Asset Management

- Retirement professional

- Personal investor

Performance and Reports

Find performance and reports content.

2021 ETF Report Card: See which funds passed and failed

michaelquirk/iStock via Getty Images

- ETF year-end report cards are in with only a few trading days left in 2021. Below is a breakdown of funds that received As and Fs for specific criteria.

- The grading conditions are broken down into five segments: inflows and outflows, performance winners and losers in passive and actively managed ETFs, along with performance leaders and laggers in sector and leveraged ETFs. All data provided is per ETF.com .

Inflows & Outflows

- Capital flows are the lifeblood of all ETFs as they determine where investors are placing their money and where they are retracting it. Below are the top and bottom three funds for 2021 regarding inflows and outflows.

- A : Vanguard S&P 500 ETF (NYSEARCA: VOO ) +$45.31B.

- A : Vanguard Total Stock Market ETF (NYSEARCA: VTI ) +$43.51B.

- A : SPDR S&P 500 ETF Trust (NYSEARCA: SPY ) +$30.47B.

- F : iShares iBoxx USD Investment Grade Corporate Bond ETF (NYSEARCA: LQD ) -$14.88B.

- F : SPDR Gold Trust (NYSEARCA: GLD ) -$10.89B.

- F : iShares MSCI USA Min Vol Factor ETF (BATS: USMV ) -$7.96B.

Passive ETF Performers

- Passive ETFs track specific indices and aim to replicate the performance of broad market segments by reflecting the same holdings as an index. Passive funds have become a staple for investors looking to track the S&P 500, Nasdaq, Dow Jones, and countless other indices. Below are the top and bottom three 2021 YTD passive ETF performers.

- A : Breakwave Dry Bulk Shipping ETF (NYSEARCA: BDRY ) +247.6% .

- A : First Trust Natural Gas ETF (NYSEARCA: FCG ) +105.2% .

- A : Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA: PXE ) +99.3% .

- F : ProShares VIX Short-Term Futures ETF (BATS: VIXY ) -70% .

- F : Global X Education ETF (NASDAQ: EDUT ) -49.9% .

- F : KraneShares CSI China Internet ETF (NYSEARCA: KWEB ) -49.2% .

Actively Managed ETF Performers

- Actively managed ETFs have taken off in 2021, logging record inflows through the year's first eleven months . The management style made widespread by popular asset manager Cathie Wood takes an active approach to investment portfolios, picking and choosing specific securities to fill an ETF at different times. Below are the top and bottom three 2021 YTD actively managed ETF performers.

- A : KraneShares Global Carbon Strategy ETF (NYSEARCA: KRBN ) +94.1% .

- A : Cambria Shareholder Yield ETF (BATS: SYLD ) +44.8% .

- A : Avantis U.S. Small Cap Value ETF (NYSEARCA: AVUV ) +39.1% .

- F : ARK Genomic Revolution ETF (BATS: ARKG ) -30.9% .

- F : AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS ) -30.5% .

- F : Cabot Growth ETF (BATS: CBTG ) -25.5% .

Sector ETF Winners and Losers

- In 2021, the winning sector has been the energy space +48.5% YTD as crude oil rose from $48/bbl to $76/bbl or a 56.9% increase. On the other end of the spectrum, utilities have lagged all other sectors on the year, returning investors +12.4% YTD. Below is a breakdown of the top three energy ETFs and the bottom three utility ETFs and their YTD performances.

- A : First Trust Natural Gas ETF ( FCG ) +105.2% .

- A : Invesco Dynamic Energy Exploration & Production ETF ( PXE ) +99.3% .

- A : Invesco DWA Energy Momentum ETF (NASDAQ: PXI ) +81.29% .

- F : iShares Emerging Markets Infrastructure ETF (NASDAQ: EMIF ) +4.2% .

- F : FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEARCA: NFRA ) +8.7% .

- F : iShares Global Utilities ETF (NYSEARCA: JXI ) +8.9% .

Leveraged ETF Leaders and Laggers

- Leveraged exchange traded funds provide investors with additional force in bullish and bearish directions to build on an underlying position. Below are the top and bottom three performing leveraged ETFs in 2021.

- A : ProShares Ultra QQQ (NYSEARCA: QLD ) +208.5% .

- A : Direxion Daily Homebuilders & Supplies Bull 3X Shares (NYSEARCA: NAIL ) +143.9% .

- A : ProShares Ultra Bloomberg Crude Oil (NYSEARCA: UCO ) +131.6% .

- F : ProShares Ultra VIX Short-Term Futures ETF (BATS: UVXY ) -98.6% .

