5 Claims Specialist Cover Letter Examples

Introduction.

In today's competitive job market, a well-tailored cover letter can make all the difference when applying for a claims specialist position. As a claims specialist, your role involves assessing insurance claims, investigating the details, and determining their validity. It is crucial to showcase your skills, experience, and passion for the field in your cover letter to capture the attention of hiring managers.

A carefully crafted cover letter serves as an introduction to your application and allows you to highlight your qualifications in a concise and compelling manner. It provides an opportunity to demonstrate your understanding of the industry, showcase your relevant accomplishments, and explain why you are the ideal candidate for the position.

In this article, we will present several claims specialist cover letter examples to inspire and guide you in creating your own impactful cover letter. Each example will outline the key elements that make it effective, along with key takeaways that can be applied to any claims specialist cover letter. Whether you are an experienced claims specialist or just starting in the field, these examples will help you craft a cover letter that stands out from the competition and increases your chances of landing your dream job. So, let's dive in and explore the world of claims specialist cover letters!

Example 1: Property Claims Adjuster Cover Letter

Key takeaways.

Samantha's cover letter effectively demonstrates her expertise and experience as a Property Claims Adjuster, positioning her as an ideal candidate for the position at State Farm Insurance.

When applying for a specialized role like a Property Claims Adjuster, it is crucial to highlight your relevant experience and skills. This shows the hiring manager that you have a deep understanding of the job responsibilities and can hit the ground running.

Samantha emphasizes her track record of exceeding departmental targets and achieving a high claims closure rate. These quantifiable achievements demonstrate her ability to handle claims efficiently and effectively.

Including specific metrics and achievements in your cover letter helps to quantify your impact and showcases your ability to deliver results. This can greatly strengthen your application and set you apart from other candidates.

She also highlights her ability to handle high-pressure situations and resolve contentious claims through effective communication and negotiation. This showcases her strong interpersonal skills and problem-solving abilities.

Property Claims Adjusters often need to navigate complex situations and negotiate with various parties. Highlighting your ability to handle difficult situations and find mutually beneficial solutions can greatly enhance your application.

While Samantha's cover letter effectively showcases her experience and skills, she could further personalize it by mentioning specific aspects of State Farm Insurance that align with her values or career goals.

Research the company and find specific reasons why you are interested in working for them. Mentioning these in your cover letter demonstrates your enthusiasm and commitment to the organization.

Example 2: Liability Claims Specialist Cover Letter

Michael's cover letter effectively showcases his experience and expertise in liability claims handling, positioning him as a strong candidate for the Liability Claims Specialist position at GEICO.

When applying for a specialized role like a Liability Claims Specialist, it's important to highlight your specific experience and achievements in the field. This demonstrates your knowledge and expertise, making you a valuable asset to the organization.

He emphasizes his track record of exceeding performance targets and earning recognition for exceptional customer service skills, which highlights his commitment to delivering high-quality results and providing excellent service to policyholders.

Highlighting your achievements and recognition in previous roles demonstrates your dedication to excellence and your ability to meet and exceed expectations. This can assure the hiring manager that you are a reliable and high-performing candidate.

Michael also mentions his experience in mentoring and training junior team members, as well as implementing process improvements. This showcases his leadership skills and ability to contribute to the growth and success of the team.

If you have experience in leadership or process improvement, make sure to mention it in your cover letter. This demonstrates your ability to take on additional responsibilities and contribute to the overall success of the organization.

To further enhance his application, Michael could consider mentioning any specific software or tools he is proficient in, as well as any relevant certifications or training he has completed in the field of liability claims handling.

Including specific technical skills and certifications can provide additional evidence of your qualifications and expertise in the field. This can strengthen your application and make you stand out as a highly qualified candidate.

Example 3: Workers' Compensation Claims Examiner Cover Letter

Sarah's cover letter effectively demonstrates her qualifications and experience in the field of workers' compensation claims examination, positioning her as an ideal candidate for the position at Zurich Insurance Group.

When applying for a specialized role like a Workers' Compensation Claims Examiner, it is crucial to highlight your relevant experience and expertise in the field. This demonstrates your ability to handle complex claims and navigate the intricacies of workers' compensation regulations.

Sarah emphasizes her accomplishments as a Claims Adjuster at Travelers Insurance, showcasing her ability to handle a diverse caseload and achieve positive outcomes. She also mentions her role as an Assistant Claims Examiner at AIG, highlighting her experience in managing complex claims and collaborating with medical professionals.

It is important to highlight specific achievements and responsibilities in previous roles that directly relate to the requirements of the position you are applying for. This demonstrates your ability to handle similar challenges and showcases your expertise in the field.

Sarah expresses her interest in Zurich Insurance Group and its reputation for excellence in the insurance industry. By aligning herself with the company's values, she shows her enthusiasm and dedication to contributing to Zurich's success.

Research the company you are applying to and mention specific reasons why you are interested in working for them. This demonstrates your genuine interest in the company and your motivation to contribute to its goals.

Example 5: Medical Claims Analyst Cover Letter

Emily's cover letter effectively showcases her relevant experience and highlights her key accomplishments as a Medical Claims Analyst.

When applying for a position as a Medical Claims Analyst, it is crucial to demonstrate your understanding of medical coding and billing procedures. This shows your ability to accurately process and analyze claims.

She emphasizes her achievements by mentioning the implementation of a new claims review process that resulted in a 20% reduction in claims processing time.

Quantify your accomplishments whenever possible. Numbers and percentages provide concrete evidence of your impact and abilities.

Emily also expresses her enthusiasm for Anthem's mission of improving healthcare access and affordability.

Demonstrating alignment with the company's mission and values can make you a more attractive candidate. It shows that you are genuinely interested in contributing to the organization's goals.

To further strengthen her cover letter, Emily could provide specific examples of her experience in handling complex claims or her knowledge of industry regulations and compliance.

Highlighting specific experiences or expertise can help differentiate you from other candidates and show your depth of knowledge in the field of medical claims analysis.

Brian's cover letter effectively showcases his experience and expertise in auto insurance claims, positioning him as a strong candidate for the Auto Claims Investigator position at Nationwide Insurance.

When applying for a niche role like an Auto Claims Investigator, it's crucial to emphasize your relevant experience and highlight your specific skills in investigating and resolving claims. This demonstrates your ability to handle complex cases and deliver fair and accurate claim settlements.

Brian highlights his achievements as a Claims Representative at State Farm Insurance, where he consistently exceeded performance targets and demonstrated strong analytical skills.

