianapolis were among the cities with the most issues reported.

By 6 p.m., the number of reports had drastically reduced.

AT&T said 911 calls were still going through, but some municipalities warned residents on social media that there may be 911 issues due to the outage.

Copyright 2024 Gray Media Group, Inc. All rights reserved.

1 injured after multi-vehicle crash on I-75 in Lowndes County

Woman found still alive at funeral home dies hours later

18-year-old arrested following GSP chase in Brooks County

New developments in the 2022 shooting death of Denisha Williams

Ethics complaint filed against Valdosta City Council member

Latest news.

Garland says he 'will not be intimidated' by GOP lawmakers' attacks on DOJ

Amanda Knox asks Italian court to clear her of slander charge, saying police forced the confession

Passenger who found fetus on bus says experience was horrifying

Woman loses $9,000 after alleged phone scammer shows up at her door

Gunman captured after attempted attack on US Embassy in Lebanon

- My View My View

- Following Following

- Saved Saved

Gold worth tens of billions smuggled to the UAE each year, report says

- Medium Text

DISCREPANCIES

Artisanal mining.

Sign up here.

Reporting by Reade Levinson and David Lewis; additional reporting by Alex Cornwell and Rachna Uppal; Editing by Aurora Ellis

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Investigative reporter specializing in using data analysis and open source materials to break news and expose wrongdoing. Written about police violence and failings of the U.S. justice system; business interests of Myanmar military family members; and the largely unregulated U.S. trade in donated human bodies. Honors include a Loeb Award, Scripps Howard Award, Shadid Award for Journalism Ethics and Goldsmith Prize finalist, among others.

World Chevron

ANC to speak as South Africa waits to find out who will govern

The African National Congress will give an early indication on Wednesday of its response to last week's election, which ended its 30-year run as the majority party and plunged South Africa into political uncertainty unseen in the democratic era.

- Deutschland

- Asia, Australia & New Zealand

- Europe, Middle East & Africa

- United States & Canada

- Latinoamérica

Year in Search 2022: India

365 days. Billions of searches. And three consumer trends that will shape your life and year ahead.

The Year in Search 2022 report uncovers what lies beneath our collective consciousness and how it moves us all to act. From understanding our place in the world to redefining value and looking for joy, we’re turning to Search to answer our questions big and small in uncertain times.

Learn what matters most to us in India, and how the insights can help you move your marketing forward in 2023.

We’re searching for who we are and who we can be, without being limited by factors such as societal and workplace expectations. As a result, our cultural, personal, and professional identities are evolving.

For one, there’s a dynamic tension between our cultural identity as both global citizens and proud denizens. We’re looking for deep connections with global cultures through music and food. Yet our identity as proud locals has also intensified, with searches for local culture and traditions spiking.

We’re also defining professional fulfillment on our own terms. This includes finding work arrangements that meet our mental health needs, whether we’re learning more about “the great resignation” or finding ways to upgrade our skills and negotiate for a higher salary.

When inflation rises, we try to make sense of the reasons and reassess the cost of things. But we are not only looking at the sticker price.

We’re focused on what we consider to be of greatest value — trust. Where it might’ve once been a factor that influenced our purchase decisions, it’s now the tipping point in our calculations.

We’re searching for clear indications of whether a brand provides quality service and reliable products. And we’re looking for the one that offers the best deal overall. It’s why we’re searching for not just “cheap flights” but also “best restaurants.”

Along the way, we’re discovering an unexpected alliance: purchases which support sustainability can actually help us be savvier about our spending, such as affordable and clean energy or items that can be recycled.

Enjoying life to its fullest is another way we’ve embraced uncertainty as the norm. Rather than let the possibility of disruption put the brakes on our lifestyle and pursuits, we’re finding our own ways of making hay while the sun shines.

