Solution to the Basic Economic Problems: Capitalistic, Socialistic and Mixed Economy

Solution to the Basic Economic Problems: Capitalistic, Socialistic and Mixed Economy!

Uneven distribution of natural resources, lack of human specialization and technological advancement etc., hinders the production of goods and services in an economy. Every economy has to face the problems of what to produce, how to produce and for whom to produce. More or less, all the economies use two important methods to solve these basic problems.

These methods are:

(a) Free price mechanism and

ADVERTISEMENTS:

(b) Controlled price system or State intervention.

Price mechanism is defined as a system of guiding and coordinating the decisions of every individual unit within an economy through the price determined with the help of the free play of market forces of demand and supply. Such system is free from state intervention.

Price of goods and services are determined when quantity demanded becomes equal to the quantity supplied. Price mechanism facilitates determination of resource allocation, determination of factor incomes, level of savings, consumption and production. Price mechanism basically takes place in a capitalistic economy.

On the other hand, Controlled price mechanism is defined as a system of state interventio n of administering or fixing the prices of the goods and services. In a socialist economy, the government plays a vital role in determining the price of the goods and services. The government may introduce ‘ceiling price’ or ‘floor price’ policy to regulate prices.

However, how a capitalist, a socialist and a mixed economic system solve their basic problems is given below:

1. Solution to Basic Problems in a Capitalistic Economy:

Under capitalistic economy, allocation of various resources takes place with the help of market mechanism. Price of various goods and services including the price of factors of production are determined with help of the forces of demand and supply. Free price mechanism helps producers to decide what to produce.

The goods which are more in demand and on which consumers can afford to spend more, are produced in larger quantity than those goods or services which have lower demand. The price of various factors of production including technology helps to decide production techniques or methods of production. Rational producer intends to use those factors or techniques which has relatively lower price in the market.

Factor earnings received by the employers of factors of production decides spending capacity of the people. This helps producers to identify the consumers for whom goods could be produced in larger or smaller quantities. Price mechanism works well only if competition exists and natural flow of demand and supply of goods is not disturbed artificially.

2. Solution to Basic Problems in a Socialistic Economy:

Under socialistic economy, the government plays an important role in decision making. The government undertakes to plan, control and regulate all the major economic activities to solve the basic economic problems. All the major economic policies are formulated and implemented by the Central Planning Authority.

In India, Planning Commission was entrusted with this task of planning. The Planning Commission of India has now been replaced by another central authority NITI Ayog (National Institution for Transforming India). Therefore, the central planning authority takes the decisions to overcome the economic problems of what to produce, how to produce and for whom to produce.

The central planning authority decides the nature of goods and services to be produced as per available resources and the priority of the country. The allocation of resources is made in greater volume for those goods which are essential for the nation. The state’s main objectives are growth, equality and price stability. The government implements fiscal policies such as taxation policy, expenditure policy, public debt policy or policy on deficit financing in order to achieve the above objectives.

The methods of production or production techniques are also determined or selected by the central planning authority. The central planning authority decides whether labor intensive technique or capital intensive technique is to be used for the production. While deciding the appropriate method, social and economic conditions of the economy are taken into consideration.

Under socialistic economy, every government aims to achieve social justice through its actions. All economic resources are owned by the government. People can work for wages which are regulated by the government as per work efficiency. The income earned determines the aggregate demand in an economy. This helps the government in assessing the demand of goods and services by different income groups.

3. Solution to Basic Problems in a Mixed Economy:

Practically, neither capitalistic economy nor socialistic economy exists in totality. Both the economic systems have limitations. Consequently, a new system of economy has emerged as a blend of the above two systems called mixed economy. Therefore, mixed economy is defined as a system of economy where private sectors and public sectors co-exist and work side by side for the welfare of the country.

Under such economies, all economic problems are solved with the help of free price mechanism and controlled price mechanism (economic planning).

Free price mechanism operates within the private sector; hence, prices are allowed to change as per demand and supply of goods. Therefore, private sector can produce goods as per their demand and their price in the market. The government may control and regulate production of the private sector through its monetary policy or fiscal policy.

On the other hand, controlled price mechanism (economic planning) is used for the public sector by the planning authority. The goods and services to be produced in the public sector, hence, are determined by the central planning authority.

Private sector determines the production technique or production method on the basis of factor prices, availability of technology etc. On the other hand, production technique or production method for the public sector is determined by the central planning authority. While determining the production technique for the public sector, national priority, national employment policy and social objectives are major considerations.

Private sector allocates its resources to produce those goods which are demanded by people who command high purchasing power. Although, production by the private sector is sometimes controlled and regulated by the government through various policies such as licensing policy, taxation policy, subsidy etc., the price determined by free price mechanism may go beyond the purchasing power of low or marginal income group.

Therefore, the government may undertake production of certain goods in its hands. The rationing policy is also introduced to provide essential goods at reasonable price to the poor people. The government, thus, ensures social justice by its actions in the mixed economy.

Related Articles:

- Basic Problems of an Economy and Price Mechanism (FAQs)

- Mixed Economy: Meaning, Features and Types of Mixed Economy

- Price Mechanism: in Free, Socialistic and Mixed Economy

- 5 Basic Problems of an Economy (With Diagram)

The Economic Problem

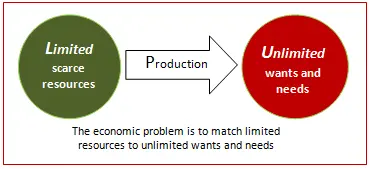

All societies face the economic problem , which is the problem of how to make the best use of limited, or scarce, resources. The economic problem exists because, although the needs and wants of people are endless, the resources available to satisfy needs and wants are limited.

Limited resources

Resources are limited in two essential ways:

- Limited in physical quantity , as in the case of land, which has a finite quantity.

- Limited in use , as in the case of labour and machinery, which can only be used for one purpose at any one time.

Choice and opportunity cost

Choice and opportunity cost are two fundamental concepts in economics. Given that resources are limited, producers and consumers have to make choices between competing alternatives. Individuals must choose how best to use their skill and effort, firms must choose how best to use their workers and machinery, and governments must choose how best to use taxpayer’s money.

Making an economic choice creates a sacrifice because alternatives must be given up. Making a choice results in the loss of benefit that an alternative would have provided. For example, if an individual has £10 to spend, and if books are £10 each and downloaded music tracks are £1 each, buying a book means the loss of the benefit that would have been gained from the 10 downloaded tracks. Similarly, land and other resources, which have been used to build a school could have been used to build a factory. The loss of the next best option represents the real sacrifice and is referred to as opportunity cost . The opportunity cost of choosing the school is the loss of the factory, and what could have been produced.

It is necessary to appreciate that opportunity cost relates to the loss of the next best alternative, and not just any alternative. The true cost of any decision is always the closest option not chosen.

Samuelson’s three questions

America’s first Nobel Prize winner for economics, the late Paul Samuelson , is often credited with providing the first clear and simple explanation of the economic problem – namely, that in order to solve the economic problem societies must endeavour to answer three basic questions – What to produce? How to produce? And, For whom to produce?

