- The 1%: Conquer Your Consulting Case Interview

- Consulting Career Secrets

- Cover Letter & Resume

- McKinsey Solve Game (Imbellus)

- BCG Online Case (+ Pymetrics, Spark Hire)

- Bain Aptitude Tests (SOVA, Pymetrics, HireVue)

- Kearney Recruitment Test

- BCG Cognitive Test Practice

- All-in-One Case Interview Preparation

- Industry Cheat Sheets

- Structuring & Brainstorming

- Data & Chart Interpretation

- Case Math Mastery

- McKinsey Interview Academy

- Brainteasers

Case Interview Examples (2024): A Collection from McKinsey and Others

Last Updated on January 11, 2024

Whenever you prepare for case interviews, you have to practice as realistically as possible and mimic the real case study interview at McKinsey , BCG , Bain , and others. One way to do this and make your preparation more effective is to practice real cases provided by the firms you apply to.

It will help you to understand what the differences are across firms, how they structure and approach their cases, what dimensions are important to them, and what solutions they consider to be strong.

Below is a steadily expanding selection of real case interview examples provided by different management consulting firms.

Before wasting your money on case interview collection books that use generic cases, use original cases first. Additionally, use professional case coaches, who interviewed for the top firms , to mimic the real interview experience and get real, actionable feedback to improve.

Please be aware that cases are just one part of a typical consulting interview. It is equally important to prepare for behavioral and fit interview questions .

McKinsey Case Interview Examples

- Loravia – Transforming a national education system

- SuperSoda – Electro-light product launch

- GlobaPharm – Pharma R&D

- Bill & Melinda Gates Foundation – Diconsa financial services offering

- Beautify – Customer approach

- Shops – DEI strategy

- Talbot Trucks – Electric truck development

- Conservation Forever – Nature conservation

We have written a detailed article on the McKinsey application process, the McKinsey interview timeline, the typical McKinsey case interview, and the McKinsey Personal Experience interview here . You can expect similar cases regardless of your position (e.g. in a McKinsey phone case interview or interviewing for a McKinsey internship as well as a full-time BA, Associate, or Engagement Manager role).

Boston Consulting Group (BCG) Case interview Examples

- Consumer Goods – Climate strategy

- Banking – Client satisfaction

- Consumer Goods – IT strategy

- Chateau Boomerang – Written case

Bain and Company case interview examples

- NextGen Tech

- FashionCo .

Ace the case interview with our dedicated preparation packages.

Deloitte Case Interview Examples

- Federal Agency – Engagement strategy

- Federal Benefits Provider – Strategic vision

- Apparel – Declining market share

- Federal Finance Agency – Architecture strategy

- MedX – Smart pill bottle

- Federal Healthy Agency – Finance strategy

- LeadAuto – Market expansion

- Federal Bureau – Talent management

Strategy& Case Interview Examples

- Strategy& tips and examples (case examples included )

Accenture Case Interview Examples

- Accenture interview tips and examples (case examples included )

Kearney Case Interview Examples

- Promotional planning

Roland Berger Case Interview Examples

- Transit-oriented development Part 1

- Transit-oriented development Part 2

- 3D printed hip implants Part 1

- 3D printed hip implants Part 2

Oliver Wyman Case Interview Examples

- Wumbleworld – theme park

- Aqualine – boats

LEK Case Interview Examples

- Video case interview example (currently unavailable)

- Market sizing video example

- Brainteaser (scroll to the bottom of the page)

Simon Kucher Case Interview Examples

- Smart phone pricing

OC&C Case Interview Examples

- Imported whiskey in an emerging market – business strategy

- Leisure clubs – data interpretation

Capital One Case Interview Examples

- How to crack case interviews with Capital One (includes case examples)

Bridgespan Case Interview Examples

- Robinson Philanthropy – Strategy

- Reach for the Stars – Student success

- Home Nurses for New Families – Expansion strategy

- Venture Philanthropy – Charity

Consulting Clubs Case Interview Books

Contact us at [email protected] for a collection of consulting club case interview books (from Harvard, ESADE, LBS, Columbia, etc.).

How We Help You Ace Your Case Interviews

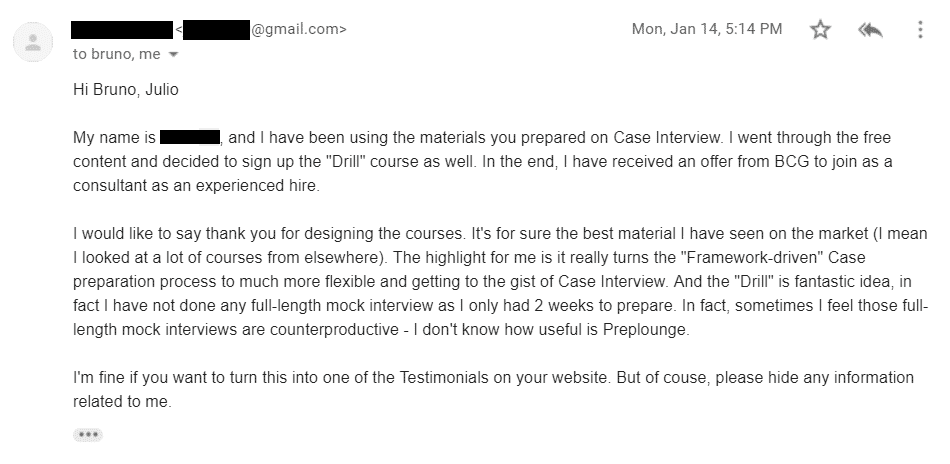

We have specialized in placing people from all walks of life with different backgrounds into top consulting firms both as generalist hires as well as specialized hires and experts. As former McKinsey consultants and interview experts, we help you by

- tailoring your resume and cover letter to meet consulting firms’ highest standards

- showing you how to pass the different online assessments and tests for McKinsey , BCG , and Bain

- showing you how to ace McKinsey interviews and the PEI with our video academy

- coaching you in our 1-on-1 sessions to become an excellent case solver and impress with your fit answers (90% success rate after 5 sessions)

- preparing your math to be bulletproof for every case interview

- helping you structure creative and complex case interviews

- teaching you how to interpret charts and exhibits like a consultant

- providing you with cheat sheets and overviews for 27 industries .

Reach out to us if you have any questions! We are happy to help and offer a tailored program to help you break into consulting.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Florian spent 5 years with McKinsey as a senior consultant. He is an experienced consulting interviewer and problem-solving coach, having interviewed 100s of candidates in real and mock interviews. He started StrategyCase.com to make top-tier consulting firms more accessible for top talent, using tailored and up-to-date know-how about their recruiting. He ranks as the most successful consulting case and fit interview coach, generating more than 500 offers with MBB, tier-2 firms, Big 4 consulting divisions, in-house consultancies, and boutique firms through direct coaching of his clients over the last 3.5 years. His books “The 1%: Conquer Your Consulting Case Interview” and “Consulting Career Secrets” are available via Amazon.

Most Popular Products

Search website

Strategycase.com.

© 2024 | Contact: +43 6706059449 | Mattiellistrasse 3/28, 1040 Vienna, Austria

- Terms & Conditions

- Privacy Policy

- Universities & consulting clubs

- American Express

Click on the image to learn more.