- F : Direxion Daily CSI China Internet Index Bull 2X Shares (NYSEARCA: CWEB ) -79.4% .

- F : Direxion Daily FTSE China Bull 3X Shares (NYSEARCA: YINN ) -58.3% .

- 2021 has been an excellent year for ETFs as they have set records, with 380 new funds launching in 2021, topping 2020's 320 funds.

Recommended For You

Related stocks, trending analysis, trending news.

Nonprofit analytics & reporting like never before!

Fundraising Report Card

Simple fundraising analytics for nonprofits, enhance your fundraising with effortless, easy & free to use analytics..

Thousands of nonprofits use Fundraising Report Card® to leverage their data.

The simplest analytics and reporting tool for nonprofit pros..

You can’t improve what you don’t measure. Now measuring is easier than ever.

Fundraising KPIs

- Average Donation Amount

- Bequest Potential

- One-time vs. Recurring Donors

- Retention Rate

- Donation Frequency

- … and many more!

Performance Metrics

- Donation Growth

- Donor Acquisition

- Lapsed Donors

- Donor Retention

- Donor Churn

- Donation Reactivation

- Donation Retention

Deliver highly optimized prospect portfolios with Export.

Recapture lost donors, increase major gift close rates, and dive into your data.

As seen on…

Have an answer at every fork in the road.

Arm yourself with timely, relevant data about your constituents.

The Fundraising Report Card® is a great tool! It allows nonprofit organizations to amplify the donor signal amidst all the noise while turning data into meaningful actionable information . The tool really allows organizations to move into a metrics and growth mindset.

TJ McGovern, MPA

President, McG Consulting Group

Using the Fundraising Report Card® has given us the insight we need to set realistic goals . We have a real-time view into the major metrics, and no longer have to spend days or weeks digging through data in spreadsheets.

Robert Wiggins

VP of Advancement

Which organizations do I see experiencing the greatest fundraising success? Nonprofits where everyone – board, staff, volunteers – are on the same page, tracking the same goals. Having a strong dashboard system focused on the metrics that count is one of the best ways of achieving that goal. And the Fundraising Report Card® gives organizations a quick way to report back on those metrics in an easily digested format. Highly recommended!

Pamela Grow

Founder, GrowConsulting & Fundraising Expert

Sync with your existing database or CRM in seconds.

Or, simply drag and drop a spreadsheet with donor ids, donation dates, and donation amounts.

1000+ nonprofits use Fundraising Report Card® to leverage their data.

- Privacy Overview

- Strictly Necessary Cookies

We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy .

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Get 7 Days Free

Report Card: Grading the Investor Experience in 26 Global Markets

Why the U.S. is one of only three markets to earn a Top grade for practices related to fees and expenses.

Global fund fees continue to trend downward, as the majority of the 26 markets we studied--including the United States--have seen asset-weighted median expense ratios for funds fall since our last analysis.

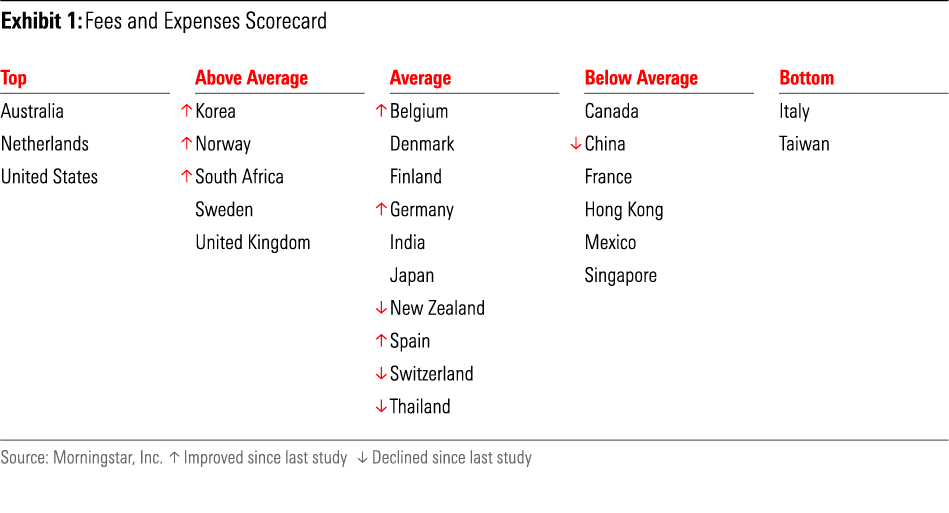

In the Fees and Expenses chapter of the latest Global Investor Experience study , we evaluate the environment for mutual fund investors in markets around the world, identifying the ones that are adopting best practices and the ones that need to improve.