What to produce?

Societies have to decide the best combination of goods and services to meet their varied wants and needs. Societies must decide what quantities of different resources should be allocated to these goods and services.

How to produce?

Societies also have to decide the best combination of factors to create the desired output of goods and services. For example, precisely how much land, labour, and capital should be used to produce consumer goods such as computers and motor cars?

For whom to produce?

Finally, all societies need to decide who will benefit from the output from its economic activity, and how much they will get. This is often called the problem of distribution. Different societies may develop different ways to answer these questions.

A free good is one that is so abundant that its consumption does not deny anyone else the benefit of consuming the good. In this case, there is no opportunity cost associated with consumption or production, and the good does not command a price. Air is often cited as a free good, as breathing it does not reduce the amount available to someone else.

Production Possibility Frontiers

Suggestions or feedback?

MIT News | Massachusetts Institute of Technology

- Machine learning

- Social justice

- Black holes

- Classes and programs

Departments

- Aeronautics and Astronautics

- Brain and Cognitive Sciences

- Architecture

- Political Science

- Mechanical Engineering

Centers, Labs, & Programs

- Abdul Latif Jameel Poverty Action Lab (J-PAL)

- Picower Institute for Learning and Memory

- Lincoln Laboratory

- School of Architecture + Planning

- School of Engineering

- School of Humanities, Arts, and Social Sciences

- Sloan School of Management

- School of Science

- MIT Schwarzman College of Computing

The power of economics to explain and shape the world

Press contact :.

Previous image Next image

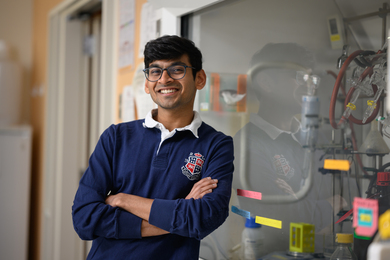

Nobel Prize-winning economist Esther Duflo sympathizes with students who have no interest in her field. She was such a student herself — until an undergraduate research post gave her the chance to learn first-hand that economists address many of the major issues facing human and planetary well-being. “Most people have a wrong view of what economics is. They just see economists on television discussing what’s going to happen to the stock market,” says Duflo, the Abdul Latif Jameel Professor of Poverty Alleviation and Development Economics. “But what people do in the field is very broad. Economists grapple with the real world and with the complexity that goes with it.”

That’s why this year Duflo has teamed up with Professor Abhijit Banerjee to offer 14.009 (Economics and Society’s Greatest Problems), a first-year discovery subject — a class type designed to give undergraduates a low-pressure, high-impact way to explore a field. In this case, they are exploring the range of issues that economists engage with every day: the economic dimensions of climate change, international trade, racism, justice, education, poverty, health care, social preferences, and economic growth are just a few of the topics the class covers. “We think it’s pretty important that the first exposure to economics is via issues,” Duflo says. “If you first get exposed to economics via models, these models necessarily have to be very simplified, and then students get the idea that economics is a simplistic view of the world that can’t explain much.” Arguably, Duflo and Banerjee have been disproving that view throughout their careers. In 2003, the pair founded MIT’s Abdul Latif Jameel Poverty Action Lab, a leading antipoverty research network that provides scientific evidence on what methods actually work to alleviate poverty — which enables governments and nongovernmental organizations to implement truly effective programs and social policies. And, in 2019 they won the Nobel Prize in economics (together with Michael Kremer of the University of Chicago) for their innovative work applying laboratory-style randomized, controlled trials to research a wide range of topics implicated in global poverty. “Super cool”

First-year Jean Billa, one of the students in 14.009, says, “Economics isn’t just about how money flows, but about how people react to certain events. That was an interesting discovery for me.”

It’s also precisely the lesson Banerjee and Duflo hoped students would take away from 14.009, a class that centers on weekly in-person discussions of the professors’ recorded lectures — many of which align with chapters in Banerjee and Duflo’s book “Good Economics for Hard Times” (Public Affairs, 2019). Classes typically start with a poll in which the roughly 100 enrolled students can register their views on that week’s topic. Then, students get to discuss the issue, says senior Dina Atia, teaching assistant for the class. Noting that she finds it “super cool” that Nobelists are teaching MIT’s first-year students, Atia points out that both Duflo and Banerjee have also made themselves available to chat with students after class. “They’re definitely extending themselves,” she says. “We want the students to get excited about economics so they want to know more,” says Banerjee, the Ford Foundation International Professor of Economics, “because this is a field that can help us address some of the biggest problems society faces.” Using natural experiments to test theories

Early in the term, for example, the topic was migration. In the lecture, Duflo points out that migration policies are often impacted by the fear that unskilled migrants will overwhelm a region, taking jobs from residents and demanding social services. Yet, migrant flows in normal years represent just 3 percent of the world population. “There is no flood. There is no vast movement of migrants,” she says. Duflo then explains that economists were able to learn a lot about migration thanks to a “natural experiment,” the Mariel boat lift. This 1980 event brought roughly 125,000 unskilled Cubans to Florida over a matter a months, enabling economists to study the impacts of a sudden wave of migration. Duflo says a look at real wages before and after the migration showed no significant impacts. “It was interesting to see that most theories about immigrants were not justified,” Billa says. “That was a real-life situation, and the results showed that even a massive wave of immigration didn’t change work in the city [Miami].”

Question assumptions, find the facts in data Since this is a broad survey course, there is always more to unpack. The goal, faculty say, is simply to help students understand the power of economics to explain and shape the world. “We are going so fast from topic to topic, I don’t expect them to retain all the information,” Duflo says. Instead, students are expected to gain an appreciation for a way of thinking. “Economics is about questioning everything — questioning assumptions you don’t even know are assumptions and being sophisticated about looking at data to uncover the facts.” To add impact, Duflo says she and Banerjee tie lessons to current events and dive more deeply into a few economic studies. One class, for example, focused on the unequal burden the Covid-19 pandemic has placed on different demographic groups and referenced research by Harvard University professor Marcella Alsan, who won a MacArthur Fellowship this fall for her work studying the impact of racism on health disparities.

Duflo also revealed that at the beginning of the pandemic, she suspected that mistrust of the health-care system could prevent Black Americans from taking certain measures to protect themselves from the virus. What she discovered when she researched the topic, however, was that political considerations outweighed racial influences as a predictor of behavior. “The lesson for you is, it’s good to question your assumptions,” she told the class. “Students should ideally understand, by the end of class, why it’s important to ask questions and what they can teach us about the effectiveness of policy and economic theory,” Banerjee says. “We want people to discover the range of economics and to understand how economists look at problems.”

Story by MIT SHASS Communications Editorial and design director: Emily Hiestand Senior writer: Kathryn O'Neill

Share this news article on:

Press mentions.

Prof. Esther Duflo will present her research on poverty reduction and her “proposal for a global minimum tax on billionaires and increased corporate levies to G-20 finance chiefs,” reports Andrew Rosati for Bloomberg. “The plan calls for redistributing the revenues to low- and middle-income nations to compensate for lives lost due to a warming planet,” writes Rosati. “It also adds to growing calls to raise taxes on the world’s wealthiest to help its most needy.”

