Login to your account

Change password, your password must have 8 characters or more and contain 3 of the following:.

- a lower case character,

- an upper case character,

- a special character

Password Changed Successfully

Your password has been changed

Create a new account

Can't sign in? Forgot your password?

Enter your email address below and we will send you the reset instructions

If the address matches an existing account you will receive an email with instructions to reset your password

Request Username

Can't sign in? Forgot your username?

Enter your email address below and we will send you your username

If the address matches an existing account you will receive an email with instructions to retrieve your username

- Institutional Access

Cookies Notification

Our site uses Javascript to enchance its usability. You can disable your ad blocker or whitelist our website www.worldscientific.com to view the full content.

Select your blocker:, adblock plus instructions.

- Click the AdBlock Plus icon in the extension bar

- Click the blue power button

- Click refresh

Adblock Instructions

- Click the AdBlock icon

- Click "Don't run on pages on this site"

uBlock Origin Instructions

- Click on the uBlock Origin icon in the extension bar

- Click on the big, blue power button

- Refresh the web page

uBlock Instructions

- Click on the uBlock icon in the extension bar

Adguard Instructions

- Click on the Adguard icon in the extension bar

- Click on the toggle next to the "Protection on this website" text

Brave Instructions

- Click on the orange lion icon to the right of the address bar

- Click the toggle on the top right, shifting from "Up" to "Down

Adremover Instructions

- Click on the AdRemover icon in the extension bar

- Click the "Don’t run on pages on this domain" button

- Click "Exclude"

Adblock Genesis Instructions

- Click on the Adblock Genesis icon in the extension bar

- Click on the button that says "Whitelist Website"

Super Adblocker Instructions

- Click on the Super Adblocker icon in the extension bar

- Click on the "Don’t run on pages on this domain" button

- Click the "Exclude" button on the pop-up

Ultrablock Instructions

- Click on the UltraBlock icon in the extension bar

- Click on the "Disable UltraBlock for ‘domain name here’" button

Ad Aware Instructions

- Click on the AdAware icon in the extension bar

- Click on the large orange power button

Ghostery Instructions

- Click on the Ghostery icon in the extension bar

- Click on the "Trust Site" button

Firefox Tracking Protection Instructions

- Click on the shield icon on the left side of the address bar

- Click on the toggle that says "Enhanced Tracking protection is ON for this site"

Duck Duck Go Instructions

- Click on the DuckDuckGo icon in the extension bar

- Click on the toggle next to the words "Site Privacy Protection"

Privacy Badger Instructions

- Click on the Privacy Badger icon in the extension bar

- Click on the button that says "Disable Privacy Badger for this site"

Disconnect Instructions

- Click on the Disconnect icon in the extension bar

- Click the button that says "Whitelist Site"

Opera Instructions

- Click on the blue shield icon on the right side of the address bar

- Click the toggle next to "Ads are blocked on this site"

System Upgrade on Tue, May 28th, 2024 at 2am (EDT)

Case Studies for Corporate Finance

- By (author):

- Harold Bierman, Jr ( Cornell )

- Add to favorites

- Download Citations

- Track Citations

- Recommend to Library

- Description

- Supplementary

Case Studies for Corporate Finance: From A (Anheuser) to Z (Zyps) (In 2 Volumes) provides a distinctive collection of 51 real business cases dealing with corporate finance issues over the period of 1985–2014. Written by Harold Bierman Jr, world-renowned author in the field of corporate finance, the book spans over different areas of finance which range from capital structures to leveraged buy-outs to restructuring. While the primary focus of the case studies is the economy of the United States, other parts of the world are also represented. Notable to this comprehensive case studies book are questions to which unique solutions are offered in Volume 2, all of which aim to provide the reader with simulated experience of real business situations involving corporate financial decision-making. Case studies covered include that of Time Warner (1989–1991), The Walt Disney Company (1995), Exxon–Mobil (1998), Mitsubishi's Zero Coupon Convertible Bond (2000), and Apple (2014).

Request Inspection Copy

- Pilgrim's Pride (2003)

- Intel (1991)

- Marriott's Spin-Off (1992)

- Host Marriott (1998)

- LTCM (1998)

- Salomon: Share Repurchase (1997)

- Microsoft (2003–2004)

- Berkshire Hathaway, Inc.

- Florida Power & Light Company (FPL) (1994)

- DIRECTV (2011)

- Apple (2014)

- "Chain Saw" AL and Sunbeam (1995–1998)

- Sun Company, Inc. (1995)

- AutoNation (2006)

- Kerr–McGee and Icahn (2005)

- Pfizer–Zoetis (2013)

- Hoffman–Sterling–Kodak (1986)

- Bendix–Marietta–Allied (1982)

- E–II Holding Inc. (1987)

- LBO of RJR Nabisco (1988)

- RJR Nabisco (1993)

- RJR–KKR–Borden (1994)

- Hilton–ITT–Starwood (1997)

- Anheuser–Busch–InBev (2008)

- Merck–Shering Plough (2009)

- The Acquisition of by P&G (2005)

- P&G and the Gillette Company (2005)

- Time Warner (1989–1991)

- Income Deposit Security (IDS) (2004)

- ZYPs (1999) Bank Austria

- The Walt Disney Company (SPN) (1995)

- Media One Group (1998)

- Computer Associates: A Synthetic Convertible

- Philips Petroleum, Mesa and Icahn (1985)

- Marrietta Corporation (1994–1996)

- The Managerial Buyout of United States Can Company (2000)

- Metromedia (1984)

- Hertz (2006)

- Fortress Investment Group (2007)

- The Blackstone Group

- TIFD vs USA (Nov 2004) GECC

- DIMAR Company: A Lease or Buy Case(2006)

- Sale-Lease of 399 Park Avenue (2002)

- Guandong International Trust (1993)

- Marlin Water Trust (1998)

- Sanofi-Synthelabo and Aventis (2004)

- Merger Water Trust (1998)

- SAFRA Republic: Debenture (1997)

- Shinsei Bank (Japan 2000–2004)

FRONT MATTER

- Pages: i–xiii

https://doi.org/10.1142/9789813148895_fmatter

- About the Author

- Acknowledgment

Section 1: Capital Structure

- Pages: 3–63

https://doi.org/10.1142/9789813148895_0001

The four cases in this section all involve the common stock section of the capital structure. It is very difficult to generate value by implementing strategies just using common stock.

Section 2: Excessive Use of Debt(also see Mergers: Raids)

- Pages: 67–70

https://doi.org/10.1142/9789813148895_0002

- Long-Term Capital Management (LTCM) (1998)

Section 3: Dividend Policy — Share Repurchase

- Pages: 73–125

https://doi.org/10.1142/9789813148895_0003

During investment from the stockholders after a dividend, the funds flow in a circle from the firm to investors and back to the firm. Thus, with a given investment policy, in the absence of taxes and transaction costs, logically dividend policy should not affect the value of a firm. Since investor taxes are necessary for dividend policy to matter, we shall focus on the interrelationship of dividend policy and tax regulations.

Section 4: Restructuring

- Pages: 129–232

https://doi.org/10.1142/9789813148895_0004

- “Chain Saw” AL and Sunbeam (1995–1998)

- Kerr-McGee and Icahn (2005)

- Pfizer-Zoetis (2013)

Section 5: Mergers: Raids: Use of Debt

- Pages: 235–394

https://doi.org/10.1142/9789813148895_0005

- Hoffman–Sterling–Kodak (1986)

- Bendix–Marietta–Allied (1982)

- E-II Holdings Inc. (1987)

- RJR–KKR–Borden (1994)

- Hilton–ITT–Starwood (1997)

- Anheuser-Busch–InBev (2008)

- Merck and Schering-Plough (2009)

- The Acquisition of Gillette by P&G (2005)

- P&G and the Gillette Company (2005)

Section 6: Use of Exotics

- Pages: 397–482

https://doi.org/10.1142/9789813148895_0006

In this section, we consider unusual financial instruments and strategies for corporations. It is interesting that none of the situations exploits directly capital structure or dividend policy, two of the more obvious areas of corporate strategy available for increasing shareholder value.

Section 7: Leveraged Buyouts

- Pages: 485–578

https://doi.org/10.1142/9789813148895_0007

A leveraged buyout may be executed by an individual, a group, one or more private equity firms, or a corporation. The buyer needs to have some investible capital and to have access to additional capital that can be borrowed so that the price being asked can be covered. The borrowed portion of the purchase price is the leveraged part of the LBO. Thus, with an LBO, a firm is being purchased and a significant part of the purchase price is being financed with borrowed (debt) capital.

Section 8: Non-Conventional Corporations

- Pages: 581–653

https://doi.org/10.1142/9789813148895_0008

The author actually invested in Fortress and Blackstone to gather information for this book. But in the summer of 2011, he received information from the two companies necessary for his 2010 tax reports. No expected return could reward him sufficiently for the increased complexity in filing his federal income tax forms.

Section 9: Buy vs. Lease

- Pages: 657–668

https://doi.org/10.1142/9789813148895_0009

Fundamental misunderstandings about the relative merits of the two modes of financing (buy or lease) continue to persist…

Section 10: An International Element

- Pages: 671–726

https://doi.org/10.1142/9789813148895_0010

- Balance-of-trade data and information and international trade theory.

- Currency exchange rate theory and institutions.

- The impact of currency exchange rate changes (actual or expected) on debt and investment decisions and on accounting measures.

- Tax considerations.