One approach: going for the little luxuries and enjoying cheap thrills. We’re saying “yes” to long-awaited holidays overseas, even if it means fulfilling detailed immigration checklists. And we’re indulging in affordable treats, including luxury perfumes and movies in theaters.

We’ve also merged our online and offline lives to get the most out of any moment. For instance, we’re turning to digital services like electronic payments to simplify offline activities such as in-store purchases. And we’re using online services like instant delivery to free up time for offline activities, especially those best enjoyed in-person, such as live concerts and fine-dining experiences.

These three consumer trends show what’s top of mind for us in India and how your brand can meet us in our need as we search for value, trust, and ways to live life to its fullest amid uncertainty.

To learn how you can tap into the trends, come up with a winning marketing strategy for 2023, and unlock growth with Search and marketing innovations, download the full Year in Search 2022: India report below.

Others are viewing

Marketers who view this are also viewing

Watch, learn, go: Why online video is key to connecting with today’s travelers

Choosing the right ad monetization platform for a sustainable app business, beyond a click: how tata aig general insurance powered profitability with google ai, scoring with gamers: new findings on html5 players that’ll grow gaming revenues, getting customers to make confident purchase decisions on every screen and format with video marketing, for the win: how non-gaming publishers can boost engagement and revenue with html5 games, eashwari deshpande, subhashini gupta, sources (1).

Google Trends, Sept. 2021 – Sept. 2022 versus year over year, unless otherwise indicated.

Others are viewing Looking for something else?

Complete login.

To explore this content and receive communications from Google, please sign in with an existing Google account.

Natural Gas

- Exploration & reserves

- Imports/exports

- Consumption

- All natural gas data reports

- Analysis & Projections

Major Topics

- Most popular

- Consumption/demand

- Exports/imports

- Forecasts/projections

- Production/supply

- All reports

- Alphabetical

Natural Gas Weekly Update

for week ending May 29, 2024 | Release date: May 30, 2024 | Next release: June 6, 2024 | Previous weeks

Note: Due to the federal government's observed holidays on December 24 and December 31, the next Natural Gas Weekly Update will be released on January 6.

Notice of holiday release schedule for Natural Gas Weekly Update (NGWU): The next NGWU will be released on January 9, 2020, because of upcoming federal holidays.

In the News:

Previous itn title.

Previous ITN article text

Note: Beginning June 11, 2024, we will publish the shale gas tight oil production data in the Short-Term Energy Outlook data tables.

Today in Energy

Recent Today in Energy analysis of natural gas markets is available on the EIA website.

- LNG-exporting Gulf Coast states drove U.S. natural gas demand growth

- U.S. exports of natural gas set a record high in the first half of 2023

- Natural gas combined-cycle power plants increased utilization with improved technology

Note: EIA has improved its play and well identification methods for the Monthly dry shale gas production, which has altered production volumes at various plays and has shifted classification of some wells from tight to other non-tight categories. Because EIA has changed the geologic model it uses to determine formation-level production of the three main oil-producing formations in the Permian Basin—Wolfcamp, Spraberry, and Bonespring—current and historical volume estimates have changed.

Market Highlights:

- Henry Hub spot price: The Henry Hub spot price fell 30 cents from $2.51 per million British thermal units (MMBtu) last Wednesday to $2.21/MMBtu yesterday.

- Henry Hub futures price: The June 2024 NYMEX contract expired yesterday at $2.493/MMBtu, down 35 cents from last Wednesday. The July 2024 NYMEX contract price decreased to $2.666/MMBtu, down 39 cents from last Wednesday to yesterday. The price of the 12-month strip averaging July 2024 through June 2025 futures contracts declined 24 cents to $3.129/MMBtu.

- Select regional spot prices: Natural gas spot price changes were mixed this report week (Wednesday, May 22 to Wednesday, May 29). Price changes ranged from a decrease of 57 cents at Transco Zone 6 New York to an increase of 30 cents at Florida Gas Transmission (FGT) Citygate.