Previous item Next item

Related Links

- Class 14.009 (Economics and Society’s Greatest Problems)

- Esther Duflo

- Abhijit Banerjee

- Abdul Latif Jameel Poverty Action Lab

- Department of Economics

- Video: "Lighting the Path"

Related Topics

- Education, teaching, academics

- Climate change

- Immigration

- Health care

- School of Humanities Arts and Social Sciences

Related Articles

Popular new major blends technical skills and human-centered applications

Report: Economics drives migration from Central America to the U.S.

MIT economists Esther Duflo and Abhijit Banerjee win Nobel Prize

More mit news.

The power of App Inventor: Democratizing possibilities for mobile applications

Read full story →

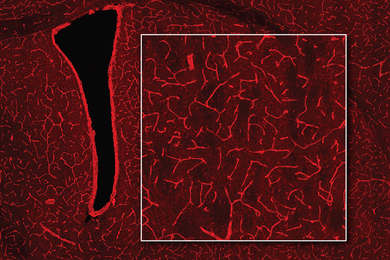

Using MRI, engineers have found a way to detect light deep in the brain

From steel engineering to ovarian tumor research

A better way to control shape-shifting soft robots

Professor Emeritus David Lanning, nuclear engineer and key contributor to the MIT Reactor, dies at 96

Discovering community and cultural connections

- More news on MIT News homepage →

Massachusetts Institute of Technology 77 Massachusetts Avenue, Cambridge, MA, USA

- Map (opens in new window)

- Events (opens in new window)

- People (opens in new window)

- Careers (opens in new window)

- Accessibility

- Social Media Hub

- MIT on Facebook

- MIT on YouTube

- MIT on Instagram

1.3 How Economists Use Theories and Models to Understand Economic Issues

Learning objectives.

By the end of this section, you will be able to:

- Interpret a circular flow diagram

- Explain the importance of economic theories and models

- Describe goods and services markets and labor markets

John Maynard Keynes (1883–1946), one of the greatest economists of the twentieth century, pointed out that economics is not just a subject area but also a way of thinking. Keynes ( Figure 1.6 ) famously wrote in the introduction to a fellow economist’s book: “[Economics] is a method rather than a doctrine, an apparatus of the mind, a technique of thinking, which helps its possessor to draw correct conclusions.” In other words, economics teaches you how to think, not what to think.

Watch this video about John Maynard Keynes and his influence on economics.

Economists see the world through a different lens than anthropologists, biologists, classicists, or practitioners of any other discipline. They analyze issues and problems using economic theories that are based on particular assumptions about human behavior. These assumptions tend to be different than the assumptions an anthropologist or psychologist might use. A theory is a simplified representation of how two or more variables interact with each other. The purpose of a theory is to take a complex, real-world issue and simplify it down to its essentials. If done well, this enables the analyst to understand the issue and any problems around it. A good theory is simple enough to understand, while complex enough to capture the key features of the object or situation you are studying.

Sometimes economists use the term model instead of theory. Strictly speaking, a theory is a more abstract representation, while a model is a more applied or empirical representation. We use models to test theories, but for this course we will use the terms interchangeably.

For example, an architect who is planning a major office building will often build a physical model that sits on a tabletop to show how the entire city block will look after the new building is constructed. Companies often build models of their new products, which are more rough and unfinished than the final product, but can still demonstrate how the new product will work.

A good model to start with in economics is the circular flow diagram ( Figure 1.7 ). It pictures the economy as consisting of two groups—households and firms—that interact in two markets: the goods and services market in which firms sell and households buy and the labor market in which households sell labor to business firms or other employees.

Firms produce and sell goods and services to households in the market for goods and services (or product market). Arrow “A” indicates this. Households pay for goods and services, which becomes the revenues to firms. Arrow “B” indicates this. Arrows A and B represent the two sides of the product market. Where do households obtain the income to buy goods and services? They provide the labor and other resources (e.g., land, capital, raw materials) firms need to produce goods and services in the market for inputs (or factors of production). Arrow “C” indicates this. In return, firms pay for the inputs (or resources) they use in the form of wages and other factor payments. Arrow “D” indicates this. Arrows “C” and “D” represent the two sides of the factor market.

Of course, in the real world, there are many different markets for goods and services and markets for many different types of labor. The circular flow diagram simplifies this to make the picture easier to grasp. In the diagram, firms produce goods and services, which they sell to households in return for revenues. The outer circle shows this, and represents the two sides of the product market (for example, the market for goods and services) in which households demand and firms supply. Households sell their labor as workers to firms in return for wages, salaries, and benefits. The inner circle shows this and represents the two sides of the labor market in which households supply and firms demand.

This version of the circular flow model is stripped down to the essentials, but it has enough features to explain how the product and labor markets work in the economy. We could easily add details to this basic model if we wanted to introduce more real-world elements, like financial markets, governments, and interactions with the rest of the globe (imports and exports).

Economists carry a set of theories in their heads like a carpenter carries around a toolkit. When they see an economic issue or problem, they go through the theories they know to see if they can find one that fits. Then they use the theory to derive insights about the issue or problem. Economists express theories as diagrams, graphs, or even as mathematical equations. (Do not worry. In this course, we will mostly use graphs.) Economists do not figure out the answer to the problem first and then draw the graph to illustrate. Rather, they use the graph of the theory to help them figure out the answer. Although at the introductory level, you can sometimes figure out the right answer without applying a model, if you keep studying economics, before too long you will run into issues and problems that you will need to graph to solve. We explain both micro and macroeconomics in terms of theories and models. The most well-known theories are probably those of supply and demand, but you will learn a number of others.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Authors: Steven A. Greenlaw, David Shapiro, Daniel MacDonald

- Publisher/website: OpenStax

- Book title: Principles of Economics 3e

- Publication date: Dec 14, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Section URL: https://openstax.org/books/principles-economics-3e/pages/1-3-how-economists-use-theories-and-models-to-understand-economic-issues

© Jan 23, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Study Notes

What is the fundamental economic problem?

Last updated 13 Jul 2023

- Share on Facebook

- Share on Twitter

- Share by Email

The basic economic problem, also known as the fundamental economic problem, refers to the scarcity of resources in relation to the unlimited wants and needs of individuals and societies. It is the central issue in economics and arises due to the imbalance between what people desire and the resources available to fulfill those desires.

In essence, the basic economic problem can be summarized by three key questions:

- What to produce: Since resources are limited, societies must decide what goods and services to produce and in what quantities. This involves making choices about which products or services are most needed or desired by the population.

- How to produce: Once the decision on what to produce is made, societies must determine the most efficient and effective methods of production. This involves deciding on the combination of resources to use, such as labor, capital, and technology, to produce the desired goods and services.

- For whom to produce: After determining what and how to produce, societies need to allocate the produced goods and services to different individuals and groups. This raises questions about the distribution of resources and the equitable allocation of goods and services among the population.

