Corporate Law

Will the real shareholder primacy please stand up.

- Ann M. Lipton

In re GGP, Inc. Stockholder Litigation

Delaware Supreme Court Reverses Dismissal for Shareholders Seeking Appraisal in Merger with Preclosing Dividend.

Public Reporting of Monitorship Outcomes

- Veronica Root Martinez

Extraterritorial Avoidance Actions Under the U.S. Bankruptcy Code

The supreme court and the pro-business paradox.

- Elizabeth Pollman

The (Indigenous) Case for Shareholder Primacy and its Role in Climate Justice

- Carla F. Fredericks

Rethinking Retirement Savings

- Jason Fernandes

- Janelle Orsi

Controller Confusion: Realigning Controlling Stockholders and Controlled Boards

Flood v. synutra international, inc..

MFW Conditions Are in Place “Before Any Substantive Economic Negotiations” in Controlling Shareholder Transactions.

Deal Process Design in Management Buyouts

- Guhan Subramanian

Global Corporate Law

Landmark cases in company law.

Victoria Barnes and Sally Wheeler (eds)

This book aims to add a new dimension to the burgeoning scholarship on landmark cases. The body of literature, which began with studies of key areas of private law, has gathered pace in recent years. It now has such momentum that there is a revisionist trend and a second wave of literature that revisits the first set of case studies. [1] The Landmark Case in… series has, for example, over 10 volumes with more planned. These books focus on foundational cases and typically cover fields of law, such as contract, property, torts, as one might well expect, but also now also extend to the more specialist and idiosyncratic areas of law, namely medical law, intellectual property law and so on. [2] Despite the growth of this literature, there is no such volume on company law.

Company law has escaped attention probably for a simple reason: it is widely understood to be a creature of statute law. This is owing to the prevalence of codes, codifying acts and legislation. The Companies Act of 2006 is a monumental piece of legislative work. Cases, however, played a central role in creating, establishing and influencing legal ideas that were later enshrined within pieces of legislation. Indeed, the key principles and rules in company law can be traced back to the Industrial Revolution of the eighteenth and nineteenth centuries. This formative period is often seen as a fulcrum for modern company law with the rise in enterprise, share ownership and insolvency proceedings. The emergence of big business in the twentieth century too resulted in fundamental changes in structure of socio-economic relations. Doctrines, which emerged during this timeframe, continue to have influence in the present, but their origins in case law have hitherto been understudied.

This book aims to uncover and reveal overlooked but inspirational landmark cases in company law. It redresses the imbalance, and the secondary role assigned to case law, in our understanding of company law. An exercise in unearthing landmark cases can thus be fruitful for a number of reasons. It can shed some much needed light on how, why and when rules came into being (or not). A novel account of company law, using the ‘law in context’ method, can be informative. This contextual analysis is missing from the original law reports as well as the legislation that we see in operation today. A simple read of these sources will only explain the rules themselves. The academic scholarship contained in the chapters within this volume informs and adds to these primary legal resources.

The chapters push beyond a simplistic account of the case that you might see in a textbook or the secondary literature explaining what the law is (or was). These chapters proffer an explanation for why legal rules took the shape that they did. As well as the context, chapters will also reveal new factual details through archival research. These archaeological analyses also provide an account of the case in greater detail. Such an excavation may inform the reader about legal advisors or the parties in the suit to explain why the litigation arose in this particular way, manner or form. It may also provide insights into why the judges took the view that they did in this case. Drawing on a range of diverse methods and interdisciplinary orientation, these chapters provide some much needed contextualisation, which helps to explain the past, present and future of company law as well as its shape, structure and trajectory.

a) Explaining the Company

| 1 | Salomon v Salomon [1896] UKHL 1, [1897] AC 22 |

| 2 | Quin & Axtens v Salmon [1909] AC 442 |

| 3 | Bushell v Faith [1970] AC 1099 |

b) Shareholders As Between Themselves

| 4 | Allen v Gold Reefs [1900] 1 Ch 656 |

| 5 | Hickman v Kent and Romney Marsh [1915] 1 Ch 881 |

| 6 | Greenhalgh v Arderne Cinemas [1951] Ch 286 |

| 7 | Russell v Northern Bank [1992] 1 WLR 588 |

c) Protecting the Minority

| 8 | Foss v Harbottle (1843) 2 Hare 461, 67 ER 89 |

| 9 | Ebrahimi v Westbourne Galleries Ltd [1973] AC 360 |

| 10 | Smith v Croft (no 2) [1988] Ch 114 |

| 11 | O’Neill v Phillips [1999] 1 WLR 1092 |

d) Way Directors Act

| 12 | Burland v Earle [1902] AC 83 |

| 13 | Cook v Deeks [1916] 1 AC 554 |

| 14 | Re City Equitable Fire Insurance Co [1925] Ch 407 |

| 15 | Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821, PC |

| 16 | Re Produce Marketing Consortium (no 2) [1989] 5 BCC 569 |

| 17 | Re Sevenoaks Stationers (Retail) Ltd [1991] Ch 164 |

e) Financing the Company

| 18 | Re Brightlife [1987] 1 Ch 200 |

| 19 | Siebe Gorman v Barclays Bank [1979] 2 Lloyd’s Rep 142 |

[1] See Jonathan Herring and Jesse Wall (eds), Landmark Cases in Medical Law (Bloomsbury Publishing 2015); Shaun D Pattinson, Revisiting Landmark Cases in Medical Law (Routledge 2018). Interestingly, the editors of the volume on criminal law decided not to include a chapter on R v Dudley and Stephens (1884) because they felt that Brian Simpson has done it so well in his monograph, nothing new could be added. See Philip Handler, Henry Mares and Ian Williams, ‘Introduction’ in Philip Handler, Henry Mares and Ian Williams (eds), Landmark Cases in Criminal Law (Bloomsbury Publishing 2017) 2.

[2] Charles Mitchell and Paul Mitchell (eds), Landmark Cases in the Law of Restitution (Bloomsbury Publishing 2006); Charles Mitchell and Paul Mitchell (eds), Landmark Cases in the Law of Contract (Bloomsbury Publishing 2008); Charles Mitchell and Paul Mitchell (eds), Landmark Cases in the Law of Tort (Bloomsbury Publishing 2010); Stephen Gilmore, Jonathan Herring and Rebecca Probert (eds), Landmark Cases in Family Law (Bloomsbury Publishing 2011); Nigel Gravells (ed), Landmark Cases in Land Law (Bloomsbury Publishing 2013); Simon Douglas, Robin Hickey and Emma Waring (eds), Landmark Cases in Property Law (Bloomsbury Publishing 2015); Herring and Wall (n 1); Jose Bellido (ed), Landmark Cases in Intellectual Property Law (Bloomsbury Publishing 2017); Eirik Bjorge and Cameron Miles (eds), Landmark Cases in Public International Law (Bloomsbury Publishing 2017); Philip Handler, Henry Mares and Ian Williams (eds), Landmark Cases in Criminal Law (Bloomsbury Publishing 2017); Satvinder Juss and Maurice Sunkin (eds), Landmark Cases in Public Law (Bloomsbury Publishing 2017).

The Global Corporate Law brings together those exploring the company regulation from around the globe. In the present era of de-globalisation, policy-makers have been either slow, reluctant or unwilling to recognise the importance of global exchanges. Following the disruption to supply chains in the wake of Brexit and now the conflict in Ukraine, there is now widespread acknowledgement that commerce is global in nature. Yet, the international commercial exchanges are not themselves new. Companies have long looked to new markets to expand and entrepreneurs have built new customer bases overseas since time immemorial. Traders have often sought finance, agents or intermediaries to facilitate the sale of goods. Law, of course, influences the terms of commercial transactions at all levels.

Company Law - Notes, Case Laws and Study Material

This course consists of 5 modules that cover a range of topics from the salient features of the companies act to various doctrines and tribunals..

The history of Indian Company Law began with the Joint Stock Companies Act of 1850 . Thereafter, a cumulative process of amendment and consolidation brought us to the most comprehensive and complicated piece of legislation, the Companies Act, 1956 . As of today, the Companies Act, 2013 has replaced the Companies Act, 1956. The new Act has 470 sections and 7 schedules as against 658 sections and 15 schedules in the 1956 Act.