BACK MATTER

- Pages: 727–738

https://doi.org/10.1142/9789813148895_bmatter

Harold Bierman is the Nicholas H Noyes Professor Emeritus of Business Administration at Cornell University, USA. He has been a consultant for many public organizations and industrial firms and is the author of more than 200 books and articles in the fields of accounting, finance, investment, taxation and quantitative analysis. In 1985, he was named the winner of the prestigious Dow Jones Award of the American Assembly of Collegiate Schools of Business for his outstanding contributions to collegiate management education.

Move fast, think slow: How financial services can strike a balance with GenAI

Take on Tomorrow @ the World Economic Forum in Davos: Energy demand

Perspectives from the Global Entertainment & Media Outlook 2024–2028

Climate risk, resilience and adaptation

Business transformation

Sustainability assurance

The Leadership Agenda

Global Workforce Hopes and Fears Survey 2024

The s+b digital issue: Corporate “power changers”

The New Equation

PwC’s Global Annual Review

Committing to Net Zero

The Solvers Challenge

Loading Results

No Match Found

Corporate finance case studies

{{filtercontent.facetedtitle}}.

{{item.publishDate}}

{{item.title}}

{{item.text}}

Let us be part of your success story

Reach out to start a conversation

David Brown

Asia Pacific Deals Leader, Global Corporate Finance Leader, Partner, PwC China

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Legal notices

- Cookie policy

- Legal disclaimer

- Terms and conditions

Applied Corporate Finance

Questions, Problems and Making Decisions in the Real World

- © 2014

- 1st edition

- View latest edition

- Mark K. Pyles 0

Associate Professor of Finance, College of Charleston, Charleston, USA

You can also search for this author in PubMed Google Scholar

- First comprehensive textbook on the topic to emphasize both quantitative and qualitative tools for enhanced learning

- Contains in-depth case studies and problems modeled after "real world" business scenarios

- Offers a dynamic presentation ideal for any intermediate or advanced corporate finance course

- Features a solutions manual to aid instructors in implementing the material into classes

- Includes supplementary material: sn.pub/extras

Part of the book series: Springer Texts in Business and Economics (STBE)

43k Accesses

13 Citations

This is a preview of subscription content, log in via an institution to check access.

Access this book

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

About this book

Applied Corporate Finance fills a gap in the existing resources available to students and professionals needing an academically rigorous, yet practically orientated, source of knowledge about corporate finance. Written by an expert in investment analysis, this textbook leads readers to truly understand the principles behind corporate finance in a real world context from both a firm and investor perspective. The focus of this text is on traditional theory applied to a holistic business case study, offering readers both a quantitative and qualitative perspective on such topics as capital budgeting, time value of money, corporate risk, and capital structure. Each section in the book corresponds to the order in which a business makes key financial decisions—as opposed to level of difficulty—allowing readers to grasp a comprehensive understanding of the corporate financial life cycle. Directly addressing the area of corporate finance in an applied setting, and featuring numerous case examples and end-of-chapter discussion questions and problems, this textbook will appeal to advanced undergraduates majoring in finance, graduate-level students, as well as professionals in need of a quick refresher on corporate financial policy.

Similar content being viewed by others

Introduction to Corporate Finance

Applications

Miller, Merton (1923–2000)

- Applied Corporate Finance Textbook

- Capital Budgeting

- Capital Structure

- Return on Captial

- Time Value of Money

Table of contents (9 chapters)

Front matter, in the beginning….

Mark K. Pyles

Financial Statement Analysis: What’s Right, What’s Wrong, and Why?

Cash flow: easy come, easy go, the right frame of time, capital structure: borrow it, capital structure: sell it off, the rocky marriage of risk and return, this is so wacc, capital budgeting decisions: the end of the roads meets the beginning of another, back matter, authors and affiliations, about the author, bibliographic information.

Book Title : Applied Corporate Finance

Book Subtitle : Questions, Problems and Making Decisions in the Real World

Authors : Mark K. Pyles

Series Title : Springer Texts in Business and Economics

DOI : https://doi.org/10.1007/978-1-4614-9173-6

Publisher : Springer New York, NY

eBook Packages : Business and Economics , Economics and Finance (R0)

Copyright Information : Springer Science+Business Media, LLC, part of Springer Nature 2014

Softcover ISBN : 978-1-4939-5299-1 Published: 23 August 2016

eBook ISBN : 978-1-4614-9173-6 Published: 02 December 2013

Series ISSN : 2192-4333

Series E-ISSN : 2192-4341

Edition Number : 1

Number of Pages : XII, 336

Number of Illustrations : 5 b/w illustrations, 20 illustrations in colour

Topics : Finance, general , Macroeconomics/Monetary Economics//Financial Economics , Business Strategy/Leadership

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- General & Introductory Accounting

- Corporate Finance

Lessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and Valuation, 2nd Edition

ISBN: 978-1-119-53783-0

Digital Evaluation Copy

Paul Asquith , Lawrence A. Weiss

An intuitive introduction to fundamental corporate finance concepts and methods

Lessons in Corporate Finance, Second Edition offers a comprehensive introduction to the subject, using a unique interactive question and answer-based approach. Asking a series of increasingly difficult questions, this text provides both conceptual insight and specific numerical examples. Detailed case studies encourage class discussion and provide real-world context for financial concepts. The book provides a thorough coverage of corporate finance including ratio and pro forma analysis, capital structure theory, investment and financial policy decisions, and valuation and cash flows provides a solid foundational knowledge of essential topics. This revised and updated second edition includes new coverage of the U.S. Tax Cuts and Jobs Act of 2017 and its implications for corporate finance valuation.

Written by acclaimed professors from MIT and Tufts University, this innovative text integrates academic research with practical application to provide an in-depth learning experience. Chapter summaries and appendices increase student comprehension. Material is presented from the perspective of real-world chief financial officers making decisions about how firms obtain and allocate capital, including how to:

- Manage cash flow and make good investment and financing decisions

- Understand the five essential valuation methods and their sub-families

- Execute leveraged buyouts, private equity financing, and mergers and acquisitions

- Apply basic corporate finance tools, techniques, and policies

Lessons in Corporate Finance , Second Edition provides an accessible and engaging introduction to the basic methods and principles of corporate finance. From determining a firm’s financial health to valuation nuances, this text provides the essential groundwork for independent investigation and advanced study.

PAUL ASQUITH is the Gordon Y. Billard professor of finance at M.I.T.'s Sloan School. He is a specialist in corporate finance and has written on all areas of corporate finance including mergers, LBOs, equity issues, dividend policy, and more.

LAWRENCE A. WEISS is professor of International Accounting at Tufts University. He is a specialist in accounting and finance and has written on corporate bankruptcy, firm performance, international accounting, mergers, and more.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Case Studies in Finance: Managing for Corporate Value Creation

2002, SSRN Electronic Journal

Related Papers

Erich Dierdorff

Edward Rock

Lamessa Tariku

Adam Kolasinski

Structures Congress 2005

David Galera Peraza

Valentina Della Corte

SSRN Electronic Journal

Phung Minh Tuan

Monika Kostera

Corporate Governance and Organisational Performance

Naeem Tabassum

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

HBS Case Selections

OpenAI: Idealism Meets Capitalism

- Shikhar Ghosh

- Shweta Bagai

Generative AI and the Future of Work

- Christopher Stanton

- Matt Higgins

Copilot(s): Generative AI at Microsoft and GitHub

- Frank Nagle

- Shane Greenstein

- Maria P. Roche

- Nataliya Langburd Wright

- Sarah Mehta

Innovation at Moog Inc.

- Brian J. Hall

- Ashley V. Whillans

- Davis Heniford

- Dominika Randle

- Caroline Witten

Innovation at Google Ads: The Sales Acceleration and Innovation Labs (SAIL) (A)

- Linda A. Hill

- Emily Tedards

Juan Valdez: Innovation in Caffeination

- Michael I. Norton

- Jeremy Dann

UGG Steps into the Metaverse

- Shunyuan Zhang

- Sharon Joseph

- Sunil Gupta

- Julia Kelley

Metaverse Wars

- David B. Yoffie

Roblox: Virtual Commerce in the Metaverse

- Ayelet Israeli

- Nicole Tempest Keller

Timnit Gebru: "SILENCED No More" on AI Bias and The Harms of Large Language Models

- Tsedal Neeley

- Stefani Ruper

Hugging Face: Serving AI on a Platform

- Kerry Herman

- Sarah Gulick

SmartOne: Building an AI Data Business

- Karim R. Lakhani

- Pippa Tubman Armerding

- Gamze Yucaoglu

- Fares Khrais

Honeywell and the Great Recession (A)

- Sandra J. Sucher

- Susan Winterberg

Target: Responding to the Recession

- Ranjay Gulati

- Catherine Ross

- Richard S. Ruback

- Royce Yudkoff

Hometown Foods: Changing Price Amid Inflation

- Julian De Freitas

- Jeremy Yang

- Das Narayandas

Elon Musk's Big Bets

- Eric Baldwin

Elon Musk: Balancing Purpose and Risk

Tesla's ceo compensation plan.

