Home » Letters » Insurance Letters » Request Letter for Surrender of Insurance Policy

Request Letter for Surrender of Insurance Policy

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, surrender request letter for insurance policy.

The Manager, __________ (Name of Insurance Company), __________ (Insurance Company Address)

Date: __/__/____ (Date)

Subject: Surrender request for Insurance policy number ________ (policy number).

Respectfully, I _________ (Your Name) am holding insurance policy from your insurance company ______________ (Insurance company name) taken on _______(Date of Insurance Policy Taken) and having policy number __________ (Policy Number). The same is due for maturity on _______(Policy Maturity Date). I want to surrender the policy due to ___________ (reason for surrender)

I request you to kindly complete the formalities of the claim of policy and transfer the surrender policy amount of this policy to my account no. ____________ (account number), which is already updated in records and terminate the aforesaid policy.

I am enclosing _________ (insurance policy bond paper/policy surrender request/ (bank account statement/cancelled cheque/bank passbook copy), photo, insurance application form) along with the application.

Your immediate action will be highly appreciated.

Signature: _____________ Your Name: __________ Policy Number: __________ Mobile number: _________

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- An insurance policy surrender refers to the process where the policyholder terminates their insurance policy before its maturity date and receives the surrender value, which is the amount accumulated in the policy until the surrender date.

- Common reasons for surrendering an insurance policy include financial difficulties, changes in financial goals, dissatisfaction with the policy terms or returns, or the availability of better investment opportunities.

- Yes, policyholders have the option to surrender their insurance policies before the maturity date. However, surrendering a policy may lead to a loss of benefits, and the surrender value received may be less than the premiums paid, especially in the early years of the policy.

- Documents required for surrendering an insurance policy typically include the original insurance policy document, a duly filled surrender request form, identification proof, and bank account details for surrender value transfer.

- The processing time for a policy surrender request varies among insurance companies. However, insurers generally aim to process such requests promptly, and the surrender value is usually disbursed to the policyholder's bank account within a few weeks of the request submission.

Incoming Search Terms:

- request letter format for surrender of life insurance policy

- sample letter for insurance policy surrender

- insurance policy surrender letter format

- letter writing format for surrender of life insurance policy

- letter format for surrender of life insurance policy

By lettersdadmin

Related post, request letter for change of life insurance policy ownership – sample letter requesting change of life insurance policy ownership due to death of previous policy holder, request letter for changing beneficiary on insurance policy – sample letter to insurance company for changing beneficiary, inquiry letter about package insurance options – sample letter inquiring about package insurance options.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Congratulations Letter to Colleague On Promotion – Sample Letter to Congratulate Colleague On Promotion

Food diet chart request letter – sample letter requesting food diet chart, letter to embassy for visa refusal reason – sample letter requesting reason for visa refusal, holiday request letter – sample letter requesting leave, privacy overview.

- Life Insurance

How to Write a Life Insurance Cancellation Letter: 5 Examples

Updated 04/22/2024

Published 09/22/2021

Bob Phillips, BA in Sociology

Licensed insurance agent

Cake values integrity and transparency. We follow a strict editorial process to provide you with the best content possible. We also may earn commission from purchases made through affiliate links. As an Amazon Associate, we earn from qualifying purchases. Learn more in our affiliate disclosure .

Have you ever had to cancel something you were paying for each month, like a gym membership or a magazine subscription? What kind of experience did you have?

Sometimes when you cancel something, the entity you’re canceling with can make it difficult by trying to sell you something different or entice you to stay for a lower price, or by asking the dreaded “Why?” question.

Fortunately, canceling a life insurance policy is as easy as writing a letter. Unless you want to, you won’t need to talk with anyone on the phone, particularly the agent who sold you the policy and could be getting charged back some of their commission money.

After reading this article, not only will you have some examples of cancellation letters, but you’ll know what to include in your cancellation letter.

Jump ahead to these sections:

When do you need to write a letter to cancel your life insurance policy , what should you include in a life insurance cancellation letter, steps for writing a life insurance cancellation letter, life insurance cancellation letter examples, frequently asked questions about cancelling a life insurance policy.

The answer to this question depends on what type of life insurance policy you want to cancel.

For a term life policy, you could just not pay the premium when it’s due and let the insurance company cancel the policy for non-payment. You could also call the agent or life insurance company and cancel, or you could write the insurer a cancellation letter.

For a permanent type of life insurance policy, like whole life, it’s a little more complicated regarding when it comes to canceling a life insurance policy . This is because whole life insurance policies not only have a life insurance protection element, as does term life, but whole life also has a cash value component. Some of your monthly premium payment goes into a special account and accumulates value over time, kind of like a savings account.

When you cancel your whole life insurance policy, you can receive some of your money back if you’ve had the policy long enough. The amount of money you’ll receive is the “surrender value” of the policy. You won’t get all of your premiums back, but you will get some.

With whole life insurance, you have a couple of other options besides canceling. You can let the cash value that’s accumulated in the policy pay your premiums until the money runs out, or you can stop paying your premiums and keep the whole life policy with a reduced death benefit.

So when do you need to write a cancellation letter for a whole life insurance policy to life insurance companies ? The best answer to that question is every time. Though it’s optional, even if you cancel by phone, it’s wise to confirm the cancellation by sending the insurer a cancellation letter. But again, it’s not necessary with a term life insurance policy.

Once you’ve decided that you want to cancel your life insurance policy and send that notification to the life insurance company, you’ll need to know what information you need to include in your cancellation letter. Here’s what to have:

- The date you wrote the letter

- Your name and mailing address

- The insurance company’s name and mailing address

- The department you are sending the letter to (normally Cancellations Dept.)

- The policy number

- The body of the letter informing the insurance company of your wish to cancel

- The date you would like the cancellation to become effective

- A request that the insurer confirm your cancellation in writing

- Your signature

There are six steps you’ll need to take as you write your cancellation letter:

- Find your policy (you’ll need the policy number)

- Get the mailing address of the life insurance company

- Get the life insurance department name you should direct your letter to

- Write your letter

- Make a copy of your letter for your files

- Mail the letter (mail it “Return Receipt Requested” if you want confirmation that the life insurance company received it)

Now that you know when and how to write a letter to the life insurance company to cancel your life insurance policy, seeing some examples will pull everything together for you. Here are five:

August 3, 2021

Bradley Filmore 4567 Drawbridge Rd. Lafayette, CA, 86709

Trusted Benefit Life Insurance Company 156 Maple Ave. Philadelphia, PA, 19007

Attn: Cancellations Department

RE: Life Insurance Policy #3697503

Please consider this letter as a formal request to cancel the above-referenced life insurance policy effective August 31, 2021. In addition, please stop all debits or charges for premium payments.

