- About / Contact

- Privacy Policy

- Alphabetical List of Companies

- Business Analysis Topics

Aldi Five Forces Analysis & Recommendations (Porter’s Model)

Aldi and its competitive environment are evaluated in this Five Forces analysis using Porter’s model. Michael Porter’s Five Forces analysis model provides insights into the external factors influencing the competitive pressure on the discount supermarket chain. Aldi’s competitors, customers or buyers, suppliers, and substitutes, as well as new entrants in the industry are considered. Despite the competitive challenges noted in this Five Forces analysis, the retail market involves business opportunities for the company’s growth. The capabilities and competitive advantages identified in the SWOT analysis of Aldi strengthen the business to ensure its growth even when facing aggressive competition in a saturated market.

The satisfaction of the business purpose and goals linked to Aldi’s mission statement and vision statement depends on strategic effectiveness in addressing the competitive issues identified in this Five Forces analysis. The company’s strategies aim to overcome competition and related challenges in the retail operating environment.

Summary: Five Forces Analysis of Aldi

This Five Forces analysis case shows the significance of buyer power, new entry, and competition in influencing Aldi’s business performance. The grocery store chain uses this competitive environment to determine the best strategies for business growth. The following are the intensities of the five forces impacting Aldi:

- Bargaining power of buyers/customers: Strong

- Bargaining power of suppliers: Weak to moderate

- Threat of substitutes: Weak

- Threat of new entrants: Strong

- Competition/competitive rivalry: Strong

Recommendations. Aldi’s operating environment highlights the bargaining power of customers, the threat of new entrants, and competitive rivalry. However, all five forces are important strategic considerations. The trends discussed in the PESTEL/PESTLE analysis of Aldi are factors determining the intensities or strengths of the five forces. For example, economic and legal trends influence retail business strategies and market dynamics. Aldi’s marketing mix (4P) and related strategies and tactics can facilitate business improvement addressing competitive challenges in this case. Based on the results of this Five Forces analysis of Aldi, the following are the recommendations:

- Enhance marketing strategies to strengthen Aldi’s brands and to combat competitors and new entrants.

- Increase product innovation and development for unique private-label products that attract and retain customers.

- Consider vertical integration for some products as a strategic option to increase quality control, reduce costs, and enable further competitive pricing to attract more shoppers to Aldi stores.

Bargaining Power of Customers/Buyers

Customers and their ability to affect retail business performance are considered in this Five Forces analysis of Aldi. Shoppers and their buying decisions influence the retailer’s business decisions and performance. The following are among the factors that lead to the strong bargaining power of Aldi’s customers:

- Consumers’ low switching costs between retailers

- High quality of information (low information asymmetry)

- Low differentiation among retailers

Consumers’ low switching costs correspond to the high ease of switching from Aldi to competing supermarkets. In the context of this Five Forces analysis, the high quality of information relates to low information asymmetry. For example, consumers can readily access information about products and retailers and use this information to switch between Aldi and its competitors. Retail companies’ low differentiation also adds to the bargaining power of buyers in Porter’s Five Forces analysis model. Aldi’s competitive strategy and growth strategies are designed to attract and retain customers and to support business development while dealing with the buyer power evaluated in this Five Forces analysis.

Bargaining Power of Suppliers

Suppliers’ influence on supply chains, inventory, and other business areas is evaluated in this Five Forces analysis of Aldi. Suppliers’ strategies and decisions affect supply availability and the related costs in the retail business. The following factors contribute to the weak to moderate bargaining power of Aldi’s suppliers:

- Moderate population of merchandise suppliers

- High level of merchandise supply

- Aldi’s low to moderate cost of switching between suppliers

The moderate population of suppliers, including manufacturers of Aldi’s private-label brands, strengthens the bargaining power of suppliers. However, in the context of Porter’s Five Forces analysis model, high supply levels are seen as a factor that limits supplier power. For example, this factor and the low cost of switching enable Aldi to change the suppliers of products sold at its stores. In this Five Forces analysis, the combination of such factors creates weak to moderate supplier power. Supply chain management and related areas of Aldi’s operations management ensure the efficiency of the supply chain despite the challenges linked to suppliers considered in this Five Forces analysis.

Threat of Substitutes

The influence of substitutes for merchandise is considered in this Five Forces analysis of Aldi. Substitution affects consumers’ purchasing decisions and the retailer’s revenues and profits. The following are among the factors leading to the weak threat of substitutes against Aldi:

- Low availability of substitutes

- High cost of switching to substitutes

- Consumers’ low to moderate propensity to substitute

There are many substitutes for Aldi’s products. For example, consumers can opt for alternatives, including home-cooked foods (sauces and other ingredients), freshly picked spices and vegetables from home gardens, and freshly made ingredients and other products from artisanal shops. In Porter’s Five Forces analysis model, the low availability of these substitutes, especially in urban areas, limits the threat of substitution. Also, the high switching costs (time, expense, and effort) discourage consumers from using substitutes instead of Aldi’s products. Moreover, consumers’ low to moderate propensity to substitute equates to their limited tendency to substitute, considering their busy schedules, the convenience (or inconvenience) of using substitutes, and other variables. In this Five Forces analysis case, such factors contribute to the weak threat of substitution against Aldi.

Threat of New Entrants

New entrants and their corresponding effect on competition are evaluated in this Five Forces analysis of Aldi. New firms can attract buyers away from the discount supermarket chain. The following factors contribute to the strong threat of new entry against Aldi:

- Buyers’ low cost of switching to new entrants

- New firms’ low to moderate cost of entry

- Moderate cost of brand development

Customers can readily shop at new entrants’ stores because of the low cost of switching. This external factor strengthens the threat of new entrants against Aldi in the context of Porter’s Five Forces analysis model. The low to moderate cost of entry also helps facilitate the entry of new retail companies into the market. However, the moderate cost of developing brands, such as Aldi’s private-label brands, limits this threat of new entrants. Nonetheless, these factors and related variables in the retail industry create the strong threat of new entry in this Five Forces analysis case.

Competitive Rivalry with Aldi

Competition and its impact on business performance, growth, and profitability are considered in this Five Forces analysis of Aldi. Competitors impact the company’s sales revenues in the saturated retail market. The following are among the factors that lead to the strong force of competitive rivalry with Aldi:

- High number of retailers

- Stable but low market growth rate

- High level of competitive aggressiveness

The retail industry is saturated with many companies. For example, Aldi competes with Lidl, Whole Foods , Costco , Walmart , and Amazon ’s e-commerce and brick-and-mortar stores. Home Depot , which is not a direct competitor, has the potential to diversify and influence the competition considered in this Five Forces analysis of Aldi. The market also has a low growth rate related to consumer demand, economic growth, inflation, population growth, and other variables. Moreover, low differentiation and high aggressiveness among competitors add to the force of competitive rivalry by making it likely for shoppers to switch between retailers. In the context of Porter’s Five Forces analysis model, these external factors lead to strong competition, especially as price-sensitive consumers can easily switch from Aldi to competitors.

