WTO / Letters and Emails / Rejection / How to Write Credit Denial Letter (Samples & Templates)

How to Write Credit Denial Letter (Samples & Templates)

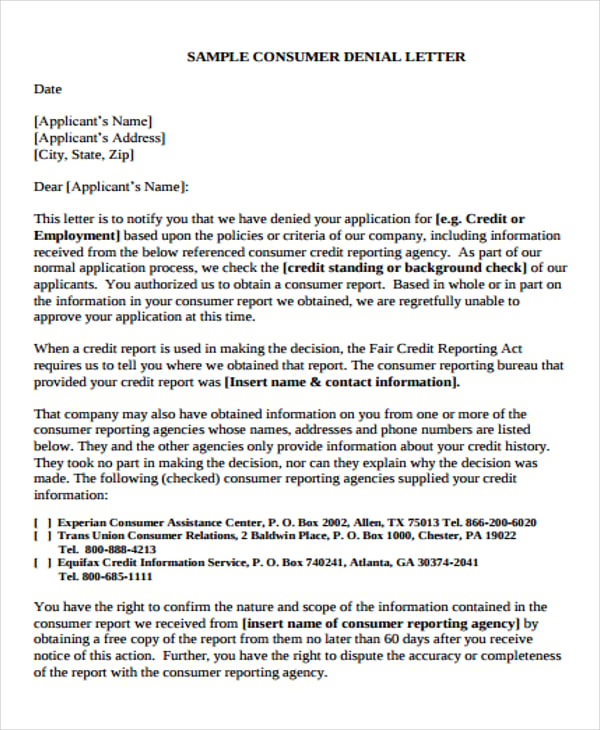

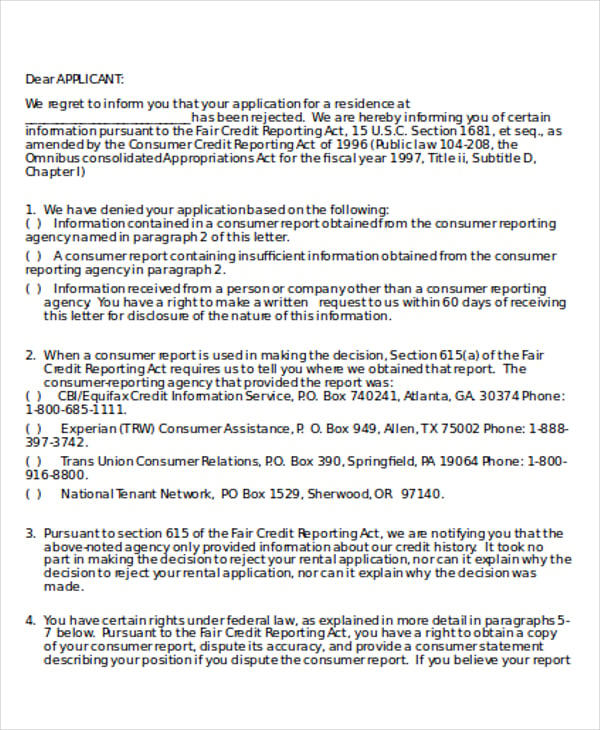

A credit denial letter is an official notification written by lenders to inform an individual or business of the rejection of their loan request.

It is usually sent for applications for loans , mortgages, credit cards, and business credit lines. It also informs the applicant why their application was rejected.

Typically, lenders will deny loan requests if the applicants are not creditworthy, which can result from multiple factors such as incomplete documents, insufficient income, bankruptcy, poor credit score, etc. The letter also communicates the applicant’s credit score, the credit reporting agency used, and the process to obtain their credit report.

Lenders can use templates that include all the information required to produce the formal letters. It is important to note that lenders are expected to reassess their decision to decline an application should the applicant object to it. They should also cite legitimate reasons, such as errors and inaccuracies in the report. Review multiple samples of such letters to understand the different reasons a lender can use to legally deny credit to their clients.

The letter is a legal requirement under the ECOA and the Fair Credit Reporting Act. It provides information to the borrower, protects the lender’s reputation, and complies with legal requirements. Also, it is professional to be transparent about the decision-making process. Online templates are practical tools that can help lenders write such letters.

This article will discuss reasons to reject credit applications and how to write a letter notifying the applicant of such a decision by providing a sample. It also educates lenders on certain legal factors they should know before sending a letter of denial to a credit application.

Reasons for Denying a Credit Request

Letters to notify applicants of refusals of their credit requests serve a valuable purpose by providing individuals with insights into the factors considered by lenders when assessing creditworthiness. By exploring the common reasons for credit denial, we can understand the criteria that financial institutions use to evaluate applicants, empowering individuals to make informed decisions and take proactive steps toward improving their credit standing.

This section discusses the key factors that can influence a credit denial decision:

Credit score

A credit score is a measure or numerical ranking of creditworthiness. Using a standardized formula, you can calculate it from credit information such as length of credit history, payment patterns, credit utilization, and outstanding debt. The higher scores indicate a lower level of risk, making it more likely for such applicants to secure loans at favorable terms. On the other hand, the lower scores may result in credit denial or less favorable loan terms, as they suggest a higher risk of defaulting on payments.

Employment history

Employment status and history are criteria used to determine an applicant’s suitability for loans because they determine their capacity to pay back the loan. So, you need to consider whether an applicant is employed, how long they have been employed, and their current and previous jobs. Having a stable job and career may indicate that they have a reliable source of income and are less likely to default. However, if their employment situation is unstable, it raises concerns about their ability to fulfill financial obligations and is a legitimate basis for refusing their loan request.

Insufficient income

One crucial factor that lending institutions carefully scrutinize when assessing loan applications is the applicant’s income. For lenders, the ability of borrowers to repay their debts is of paramount importance to mitigate the risk of defaults. Therefore, income serves as a critical indicator of an individual’s capacity to meet their financial obligations. When an applicant’s income is deemed insufficient, it can be a compelling reason for denial.

Debt-to-income ratio

The debt-to-income ratio compares an individual’s monthly debt payments to their income. If the ratio is too high, it indicates that a significant portion of income is already allocated towards existing debts, and lenders may perceive the applicant as having a higher credit risk and reject the loan request.

Payment history

Payment history is a reliable criterion for determining an applicant’s eligibility for a loan. If an applicant has a history of late payments or defaults with a specific financial institution, it can significantly impact their chances of getting approved for new credit from that institution.

Unstable housing situation

Lenders might have a negative opinion of housing instability, such as frequent moves or a lack of a permanent address. It can be an indicator of financial uncertainty and affect an applicant’s creditworthiness.

Inaccurate information on a credit report

You can reject an application if the credit report results are inaccurate. The report will indicate the borrowing history, current and previous addresses, bank accounts, employment history, etc. Incorrect information, such as accounts that do not belong to the applicant or inaccurate payment records, can be particularly detrimental.

The accuracy and reliability of this information are of utmost importance in determining an applicant’s creditworthiness. Unfortunately, mistakes or inaccuracies in the reports can occur, and they have the potential to significantly impact an individual’s credit standing. From a lender’s perspective, such errors pose risks and can be a valid reason for credit denial.

Multiple loan applications

You can deny credit to individuals or businesses that have applied too many times in a short period. This will often indicate that the applicant is struggling financially and in desperate need of money, which poses a risk of inability to repay once approved.

How to Write a Letter to Notify Rejection of Credit Application

Most applicants will be distressed by the news, so it is critical to approach the rejection professionally. Your communication must be objective and clearly explain the situation. Using a template can be helpful in properly organizing information and ensuring the decision is effectively conveyed to the client.

The information required in a letter to formally notify applicants that they are ineligible for credit is presented below:

Specify the date

The first element on the letter is the date it was written or issued. The date is needed for reference and filing purposes. A proper format should be used,

March 24, 2023.

Include borrower’s information

Secondly, it must be clear to whom the letter is addressed, i.e., the applicant. Your letter must have the borrower’s name, mailing address, account number, and application ID.

For example, this information can be presented as follows:

Jack Geller 103 City Park Road, New York City, NY 8007 Account No.: 1234 4567 7890 Application ID: JG009282NY

A subject line indicating the purpose of the letter can be included if you are sending an email. For example, RE: Credit Denial Letter for Application ID-2363. This should be followed by a formal greeting such as Dear Mr. Schumacher.

Mention the reason for the denial

Next, indicate the letter’s purpose for rejecting the application and provide a valid reason. You can begin by acknowledging the borrower’s interest in the opening statement before stating that their application is being rejected.

“Thank you for your inquiry about a credit card with B&G Platinum. We are honored by your interest in our company and our services. Unfortunately, we regret to notify you that your application was declined as your debt-to-income ratio is too high and a principal concern for our team.”

Provide credit reporting agency information

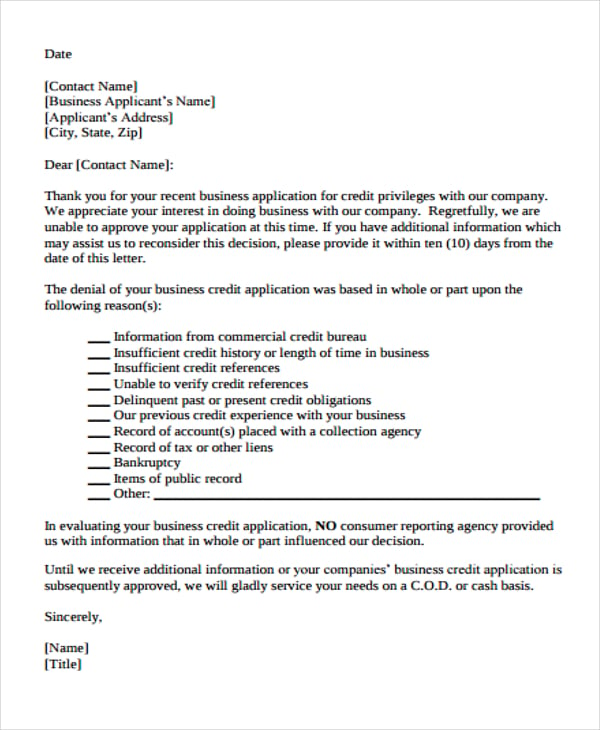

Lenders are usually obligated to inform applicants about the credit reporting agency (or agencies) they use to assess their creditworthiness. This section provides details of the agency’s name, contact information, and instructions on how to obtain a free copy of the report for further review. Note that while this information is necessary for a consumer credit application , it is not needed for a commercial application. This is because, in such situations, it is not a requirement of the FCRA.

For example, this section can be written as follows:

“After a thorough search, we determined that your total debt is above $150,000. When compared to your assets, this amount indicates that you have a credit score of 450, which is lower than the 650 required for eligible candidates.”

Specify the adverse action reasons

The letter should include a section detailing the specific adverse action reasons, which are the key factors that contributed to the denial decision.

