Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Equity crowdfunding: a systematic review of the literature

- Author & abstract

- 71 References

- 37 Citations

- Most related

- Related works & more

Corrections

(University of Wuppertal)

Suggested Citation

Download full text from publisher, references listed on ideas.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

You are using an outdated browser. Please upgrade your browser to improve your experience.

Equity crowdfunding: a systematic review of the literature

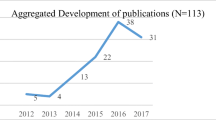

Equity crowdfunding is an emerging area of research within the broader sphere of entrepreneurship. Since 2012, research activities are steadily advancing, providing the foundation for a promising field of research. Despite ongoing scientific discussions, equity crowdfunding research is still in its infancy and scholarly knowledge remains limited and fragmented. To bring clarity to this fragmented field and to further advance the scientific process, we conduct a systematic literature review of 113 journal contributions and gray papers, published between 2012 and 2017. Based on an in-depth analysis of identified publications, we describe the landscape of the equity crowdfunding field concentrating on two aspects. First, we conduct a descriptive analysis of equity crowdfunding research to illustrate the scientific development. Second, we categorize relevant contributions into five different perspectives: capital market, entrepreneur, institutional, investor, and platform and perform a thematic analysis to reveal dominant themes and sub-themes within each perspective. Our study highlights several promising directions for encouraging further advancements in equity crowdfunding research.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, regulatory framework on governing equity crowdfunding: a systematic literature review and future directions.

Journal of Financial Regulation and Compliance

ISSN : 1358-1988

Article publication date: 16 May 2024

The purpose of this study is to comprehensively analyse and compare equity crowdfunding (ECF) regulations across 26 countries, shedding light on the diverse regulatory frameworks, investor and issuer limits and the evolution of ECF globally. By addressing this research gap and providing consolidated insights, the study aims to inform policymakers, researchers and entrepreneurs about the regulatory landscape of ECF, fostering a deeper understanding of its potential and challenges in various economies. Ultimately, the study contributes to the advancement of ECF as an alternative financing method for small and medium enterprises (SMEs) and startups, empowering them to access much-needed capital for growth.

Design/methodology/approach

The study used the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) model for a systematic literature review on global ECF regulations. Starting with 74 initial articles from Web of Sciences and Scopus databases, duplicates were removed and language criteria applied, leaving 42 articles. After a thorough full-text screening, 20 articles were excluded, resulting in the review of 22 papers from 2016 to 2022. PRISMA’s structured framework enhances the quality of systematic reviews, ensuring transparency and accessibility of findings for various stakeholders, including researchers, practitioners and policymakers, in the field of ECF regulations.

This study examines ECF regulations across various countries. Notably, the UK has advanced regulations, while the USA adopted them later through the Jumpstart Our Business Startups Act. Canada regulates at the provincial level. Malaysia and China were early adopters in Asia, but Hong Kong, Japan, Israel and India have bans. Turkey introduced regulations in 2019. New Zealand and Australia enacted laws, with Australia referring to it as “crowd-sourced equity funding”. Italy, Austria, France, Germany and Belgium have established regulations in Europe. These regulations vary in investor and issuer limits, disclosure requirements and anti-corruption measures, impacting the growth of ECF markets.

Research limitations/implications

This study’s findings underscore the diverse regulatory landscape governing ECF worldwide. It reveals that regulatory approaches vary from liberal to protectionist, reflecting each country’s unique economic and political context. The implications of this research highlight the need for cross-country analysis to inform practical implementation and the effectiveness of emerging ECF ecosystems. This knowledge can inspire regulatory adjustments, support startups and foster entrepreneurial growth in emerging economies, ultimately reshaping early-stage funding for new-age startups and SMEs on a global scale.

Originality/value

This study’s originality lies in its comprehensive analysis of ECF regulations across 26 diverse countries, shedding light on the intricate interplay between regulatory frameworks and a nation’s political-economic landscape. By delving into the nuanced variations in investor limits, investment types and regulatory strategies, it unveils the multifaceted nature of ECF regulation globally. Furthermore, this research adds value by comparing divergent perspectives on investment constraints and offering an understanding of their impact on ECF efficacy. Ultimately, the study’s unique contribution lies in its potential to inform practical implementation, shape legislative frameworks and catalyse entrepreneurial ecosystems in emerging economies, propelling the evolution of early-stage funding practices.

- Systematic literature review

- Crowdfunding

- Equity crowdfunding

- Regulations

- Entrepreneurial finance

Gupta, P. , Singh, S. , Ghosh, R. , Kumar, S. and Jain, C. (2024), "Regulatory framework on governing equity crowdfunding: a systematic literature review and future directions", Journal of Financial Regulation and Compliance , Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JFRC-10-2023-0160

Emerald Publishing Limited

Copyright © 2024, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Springer Nature - PMC COVID-19 Collection

- PMC10148577

Language: English | Spanish

Crowdfunding platforms: a systematic literature review and a bibliometric analysis

Alexandra mora-cruz.

1 School of Business Administration, Technological Institute of Costa Rica, 30101 Cartago, Costa Rica

Pedro R. Palos-Sanchez

2 Department of Financial Economy and Operation Research, University of Seville, 41018 Seville, Spain

Due to the financial crisis caused by the COVID-19 pandemic, entrepreneurs and small businesses have had multiple difficulties accessing conventional types of financing. Crowdfunding platforms have gained popularity as an alternative means of online financing. The main objective of this research is to analyze the most important articles that may influence future studies on crowdfunding platforms in Latin America. This article analyzes the Scopus and Web of Science databases considering three of the four categories of crowdfunding based on capital flows: Reward, Equity, and Lending, using a systematic review of the literature and bibliometric analysis. This research resulted in a total of 1032 articles which, after applying the appropriate criteria, resulted in 55 selected articles. The results show that the number of studies conducted in the field of crowdfunding platforms is increasing. Crowdfunding platforms provide a great opportunity for entrepreneurs to obtain alternative financing and a new way for investors to invest their capital. Future lines of research include conducting studies that involve a stronger focus on the technology used in crowdfunding platforms. With systematized access to information, the different actors can understand how the dynamics of crowdfunding platforms can stimulate the development of business projects, as well as the decision-making factor when investing. This document is of great interest to researchers and professionals who wish to increase their knowledge of crowdfunding platforms, especially those of Reward, Equity, and Lending, in addition to gaining knowledge on relevant conclusions and suggestions for future research.

Debido a la crisis financiera provocada por la pandemia del COVID-19, los emprendedores y pequeñas empresas han tenido múltiples dificultades para acceder a los tipos de financiamiento convencionales. Las plataformas de crowdfunding han adquirido popularidad al ser un medio de obtención de recursos online alternativo. El objetivo principal de esta investigación es analizar los artículos más importantes que pueden influir en futuros estudios sobre las plataformas de crowdfunding. Este artículo analiza las bases de datos Scopus y Web of Science tomando en cuenta tres categorías de crowdfunding basadas en flujos de capital: Reward, Equity y Lending, usando una revisión sistemática de la literatura y un análisis bibliométrico. La búsqueda arrojó un total de 1 032 artículos y, según los criterios aplicados, resultaron 55. Los resultados muestran que el número de estudios realizados en este campo se está incrementando. Estas plataformas dan una gran oportunidad de obtener un financiamiento alternativo a los emprendedores y una nueva forma de invertir su capital a los inversores. Entre las futuras líneas de investigación se encuentra la de realizar estudios que involucren una orientación más fuerte hacia la tecnología utilizada en las plataformas de crowdfunding. Con el acceso sistematizado de la información, se puede comprender cómo las dinámicas de estas plataformas pueden estimular el desarrollo de los proyectos empresariales, así como también la toma de decisiones para realizar inversiones. Este documento es de gran interés para investigadores y profesionales que deseen aumentar sus conocimientos en plataformas de crowdfunding. Además, de presentar conclusiones relevantes y sugerencias para futuras investigaciones.

Introduction

In today's economy, entrepreneurs are extremely important as they offer new jobs and new innovative products. As a result of the crises caused by the different phenomena worldwide, entrepreneurs face various difficulties that restrict their access to financing to support the initial stages of the projects (Croux et al., 2020 ; Shafi & Mohammadi, 2020 ). The search for financing has become an increasing challenge and with many obstacles (Hörisch & Tenner, 2020 ). Crowdfunding has become a method that helps companies in their initial stage avoid resorting to bank financing sources (Martínez-Climent et al., 2018 ; Madsen & McMullin, 2018 ; Yang et al., 2020 ), achieving great popularity among the business community.