I am also requesting written confirmation of this cancellation and the return of any unused premiums. In addition, the cash value of the policy should also be sent with any returned premium. This action needs to occur within 30 days from the receipt of this letter.

Bradley Filmore

National Mutual Life Insurance Company Attention: Cancellation Department 8512 Maryland St. Columbia, MD 21097

Re: Cancellation of Policy Number: 6970325

To Whom It May Concern:

The purpose of this letter is to inform you that I have decided to terminate my life insurance coverage effective immediately.

The reason for my decision is based on finding a more comprehensive policy for a lower cost. Please send me a written confirmation of the cancellation for my records at your earliest convenience.

Sincerely,

Lee Loughnane 672 Chicago St. Great Bend, Indiana 42586

Attn: Cancellation Department Universal Benefit Life Insurance Co. 672 Discovery Blvd. New York, NY 10027

Re: Cancellation of Life Insurance Policy #286471

To Cancellation Department:

I regret to inform you that I, Penelope Mason, have decided to terminate my life insurance coverage effective immediately.

The reason for my decision is based on losing my job and being unable to pay premiums. Please send me a written confirmation of the cancellation for my records at your earliest convenience.

Penelope Mason 158 Euclid Ave. San Diego, CA 91954

Texas Life Insurance Company 677 James Street Dallas, TX 76943

Attn: Texas Life Insurance Company Cancellations Department Re: Cancellation of Life Insurance Policy #459203

To whom it may concern,

This letter is a formal request to cancel the life insurance policy referenced above.

Please stop all debits or charges for future premium payments upon receipt of this letter.

I would like to cancel the policy immediately. Therefore, I am requesting the refund of any unused premiums within a period of 30 days from the receipt of this letter and a written confirmation of the cancellation for my records at your earliest convenience.

Thomas Tanner 90378 Oliver Circle Tampa, FL 33676

Andrea Gilbert 676 Idaho Ave. Kansas City, MO 58947

Trans Union Life Insurance Company 67294 Broad Avenue Birmingham, AL 86377

Attn: Cancellation Department RE: Life Insurance Policy #759824

Please allow this letter to constitute my formal demand for cancellation of the above referenced life insurance policy. Please make this cancellation effective as of August 15, 2021. I am also requesting written confirmation of this cancellation, along with a refund for unused premiums, within 30 days from the receipt of this letter.

Andrea Gilbert

Here are some questions that people often ask about canceling a life insurance policy:

Do I get any of my money back when I cancel my life insurance policy?

If it’s a term life insurance policy, you won’t be receiving back any of the premiums paid, no matter how long you’ve been paying them. However, if you cancel in the middle of a billing cycle, you should get a refund for the period of time between your date of cancellation and your next premium payment date.

With whole life insurance, you may get some money back, depending upon how long you’ve been paying for the policy. Typically, in the first 2-3 years, your policy has no “surrender value.”

Each year after that, you can get back a percentage of the accumulated surrender value (which will be less than the premiums you paid for the policy). Your life insurance policy will have a detailed breakdown of surrender charges deducted from your policy’s cash value if you cancel your policy.

What are the most common reasons people cancel their life insurance policy?

There are many different reasons people cancel their policy. Some of those are:

- They can no longer afford the premiums

- They no longer need the policy (i.e., the kids graduated college or the mortgage is paid off)

- They found more affordable coverage elsewhere

- They want to get the cash value out of a permanent life insurance policy, such as whole life insurance or universal life insurance

- Some people cancel for life insurance and divorce

Can my life insurance company cancel my policy?

Your life insurance company cannot arbitrarily cancel your policy unless they have a specific reason written into your policy contract. The two reasons are:

- You didn’t pay your premiums. Your policy should be paid on the due date, but life insurers give you a 30-day grace period when you can still pay your premium and not have the policy canceled, even though you were late paying it.

- You were intentionally dishonest in your application. In essence, you committed a fraudulent act if you knowingly provided misinformation that would have caused the insurer to reject your application or charge you additional premiums because you weren’t truthful about factors like your smoking status or your health history.

A Final Thought

Canceling life insurance is relatively easy to do, but be aware that you will be giving up financial protection for your family that you once had a reason for buying. Before canceling, consider discussing your reasons for wanting to cancel with a trusted friend or a financial advisor.

Categories:

- Closing & Managing Accounts

You may also like

How to Cancel Life Insurance Policy Online or By Mail

6 signs it’s time to terminate a term life insurance policy.

How to Find Out if a Deceased Person Had Life Insurance

How to Find a Deceased Parent’s Life Insurance Policy

How to cancel a life insurance policy

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our content is backed by Coverage.com, LLC, a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed . Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Auto insurance

- • Life insurance

- Connect with Mary Van Keuren on LinkedIn Linkedin

- Get in contact with Mary Van Keuren via Email Email

- • Comparing insurance policies

- Connect with Lisa McArdle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . This content is powered by HomeInsurance.com (NPN: 8781838). For more information, please see our Insurance Disclosure .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

This content is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate.com. HomeInsurance.com LLC services are only available in states where it is licensed and insurance coverage through HomeInsurance.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

People buy life insurance for a purpose, whether it is to replace income, cover debts, send a child to college or for many other reasons. Sometimes, it makes sense to cancel a life insurance policy if the need has been satisfied, like children growing up or paying off debt. Regardless of your reason to cancel a life insurance policy, it is relatively easy to do. The process depends on the type of life insurance policy you have.

Life insurance options if you have financial struggles

Rising inflation, job loss, job stagnation and other misfortunes are causing many to have financial struggles. With less money to go around, it could mean you can no longer afford your premiums. While canceling your life insurance policy may be the right choice, it may not be your only option if you are struggling financially.

Depending on the type of insurance policy you have and when you got it, these options may be a viable alternative to canceling your life insurance policy:

- If you have a whole life policy, and you have had it for at least a decade, you may have built up enough cash value in the policy to be able to use your dividend payments to pay your premiums.

- If your health has improved since you purchased a life insurance policy , you can request a new medical exam to prove that you are in better shape and thus eligible for lower premiums. This could be a good option if you have quit smoking or no longer have a health issue that you had in the past.

- If you think you can afford lower payments, talk to your insurer about whether you can lower your rate of coverage. Some companies will allow you to reduce the amount of death benefit — from $500,000 to $100,000, for example — to allow you to take advantage of lower premiums. If, after some time passes, you find yourself in better financial shape, you can always request an increase in coverage back to your original amount.

