Risk Management Report Sample

March 20, 2024

A risk management report sample typically provides a structured document that outlines the results and summary of risk management activities within an organization.

It includes details on the risk assessment process , identification of potential risks , analysis of the likelihood and impact of these risks, and the measures taken to mitigate them.

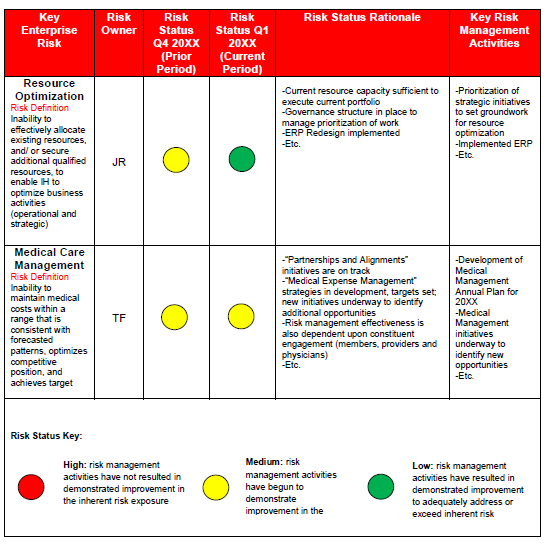

For instance, a risk management report template provides key oversight of an organization’s risk management reporting functions and might include reporting on the status of key risks, actions taken, and an overview of the risk profile.

Another example includes a sample risk analysis report , which would typically reflect the results of risk factor identification and assessment, quantification of risks, and contingency analysis.

These reports are essential for communicating with stakeholders, like a board of directors, about the current risk landscape and the steps the organization is taking to manage risk effectively .

Risk management reports are essential for businesses of all sizes, providing a structured approach to identify, evaluate, and address risks through strategies like risk avoidance and mitigation.

These reports include key elements like risk identification methods , impact assessment techniques , and reporting with monitoring to enhance decision-making processes .

By exploring sample risk assessment templates and case studies, organizations can gain valuable insights into effective risk management practices to strengthen their resilience in handling uncertainties and emerging threats.

Key Takeaways

- In-depth risk assessment methodologies .

- Comprehensive risk mitigation strategies .

- Detailed risk impact analysis .

- Effective risk monitoring techniques .

- Clear and concise risk reporting formats .

Importance of Risk Management Reports

Risk management reports play a pivotal role in organizations by outlining risk mitigation strategies and providing support for decision-making processes.

These reports offer a structured approach to identifying, evaluating, and addressing potential risks that could impact the business.

Risk Mitigation Strategies

Effective risk mitigation strategies are essential components of thorough risk management reports for businesses of all sizes.

These strategies aim to identify, assess, and prioritize risks , followed by implementing measures to minimize, monitor, and control them.

Common risk mitigation strategies include risk avoidance , where the business chooses not to engage in high-risk activities, risk reduction through implementing safety measures , risk transfer by purchasing insurance, and risk acceptance for risks deemed unavoidable or too costly to mitigate.

Decision-making Support

In the domain of business operations, well-crafted risk management reports play an essential role in providing decision-making support by offering valuable insights into potential threats and opportunities .

These reports enable stakeholders to make informed decisions that can help mitigate risks and capitalize on emerging possibilities.

By presenting data in a structured manner, risk management reports aid in understanding the current risk landscape and assist in prioritizing actions to address these risks effectively.

The table below illustrates the types of decision-making support that can be derived from thorough risk management reports .

Key Elements of a Risk Report

The key elements of a risk report include :

- Risk identification methods.

- Impact assessment techniques.

- Risk mitigation strategies.

- Reporting and monitoring.

These components collectively form the bedrock of a thorough risk management strategy , aiding organizations in understanding, addressing, and minimizing potential risks.

Risk Identification Methods

Identifying risks is a fundamental aspect of compiling a thorough risk management report . There are various methods used by organizations to identify potential risks .