To comply with regulatory requirements, for example:

“The decision was based specifically on the key adverse action reasons that influenced our decision: a poor credit history and insufficient income.”

Right to obtain a free report

Lenders typically highlight the recipient’s right to access a free copy of their report within a specified timeframe. This provision allows individuals to review the report for inaccuracies or discrepancies that may have impacted the credit decision.

“We understand that credit denial can be disappointing, and we encourage you to review your credit report, which you can obtain free of charge from [credit reporting agency’s name], to ensure its accuracy and address any areas that may require improvement.”

Your contact information

The letter for denial should be concluded by providing your contact information, including your name and contact details such as phone number, email address, and mailing address. This information is meant to facilitate future correspondence if the borrower has questions about the denial or future applications.

Charles MajorsJenkins Micro-Finance CompanyDownhill AvenueAugusta, Maine [email protected] (0288) 3630-8999

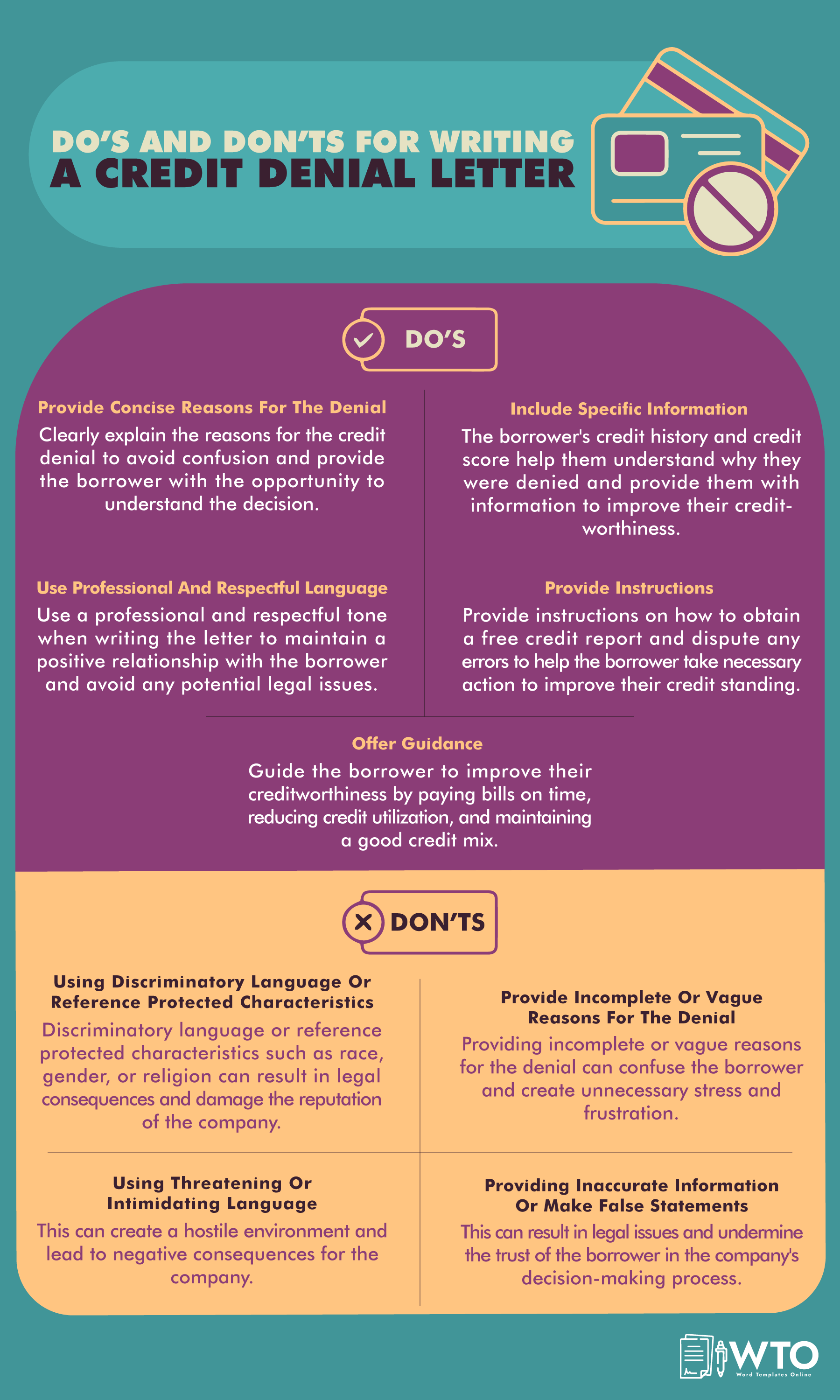

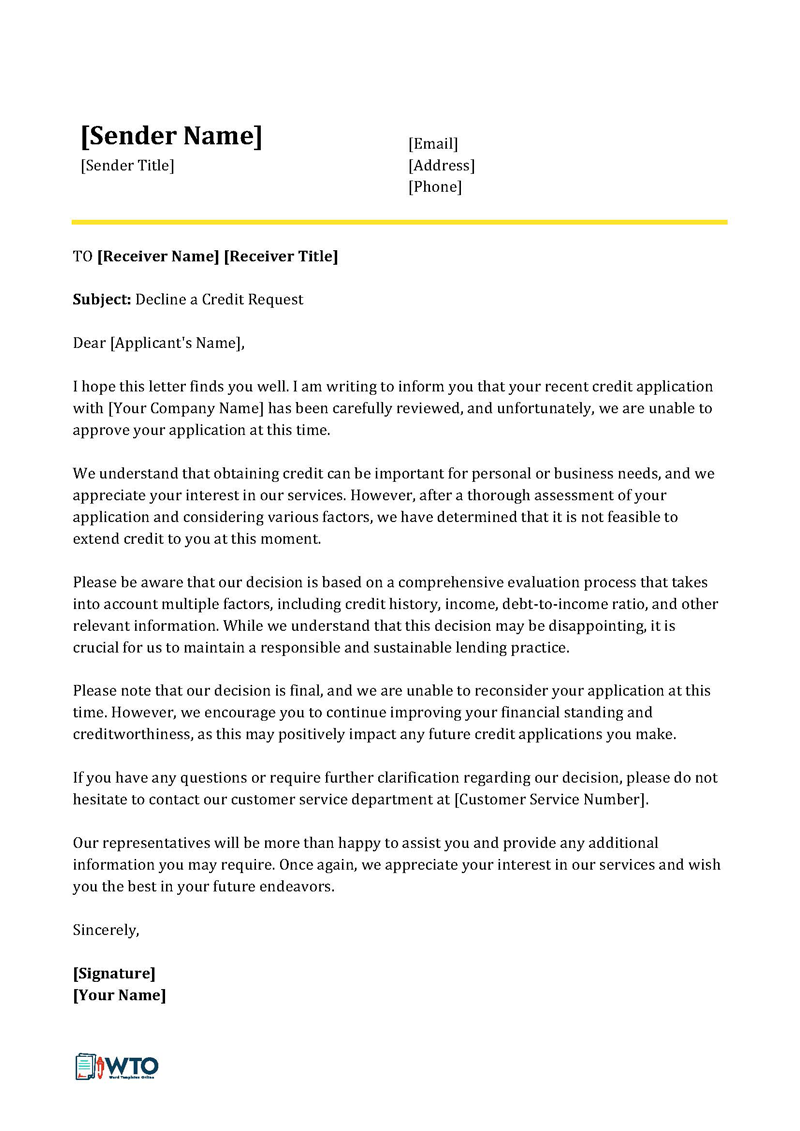

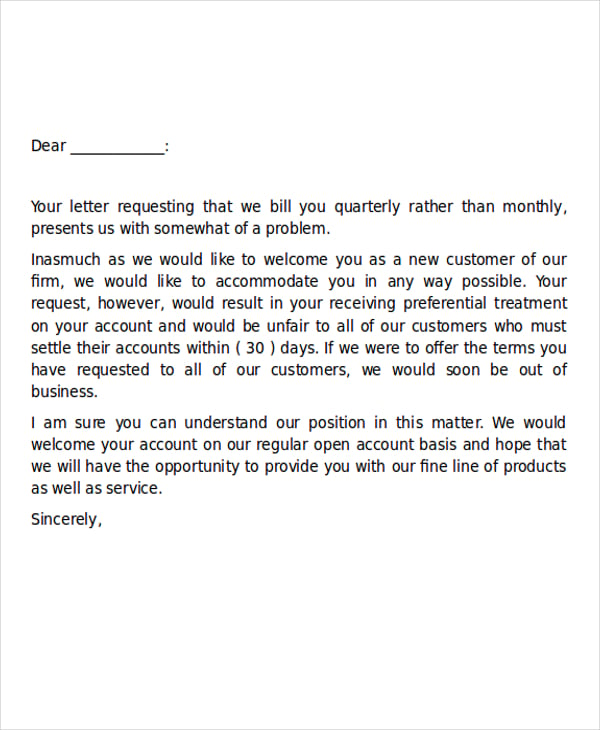

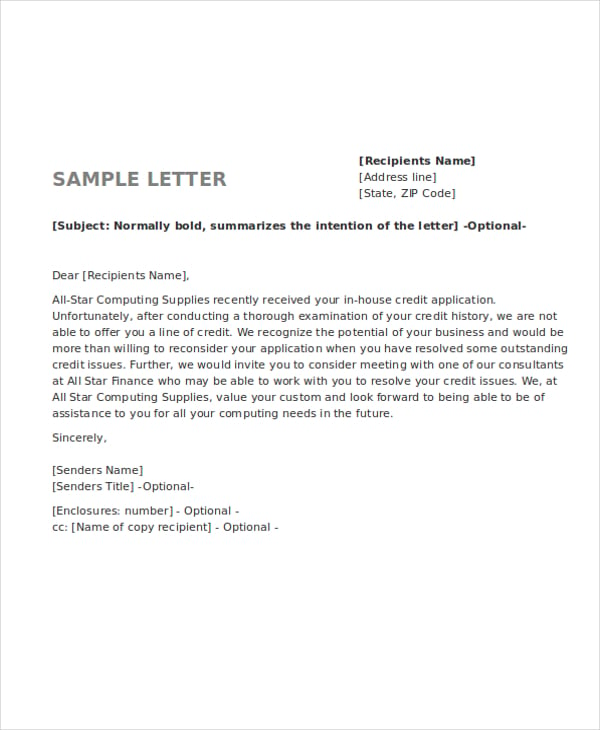

Free Templates

To simplify the writing process, you can use the free downloadable templates for these letters provided in this article. They can be customized to suit your needs and preferences. Also, they are professionally designed to create legible and presentable letters that protect a financial institution’s reputation.

Credit Denial Letter Template

[Your Company Name]

[Your Company Address Line 1]

[Address Line 2]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Today’s Date]

[Applicant’s Name]

[Applicant’s Address Line 1]

Dear [Applicant’s Name],

Thank you for your interest in [Credit Product/Service, e.g., credit card, loan, etc.] with [Your Company Name]. We appreciate the opportunity to review your application. After careful consideration, we regret to inform you that we are unable to approve your request at this time.