- About Aldi .

- Aldi – Our Food Philosophy .

- Aldi Supplier Information .

- He, K., Lei, H., & Liu, J. (2024). Comparative analysis of business strategy and compensation system in the US retail industry. Highlights in Business, Economics and Management, 24 , 516-520.

- Kostetska, N. (2022). M. Porter’s Five Forces model as a tool for industrial markets analysis. Innovative Economy , (4), 131-135.

- Theeb, K. A., Mansour, A. M. D., Khaled, A. S., Syed, A. A., & Saeed, A. M. (2023). The impact of information technology on retail industry: An empirical study. International Journal of Procurement Management, 16 (4), 549-568.

- Copyright by Panmore Institute - All rights reserved.

- This article may not be reproduced, distributed, or mirrored without written permission from Panmore Institute and its author/s.

- Educators, Researchers, and Students: You are permitted to quote or paraphrase parts of this article (not the entire article) for educational or research purposes, as long as the article is properly cited and referenced together with its URL/link.

The Thrifty Business Model of Aldi

Suppose you ask people to recall the first brand that comes to mind while online shopping; the answer would unanimously be Amazon. Similarly, when you ask them to recognize a brand name in the offline retail space, the chances are that the answer would be Walmart. These two are often known as the Big Daddies of the retail world (online and offline).

So, when the CEO of Walmart, Greg Foran (2014 – 2019), uses adjectives like “fierce,” “clever,” and “good” when talking about a competitor he admires, these words are not being used about Amazon but rather for Aldi, you sit up and notice.

A grocery business that started in a small town in Germany is today a giant in the retail world with almost 12,000 stores globally. In 2021, Aldi Group’s net sales amounted to just under 134 billion U.S. dollars, a 15.3 percent growth compared to the previous year .

So, what has made Aldi such a force to reckon with?

Before we understand Aldi’s business model and pricing approach, it makes sense to delve into its history. So, where and how did it all begin?

It started with two brothers obsessed with Frugality

After World War II, brothers Theo and Karl Albrecht decided to expand their family’s grocery business from a small-town Essen in Germany. They were pretty clear from early on that they would grow their business and do better than the competition by providing the best prices to their customers.

To do that, the brothers knew that they had to keep their costs low, and hence they were mindful of every little expense at their store. In fact, Theo was switching off the store’s lights in the daytime and taking copious notes on every deal. They also kept the store design to a bare minimum. These principles of the brothers continue to remain the foundation of Aldi to date.

However, the union between the brothers did not last. A dispute in 1961 on whether Aldi should sell cigarettes or not led to the brothers splitting the business into two: Aldi Nord (North Germany) and Aldi Sud (South Germany). Funnily enough, the area that divides the Aldi Nord and Aldi Sud regions in Germany is known as the ‘Aldi Equator.’

Even though the Albrecht brothers passed away, the two businesses remain separate. They operate in 18 countries between the two chains and are often known as just Aldi, irrespective of whether it is Aldi Nord or Aldi Sud. Together the two Aldi companies are the eighth biggest retailer in the world.

Aldi operates with the motto: “the best quality at the lowest price.”, and its 203,000 employees around the world live this motto every day.

Aldi SWOT Analysis

Aldi’s business model of keeping prices low

There are three key components of Aldi’s business model that help the brand keep low prices: Low Operating Cost, High Margin through Private brands & Limited SKUs. Let’s understand each one in detail.

1. Low Operating Costs :

One of the big reasons for Aldi to be able to keep its prices low is by deploying tactics that keep its operating costs as low as possible. These include:

- Essential Customer Experience Only : If you are looking for a delightful customer experience, then maybe you should remove Aldi from your itinerary because keeping the customer experience to a bare minimum is part of Aldi’s strategy to keep its costs low.

This means that Aldi customers are expected to go through a few inconveniences: change to rent a shopping cart, paper, and plastic bags at a fee and packing your groceries. As a result, Aldi does not need to have employees or their time going in retrieving shopping carts as the customer is incentivized/penalized if they do not return the cart. This practice is not new as supermarkets in Europe have been doing this for years, but the American customers find this an inconvenience from Aldi.

- Smart Design Principles : Aldi employs several key design details that maximize efficiency at checkout, too. Aldi puts supersized barcodes on many of its products and prints them on multiple sides. This makes scanning relatively easy and quick. Once the billing is done, the cashier drops the groceries directly into the shopping cart. Aldi doesn’t waste time bagging groceries. It is left to the customers to bag their purchases, and each bag comes at a fee.

Much of the Aldi store merchandise is put up in their original cardboard shipping boxes rather than individually. This saves a lot of employee time, which otherwise would go in stocking shelves with individual products.

Not a single lie was told. pic.twitter.com/jFRhUE1T3r — Momba (@TMikaMouse) December 24, 2020

- Lower Real Estate : Aldi does not carry as many SKUs as its competitors. Hence, it can keep its store size limited to 12,000 square feet on average compared to 178,000 square feet for Walmart and 145 000 square feet for Costco. The benefit is that its returns per square foot are much higher, and there is less inventory storage, refilling, ordering, and cleaning. As a result, Aldi stores do not need to keep as much staff as their competitors.

Costco is a membership-only retail company, which offers goods in bulk at competitive prices. What is Costco’s business model?

- Employees do more than one role : Aldi does not follow the conventional approach like other supermarkets of dividing labor as per roles – cashiers, clerks, operators, etc. At Aldi, employees are cross-trained to do various jobs at the store. Aldi also does not want its staff to answer calls, so it does not publicly share its phone numbers. As a result, quite often, an Aldi store might just have three to five employees in a store, saving them significant money.

All these savings are passed on to customers as discounts or lower prices.

2. High Margins through Private Brands :

90% of Aldi’s portfolio in its stores comes from private labels. This helps them keep their marketing and distribution costs low and gives them flexibility on pricing and margins. In fact, the products and packaging of some of these private labels look pretty similar to the big brands. So do not be surprised if you find a ‘Tandil’ laundry detergent that reminds you of the ‘Tide’ brand.

% of Revenue from Private Label Goods (Store Brand) Aldi: 90% Trader Joe's: 85% Save-A-Lot: 60% Dollar Tree: 30% Kroger: 29% Costco: 25% Walgreens: 25% CVS: 25% Target: 24% Walmart: 19% Amazon: 1% pic.twitter.com/VtwPMNWq17 — Alec Stapp (@AlecStapp) November 10, 2020

3. Limited SKUs :

Instead of providing its customers a wide range and aisles of products, Aldi carries only about 1,400 SKUs per store compared to the 40,000 traditional supermarkets carry and 100,000 Walmart supercenters hold. This allows Aldi to have a much faster turnaround of its inventory and helps the customers to make choices faster.