The basic economic problem arises from the reality of scarcity. Resources such as land, labor, capital, and natural resources are limited, while human wants and needs are virtually unlimited. As a result, individuals, businesses, and societies must make choices and trade-offs to allocate resources efficiently, optimize production, and satisfy the most pressing needs and desires.

Economics as a social science discipline seeks to study and analyse the basic economic problem and develop theories and models to understand how societies make decisions regarding resource allocation, production, and distribution in the face of scarcity.

Here are some of the ways that economic systems try to address the fundamental economic problem:

- Market economies: Market economies are based on the principle of supply and demand. Prices are determined by the interaction of buyers and sellers in the market. This system allows for the efficient allocation of resources, but it can also lead to inequality and environmental problems.

- Planned (command) economies: Planned economies are based on the principle of central planning. The government decides what goods and services will be produced and how resources will be allocated. This system can ensure that everyone's basic needs are met, but it can also be inefficient and inflexible.

- Mixed economies: Mixed economies combine elements of market economies and planned economies. The government plays a role in the economy, but it also allows for some degree of free market activity. This system is often seen as a way to balance the efficiency of market economies with the equity of planned economies.

The fundamental economic problem is a complex issue that has no easy solutions. However, different economic systems offer different approaches to addressing the problem.

- Water Scarcity

- Scarcity bias

- Resource Scarcity

- Opportunity cost

You might also like

Venezuela – fingerprinting as a rationing device..

26th August 2014

Opportunity Cost - Some Numerical Examples as a Worksheet

11th August 2015

The Opportunity Cost of a pair of Apple AirPods

12th September 2016

Behavioural Economics (Quizlet Revision Activity)

Quizzes & Activities

Basic Economic Problem - Revision Video Playlist

Topic Videos

Opportunity Cost - Two Applied Examples

Price mechanism in action - californian drought raises grocery prices.

11th October 2022

Who should pay to clean up the UK's rivers?

2nd October 2023

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Policies to deal with economic crisis

A look at various economic policies to deal with an economic crisis, such as a fall in GDP.

Economic crisis could involve

- Lack of economic growth/recession

- High Unemployment

- Long-term structural deficits

- Lack of confidence in finance and consumer sector.

- Rapid devaluation

Solutions to economic crisis

- Government investment in new infrastructure (e.g. New Deal in the 1930s) helps to stimulate demand and creates jobs.

- Income tax cuts – increasing the disposable income of workers, encouraging them to spend.

- Cutting interest rates – makes borrowing cheaper and should increase the disposable income of firms and households – leading to higher spending.

- Quantitative easing – when Central Bank creates money and buys bonds to reduce bond yields and

- Helicopter money – when the central bank creates (prints) money and gives it to everyone in the economy.

- Free market supply-side policies – reducing government intervention in the economy, e.g. lower taxes

- Interventionist policies – government spending on education and training

- IMF bailout – IMF give money to stem the loss of confidence and implement structural adjustment policies, e.g. better tax collection, privatisation, price liberalisation.

- Government bailout of industries/banks. To prevent loss of confidence in financial sectors.

Example – March 2020

In March 2020, the coronavirus has caused a sharp shock to demand – leading to recessionary pressures. It has caused a plummet in the oil price and the stock market falls. Some sectors of the economy have been particularly hard hit – travel, leisure, the gig economy. It is not known whether it will prove a temporary blip or turn into a full-scale recession. What is the best response to this crisis?

- Interest rate cut – The Bank of England and the Federal Reserve have cut interest rates. This will provide some relief to businesses and homeowners (they will have lower mortgage costs). However, it is unlikely to stimulate demand or make that much difference. In a difficult climate, business won’t start investing because of a minor cut in interest rates. Many gig-economy workers will not notice the interest rate cut. In essence, the interest rate cut is outweighed by negative sentiment.

- Income tax cut . Proposed by the White House, a payroll (income) tax cut increases disposable income and in theory, may encourage spending. However, an income tax cut doesn’t help those most affected by the crisis. Those made unemployed or the self-employed who see a fall in income. Also, many householders will probably save the tax cut – because of low confidence and uncertainty.

- Helicopter Money . This involves the Central Bank creating money and giving a fixed amount to everyone. This avoids means-testing and means those badly affected will get some income. In normal circumstances, printing money causes inflation. But, at the moment, there is a greater threat from deflationary pressures.

- Higher unemployment/sickness benefits . Higher benefits for those sick or unemployed – and make it easier to claim benefits. This will make big difference to those on the fringes of the economy. It will enable them to keep spending and pay their rent. Higher benefits are disliked by those who think it creates disincentives to work.

- Expansionary fiscal policy – Higher spending on public investment can kickstart the economy. But, this is a slow policy to act.

- Rent relief/mortgage relief – – Since this may prove to be a very short-run but steep crisis, the other option is to force banks to allow those with lost income to delay paying rent/mortgage relief or the government can offer relief on tax bills and rates. This could make a difference between bankruptcy and surviving for firms on the edge after fall in demand.

To some extent, there are no policies that can prevent a slump in demand, when you get a crisis like this. But, the government can

- Mitigate the effects for those left with no income – direct payment, rent relief, tax relief

- Prevent the temporary slump turning into larger-scale recession – if the private sector cuts back investment, there is a role for both monetary and fiscal policy to provide additional demand.

Example of 2008/09 Recession

The first policy response was a cut in interest rates. In the UK, rates fell from 5% to 0.5%

In theory, lower interest rates make borrowing cheaper, and this should encourage consumption and investment. In the long term this may lead to higher growth.

However, cutting interest rates was not particularly effective in 2008/09. This was because

- Interest rates were lower but banks didn’t want to lend – there was a shortage of funds.

- Time lags involved – homeowners on fixed rate mortgages don’t notice for perhaps 2 years.

- Consumers had an inelastic response to lower rates, people didn’t want to spend because of economic climate

There was also a government bailout out for banks to prevent a loss of confidence in the financial system. This was a significant factor in preventing the crisis escalating.

Fiscal policy

In 2009 the UK, the government cut the rate of VAT to provide a fiscal stimulus.

In the US, there was a modest fiscal stimulus from the Obama administration.

The US also agreed to bailout large car firms which were at risk of going bankrupt. Bailing out car firms cost a lot, but it prevented a further rise in unemployment in the car and related industries.

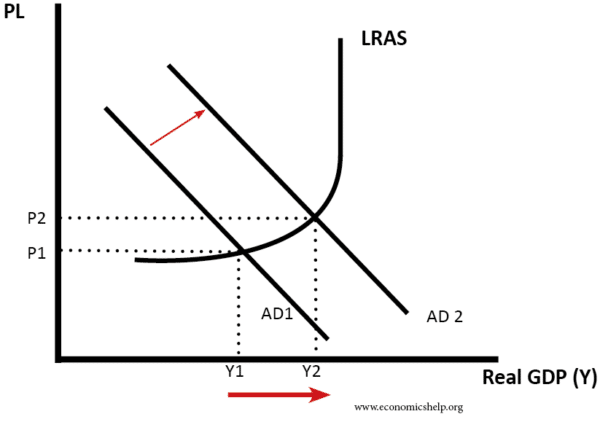

It helped mitigate the effect of falling income and provide some receovery. In theory, lower taxes should increase consumer disposable income and therefore help increase Aggregate Demand (AD).