It's important to highlight specific achievements and quantifiable results in your cover letter. By showcasing your ability to meet or exceed targets, you demonstrate your effectiveness in managing claims and resolving issues efficiently.

He also emphasizes his experience as an Auto Claims Adjuster at Farmers Insurance, where he handled a high volume of claims and successfully resolved complex cases involving fraud and disputed liability.

Providing details about the types of claims you have handled and the challenges you have overcome can help highlight your expertise in the field. This gives the hiring manager confidence in your ability to handle similar situations at their organization.

Brian effectively communicates his interest in Nationwide Insurance and aligns his skills and experience with the company's reputation for excellence in claims management and commitment to customer satisfaction.

Research the company you are applying to and tailor your cover letter to showcase how your skills and experience align with their values and goals. This demonstrates your genuine interest in the company and your understanding of how you can contribute to their success.

Skills To Highlight

As a claims specialist, your cover letter should highlight the key skills that make you a strong candidate for the role. These skills are vital in the field of claims handling and can greatly contribute to your success in the position. Here are the key skills you should emphasize in your cover letter:

Attention to Detail : Claims specialists are responsible for reviewing and assessing claims, ensuring that all information is accurate and complete. Attention to detail is crucial in this role to avoid errors or discrepancies that could impact the claims process. Highlight your ability to meticulously analyze documents, identify inconsistencies, and pay close attention to important details.

Communication Skills : Effective communication is essential for claims specialists as they interact with various stakeholders, including policyholders, insurance agents, and other professionals. Showcase your strong communication skills by providing examples of your ability to explain complex information clearly, listen actively, and provide excellent customer service. Highlight your written and verbal communication skills, as well as your ability to adapt your communication style to different audiences.

Negotiation Skills : Claims specialists often need to negotiate with policyholders, third-party claimants, and other parties involved in the claims process. Demonstrate your negotiation skills by describing situations where you successfully resolved conflicts, reached mutually beneficial agreements, or provided fair settlements. Highlight your ability to remain calm under pressure, analyze different perspectives, and find creative solutions to resolve disputes.

Customer Service : Claims specialists play a crucial role in providing support and assistance to policyholders during the claims process. Showcase your customer service skills by highlighting instances where you went above and beyond to address customer needs, provided empathy and understanding, and ensured a positive customer experience. Emphasize your ability to handle difficult situations with professionalism and empathy.

Analytical Thinking : Claims specialists need to analyze complex information, evaluate evidence, and make informed decisions. Highlight your analytical thinking skills by showcasing your ability to gather and interpret data, assess the validity of claims, and identify patterns or trends. Provide examples of how you use critical thinking to evaluate evidence, identify potential fraud, and make sound judgments.

By emphasizing these key skills in your cover letter, you can demonstrate your suitability for the role of a claims specialist and stand out as a strong candidate. Remember to provide specific examples and quantify your achievements whenever possible to make your cover letter more impactful.

Common Mistakes To Avoid

When crafting your cover letter as a claims specialist, it's important to avoid these common mistakes:

Being Too General : One of the biggest mistakes you can make in your claims specialist cover letter is being too generic. Avoid using vague language and instead, focus on specific examples of your experience and skills that are relevant to the claims handling role. Tailor your letter to the specific company and job description to demonstrate your understanding of their needs.

Failing to Showcase Your Ability to Handle Difficult Cases : Claims handling can be a complex and challenging job, and employers are looking for candidates who can effectively handle difficult cases. Don't just mention your ability to handle claims generally; provide specific examples of challenging cases you have successfully managed. Highlight your problem-solving skills, attention to detail, and ability to navigate complex situations.

Not Addressing the Company's Specific Claims Handling Needs : Every company has its own unique claims handling processes and requirements. It's important to research the company and understand their specific needs in order to tailor your cover letter accordingly. Avoid sending a generic cover letter that doesn't address the company's specific claims handling needs. Instead, highlight how your expertise and experience align with what the company is looking for.

Neglecting to Highlight Your Communication Skills : Effective communication is crucial for claims specialists, as they often need to interact with clients, insurance adjusters, and other stakeholders. Make sure to emphasize your strong communication skills in your cover letter. Provide examples of situations where you effectively communicated complex information, resolved conflicts, or provided excellent customer service.

Failing to Demonstrate Your Knowledge of Insurance Policies and Regulations : Claims specialists need to have a deep understanding of insurance policies, regulations, and industry best practices. Don't forget to showcase your knowledge and expertise in your cover letter. Highlight any relevant certifications or training you have completed, and provide examples of how your understanding of insurance policies and regulations has contributed to your success as a claims specialist.

Avoiding these common mistakes will help you create a strong and compelling cover letter that showcases your skills and experience as a claims specialist. By tailoring your letter to the specific company and addressing their unique needs, you will increase your chances of standing out as a top candidate for the position.

In conclusion, a well-crafted cover letter is an essential tool for any claims specialist looking to make a strong impression during the job application process. The examples provided in this article demonstrate effective strategies for showcasing the skills, experience, and qualifications that make a candidate stand out in this competitive field.

By following the key takeaways highlighted in each example, applicants can create personalized cover letters that effectively communicate their value and suitability for the position. These takeaways include the importance of tailoring the cover letter to the specific job requirements, highlighting relevant achievements and experiences, and demonstrating a genuine passion for the claims specialist role.

Additionally, avoiding common mistakes such as generic language, excessive use of jargon, and failure to address the hiring manager by name can significantly impact the impact of a cover letter. By paying attention to these details, applicants can ensure that their cover letters are professional, engaging, and tailored to the needs of the employer.

In a competitive job market, a well-written cover letter can make all the difference in securing an interview and ultimately landing a rewarding position as a claims specialist. By investing time and effort into crafting a strong cover letter, applicants can enhance their chances of success and demonstrate their commitment to excellence in the field of claims handling.

So, whether you're an experienced claims specialist or just starting your career in this field, take the time to create a compelling cover letter that showcases your unique skills and qualifications. With the examples and tips provided in this article, you'll be well on your way to standing out from the competition and securing your dream job as a claims specialist. Good luck!