The accelerated adoption of new technology and the emergence of new tools have been fundamental in fostering business growth and interpersonal relationships (Saura et al., 2017 ), allowing the way of financing new innovative projects to evolve (Jiang et al., 2020 ; Fu et al., 2021 ). Through platforms that facilitate the exchange of resources, such as knowledge and eLearning (Mora-Cruz et al., 2022 , 2023 ), crowdfunding has opened the way for entrepreneurs and investors to develop projects. The term crowdfunding was coined in 2008, and it has expanded on a large scale, providing the infrastructure to attract millions of investors and entrepreneurs (Moysidou & Hausberg, 2020 ). Crowdfunding has been a term used to describe different types of fundraising where entrepreneurs campaign for individuals to financially support their innovative products through Web 2.0 (De Crescenzo et al., 2020 ; Regner, 2021 ). Crowdfunding platforms (CFPs) act as intermediaries for innovative new financial methods to attract parties and thus grow new business initiatives (Vrontis et al., 2021 ; Chan et al., 2020 ). Although CFPs benefit those involved, creativity in attracting alternative capital plays an important role. Investors seek to identify attractive investment opportunities, valuing factors such as the quality and human capital of companies (Shafi, 2021 ). Therefore, entrepreneurs must adjust their campaign strategies for a changing and competitive environment (Tiberius & Hauptmeijer, 2021 ).

Due to the great interest in the topic, the literature on CFPs has been growing rapidly (Belavina et al., 2020 ). In this sense, the main objective of this research is to analyze the most important articles that may influence future studies on CFPs. Focusing mainly on the three categories of crowdfunding based on capital flows: Reward, Equity, and Lending, the exponential growth of this phenomenon worldwide has led to an increasing interest in researching this topic. The research carried out is of utmost importance to provide a real perspective of how this type of alternative financing is being studied and what could be the future lines of research that allow obtaining a greater knowledge of this phenomenon. The research questions for this study are the following:

RQ1 What are the main types of crowdfunding that are most researched and how do they help entrepreneurs and investors? RQ2 What are the main CFPs that have been investigated and why? RQ3 What are the gaps in existing research and possible areas for future research?

To answer the above questions, this article is structured as follows: followed by this introduction, first a section with a review of the CFP literature and three of the main types of crowdfunding: Reward, Equity and Lending. Second, a methodology section that includes a systematic review of the literature (SLR) and, in addition, a bibliometric analysis is developed through the use of the Bibliometrix package to measure scientific data (Aria & Cuccurullo, 2017 ). Third, the relevant results are presented concerning the data found in the CFP literature. Finally, the results are discussed, and it closes with the conclusions.

Literature review

Crowdfunding platforms as new financing alternatives.

The use of the Internet and the appearance of online platforms have revolutionized communication between human beings. This has allowed new financing alternatives such as CFPs to be available to entrepreneurs and their new innovative products. In recent years, CFPs have gained notoriety among capital-constrained entrepreneurs and small investors (Martínez-Climent et al., 2020 ; Reza-Gharehbagh et al., 2021 ). Digital financing sources such as the CFP reduce the costs of access to information and facilitate communication between entrepreneurs and investors (Meoli & Vismara, 2021 ). The Internet and online platforms have made it easier for homeowners to express their ideas more efficiently and for investors to learn more quickly (Ullah & Zhou, 2020 ). Even so, banking entities continue to be the main sources of investment attraction for the start-up of business projects. Some of the traditional sources for financing new projects are business angels, venture capital and private equity investors (Butticè & Vismara, 2021 ; Coakley et al., 2021 ).

Crowdfunding is a method of raising capital in small amounts from a large group of investors without traditional financial intermediaries, but usually with the help of a platform (Allon & Babich, 2020 , Chan et al., 2020 ; Tiberius & Hauptmeijer, 2021 ). One of the characteristics of this method is the democratization of financing, allowing all types of entrepreneurs to take advantage of opportunities to enhance their products (Gafni et al., 2021 ). Although the term crowdfunding dates back to times before the use of digital platforms, its implementation has been a creative method to finance business projects, revolutionizing the market (Martínez-Climent et al., 2018 ). It is important to emphasize those small investors can widely benefit from CFPs by finding more opportunities to generate financial returns in times of low deposit rates (Tiberius & Hauptmeijer, 2021 ), helping to reduce the risks associated with investment decisions. As for entrepreneurs, the advantages are multiple, since the interaction in the CFPs allows obtaining feedback by taking advantage of the collective skills and knowledge of the investors, which can help them develop their products or services before being launched on the market (Troise & Tani, 2020 ).

In this financing alternative, financiers (sponsors, donors, investors) and recipients (entrepreneurs, creators, companies) interact with CFPs (Allon & Babich, 2020 ; Ryu & Suh, 2020 ). The boom both in CFP and in campaigns generated to attract financing means that there is strong competition. In this interaction and for the campaigns to be successful, certain aspects such as quality, creativity and even the linguistic style used can be decisive (Ryu et al., 2020 ; Defazio et al., 2021 ). For Troise et al. ( 2020 ), the actors of these platforms must take into account the following: entrepreneurs must improve the quality of the campaigns and their dissemination through the different social networks; Investors must analyze the previous experience of entrepreneurs in the industry and the efforts of companies in product innovation, since this enhances the growth of their shares, and platform administrators must work so that entrepreneurs provide quality in the information to improve the experience. The CFPs that prevail in business financing are those based on Equity, Reward and Lending crowdfunding (Moysidou & Hausberg, 2020 ).

Equity crowdfunding platforms

Equity crowdfunding (ECF) is a way in which companies obtain financing in exchange for their shares (Butticè et al., 2021 ). In equity crowdfunding platforms (ECFP), entrepreneurs make an open call to sell a predetermined amount of their equity shares through the platforms where investors participate to obtain a financial return (Butticè & Vismara, 2021 ). According to Coakley et al. ( 2021 ) the main platforms of this type of crowdfunding bring together three models of shareholder structures: the first is the post-campaign role of the platform as an intermediary is minimal, so the startup communicates directly with its investors, who are the legal owners, in the second the platform, as legal owner, acts on behalf of all the investors who are the beneficial owners and in the third co-investment or lead investor model it is open only to qualified investors. ECFPs differ from the rest, as they involve making investment decisions with the perspective of a possible return on investment, thus leading to higher levels of risk, on the other hand, ECF investors are less experienced and face large information asymmetries when evaluating projects (Mochkabadi & Volkmann, 2020 , Cumming et al., 2021b ). In this sense, almost anyone can participate in the financing of innovations without having a high net worth (Ralcheva & Roosenboom, 2020 ). In other words, investors receive performance-related payments, comparable to stock dividends, as a reward for putting a small amount of equity into the company (Tiberius & Hauptmeijer, 2021 ). The external capital that the recipients receive is crucial to achieving their growth objectives and, in addition, with advantages such as the optimization of the investor solicitation process, the amount of capital versus the loss of ownership and control thanks to a large number of small investors. (Troise & Tani, 2020 ). Another benefit for the recipients is that the financial cost is lower than that of traditional sources (Xiao, 2019 ). ECFPs democratize business finance by providing access to finance to categories of entrepreneurs with fewer opportunities (Cicchiello et al., 2020 ).

Before ECFPs, angel investments and venture capital were the sources of financing for the initial stages of projects (Hornuf et al., 2021 ), today they compete with each other (Allon & Babich, 2020 ). Some of the most popular ECFPs worldwide are Mintos, MicroVentures, StartEngine, Broota, Dozen, and AngelList, among others.

Reward crowdfunding platforms

Reward crowdfunding platforms (RCFP) allow companies to raise funds through consumers, promising in return the launch of innovative products on the market (Bürger & Kleinert, 2021 ; Chemla & Tinn, 2020 ; Yang et al., 2020 ). without sacrificing their heritage (Chan et al., 2020 ). In other words, individuals donate money to these companies and they commit to returning the investment through their products or services. For Chakraborty and Swinney ( 2021 ) the products in the RCFP can be varied, some examples are physical goods, such as electronic devices, a piece of information good, such as software, a movie or music, or a service, such as a live show or a restaurant. RCFPs provide a simple process where the entrepreneur creates their campaign page, investors pay a commitment price, and the platform earns a profit percentage (Belavina et al., 2020 ). This crowdfunding model is predominant in entrepreneurial companies, but beyond the magnitude of the rewards they offer to attract investors, they value the success they may have in the future (Clauss et al., 2020 ). On the other hand, investors in RCFPs are considered altruistic for making investment decisions based on the little information they obtain from entrepreneurs with little experience or short business history (Testa et al., 2020 ). RCFPs are an ideal means to create a community of sponsors who can provide ideas, feedback and inspiration to improve products and benefit companies (Tafesse, 2021 ).