How to cancel life insurance

Canceling a life insurance policy is typically not hard. You have the right to cancel anytime during the free look period , which lasts anywhere from 10 to 30 days depending on what U.S. state you live in. If you realize within that period that you have changed your mind about buying the policy, you can call or write to your insurer to cancel and any premiums you have paid will be fully refunded.

After the free look period, however, how you cancel depends on the type of policy you have.

Canceling a term life insurance policy

Term life insurance , as the name suggests, provides coverage during an agreed-upon term of time, such as 10 or 20 years. Premiums tend to be low for this type of insurance, and the coverage features a simple death benefit and no investment vehicles within the policy.

Canceling your term policy couldn’t be easier: just stop paying your premium and write a letter or call your insurer to let them know you are canceling the policy. Check the website of your insurer, too — there may be a form there you can fill out to terminate your policy.

Surrendering a whole life insurance policy

Whole life insurance is different from term insurance in a couple of ways. It never expires, for one thing, and the premiums are usually higher than for term insurance. The big difference, though, is the investment component : a portion of the money you pay in premiums goes to build up equity in the policy, which you can draw on during your lifetime.

Surrendering life insurance means that you want to opt out or cancel your life insurance policy. Surrendering or canceling your policy may mean that you might get a check from your insurer — but only if you’ve had the policy long enough to build up cash value. If you surrender in the first 10 years or so, fees will probably eat up any value that you have. If your policy is older, however, and you find yourself in need of money more than you are in need of a life insurance policy, you may be able to cash in your policy for a payout.

However, if you think you may need the death benefit in the future, there is an alternative that could be a better option. Instead of surrendering the policy, you could use the cash value as collateral and take a policy loan. It keeps the death benefit intact but gives you the cash infusion you need now. However, it’s worth noting that if the loan is not repaid, typically, the principal amount of the loan and any accrued interest is taken from the policy’s death benefit when the insured passes away and the beneficiary requests the proceeds from the policy.

Some insurers allow you to modify your policy so you keep some death benefits while paying a reduced premium or no premium at all, with all fees being paid by your equity in the account. But beware: if you just stop making payments without an agreement in place with your insurer, the policy could lapse. So, in this case, talk to your insurance agent to see what options are allowed by your policy.

Other options for a whole life insurance policy

If you do not want to surrender your whole life insurance policy, there are a few alternatives you might consider. One option is to look into a tax-free life insurance policy exchange, and another is to sell your life insurance policy for profit.

Tax-free exchange

A tax-free exchange, formally called a 1035 exchange , allows you to get rid of one life insurance policy and replace it with a new one, without paying taxes. With a tax-free exchange, you surrender your whole life insurance policy, and instead of collecting the money and depositing it into your personal account, you roll it over into a new policy, therefore avoiding income taxes.

Sell your policy

Another option if you no longer need a whole life insurance policy is to sell it . But keep in mind that this process can be complicated. You will need to find a few reputable brokers who will purchase the policy from you, and then get offers from each of them. The amount of money you can get from selling your whole life insurance policy varies, since the broker expects a commission for selling it. But if you need cash, it may be a good option. Keep in mind that it can take a few months to sell a life insurance policy.

When to cancel your life insurance policy

There are a number of reasons why you might want to cancel your life insurance policy. Here are some of the most common situations when it could make sense to stop paying for it:

- You no longer need coverage: If your family is grown and your spouse or partner is able to manage on their own without a death benefit, it may be that life insurance does not need to be part of your financial portfolio any longer.

- You are changing your investment strategy: You may have realized that the investment options of your whole life policy are not as good as another financial vehicle for long-term savings. A financial advisor can help you determine if you would be better off with, say, an annuity or mutual fund. If you have a whole life policy, cashing it in could give you a nest egg to invest in a higher-interest-bearing account.

- You cannot afford the premiums: If you are struggling to afford your life insurance premium, you may think about canceling your policy. Before you do, consider the options laid out above for those with financial struggles. You may be able to keep the policy in force by using one of those strategies to lower the cost of life insurance to meet your other financial obligations.

A good thing to remember is that your life insurance policy should be part of a greater financial strategy that you have in place to provide a secure future for yourself and your loved ones. If there are better ways to do that, it might make sense to cancel your policy and invest the money you would have paid in premiums into another savings vehicle.

Do you get money back when canceling life insurance?

The answer to this question is that it depends. If you have a term life insurance policy, which has no cash value component or investment option, the only possibility of getting money back is if you cancel in the middle of your payment cycle. Then, you may receive a check for any premium that has not yet been applied to your account — which is going to be a very small amount compared to the policy’s death benefit.

If you have a permanent life policy, and you have equity built up in the policy because you have been paying into it for a decade or more, you may receive a lump sum payment from your insurer. They will subtract any fees or outstanding loan balance out of this payment and send you the rest of the cash value of your policy. This, too, will probably be far less than your death benefit.

You lose your premium payments

It’s important to know what the consequences are for canceling life insurance. When it comes to your premium payments, it depends on the life insurance. In most cases your premium payments will be forfeited, and you will not receive anything for your previous payments.

The one exception to this is if you have whole life insurance and cancel it. You may have built up equity for all of the payments you have made so you may receive a lump sum payment from your insurer. Keep in mind, if you cancel whole life insurance in the first 10 or 20 years, you may have to pay surrender fees, which can greatly reduce the lump sum you get from the insurance company.

Frequently asked questions

Can you cancel a life insurance policy at any time, how do i know when to stop term life insurance, can i exchange my life insurance policy for an annuity, what happens when you cancel a life insurance policy, can your insurance company cancel your life insurance policy, can my beneficiaries take over my premium payments, is it possible to convert my term life insurance policy to a whole life insurance policy.

Related Articles

How to buy life insurance in 8 steps

Reduced paid-up life insurance

What to do if your life insurance company denies a claim

How to get life insurance with a pre-existing condition

Want to Surrender a Life Insurance Policy? Here's What Happens

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our editorial standards and how we make money.

Taking out a life insurance policy provides your family with financial protection following your death. When you take out a policy, you have the option of term life or whole life. Term life covers you for a set number of years, while a whole life policy remains in place for your entire life.

For one reason or another, you may decide that you want or need to cancel your life insurance policy. Rather than hanging onto it and continuing to pay into it, a common solution is to surrender it. Here’s what you can expect.

What Does It Mean to Surrender A Life Insurance Policy?

