Present Value Calculator

This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments.

Present Value of Future Money

Present Value: $558.39

Total Interest: $441.61

Present Value of Periodical Deposits

Present Value: $736.01

Related Investment Calculator | Future Value Calculator

Present Value

Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

Net Present Value

A popular concept in finance is the idea of net present value, more commonly known as NPV. It is important to make the distinction between PV and NPV; while the former is usually associated with learning broad financial concepts and financial calculators, the latter generally has more practical uses in everyday life. NPV is a common metric used in financial analysis and accounting; examples include the calculation of capital expenditure or depreciation. The difference between the two is that while PV represents the present value of a sum of money or cash flow, NPV represents the net of all cash inflows and all cash outflows, similar to how the net income of a business after revenue and expenses, or how net benefit is found after evaluating the pros and cons to doing something. The inclusion of the word 'net' denotes the combination of positive and negative values for a figure.

The Time Value of Money

PV (along with FV, I/Y, N, and PMT) is an important element in the time value of money, which forms the backbone of finance. There can be no such things as mortgages , auto loans , or credit cards without PV.

To learn more about or do calculations on future value instead, feel free to pop on over to our Future Value Calculator . For a brief, educational introduction to finance and the time value of money, please visit our Finance Calculator .

- Present Value (PV)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, what is present value (pv).

Present Value is a financial concept that represents the current worth of a sum of money or a series of cash flows expected to be received in the future.

PV takes into account the time value of money , which assumes that a dollar received today is worth more than a dollar received in the future due to its potential earning capacity.

The time value of money is a fundamental concept in finance, which states that money available at the present time is worth more than the same amount in the future.

This is because of the potential earnings that could be generated if the money were invested or saved.

PV is a crucial concept in finance, as it allows investors and financial managers to compare the value of different investments , projects, or cash flows.

Understanding PV is essential for making informed decisions about the allocation of resources and the evaluation of investment opportunities.

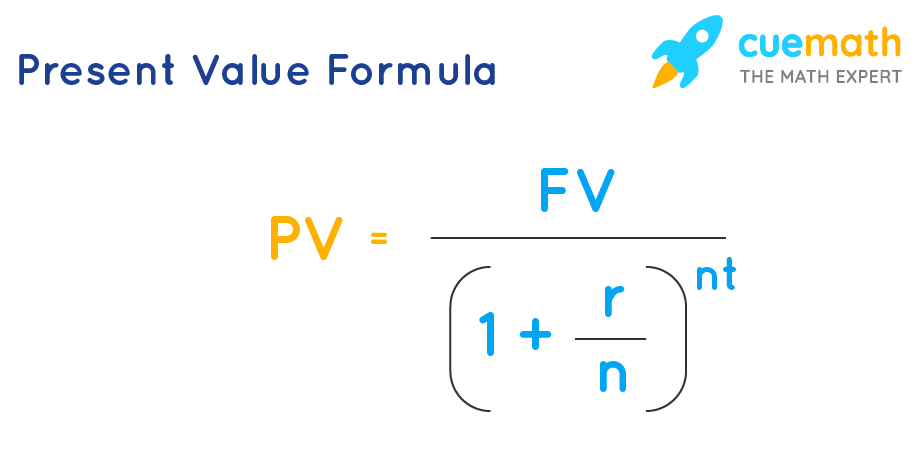

Present Value Formula

Components of the formula.

The Present Value formula is calculated using the following components:

Future Cash Flow: The amount of money expected to be received in the future.

Discount Rate: The interest rate used to discount future cash flows back to their present value.

Time Period: The number of periods into the future when the cash flow is expected to occur.

The formula for calculating Present Value is as follows:

PV = CF / (1 + r)^n

Where PV is the Present Value, CF is the future cash flow, r is the discount rate, and n is the time period.

PV Calculation Examples

Suppose an investor expects to receive $10,000 in five years and uses a discount rate of 5%. Using the Present Value formula, the PV of this future cash flow can be calculated as:

PV = $10,000 / (1 + 0.05)^5 = $7,835.26

This means that the current value of the $10,000 expected in five years is $7,835.26, considering the time value of money and the 5% discount rate.

Applications of Present Value

Investment analysis.

PV is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash flows. This helps investors determine the most profitable investments.

Capital Budgeting

Companies use PV in capital budgeting decisions to evaluate the profitability of potential projects or investments. By calculating the present value of projected cash flows, firms can compare the value of different projects and allocate resources accordingly.

Bond Valuation

In bond valuation, PV is used to calculate the present value of future coupon payments and the bond's face value. This information is used to determine the bond's fair market price.

Loan Amortization

PV calculations are used in loan amortization schedules to determine the present value of future loan payments. This information helps borrowers understand the true cost of borrowing and assists lenders in evaluating loan applications.

Retirement Planning

Individuals use PV to estimate the present value of future retirement income, such as Social Security benefits or pension payments . This information helps individuals determine how much they need to save and invest to achieve their desired retirement income.

Factors Affecting Present Value

Interest rates.

Interest rates have a significant impact on PV calculations. Higher interest rates result in lower present values, as future cash flows are discounted more heavily. Conversely, lower interest rates lead to higher present values.

Inflation affects the purchasing power of money over time, which in turn influences the present value of future cash flows. Higher inflation rates reduce the present value of future cash flows, while lower inflation rates increase present value.

Risk and Uncertainty

The level of risk and uncertainty associated with future cash flows can impact the discount rate used in PV calculations. Higher levels of risk and uncertainty typically require higher discount rates, which result in lower present values.

Conversely, lower levels of risk and uncertainty lead to lower discount rates and higher present values.

Time Horizon

The time horizon , or the length of time until a future cash flow is expected to be received, also impacts the present value. The longer the time horizon, the lower the present value, as future cash flows are subject to a greater degree of discounting.

Present Value vs Net Present Value (NPV)

Definitions and distinctions.

While Present Value calculates the current value of a single future cash flow, Net Present Value (NPV) is used to evaluate the total value of a series of cash flows over time.

NPV is calculated by summing the present values of all future cash flows, including inflows and outflows, and represents the net benefit of an investment or project.

