- My View My View

- Following Following

- Saved Saved

US labor market cooling; unemployment rate rises to two-year high of 3.9%

- Medium Text

- Nonfarm payrolls increase 275,000 in February

- December, January payrolls revised lower by 167,000

- Unemployment rate rises to 3.9% from 3.7%

- Average hourly earnings gain 0.1%; up 4.3% year-on-year

BROAD JOB GAINS

Sign up here.

Reporting by Lucia Mutikani; Editing by Chizu Nomiyama and Andrea Ricci

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Markets Chevron

Canada's retail sales contracted for a third consecutive month and dropped by 0.2% in March, data showed on Friday, led primarily by sales of furniture, home furnishings, electronics and appliances.

Advertisement

Supported by

U.S. Hiring Settles Into a Lower Gear

Employers added 187,000 jobs in August and unemployment rose to 3.8 percent as the economy continued to lose momentum built up after pandemic lockdowns.

- Share full article

By Lydia DePillis

Monthly change in jobs

+400,000 jobs

+187,000 jobs

jobs in August

Aug. ’22

Feb. ’23

The United States labor market is starting to look a lot like its old self — the one that existed before the pandemic.

The Federal Reserve’s interest rate increases have chilled investment, high-flying industries have returned to earth, and workers are staying put in their jobs rather than jumping for higher pay.

Employers added 187,000 jobs in August, the Labor Department reported Friday, and the previous two months’ figures were revised downward. That brings the three-month average to 150,000 — a marked slowdown from the 200,000 achieved for 29 consecutive months before that, and slightly lower than the average pace of 163,000 in 2019.

The question is whether that cooling will continue to levels that feel more like a real freeze as borrowing costs remain high and pressures on consumer spending mount.

“I think the labor force is finally healing to the point where we’re seeing some pre-Covid numbers,” said Chris Chmura, chief executive of Chmura Economics & Analytics. “But taking a step back and looking at broader trends in the economy, we’re not ruling out the potential of a recession next year.”

Hoping to contain price growth without causing a painful recession, the Federal Reserve has been looking for assurance that the labor market is loosening enough to reduce the risk that excessive demand for goods and services might cause inflation troubles to reignite.

Unemployment ticked up in August

Unemployment rate

A jump in the unemployment rate, to 3.8 percent in August from 3.5 percent, provides some of that evidence. The difference came from an increase of 736,000 people who are working or looking for work, raising the overall labor force participation rate to 62.8 percent, within a half a percentage point of its prepandemic high.

A slightly softer-than-expected increase in wages adds to that picture, with hourly earnings rising 4.3 percent from a year earlier, mostly level with the pace of wage growth since the spring. The August report reinforced market expectations that the Fed will hold interest rates steady at its next meeting, in mid-September, as it waits to assess the impact of the five-percentage-point increase over the past year and a half.

Wage growth slowed slightly in August

Year-over-year percentage change in earnings vs. inflation

AVG. HOURLY

PRICE INDEX

The recent hiring figures are subject to further revision; the Bureau of Labor Statistics has already indicated that job growth will look slightly weaker when it completes its annual benchmarking process.

But the overall trajectory is a sign that although the labor market is not as hot as it was during the height of the pandemic recovery, it may be leveling out in a better form than it took before 2020.

“The good news is, it’s a normal that favors workers more than we’re used to over the past 25 years,” said Justin Bloesch, an assistant professor of economics at Cornell University. Moreover, he noted, stability has its own benefits: People are more likely to join the work force if they feel confident they will be able to stay there awhile.

“This is where we start to get to the time where the duration of a good labor market matters more than how good,” Dr. Bloesch said.

Much of the slowdown has come from industries that are returning to more typical levels after the pandemic’s upheaval. Exhibit A: truck transportation, which grew to serve a stay-at-home online shopping spree and shrank as it died down. Trucking company payrolls flattened out over the past year, which probably masks an outright decline because many contracted owner-operators have also parked their rigs.

Last month, the industry subtracted nearly 37,000 jobs all at once with the bankruptcy of Yellow, which employed about 30,000 drivers and other staff members. If the mid-August jump in initial claims for unemployment insurance are any indication, most of those drivers did not immediately find new jobs.

“The truck job market has gone from excruciatingly tight in 2021 and the first half of 2022 to being as loose as it’s been since sometime shortly after the Great Recession,” said Kenny Vieth, president and senior analyst at ACT Research. “With Yellow taking 20-plus-thousand drivers out of the market, it’s a start in getting supply under control.”

It’s not just the trucking industry, however. The rest of the labor market is also coming into balance, with the number of job openings per unemployed worker declining to about 1.5 in July from more than two in early 2022, indicating that employers’ appetite for labor is nearly sated. Over the past year, the temporary help services industry has lost 185,000 jobs as employers have less need for extra short-term labor and can rely on their regular employees. The average number of hours worked per week has also receded, with overtime becoming less essential as payrolls have filled out.

That squares with what Kevin Vaughan has been seeing at his collection of six bars and restaurants in Chicago. It’s been a very busy summer, and over the past year, he’s had to fight to keep cooks and servers. Lately, though, he’s seen more qualified job applicants who need work because their starting dates at law firms have been deferred. He worries that the resumption of student loan payments may cause his customers to cut back on nights out with friends, but it helps him maintain consistent staffing.

“Now we’re becoming much more cost-focused,” Mr. Vaughan said. “And those who are already on our payroll are becoming much more focused on, ‘I need to make money, I got expenses, I need to show up to work.’”

Education and health saw the largest job gains

Change in jobs in August 2023, by sector

+102,000 jobs

Education and health

Leisure and

hospitality

Construction

Manufacturing

Leisure and hospitality

Business services

With hiring frenzies abating, employment growth has narrowed to a few industries that are still in recovery, like leisure and hospitality, or are set up for sustained demand because of structural factors in the economy, like private health care and education services. Those two broad sectors have accounted for 85 percent of the job gains over the past three months. Both are also disproportionately supplied by immigrants and women, groups that have entered the labor force at rates that surprised many analysts.