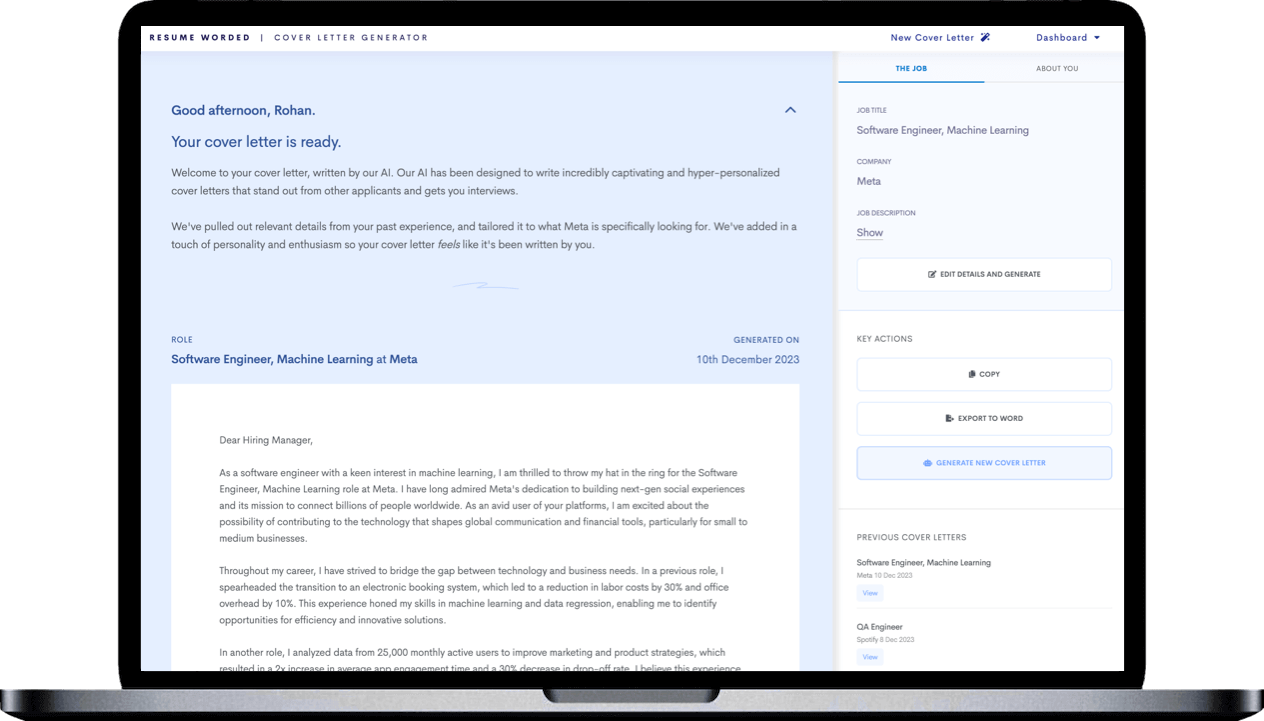

Claim Specialist Cover Letter Example (Free Guide)

Create an claim specialist cover letter that lands you the interview with our free examples and writing tips. use and customize our template and land an interview today..

Writing a compelling cover letter for a claim specialist role can be difficult. But, with the right knowledge and advice, you can make sure you stand out from the competition and get noticed by potential employers. This guide will provide you with the tips and tricks needed to create an effective cover letter for a claim specialist role.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Finance Advisor Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Experienced Mortgage Advisor Cover Letter Sample

- Compliance Analyst Cover Letter Sample

- Credit Administrator Cover Letter Sample

- Credit Manager Cover Letter Sample

- Finance Manager Cover Letter Sample

- Actuary Cover Letter Sample

Claim Specialist Cover Letter Sample

- Account Administrator Cover Letter Sample

- Account Analyst Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Accounting Associate Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Consultant Cover Letter Sample

- Accounting Coordinator Cover Letter Sample

- Accounting Manager Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Audit Director Cover Letter Sample

Dear Hiring Manager,

I am excited to apply for the position of Claim Specialist with your organization. As a highly organized professional with experience in the insurance industry, I believe I can make an immediate and positive contribution.

For the past five years, I have worked as a Claim Specialist for XYZ Insurance. In this role, I have gained a comprehensive understanding of the claim process, from the initial assessment to the resolution of the claim. I am adept at analyzing policies and regulations to ensure the proper compensation for claimants. I also have a good understanding of the nuances of the insurance industry, which has enabled me to provide exceptional customer service.

I am highly organized and have excellent time management skills. My ability to prioritize tasks and multitask has enabled me to stay on top of the claim process. I am also highly detail-oriented and take pride in ensuring accuracy in my work. I am a team player and accustomed to working with people in different departments to ensure that claims are properly processed.

In addition, I have a strong customer service background. I understand the importance of providing excellent customer service to claimants and I have the ability to handle difficult and emotional conversations in a professional manner. I am skilled at resolving conflicts and finding solutions that are satisfactory to all parties.

I am confident that I have the skills and experience necessary to be a successful Claim Specialist for your organization. Please review my attached resume and contact me if you have any questions. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Claim Specialist Cover Letter?

- A Claim Specialist cover letter is essential when applying for a job in the insurance claims industry.

- It serves as a way to introduce yourself to the employer and to explain why you are the best candidate for the position.

- In the cover letter, you can highlight your skills and experience related to the field of insurance claims and provide examples of how you can help the employer.

- A cover letter also helps you stand out from other candidates, as it allows you to demonstrate your knowledge and passion for the job.

- In addition, a well-crafted cover letter can give the employer a better understanding of why you think you are the right person for the job.

- Finally, a cover letter is a great way to showcase your writing skills and to demonstrate your enthusiasm for the position.

A Few Important Rules To Keep In Mind

- Make sure to include a brief introduction of yourself, emphasizing your relevant experience and qualifications.

- Highlight your ability to communicate effectively with customers, adjusters, and medical providers.

- Mention any specialized training you may have received in the claims field.

- Demonstrate your knowledge of the insurance industry, with an emphasis on claims.

- Provide examples of how you have successfully managed claim processes in the past.

- Describe any strategies you have used to improve the claims process.

- Explain how your skills and experience will benefit the insurance company.

- Use strong and clear language to explain your qualifications.

- Proofread your letter to ensure that it contains no errors.

What's The Best Structure For Claim Specialist Cover Letters?

After creating an impressive Claim Specialist resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Claim Specialist cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Claim Specialist Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As a claim specialist, I am highly knowledgeable in all aspects of claim processing. I have a proven track record of successfully resolving complex claims and providing excellent customer service. With my expertise and experience, I am confident that I can make a positive impact on your organization.

I have a comprehensive understanding of the claims process, from filing, to investigation, and resolution. I am adept at identifying and correcting discrepancies, as well as researching and negotiating settlements. In addition, I am well-versed in insurance laws and regulations, and I am comfortable working with many different types of policies. My analytical skills and attention to detail have enabled me to identify and resolve issues quickly and efficiently.