The decision to decline your application was based on the following reason(s):

- [Reason for denial, e.g., credit score below our minimum requirement, insufficient income, employment history, etc.]

- [Any additional reason(s)]

In accordance with the Fair Credit Reporting Act, you have the right to a free copy of the credit report used in our decision-making process. To obtain your report, please contact the credit reporting agency listed below within 60 days of receiving this notice:

Credit Reporting Agency Information:

[Agency Name]

[Agency Address]

[Agency Phone Number]

[Agency Website]

Furthermore, you have the right to dispute the accuracy or completeness of any information in your credit report. If you have any questions or believe this decision is based on incorrect information, please do not hesitate to contact us at [Your Phone Number] or [Your Email Address].

We understand that this may be disappointing news, and we encourage you to review your credit report and financial situation. Improving certain factors may increase your eligibility for [Credit Product/Service] in the future. For any questions about improving your creditworthiness or to discuss potential options moving forward, please feel free to reach out to our customer service team.

Thank you again for considering [Your Company Name] for your financial needs. We hope to have the opportunity to serve you under different circumstances in the future.

[Your Name]

[Your Title]

Sample Credit Denial Letter

Dear Mr. Doe,

Thank you for applying for the Sunset Credit Card with Sunset Bank. We value your interest in our products and services and appreciate the opportunity to review your application.

After a thorough review of your application and credit information, we regret to inform you that we are unable to approve your request for credit at this time. The decision is based on the following primary reason(s):

- Credit Score Below Minimum Requirement: Your current credit score of 620 falls below our minimum requirement for the Sunset Credit Card, which is set at 650. Our decision was influenced by the credit report obtained from Equifax, one of the leading credit reporting agencies.

- High Utilization of Existing Credit Lines: Our review also noted a high utilization rate on your existing credit lines, which is another factor in our decision-making process.

In accordance with the Fair Credit Reporting Act, you are entitled to a free copy of your credit report from Equifax, used in our decision-making process, if you request it within 60 days of receiving this letter. To obtain your report, please contact:

P.O. Box 740241

Atlanta, GA 30374-0241

Phone: 1-800-685-1111

Website: www.equifax.com

You also have the right to dispute any inaccuracies in the information provided by the credit reporting agency.

We encourage you to review your credit report and address the factors that have affected our decision. Improving your credit score and lowering your credit utilization may enhance your eligibility for credit in the future.

Please understand that this decision does not diminish the value we place on your interest in our services. We would be happy to review another application from you in the future, should your financial situation change.

If you have any questions or require further clarification, please do not hesitate to contact our customer service team at (555) 890-1234 or via email at [email protected].

Thank you again for considering Sunset Bank for your credit needs. We hope to have the opportunity to serve you in the future.

Credit Manager

Sunset Bank

Key Takeaways

This rejection letter from Sunset Bank regarding the credit card application is a well-structured and considerate communication. Here’s why it’s effective:

Gratitude and Politeness: The letter starts with a courteous tone, expressing gratitude for the applicant’s interest in the bank’s services, which sets a positive tone despite the disappointing news.

Clear Explanation: It provides a clear explanation for the decision, citing specific reasons such as the credit score falling below the minimum requirement and high utilization of existing credit lines. This transparency helps the applicant understand the basis of the decision.

Reference to Rights: By mentioning the Fair Credit Reporting Act, it informs the applicant of their rights to access their credit report and dispute any inaccuracies, demonstrating the bank’s commitment to regulatory compliance and consumer rights.

Encouragement for Improvement: Despite the rejection, the letter encourages the applicant to take steps to improve their creditworthiness, indicating a willingness to consider future applications if their financial situation improves. This supportive approach maintains a positive relationship with the applicant.

Openness to Future Applications: It leaves the door open for future interactions by expressing a willingness to consider another application in the future, fostering goodwill and preserving the possibility of a future relationship with the bank.

Clear Contact Information: The letter provides clear contact information for the bank’s customer service team, allowing the applicant to seek further clarification or assistance if needed, which enhances accessibility and customer support.

Closing Appreciation: It ends with a sincere expression of appreciation for the applicant’s consideration of the bank’s services, reinforcing the bank’s commitment to customer service and leaving a positive final impression.

In summary, this rejection letter effectively communicates the decision while maintaining professionalism, transparency, and a customer-centric approach, which are crucial for preserving the bank’s reputation and fostering goodwill with the applicant.

Legal Requirements for Credit Denial Letters

As previously stated, it is legally necessary for you to notify the applicant in writing of the reasons for the application’s denial.

These include:

- Fair Credit Reporting Act (FCRA): FCRA mandates you to notify applicants of any information, such as credit scores and reports, used as a basis for credit refusal. Also, it gives the applicant the right to reevaluate the credit report and appeal the decision if any inaccuracies are identified. According to the FCRA, borrowers should request the credit report within 60 days of being notified of the refusal.

- Equal Credit Opportunity Act (ECOA): ECOA prohibits discriminating against applicants based on race, gender, age, religion, marital status, or receipt of public assistance.

- Truth in Lending Act (TILA): TILA promotes transparency in lending. It requires the lenders to disclose the terms, credit terms, costs, and fees to consumers. Even though TILA regulations may not directly control credit refusal, lenders are nevertheless required to abide by other TILA provisions when providing credit to customers.

- State-Specific Regulations: Each state may have additional laws or regulations that govern the content and delivery of credit refusal letters. Lenders must familiarize themselves with state-specific requirements to ensure compliance.

You can deny credit applications as long as you have valid and lawful reasons. However, you must issue a letter to explain with clarity the reasons for the refusal. Compliance with legal requirements, such as the Fair Credit Reporting Act and Equal Credit Opportunity Act, is crucial to avoid legal issues and maintain ethical lending practices. By understanding the importance of effective communication and adherence to regulations, lenders can ensure fair treatment of applicants while protecting their institution’s reputation. The most common reasons for credit denial are a high debt-to-income ratio, a poor credit score, and a poor payment history. You can use templates to save time and effort when writing this type of letter. Consider reviewing sample letters of this type to learn the proper format and language to use when writing one.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Letters and Emails

25 interview rejection letters (before & after interview).

Letters and Emails , Rejection

15 scholarship rejection letter examples.

Human Resource , Letters and Emails

10 sample job candidate rejection letters.

10 Internship Rejection Letter Samples (Guide & Tips)

Rejection Letter Without an Interview (Samples)

How to Respond to a Job Rejection Email (Perfect Examples)

Formal Rejection Letter to Decline Job Offer (Samples)

College Rejection Letter Samples | How to Write (Format)

Cover Letters , Letters and Emails

Letter of intent for nursing school (examples & tips).

Cover Letters

Cover letter for an internal position (examples & tips).

Continue Working Letter of Intent Examples

Letters and Emails , Verification

Verification letter for student status (free templates), thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Why can’t I get approved for a credit card?

April 18, 2024 | 9 min read

Being denied a credit card can be disappointing. But the good news is you don’t have to guess why your application was denied. That’s because lenders are required to provide the reasons they rejected your application or tell you that you have the right to find out why.

Keep reading to learn more and what you can do to improve your creditworthiness.

Key takeaways

- Lenders are required to provide an adverse action notice as to why your credit card application was denied.

- Even if your application is denied, you can help improve your credit over time by doing things like paying your bills on time.

- It’s a good idea to consider eligibility requirements for the credit card you’re considering. And if you’re new to credit, you might want to look at cards designed for people who are building credit.

- If you apply for too many credit cards in a short amount of time, it could affect your credit scores. But by getting pre-approved, you could see what cards you may be eligible for without hurting your credit.

See if you’re pre-approved

10 possible reasons why your credit card application was denied.

If your credit card application was denied, lenders are required by law to send you an adverse action notice within 30 days of receiving your application, telling you why it was denied. But if you haven’t received your letter yet, here are 10 reasons why credit card applications get denied. And if you think any of these apply to you, there are also ideas for what might help you to improve your credit.

1. You have low credit scores

When you apply for a credit card, the issuer may check your credit reports and scores to see how you’ve managed debt in the past. Requirements vary depending on the issuer and the card. But higher credit scores and a good credit history might help you qualify for a credit card.

What you can do: Different factors affect your credit scores . You’ll read about some of the specifics below. But in general, using the credit you have responsibly is one way to improve your scores . That means doing things like paying your statement on time every month. If you haven’t established credit, make sure you’re considering eligibility requirements and looking at cards designed for people who are building credit. But it’s also important to remember that applying for too many cards in a short period of time can hurt your credit scores.

2. There are too many inquiries on your credit reports

A credit card issuer may hesitate to approve your application if you have a lot of hard inquiries on your credit report, especially within a short period of time. If these credit inquiries were from multiple credit card applications, they could suggest to the lender that your financial circumstances have changed negatively. Hard inquiries can also cause a temporary dip in your credit scores.

What you can do: Depending on your financial circumstances, you might want to wait between applications—for instance, a few months. It’s also a good idea to apply only for credit you need, as the Consumer Financial Protection Bureau (CFPB) recommends. One way to avoid hard inquiries is to check whether you’re pre-approved for credit cards before applying. Pre-approval won’t affect your credit scores because it typically uses a soft inquiry to check your credit. But keep in mind, pre-approval also doesn’t guarantee you’ll be approved for the credit card.

3. You have high outstanding debt

Having too much debt might hurt your chances of being approved for new credit, especially if your debt-to-income ratio or credit utilization ratio is high.

Your debt-to-income ratio measures your debt as it relates to your income, and it may indicate whether you can handle more debt. And your credit utilization ratio measures how much of your available credit you’re using. If either of these is high, it might be an indicator that you could struggle to make the required payments for any new credit.

What you can do: If your budget allows, consider paying down debt before applying for new credit. The CFPB recommends keeping your debt-to-income ratio below 36% for homeowners, including mortgage payments, and below 15%-20% for renters, not including rent payments. And the agency recommends keeping your credit utilization ratio under 30%. These lower ratios could be a sign to lenders that you’re using credit responsibly and not overspending.

4. Your credit history is limited

To assess your creditworthiness, lenders typically review your credit history , which includes whether you have a track record of making payments on time. If you’re new to credit or have a thin credit file , you may not have had a chance to prove your creditworthiness yet. This can make it difficult to qualify for a credit card.

What you can do: You may want to consider applying for a secured credit card , which can be used to build credit history with responsible use. Plus, after showing responsible credit use over time, the card issuer may let you upgrade to a traditional, unsecured card.

5. You have insufficient income

A credit card issuer has to make sure you have enough income to make the required payments for your card. If you don’t have enough income to make the minimum payments, you might not be approved.

What you can do: Make sure you’ve listed all sources of your income , including those from full-time, part-time or seasonal jobs, as well as self-employment. Your income might also include interest, dividends, public assistance or shared income, which includes money someone else regularly deposits into your account or a joint account.