RCFPs compete with traditional start-up funding sources and sales channels (Allon & Babich, 2020 ). One of the limitations of the RCFP is that they are not legally committed to ensuring that the companies fulfill their promise and are not sure if they will deliver the rewards of the campaign (Chemla & Tinn, 2020 ; Chakraborty & Swinney, 2021 ). Another limitation is the asymmetric information that investors obtain to make economic decisions, which leads them to be guided by the decisions of other investors during the campaign (Chan et al., 2020 ). Among the most recognized RCFPs are Indiegogo, Kickstarter, Ulele, Patreon and Idea.me.

Lending crowdfunding platforms

Many small entrepreneurs seek traditional financing without success due to the large number of requirements requested by banks (Zhou et al., 2021 ) and, on the other hand, many people with large incomes seek to find investments that provide attractive returns (Kollenda, 2022 ). LCFP lending crowdfunding platforms are also known as Peer to Peer (P2P) platforms that allow interaction between lenders and entrepreneurs thanks to the use of financial technology (Demir et al., 2021 ; Nisar et al., 2020 ). LCFPs are an affordable alternative to obtaining loans (Berns et al., 2020 ). This model has some advantages that benefit entrepreneurs, such as lower interest rates and taxes, financing opportunities for individuals and legal entities that cannot obtain traditional external financing, and efficiency in the process thanks to the technologies used (Keliuotytė-Staniulėnienė & Kukarėnaitė, 2020 ). As for investors, in this type of P2P platform, they have the possibility to choose between a large number of projects with different conditions (interest rates, default scenarios, product quality) and each loan is unique (Ge et al., 2021 ). Like the other models, P2P loans have their limitations, in general, the amount is small and the interest rates are higher (Cumming et al., 2021a ). LCFPs compete with loans from financial organizations, friends and family (Allon & Babich, 2020 ). Some of the LCFPs that are used worldwide are Mintos, EstateGuru, PeerBerry, LendingClub, NEO Finance, Lendermarket among others.

Methodology

The purpose of this research was the implementation of a systematic review of the literature (SLR) to measure the most relevant scientific data about CFPs focusing on ECFP, RCFP, and LCFP and a bibliometric analysis (BA). For this article, the methodology proposed by Abarca et al. ( 2020 ), Arenas-Escaso et al. ( 2022 ), Palos-Sanchez et al. ( 2022 ), Bonilla-Chaves and Palos-Sánchez ( 2023 ) and Rojas-Sánchez et al. ( 2022 ) are followed, using SLR to determine the articles that contribute the most to this study and BA that allows a broader vision of the investigated topic, as well as the study by deMatos et al. ( 2021 ), Singh et al. ( 2023 ) and Wattanacharoensil and La-ornual ( 2019 ), who perform a series of steps that allow the information to be systematized (see Table Table9 9 in Appendix). While the SLR explains the meaning of crowdfunding and its types, as well as the implications of the use of CFP, the BA will make it possible to identify the most relevant data such as topics, journals, citations, the countries that publish the most on this topic, among others. For the SLR, the study carried out by Hakala ( 2011 ), was taken as a basis, which proposes a series of simple steps to determine which are the most relevant articles for the development of this research: first, the choice of the database; second, the identification of keywords; and third, the deep reading of the complete articles. To these steps, the application of different criteria was also added, which allowed for more consistency when choosing the articles (see Fig. 1 ).

Steps for SLR in the field of CFP

Review protocol of inclusion/exclusion criteria of articles and their justification

To carry out the BA, the recommended Workflow Model is followed to carry out scientific mapping studies proposed by Zupic and Čater ( 2015 ), which is composed of five steps: 1) define the research question(s) and choose the appropriate bibliometric methods, 2) select the database containing the bibliometric data, 3) use bibliometric software for analysis, 4) decide which display method to use on the results of the third step, and 5) interpret the results. The Scientific Mapping Workflow is shown in Fig. 2 .

Scientific Mapping Workflow

To use the measurement of the data, R is used as statistical software in the Bibliometrix and Biblioshany package (Aria & Cuccurullo, 2017 ). This allows the use of a variety of scientific mapping tools, the analysis of bibliographic information, and the visualization of results.

Research strategy

To carry out the search of the articles, two databases were chosen: Web of Science and Scopus. Web of Science (WoS) is a scientific information platform from Clarivate Analytics for consulting databases from the Institute for Scientific Information (ISI), with analysis tools that allow the scientific quality of publications to be assessed. Scopus, for its part, is a database of bibliographical references and citations from the Elsevier company, peer-reviewed literature, and quality web content. The use of these databases allowed us to find a large amount of literature on digital platforms, taking into account three categories of crowdfunding based on capital flows: Reward, Equity and Lending.

To start the study, the keywords that included crowdfunding and platforms were chosen; in addition, the timeline was limited to the years 2020 and 2021, due to the interest in analyzing the most critical period of the crisis caused by the COVID-19 pandemic. To achieve the final result, 5 Boolean chains were made in each database, using criteria that limited the search in terms of a subject area, English language, and scientific article (see Table Table1). 1 ). The first search on both platforms yielded a total of 1,032 documents, to which different criteria were applied. The search was then divided into the three crowdfunding categories discussed in this article using the same criteria mentioned above.

Database search text in the field of CFP

From this and with the articles obtained, they were ordered by the highest citation criterion. The deep reading was the next step to deciding which would be the studies that would have the most significance in this review. In this step, the duplication of articles was taken into account, since some that appeared in both databases were found. Through deep reading, the titles, abstracts, keywords, and each of the sections of the articles were analyzed. In this way, it was possible to obtain a list of 55 articles that met the parameters to answer the research questions of this study.

Of the 55 articles read in-depth, 47 use quantitative data while of the remaining 8, 5 are based on literature reviews and 3 on qualitative cases. As shown in Table Table2, 2 , 26 of the studies refer to the subject of equity-based CFP, 19 to reward and 10 to lending, 2 of the articles make a comparison of two categories equity and reward, and equity and lending respectively.

Contributions studied according to the systematic review of the literature

Analysis of results

Description of bibliometric analysis.

Table Table3 3 summarizes the critical details extracted from the WoS and Scopus databases for the study period 2020 to 2021 with a result of 55 articles after having applied the selection criteria mentioned above. Those articles have been published in 37 sources consisting mainly of scientific journals.

Main information about CFP

The "Keywords Plus" is the total number of keywords that appear frequently in the title of the article, that is, 212, which is approximately 3.8 times the number of articles studied. On average, two authors write per article (2.64); and the Collaboration Index (CI) of the Total Authors of Articles with Multiple Authors (Total Articles with Multiple Authors) is 2.84.

On the other hand, Table Table4 4 identifies the top 20 journals that have published the most articles in the field of CFP for the study period. The list is headed by the Journal of Technology Transfer with a total of 6 articles, followed by Small Business Economics with 5 and Information Systems Research magazine with 4.