I am also an excellent communicator, both in person and over the phone. I am able to provide clear and concise explanations of policies, procedures, and outcomes to customers. I am also able to build positive relationships with customers, which helps to ensure they have a positive experience with the company.

In addition, I have experience working with various software systems, such as Microsoft Office and claims management programs. I am comfortable learning new software and have the ability to quickly become proficient in its use. I am always looking for ways to increase efficiency and accuracy when processing claims.

I am confident that I can be an asset to your team. I am excited to have the opportunity to discuss my qualifications in further detail. Thank you for your time and consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Claim Specialist Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not personalizing the cover letter to the company or position

- Including irrelevant information

- Not proofreading for spelling and grammar errors

- Not making the letter concise and to the point

- Not demonstrating knowledge of the company

- Not describing relevant experience and skills

- Not providing enough details about past accomplishments

- Not using a professional tone

- Not expressing enthusiasm for the position

- Not asking for an interview

Key Takeaways For a Claim Specialist Cover Letter

- Strong organizational and communication skills

- Ability to work independently and in a team environment

- Proficient in claim processing and data entry techniques

- Detail-oriented and highly organized

- Knowledge of insurance regulations and procedures

- Experienced in customer service and problem-solving

- Knowledge of computer systems and software

What Does a Claims Administrator Do?

Find out what a Claims Administrator does, how to get this job, salary information, and what it takes to succeed as a Claims Administrator.

The Claims Administrator plays an essential role within the framework of insurance and risk management operations, focusing on the efficient handling and processing of claims from initiation to resolution. This position acts as a liaison between claimants and insurers, ensuring that all parties are informed and that the documentation necessary for claim assessment is accurately compiled and submitted. By maintaining a thorough understanding of policy details and claim procedures, the Claims Administrator supports a smooth operational flow, contributing to the timely and fair settlement of claims. Their efforts directly impact customer satisfaction and trust, reinforcing the company’s commitment to service excellence and integrity in the face of unforeseen events or losses.

Claims Administrator Job Duties

- Review and process incoming insurance claims, ensuring all necessary documentation is complete and accurate.

- Liaise with policyholders to gather additional information or clarify existing data related to claims.

- Evaluate claims to determine the extent of the company’s liability in accordance with policy terms and conditions.

- Authorize payments for valid claims and determine appropriate settlement amounts based on assessments of damage or loss.

- Deny claims that do not meet policy conditions, providing clear and comprehensive explanations to claimants about the reasons for denial.

- Coordinate with legal counsel to defend the company’s position in disputed claims and participate in negotiations to settle claims out of court.

- Maintain detailed records of all claims, decisions, and financial transactions related to claim settlements.

- Develop and implement strategies for fraud detection and prevention to minimize financial losses from fraudulent claims.

Claims Administrator Salary & Outlook

Factors influencing a Claims Administrator’s salary include industry experience, the complexity of claims handled, employer size, and specialization within certain claim types (e.g., automotive, health insurance). Additionally, proficiency in claims management software and a track record of efficient claims processing can significantly impact earnings.

- Median Annual Salary: $67,725 ($32.56/hour)

- Top 10% Annual Salary: $114,500 ($55.05/hour)

The employment of claims administrators is expected to decline over the next decade.

This decline is primarily due to advancements in automation and artificial intelligence, which streamline claims processing and reduce the need for manual review. Additionally, the integration of sophisticated software systems allows for more efficient management of claims, further diminishing the demand for Claims Administrators.

Claims Administrator Job Requirements

Education: A Claims Administrator often holds a Bachelor’s Degree, with majors in Business Administration, Finance, or a related field being advantageous. Courses in communication, legal studies, and data analysis are beneficial for understanding the complexities of claim processes. Some pursue further education, obtaining a Master’s Degree to advance in their careers, focusing on specialized areas such as insurance law or advanced business management, enhancing their analytical and decision-making skills in handling claims efficiently.

Experience: Claims Administrators typically possess a blend of on-the-job experience and participation in specialized training programs. Ideal candidates have a background in handling insurance claims, showcasing skills in claim processing, negotiation, and customer service. Experience in a related administrative role, with a focus on detail-oriented tasks and decision-making, is also valuable. Continuous professional development through training programs in claims management and regulatory compliance is essential to stay abreast of industry standards and practices.

Certifications & Licenses: No specific certifications or licenses are typically required for the job of a Claims Administrator.

Claims Administrator Skills

Claims Processing: Evaluating and adjudicating insurance claims with precision involves a comprehensive understanding of policy provisions, regulations, and industry standards. Claims Administrators are tasked with making accurate eligibility determinations, calculating benefits correctly, and ensuring timely payment, all while minimizing fraud risk.

Regulatory Compliance: Claims Administrators audit processes and documentation to ensure adherence to the myriad of laws at local, state, and federal levels that govern insurance claims and settlements. Their role involves staying abreast of evolving regulations and implementing compliant procedures effectively throughout the claims processing lifecycle.

Dispute Resolution: Handling disagreements between claimants and insurers requires an ability to analyze information, interpret policy details accurately, and propose solutions that are fair and adhere to legal and company standards. It’s a process that demands a balance of empathy and assertiveness to communicate decisions, ensuring all parties feel heard and respected.

Fraud Detection: Identifying irregular patterns and discrepancies in claims submissions is critical for protecting against financial losses and maintaining the integrity of the claims process. Claims Administrators use their detailed understanding of typical claim behaviors and processes to spot and investigate suspicious activities promptly.

Data Analysis: Interpreting and evaluating claims data helps in identifying patterns and anomalies, which could indicate fraudulent activity or areas for process improvement. This capability is also crucial for forecasting trends and making informed decisions regarding claim settlements and policy adjustments.

Policy Interpretation: A meticulous attention to detail and an analytical mindset are required for deciphering the nuances of insurance policies. This skill ensures Claims Administrators can accurately assess coverage limits and exclusions, leading to the equitable and efficient resolution of claims while protecting the interests of both insurers and claimants.

Claims Administrator Work Environment

A Claims Administrator typically operates within an office setting, where the ambiance is structured yet accommodating to the nature of the work. The workspace is equipped with standard office tools and technology, including computers with specialized software to manage and process claims efficiently. Work hours are generally fixed, but there’s a growing trend towards flexibility, acknowledging the need for a healthy work-life balance.

The environment encourages a professional dress code, though it may lean towards business casual to foster a comfortable yet focused atmosphere. Interaction with others is a significant aspect of the role, involving communication with claimants, colleagues, and insurance representatives, necessitating a level of emotional intelligence to navigate various conversations effectively.