The recovery in the US was strong than the Eurozone, where governments were more concerned about levels of government borrowing and there was no real fiscal stimulus.

The drawback of fiscal policy is that developing countries may already have large public debts and therefore they may be nervous about borrowing more. In the Eurozone this was a big factor.

Fiscal policy can also be ineffective in increasing AD, for various reasons. See: limitations of fiscal policy

Supply Side Policies

Some economic crisis arise from structural problems in the economy. For example, they may involve

- Corruption and failure to raise sufficient tax revenue

- Lack of competitiveness (e.g. rising wage costs)

- Poor productivity growth

- Low levels of education and training

In these cases, countries may not just need an increase in Aggregate demand, but also to reform the supply side of the economy to improve competitiveness. Therefore, it may be necessary to pursue policies such as:

- Education and training – increase skills and mobility of labour.

- Reduce the power of trades unions and minimum wages to reduce labour costs

- Reduce labour market protection which increases costs of labour and discourages firms from employing workers.

- Privatisation and deregulation

Devaluation

Devaluation is a policy to reduce the value of the exchange rate. This has the advantage of:

- Reducing the cost of exports and improving competitiveness

- Helping to boost export demand and therefore increase aggregate demand and economic growth.

For example, countries in the Euro-zone such as Italy, Greece and Spain have suffered from a decline in competitiveness which has contributed to lower growth and higher unemployment.

The drawback of devaluation is that it can cause inflationary pressures, but if an economy is experiencing low growth, then inflation may not be a problem.

Dealing with a debt crisis

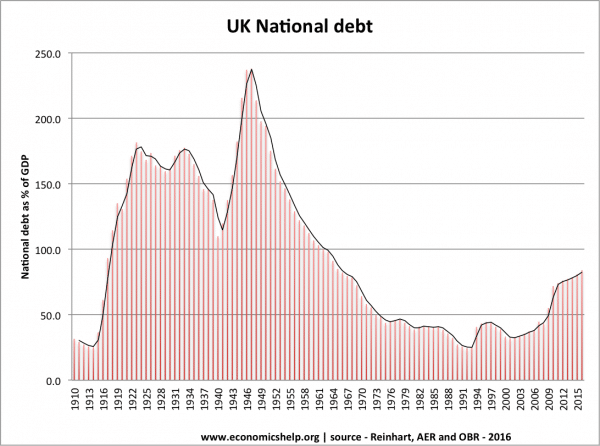

UK National debt – grew significantly during First and Second World War – long period of economic growth enabled the economy to pay off debt.

Many countries are making the mistake of trying to solve long term structural deficits, by sacrificing short term growth. In the name of long term structural change, governments are deflating the economy at a time when they should be doing the opposite.

The UK and US should be setting out plans to reduce the long term deficit, but this should not be involving short term cuts in spending on important capital investment. These long term policies should involve:

- Raising retirement age in response to an ageing population.

- Evaluating automatic health care spending in the US.

- Seeking to move people off long term benefit (e.g. helping those on disability allowance find less taxing jobs)

- Planned tax rises which are appropriate for incentives, efficiency and equality. e.g. US should be planning to raise tax on petrol, and tax on those high income earners who have befitted from recent tax cuts.

These kind of policies are sustainable and actually, make a big difference to long term budget situation. If you sell off assets or stop current capital investment projects, it is a very limited benefit to the long term budget. But, if you make changes to retirement age or entitlement spending this isn’t just a one off benefit, but a permanent improvement to the government’s fiscal position.

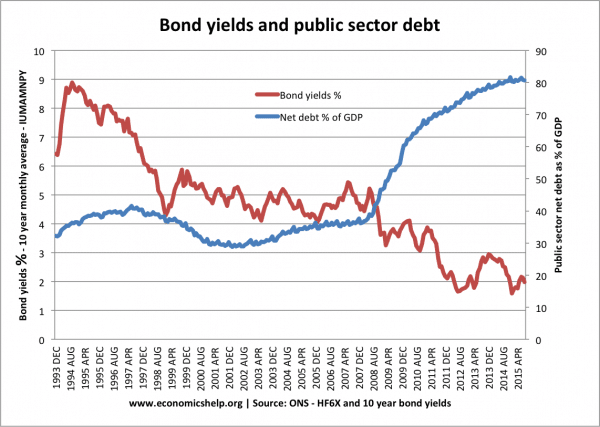

Bond yields in the UK and US are near record lows . If the government came up with plans to improve long term budget situation over next 20 years, markets would be willing to lend for short-term economic recovery.

Higher debt leads to lower bond yields (lower borrowing costs)

- Problems in recovering from recessions

- Policies to overcome recessions

- Marketplace

- Marketplace Morning Report

- Marketplace Tech

- Make Me Smart

- This is Uncomfortable

- The Uncertain Hour

- How We Survive

- Financially Inclined

- Million Bazillion

- Marketplace Minute®

- Corner Office from Marketplace

- Latest Stories

- Collections

- Smart Speaker Skills

- Corrections

- Ethics Policy

- Submissions

- Individuals

- Corporate Sponsorship

- Foundations

How to problem-solve through economic issues

Share Now on:

- https://www.marketplace.org/2021/01/01/how-to-problem-solve-through-economic-issues/ COPY THE LINK

HTML EMBED:

Identifying problems, especially economic issues, can seem obvious. What’s harder is figuring out the constraints that prevent them from being solved. But there are ways to arrive at solutions.

It’s the subject of a new book, “The Economic Superorganism” by Carey King, a research scientist and assistant director of the Energy Institute at the University of Texas at Austin. He recently spoke with Marketplace’s Andy Uhler.

The following is an edited transcript of Uhler and King’s conversation.

Andy Uhler: So when we think of the traditional economic model of the energy industry, what does that model or what do those models get wrong?

Carey King: Well, my narratives in my book are a little bit more about macroeconomic narratives, or how do people approach what the economy is and how does it grow in general? And so I simplify into the techno optimistic narrative of infinite growth and substitutability of technologies. On the opposite end of that spectrum is technorealism. Which is to say, well, there are constraints in the world, there are things like physical laws that we understand. And there are constraints of time. And we need to take these into account to actually understand what’s possible and how the economy evolves. So those are really the two narratives and they get applied to the energy industry. And by applying them, I would say, less accurate narratives to how the energy system interacts with the broader economy. I think we get answers from reports and analyses that are less accurate than we can do.

Uhler: Because you’re talking about using the data to then ask different questions and also sort of come up with different narratives and ultimately, different answers. Right?

King: Right. So everybody’s kind of coming up with their own narratives. In my book, the narratives are in some sense, strawmen, but they’re set up so that I can then go into detail about well, here’s a coherent way to think about what the economy is. And one of those ways is to say that the economy is an organism, like living organisms that need energy and resources to grow. It needs energy and resource consumption to maintain itself. And it has to distribute these resources internally. So by taking these kinds of physical aspects into account, we have a better interpretation for the economic patterns that we see.