- Krishna G. Palepu

- John R. Wells

- Gabriel Ellsworth

China Rapid Finance: The Collapse of China's P2P Lending Industry

- William C. Kirby

- Bonnie Yining Cao

- John P. McHugh

Forbidden City: Launching a Craft Beer in China

- Christopher A. Bartlett

- Carole Carlson

Booking.com

- Stefan Thomke

- Daniela Beyersdorfer

Innovation at Uber: The Launch of Express POOL

- Chiara Farronato

- Alan MacCormack

Racial Discrimination on Airbnb (A)

- Michael Luca

- Scott Stern

- Hyunjin Kim

Unilever's Response to the Future of Work

- William R. Kerr

- Emilie Billaud

- Mette Fuglsang Hjortshoej

AT&T, Retraining, and the Workforce of Tomorrow

- Joseph B. Fuller

- Carl Kreitzberg

Leading Change in Talent at L'Oreal

- Lakshmi Ramarajan

- Vincent Dessain

- Emer Moloney

- William W. George

- Andrew N. McLean

Eve Hall: The African American Investment Fund in Milwaukee

- Steven S. Rogers

- Alterrell Mills

United Housing - Otis Gates

- Mercer Cook

The Home Depot: Leadership in Crisis Management

- Herman B. Leonard

- Marc J. Epstein

- Melissa Tritter

The Great East Japan Earthquake (B): Fast Retailing Group's Response

- Hirotaka Takeuchi

- Kenichi Nonomura

- Dena Neuenschwander

- Meghan Ricci

- Kate Schoch

- Sergey Vartanov

Insurer of Last Resort?: The Federal Financial Response to September 11

- David A. Moss

- Sarah Brennan

Under Armour

- Rory McDonald

- Clayton M. Christensen

- Daniel West

- Jonathan E. Palmer

- Tonia Junker

Hunley, Inc.: Casting for Growth

- John A. Quelch

- James T. Kindley

Bitfury: Blockchain for Government

- Mitchell B. Weiss

- Elena Corsi

Deutsche Bank: Pursuing Blockchain Opportunities (A)

- Lynda M. Applegate

- Christoph Muller-Bloch

Maersk: Betting on Blockchain

- Scott Johnson

Yum! Brands

- Jordan Siegel

- Christopher Poliquin

Bharti Airtel in Africa

- Tanya Bijlani

Li & Fung 2012

- F. Warren McFarlan

- Michael Shih-ta Chen

- Keith Chi-ho Wong

Sony and the JK Wedding Dance

- John Deighton

- Leora Kornfeld

United Breaks Guitars

David dao on united airlines.

- Benjamin Edelman

- Jenny Sanford

Marketing Reading: Digital Marketing

- Joseph Davin

Social Strategy at Nike

- Mikolaj Jan Piskorski

- Ryan Johnson

The Tate's Digital Transformation

Social strategy at american express, mellon financial and the bank of new york.

- Carliss Y. Baldwin

- Ryan D. Taliaferro

The Walt Disney Company and Pixar, Inc.: To Acquire or Not to Acquire?

- Juan Alcacer

- David J. Collis

Dow's Bid for Rohm and Haas

- Benjamin C. Esty

Finance Reading: The Mergers and Acquisitions Process

- John Coates

Apple: Privacy vs. Safety? (A)

- Henry W. McGee

- Nien-he Hsieh

- Sarah McAra

Sidewalk Labs: Privacy in a City Built from the Internet Up

- Leslie K. John

Data Breach at Equifax

- Suraj Srinivasan

- Quinn Pitcher

- Jonah S. Goldberg

Apple's Core

- Noam Wasserman

Design Thinking and Innovation at Apple

- Barbara Feinberg

Apple Inc. in 2012

- Penelope Rossano

Iz-Lynn Chan at Far East Organization (Abridged)

- Anthony J. Mayo

- Dana M. Teppert

Barbara Norris: Leading Change in the General Surgery Unit

- Boris Groysberg

- Nitin Nohria

- Deborah Bell

Adobe Systems: Working Towards a "Suite" Release (A)

- David A. Thomas

- Lauren Barley

Home Nursing of North Carolina

Castronics, llc, gemini investors, angie's list: ratings pioneer turns 20.

- Robert J. Dolan

Basecamp: Pricing

- Frank V. Cespedes

- Robb Fitzsimmons

J.C. Penney's "Fair and Square" Pricing Strategy

J.c. penney's 'fair and square' strategy (c): back to the future.

- Jose B. Alvarez

Osaro: Picking the best path

- James Palano

- Bastiane Huang

HubSpot and Motion AI: Chatbot-Enabled CRM

- Thomas Steenburgh

GROW: Using Artificial Intelligence to Screen Human Intelligence

- Ethan S. Bernstein

- Paul D. McKinnon

- Paul Yarabe

GitLab and the Future of All-Remote Work (A)

- Prithwiraj Choudhury

- Emma Salomon

TCS: From Physical Offices to Borderless Work

Creating a virtual internship at goldman sachs.

- Iavor Bojinov

- Jan W. Rivkin

Starbucks Coffee Company: Transformation and Renewal

- Nancy F. Koehn

- Kelly McNamara

- Nora N. Khan

- Elizabeth Legris

JCPenney: Back in Business

- K. Shelette Stewart

- Christine Snively

Arup: Building the Water Cube

- Robert G. Eccles

- Amy C. Edmondson

- Dilyana Karadzhova

(Re)Building a Global Team: Tariq Khan at Tek

Managing a global team: greg james at sun microsystems, inc. (a).

- Thomas J. DeLong

Organizational Behavior Reading: Leading Global Teams

Ron ventura at mitchell memorial hospital.

- Heide Abelli

Anthony Starks at InSiL Therapeutics (A)

- Gary P. Pisano

- Vicki L. Sato

Wolfgang Keller at Konigsbrau-TAK (A)

- John J. Gabarro

The 2010 Chilean Mining Rescue (A)

- Faaiza Rashid

IDEO: Human-Centered Service Design

- Ryan W. Buell

- Andrew Otazo

- Benjamin Jones

- Alexis Brownell

Midland Energy Resources, Inc.: Cost of Capital

- Timothy A. Luehrman

- Joel L. Heilprin

Globalizing the Cost of Capital and Capital Budgeting at AES

- Mihir A. Desai

- Doug Schillinger

Cost of Capital at Ameritrade

- Mark Mitchell

- Erik Stafford

Finance Reading: Cost of Capital

Circles: series d financing.

- Paul W. Marshall

- Kristin J. Lieb

- William A. Sahlman

- Michael J. Roberts

Andreessen Horowitz

- Thomas R. Eisenmann

Entrepreneurship Reading: Partnering with Venture Capitalists

- Jeffrey J. Bussgang

David Neeleman: Flight Path of a Servant Leader (A)

- Matthew D. Breitfelder

Coach Hurley at St. Anthony High School

- Scott A. Snook

- Bradley C. Lawrence

Shapiro Global

- Michael Brookshire

- Monica Haugen

- Michelle Kravetz

- Sarah Sommer

Kathryn McNeil (A)

- Joseph L. Badaracco Jr.

- Jerry Useem

Carol Fishman Cohen: Professional Career Reentry (A)

- Myra M. Hart

- Robin J. Ely

- Susan Wojewoda

Alex Montana at ESH Manufacturing Co.

- Michael Kernish

Michelle Levene (A)

- Tiziana Casciaro

- Victoria W. Winston

John and Andrea Rice: Entrepreneurship and Life

- Howard H. Stevenson

- Janet Kraus

- Shirley M. Spence

Partner Center

- International Center for Finance

- ICF Case Studies

Finance Case Studies

Featured finance case studies:.

Canary Wharf: Financing and Placemaking

Fondaco dei Tedeschi: A New Luxury Shopping Destination for Venice

Nathan Cummings Foundation: Mission-Driven Investing

The Decline of Malls

Expand the sections below to read more about each case study:, nathan cummings foundation, ellie campion, dwayne edwards, brad wayman, anna williams, william goetzmann, and jean rosenthal.

Asset Management, Investor/Finance, Leadership & Teamwork, Social Enterprise, Sourcing/Managing Funds

The Nathan Cummings Foundation Investment Committee and Board of Trustees had studied the decision to go “all in” on a mission-related investment approach. The Board voted 100% to support this new direction and new goals for financial investments, but many questions remained. How could NCF operationalize and integrate this new strategy? What changes would it need to make to support the investment strategies' long-term success? How could NCF measure and track its progress and success with this new strategy?

William Goetzmann, Jean Rosenthal, Jaan Elias, Edoardo Pasinato, Lukas Cejnar, Ellie Campion

Business History, Competitor/Strategy, Customer/Marketing, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The renovation of the Fondaco dei Tedeschi in Venice represented a grand experiment. Should an ancient building in the midst of a world heritage site be transformed into a modern mall for luxury goods? How best to achieve the transformation and make it economically sustainable? Would tourists walk to the mall? And would they buy or just look? What could each stakeholder learn from their experiences with the Fondaco dei Tedeschi?

Gardner Denver

James quinn, adam blumenthal, and jaan elias.

Asset Management, Employee/HR, Investor/Finance, Leadership & Teamwork

As KKR, a private equity firm, prepared to take Gardner-Denver, one of its portfolio companies, public in mid-2017, a discussion arose on the Gardner-Denver board about the implications of granting approximately $110 million in equity to its global employee base as part of its innovative "broad-based employee ownership program." Was the generous equity package that Pete Stavros proposed be allotted to 6,100 employees the wisest move and the right timing for Gardner Denver and its new shareholders?

Home Health Care

Jean rosenthal, jaan elias, adam blumenthal, and jeremy kogler.

Asset Management, Competitor/Strategy, Healthcare, Investor/Finance

Blue Wolf Capital Partners was making major investments in the home health care sector. The private equity fund had purchased two U.S. regional companies in the space. The plan was to merge the two organizations, creating opportunities for shared expertise and synergies in reducing management costs. Two years later, the management team was considering adding a third company. Projected revenues for the combined organization would top $1 billion annually. What was the likelihood that this opportunity would succeed?