A Comprehensive Guide to McKinsey Case Interview Preparation

Looking to ace your McKinsey case interview? Our comprehensive guide has got you covered! From understanding the interview process to mastering case frameworks, we provide expert tips and strategies to help you prepare and succeed.

Posted June 8, 2023

Featuring Manali P.

Beyond the Case: Ace Your MBB Behavioral Interviews

Starting monday, july 15.

6:00 PM UTC · 30 minutes

Table of Contents

Preparing for a McKinsey case interview can be a daunting task, especially if you’re not sure where to start. As one of the most prestigious consulting firms in the world, McKinsey & Company is known for its rigorous interview process, which involves a unique problem-solving approach and an emphasis on communication skills. In this comprehensive guide, we’ll take you through all the steps you need to take to prepare for the McKinsey case interview and give you the best chance of success.

Understanding the McKinsey Case Interview Process

The McKinsey case interview is a simulation of a real-world business problem. The interviewer will present you with a hypothetical scenario based on a real-life company, and ask you to analyze the situation, identify the key issues, and provide a recommendation for how the company should proceed. The objective of the case interview is to test your analytical and problem-solving skills, as well as your ability to communicate your ideas in a clear and concise manner.

It is important to note that the McKinsey case interview is not just about getting the right answer. The interviewer is also evaluating your thought process, creativity, and ability to think on your feet. Therefore, it is important to approach the case interview with an open mind and be willing to explore different solutions and perspectives.

One way to prepare for the McKinsey case interview is to practice with case studies. There are many resources available online, including sample cases and practice questions. It is also helpful to work with a partner or mentor who can provide feedback on your approach and communication skills.

Key Skills Required for a Successful McKinsey Case Interview

To succeed in a McKinsey case interview, you need to possess several key skills. First and foremost, you need to be able to think critically and strategically. You must also be able to communicate your ideas in a clear and concise manner, and be comfortable with numbers and data analysis. Additionally, you need to demonstrate the ability to manage your time effectively, remain calm under pressure, and work collaboratively with others.

Another important skill to have for a successful McKinsey case interview is the ability to ask insightful questions. You should be able to identify the key issues and ask relevant questions that will help you understand the problem at hand. This will also demonstrate your curiosity and eagerness to learn.

Lastly, it is important to have a strong business acumen. You should have a good understanding of the industry and market trends, as well as the company's goals and objectives. This will help you provide relevant and practical solutions to the case problem, and showcase your ability to think like a business leader.

For more tips on how to maximize your chances of landing a management consulting position that's right for you, check out these resources:

- Mastering Case Interview Math: Essential Formulas

- Writing a Winning Consulting Cover Letter: A Comprehensive Guide

- Understanding the Salary Structure in Management Consulting

Mastering Consulting Case Frameworks: A Comprehensive Guide

- Five Tips for Breaking Into Management Consulting

Free trial!

From 118 top coaches

Access a library of videos, templates, and examples curated by Leland’s top coaches.

Example resumes.

Example Cases

Casing Drills

Mock Interviews

Tips to Ace McKinsey Case Interview

Preparation is key when it comes to acing a McKinsey case interview. Here are some tips to help you succeed:

- Be well-prepared: Research the firm and the industry you are interested in and practice case studies.

- Be analytical: Use a structured framework to analyze the case and identify the key issues.

- Be confident: Always articulate your thoughts and recommendations with clarity and confidence.

- Be concise: Communication is key, so make sure you get to the point and avoid unnecessary information.

- Practice: Mock interviews are essential to improving your skills and getting used to the interview process.

It's also important to remember that the interviewer is not looking for a perfect solution, but rather how you approach the problem and your ability to think critically. Don't be afraid to ask clarifying questions and take time to gather your thoughts before answering. Additionally, be sure to listen actively to the interviewer and incorporate their feedback into your analysis. By following these tips and staying calm under pressure, you can increase your chances of acing the McKinsey case interview.

The Importance of Researching the Company and Industry before the Interview

Before the interview, it’s crucial to research the company and the industry you are interested in. Knowing the company's history, values, and key clients will help you demonstrate your interest and knowledge during the interview. Additionally, understanding the industry trends, challenges, and opportunities can help you come up with more insightful and strategic recommendations.

Another reason why researching the company and industry is important is that it can help you tailor your responses to the interviewer's questions. By understanding the company's goals and challenges, you can highlight your skills and experiences that align with their needs. Moreover, knowing the industry trends and best practices can help you provide relevant examples and insights that showcase your expertise.

Furthermore, researching the company and industry can also help you assess whether the company is a good fit for you. By learning about the company culture, work environment, and values, you can determine whether they align with your own goals and values. This can help you make an informed decision about whether to accept a job offer if one is extended to you.

How to Structure Your Responses in a McKinsey Case Interview

Structuring your responses is essential to communicating your ideas effectively and showing your analytical skills. Use a structured framework such as MECE (Mutually Exclusive and Collectively Exhaustive) to break down the problem and identify the key issues. Once you have identified the issues, prioritize them and develop recommendations based on your analysis. Make sure to articulate your thought process clearly and concisely throughout the exercise.

It is also important to actively listen to the interviewer and ask clarifying questions to ensure you fully understand the problem at hand. This will help you tailor your response to the specific needs of the client and demonstrate your ability to work collaboratively. Additionally, be prepared to adapt your approach if new information is presented during the interview. Flexibility and agility are highly valued qualities in a consultant and can set you apart from other candidates.

Common Mistakes to Avoid in a McKinsey Case Interview

Common mistakes that applicants make in McKinsey case interviews include:

- Jumping to conclusions without sufficient analysis.

- Overcomplicating the problem.

- Providing vague or incomplete recommendations.

- Getting frazzled under pressure.

Avoiding these pitfalls can help you stand out and demonstrate your problem-solving skills effectively.

Another common mistake that applicants make in McKinsey case interviews is not asking enough clarifying questions. It is important to fully understand the problem and the context before jumping into analysis and recommendations. Additionally, not asking questions can make it seem like you are not engaged or interested in the problem at hand. Therefore, make sure to ask thoughtful and relevant questions throughout the interview to demonstrate your curiosity and analytical skills.

Sample McKinsey Case Interview Questions and Answers

Sample McKinsey case interview questions can range from market sizing to competitive strategies. Here are some examples:

- How would you estimate the size of the global coffee market?

- How would you advise a chain of retail stores facing declining sales?

- How would you help a software company develop a new product?

- How would you advise a hospital facing budget constraints?

Answers to these questions require a structured approach, including the identification of key issues, relevant analysis, and well-supported recommendations.

It is important to note that McKinsey case interviews are not just about finding the right answer, but also about demonstrating strong problem-solving skills and the ability to communicate effectively. Candidates are expected to ask clarifying questions, think critically, and present their ideas in a clear and concise manner.

In addition to the case interview questions, candidates may also be asked behavioral questions to assess their fit with the company culture and values. These questions may focus on leadership, teamwork, and communication skills, among others.

The Role of Creativity in Solving McKinsey Case Study Problems

Creativity is just as important as analytical skills in the McKinsey case interview. You must demonstrate creativity in identifying potential solutions and making recommendations that are both innovative and realistic. Creative problem-solvers are valued in the consulting industry, as they can offer fresh ideas and perspectives that can benefit their clients.