“At some point, and you’re seeing that somewhat on the leisure and hospitality side, those legs run out,” said Stephen Juneau, an economist with Bank of America Merrill Lynch. “Health services are structurally supported by aging demographics, and we’re just getting hospital funding back to normal. Once those support legs come off, what are we left with?”

One possible answer is renewed energy on the goods-providing side of the economy. Construction has remained surprisingly resilient. Home building has buckled under the strain of rising interest rates, and high vacancy rates have stalled office construction, but public infrastructure funding and tax breaks for renewable energy installations and semiconductor plants are creating more demand on the horizon.

Demand for cement is a leading indicator of jobs in construction, and it’s expected to decline by 2 percent this year, after a 13-year growth streak. But Ed Sullivan, chief economist for the Portland Cement Association, sees a turnaround next year fueled by federal spending on roads, bridges and other infrastructure.

“We haven’t really seen a heck of a lot of demand yet, but it’s starting to emerge,” Mr. Sullivan said. So far, a long backlog in orders has prevented significant layoffs. “It’s not having a significant adverse impact on employment, because we still need the drivers, we still need the contractors, et cetera,” he said.

Much of that construction spending is on new factories, which indicates that manufacturing employment — which has been flat in 2023 — may pick up next.

Lydia DePillis is a reporter on the Business desk who covers the changing American economy and what it means for people’s lives. More about Lydia DePillis

The Pandemic's Impact on Unemployment and Labor Force Participation Trends

Following early 2020 responses to the pandemic, labor force participation declined dramatically and has remained below its 2019 level, whereas the unemployment rate recovered briskly. We estimate the trend of labor force participation and unemployment and find a substantial impact of the pandemic on estimates of trend. It turns out that levels of labor force participation and unemployment in 2021 were approaching their estimated trends. A return to 2019 levels would then represent a tight labor market, especially relative to long-run demographic trends that suggest further declines in the participation rate.

At the end of 2019, the labor market was hotter than it had been in years. Unemployment was at a historic low, and participation in the labor market was finally increasing after a prolonged decline. That tight labor market came to an abrupt halt with the COVID-19 pandemic in the spring of 2020.

Now, two years later, the labor market has mostly recovered from the depths of the pandemic recession. The unemployment rate is close to pre-pandemic lows, and job openings are at record highs. Yet, participation and employment rates have remained persistently below pre-pandemic levels. This suggests the possibility that the pandemic has permanently reduced participation in the economy and that current participation rates reflect a new normal. In this article, we explore how the pandemic has affected labor markets and whether a new normal is emerging.

What Is "Normal"?

One way to define the normal level of a variable is to estimate its trend and compare the observed data with the estimated trend values. Constructing a trend essentially means drawing a smooth line through the variations in the actual data.

But this means that constructing the trend for a point in time typically involves considering what happened both before and after that point in time. Thus, constructing the trend at the end of a sample is especially hard, since we do not yet know how the data will evolve.

We construct trends for three aggregate labor market ratios — the labor force participation (LFP) rate, the unemployment rate and the employment-population ratio (EPOP) — using methods described in our 2019 article " Projecting Unemployment and Demographic Trends ."

First, we estimate statistical models for LFP and unemployment rates of demographic groups defined by age, gender and education. For each gender and education, we decompose its unemployment and LFP into cyclical components common to all age groups and smooth local trends for age and cohort effects.

Second, we aggregate trends from the estimates of the group-specific trends. Specifically, we construct the trend for the aggregate LFP rate as the population-share-weighted sum of the corresponding estimated trends for demographic groups. We construct the aggregate unemployment rate and EPOP trends from the group-specific LFP and unemployment trends and the groups' population shares.

In our previous work, we estimated the trends for the unemployment rate and LFP rate of a gender-education group separately using maximum likelihood methods. The estimates reported in this article are based on the joint estimation of LFP and unemployment rate trends using Bayesian methods.

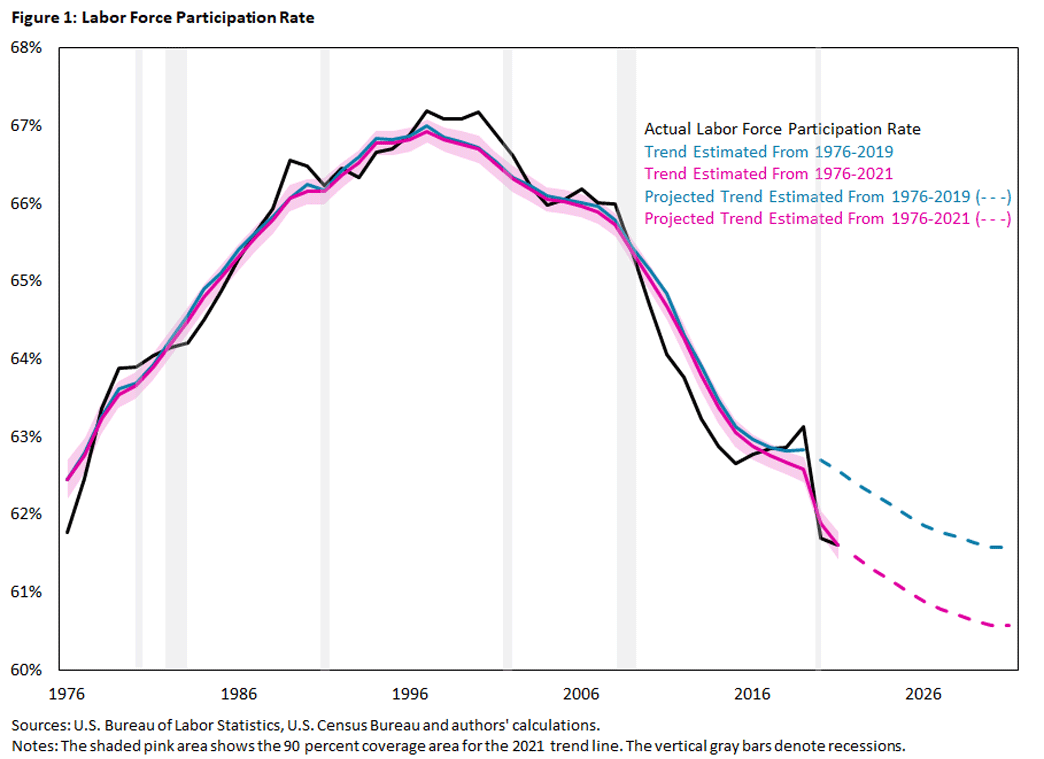

We separately estimate the trends using data from 1976 to 2019 (pre-pandemic) and from 1976 to 2021 (including the pandemic period). Figures 1, 2 and 3 display annual averages for the three aggregate labor market ratios — the LFP rate, the unemployment rate and EPOP, respectively — from 1976 to 2021.