Suwanee Lumber Company

Jaan elias, adam blumenthal, james shovlin, and heather e. tookes.

Asset Management, Investor/Finance, Sustainability

In 2016, Blue Wolf, a private equity firm headquartered in New York City, confronted a number of options when it came to its lumber business. They could put their holdings in the Suwanee Lumber Company (SLC), a sawmill they had purchased in 2013, up for sale. Or they could continue to hold onto SLC and run it as a standalone business. Or they could double down on the lumber business by buying an idle mill in Arkansas to run along with SLC.

Alternative Meat Industry: How Should Beyond Meat be Valued?

Nikki springer, leon van wyk, jacob thomas, k. geert rouwenhorst and jaan elias.

Competitor/Strategy, Customer/Marketing, Investor/Finance, Sourcing/Managing Funds, Sustainability

In 2009, when experienced entrepreneur Ethan Brown decided to build a better veggie burger, he set his sights on an exceptional goal – create a plant-based McDonald’s equally beloved by the American appetite. To do this, he knew he needed to transform the idea of plant-based meat alternatives from the sleepy few veggie burger options in the grocer’s freezer case into a fundamentally different product. Would further investments in research and development help give Beyond Meat an edge? Would Americans continue to embrace meat alternatives, or would the initial fanfare subside below investor expectations?

Hertz Global Holdings (A): Uses of Debt and Equity

Jean rosenthal, geert rouwenhorst, jacob thomas, allen xu.

Asset Management, Financial Regulation, Sourcing/Managing Funds

By 2019, Hertz CEO Kathyrn Marinello and CFO Jamere Jackson had managed to streamline the venerable car rental firm's operations. Their next steps were to consider ways to fine-tune Hertz's capital structure. Would it make sense for Marinello and Jackson to lead Hertz to issue more equity to re-balance the structure? One possibility was a stock rights offering, but an established company issuing equity was not generally well-received by investors. How well would the market respond to an attempt by Hertz management to increase shareholder equity?

Twining-Hadley Incorporated

Jaan elias, k geert rouwenhorst, jacob thomas.

Employee/HR, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

Jessica Austin has been asked to compute THI's Weighted Average Cost of Capital, a key measure for making investments and deciding executive compensation. What should she consider in making her calculation?

Shake Shack IPO

Vero bourg-meyer, jaan elias, jake thomas and geert rouwenhorst.

Competitor/Strategy, Innovation & Design, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds, Sustainability

Shake Shack's long lines of devoted fans made investors salivate when the company went public in 2015 and shares soared above expectations. Was the enthusiasm justified? Could the company maintain its edge in the long run?

Strategy for Norway's Pension Fund Global

Jean rosenthal, william n. goetzmann, olav sorenson, andrew ang, and jaan elias.

Asset Management, Investor/Finance, Sourcing/Managing Funds

Norway's Pension Fund Global was the largest sovereign wealth fund in the world. With questions in 2014 on policies, ethical investment, and other concerns, what was the appropriate investment strategy for the Fund?

Factor Investing for Retirement

Jean rosenthal, jaan elias and william goetzmann.

Asset Management, Investor/Finance

Should this investor look for a portfolio of factor funds to meet his goals for his 401(k) Retirement Plan?

Bank of Ireland

Jean w. rosenthal, eamonn walsh, matt spiegel, will goetzmann, david bach, damien p. mcloughlin, fernando fernandez, gayle allard, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork, Macroeconomics, State & Society

In August 2011, Wilbur Ross, an American investor specializing in distressed and bankrupt companies, purchased 35% of the stock of Bank of Ireland. Even for Ross, investing in an Irish bank seemed risky. Observers wondered if the investment made sense.

Commonfund ESG

Jaan elias, sarah friedman hersh, maggie chau, logan ashcraft, and pamela jao.

Asset Management, Investor/Finance, Metrics & Data, Social Enterprise

ESG (Environmental Social and Governance) investing had become an increasingly hot topic in the financial community. Could Commonfund offer its endowment clients some investment vehicle that would satisfy ESG concerns while producing sufficient returns?

Glory, Glory Man United!

Charles euvhner, jacob thomas, k. geert rouwenhorst, and jaan elias.

Competitor/Strategy, Employee/HR, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds

Manchester United might be the greatest English sports dynasty of all time. But valuation poses unique challenges. How much should a team's success on the pitch count toward its net worth?

Walmart de México: Investing in Renewable Energy

Jean rosenthal, k. geert rouwenhorst, isabel studer, jaan elias, and juan carlos rivera.

Investor/Finance, Operations, State & Society, Sustainability

Walmart de México y Centroamérica contracted for power from EVM's wind farm, saving energy costs and improving sustainability. What should the company's next steps be to advance its goals?

Voltaire, Casanova, and 18th-Century Lotteries

Jean rosenthal and william n. goetzmann.

Business History, State & Society

Gambling has been a part of human activity since earliest recorded history, and governments have often attempted to turn that impulse to benefit the state. The development of lotteries in the 18th century helped to develop the study of probabilities and enabled the financial success of some of the leading figures of that era.

Alexander Hamilton and the Origin of American Finance

Andrea nagy smith, william goetzmann, and jeffrey levick.

Business History, Financial Regulation, Investor/Finance

Alexander Hamilton is said to have invented the future. At a time when the young United States of America was disorganized and bankrupt, Hamilton could see that the nation would become a powerful economy.

Kmart Bankruptcy

Jean rosenthal, heather tookes, henry s. miller, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance

Less than 18 months after Kmart entered Chapter 11, the company emerged and its stocked soared. Why had the chain entered Chapter 11 in the first place and how had the bankruptcy process allowed the company to right itself?

Oil, ETFs, and Speculation

So alex roelof, k. geert rouwenhorst, and jaan elias.

Since the markets' origins, traders sought standardized wares to increase market liquidity. In the 1960s and later, they sought assets uncorrelated to traditional bonds and equities. By late 2004, commodity-based exchange-traded securities emerged.

Newhall Ranch Land Parcel

Acquired by a partnership of two closely intertwined homebuilders, Newhall Ranch was the last major tract of undeveloped land in Los Angeles County in 2003.

Brandeis and the Rose Museum

Arts Management, Asset Management, Investor/Finance, Social Enterprise, Sourcing/Managing Funds

The question of the role museums should play in university life became urgent for Brandeis in early 2009. Standard portfolios of investments had just taken a beating. Given that environment, should Brandeis sell art in order to save its other programs?

Taking EOP Private

Allison mitkowski, william goetzmann, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork

With 594 properties nationwide, EOP was the nation’s largest office landlord. Despite EOP's dominance of the REIT market, analysts had historically undervalued EOP. However, Blackstone saw something in EOP that the analysts didn’t, and in November, Blackstone offered to buy EOP for $48.50 per share. What did Blackstone and Vornado see that the market didn’t?

Subprime Lending Crisis

Jaan elias and william n. goetzmann.

Asset Management, Financial Regulation, Investor/Finance, State & Society

To understand the collapse of the subprime mortgage market, we look at a failing Mortgage Backed Security (MBS) and then drill down to look at a single loan that has gone bad.

William N. Goetzmann, Jean Rosenthal, and Jaan Elias

Asset Management, Business History, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The financial engineering of London's Canary Wharf was as impressive as the structural engineering. However, Brexit and the rise of fintech represented new challenges. Would financial firms leave the U.K.? Would fintech firms seek new kinds of space? How should the Canary Wharf Group respond?

The Future of Malls: Was Decline Inevitable?

Jean rosenthal, anna williams, brandon colon, robert park, william goetzmann, jessica helfand .

Business History, Customer/Marketing, Innovation & Design, Investor/Finance

Shopping malls became the "Main Street" of US suburbs beginning in the mid-20th century. But will they persist into the 21st?

Hirtle Callaghan & Co

James quinn, jaan elias, and adam blumenthal.

Asset Management, Investor/Finance, Leadership & Teamwork

In August 2019, Stephen Vaccaro, Yale MBA ‘03, became the director of private equity at Hirtle, Callaghan & Co., LLC (HC), a leading investment management firm associated with pioneering the outsourced chief investment office (OCIO) model for college endowments, foundations, and wealthy families. Vaccaro was tasked with spearheading efforts to grow HC’s private equity (PE) market value from $1 billion to a new target of roughly $3 billion in order to contribute to the effort of generating higher long-term returns for clients. Would investment committees overseeing endowments typically in the 10s or 100s of millions embrace this shift, and, more pointedly, was this the best move for client portfolios?

The Federal Reserve Response to 9-11

Jean rosenthal, william b. english, jaan elias.

Financial Regulation, Investor/Finance, Leadership & Teamwork, State & Society

The attacks on New York City and the Pentagon in Washington, DC, on September 11, 2001, shocked the nation and the world. The attacks crippled the nerve center of the U.S. financial system. Information flow among banks, traders in multiple markets, and regulators was interrupted. Under Roger Ferguson's leadership, the Federal Reserve made a series of decisions designed to provide confidence and increase liquidity in a severely damaged financial system. In hindsight, were these the best approaches? Were there other options that could have taken place?

Suwanee Lumber Company (B)

In early 2018, Blue Wolf Capital Management received an offer to sell both its mill in Arkansas (Caddo) and its mill in Florida (Suwanee) to Conifex, an upstart Canadian lumber company. Blue Wolf hadn’t planned to put both mills up for sale yet, but was the deal too good to pass up? Blue Wolf had invested nearly $36.5 million into rehabilitating the Suwanee and Caddo mills. However, neither was fully operational yet. Did the offer price fairly value the prospects of the mills? How should Blue Wolf consider the Conifex stock? Should Blue Wolf conduct a more extensive sales process rather than settle for this somewhat unexpected offer?