USA: Exploiting The Retail Playground

Even though Aldi is from Europe, knowing the potential of the USA, Aldi Sud has been quite aggressively expanding its base and now has 2,100+ stores spread across 35 states of the country. It has ambitions to have 2,500 stores by the end of 2022, becoming America’s third-largest supermarket chain behind Walmart and Kroger. Illinois has 201 Aldi stores, which is 9% of all Aldi stores across the United States.

Aldi as a strong competitor

One of the biggest mistakes retail chains have made in many different markets is dismissing Aldi’s entry and expansion and not considering it a significant threat to their own business.

Some of them were naïve enough to think that Aldi’s pricing and business model is different from theirs will cater to another segment of customers. This is where they were wrong, and as a result, countries like the USA, Hungary, Ireland, Switzerland, and United Kingdom are places where Aldi has really taken a massive chunk of the market, and the grocers realized this too late.

Aldi not only caters to the low- or mid-income shoppers but also targets the wealthy shoppers. Walmart’s previous CEO, Greg Foran, marveled that he saw so many BMWs and Mercedes in the parking lot of the Aldi store he visited in Australia once. In fact, luxury cars like Jaguar and Tesla Model X are often seen in the parking lots of Aldi stores in the USA.

Aldi has noticed this profile of shoppers as well, and it has smartly ramped up its portfolio and offer by keeping exotic items like brioche from France, Irish cheese, imported items, organic products, pastas from Italy, and much more, which not only helps it to get the high-income shopper but also allows it to earn high margins.

Trader Joe’s has no online presence, discounted sales, loyalty rewards, or membership program but is thriving with its 3 critical pillars in its business model. What are they?

Aldi’s Marketing strategy of connecting with the millennials shoppers

Purpose, private brands, great marketing.

Today’s Millennial and Gen-Z shoppers are much more mindful of the products they buy and more than the brand name; what matters to them are the authenticity of ingredients, the purpose behind the company, and of course, low prices and convenience. Aldi’s reliance on private labels ticks all these boxes and helps them win that set of consumers.

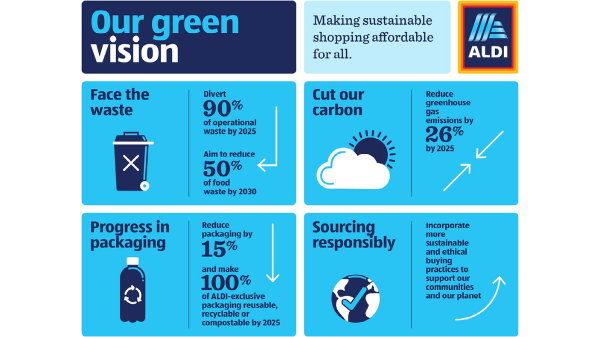

100% of ALDI-exclusive chocolate bars and chocolate confectionery are from sustainable sources, and all of its coffee will be sustainably sourced by 2022.

Aldi understands society and its customers’ needs and keeps their priorities at the forefront. It has several eco-friendly initiatives. ALDI has also been recognized by the EPA (Environmental Protection Agency) for its record-breaking green efforts . The retail giant is dedicated to sustainable business practices while delivering high-quality products and affordable prices.

We believe in acting with integrity and are dedicated to reducing our environmental impact. We’re committed to reducing, reusing and recycling waste , increasing energy efficiency, decreasing our carbon footprint and improving our green building standards across all of our stores and operations. Aldi’s Website On Environment

In fact, Aldi has a robust Corporate Responsibility Program that comprises of five main areas:

- Employee Appreciation

- Supply chain responsibility

- Resource conservation

- Social commitment

- Dialogue promotion

If you thought that a low-priced chain would not be doing great marketing, let me tell you that Aldi’s ad was crowned 2021’s most effective Christmas ad . Research done by Kantar declared Aldi’s ad of reimagining Charles Dickens’ ‘A Christmas Carol,’ featuring Kevin the Carrot and new character Ebanana Scrooge, as the Christmas ad that would most likely deliver on long and short-term measures for the brand.

These are the perfect recipe to keep the millennials and Gen-Z customers hooked to the chain and coming back for more.

Building Fan Following

With such a business model, you would expect customers not to be delighted with an Aldi experience other than the price benefits. Contrary to expectations, Aldi scores much higher on customer satisfaction surveys than Walmart and other supermarket chains.

In fact, as per Bain & Company, Aldi has one of the highest NPS of ~45 (Net Promoter Scores), which is an excellent indication of how likely customers are going to promote and advocate the brand to others. To give you a perspective, Walmart has an NPS of 16 .

Walmart is known for its EDLP or Everyday Low Pricing. However, such is the aura of Aldi that every time a new Aldi opens up, especially in the USA, it results in hundreds of people flocking to the opening as the prices are sometimes even lower than Walmart.

This aura is not limited to people interested in Aldi’s low prices. Such is the cult following of Aldi that there is a fan blog called Aldi Nerd (run by a stay-at-home mom of three kids), and there are people who love to buy Aldi Nerd merchandise. The community has 1.4 Mn members on Facebook .

Unchartered Territories

Aldi opened its first store in China only in 2019 and, to date, has a meager presence of 6 stores in the entire country where retail and e-commerce are part and parcel of everyday living. Aldi has not even made an in-roads into the Indian market as yet.

So other than the frontiers that Aldi is crossing every year, there are still two huge markets that the retail chain has not even tapped into. Aldi’s business model shows you the brand’s potential and why all retail brands should continue watching their shoulder as soon as they see the presence of Aldi in their vicinity.

A marketer by profession, a writer by heart and a traveller from the soul. Kunal calls himself a 'Collector of Experiences', who strongly observes human behaviour and societal truths. Kunal is an experienced professional across categories and countries in B2C and B2B industries. Currently, he is the Global Director: Marketing & Communication at DSM Nutritional Products, Switzerland and he has also worked in companies like Nestle, Britannia and Arvind Brands. Building and growing brands is a challenge that he enjoys and he is always on the lookout for great marketing, advertising or innovation stories from around the world. He regularly posts about these case studies on his LinkedIn.

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

How Aldi Became A Global Supermarket Giant

Table of contents.

The Albrecht brothers had a vision to bring affordable food and goods to the people of Germany at the end of World War II. Their unique approach to bring a low-cost, no-frills business model has helped them stand out with their loyal customer base. Important Stats to Know About Aldi:

- Aldi employs 203,600 employees around the world

- Headquartered in Essen and Mülheim, Germany

- The combined brand generates about $80 billion each year

- Operates over 12,000 grocery stores worldwide

- Aldi is family-owned and not publicly traded

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

The History of Aldi

In 1913, Anna Albrecht opened a small grocery store in Essen, Germany. The store remained relatively unchanged and even survived the widespread bombings and destruction in Germany during World War II. In 1946, her sons, Karl and Theo Albrecht took over the business with the goal of expanding its operations. By 1950, the brothers had grown the business to 13 locations across the Ruhr Valley.

