Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, what is an annual report , and how do you file it.

The U.S. Securities and Exchange Commission and many states require businesses to file annual reports. Use this guide to meet your reporting obligations.

Certain business entities must file annual reports (statements of information) with state governments, typically through the State Department. Public companies must give shareholders a yearly report detailing their operational and financial condition.

Additionally, public and certain private organizations may need to file a separate document with the U.S. Securities and Exchange Commission (SEC). So, which reports do you need to file or share with stakeholders? Explore the types of annual reports and learn how (and when) to file them.

What is an annual report for a small business?

A state-required annual report is a short document that explains who owns the company, what products or services it sells, and how to contact the people in charge. Many small businesses file an annual report with their formation state (where they initially registered their company) and any foreign states where they are registered to do business.

Wolters Kluwer said the following statutory business entities might need to file an information report:

- Business corporations .

- Nonprofit corporations.

- Limited liability companies (LLCs).

- Limited partnerships (LPs).

- Limited liability partnerships (LLPs).

The SEC requires publicly traded companies to share yearly reports with shareholders. Unlike state-mandated forms, this annual report is an in-depth accounting of a corporation’s finances and operations. Lastly, federal security laws mandate public corporations to file Form 10-K yearly.

[ Read more: S Corp vs. LLC: What’s the Difference? ]

State-mandated annual report filing

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn’t require an LLC annual report, and if you formed your company in Indiana , you only need to send the report every two years.

Since rules and due dates differ, always check with your state’s business department. States usually send a reporting form to the business address on file. You can return it via postal mail along with any annual registration fees. Many also allow you to file your yearly report online.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health.

SCORE noted that state-mandated annual reports are “relatively short documents” and include:

- Your company’s name and address.

- Purpose of the business.

- Names and addresses of a corporation’s directors and officers.

- Registered agent’s name and address.

- Names and addresses of LLC members or managers.

Annual reports for shareholders

According to Investopedia , “Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.” These documents give a comprehensive view of your organization, allowing shareholders, stakeholders, and investors to understand your corporation’s financial position.

Unlike state reporting requirements, a company’s annual report for shareholders is lengthy and tells a story about its financial health. Harvard Business School Online said, “Usually, an annual report is split into two halves.” The first section shares “the company’s narrative,” and the second part “presents data” minus the “narrative components.”

Investor.gov stated that businesses must provide shareholders with annual reports when holding yearly meetings to elect the board of directors . Additionally, proxy rules require companies to “post their proxy materials, including their annual reports, on their company websites.”

An annual report template has the following sections:

- Summary of general business information.

- Annual performance highlights.

- CEO’s letter to the shareholders.

- Management’s discussion and analysis (MD&A).

- Financial statements .

- Supporting notes, photos, and graphics.

- Auditor’s report.

- Financial information summary.

- Review of accounting policies.

[ Read more: Which Type of Accounting Service Do You Need? ]

SEC rules for filing annual statements

Organizations required to report to the SEC — including all public and some private companies — must disclose financials yearly to the SEC. Section 12 of the Exchange Act defines a private reporting company as one that has more than $10 million in total assets and a class of equity securities with either 2,000 or more persons or 500 or more individuals who are not accredited investors, or one that “lists the securities on a U.S. Exchange.”

According to Form 10-K instructions

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Other Filters

Frequently Asked Questions

AnnualReports.com is America's largest annual report service. Our directory is a Free Service that allows users to review and annual report in an easy and convenient manner. Boasting the most complete and up-to-dae listings of annual reports on the internet, AnnualReports.com provides instant access to annual reports in their actual format in one single location.

All publicly traded companies are required by the SEC (Securities and Exchange Commission) to publish certain financial data annually. The annual report is a publication that is distributed by these publicly traded companies to their shareholders. Most annual reports are very similar in the different types of information contained. Some of the common sections are: Letter from the chairman (or CEO) to the shareholders; Financial Highlights; Balance Sheets; Profit and Loss Statements; New Business; Year in Review; Projections; Outstanding Shares of Stock and Complete list of Board Members. Because this information is audited and required by the SEC, Annual Reports are an excellent way to familiarize your self with a company before you invest.

Users include shareholders, individual investors, money managers, company employees, financial institutions, and students.

AnnualReports.com is provided with our information directly from participating companies. The annual reports in our directory contain the exact information that would be seen in a companies' hard copy annual report or prospectus.

AnnualReports.com is an easy site to use. Visitors are able to look for a company through 3 search criteria: alphabetically, by company name, or by ticker symbol. Once a company is found, it can be viewed in either HTML or PDF format.

AnnualReports.com provides a potential investor with another way to view a company annual report. The traditional way is to order a report from the investor relations department of a company and wait 5-7 days to receive it. Now with AnnualReports.com an annual report can be received instantly with no waiting. This is a benefit potential investors will not pass up.

- More Filters

You are using an outdated browser. Please upgrade your browser to improve your experience.

- View/Edit Order

- About

- Products & Services

- Annual Report Search

Get annual reports. Mailed within 48 hours.

- Advertiser Index

- Search Search Please fill out this field.

What Is an Annual Report?

Understanding annual reports, special considerations, mutual fund annual reports, the bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Annual Report Explained: How to Read and Write Them

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

An annual report is a document that public corporations must provide annually to shareholders that describes their operations and financial conditions. The front part of the report often contains an impressive combination of graphics, photos, and an accompanying narrative, all of which chronicle the company's activities over the past year and may also make forecasts about the future of the company. The back part of the report contains detailed financial and operational information.

Key Takeaways

- An annual report is a corporate document disseminated to shareholders that spells out the company's financial condition and operations over the previous year.