Andy Uhler: I’m curious sort of how your model fits with this new shift in renewable energy. And in sort of the way that we think about zero carbon as well, how does it fit?

King: So a lot of the shift of the energy system and other industries in general is to lower marginal cost in general. So you might have higher capital costs, which we take into account or when we think about things like solar and photovoltaic systems and batteries, they have a high upfront capital cost, lower marginal cost. And this is essentially the same kind of growth pattern we see in biology and ecosystems in the sense that the last bits of growth of an animal consume less energy than the previous set. So it’s a similar pattern that we might see in ecosystems.

Stories You Might Like

OPEC has to decide whether it will continue to curb oil output

How will the world respond to the European Union’s proposed carbon border tax?

David Brooks on what’s responsible for America’s class divisions

What we get wrong about the energy grid

There’s a new website publishing news stories in Texas. It’s run by Chevron.

How fantasy football became a billion-dollar industry

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on . For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.

Latest Episodes From Our Shows

Americans have blown through excess pandemic savings. What does that mean for the economy?

New drugs transform weight loss industry

Gen Z is taking on more credit card debt

U.S. rents have grown faster than wages for the past 5 years

9 ways to strengthen the global economic response to COVID-19

Governments in developing economies lack the resources to do fiscal stimulus. Image: REUTERS/Thomas Mukoya

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Khalid Abdulla-Janahi

Erik berglof.

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} COVID-19 is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, long-term investing, infrastructure and development.

- We need to find new ways of funding the IMF and World Bank.

- The G20 could make a “whatever-it-takes” statement, promising additional capital if the situation further deteriorates.

- We need to bring together the global financial safety net, the development finance architecture and the private sector to tackle the crisis.

The IMF and the World Bank – the two organizations at the centre of development finance – are organizing their (virtual) Spring Meetings this week. They are doing so at a time when the COVID-19 pandemic is exposing the global financial safety net and the development finance architecture to the most serious shock since both organizations emerged out of the ruins of two world wars and the Great Depression.

Have you read?

This is the effect coronavirus has had on air pollution all across the world, coronavirus has exposed the digital divide like never before.

We urgently need to find new ways of securing funding for these multilateral institutions, including from the private sector, and, in the process, bring them closer together. This will require the same kind of leadership and innovative thinking and institution-building that marked their founding.

The two sides of the COVID-19 crisis – the medical emergency and economic impact – are closely intertwined. Many emerging and developing economies are actually hit first by the economic impact. Falling commodity prices, drops in tourism revenues, reduced remittances from citizens abroad and the rapid outflows of capital are ravaging their economies, even before the virus has taken hold. The economic devastation, in turn, will undermine their capacity to respond to the virus and threatens social and political stability in the medium term

The first responses from the IMF and the World Bank, and the regional development banks, have been powerful and welcome, but the demands on them will only increase as the crisis accelerates in the emerging and developing world. To effectively fight the virus and mitigate its broader impact, these institutions must be allowed to use their existing resources more effectively and ultimately they will need additional resources.

We suggest three reforms each to the global financial safety net, the development architecture and the capacity of the core institutions to crowd in the private and institutional capital.

The global financial safety net, with the IMF at the core, but complemented by a patchy and incomplete system of regional arrangements, mainly in Europe and Asia, is critical in providing liquidity and maintaining financial stability. Yet the current firepower of the IMF is insufficient to deal with the magnitude of this crisis. The IMF is already processing more than 90 requests from countries for emergency financing, and another 50 or so are in the wings. Countries need liquidity to address the medical emergency, but most of all to deal with the economic impact. There have been many ideas proposed for how to strengthen the global financial safety net, several of them discussed in the final report from the G20 Eminent Persons Group on Global Financial Governance (EPG) presented a couple of years ago.

1. Establish liquidity support lines

One such proposal was to establish a liquidity facility to which prequalified countries in need could turn. Prequalification could avoid the stigma associated with applying for support.

2. Give the IMF a role in a network of central bank swap lines

Such liquidity lines could be supplemented by the IMF intermediating support lines from systemic central banks to central banks in well-run emerging economies with liquidity problems.

3. Issue Special Drawing Rights

Proposals 1 and 2 would rely on the IMF’s existing resources and would still not meet the enormous liquidity requirements that will eventually lead to solvency threats in many countries. The most direct way to provide additional capital to the IMF would be to issue additional Special Drawing Rights (SDR), the special currency through which the member states support the IMF. The EPG carefully avoided this proposal, due to the limitations to its mandate, but an SDR issue would both increase firepower and offer a valuable stimulus to the global economy.

The World Bank has responded with a massive effort to help address both the medical and economic emergencies. It has strong expertise in the health and well-functioning cash transfer programmes and local community schemes in a very large number of countries that can be used to reach the most vulnerable, but its resources are also insufficient. As the economic impact from lockdowns and supply disruptions starts to bite, the World Bank’s financing needs will increase dramatically. Most governments in emerging and developing economies lack the resources to do meaningful monetary and fiscal stimulus.

Fortunately, many of the multilateral development banks (MDBs) were recently recapitalized or have free capacity, and can respond in the short term. But on the current trajectory, they will run out of “headroom”, impeding their ability to respond. Added to this, the quality of their portfolios will deteriorate as the economic impact from the pandemic works its way through the system. There are already signs that the costs of borrowing are going up for some of the weaker institutions. At some point, the rating agencies will look at their portfolios and the creditworthiness of their shareholders.

4. Establish liquidity backstop for MDBs

One innovation that could help the MDBs increase their lending capacity would be to provide them with a so-called liquidity backstop. Unlike commercial banks most multilateral development banks lack automatic access to support from governments in the case of a liquidity shortfall. Rating agencies would upgrade them if a group of central banks came together, possibly intermediated through the IMF, and provided a liquidity facility. The European Investment Bank has access to such support from the ECB.

5. Introduce new form of equity capital

A related proposal would be to provide the development banks with a new form of capital. Today they have two types of capital – paid-in capital which counts as equity on the banks’ balance sheets; and callable capital which can only be used when a development bank is closed down to pay off bondholders. It would be useful to have an intermediate form of capital that could be called in when banks are exposed to a shock like the current one. Again rating agencies would recognise such support in their ratings. The European Stability Mechanism has this type of contingent capital.

6. Make a G20 “whatever-it-takes” statement

Even if these two ideas could not be realized at the moment, the G20 could, with support from other key shareholders, make a “whatever-it-takes” statement, promising that additional capital would be forthcoming if the situation further deteriorated. While such a statement might not immediately impress rating agencies, it could inspire innovation and big ideas inside and outside the MDBs. It would also reassure governments in the worst-hit emerging and developing economies that resources will be forthcoming.

Responding to the COVID-19 pandemic requires global cooperation among governments, international organizations and the business community , which is at the centre of the World Economic Forum’s mission as the International Organization for Public-Private Cooperation.