This course consists of 5 modules that cover a range of topics from the salient features of the Companies Act to various doctrines and Tribunals. To help readers get an in-depth understanding of Indian Company Law, we have also provided well-researched and analytical articles on miscellaneous subjects towards the end of the course.

Important articles and study material on Company Law – Click on the links to Read:

- A Comparative Analysis of the Provisions of Companies Act, 1956 and Companies Act, 2013

- Introduction to Company Law: Meaning, Nature, and Characteristics

- Salomon v. A Salomon and Co. Ltd (1897)

- Companies Act 2013 – Bare Act

- Types of Company

- Comparison of a Company with a Partnership firm and an LLP

- Formation of a Company under the Companies Act, 2013

- Disadvantages of Incorporation of a Company

- A Comprehensive Analysis of Section 9 of the Companies Act, 2013

- Case Study: Foss v Harbottle (1843)

- Promoters of a Company

- Memorandum of Association (MoA)

- Articles of Association: Meaning, Nature, and Explanation

- Doctrine of Ultra Vires in Company Law

- Doctrine of Harmonious Construction: A Comprehensive Analysis

- Doctrine of Indoor Management in Company Law

- Prospectus of the Company

- Meetings under the Companies Act of 2013

- Shares, Share Capital, and Debentures: Explained

- Winding Up of Companies

- Corporate Social Responsibility (CSR)

- National Company Law Tribunal (NCLT)

- National Company Law Appellate Tribunal (NCLAT)

- Write Short notes on Share Warrant.

- Write Short notes on Share Certificate.

Other important articles and study material on Company Law:

Theories of Corporate Personality

Minority Shareholders & Their Rights in a Company

- Types of Directors in a Company

Power and Liabilities of Directors

- Allotment of shares

- Majority Powers And Minority Rights

- Prevention of Oppression and Mismanagement

- Inspection, Inquiry, and Investigation

- Debenture: Meaning, Features and Kinds

- Debentures and its impact on Company and Shareholders

- Internal Audit under the Companies Act, 2013

- A Comprehensive Study of the Company Law Committee Report 2022

- Difference between Dissolution and Winding Up of a Company

Equity Funding under The Companies Act, 2013

Company Law Mains Questions-Answer Series: Important Questions for Judiciary Exams

- Company Law Mains Question Series Part I

- Company Law Mains Question Series Part III

- Company Law Mains Question Series Part IV

Company Law Mains Question Series Part V

Your valuable feedback in the form of comments or any desired inputs are encouraged and always welcome. Every contribution toward a goal is valuable, regardless of how small it may be.

Admin Legal Bites

Legal Bites Study Materials correspond to what is taught in law schools and what is tested in competitive exams. It pledges to offer a competitive advantage, prepare for tests, and save a lot of money.

Related News

Company Law

Case Studies in a Business Context

- © 1988

- Desmond Painter 0

Dorset Institute of Higher Education, UK

You can also search for this author in PubMed Google Scholar

373 Accesses

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

About this book

Similar content being viewed by others.

Introduction

The Rules Governing the Relationships Among a Company’s Stakeholders: Company Law

Introduction: “Run Legal as a Business!”

Case studies.

- company law

Table of contents (6 chapters)

Front matter.

Desmond Painter

Summary of Case-Study Contents

Summary of legal topics, introduction to the notes, notes on each case study, authors and affiliations, bibliographic information.

Book Title : Company Law

Book Subtitle : Case Studies in a Business Context

Authors : Desmond Painter

DOI : https://doi.org/10.1007/978-1-349-09261-1

Publisher : Palgrave Macmillan London

eBook Packages : Palgrave Political & Intern. Studies Collection , Political Science and International Studies (R0)

Copyright Information : Desmond Painter 1988

Softcover ISBN : 978-0-333-43465-9 Published: 18 June 1989

eBook ISBN : 978-1-349-09261-1 Published: 18 June 1989

Edition Number : 1

Number of Pages : XI, 204

Topics : Commercial Law

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- --> Login or Sign Up

Shop by Author

- Sabrineh Ardalan

- Robert Bordone

- Robert Clark

- John Coates

- Susan Crawford

- Alonzo Emery

- Heidi Gardner

- Philip B. Heymann

- Howell E. Jackson

- Wendy Jacobs

- Adriaan Lanni

- Jeremy McClane

- Naz Modirzadeh

- Catherine Mondell

- Ashish Nanda

- Charles R. Nesson

- John Palfrey

- Bruce Patton

- Todd D. Rakoff

- Lisa Rohrer

- Jeswald W. Salacuse

- James Sebenius

- Joseph William Singer

- Holger Spamann

- Carol Steiker

- Guhan Subramanian

- Lawrence Susskind

- David B. Wilkins

- Jonathan Zittrain

Shop by Brand

Howell Jackson

- Ashish Nanda and Nicholas Semi Haas

- Chad M. Carr

- John Coates, Clayton Rose, and David Lane

- Ashish Nanda and Lauren Prusiner

- Ashish Nanda and Lisa Rohrer

- Ashish Nanda and Monet Brewerton

- View all Brands

Free Materials

- Published Old-New

- Published New-Old

Investor Access to Private Investment

Hannah Valentine under the supervision of Howell Jackson

First National Bank of Ames Corporation

Share-Inn Economy: Student Materials

Emily M. Broad Leib, Jude Lee, Amy Hoover & Rachel Gordon

Share-Inn Economy: Teaching Note

Share-Inn Economy (C)

Emily M. Broad Leib, Jude Lee & Amy Hoover

Share-Inn Economy (A)

Robo Advising

Ryan Chan-Wei HLS LLM '19 under the supervision of Howell Jackson

Fintech Charter

Margaret Tahyar, Madison Roberts, and Carol Rodrigues of Davis Polk & Wardwell, with the assistance of Professor Howell E. Jackson

Strategic Options and Legal Risks for Elite ReFi, Inc.

Margaret Tahyar, Jai Massari, Madison Roberts, and Adam Fovent of Davis Polk & Wardwell, with the assistance of Professor Howell E. Jackson

Civilian Protection in Partnered Conflicts

Dustin A. Lewis, Naz K. Modirzadeh, C. Danae Paterson, Lisa Brem

OUR Walmart

Sharon Block, Lisa Brem, and Brittany Deitch

Worker Centers

Exercise on Alternative Strategies for Depository Institutions

Sanctuary Cities

Brittany Deitch and Lisa Brem, under the supervision of Sabrineh Ardalan

Wells Fargo Corporate Governance

Ed Stein under the supervision of Howell Jackson

Anti-Money Laundering and Blockchain Technology

Dylan M. Aluise under the supervision of Howell Jackson

The Future of Affiliate Transaction Restrictions for Banks and the Federal Reserve’s Emergency Intervention Authority

Margaret Tahyar and Howell Jackson

Closed-End Fund Regulation

Daniel Wertman under the Supervision of Howell Jackson

Unidentified Financial Institutions

Howell Jackson and Peter Tufano with assistance from Andrea Ryan

Asset Securitization, Marketplace Lending, and the Future After the Madden Decision

Consumer Financial Protection Bureau: Responding to the PHH Litigation

Ryan M. Johansen under the supervision of Howell Jackson

Wal-Mart and Banking

Joshua Cutler under the supervision of Howell Jackson

Lending Club: 2008

Anooshree Sinha and Corrine Snow under the supervision of Howell Jackson

Ames’ Auto Insurance Regulations — Racial Disparities in Insurance Premiums

Federal Preemption of State Consumer Protection Laws: The Office of the Comptroller of the Currency's Dodd-Frank Act Implementation Rules

Melanie Berdecia and Dylan Aluise under supervision of Howell Jackson

The OCC’s FinTech Charter: Testing the Scope of the OCC’s Chartering Powers

Lotus v. Borland: A Case Study in Software Copyright

Ben Sobel, under the supervision of Jonathan Zittrain

The Color of Police Action in these United States

Saptarishi Bandopadhyay, under supervision of Charles R. Nesson

The Decriminalization of Marijuana in Jamaica: A Key Step toward International Legalization?