- It was not until legislation was enacted after the stock market crash of 1929 that the annual report became a regular component of corporate financial reporting.

- Registered mutual funds must also distribute a full annual report to their shareholders each year.

Investopedia / Jake Shi

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm's financial performance and to make investment decisions.

Typically, an annual report will contain the following sections:

- General corporate information

- Operating and financial highlights

- Letter to the shareholders from the CEO

- Narrative text, graphics, and photos

- Management's discussion and analysis (MD&A)

- Financial statements, including the balance sheet, income statement, and cash flow statement

- Notes to the financial statements

- Auditor's report

- Summary of financial data

- Accounting policies

Current and prospective investors, employees, creditors, analysts, and any other interested party will analyze a company using its annual report.

In the U.S., a more detailed version of the annual report is referred to as Form 10-K and is submitted to the U.S. Securities and Exchange Commission (SEC). Companies may submit their annual reports electronically through the SEC's EDGAR database . Reporting companies must send annual reports to their shareholders when they hold annual meetings to elect directors. Under the proxy rules, reporting companies are required to post their proxy materials, including their annual reports, on their company websites.

The annual report contains key information on a company's financial position that can be used to measure:

- A company's ability to pay its debts as they come due

- Whether a company made a profit or loss in its previous fiscal year

- A company's growth over a number of years

- How much of earnings are retained by a company to grow its operations

- The proportion of operational expenses to revenue generated

The annual report also determines whether the information conforms to the generally accepted accounting principles (GAAP). This confirmation will be highlighted as an " unqualified opinion " in the auditor's report section.

Fundamental analysts also attempt to understand a company's future direction by analyzing the details provided in its annual report.

In the case of mutual funds, the annual report is a required document that is made available to a fund's shareholders on a fiscal-year basis. It discloses certain aspects of a mutual fund's operations and financial condition. In contrast to corporate annual reports, mutual fund annual reports are best described as "plain vanilla" in terms of their presentation.

A mutual fund annual report, along with a fund's prospectus and statement of additional information, is a source of multi-year fund data and performance, which is made available to fund shareholders as well as to prospective fund investors. Unfortunately, most of the information is quantitative rather than qualitative, which addresses the mandatory accounting disclosures required of mutual funds.

All mutual funds that are registered with the SEC are required to send a full report to all shareholders every year. The report shows how well the fund fared over the fiscal year. Information that can be found in the annual report includes:

- Table, chart, or graph of holdings by category (e.g., type of security, industry sector, geographic region, credit quality, or maturity)

- Audited financial statements, including a complete or summary (top 50) list of holdings

- Condensed financial statements

- Table showing the fund’s returns for one-, five- and 10-year periods

- Management’s discussion of fund performance

- Management information about directors and officers, such as name, age, and tenure

- Remuneration or compensation paid to directors, officers, and others

How Do You Write an Annual Report?

An annual report has a few sections and steps that must convey a certain amount of information, much of which is legally required for public companies. Most public companies hire auditing companies to write their annual reports. An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows. The last part will typically be notes to the financial statements, explaining certain facts and figures.

Is an Annual Report the Same As a 10-K Filing?

In general, an annual report is similar to the 10-K filing in that both report on the company's performance for the year. Both are considered to be the last financial filing of the year and summarize how the company did for that period. Annual reports are much more visually friendly. They are designed well and contain images and graphics. The 10-K filing only reports numbers and other qualitative information without any design elements or additional flair.

What Is a 10-Q Filing?

A 10-Q filing is a form that is filed with the Securities and Exchange Commission (SEC) that reports the quarterly earnings of a company. Most public companies have to file a 10-Q with the SEC to report their financial position for the quarter.

Public companies must produce annual reports to show their current financial conditions and operations. Annual reports can be used to examine a company's financial position and, possibly, understand what direction it will move in the future. These reports function differently for mutual funds; in this case, they are made available each fiscal year and are typically simpler.

U.S. Securities and Exchange Commission. " Speech By SEC Commissioner: Remarks Before the Securities Traders Association ."

U.S. Securities and Exchange Commission. " Annual Report ."

U.S. Securities and Exchange Commission. " How to Read a 10-K/10-Q ."

U.S. Securities and Exchange Commission. " Final Rule: Shareholder Reports and Quarterly Portfolio Disclosure of Registered Management Investment Companies ."

U.S. Securities and Exchange Commission. " Mutual Funds - The Next 75 Years ."

:max_bytes(150000):strip_icc():format(webp)/10-K--f7185a10d5d342c68235646bd3ceefcd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare an Annual Report

- 16 Dec 2021

Investors must carefully analyze the financial health and performance of any business they consider funding. To do this, they turn to several financial statements that offer glimpses into the organization's inner workings.

Few financial statements are more highly anticipated each year than a company’s annual report, which not only summarizes its performance for the preceding year but charts a course for the one ahead.

With this in mind, knowing how to prepare an annual report is essential for anyone interested in a leadership position. Whether you’re an aspiring entrepreneur, functional lead, or member of your organization’s C-suite, learning how to prepare an annual report can help advance your career.

Here’s a look at what an annual report is, its key components, and steps you should follow to create one.

Access your free e-book today.

What Is An Annual Report?

An annual report is a document that describes a company’s financial condition and business operations for the previous year.

Any publicly traded business is required by law to prepare and publish an annual report, which helps current and potential investors decide whether to provide funding.

Businesses not publicly traded can still prepare an annual report if they have private investors who must be apprised of their performance or are in the process of securing private funding.