Since its launch on 11 March, the Forum’s COVID Action Platform has brought together 1,667 stakeholders from 1,106 businesses and organizations to mitigate the risk and impact of the unprecedented global health emergency that is COVID-19.

The platform is created with the support of the World Health Organization and is open to all businesses and industry groups, as well as other stakeholders, aiming to integrate and inform joint action.

As an organization, the Forum has a track record of supporting efforts to contain epidemics. In 2017, at our Annual Meeting, the Coalition for Epidemic Preparedness Innovations (CEPI) was launched – bringing together experts from government, business, health, academia and civil society to accelerate the development of vaccines. CEPI is currently supporting the race to develop a vaccine against this strand of the coronavirus.

Yet, the governments behind both the IMF and the development banks are also weakened by the crisis and domestic needs will be gigantic. New ways must be found to crowd in private and institutional capital. The EPG Report pointed to a number of steps which could be taken, all on a much greater scale than today.

7. Allow the IMF to borrow from markets

The IMF could be allowed to borrow in the capital markets, potentially using currently unused SDRs as collateral. Such lending would have to be associated with important safeguards to prevent private sector bias in lending, but it could significantly increase IMF firepower.

8. Pool balance sheets to increase MDB borrowing capacity

On the side of the development finance institutions, there should be scope for more pooling of balance sheets, after all they have more or less the same shareholders, if in somewhat different constellations. There are limits to what can be achieved through such efforts, but particularly for the smaller institutions with concentrated portfolios this could prove very important. As a by-product, the participating institutions would be encouraged to standardize loan agreements and generally become more coherent as a system.

9. Crowd in private and institutional capital on country platforms

A core EPG proposal is the establishment of country platforms where governments can coordinate their collaboration with international financial institutions, including bilateral donors and the entire UN system. These platforms, now being piloted in a large number of countries, should be opened up to the private sector and be used to crowd in private and institutional capital by mitigating risk for investors, but also to ensure that agreed governance standards are enforced and debt sustainability requirements respected.

When the EPG was first set up there were questions as to why the group should deal with both the development finance architecture and the global financial safety net in the same report. The COVID-19 crisis has proven how intimately linked these are. The nine ideas we have put forward here would bring together the global financial safety net, the development finance architecture and the private sector to enable the powerful global response that the current crisis requires.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Health and Healthcare Systems .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How midwife mentors are making it safer for women to give birth in remote, fragile areas

Anna Cecilia Frellsen

May 9, 2024

From Athens to Dhaka: how chief heat officers are battling the heat

Angeli Mehta

May 8, 2024

How a pair of reading glasses could increase your income

Emma Charlton

Nigeria is rolling out Men5CV, a ‘revolutionary’ meningitis vaccine

5 conditions that highlight the women’s health gap

Kate Whiting

May 3, 2024

How philanthropy is empowering India's mental health sector

Kiran Mazumdar-Shaw

May 2, 2024

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

What are the Three Basic Economic Problems and Their Solutions?

What are the basic economic problems and why?

According to economics, the main challenge in an economy is to face basic economic problems. Every country and every society have to face these economic problems. There are three main basic economic problems in every economy. So, they are,

- What to produce

- How to produce

- For whom to produce

Economic problems are mainly caused by the lack of economic goods in an economy and the unlimited needs and wants of people.

You may be interested into read more,

Needs and wants: Meaning, examples and differences

Economic goods definition, characteristics, examples, vs free goods

Free goods characteristics, examples, & vs economic goods

Basic economic problems with examples.

1 st basic economic problem: what to produce.

This is the first question that arises from basic economic problems. If a society is to allocate its resources efficiently and effectively, a good solution to this problem must first be found. There are so many goods and services we need and want. However, first we must decide which good or service we produce. And how much will the product or service be produced? We cannot practically produce all the goods and services in our society because there are not enough resources for that. That means resource scarcity.

For Example: Should we produce more cars or more cakes?

2 nd Basic Economic Problem: How to produce

This question regards the mix of resources to use to create the goods and services we decide on in the above. Organizations are motivated to produce goods and services at a very low cost. Answering this question requires us to determine the production methods we use. This problem is about the choice of techniques for producing goods and services. Production of goods and services is possible through various methods. We mainly use two techniques. There are,

Labor-intensive techniques: In this technique, more labor is used in the production process than machines to produce goods and services.

Capital-intensive techniques: On the other hand, capital-intensive techniques include more physical capital and the least amount of labor. We use sophisticated machines and are assisted by computers to control them.

For example : You can produce ice cream manually (labor intensive) or with automatic machines (capital intensive).

Four factors of production are used to produce goods and services.

What are the four factors of production?

3 rd Basic Economic Problem: For whom to produce

This is the last basic economic problem, but not the least. When an economy is built, it must be decided which community it will target and produce goods and services for. Who will use these goods and services in the end is a very important question. Which population—the vast majority or a select few—will be the objective of that production? Answering this question has to do with the distribution of income among individuals in the entire population. We earn by supplying factors of production. In relation to the resources we provide, we get an income. Land owners get rent; capital owners get interest; labor providers get wages; and entrepreneurs get the opportunity to earn profit, etc. Depending on their income level, each person and family has a different share of the production that they can consume.

How can we solve economic problems?

In this part, we will discuss how different types of economies solve these basic economic problems.

Solution to Basic Economic Problems in a Capitalistic Economy / laissez-faire economy/ market economy,

The market mechanism is used in a capitalist system to allocate different resources. The dynamics of supply and demand are used to establish prices for a variety of goods and services, including the cost of production variables. Producers can choose what to produce thanks to the free market system.

In comparison to less-in-demand goods or services, more of the more-in-demand commodities are produced since consumers can afford to spend more on them. The cost of many production elements, including technology, influences the choice of production techniques or procedures. A rational producer will employ materials or methods that are relatively less expensive on the market.

The amount of factor earnings that the employers of the factors of production receive determines the population’s purchasing power. This makes it easier for producers to pinpoint the customers for whom they should produce things in higher or lower quantities. Only when there is competition and no artificial disruption to the natural flow of supply and demand for goods does the price mechanism function well.

Solution to Basic Economic Problems in a Command Economy :

In a command economy, the government has a big say in what happens. To address the basic economic problems, the government commits to organizing, managing, and regulating all significant economic activities. The Central Planning Authority develops and implements all significant economic policies.

According to the nation’s priorities and the resources that are available, the central planning authority determines the types of goods and services that will be produced. Resources are distributed more widely for those items that are necessary for the country. Growth, equality, and price stability are the primary goals of the state. To accomplish the aforementioned goals, the government enacts fiscal policies such as taxation, spending, public debt, and deficit financing programs.

Solution to Basic Economic Problems in a Mixed Economy :

Above both economic systems have their drawbacks. As a result, a new economic system known as the mixed economy has arisen as a combination of the two systems mentioned above. Hence, a mixed economy is described as an economic structure in which the public and private sectors coexist and cooperate for the benefit of the nation.

In such economies, the free price mechanism and the controlled price mechanism are used to solve basic economic problems.