When to Use PV or NPV

PV is suitable for evaluating single cash flows or simple investments, while NPV is more appropriate for analyzing complex projects or investments with multiple cash flows occurring at different times.

Comparison of the Two Methods

Both PV and NPV are important financial tools that help investors and financial managers make informed decisions.

PV provides a snapshot of the value of a single future cash flow, while NPV offers a comprehensive assessment of the net value of an investment or project, considering all cash flows over time.

Limitations of Present Value

Dependence on accurate cash flow estimation.

PV calculations rely on accurate estimates of future cash flows, which can be difficult to predict. Inaccurate cash flow estimates can lead to incorrect present values, which may result in suboptimal investment decisions.

Sensitivity to Discount Rate Changes

PV calculations are sensitive to changes in the discount rate. Small changes in the discount rate can significantly impact the present value, making it challenging to accurately compare investments with varying levels of risk or uncertainty.

Challenges With Non-conventional Cash Flow Patterns

PV calculations can be complex when dealing with non-conventional cash flow patterns, such as irregular or inconsistent cash flows. In these cases, calculating an accurate present value may require advanced financial modeling techniques.

Present Value is a fundamental concept in finance that enables investors and financial managers to assess and compare different investments, projects, and cash flows based on their current worth.

By taking into account factors such as interest rates, inflation, risk, and time horizon, financial professionals can employ Present Value calculations to make informed decisions about resource allocation and investment opportunities.

Understanding the applications and limitations of Present Value, including its dependence on accurate cash flow estimation and sensitivity to discount rate changes, is essential for making sound financial decisions.

Moreover, it is vital to recognize the differences between Present Value and Net Present Value, as each method serves a unique purpose in financial analysis.

While Present Value calculates the current value of a single future cash flow, Net Present Value evaluates the total value of a series of cash flows over time, offering a comprehensive assessment of an investment or project's net value.

By utilizing these financial tools effectively, investors and financial managers can optimize their investment portfolios and maximize their returns on investment.

Present Value (PV) FAQs

What is present value (pv).

Present value is a financial concept that represents the current value of an expected future sum of money, after accounting for the time value of money and the risk associated with the investment.

How is present value calculated?

PV is calculated by taking the future sum of money and discounting it by a specific rate of return or interest rate. This discount rate takes into account the time value of money, which means that money today is worth more than the same amount of money in the future.

What is the significance of present value in finance?

PV is a significant concept in finance, as it helps individuals and businesses to make investment decisions by estimating the current value of future cash flows. By calculating the PV of potential investments, investors can determine if an investment is worth pursuing or if they would be better off pursuing alternative investment opportunities.

What factors affect present value?

The primary factors that affect PV include the interest rate or discount rate used in the calculation, the length of time until the expected future cash flow is received, and the risk associated with the investment. Generally, a higher interest rate will result in a lower PV, while a longer time horizon or higher risk will result in a lower PV.

What are some common applications of present value?

PV is commonly used in a variety of financial applications, including investment analysis, bond pricing, and annuity pricing. It is also used to evaluate the potential profitability of capital projects or to estimate the current value of future income streams, such as a pension or other retirement benefits.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Break-Even Time (BET)

- Discount Rate

- Discounted Cash Flow (DCF) Model

- Excess Present Value Index

- Internal Rate of Return (IRR) | IRR Formula

- Net Present Value (NPV)

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Aggressive Investing

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

Ask a Financial Professional Any Question

Discover wealth management solutions near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- Search Search Please fill out this field.

What Is Present Value?

How to calculate the present value of an investment

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

Definitions and Examples of Present Value

Types of present value, how present value works, present value vs. future value.

Brand X Pictures / Getty Images

Present value is what a sum of money in the future is worth in today’s dollars at a rate of interest.

The basic principle behind the time value of money is simple: One dollar today is worth more than one dollar you will receive in the future. This is because you can invest the dollar you have today, and it can grow over time at a rate of return, or interest. The dollar you receive “tomorrow” can’t be invested today, and therefore doesn’t have the same potential to increase in value.

Present value is what cash flow received in the future is worth today at a rate of interest called the “discount” rate.

Here’s an easy way to look at present value. If you invest $1,000 in a savings account today at a 2% annual interest rate, it will be worth $1,020 at the end of one year ($1,000 x 1.02). Therefore, $1,000 is the present value of $1,020 one year from now at a 2% interest, or discount, rate.

The discount rate has a big impact on the present value. What if we changed the discount rate in our example from 2% to 5%? How much money do we need to invest at 5% to have $1,020 at the end of one year? The calculation would look like this: $971.43 X 1.05 = $1,020.

So instead of needing $1,000, we only need $971.43 to reach the same resulting amount. More on this calculation later.

Present Value of a Lump Sum

Think of the present value of a lump sum in the future as the money you would need to invest today at a rate of interest that would accumulate to the desired amount in the future. In the example above, the amount of money you need to invest today that will accumulate to $1,020 a year in the future at 2% is $1,000.

Present Value of an Annuity

An annuity is a series of equal payments received for a fixed period of time. For example, lottery winners often have the option to receive their prize money in equal payments over 20 years.

The present value of an annuity is the value of all the payments received over a period of time in the future in today’s dollars, at a certain discount rate.

One way to think of the present value of an annuity is a car loan. The initial loan is the present value. The annuity is the principal and interest payments you make every month until the balance of the loan is zero.

Present Value of Unequal Cash Flows

When a business invests in new equipment or a project, it may take time to see results. The revenue or cash flow projected may be low at first but grow over time.

When making investment decisions, a business has to analyze the present value of unequal cash flows.

The easiest way to calculate present value is to use one of the many free calculators on the internet, or a financial calculator app like the HP12C Financial Calculator, available on Google Play and in the Apple App Store. Most spreadsheet programs have present-value functions as well.

Present Value Tables

Another easy way to calculate present value is to use a present value table. These tables have factors and interest rates for annuity payments and lump sums. They look like this:

If we want to know the present value of $100,000 two years in the future at 4%, for instance, the calculation is:

Future value = $100,000

Present value factor at 4% for two years = .925 (see first table above)

Present value = $100,000 X .925 = $92,500

Real-World Example of Present Value

Joseph and Josephine are planning for their retirement . They decide that they will need an income as of age 65 of $80,000 a year, and they project living to age 85. Joseph and Josephine need to know how much money they need at age 65 to produce $80,000 of income for 20 years, assuming they will earn 4% (the discount rate).