As shown below, the highest overall grades went to Australia, the Netherlands, and the U.S., while Italy and Taiwan earned Bottom grades. This is the fourth study in a row that these three countries have nabbed the highest grade; it's the third in which Taiwan came in at the bottom and the second in succession for Italy.

In this report, we detail the market characteristics that drive increased transparency and lower global fund fees for retail investors. Here's what we're seeing.

United States: Vanguard Pushes Down Fees, Investors Move Toward Fee-Based Advice

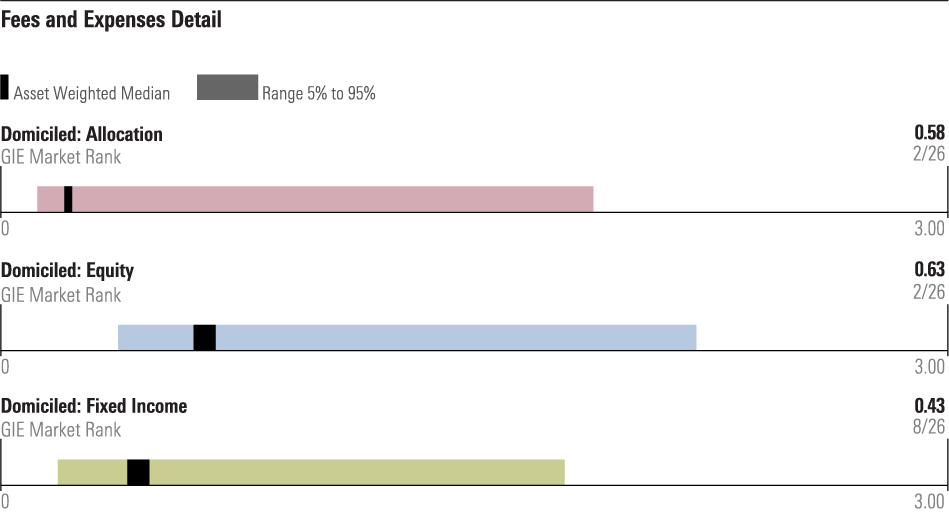

The U.S.' Top grade was driven largely by low asset-weighted median expenses across asset classes: 0.43% on fixed-income funds, 0.58% for allocation, and 0.63% for equity funds.

Source: Morningstar.

The U.S. investing environment is also benefiting from the growth of the fee-based advice market and the broad availability of no-load, no-trailer share classes for do-it-yourself investors.

Though front loads and trail commissions still exist, market forces are driving investments away from share classes that employ these traditional fee arrangements. As reported in our most recent fee study, these share classes have been in aggregate outflows for the past 10 years.

And investors' migration to fee-based advisors has led fee-based arrangements to constitute most of the retail fund assets in the U.S. In addition, it's increasingly common for investors to forgo advice entirely and invest directly in funds without loads or commissions.

This move toward fee-based, self-directed investment also means people are making good use of domestically listed exchange-traded funds. These funds lack the minimum investment requirements of open-end funds and feature prominently in digital advice solutions such as robo-advisors .

It's worth noting the influence that Vanguard has on the U.S. fee landscape. The firm offers numerous passive strategies and operates at enormous scale in a mutual ownership structure, which make it possible for them to offer investments to their clients at exceptionally low prices. The firm's size and influence have thus pushed down pricing more widely.

5 Takeaways From This Chapter of the 2022 Global Investor Experience Study

- The majority of the 26 markets studied saw the asset-weighted median expense ratios for domestic and available-for-sale funds fall since the 2019 study . For domestically domiciled funds, the trend was most notable in allocation and equity funds, with 17 markets in each category reporting reduced fees. Globally, lower asset-weighted median fees are driven by a combination of asset flows to cheaper funds as well as the repricing of existing investments. In markets where retail investors have access to multiple sales channels, people are increasingly aware of the importance of minimizing investment costs, which has led them to favor lower-cost fund share classes.

- Price wars in the ETF space have put downward pressure on fund fees across the globe. In the U.S., competition has driven fees to zero in the case of a handful of index funds and ETFs, and these competitive forces are spreading to other corners of the fund market.

- In global markets where banks dominate fund distribution, there is no sign that market forces alone will drive down asset-weighted median expense ratios for retail investors. This is particularly evident in markets like Italy, Taiwan, Hong Kong, and Singapore, where expensive offshore fund sales predominate over those of cheaper locally domiciled funds.