Top 20 of the sources that involve CFP

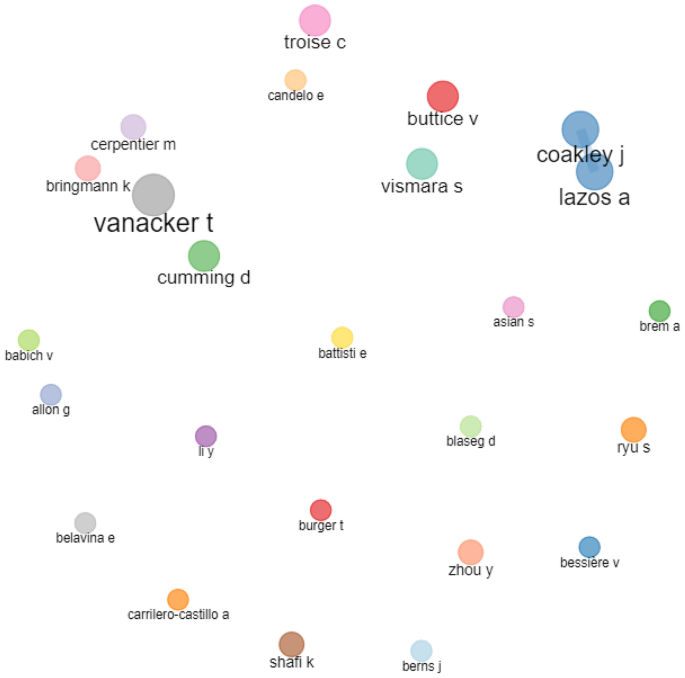

Regarding the authors, Fig. 3 identifies the top 20 authors who have published the most in this research period. Of the total of 147 authors, 11 authors have published two articles each and the rest have published only once. Regarding the perspective of the most relevant authors (Table (Table5), 5 ), the first author on the list is Vincenzo Butticè, with 2 articles, who is an Assistant Professor at the Politecnico di Milano University. He has conducted studies in the areas of crowdfunding, entrepreneurship, and finance. For the article "Inclusive digital finance the industry of equity crowdfunding" the co-author is Silvio Vismara. The primary objective of this study was to identify research needs and opportunities in equity crowdfunding with traditional venture capital providers to identify three main areas of academic research: 1) equity crowdfunding offerings reduce costs for entrepreneurial companies to raise funds, 2) seed finance involves professional investors negotiating deals with entrepreneurs, and 3) equity crowdfunding and initial public offerings have strong similarities, as they both involve public offerings of shares, where companies raise capital from the risk of external investors (Butticè & Vismara, 2021 ). For “They do not look alike what kind of private investors do equity crowdfunded firms attract” the co-authors are Francesca Di Pietro and Francesca Tenca. The objective of the article was to compare the companies that launched successful equity crowdfunding campaigns with companies that were financed by business angel investors according to the reputation of the investors; the result showed that the reputation of the investors that finance through equity crowdfunding is lower (Butticè et al., 2021 ). The second author, Jerry Coakley, is a Professor of Finance at Essex Business School, University of Essex. He has published more than 60 articles in international peer-reviewed financial and economics journals. Both the first article by this author and the second related to this bibliometric analysis were carried out jointly with Aristogenis Lazos and Jose Liñares‑Zegarra. The objectives of the study entitled "Seasoned equity crowdfunded offerings" were first to investigate the factors that drive companies to make a first financing offer on equity crowdfunding platforms, as well as the drivers of their success, and second to analyze how the shareholder structures of the platform impact the probability that companies carry out their first campaign (Coakley et al., 2021 ). The main objective of the other study was to adopt the view of entrepreneurs as strategic fund seekers but in the context of the ECF market in the UK (Coakley et al., 2021 ).

Most Relevant Authors in the field of CFP

Top 10 influential authors in the field of CFP

This research involves 147 authors, of which eleven have 2 articles published in the field of CFP in the period 2020 to 2021. Table Table5 5 shows that in the Top 10 of the authors that most influence the field studied, none stands out for this line of time.

Author dominance ranking

The dominance factor is a ratio indicating the fraction of multi-author articles in which a scholar appears as the first author (Nmf) concerning the total number of multi-author publications (Nmt) (Kumar & Kumar, 2008 ). Table Table10 10 shows the top 20 authors in the ranking. For this analysis, the following authors have the highest level of dominance and also have two publications: Buttic è, Coakley, Cumming, Ryus, and Shafi (he has an article where he is the only author) and Troise.

Dominance ranking of the authors

The keywords provide relevant information for the study since they are high-level summaries. The analysis of the keywords allows for evaluating the trend of the research, identifying gaps and the fields that may be important as areas of research. In the top 20 positions, Table Table6 6 highlights the total number of keywords. In this sense, the keyword "crowdfunding" was identified 31 times in the total number of keywords used by the authors. The rest of the keywords indicate the relationship between the various topics with crowdfunding, for example, classification, correlation with entrepreneurship, and alternative sources of financing.

Author's keywords in the field of CFP

The TreeMap highlights the combination of possible keywords. As Fig. 4 shows, the most representative keywords are crowdfunding 23%, equity crowdfunding 17%, and entrepreneurial finance 13%. On the other hand, words like COVID-19, credit controls, and big data are among the least cited, which indicates that there is not yet enough literature to measure the impact they have on crowdfunding. The World TreeMap confirms the trend of the words adopted and anticipates some identified threads. Figure 5 represents the keywords in order of magnitude using a word cloud, which reflects that the analyzed studies have been based on investigating the ECFP model more than the other two, RCFP and LCFP. It is important to emphasize that although there is a tendency to study how the CFP and quality campaigns benefit entrepreneurs, it has also begun to analyze how the asymmetric information exposed in the CFP affects investors.

Word TreeMap of high-frequency keywords in the field of CFP

World cloud Crowdfunding Platforms

Table Table7 7 shows the top 10 of the most cited articles globally. The article by Mochkabadi and Volkmann ( 2020 ), has 50 citations as of the end of 2021. This systematic review of the literature analyzes the development of the literature and identifies current methodological approaches. In addition, it highlights the current research topics and future lines of research based on the various topics and subtopics identified.

Top 10 global citation scores (GCS) in CFP

For their part, Chemla and Tinn ( 2020 ) have 43 citations and in their study, they develop a theoretical model to understand the main sources of RCFP value creation in product innovation projects, as well as explain the importance of RCFP and how companies can launch products early in their development.

The third most cited article of the documents under study is that of Chakraborty and Swinney ( 2021 ), in this document the authors detail how an entrepreneur through his campaign in an RCFP can demonstrate the quality of the product to his sponsors, including the amount of the reward and the financing objective.

The other articles shown in Table Table7 7 are described below. Ralcheva and Roosenboom ( 2020 ) extend the existing knowledge of the ECFP by studying the factors that are associated with the success of the campaigns with a literature survey that gave results such that the campaigns length and the maturity of the companies are important determinants. Like the previous authors, De Crescenzo et al. ( 2020 ) analyzes the factors that determine the success of RCFP campaigns, but also the failures, one of the most relevant results indicates that the greater the rewards and the greater the number of images in the campaign, the greater the probability of success. For their part, Vrontis et al. ( 2021 ) indicate that the success rate of ECFP campaigns is positively related to intellectual capital and positively related to the number of connections that the platforms have. To better understand the terms' crowdsourcing and crowdfunding, Allon and Babich ( 2020 ) define and compare these new business models with the traditional ones and summarize the contribution made by the research community on this topic. An important issue is how confidence affects project financing and how it is transferred to investors. In this sense, Moysidou and Hausberg ( 2020 ) explain through a model how the fundamental factors for trust influence LCFP projects. Another line of study is the asymmetric information available to investors in RCFPs. Chan et al. ( 2020 ) expand the research on observational learning using knowledge from other research on social influence and how it influences the behaviors of investor decision-making. The last of the top 10 most cited articles is that of Bessière et al. ( 2020 ) who focus on examining the different forms of financing entrepreneurs, including RCFP, ECFP combined with business angels, and ECFP combined with business angels and venture capital.

In this part of the research, the geographical development of the publications on the CFP topic is analyzed. This analysis highlights the number of citations, the frequency, and publication capacity in each region, the representativeness of dissemination, and, the relationship between countries in the analysis of the topic. Figure 6 and Table Table11 11 show the countries where the PIC topic has been studied for the period between 2020 and 2021. The first place is for the USA (29). However, many studies, despite being written by American authors, have been carried out with authors present in other countries. This country has been one of the forerunners of the CFP. The strongest platforms worldwide only accept projects from certain countries and limit projects from others. Second and third place for China (17) and Italy (14) and Germany is the fourth country considered by the number of publications (13) in the sector.

Scientific production distribution in the field of CFP

Total articles per country

One of the objectives of this study is to observe the cooperation and networking between researchers working and studying the topic of CFP in different countries. Table Table8 8 highlights the average number of citations by country. The United States has the highest citations in terms of the number of publications (147); the data has historical and trend relevance; since it is the main country to coin the term, followed by Italy (102), Germany (96), and China (52).

The average number of citations by country

Figure 7 shows the trajectory of cooperation between countries: the blue color on the map represents the existence of research networks with other nations. The information collected shows that in the period studied, the countries that collaborated the most to enhance the creation of knowledge on the subject were China, Korea, the United Kingdom, Belgium, France, the United States, and Denmark.

Country's collaboration Map

Conceptual structure

Through a co-occurrence network approach, the conceptual structure is analyzed, as shown in Fig. 8 , topics related to CFP are identified, these have similarities with the keywords analyzed, for example, crowdfunding, and ECFP entrepreneurial finance. Other terms such as entrepreneurship and new business models are also listed in nodes.

Co-occurrence network

The thematic map allows visualizing four different typologies of topics, as shown in Fig. 9 . According to Lizano-Mora et al. ( 2021 ) in this analysis, centrality is the importance of a certain research topic and Density is a measure of the development of the theme. The lower right quadrant shows the main themes. They are characterized by both their high centrality and their density. Among the most developed topics in the analyzed articles is crowdfunding, which is related to different concepts such as ECF, Fintech, and intellectual capital, among others.

Thematic Map

To develop a co-word analysis to identify the conceptual structure, the Conceptual Structure Map (MCA) and cluster analysis were used to group the documents that express a common theme (Aria & Cuccurullo, 2017 ). The points on the map represent the keywords. The closest points indicate that the articles mention them more frequently (Cuccurullo et al., 2016 ). The objective of this analysis is to identify the latent factors that create a common element in the data records, and this statistical method can identify a smaller number of underlying variables, within a large number of observed variables.