Annuity payment = $80,000

Years paid = 20

Discount rate = 4%

Annuity factor from a present value table = 13.9503

Present value = $80,000 X 13.9503 = $1,116,024

At age 65, Joseph and Josephine will need $1,116,024 to produce $80,000 of income for 20 years at 4%.

Unequal Cash Flows

No matter what method you use– spreadsheet , calculator, table, or formula–calculating the present value of unequal cash flows takes a bit of work. An Excel spreadsheet is the easiest way to use the NPV (net present value) function; however, here’s an example of how to use the tables.

We can also measure future value . Future value is what a sum of money invested today will be worth over time, at a specified rate of interest.

As discussed earlier, $1,000 deposited in a savings account at a 2% annual interest rate has a future value of $1,020 at the end of one year. Let's look at what happens at the end of two years:

That $1,000 deposit becomes $1,040.40. The extra change is the 2% return on the $20 earned at the end of Year 1. The process of interest earning interest is called “compounding,” and it has a powerful effect on the future value of an investment.

Future value is the mirror image of present value.

Key Takeaways

- Present value measures the effect of time on money.

- Present value is what a sum of money or a series of cash flows paid in the future is worth today at a rate of interest called the “discount” rate.

- Present value is used to plan for financial goals and to make investment decisions.

Texas A&M University Commerce Department. " Present Value Tables ." Accessed July 29, 2021.

- Search Search Please fill out this field.

- An Overview

Present Value

Net present value, key differences, the bottom line.

- Business Essentials

Present Value vs. Net Present Value: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/100378251brianbeersheadshot__brian_beers-5bfc26274cedfd0026c00ebd.jpg)

Present Value vs. Net Present Value: An Overview

Present value (PV) is the current value of a future sum of money or stream of cash flow given a specified rate of return. Meanwhile, net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Present value tells you what you'd need in today's dollars to earn a specific amount in the future. Net present value is used to determine how profitable a project or investment may be. Both can be important to an individual's or company's decision-making concerning investments or capital budgeting.

While PV and NPV both use a form of discounted cash flows to estimate the current value of future income , these calculations differ in an important way. The NPV formula also accounts for the initial capital outlay required to fund a project, making it a net figure. That makes it a more comprehensive indicator of potential profitability.

Since the value of revenue earned today is higher than that of revenue earned down the road , businesses discount future income by the investment's expected rate of return. This rate, called the hurdle rate , is the minimum rate of return a project must generate for the business to consider investing in it.

Key Takeaways

- Present value is the current value of a future sum of money that's discounted by a rate of return.

- It tells you the amount you'd need to invest today in order to earn a specific amount in the future.

- Net present value is the difference between the present value of cash inflows and cash outflows over a period of time.

- Both present value and net present value use discounted cash flows to estimate the current value of income.

- However, net present value also accounts for the initial outlay required to fund a project.

The PV calculation takes a future amount of cash and discounts it back to the present day. The formula for this is:

Present Value = FV/(1 + r) n

where FV is the future value, r is the required rate of return, and n is the number of time periods.

The NPV calculation takes the current value of future cash inflows and subtracts from it the current value of cash outflows. The formula for this is:

Net Present Value = cash flow/(1+i) t − initial investment

Where "i" is the required rate of return and "t" is the number of time periods.

Say that you can either receive $3,200 today and invest it at a rate of 4% or take a lump sum of $3,500 in a year. Calculating the PV of $3,500 can help you make a choice.

Present value = FV/(1 + r) n

Present value = $3,500/(1 + .04) 1

Present value = $3,365.38

That means you'd need to invest $3,365.38 today at 4% to get $3,500 a year later. The $3,200 today will result in a smaller return. Based on that, you may feel that the lump sum in a year looks more attractive.

Say that a company is considering investing in a potential project. It requires an initial investment of $10,000 and offers a future cash flow of $14,000 in a year. The required rate of return is 6%. We'll calculate the NPV using a simplified version of the formula shown previously.

Net present value = today's value of expected cash flows - today's value of cash invested

Net present value = $13,208 (the present value) - $10,000

Net present value = $3,208

The NPV is $3,208 and indicates project profitability. Based on that and other metrics, the company may decide to pursue the project.

What Does Net Present Value Indicate?

Net present value indicates the potential profit that could be generated by a project or investment. A positive net present value means that a project is earning more than the discount rate and may be financially viable.

Is a Higher Net Present Value Better?

A project or investment with a higher net present value is typically considered more attractive than one with a lower NPV or a negative NPV. Bear in mind, though, that companies normally look at other metrics as well before a final decision on a go-ahead is made.

Is PV or NPV More Important for Capital Budgeting?

NPV is. That's because it accounts for the PV and the costs required to fund a project. So it can provide a more informed view of project feasibility. That, in turn, informs capital budgeting.

While the PV value is useful, the NPV calculation is invaluable to capital budgeting . A project with a high PV figure may actually have a much less impressive NPV if a large amount of capital is required to fund it. As a business expands, it looks to finance only those projects or investments that yield the greatest returns, which in turn enables additional growth. Given a number of potential options, the project or investment with the highest NPV is generally pursued.

:max_bytes(150000):strip_icc():format(webp)/dv740090-5bfc2b8b46e0fb00265bea71.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Finance Formulas

- General Finance

- Stocks/Bonds

- Corporate Finance

- Financial Markets

- Alphabetical List

- Present Value

PV Calculator (Click Here or Scroll Down)

Present Value (PV) is a formula used in Finance that calculates the present day value of an amount that is received at a future date. The premise of the equation is that there is "time value of money".

Time value of money is the concept that receiving something today is worth more than receiving the same item at a future date. The presumption is that it is preferable to receive $100 today than it is to receive the same amount one year from today, but what if the choice is between $100 present day or $106 a year from today? A formula is needed to provide a quantifiable comparison between an amount today and an amount at a future time, in terms of its present day value.