- Outside the United Kingdom, U.S., Australia, and the Netherlands, it is rare for investors to pay for financial advice directly . A lack of regulation toward limiting loads and trail commissions can cause many people to unavoidably pay for advice they do not seek or receive. Even in markets where share classes without trail commissions are for sale, such as Italy, they are not easily accessible for the average retail investor, given that fund distribution is dominated by intermediaries, notably banks.

- Australia, the Netherlands, and the U.S. earned Top grades because of their typically unbundled fund fees. As discussed above, this is the fourth study in a row that these three countries have received the highest grade in this area. The move toward fee-based financial advice in the U.S. and Australia has spurred demand for lower-cost funds like passives. Institutions and advisors have increasingly opted against costlier share classes that embed advice and distribution fees. The trend extends to markets such as India and Canada.

Fees and Expenses is the first of three chapters in this edition of the Global Investor Experience study. Up next is Disclosure, followed by Regulation and Taxation.

More details about the Global Investor Experience Study's methodology are available on the Signature Research and Methodology page.

More in Funds

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

US Fund Flows: Inflows Come to a Screeching Halt

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

3 Funds With Double-Digit Stakes in a Single Stock

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

Why We Highly Rate Vanguard Wellesley Income

About the author.

Grant Kennaway

Grant Kennaway is director of manager research for Morningstar Australasia Pty Ltd, a wholly owned subsidiary of Morningstar Inc. Kennaway takes overall leadership for Morningstar's global manager selection teams to deliver research output solutions for clients.

Prior to joining Morningstar in 2011, Kennaway spent 11 years at Australian research house Lonsec, where he served as a fund analyst, head of funds research, and ultimately as general manager/director. He started his career in fund management, working for global funds management businesses including HSBC and Goldman Sachs.

Kennaway holds a bachelor's degree in arts from the University of Melbourne and a master's degree in business administration from Deakin University. He also holds a diploma of financial planning from the Financial Planning Association and a post-graduate diploma in management from the University of Melbourne Business School.

Mutual Fund Disclosures: Regulators Focus on Foiling Greenwashing in Global Markets

Global investor experience study: disclosure, global disclosure practices: how markets around the world stack up, global investor experience study: fees and expenses, sponsor center.

Go Paperless

Receive reports electronically, typically by e-mail.

Paper Reports

Notice - Receive a notice of the availability of the annual or semi-annual report. The notice will provide a website where you can view the reports. Full Report - Receive the current paper annual or semi-annual report.

Customize how you receive eligible shareholder communications

3 steps to customize how you receive eligible shareholder communications, important information important information, what has changed, what you need to do, existing electronic delivery, how to read your report.

As an investor, you have options for how mutual fund reports are received.

Make your choice here - it's a simple three step process:

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Investor Information

Want to know more about mutual funds managed by Schwab Asset Management? Find the information you need with prospectuses, reports, tax information, and proxy voting information for each fund.

Schwab Funds

Take the next step., ready to start investing, need help understanding your mutual fund options.

Malala Fund Girls’ Education Report Cards

Making the grade

Girls’ Education Report Cards Last Updated: April 2023

The Challenge

For decades, politicians, scholars, activists and professionals have hailed girls’ education as “the world’s best development investment.”

In 2015, world leaders enshrined their commitment to girls’ education in Sustainable Development Goal 4: Achieve universal quality education for all by 2030.

Yet high-level pledges have too rarely translated into good policies and strong investment. The result: millions of girls shut out of classrooms, dropping out early or left behind in learning.

Malala Fund’s report cards are for advocates who want to understand the world’s slow progress on girls’ education—and demand action to remedy it.

We hope that you will use this information to demand change and accountability from governments—collectively and individually—as the SDG deadline approaches. Girls can’t wait any longer to see their dreams become reality.

Report card for lower-income countries

This report card examines the current status of girls’ education in 120 countries using official government data on progress (SDG score) and assessment of policy frameworks (policy score) proven to help girls learn and lead.

Report card for donor countries

Tracks donor countries’ progress on their commitments and prioritisation of girls’ education within their Overseas Development Assistance (donor score).

Key Takeaways

Girls’ education is in a state of emergency

- 232 million girls live in countries failing to “make the grade” in helping girls learn and lead without fear.

- Donor spending does not match support for girls’ education. Just 0.22% of aid is spent on programmes targeting girls’ education.

- On current trends, leaders will not achieve universal quality education by 2030. Worryingly, the number of out-of-school girls is growing in sub-Saharan Africa.