Since the private sector uses a free price mechanism, prices may vary according to supply and demand for certain items. As a result, the private sector is able to produce items based on consumer demand and market prices. By its monetary or fiscal policies, the government may manage and control private sector production. The planning authority, on the other hand, uses a controlled price mechanism for the public sector. The central planning body thus determines the commodities and services to be produced in the public sector. As a result, the government ensures social fairness by its participation in the mixed economy .

Related articles

What are the four types of goods in economics?

Private goods definition, characteristics, examples

Public vs private goods: What are the differences?

Public goods characteristics, examples, graph, types, and issues

Common resources characteristics, examples, & vs public goods

Similar Posts

Market Equilibrium – With Examples & Graph

What is the market equilibrium? Market equilibrium definition Market equilibrium can be identified as the market condition where market supply…

Perfect Competition Graph in Short Run and Long Run

What is the perfect competition? A perfectly competitive market is a hypothetical market structure where a large number of buyers…

Accounting Profit and Economic profit – Meanings & Differences

What is the main difference between accounting and economic profit? Accounting profit = Total revenue – Explicit cost. But, Economic…

Sunk cost meaning and sunk cost fallacy relationships

What is sunk cost meaning? Sunk cost definition Sunk cost meaning: The cost that you have incurred already and cannot…

Price Floor Definition, Graph, Examples and Effects

Price floor definition What is a price floor? A price floor implies that the government has fixed the minimum permitted…

8 Microeconomics Graphs You Must Need To Know

Essential Graphs for Microeconomics There are many graphs in microeconomics. In this article, we will discuss about an eight main…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

A business journal from the Wharton School of the University of Pennsylvania

How to Manage the Top Five Global Economic Challenges

November 1, 2017 • 14 min read.

The world’s economic system faces five tough challenges. Multilateral institutions offer the best hope of managing them, notes this opinion piece by the secretary general of the European Stability Mechanism.

- Public Policy

The world’s economic system has been through a lot in recent years — from the challenge of the financial crisis to income inequality, the pressures of immigration, changing technologies and geographic shifts in production, to name a few. In this opinion piece, Kalin Anev Janse, secretary general and a member of the management board of the European Stability Mechanism (the eurozone’s lender of last resort), considers five major challenges and why international organizations offer the best hope for managing them.

A year ago, we were shaken by geopolitical shifts with unpredictable ripple effects. The situation looks no more stable today. The Brexit vote and the U.S. presidential election outcome signal dramatic changes in cooperation globally and a push for more protectionism. In practice, these votes called into question the multilateral institutions and international collaboration among countries that embody that cooperation. In autumn 2017, we gathered together a group of senior officials from the 13 largest international organizations to try to crack these problems.

What happened?

Exactly 10 years ago, in 2007, the first signs of the Great Recession emerged. By 2008, the U.S.-led subprime crisis evolved into a global financial crisis. By 2010, Europe had become engulfed in its own crisis, throwing financial markets into turmoil and several sovereigns into a downward spiral of debt and banking crises.

Despite the current ongoing recovery, and the successful economic rebound both in North America and Europe, worrying trends became apparent in 2016. Some major players demonstrated a reduced commitment to multilateral cooperation, criticism of open and free trade, and fading interest in climate change. This new landscape increased uncertainty and poses a threat to more buoyant macroeconomic and financial fundamentals. It also puts a strain on relations between major players internationally, as well as between citizens domestically. In countries like the U.S. and the UK, it abruptly split societies in half and threatened a reverse of seven decades of international cooperation.

All these elements are putting pressure on international organizations as well. International organizations are increasingly called upon to redefine their role to ensure that their programs and activities are still relevant in this evolving political and macroeconomic landscape. They are also pushed to show how they add value to citizens’ lives. At the same time, they need to maintain lean structures to minimize the burden on taxpayers, and enhance efficiency and effectiveness of their activities. So, what has changed?

Five Major Shifts that Rocked Our World

There are five trend shifts globally that by their nature call for international cooperation, but they have been underestimated, undervalued and under-addressed both nationally and internationally. The results shook our world with an unforeseeable force.

1. Growing Income Inequality

People have an age-old tendency to compare themselves to their neighbors, especially when it comes to wealth. We are less concerned about our absolute level of wealth, but look more at what we have and own in relative terms to the people around us. Global private wealth reached a record $166.5 trillion in 2016, an increase of 5.3% over the previous year, according to a report by the Boston Consulting Group (BCG). 1 In 2015, the increase was 4.4%. Faster economic growth and stock price performance mainly drove the rapid increase.

But this growth is not spread equally. Private wealth in Asia-Pacific is likely to surpass that of Western Europe by as early as the end of this year, BCG’s analysis shows. This could be an economic shock for many citizens of traditional western powerhouses. Such changes need to be watched and managed carefully as they tilt economic and political power. British geographer and politician Sir Halford Mackinder used to say: “Unequal growth among nations tends to produce a hegemonic world war about every 100 years.” We can only hope he is wrong.

“Just eight men now own the same wealth as 3.6 billion people globally, more than half of humanity….”

Inequality is getting ever worse. A tipping point was reached in 2015, when the richest 1% in the world owned as much as the rest of humanity. This trend has continued and further accelerated. Just eight men now own the same wealth as 3.6 billion people globally, more than half of humanity, according to a January 2017 Oxfam report. Income inequality is on the rise as the affluent continue to accumulate wealth, often at the expense of the poorer.

Richard Reeves points out in his book Dream Hoarders , that we shouldn’t only be worried about the top 1% or 0.01%. More importantly, in some countries, like the U.S., there is a widening gap in society between the upper middle class and everyone else. (Reeves defines the upper middle class as those whose incomes are in the top 20% of U.S. society.) These growing disparities are reflected in family structure, neighborhoods, attitudes and lifestyle. The top income earners are becoming more effective at passing on their status to their children, thus reducing overall social mobility and increasing social divisions, along class as well as income lines.

And all this has an interesting twist: the inequality paradox. Despite the progress in reducing global poverty and reduction of inequality among countries since 1980s, income inequality within countries has been rising. These days, almost one-third of global inequality is attributable to in-country inequality (figure 1), making clear why many voters across the western world feel as they do.

2. Technology Driving Change in Jobs

How disruptive will the effect of globalization and technological advances be on labor markets? That is a key question today. Over the last three decades, advanced economies have seen labor-intensive sector jobs move to emerging markets. In other cases, new technologies have made certain occupations obsolete. UNCTAD (United Nations Conference on Trade and Development) released a policy brief last year that said robots could take away two-thirds of jobs in developing countries.

We see some of these shifts already. Today’s five largest global companies are: Apple, Alphabet (Google), Microsoft, Amazon, and Facebook. They employ around 720,000 people. A decade ago, the big five were completely different: Petrochina, Exxon Mobile, General Electric, China Mobile, and Bank of China. They employed around 1.3 million people. What a decade can do! Today’s five biggest companies are all technology companies. Their market capitalization is 30% higher than that of the top five a decade ago; they achieve that with a whopping 44% less staff (figure 2). This has a large impact on labor markets and jobs.