Use of Present Value Formula

The Present Value formula has a broad range of uses and may be applied to various areas of finance including corporate finance, banking finance, and investment finance. Apart from the various areas of finance that present value analysis is used, the formula is also used as a component of other financial formulas.

Example of Present Value Formula

An individual wishes to determine how much money she would need to put into her money market account to have $100 one year today if she is earning 5% interest on her account, simple interest.

The $100 she would like one year from present day denotes the C 1 portion of the formula, 5% would be r , and the number of periods would simply be 1.

Putting this into the formula, we would have

When we solve for PV, she would need $95.24 today in order to reach $100 one year from now at a rate of 5% simple interest.

Alternative Formula

The Present Value formula may sometimes be shown as

Return to Top

- Formulas related to Present Value

- Future Value

- Present Value Factor

- Net Present Value

- Annuity - Present Value

- PV - Continuous Compounding

- Solve for Number of Periods - PV&FV

New to Finance?

Start with the Basics

- Compound Interest

- Simple Interest

Present Value Calculator

Your browser does not support iframes.

- Alphabetical Index:

- Privacy Policy

*The content of this site is not intended to be financial advice. This site was designed for educational purposes. The user should use information provided by any tools or material at his or her own discretion, as no warranty is provided. When considering this site as a source for academic reasons, please remember that this site is not subject to the same rigor as academic journals, course materials, and similar publications. Feel Free to Enjoy! Contact us at: [email protected]

Present Value Calculator

Table of contents

Present value calculator is a tool that helps you estimate the current value of a stream of cash flows or a future payment if you know their rate of return. Present value, also called present discounted value , is one of the most important financial concepts and is used to price many things, including mortgages, loans, bonds, stocks, and many, many more.

Many of the world's economies are based on future value calculations. Money is worth more now than it is later due to the fact that it can be invested to earn a return. (You can learn more about this concept in our time value of money calculator ).

Present value is also useful when you need to estimate how much to invest now in order to meet a certain future goal, for example, when buying a car or a home. So, if you're wondering how much your future earnings are worth today, keep reading to find out how to calculate present value.

If you find this topic interesting, you may also be interested in our future value calculator , or if you would like to calculate the rate of return, you can apply our discount rate calculator . Keep reading to find out how to work out the present value and what's the equation for it.

Present value formula

To calculate the present value of future incomes, you should use this equation:

PV = FV / (1 + r)

- PV — Present value;

- FV — Future value; and

- r — Interest rate.

Thanks to this formula, you can estimate the present value of an income that will be received in one year. If you want to calculate the present value for more than one period of time, you need to raise the (1 + r) by the number of periods. This turns the equation into this:

PV = FV / (1 + r) n

- n — Number of periods.

This is the most commonly used present valuation model. It applies compound interest , which means that interest increases exponentially over subsequent periods.

How to calculate present value

If you read the previous section, you already know that to estimate the present value, you need to:

- Determine the future value. In our example, let's make it $100 .

- Determine a periodic rate of interest. Let's say 8% .

- Determine the number of periods, n . Let's make it 2 years .

- Divide the future value by (1 + rate of interest) n .

In our example, it will look like this:

$100 / (1 + 0.08) 2 = $85.73

Now you know how to estimate the present value of your future income on your own, or you can simply use our present value calculator.

Other important present value calculations

Present value calculations are tied closely to other formulas, such as the present value of annuity . Annuity denotes a series of equal payments or receipts, which we have to pay at even intervals, for example, rental payments or loans. This causes the equation to be slightly different. Click through to our present value of annuity calculator to learn more.

What is present value?

The present value of an investment is the value today of a cash flow that comes in the future with a specific rate of return.

That means if I want to receive $1000 in the 5th year of investment, that would require a certain amount of money in the present, which I have to invest with a specific rate of return ( r ).

For example, if r = 20% , the present value would be $401.88 .

How to use present value for investing?

There are two main ways you can use the Omni Calculator present value tool:

- To calculate how much you should invest now for a specific cash flow in the future, given the yearly return.

- Given the desired future cash flow, the rate of return, and its present value, you can use the tool to determine how much time you have to leave the money compounding (gaining interest).

What is the present value of a cash flow of $1000 in 5 years?

$620.92. Here is how this answer is calculated:

- We have to define the rate of return ( r ).

- Suppose we take r = 10% . Then, we divide $1000 by the result of (1 + r) to the power of 5, or 1000/(1.1)⁵.

- We obtain $620.92 , the present value of $1000 in 5 years, with a rate of return of 10% annually.

How to know if a present value of an investment is good or bad?

Here's what you need to do to answer this question:

Acknowledge all the future cash flows that will come in the future and their specific time.

Bring all those future cash flows to the present, meaning we have to calculate their present value. You could try the Omni Calculator present value tool for this step.

Sum all the present values, then subtract the initial investment from that sum. If the final result is positive , then it is a good investment .

Future value

Interest rate

Compound frequency

How often the interest is added.

Present value

- Skip to main content

- Skip to footer

Unlock Unlimited Financial Mastery: Get Access To All Our Premium Finance & Investing Courses. Learn More >>

Fervent | Finance Courses, Investing Courses

Rigorous Courses, Backed by Research, Taught with Simplicity.

How to Calculate Present Value (Detailed Examples Included)

April 14, 2021 By Vash Leave a Comment

In this article, we’re going to explore how to calculate Present Value. It’s a pretty in-depth article, so you might want to grab a cup of tea. If you’re just looking for the Present Value formula, we’ve included it just below.

Okay, let’s get into it.

The Present Value is calculated as…

Now, if you want to understand how it really works (and why it works), then keep reading.

If the equation above is freaking you out, calm down. We’ve got your back. Stay with us.

What is Present Value?

Firstly, what is Present Value?

So it’s the value of future expectations or future cash flow, expressed in today’s terms.

Thus, the Present Value ultimately just reflects how much something is worth right here, right now, in the present. Hence the term “Present” value.

The Present Value Function

The Present Value is ultimately a function of two things, including:

- future expectations, and

Uses of the Present Value

The Present Value is probably the most important concept in Finance. Approximately 70%-80% of concepts in Finance end up relying on the PV in one way or another.