If you can’t show adequate independent income, you could consider asking a trusted family member to co-sign your card or add you as an authorized user on their account. Keep in mind that not all credit card issuers allow co-signers, though.

6. You’re too young to apply

You need to be at least 18 years old to apply for your own credit card account. But if you’re under 21, you have to prove that you have enough independent income to make your minimum credit card payments. Having a co-signer who’s older than 21 is another option. But remember, not all issuers allow co-signers.

What you can do: If you don’t meet the age requirements, consider asking a trusted loved one if you could be an authorized user on their card. If the primary account holder uses credit responsibly, becoming an authorized user may help you build credit before you apply for your own card. But negative actions can reflect poorly on both your credit scores.

7. There’s a charge-off on your credit reports

A charge-off generally occurs if you haven’t made a required payment on your credit card account for 180 days. The creditor or lender considers the debt a loss and closes the account, but you’re generally still responsible for paying the amount owed.

If you have a charge-off on your credit reports, it might hurt your credit scores. It also could signal to a lender that you might default on another credit card in the future, so it may be difficult to get approved.

What you can do: If the charge-off isn’t accurate, you could dispute it. Keep in mind, a charge-off will generally stay on your credit reports for up to seven years after the first late or missed payment that led to the charge-off status.

8. The application was filled out incorrectly

Credit card applications may seem straightforward, but it’s possible to make errors on them. For instance, you could mistakenly report a lower income or enter the wrong Social Security number.

What you can do: If your credit card application was denied, you’ll receive a written adverse action notice within 30 days about why it was denied. If the rejection was due to an application error, you could ask about reapplying.

9. You’ve had a recent bankruptcy filing

You may want to start rebuilding credit after bankruptcy , but some credit card issuers might hesitate to approve your application. That’s because a bankruptcy could indicate you had trouble paying back debt in the past.

What you can do: Some credit card issuers may approve you for a secured credit card after the bankruptcy is discharged. Other issuers might require a certain amount of time to pass—with no additional bankruptcy filings—before you qualify for a new account.

10. Your credit report is frozen

If your credit is frozen to protect against identity theft, it restricts access to your credit reports. But if you don’t lift the freeze before applying for new credit, the issuer might not be able to access your credit reports. And that could result in your application being denied.

What you can do: Contact the credit bureaus to unfreeze your credit . This can be done permanently or temporarily, but each credit bureau has a different process. Once your credit is thawed, you may be able to reapply for the credit card.

What to do if you get denied for a credit card

Getting denied for a credit card can be frustrating. But depending on your personal circumstances, here are some steps you can take:

- Find out why your application didn’t get approved. You should receive an adverse action notice within 30 days of the lender receiving your application. After finding out why you were declined, reviewing your credit reports may also help you understand areas where you could improve. You can get free copies of your credit reports by visiting AnnualCreditReport.com . You could also use CreditWise from Capital One , which provides access to your TransUnion® credit report and VantageScore® 3.0 credit score.

- Dispute credit report inaccuracies. If you spot errors in your credit reports, you can contact the credit bureaus to report the inaccuracies and possibly have them removed.

- See if there’s a credit card better suited for you. Eligibility requirements vary from card to card. So it’s possible that you could get approved for a different card. But to avoid having too many hard inquiries on your credit file, you may want to consider getting pre-approved before applying for a new credit card.

- Work on improving your situation before applying for another credit card. Depending on your personal circumstances, it may take time to improve your financial situation. But practicing good credit habits, like paying your bills on time every month, can help pave the way for future financial success.

Getting denied for a credit card in a nutshell

If you’re feeling confused about why you can’t get approved for a credit card, remember that lenders are required to disclose why your application was denied. And there are things you can do to improve your chances of approval in the future.

Capital One’s card comparison tool allows you to explore cards based on your credit level. Plus, you can first find out if you’re pre-approved without hurting your credit.

Explore more from Capital One

Are you new to credit or searching for your next credit card? Capital One can help:

- Check for pre-approval offers with no risk to your credit scores.

- Earn unlimited 1.5% cash back on every purchase, every day with Quicksilver or other cash back rewards cards .

- Explore credit cards you can use to build credit responsibly and earn rewards.

- Monitor your credit score with CreditWise from Capital One . It won’t hurt your credit, and it’s free for everyone.

Related Content

How do lenders decide if you're creditworthy.

article | March 6, 2017 | 5 min read

How to improve your credit scores: 7 tips that can help

article | April 4, 2024 | 6 min read

How long does it take to build credit?

article | April 9, 2024 | 6 min read

Decline a Request For Credit

Thank you for contacting Doe's about your credit needs. Unfortunately, after careful review of your application, we must decline your loan request at this time. However, we would gladly reconsider your request if someone signed with you on the loan.

Thank you for your recent application for a Doe credit card. Unfortunately, you do not meet our current criteria for credit approval. First, you must be employed for at least one year before we can approve your application. Second, your credit report reveals a couple of delinquent accounts.

If you feel that you have information that will make a difference in these two considerations, please write us at:

Credit Department

Doe Corporation

1600 Main Street

Springfield, Kansas 12346

In any case, we invite you to reapply after you have been with your current employer for more than a year and after your delinquent accounts are in order.

Thank you for applying for in-house credit with Doe & Sons. While it appears that your business holds good financial promise, we are unable to approve your line of credit due to your troubled credit history. Please feel free to resubmit your credit application when you feel more secure about your credit record. For the time being, we will gladly accept your cash, checks or credit cards at Doe & Sons and, as always, we appreciate your business.

We appreciate your interest in obtaining a Doe's credit card. After carefully reviewing your credit application, we have concluded that we cannot offer you a credit card at this time. Although your work record is excellent and your income is sufficient to qualify, several entries on your credit report show payments over 60 days delinquent. In considering credit card applications, we hope to find no payments in the past year that are over 30 days delinquent.

Doe's has a layaway plan, and we hope you will take full advantage of that service until we can offer you credit. As you situation improves, please reapply for a Doe's credit card. We greatly value your business.

How to Write this Refusal Letter: Expert Tips and Guidelines

A letter declining a request for credit, either from a business or a private citizen, should retain the good will of the reader. In most cases, your refusal should leave the door open to future applications from the same party.

- Thank the applicant for applying for credit.

- Soften the refusal, if possible, by noting any positive items in the reader's application. State the reasons for the refusal, followed by a brief refusal.

- Suggest, if appropriate, other possibilities for doing business.

- Offer encouragement or a suggestion to reapply later.

Write Your refusal in Minutes: Easy Step-by-Step Guide with Sample Sentences and Phrases

1 thank the applicant for applying for credit., sample sentences for step 1.

- Thank you for your interest in Doe's Luggage. We appreciate your application for a credit card.

- We appreciate your interest in a loan from Doe Mortgage.

- Thank you for your recent request for a line of credit with Doe's Wholesalers.

- Thank you for taking the time to fill out a credit application during your recent visit to Doe's Department Store.

- We greatly appreciate the order you sent us on June 30.

- We appreciate your interest in doing business with Doe's.

- Thank you for sending us your credit application. We appreciate your confidence in our services.

- Thank you for your letter expressing interest in opening a charge account with our corporation.

Key Phrases for Step 1

- appreciate your interest in a loan

- appreciate your request for a credit card

- appreciate your interest in doing business with

- appreciate your application

- desire to establish credit with us

- greatly appreciate the order you sent us on

- greatly appreciate your interest in obtaining

- happy to grant your request when

- memo requesting credit for

- new business venture sounds exciting and challenging

- thank you for filling out a credit application

- thank you for your interest in

- thank you for your recent request for a line of credit with

- thank you for your patience

- thank you for your recent charge card application

- underwent our standard credit investigation

- want to do business with you

- would like to grant the terms you request

2 Soften the refusal, if possible, by noting any positive items in the reader's application. State the reasons for the refusal, followed by a brief refusal.

Sample sentences for step 2.

- Although your part-time work record is excellent, you must be employed full time for at least six months before we can offer you a Doe credit card.

- Your new business venture sounds exciting and challenging; however, company policy prevents us from extending credit until a company has been established for at least one year.

- According to your financial statements and our credit information, you are not able to promptly meet all of your current obligations. Because of this, we must delay credit approval until you demonstrate your ability to pay your open accounts.

- The financial information you provided us does not include your current income or your outstanding debts. Until you furnish that information to us, we cannot process your application.

- You have been making regular payments on all your current accounts; however, because you are unemployed we cannot offer you credit at this time.

- From the information we have received, you had difficulty paying your previous supplier in a timely manner. Therefore, our credit department suggests that for now we operate on a cash-only basis.

- We have thoroughly examined the credit information you recently submitted and have concluded that, due to your current obligations, we can best serve you by offering a payment alternative other than credit.

Key Phrases for Step 2

- according to your financial statements and our credit information

- after a careful review of your application

- after reviewing all the information on your credit application

- although your work record is excellent

- are not in a position to extend the amount of credit you desire

- authorities consulted have not given us sufficient

- based on your application and the formulas we use

- based on the information you supplied us

- because your current liabilities exceed

- been making regular payments on all your current accounts

- before we can offer you a credit card

- being unemployed makes it impossible for us to offer

- by then you should have less difficulty

- cannot see adding to your outstanding debts

- cannot process your application

- careful evaluation of your application indicates

- committee decided to not grant the requested line of credit

- company policy does not allow us to process orders on credit

- company has been established for at least

- credit criteria require that a customer's liabilities not exceed

- current income

- demonstrate your ability to pay your open accounts

- does not conform to our company credit requirements

- enclosed is a copy of their report

- feel credit approval should be delayed

- financial information you provided us does not include

- for your own protection

- have been endeavoring to establish your credit

- it appears from the credit report we just received

- lack of a permanent work record at this time

- looked into your credit standing

- merit approval under our criteria for extending credit

- must be employed full-time for at least

- my unfortunate duty to inform you of your ineligibility

- not able to promptly meet all your current obligations

- not able to extend credit to you

- notice that you have been in this area only a few

- our research has not provided sufficient

- payment has consistently been getting further and further behind

- perhaps a further review of your current situation will reveal

- refuse credit to any applicant who has filed for bankruptcy

- regret to inform you

- regrettably we cannot approve your credit application

- saying no to a customer is not easy

- since receiving your application

- sorry to report that we must decline your application

- sorry to report that your references

- sorry to inform you that we cannot extend credit at this time

- unable to grant you the open credit you requested

- unfortunately the information we received does not allow us

- until you furnish this information to us

- when you have established a bank account

- your outstanding debts

3 Suggest, if appropriate, other possibilities for doing business.

Sample sentences for step 3.

- Until then, we hope you will take advantage of Doe's layaway plan.

- While you are establishing your business, we would be happy to process orders accompanied by cash or check.

- Have you considered finding a co-signer for your loan?

- As soon as you send us the missing information, we will process your application.