How to Develop a Personalized Strategy for McKinsey Case Interviews

Developing a personalized strategy for McKinsey case interviews is crucial to success. Understand your strengths and weaknesses and focus on improving your weaknesses. You should also participate in mock interviews and receive feedback from others to help you improve your performance. Consider working with a coach or mentor who can provide you with additional guidance and advice.

The Benefits of Mock Interviews in Preparing for a McKinsey Case Interview

Mock interviews are an essential tool in preparing for a McKinsey case interview. Mock interviews help you get used to the format of the interview, identify your strengths and weaknesses, and receive feedback on your performance. Practicing with different problems and cases also helps you become more comfortable with the analytical process and develop creative problem-solving skills.

The Importance of Confidence and Communication Skills in a McKinsey Case Interview

Confidence and communication skills are equally essential in a McKinsey case interview as analytical skills. You must be able to articulate your ideas in a clear and concise manner and demonstrate your confidence in your recommendations. Additionally, being comfortable with numbers and data analysis is essential in communicating your insights effectively. Practice your communication skills and prepare accordingly to increase your confidence and show your potential.

How to Follow Up After a Successful McKinsey Case Interview

Following up after a successful McKinsey case interview is an essential step that many candidates overlook. Send a thank-you note or email expressing your appreciation for the opportunity, and reiterate your interest in the position. Keep the communication positive, professional, and timely. This follow-up can help set you apart from other candidates and demonstrate your attention to detail and enthusiasm for the company.

Resources for Further Practice and Preparation for a McKinsey Case Interview

There are plenty of resources available online and offline to help you prepare for a McKinsey case interview. Some of the popular ones include:

- Case in Point: Complete Case Interview Preparation by Marc P. Cosentino

- McKinsey & Company interview preparation resources

- Victor Cheng’s Case Interview Videos

Make use of these resources, attend networking events, and seek out advice from professionals in the consulting industry to help you prepare for the interview.

Preparing for a McKinsey case interview can be challenging, but with practice and preparation, you can increase your chances of success. Keep in mind the key skills required for success and practice your communication skills, and make use of the resources available to you. Follow the tips mentioned in this guide, and put in the effort required to succeed. With hard work and dedication, you can ace your McKinsey case interview and start your career in consulting.

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.

Browse Related Articles

May 18, 2023

McKinsey Bonus Structure: Understanding the Reward System

Discover how the McKinsey bonus structure works and gain a deeper understanding of the reward system in this comprehensive guide.

June 12, 2023

Bain Case Interviews: A Comprehensive Preparation Guide

Are you preparing for a Bain case interview? Look no further! Our comprehensive guide covers everything you need to know to ace your interview and land your dream job at Bain.

March 12, 2024

The Ultimate Guide to the Consulting Case Interview – With Examples

This guide, written by a former McKinsey consultant and Wharton MBA, breaks down the management consulting case interview into comprehensible parts with relevant, realistic examples at every turn.

May 11, 2023

How to Prepare for McKinsey Management Consulting Behavioral Interviews?

If you're preparing for a McKinsey management consulting behavioral interview, this article is a must-read.

How to Prepare for McKinsey Management Consulting Networking Calls?

Learn how to ace your McKinsey management consulting networking calls with these expert tips and strategies.

July 31, 2023

Looking to excel in consulting case interviews? Our comprehensive guide to mastering consulting case frameworks is here to help! Learn the essential skills and strategies needed to ace your next case interview and land your dream consulting job.

IQVIA Case Study Interview: A Comprehensive Preparation Guide

If you're preparing for an IQVIA case study interview, this comprehensive guide is a must-read.

McKinsey First Year Salary: What to Expect and How to Negotiate

Are you curious about what your first year salary at McKinsey might be? This article provides insights on what to expect and tips on how to negotiate your salary.

Mckinsey Consulting Salary: A Comprehensive Overview

Discover everything you need to know about McKinsey consulting salaries in this comprehensive overview.

Business Analyst McKinsey: A Comprehensive Career Guide

Discover the ins and outs of a career as a Business Analyst at McKinsey with our comprehensive guide.

IQVIA Interview Process: A Comprehensive Guide for Success

Looking to ace your IQVIA interview? Our comprehensive guide covers everything you need to know to succeed, from the application process to common interview questions and tips for impressing your interviewer.

Navigating the Shift from Energy Sector to Management Consulting: An Insider's Guide

Are you considering a career shift from the energy sector to management consulting? Look no further than our insider's guide, filled with tips and insights to help you navigate this exciting transition.

McKinsey recruiters reveal exactly how to nail the interview and case study to land a 6-figure job at the consulting firm

- The latest salaries report from Management Consulted, a consulting careers resource website, showed that McKinsey's hires with MBAs and PhDs make a base salary of $165,000.

- The consulting firm is working to diversify their applicant pool and bring in more hires from non-Ivy League schools.

- Business Insider spoke with two McKinsey recruitment directors on how to nail the interview and score a spot at the company.

- Click here for more BI Prime stories.

Top management consulting firm McKinsey & Company offers some of the highest-paying salaries for recent grads. But it's hard to land a coveted six-figure role at the firm.

According to the latest salaries report from Management Consulted , a careers resource website catered to job seekers in the consulting field, McKinsey's MBA and PhD hires make a base salary of $165,000 — and that's not including the $35,000 performance bonus for all employees, and the 50% MBA tuition reimbursement for returning interns.

It's no surprise that management consultants are getting paid six figures from get-go. It's been that way for years. However, the report noted an emerging trend that serves as good news for those who might not have an Ivy League degree : Consulting firms are increasing recruitment from non-target schools — this means they're steering away from relying on Ivy League universities like Harvard for hires. In fact, these companies are holding up to 20% of their recruitment slots for those with non-target backgrounds, according to the report.

McKinsey, for example, hired about 8,000 people out of an applicant pool of 800,000 in 2018. Those employees were recruited from 325 different schools around the world, the company shared.

Business Insider recently spoke with Kerry Casey , McKinsey's director of recruitment in the North American region and Caitlin Storhaug , McKinsey's global director of recruitment marketing and communications.

The two experts shared insights on how to nail an interview with the company.

When it comes to the case exercise: Don't wing it

Every McKinsey interview follows a standardized process that is broken down into two components. Prospective candidates are asked to complete a personal experience interview and a case study exercise.

" It doesn't matter if you're interviewing from San Francisco, New York City, or Shanghai — the interview process is standard," Storhaug said. "There aren't harder or easier countries for you to get in."

Every business school graduate is probably familiar with case studies. Harvard Business School (HBS) developed the case method teaching practice , where students are required to read up to 500 cases during their two-year program. Other MBA schools also adopted this strategy to prepare students for tackling real-world businesses problems.

McKinsey's case interviews, in particular, take about 25 to 30 minutes, and it's an opportunity for candidates to showcase how they approach problem solving and think on their feet, Casey explained. When you're tackling a case exercise, focus on how you would go about solving the client problem and not what you think the recruiters want to see in your responses.

The company provided a case exercise sample and encouraged applicants to practice so that they know the exact format and the type of answers the recruiters look for.

When you're prepping for an interview with the firm, keep those samples in mind, Storhaug added.

Emphasize on your soft skills

One of the most common mistakes that McKinsey's applicants make is that they focus too much on acing case exercises that they fail to really prepare for the personal interview, Casey explained in an email to Business Insider.

"I encourage them to focus also on what are often referred to as soft skills — their aptitude for collaboration, team work, empathy, and leading others," she wrote. "In the long run, those are the qualities that make for success."