Broadly speaking though, the PV can be used for:

Investment Appraisal / Capital Budgeting

- Valuation (using the Discounted Cash Flow (DCF) valuation method)

Let’s now briefly consider these two.

We have a separate post on what capital budgeting is if you’re interested in learning more. But one of the most popular investment appraisal tools is the Net Present Value (NPV) .

And the Net Present Value is heavily reliant on the PV. We can even see this in the name!

The Net Present Value is just the Present Value, net of the investment.

The value of a company, or a stock, a business, etc, is all fundamentally based on the Present Value of future expectations.

And while the specific cash flows vary depending on the valuation model, for instance:

- Free cash flow

- Free cash flow to Equity (aka Flow to Equity, FTE)

It’s still fundamentally about “discounting” those future cash flows back to the present. Much more on “discounting” further down, but we do also have a separate article on discounting future cash flows if you’re interested.

For now, let’s think about how to calculate Present Value.

How to Calculate Present Value

Calculating the Present Value is actually incredibly straightforward.

Present Value of a Single Cash flow

Let’s start with the simplest case, of estimating the Present Value of a single cash flow.

The formula for PV of a single cash flow is as follows…

Now, as with most things in math, stuff makes so much more sense when we look at examples.

So before we get into explaining the PV formula above, let’s consider an example.

Related Course

This Article features concepts that are covered extensively in our course on Financial Math Primer for Absolute Beginners .

If equations and / or math freaks you out, then it’s time to get past your fear.

Take the first step to build your mathematical foundation .

Present Value Calculation Example #1

Imagine that you want to have $12,500 in your bank account exactly 1 year from today. Assume that your bank pays 5% interest. Assuming that you don’t have anything in your bank account right now, how much would you need to deposit today in order to have $12,500 in your account next year?

To figure this out, as with most things, when you’re working with different timeframes, it’s a good idea to work with the timeline.

Setup a timeline

And we’re saying that we want to have exactly $12,500 in our bank account in precisely one year’s time.

We can think of all of this information like this…

The question is, how much do we need to deposit today?

To solve this, we can actually start with something that we already know.

Stick to the fundamentals

At this stage, you should know how to calculate future value . If you don’t, then don’t worry – just have a quick read of our sister article and then come back here.

We’re going to assume that you (at least roughly) know how to calculate the FV.

So we can actually start with something that looks like the future value.

In other words, we can take this timeline and transform it into an equation, and that would look something like this…

Why can we express it like this?

We know that we want the cash to be worth $12,500 in a year’s time. Thus we can say…

Solve for the Cash Flow

Rearranging the equation gives us…

Are you struggling with rearranging equations? Don’t quite “get” it? It’s time to build your foundation in financial math. Explore our Financial Math Primer course , designed for absolute beginners like you.

Solve this and you’ll find that the exact value we need to deposit is approximately equal to $11,904.76

And because this particular cash flow represents the cash in the present, we can essentially see this as the present value.

Thus, we can say…

Does that make sense? If any part of the example is not quite clear, please read it again before moving on any further.

We’re going to assume that you’re more or less alright, so let’s actually just think about that equation in a little more detail.

Want to get past your fear of financial math?

Get the financial math primer study pack (for free)..

Present Value Formula (for a single cash flow)

Here’s the generalised equation for the present value for single cash flow we saw earlier on…

Components of the PV Formula

- interest rate,

- hurdle rate

- cost of capital

- required rate

- the required rate of return

- the opportunity cost of capital

- we could go on, really…

And it’s called the discount rate because this is the rate that we’re using to discount the future cash flow .

The Discounting Process

“Discounting” is the process of taking a future cash flow expressing it in present terms by “bringing it back” to the present day.

Now, recall that earlier we said that the Present Value is ultimately a function of two things, including:

The discount rate is actually a proxy for risk, and therefore, it’s how we penalise future cash flows for their level of risk.

That’s how we incorporate the risk of not earning future expectations, into our estimate for the present value.

Hopefully, you kind of understand the intuition behind the present value formula.

If you haven’t quite understood it just yet, then please pause for a moment now. Take your time to think about the equation and think about how it is actually a function of two things — future expectations and risk.

And take your time to see how we’re discounting future cash flows to get to the present value. Because this really is very important.

Okay. We’re going to assume that you’re more or less alright. So let’s go ahead now and step things up just a little bit by considering the case with multiple cash flows.

Present Value of Multiple Cash flows

Calculating the Present Value of multiple cash flows is actually very similar to the single cash flow case.

In a sense, you can think of it as calculating the PV of a single cash flow, multiple times .

This will make more sense when you see it work in an example, so let’s go ahead and do that now.

Present Value Calculation Example #2

Consider the following cash flow stream. You expect to earn $10,000; $15,000; and $18,000 in 1, 2, and 3 years’ times respectively.

Assume the discount rate is 10%.

What is the Present Value of these cash flows?

As always, because we’re working with timeframes over here, it’s a good idea to start with the timeline.

It’s just a different way of writing it. But the point is that we’ve got three different timeframes.

The approach to discount these 3 cash flows is actually identical to the case of the single cash flow we saw earlier.

We know that for a single cash flow, the present value is equal to…

Thus, if we think of these 3 cash flows as 3 separate and individual cash flows, then we can say that the first cash flow can be discounted as…

Put differently, we need to discount this cash flow over 2 years in order to express it in present terms.

Solve for the PV

Combining all 3 individual discounted cash flows we have…

Solving for each item gives us…

Finally, we just need to add the 3 numbers to get our answer!

And now that we know how to estimate the Present Value of multiple cash flows, we can think about what the Present Value formula actually looks like.

So we can say that the formula for the Present Value of multiple cash flows is…

And because the process of discounting the cash flows is identical across all cash flows, we can actually summarise this further as…

In a nutshell, then, we can say that the Present Value is nothing but the sum of the discounted future cash flows .

And with that, you now know how to calculate Present Value!

Wrapping Up

Hopefully, all of this makes sense.

So it’s the value of something expressed in today’s terms or in present terms .

Furthermore, you learned that the Present Value can be calculated by using this particular formula…

In a nutshell, it’s just sum of the discounted cash flows.