One common method is the brainstorming technique , where team members come together to generate a list of possible risks based on their expertise and experience.

Another method is the use of checklists and historical data to identify risks that have occurred in similar projects or situations.

Additionally, interviews with stakeholders, conducting risk surveys, and utilizing risk assessment tools can help in identifying risks that may impact the project or organization.

Impact Assessment Techniques

Effectively evaluating the potential consequences of identified risks is crucial in developing a thorough risk management report.

Impact assessment techniques serve as valuable tools in this process, aiding in understanding the severity and implications of various risks on the organization.

Common techniques include qualitative assessments , which involve evaluating risks based on predefined criteria, and quantitative assessments , which assign numerical values to risks for better comparison.

Scenario analysis is another technique where different risk scenarios are explored to gauge their potential impact.

Sensitivity analysis helps in understanding how changes in variables can affect risk outcomes.

By utilizing these techniques, organizations can gain a holistic understanding of the potential impacts of identified risks, enabling them to make informed decisions and develop effective risk mitigation strategies .

Utilizing evaluation techniques to understand the severity and implications of identified risks is fundamental in developing effective risk mitigation strategies within a thorough risk management report .

By analyzing the potential impact of risks, organizations can proactively implement strategies to minimize the likelihood of these risks occurring or reduce their negative consequences. Below is a table outlining common risk mitigation strategies:

Reporting and Monitoring

An integral aspect of a thorough risk management report is the meticulous documentation and vigilant oversight of potential risks through exhaustive reporting and monitoring.

Reporting involves the detailed analysis and presentation of risk data, highlighting areas of concern and potential vulnerabilities.

Monitoring, on the other hand, requires continuous tracking and evaluation of identified risks to guarantee prompt responses and effective risk mitigation strategies.

By implementing robust reporting mechanisms and establishing regular monitoring practices, organizations can proactively identify, assess, and address risks before they escalate into significant threats.

This systematic approach not only enhances risk awareness but also enables informed decision-making and the timely implementation of corrective actions to safeguard business operations and objectives.

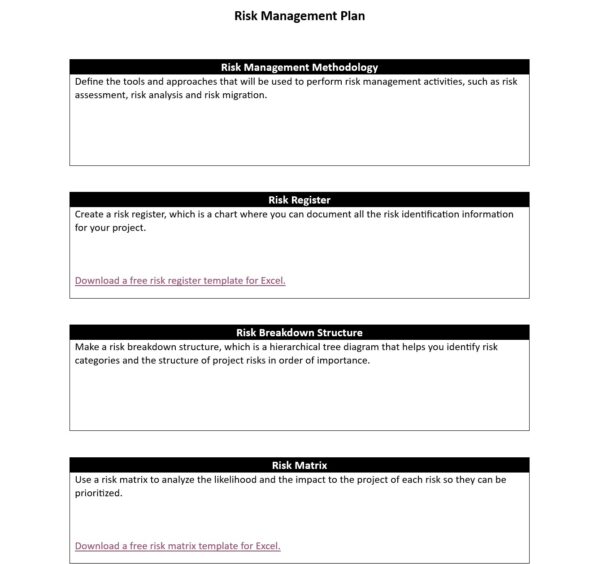

Sample Risk Assessment Template

The sample risk assessment template includes key risk factors and mitigation strategies to help organizations identify and address potential threats to their operations.

By outlining these factors and strategies, businesses can proactively manage risks and protect their assets.

Implementing a structured risk assessment template enhances decision-making processes and promotes a culture of risk awareness within the organization.

Key Risk Factors

Identifying and analyzing key risk factors is vital in developing an effective risk assessment template for thorough risk management.

Key risk factors are elements or situations that could potentially jeopardize the achievement of a project or business goal.

These factors can vary widely depending on the nature of the project or industry but commonly include financial risks , market competition, regulatory changes , and technological disruptions .

By thoroughly understanding and documenting these key risk factors , organizations can proactively plan for potential challenges , allocate resources efficiently, and implement strategies to minimize negative impacts .