The MCA generates two clusters. The first cluster is made up of 16 keywords found in articles describing ECFPs and LCFPs and their relationship to both success and investment risk. The second cluster relates the RCFP with new business models for entrepreneurs without neglecting risk, it contains 5 keywords. On the other hand, keywords that are close to the center point indicate that they have received a lot of attention in recent years. In this sense, in the upper left quadrant, it can be seen that the studies focus on the success that both entrepreneurs and investors can have using platforms to invest capital. The upper right quadrant houses a complete cluster, which as mentioned above, these studies have analyzed the role of entrepreneurs in these new business models. The lower left quadrant shows that “fundraising”, “information asymmetry” and “P2P lending” are the topics on which most research is focused. Finally, the lower right quadrant identifies terms more related to CF opportunities such as gender, as well as one of the most popular Kickstarter RCFPs (Fig. (Fig.10 10 ).

Factor Analysis (MCA)

The dendrogram in Fig. 11 shows the hierarchical order and the connections between the concepts identified by the hierarchical grouping. The graph assigns weight to each element based on the clusters and measures the connections between them. In other words, each element is a collection of keywords related to concepts in the CFP field.

Topic Dendrogram

Intellectual structure

The co-citation networks of references in the field of PFCs are shown in Fig. 12 . The size of the bubble presents the normalized number of citations received by the articles and the thickness of the lines represents the strength of the co-citation’s quotes. The link and proximity between two items identify the co-citation relationship between them. The color of the bubble indicates the cluster to which the article is associated. Each bubble was labeled by the first author and the year of publication of the article.

Co-citation network

Social structure

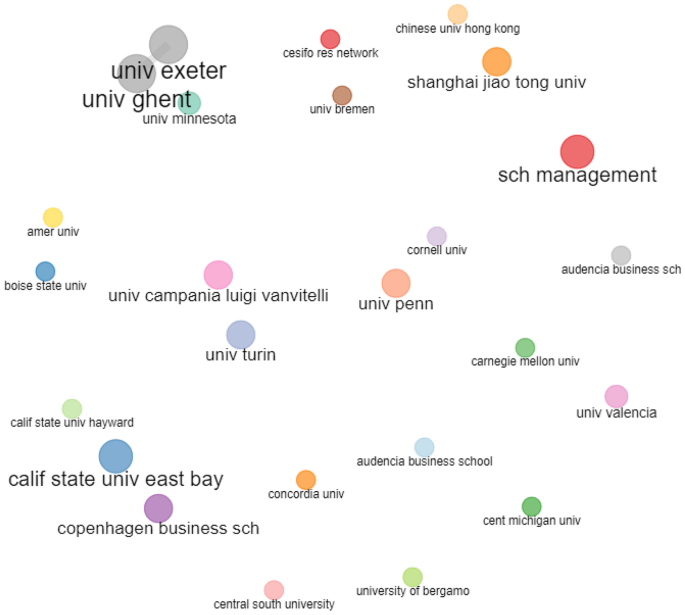

According to Aria and Cuccurullo ( 2017 ) collaboration networks show how the different parties (authors, institutions and countries) carry out collaborative research. Figure 13 shows the structure of collaborative authors. While Fig. 14 shows the networks between the research institutions.

Collaboration Network (Co-Authors)

Collaboration Network (Institutions)

The collaboration between countries is shown in the network map in Fig. 15 , where the United States, China, Korea, Luxembourg, and Denmark present the largest collaborations. Which shows similarity with Fig. 7 .

Collaboration Network (Countries)

Discussion and conclusions

The CFPs have become a means of alternative financing that has made it possible to break schemes in terms of traditional ways to seek seed capital. Web 2.0 has succeeded in simplifying the relationship between entrepreneurs and investors thanks to the interaction with platforms. The importance of crowdfunding within the context of entrepreneurship and the growing number of platforms in multiple countries around the world have led to different studies on the subject. Although more and more attention has been paid to crowdfunding in recent years, the literature on this emerging area is still not enough (Ullah & Zhou, 2020 ). In this sense, it should not be forgotten that the educational competences of entrepreneurs are very important (Palos-Sanchez et al., 2019 ), specially using digital competences.

The present study, carried out using SLR and BA, allowed us to analyze highly relevant data found in the 55 articles used. As for the CFPs, these allow the information of the creators and the fundraising campaigns to be available for the evaluation of potential investors. The facilities provided by the platforms have made it possible to obtain more accessible monetary resources compared to traditional financing methods.

The review of selected articles has allowed us to answer the research questions raised in this study. First of all, three categories of crowdfunding are based on capital flows: Equity, Reward, and Lending. Regarding the first category, experts expect rapid growth of ECFPs as they are a means of financing for entrepreneurs (Tiberius & Hauptmeijer, 2021 ). In the second category, the findings indicate that the RCFPs have been a favorite medium for entrepreneurs as it is a model in which the share capital is not risked and is seen by investors as a means of social action. And finally, research on LCFP is limited (Zhao et al., 2022 ). Although fewer studies were found in this field, the articles analyzed to provide relevant information. Such as the study carried out by Cumming et al. ( 2021a ) where it is argued that the crisis caused by COVID-19 caused P2P loans to grow thanks to technological facilities. Different authors highlight the importance of CF as a means of financing projects, mainly because it comes from a large number of investors and, therefore, is distributed among all of them. On the other hand, entrepreneurs can take advantage of the willingness of the crowd to invest their savings (small amounts) to be able to carry out their business models. Second, few CFPs have been studied. The authors have chosen the most positioned platforms, such as Kickstarter, to carry out their studies (Blaseg et al., 2020 ; Gafni et al., 2021 ; Ullah & Zhou, 2020 ). Although it is true that there are CFPs that have been on the market for longer and are more recognized, in recent years and thanks to the changes caused by the pandemic, the offer of this type of platform has grown and has been adapted in different countries. Another important point is that the CFPs limit the countries that can present their ideas, so they are not accessible to any entrepreneur.

Finally, one of the limitations with the greatest impact on this research is that, although this analysis was based on the period of 2020 and 2021, when the pandemic was most affected, many of the studies were carried out before this period of time, so which in these cases do not reflect the impact of the pandemic on this phenomenon. In this sense, a future line of research is to extend the time period to analyze, through an SLR and BA, more contributions that show the repercussions on the PFCs and their participants. As well as carry out both qualitative and quantitative research on each type of CFP. Another limitation is that due to age, size and scope, PFCs cannot be considered a mature industry (Blaseg et al., 2020 ). In addition, this review has made it possible to identify different future lines of research such as: i) studies based on platforms with more experience; ii) studies that involve a stronger orientation towards the technology used in CFP, such as the role of blockchain (Tiberius & Hauptmeijer, 2021 ); iii) what is the decision criteria of investors to invest in successful projects, iv) what have been the success or failure factors in the campaigns of entrepreneurs, platforms and investors; v) how CFPs are influencing local economies; vi) how the CF and its evolution influence the relationship of the different parties involved; vii) how the quality of the content and audiovisual content influences the success of achieving project financing goals; viii) compare public and private project categories; ix) how individual features affect withdrawal choices, and how the context affects this strategic behavior. All these lines of research can be studied using different methodologies that provide data with more theoretical support.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Contributor Information

Alexandra Mora-Cruz, Email: rc.ca.rcti@aromla .

Pedro R. Palos-Sanchez, Email: se.su@solapp .

- Abarca VMG, Palos-Sanchez PR, Rus-Arias E. Working in Virtual Teams: A Systematic Literature Review and a Bibliometric Analysis. IEEE Access. 2020; 8 :168923–168940. doi: 10.1109/ACCESS.2020.3023546. [ CrossRef ] [ Google Scholar ]

- Allon G, Babich V. Crowdsourcing and Crowdfunding in the Manufacturing and Services Sectors. Manufacturing & Service Operations Management. 2020; 22 (1):102–112. doi: 10.1287/msom.2019.0825. [ CrossRef ] [ Google Scholar ]

- Arenas Escaso, J. F., Folgado Fernández, J. A., & Palos Sánchez, P. R. (2022). Digital disconnection as an opportunity for the tourism business: A bibliometric analysis . 10.28991/ESJ-2022-06-05-013

- Aria M, Cuccurullo C. bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics. 2017; 11 (4):959–975. doi: 10.1016/j.joi.2017.08.007. [ CrossRef ] [ Google Scholar ]

- Belavina E, Marinesi S, Tsoukalas G. Rethinking Crowdfunding Platform Design: Mechanisms to Deter Misconduct and Improve Efficiency. Management Science. 2020; 66 (11):4980–4997. doi: 10.1287/mnsc.2019.3482. [ CrossRef ] [ Google Scholar ]