If any part of the article isn’t quite clear, please read it again.

The Present Value is an incredibly important concept – it’s what approximately 70-80% of Finance is based on in one way or another.

If the math in this article was a bit too advanced for you, then we strongly recommend exploring and enrolling on our Financial Math Primer course (see below).

The course is designed for the absolute beginner , and will really help you finally get the mathematical foundation you’ve always needed.

Finally get the mathematical foundation you’ve always needed.

Explore the Course

Reader Interactions

Leave a reply cancel reply.

You must be logged in to post a comment.

Do You Want Unlimited Access To All Our Courses?

Yes! Tell Me More

Privacy Overview

Present Value (PV)

Money now is more valuable than money later on .

Why? Because you can use money to make more money!

You could run a business, or buy something now and sell it later for more, or simply put the money in the bank to earn interest.

Example: You can get 10% interest on your money.

So $1,000 now can earn $1,000 x 10% = $100 in a year.

Your $1,000 now can become $1,100 in a year's time .

Present Value

We say the Present Value of $1,100 next year is $1,000

Because we could turn $1,000 into $1,100 (if we could earn 10% interest).

Now let us extend this idea further into the future ...

How to Calculate Future Payments

Let us stay with 10% Interest . That means that money grows by 10% every year, like this:

- $1,100 next year is the same as $1,000 now .

- And $1,210 in 2 years is the same as $1,000 now .

In fact all those amounts are the same (considering when they occur and the 10% interest).

Easier Calculation

But instead of "adding 10%" to each year it is easier to multiply by 1.10 (explained at Compound Interest ):

So we get this (same result as above):

Future Back to Now

And to see what money in the future is worth now , go backwards (dividing by 1.10 each year instead of multiplying):

Example: Sam promises you $500 next year , what is the Present Value?

So $500 next year is $500 ÷ 1.10 = $454.55 now (to nearest cent).

The Present Value is $454.55

Example: Alex promises you $900 in 3 years , what is the Present Value?

So $900 in 3 years is:

Better With Exponents

But instead of $900 ÷ (1.10 × 1.10 × 1.10) it is better to use exponents (the exponent says how many times to use the number in a multiplication).

Example: (continued)

The Present Value of $900 in 3 years (in one go):

As a formula it is:

PV = FV / (1+r) n

- PV is Present Value

- FV is Future Value

- r is the interest rate (as a decimal, so 0.10, not 10%)

- n is the number of years

Use the formula to calculate Present Value of $900 in 3 years :

Let us use the formula a little more:

Example: What is $570 next year worth now, at an interest rate of 10% ?

But your choice of interest rate can change things!

Example: What is $570 next year worth now, at an interest rate of 15% ?

Or what if you don't get the money for 3 years

Example: What is $570 in 3 years worth now, at an interest rate of 10% ?

One last example:

Example: You are promised $800 in 10 years time. What is its Present Value at an interest rate of 6% ?

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

Finance and capital markets

Course: finance and capital markets > unit 1, time value of money.

- Introduction to present value

- Present value 2

- Present value 3

- Present value 4 (and discounted cash flow)

Want to join the conversation?

- Upvote Button navigates to signup page

- Downvote Button navigates to signup page

- Flag Button navigates to signup page

Video transcript

Financial Mentor

Present value calculator – npv, what is the net present value (npv calculator) of a lump sum payment discounted for inflation.

Use this present value calculator to compute the value today of a lump sum payment in the ...show more instructions future – discounted for inflation and the time value of money.

The net present value calculates your preference for money today over money in the future because inflation decreases your purchasing power over time.

If you want to calculate the present value of a stream of payments instead of a one time, lump sum payment then try our present value of annuity calculator here.

And when you're done calculating present values then put that knowledge to use in this free 5-part video series showing you 5 Rookie Financial Planning Mistakes That Cost You Big-Time (and what to do instead!)

The One Decision That Can Make Or Break Your Financial Future

There are only four paths you can choose from.

Click below to find out which path is best for you, and why.

Yes! Tell Me About Expectancy Wealth Planning strategy

What Is The Present Value Of A Future Lump Sum?

Are you expecting to receive a lump sum of money in the future?

What is the value of that money in today's dollars? What is it worth to you today?

You must always think about future money in present value terms so that you avoid unrealistic optimism and can make apples-to-apples comparisons between investment alternatives.

This Present Value Calculator makes the math easy by converting any future lump sum into today's dollars so that you have a realistic idea of the value received.

Below is more information about present value calculations so you understand the factors that affect your money and how to use this calculator properly.

Net Present Value

Net present value (NPV) is the value of your future money in today’s dollars. The concept is that a dollar today is not worth the same amount as a dollar tomorrow.

The purchasing power of your money decreases over time with inflation, and increases with deflation .

In addition, there is an implied interest value to the money over time that increases its value in the future and decreases (discounts) its value today relative to any future payment.

Since the value of money changes with time, all financial calculations must be brought to a constant date (usually today, thus the term “present” value) to make accurate comparisons between competing investment alternatives.

Net present value is considered a standard way of making these investment decisions.

Related: How to take back control of your portfolio

Businesses use present value calculations for capital expenditures and routine business planning. Similarly, smart wealth builders run their finances like a business so they also use net present value for better family financial planning.

Net Present Value Illustration

Imagine someone owes you $10,000 and that person promises to pay you back after five years. If we calculate the present value of that future $10,000 with an inflation rate of 7% using the net present value calculator above, the result will be $7,129.86.

What that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%.

In other words, you would view $7,129.86 today as being equal in value to $10,000 in 5 years, based on the same assumptions.

That's because the impact to your net worth of $7,129.86 today is roughly equal to $10,000 in 5 years net of inflation and interest.

That is what this present value calculator is demonstrating.

Present Value Formula

It is important to understand that the three most important components of present value are time, expected rate of return, and the size of the future cash amount. All of this is shown below in the present value formula:

PV = FV/(1+r) n

PV = Present value, also known as present discounted value, is the value on a given date of a payment. FV = This is the projected amount of money in the future r = the periodic rate of return, interest or inflation rate , also known as the discounting rate. n = number of years

When Is The Present Value Used?