Regular review and updates to the list of key risk factors are essential to make sure that risk management efforts remain relevant and effective in addressing potential threats.

Mitigation Strategies

Developing effective mitigation strategies is essential for organizations to proactively address potential risks identified in the risk assessment template.

These strategies aim to reduce the likelihood of risks occurring or minimize their impact if they materialize.

Mitigation strategies can include implementing robust security protocols, conducting regular training sessions for employees, diversifying supply chains, creating backup systems for critical operations, and establishing emergency response plans .

By identifying vulnerabilities and formulating tailored mitigation strategies , organizations can enhance their resilience against various risks.

Continuous monitoring and periodic reviews are critical to guarantee the effectiveness of these strategies and adapt them to evolving threats.

Mitigation strategies play a significant role in safeguarding organizational assets and maintaining operational continuity in the face of uncertainties.

Case Studies in Risk Management

Effective risk management hinges on the meticulous analysis and application of proven strategies in real-world scenarios. Examining case studies provides valuable insights into how organizations navigate challenges.

For example, Company X faced a supply chain disruption due to a natural disaster . By having a robust risk management plan in place, they quickly identified alternative suppliers, mitigating the impact on their operations.

In another case, Company Y encountered a cybersecurity breach that threatened sensitive data.

Through proactive risk assessment and cybersecurity measures, they were able to contain the breach and strengthen their defenses.

These real-life examples demonstrate the importance of proactive risk management and the effectiveness of implementing strategies to mitigate potential risks .

Tips for Effective Risk Reporting

To effectively report risks , it is essential to employ clear communication methods that ensure stakeholders understand the potential threats. Utilizing visual aids , such as graphs or charts, can help convey complex information in a more digestible format.

Clear Risk Communication Methods

Clear and concise risk communication is essential for effective risk reporting in any organization. When communicating risks, it’s vital to use simple language that is easily understandable by all stakeholders.

Avoid jargon and technical terms unless explaining them is necessary.

Clearly outline the nature of the risk , its potential impact, and the actions being taken to mitigate it. Utilize multiple communication channels such as emails, presentations, or reports to guarantee the message reaches all relevant parties.

Tailor the communication style to the audience, providing detailed information to management while summarizing key points for other team members.