- Berns JP, Figueroa-Armijos M, da Motta Veiga SP, Dunne TC. Dynamics of Lending-Based Prosocial Crowdfunding: Using a Social Responsibility Lens. Journal of Business Ethics. 2020; 161 (1):169–185. doi: 10.1007/s10551-018-3932-0. [ CrossRef ] [ Google Scholar ]

- Bessière V, Stéphany E, Wirtz P. Crowdfunding, business angels, and venture capital: An exploratory study of the concept of the funding trajectory. Venture Capital. 2020; 22 (2):135–160. doi: 10.1080/13691066.2019.1599188. [ CrossRef ] [ Google Scholar ]

- Blaseg D, Schulze C, Skiera B. Consumer Protection on Kickstarter. Marketing Science. 2020; 39 (1):211–233. doi: 10.1287/mksc.2019.1203. [ CrossRef ] [ Google Scholar ]

- Bonilla-Chaves EF, Palos-Sánchez PR. Exploring the Evolution of Human Resource Analytics: A Bibliometric Study. Behavioral Sciences. 2023; 13 (3):244. doi: 10.3390/bs13030244. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Bürger T, Kleinert S. Crowdfunding cultural and commercial entrepreneurs: An empirical study on motivation in distinct backer communities. Small Business Economics. 2021; 57 (2):667–683. doi: 10.1007/s11187-020-00419-8. [ CrossRef ] [ Google Scholar ]

- Butticè, V., Di Pietro, F., & Tenca, F. (2021). They do not look alike: What kind of private investors do equity crowdfunded firms attract? The Journal of Technology Transfer, 1–30. 10.1007/s10961-021-09895-w

- Butticè V, Vismara S. Inclusive digital finance: The industry of equity crowdfunding. The Journal of Technology Transfer. 2021 doi: 10.1007/s10961-021-09875-0. [ CrossRef ] [ Google Scholar ]

- Cerpentier M, Vanacker T, Paeleman I, Bringmann K. Equity crowdfunding, market timing, and firm capital structure. The Journal of Technology Transfer. 2022; 47 (6):1766–1793. doi: 10.1007/s10961-021-09893-y. [ CrossRef ] [ Google Scholar ]

- Chakraborty S, Swinney R. Signaling to the crowd: Private quality information and rewards-based crowdfunding. Manufacturing & Service Operations Management. 2021; 23 (1):155–169. doi: 10.1287/msom.2019.0833. [ CrossRef ] [ Google Scholar ]

- Chan, C. S. R., Parhankangas, A., Sahaym, A., & Oo, P. (2020). Bellwether and the herd? Unpacking the u-shaped relationship between prior funding and subsequent contributions in reward-based crowdfunding. Journal of Business Venturing , 35 (2), 105934. 10.1016/j.jbusvent.2019.04.002

- Chemla G, Tinn K. Learning Through Crowdfunding. Management Science. 2020; 66 (5):1783–1801. doi: 10.1287/mnsc.2018.3278. [ CrossRef ] [ Google Scholar ]

- Cicchiello AF, Kazemikhasragh A, Monferrà S. Gender differences in new venture financing: Evidence from equity crowdfunding in Latin America. International Journal of Emerging Markets. 2020; 17 (5):1175–1197. doi: 10.1108/IJOEM-03-2020-0302. [ CrossRef ] [ Google Scholar ]

- Clauss T, Niemand T, Kraus S, Schnetzer P, Brem A. Increasing crowdfunding success through social media: The importance of reach and utilisation in reward-based crowdfunding. International Journal of Innovation Management. 2020; 24 (03):2050026. doi: 10.1142/S1363919620500267. [ CrossRef ] [ Google Scholar ]

- Coakley, J., Lazos, A., & Liñares-Zegarra, J. (2021). Strategic entrepreneurial choice between competing crowdfunding platforms. The Journal of Technology Transfer , 1–31.

- Coakley, J., Lazos, A., & Liñares-Zegarra, J. M. (2022). Seasoned equity crowdfunded offerings. Journal of Corporate Finance , 77 , 101880. 10.1016/j.jcorpfin.2020.101880

- Croux C, Jagtiani J, Korivi T, Vulanovic M. Important factors determining Fintech loan default: Evidence from a lendingclub consumer platform. Journal of Economic Behavior & Organization. 2020; 173 :270–296. doi: 10.1016/j.jebo.2020.03.016. [ CrossRef ] [ Google Scholar ]

- Cuccurullo, C., Aria, M., & Sarto, F. (2016). Foundations and trends in performance management. A twenty-five years bibliometric analysis in business and public administration domains. Scientometrics , 108 (2), 595–611. 10.1007/s11192-016-1948-8

- Cumming, D. J., Martinez-Salgueiro, A., Reardon, R. S., & Sewaid, A. (2021b). COVID-19 bust, policy response, and rebound: Equity crowdfunding and P2P versus banks. The Journal of Technology Transfer , 1–22. 10.1007/s10961-021-09899-6 [ PMC free article ] [ PubMed ]

- Cumming DJ, Vanacker T, Zahra SA. Equity crowdfunding and governance: Toward an integrative model and research agenda. Academy of Management Perspectives. 2021; 35 (1):69–95. doi: 10.5465/amp.2017.0208. [ CrossRef ] [ Google Scholar ]

- De Crescenzo V, Ribeiro-Soriano DE, Covin JG. Exploring the viability of equity crowdfunding as a fundraising instrument: A configurational analysis of contingency factors that lead to crowdfunding success and failure. Journal of Business Research. 2020; 115 :348–356. doi: 10.1016/j.jbusres.2019.09.051. [ CrossRef ] [ Google Scholar ]

- Defazio D, Franzoni C, Rossi-Lamastra C. How Pro-social Framing Affects the Success of Crowdfunding Projects: The Role of Emphasis and Information Crowdedness. Journal of Business Ethics. 2021; 171 (2):357–378. doi: 10.1007/s10551-020-04428-1. [ CrossRef ] [ Google Scholar ]

- deMatos, N. M. da S., Sá, E. S. de, & Duarte, P. A. de O. (2021). A review and extension of the flow experience concept. Insights and directions for tourism research. Tourism Management Perspectives, 38 , 100802. 10.1016/j.tmp.2021.100802

- Demir, T., Mohammadi, A., & Shafi, K. (2021). Crowdfunding as gambling: Evidence from repeated natural experiments. Journal of Corporate Finance, 101905. 10.1080/00207543.2020.1821117

- Fu R, Huang Y, Singh PV. Crowds, lending, machine, and bias. Information Systems Research. 2021; 32 (1):72–92. doi: 10.1287/isre.2020.0990. [ CrossRef ] [ Google Scholar ]

- Gafni H, Marom D, Robb A, Sade O. Gender Dynamics in Crowdfunding (Kickstarter): Evidence on Entrepreneurs, Backers, and Taste-Based Discrimination*. Review of Finance. 2021; 25 (2):235–274. doi: 10.1093/rof/rfaa041. [ CrossRef ] [ Google Scholar ]

- Ge R, Zheng Z, Tian X, Liao L. Human–robot interaction: When investors adjust the usage of robo-advisors in peer-to-peer lending. Information Systems Research. 2021; 32 (3):774–785. doi: 10.1287/isre.2021.1009. [ CrossRef ] [ Google Scholar ]

- Hakala H. Strategic orientations in management literature: Three approaches to understanding the interaction between market, technology, entrepreneurial and learning orientations. International Journal of Management Reviews. 2011; 13 (2):199–217. doi: 10.1111/j.1468-2370.2010.00292.x. [ CrossRef ] [ Google Scholar ]

- Hörisch, J., & Tenner, I. (2020). How environmental and social orientations influence the funding success of investment-based crowdfunding: The mediating role of the number of funders and the average funding amount. Technological Forecasting and Social Change , 161 , 120311. 10.1016/j.techfore.2020.120311

- Hornuf, L., Stenzhorn, E., & Vintis, T. (2021). Are sustainability-oriented investors different? Evidence from equity crowdfunding. The Journal of Technology Transfer, 1–28. 10.1007/s10961-021-09896-9

- Jiang Y, Ho YC, Yan X, Tan Y. When online lending meets real estate: Examining investment decisions in lending-based real estate crowdfunding. Information Systems Research. 2020; 31 (3):715–730. doi: 10.1287/isre.2019.0909. [ CrossRef ] [ Google Scholar ]

- Keliuotytė-Staniulėnienė, G., & Kukarėnaitė, M. (2020). Financial Innovation Management: Loan Price in the Crowdfunding and Peer-To-Peer Lending Platforms. Marketing and Management of Innovations , 2 , 256–274. 10.21272/mmi.2020.2-19

- Kollenda, P. (2022). Financial returns or social impact? What motivates impact investors’ lending to firms in low-income countries. Journal of Banking & Finance , 136 , 106224. 10.1016/j.jbankfin.2021.106224

- Kumar, S., & Kumar, S. (2008, July). Collaboration in research productivity in oil seed research institutes of India. In Proceedings of fourth international conference on webometrics, informetrics and scientometrics (Vol. 28). Berlin: Humboldt‐Universitat zu Berlin, Institute for Library and Information Science (IBI).