When you surrender your life insurance policy, you essentially cancel it. Surrendering is common for whole life insurance policies, which accrue cash value over time. By surrendering, you agree to take the cash surrender value (which is assigned by your insurance provider) while also forgoing the death benefit.

Can You Surrender at Any Time?

You can surrender your life insurance policy whenever you need to. Keep in mind, however, that the age of your policy could affect the money you receive. Generally speaking, the longer you’ve had the policy, the more you’re likely to get. Younger policies, on the other hand, might not pay out much (if anything) at all.

Many insurance companies have what’s known as a “surrender period” in place during the first few years. Surrendering during this time could mean that you get no money. Other insurers may impose steep penalties for canceling early on to recoup the costs associated with selling you the policy and getting it set up.

If you’ve decided that you no longer want or need your life insurance policy, the first step is to contact your insurance company. You may be able to write a letter of intent, or the company may require you to fill out a surrender form. Send the required information to the company and make sure they receive it. Once your insurer processes the request, you should receive the cash surrender value for your policy.

What About a Term Life Policy?

Term life insurance is a bit different from whole life. It’s only in place for a set number of years, as opposed to your entire life. You can renew it after the policy period ends, but it’s not always necessary.

Another significant difference between term and whole life insurance is that term life policies don’t accrue any cash value. If you decide that you want to surrender the policy before the end of your coverage period, you don’t receive any money for doing so. Canceling the policy means that you don’t have to make any more monthly payments.

Understanding Your Cash Surrender Value

As mentioned above, the longer you’ve had your life insurance policy, the more you’re likely to receive. What you get is known as the cash surrender value. While often confused with the cash value, the surrender value is generally lower. The reason for this is because of the costs associated with canceling your insurance policy.

Your insurer calculates your cash surrender value based on a few different factors:

The total amount you’ve paid into the policy

The performance of the investments your money is held in

Surrender fees

Essentially, the cash surrender value is what you receive after your insurance company takes out all applicable surrender fees, administrative fees, and any outstanding loans you might have through the policy. Different insurance companies charge different fees to surrender a policy. You should contact your insurer to find out the exact costs for canceling yours.

In general, the earlier you cancel your life insurance policy, the steeper the fees you pay. Some insurers may decrease the fee annually during the first 10 to 15 years of the policy, which means you’ll pay less the longer you wait. After this period ends, the company may not charge any fees. Again, check with your insurance company to get a better understanding of the fees you might have to pay if you decide to surrender your policy.

Tax Implications for Surrendering Your Life Insurance Policy

Another thing to keep in mind when surrendering your life insurance policy is that some of the funds are subject to being taxed as income. The money you pay in (the cost basis) won’t be, but anything you receive over what you paid in is taxable.

Let’s say that you paid $10,000 into your policy while you had it. When you surrender it, the cash value is $15,000. If you pay $1,500 in fees, you receive $13,500. The $10,000 you paid in originally is your tax-free return on investment. You will, however, pay taxes based on your tax bracket on the additional $3,500.

Reasons You Might Surrender Your Policy

So, why would you want to surrender your life insurance policy anyway? There are several reasons people choose to cancel their current policies, including:

You no longer need the coverage (your beneficiary passed away, you’re getting divorced, or your children are adults and you no longer need the policy)

You improved your health, and you now have access to cheaper life insurance options

You want or need to access the money (you need the funds to cover an emergency expense, or you want to put the money toward a more lucrative investment opportunity)

The premiums are too expensive

The policy doesn’t meet your needs anymore

Alternatives to Surrendering

While you can surrender your life insurance policy if you want, you should know that you have other options available. Explore these options before you make a decision.

Take Out a Policy Loan

One of the most common options for accessing the cash value of your life insurance policy without surrendering it is to take out a policy loan. With this solution, you receive funds while using your policy as collateral. While you’re borrowing money from yourself, you do have to pay interest while paying back the loan. In most cases, however, the rate is lower than what you’d get if you took out a personal loan from a bank. There are also no underwriting requirements, so you can still take out a loan even if you don’t have the best credit. Defaulting on your payments, however, could cost you your policy.

Make a Direct Withdrawal

With a direct withdrawal, you take out some of the cash value, but leave enough behind to keep your policy active. You also continue to make your monthly premium payments so that you keep your death benefit.

While a direct withdrawal is fairly simple, there are a couple of things to keep in mind. First, withdrawing the money could increase your monthly payments. If your new premiums are higher than you can afford, your policy may lapse , and you lose the coverage. Second, your death benefit may decrease by the amount you take out, decreasing the amount your beneficiaries receive upon your death. In some cases, the money you withdraw may also be subject to taxes.

Take a Life Settlement

A third, and possibly most profitable, alternative to surrendering your life insurance policy is to take a life settlement. Using this option, you sell your policy to a qualified buyer. The buyer assumes the payments and their beneficiaries receive the death benefit. One of the main advantages of this is that you get a lump sum payment at the time of purchase. You’ll likely get more money than if you surrender the policy. You may even be able to get up to three times the policy’s cash value. The thing to remember, however, is that the money you receive is subject to taxes, so it may be worth your while to consult with a tax professional.

If you no longer want or need whole life insurance, surrendering it provides you with access to the funds that you’ve accumulated during its life. While it can be a good option if you’ve had your policy for many years (or even a few decades), surrendering it early on could lead to significant fees. Make sure you look into how your insurer handles surrendering, as well as what other options you have available before you make your decision.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Cancel a Life Insurance Policy

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Life insurance is meant to help your family avoid financial hardship if you die. But being stuck with the wrong policy or a policy you no longer need or can afford, could cause plenty of problems while you’re alive.

The good news is that you can cancel your life insurance policy at any time. But your cancellation options vary depending on how long you’ve had the policy, your age and the type of policy you have.

» MORE: Term vs. whole life insurance

Key takeaways for canceling your life insurance

These are the most common reasons people cancel their life insurance coverage. The best route to take comes down to your situation.

» COMPARE: Life insurance quotes

Ways to cancel your life insurance

Here’s a closer look at the best ways to cancel a life insurance policy depending on your needs and policy type.

Use the free look period

If you have immediate regrets, you might be able to back out of a life insurance policy . “Free look” periods allow consumers a short amount of time, typically 10 to 30 days from receiving the policy, during which they can terminate it for a full refund. State rules and your policy type determine the specific period.

Within the free look period, call your agent or insurer and follow their steps to cancel the policy.

Term life insurance policy? Stop paying

You can stop paying premiums and allow a term life policy to lapse, meaning coverage will end. You may also be able to cancel your policy and receive a partial refund for any months you’ve paid in premiums upfront. Note that if you decide to buy life insurance again in the future, your rates will be higher because you’ll be older or possibly less healthy.