Components of an Annual Report

An annual report typically consists of the following documents or sections:

- Letters to shareholders

- Management’s discussion and analysis (MD&A)

- General corporate information or business profile

- Operating and financing highlights

- Financial statements

Usually, an annual report is split into two halves. The first half contains the company’s narrative in the form of the letters to shareholders, management’s discussion and analysis, general corporate information, and operating highlights—all of which tell a story about how the company performed and worked toward its goals. The second half of the report strips out narrative components and presents data, which investors are encouraged to analyze to draw conclusions about the company.

1. Compile the Business Profile

The business profile is the section of the annual report where you summarize key information about your business. It typically includes information about:

- Your company’s key products or services

- Your company’s mission and vision

- The board of directors and other business officers

- Your investor profile

- Your competition

- Opportunities and risks

This section is also sometimes referred to as the general business information section of the annual report.

When writing this section, remember your goals: to quickly provide new, current, or potential investors the information needed to understand your business and industry.

2. Generate Key Financial Statements

The purpose of the annual report is to provide data and analysis regarding your company’s operations and financial performance. As such, the financial statements it contains are essential.

Important financial statements include your company’s:

- Income statement

- Cash flow statement

- Balance sheet

- Statement to shareholders

While you can compile the report’s other sections before generating financial statements, it’s best to avoid doing so because your letters to shareholders, management’s discussion and analysis, and other narrative elements should be backed by financial data. Not creating financial statements first makes it possible to tell an inaccurate or incomplete story you’ll later need to correct.

3. Select Operational and Financial Highlights

After generating financial statements, select highlights for your report’s narrative elements. Incorporate a mix of operational and financial highlights. Some examples include:

- The launch of new products or services

- The opening of new facilities

- Major contracts or partnerships

- News about mergers and acquisitions

- Rate of revenue growth

- Whether the company turned a profit or loss for the year

4. Write the Management Discussion and Analysis

While the financial statements included in the annual report allow investors and analysts to analyze your business, the management discussion and analysis section offers you and your team the opportunity to present an internal analysis of financial performance and statements.

The MD&A section also typically contains information regarding key issues your company faces, such as compliance with laws or regulations, systems and controls recently put in place, and new or emerging risks.

While the MD&A section is more subjective than financial statements, it must meet the standards set by the Financial Accounting Standards Board (FASB). This includes ensuring the MD&A is balanced, based on fact, and has both positive and negative information.

5. Write the Letter to Shareholders

The final step is to write the letter to shareholders. This letter is drafted by the CEO, chairperson, or company owner and offers a high-level overview of the business’s operating activities and finances for the previous year.

The letter to shareholders ultimately acts as the introduction to the entire annual report and is the first piece of information investors review. While each component of the annual report is essential, the letter to shareholders is one of the most important to get right.

One of the Most Important Financial Documents

The annual report is one of the most crucial financial documents your company produces.

While doing so is typically a team effort spanning multiple departments, knowing what goes into preparing one is a vital skill for aspiring business leaders and entrepreneurs.

Do you want to take your career to the next level? Consider enrolling in Financial Accounting —one of three courses that comprise our Credential of Readiness (CORe) program —and discover how you can learn key financial topics that enable you to understand business performance and potential.

About the Author

ANNUAL REPORT FILING SERVICE

1. Insert your record id and add your contact information

2. Complete a simple questionnaire that will be sent to you via email

3. Sign the form and we will process your Annual Report

What is an Annual Report?

After a business is created, most states require you to submit an annual report to keep your entity in an active state. Its main purpose is to provide the Business Division of the Secretary of State, updated information about your entity. Throughout a business entity’s life, many changes can occur. For example, a corporation’s owners, managers, registered agents, principal addresses and mailing addresses are part of information that will need to be updated in an annual report. If all your entity’s info has not changed from the previous year, you are still required to file the annual report, so the Secretary of State knows that your information is up to date. Annual reports vary from state to state including its fees, due dates and information required information.

Why is it Important?

By filing an Annual Report, you are advising the Secretary of State that your entity’s information is up to date. The Secretary of State may notify your company of issues surrounding any filing and/or the filing of any lawsuit naming your company as a party which has been served upon. If the Secretary of State cannot find your company because the address has not been updated, you run the risk of not knowing that such a lawsuit has been filed.

What Happens if You Don’t File?

If you do not file an annual report in a timely manner, the Secretary of State can administratively dissolve your company. Once, administratively dissolved, your company is no longer in good standing with the state, though it may still be sued. If your company is no longer in good standing, company business may be slowed because potential creditors or buyers may refuse to do business with a company that is not in good standing. If an administrative dissolution does occur, you must file the delinquent annual report(s) as well as an application to reinstate with the Secretary of State, which carries a filing fee as well. Most states will also require a late fee to be paid along with the delinquent annual report(s).

No longer in business?

Unfortunately, not all businesses succeed but its part of entrepreneurship. If your corporation is no longer operating, then you need to file a business dissolution. When you dissolve your entity, you are letting the Secretary of State know that you wish to no longer do business.

What is An EIN?

An Employer Identification Number (EIN), Federal Employer Identification Number (FEIN), or Federal Tax Identification Number (FTIN), is like a Social Security Number (SSN) for your business. The EIN number allows the Internal Revenue Service (IRS) to identify taxpayers and keep track of a business’s tax reporting.

Need An EIN?

When filing an Annual Report, some states require you to enter your Employer Identification Number (EIN). This information is then posted with state's business information on the Secretary of States database.

Annual Report State Deadlines

Get product updates.

Stay connected by signing up to our entity update service!

© 2024 Powered by All Rights Reserved

Spot identity theft early. Review your credit reports.

Suspicious activity or accounts you don't recognize can be signs of identity theft. Review your credit reports to catch problems early.