Occidental Petroleum's Acquisition of Anadarko

Jaan elias, piyush kabra, jacob thomas, k. geert rouwenhorst.

Asset Management, Competitor/Strategy, Investor/Finance, Sourcing/Managing Funds

In May of 2019, Vicki Hollub, the CEO of Occidental Petroleum (Oxy), pulled off a blockbuster. Bidding against Chevron, one of the world's largest oil firms, she had managed to buy Anadarko, another oil company that was roughly the size of Oxy. Hollub believed that the combination of the two firms brought the possibility for billions of dollars in synergies, more than offsetting the cost of the acquisition. Had Hollub hurt shareholder value with Oxy's ambitious deal, or had she bolstered a mid-size oil firm and made it a major player in the petroleum industry? Why didn't investors see the tremendous synergies in which Hollub fervently believed?

Hertz Global Holdings (B): Uses of Debt and Equity 2020

In 2019, Hertz held a successful rights offering and restructured some of its debt. CEO Kathyrn Marinello and CFO Jamere Jackson were moving the company toward what seemed to be sustainable profitability, having implemented major structural and financial reforms. Analysts predicted a rosy future. Travel, particularly corporate travel, was increasing as the economy grew. With all the creativity that the company had shown in its financial arrangements, did it have any options remaining, even while under the court-led reorganization?

Prodigy Finance

Vero bourg-meyer, javier gimeno, jaan elias, florian ederer.

Competitor/Strategy, Investor/Finance, Social Enterprise, State & Society, Sustainability

Having pioneered a successful financing model for student loans, Prodigy also was considering other financial services that could make use of the company’s risk model. What new products could Prodigy offer to support its student borrowers? What strategy should guide the company’s new product development? Or should the company stick to the educational loans it pioneered and knew best?

tronc: Valuing the Future of Newspapers

Jean rosenthal, heather e. tookes, and jaan elias.

Business History, Competitor/Strategy, Investor/Finance, Leadership & Teamwork

Gannet offered Tribune Publishing an all-cash buyout offer. Tribune then made a strategic pivot: new stock listing, new name "tronc," and a goal of posting 1,000 videos/day. Should the Tribune board take the buyout opportunity? What was the right price?

Role of Hedge Funds in Institutional Portfolios: Florida Retirement System

Jaan elias, william goetzmann and lloyd baskin.

Asset Management, Financial Regulation, Investor/Finance, Metrics & Data, State & Society

The Florida Retirement System, one of the country’s largest state pensions, had been slow to embrace hedge funds, but by 2015, they had 7% of their assets in the category. How should they manage their program?

Social Security 1935

Jean rosenthal, william n. goetzmann, and jaan elias.

Business History, Financial Regulation, Innovation & Design, Investor/Finance, State & Society

Frances Perkins, Franklin Roosevelt's Secretary of Labor, shaped the Social Security Act of 1935, changing America’s pension landscape. What might she have done differently?

Ant Financial: Flourishing Farmer Loans at MYbank

Jingyue xu, jean rosenthal, k. sudhir, hua song, xia zhang, yuanfang song, xiaoxi liu, and jaan elias.

Competitor/Strategy, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Leadership & Teamwork, Operations, State & Society

In 2015 Ant Financial's MYbank (an offshoot of Jack Ma’s Alibaba company) created the Flourishing Farmer Loan program, an all-internet banking service for China's rural areas. Could MYbank use financial technology to create a program with competitive costs and risk management?

Low-Carbon Investing: Commonfund & GPSU

Jaan elias, william goetzmann, and k. geert rouwenhorst.

Asset Management, Ethics & Religion, Investor/Finance, Social Enterprise, State & Society, Sustainability

In August of 2014, the movement to divest fossil fuel investments from endowment portfolios was sweeping campuses across the United States, including Gifford Pinchot State University (GPSU). How should GPSU and its investment partner Commonfund react?

360 State Street: Real Options

Andrea nagy smith and mathew spiegel.

Asset Management, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

360 State Street proved successful, but what could Bruce Becker construct on the 6,000-square-foot vacant lot at the southwest corner of the project? Under what set of circumstances and at what time would it be most advantageous to proceed? Or should he build anything at all?

Centerbridge

Jean rosenthal and olav sorensen.

When Jeffrey Aronson and Mark Gallogly founded Centerbridge, they hoped to grow the firm, but not to a point that it would lose its culture. Having added an office in London, could the firm add more locations and maintain its collegial character?

George Hudson and the 1840s Railway Mania

Andrea nagy smith, james chanos, and james spellman.

Business History, Financial Regulation, Investor/Finance, Metrics & Data

Railways were one of the original disruptive technologies: they transformed England from an island of slow, agricultural villages into a fast, urban, industrialized nation. George Hudson was the central figure in the mania for railroad shares in England. After the share value crashed, some analysts blamed Hudson, others pointed to irrational investors and still others maintained the crash was due to macroeconomic factors.

Demosthenes and Athenian Finance

Andrea nagy smith and william goetzmann.

Business History, Financial Regulation, Law & Contracts

Demosthenes' Oration 35, "Against Lacritus," contains the only surviving maritime loan contract from the fourth century B.C., proving that the ancient Greeks had devised a commercial code to link the economic lives of people from all over the Greek world. Athenians and non-Athenians alike came to the port of Piraeus to trade freely.

South Sea Bubble

Frank newman and william goetzmann.

Business History, Financial Regulation

The story of the South Sea Company and its seemingly absurd stock price levels always enters into conversations about modern valuation bubbles. Because of its modern application, discerning what was at the root of the world's first stock market crash merits considerable attention. What about the South Sea Company and the political, economic and social context in which it operated led to its stunning collapse?

Jean W. Rosenthal, Jaan Elias, William N. Goetzmann, Stanley Garstka, and Jacob Thomas

Asset Management, Healthcare, Investor/Finance, Sourcing/Managing Funds, State & Society

A centerpiece of the 2007 contract negotiations between the UAW and GM - and later with Chrysler and Ford - was establishing a Voluntary Employee Beneficiary Association (VEBA) to provide for retiree healthcare costs. The implications were substantial.

Northern Pulp: A Private Equity Firm Resurrects a Troubled Paper Company

Heather tookes, peter schott, francesco bova, jaan elias and andrea nagy smith.

Investor/Finance, Macroeconomics, State & Society, Sustainability

In 2008, the lumber industry was in a severe recession, yet Blue Wolf Capital Management was considering investment in a paper mill in Nova Scotia. How should they proceed?

Lahey Clinic: North Shore Expansion

Jaan elias, andrea r. nagy, jessica p. strauss, and william n. goetzmann.

Asset Management, Financial Regulation, Healthcare, Investor/Finance

In early 2007 the Lahey Clinic in Massachusetts believed that expansion of its North Shore facility was not only a smart strategy but also a business necessity. The two years of turmoil in the Massachusetts health care market prompted observers to question Lahey's 2007 decisions. Did the expansion strategy still make sense?

Carry Trade ETF

K. geert rouwenhorst, jean w. rosenthal, and jaan elias.

Innovation & Design, Investor/Finance, Macroeconomics, Sourcing/Managing Funds

In 2006 Deutsche Bank (DB) brought a new product to market – an exchange traded fund (ETF) based on the carry trade, a strategy of buying and selling currency futures. The offering received the William F. Sharpe Indexing Achievement Award for “Most Innovative Index Fund or ETF” at the 2006 Sharpe Awards. These awards are presented annually by IndexUniverse.com and Information Management Network for innovative advances in the indexing industry. The carry trade ETF shared the award with another DB/PowerShares offering, a Commodity Index Tracking Fund. Jim Wiandt, publisher of IndexUniverse.com, said, "These innovators are shaping the course of the index industry, creating new tools and providing new insights for the benefit of all investors." What was it that made this financial innovation successful?

William Goetzmann and Jaan Elias

Asset Management, Business History

Hawara is the site of the massive pyramid of Amenemhat III, a XII Dynasty [Middle Kingdom, 1204 – 1604 B.C.E.] pharaoh. The Hawara Labyrinth and Pyramid Complex present a wealth of information about the Middle Kingdom. Among its treasures are papyri covering property rights and transfers of ownership.

What are Financial Statements?

- #1 Financial Statements Example – Cash Flow Statement

- #2 Financial Statements Example – Income Statement

- #3 Financial Statements Example – Balance Sheet

Additional Resources

Financial statements examples – amazon case study.

An in-depth look at Amazon's financial statements

Financial statements are the records of a company’s financial condition and activities during a period of time. Financial statements show the financial performance and strength of a company . The three core financial statements are the income statement , balance sheet , and cash flow statement . These three statements are linked together to create the three statement financial model . Analyzing financial statements can help an analyst assess the profitability and liquidity of a company. Financial statements are complex. It is best to become familiar with them by looking at financial statements examples.

In this article, we will take a look at some financial statement examples from Amazon.com, Inc. for a more in-depth look at the accounts and line items presented on financial statements.

Learn to analyze financial statements with Corporate Finance Institute’s Reading Financial Statements course!