Apart from those technical skills, a management consulting job requires collaborative and relationship-building skills. Ultimately, you can't get to the problem-solving component if you don't have a track record of working well with others.

Additionally, Casey added that the personal experience interview doesn't have to be as formal as one might expect. In fact, she wrote that the best interviews are actually conversations rather than strictly planned questions.

This second round is your opportunity to show your attributes beyond your résumé. What are some skills you're hoping to develop with this job? What are your own professional goals in five years?

Casey recommends sharing your own career aspirations. That way, it shows that you know what you want.

Talk about your technical skills if you have them

Technical skills are in high demand, and it's beneficial to have employees who understand how tech can impact clients.

"While not everyone is a tech-focused consultant, of course, we see tech and digital skills being more necessary as we grow and expand into new areas," Casey wrote. "We appreciate candidates who may have expanded their knowledge to include coding, programming and other tech aspects."

Some other top tech skills that employers want are program languages like Python, C++, and JavaScript, Business Insider previously reported.

- Main content

15 case interviews tips for McKinsey, BCG and Bain

If you are targeting a job in consulting, you probably already know what type of interviews to expect: a case.

In a case interview, your interviewer will ask you to solve a business problem. For instance, they might ask you how Coca-Cola could double their profit margin next year. Cases have got the reputation to be amongst the most challenging types of interviews and candidates tend to fear them. But it doesn't have to be that way.

Over the past few years, we've helped more than 20,000 candidates prepare for consulting interviews. We've learned about what works and what doesn't. We have also analysed all the case interview advice from McKinsey , BCG , Bain , Deloitte and other sources.

In this article we summarise the most important tips we have learned along the way. So let's get started!

Click here to practise 1-on-1 with MBB ex-interviewers

1. preparation tips.

It all starts with a good preparation. Here are a few tips you should follow to structure your consulting interview practice.

Tip #1: Start early

This might sound obvious, but case interviews can be challenging, so you should start preparing early. Some of the people we work with start studying up to 6 months before their interview. Starting that much in advance is not necessary to get an offer, but the earlier you start the higher your chances of getting an offer are.

Tip #2: Learn the fundamentals

The first thing you should do is learning the key concepts and core skills you need to get an offer in consulting. In other words, you need to learn the fundamentals. This website has many free resources you can use to do this. We recommend starting with our free case interview guide and our list of free case interview examples .

Tip #3: Practice with peers

Practicing with peers is useful to get live interview practice. This is something that is common on university campuses and is often organised by consulting societies.

If you are not already doing so, we definitely encourage you to find one or a couple of friends who are also preparing for consulting interviews and with whom you can practice. You will learn a lot both by playing the role of the interviewer and the candidate. Here's a list of consulting interview questions you can practice with.

Tip #4: Practice with experts

Practicing with peers will only get you so far. I f you really want the best possible preparation for your case interview, you'll also want to get feedback from ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock interviews 1-on-1 with ex-interviewers from MBB firms. Learn more and start scheduling sessions today.

Tip #5: Keep it up

Learning any new skill has got its ups and downs. Mastering case interviews is no different. Your performance probably won't be amazing on your first few cases. You will probably make mistakes even after you have practiced 15+ cases. Keep it up. It might take a while but everyone can make it to consulting by following the right step-by-step preparation plan.

2. Case interview tips

Now that you know how to approach your preparation, let's focus on a few tips that you should use during your actual case interview.

Tip #6: Listen carefully and ask clarification questions

At the beginning of the case, your interviewer will layout the situation of the company you are trying to help (e.g.: Coca-Cola's profits have decreased by 10% over the past 12 months). Your job in that part of the interview is to make sure that you understand the situation correctly by asking the right clarification questions (e.g.: in which countries have profits declined? And for which products?).

This is what partners at McKinsey and other firms do with clients. They sit down with them, listen carefully to the problem they have, and ask clarification questions before trying to solve the problem. They do this because it's impossible to solve a business problem you don't understand in details. And you should therefore follow a similar approach in your cases.

Tip #7: Structure, structure, structure

Once you understand the situation in detail, your interviewer will expect you to put together a framework that you will use to solve the problem your client is facing. For instance, if your client is facing a profits' issue, your interviewer will expect you to look into 1) potential revenue issues and 2) potential cost issues because profits issues can be due to one or both of these factors.

Consultants use frameworks and structure their thinking all the time because it's client-friendly. If you don't solve the problem in a structured way, your client will probably lose track of what you are doing and be unhappy. If you solve it in a structured way, they will know what you are working on at all times and feel that you have things under control. Interviews are the same. If you structure your approach and communicate in a structured way, you'll have a happy interviewer!

Tip #8: Don't reuse frameworks

One trap many candidates fall into is to reuse pre-existing frameworks in their interviews. As we explain in our case frameworks guide , interviewers will immediately notice if you do this and you will get penalised. Each case is unique, and you should therefore create a custom framework for every case you do. This might sound difficult but it actually isn't if you take the right approach.

Tip #9: Think before speaking

Consultants sell advice. Once you have said something it's hard to take it back. One of the things you learn as a junior consultant is to think first, decide how you are going to say what you want to say, and then finally say it. If you can do that well in your interviews it will truly set you apart. In practice, it means that you should take some time to organise your thoughts before speaking and that you should avoid jumping to conclusions.

Tip #10: Brush up your maths

Virtually all case interviews involve doing maths computations without a calculator. Having rusty maths at the beginning of your preparation is normal. But in our experience successful candidates take some time to brush up their maths when they start practicing. You should take the time to refresh your memory and be 100% comfortable doing basic additions, subtractions, divisions, multiplications and growth rate calculations mentally. We really encourage you to take the time to do this. Trust us, it's really worth it!

Tip #11: Draw conclusions

As we mentioned above, consultants get paid for their advice. One of the things clients hate is to pay a large sum of money and not get a clear answer about their problem. Even if they are halfway through the project, consultants avoid telling their clients: "We don't know yet." What they say instead is: "Based on what we have seen so far, our current hypothesis is that the profit decline you are experiencing is mainly driven by the Chinese market. We think this is the case for 3 reasons. Reason #1 is etc."

You need to do the same thing in your cases. At the end of the interview, your interviewer will ask for your conclusion. You can't dodge the question. You've got to give a clear answer with supporting arguments based on what you have learned doing the analysis. The trick is to caveat your answer with a sentence such as "Based on this initial analysis, etc." And to also highlight additional areas to explore to confirm that your current understanding is the right one.

Tip #12: Catch the hints

Finally, 99% of interviewers have good intentions. They're here to help you perform at your best. During your interviews they will give you hints about whether you are doing well or not. If they try to steer you in a direction, follow them, they're trying to help you. This might sound obvious but candidates sometimes get so stressed out that they don't pick up on the hints interviewers give them.

3. Fit / PEI questions tips

In addition to a case, your interviewer will also ask you one or two behavioural questions. Let's turn our attention to those and go through a few tips that you can use to impress your interviewer.

Tip #13: Research consulting / the company

The two most frequently asked fit questions you will come across are " Why consulting? " and " Why McKinsey? / Why BCG? / Why Bain? " You therefore need to do your research about consulting as well as the company and office your are interviewing for. Try to really understand whether consulting is a job you will enjoy doing. Try to meet consultants from the firm and office you are interviewing for. This will help you give genuine answers to these fit questions and will set you apart from other candidates.