» MORE: Average life insurance rates

Surrender a permanent policy

As you pay premiums, permanent life insurance policies typically accumulate a cash value . Your cash value grows over time, and once you’ve accumulated enough, you can begin to make withdrawals, borrow against it and more. If you surrender a permanent policy, your insurer will give you the “surrender value,” which is the cash value minus any surrender fees.

In the first few years of the policy, the cash value will likely build up slowly and not be worth surrendering.

Be aware that you might owe income tax on the amount you get from surrendering your policy if it exceeds the total you’ve paid so far in premiums.

Life insurance policies typically have surrender charges for the first 10 to 15 years of the policy. They usually start at 100% in the first year, then decline. It can take 10 to 20 years before the cash value equals the sum of premiums paid.

Perform a tax-free exchange

You may be able to swap your life insurance policy for a similar insurance product, like an annuity, long-term care insurance or even another life insurance policy, tax-free.

Called a “1035 exchange,” swapping one life insurance policy for another may come in handy in a few situations. For example, maybe the reasons you bought the policy are no longer valid, or maybe the features and benefits of newer policies align better with your current needs.

It's important to work with a qualified life insurance advisor to ensure the exchange is done correctly.

Take a life settlement

You might be able to sell a life insurance policy for cash. Known as a life settlement, this option is typically only available if you’re around 65 or older and your life insurance death benefit is $100,000 or more, although there are exceptions.

In a life settlement, your insurance policy remains in force and an investor — often a bank or financial services company — becomes the policy owner and beneficiary. The investor pays the premiums and can sell the policy to another investor without telling you. You can be taxed on a portion of the money you get from the settlement.

When you die, the new beneficiary receives your policy’s death benefit. The investor has the right to check on your health and may have lifetime access to your medical records, so you might lose some privacy.

While selling your policy might get you more cash than surrendering it, both options will result in a substantially smaller sum of money than the amount your loved ones would get if you kept the policy.

Alternatives to canceling your life insurance

If you still want or need life insurance, there are a few ways to adjust your premiums without losing your coverage:

Switch to paid-up status. One type of permanent life insurance, a whole life policy, might allow you to use cash value — if you have enough — to pay all your premiums. This will decrease your death benefit.

Lower your death benefit. You can typically reduce your term or permanent policy’s face value to lower premiums, but ask your insurer for details.

Pay with dividends. If your policy is with a mutual company, it might be eligible to earn dividends based on the insurer’s financial performance. You can funnel these funds toward your premium.

Use the cash value. If you have a permanent life insurance policy, you might be able to use your policy’s cash value to pay premiums — so long as you’ve built up enough.

At the end of the day, the highest return you can get from a policy will most likely be the sum of money your life insurance beneficiaries receive when you die. Before you cancel your policy or lower your death benefit, check with your beneficiaries to see if they might be willing to continue paying your policy’s premiums to keep it active.

On a similar note...

Compare term life insurance rates

Get free quotes from top companies.

Sample Insurance Surrender Letter

Surrendering your insurance policy may not be a wise decision. However, if you still want to do it, a formal letter needs to be sent to your insurer.

Below you'll find a sample insurance surrender letter which might be of assistance:

This is to inform you that I won't be able to continue paying the premiums on the above policy. Therefore, I would like to surrender my insurance policy for payment of its full cash value with effect from . I would appreciate a written confirmation from you within 30 days of the effective date. I understand that surrendering this policy means that it cannot be reinstated later on, and the death benefit, which goes along with it, also gets terminated. Please reimburse the full cash value that I am entitled to receive, and cease the premium payments that are charged from my bank account. Thank you for your timely consideration in this matter.

Related reading:

- What if you want to surrender your life insurance policy?

Related letter:

- Sample Insurance cancellation letter

Manage policies

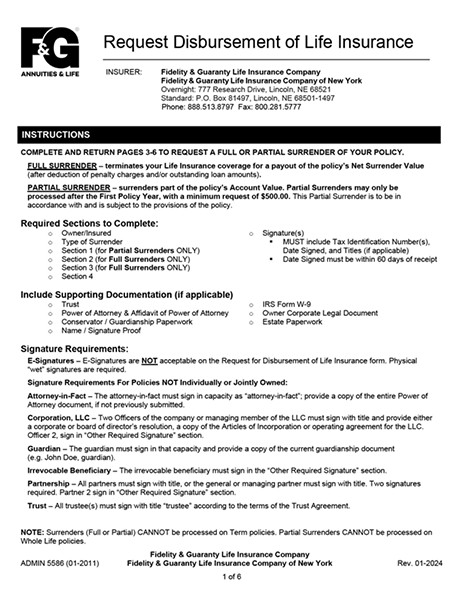

Instructions.

Follow the instructions to request a surrender of your life insurance policy.

- Complete form Provide information according to the instructions on the form.

- Submit form Submit your documents according to the instructions on the form.

- Allow 25-30 days to process F&G will process the request within 25-30 business days of receipt if in good order. Please note: The processing time includes time to mail surrender information and the implication of a complete surrender to the policy owner.

- Disburse Payment will be mailed to the owner's address on record.

Request Disbursement of Life Insurance [ADMIN 5586]

How To Write An Insurance Cancellation Letter

Jun 22, 2020, writing an insurance cancellation letter with samples.

Writing an insurance cancellation letter can be an intimidating process. Are there certain steps to follow? Do I need to write one to cancel my insurance? What should I include in it?

The following outlines what to include in cancellation letters, tips for writing them, and sample letters for you to reference.

Do I Need To Write A Cancellation Letter?

Yes. A cancellation letter is commonly required by companies for drivers to cancel.

What Do You Need To Include In Your Insurance Cancellation Letter?

The following information should be included in your letter when you cancel insurance :

- Your name : You must be a policyholder to cancel.

- Policy number : Double check to ensure your it is correct on the letter.

- Your address and contact information : This can be used to follow up with you.

- Company name : Name the insurance company, not your advisor.

- The current date : The date when you are writing the letter.

- Cancellation date : Provide a specific date for the changes to take effect.

- Reasons : Provide a reason for your cancellation.

- Stop payment or refund request : Request the insurer stop automatic payments immediately if you pay monthly. If you paid in advance, request a refund for the remaining balance.

The above applies to the cancellation of all types of insurance.

How Do You Write An Insurance Cancellation Letter?

- Keep it simple : A one-page notice of cancellation will do. Get to the point. There is no need to elaborate in detail reasons for cancellation or to express dissatisfaction with their services.