The present value formula has a broad range of uses.

It is used both independently in a various areas of finance to discount future values for business analysis, but it is also used as a component of other financial formulas.

For example, present value is used extensively when planning for an early retirement because you'll need to calculate future income and expenses.

Present value can also be used to give you a rough idea of the amount of money needed at the start of retirement to fund your spending needs. You'll then compare that to what you have saved now – or what you think you'll have saved by your retirement date – and that gives you a rough idea of whether your savings is on track or not.

Related: How to be a pro at growing your wealth

To get a full picture of the amount you need to retire, see our Ultimate Retirement Calculator here and how it applies net present value analysis for your retirement planning needs.

Pros And Cons Of The Present Value Method

The net present value calculator is easy to use and the results can be easily customized to fit your needs. You can adjust the discount rate to reflect risks and other factors affecting the value of your investments.

Another advantage of the net present value method is its ability to compare investments. As long as the NPV of each investment alternative is calculated back to the same point in time, the investor can accurately compare the relative value in today's terms of each investment.

However, there are few disadvantages of using the net present value method.

Always keep in mind that the results are not 100% accurate since it's based on assumptions about the future. The calculation can only be as accurate as the input assumptions – specifically the discount rate and future payment amount.

Since the future can never be known there is always an element of uncertainty to the calculation despite the the scientific accuracy of the calculation itself.

Another problem with using the net present value method is that it does not fully account for opportunity cost. However, you can adjust the discount rate used in the calculator to compensate for any missed opportunity cost or other perceived risks.

Final Thoughts

The Present Value Calculator is an excellent tool to help you make investment decisions.

It discounts any future lump sum payment to today's value so you can make apple-to-apples comparisons and make smart investment choice.

Simply knowing about future value and using it in your calculations will help you save money and make better investment decisions.

Present Value Calculator Terms & Definitions

- Future Value – The value of an asset at a specific date in the future.

- Inflation Rate – The rate at which the general level of prices for services and goods is rising, and, subsequently, purchasing power is falling.

- Compound Interval – How often inflation compounds.

- Present Value – The value today of a sum of money in the future, in contrast to some future value it will have when it has been invested at compound interest.

Other Personal Finance Calculators :

- Net Worth Calculator What is my financial net worth?

- Budget Calculator How much of my income should go to each expense category?

- Expense Calculator How much of my income is going to each expense category?

- Convert Irregular Payments To Monthly Budget How much should I budget each month for all my quarterly, annual, and irregular payments?

- Compound Interest Calculator How will my savings compound and grow over time?

- Cash Flow Calculator How do I project all my irregular income and uneven expenses into a reliable cash flow projection?

- Latte Factor Calculator Do periodic, unnecessary expenses really matter?

- Life Insurance Calculator How much life insurance do I need?

- Wage Calculator – Convert Salary To Hourly Pay What does my salary equal in hourly pay – both real and nominal?

Anybody can learn to build a secure retirement -- and you don't need a financial advisor.

My course, Expectancy Wealth Planning , has been called "the best financial education on the internet" and provides all the knowledge you'll ever need to build the life -- and retirement -- of your dreams.

Click Below To Learn How To...

Invest smart. Build wealth. Retire early. Live free.

Get your free wealth building tooklit:.

- FREE COURSE: 52 Weeks To Financial Freedom

- FREE BOOK: 18 Essential Lessons From A Millionaire

- Tools and Tips Not Found On This Site

Calculators

Retirement Mortgage Credit Card Debt Payoff Auto Loan Savings Investment Loan Personal Finance Compound Interest Calculator Debt Snowball Calculator

About Financial Mentor About Financial Coaching Our Books 7 Steps To 7 Figures Podcast Todd R. Tresidder Press Room Contact

How To Invest Your Money Recommended Reading Recommended Tools New Visitors Start Here Ask Todd Courses Books Audio

Home Privacy Statement Terms of Use Contact Us

Yes, Send My FREE Wealth Building Blueprint!

- E-Course: “52 Weeks to Financial Freedom”

- Audio: Get my top tips

- E-Book: "18 Essential Lessons From A Self-Made Millionaire"

Yes, email me a screenshot of my calculator results!

We’ll email you a screen print of the calculator you just completed, exactly as it appears on your screen. We don’t save any of your data: it’s just an image. You can unsubscribe whenever you want.

Enter Your Email And We’ll Send You A Convenient PDF Of This Article!

Tell us where to send your 2 video guide showing uncommon strategies for accurately calculating how much you need to retire….

Tell Me When The Course Is Ready!

You’ll learn how to make more by risking less.

You’ll learn how to calculate your retirement number with confidence.

Hey, I understand that buying this course is an important decision. That’s why I let you…

Test Drive The Course – FREE! Get 5 Sample Lessons Immediately

- No cost or obligation.

- No hooks or gimmicks.

- The goal is to let you experience the quality for yourself.

- You can unsubscribe anytime.

Take your financial strategy to the next level…

Get 5 FREE Video Lessons With Uncommon Insights To Accelerate Your Financial Growth

Present Value Formula

The present value formula refers to the application of the time value of money that discounts the future cash flow to arrive at its present-day value. The present value formula consists of the present value and future value related to compound interest. The present value or PV is the initial amount (the amount invested, the amount lent, the amount borrowed, etc). The future value or FV is the final amount. i.e., FV = PV + interest. Let us understand the present value formula in detail in the following section.

What is the Present Value Formula?

Present value (PV) formula finds application in finance to calculate the present day value of an amount that is received at a future date. The present value formula (PV formula) is derived from the compound interest formula. The compound interest formula is,

FV = PV (1 + r / n) nt

Dividing both sides by (1 + r / n) nt ,

PV = FV / (1 + r / n) nt

Thus, the present value formula is:

PV = FV / (1 + r / n) nt

- PV = Present value

- FV = Future value

- r = Rate of interest (percentage ÷ 100)

- n = Number of times the amount is compounding

- t = Time in years

The value of n varies depending on the number of times the amount is compounding.

- n = 1, if the amount is compounded yearly.

- n = 2, if the amount is compounded half-yearly.

- n = 4, if the amount is compounded quart-yearly.