Tip #14: Prepare for PEI questions

In addition to typical CV questions, consulting firms also ask personal experience interview questions . These questions are easy to recognise, they always start with: "Tell me about a time when..." They aim to test your soft skills such as your leadership or your ability to work in a team. A lot of candidates underestimate their importance and end up not preparing sufficiently for them. We recommend setting about 25% of your time to prepare for fit and PEI questions.

Tip #15: Try to convey confidence

We know this one is hard, but conveying confidence can make a big difference in your interviews. We all have doubts, and we are all stressed when we interview. It's perfectly normal. But you should try to keep these doubts and stress to yourself. You should try to look your interviewer in the eye and speak as confidently as possible. Conveying confidence is a core consulting skill and if you can do it in your interviews it will really take you a long way!

4. Conclusion

When it comes to preparing case interviews, it can seem like there's a lot to take in. Even when you've covered everything mentioned above, it's still hard to gauge your level and to be sure whether or not you're really ready to ace your interview.

That's one reason why mock interviews are so helpful. If you're interested, click below to browse from our many ex-interviewers from MBB firms, and book your mock interview at a time to suit you. Learn more and start scheduling sessions today.

Related articles:

McKinsey Phone Case Interview – What to Expect & How to Pass

- Last Updated August, 2021

Former McKinsey

Beginning in 2021, many experienced hire and Ph.D. prospects have been invited to a 30-minute “McKinsey Phone Case Interview” at the beginning of the recruiting process.

The McKinsey phone case interview is a 30-minute case interview conducted over the phone. It’s similar to a first-round case interview but requires slightly less depth in the case structure. Its purpose is to weed out candidates who are unlikely to pass first-round case interviews.

So if you’re considering a career in consulting as an experienced hire or a Ph.D., you’ll want to know what these interviews are like and how to put your best put forward.

In this article, we’ll discuss:

- Why is McKinsey doing phone case interviews?

- What the McKinsey phone case interview looks like.

- 8 tips for passing the McKinsey phone assessment.

- What the McKinsey recruiting process looks like after the phone case interview.

Let’s get started!

Why Is McKinsey Doing Phone Case Interviews?

The McKinsey phone case interview is a new form of candidate screening. This interview is meant to identify the candidates who are less likely to make it past the first round of interviews.

In other words, McKinsey is using the phone assessment to weed out candidates who do not meet “the bar.”

But what is “the bar?”

While not an official term, if someone doesn’t meet the bar, it generally means they are not likely to be a valuable consulting team member. In the reality of consulting case interviews, it really means that someone crashed and burned. Or maybe they couldn’t even figure out how to find the cockpit.

As hard as you all work to prepare for consulting interviews, it shouldn’t surprise you that there are some candidates who just simply can’t get over their nerves or have not practiced case interviews enough to feel confident during the first rounds.

And sometimes those people have the worst 2 hours of their lives during their first-round interviews. (You may be dodging a bullet if consulting was not really a good fit!) The McKinsey phone case interview is partly intended to save both the interviewer and the interviewee from that misery.

So don’t panic! If you’re preparing for interviews and working on case structures, you’re going to do fine on the McKinsey phone assessment.

You may not even have a phone assessment as the practice varies by region and by the office. Certain offices in Asia have been using the McKinsey phone assessment for a while. In the past, it has been less common in other regions, but it is starting to gain traction.

In North America, we have only seen McKinsey phone assessments for Ph.D.’s and experienced hires. As recruiting ramps to back up later this year, it’s unclear whether MBAs and undergraduates will be required to pass a McKinsey phone case interview before the first rounds.

What Does the McKinsey Phone Case Interview Look Like?

The McKinsey phone case interview is actually fairly similar to what you’d expect in a Round 1 case interview. It’s a bit simpler and focused on assessing a few basic skills.

The McKinsey phone assessment typically is:

- A 30-minute call with a consultant.

- An “easy case.” There is less depth required in the case structure.

- An evaluation that is focused on screening out candidates who can’t structure a case question or do consulting math.

Generally speaking, you can prepare for the McKinsey phone case interview similarly to how you prepare for other case interviews. However, there are a few nuances of the McKinsey phone assessment:

- The McKinsey phone case interview is interviewer-led. All McKinsey interviews are interviewer-led, but these phone assessments are even more so. The interviewers really drive these interviews to make sure they can “tick all the boxes” in 30 minutes. Do not worry about driving this case, and let the McKinsey interviewer drive.

- It is designed to evaluate you quickly on your ability to structure a case. In the McKinsey phone assessment, structures should only be two levels deep and you should incorporate a small number of broad hypotheses. Be prepared to communicate your structure in just 2-3 minutes. Your structure should still be logical, MECE , and customized (e.g., not something pulled straight out of a textbook). Note: It’s not unusual for McKinsey interviewers to cut off interviewees who go on for too long or were too detailed.

- You may need to do some brainstorming. Be prepared to outline some basic conceptual ideas and tack on 4+ ideas per bucket. This could be a list of analyses to perform or the list of options for your recommendations for the client.

- There will be McKinsey case math. All of these interviews have a math component, and it is typically the same depth and difficulty as a Round 1 interview. You should over-prepare for math because you will be expected to get it right quickly. If you miss this portion of the assessment, it does not bode well for your progress. For more on this, see our article on case interview math .

- There will be no exhibit reading or market sizing .

- You still need to provide a recommendation: You’ll have to move at a fast clip, so keep track of time and make sure you have time to get to your recommendation. Note: It’s not a dealbreaker if you aced your structure and the math but don’t get enough time to thoroughly cover your recommendation.

- There is rarely time to discuss your personal experience. So you will be scored in the McKinsey phone assessment on how well you do on the case.

Now that we’ve covered some of the differences of the McKinsey phone assessment, let’s talk tips!

8 Tips for Passing the McKinsey Phone Assessment

Here are some tips to ace the McKinsey phone case interview, including some general basics for making a good impression over the phone and some specifics for the McKinsey phone assessment.

1. Listen intently and don’t interrupt.

It is hard to do an interview over the phone. Err on the side of giving your interviewer an extra 2 seconds before you start speaking.

2. Communicate clearly.

You don’t have the benefit of reading visual cues, so make sure you focus on clear and organized language.

3. Make lists!

Because you’re on the phone, you won’t be able to impress your interviewer with a neatly drawn line down the left side of the page or how symmetrical your boxes are. Use numbers and letters in your conversation to help your interviewer follow along with your structure. Remember: lists are your friend.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

4. Find ways to help your interviewer engage with you in the process.

It’s difficult to build rapport during such a quick interview, but use tactics like asking clarifying questions, or confirming that you have all the information for the next step to show your interviewer that you are in a dialogue with them.

5. Nail your structure.

Unfortunately, this can be a dealbreaker for you. The good news is, the case should be pretty straightforward and you should not encounter really difficult concepts that you may come across during your first round interviews.

6. Nail the math.

This is another possible dealbreaker. Do your case prep so you are really solid on McKinsey math. It’s trickier than other firms’ and you don’t want to blow your chances with McKinsey if this is one of your early interviews. (See our article on interviewer vs. interviewee-led case interviews for more info on this.)

7. Keep an eye on the clock.

Remember, you only have about 25 minutes for this case, so keep some kind of clock or timer handy. You should not spend more than 2-3 minutes on your structure and should get to the recommendations between 20-25 minutes into the case.