In each figure, the solid black line denotes the observed values, and the blue and pink lines denote the estimated trend using data from 1976 up to and including 2019 and 2021, respectively. The estimated trends are subject to uncertainty, and the plotted trends represent the median estimate of the trend.

For the estimates based on data up to 2021, we also include the 90 percent coverage area shown as the shaded pink area. According to the statistical model, there is a 90 percent probability that the trend is contained in the coverage area. The blue and pink dotted lines represent our projections on how the labor market ratios will evolve until 2031, again based on the estimated trend up to and including 2019 and 2021. The shaded gray vertical areas highlight recessions as defined by the National Bureau of Economic Research (NBER).

Pre-Pandemic Trends: 1976-2019

We start with the pre-pandemic trends for the LFP rate and unemployment rate estimated for data from 1976 through 2019. After a long recovery from the 2007-09 recession, the LFP rate was 63.1 percent in 2019 (slightly above the estimated trend value of 62.8 percent), and the unemployment rate was 3.7 percent (noticeably below its estimated trend value of 4.7 percent).

The LFP rate being above trend and the unemployment rate being below trend reflects the characterization of the 2019 labor market as "hot." But note that even though the LFP rate exceeded its trend value in 2019, it was still lower than during the 2007-09 period. This difference is accounted for by the declining trend in the LFP rate.

As noted in our 2019 article , LFP rates and unemployment rates differ systematically across demographic groups. Participation rates tend to be higher for younger, more-educated workers and for men. Unemployment rates tend to be lower for men and for the older and more-educated population.

Thus, changes in the population composition over time — that is, the relative size of demographic groups — will affect the aggregate LFP and unemployment rates, in addition to changes in the LFP and unemployment rate trends of the demographic groups.

As also noted in our 2019 article, the hump-shaped trend of the aggregate LFP rate reflects a variety of forces:

- Prior to 1990, the aggregate LFP rate was boosted by an upward trend in the LFP rate of women. But after 1990, the LFP rate of women began declining. Combining this with declining trend LFP rates for other demographic groups has reduced the aggregate LFP rate.

- Changes in the age distribution had a limited impact prior to 2005, but the aging population since then has lowered the aggregate LFP rate substantially.

- Increasing educational attainment has contributed positively to aggregate LFP throughout the period.

The steady decline of the unemployment rate trend reflects mostly the contributions from an older and more-educated population and, to some extent, a decline in the trend unemployment rates of demographic groups.

Pre-Pandemic Expectations of Future LFP and Unemployment Trends

Our statistical model of smooth local trends for the LFP and unemployment rates of demographic groups has the property that the best forecast for future trend values of demographic groups is their last estimated trend value. Thus, the model will only predict a change in the trend of aggregate ratios if the population shares of its constituent groups are changing.

We combine the U.S. Census Bureau population forecasts for the gender-age groups with an estimated statistical model of education shares for gender-age groups to forecast population shares of our demographic groups from 2020 to 2031 (the dotted blue lines in Figures 1 and 2).

As we can see, the changing demographics alone imply further reductions of 1 percentage point and 0.2 percentage points in the trend LFP rate and unemployment rate, respectively. This projection is driven by the forecasted aging of the population, which is only partially offset by the forecasted higher educational attainment.

Based on data up to 2019, the same aggregate LFP rates in 2021 as in 2019 would have represented a substantial cyclical deviation upward from the pre-pandemic trends.

It is notable that the unemployment rate is much more volatile relative to its trend than the LFP rate is. In other words, cyclical deviations from trend are much more pronounced for the unemployment rate than for the LFP rate.

In fact, in our estimation, the behavior of the unemployment rate determines the common cyclical component of both the unemployment rate and the LFP rate. Whereas the unemployment rate spikes in recessions, the LFP rate response is more muted and tends to lag recessions. This feature will be important for interpreting how the estimated trend LFP rate changed with the pandemic.

Finally, Figure 3 combines the information from the LFP rate and unemployment rate and plots actual and trend rates for EPOP. On the one hand, given the relatively small trend decline of the unemployment rate, the trend for EPOP mainly reflects the trend for the LFP rate and inherits its hump-shaped path and the projected decline over the next 10 years. On the other hand, EPOP inherits the volatility from the unemployment rate. In 2019, EPOP is notably above trend, by about 1 percentage point.

Unemployment and Labor Force Participation During the Pandemic

The behavior of unemployment resulting from the pandemic-induced recession was different from past recessions:

- The entire increase in unemployment between February and April 2020 was accounted for by the increase in unemployment from temporary layoffs. This differed from previous recessions, when a spike in permanent layoffs led the bulge of unemployment in the trough.

- The recovery started in May 2020, and the speed of recovery was also much faster than in previous recessions. After only seven months, unemployment declined by 8 percentage points.

- The behavior of the unemployment rate is reflected in the 2020 recession being the shortest NBER recession on record: It lasted for two months (March to April 2020).

To summarize, the runup and decline of the unemployment rate during the pandemic were unusually rapid, but the qualitative features were not that different from previous recessions after properly accounting for temporary layoffs, as noted in the 2020 working paper " The Unemployed With Jobs and Without Jobs . "

The decline in the LFP rate was sharp and persistent. The LFP rate dropped from 63.4 percent in February 2020 to 60.2 percent in April 2020, an unprecedented drop during such a short period of time. After a rebound to 61.7 percent in August 2020, the LFP rate essentially moved sideways and remained below 62 percent until the end of 2021.