- Lizano-Mora H, Palos-Sánchez PR, Aguayo-Camacho M. The Evolution of Business Process Management: A Bibliometric Analysis. IEEE Access. 2021; 9 :51088–51105. doi: 10.1109/ACCESS.2021.3066340. [ CrossRef ] [ Google Scholar ]

- Madsen, J., & McMullin, J. L. (2018). Economic Consequences of Risk and Ability Disclosures: Evidence From Crowdfunding (SSRN Scholarly Paper No. 3202453). 10.2139/ssrn.3202453

- Martinez-Climent C, Guijarro-Garcia M, Carrilero-Castillo A. The motivations of crowdlending investors in Spain. International Journal of Entrepreneurial Behavior & Research. 2021; 27 (2):452–469. doi: 10.1108/IJEBR-05-2020-0304. [ CrossRef ] [ Google Scholar ]

- Martínez-Climent C, Zorio-Grima A, Ribeiro-Soriano D. Financial return crowdfunding: Literature review and bibliometric analysis. International Entrepreneurship and Management Journal. 2018; 14 (3):527–553. doi: 10.1007/s11365-018-0511-x. [ CrossRef ] [ Google Scholar ]

- Meoli, M., & Vismara, S. (2021). Information manipulation in equity crowdfunding markets. Journal of Corporate Finance , 67 , 101866. 10.1016/j.jcorpfin.2020.101866

- Mochkabadi K, Volkmann CK. Equity crowdfunding: A systematic review of the literature. Small Business Economics. 2020; 54 (1):75–118. doi: 10.1007/s11187-018-0081-x. [ CrossRef ] [ Google Scholar ]

- Mora-Cruz, A., Palos-Sánchez, P. R., & Murrell-Blanco, M. (2023). Plataformas de aprendizaje en línea y su impacto en la educación universitaria en el contexto del COVID-19. Campus Virtuales , 12 (1), Article 1. 10.54988/cv.2023.1.1005

- Mora-Cruz, A., Saura, J. R., & Palos-Sanchez, P. R. (2022). Social media and user-generated content as a teaching innovation tool in universities. In Teaching innovation in university education: Case studies and main practices (pp. 52–67). IGI Global. 10.4018/978-1-6684-4441-2.ch004

- Moysidou K, Hausberg JP. In crowdfunding we trust: A trust-building model in lending crowdfunding. Journal of Small Business Management. 2020; 58 (3):511–543. doi: 10.1080/00472778.2019.1661682. [ CrossRef ] [ Google Scholar ]

- Nisar TM, Prabhakar G, Torchia M. Crowdfunding innovations in emerging economies: Risk and credit control in peer-to-peer lending network platforms. Strategic Change. 2020; 29 (3):355–361. doi: 10.1002/jsc.2334. [ CrossRef ] [ Google Scholar ]

- Palos-Sánchez, P., Baena-Luna, P., & Casablanca Peña, A. (2019). Ana¿lisis de las competencias educativas para evaluar a las personas emprendedoras . https://rio.upo.es/xmlui/handle/10433/6569

- Palos-Sanchez, P., Baena-Luna, P., & Infante-Moro, J. C. (2022). Artificial intelligence and human resources management: a bibliometric analysis. Applied Artificial Intelligence, 36 (1). 10.1080/08839514.2022.2145631

- Ralcheva A, Roosenboom P. Forecasting success in equity crowdfunding. Small Business Economics. 2020; 55 (1):39–56. doi: 10.1007/s11187-019-00144-x. [ CrossRef ] [ Google Scholar ]

- Regner T. Crowdfunding a monthly income: An analysis of the membership platform Patreon. Journal of Cultural Economics. 2021; 45 (1):133–142. doi: 10.1007/s10824-020-09381-5. [ CrossRef ] [ Google Scholar ]

- Reza-Gharehbagh, R., Asian, S., Hafezalkotob, A., & Wei, C. (2021). Reframing supply chain finance in an era of reglobalization: On the value of multi-sided crowdfunding platforms. Transportation Research Part E: Logistics and Transportation Review , 149 , 102298. 10.1016/j.tre.2021.102298

- Rojas-Sánchez M, Palos-Sánchez P, Folgado-Fernández JA. Systematic literature review and bibliometric analysis on virtual reality and education. Education and Information Technologies. 2022 doi: 10.1007/s10639-022-11167-5. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Ryu S, Park J, Kim K, Kim YG. Reward versus altruistic motivations in reward-based crowdfunding. International Journal of Electronic Commerce. 2020; 24 (2):159–183. doi: 10.1080/10864415.2020.1715531. [ CrossRef ] [ Google Scholar ]

- Ryu, S., & Suh, A. (2020). Online service or virtual community? Building platform loyalty in reward-based crowdfunding. Internet Research . 10.1108/INTR-06-2019-0256

- Saura, J. R., Palos-Sánchez, P., & Cerdá Suárez, L. M. (2017). Understanding the Digital Marketing Environment with KPIs and Web Analytics. Future Internet , 9 (4), Article 4. 10.3390/fi9040076

- Shafi K. Investors’ evaluation criteria in equity crowdfunding. Small Business Economics. 2021; 56 (1):3–37. doi: 10.1007/s11187-019-00227-9. [ CrossRef ] [ Google Scholar ]

- Shafi, K., & Mohammadi, A. (2020). Too gloomy to invest: Weather-induced mood and crowdfunding. Journal of Corporate Finance , 65 , 101761. 10.1016/j.jcorpfin.2020.101761

- Singh, A., Lim, W. M., Jha, S., Kumar, S., & Ciasullo, M. V. (2023). The state of the art of strategic leadership. Journal of Business Research , 158 , 113676. 10.1016/j.jbusres.2023.113676

- Tafesse W. Communicating crowdfunding campaigns: How message strategy, vivid media use and product type influence campaign success. Journal of Business Research. 2021; 127 :252–263. doi: 10.1016/j.jbusres.2021.01.043. [ CrossRef ] [ Google Scholar ]

- Testa S, Roma P, Vasi M, Cincotti S. Crowdfunding as a tool to support sustainability-oriented initiatives: Preliminary insights into the role of product/service attributes. Business Strategy and the Environment. 2020; 29 (2):530–546. doi: 10.1002/bse.2385. [ CrossRef ] [ Google Scholar ]

- Tiberius V, Hauptmeijer R. Equity crowdfunding: Forecasting market development, platform evolution, and regulation. Journal of Small Business Management. 2021; 59 (2):337–369. doi: 10.1080/00472778.2020.1849714. [ CrossRef ] [ Google Scholar ]

- Troise C, Matricano D, Candelo E, Sorrentino M. Crowdfunded and then? The role of intellectual capital in the growth of equity-crowdfunded companies. Measuring Business Excellence. 2020; 24 (4):475–494. doi: 10.1108/MBE-02-2020-0031. [ CrossRef ] [ Google Scholar ]

- Troise C, Tani M. Exploring entrepreneurial characteristics, motivations and behaviours in equity crowdfunding: Some evidence from Italy. Management Decision. 2020; 59 (5):995–1024. doi: 10.1108/MD-10-2019-1431. [ CrossRef ] [ Google Scholar ]

- Ullah, S., & Zhou, Y. (2020). Gender, Anonymity and Team: What Determines Crowdfunding Success on Kickstarter. Journal of Risk and Financial Management , 13 (4), Article 4. 10.3390/jrfm13040080

- Vrontis D, Christofi M, Battisti E, Graziano EA. Intellectual capital, knowledge sharing and equity crowdfunding. Journal of Intellectual Capital. 2021; 22 (1):95–121. doi: 10.1108/JIC-11-2019-0258. [ CrossRef ] [ Google Scholar ]

- Wattanacharoensil W, La-ornual D. A systematic review of cognitive biases in tourist decisions. Tourism Management. 2019; 75 :353–369. doi: 10.1016/j.tourman.2019.06.006. [ CrossRef ] [ Google Scholar ]

- Xiao L. How lead investors build trust in the specific context of a campaign: A case study of equity crowdfunding in China. International Journal of Entrepreneurial Behavior & Research. 2019; 26 (2):203–223. doi: 10.1108/IJEBR-05-2019-0265. [ CrossRef ] [ Google Scholar ]