The pace can be brisk, driven by deadlines and the need to resolve claims efficiently. While the job seldom requires travel, it demands a continuous engagement with technology to streamline processes. Professional development opportunities are often available, reflecting the organization’s commitment to employee growth and adaptation to industry advancements.

Advancement Prospects

A Claims Administrator can advance to a Claims Supervisor or Manager by demonstrating exceptional organizational, negotiation, and decision-making skills. Mastery in handling complex claims and a deep understanding of insurance policies and regulations are crucial.

To achieve these roles, gaining experience in various types of claims, such as property, casualty, or health insurance, is beneficial. Specializing in a particular type of claim can also lead to opportunities in senior management or technical advisory positions.

Leadership qualities are essential for progression. Developing these through leading small teams or projects can showcase the ability to manage larger teams and more significant responsibilities.

Innovation in claims processing and cost-saving strategies can further highlight a candidate’s potential for advancement. Implementing new technologies or procedures that improve efficiency or customer satisfaction can be a significant career boost.

What Does an Attendance Clerk Do?

What does a substation technician do, you may also be interested in..., what does an epic analyst do, 16 nuclear pharmacist skills for your career and resume, 16 patent paralegal skills for your career and resume, what does a clinical liaison do.

Claims Assistant Cover Letter Examples

A great claims assistant cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following claims assistant cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Channel Roote

(922) 294-6159

Dear Ms. Fechtel,

I am writing to express my interest in the Claims Assistant position at Allstate Insurance Company as advertised. With a solid foundation of five years of experience at Progressive Casualty Insurance Company, I have honed my skills in claims processing, customer service, and administrative support, all of which I am eager to bring to your esteemed team.

Throughout my tenure at Progressive, I have consistently demonstrated an ability to manage a high volume of claims with efficiency and accuracy. My role required a keen eye for detail and a strong understanding of insurance policies and procedures, which ensured that claims were processed in compliance with company standards and regulatory requirements. I pride myself on my ability to navigate complex claims, and I am confident in my capacity to address and resolve any challenges that may arise in the claims process.

In addition to my technical abilities, I have developed a compassionate approach when interacting with claimants, understanding that behind every claim is a person dealing with a potentially stressful situation. I believe in creating a positive experience for customers through clear communication, empathy, and a commitment to finding fair resolutions quickly.

I am particularly attracted to the opportunity at Allstate Insurance Company because of your dedication to innovation and customer service excellence. I am excited about the prospect of contributing to such a dynamic and forward-thinking environment, where I can continue to grow professionally and make a meaningful impact.

Thank you for considering my application. I am looking forward to the possibility of discussing how my background, skills, and enthusiasms align with the needs of your team. I am confident that my experience at Progressive Casualty Insurance Company has prepared me well to make a significant contribution to Allstate Insurance Company.

Warm regards,

Related Cover Letter Examples

- Claims Adjuster

- Claims Clerk

- Claims Examiner

- Claims Investigator

- Claims Processor

- Claims Representative

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Insurance Claims Manager Cover Letter Example

Writing a cover letter for a role as an insurance claims manager is an important step in the job search process. Crafting an effective cover letter requires careful consideration of your skills and qualifications, and how they make you the ideal candidate for the job. In this guide, we’ll walk you through the process of writing an insurance claims manager cover letter, providing helpful tips and an example to refer to as you create your own.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Insurance Claims Manager Cover Letter Sample

Dear [Hiring Manager],

I am writing to express my interest in the Insurance Claims Manager position at [Company Name]. With more than 10 years of experience managing and overseeing the operations of large- scale insurance organizations, I have the requisite knowledge and skills to effectively lead your team.

My current role as a Senior Claims Manager at [Current Company] has allowed me to hone my expertise in insurance claims management, operations, and customer service. I have a successful track record of meeting and exceeding customer expectations and performance targets. I have also implemented new processes and procedures to improve customer service, reduce costs, and increase efficiency.

In addition to my experience, I also hold a Bachelors’ degree in Business Administration and a Masters’ degree in Insurance and Risk Management. My formal education, coupled with my practical experience, has provided me with the essential skills to effectively handle insurance claims. I have managed teams of up to 20 members and have a comprehensive understanding of insurance regulations and laws.

I am confident in my ability to exceed your expectations and am sure that my contribution will be invaluable to [Company Name]’s success. I would welcome the opportunity to discuss my qualifications in further detail.

Thank you for your time and consideration.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Claims Manager cover letter include?

A cover letter for an Insurance Claims Manager position should include information that showcases the applicant’s knowledge and experience in the insurance industry. It should demonstrate their ability to process and manage claims, as well as their problem- solving skills. In particular, the cover letter should highlight the applicant’s understanding of the claims process and their ability to handle customer complaints and difficult situations. The cover letter should also emphasize their knowledge of legal regulations, their understanding of auditing policies, and their proficiency in paperwork processing. The cover letter should also showcase the applicant’s ability to work well with both colleagues and clients. Additionally, the cover letter should emphasize the applicant’s dedication to providing quality customer service and their commitment to accuracy and integrity.

Insurance Claims Manager Cover Letter Writing Tips

A cover letter is a crucial part of any job application, and especially important when applying for a role as an Insurance Claims Manager. Your cover letter should give potential employers an insight into your experience and qualifications, as well as demonstrating your enthusiasm and commitment to the role. Here are a few tips to help you create an effective cover letter for an Insurance Claims Manager role.

- Make sure your cover letter is tailored to the specific job you are applying for. Highlight any qualifications, skills and experience that you have that are relevant to the role.

- Use a clear and professional font. Avoid long sentences and complicated language. Keep your tone professional and friendly.

- Start your letter off with a strong opening that immediately indicates why you are the best candidate for the job.

- Use specific examples to demonstrate your qualifications and experience in the field of insurance claims management.

- Explain why you are interested in the role and how you can contribute to the success of the company.

- Finish your letter with a call to action. Ask the employer to contact you to discuss the role further and to arrange an interview.

Writing a strong cover letter is a key step in the job application process. Following these tips can help you create a professional and effective cover letter that will help you stand out from the crowd.

Common mistakes to avoid when writing Insurance Claims Manager Cover letter

Cover letters are often the most important aspect of your job application – they can be the difference between getting an interview and being overlooked. As an Insurance Claims Manager, your cover letter should draw attention to your experience in insurance, as well as your ability to manage claims. Here are some common mistakes to avoid when writing an effective cover letter for an Insurance Claims Manager position:

- Not Customizing the Letter: Your cover letter should be tailored to the specific job you are applying for. Generic cover letters are often overlooked, so be sure to research the company and customize your letter accordingly.