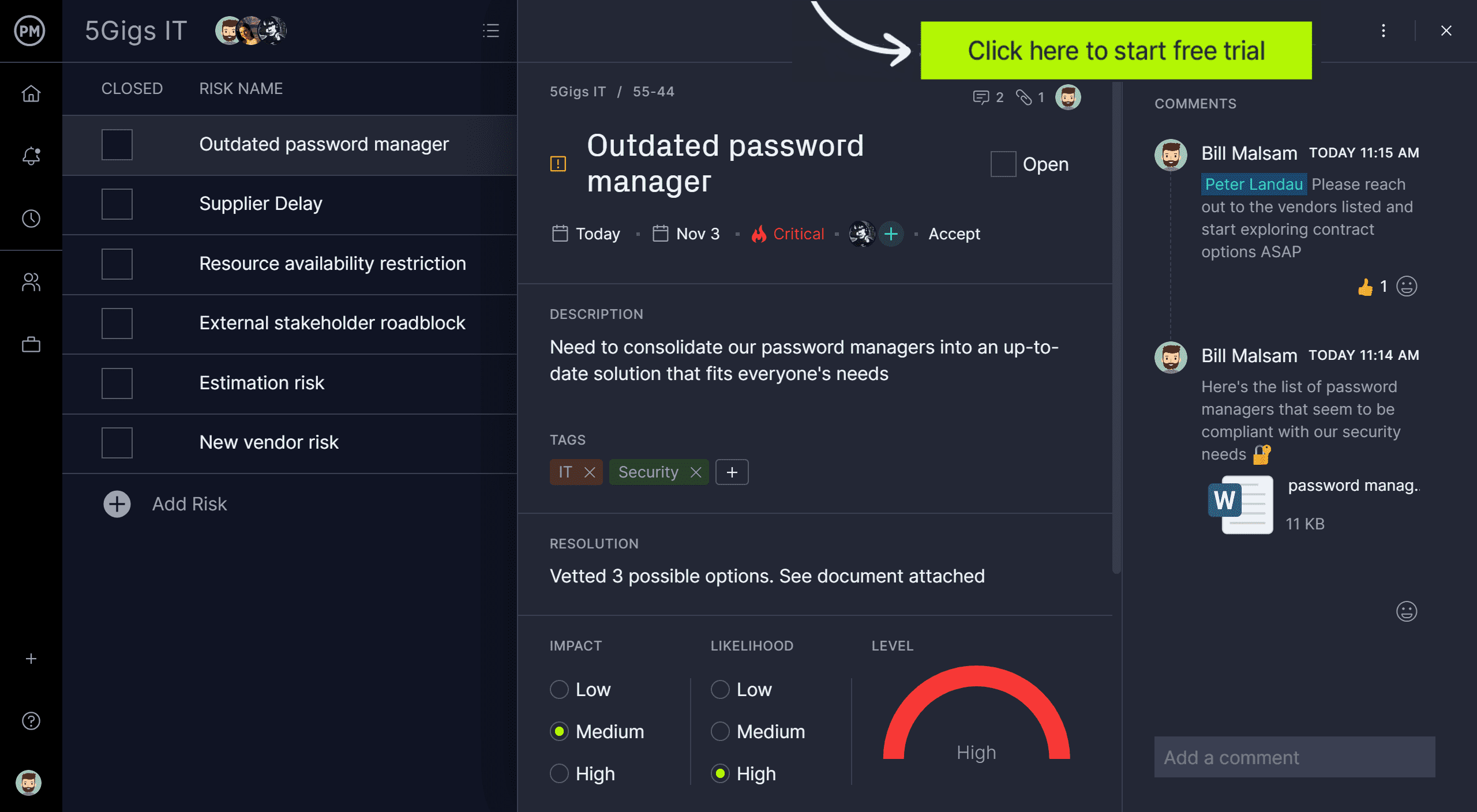

Utilize Visual Aids

Employing visual aids is a vital approach to enhance the comprehensibility and impact of risk reporting within an organization.

Visual representations such as graphs, charts, and diagrams can simplify complex data , making it easier for stakeholders to grasp key information at a glance.

These aids can help in identifying trends, patterns, and outliers, enabling more informed decision-making processes.

When utilized effectively, visual aids not only improve the clarity of risk reports but also enhance their overall effectiveness.

It is essential to choose the right type of visual aid that aligns with the nature of the data being presented and the intended audience.

Visual aids should complement the written information, providing a visual summary that reinforces the key messages being conveyed.

Regular Stakeholder Updates

For effective risk reporting, providing regular updates to stakeholders is essential in maintaining transparency and ensuring informed decision-making within the organization.

Regular stakeholder updates help in keeping all involved parties informed about the current status of risks, mitigation strategies, and any emerging issues that may impact the project or business.

Frequently Asked Questions

What are the common challenges faced when implementing risk management reports in an organization.

Implementing risk management reports in organizations can face challenges like data accuracy, stakeholder alignment, and resource constraints.

Ensuring consistent data collection, engaging key stakeholders, and allocating adequate resources are essential for successful implementation.

How Can Organizations Ensure That Risk Management Reports Are Effectively Communicated to All Stakeholders?

Organizations can guarantee effective communication of risk management reports to stakeholders by utilizing clear and concise language, incorporating visual aids for better comprehension, scheduling regular updates and feedback sessions, and establishing a designated communication protocol for dissemination.

What Are Some Best Practices for Continuously Monitoring and Updating Risk Management Reports?

Continuous monitoring and updating of risk management reports require regular review of data, identification of emerging risks, and collaboration among stakeholders.

Utilizing technology for real-time tracking, engaging in regular risk assessments, and fostering a culture of risk awareness are key best practices.