You've found your dream house. Are your credit reports ready?

People with good credit should check their credit reports too. Regular checks ensure the information stays accurate. Your good credit will be ready when you need it.

Don't be fooled by look-alikes.

Lots of sites promise credit reports for free. AnnualCreditReport.com is the only official site explicitly directed by Federal law to provide them.

There's more to the game than a score.

How you play changes your score. Details such as how much credit you have, how much you owe, and how often you pay affect your credit scores. Do you know what else does?

One of these things is not like the others.

You may think you have one credit report and one credit score. But you really have several, and they may differ. You should check all three reports regularly.

Your credit reports matter.

- Credit reports may affect your mortgage rates, credit card approvals, apartment requests, or even your job application.

- Reviewing credit reports helps you catch signs of identity theft early.

FREE Credit Reports. Federal law allows you to:

- Get a free copy of your credit report every 12 months from each credit reporting company.

- Ensure that the information on all of your credit reports is correct and up to date.

Brought to you by

- About this site

- Accessibility

- Terms of use

Copyright © 2024 Central Source, LLC

Secure Transaction: For your protection, this website is secured with the highest level of SSL Certificate encryption.

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

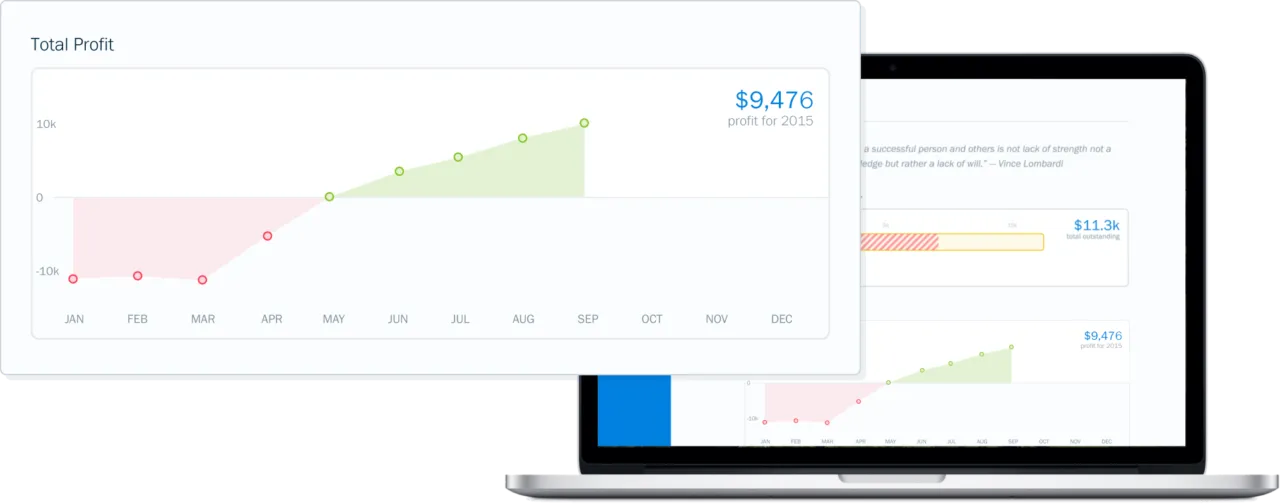

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to write an annual report: 4 tips for getting started.

Connecting with shareholders, investors , and the public is key to growing your small business. Your annual report communicates the strength of your business, so your current shareholders can feel confident knowing how your business operates. It’s also a chance to build new relationships with investors and clients by showcasing your management, financial performance, company mission, and goals.

Learning to write strong annual reports is important for delivering required year-end documents, but it can also help you forge personal connections. Explore the essential components of the annual report, as well as strategies for adding a creative touch that sets your business apart.

Key Takeaways

- An annual report communicates your business affairs to stakeholders and the public

- It typically includes mission goals, financial position, structure, and strategies

- Depending on the size of your business, you may be legally required to provide an annual report

- A good annual report can also be used as a marketing tool

- Aim to create an annual report that’s clear, honest, and engaging

What this article covers:

What Is an Annual Report?

What to include in an annual report, how do you write a good annual report, why is an annual report important.

- Frequently Asked Questions

To write an annual report, the business operations and the financial position are listed, summarized, and recorded. The annual report is a financial document businesses provide to shareholders, potential investors, and analysts. It is the best source of information about the business performance and financial well-being of a business.

Publicly traded companies are required to file annual reports to the Securities and Exchange Commission. However, small businesses and non-profit organizations also prepare yearly reports to connect with customers and provide information about yearly operations, past performance, and future goals.

The annual report is an integral part of corporate reporting. Since the annual reports are based on specific legal requirements , the items included in the report vary.

Most annual reports provide a fundamental overview of the business over the past year. The sections typically included in an annual report are an opening letter from the chairman, a business profile, an analysis by management, and financial data.

Chairman’s Letter

Annual reports usually start with an introduction and a letter from the company’s chairman, primary owner, or CEO to the shareholders providing a snapshot of the significant developments in the past financial year, company initiatives, and a brief summary of the financials. Key elements included in this section are the challenges that the business faced, its successes, and insight into the growth of the company.

A table of contents follows the section.

Business Profile

This section includes the vision and mission statement of the company, details of directors, officers, and registered and corporate office, investor profile, the products or services that are the main source of revenue for the business, competitor profile, and risk factors of the business.

Management Discussion and Analysis

The section provides an overview of the business performance over the past three years and discusses profit margins, sales, and income

If the business has launched a new product or service or there are drastic shifts in sales and marketing efforts, this section should include them. The other topics of discussion include new hires, business acquisitions, and other information that the management thinks would benefit the stakeholders.