- Not Highlighting Your Experience: It’s important to include details about your experience in the insurance industry, as well as any claims management experience you may have. Showcase your expertise and knowledge of the insurance industry and make sure to emphasize your achievements.

- Not Focusing on Your Strengths: Make sure to highlight the characteristics that make you a great fit for the role. Focus on the skills and abilities that make you unique and draw attention to the key areas that will help you excel in the role.

- Not Being Concise: Your cover letter should be concise, professional and to the point. Make sure to use clear and concise language and try to keep your letter to one page.

- Not Proofreading: Before you submit your cover letter, make sure to proofread it for any spelling, grammar or factual errors. These errors can make you appear unprofessional, so double- check your work before submitting.

By avoiding these mistakes and writing a tailored and professional cover letter, you can catch the attention of potential employers and give yourself the best chance of landing an interview. Good luck!

Key takeaways

Writing an impressive cover letter for an Insurance Claims Manager position is key for landing the job. Here are some key takeaways for making your cover letter stand out:

- Highlight your technical skills: Showcase your expertise in claims processing, customer service and communication, data entry and analysis, and other relevant skills.

- Demonstrate your organizational skills: Showcase how you are able to manage multiple claims and tasks while meeting deadlines.

- Showcase your problem- solving skills: Describe a situation where you solved a difficult issue or improved the existing claims process.

- Mention your interpersonal skills: Describe how you are able to effectively communicate and collaborate with a variety of stakeholders (e.g. customers, insurance companies, and other associates).

- Describe your experience: Elaborate on your relevant experience in the insurance or financial sector, or any other related roles.

- Showcase your enthusiasm: Share your enthusiasm for the position and why you would be a great fit for the role.

By following these key takeaways when writing your cover letter, you will be able to create an effective and impressive cover letter for the Insurance Claims Manager position.

Frequently Asked Questions

1. how do i write a cover letter for an insurance claims manager job with no experience.

Writing a cover letter for an Insurance Claims Manager job with no experience can be daunting, but it is possible! Start by introducing yourself at the top of the letter, and explain why you’re interested in the position. Highlight any transferable skills that you have that make you a good fit for this job, such as communication, organization, and problem- solving abilities. Finally, make sure to demonstrate genuine enthusiasm and a commitment to learn the necessary skills to excel in the role.

2. How do I write a cover letter for an Insurance Claims Manager job experience?

When writing a cover letter for an Insurance Claims Manager job with experience, emphasize your achievements in previous roles. Start by introducing yourself and provide a brief overview of your professional background. Then, discuss any awards or recognitions that you have received for your work in insurance claims management. Finally, highlight any skills and knowledge that you possess that make you a great fit for this particular role.

3. How can I highlight my accomplishments in Insurance Claims Manager cover letter?

When highlighting your accomplishments in your Insurance Claims Manager cover letter, focus on the areas where you had the greatest successes. For example, discuss any awards or recognitions that you have earned for your work in insurance claims management. Additionally, focus on any strategies or processes you implemented that resulted in improved service or efficiencies. Finally, emphasize any new knowledge or skills you acquired while in a previous role and how they can be used in this position.

4. What is a good cover letter for an Insurance Claims Manager job?

A good cover letter for an Insurance Claims Manager job should begin by introducing yourself and providing a brief overview of your professional background. Next, emphasize any successes or achievements that you have had in insurance claims management. Then, discuss any technical or other skills that you possess that make you a great fit for this particular role. Finally, express your enthusiasm and commitment to excel in the position.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

Claims Associate Cover Letter Example

A Claims Associate is a professional who works in the insurance industry and is responsible for reviewing the claim made by the policyholder. He ensures that the full payment for approved claims is processed to the account of the policyholder as per the policy.

A well-crafted Claims Associate Cover Letter should explain to the recruiter what you can offer to the company. The cover letter should be tailored in a precise way to target the employer. You can use our professional writing tips to customize your cover letter according to the company you are applying to.

- Cover Letters

What to Include in a Claims Associate Cover Letter?

Roles and responsibilities.

The primary responsibilities of a Claims Associate include interacting with policyholders and agents, reviewing claims , gathering data and, maintaining reports, and ensuring that the claim is approved if the terms of the policy are met.

- Accurate processing and completion of medical claims .

- Process claims that route out of automatic adjudication, within current turnaround standards.

- Demonstrate proficiency in product lines applicable to the processing unit.

- Understand and apply plan concepts: Deductible, Coinsurance, Copay, Out-of-pocket, State variations.

- Evaluate progress for all claims and coordinate with the team leader for all issues and effective resolution and develop new methods to handle all claims.

- Administer and settle all claims effectively and inform all customers and claimants of any denial on claims.

Education & Skills

Cover letter for Claims Associate Should preferably mention the following skills :

- Excellent communication skills.

- Claim analysis and processing.

- Customer service skills.

- Strong analytical and organizational skills.

- Multitasking abilities.

- Ability to work under pressure in a fast-paced environment.

Successful cover letters for Claims Associate Often mention the following qualification(s):

- An Associate’s degree in Business Administration or similar field; and at least 2-3 years of relevant experience.

Claims Associate Cover Letter Example (Text Version)

Dear Mr./Ms.,

Please accept my application for the position of Claims Associate at [XXX Insurance]. With a Bachelor’s degree in Business Administration and proven work experience of over two years as a Claims Associate, I am sure my skills would be a great addition to the [XXX]’ s workforce.

Over the past few years, [XXX Company] has emerged as one of the leading Insurance companies in the country. The company is regarded highly for its ethical work practices in helping clients meet their goals. I sincerely believe that your company can provide an ideal platform for me to upgrade my skills.

I am a performance-driven individual offering excellent leadership and communication skills, and the crucial ability to work independently as well as in a team setting. With my skills and abilities, I have successfully solved problems, resolving conflicts, and contributed to shared objectives. I have over two years of experience as a Claims Associate at [YYY Insurance].

At YYY, my current responsibilities include:

- Evaluate all claim and policy information.

- Perform interviews and gather all statements from physicians, insured clients, and attorneys for all claim information.

- Investigate and prepare reports for all denials of settlements and claims

- Providing high-quality customer service.

- Administer all claims effectively and inform all customers and claimants of any denial of claims.

- Maintain proper records of all benefits and resolve all issues in claim processes.