- Include all required information : Make sure to include all required information by your insurer for cancellation notification.

- Be polite, but firm : Write in a polite, yet firm tone

- Proofread : Re-read your content to ensure all information is correct.

- Sign the document : Sign the document by hand.

- Confirm the address : Confirm the location to mail it before sending.

Sample Insurance Cancellation Letter

To help you write a letter for cancellation, we’ve created a sample you can reference below :

Please note that these templates are here to help you get started. However, it’s crucial to use the template as a guide and not copy it directly. Customize the template to meet your specific purpose.

Sample Auto Insurance Cancellation Letter

This sample provides you with an example of what it should look like. Customize it for your specific purpose and your personal information : Sample Car Insurance Cancellation Letter

Sample Home Insurance Cancellation Letter

This sample home insurance letter of cancellation provides you with an example of what it should look like. Customize it for your specific purpose : Sample Home Or Rental Cancellation Letter

Letter of Cancellation FAQs

Why do i need to write an insurance cancellation letter.

- Phone calls and emails are not sufficient : Most insurance companies require a letter of cancellation.

- Avoid miscommunication : Getting the details of your changes on paper reduces miscommunications between you and your insurer.

- Create a record of cancellation : A letter gives you a record of your intention to cancel your insurance.

How Do You Cancel Your Insurance With A Letter?

Cancelling requires you to follow the proper steps. The first step is to contact your insurer. Inform them of your plans to cancel. At this point, you will likely be asked to submit in writing your intentions to cancel.

Important Tip : Even if your insurer does not request an cancellation letter, it is a good idea to send one so you have a record of your request.

Before sending your letter, take time to compare car insurance quotes to ensure you do not have a lapse, and you are always protected.

Where Can You Get A Sample Cancellation Letter?

You can contact your insurer to see what information they require for one of these letters and if they have a sample you can use.

- Car Insurance Cancellation Letter Sample

- Home Or Rental Insurance Cancellation Letter Sample

Have More Questions About Cancellations Letters?

There are multiple ways you can write a letter outlining the cancellation. If you have questions about the process, don't hesitate to contact us today. We are happy to help you explore your options and help you make the switch.

Latest Articles

Checkout our latest articles on insurance and other helpful topics.

Types of Hybrid Vehicles

What are the differences between a hybrid, a plug-in hybrid, and a mild hybrid? Get the answers to the most common differences between hybrid types.

Certified Pre-Owned Cars (CPO)

Buying a Certified Pre-Owned car may be the solution to finding a new-used car on a budget. Explore the benefits, certification process, and where to buy a CPO vehicle.

Best Used Cars To Buy In Canada 2024

Looking for the top used cars to buy in Canada in 2024? Check out our guide to jumpstart your search for an affordable and reliable used car

Buying a Hybrid: Pros & Cons

What are the pros and cons of buying a hybrid in Canada? This guide will help you decide if a hybrid vehicle is worth buying instead of a gas car.

Compare rates and save more today!

I want to surrender my policy

For Online/NRI/PIO/Foreign National customers, their request can be considered through registered email id at [email protected]

Was this helpful

We appreciate your feedback!

Letters to the Editor, May 17

Marco parking issue

Marco Island City Council appears to have a simple arithmetic problem. Over the years, at the behest of freestanding restaurant pressure, the City Council continued to increase the restaurant seating requirement per parking space but never required them to increase their number of parking spaces. Initially the requirement was two seats per parking space; to three seats per parking space; to four seats per parking space, then in 2010, one parking space per 200 square feet indoor and outdoor seating. City staff at that time in their report stated that it would require each vehicle to have seven occupants per parking space. As ridiculous as that sounds, the council passed the ordinance. The next council passed an ordinance back to four seats per parking space. Nowhere in the city ordinances does it require parking spaces for restaurant employees. That’s the other problem!

The restaurateurs are looking to the city to provide them with more parking spaces to accommodate their customers. The city has already spent millions of dollars to improve alleyways for more parking for restaurants, with more to come at taxpayer expense. Where is it written in the city code of ordinances that the city is obligated to provide parking spaces for privately owned businesses?

And if that wasn’t bad not enough, they passed an ordinance for Town Center and possibly for other centers, changing their parking requirement from two seats per parking space to four seats per parking space without an increase in parking spaces.

Since 2017, the council has concentrated their goal of making this island a tourist and visitor destination at the expense of full-time residents.

Amadeo Petricca, Marco Island

Hamas was the aggressor

Why were our limits of engagement different from Israel’s? Was our demand for unconditional surrender worth the complete destruction of civilian inhabited cities in Germany? Was the dropping of, not one, but two atom bombs in Japan decimating entire civilian populations in two cities necessary? It may be debated now but at the time it was necessary. Both could have surrendered, preventing the taking of the next step.

The Jews had presence centuries before the Christians and Muslims and after the Holocaust have a right to exist with a place they can rightfully call home. Originally the land would have been divided into Israeli and Palestinian states. All the Arab countries united and attacked the nascent Israel and were defeated. Over time most Muslim countries were willing to accept the state of Israel except for a radical few. President Biden in wanting to end the war had to guarantee, with our presence, that it would never happen again. Words alone will not succeed. The Hamas perpetrators should be declared the aggressors who killed thousands of civilians and took hundreds of hostages. We would not be in this situation if Hamas had not acted with the support of Iran.

Ted Raia, Naples

Ignoring global warming

I read with increasing incredulity the article "DeSantis resisting climate measures" (May 6). The article began by noting short-sighted, petty measures taken by the governor and his supporters, i.e., discouraging bike lanes and efforts to improve public transport (buses).

It then moved on to highlight more epic negligence: the rejection of some $670 million in federal funding over the past year aimed at improving energy efficiency and reducing emissions and the banning (apparently a favored DeSantis technique) of the term "climate change" in state law.

Last but not least, the article captured the approach of successive governors in the quoted remark of former Governor Scott regarding global warming: "I am not a scientist," a statement at once pathetic and arrogant in its expression of willful ignorance. We are facing ongoing vertiginous increases in home and car insurance premiums, both linked in large part to weather-related factors. The top priority of responsible governments everywhere, and especially in Florida, should be to mitigate to the extent possible the negative impacts of global warming, not to ignore them, or to pretend that, by banning the term, it doesn't exist.

Anthony Rottier, Naples

Choice of running mate

As of this writing there hasn't been a vice president running mate for the G.O.P. This has me pondering. It seems the last four or five have been odd choices. Dan Quayle, Dick Cheney, Sarah Palin, and finally Mike Pence. What's up with this? Are they selected by using the old dart board method? I literally laughed at the selection of Palin.