Thinking Big: Bringing Big Sport's Energy and Innovation to Education

Elizabeth Moroney, under supervision of Charles R. Nesson

The Snowden Effect

Anastasia Tolu, under supervision of Charles R. Nesson

The Art of Deliberation

Algorithmic Allegories (version 1.0)

Marcus Comiter, Ben Sobel, and Jonathan Zittrain

Somalia in Crisis: Famine, Counterterrorism, & Humanitarian Aid | Part B2: The NGO General Counsel Dilemma

Naz K. Modirzadeh, Dustin A. Lewis, and Molly R. Gray, with Lisa Brem

Somalia in Crisis: Famine, Counterterrorism, & Humanitarian Aid | Part B1: The National Security Council Dilemma

Somalia in Crisis: Famine, Counterterrorism, & Humanitarian Aid | Part A: General Background Document

What’s Fair about Fair Use? The Battle over E-Reserves at GSU (B)

Elizabeth Moroney, under the supervision of Kyle Courtney and William Fisher

Prosecutorial Discretion in Charging and Plea Bargaining: The Aaron Swartz Case (B)

Elizabeth Moroney, under the supervision of Adriaan Lanni and Carol Steiker

What’s Fair about Fair Use? The Battle over E-Reserves at GSU (A)

The Battle for Unocal

Holger Spamann, Amanda Ravich, and Lisa Brem

Prosecutorial Discretion in Charging and Plea Bargaining: The Aaron Swartz Case (A)

Elizabeth Moroney, under supervision of Adriaan Lanni and Carol Steiker

Sue the Consumer: Digital Copyright in the New Millennium

Charles Nesson and Sarah Jeong

MOOCs and Consequences for the Future of Education

Jeffrey R. Young and Charles Nesson

In the Stadium and in the Street: The Brazil Soccer Riots

Cost-Benefit Analysis at the Consumer Financial Protection Bureau

Howell Jackson and Kelley O'Mara

Ching Pow: Far East Yardies!!

Charles Nesson and Saptarishi Bandopadhyay

From Sony to SOPA: The Technology-Content Divide

John Palfrey, Jonathan Zittrain, Kendra Albert, and Lisa Brem

Game Changers: Mobile Gaming Apps and Data Privacy

Susan Crawford, Jonathan Zittrain and Lisa Brem

The Smart Grid

Sonia McNeil, with Paul Kominers, J. Palfrey and J. Zittrain

The WikiLeaks Incident: Background, Details, and Resources

Alan Ezekiel, under supervision of John Palfrey and Jonathan Zittrain

Drafting an IP Strategy at MNC (C): New Puzzles

John Palfrey and Lisa Brem

Drafting an IP Strategy at MNC (B): Getting Started

Drafting an IP Strategy at MNC (A)

How to Approach a Case Study in a Problem Solving Workshop

- RMIT Australia

- RMIT Europe

- RMIT Vietnam

- RMIT Global

- RMIT Online

- Alumni & Giving

- What will I do?

- What will I need?

- Who will help me?

- About the institution

- New to university?

- Studying efficiently

- Time management

- Mind mapping

- Note-taking

- Reading skills

- Argument analysis

- Preparing for assessment

- Critical thinking and argument analysis

- Online learning skills

- Starting my first assignment

- Researching your assignment

- What is referencing?

- Understanding citations

- When referencing isn't needed

- Paraphrasing

- Summarising

- Synthesising

- Integrating ideas with reporting words

- Referencing with Easy Cite

- Getting help with referencing

- Acting with academic integrity

- Artificial intelligence tools

- Understanding your audience

- Writing for coursework

- Literature review

- Academic style

- Writing for the workplace

- Spelling tips

- Writing paragraphs

- Writing sentences

- Academic word lists

- Annotated bibliographies

- Artist statement

- Case studies

- Creating effective poster presentations

- Essays, Reports, Reflective Writing

- Law assessments

- Oral presentations

- Reflective writing

- Art and design

- Critical thinking

- Maths and statistics

- Sustainability

- Educators' guide

- Learning Lab content in context

- Latest updates

- Students Alumni & Giving Staff Library

Learning Lab

Getting started at uni, study skills, referencing.

- When referencing isn't needed

- Integrating ideas

Writing and assessments

- Critical reading

- Poster presentations

- Postgraduate report writing

Subject areas

For educators.

- Educators' guide

How to study company law

This resource will help you to develop strategies for learning and remembering the course content and demonstrate a four-step technique for writing case study answers.

Company Law is a challenging course for students because it involves:

- difficult legal terminology

- complex and detailed content

- a particular writing style

In this tutorial

- Writing a legal scenario

- Learning a legal language

- Managing the reading

Still can't find what you need?

The RMIT University Library provides study support , one-on-one consultations and peer mentoring to RMIT students.

- Facebook (opens in a new window)

- Twitter (opens in a new window)

- Instagram (opens in a new window)

- Linkedin (opens in a new window)

- YouTube (opens in a new window)

- Weibo (opens in a new window)

- Copyright © 2024 RMIT University |

- Accessibility |

- Learning Lab feedback |

- Complaints |

- ABN 49 781 030 034 |

- CRICOS provider number: 00122A |

- RTO Code: 3046 |

- Open Universities Australia

Law Explorer

Fastest law search engine.

If you have any question you can ask below or enter what you are looking for!