Aldi’s Early Discount Strategy

The economic conditions in Germany following the war were difficult. The Albrecht brothers were frugal people and believed that consumers should have the opportunity to purchase high-quality food and goods at affordable prices.

At the time, people who wanted to purchase inexpensive goods would normally participate in a discount cooperative. These cooperatives would provide members with rebate stamps with each purchase that could be redeemed at a later date to get a portion of their money back. The challenge was that this process was time-consuming and painful to track. The Albrecht brothers decided on a different approach. Instead of making their customers pay full price and get their money returned later, they decided to offer the discount before the sale. This discount was restricted to 3% which was the maximum legal rebate amount allowed at the time. Thus, making Aldi one of the first discount stores on the planet.

The brothers were diligent to monitor their inventory to identify which products sold quickly and removed those that didn’t sell. Other retailers would often lose money if a product didn’t sell. In order to get the unpopular item off their shelves, they would have to spend money on advertising or discount them. Karl and Theo Albrecht refused to pay for any advertisements at all and removed items from their shelves that didn’t sell easily.

Times after the war were tough in Germany. The brothers chose to carry only non-perishable food items. This benefited the grocery store chain by reducing the risk of losing money from spoilage.

Another strategy was to keep the average store small compared to some of its competitors. With a smaller store, there was no need to spend large amounts of money on inventory to keep the shelves full. The brothers also didn't have the overhead (rent, utilities, etc.) of a larger commercial space. This allowed them to focus on keeping their shelves full of only the most popular items.

Interesting Fact

The albrecht brothers refused to pay for telephones to be installed in their stores until the 1990s. until this time, employees were required to use a local payphone to make business calls., splitting the company and creation of the aldi brand.

By 1960, the brothers had about 300 locations in operation. As the chain continued to expand, the Albrecht brothers needed to make some decisions to continue growing the company. Theo proposed that the stores start carrying cigarettes and other tobacco products to boost sales. Karl disagreed and felt that carrying these types of products would attract shoplifters.

This dispute led to the brothers making the decision to amicably split the company. While the two brothers would operate their own grocery store chains, they chose to both operate under a unified brand name. In 1962, the name Aldi (often shown in all caps, ALDI) was introduced as a shortened version of Albrecht Diskont . By 1966, the company was officially financially and legally separated.

Key Takeaways

- Karl and Theo Albrecht understood that the people of post-World War II Germany needed access to inexpensive products. They launched the first discount store that was not formed as a cooperative by offering discounts before the sale rather than post-sale rebates.

- The chain of stores focused on a no-frills experience to keep costs down. Strategies included removing unpopular items from shelves, reducing overhead through smaller stores, and spending no money on advertising.

- Despite its popularity, the Albrecht brothers chose to divide the company after a dispute over whether to sell cigarettes. The brothers wisely chose to continue operating the two separate companies under the same brand name — Aldi.

Two Companies, One Brand

When Aldi split into two entities, the companies were officially named Aldi Süd and Aldi Nord. Aldi Süd took the stores that were located in the south of Germany, while Aldi Nord took the northern stores. This dividing line is commonly referred to as the Aldi-Äquator (which literally means Aldi equator).

Both companies took a similar approach in the way they organized their extensive network of grocery stores. Stores are divided into regions. These regions are operated as limited partnerships that are managed by a regional manager. The regional manager then reports directly to the parent company headquarters — Aldi Nord in Essen or Aldi Süd in Mülheim. In Germany, Aldi Nord consists of 35 regional branches that operate approximately 2,500 stores. Aldi Süd comprises 31 regional branches with about 1,900 stores.

Although the two companies operate separately, they do work together in some respects. For example, they share many of the same marketing and store design strategies. The company even has a common company website — www.aldi.com — which redirects users to the appropriate site depending on the country they select. This effort appears seamless and has helped the Aldi brand reach millions of customers in numerous markets.

International Expansion of the Aldi Brand

Aldi began expanding beyond the borders of Germany in 1967 when Aldi Süd purchased the Hofer grocery chain in Austria. Aldi Nord followed suit shortly after and opened its first international location in the Netherlands in 1973.

In its early years, Germany was still separated into East and West Germany. This limited Aldi’s ability to expand internationally, but once the Iron Curtain fell and Germany was reunified in 1990, growth accelerated rapidly.

To avoid competing against one another, Aldi Nord and Aldi Süd avoid operating in the same markets or countries. Today, Aldi Nord operates in Denmark, France, Benelux (Belgium, Netherlands, and Luxembourg), Portugal, Spain, Poland. Aldi Sud operates in Ireland, the UK, Hungary, Switzerland, Australia, China, Italy, Austria, and Slovenia.

The combined Aldi brand currently has over 12,000 locations around the globe. Aldi Nord and Aldi Süd together make up the fourth-largest grocery chain by the number of stores.

Growth in the United States

Outside of Germany, the only shared market is the United States. Aldi Süd opened the first US-based Aldi store in Iowa in 1976. Aldi stores quickly expanded throughout the Midwest and Eastern United States.

Aldi Nord also expanded operations to the United States in the same year but chose a different approach. Instead of using the Aldi name, Theo Albrecht found that the California-based Trader Joe’s had a loyal customer base and was committed to a similar mission to providing its customers with low-priced goods. In 1976, Aldi Nord purchased Trader Joe’s.

Between the Aldi and Trader Joe’s brand, the US operation makes up about 10 percent of Aldi’s global footprint.

Current Ownership of Aldi

The companies continue to be privately owned and are not traded on any public stock exchange. The Albrecht brothers ran their respective companies as CEO until they both retired in 1993. Upon their retirement, the control of the company was transferred to private family foundations. The Siepmann Foundation controls Aldi Süd and the Markus, Jakovus, and Lukas Foundation controls both Aldi Nord and Trader Joe’s.

The significant growth of the Aldi brand has led to Karl and Theo Albrecht being ranked among the wealthiest people on the planet. In 2010, Theo was ranked by Forbes magazine as the 31st richest person with a net worth of over $16 billion. Around the same time, Karl was ranked as the 21st richest person by the Hurun Report. Today, the Albrecht family is estimated to be worth a combined $53.5 billion.

Having a lot of money made the Albrecht brothers a target. In 1971, two kidnappers successfully abducted Theo and held him for ransom for 17 days. A ransom of 7 million Deutschmarks (about $3.5 million) was paid for his release. Following the incident, the brothers became very reclusive and would travel in armored cars to and from the office.