The large drop in the aggregate LFP rate has been attributed to, among others:

- More people — especially women — leaving the labor force to care for children because of school closings or to care for relatives at increased health risk, as noted in the 2021 work " Assessing Five Statements About the Economic Impact of COVID-19 on Women (PDF) " and the 2021 article " Caregiving for Children and Parental Labor Force Participation During the Pandemic "

- An increase in retirement due to health concerns, as noted in the 2021 working paper " How Has COVID-19 Affected the Labor Force Participation of Older Workers? "

- Generous pandemic income transfers and unemployment insurance programs, as noted in the 2021 article " COVID Transfers Dampening Employment Growth, but Not Necessarily a Bad Thing "

All of these factors might impact the participation trend, but by how much?

The Pandemic's Effect on Trend Estimates for LFP and Unemployment

The aggregate trend assessment for the LFP and unemployment rates has changed considerably as a result of 2020 and 2021. Repeating the estimation of trend and cycle for our demographic groups using data from 1976 up to 2021 yields the pink trend lines in Figures 1 and 2.

The updated trend estimates now put the positive cyclical gap in 2019 for LFP at 0.5 percentage points (rather than 0.3 percentage points) and the negative cyclical gap for the unemployment rate at 1.4 percentage points (rather than 1 percentage point). That is, by this estimate of the trend, the labor market in 2019 was even hotter than by the estimates from the 1976-2019 period.

In 2021, the actual LFP rate is essentially at trend, and the unemployment rate is only slightly above trend. That is, by this estimate of the trend, the labor market is relatively tight.

Notice that even though the new 2021 trend estimates for both the LFP and the unemployment rates differ noticeably from the trend values predicted for 2021 based on data up to 2019, the trend revisions for the LFP rate are limited to more recent years, whereas the trend revisions for the unemployment rate apply to the whole sample.

The difference in revisions is related to how confident we can be about the estimated trends. The 90 percent coverage area is quite narrow for the LFP rate for the entire sample up to the last four years. Thus, there is no need to drastically revise the estimated trend prior to 2017.

On the other hand, the 90 percent coverage area for the trend unemployment rate is quite broad throughout the sample. That is, a wide range of values for trend unemployment is potentially consistent with observed unemployment values. Consequently, the last two observations lead to a wholesale reassessment of the level of the trend unemployment rate.

Another way to frame the 2020-21 trend revisions is as follows. The unemployment rate is very cyclical, deviations from trend are large, and though the sharp increase and decline of the unemployment rate in 2020-21 is unusual, an upward level shift of the trend unemployment rate best reflects the additional pandemic data.

The LFP rate, however, is usually not very cyclical, and it is only weakly related to the unemployment rate. Since the model assumes that the cyclical response does not change over the sample, it then attributes the large 2020-21 drop of the LFP rate to a decline in its trend and ultimately to a decline of the trend LFP rates of most demographic groups.

Finally, the EPOP trend is again mainly determined by the LFP trend, seen in Figure 3. Including the pandemic years noticeably lowers the estimated trend for the years from 2017 onwards. The cyclical gap in 2019 is now estimated to be 1.4 percentage points, and 2021 EPOP is close to its estimated trend.

What Does the Future Hold?

In our framework, current estimates of trend LFP and the unemployment rate for demographic groups are the best forecasts of future rates. Combined with projected demographic changes, this implies a continued noticeable downward trend for the LFP rate and a slight downward trend for the unemployment rate.

The trend unemployment rate is low, independent of how we estimate the trend. But given the highly unusual circumstances of the pandemic, the model may well overstate the decline in the trend LFP rate. Therefore, it is likely that the "true" trend lies somewhere between the trends estimated using data up to 2019 and data up to 2021.

That being a possibility, it remains that labor markets as of now have been unusually tight by most other measures, such as nominal wage growth and posted job openings relative to hires. This suggests that the true trend is closer to the revised 2021 trend than to the 2019 trend. In other words, the LFP rate and unemployment rate at the end of 2021 relative to the 2021 estimate of trend LFP and unemployment rate are consistent with a tight labor market.

Andreas Hornstein is a senior advisor in the Research Department at the Federal Reserve Bank of Richmond. Marianna Kudlyak is a research advisor in the Research Department at the Federal Reserve Bank of San Francisco.

To cite this Economic Brief, please use the following format: Hornstein, Andreas; and Kudlyak, Marianna. (April 2022) "The Pandemic's Impact on Unemployment and Labor Force Participation Trends." Federal Reserve Bank of Richmond Economic Brief , No. 22-12.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

V iews expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Subscribe to Economic Brief

Receive a notification when Economic Brief is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.

Thank you for signing up!

As a new subscriber, you will need to confirm your request to receive email notifications from the Richmond Fed. Please click the confirm subscription link in the email to activate your request.

If you do not receive a confirmation email, check your junk or spam folder as the email may have been diverted.

Phone Icon Contact Us

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Unemployment

After dropping in 2020, teen summer employment may be poised to continue its slow comeback.

Last summer, businesses trying to come back from the COVID-19 pandemic hired nearly a million more teens than in the summer of 2020.

Most in the U.S. say young adults today face more challenges than their parents’ generation in some key areas

About seven-in-ten say young adults today have a harder time when it comes to saving for the future, paying for college and buying a home.

Some gender disparities widened in the U.S. workforce during the pandemic

Among adults 25 and older who have no education beyond high school, more women have left the labor force than men.

Immigrants in U.S. experienced higher unemployment in the pandemic but have closed the gap

With the economic recovery gaining momentum, unemployment among immigrants is about equal with that of U.S.-born workers.

During the pandemic, teen summer employment hit its lowest point since the Great Recession

Fewer than a third (30.8%) of U.S. teens had a paying job last summer. In 2019, 35.8% of teens worked over the summer.