- Law Explorer /

- CONSTITUTIONAL LAW /

INTRODUCTION TO COMPANY LAW

1 Introduction to company law AIMS AND OBJECTIVES After reading this chapter you should understand: The scope of ‘company law’ The relationship between core company law, insolvency law, securities regulation and corporate governance The sources of company law The importance in the study of company law of foundation course legal knowledge and skills The historical development of the registered company and its statutory framework The arguments for and against limited liability The influence of the European Union on UK company law The rationale behind the Companies Act 2006 and subsequent developments 1.1 Who this book is for This book is written primarily for undergraduate law students studying company law. It aims to guide students to an understanding of: the scope of company law and how it is linked to other specialist legal subjects such as securities regulation and insolvency law; the sources of company law; key legal principles of company law; key moot, or unsettled, issues in company law. It is also written to assist students to develop their ability to: understand and appreciate the context in which company law operates; apply key principles of company law to solve problem questions; interpret legislation; use precedents to construct logical and persuasive arguments and discuss moot points of law; think reflectively and critically about the strengths, shortcomings and implications of various aspects of company law. Company law and company law scholarship have grown rapidly in volume in recent years making it unrealistic to cover the whole of even ‘core’ company law (a term explained in the next section) in what is usually little more than two terms if students are to achieve understanding rather than acquire a superficial level of knowledge. Three filters commonly used to limit the volume of material covered are adopted in this book, which focuses on: companies formed to run businesses for profit , not companies formed for charitable or other non profit-making purposes; registered limited liability companies with a share capital rather than other types of registered company such as unlimited companies or companies limited by guarantee; the Companies Act 2006 , with limited coverage of securities regulation (also known as capital markets law or financial services law) or insolvency law. Whilst students choose to study company law for a number of reasons, all share the aim of successfully completing their assessment(s). The activities and sample essay questions in each chapter of this book are designed to help you to test your knowledge and understanding and develop a successful approach to answering company law questions. core company law The law governing the creation and operation of registered companies 1.2 What we mean by ‘company law’ 1.2.1 Core company law The focus of this book is what is sometimes referred to as ‘core company law’, which is essentially the law governing the creation and operation of registered companies. It is very easy to identify core company law today as it is almost all contained in the 1,300 sections and 16 schedules of the Companies Act 2006, regulations made pursuant to that Act, and cases clarifying the application of the statutory rules and principles. That said, the Companies Act 2006 is not a comprehensive code of core company law in the sense of a body of rules that has replaced all common law rules and equitable principles previously found in cases. Certain aspects of core company law, such as remedies available for breach of directors’ duties, remain case-stated law distinct from statute law and many cases interpreting provisions of past Companies Acts remain relevant today. The Companies Act 2006 is also not the only current statute containing core company law. Key relevant statutes and the role of case law in core company law are considered in section 1.3 under the heading ‘Sources of company law’. Limits of core company law A more comprehensive review of law relevant to companies would include insolvency law and securities regulation (the latter is part of a larger body of law known as capital markets law or financial services law) to the extent that they apply to companies. In the last 25 to 30 years, each of these areas of law has become a highly developed and voluminous legal subject in its own right. Realistically, not even the parts of each relevant to companies can be covered in any depth in a company law textbook of moderate length and no attempt is made here to do so. Students interested in those subjects specifically can find references to texts providing a good starting point for their studies at the end of this chapter. Figure 1.1 Company law includes parts of securities regulation and insolvency law. Corporate governance has also emerged as a subject of study in its own right over the last 25 to 30 years, so much so that it is appropriate to say a few words about it in the context of setting out what we mean by core company law. Corporate governance is not a legal term, rather, it is a label, or heading under which the questions how, by whom and to what end corporate decisions are or should be taken, are analysed and reflected upon. Issues such as the role law plays and how far the law can and should be used to achieve effective or good corporate governance arise as part of those analyses and reflections. Those who support extensive use of law and regulation backed up by law to achieve effective corporate governance are said to support the ‘juridification’ of corporate governance, those against include those who are said to prefer ‘private ordering’. Core company law and corporate governance overlap to the extent that a large part of core company law is a body of rules and principles establishing how and by whom corporate decisions may lawfully be made or are legally required to be made. Core company law textbooks differ in the extent to which they deal with insolvency law, securities regulation and corporate governance. The approach taken in this book to each is set out in the following three sections. Figure 1.2 Corporate governance. 1.2.2 Insolvency law Even though in theory they could, companies do not tend to continue in existence forever. They either outlive their usefulness or become financially unviable. Before a company ceases to exist, or is ‘dissolved’, to use the legal term, its ongoing operations are brought to an end, its assets are sold and the proceeds of sale are used to pay those to whom it owes money. This process is called ‘winding up’ or ‘liquidating’ the company. Some companies that are wound up or liquidated are able to pay all their debts in full, that is, they are ‘solvent’, yet the law governing winding up of solvent companies is set out in the Insolvency Act 1986 (and rules made pursuant to that Act, the most important of which are the Insolvency Rules 1986). The explanation for this is that most winding ups involve insolvent companies and when, in the mid-1980s, the law governing insolvent company winding ups was moved out of company law legislation into specific insolvency legislation, it made sense to deal with solvent winding ups in the same statute. This avoided the need for duplication of those winding-up provisions relevant to both solvent and insolvent companies in both the Companies Act 1985 (now replaced by the Companies Act 2006) and the Insolvency Act 1986. Note that insolvency is a term relevant to both companies and individuals but in the UK the term bankruptcy is used only to refer to the insolvency of individuals, not companies. It is legally incorrect to refer to a company going bankrupt. Insolvency law is a highly detailed and specialised area of legal practice requiring study of specialist texts for a full understanding of its scope and complexity. That said, the two key formal processes forming the core of insolvency law are administration (a process designed to facilitate the rescue of financially troubled companies) and liquidation (the process by which companies are wound up). Administration is outlined in Chapter 15 and liquidation is examined in Chapter 16 . During the administration and liquidation processes, administrators and liquidators have various powers, including powers to bring legal actions and to review and challenge the validity of certain transactions entered into by the company. Clearly, it is important for anybody seeking to understand the rights of those who deal with companies and the law governing directors (because many of these legal actions and transactions involve directors), to have a basic understanding of these powers. For this reason the relevant provisions of the Insolvency Act 1986 are included in Chapter 16 . Finally, in the case of a winding up, once the assets of the company have been turned into money and any and all contributions secured, the liquidator is required to follow a statutory order of distribution which determines the priority of payment of different types of creditors. Given the significance of this statutory ordering to the decision whether or not to deal with a company, and the terms on which to do so, the statutory order of distribution on liquidation is also covered in Chapter 16 . 1.2.3 Securities regulation It is difficult to decide which, if any, part of securities regulation to include in a core company law textbook. The aim of securities law is essentially to provide protections to those who decide to invest their money in securities. The term ‘securities’ covers a complex range of investment products, including products unrelated to companies. A student of core company law is concerned only with securities taking the form of shares and corporate bonds. Securities regulation is part of what is often called finance law. For our purposes, finance law can be viewed as made up of three parts: banking law; the regulation of those who conduct investment business and the markets on which investments are traded; and, increasingly, the regulation of companies whose securities (shares and bonds) are offered to the public. Consequently, basically, securities regulation is only relevant to those companies with shares or bonds traded or ‘listed’, i.e. bought and sold, on stock exchanges. As only a very small minority of UK companies have shares or bonds that are traded/listed, it is very important to appreciate that it is a very small number of companies that need to engage with and comply with securities regulation. Securities regulation does not apply to over 99 per cent of registered companies. Regulatory shortcomings highlighted by the global financial crisis of 2008 and its aftermath have resulted in extensive, ongoing reform of finance law globally. Reform of UK law is the result of both UK and EU initiatives. Most of the changes relate to the regulation of banks and the re-alignment of regulatory responsibilities. Re-alignment has been effected by the Financial Services Act 2012. The Financial Services Authority (FSA), as such, has been abolished and its functions have been split between two new regulatory bodies. A new ‘macro-prudential authority’ has been established, called the Financial Policy Committee (FPC), and the two key regulators sitting underneath this umbrella body are the Prudential Regulation Authority (PRA), which is a subsidiary of the Bank of England, and the Financial Conduct Authority (FCA). The key securities regulator (the successor to the FSA) is the FCA. Fortunately, apart from this change of regulator, the framework of securities regulation has remained intact. Arguably, the FSA has simply been renamed and refocused, with some of its functions having been removed and given to the Prudential Regulation Authority (PRA) The key securities regulation statute in the UK remains the Financial Services and Markets Act 2000 (FSMA), as amended (most recently by the Financial Services Act 2012). The 2000 Act established and empowered the main securities regulator to make detailed provisions governing securities. Those detailed provisions can be found in what is now the Financial Conduct Authority Handbook (FCA Handbook). The heart of securities regulation is disclosure of accurate information. This theme has been reinforced and supplemented in recent years, in no small part because securities regulation is being used to implement legal initiatives to achieve effective or good corporate governance, which is seen as supportive of efficient capital markets and essential to achieve economic growth. This trend is part of the juridification of corporate governance referred to above. It also causes lawyers to rethink what they mean when they use the terms law and regulation. Focusing for a moment on the sources of securities regulation, statutory provisions in the FSMA are supplemented by detailed provisions made by the FCA pursuant to powers under the FSMA (the FCA Handbook). This clearly legal regime is supplemented by what is increasingly referred to as ‘soft law’, important examples of which are the UK Corporate Governance Code and the Stewardship Code. Disclosure of information by companies is provided for both by the Companies Act 2006 and by securities regulation. Accordingly, Chapter 17 , which deals with transparency, ventures into securities regulation so that students have an idea of how the securities regulation framework of disclosure for traded/listed companies supplements the Companies Act provisions. Accurate information disclosure is particularly important when shares are being offered to the public for the first time and, for this reason, the corresponding part of securities regulation, the Prospectus Rules, are outlined in Chapter 7 . corporate governance The system by which companies are directed and controlled 1.2.4 Corporate governance Corporate governance means different things to different people in different contexts. Whenever the term is used, the first question to ask is, in what sense is it being used by the writer? If this is not made clear, it is usually helpful to examine the context in which the term is being used (see also section 9.5 of Chapter 9 ). Subject to this caveat, two definitions of corporate governance are often referenced (as, for example, in the European Commission Green Paper, ‘The EU Corporate Governance Framework’ (COM(2011) 164 final). The first is a definition laid down in 1992 in the Report of the Cadbury Committee, a Committee established by the Financial Reporting Council, the London Stock Exchange and the accountancy profession to consider the financial aspects of corporate governance. According to the Cadbury Committee (at para 2.5), ‘Corporate Governance is the system by which companies are directed and controlled.’ The second definition is that first provided by the Organisation of Economic Cooperation and Development (OECD) in 1999 and repeated in 2004 in the preamble to its revised Principles of Corporate Governance (which principles are subject to a 2014 review) in which corporate governance is identified as one key element in improving economic efficiency and growth as well as enhancing investor confidence. QUOTATION ‘Corporate governance involves a set of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined.’ ‘OECD Principles of Corporate Governance’ (2004) at p. 11 These definitions were crafted in the context of exercises focused on publicly traded (or listed) companies. They were developed with large companies, or groups of companies under common control/governance, and investor/manager conflict forefront in the minds of the drafters. Before turning to the concept of corporate governance in such contexts, and, in particular, the problem of reconciling shareholder primacy and corporate social and environmental responsibility, it is instructive to recall that, as mentioned earlier, most companies are not publicly traded. Most companies are micro, small or medium-sized entities (SMEs) (this term is explained in more detail in section 2.2.2 ). To date, in the SME context, core company law has been (and largely remains) the alpha and omega of corporate governance. Corporate governance and small companies The vast majority of independent companies, that is, companies that are neither part of a larger corporate group of companies nor have shares that are publicly traded, are managed and governed by individuals who own the whole, or a large block of the company’s shares. Additional shareholders are typically related to the majority owner or participate in running the company alongside the majority owner, and it is not uncommon for them to be relatives, co-managers and governors. Most of these companies are not large and are registered as private rather than public companies. Questions about how such companies are governed usually arise out of one of two types of dispute. The first type of dispute is between majority and minority shareholders. It raises the question whether the director(s) (who is/are the majority shareholder) can behave, or cause the company to behave (i.e. can the company be governed?), in a manner objectionable to, and inconsistent with the interests of its minority shareholders. The second type of dispute is between the company and its creditors. It raises the question whether or not the director(s) (who is/are the shareholders) can behave, or cause the company to behave (i.e. can the company be governed?), in a manner that undermines the ability of the company to pay its creditors. Whilst other groups, such as employees, suppliers and customers, may be affected by the manner in which a small company is governed, such impacts are typically either relatively minor or can be worked around because these other groups are not really ‘stakeholders’. The size of a small company’s operations means that members of these groups can turn to other companies. Also, self-interested action by managers or directors of small companies is not generally an issue because the manager/directors own the company. To the extent that the managers/directors do not own all of the shares, their pursuit of self-interest raises issues not only, or even mainly, of how to prevent abuse of the powers of directors, but rather, of the legal constraints that exist, or should be imposed, on majority shareholders who seek to operate the company for their own gain rather than for the benefit of all of the company’s shareholders. Company laws important to regulating small company governance include obvious topics such as directors’ duties and disclosure obligations. However, as the preceding paragraphs suggests, key to small company governance are legal constraints on majority shareholders and remedies available to minority shareholders confronted with majority shareholder abuse, such as the unfairly prejudicial conduct petition examined along with other minority shareholder protection mechanisms in Chapter 14 . Principally found in the Companies Act 2006, laws designed to bring about effective corporate governance can also be found in insolvency law. For the above reasons, a legalistic approach to the concept of corporate governance has been taken and this approach has been justified to date in relation to small, if not all, private companies. Broader-based corporate governance debates have focused on companies with publicly traded shares but this is changing. Corporate governance of unlisted companies is of increasing interest and can be seen in initiatives such as the Corporate Governance Guidance and Principles for Unlisted Companies in Europe published by the European Confederation of Directors’ Association. This development is evidenced by the 2011 EU Green Paper on The EU Corporate Governance Framework: QUOTATION ‘Good corporate governance may also matter to shareholders in unlisted companies. While certain corporate governance issues are already addressed by company law provision on private companies, many areas are not covered. Corporate governance guidelines for unlisted і companies may need to be encouraged: proper and efficient governance is valuable also for unlisted companies, especially taking into account the economic importance of certain very large unlisted companies. Moreover, putting excessive burdens on listed companies could make listing less attractive. However, principles designed for listed companies cannot be simply transposed to unlisted companies, as the challenges they face are different. Some voluntary codes have already been drafted and initiatives taken by professional bodies at European or national level. So the question is whether any EU action is needed on corporate governance in unlisted companies.’ European Commission Green Paper, ‘The EU Corporate Governance Framework’ (COM(2011) 164 final) at p. 4 Corporate governance and large companies In relation to large companies, corporate governance is typically addressed as a much more complex and broad-ranging concept because of the clear impact the quality of corporate governance of large companies with extensive business operations has on the economy and society. It is the role of law in corporate governance, however, that is, and must be, the focus of law courses. Even if we set aside questions of the role the law could and should play in improving corporate governance, the study of how existing company law influences corporate governance is more complex in relation to large companies than it is in relation to small companies. This complexity arises in part out of the model of ownership of many large companies. The scope of impact of business operations The larger the business of a company, the greater will be the impact of its operations, on individuals, other businesses, the community, the environment and, consequently, the economy and public interest. Consider the potential for the environment to be very significantly adversely affected by a company that owns and is actively expanding its network of oil pipelines. Similarly, a large company may run nuclear power stations producing by-products, best practice waste-management of which involves the storage into the long-term future of active nuclear material. A large company may employ a significant proportion of workers in a local community. It may be the largest purchaser of a particular product or products so that producers are dependent upon it continuing to buy a large share of their output (the four leading UK grocery chain corporate groups, Tesco, Sainsbury’s, Morrisons and Asda exemplify this in relation to the purchase of food products). A large company (or corporate group) may be one of only a handful of suppliers of a particular consumer product or service with, consequently, millions of consumer (distinct from business) customers. Mobile telephone network service providers such as Telefonica (providing O2), EE (providing EE, Orange and T-Mobile), Vodafone and the currently much smaller but growing Hutchison Whampoa (providing 3, which was the first 3G network in the UK), illustrate this. Other suppliers of mobile phone services to consumers, such as Virgin Media, lease the right to use networks maintained by these four companies. The point to note is that the effect of decision-making by such companies is not confined to the shareholders of the company or even to those (typically other companies or businesses) who have chosen to do business with the company. Decision-making by large companies can significantly affect the environment, the local community, the livelihood of large numbers of people who work for the company, consumer choice and the viability of suppliers. The various groups affected by, or interested in, a company are sometimes referred to as ‘stakeholders’. The extent to which the interests of different stakeholders as a matter of law , must be as a matter of fact , are as a matter of policy , should be taken into account in company decision-making are important questions that fall within the corporate governance rubric. Closely related questions are who must be , who is and who should be involved in company decision-making. The extent to which each question is explored in a company law course will depend in large part upon the interests of the lecturers and tutors delivering the course. On a course in which the traditional approach, sometimes referred to as a ‘black letter law’ approach, is adopted, the focus will be on current rules and regulations to answer the first question and its corollary: as a matter of law to what extent must the interests of different stakeholders be taken into account and who must be involved in company decision-making. Even where this approach is adopted, however, introduction into core company law, in s 172 of the Companies Act 2006, of the concept of ‘enlightened shareholder value’ (a concept examined in Chapter 11 at 11.3.2 ) means that some analysis of the larger issues of corporate governance are called for, if only to explain this development and provide some insight into how s 172 may be interpreted in the future by boards of directors and the courts. On a course in which a ‘law in context’ approach or a ‘socio-legal studies’ approach is adopted, time is likely to be spent focused on the third question and its corollary: as a matter of policy, to what extent should the interests of different stakeholders be taken into account in company decision-making and who should be involved in company decision-making. A wide range of approaches can be taken to this line of enquiry. An historical approach, for example, may involve reviewing initiatives in the UK over the years to engage workers in company decision-making. A comparative law approach may involve reviewing, comparing and contrasting company decision-making in a selection of legal jurisdictions across the world. A European Union perspective may be adopted, perhaps