- With the enclosed thank you certificate, you can purchase any regularly priced merchandise at 10% off on March 30, using cash or check.

- When we receive payment from you, we will ship your order immediately.

- Again, we appreciate your interest in our firm and hope you will take us up on our offer of 5% off all your cash orders.

Key Phrases for Step 3

- as soon as you send us the missing information

- as soon as you establish a permanent work record

- based on the information we have on hand

- certainly want you to look to us as your regular suppliers

- considered finding a co-signer for your loan

- glad to consider any additional information you can provide

- happy to reconsider our disappointing decision

- happy to review your account later

- happy to reconsider your application

- happy to process orders accompanied by cash or check

- have no choice

- hope you will understand our position

- hope you will take advantage of our layaway plan

- if you feel the report is in error

- if you wish to reapply for a line with a lower ceiling

- if you would like additional information

- if you can supply us with additional references

- look forward to establishing a long-term relationship with you

- profits accruing from our products will more than compensate

- remember that cash purchases have no monthly interest charge

- sure we can set up a program of gradually increasing credit

- want very much for you to join our family of customers

- welcome any cash orders

- when we receive payment from you

- when your financial situation improves

- when your income/debt ratio changes

- will be very happy to reconsider

- will find both our service and products outstanding

- will be happy to consider your application again

- will be as flexible and cooperative as possible

- will do all we can to serve you

- wish you every success in your new business

- work out a mutually satisfying arrangement

4 Offer encouragement or a suggestion to reapply later.

Sample sentences for step 4.

- We wish you every success in your new business and look forward to establishing a line of credit for you in the near future.

- I am available at your convenience to discuss a smaller line of credit that we can gradually increase as your circumstances improve.

- We would be happy to consider your application again when your financial situation improves.

- We hope you will apply again later. As always, we thank you for shopping at Doe's.

- Let's plan on reviewing your request for credit again in six months. We hope the future will bring a mutually profitable relationship.

- We hope you will understand our position. If we can assist you further, please let us know.

- Thank you for your understanding. Contact us again in another year, and we will discuss opening a charge account.

- Once you have concluded your job search and have settled into the community, we will be pleased to review your application. We wish you all the best.

- We appreciate your business and hope you will reapply next year.

Key Phrases for Step 4

- am sorry we can't do more for you at this time

- available at your convenience to discuss a smaller line of credit

- can take advantage of our layaway service

- can gradually increase as your circumstances improve

- hope to hear from you again

- hope you will apply again later

- hope to extend credit terms then

- hope to open a credit account for you when you apply again

- if we have left any questions unanswered

- if you think your status will improve

- if I can further assist you

- if you have any questions

- let me hear from you soon

- look forward to continuing our business association

- look forward to a mutually profitable relationship

- look forward to establishing a line of credit for you

- looking forward to working with you

- plan on reviewing your request for credit again in

- please don't hesitate to get back in touch with us

- please come in and talk to me at your convenience

- please contact us again in

- please allow us to serve you in any way possible

- regret we could not be more helpful at this time

- reopen your application at some future time if you so desire

- sincerely want you as a customer

- thank you for your interest

- thank you for shopping at

- when your financial picture changes

- will be able to reconsider granting you credit

- will make every effort to serve you well

Recommended Articles

Recommended letter-writing resources.

Action Verbs for Resumes and Cover Letters

Business Letter Format Tips

Letter Closings

Sequin Blog

Credit card rejection letters: demystified.

November 6, 2023

Vrinda Gupta

Sequin CEO & Co-Founder | Women's Finance Expert | Visa Alum

We’ve been there: the dreaded credit rejection letter. In fact, Sequin started because our founder, Vrinda Gupta, received a credit card rejection letter from the credit card on a platform she built while at Visa.

Of course, a best case scenario is that you avoid a rejection letter all together. The best way to do this is to do your research ahead of time: before applying for a new line of credit, model out how doing so may impact your credit score. Check your credit free with Sequin's credit score tool ! and consider using our matchmaking quiz to help determine what types of credit cards you might be eligible for.

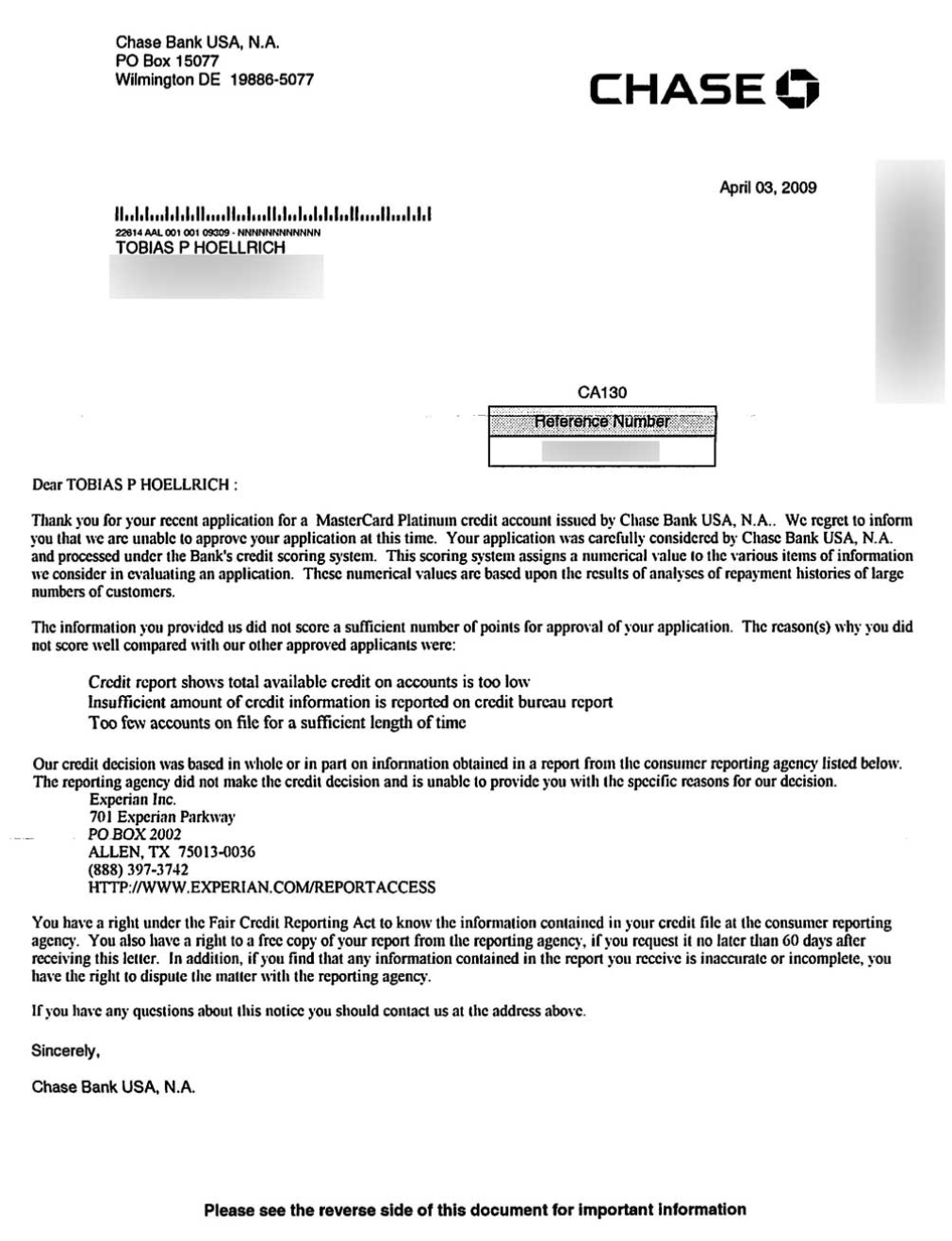

What it says: “Credit report shows total available credit on accounts is too low”, “Insufficient amount of credit information is reported on credit bureau report”, “Too few accounts on file for a sufficient length of time”

What it means: In this rejection notice, Chase is saying that they went to the credit bureau Experian, pulled your credit history, and found that there was not enough credit history to apply for this credit card. There are both too few credit accounts and the accounts that are open haven’t been used for long enough. When credit card issuers like Chase are trying to determine whether or not they want to extend credit to an applicant, they look for how credit worthy you’ve been in the past. In this case, there was not enough data to demonstrate creditworthiness.

What you can do:

• Stop being an authorized user, and start getting a credit card in your own name. A 2010 study by the Federal Reserve showed that married women are 2x as likely to be authorized users than married men. We’ve talked to countless women who find out too late, after being an authorized user for years, that they have not built up a sufficient credit history. If you are currently an authorized user on a card and have no other credit cards in your own name, we recommend beginning to build credit in your own name as soon as possible (see the next tip for how!).

• Use a secured card if needed in order to build credit history. A secure card is one in which you put down cash to back your own credit line, rather than being extended credit by a bank. Over time, you build up your credit history by demonstrating strong credit habits. A secured card both increases the number of accounts open and the length of time building credit, which will give useful data that helps the issuer assess their risk the next time they apply for a credit card.