College graduates in the year of COVID-19 experienced a drop in employment, labor force participation

The challenges of a COVID-19 economy are clear for 2020 college graduates, who have experienced downturns in employment and labor force participation.

U.S. labor market inches back from the COVID-19 shock, but recovery is far from complete

Here’s how the COVID-19 recession is affecting labor force participation and unemployment among American workers a year after its onset.

Long-term unemployment has risen sharply in U.S. amid the pandemic, especially among Asian Americans

About four-in-ten unemployed workers had been out of work for more than six months in February 2021, about double the share in February 2020.

A Year Into the Pandemic, Long-Term Financial Impact Weighs Heavily on Many Americans

About a year since the coronavirus recession began, there are some signs of improvement in the U.S. labor market, and Americans are feeling somewhat better about their personal finances than they were early in the pandemic.

Unemployed Americans are feeling the emotional strain of job loss; most have considered changing occupations

About half of U.S. adults who are currently unemployed and are looking for a job are pessimistic about their prospects for future employment.

REFINE YOUR SELECTION

Research teams.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

US applications for jobless benefits fall as labor market continues to thrive

A sign seeking job applicants is displayed at a restaurant in Wheeling, Ill., Thursday, May 16, 2024. On Thursday, May 23, 2024, the Labor Department reports on the number of people who applied for unemployment benefits last week.(AP Photo/Nam Y. Huh)

- Copy Link copied

The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low despite the Federal Reserve’s efforts to loosen the labor market.

Jobless claims for the week ending May 18 fell by 8,000 to 215,000, down from 223,000 the week before, the Labor Department reported Thursday.

The four-week average of claims, which softens some of the week-to-week volatility, rose a modest 1,750 to 219,750.

Weekly unemployment claims are considered a proxy for the number of U.S. layoffs in a given week and a sign of where the job market is headed. They have remained at historically low levels since millions of jobs were lost when the COVID-19 pandemic hit the U.S. in the spring of 2020.

The Federal Reserve raised its benchmark borrowing rate 11 times beginning in March of 2022 in a bid to stifle the four-decade high inflation that took hold after the economy rebounded from the COVID-19 recession of 2020. The Fed’s intention was to loosen the labor market and cool wage growth, which can fuel inflation.

Many economists thought there was a chance the rapid rate hikes could cause a recession, but jobs remain plentiful and the economy still broadly healthy thanks to strong consumer spending.

In April, U.S. employers added just 175,000 jobs , the fewest in six months and a sign that the labor market may be finally cooling off. The unemployment rate inched back up to 3.9% from 3.8% and has now remained below 4% for 27 straight months, the longest such streak since the 1960s.

The government also recently reported 8.5 million job openings in March, the lowest number of vacancies in three years.

Moderation in the pace of hiring, along with a slowdown in wage growth, could give the Fed the data its been seeking in order to finally issue a cut to interest rates. A cooler reading on consumer inflation in April could also play into the Fed’s next rate decision.

Though layoffs remain at low levels, companies have been announcing more job cuts recently , mostly across technology and media. Google parent company Alphabet, Apple and eBay have all recently announced layoffs.

Outside of tech and media, Walmart , Peloton, Stellantis, Nike and Tesla have recently announced job cuts.

In total, 1.79 million Americans were collecting jobless benefits during the week that ended May 11. That’s from up 8,000 from the previous week and 84,000 more than the same time one year ago.

Take the Quiz: Find the Best State for You »

What's the best state for you ».

US Applications for Jobless Benefits Fall as Labor Market Continues to Thrive

The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low levels

A sign seeking job applicants is displayed at a restaurant in Wheeling, Ill., Thursday, May 16, 2024. On Thursday, May 23, 2024, the Labor Department reports on the number of people who applied for unemployment benefits last week.(AP Photo/Nam Y. Huh)

The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low despite the Federal Reserve's efforts to loosen the labor market.

Jobless claims for the week ending May 18 fell by 8,000 to 215,000, down from 223,000 the week before, the Labor Department reported Thursday.

The four-week average of claims, which softens some of the week-to-week volatility, rose a modest 1,750 to 219,750.

Weekly unemployment claims are considered a proxy for the number of U.S. layoffs in a given week and a sign of where the job market is headed. They have remained at historically low levels since millions of jobs were lost when the COVID-19 pandemic hit the U.S. in the spring of 2020.

The Federal Reserve raised its benchmark borrowing rate 11 times beginning in March of 2022 in a bid to stifle the four-decade high inflation that took hold after the economy rebounded from the COVID-19 recession of 2020. The Fed’s intention was to loosen the labor market and cool wage growth, which can fuel inflation.

Many economists thought there was a chance the rapid rate hikes could cause a recession, but jobs remain plentiful and the economy still broadly healthy thanks to strong consumer spending.

In April, U.S. employers added just 175,000 jobs , the fewest in six months and a sign that the labor market may be finally cooling off. The unemployment rate inched back up to 3.9% from 3.8% and has now remained below 4% for 27 straight months, the longest such streak since the 1960s.

The government also recently reported 8.5 million job openings in March, the lowest number of vacancies in three years.

Moderation in the pace of hiring, along with a slowdown in wage growth, could give the Fed the data its been seeking in order to finally issue a cut to interest rates. A cooler reading on consumer inflation in April could also play into the Fed’s next rate decision.

Though layoffs remain at low levels, companies have been announcing more job cuts recently , mostly across technology and media. Google parent company Alphabet, Apple and eBay have all recently announced layoffs.

Outside of tech and media, Walmart , Peloton, Stellantis, Nike and Tesla have recently announced job cuts.

In total, 1.79 million Americans were collecting jobless benefits during the week that ended May 11. That’s from up 8,000 from the previous week and 84,000 more than the same time one year ago.