examining the dichotomy within the European Union between Member States with worker participation (such as Germany) and those without (such as the UK), a matter that has presented insuperable difficulties in harmonising company law in the European Union. Writings of theorists in an array of scholarly disciplines, sociology and economics to name but two, may be drawn upon to explore corporate governance (as well as other aspects of company law) and underpin policy proposals. In particular, theories and models developed by economists have been drawn upon (extensively in the USA, in the EU and to a lesser, albeit influential, extent in the UK) to explore the operation of law, predict the effects of changes to company law and, more contentiously, propose what the law should be. This law and economics scholarship is more developed in relation to corporate governance issues raised by the phenomenon of the separation of ownership from the control/management of companies, an ownership structure that is addressed in the next section. The second of the three questions identified above: to what extent are the interests of different stakeholders taken into account as a matter of practice and who actually takes part in (or perhaps the question should be, who actually influences) company decision-making, are questions of fact. The focus here needs to be on empirical studies yet, as it appears that little empirical research has taken place in the UK on decision-making in companies, this question is often answered, somewhat unsatisfactorily, by making assumptions. Corporate governance and the separation of ownership and control of companies The second factor adding to the complexity of corporate governance of large companies is the model of ownership of large publicly traded companies. Separation of those who ‘own’ a company (the shareholders) from those who run the company (the directors and executives) has long been a feature of large companies in the UK. This separation raises the problem of ensuring that those who manage and govern companies do not run them for their own personal benefit rather than for the benefit of those on whose behalf the law requires companies to be managed. The management self-interest problem is exacerbated where a company’s shares are owned by a large number of shareholders with no single person owning a significant shareholding. This pattern of shareholding is called the ‘dispersed ownership structure’. It reflects modern portfolio theory which underpins investment risk management by diversification. The interest of almost all beneficial owners of shares in dispersed owner publicly traded companies is, first and foremost if not exclusively, financial in nature. Shareholders seek dividends, increased share value (that is, they want the price at which they can sell their shares to increase) and, ideally, both. This share ownership structure is said to reflect investor capitalism as distinct from entrepreneurial capitalism: shareholders are not interested in engaging in management and management hold an insignificant, if any, shareholding in the companies they manage. In this type of company, legal protection based on a balance of power between the board of directors and shareholders has little if any meaningful effect exactly because shareholders have little inclination to exercise the powers reserved to the shareholding body: the divorce of ownership and control is virtually complete. Yet this scenario is believed to present the greatest risk of management and directors acting in their own self-interest rather than promoting the success of the company, and it is in relation to dispersed ownership companies that the most stringent laws promoting good practice in corporate governance are considered to be necessary. This explains why corporate governance law is more developed for companies with shares listed on stock exchanges than it is for private companies and unlisted public companies. It also explains why relevant laws are found not in core company law, but in securities law. Corporate governance law, beyond the Companies Act 2006, is made up of a combination of hard law (legislation such as the Financial Services and Markets Act 2000 and regulations and rules made pursuant to that Act) and ‘soft law’ such as guidance and, particularly, codes. Two important codes designed to promote good corporate governance can be found on the Financial Reporting Council website (which is referenced at the end of this chapter). The UK Corporate Governance Code (the successor to the Combined Code) sets out good practice for boards of directors of companies with shares with a Premium Listing on the Main Market of the London Stock Exchange on issues such as board composition and effectiveness, risk management, director remuneration and relations with shareholders. The Code is subject to consultation and revision every two years. A company with a Premium Listing is required by the Listing Rules in the FCA Handbook to state in its annual report and accounts how it has applied the Main Principles set out in the UK Corporate Governance Code and whether it has complied or not with all relevant provisions of the code. It must set out any provisions with which it has not complied and give reasons for its non-compliance. The newer UK Stewardship Code is aimed at enhancing the quality of engagement between asset managers and the companies in which they invest. It sets out good practice on engagement with companies, to which asset managers should aspire, to help improve efficient exercise of governance responsibilities. Currently, as is the case with the UK Corporate Governance Code, no legal obligation to comply with this code exists. However, unlike the UK Corporate Governance Code, no legally enforceable reporting obligations exist in relation to the UK Stewardship Code, not even ‘comply or explain’ reporting. Corporate governance codes from all around the world can be accessed on the European Corporate Governance Institute website referenced at the end of this chapter. Corporate governance and large private and unquoted companies Large private companies and large public companies with no publicly traded shares present a challenge to corporate governance law. They highlight what seems to be a structural difficulty with the current law, namely that enhancements to corporate governance laws, the justification for some of which arises from the implications of large-scale operations rather than the divorce of ownership from control, have been implemented by laws applicable only to publicly traded companies. An example of this was the requirement in the Companies Act 2006 that companies report to the public information about the impact of their operations and decisions on the physical and social environment, company employees and the community, as well as disclosing company policies on these matters and the effectiveness of those policies. This obligation applied only if the company was a ‘quoted company’ as that term is defined in the Companies Act 2006. No private company or unquoted public company, regardless of how extensive its operations were, was subject to these reporting obligations. The legal obligation to publish a business review covering the matters outlined above has now been replaced by the obligation imposed on all companies except small companies to publish a strategic report (s 414C). The required contents of this report are considered under narrative reporting in Chapter 17 . Overlooked in the reform resulting in the Companies Act 2006, the problem of how to regulate the governance of large companies that are not publicly traded is an important challenge facing company law. In addition to being raised in the EU Corporate Governance Framework Green Paper quoted from above, the Reflection Group on the Future of EU Company Law, appointed by the European Commission, addressed this issue in its report published in April 2011. QUOTATION ‘As it is important to avoid broad and imprecise categorisations, the Reflection Group is particularly concerned about the distinction between public and private limited companies that has traditionally dominated legislation within company law for more than a century. The origin of the distinction is the still correct observation that a company with a large and dispersed і crowd of shareholders may in certain respects warrant different regulation from a company with a small and closely knit circle of shareholders. However, in its traditional form the distinction relies on an inapt choice of company form, whereby a company is deemed “public” or “private” simply by its choice of company form. Thus, a “public company” does not necessarily have a large and dispersed crowd of shareholders; in fact, it may not even be listed and may have a single shareholder. Nor does a “private company” have to be a small company in any way; it can have more shareholders, more employees and a greater turnover than a “public company”.’ European Commission, ‘Report of the Reflection Group on the Future of EU Company Law’, Brussels (5 April 2011) The approach to corporate governance taken in this book Developments in share ownership patterns (including the more limited role and importance of traditional institutional investors, growth in the proportion of shares on publicly traded companies in overseas ownership and the creeping number of publicly traded companies with block-holding shareholders), concern and steps to regulate the gender composition of boards of directors, enhanced focus on shareholder engagement as a tool to improve corporate governance, the emergence of corporate governance guidance and codes for unlisted companies, heightened concern and steps to ensure effective governance of SMEs (driven by political focus on SMEs as important drivers of economic growth and employment), promotion of employee share ownership and sustained demand for corporate social and environmental responsibility to be given legal backing (the beginnings of which can arguably be seen in company law in narrative reporting developments) combine to make the study of corporate governance a fascinating and contentious field of study. Unfortunately, in a basic text on core company law, it is only possible to alert readers to the rich tapestry of interests and initiatives that make up the multi-faceted world of corporate governance. Before engaging with this complex realm, it is helpful to understand the relevance of core company law to corporate governance. Large parts of the Companies Act 2006 can be characterised as laws existing to support and promote good practice in corporate governance. Being so pervasive, these laws are not separated out and expressly dealt with under the rubric ‘corporate governance’ (although that term is used as the title to Chapter 9 in which the key organs of governance, their composition and decision-making processes are examined). To the extent that securities regulation can be regarded as containing corporate governance provisions, limited space requires that a line be drawn somewhere and the only securities regulation covered briefly in this book is the framework of periodic and insider information reporting for publicly traded companies outlined in Chapter 17 , the Prospectus Rules outlined in Chapter 7 and, because some of its provisions are so widely discussed and lend a fuller picture to some aspects of core company law, certain provisions of the UK Corporate Governance Code are examined at appropriate points in the text. The impact of the quality of corporate governance on the political economy makes it an important topic of scholarly interest. Beyond examining the existing law, this book simply introduces readers to the enormous potential scope of this area of study and provides those interested in expanding their understanding with suggestions for further reading. An excellent starting point for those seeking to understand the European Union’s current approach to corporate governance is the European Commission EU Corporate Governance Framework Green Paper already referred to. 1.3 Sources of company law 1.3.1 Legislation Statute law takes the lead in the sources of company law. The main statute containing company law is currently the Companies Act 2006. The most important statutes containing provisions regarded as part of core company law are: Companies Act 2006; Insolvency Act 1986; Company Directors Disqualification Act 1986; Financial Services and Markets Act 2000; Criminal Justice Act 1993 (insider dealing); Companies Act 1985 (company investigations); Companies (Audit, Investigations and Community Enterprise) Act 2004 (company investigations and community interest companies (CICs)). BIS The Department for Business, Innovation and Skills (formerly BERR and before that the DTI) is the government department responsible for company law (amongst other things)