The Conclusion

The world is off-track to provide 12 years of free, safe, quality education to all girls by 2030

Education advocates face crises, misogyny and inadequate resources in their fight to achieve gender equality in and through education.

Despite challenges, some countries demonstrate progress is possible. World leaders must come together and support others to follow suit.

Girls can’t wait another generation for their education.

Our Recommendations

Low- and middle-income countries should:

- Adopt and implement policies that have been proven to improve girls’ opportunities for the future

- Recommit to spending 20% of budgets and 6% of gross domestic product (GDP) on education

- Redouble efforts to reach low-income and marginalised girls

Higher-income countries should:

- Renew—and set a timeline to reach—the global target to spend 0.7% of gross national income (GNI) on aid

- Ensure at least 10% of aid is spent on education, prioritising low-income countries and those with large gender disparities in education

- Reform global financial institutions to create the conditions for investment in education

All countries should:

- Extend the right to education to include one year of pre-primary education, in addition to 12 years of school

- Ensure education is a force for gender equality

- Revise curriculums so that girls gain the knowledge and skills to cope with and address 21st century challenges

- Make education systems resilient to the impacts of shocks

- Collect and increase the availability of high-quality, timely and reliable gender-disaggregated data

- Leverage the National SDG 4 Benchmark process to adopt further benchmark values on gender targets

LIVE UPDATES

Stock Market News: Markets Open Up After CPI Inflation Report

S&p 500 and nasdaq set intraday record highs and the dow also opens up..

Last Updated:

5 hours ago

Grayscale’s Bitcoin Fund Has Hefty Fees. Why You Might Be Stuck.

What to Know

Grayscale faces competition from companies that charge less for handling Bitcoin transactions. But investors might face a big tax hit for switching.

Advertisement - Scroll to Continue

- Cryptocurrencies

- Stock Picks

- Barron's Live

- Barron's Stock Screen

- Personal Finance

- Advisor Directory

Memberships

- Subscribe to Barron's

- Saved Articles

- Newsletters

- Video Center

Customer Service

- Customer Center

- The Wall Street Journal

- MarketWatch

- Investor's Business Daily

- Mansion Global

- Financial News London

For Business

- Corporate Subscriptions

For Education

- Investing in Education

For Advertisers

- Press & Media Inquiries

- Advertising

- Subscriber Benefits

- Manage Notifications

- Manage Alerts

About Barron's

- Live Events

Subscribe Sign In Register

The Hedge Fund Report Card

Performance isn’t the only factor that determines how well a firm fares in the eyes of its investors — but it’s by far the most important..

- Copy Link copied

Last year was a disaster for William Ackman’s Pershing Square Capital Management .

To continue reading, subscribe now to Premium Journalism. Already a subscriber? login .

- Login / Sign-up

- Logout Get Support

- All about Mutual Funds

- Know your Investor Personality

- Mutual Funds Home

- Explore Mutual Funds

- Check Portfolio Health

- Equity funds

- Hybrid funds

- Explore Genius

- Genius Portfolios

- MF Portfolios

- Stocks Portfolios

- Term Life Insurance

- Health Insurance

- SIP Calculator

- Mutual Fund Calculator

- FD Calculator

- NPS Calculator

- See all calculators

- Help & Support

Great! You have sucessfully subscribed for newsletters for investments

Subscribed email:

Invest in the freedom to choose

Wealth is not just about money. It's about what all you can do with it. It is having your own story of progress. And living it every single day. So go ahead, imagine a future you want to shape.

And make it happen.

Live your choices.

When you are free to choose, the possibilities are endless. Maybe you want to create the next big startup, or take YouTube by storm, take your mom on a world tour, or write a bestseller. Whatever you want from life, go for it.

Wants his son to become an astronaut

Wants to go big on teaching yoga to the world!

Wants to become the next Zakir Khan

Aspires to write a global best-seller

Get there faster with 1% higher returns

Whoever you are and wherever you want to reach in life, zero-commission Direct Mutual funds on ET Money help you get there faster with upto 1% more returns every year.

Simplified data for amplified returns

You win at investing when you make sense of complex data. ET Money presents you all the useful data in the most simplified manner that helps you separate the investing signals from the noise.

Bring advantage of your personality to investing

Success in your story happens when you know what you are doing and why. Bring an edge to your investing by taking decisions that match with your investor personality.

Leave no room for second guessing

Right investing decisions can alter the story of one's life. That's why one seeks approvals and assurances from others. ET Money Genius removes fears and anxieties by bringing method to your investing.