- With the company split into Aldi Nord and Aldi Süd, the Albrecht brothers agreed to divide the territory and work under a unified brand.

- Both companies focused their growth on international markets and agreed to not operate in the same countries to reduce competition with one another (Germany and the United States are the exceptions).

- In the United States, Aldi Süd opened stores under the Aldi name. Aldi Nord purchased the small grocery chain Trader Joe’s and expanded operations under this brand.

Trader Joe’s Recipe for Success

Theo Albrecht’s decision to purchase Trader Joe’s was a smashing success. What started as a handful of stores in Southern California has expanded to over 500 locations nationwide. The brand is recognized as having one of the highest sales per square foot of store space compared to its competitors. Despite making up less than 5 percent of the total number of Aldi-owned stores, Trader Joe’s accounts for approximately 16 percent of the total revenue. While Trader Joe’s does follow some of the similar strategies of the Aldi brand, there are a few differences.

Fun Atmosphere

When a customer walks into Trader Joe’s, they will immediately notice the island or tiki-themed decor. The brand works hard to give their customers a feel-good experience when they shop. Employees are referred to as “crew members” and can be seen wearing Hawaiian shirts (managers are called “captains”). They also have nautical bells that they use to communicate instead of the traditional PA system found in most grocery stores.

The original owner, Joe Coulombe, felt that his stores were too similar to boring convenience stores at the time. He set out to create something unique and different that customers would remember. Joe was obsessed with the South Pacific, so he went with that theme. While the island theme is found in all Trader Joe’s stores, most mix in elements from the local community. For example, a Trader Joe’s in Denver might feature artwork that has mountains.

Unique and Specialty Products

Trader Joe’s has a wide range of products that you can't find anywhere else such as their apple chicken sausage links or Indonesian salsa. They are big on having plenty of specialty options that are vegetarian, vegan, gluten-free, and other dietary restrictions. Customers can usually find free samples throughout the store. Employees are encouraged to try as many of the store’s products as possible so they can easily describe or make recommendations to customers.

Low Prices Through Trader Joe’s Branding

In a Trader Joe’s store, customers won’t see a lot of name-brand products. The reason for this is that about 80 percent of products sold in the store carry the Trader Joe’s brand. Many of these products are name-brand goods under the generic label. This helps Trader Joe’s secure lower pricing from its suppliers. Trader Joe’s has strict privacy agreements with its suppliers to not make their relationship known to the public.

Cult Following

While the Aldi and Trader Joe’s brands are known for low prices, they both attract a different type of crowd. Aldi is popular among low-income or blue-collar workers. Trader Joe’s has focused on catering to higher-income families and college students. They do this by constructing stores in more affluent neighborhoods. This has attracted more of a cult following. Trader Joe’s customers are extremely loyal to the brand.

Social Responsibility

Trader Joe’s is known for responding well to feedback and criticism from the local community. For example, it removed some Chinese-based food products due to consumer health concerns.

The chain also eliminated six unsustainable fish species from its shelves to help protect the environment. This helped earn Trader Joe’s the 3rd spot (up from the 15th spot) on Greenpeace’s CATO (Carting Away from Oceans) scale.

- Trader Joe’s has become a significant contributor to Aldi’s annual revenue by offering a unique set of products, catering to a specific customer base, and deploying a memorable tiki-theme in their stores.

- Their strategic placement of stores in affluent neighborhoods and near college campuses has allowed them to secure a cult following in many areas around the country.

A Brand Built on Frugality

There isn’t much known about the Albrecht brothers outside of their involvement in building the Aldi brand. However, they are known for being extremely frugal individuals despite being worth billions of dollars at the peak of their lives. This frugality bled over into their business model helping them create a company that was dedicated to keeping prices low while minimizing risk and overhead costs.

No Frills Shopping Experience

Theo and Karl Albrecht understood that every business expense must be charged back to the customer. For this reason, Aldi has focused on creating a shopping environment that provides customers with high quality, low-cost products, and nothing more.

Aldi has historically viewed any form of advertising as a wasted expense. Outside of their sales ad that shows the deals going on that week and social media presence, very little money is spent on marketing or advertising. Aldi has stuck to this stance from the very beginning. When you enter an Aldi store, you will see promotion of the company’s mission and value statement but nothing advertising the actual products.

While the brand has recently started investing money in the look of their stores, many traditional Aldi locations display goods in their original shipping boxes. This reduces the cost of paying store clerks to transfer the goods from boxes to the shelves.

Aldi also encourages its shoppers to bring their own grocery bags. Even in areas where this is now mandated by law, Aldi is historically charged for plastic or paper bags. Customers are also responsible for bagging their own groceries saving the salary of a bagger. Customers will often simply use empty or discarded boxes found throughout the store. This also reduces the cost for the store for garbage disposal.

Most grocery stores are forced to hire staff to go into the parking lot to collect shopping carts and bring them back for the next customers to use. Aldi took a unique approach to this by installing devices on the carts that lock them together. When a customer wants to use the cart, they must insert a coin (like a quarter). The customer then gets this coin back when they return the cart. Example below.

Aldi also carries far fewer products than a traditional grocery store. Many popular competitors can carry tens of thousands of different products. For Aldi, the store size is kept small (about 12,000 square feet) with approximately 1,400 products. Many of these products are displayed with Aldi’s brand name on the packaging. This helps keep the costs of goods low since customers aren’t paying for popular name brands.

- The Albrecht brothers were known for being extremely frugal. These practices heavily influenced the way that Aldi is operated and has led to much of its success.

- The interior of Aldi stores provides a no-frills experience with food displayed in shipping boxes and no advertising. This helps to keep the cost low for consumers.

- Aldi relies on the customer to provide their own bags and labor to keep costs low. For example, customers participate in bagging their own groceries, removing empty boxes from the store, and returning shopping carts for the next customer.

The Future and Innovation of the Aldi Brand

.jpg)

Aldi has an ambitious goal to continue growing in the near future. This is especially true in the United States. Aldi US (Aldi Süd’s United States division) announced that it planned to become the third-largest grocery chain in the United States after Walmart and Kroger by the end of 2022. Aldi currently ranks 9th when compared by revenue to other grocery store chains in the United States. The company hopes to achieve this by focusing on new opportunities to expand services and take advantage of e-commerce. They also plan to rapidly expand the number of operating stores.

Embracing the COVID-19 Pandemic

Aldi has taken advantage of and adapted well to the COVID-19 pandemic. With workers across the globe transitioning to remote work, there has been a higher demand for groceries. While other foodservice businesses struggled, Aldi US seized the opportunity to expand their services to capture new market share including curbside pickup at hundreds of stores, alcohol sales, Instacart deliveries, and other e-commerce initiatives.