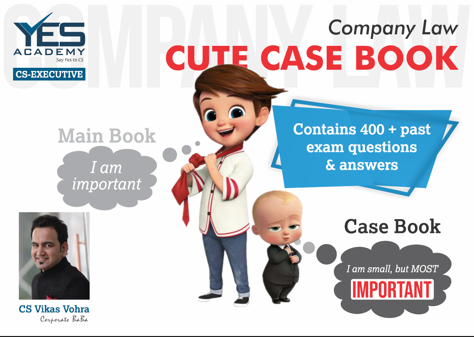

- CS Executive (New syllabus)

- CS Executive (Old Syllabus)

- CS Professional (New Syllabus)

- CS Professional (Old Syllabus)

- CS Executive (New Syllabus)

- CS Executive (old syllabus)

- CS Professional (old syllabus)

Company Law Case Book

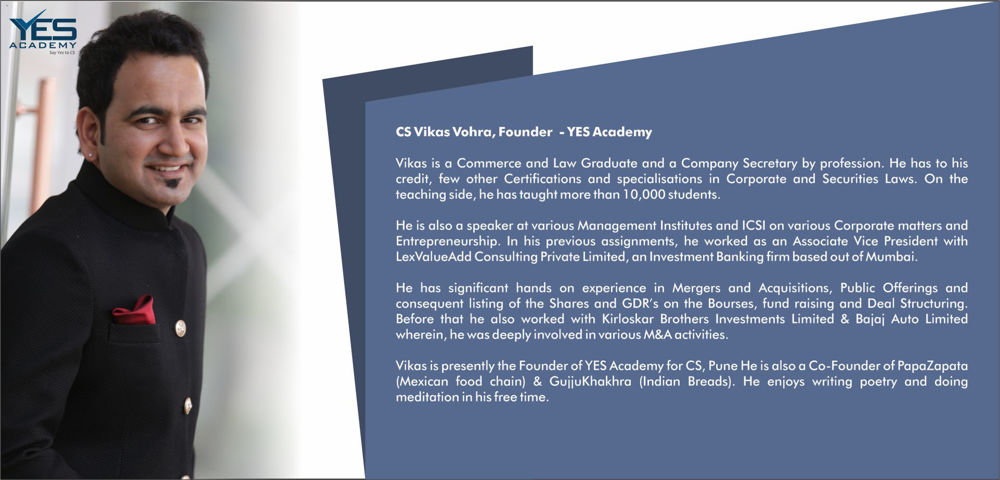

- About Faculty

- Sample Notes

| Company Law Case Book | |

| CS Executive | |

| Book | |

| New | |

| Printed Material, No of Pages - 574 | |

| Covers past exam questions & answers to almost 300 plus questions and all important judgments | |

| CS Vikas Vohra | |

| English | |

| Yes Academy | |

| Jun 23 & Dec-23 |

- Only registered users can write reviews

- Office 30A, 1st floor, Prestige Point, Behind BSNL Telephone Exchange, Bajirao Road, Shukrawar Peth, Pune-411 002

- [email protected]

- (+91) 8888545545 / 8888280280

- (+91) 8888235235 / 8888569569

- Privacy notice

- Conditions of Use

- Popular Courses

- Excel Power Tools

- More classes

- More Courses

Important caselaws on Company law

Leading Cases on Company Law

As the trend of asking questions have been changed by ICAI, I thought this might be useful. I compiled these decided case laws from various sources like RTP, study module, compilation of suggested answers. I am laying down only those which I feel important from examination point of view. These caselaws make the concept even clearer because example is a better teacher.

Cases on separate legal entity

Kandoli tea company Ltd(1886)

Facts Certain persons transferred their properties in the name of company on which tax was payable.

Petition Petitioners claimed exemption from such tax on the ground that the transfer was from them individually to themselves in another name.

Judgment Company is separate from its shareholders and this should be treated as transfer.

Saloman Vs. Saloman & Co. Ltd. (1895 - 99)

Facts- Saloman sold his business to a company named Saloman & Company Ltd., which he formed. Saloman took 20,000 shares. The price paid by the company to Saloman was 30,000, but instead of paying him, cash, the company gave him 20,000 fully paid shares of 1 each &10,000 in debentures. The company wound up & the assets of the company amounted to 6,000 only. Debts amounted to 10,000 due to Saloman & Secured by debentures and a further 7,000 due to unsecured creditors. The unsecured creditors claimed that as Saloman & Co. Ltd., was really the same person as Saloman, he could not owe money to himself and that they should be paid their 7,000 first.

1. A Company is a "legal person" or "legal entity" separate from and capable of surviving beyond the lives of, its members.

2. The company is not in law the agent of the subscribers or Trustee for them.

3. Saloman was entitled to 6,000 as the company was an entirely separate person from Saloman.

4. The unsecured creditors got nothing.

Lee Vs. Lee's Farming Co. Ltd. (1960)

Facts- Lee incorporated a company of which he was the managing director. In that capacity he appointed himself as a pilot of the company. While on the business of the company he was lost in a flying accident. His widow claimed compensation for personal injuries to her husband while in the course of his employment. It was argued that no compensation was due because L & lee's Air Farming Ltd. were the same person.

1.L was separate person from the company he formed and compensation was payable.

2. His widow recovered compensation under the Workmen's Compensation Act

3. A member of a company can contract with a company of which he is a shareholder.

4. The directors are not precluded from being an employee of the company for the purpose of workmen's compensation legislation.

MacauraVs. Northern Assurance Co. Ltd. (1925)

Facts- M was the holder of nearly all the shares except one of a timber company. He was also a substantial creditor of the company. He insured the company's timber in his own name. The timber was destroyed by fire & M claimed the loss from Insurance Company.

1.The Insurance Company was not held liable to him.

2.A shareholder cannot insure the company's property in his own name even if he is the owner of all or most of the company's shares.

Lifting of corporate veil

Gol ford Motor Co. Vs. Home (1933)

Facts- Home was appointed as a managing director of the plaintiff company on the condition that "he shall not at any time while he shall hold the office of a managing director or afterwards, solicit or entice away the customers of the company." His employment was determined under an agreement.

Shortly afterwards he opened a business in the name of a company which solicited the plaintiffs customers.

Judgment-It was held that the company was a mere cloack or shaw for the purpose of enabling the defendant to commit a breach of his covenant against solicitation. The court will refuse to uphold the separate existence of the company where it is formed for a fraudulent purpose or to avoid legal obligations.

Daimler Co. Ltd. Vs. Continental Tyre & Rubber Co. Ltd. (1916)

Facts- In a company incorporated in England for the purpose of selling tyres manufactured in Germany by a German Company, all the shares except one was held by the German subjects residing in Germany. The remaining one was held by a British. Thus the real control of English Company was in German hands. Question arose whether the company had become an enemy company due to war&should be barred from maintaining the action.

1.A Company incorporated in United Kingdom is a legal entity, a creation of law with the status & capacity which the law confers.

2.It is not a natural person with mind or conscience. It can neither be loyal nor disloyal. It can be neither friend nor enemy. But it can assume enemy character when persons in defacto control of its affairs are residents in any enemy country or whenever resident, are acting under the control of enemies.