And helps you invest like a pro.

I paid the downpayment of my dream home with the returns I got from my SIP.

Never thought the KYC process would be so fast and effortless. I'm impressed!

ET Money helped me invest with discipline via timely reminders and one tap payments.

I started investing in MF with this app. Everything was so easy to understand!

Just imported all my MF investments into ET Money. Tracking them here is so convenient!

Fund report card is by far the coolest feature on ET Money, esp. for newbies like me

We are loved by people from all parts of India

Registered users from 1300+ cities

₹ 25,000 cr

Money under management

Monthly SIPs registered

Average time gap between new SIPs

Start your investing journey today.

Why lose ₹25 Lakh over your 25 year investment period when there is an option to invest without 1% commission every year? Choose ET Money for your SIP Investments today!

Up to 1% higher returns are indicative basis the average difference between expense ratios of Regular & Direct plans for Equity Category Schemes only.

The extent of difference in expense ratios & hence respective returns from them shall very widely for other Category of Schemes.

Where do you want to get started?

- Kreyòl Ayisyen

CFPB Report Highlights Consumer Frustrations with Credit Card Rewards Programs

Consumers report losing benefits to devaluation, limited redemption opportunities, and vague or hidden terms and conditions

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) issued a new report finding consumers encounter numerous problems with credit card rewards programs. Consumers tell the CFPB that rewards are often devalued or denied even after program terms are met. Credit card companies focus marketing efforts on rewards, like cash back and travel, instead of on low interest rates and fees. Consumers who carry revolving balances often pay far more in interest and fees than they get back on rewards. Credit card companies often use rewards programs as a “bait and switch” by burying terms in vague language or fine print and changing the value of rewards after people sign up and earn them. New problems have been created by the growth of co-brand credit cards and rewards programs where consumers can transfer miles or points to merchants.

“Credit card companies promise upfront benefits for signing up and using their rewards card, but often bury complex terms in the fine print for using the rewards,” said CFPB Director Rohit Chopra. “The CFPB will be looking for ways to protect people's points, stop bait-and-switch scams, and promote a fair and competitive market for credit card rewards.”

Credit card rewards programs have become increasingly complex in recent years. Especially for credit cards with high annual fees, a key part of attracting consumer interest comes from benefits like getting airline miles or hotel points and access to exclusive lounges and loyalty status that affords premium service or additional perks. Introductory offers have existed since the first rewards cards, but their amount and prevalence has dramatically climbed. Nearly 1-in-10 dollars earned by consumers in rewards are linked to sign-up bonuses.

The CFPB has received a growing number of complaints on how these rewards programs have been administered. As mentioned in today’s report, consumers have encountered numerous issues in using these programs, including:

- Credit card issuers impose vague or hidden conditions that keep consumers from receiving rewards: Consumers indicate that requirements detailed in the fine print of rewards programs’ terms and conditions do not match marketing materials, turning sign-up offers or other promotional rewards into a “bait and switch.”

- Companies devalue rewards : Consumers mention that issuers and merchant partners reduce the value of rewards already earned by increasing the number of points or miles needed for a redemption. Consumers also observe that card issuers do not protect them from rewards program partner decisions to remove benefits from rewards programs or increase requirements for achieving status.

- Consumers encounter redemption issues with earned benefits : Consumers describe customer service issues and technical glitches that block or delay redemption, which prevent an easy transfer of rewards to third-party merchants. Issuers often redirect cardholders to partners and fail to reinstate rewards when consumers are unable to redeem them through no fault of their own.

- Companies revoke previously earned rewards : Consumers indicate their points, cash back, and miles vanish when an account closes. Consumers also describe financial institutions revoking rewards on open and active accounts through expiration policies, which is often done without prior communication.

Federal consumer protection laws apply to rewards programs offered in connection with consumer financial products or services. The CFPB has taken action against credit card issuers such as American Express and Bank of America for engaging in unfair, deceptive, or abusive acts or practices related to rewards programs. CFPB will continue to monitor credit card rewards programs and will take necessary action on these issues as appropriate.

Read the report, Credit Card Rewards .

Consumers can submit complaints about financial products or services by visiting the CFPB’s website or by calling (855) 411-CFPB (2372) .

Employees who believe their company has violated federal consumer financial laws are encouraged to send information about what they know to [email protected] .

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. For more information, visit www.consumerfinance.gov .

Take the Quiz: Find the Best State for You »

What's the best state for you ».