Financial Statements

The financial statements are the most important part of the annual report that allows current and future investors, shareholders, employees, and other business stakeholders to determine how well the company has performed in the past, its ability to pay off its debts , its cash flow, and its plans for growth. The statements that are included are:

- Balance sheet

- Cash flow statement

- Income statement

- Statement to shareholders

These statements show whether the company has made a profit or loss in the past year, how much earnings it has retained, and the proportion of revenues to operational expenses the previous year. Apart from the financial statements, information about the market price of shares of the company and the dividends paid have to be provided.

Looking for an easier way to organize your accounts? FreshBooks’ bookkeeping software lets you manage your own bookkeeping with easy filing methods and specialist support. Click here to get started.

Other elements included in the year-end report are:

- Notes to accounts with details about the accounting policies

- Comments by auditors on the financials of the company.

- Disclaimers about forecasted income and expenses

- Stories, infographics, and photographs

Annual reports are important elements of a brand’s transparency and accountability. However, rather than writing a ponderous document that only a few can understand, businesses are creating annual reports that speak to a broad group of people.

These reports communicate the values and goals of the company’s mission and brand. Producing a highly visual and narrative-driven interactive annual report can help businesses connect with shareholders, investors, and customers. Aim to include visual elements throughout the entire report to keep the document engaging.

Determine the Key Message

Annual reports are a perfect opportunity to highlight your accomplishments and the impact of these accomplishments. The investors and employees want to know what you did and why you did it. By connecting your business activities and your accomplishments to the final goals and mission statement, businesses can build trust and foster long-lasting connections.

Finalize Structure and Content

One of the most difficult parts of writing an annual report is deciding what to include and leave out. It’s important to map out the report’s content and structure.

Apart from the basic elements such as the introduction, chairman’s letter, business profile, and financial statement, the annual report should have a storyline that defines the report’s overall structure and shapes the content around a narrative thread. This makes identifying and cutting out information that does not actively move the story forward easier.

Use clear, precise, and unambiguous writing. Maintain a professional and unbiased position throughout the document. The content of the annual report should be transparent and honest. Don’t inflate accomplishments or disguise the losses that you faced.

Make writing your annual report easier by keeping clear and detailed records as you go. FreshBooks’ accounting templates help you organize your expenses, income, and receipts so you’ve got everything ready for the end of the year. Click here to start your free trial and learn how FreshBooks can help make accounting easy.

Use Compelling Design

A well-designed, engaging, professional report can be used as a marketing tool by a business. Ideally, readers should be able to scan through the document and get the relevant information they need. Here are some pointers for a good annual report design:

- Use headings and subheadings

- Devote space to photographs, infographics, and other compelling visual elements

- Keep the text short and simple

- Use a bold and complimentary color scheme and layout techniques that are in sync with your brand

- Emphasize key areas with colored text boxes, quotes, and captions

Plan in Advance

Creating an annual report is a long-term process that requires an organized system for recording and tracking data, media clipping, photographs, and a list of business achievements. While a number of companies create the annual reports in-house, others may hire a design firm to compile, proofread and finalize the document.

Ready to create a clear and compelling digital annual report? FreshBooks’ reports feature lets you explore report templates, performance tools, and accounting details so you can write your reports in-house. Try it free to begin your annual report today.

Both public and private companies use annual reports to provide important business and financial information to customers, investors, employees, and the media. Here are some reasons why writing annual reports is necessary for businesses:

- Provides an opportunity to highlight a company’s key achievements, expectations for the coming year, and overall goals and objectives

- Gives information on the company’s financial position

- Introduce you’re the key members of the business to stakeholders and the general public

- Tells shareholders and employees the company’s strategy for growth in the coming year

- Useful as a decision-making tool for managers

The annual reports keep your critical business information up to date. A failure by public companies to update the investors and the state might result in late fees or even the dissolution of your company.

Writing an annual report is essential for communicating your business position to shareholders, investors, and the public. Depending on the size of your company, you may also be legally required to produce annual reports for the Securities and Exchange Commission.

Your annual report should include four main components: the chairman’s letter, a profile of your business, an analysis of your management strategies, and your financial statements. Adding creative elements like graphic design and a narrative can also help your annual report double as a marketing tool. Learning to create a strong annual report is essential for guiding management decisions in your company and connecting to those who support and grow your business.

FAQs on How to Write an Annual Report

How do you write an annual report for a small business.

Writing the annual report for a small business follows a similar process as writing for a large company – you should include a chairman’s letter, business profile, management analysis, and financial statements. However, since you’re writing for a smaller business, you also have more flexibility to be creative. You can tailor your report to shareholders or make it a public-oriented document that you can use to market your small business.

Who Prepares the Annual Report?

Companies may have their own in-house writing and design team, or they may choose to hire an outside firm to prepare their report. Teams usually include accounting, writing, and graphic design professionals.

Which Things Should be Avoided while Writing a Report?

Avoid leaving your annual report to the last minute, trying to mask challenges your business has faced, or overloading the report with details and jargon. The aim is to be clear in your communication – be upfront about both your successes and losses, and write with accessible language that’s understandable to all your readers.

What are the 5 Basic Structures of a Report?

A good report can be structured in a simple 5-part setup to showcase your company’s performance. These sections are:

1. Introduction

3. Comments and disclaimers

4. Conclusion

5. References

You’ll start with a brief overview, then provide the body of information. Comments and disclaimers should explain any claims or facts, then summarize your information in the conclusion and cite any external references.

What are the 4 components of an annual report?