Copyright 2024 The Associated Press . All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Photos You Should See - May 2024

Tags: Associated Press , business , labor

America 2024

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

Biden vs. the Border

Elliott Davis Jr. May 23, 2024

Supreme Court Upholds South Carolina Map

Laura Mannweiler May 23, 2024

The U.S.-ICC Relationship, Explained

Aneeta Mathur-Ashton May 23, 2024

LA’s Abortion Pill Bill, Explained

Cecelia Smith-Schoenwalder May 23, 2024

What to Expect This Hurricane Season

The White House Hosts Kenya

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Unemployment Compensation

More in file.

- Who Should File

- Your Information

- Life Events

- Seniors & Retirees

- Businesses and Self-Employed

- Governmental Liaisons

- Federal State Local Governments

Unemployment compensation is taxable income. If you receive unemployment benefits, you generally must include the payments in your income when you file your federal income tax return.

Check If Your Unemployment Compensation Is Taxable

Report unemployment compensation, exclusion for tax year 2020 only, pay taxes on unemployment compensation, report unemployment fraud, more information.

Some types of unemployment compensation are taxed differently based on the program paying the benefits. Use our Interactive Tax Assistant tool to see if your unemployment compensation is taxable .

For more information, see Publication 525, Taxable and Nontaxable Income .

You should receive Form 1099-G, Certain Government Payments, showing the amount of unemployment compensation paid to you during the year.

To report unemployment compensation on your 2021 tax return:

- Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1, (Form 1040), Additional Income and Adjustments to Income PDF

- Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR

- Attach Schedule 1 to your return

If you received unemployment compensation but didn't get Form 1099-G in the mail, find the amount of your payments on your state unemployment agency website .

You can exclude unemployment compensation of up to $10,200 for tax year 2020 under The American Rescue Plan Act of 2021. See Exclusion of up to $10,200 of Unemployment Compensation .

Find more information:

- 2020 Unemployment Compensation Exclusion FAQs

- Tax Treatment of 2020 Unemployment Compensation

To pay tax on unemployment compensation, you can:

- Submit Form W-4V, Voluntary Withholding Request to the payer to have federal income tax withheld or

- Make quarterly estimated tax payments

Not sure which is best for you?

- See Publication 505, Tax Withholding and Estimated Tax

- Find information about tax withholding

If you receive Form 1099-G showing the wrong amount of unemployment compensation, contact your state unemployment agency to correct it. If you believe someone fraudulently collected unemployment payments using your information, take these steps to report it and protect yourself .

Find more information about identity theft and unemployment benefits .

- Publication 525, Taxable and Nontaxable Income

- Tax Topic 418, Unemployment Compensation

- Economic and Social Council

Global unemployment to increase in 2024, warns ILO report

- News: UN System

- Press Releases

- Media Accreditation

- What is ECOSOC?

- ECOSOC Members

- Publications

- ECOSOC at a Glance

- Subsidiary Bodies

- Rules of Procedure

- ECOSOC Newsletters

- ECOSOC Brochure

- Office for Intergovernmental Support and Coordination for Sustainable Development

- Department of Economic and Social Affairs

- Promoting Sustainable Development

- ECOSOC Coordination Segment

- Development Cooperation Forum

- Financing for Sustainable Development

- Coordinating Humanitarian Action

- Guiding Operational Activities for Development

- Management Segment

- Building Partnerships

- Engaging Youth

- Raising awareness on emerging issues

- Advising on Haiti's Long-term Development

- Promoting Peaceful and Inclusive Societies

- Working with Civil Society

- ECOSOC Sessions

- Code of Conduct

- Resolutions

- Ministerial Declarations

- Search ECOSOC Documents

Canada unexpectedly added 90,000 jobs in April, though unemployment stayed flat at 6.1%

Statscan's monthly labour force survey shows employment rate steady after 6 months of declines.

Social Sharing

The Canadian economy gained 90,000 jobs in April, much higher than the average of 20,000 jobs many economists were predicting for the latest Labour Force Survey numbers from Statistics Canada.

The federal agency pinned the increases in employment on part-time work, with more than 50,000 more of those types of positions. There were more jobs in the professional, scientific and technical services industries.

As well, employment for those aged 15 to 24 went up by 40,000 in April, the first monthly increase for that demographic since December 2022.

However, the unemployment rate was unchanged from the month before, staying at 6.1 per cent. This is higher than a year ago.

- It's even harder for young people to find jobs, and the unemployment rate proves it

- Canada's job numbers almost unchanged in March, while unemployment rose to 6.1%

"Within these numbers is strong employment growth but also still strong population growth," CIBC senior economist Andrew Grantham told CBC News, explaining why the unemployment rate was stable despite higher job growth.

More people are also actively employed or looking for work in Canada, with April's 0.1 per cent increase the first since June 2023.

That matches the experience of Dan Hong, owner of Ah-So Fine Foods in Toronto, who told CBC News his company is growing these days — and struggling to hire enough staff.

"We're willing to train, but unfortunately, it's been very challenging to find people to work," said Hong, whose company prepares and delivers fresh sushi to retailers in Ontario.

"We could use 20 to 30 people at any given time," he added, because his business operates in cities such as London, Toronto and Ottawa.

Statistics Canada said private sector employment went up in April after four months of little change. Grantham noted that while employment growth over the past year has been at least partly driven by the public sector, April's numbers show an encouraging move.

"This time around we did see quite a significant increase in private sector hiring, which was good news from an economic point of view," said the economist.

The employment rate, or the percentage of the population that is employed, was also steady at 61.4 per cent, which StatCan pointed out comes after six consecutive months of drops. That rate was also nearly one per cent lower in April 2024 than the year before, as population growth in Canada was higher than employment growth.

Wage growth down compared to March

These numbers come after a loss of 2,200 jobs in March, with that month's unemployment rate showing the largest increase since summer 2022.

Grantham said for the majority of people, this data is "good news" because the country is adding jobs, but measures that contribute to inflation, such as wage growth, are starting to come down.

Canada added 90,000 jobs in April, unemployment rate unchanged

Average hourly wages went up to $34.95, a 4.7 per cent increase compared to April 2023. However, that is a lower increase than March, which saw wages jump 5.1 per cent.

The Bank of Canada will be taking this report into account as it determines whether it will change interest rates in a decision next month.