US Judge Halts Rule Capping Credit Card Late Fees at $8

A cashier charges products at a supermarket ahead of the Thanksgiving holiday in Chicago, Illinois, U.S. November 22, 2022. REUTERS/Jim Vondruska/File photo

By Nate Raymond

(Reuters) -A federal judge in Texas on Friday halted the Consumer Financial Protection Bureau's new rule capping credit card late fees at $8, a victory for business and banking groups challenging part of the Biden administration's crackdown on "junk fees."

U.S. District Judge Mark Pittman in Fort Worth issued a preliminary injunction preventing the rule from taking effect next week. The injunction was sought by groups including the U.S. Chamber of Commerce and the American Bankers Association.

Pittman, appointed by Republican then-President Donald Trump, cited a 2022 ruling by the New Orleans-based 5th U.S. Circuit Court of Appeals, which found the CFPB's funding structure unconstitutional.

"Consequently, any regulations promulgated under that regime are likely unconstitutional as well," Pittman wrote. "Thus, Plaintiffs establish a likelihood of success on the merits."

The U.S. Supreme Court is reviewing the 2022 ruling, and during oral arguments in October appeared wary of upholding it. Pittman remains bound by the ruling because his court is in the 5th Circuit's jurisdiction.

Maria Monaghan, counsel to the U.S. Chamber of Commerce Litigation Center, in a statement called Pittman's decision "a major win for responsible consumers who pay their credit card bills on time and businesses that want to provide affordable credit."

A CFPB spokesperson said the regulator will keep defending the rule, saying "consumers will shoulder $800 million in late fees every month that the rule is delayed - money that pads the profit margins of the largest credit card issuers."

The rule has the backing of President Joe Biden, a Democrat. White House spokesperson Jeremy Edwards in a statement called the ruling disappointing, saying the CFPB's rule is "a critical measure to save American families billions in junk fees."

The CFPB adopted the rule to counteract what it called "excessive" fees that credit card issuers charge for late payments.

The rule would block card issuers with more than 1 million open accounts from charging more than $8 for late fees, unless they could prove higher fees are necessary to cover their costs.

According to the CFPB, issuers collected more than $14 billion worth of credit card late fees in 2022, with an average fee of $32.

Business and banking groups sued in March to block the rule. The case had been delayed in a jurisdictional back-and-forth over whether the case should remain in Texas, after Pittman initially transferred it to Washington, D.C.

A 5th Circuit panel dominated by Trump appointees ultimately reversed that decision and last week gave Pittman a May 10 deadline on whether to issue an injunction.

Pittman in Friday's order expressed concern over the 5th Circuit's rulings in the case and said he still believed a judge in Washington could have him himself issued a "just and fair" ruling. "We must trust the system," he said.

(Reporting by Nate Raymond in Boston; Editing by Leslie Adler, David Gregorio, Gerry Doyle and William Mallard)

Copyright 2024 Thomson Reuters .

Join the Conversation

Tags: United States , loans , financial regulation

America 2024

Health News Bulletin

Stay informed on the latest news on health and COVID-19 from the editors at U.S. News & World Report.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

Consumers Get a Break From Inflation

Tim Smart May 15, 2024

Trump Team Gets Its Shot at Cohen

Lauren Camera May 14, 2024

New China Tariffs: What to Know

Cecelia Smith-Schoenwalder May 14, 2024

Maryland’s Primary Takes Center Stage

Aneeta Mathur-Ashton May 14, 2024

All the Ex-President’s Men

What to Know About the Menendez Trial

Laura Mannweiler May 14, 2024

IMAGES

VIDEO

COMMENTS

How is fund report card different from previous one? How fund report card works? What is consistency of return? What is protection from volatility? Why are the top ranked funds not the funds with the best return? Still have questions? Get in touch . Home; Help & Support; Mutual Funds;

This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time ...

However, with ET Money's fund report card, it has now become possible to discover a fund that consistently maintains a top position and generates wealth over an extended period of time. This exclusive feature facilitates navigation through the complex and ever-changing world of financial markets. At ET Money, we have developed an intelligent ...

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. ( Member SIPC ), and its affiliates offer investment services and products. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an ...

Fund holdings subject to change and not a recommendation to transact in any security. Schwab Exchange Traded Funds Report Card Report generated on 05/14/2024, 12:52AM PRICE Data as of 05/13/2024 $79.56 TODAY'S CHANGE Data as of 05/13/2024 $+0.26 (+0.33%) PORTFOLIO OVERVIEW as of 05/13/2024 Total Number of Holdings 103 Non-Diversified Portfolio No

Find Performance and Reports content. Schwab Asset Management® is the dba name for Charles Schwab Investment Management, Inc., the investment adviser for Schwab Funds, Schwab ETFs, and separately managed account strategies. Schwab Funds are distributed by Charles Schwab & Co., Inc. (Schwab), Member .