With the economy being what it was the polls had it too close for comfort. They had to throw this contest; but how? BOOM, In steps half-term Governor Palin. You see, the G.O.P. was concerned their policies would continue to tank, thus Sarah! How'd that work out? LOL!

Robert Jenkins, Naples

More Letters to the Editor, April 30

And Letters to the Editor, April 19

Letter Templates & Example

Authorisation Letter to Surrender Insurance Policy: Everything You Need to Know

Are you in need of surrendering your insurance policy, but don’t know where to start? Look no further! An authorisation letter to surrender insurance policy is your solution. This letter is a helpful document that allows someone else to act on your behalf when you are unavailable or unable to do so. It’s simple, fast, and easy to create! You can find examples of authorisation letters to surrender insurance policies online and edit them as needed to best suit your unique circumstances. Don’t struggle with the process of surrendering your policy when a solution is readily available. Let an authorisation letter to surrender insurance policy help you simplify the process and get it done quickly.

The Best Structure for an Authorization Letter to Surrender an Insurance Policy

When it comes to cancelling or surrendering an insurance policy, sometimes it is not always possible for the policyholder to do so in person. In such cases, an authorization letter can be used to delegate the responsibility of cancelling the policy to a third party. However, when drafting an authorization letter, there are several key components that must be included in order for it to be legally binding and effective.

The first element to consider is the inclusion of key identifying information. This should include the name of the policyholder, policy number, and details of the policy itself, such as the type of insurance and the date it was first taken out. This information will help to establish the authenticity of the letter and ensure that the correct policy is being cancelled.

The second component to consider is the authorization itself. This should clearly state that the policyholder authorizes the named individual or organization to cancel the policy on their behalf. It should also specify the date that the authorization comes into effect and the length of time that it is valid for. This will help to prevent any confusion or misunderstandings around the scope of the authorization.

The third component to include is the signature of the policyholder. This should be done in ink and with the date clearly marked. This is important as it demonstrates that the policyholder has given their consent and authorization for the policy to be cancelled. If the authorization is being sent via email or other digital means, it may be necessary to use electronic signature software to ensure that the signature is legally valid.

Finally, it is important to address the letter to the correct recipient. This could be the insurance company itself, or a specific individual within the organization who is responsible for handling cancellations. The letter should be sent via registered post or another secure means to ensure that it is received by the intended recipient.

In conclusion, the best structure for an authorization letter to surrender an insurance policy includes key identifying information, a clear and concise authorization statement, a signature from the policyholder, and correct address information for the recipient. By following these guidelines, policyholders can ensure that their authorization letter is legally valid and that their policy will be cancelled as requested.

7 Samples of Authorization Letter to Surrender Insurance Policy

Surrendering insurance policy due to death of policyholder.

I, [Your name], am the legal heir of [Policyholder’s name], who passed away on [date]. I am writing this letter to surrender the policy [Policy number] of the deceased.

As the designated beneficiary of the said policy, I understand that I may choose to keep it active. However, considering the circumstances, I have decided to cancel it.

Thank you for your understanding on this matter. Please let me know the necessary steps to complete the process.

Respectfully,

[Your Name]

Surrendering Insurance Policy Due to Cancellation of Contract

Dear Sir/Madam,

I am a policyholder, and I would like to surrender my insurance policy [Policy number]. The reason for this request is because the contract was cancelled by the provider due to a breach of agreement by their end.

I hope that the process would be fast and smooth, as I would like to apply for a new policy as soon as possible. I would also appreciate if you could provide me with a refund equivalent to the amount I have paid so far.

Thank you for your attention to this matter.

Best regards,

Surrendering Insurance Policy Due to Change of Address

I am writing to inform you that I would like to surrender my insurance policy [Policy number] due to a change in address. I have decided to cancel the policy as it does not fit my current lifestyle and budgetary constraints.

Please process my request and inform me of any necessary actions I need to take. I would also like to request a refund for the amount paid for the premium.

Thank you for your understanding and cooperation on this matter.

Yours sincerely,

Surrendering Insurance Policy Due to Financial Difficulty

Dear Insurance Provider,

I am writing to request the cancellation of my insurance policy [Policy number]. Due to financial difficulty, I am no longer capable of paying the premiums, and I have exhausted all other options to keep up with the payment schedule.

I have appreciated the services provided to me during my time as a policyholder, but I believe that surrendering the policy is the most feasible option at this time. I kindly request that you process my request and provide me with any necessary information regarding the refund of my premium.

Thank you for your understanding and consideration in this matter.

Kind regards,

Surrendering Insurance Policy Due to Retirement

I would like to request the cancellation of my insurance policy [Policy number] as I have recently retired from my job. Since my retirement, I no longer have the need to maintain the policy, and I am looking to free up some funds to support my lifestyle during my retirement years.

Please let me know the necessary steps to complete the process, including any information regarding the return of the premium.

Thank you very much for your assistance.

Yours truly,

Surrendering Insurance Policy Due to Medical Reasons

Dear [Insurance Provider Name],

I am writing to request the cancellation of my insurance policy [Policy number] due to medical reasons. I have been diagnosed with an illness that requires me to undergo costly treatments, and I can no longer afford to pay for the premiums to maintain the policy.

I would appreciate your cooperation in processing my request and providing me with any information regarding the return of the premium.

Thank you for your consideration.

Surrendering Insurance Policy Due to Dissatisfaction with Coverage

Dear Insurance Provider Name,

I would like to request the cancellation of my insurance policy [Policy number] due to my dissatisfaction with the coverage provided by the policy. Upon reading the policy agreement, I realized that my needs are not entirely covered, and I believe that there are better options out there for me.

Please inform me of any steps I need to take to complete this process and how I can receive the refund for the premium paid.

Thank you for your cooperation and understanding in this matter.

Tips for Writing an Authorization Letter to Surrender an Insurance Policy

Are you looking to surrender your insurance policy but cannot do it in person? An authorization letter is a document that can give someone you trust the authority to make important decisions on your behalf, including surrendering your insurance policy. Here are some tips to ensure that you write a clear and effective authorization letter:

- Be clear and specific – State the exact policy you want to surrender and the date it was issued.

- Provide full details – Include your full name, address, policy number, and contact information as well as the name, address, and contact information of the person you are authorizing to surrender the policy on your behalf.

- Keep it concise – Avoid using long, complicated sentences or unnecessary words. Make your letter easy to read and understand.

- Be professional – Use a professional tone and avoid informal language or phrases. Address the letter to the appropriate party or authority.