There are 4 key components to include when writing an annual report:

1. Chairman’s letter

2. Business profile

3. Management analysis

4. Financial statements

You can also include creative elements like stories, infographics, and photographs to make your report more visually engaging to your target audience.

Kristen Slavin, CPA

About the author

1000 more rows at the bottom Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Annual Report Preparation and Filing

Save time, avoid risk, and never miss a filing deadline, make an inquiry.

All fields marked with * are required.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Staying compliant has become increasingly complex when it comes to filing annual reports. Each jurisdiction has regulations that prove confusing when dealing with different filing requirements, deadlines, and filing processes. Navigating the complexities on your own can result in errors, endangering your company’s good standing.

When CSC handles your annual reports, franchise tax reports, and related filing obligations, you won’t have to worry about compliance, risk, or missing a filing deadline. CSC centralizes annual report preparation, filing, and tracking with one expert team and one integrated technology platform, covering all 50 states, as well as the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, the Northern Marina Islands, Canada, and beyond.

With CSC preparing and filing your annual reports, you can trust that your business will stay in good standing year-round.

- Pre-filing services

- Filing services

- Post-filing services

CSC conducts an initial audit of the status of all your entities

You receive a report that outlines upcoming filings 45 days in advance, along with the good standing status of each entity that has a filing due in this window

CSC prepares and files annual reports

CSC prepares and submits all franchise tax reports

CSC uploads filed evidence to CSCNavigator SM , automatically linking the documents to your entities for easy review and 24x7 access

CSC updates the good standing Compliance Calendar® in CSCNavigator in real time, so you can check the status of your annual report filing events

Secretary of state good standing status is visible in CSCNavigator, ensuring complete transparency

Keeping Your Business Compliant: Annual Reports And Business License Basics

Annual Reports Best Practices: How to Stay in Good Standing

Cscnavigator.

CSCNavigator is our proprietary secure hub for our unified legal and compliance management network of solutions—powering CSC corporate compliance solutions, entity and matter management, service of process, annual reports, and business licenses.

Related services and technology

Registered agent, global subsidiary management, csc entity management sm, business licenses, search results.

Create a user profile to view over 5,000 online annual reports or 10-K presentations. Your name and address may be forwarded to the company you review. The company may choose to send you additional financial information. We do not sell mailing lists to any third party. Please read our privacy policy .

Featured Companies

©2018 Bay Tact Corporation

- Division of Corporations

The Division of Corporations is the State of Florida's official business entity index and commercial activity website.

Para español, seleccione de la lista

- Department of State

- Manage/Change Existing Business

Manage/Change with E-Filing

File annual report.

Important Message Regarding Credit/Debit Card Payments for Online Filings

The Division of Corporations uses a 3 rd party, NIC Services, LLC dba Tyler Payment Services, to process our credit/debit card payments for Online filings. A confirmation payment receipt will be emailed from [email protected] for successful transactions. Please keep a copy of the receipt, there is information contained in the receipt that will help us locate your filing and reconcile it.

Before filing your annual report:

- Review the filing instructions for annual reports .

- Gather your business information, including your document number and a valid form of payment .

- Any profit corporation, limited liability company, limited partnership or limited liability limited partnership annual report filing will have until 11:59 PM EST on Wednesday May 1, 2024, before a $400 late fee is assessed.

- Annual reports are due by the third Friday in September to avoid administrative dissolution.

- New Security Alert: An email filing confirmation will be sent to the entity's current email address on file.

Chapter 496, F.S., the Solicitation of Contributions Act , requires anyone who solicits donations from a location in Florida or from people in Florida to register with the Florida Department of Agriculture and Consumer Services (FDACS) and to renew annually. To register online, please visit www.FDACS.gov . If you wish to speak with someone regarding registration, contact FDACS at 1-800-HELP-FLA (435-7352) or via email at [email protected] .

Click Here to File Your 2024 Annual Report

More Information

Answers to common questions about e-filing an annual report are listed below.

Reporting of Beneficial Ownership Information

Effective January 1, 2024 there is a Federal requirement for the Reporting of Beneficial Ownership information. The Division of Corporations’ responsibility is to provide notice of the requirement. For additional information please visit the Beneficial Ownership Page " Reporting of Beneficial Ownership Information ".

What Web Browsers are supported?

The Division of Corporations' Web Application supports later versions of the following browsers:

The above browsers cover over 96% of browser market share. Other browsers supporting HTML5 should also work fine with our web application. If you are considering choosing or adding a new browser, you can see how they compare in HTML5 feature support here .

What is an annual report?

- The form updates or confirms the Florida Department of State, Division of Corporations' records.

- It is not a financial statement.

- An annual report must be filed each year for your business entity to maintain an "active status" with the Department of State.

- It is required, whether or not you need to make changes.

- The data displayed on the entity’s annual report is the most current data on file with the Division of Corporations.

I don’t remember my document number. Where do I find it?

- Refer to your notice or search our records by name.

- Read our search guide if you need assistance searching our database.

What are my payment options to file an annual report?

Online Payment Options:

- Credit card (Visa, MasterCard, American Express or Discover).

- Debit card (Visa or MasterCard logo).

- Prepaid Sunbiz E-File Account .

By Mail or Courier:

- Make checks payable to the Florida Department of State .

- Must be payable in U.S. currency drawn from a U.S. bank.

- An automatic prompt will allow you to print the voucher when you select the “Pay by Check” option.

- Reprint your check payment voucher .

- Your tracking number is required.

- Your payment voucher and check or money order must be postmarked and mailed on or before May 1 to avoid a late fee.

What happens if I pay after May 1st?