Expanding Product Lines

In 2020, Aldi announced that it would break from its approach of stocking many non-perishable food items and expand fresh food options by 40%. Due to consumer demands and changing diets, Aldi has made additional produce, meat, organic items, and prepared foods available to its customers. This is especially critical as Aldi expands into agriculture hubs like California that is known for its readily available fresh fruits and vegetables.

Creating Strategic Partnerships

Aldi is known for coming up with creative solutions to keep costs low and tackle challenges. The labor shortage coming out of the COVID-19 pandemic is no exception. With many companies laying off workers or reducing hours, Aldi partnered with the fast-food giant McDonald’s to share employee resources. This was a win-win for everyone involved — Aldi could get much-needed help with increased demand for groceries, employees would be able to maintain their income, and McDonald’s would be able to retain those employees for when economic conditions improved.

Rumors of a Consolidation

Since Aldi is privately owned, they don’t often share their strategies openly with the public. However, both Aldi Nord and Aldi Süd have made efforts in recent years to better align their product offerings to be more similar. Many speculate that this could be an indicator that the two entities plan to combine once more in the near future.

The company could potentially benefit from being publicly traded. An IPO (Initial Public Offering) could help generate some additional funding to be used toward the expansion and remodeling of existing stores.

- Aldi plans to continue to grow its market share by opening a large number of new stores by the end of 2022.

- The brand has worked diligently to adapt and capture new opportunities that came with the COVID-19 pandemic including curbside pickup, e-commerce, and labor sharing partnerships.

- Some rumors exist that Aldi could be making moves to boost its market strength by combining Aldi Nord and Aldi Süd into a single entity.

Final Thoughts and Key Takeaways

The Aldi brand is a true powerhouse in the grocery store industry. While other brands have focused their efforts on traditional approaches such as paying for expensive advertising or trying to stock the largest variety of products, Aldi has taken the opposite approach. From its frugal beginnings, the brand has captured the attention of consumers across the globe. In many cases, Aldi’s strategy has kept pricing so low that competitors have been forced to slash their prices. This has helped Aldi continue to gain a foothold in new markets around the world.

Quick Comparison of Aldi Brands

- The Aldi brand started as a small, family-owned grocery store owned by Anna Albrecht. Once her sons took over the business in the 1940s, the business grew rapidly and expanded across Germany.

- The early strategy was to offer discounts to customers before the sale. This was a new approach at the time as most consumers purchased inexpensive food products from cooperatives.

- The Albrecht brothers decided to split the business into two separate companies after a dispute over whether to sell tobacco products. The two companies would continue to operate under the combined brand Aldi (short for Albrecht Diskont).

- The two Aldi companies avoid operating in the same countries to avoid competition. The only exception is Germany and the United States. In the US, Aldi Nord operates under the Trader Joe’s brand while Aldi Süd uses the Aldi name.

- Both Aldi companies are still family-owned and have never been publicly traded.

- The Trader Joe’s brand is extremely popular in the United States and makes up a sizable portion of the brand’s annual revenue.

- Aldi gives its customers a no-frills shopping experience to keep costs low including generic brands, products displayed in original shipping boxes, and making customers bag their own groceries.

- Aldi stores are much smaller than their competitors and carry far fewer products. This allows them to focus their efforts on stocking only products that sell quickly.

- The Aldi brand plans to continue rapid expansion efforts around the globe. In the United States, the brand plans to open hundreds of new locations, securing them the number three spot after Walmart and Kroger.

- Aldi has used the pandemic to launch new initiatives and create special partnerships to strengthen and grow the brand.

- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Aldi: The Dark Horse Discounter

- Strategy & Execution / MBA EMBA Resources

Next Case Study Solutions

- Bharat Petroleum's Upstream Strategy and Exploration Success Case Study Solution

- Innovation and Development of China Machine Press in the New Century Case Study Solution

- OWNI: Disrupting the French Media Landscape Case Study Solution

- Alcoa's Bid for Alcan (A) Case Study Solution

- Dongfeng Nissan's Venucia (A) Case Study Solution

Previous Case Solutions

- Innovative Public Health in Alberta: Scalability Challenge Case Study Solution

- Ethiopian Airlines: Bringing Africa Together Case Study Solution

- Warren Buffet and his Newspaper Investments Case Study Solution

- Colin's Car Detailing Case Study Solution

- HeidelbergCement: The Baltic Kiln Decision Case Study Solution

Predictive Analytics

May 30, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Aldi: the dark horse discounter description.

In 2013, Aldi-the world's 8th largest retailer-planned to accelerate its US expansion. Aldi was a German-based hard discounter that sold a limited assortment of private-label groceries and household items in barebones stores. Despite its presence with 1200 stores in 32 states, Aldi was still relatively unknown in the US. But it was often cited as one of the reasons for Walmart's exit from Germany. Could it compete with Walmart in the US, Walmart's home market?

Case Description Aldi: The Dark Horse Discounter

Strategic managment tools used in case study analysis of aldi: the dark horse discounter, step 1. problem identification in aldi: the dark horse discounter case study, step 2. external environment analysis - pestel / pest / step analysis of aldi: the dark horse discounter case study, step 3. industry specific / porter five forces analysis of aldi: the dark horse discounter case study, step 4. evaluating alternatives / swot analysis of aldi: the dark horse discounter case study, step 5. porter value chain analysis / vrio / vrin analysis aldi: the dark horse discounter case study, step 6. recommendations aldi: the dark horse discounter case study, step 7. basis of recommendations for aldi: the dark horse discounter case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Aldi: The Dark Horse Discounter

Aldi: The Dark Horse Discounter is a Harvard Business (HBR) Case Study on Strategy & Execution , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Aldi: The Dark Horse Discounter is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Aldi: The Dark Horse Discounter case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Aldi: The Dark Horse Discounter will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Aldi: The Dark Horse Discounter case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Strategy & Execution, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Aldi: The Dark Horse Discounter, is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Aldi: The Dark Horse Discounter case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Strategy & Execution Solutions

In the Texas Business School, Aldi: The Dark Horse Discounter case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Aldi: The Dark Horse Discounter

Step 1 – Problem Identification of Aldi: The Dark Horse Discounter - Harvard Business School Case Study

The first step to solve HBR Aldi: The Dark Horse Discounter case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Aldi Discounter is facing right now. Even though the problem statement is essentially – “Strategy & Execution” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Aldi Discounter, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Aldi: The Dark Horse Discounter. The external environment analysis of Aldi: The Dark Horse Discounter will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Aldi: The Dark Horse Discounter case study. PESTEL analysis of " Aldi: The Dark Horse Discounter" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Aldi: The Dark Horse Discounter macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Aldi: The Dark Horse Discounter

To do comprehensive PESTEL analysis of case study – Aldi: The Dark Horse Discounter , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Aldi: The Dark Horse Discounter