How Can Organizations Measure the Effectiveness of Their Risk Management Strategies Based on the Information Provided in the Reports?

Organizations can measure the effectiveness of their risk management strategies by analyzing key performance indicators , conducting regular risk evaluations, tracking incident response times, evaluating the alignment of risk strategies with business objectives, and soliciting feedback from stakeholders.

What Are Some Emerging Trends or Technologies That Are Impacting the Field of Risk Management Reporting?

Emerging trends in risk management reporting include the adoption of advanced analytics, AI, and machine learning for more accurate risk assessments .

Blockchain technology is also revolutionizing data security and transparency in risk management processes.

In summary, risk management reports play a vital role in identifying, evaluating, and mitigating potential risks within an organization.

By including key elements such as risk assessments , case studies, and effective reporting tips, businesses can better understand and manage risks to achieve their objectives.

Organizations need to prioritize risk management and utilize thorough reports to guarantee the sustainability and success of their operations.

Chris Ekai is a Risk Management expert with over 10 years of experience in the field. He has a Master’s(MSc) degree in Risk Management from University of Portsmouth and is a CPA and Finance professional. He currently works as a Content Manager at Risk Publishing, writing about Enterprise Risk Management, Business Continuity Management and Project Management.

Risk Reporting: Importance and Best Practices

Ai Risk Management

Reach out to understand more about Enterprise Risk Management, Project Management and Business Continuity.

© 2024 Risk Management

The Risk Report in Project Management

Project management is most frequently associated with the topics of cost, quality, and time. Yet, those three legs of project management are all directly impacted by risk. Risk management is crucial in all projects; whether an opportunity or threat, all risks should be identified and planned to increase the possibility of a successful outcome for a project. Project managers (PMP) conduct risk analysis work, maintain a risk watch list, and generate a risk report as part of overall risk management work.

On this page:

- Risk Report

- Purpose of a Risk Report

Basics of a Risk Report

- How a Risk Report fits into Risk Management documents

Get Your Comprehensive Guide to Risk Management

Learn how to manage risk in every project.

Risk Report PMP

The Project Management Professional (PMP)® certification exam seeks to assess one’s knowledge of all things project management, including risk management tools, activities, and documents. Depending on the industry, the type of project management methodology used, and the specific project management tools employed by an organization, there can be different levels of formal risk tools and documents used. However, there are foundational aspects of risk management that through the standards measured by Project Management Institute (PMI)’s PMP exam and their A Guide to the Project Management Body of Knowledge ( PMBOK ® Guide ), all PMP credential holders know.

Purpose of a Risk Report PMP

Searching for the difference between the risk report, risk analysis, and risk register can be frustrating. If the project manager is conducting risk analysis and maintaining a list of identified risks in the risk register, what is the need for a risk report? The answer lies in understanding stakeholders and the ongoing communications required for any project.

For example, the team members are actively using the risk register to capture risks and potential mitigation strategies for each, as they should. The risk register may end up being quite lengthy (images of small font sizes and excel files that require seemingly endless scrolling could be flashing in your mind). The CEO, a primary stakeholder, asks the project manager, “what is the status of the project’s risk? Are we at high risk for any problems?” If the project manager only shows the CEO the risk register in response, trying to convey how risk is being managed, there is a failure to communicate the overall status of risk management. The risk of only using the risk register to convey the status of risk is the stakeholders will lose confidence in the work and that can lead to a lack of support. This is where the risk report fits into the overall project management strategy – it is a risk summary reflecting the potential impacts to the budget, timeline, and deliverables which can convey key points to stakeholders.

The difference between a risk register and a risk report is the register is an ongoing document used throughout the project to make informed risk management decisions whereas the risk report is a snapshot of risk management work in a given moment.

By definition, a risk report is a communication tool within risk management. The report should be clear, concise, and indicate actions taken, preparation for other risk-related actions, and any inputs needed by stakeholders to ensure continuous risk management support.