3.Held that company was an enemy company for the purpose of trading and therefore it was, barred from maintaining the action.

Workmen employed in associated rubber industries

Facts A subsidiary company was formed wholly by the holding company with no assets of its own except those transferred to it by the holding company, with no business or income of its own except receiving dividend from shares transferred to it by the holding company.

Judgment Court held that the company was formed as a devide to reduce the profitsof the holding company and thereby reduce the bonus to workmen.

F.G.Films Ltd., case

Facts An American company produced a film in India actually in the name of British company wherein 90% of the share capital was held by the chairman of the American company which financed the production of the film.

Judgement The contention of the sensor board of films refusing to register the film on the ground that British company has acted merely as an agent of British company was correct.

COI is conclusive evidence that all the requirements have been complied with

Moosa Goola Arif Vs Ibrahim Goola Arif

Facts Company registered on the basis of MOA&AOA signed by two persons and a guardian on behalf of 5 minor members. Guardian signed separately for each of 5 memebers. The ROC however registered the company and issued under his hand a certificate of incorporation.

Petition Plaintiff contended that COI should be declared as void.

Judgment The court held the certificate to be conclusive for all purposes.

Jubilee Cotton Mills Ltd.,

Facts The ROC issued a COI on Jan 8thbut dated it Jan 6thwhich was the date he received application. On Jan 6ththe company made an allotment of shares to Lewis

Judgment Court held that certificate was conclusive evidence of incorporation on Jan 6thand that the allotment was not void on the ground that it was made before the company was incorporated.

Decided case on objects clause of MOA

Crowns bank case

Facts A companys objects clause enabled it to act as a bank and further to invest in securities and to underwrite issue of securities. The company abandoned its banking business and confined itself to investment activities.

Judgment Court held that the company was not entitled to do.

Doctrine of ultravires

Ashbury railways carriage & Iron Co Ltd Vs Riche

Facts A railway company was formed with an object of selling railway wagons. The directors entered into a contract with Richie to finance the construction of railway line. The shareholders later rejected the contract as ultravires.

Judgment The court held that the contract was ultravires and therefore null and void.

Doctrine of indoor management / Turquand rule

Royal British Bank Vs. Turquand (1856)

Facts- The Directors of a company borrowed a sum of money from the plaintiff. The company's articles provided that the directors might borrow on bonds such sums as may from time to time be authorised by a resolution passed at a general meeting of the company. The shareholders claimed that there had been no such resolution authorising the loan and, therefore, it was taken without their authority. The company was however held bound by the loan. Once it was found that the directors could borrow subject to a resolution, the plaintiff had a right to infer that the necessary resolution must have been passed.

1.Persons dealing with the company are bound to read the registered documents and to see that the proposed dealing is not inconsistent therewith.

2.Outsiders are bound to know the external position of the company, but are not bound to know its indoor management.

3.Company may ratify the ultra vires borrowing by the directors if it is taken bonafide for the benefit of the company.

Exception to Turquand rule

Ruben Vs. Great Fingall Consolidated (1906)

Facts- The plaintiff was the transferee of a share certificate issued under the seal of a defendant company. The certificate was issued by the company's secretary, who had affixed the seal of the company & forged the signatures of two directors.

1.It is quite true that persons dealing with limited liability companies are not bound to enquire into their indoor management and will not be affected by irregularities of which they have no notice. But the doctrine of indoor management, which is well established, applies to irregularities which otherwise might affect a genuine transaction. It can't apply to a forgery.

2.Plaintiffs suit for damages did not succeeded because turquand's rule did not apply where the document was forged.

Anand Biharilal Vs Dinshaw and Co.,

Facts The plaintiff accepted a transfer of the companys property from its accountant.

Judgment The court held that since it is beyond the scope of an accountants authority, it was held void.

The offer in prospectus should be made to public (atleast to 50 persons)

Nash Vs Lynde

Facts Some copies of documents marked strictly confidential and containing particulars of a proposed issue of shares, were sent by the managing director to his relatives and friends. Thus the document was passed on privately through a small circle of friends of directors.

Judgment The court held that there was no issue to public, and it doesnot amount to prospectus as it was not offered to public.

Who can sue on a false and misleading prospectus

Only primary market allotees

Peek Vs Gurney

Facts A fraudulent prospectus was issued by the directors. Peek received a copy of it and did not took any shares. After several months Peek bought few shares from the stock exchange.

Judgment His action against the directors for fraudulent prospectus was rejected as he took the shares throughthe secondary market.

Misc. Case laws

Needle Industries Ltd. Vs. Needle Industries ly (India) Holding Ltd. (1981)

Facts-The articles of a private company contained a clause that when the directors decided to increase the capital of the company by the issue of shares the same should be offered to the shareholders, and if they failed to take, may be offered to others. The company was a wholly owned subsidiary of an English Company. The Govt, of India adopted a policy of diluting foreign holdings. The company accordingly issued shares to its employees and relatives reducing the foreign holding to 60%. The company became a deemed public company because more than 28% of its share capital was held by a body corporate.

1.A deemed public company is neither a private company nor a public company but a company in a third category.

2.If the power of appointing additional directors is delegated to the Board by the articles, the Board can appoint additional directors without taking this item on the agenda of its meeting.

Gramophone Ltd. Vs. tanley (1908)

1."Even a resolution of a numerical majority, at a general meeting cannot impose its will upon the directors. When the articles have confided to them the control of the company's affairs."

2.A company will be regarded as an Indian Company even if it is incorporated in India by promoters of foreign nationality.

T.R. PRATT Ltd. Vs. Sasson & Co. Ltd. (1936)

Facts- There were three companies, namely, 'S\ 'MT' & 'P' Company. S company had been financing P Company for a number of years and all transactions of loans were entered into through the agency of MT Company which held almost all the shares of P Company. The Directors of MT Company were also the Directors of P Company and this fact was known to S Company. An equitable mortgage was created on the property of 'P' Company for a loan granted by S to MT Company. In the winding up of P Company, it was held that the official liquidator was entitled to avoid the equitable mortgage as S Company had the knowledge of the facts through its directors.

1.Just as in case of agency, a notice to agent will amount to a notice to the principal, in the same way a notice to director will be deemed as a notice to the company.

2.Money having borrowed and used for the benefit of the principal, i.e. company in either paying off debts or for its legitimate business, the company could not repudiate its liability on the ground that the agents i.e., directors had no authority from the company to borrow.

3. "Under the law an incorporated company is a distinct entity, and although all the shares may be practically controlled by one person, in law a company is a distinct entity and it is not permissible or relevant to enquire whether the directors belonged to the same family or whether it is compendiously described as one man company.

EwingVs. Butter Cut Margarine Company Ltd. (1917)

Facts- The plaintiff was an incorporated firm carrying on substantial business under the trade name of Butter Cap Dairy Company. The defendant company was registered to trade in similar commodities and selected the name bonafide believing that there was no other company in existence with a similar name. The plaintiff alleged that the name of the company would lead to confusion and was detrimental to the plaintiffs business.

Judgment-Plaintiff was entitled to restrain the ly registered company from carrying on business on the ground that the public might reasonably think that the registered company was connected with his business.

Mackinnon Mackenzee & Co. Re, (1967)

Facts- A Company desired to shift its registered office from the State of West Bengal to Bombay. The Company's petition was resisted by the state on the grounds of loss of revenue.

Judgment- Held that there is no statutory right of the state, as a state, to intervene in an application made u/s 17 for alteration of the place of the registered office of a company. To hold that the possibility of the loss of revenue is not only relevant, but of persuasive force in regard to the change is to rob the company of the statutory power conferred on it by Sec. 17. The question of loss of revenue to one state would have to be considered in the total conspectus of revenue for the Republic of India and no parochial consideration should be allowed to turn the scale in regard to change of registered office from one state to another within India.

Scientific Poultry Breeder's Association, Re (1933)

Facts- Memorandum of the company prohibited payment of any remuneration to the directors. When the business of the company increased it was found that the directors could not pay sufficient attention unless some remuneration was paid to them.