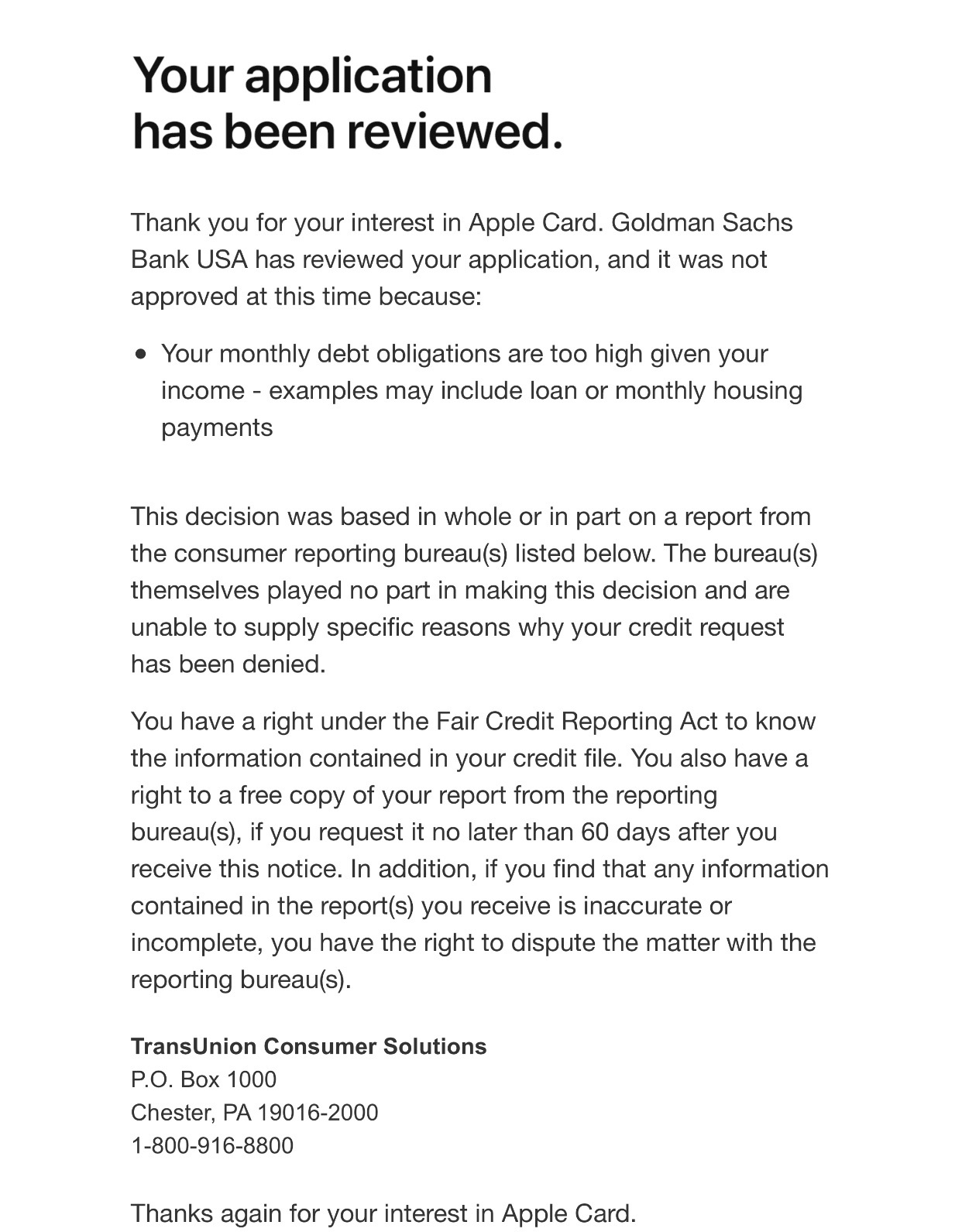

What it says: “Your monthly debt obligations are too high given your income — examples may include loan or monthly housing payments.”

What it means: “Your monthly debt obligations are too high given your income” means your debt-to-income ratio is too high. You want to have little debt and a high income when you apply for a credit card, because that gives them assurance that you will be able to pay your credit card off every month. When lenders calculate debt, they look at your rent and/or mortgages, student loan debt, auto loan debt, and minimum monthly credit card payments. They ask themselves: based on your income and how much you already owe your landlords and lenders, are you in a position to take on more debt? Are you living within your means, or are you living beyond your means?

What you can do: Achieving an optimal debt-to-income ratio may be particularly challenging for women: women tend to carry more student debt than men, and their salaries are lower (hello, gender wage gap!). Here are a few ways that you can work toward an optimal debt-to-income ratio.

Take stock of the debt you have and pay off any debt that you can. Pull your own credit report (you can pull them for free once a year at Experian, Transunion, and Equifax) and determine how much you owe on your existing credit cards, mortgage/rent, auto loans, student loans, and personal loans. You can also use a debt-to-income calculator like this one, by Nerdwallet . Are there any debts that you are in a position to pay off right now?

Make sure you are reporting all of your income. When we spoke with women, we learned that many of you have side hustles and alternative sources of income. Make sure that you are reporting all of your income — not just your yearly salary from one job.

Consider calling your bank to switch cards as opposed to applying for a new card. Transferring your credit line as opposed to applying for a new one means that the bank won’t have to issue you more credit. If your bank is offering a cool new credit card that you’re excited about, call them to see if they will switch your current credit line over to the new card rather than applying for a whole new line of credit. Explain to the bank why you’re excited about the new credit card and how you plan to use it. You may need to downgrade your existing credit card to avoid paying two annual fees.

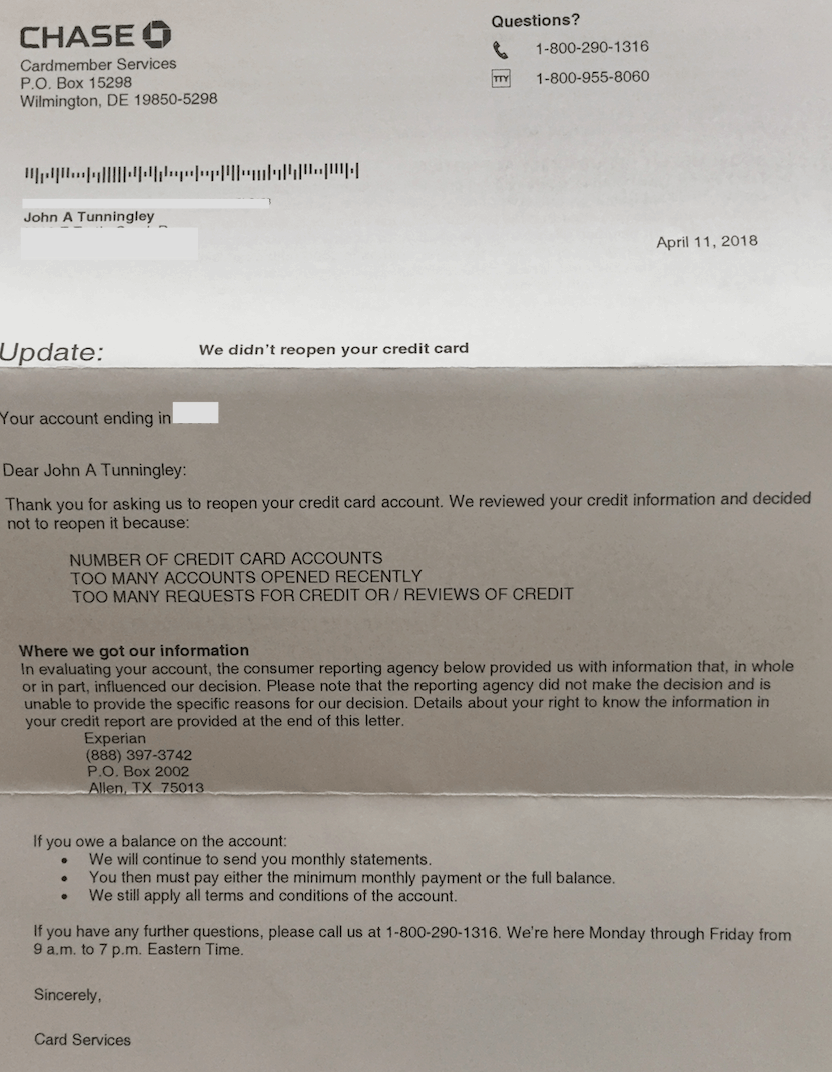

What it says: “Number of credit card accounts”, “Too many accounts opened recently”, “Too many requests for credit or / reviews of credit”

What it means: This rejection letter is telling you that there are too many hard inquiries on your account and too many credit card lines currently open. When lenders see that you are searching around for loans, even after you have credit lines open, they wonder if you are in financial trouble. Applying for multiple loans and/or credit cards raises a big red flag and can cause your credit score to take a hit.

Do your research ahead of time before applying again. Before applying for a new line of credit, do your research on how doing so may impact your credit score and consider using a pre-qualification tool ( like our quiz to determine what types of credit cards you might be eligible for.

Check your credit score report often. If you’re surprised by the news that you have too many accounts open, double check that there are no fraudulent accounts open in your name. You can do that by pulling your credit report at Equifax, Transunion, or Experian and reviewing it for fraudulent accounts. If you find any accounts on the report that you didn’t open, call right away to report it.

Build your credit score back up. If you are applying for credit often and being rejected, your credit score will undoubtedly take a toll. Make sure to pay your existing credit card balances off on time and wait a little while before applying again.

Disclaimer: A friendly and earnest reminder that content in the Sequin Project is not intended to be financial advice, and that the writers at Sequin are not certified financial advisors. If you’re looking to make any decisions related to the content above, please contact a certified financial advisor first.

✨ Learn more about the Sequin Women's Finance Club ✨

Disclaimer:

Opinions expressed here are author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Fight the Pink Tax.

Terms & Conditions

All genders welcome!

Sequin is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC.

The Sequin Rewards Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks . Please contact [email protected] with questions regarding the sweep program.

+ Terms and conditions apply to the cashback rewards program. See http://sequincard.com/rewards-terms for details. Cashback rewards earned will be credited to your account on the second day of the month. ATM transactions, the purchase of money orders or cash equivalents, and account funding made with your debit card are not eligible for cashback. Please refer to the Rewards Terms and Conditions for more details. No minimum opening deposit required to open a Sequin High-Interest Checking Account & $25 minimum opening deposit required for a Sequin Rewards Checking Account.

Earn cashback rewards at a rate of 6% on eligible categories in a calendar month in which you spend at least $500 on the Sequin Visa® Rewards Debit Card. If you make less than $500 in settled debit transactions on the Sequin Visa® Rewards Debit Card in a calendar month, you earn cashback rewards on debit transactions at a rate of 0.5% cashback on eligible categories.

§ We are not affiliated, associated or endorsed by the brands we list on sequincard.com . All names, marks, emblems and images are registered trademarks of their respective owners. Any product names, logos, brands, and other trademarks or images featured or referred to within the Sequin website ( sequincard.com ) and/or on any social media forum are the property of their respective trademark holders. We declare no affiliation, sponsorship, nor any partnerships with any registered trademarks.

† The interest rate on your account is 3.50% with an Annual Percentage Yield (APY) of 3.56% for a Sequin High-Interest Checking Account, and 1.00% with an Annual Percentage Yield (APY) of 1.01% for a Sequin Rewards Checking Account effective as of 01/04/2024. Rate is variable and is subject to change after account opening. Rate is compounded daily and credited monthly. No minimum deposit required to open a Sequin High-Interest Checking Account & $25 minimum deposit required for a Sequin Rewards Checking Account. Fees may reduce earnings.

National average bank interest rate is 0.08% APY as of June 2024. Obtained from the FDIC.

1 Sequin Consumer Deposit Account Agreement

2 With a Sequin High-Interest Checking Account (available to Sequin Members), you get up to four international ATM fee reimbursements per month, up to $20.00. Sequin Members will receive their reimbursement by the 10th day of the following month.