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Aldi: The Dark Horse Discounter ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Aldi Discounter is operating, firms are required to store customer data within the premises of the country. Aldi Discounter needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Aldi: The Dark Horse Discounter has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Aldi Discounter in case study Aldi: The Dark Horse Discounter" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Aldi Discounter in case study “ Aldi: The Dark Horse Discounter ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Aldi Discounter in case study “ Aldi: The Dark Horse Discounter ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Aldi: The Dark Horse Discounter ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Aldi Discounter can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Aldi: The Dark Horse Discounter case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Aldi Discounter needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Aldi: The Dark Horse Discounter

Social factors that impact aldi: the dark horse discounter, technological factors that impact aldi: the dark horse discounter, environmental factors that impact aldi: the dark horse discounter, legal factors that impact aldi: the dark horse discounter, step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: aldi: the dark horse discounter case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

ALDI’s marketing strategy: The key growth ingredients of the FMCG titan

A giant in the UK’s grocery industry, ALDI prides itself in selling the most economical quality items. Over the past decade, ALDI’s marketing strategy has aimed at aggressive growth globally, trying to ensure everyone has nearby ALDI stores or a nearby ALDI supermarket. This mindset has helped the company become the third-largest grocery brand in Australia and has placed it on track to become the third-largest in the U.S. by the end of 2022 .

This ALDI case study will dive into ALDI’s marketing strategy and analyze its eCommerce page to help other companies learn about marketing strategies for supermarkets and see the kind of growth that the brand has been enjoying.

Table of Contents

- > ALDI through the years: how the retail titan was created

- > ALDI marketing strategies that unlocked its growth.

- > ALDI’s eCommerce website

- > New tech that would be a service to ALDI’s customer engagement strategy

- > Engrossing technology tools that ALDI is utilizing

- > Fresh news of the supermarket retailer

- > Insightful ALDI statistics to check

ALDI through the years: how the retail titan was created

Once a small German grocery store that two brothers took over for their mother in 1945, ALDI’s brand positioning of selling quality low-cost products grew out of its environment. Since World War II had just ended, Germany’s economy was weak and many citizens couldn’t spare much money for groceries.

To reclaim money from other market leaders at the time, customers had to collect rebate stamps to send to their local co-operative at regular intervals. ALDI, then called Albrecht, thrived by subtracting the legal maximum rebate of 3% before all sales, eliminating the process to entice customers. To save costs further, the store didn’t spend on any advertising, and items that didn’t sell would promptly come off the shelves to conserve space for only what people wanted.

By 1960, the brothers jointly owned 300 shops, leaving no one wondering why ALDI is the best.

ALDI then began expanding internationally, building its first American store in Iowa. Today, just in America, the chain has grown to over 2,000 stores across 35 states, managing more than 25,000 employees . The company has received over 1,200 product awards and recognitions since 2017, including BrandSpark American Trust Study’s most trusted Discount Grocery Store Chain.

The ALDI marketing strategies that unlocked its growth.

ALDI’s growth clearly came from 9 key factors. We’ve spotted and analyzed them below, so feel free to try the same strategies for your business.

Key Strategy #1: Omnichannel transformation

A strong, consistent omnichannel presence reduces friction along the customer journey, building and strengthening brand associations quickly. ALDI’s omnichannel strategy has been to meld its online and offline channels, investing in services like click-and-collect, letting a customer shop online and pick up their order from the store.

As a part of this effort, ALDI partnered with delivery services like Deliveroo and Instacart, which let shoppers who live far from its stores buy items as though they were physically present. Some of these services also let people access features such as click-and-collect, so they can customize their experience to best fit their needs and wants.

Key Strategy #2: Choosing the optimum target market

The grocery giant positions itself as the most cost-effective retail store to target the middle-income group worldwide. ALDI’s pricing strategy of maintaining the lowest possible prices and no-frills discounts encourages men and women in low and mid-level income groups and economical shoppers around the world to become regular customers.

To better cater to this market, ALDI continuously finds ways to reduce operational costs. For instance, it introduced a cart rental system. Shoppers would pay a quarter to unlock a cart from a corral at the front of the store, and they would get it back once they returned their cart. This added no charge to the customer but allowed ALDI to avoid hiring employees just to manage the carts.

Key Strategy #3: Creating an “As Is” map of the supply chain

ALDI maintains an “as is” map of its supply chain for some of its products to accurately pinpoint areas for expansion, as well as potential process breakdowns and risks. It also makes this information public on its website , letting its customers hold it accountable, which helps position ALDI as a transparent, trustworthy brand that values ethical product sourcing.

Key Strategy #4: Differentiation: The ‘Good Different’ new brand positioning

ALDI’s low prices make it stand out against all other major retailers. To raise consumer awareness about its uniqueness, ALDI’s marketing strategy in Australia incorporated new brand positioning, “Good Different,” which reinforced that the company’s low prices are a result of conscientious business practices — for instance, it sources products ethically and treats staff and suppliers with respect.

The “Good Different” campaign told customers that ALDI’s prices are better because the company is better, quelling any concerns over why it can charge so little.

Key Strategy #5: Social responsibility

ALDI understands the brand expectations that millennial and Gen-Z shoppers hold. They want a brand they support to take interest in its impact on the world. As a result, ALDI focuses on and constantly discusses its CSR efforts, such as sourcing all of its ALDI-exclusive chocolate bars and confectionery sustainably.

This focus also helps the brand build earned media, which is more influential than either paid or owned media. For instance, the EPA has ranked ALDI 15th on its Green Power Partnership’s “National Top 100 List” for its record-breaking green efforts. This ranking will attract more customers than ALDI Tweeting about its environmental awareness.

Key Strategy #6: Simple, cost-effective distribution

ALDI was able to open roughly one store every week in Britain, largely because its product distribution is uncomplicated. It purchases items in bulk and stores them in local warehouses, minimizing transit time and waste disposal while transporting goods.

Key Strategy #7: Ads promote USP

Though there is no ALDI marketing department in Germany, ALDI’s promotion strategy in the U.S., UK, and Australia, makes significant use of print, electronic, and display media to promote its stores. In these countries, it runs copies like “Swap and save” and “Like brands, only cheaper” to entice customers to switch from competitors’ brands to their own and build trust in its products.

Key Strategy #8: Simplified in-store layout

ALDI keeps its layout as simple as possible to drive down operational costs. Customers can generally find and pick out products on their own, reducing the number of employees necessary to assist them. ALDI’s marketing strategy also includes keeping only a limited amount of high-quality, name-brand products, so customers don’t have many options to confuse them, reducing their selection time.