As you learn more about the Fundraising Report Card® (and your donors), you'll find new questions, options, metrics, and even a powerful suite of Enterprise features that you can use to help take your data analysis to the next level. If you have any questions that weren't addressed in this guide, give us a call at 301.289.3670 ext. 146 ...

michaelquirk/iStock via Getty Images. ETF year-end report cards are in with only a few trading days left in 2021. Below is a breakdown of funds that received As and Fs for specific criteria.

Medalist funds in the allocation and fixed-income asset classes fared considerably better, notching positive excess returns, but Neutral- and Negative-rated bond funds did even better than higher ...

The Fundraising Report Card® is a great tool! It allows nonprofit organizations to amplify the donor signal amidst all the noise while turning data into meaningful actionable information. The tool really allows organizations to move into a metrics and growth mindset. TJ McGovern, MPA. President, McG Consulting Group

Grant Kennaway Mar 30, 2022. Global fund fees continue to trend downward, as the majority of the 26 markets we studied--including the United States--have seen asset-weighted median expense ratios ...

Clearly, investors took notice: TCI finishes in seventh place in Alpha's annual Hedge Fund Report Card — up from No. 53 just two years ago — and is one of only 14 firms to earn an A grade.

New rules by the U.S. Securities and Exchange Commission (SEC) permit certain funds to mail you a notice of internet availability of your annual and semi-annual reports (beginning January 1, 2021) instead of a full paper report. This notice will provide a website address where you can view the full report.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. ( ), and its affiliates offer investment services and products. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing ...

Scores for alpha generation in this year's Hedge Fund Report Card range from 9.75 to 4.67. Baupost Group topped the category, followed by Adage in second place and Pershing Square in third. TPG ...

Fund prospectuses provide detailed information about a fund's investment strategy, risks, fees and expenses, and investment policies. Shareholder reports (annual and semi-annual) provide timely performance, portfolio characteristics, commentary and other current information. Read a description of our CSIM and Funds proxy voting policy, Ariel ...

The Report Card only ranks hedge fund firms that appear on Alpha 's most recent Hedge Fund 100 ranking of the world's largest hedge fund firms. Although the scoring methodology is the same as ...

Malala Fund's report cards are for advocates who want to understand the world's slow progress on girls' education—and demand action to remedy it. We hope that you will use this information to demand change and accountability from governments—collectively and individually—as the SDG deadline approaches. Girls can't wait any longer ...

Scorecards | Commonwealth Fund. Our Scorecard ranks every state's health care system based on how well it provides high-quality, accessible, and equitable health care. Read the report to see health care rankings by state.

Advice about 401 (k) rollovers is poised for a big change. Here's why. The maximum federal monthly SSI benefit is currently $943 per eligible individual and $1,415 for an eligible individual and ...

Grayscale faces competition from companies that charge less for handling Bitcoin transactions. But investors might face a big tax hit for switching. Nasdaq futures are flat in premarket trading ...

the OASI and DI Trust Funds. The 2024 report is the 84th such report. The intermediate (best estimate) assumptions for this report were set in Decem-ber 2023. The Trustees will continue to monitor future developments and modify the projections in later reports as appropriate.

CPI Report Today: Bond Yields Fall Ahead of Key Inflation Report The consumer-price index for April is due out at 8:30 a.m. ET; GameStop and AMC are volatile in premarket trading

(The Report Card scores the firms that land on Alpha's annual Hedge Fund 100 ranking of the world's largest hedge fund firms. This year's Report Card includes results for the 51 firms that ...

Among the various payment tools, payment cards "lead the e-commerce space with a combined market share of 54.3% in 2023." Among card types, credit and charge cards "are highly favored ...

Invest in Direct Mutual Funds, Stocks & diversified multi asset portfolios curated by experts & earn market beating returns. ... Fund report card is by far the coolest feature on ET Money, esp. for newbies like me. Vivek Thorat Hubli. We are loved by people from all parts of India.

Read the report, Credit Card Rewards. Consumers can submit complaints about financial products or services by visiting the CFPB's website or by calling (855) 411-CFPB (2372). Employees who believe their company has violated federal consumer financial laws are encouraged to send information about what they know to [email protected].

By Nate Raymond. (Reuters) -A federal judge in Texas on Friday halted the Consumer Financial Protection Bureau's new rule capping credit card late fees at $8, a victory for business and banking ...