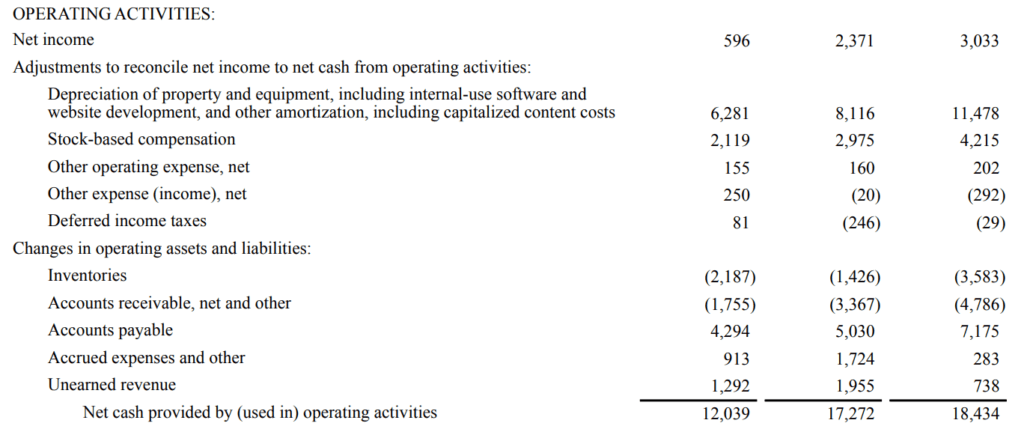

#1 Financial Statements Example – Cash Flow Statement

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company’s cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning of the period to the end of the period.

Most companies begin their financial statements with the income statement. However, Amazon (NASDAQ: AMZN) begins its financial statements section in its annual 10-K report with its cash flow statement.

The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. The adjustments are grouped under operating activities , investing activities , and financing activities .

The following are explanations for the line items listed in Amazon’s cash flow statement. Please note that certain items such as “Other operating expenses, net” are often defined differently by different companies:

Operating Activities:

Depreciation of property and equipment (…) : a non-cash expense representing the deterioration of an asset (e.g. factory equipment).

Stock-based compensation : a non-cash expense as a company awards stock options or other stock-based forms of compensation to employees as part of their compensation and wage agreements.

Other operating expense, net: a non-cash expense primarily relating to the amortization of Amazon’s intangible assets .

Other expense (income), net: a non-cash expense relating to foreign currency and equity warrant valuations.

Deferred income taxes : temporary differences between book tax and actual income tax. The amount of tax the company pays may be different from what it shows on its financial statements.

Changes in operating assets and liabilities : non-cash changes in operating assets or liabilities. For example, an increase in accounts receivable is a sale or a source of income where no actual cash was received, thus resulting in a deduction. Conversely, an increase in accounts payable is a purchase or expense where no actual cash was used, resulting in an addition to net cash.

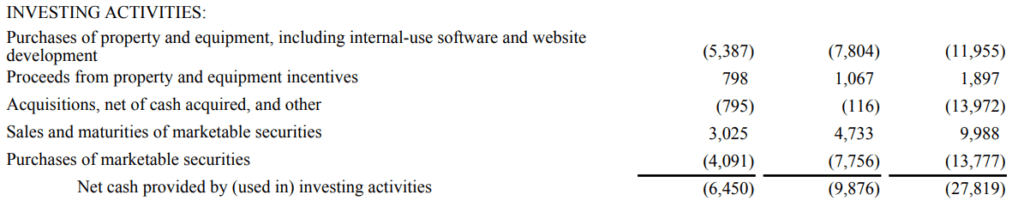

Investing Activities:

Purchases of property and equipment (…): purchases of plants, property, and equipment are usages of cash. A deduction from net cash.

Proceeds from property and equipment incentives: this line is added for additional detail on Amazon’s property and equipment purchases. Incentives received from property and equipment vendors are recorded as a reduction in Amazon’s costs and thus a reduction in cash usage.

Acquisitions , net of cash acquired, and other: cash used towards acquisitions of other companies, net of cash acquired as a result of the acquisition. A deduction from net cash.

Sales and maturities of marketable securities : the sale or proceeds obtained from holding marketable securities (short-term financial instruments that mature within a year) to maturity. An addition to net cash.

Purchases of marketable securities: the purchase of marketable securities. A deduction from net cash.

Financing Activities:

Proceeds from long-term debt and other: cash obtained from raising capital by issuing long-term debt. An addition to net cash.

Repayments of long-term debt and other: cash used to repay long-term debt obligations. A deduction from net cash.

Principal repayments of capital lease obligations: cash used to repay the principal amount of capital lease obligations. A deduction from net cash.

Principal repayments of finance lease obligations: cash used to repay the principal amount of finance lease obligations. A deduction from net cash.

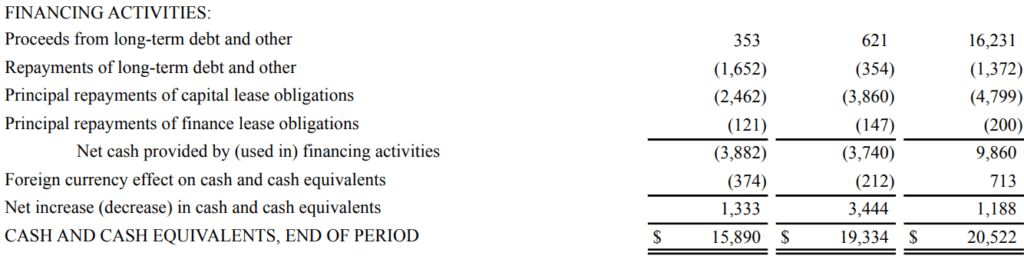

Foreign currency effect on cash and cash equivalents : the effect of foreign exchange rates on cash held in foreign currencies.

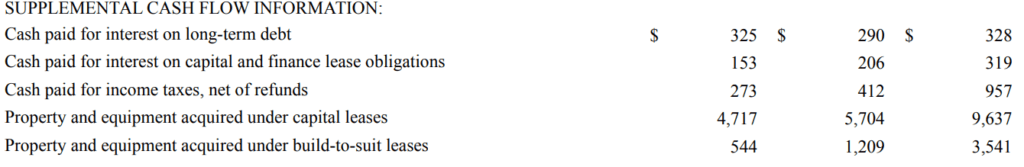

Supplemental Cash Flow Information:

Cash paid for interest on long-term debt: cash usages to pay accumulated interest from long-term debt.

Cash paid for interest on capital and finance lease obligations: cash usages to pay accumulated interest from capital and finance lease obligations.

Cash paid for income taxes , net of refunds: cash usages to pay income taxes.

Property and equipment acquired under capital leases: the value of property and equipment acquired under new capital leases in the fiscal period.

Property and equipment acquired under build-to-suit leases: the value of property and equipment acquired under new build-to-suit leases in the fiscal period.

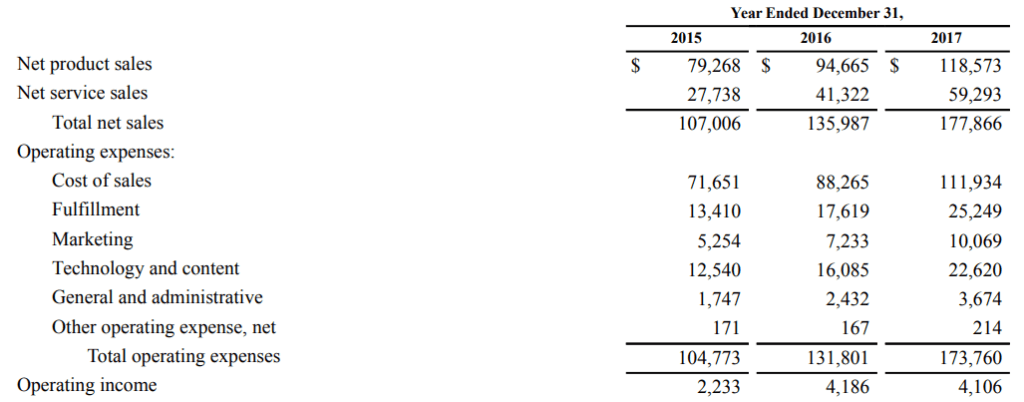

#2 Financial Statements Example – Income Statement

The next statement in our financial statements examples is the income statement. The income statement is the first place for an analyst to look at if they want to assess a company’s profitability .

Want to learn more about financial analysis and assessing a company’s profitability? Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you everything you need to know to become a world-class financial analyst!

The income statement provides a look at a company’s financial performance throughout a certain period, usually a fiscal quarter or year. This period is usually denoted at the top of the statement, as can be seen above. The income statement contains information regarding sales , costs of sales , operating expenses, and other expenses.

The following are explanations for the line items listed in Amazon’s income statement:

Operating Income (EBIT):

Net product sales: revenue derived from Amazon’s product sales such as Amazon’s first-party retail sales and proprietary products (e.g., Amazon Echo)

Net services sales: revenue generated from the sale of Amazon’s services. This includes proceeds from Amazon Web Services (AWS) , subscription services, etc.

Cost of sales: costs directly associated with the sale of Amazon products and services. For example, the cost of raw materials used to manufacture Amazon products is a cost of sales.

Fulfillment: expenses relating to Amazon’s fulfillment process. Amazon’s fulfillment process includes storing, picking, packing, shipping, and handling customer service for products.

Marketing : expenses pertaining to advertising and marketing for Amazon and its products and services. Marketing expense is often grouped with selling, general, and administrative expenses (SG&A) but Amazon has chosen to break it out as its own line item.

Technology and content: costs relating to operating Amazon’s AWS segment.

General and administrative : operating expenses that are not directly related to producing Amazon’s products or services. These expenses are sometimes referred to as non-manufacturing costs or overhead costs. These include rent, insurance, managerial salaries, utilities, and other similar expenses.