Furthermore, I possess the ability to use the software required for this job, including MS Office, CCAP, and GEARS. I am adept at providing solutions in a fast-paced environment. I am looking forward to an opportunity to work in a reputed organization such as yours.

Thank you for your patience.

Sincerely, [Your Name]

A good Claims Associate Cover Letter should highlight your technical skills, hands-on software experience, specialized certifications, and career achievements. Other basic information, such as educational background and work experience, can be included in your resume. For ideas on how to create a good resume for the said position, refer to our Claims Associate Resume Sample .

Customize Claims Associate Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Legal Cover Letters

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Administrative

Claims Administrator Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the claims administrator job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Provide assistance and ensure transparency in the communication to key internal and external clients e.g., IT, business development, actuarial

- Assess accuracy and efficiency of claims management strategies, and provide feedback and recommendations

- Develop a good working knowledge with Claims Module

- Prepares correspondence explaining adjustments, denials and makes written requests for missing information

- Create accurate records of each loss on the claims management system

- Effective time management and strong work ethic

- Contract Analysis: Use of established claims handling protocols to review and provide claims administration

- Participate in individual and team development activities/training to maximise both individual and team performance

- Developing and maintaining strong relationships with our broker clients to ensure that we retain post retirement business and not lose it to our competitors (Annuities and ARFs)

- Positive and pro-active attitude towards change and continuous improvement

- Answering all customer queries in a timely and efficient manner

- Adhering to all relevant Revenue Legislation

- Strong technical competence

- Adhering to the Service Level Agreements in place for claims settlement

- Advises management of potential areas of improvement for loss control

- Searches for opportunities to pursue indemnification, contribution or subrogation while reviewing claim files

- Handles pending cases as assigned

- Handles and resolves complaints and problems arising out of daily operations of the department

- Makes recommendations on how to precisely move forward with mandatory settlement conferences, mediations, arbitrations and trials as well as formal requests for authority /resolution

- Maintain GL files using internal and external computer systems

- Critical claims analysis on new and existing files

- Keen attention to detail with strong analytical ability

- Approachable being able to listen to clients

- Highly organized, delivery-orientated with the ability to proactively manage stakeholder expectations

- A good team player with good interpersonal skills

- Excellent organization skills and ability to plan and prioritize workload and work effectively under pressure

- Ensures quality and timeliness of team deliverables are consistent within segment of responsibility

- Strong attention to detail

- Excellent attention to detail and accuracy

- Strong interpersonal skills

- RG146 certification / Diploma in Financial Planning is highly regarded

15 Claims Administrator resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, german claims administrator resume examples & samples.

- Provide operational support to Payment Protection Insurance (PPI) business units

- Demonstrate strong understanding of processes and activities

- Report on PPI activity

- Proactively support all units and teams

- Fluent German

- Excellent knowledge of Microsoft Excel

- Driven & motivated by achievement

- A call centre background

- General insurance knowledge, and/or specifically in Payment Protection Insurance

- Knowledge of insurance regulation/compliance requirements

Life Claims Administrator Resume Examples & Samples

- Exceptional communication and interpersonal skills

- Strong ability to self-motivate, prioritise competing demands and manage own workload to meet individual and team targets whilst continuing to provide a high quality level of service

Pensions Claims Administrator Resume Examples & Samples

- Administering claims on all of the core systems to include calculation of tax free lump sums, taxable balances, Annuities and Approved Retirement Funds (ARF) which require an in depth knowledge of both Revenue Legislation and the internal suite of Individual and Corporate Pension Products

- Ability to work under pressure especially coming up to year end and in the run up to the budget

- Third Level Degree

- Superior communication skills, written, verbal and excellent customer focus

- Team player with the ability to take full ownership of work and responsibility for performance

- Highly organised with the ability to multi-task and make decisions

- Excellent accuracy and numeric ability with a strong focus on attention to detail

HOA Claims Administrator Resume Examples & Samples

- Associates Degree or in lieu of a degree two years’ relevant work experience

- Minimum two years collections and/or loss mitigation experience

- One year post charge off collections, repossession, remarketing, REO, foreclosure, loss mitigation or bankruptcy experience

- Working knowledge of MS Office, including Outlook, Excel, Word; Black Knight/Director

- Functional expert in the specific area of specialization (foreclosure, collections, REO, bankruptcy, loss mitigation)

- Analytic oriented

- Minimum three years’ collections experience and two years’ post charge off collections, repossession, remarketing, REO, foreclosure, loss mitigation or bankruptcy

- Knowledge of skip tracing software and BK servicing systems

- Prior departmental experience; foreclosure claims experience or pre-foreclosure experience

Claims Administrator Resume Examples & Samples

- Experience within the Financial Services Industry (preferably life insurance) working in a similar role

- Strong administration computer skills

- High computer skills

- Understanding of life insurance products and claims process

- Exposure to medical terminology through work experience or education

- Act as the first point of contact for clients, customers and employees

- Confident working in a fast moving, exciting environment

- A minimum of APA or CIP qualifications

- Administrative Analysis: Includes claims data analysis and first level adjudication for life, medical, accident and flex benefit claims administration

- Compliance: Review and adherence to internal compliance and client disclosure requirements, external vendor contracts and benefit provisions, policy digests and employee communications to ensure alignment with client expectations and legal requirements

- Participates in select client meetings to provide specific solution when needed

- College Graduate

- 3 years of experience in the insurance or financial services industry; life insurance / benefits administration experience is an advantage

- Knowledge with Microsoft Office

Group Claims Administrator Resume Examples & Samples

- Understanding of life insurance products

- Proven Customer Service experience

- Ability to operate under pressure with conflicting multiple priorities

- At least 1 year experience in insurance or financial services industry, life insurance, benefits administrations experience an advantage

- Knowledge with MS Office

- Ability to work with teams

- Processes customer requests in a timely and accurate manner

- Meets established quality control measures

- Meets individual productivity requirements

- Communicates with customers through written and oral correspondence

- Provides follow up on requests that cannot be immediately resolved

- Builds relationships with staff from other departments to ensure queries are responded to in a timely manner

- Escalates issues to management when needed

- Works with management to set daily priorities to ensure prompt and efficient service

- Maintains flexibility in a high speed, demanding team environment

- Identifies process improvements to increase efficiencies and streamline processes

- Actively participates in departmental team meetings and other open forums

- Assists with department projects and initiatives as needed

- 1-2 years of industry experience (annuity, mutual funds, banking, or insurance)