- A $400 late fee will be imposed on all profit corporations, limited liability companies, limited partnerships and limited liability limited partnerships.

- Non-profit corporations are not subject to the $400 late fee.

What happens if I don’t file the annual report?

- If you do not file an annual report by the third Friday of September, your business entity will be administratively dissolved or revoked in our records at the close of business on the fourth Friday of September. (Chapters 607 , 617 and 620 , F.S.)

- Administratively dissolved or revoked entities may be reinstated, but it requires submitting a reinstatement application and paying all associated fees (the reinstatement fee + annual report fees due) at the time of submission.

- For the 2023 calendar year, the last day to pay by check is September 15th. You may pay by credit card through 5:00pm EST, September 22, 2023.

If my business has closed, do I still need to file the annual report?

No. You do not need to file the annual report if the business has closed.

- File to dissolve or withdraw a Florida or Foreign Corporation or LLC .

- File to dissolve or cancel a Florida or Foreign Limited Partnership or Limited Liability Limited Partnership .

How long does it take for my annual report to post on Sunbiz?

- Filed online with a credit card: Reports are processed and posted immediately.

- If paying by check or money order: Your document will be processed in the order it was received.

Can I make changes when I file my annual report?

Yes, the annual report allows you to:

- Add, delete, or change the names and/or addresses of the officers, directors, managers, authorized members; and make changes to addresses only for any general partners.

- Change the registered agent and registered office address.

- Change the principal office address and mailing address for the business entity.

- Add or change the federal employer identification number.

NOTE: The annual report does not permit you to change the name of your business. To change the name, download and complete the appropriate amendment form . Mail the completed form with payment to the Division of Corporations.

How do I make changes if I have already filed this year’s annual report?

- Profit or Non-Profit Corporation: $61.25

- Limited Liability Company: $50.00

- If the entity is a limited partnership or limited liability limited partnership, download and complete an amendment form . Mail the form and fee to the Division of Corporations.

How do you sign the online form?

- Typing your name in the signature block is sufficient pursuant to s. 15.16 , F. S.

- Electronic signatures have the same legal effect as original signatures.

- Typing someone’s name (signature) without permission constitutes forgery.

Can I get a copy of my filed annual report?

Yes. Once the annual report has been processed and posted, you can download an image of the report free of charge.

- Annual Report Instructions

- Search Corporation Records

- File Reinstatement

- Fictitious Name Renewal

Annual Report Fees

Public Records Notice: Any information you submit on an annual report will be part of the public record and made available for public view on the Division’s website.

Back to Top

Ron DeSantis, Governor Cord Byrd, Secretary of State

- Privacy Policy

- Accessibility

Questions or comments? Contact Us Submit a public records request.

Under Florida law, e-mail addresses are public records. If you do not want your e-mail address released in response to a public records request, do not send electronic mail to this entity. Instead, contact this office by phone or in writing.

Copyright © 2024 State of Florida, Florida Department of State.

Florida Department of State

The Centre of Tallahassee 2415 N. Monroe Street, Suite 810 Tallahassee, FL 32303

- Mission, Vision, Constitution and Strategic Plan

- Organization

- Foundations

- NP/APN Network

- Job vacancies

- Global Health

- Position statements

- Regulation and Education

- Socio-economic welfare

- Nursing students

- World Health Organization

- Other international organizations

- NNA Development & Leadership Programmes

- Education & training

- Global Nurse Consultants

- The nurses changing lives in their communities

- Our members

- Become a member

- Specialist Affiliates

- Publications

- Nursing Definitions

- International Nursing Review

International Nurses Day 2024 report

Advanced practice nursing, Education, Health workforce, Jobs, Leadership, Nursing regulation, Professional practice, Service delivery

Publication description

The theme for International Nurses Day 2024 is: “Our Nurses. Our Future. The economic power of care”. This theme and our IND report present an in-depth analysis of how elevating the nursing profession can catalyse transformative improvements in health care delivery, economic development, peace and societal well-being.

Our report demonstrates the impact that investing in the nursing workforce has, not only on the well-being of populations, but also on boosting economic growth by enhancing workforce productivity; strengthening health care systems, which is critical for ensuring preparedness and effective response during public health emergencies; alleviating poverty and improving gender equality; and contributing to social cohesion, peace and prosperity.

We urge all nurses to use this report to increase their influence on policy makers, employers and politicians so that everyone can benefit from the power of nurses and the economic returns that will ensue.

Suggestion of other publications

Icn annual report 2023.

Leadership, Nursing regulation, Professional practice, Social-economic welfare

Download the publication

Guidelines on mental health nursing

Professional practice

OpenAI plans to announce Google search competitor on Monday, sources say

- Medium Text

Sign up here.

Reporting by Anna Tong in San Francisco; Editing by Kenneth Li, Matthew Lewis and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Anna Tong is a correspondent for Reuters based in San Francisco, where she reports on the technology industry. She joined Reuters in 2023 after working at the San Francisco Standard as a data editor. Tong previously worked at technology startups as a product manager and at Google where she worked in user insights and helped run a call center. Tong graduated from Harvard University.

Technology Chevron

Openai unveils new ai model as competition heats up.

ChatGPT maker OpenAI said on Monday it would release a new AI model called GPT-4o, capable of realistic voice conversation and able to interact across text and vision, its latest move to stay ahead in a race to dominate the emerging technology.

IMAGES

COMMENTS

Annual reports for 10,219 international companies. Search 140,099 annual reports from 10,219 global companies help you make the right investment decision. AnnualReports.com is the most complete and up-to-date listing of annual report on the internet.