Other operating expenses, net: expenses primarily relating to the amortization of Amazon’s intangible assets.

Operating income : the income left over after all operating expenses (expenses directly related to the operation of the business) are deducted. Also known as EBIT .

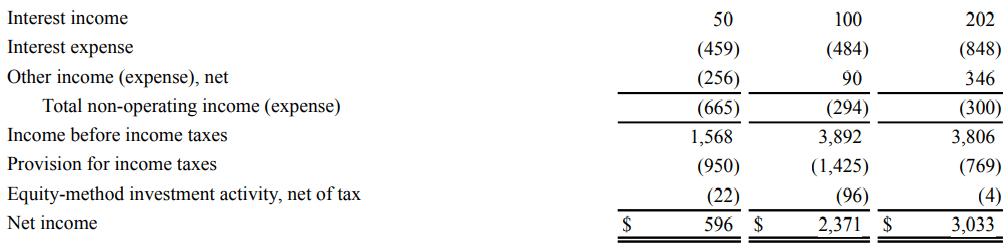

Net Income:

Interest income: income generated by Amazon from investing excess cash. Amazon typically invests excess cash in investment-grade , short to intermediate-term fixed income securities , and AAA-rated money market funds.

Interest expense : expenses relating to accumulated interest from capital and finance lease obligations and long-term debt.

Other income (expense), net: income or expenses relating to foreign currency and equity warrant valuations.

Income before income taxes : Amazon’s income after operating and non-operating expenses have been deducted.

Provision for income taxes: the expense relating to the amount of income tax Amazon must pay within the fiscal year .

Equity-method investment activity, net of tax: proportionate losses or earnings from companies where Amazon owns a minority stake .

Net income: the amount of income left over after Amazon has paid off all its expenses.

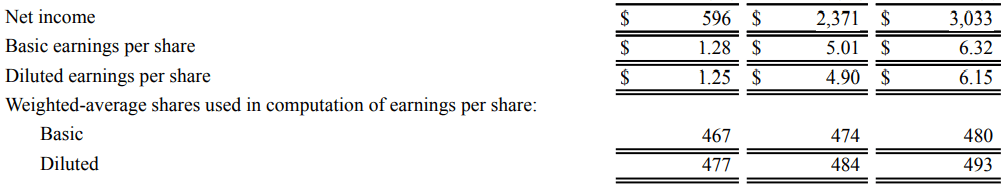

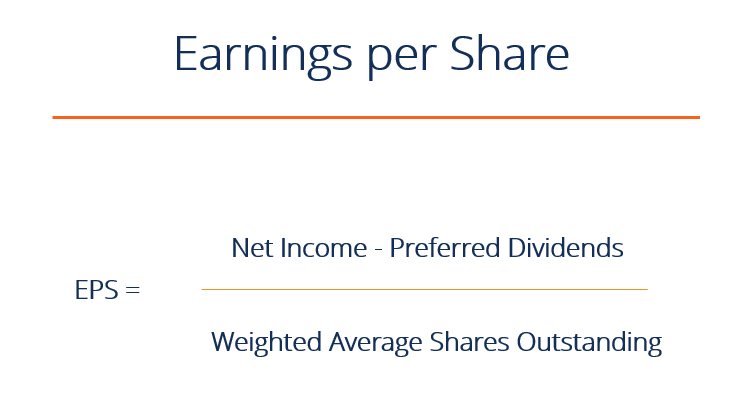

Earnings per Share (EPS):

Basic earnings per share : earnings per share calculated using the basic number of shares outstanding.

Diluted earnings per share: earnings per share calculated using the diluted number of shares outstanding.

Weighted-average shares used in the computation of earnings per share: a weighted average number of shares to account for new stock issuances throughout the year. The way the calculation works is by taking the weighted average number of shares outstanding during the fiscal period covered.

For example, a company has 100 shares outstanding at the beginning of the year. At the end of the first quarter, the company issues another 50 shares, bringing the total number of shares outstanding to 150. The calculation for the weighted average number of shares would look like below:

100*0.25 + 150*0.75 = 131.25

Basic: the number of shares outstanding in the market at the date of the financial statement.

Diluted : the number of shares outstanding if all convertible securities (e.g. convertible preferred stock, convertible bonds ) are exercised.

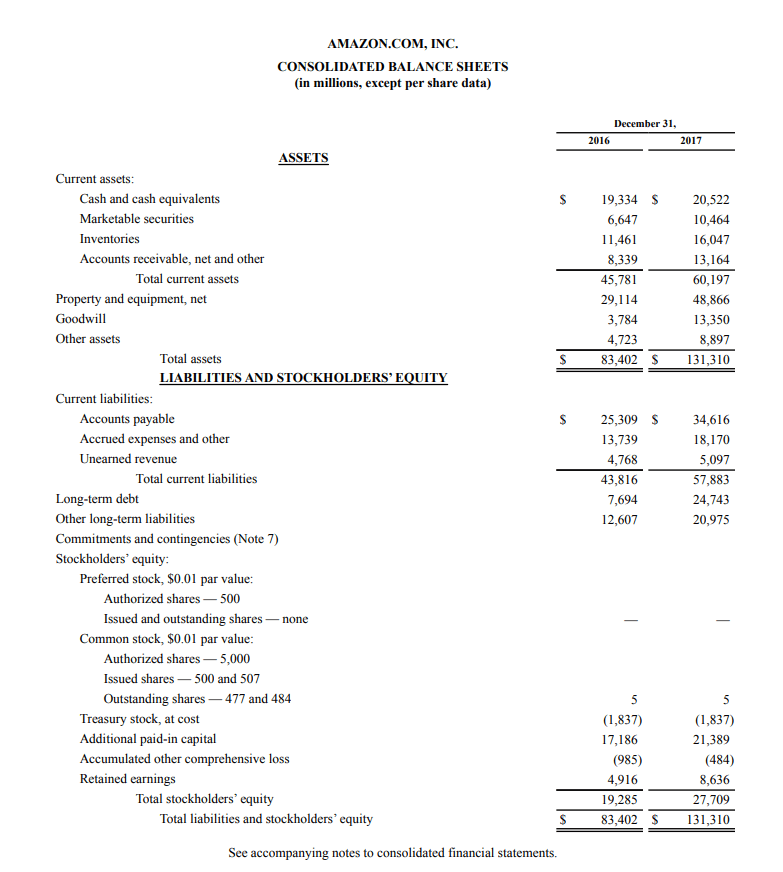

#3 Financial Statements Example – Balance Sheet

The last statement we will look at with our financial statements examples is the balance sheet. The balance sheet shows the company’s assets , liabilities , and stockholders’ equity at a specific point in time.

Learn how a world-class financial analyst uses these three financial statements with CFI’s Financial Modeling & Valuation Analyst (FMVA)® Certification Program !

Unlike the income statement and the cash flow statement, which display financial information for the company during a fiscal period, the balance sheet is a snapshot of the company’s finances at a specific point in time. It can be seen above in the line regarding the date.

Compared to the Cash Flow Statement and Statement of Income, it states ‘December 31, 2017’ as opposed to ‘Year Ended December 31, 2017’. By displaying snapshots from different periods, the balance sheet shows changes in the accounts of a company.

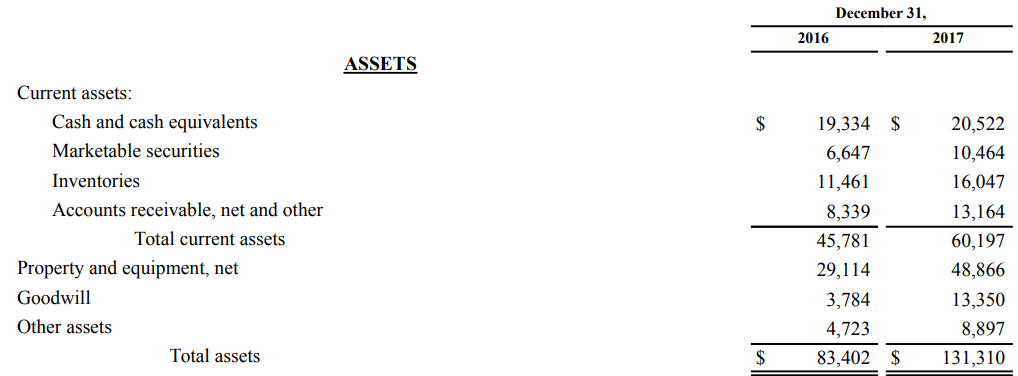

The following are explanations for the line items listed in Amazon’s balance sheet:

Cash and cash equivalents : cash or highly liquid assets and short-term commitments that can be quickly converted into cash.

Marketable securities: short-term financial instruments that mature within a year.

Inventories : goods currently held in stock for sale, in-process goods, and materials to be used in the production of goods or services.

Accounts receivable , net and other: credit sales of a business that have not yet been fully paid by customers.

Goodwill : the difference between the price paid in an acquisition of a company and the fair market value of the target company’s net assets.

Other assets: Amazon’s acquired intangible assets, net of amortization. This includes items such as video, music content, and long-term deferred tax assets.

Liabilities:

Accounts payable : short-term liabilities incurred when Amazon purchases goods from suppliers on credit.

Accrued expenses and other: liabilities primarily related to Amazon’s unredeemed gift cards, leases and asset retirement obligations, current debt, acquired digital media content, etc.

Unearned revenue : revenue generated when payment is received for goods or services that have not yet been delivered or fulfilled. Unearned revenue is a result of revenue recognition principles outlined by U.S. GAAP and IFRS .