- Strong Math Skills

- Strong commitment to customer service and quality

- Strong research and follow-up skills

- Proven ability to work independently and in a team environment

- Knowledge of Microsoft Office Suite and Lotus Notes preferred

Asbestos Claims Administrator Resume Examples & Samples

- Under general supervision and acting on own initiative, performs advanced secretarial, clerical, and administrative duties for Executive level management

- Possesses extensive knowledge of office practices and procedures

- Possesses and displays the ability to apply techniques, procedures and criteria in carrying out a wide variety of related clerical and administrative tasks for executive management

- 4 + years of prior related experience

- Demonstrated experience designing, organizing, and administering a detailed document flow process

- Demonstrated excellent verbal and writing skills

- Demonstrated experience handling multiple tasks

- Knowledge of litigation process preferred

- 2 years of experience with the company preferred

- Familiarity with LawTrac, Serengeti Tracker or equivalent legal matter management software, MS Office Suite programs, specifically Word, Excel, and familiarity with database software including Access or equivalents for information management and production of reports for in-house and outside legal counsel, financial tracking and reporting, audit and risk management

- Entering new claims into the computer system

- General administration related to claims including information gathering, treatment requests and obtaining incident reports

- Answering incoming calls and, where possible, dealing with inquiries, or directing the call to the appropriate person

- Generating and sending appropriate letter/faxes/emails to follow up on claims and sending referrals to specialists

- Keep updated records and provide these to key stakeholders in a timely manner

- Project & Process Excellence

- Performance & Total Cost Management

- Value Creation

- Grade 12 National Certificate with Exemption

- Clear ITC and Police clearance

Trade Claims Administrator Resume Examples & Samples

- Support BSC / Genpact & LOC sales teams in the administration of trade claims, including leading issue resolution & process improvement

- Ensure complete and comprehensive Audit (all – internal, external, controls & financial) control & compliance for ANZ. Governance on end to end month end process from commercial teams to GL delivery

- Build & maintain strong working relationships with the BSC, global TCM colleagues, Sales finance partners

- Undertaking reviews/audits of claims against a qualitative audit tool

- Conducting audits of policies and procedures ensuring that “best practice” is met with regards to statutory, regulatory and ethical requirements

- Applying critical thinking and an evidence based approach to case management and claims settlement

- Utilising audit data and results to develop reports for the U.S

- Identification of key strengths and areas for improvement in U.S. operations; and

- Providing recommendations and feedback to stakeholders in relation to skill gaps identified

Senior Claims Administrator Resume Examples & Samples

- Determine compensability and total value of claim

- 4+ years of experience in an adjuster role, demonstrating ability to manage simple to complex claims

- Proven critical thinking skills that demonstrate analysis/judgment and sound decision making with focus on attention to details

- Computer literacy, including MS Office, Word, Excel

- Convey positive attitude and team spirit for optimum provision of services to customers

- Determine subrogation potential and pursue recovery where applicable

- Maintain acceptable claim closure ratio

- Negotiate settlement of claim if warranted

- Bachelor’s degree, or four or more years of equivalent work experience

- Receives client correspondence and files it in the correct files

- Draw claims files for Claims Advisors

- Metrofile / archive older claims files

- Ad hoc administrative tasks

- Registering of new claims and updating claims records on system

- Creating of claims files

- Prepare insurance claims forms or related documents and review them for completeness

- Call or write to insured or other involved person for missing information and post or attaches information to claim file

- Generate First Notification of Loss, acknowledgments, closing and additional correspondence

- Facilitate / Assist with payment for claims where required

- Minimum of 1 years' work experience required

- Clear and concise oral and written communication skills

- Proficient in Microsoft Office tools (or equivalent) - Outlook, Word and Excel

- Self-organized and can work independently

- Good command of English an Afrikaans

- Good written communication

- Strong admin skills

- Complete claims reviews to validate accuracy and validity of client reported claims

- Perform claims administration as required: validating and logging claims files and data, tracking, reviewing and aging of claims

- Produce, analyze and update control reports and escalate any issues with potential or known financial impact

- Develop effective working relationships with external clients (ceding companies) and local office and colleagues across the organization to ensure both client and internal customer needs are met

- Analyze and validate reinsurance files and corresponding premium payments. Processing and providing accurate and timely information to internal and external stakeholders in relation to the client data

- Actively seek enhancements and make recommendations for new processes to improve efficiencies or rectify inaccuracies or information gaps. Assist with small to medium sized client projects

- Document and follow operations procedures and adhere to SOX process controls

- Ensure accurate, complete and timely checking of all personal data received against OFAC list/PRIME software

- Perform ad hoc tasks as requested

- 1-3 years experience in reviewing/approving insurance claims

- 1-3 years life reinsurance/insurance experience preferred

- Post -secondary education or equivalent with a background in business, mathematics, economics or accounting

- Strong analytical and problem-solving skill

- Intermediate to advanced MS Excel skills

- Shows judgment in critically evaluating client data

- Takes responsibility for quality, completeness and accuracy of work

General Liability Claims Administrator Resume Examples & Samples

- Work directly with TPA in proactively handling the general liability claims through timely investigations, accurate reserves and resolution focused action plans and strategy

- Promptly respond to calls from customers, store associates and division personnel

- Drives thorough file documentation and active diary review

- Regular examination of ways to improve claim handling making recommendations to the liability manager for continued improvement of Company guidelines for processing general liability claims

- Attend regularly scheduled File Reviews with TPA and Roundtables where appropriate

- Indirectly leads, mentors and trains Claims Adjusters and Claims Investigators

- Analyze and interpret claims documents to locate correct data applicable to adjudication of the claim

- Prepares the Explanation of Payment showing relevant amounts and deductions (i.e., unpaid payment, interest, refundable insurance and fees, deductions from auto insurance claim settlements)

- Determines Retail Value and value at date of loss using appropriate reference materials

- Prepares Supplementary GAP payments based on new information submitted by lender, dealers, insurance companies and Agreement Holders

- High school diploma required, finance and/or accounting courses preferred

- Experience in a customer service role, strong preference for experience in an office and/or call center environment

- Insurance experience a plus

- Knowledge of finance and insurance

- Microsoft Word and Excel

- High School Diploma, 2 years’ college preferred

- 3 years of risk management, insurance, claims experience

- Ability to utilize online claim management systems

- Load Claims Notifications onto admin system

- Prepare payment requests for settlement

- Communicate effectively with Internal and external clients

- Update and maintain procedure notes/processes

- Generate reports for internal/external clients

- Maintaining Month End closure

- Maintain claims admin system