8. Try to make it fun.

You want to come across as a good team member. So even though this is a quick sprint, make it seem like you’re enjoying the challenge.

The McKinsey Recruiting Process After the Phone Case Interview

Once you’ve made it through the McKinsey phone case interview, you may have options for how to proceed with additional case interviews.

Certain McKinsey offices are offering a “single round” option to candidates which is a single round of 4-5 interviews. Some offices are just mandating this, while others are giving candidates the choice between the traditional two rounds and the single round.

If you have the choice, we recommend taking the traditional option with 2 rounds of interviews. This option allows you to get feedback from your first-round interviews and practice any areas of weakness before you get to the more challenging final-round interviews. It also gives you time to reach out to anyone in the office you’ve been networking with. This could push them to champion for you with the recruiting team, giving you that extra boost toward getting an offer.

Of course, if you have outstanding offers, you may need to choose the single-round option to get your decision from McKinsey faster.

You may also have to take the McKinsey Digital Assessment . The firm seems to be experimenting with different configurations to figure out the best screening steps.

In this article, we’ve covered:

- Why McKinsey has phone case interviews.

- What the McKinsey phone case interview is all about.

- 8 tips for passing the McKinsey phone case interview.

- What the recruiting process is like once you pass the phone case interview.

Still have questions?

If you have more questions about the McKinsey phone case interview, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for McKinsey phone assessment found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep .

- Pyramid Principle .

- MECE (mutually exclusive, collectively exhausting) .

- Transitioning from a Ph.D. Program to Consulting .

Help with Consulting Interview Prep

Thanks for turning to My Consulting Offer for advice on the McKinsey phone case interview. My Consulting Offer has helped almost 85% of the people we’ve worked with to get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Tanya was able to get her offer from McKinsey.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

Hacking the Case Interview

It can be challenging to determine which resources are the best to use to prepare for your McKinsey case interview . There are a countless number of case interview articles, videos, prep books, courses, and coaching services.

So, which resources teach case interviews the quickest, most efficient way? Which resources teach the best McKinsey case interview strategies and techniques? What are the best free resources available?

If you have an upcoming McKinsey case interview, we have you covered. In this article, we’ll cover the best resources to prepare for your McKinsey case interview given your needs and budget.

We categorize these McKinsey case interview prep resources into the following categories:

- Free resources to prepare for your McKinsey case interview

- McKinsey case interview prep books

- McKinsey case interview courses

- McKinsey case interview coaching

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

Free Resources to Prepare for Your McKinsey Case Interview

Case Interview Videos

If you are completely new to McKinsey case interviews, you can watch our 80-minute complete guide to case interviews. This is the perfect introductory video for beginners because you’ll get an overview on:

- What is a case interview

- The eight parts of a case interview

- The six common types of cases

- Written case interviews and group case interviews

- 25 of the best case interview tips

Make sure to check out our YouTube channel and subscribe for free case interview lessons, tips, and practice cases.

McKinsey’s Website

You should also check out McKinsey’s interview preparation website because they provide four practice cases that you can work on without having to rely on a case partner.

The four cases are:

Diconsa case : Non-profit case focused on deciding whether to leverage a chain of convenience stores to deliver basic financial services to inhabitants of rural Mexico. You can watch a video walkthrough of how to solve the case below.

GlobaPharm case : Acquisition case focused on deciding whether a large pharmaceutical company should acquire a smaller startup. You can watch a video walkthrough of how to solve the case below.

Electro-light case : New product launch case focused on deciding whether a beverage company should launch a new sports drink.

National Education case : Non-profit case focused on helping an Eastern European country’s Department of Education improve their school system.

MBA Consulting Casebooks

Consulting casebooks are documents that MBA consulting clubs put together to help their members prepare for consulting case interviews. Consulting casebooks provide some case interview strategies and tips, but they mostly contain case interview practice cases.

You can download 23 MBA consulting casebooks with over 700+ free practice cases in our MBA casebook compilation .

Many of these cases come from previous McKinsey interviews, so they can be a great resource to get McKinsey case interview practice. We’ve included a few of our recommended consulting casebooks below:

- Wharton (2017)

- Darden (2019)

- Kellogg (2012)

- Fuqua (2018)

- Sloan (2015)

You should know that a major caveat of using these consulting casebooks is that the quality of cases varies significantly. Some practice cases may not be representative of what an actual case interview is like. Other cases may provide poor explanations of the sample answers.

McKinsey Case Interview Prep Books

In the next section of this article, we’ll move onto the best paid resources to use to prepare for your McKinsey case interview. We’ll start by covering the best case interview prep books.

Case interview prep books are great resources to use because they are fairly inexpensive, only costing $20 to $30. They contain a tremendous amount of information that you can read, digest, and re-read at your own pace.

Based on our comprehensive review of the 12 popular case interview prep books , we ranked nearly all of the case prep books in the market.

The three case interview prep books we recommend using are:

- Hacking the Case Interview : In this book, learn exactly what to do and what to say in every step of the case interview. This is the perfect book for beginners that are looking to learn the basics of case interviews quickly.

- The Ultimate Case Interview Workbook : In this book, hone your case interview skills through 65+ problems tailored towards each type of question asked in case interviews and 15 full-length practice cases. This book is great for intermediates looking to get quality practice.

- Case Interview Secrets : This book provides great explanations of essential case interview concepts and fundamentals. The stories and anecdotes that the author provides are entertaining and help paint a clear picture of what to expect in a case interview, what interviewers are looking for, and how to solve a case interview.

McKinsey Case Interview Courses

Case interview courses are more expensive to use than case interview prep books, but offer more efficient and effective learning. You’ll learn much more quickly from watching someone teach you the material, provide examples, and then walk through practice problems than from reading a book by yourself.

Courses typically cost anywhere between $200 to $400.

If you are looking for a single resource to learn the best McKinsey case interview strategies in the most efficient way possible, enroll in our comprehensive case interview course .

Through 70+ concise video lessons and 20 full-length practice cases based on real interviews from top-tier consulting firms, you’ll learn step-by-step how to crush your McKinsey case interview.

We’ve had students pass their McKinsey first round interview with just a week of preparation, but know that your success depends on the amount of effort you put in and your starting capabilities.

McKinsey Case Interview Coaching

With case interview coaching, you’ll pay anywhere between $100 to $300 for a 40- to 60-minute mock case interview session with a case coach. Typically, case coaches are former consultants or interviewers that have worked at top-tier consulting firms.

Although very expensive, case interview coaching can provide you with high quality feedback that can significantly improve your case interview performance. By working with a case coach, you will be practicing high quality cases with an expert. You’ll get detailed feedback that ordinary case interview partners are not able to provide.

Know that you do not need to purchase case interview coaching to receive a consulting job offer. The vast majority of candidates that receive offers from top firms did not purchase case interview coaching. By purchasing case interview coaching, you are essentially purchasing convenience and learning efficiency.

Case interview coaching is best for those that have already learned as much as they can about case interviews on their own and feel that they have reached a plateau in their learning. For case interview beginners and intermediates, it may be a better use of their money to first purchase a case interview course or case interview prep book before purchasing expensive coaching sessions.

If you do decide to eventually use a case interview coach, consider using our personalized, one-on-one case interview coaching service .