- Use a legal format – The letter should be written in a formal tone and should follow legal convention. Make sure that it includes a clear declaration of your intention to authorize someone else to surrender the policy.

- Ensure accuracy – Double-check the letter to make sure it is free of errors or discrepancies. Make sure that all the information is consistent and accurate.

- Sign the letter – You must sign the letter yourself and provide a copy of your ID to prove your identity.

- State the purpose – Clearly state the purpose of the authorization letter, which is to surrender the insurance policy.

- Validate the document – The document must be notarized or witnessed to lend it legal weight and to show that you are the individual who gave the given authorization.

- Provide any additional instructions – If there are any additional instructions for surrendering the policy, make sure to include them in the letter as well.

Writing an authorization letter can be a critical act, especially if you cannot be present in person to surrender your insurance policy. These tips can help you draft an effective authorization letter that gives someone you trust the power to act on your behalf efficiently and in a legally sound manner.

Authorisation Letter to Surrender Insurance Policy FAQs What is an authorisation letter to surrender an insurance policy?

An authorisation letter is a legal document giving a third party the right to act on a specified matter on your behalf. In this case, it would be to surrender an insurance policy.

Why do I need an authorisation letter to surrender an insurance policy?

Some insurance companies require a written authorisation to be submitted along with the policy for surrender. This is done to ensure that the right person is surrendering the policy and to prevent any fraudulent activity.

What should I include in my authorisation letter?

Your authorisation letter should include your full name and policy number, the name of the person you are authorising to surrender the policy, the reason for surrendering the policy, and your signature. Additionally, you may include any specific instructions or conditions you want the person to follow.

Can I authorise someone else to surrender my policy if I am not available?

Yes, you can authorise someone else to surrender your policy on your behalf if you are not available or unable to do so yourself. The person you authorise should be someone you trust and who understands your wishes regarding the surrender of the policy.

Is there a deadline for submitting the authorisation letter with the policy for surrender?

It is best to check with your insurance company for their specific requirements regarding the timeline for submitting the authorisation letter along with the policy for surrender. Some companies may have a specific deadline, while others may accept the letter and policy at any time.

Can I revoke my authorisation letter at any time?

Yes, you can revoke your authorisation letter at any time before the policy is surrendered. You should notify your insurance company in writing that you no longer wish to authorise the person to surrender the policy on your behalf.

What happens after my policy is surrendered?

After your policy is surrendered, the insurance company will often issue a surrender value, which is the amount of money you will receive for surrendering your policy. This amount may vary depending on several factors, such as the length of time the policy has been in force and the premiums paid.

Wrapping it up!

Well, folks, that’s all you need to know about obtaining an authorisation letter to surrender an insurance policy. We hope our guide has helped you clarify any doubts you may have had about the process. If you have any other questions, feel free to drop us a message in the comments section below. Thanks for reading, and we hope to see you again soon for some more useful tips and tricks!

Letter Format for Surrender of Life Insurance Policy: A Comprehensive Guide How to Write an Effective Letter to Surrender Insurance Policy How to Write a Letter to Surrender Life Insurance Policy: A Step-by-Step Guide Sample Letter of Surrender Insurance Policy: How to Write It and What to Include Sample Letter to Surrender Your Insurance Policy - A Step-by-Step Guide Sample Letter for Insurance Policy Surrender: Easy Steps to Follow

COMMENTS

When drafting a request letter for surrendering an insurance policy, it's essential to maintain clarity and politeness throughout the communication. Clearly state the policy details including the policy number, date of inception, and maturity date. Provide a valid reason for surrendering the policy and include all necessary documentation such ...

Learn the best structure and format for a letter of surrender insurance policy and see seven different samples. Find out what information to include and how to request the cash value of your policy.

Learn the best structure and examples of a letter to surrender your insurance policy to your company. Find out the reasons, details, and methods of payment and delivery to include in your letter.

Bradley Filmore 4567 Drawbridge Rd. Lafayette, CA, 86709. Trusted Benefit Life Insurance Company 156 Maple Ave. Philadelphia, PA, 19007. Attn: Cancellations Department. RE: Life Insurance Policy #3697503. Please consider this letter as a formal request to cancel the above-referenced life insurance policy effective August 31, 2021.

1. Clearly state your intention to surrender the policy. The first paragraph of your letter should clearly state that you are surrendering your insurance policy. It's important to be direct and concise, as this will help to avoid any confusion or misunderstandings. Make sure to include your policy number and the name of the insured to help ...

Canceling a life insurance policy is typically not hard. You have the right to cancel anytime during the free look period, which lasts anywhere from 10 to 30 days depending on what U.S. state you ...

Learn what happens when you cancel your life insurance policy and how to get the cash surrender value. Find out the fees, taxes, and alternatives to surrendering your policy.

Life insurance policies typically have surrender charges for the first 10 to 15 years of the policy. They usually start at 100% in the first year, then decline. It can take 10 to 20 years before ...

Note: Your state may require completion of an election form for state withholding. If that is the case, additional forms will be sent to you prior to any distribution. If you are uncertain about your state requirements, please contact the Home Ofice at (800) 852-4678 for details. TOS2191118. NF.

For that, letter to surrender the LIC policy has to be written. Sample insurance surrender letter has to be written to formally submit this request. If you also wish to write a letter to surrender the LIC policy, you can use the sample Insurance letter of application to the branch manager for surrendering of LIC policy. In this post, we have ...

Surrender. Surrendering a life insurance policy means canceling the policy and receiving its surrender value, which is the cash value minus any surrender fees. If you go this route, the coverage ...

Complete and sign this form for all life insurance cash surrenders, excluding Qualified Plan and Keogh (H.R. 10) Plan owned policies. Do not complete this request to surrender the policy without understanding the implications. Once the surrender is processed, the policy and insurance coverage will be terminated. The policy cannot be reinstated ...

In the body of your letter, you should provide all the necessary details. Explain that you want to surrender your policy and include your policy number, date of issue, and the amount of coverage you have. You may also want to include a copy of your policy as an attachment to your letter. It's essential to make sure that your letter is clear ...

Below you'll find a sample insurance surrender letter which might be of assistance: Date: This is to inform you that I won't be able to continue paying the premiums on the above policy. Therefore, I would like to surrender my insurance policy for payment of its full cash value with effect from . I would appreciate a written confirmation from ...

Request Letter. This Request Letter is a convenient way to request a change in your life insurance policy and/or the related office records. If you are contemplating any change in your policy, we strongly urge that you first contact your State Farm® agent who will be happy to assist you.