- Yang L, Wang Z, Hahn J. Scarcity Strategy in Crowdfunding: An Empirical Exploration of Reward Limits. Information Systems Research. 2020; 31 (4):1107–1131. doi: 10.1287/isre.2020.0934. [ CrossRef ] [ Google Scholar ]

- Zhao H, Liu X, Zhang X, Wei Y, Liu C. The effects of person-organization fit on lending behaviors: Empirical evidence from Kiva. Journal of Management Science and Engineering. 2022; 7 (1):133–145. doi: 10.1016/j.jmse.2021.09.004. [ CrossRef ] [ Google Scholar ]

- Zhou Y, Zhang J, Zeng Y. Borrowing or crowdfunding: a comparison of poverty alleviation participation modes considering altruistic preferences. International Journal of Production Research. 2021; 59 (21):6564–6578. doi: 10.1080/00207543.2020.1821117. [ CrossRef ] [ Google Scholar ]

- Zupic I, Čater T. Bibliometric Methods in Management and Organization. Organizational Research Methods. 2015; 18 (3):429–472. doi: 10.1177/1094428114562629. [ CrossRef ] [ Google Scholar ]

Crowdfunding platforms: a systematic literature review and a bibliometric analysis

- Published: 29 April 2023

- Volume 19 , pages 1257–1288, ( 2023 )

Cite this article

- Alexandra Mora-Cruz ORCID: orcid.org/0000-0001-5157-5232 1 &

- Pedro R. Palos-Sanchez ORCID: orcid.org/0000-0001-9966-0698 2

5103 Accesses

6 Citations

Explore all metrics

Due to the financial crisis caused by the COVID-19 pandemic, entrepreneurs and small businesses have had multiple difficulties accessing conventional types of financing. Crowdfunding platforms have gained popularity as an alternative means of online financing. The main objective of this research is to analyze the most important articles that may influence future studies on crowdfunding platforms in Latin America. This article analyzes the Scopus and Web of Science databases considering three of the four categories of crowdfunding based on capital flows: Reward, Equity, and Lending, using a systematic review of the literature and bibliometric analysis. This research resulted in a total of 1032 articles which, after applying the appropriate criteria, resulted in 55 selected articles. The results show that the number of studies conducted in the field of crowdfunding platforms is increasing. Crowdfunding platforms provide a great opportunity for entrepreneurs to obtain alternative financing and a new way for investors to invest their capital. Future lines of research include conducting studies that involve a stronger focus on the technology used in crowdfunding platforms. With systematized access to information, the different actors can understand how the dynamics of crowdfunding platforms can stimulate the development of business projects, as well as the decision-making factor when investing. This document is of great interest to researchers and professionals who wish to increase their knowledge of crowdfunding platforms, especially those of Reward, Equity, and Lending, in addition to gaining knowledge on relevant conclusions and suggestions for future research.

Debido a la crisis financiera provocada por la pandemia del COVID-19, los emprendedores y pequeñas empresas han tenido múltiples dificultades para acceder a los tipos de financiamiento convencionales. Las plataformas de crowdfunding han adquirido popularidad al ser un medio de obtención de recursos online alternativo. El objetivo principal de esta investigación es analizar los artículos más importantes que pueden influir en futuros estudios sobre las plataformas de crowdfunding. Este artículo analiza las bases de datos Scopus y Web of Science tomando en cuenta tres categorías de crowdfunding basadas en flujos de capital: Reward, Equity y Lending, usando una revisión sistemática de la literatura y un análisis bibliométrico. La búsqueda arrojó un total de 1 032 artículos y, según los criterios aplicados, resultaron 55. Los resultados muestran que el número de estudios realizados en este campo se está incrementando. Estas plataformas dan una gran oportunidad de obtener un financiamiento alternativo a los emprendedores y una nueva forma de invertir su capital a los inversores. Entre las futuras líneas de investigación se encuentra la de realizar estudios que involucren una orientación más fuerte hacia la tecnología utilizada en las plataformas de crowdfunding. Con el acceso sistematizado de la información, se puede comprender cómo las dinámicas de estas plataformas pueden estimular el desarrollo de los proyectos empresariales, así como también la toma de decisiones para realizar inversiones. Este documento es de gran interés para investigadores y profesionales que deseen aumentar sus conocimientos en plataformas de crowdfunding. Además, de presentar conclusiones relevantes y sugerencias para futuras investigaciones.

Similar content being viewed by others

Advances in the Research Domain of Crowdfunding: A Systematic Literature Review

Equity crowdfunding: a systematic review of the literature

Crowdfunding in Public Sector: A Systematic Literature Review

Avoid common mistakes on your manuscript.

Introduction

In today's economy, entrepreneurs are extremely important as they offer new jobs and new innovative products. As a result of the crises caused by the different phenomena worldwide, entrepreneurs face various difficulties that restrict their access to financing to support the initial stages of the projects (Croux et al., 2020 ; Shafi & Mohammadi, 2020 ). The search for financing has become an increasing challenge and with many obstacles (Hörisch & Tenner, 2020 ). Crowdfunding has become a method that helps companies in their initial stage avoid resorting to bank financing sources (Martínez-Climent et al., 2018 ; Madsen & McMullin, 2018 ; Yang et al., 2020 ), achieving great popularity among the business community.

The accelerated adoption of new technology and the emergence of new tools have been fundamental in fostering business growth and interpersonal relationships (Saura et al., 2017 ), allowing the way of financing new innovative projects to evolve (Jiang et al., 2020 ; Fu et al., 2021 ). Through platforms that facilitate the exchange of resources, such as knowledge and eLearning (Mora-Cruz et al., 2022 , 2023 ), crowdfunding has opened the way for entrepreneurs and investors to develop projects. The term crowdfunding was coined in 2008, and it has expanded on a large scale, providing the infrastructure to attract millions of investors and entrepreneurs (Moysidou & Hausberg, 2020 ). Crowdfunding has been a term used to describe different types of fundraising where entrepreneurs campaign for individuals to financially support their innovative products through Web 2.0 (De Crescenzo et al., 2020 ; Regner, 2021 ). Crowdfunding platforms (CFPs) act as intermediaries for innovative new financial methods to attract parties and thus grow new business initiatives (Vrontis et al., 2021 ; Chan et al., 2020 ). Although CFPs benefit those involved, creativity in attracting alternative capital plays an important role. Investors seek to identify attractive investment opportunities, valuing factors such as the quality and human capital of companies (Shafi, 2021 ). Therefore, entrepreneurs must adjust their campaign strategies for a changing and competitive environment (Tiberius & Hauptmeijer, 2021 ).

Due to the great interest in the topic, the literature on CFPs has been growing rapidly (Belavina et al., 2020 ). In this sense, the main objective of this research is to analyze the most important articles that may influence future studies on CFPs. Focusing mainly on the three categories of crowdfunding based on capital flows: Reward, Equity, and Lending, the exponential growth of this phenomenon worldwide has led to an increasing interest in researching this topic. The research carried out is of utmost importance to provide a real perspective of how this type of alternative financing is being studied and what could be the future lines of research that allow obtaining a greater knowledge of this phenomenon. The research questions for this study are the following:

RQ1 What are the main types of crowdfunding that are most researched and how do they help entrepreneurs and investors? RQ2 What are the main CFPs that have been investigated and why? RQ3 What are the gaps in existing research and possible areas for future research?

To answer the above questions, this article is structured as follows: followed by this introduction, first a section with a review of the CFP literature and three of the main types of crowdfunding: Reward, Equity and Lending. Second, a methodology section that includes a systematic review of the literature (SLR) and, in addition, a bibliometric analysis is developed through the use of the Bibliometrix package to measure scientific data (Aria & Cuccurullo, 2017 ). Third, the relevant results are presented concerning the data found in the CFP literature. Finally, the results are discussed, and it closes with the conclusions.

Literature review

Crowdfunding platforms as new financing alternatives.

The use of the Internet and the appearance of online platforms have revolutionized communication between human beings. This has allowed new financing alternatives such as CFPs to be available to entrepreneurs and their new innovative products. In recent years, CFPs have gained notoriety among capital-constrained entrepreneurs and small investors (Martínez-Climent et al., 2020 ; Reza-Gharehbagh et al., 2021 ). Digital financing sources such as the CFP reduce the costs of access to information and facilitate communication between entrepreneurs and investors (Meoli & Vismara, 2021 ). The Internet and online platforms have made it easier for homeowners to express their ideas more efficiently and for investors to learn more quickly (Ullah & Zhou, 2020 ). Even so, banking entities continue to be the main sources of investment attraction for the start-up of business projects. Some of the traditional sources for financing new projects are business angels, venture capital and private equity investors (Butticè & Vismara, 2021 ; Coakley et al., 2021 ).