About AnnualReports.com. AnnualReports.com (a division of IR Solutions) is the most complete and up-to-date listing of annual Reports online. We are America's largest annual report service. Our directory is a free Internet service that will enable potential investors to review a company's annual report in an easy convenient manner.

The SEC requires publicly traded companies to share yearly reports with shareholders. Unlike state-mandated forms, this annual report is an in-depth accounting of a corporation's finances and operations. Lastly, federal security laws mandate public corporations to file Form 10-K yearly.

What is AnnualReports.com? AnnualReports.com is America's largest annual report service. Our directory is a Free Service that allows users to review and annual report in an easy and convenient manner. Boasting the most complete and up-to-dae listings of annual reports on the internet, AnnualReports.com provides instant access to annual reports ...

Get annual reports. Mailed within 48 hours. The Public Register provides free annual reports of public companies trading on the NYSE, NASDAQ, AMEX, OTC and TSX exchanges. We aim to provide a quality service that fulfills annual report orders in a timely manner. Orders are processed and mailed within one business day.

Annual Report: An annual report is a publication that public corporations must provide annually to shareholders to describe their operations and financial conditions. The front part of the report ...

Welcome to The Public Register Online, the largest FREE directory of online annual reports available on the web. The Public Register Online (formerly Annual Report Service) is the Green Alternative to our companion site the The Public Register's Annual Report Service. Create a user profile to view over 5,000 online annual reports or 10-K ...

About Public Register Online (formerly AnnualReportService.com) Founded in 1985, with a web presence in 1996, PublicRegisterOnline.com is the oldest and largest free annual report service. Providing fast online access to a company's financial information. Currently the directory lists over 5,000 annual reports and 10-K Filings for online viewing.

2. Generate Key Financial Statements. The purpose of the annual report is to provide data and analysis regarding your company's operations and financial performance. As such, the financial statements it contains are essential. Important financial statements include your company's: Income statement.

We file your annual, biannual or initial reports with the state and stay on top of your state's requirements. and deadlines to help ensure everything is done correctly and on time. Add our annual report filing service for an existing business in your dashboard. Receive updates from us when we file the report and notify you once it's complete.

Procedure. 1. Insert your record id and add your contact information. 2. Complete a simple questionnaire that will be sent to you via email. 3. Sign the form and we will process your Annual Report. File Annual Report Now.

Through this service, you will be able to file annual reports, change a business's registered agent/office, reinstate a business, and close a business. All of these filings will generate certificates as proof of filing that can be validated. Additionally, you will be able to file an amendment and update your business's tax and employer information.

Call 1-877-322-8228. You will go through a verification process over the phone. Your credit report will be mailed to you within 15 days. Blind and Visually Impaired Consumers can ask for your free annual credit reports in Braille, Large Print or Audio Formats. Call toll free at 877-322-8228. Provide personal information to validate your identity.

Process your Annual Report; Notify you of the successful filing; Exceptional Annual Report Service. BizFilings monitors, manages, and files every one of your annual reports to ensure that they are filed on time and according to state specifications. Key Benefits. We monitor your state deadlines to ensure that each report is filed in a timely manner

Free weekly online credit reports are available from Equifax, Experian and TransUnion. Credit reports play an important role in your financial life and we encourage you to regularly check your credit history. Request your free credit reports. Spot identity theft early. Review your credit reports.

Ideally, readers should be able to scan through the document and get the relevant information they need. Here are some pointers for a good annual report design: Use headings and subheadings. Devote space to photographs, infographics, and other compelling visual elements. Keep the text short and simple.

With CSC preparing and filing your annual reports, you can trust that your business will stay in good standing year-round. Pre-filing services. Filing services. Post-filing services. CSC conducts an initial audit of the status of all your entities. You receive a report that outlines upcoming filings 45 days in advance, along with the good ...

Welcome to The Public Register Online, the largest FREE directory of online annual reports available on the web. The Public Register Online (formerly Annual Report Service) is the Green Alternative to our companion site the The Public Register's Annual Report Service. Create a user profile to view over 5,000 online annual reports or 10-K ...

If you need assistance with submitting an Annual Report online, please contact the Reporting and Information Section at 207-624-7752. Division of Corporations. Reporting and Information Section. 101 State House Station. Augusta, ME 04333-0101. Telephone: (207) 624-7752. FAX: (207) 287-5874. e-mail.

Before filing your annual report: Review the filing instructions for annual reports. Gather your business information, ... Service Price; Annual Report - Profit Corporation: $150.00: Annual Report - Non-Profit Corporation: $61.25: Annual Report - Limited Liability Company: $138.75:

Annual reports for all corporations, limited liability companies, limited partnerships and limited liability limited partnerships are due each year between January 1 and May 1. The Department of State encourages business owners to file early. Submitting your annual report on time avoids a late fee. Review and verify your information for accuracy.

Investor Type. Address. Country. Work Phone. 555-555-5555 #3456. Fax. Home Phone. Comments. Find the latest Chevron Corporation (CVX) reports and filings with the US Securities and Exchange Commission (SEC) here.

Publication description. The theme for International Nurses Day 2024 is: "Our Nurses. Our Future. The economic power of care". This theme and our IND report present an in-depth analysis of how elevating the nursing profession can catalyse transformative improvements in health care delivery, economic development, peace and societal well-being.

We have the honor of transmitting to you the 2024 Annual Report of the Board of Trust-ees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance ... 1 Adjustments include adding deemed wage credits based on military service for 1983-2001 and reflecting the lower effective tax rates (as compared to the combined employee ...

OpenAI plans to announce its artificial intelligence-powered search product on Monday, according to two sources familiar with the matter, raising the stakes in its competition with search king Google.