There is a wide range of quality among coaches, so ensure that you are working with someone that is invested in your development and success. If possible, ask for reviews from previous candidates that your coach has worked with.

Final Thoughts on Preparing for McKinsey Case Interviews

We hope that you’ve found this article helpful in narrowing down which resources to use to prepare for your McKinsey case interviews.

Whether you choose to exclusively use free resources or purchase case interview prep books, courses, or coaching, we want to offer you these five critical McKinsey case interview preparation tips. Lastly, make sure that you perfect your McKinsey resume to ensure that you even get an interview.

1. Learn the right strategies the first time

It is very important to learn the right case interview strategies the first time. If you learn poor case interview strategies and then practice solving cases using these strategies, you’ll develop bad case interview habits. These habits will be difficult to correct later on when you decide to switch to using more effective case interview strategies.

If you learn the effective and robust strategies in the beginning, you’ll save yourself many hours of preparation time.

2. Practice with high-quality practice cases

When practicing cases, try to use the highest quality practice cases you can find. Ideally, these cases will come directly from McKinsey and be representative of an actual case interview in terms of difficulty and length.

You’ll find yourself improving much more quickly if you use high-quality practice cases versus low-quality cases.

3. Practice with a case partner whenever possible

While it may be helpful to practice solving cases by yourself in the beginning, you should practice with a case partner when you feel comfortable solving cases. Practicing with a case partner is the best way to simulate a real case interview.

4. Keep a list of improvement areas

Don’t just work through practice cases and stop once you have answered all of the questions. Take the time to go through exactly what you did to solve the case and identify areas you could have done better. Keep a list of everything you could have improved on after each case.

After doing a few practice cases, you’ll likely notice patterns on things that you consistently don’t do well. This is a great way to identify your weaknesses so that you can work on improving them.

5. Work on improving one thing at a time

Finally, focus on improving one thing at a time. Trying to work on all of your improvement areas at once is difficult to do and will likely be unproductive. Before each practice case interview, pick one thing that you want to work on. When you have mastered that one thing, move onto the next improvement area.

Land Your Dream Consulting Job

Here are the resources we recommend to land a McKinsey consulting offer:

For help landing consulting interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple consulting interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing consulting behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

- Skip to main content

Crafting Cases

Case Interview Examples: The 9 Best in 2024 (McKinsey, Bain, BCG, etc.)

February 7, 2024 By Julio Tarraf

Today I’m gonna show you a curated list of the 9 VERY BEST Case Interview Example videos from all around the web.

So you don’t have to go through the same pains I did back when I was preparing:

- I watched TONS of videos on YouTube, but most of my time was WASTED because many weren’t helpful at all.

- I couldn’t tell which cases were realistic and which were unrealistic, or which were hard and which were easy.

- I couldn’t even tell whether each answer by the candidates was good enough to pass the interview or not (my best proxy was their confidence, which I later found was NOT a good proxy).

So that brings us to this article.

What's in for you:

Every hour you spend on the examples in this article is the equivalent of spending 3-5 hours browsing YouTube on your own, reading Case in Point, or going through piles of casebooks.

This article is the result of...

24 of those videos didn’t make it to the list: they were a mix of poorly recorded, unrealistic and even misleading .

I curated just the best so you wouldn’t have to waste your own 20+ hours to find them.

Table of contents:

- #1. Playworks market entry [Best for beginners]

- #2. Agricultural chemicals product launch [Advanced candidates only]

- #3. A+ Airlines’ reaction to competitor’s change

- #4. Auto manufacturer profitability decrease [Best profitability case]

#5. Swift fox population decrease

- #6. Bed and Bath e-commerce acquisition [Best for solo practice]

#7. FlashFash acquires LaMode

#8. medical supplies manufacturer demand decrease.

- #9. Pepsi’s LA bottling plant

- #10. 1930’s gangster growth strategy

#1. Playworks market entry

- Easy case, with one Estimation, one Quantitative Analysis, and one Chart Interpretation questions within. Overall, good to practice and to get a feel for case interview dynamics

- You can’t see the Exhibit the candidate is shown, but you can find it in this link provided by Yale SOM Consulting Club (go to page 9)

CANDIDATE’S PERFORMANCE

- Stellar framework, touching on all relevant issues and showing a plan to solve the problem from beginning to end

- Great job performing a spontaneous reality check to his estimation

- I would expect more reasoning behind some of the key assumptions (# of high schools and colleges in the US). He was, however, close to the real values – his background as a teacher could have played a role, but as an interviewer I would still have needed to see his reasoning behind those numbers

- Big mistake inadvertently converting square yards to square feet (~10x difference in final answer) combined with math confusion within the Estimation and inefficiencies in Analysis: his analytical skills would have to be tested more thoroughly in a third interview or in a next round

The next case is mostly useful for its framework question.

It’s a high-quality, nuanced case question, similar to the ones you’ll get in McKinsey, Bain and BCG interviews.

The problem with this case is…

It requires either a well-structured answer or a ton of business sense, and the candidate solving it had neither.

As a result, he missed so many great insights, which made the video poor where it could have been rich for those who are practicing: business insight.

To spice up your practice, I’ll list those insights after the video under a spoiler alert, so you can add them to your own business sense library.

Given all of this, I would recommend this video for advanced candidates only .

(To understand what elements a perfect answer would need and how to create one for any case, check out our free course, Case Interview Fundamentals.)

#2. Agricultural chemicals product launch

Product launch

Candidate-led

- Tough case. Full of nuance, and suitable for an MBB first-round (perhaps even for a final-round).

- The analysis at 26:15 is a tough one, great practice for advanced students looking to improve their quantitative skills. Don’t forget that you need to provide an insight after getting to the numerical answer.

- Right from the start, you can see that you’d need to (1) size the financial benefits orchards would get from using your product and (2) run viability and pricing analyses. The candidate fails to see this until the interviewer suggests it.

- The candidate missed several other important insights which would have been impressive. Can you spot any? Read them below, under the spoiler alert.

As I said, I’ll quickly go over the insights this candidate missed, as I think they could greatly add to your business sense library.

1) The one and most important is the pricing and viability analysis.

- One of the first questions that need to be answered when solving this case is, “what’s the size of the financial benefits of this product to the buyer, how much can we capture of it, and does it covers the manufacturing and distribution costs?”.

- The reason is simple: this analysis can be run entirely on data we most likely have (from research while developing the product), and it will quickly tell us if the product isn’t viable or if we need a strategy pivot.

- When guided, the candidate eventually runs this analysis, but the fact that this isn’t even explicit in his initial structure is still a red flag.

- Here’s what I would expect from a top-2% candidate. This analysis should have been outlined in the initial structure, along with a quick brainstorming of how this product might bring increased profits for the buyer.

2) There are several other potential sources of increased ROI that the launch of this product could yield that he didn’t even consider:

- Cross-selling opportunities to these same clients, once we’re selling Mango Maker to them.

- The possibility of selling this product in several other countries (thus potentially decreasing the costs of production with scale gains.)

- The possibility of selling this product to producers of other tropical fruits (to his credit, he did mention this when pressed, by the end of the video).

- The possibility of acting towards increasing the patent duration.

- The possibility of having some cash flow from the product after the patent expires.

The key to getting to those insights would have been to build a more robust initial framework. More business sense would help for sure, but structuring techniques are more feasible to practice and develop.