CIBC's Grantham said the central bank could still cut rates in June, even with the job growth being stronger than expected, though economists from other institutions such as Citi are projecting a July rate cut.

BMO's Doug Porter wrote in an emailed note to subscribers, "Today's showy headline jobs increase will give the Bank of Canada some pause" when it comes to interest rate cuts, but that a June cut could be a "toss-up."

Regardless of the specific month, economists widely expect the bank to lower its trend-setting policy rate sometime this summer, though April's consumer price index data measuring inflation will heavily influence that decision.

ABOUT THE AUTHOR

Senior Reporter

Anis Heydari is a senior business reporter at CBC News. Prior to that, he was on the founding team of CBC Radio's "The Cost of Living" and has also reported for NPR's "The Indicator from Planet Money." He's lived and worked in Edmonton, Edinburgh, southwestern Ontario and Toronto, and is currently based in Calgary. Email him at [email protected].

- Follow Anis on Twitter

With files from Nisha Patel and Laura MacNaughton

Related Stories

- Some consumers, businesses are feeling more optimistic about the economy, say BoC surveys

- Bank of Canada holds key interest rate at 5%, says things moving in right direction

Add some “good” to your morning and evening.

Your weekly look at what’s happening in the worlds of economics, business and finance. Senior business correspondent Peter Armstrong untangles what it means for you, in your inbox Monday mornings.

This site is protected by reCAPTCHA and the Google Privacy Policy and Google Terms of Service apply.

Chattanooga FC Women Open 2024 WPSL Season Friday At Home

Sb preview: 2024 knoxville super regional.

- Top-Ranked Vols Bounce Back With 7-4 Win Over No. 3…

Latest Hamilton County Arrest Report

Nine-peat: baylor softball wins another title.

- McCallie Soccer Caps Undefeated Season with 3-2 Win…

- Lookouts Take Early Lead; Lose 8-5 To Mississippi

- Pollard Goal Leads Boyd Buchanan To DII-A State Soccer Title

- Dalton State Golfers Second Going Into Final Day Of…

- Lee Men, Women Golfers End Season At National Championships

Business/Government

Georgia regional commissions report decline in april unemployment rates.

- Thursday, May 23, 2024

Latest Headlines

Top-Ranked Vols Bounce Back With 7-4 Win Over No. 3 Texas A&M

- Breaking News

- Prep Sports

McCallie Soccer Caps Undefeated Season with 3-2 Win Over Christian Brothers In Spring Fling Final

Latest bradley county arrest report.

Click here for the latest Bradley County arrest report. more

Grand Jury True Bills

Here are the grand jury true bills: 317390 1 ANDRE JR, GERALD DOMESTIC ASSAULT 05/22/2024 317390 2 ANDRE JR, GERALD VIOLATION OF ORDER OF PROTECTION 05/22/2024 317391 1 ASKINS, SAMUEL ... more

CARTA’s Memorial Day Schedule

In observance of Memorial Day, CARTA’s fixed route, Downtown Shuttle, North Shore Shuttle and St. Elmo/Incline Shuttle bus services will operate on Saturday schedules on Monday. The CARTA Care-a-van ... more

in the Business/Government section">Business/Government

Chattanooga chamber calendar of events may 27-31, north parkdale avenue and one lane of brainerd road closed due to water main break.

Signal Mountain Police And Fire Department To Hold Open House June 8

$6.4 million in grant funding to expand local broadband, digital opportunities, city of chattanooga announces memorial day holiday garbage and recycle collection and site schedule, in the breaking news section">breaking news, soddy daisy approves 34-cent property tax increase on 1st reading, black denies any ties to wrecker firm charging "astonishing" fees despite girlfriend, brother, his own involvement.

Dottie Manis - Volunteering At Memorial Since 1959

In the opinion section">opinion, poor staffing model at soddy daisy high, stay safe this summer, send your opinions to chattanoogan.com; include your full name, address, phone number for verification, more staff information in hcde, snap is under threat of cut, in the happenings section">happenings.

Chattanooga Audubon Society Fairy And Folk Festival Is Friday-Sunday

Zine Fest Returns For Library’s 10 Years In The Making Celebration May 25

Jerry Summers: John W. Butler - Scopes Trial

A touch of elegance fashion show fundraiser is june 22, upcoming street closures, in the entertainment section">entertainment, attorney general skrmetti looking into attempted foreclosure of graceland.

Jazz Futures Is Thursday Evening At Songbirds

Cultural Cross Ties - Sister Cities in Conversation Is Friday

Attorney general skrmetti and doj lead federal antitrust lawsuit to break up live nation/ticketmaster.

Jeff Hoffinger And Friends Play At Heritage House June 6

In the dining section">dining, five star breaktime solutions acquires van vending service, hot chocolatier faces challenges.

UT Extension Hosts Canning And Freezing Classes In June And July

Unemployment Rates Drop In Every County Across Tennessee

Land Rover Chattanooga, Porsche Chattanooga To Serve As Exclusive Automotive Partners With McLemore Resort

Officers make arrest for domestic assault - and other collegedale police calls, in the real estate section">real estate.

Kadi Brown: Realtors Essential In Home-Buying

Independent Living Facility Sells For $11.049 Million

Kadi Brown: 2024 April Market Report

In the student scene section">student scene.

United Way Of Greater Chattanooga, Unum And HCS Partner To Refresh "Calming Corner" At East Brainerd Elementary

GNTC, Floyd County Prison Partnership Routes Career Path For Inmates

Bright School Students Learn Math Through Boatbuilding

In the living well section">living well, county health department announces implementation of “healthmatters”.

The Salvation Army Of Cleveland Transitions Inman Coffee To Mobile Ministry

Shedding Light On Chattanooga’s Unseen: Homelessness Exhibit Returns To Library May 24-July 31

In the memories section">memories.

Coal Mining History Offered At Good Old Days Museum On Saturday

Eddy Arnold – Fan Favorite For 7 Decades

Preserve chattanooga revisits 2017 endangered list, in the outdoors section">outdoors, jack benson heritage park to get new inclusive playground.