Key Strategy #9: Engaging with followers

By engaging with its followers, ALDI can build brand loyalty. For instance, it has run a “Fan-Favorite Survey” since 2019 , where fans can enroll in a lottery for up to $1,000 in ALDI gift cards by voting for their favorite ALDI product. This loyalty helps the brand activate its following, turning its fans into marketers by encouraging people to use its hashtags for its products, which helps it access people its efforts hadn’t reached previously.

Social media lets a brand reach a far wider pool of potential customers than any other tool. ALDI maintains a strong social media presence — boasting 2.8 million Facebook followers, 830,000 Instagram followers, and 106,000 Twitter followers at the time of writing — to get its brand in front of the internet-savvy section of its target audience.

ALDI’s eCommerce website

ALDI is undoubtedly one of the most highly evaluated retail brands out there. To achieve this, they mastered the art of eCommerce conversions. Or not? We’ve analyzed four-page templates of their site to identify eCommerce best practices and mistakes you should avoid.

A. Analyzing ALDI’s Home Page

What we liked:

- Noninvasive offers: Pop-ups still boast an average conversion rate of 3.9% , and the main barrier preventing retailers and CRMs from using pop-up ads is their invasiveness. Because the offer appears on a bright banner that feels native to the page, it still catches a visitor’s eye but doesn’t irritate them, which can help increase conversions.

- Attractive deals: ALDI’s website reinforces the brand positioning by placing copy about ALDI’s low prices against a bold, eye-catching red background. Even if the customer doesn’t consciously register it, this reinforces the brand image in their mind.

- UX design: The page focuses strongly on user intent, letting customers start adding items to their cart directly from the home page. This removes friction between arriving at the home page and making a purchase, speeding customers along in the sales funnel.

- Search bar: A search bar is available on every page, letting the customer redirect their journey at any point if they decide they want a different item. The ubiquity of search bars reduces friction points, too. A customer can start searching for items quickly from the home page.

What we didn’t:

- Slow to load: Because it uses dynamic elements, the page loads slowly. As the user scrolls down, sections load in, freezing the page for seconds. The sidebar also sometimes fails to open when clicked. This increases the site’s bounce rate, since the probability of bounce increases by 32% if a page load time goes just from one to three seconds and by 90% if it reaches five seconds.

- Non-unique design: Though effective, the website interface is identical to Instacart’s. Visitors who have used Instacart before will automatically expect similar functionality, which may exacerbate frustration with the loading times. A website design is also an opportunity to build and reinforce brand associations and maintain consistency across platforms, which enhances the omnichannel experience.

B. Analyzing ALDI’s Category Page

- Sticky cart: The options to add an item to the cart and view the cart are conveniently available no matter where the customer scrolls on the page, empowering users to add items to their cart even if they’re unsure about buying them. A/B testing shows that sticky carts increase orders from the product page by 7.9% and all add-to-carts by 8.6%.

- Sorting options: Letting the user customize their search helps them find the items they want more quickly, reducing churn.

- Useful information on display: By displaying deals available for items on sale and small text for other information, like if a product is gluten-free, this page enhances the customer experience, increasing retention and CLV.

- No filters: Like sorting options, filters help a user customize their search to find items more easily. This category page permits the user to reduce their options to smaller subcategories, but there is no ability to filter items based on features like brand, price, and common dietary restrictions. Adding this would reduce customer choice overload, which otherwise leads to cart abandonment.

C. Analyzing ALDI’s Product Page

- Minimalist presentation: The above-the-fold information is minimal, stopping at the “Favorite” button. However, its design and arrangement make the page still look complete, enhancing the customer experience while reducing extra noise that could complicate their decision-making process.

- Item suggestions: Customers can look through similar products if the current one doesn’t fit their needs, so they can immediately find a better option instead of abandoning their cart. They can also check items that other users frequently buy with the current product, making it easier to pair products while expanding their final cart, increasing ALDI’s revenue.

- Add item to Favorites: The option to add an item to a “Favorites” list boosts CLV by promoting repeated use while adding value to the customer, who can find the item more easily in the future.

- Simple content copy: The product details are simple, laying out the benefits for the customer clearly and without confusing data that might distract or confuse the customer.

- Nutrition facts sometimes missing: Not all food product pages include the nutrition information of the item, which is vital in simulating an in-person grocery shopping experience. Ensuring all food items contain their nutrition facts reduces friction and improves the omnichannel experience.

- No reviews: Almost 50% of people trust consumer reviews like they were recommendations from a family member or friend. Groceries are relatively inexpensive everyday purchases, so fewer customers may read these reviews, but giving customers the ability to leave a review would add to ALDI’s marketing objectives of portraying transparency and confidence in its products.

D. Analyzing ALDI’s Checkout Process

- Pre-checkout suggestions: The pre-checkout suggestions function like point-of-purchase marketing displays, enticing shoppers who are ready to purchase to add just one or two more items to their order.

- Simple steps: Each step in the checkout process is separate and concise, walking the customer through entering all the data necessary without overloading or tiring them.

- Savings callout: Customers who have bought items on sale see their savings in bright red under the final bill. The text color makes them focus on it, prompting them to feel more satisfied with their order even if they only saved $1.

- Multiple available delivery slots: Customers can choose from a wide selection of two-hour delivery slots throughout the day. This increases customer convenience, especially for those working long hours or those who are otherwise only able to receive their order in a specific window of time.

- Several delivery plans are available: Customers have multiple delivery options according to their needs. If they want to place an order in advance, they can set the delivery for a different day. If they need it to reach early, they can pay a small extra fee to get priority delivery within a certain time frame. Having these options available increases customer satisfaction and encourages repeat ALDI site visits.

- Pick-up option: An employee can prepare the order so the customer can simply come to pick it up, combining online and offline channels to enhance customer satisfaction.

- Google/Facebook sign-in: Internet users today expect any website that requires an account to let them connect their social media accounts, saving them the time of entering all their personal information and the trouble of remembering their username and password. If the customer already has an Instacart account, their usual settings will also auto-populate upon their login.

- No way to remove items post-checkout: Though customers can add more items to their order even after checking out, they can’t remove items they may have purchased accidentally. This can make them feel like they’re being valued less post-payment.

- No guest checkout option: However easy it is to become a member, forcing the customer to sign up adds a step in the checkout process and makes them consider the number of company emails they already receive. This increases the risk of checkout abandonment .

New tech that would be a service to ALDI’s customer engagement strategy

ALDI’s eCommerce website is effective but it could be enhanced with the help of some online tools. One tool that would significantly benefit ALDI is ContactPigeon’s Omnichannel Chat solution.

This chat feature helps a brand respond to customers immediately, preventing long waiting times and increasing customer satisfaction and brand loyalty. ALDI could use it as a way to deepen its relationship with its followers, taking a deep dive into its customers’ journey and creating smart types of automation that personalize the eCommerce experience and make users feel as though they were in a physical store.