- n = 12, if the amount is compounded monthly.

- n = 52, if the amount is compounded weekly.

- n = 365, if the amount is compounded daily.

Book a Free Trial Class

Examples Using Present Value Formula

Example 1: Jonathan borrowed some amount from a bank at a rate of 7% per annum compounded annually. If he finished paying his loan by paying $6,500 at the end of 4 years, then what is the amount of loan that he had taken? Round your answer to the nearest thousands.

The future value is, FV = $6500.

The time is t = 4 years.

n = 1 (as the amount is compounded annually).

The rate of interest is, r = 7% =0.07.

Substitute all these values in the the present value formula:

PV = 6500 / (1 + 0.07/1) 1(4) = 6500 / (1.07) 4 = 5,000 (The answer is rounded to the nearest thousands).

Therefore, the borrowed amount = $5,000

Example 2: Mia invested some amount in a bank where her amount gets compounded daily at 5% annual interest. What is the amount invested by Mia if the amount she got after 10 years is $1,650? Round your answer to the nearest thousands.

The future value is, FV = $1650.

The time, t = 10 years.

n = 365 (as the amount is compounded daily).

The rate of interest is, r = 5% =0.05.

Substitute all these values in the present value formula:

PV = FV / (1 + r / n) n t

PV = 1650 / (1 + 0.05/365) 365(10) = 1000 (The answer is rounded to the nearest thousands).

Therefore, the invested amount = $1,000

Example 3: Josie borrowed some amount from a bank at a rate of 5% per annum compounded annually. If she finished paying her loan by paying $4,500 at the end of 4 years, then what is the amount of loan that she had taken? Round your answer to the nearest thousands.

Solution:

The future value is, FV = $4500.

PV = 4500 / (1 + 0.05/1) 1(4) = 4500 / (1.05) 4 = 3,800 (The answer is rounded to the nearest thousands).

Therefore, the borrowed amount = $3,800

FAQs on Present Value Formula

What is the present value formula .

The term present value formula refers to the application of the time value of money that discounts the future cash flow to arrive at its present-day value. By using the present value formula, we can derive the value of money that can be used in the future.

What is the Formula to Calculate the Present Value?

The present value formula (PV formula) is derived from the compound interest formula. Hence the formula to calculate the present value is:

What is the Present Value Formula in Excel?

Calculating the present value in excel is extremely easy and quick and uses a different formula. Present value formula helps in calculating the money coming but not in the current situation but in the future. The present value formula in excel is:

PV in excel is =PV(rate, nper, pmt, [fv], [type])

- Rate = Interest rate per period

- nper = Number of payment periods

- pmt = Amount paid each period (if omitted—it’s assumed to be 0 and FV must be included)

- [fv] = Future value of the investment (if omitted—it’s assumed to be 0 and PMT must be included)

- [type] = When payments are made (0, or if omitted—assumed to be at the end of the period, or 1—assumed to be at the beginning of the period)

What is the Future Value Formula that is Used in the Present Value?

The future value formula is:

How to calculate the present and future value of annuities

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Investing

- • Retirement planning

- Connect with Rachel Christian on LinkedIn Linkedin

- • Stock analysis

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit . Presently, she is the senior investing editor at Bankrate, leading the team’s coverage of all things investments and retirement. Prior to this, Mercedes served as a senior editor at NextAdvisor.

- Connect with Mercedes Barba on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

In the world of finance, an annuity is a contract between you and a life insurance company in which you give the company a lump sum or series of payments, and in return, the insurer promises to provide you with a stream of income, either now or in the future.

But annuities can also be more of a general concept that describes anything that’s broken up into a series of payments. For example, a lottery winner may opt to receive a series of payments over time instead of a single lump sum distribution. This can also be called an annuity.

Two terms related to annuities are present value and future value.

Here’s what you need to know.

Present value of an annuity vs. future value of an annuity: What’s the difference?

While future value tells you how much a series of investments will be worth in the future, present value takes the opposite approach. It calculates the current amount of money you’d need to invest today to generate a stream of future payments, considering a specific interest rate.

The future value should be worth more than the present value since it’s earning interest and growing over time.

Ordinary annuity vs. annuity due: What’s the difference?

When using the general term “annuity,” there are two types of annuities: ordinary and period due.

- Ordinary annuity: Payments are due at the end of the period.

- Annuity due: Payments are due at the beginning of the period.

This seemingly minor difference in timing can impact the future value of an annuity because of the time value of money . Money received earlier allows it more time to earn interest, potentially leading to a higher future value compared to an ordinary annuity with the same payment amount.

You can use an online calculator to figure both the present and future value of an annuity, so long as you know the interest rate, payment amount and duration.

How to calculate future value of an ordinary annuity

The future value tells you how much a series of regular investments will be worth at a specific point in the future, considering the interest earned over time.

In simpler terms, it tells you how much money the annuity will be worth after all the payments are received and compounded with interest .

It’s a tool for planning how much you’ll accumulate by consistently contributing to a retirement plan or understanding the total repayment amount for a loan with regular installments.

Imagine you plan to invest a fixed amount, say $1,000, every year for the next five years at a 5 percent interest rate. The time value of money comes into play here. The first $1,000 you invest earns interest for a longer period compared to subsequent contributions. So, the earlier contributions have a greater impact on the final value.

To calculate the future value of these regular investments, we can use the following formula for ordinary annuities:

FV = C x [((1 + i)^n – 1) / i] where: FV = Future Value C = Cash flow per period (your regular investment amount – $1,000 in this example) i = Interest rate (expressed as a decimal) n = Number of compounding periods (number of years you invest)

This formula considers the impact of both regular contributions and interest earned over time. By using this formula, you can determine the total value your series of regular investments will reach in the future, considering the power of compound interest.

Using the example above:

FV = $1,000 x [((1 + 0.05)^5 – 1) / 0.05] Solving for FV: Calculate (1 + 0.05)^5: (1 + 0.05)^5 = 1.2762815625 Subtract 1 and divide by the interest rate (0.05): (1.2762815625 – 1) / 0.05 = 5.52563125 Multiply the result by the cash flow per period (C): $1,000 x 5.52563125 ≈ $5,525.63