Tennessee National Guard Rescues Hiker In Smoky Mountains

Summer Means Road Trips And Increased Bear Activity

In the travel section">travel.

Tennessee Tourism Launches Statewide Road Cycling Program: Bike Tennessee

Creative Discovery Museum Opens Summer Exhibit, Wallace & Gromit: Get Cracking!

Tennessee Aquarium Hosts Rare, Stunning Spawning Event In Newest Gallery

In the church section">church.

Bob Tamasy: Do You Know Where Your Treasure Is?

Chattanooga Native Hosts 2 Book Signings In July For "A Journey Of Faith"

Union Gospel Mission Partners With Greater Images And Receives A One-Of-A-Kind Gift

In the obituaries section">obituaries.

Kay Dodson Nottingham Lee

Helen Naomi White (South Pittsburg)

Kay Rickman Campbell Boney

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

SSH-MOZHAYSK - FSSH-VOSTOK-ELEKTROSTAL head to head game preview and prediction

Oops! We detected that you use AdBlocker...

Please disable adblocker to support this website. Thank you!

I disabled all my adblockers for this website. Reload...

Open Modalf

IMAGES

COMMENTS

Unemployment rate rises to 3.9% from 3.7%. Average hourly earnings gain 0.1%; up 4.3% year-on-year. WASHINGTON, March 8 (Reuters) - U.S. job growth accelerated in February, but that likely masks ...

Monthly reports on all mass layoffs and quarterly reports on layoffs lasting more than 30 days. Unemployment Insurance Data and Statistics Unemployment insurance information from the Department of Labor's Employment and Training Administration, including weekly claims data, projections, and annual state taxable wage bases and rates.

U.S. Hiring Settles Into a Lower Gear. Employers added 187,000 jobs in August and unemployment rose to 3.8 percent as the economy continued to lose momentum built up after pandemic lockdowns. Note ...

The estimates reported in this article are based on the joint estimation of LFP and unemployment rate trends using Bayesian methods. We separately estimate the trends using data from 1976 to 2019 (pre-pandemic) and from 1976 to 2021 (including the pandemic period). ... Unemployment and Labor Force Participation During the Pandemic.

Long-term unemployment has risen sharply in U.S. amid the pandemic, especially among Asian Americans. About four-in-ten unemployed workers had been out of work for more than six months in February 2021, about double the share in February 2020. reportMar 5, 2021.

addition, for the week ending June 12, 52 states reported 118,025 initial claims for Pandemic Unemployment Assistance. The advance unadjusted insured unemployment rate was 2.4 percent during the week ending June 5, unchanged from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 3,288,318, a decrease of

Maybe not. America's latest report on unemployment benefits is proof that the US jobs recovery is still in full-swing. The average number of weekly jobless benefits claims over the past four ...

Updated 5:40 AM PDT, May 23, 2024. The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low despite the Federal Reserve's efforts to loosen the labor market. Jobless claims for the week ending May 18 fell by 8,000 to 215,000, down from 223,000 the week before, the Labor Department reported ...

Aaron M. Sprecher/AP. New York CNN —. First-time applications for unemployment benefits rose last week to 231,000, the highest level since August, in another sign that the white-hot labor market ...

There were 199,654 initial claims in the comparable week in 2023. The advance unadjusted insured unemployment rate was 1.1 percent during the week ending May 4, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,693,065, a decrease of 50,364 (or -2.9 percent ...

The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low despite the Federal Reserve's efforts to loosen the labor market. Jobless claims for ...

To report unemployment compensation on your 2021 tax return: Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1, (Form 1040), Additional Income and Adjustments to Income PDF. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR.

Global unemployment to increase in 2024, warns ILO report. 10 January 2024.

PDF | On Feb 27, 2020, Prajjwal Kaushik and others published "Research report on Indian Unemployment scenario and its analysis of causes , trends and solutions" A PROJECT STUDY SUBMITTED IN ...

Canada added 90,000 jobs in April, unemployment rate unchanged. A sign displays a vacant position in Halifax. Average hourly wages went up to $34.95, a 4.7 per cent increase compared to April 2023 ...

Atlanta Regional Commission. • The unemployment rate was down two-tenths to 2.9 percent over-the-month, the rate was 2.7 percent one year ago. • The labor force was down 13,906 over-the-month ...

Unemployment in the youth aged between 20 and 24 increased to 44.49 percent, which was 43.65 percent in the July-September quarter. Similarly, unemployment among the youth aged between 25 and 29 ...

Insee's report showed a rise in unemployment in the first quarter among 15-to-25-year-olds, who benefited from state-financed apprenticeships and job-support programs during Covid.

DUA, which is an unemployment insurance benefit made available especially for victims of disaster, is available to individuals who: Have applied for and used all regular unemployment benefits, or do not qualify for unemployment benefits; Worked or were self-employed or were scheduled to begin work or self-employment in the disaster area;

Elektrostal , lit: Electric and Сталь , lit: Steel) is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow. Population: 155,196 ; 146,294 ...

May 17, 2024 at 4:30 AM PDT. Listen. 6:39. Americans give Donald Trump the edge over Joe Biden on the economy in poll after poll. That's even as the Biden years have been the best time to find ...

FSSH-VOSTOK-ELEKTROSTAL vs KHIMKI-2 team performances, predictions and head to head team stats for goals, first half goals, corners, cards. RUSSIA MOSCOW-OBLAST-CHAMPIONSHIP---LEAGUE-A

LYTKARINO vs FSSH-VOSTOK-ELEKTROSTAL team performances, predictions and head to head team stats for goals, first half goals, corners, cards. RUSSIA MOSCOW-OBLAST-CHAMPIONSHIP---LEAGUE-A

SSH-MOZHAYSK vs FSSH-VOSTOK-ELEKTROSTAL team performances, predictions and head to head team stats for goals, first half goals, corners, cards. RUSSIA MOSCOW-OBLAST-CHAMPIONSHIP---LEAGUE-A