3 Sequin University, Credit Tools, and Perks are not affiliated with Thread Bank. Sequin Member results are based on a 2022 study of 100 participants over a period of three weeks. Results may vary.

|| Women have more anxiety about finances than men , Morning Consult Pro , 2024

|| 14% of women go into debt for beauty , Lending Tree , 2023

|| Women are less likely to invest our assets , Magnify Money , 2019

|| Women pay higher interest rates and more in fees - while investing less , FINRA , 2012

|| Debit cards don’t usually earn rewards , Banks.com , 2024

|| Women pay 30% more in overdraft fees as compared to men , BankingDive , 2019

|| Most cards are black and blue , CanStar , 2022

|| Women were granted rights to bank accounts and debit cards only 50 years ago , Forbes , 2023

|| Sequins were a Venetian gold currency until, over time, the reflective metals became decorative accents, Research Gate , 2013

|| Everyday products and services cost women $188,000 more over our lifetimes , BankRate , 2023

|| Women pay more for the same everyday goods and services, such as razors, deodorant, and hair care 42% of the time , DailyCampus , 2024

|| We've selected "Pink Tax" categories based on where women typically spend more on everyday products and services , GoBankingRates , 2024

Content for Educational and Informational Purposes Only. Our Service is designed to provide you with a general overview regarding finance, credit, and investing. It is not designed to be a definitive finance guide or to take the place of advice from a qualified financial planner or other professional. Given the risk involved in investing of almost any kind, there is no guarantee that the investment methods suggested will be profitable. We will not assume liability of any kind for any losses that may be sustained as a result of applying the methods suggested through the Service, and any such liability is hereby expressly disclaimed.

© Copyright 2024 Sequin Financial Inc. All rights reserved.

How to Avoid a Scary Credit Card Rejection Letter

If ghosts and goblins weren’t bad enough this Halloween, the sight that credit card users might actually fear is the mailman. If you’ve recently applied for a credit card, then your mail carrier may be delivering one of the most frightening letters you can get: a credit card rejection notice.

How to Avoid These Scary Letters

Whether you are asking someone out on a date, looking for a new job or applying for a personal or business credit card , everyone hates being rejected. And when your application for new credit is declined, you will likely be notified by mail.

Thankfully, there are several things that you can do to help your chances of being approved for your next credit card.

Only Apply For Credit Cards That You Can Qualify For

An easy way to avoid rejection letters is make sure that you’re applying for a card that you’re qualified to receive.

To find the right card for your, be sure to check your credit score first, and then see how it correlates with how the card is marketed. For example, if you have a limited credit history , or poor credit, then you shouldn’t bother applying for a premium rewards card that’s designed for those with excellent credit. If you have a very limited credit history, then you’ll want to start with a very basic credit card that doesn’t offer rewards. If you have a poor credit history, then you might need to start with a secured card . A secured card works much like a standard, unsecured card, but it requires the payment of a refundable security deposit before your account can be opened.

Pay Down as Much of Your Outstanding Balances as Possible

When a card issuer is deciding on your credit card application, one of its most important considerations is its exposure to default. When it looks at a copy of your credit report, it will be much more likely to approve your application if you have don’t have large outstanding balances .

But what many people don’t realize is that their credit report will show all of their most recent credit card’s statement balances as debt, even if they always avoid interest by paying their balances in full. To reduce the amount of debt indicated on your credit reports, you can pay off your outstanding balances before your statement period closes. When you do this, your credit report will show a zero balance on your cards. It’s also important to pay down any current balances on other accounts from the same issuer as the one you are applying for.

Include All Eligible Income on Your Application

Credit card issuers also place a lot of importance on your ability to repay a loan, and want to see sufficient income. Unfortunately, many credit card applicants will fail to include all of the sources of income that they use to qualify for a credit card. In addition to your business or employment income, you can also include investment returns, Social Security or pension income, retirement fund distributions, inheritance or trust fund payments, unemployment benefits, alimony, and child support. Also, federal regulations say you can include the income of your spouse or domestic partner, so long as you have a reasonable expectation of access to those funds for repayment of your loan.

Reach Out Directly to the Card Issuer

If your credit card application isn’t initially approved, you can take one last step to avoid flat out rejection. Contact the credit card issuer, and ask to speak with a reconsideration specialist. Most card issuers have these representatives which can approve your application over the phone, even if their system had originally rejected it. You can use this opportunity to include additional sources of income that you originally failed to include. And if you have other accounts open with the same issuer, you can also request to have some of those credit lines transferred to your new account, or even to close another account that you don’t need. This allows the card issuer to approve your new account without increasing its exposure to default.

Bottom Line

Most adults have long since outgrown the fear associated with the scary symbols of the season, but the fear of rejection can last a lifetime. By taking these simple steps, you’ll be doing everything you can to avoid receiving that scary letter from a credit card issuer.

This article was originally written on October 30, 2017 and updated on December 10, 2020.

Rate This Article

This article currently has 11 ratings with an average of 4.5 stars.

Jason Steele

As one of the nation's leading experts in credit cards award travel, Jason Steele has been published in over 100 outlets. His articles are regularly syndicated to Yahoo! Finance, MSN Money and other mainstream outlets. Jason is also the founder of CardCon, which is the annual conference for credit card and consumer credit media.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

2 responses to “ How to Avoid a Scary Credit Card Rejection Letter ”

Great tips for avoidance of a rejection letter, I especially like the idea of speaking to a rejection specialist, I have never heard this term before so thank you for adding something new to my knowledge circle.I would also like to add one more technique and that is to use a written application whenever possible, this just seemed to always get better results for me.thanks. Steve

Hi Steve, thanks for the additional tip!

- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

Rejected for a credit card I didn’t apply for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Printer Friendly Page

Get your FICO ® Score for free

No credit card required

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Report Inappropriate Content

- Credit & loan qualification

- All forum topics

- Previous Topic

- « Previous

- Next »

Re: Rejected for a credit card I didn’t apply for

Forgot password

My Suspicious Credit Card Rejection Letters…

- Ben Schlappig

- Published: May 7, 2023

- Updated: May 7, 2023

I’m not sure what to make of this, though it sure is strange. Is someone just playing a trick on me, or is this part of a larger problem? I first wrote about this situation around a month ago, but it has now happened to me again, though in a slightly different way…

In this post:

My first suspicious credit card situation

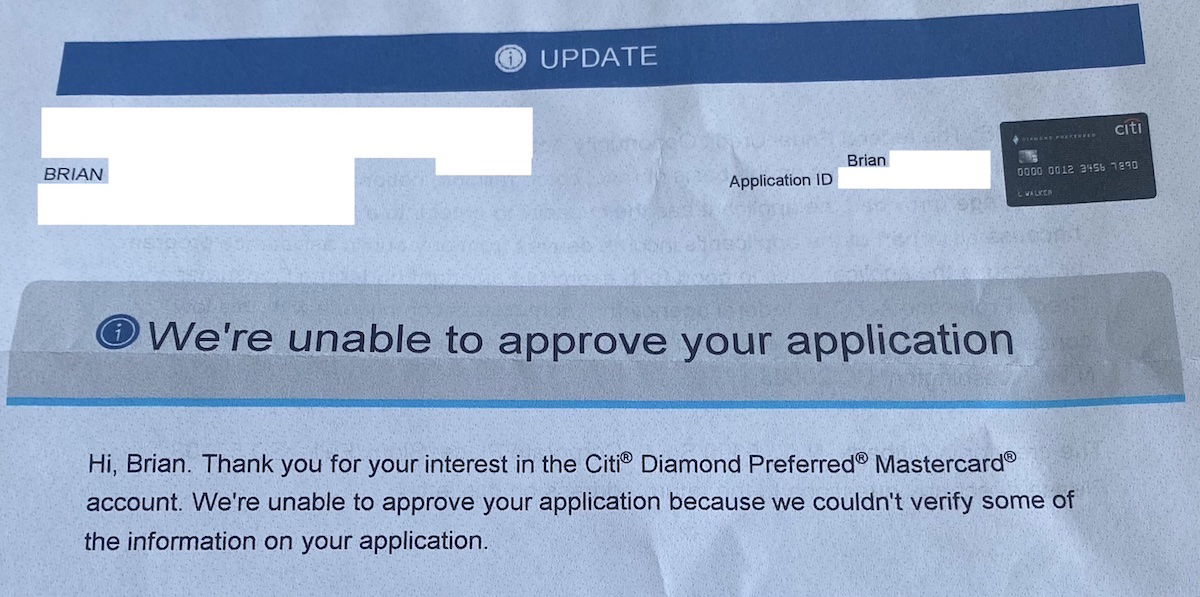

In early April, I got a phone call from Citi, asking to speak to someone with the exact same middle initial and last name as me. However, his first name was Brian, while my first name is Benjamin (interestingly both start with “B”).

I was confused, and explained the above to the agent. The other thing is that I have a distinctive last name, and I know that no one with the name she asked for exists. The agent thanked me for my time, and that was it. I thought that whole situation was weird, but didn’t put much more thought into it at the time.

Then around a week later, I received a letter in the mail with a credit card rejection for the Citi Diamond Preferred Mastercard. The letter stated that the rejection was because Citi “couldn’t verify some of the information” on the application.

There’s only one thing — I never applied for this card, and it was once again addressed to Brian (with the same middle initial and last name), rather than me.

My second suspicious credit card situation

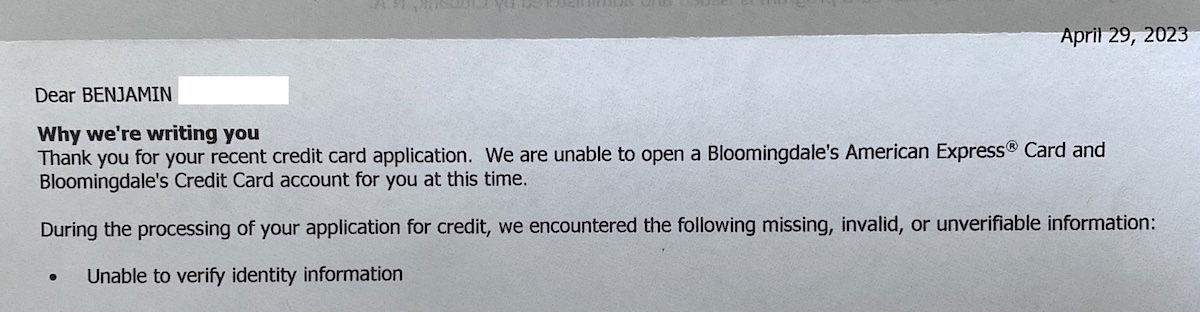

I wrote about the above situation about a month ago, but now there’s a further update. I just received a letter in the mail for my application for the Bloomingdale’s American Express Card. I got rejected for the card, on the grounds that they were “unable to verify identity information.”

I’m sure you can guess what I’m about to say next — no, I didn’t apply for a Bloomingdale’s American Express Card. This rejection letter is the first notice I received about my alleged application.

I’m not sure what exactly to do here?

Obviously I could call up Citi and American Express regarding this, but I’m not sure what that would accomplish? Once they realize I can’t verify whatever details were put on the application, they won’t be able to talk to me about the account, never mind that they likely won’t have any information to share.

I would imagine that what’s going on here is somewhere between a practical joke and an attempt at identity theft. Over the past 15+ years of blogging, I’ve had a countless number of people try to screw around with me. This ranges from people canceling my airline tickets, to people ordering room service on my behalf while at a hotel. It’s one of the reasons that nowadays I usually write about my travels after the fact. I’m not sure why people do this, exactly, but… I’ve gotten used to it.