Lastly: the interviewer says, by the end of the video, that the interviewer would pass his first-round MBB interview with this performance. I do not agree with her.

While it is possible that his interviewers would pass him and let partners decide whether or not he’s suitable for the firm, the risk is just too high.

Some interviewers might pass him, but many others definitely would not.

Before we move on…

Did you know there are ONLY 6 types of questions an interviewer will ask you in a case?

Join our FREE 7-day case interview course to…

- Learn what these six types of questions are…

- Get step-by-step approaches to answering them…

- And get several in-depth examples taylored for solo practice.

Now to the next video…

Yale SOM Consulting Club and Elaine Dang deserve congratulations on the two videos they made.

It’s super high quality work.

Both of their video examples are similar to real case interviews in format and content, and they’re even superior to some made by case interview prep websites.

#3. A+ Airlines' reaction to competitor's change

- Questions and difficulty realistic for McKinsey, Bain, or BCG

- A real case might have more Brainstorming questions within the case

- Negative: you can’t se the exhibits the candidate is shown

- Great: all of her answers were backed by at least one layer of structure

- Insights provided after calculating every new number, which is super important (learn more)

- She did a good job keeping the interviewer on board by doing her math out loud at all times

- One thing she could’ve done better was to not constantly come back to the “cash tied up in the cash box” idea – she should’ve tested it once and definitively as to whether that is relevant or not (it isn’t) – a partner would have certainly challenged her on that

Featuring next: me reviewing my own video from a neutral point of view.

Yes, I know that can’t possibly be unbiased.

But here’s why I think this video will get you ahead of other candidates and why you should ABSOLUTELY NOT miss out on this :

- The case comes nearly straight from my own Bain final round.

- My question in the end is difficult (even for McKinsey, Bain or BCG’s standards), and Bruno’s answer is impressive.

- Bruno’s solution is not perfect, and this gives us both an opportunity to openly discuss how it could’ve been better by the end.

#4. Auto manufacturer profitability decrease

- Average-difficulty profitability case in the first half, and a difficult question at 15:44

- Full realistic drill-down to find the real root cause of the problem, which is a common thing in case interviews that you’ll only find in this video

- Bruno should have presented his answer as a plan before diving into the profit tree , which is an advanced skill that makes you sound more like a consultant and less like a candidate

- Efficient and organized drill-down in the profit tree, a must-master habit for all candidates

- Super insightful answer to the second question because it shows second-order level thinking

If you’re mainly looking to improve your performance in profitability cases, there are two pieces of content worth checking out:

- This video: 5 Tactics To Stand Out In Your Profitability Case Interviews

- And this article, the state-of-the-art in profitability trees: Profitability Trees: The Complete Guide

What I love about the next case is that the first question is on diagnosing a client’s issue, but it’s not a profitability case.

It’s actually a public sector case!

Most beginners think you only use issue trees and drill-down analysis when solving a profit problem, but as you’ll see in this case, this is not true at all.

The candidate’s answer is good, so you can compare your own answer to his.

- This is a difficult, realistic diagnostics case, great for advanced candidates to step up their practice with hard cases

- You are not shown a critical exhibit the candidate gets in the middle of the case, making it unsuitable for practice from then on

- The candidate’s initial structure is insightful because it breaks down the population problem into its key drivers

- The insights the candidate provided on the exhibits are spot-on, but I would expect next-steps after the conclusions (e.g. after 10:33 , he could have said “And to figure out whether this really is the cause of the population decrease, the next thing I would do is…” )

- But he doesn’t make the same mistake twice – at 23:20 , he gets to a number the interviewer asked and, this time, he leads the case perfectly: he comes up with a conclusion (the insight), and then proactively leads the case with next steps

The next video is THE SINGLE BEST in this list for solo practice.

You will see Bruno’s reaction to challenges most people only face in their actual interviews. Mock interviews hardly prepare you for this at all:

- How should you react when an interviewer asks you for more ideas after you’ve given everything you have?

- What do you do when your interviewer asks for a recommendation having given you nearly no data?

Go ahead and see for yourself.

(And how would a real candidate do in this case? I interviewed a candidate with this very same case and recorded it so you could see for yourself. )

#6. Bed and Bath e-commerce acquisition

- Pay special attention to how I made spontaneous challenges to Bruno after his answers. Most mock interviews, even with consultants, don’t have that. So candidates end up getting surprised by them in their actual interviews. You might even want to show this to your peers so they’ll do more realistic mock interviews with you

- In 9:00 I challenge Bruno to see if he’s sure whether customer loyalty was good (higher customer lifetime value) or bad (harder to increase market share) for the acquisition

- In 16:22 I challenge Bruno to find even more ideas other than the ones he had already given

- Due to being interviewer-led AND having great benchmark answers, this is the best video in this list for solo practice

- Super structured brainstorming, which showed me he would not leave any important area behind and helped him give me a ton of creative, insightful ideas

- Insightful framework answer (e.g., 99% of candidates would not talk about whether running this business would be attractive to the friend, much less in depth like he did)

The next case is one of the unmissable videos in this list for two main reasons.

Number one, the candidate’s answers are great, good enough to be benchmarks to your own.

Number two, it’s a difficult M&A case (which is not as exciting as watching the last Avengers movie, I get, but still…).

- Realistic, challenging interviewer-led case for McKinsey, Bain and even BCG (as some interviewers there have been doing this type of case recently)

- Quality answers make it great for solo practice

- Insightful, well-built framework, definitely a benchmark

- Notice how the candidate shows his structure for the quantitative analysis before diving into the math – that’s a great habit you definitely want to copy

I chose this next video mostly due to the quality of the initial case question. Here’s why.

Most profitability cases in casebooks are simple: “industry Y, profits fell. Why?”

But the truth is, in real MBB interviews, the case question almost always has more nuance than that.

That’s what this next video’s initial case question shows.

Just a quick heads up: I would not pass this candidate, as I wasn’t a fan of his initial structure nor of his business sense in general. Your initial structure should be more robust than his.

Profitability

Below average

- The nuances of the case question make it a realistic one for MBB first-round interviews.

- This case could be way more interesting and insightful if the candidate had followed a different path, like finding different sources of revenue, different segments they could cater to at a higher price point, or new markets they could enter with the resources they have.

- Your answers to the initial case question and to all the other brainstormings in the case could (and should, if you’re aiming for the moon) be 5X more robust than this candidate’s. Don’t base your answers off his. (Learn how to create robust brainstorming structures here.)

- The analysis he performs is good, structure and communication-wise.

- Great insight that buyers’ price sensitivity would be driven by the switching costs if there were any ( 19:30 )

The next video shows an operations case example.

It’s a wonderful use of process structures to diagnose an issue on production line.

I don’t really like its style for practicing for two main reasons.

First, it just doesn’t have the right tempo for you to pause and practice and then compare answers.

Second, the comments in the middle break the flow.

Nothing wrong with those comments. They’re actually helpful.

The problem is they make this video good for learning a few new concepts, watching a good structure put to use, but not really to practice by yourself.

If you’re an advanced candidate and your practice is up to date and you’re just looking to learn something new, jump right in.

#9. Pepsi's LA bottling plant

- Only one person playing the interviewer’s and the candidate’s roles, which doesn’t give you an idea of how the case would flow

- Difficult case, great case for advanced candidates to increase their experience/library