Long-term debt: the amount of outstanding debt a company holds that has a maturity of 12 months or longer.

Other long-term liabilities: Amazon’s other long-term liabilities, which include long-term capital and finance lease obligations, construction liabilities, tax contingencies, long-term deferred tax liabilities, etc. (Note 6 of Amazon’s 2017 annual report).

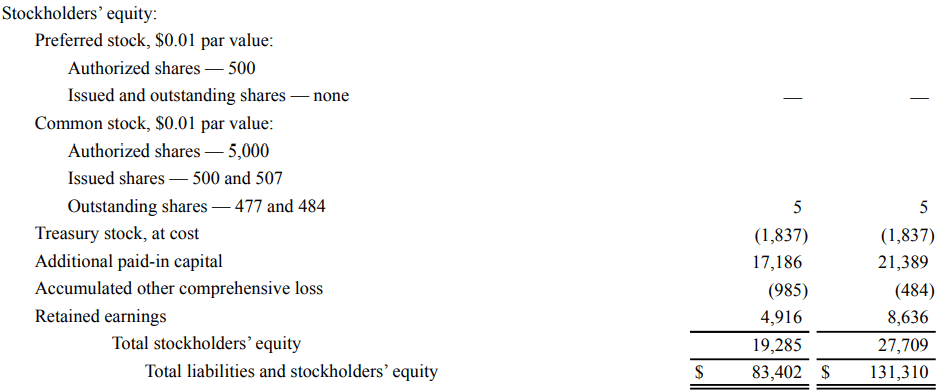

Stockholders’ Equity:

Preferred stock : stock issued by a corporation that represents ownership in the corporation. Preferred stockholders have a priority claim on the company’s assets and earnings over common stockholders. Preferred stockholders are prioritized with regard to dividends but do not have any voting rights in the corporation.

Common stock : stock issued by a corporation that represents ownership in the corporation. Common stockholders can participate in corporate decisions through voting.

Treasury stock , at cost: also known as reacquired stock, treasury stock represents outstanding shares that have been repurchased from the stockholder by the company.

Additional paid-in capital : the value of share capital above its stated par value in the above line item for common stock ($0.01 in the case of Amazon). In Amazon’s case, the value of its issued share capital is $17,186 million more than the par value of its common stock, which is worth $5 million.

Accumulated other comprehensive loss: accounts for foreign currency translation adjustments and unrealized gains and losses on available-for-sale/marketable securities.

Retained earnings : the portion of a company’s profits that is held for reinvestment back into the business, as opposed to being distributed as dividends to stockholders.

As you can see from the above financial statements examples, financial statements are complex and closely linked. There are many accounts in financial statements that can be used to represent amounts regarding different business activities. Many of these accounts are typically labeled “other” type accounts, such as “Other operating expenses, net”. In our financial statements examples, we examined how these accounts functioned for Amazon.

Now that you have become more proficient in reading the financial statements examples, round out your skills with some of our other resources. Corporate Finance Institute has resources that will help you expand your knowledge and advance your career! Check out the links below:

- Financial Modeling & Valuation Analyst (FMVA)® Certification Program

- Financial Analysis Fundamentals

- Three Financial Statements Summary

- Free CFI Accounting eBook

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

1st Edition

Cases in Corporate Finance

- Taylor & Francis eBooks (Institutional Purchase) Opens in new tab or window

Description

Cases in Corporate Finance includes 60 unique case studies that illustrate the application of finance theories, models, and frameworks to real-life business situations. The topics cover a wide range of sectors and different life cycle stages of firms. The book bridges a crucial gap in topical emerging market case coverage by presenting industry-relevant case studies in the Indian context and on themes pertinent to the current business environment. Through the case studies included in the book, the authors offer insights into the essential areas of corporate finance, including risk and return, working capital management, capital budgeting and structure, dividend decisions, business valuation, and long-term financing. Cases included in the book are decision-focused and provide opportunities to carefully analyse risk-return trade-offs and apply tools to evaluate critical financial decisions. The book will be helpful for students, researchers, and instructors of business management, commerce, and economics.

Table of Contents

Mayank Joshipura is a Professor of Finance, Associate Dean-Research, and Chairperson of the Ph.D. programme at the School of Business Management, NMIMS Deemed to be University, Mumbai. He holds a Ph.D. and an MBA in Finance and a Bachelor of Engineering degree in Power Electronics. He attended and completed a certificate programme on “Creating Value through Financial Management” from the Wharton Business School, USA, and the Glocoll progamme from Harvard Business School, USA. He has two and half decades of experience in management education, research, and consulting. Sachin Mathur is Associate Professor, Finance, at the School of Business Management, NMIMS Deemed to be University, Mumbai. He holds an MMS degree and a Ph.D. from NMIMS, Mumbai and a Bachelor of Technology degree in Chemical Engineering from Institute of Technology, BHU, Varanasi. He has over 15 years of industry experience including as Head of Research at CRISIL Ltd. He is a CFA charter holder.

About VitalSource eBooks

VitalSource is a leading provider of eBooks.

- Access your materials anywhere, at anytime.

- Customer preferences like text size, font type, page color and more.

- Take annotations in line as you read.

Multiple eBook Copies

This eBook is already in your shopping cart. If you would like to replace it with a different purchasing option please remove the current eBook option from your cart.

Book Preview

The country you have selected will result in the following:

- Product pricing will be adjusted to match the corresponding currency.

- The title Perception will be removed from your cart because it is not available in this region.

COMMENTS

by Lauren Cohen, Christopher J. Malloy, and Quoc Nguyen. The most comprehensive information windows that firms provide to the markets—in the form of their mandated annual and quarterly filings—have changed dramatically over time, becoming significantly longer and more complex. When firms break from their routine phrasing and content, this ...

Case Studies for Corporate Finance: From A (Anheuser) to Z (Zyps) (In 2 Volumes) provides a distinctive collection of 51 real business cases dealing with corporate finance issues over the period of 1985-2014. Written by Harold Bierman Jr, world-renowned author in the field of corporate finance, the book spans over different areas of finance which range from capital structures to leveraged ...

Bulk Lift International case study. This is a story about how PricewaterhouseCoopers Corporate Finance, LLC ("PwC Corporate Finance") advised Bulk Lift International ("Bulk Lift" or the "Company") on its sale to New Water Capital L.P. ("New Water Capital").

Fifty four percent of raw case users came from outside the U.S.. The Yale School of Management (SOM) case study directory pages received over 160K page views from 177 countries with approximately a third originating in India followed by the U.S. and the Philippines. Twenty-six of the cases in the list are raw cases.

Forgiving Medical Debt Won't Make Everyone Happier. by Rachel Layne. Medical debt not only hurts credit access, it can also harm one's mental health. But a study by Raymond Kluender finds that forgiving people's bills—even $170 million of debt—doesn't necessarily reduce stress, financial or otherwise. 16 Jul 2024.

In corporate finance, a debenture is a medium to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The ... A Handbook of Case Studies in Finance 7 Depository On the simplest level, depository is used to refer to any place where

Financial analysis Magazine Article. James McNeill Stancill. The primary goal of any company is to attract the customers to its product or service. But smaller companies often pursue the goal so ...

by Carolin E. Pflueger, Emil Siriwardane, and Adi Sunderam. This paper sheds new light on connections between financial markets and the macroeconomy. It shows that investors' appetite for risk—revealed by common movements in the pricing of volatile securities—helps determine economic outcomes and real interest rates.

This book was prepared for the Finance Master program of the Corvinus University of Budapest started in the academic year 2019/2020. The book consists of two main parts, the first part deals with corporate finance and financing issues, while the second part covers risk management and liquidity management in financial markets.

Applied Corporate Finance fills a gap in the existing resources available to students and professionals needing an academically rigorous, yet practically orientated, source of knowledge about corporate finance. Written by an expert in investment analysis, this textbook leads readers to truly understand the principles behind corporate finance in a real world context from both a firm and ...

A discussion-based learning approach to corporate finance fundamentals Lessons in Corporate Finance explains the fundamentals of the field in an intuitive way, using a unique Socratic question and answer approach. Written by award-winning professors at M.I.T. and Tufts, this book draws on years of research and teaching to deliver a truly interactive learning experience. Each case study is ...

An intuitive introduction to fundamental corporate finance concepts and methods Lessons in Corporate Finance, Second Edition offers a comprehensive introduction to the subject, using a unique interactive question and answer-based approach. Asking a series of increasingly difficult questions, this text provides both conceptual insight and specific numerical examples. Detailed case studies ...

Financial analysis Magazine Article. Thomas R. Piper. William E. Fruhan, Jr. Valuation of a company and its common stock is an important part of financial management. In a publicly owned company ...

This case study examines corporate governance issues at Wells Fargo and Company. The bank was embroiled in controversies due to its cross-selling tactics and the enormous pressure the management exerted on the employees to ensure its success. Investigations by media, followed by statutory agencies, revealed the creation of fake accounts without ...

Case Studies in Finance Managing for Corporate Value Creation Seventh Edition Robert F. Bruner Kenneth M. Eades Michael J. Schill UNIVERSITY ^VIRGINIA DARDEN SCHOOL OF BUSINESS I McGraw-Hill I Irwin ^ContentsDedication vii About the Authors viii Contents x Foreword xiii Preface xiv Note to the Student: How To Study and Discuss Cases Ethics in Finance xxxii Settihg Some Themes 1.

Career decisions are about more than just your career. Find new ideas and classic advice on strategy, innovation and leadership, for global leaders from the world's best business and management ...