But this situation is kind of odd, because I’m not sure I get the motive. There were no inquiries on my credit report for either of these applications, so it doesn’t look like this person has actually managed to steal my identity in any sort of meaningful way. So that makes me think that it’s more a weird practical joke than anything else.

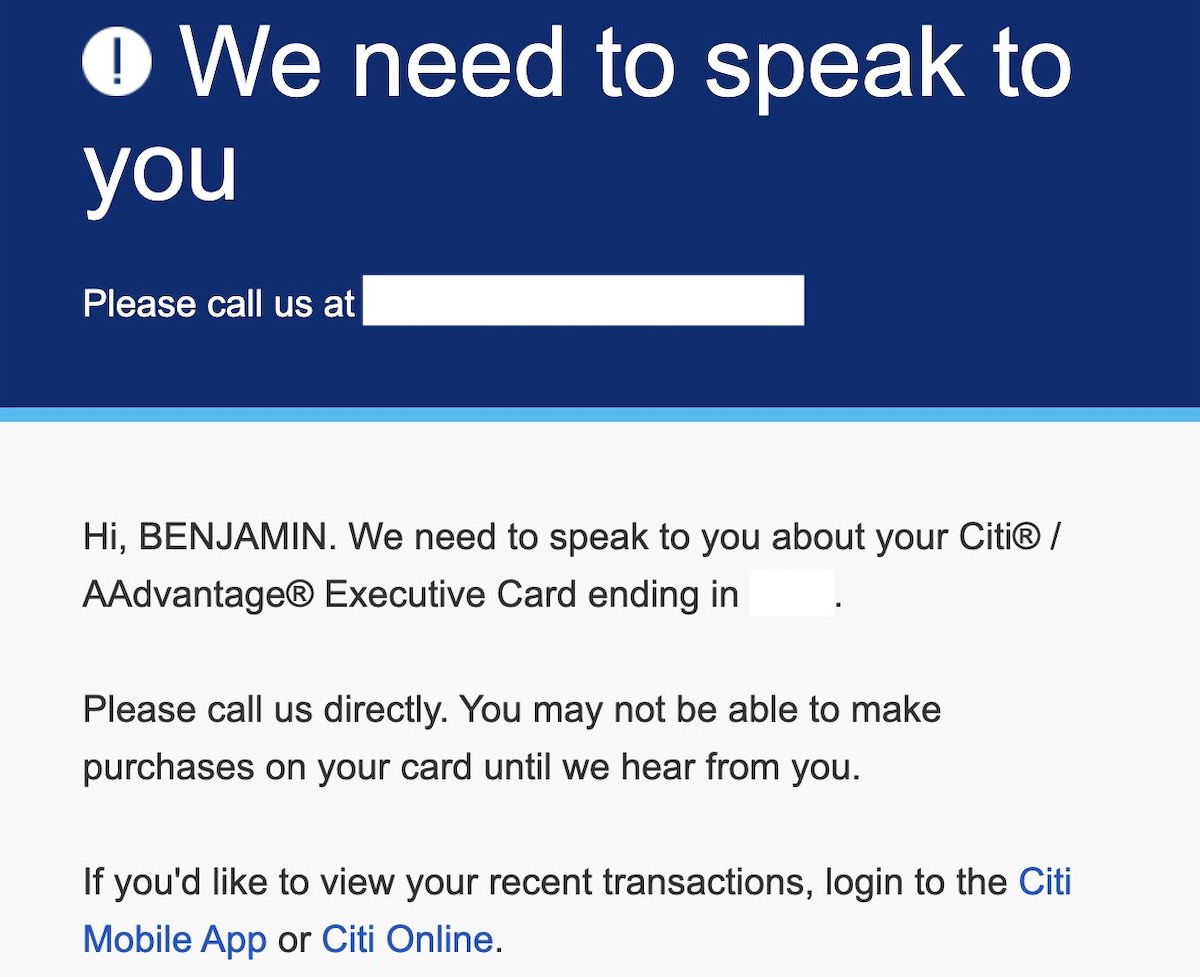

The only other thing worth mentioning is that I’ve had some odd fraud-related situations in the past several weeks. For one, my AAdvantage account was shut down and replaced by a new account , due to alleged unauthorized access (though no details beyond that were shared with me).

Furthermore, I had a fraud alert on a Citi card, where I was told that Citi had identified that someone had allegedly tried to call in as me, but couldn’t make it through the automated system. However, this person didn’t actually attempt to make any purchases, or necessarily have access to my account info.

I continue to closely monitor my credit, use two factor authentication, track my points balances, etc. I’m not sure if there’s anything I should be doing beyond that, as I don’t think there’s a lot of action I can take here.

I know many people would suggest that I should probably freeze my credit . However, that seems like a headache, and I’m not sure what that would accomplish, exactly:

- There’s nothing suggesting that anyone has stolen my social security number, based on the rejections being due to lack of available information, and no new credit inquiries showing on my credit report

- In other words, freezing my credit wouldn’t actually change anything compared to what’s happening now; I could keep getting rejection letters for cards I never applied for

- While I realize freezing credit falls in the category of “better safe than sorry,” it’s kind of an annoying thing to do if you’re like me, and apply for credit cards with some frequency

Bottom line

I’ve dealt with credit card fraud in the past. If someone tries to make a $500 purchase at Kohl’s in Irvine, that’s easy enough to fix, because it’s obvious fraud that’s easy to identify, the charges are removed, and a new card can be issued.

But this is a bit different, as it’s hard to know what exactly is going on…

What would you do in my situation?

- Most Recent

- Oldest First

- Most Helpful

My son has had this same thing happen several times now from more than one place. Basically we have ignored it as a scam because we don't know what to do. How do we know if the phone number on the letter isn't the frauds number?

from another article - but I've seen many over the years Fraudsters create synthetic identities and it’s easier to do it than most people would imagine. They’re creating a person financially or digitally that doesn’t exist, new identities using a combination of real data and fabricated information.

Social security numbers are easy for people who know what they’re doing. Prior to 2008 social security numbers weren’t randomized, and there’s still an algorithm used to...

Social security numbers are easy for people who know what they’re doing. Prior to 2008 social security numbers weren’t randomized, and there’s still an algorithm used to create these numbers. Social security numbers that get targeted most are ones infrequently used — those of children and the elderly — he recommends freezing the credit file of your children. Everyone’s data is out there. Using social security numbers, dates of birth, and mother’s middle name for validation has become worthless, after the Equifax breach but even before.

Here’s how a phantom borrower is born. The scammer creates their fake identity, gets a fake ID and decides what social security number to use. They go into a store, say Target, and they’re offered a credit card at checkout. The clerk at the store isn’t looking for fraud, they’re incentivized for getting the application. read the rest or do a search - https://viewfromthewing.com/paypal-shares-people-committing-fraud-looks-like-fraud/

Besides freezing credit, you should also put a fraud alert notice on your credit , so a new lender has to call the number listed in the fraud alert when opening a new line of credit.

It's likely attempted identity theft. No doubt your information has been leaked by careless companies (hello T-Mobile with 5+ MAJOR data breaches recently...!!). It's highly likely that your details were shared on the dark web and people are trying to use the details. This is all a result of the careless that "take security very seriously...blah...blah...blah" but do little to actually fix problems. They just give the standard (now largely useless) 2 years of free...

It's likely attempted identity theft. No doubt your information has been leaked by careless companies (hello T-Mobile with 5+ MAJOR data breaches recently...!!). It's highly likely that your details were shared on the dark web and people are trying to use the details. This is all a result of the careless that "take security very seriously...blah...blah...blah" but do little to actually fix problems. They just give the standard (now largely useless) 2 years of free monitoring. These companies have no incentives to actually fix the problems as fine are pennies and they are not liable for any issues that people like us have to deal with.

Now, as for fixing this, I hope you find the way. Please DO keep us updated with a follow up posting. This is something that many of us will suffer at some point. It's almost guaranteed at some point with all of the breaches that have happened and continue to happen.

It clearly appears somebody is trying to use your identity to apply for credit, so keep a close eye on it. The call you got may have been the perpetrator himself trying to get more information out of you. Freezing your credit would cause you more trouble than it’s worth, but you should inform all your credit card companies to be aware as it appears somebody is using your name and address to apply for...

It clearly appears somebody is trying to use your identity to apply for credit, so keep a close eye on it. The call you got may have been the perpetrator himself trying to get more information out of you. Freezing your credit would cause you more trouble than it’s worth, but you should inform all your credit card companies to be aware as it appears somebody is using your name and address to apply for credit and advise them you are not applying for any additional cards with them at this time.

Make sure you file with the IRS. Once they have a social security number they can file fraudulent returns for refunds. I now file with a PIN number that the IRS sends out every year.

Floridians are allowed to sign up for IP PIN regardless of any identity theft.

Agree with the comment about blogging about it. Some things you just can't discuss here or could make the situation worse. If it is the case of stolen identity, you will need to report it to the police and apply for new credit cards, etc. If this is a one-off, then I suggest calling Citi and Amex to cancel the cards and to ensure it will not affect your credit score. If you keep the...

Agree with the comment about blogging about it. Some things you just can't discuss here or could make the situation worse. If it is the case of stolen identity, you will need to report it to the police and apply for new credit cards, etc. If this is a one-off, then I suggest calling Citi and Amex to cancel the cards and to ensure it will not affect your credit score. If you keep the cards open then you could be liable for the charges and explain that you did not make those charges. Good luck.

This happened to my Mom. She received a letter of a credit card application to Express that was rejected. I researched the name in the letter and found an address to this person 30 miles away. But this person had no social media. It's an attempt of credit fraud. This way the person receiving the rejection letter would call the number in the letter to say "no one by that name lives at this address"...

This happened to my Mom. She received a letter of a credit card application to Express that was rejected. I researched the name in the letter and found an address to this person 30 miles away. But this person had no social media. It's an attempt of credit fraud. This way the person receiving the rejection letter would call the number in the letter to say "no one by that name lives at this address" only to have the person on the other end of the phone ask you to provide your actual information.

Do you or did you have tmobile? If so, they probably do have your SSN.

T-Mobile is a favorite for opening fraudulent accounts. When my info was stolen, they must have tried 10 times at least to open T-mobile accounts + they then get phones shipped to drop address.

Someone tried to apply for a PPP loan with my information in 2020. I had credit alerts set up with Experian and was notified in real time and was able to call and stop it. At the very least you should set up alerts with the 3 credit bureas. I went a step further and pay Experian and TransUnion a combined $60 a month to be able to lock and unlock my credit from my phone or computer. As an aside TransUnion allows you to lock Equifax.

You're wasting your money. By law, all bureaus now allow you to freeze/unfreeze for free via the web.

Make sure your 2FA is not tied to your public or personal phone number that you use on all other sites. I had someone call into T-mobile and sim swap me. I got super lucky that I caught it quickly. If they have your main phone number, they can reset your main email and then it is game over.