When to Create the Report

In the context of formal traditional (waterfall) project management, a risk report is created during the Identify Risk process. Then the report is updated during the processes of :

- Perform Qualitative Risk Analysis

- Perform Quantitative Risk Analysis

- Plan Risk Responses

- Implement Risk Responses

- Monitor Risks

From a “risk report PMP” lens, that is the strict timing of creating and updating the risk report which is the basis of related PMP certification exam questions. However, a project manager should strive to understand the culture of the business and the needs of critical stakeholders, which can influence when a risk report is needed. It would not behoove a project manager to reply to the inquiry of “what is the status of our risk?” with a reply of “we are not at the point where I update the risk report, so you need to wait to find out.” Factors to consider for the timing of risk reports:

- The needs of the most influential stakeholders

- The results of the risk watch list work that indicate significant changes in risk

- Following a reporting schedule to manage the time needed for reporting

- Maintaining consistent communication with the team and with stakeholders on risk activities

When considering the timing of risk reports, aim to be consistent and timely versus trying to follow an inflexible schedule.

What to Include in the Report

The type of project, the project management methodology practiced, the project management standards of the business, and the scope of the project will all influence the level of detail and content of a risk report. Most commonly, these information types are included in a risk report:

- overall project risk sources

- overall project risk status (e.g. high, medium, low)

- number of identified risks, labeled as threats or opportunities

- distribution of risks across risk categories

- risk trends across risk categories

- identified risks that have occurred and what action taken

- changes in how risks are assessed for the probability of occurrence

- financial impact of occurred risks

- timeline impact of occurred risks

- predicted level of overall project risk for next risk report milestone

Additionally, the inputs from risk analysis efforts will shape risk report content as will changes in the risk watch list.

Studying for the PMP Exam?

How to create a Risk Report

There is not a single perfect risk report template. As indicated by the range of information that can be included in a report, so too does the report vary by project. What should not vary is the report itself within a given project. It is important that within a project, the risk reports are consistent in content and approach. The team and stakeholders should know what to expect in the report and what information will be found in it.

From just one risk management consulting firm, they show five different risk reports as examples of the range of options.

Where possible, leverage existing proven templates and software to create a report that is accurate and easy to maintain. If the project manager can influence existing templates or is in the situation of creating a new risk report, use these guidelines:

- Does the report provide the information needed to make decisions (versus showing a bunch of colored graphs for the sake of having a graph)?

- Does the report convey how risk is being managed (versus just reporting status)?

- Is the report giving equal attention to all risks (versus focusing on the highest potential risks)?

- Is the report data connected to risk management activities (versus functioning as a standalone document)?

- Do report updates require excessive time from the team (versus the use of automation or software tools to minimize time and maximize accuracy)?

As the project manager builds out the template for a project’s risk report, know it can leverage a combination of summary text, dashboards, heat maps, and/or matrixes, but what is most important is the value it brings to the overall risk management work.

How Risk Report fits into Risk Management documents

The risk report does not replace other risk management documents. It serves a specific purpose within the overall project risk management efforts.

The risk register document has information about individual risks, assessment, and status. It is an input into the risk report which conveys the overall risk status at a given moment. Both are part of the overall risk management plan.

A risk report is an indicator of the performance of the overall risk management work. Project managers should use the risk report to convey risk status to the team and to provide information to stakeholders to inform risk management decisions.

Upcoming PMP Certification Training – Live & Online Classes

- Megan Bell #molongui-disabled-link What is a Project Schedule Network Diagram?

- Megan Bell #molongui-disabled-link Scheduling Methodology: Build & Control Your Project Schedule

- Megan Bell #molongui-disabled-link Schedule Baseline: How to Create, Use, and Optimize

- Megan Bell #molongui-disabled-link How to Use Agile in Project Management as a PMP® Credential Holder

Popular Courses

PMP Exam Preparation

PMI-ACP Exam Preparation

Lean Six Sigma Green Belt Training

CBAP Exam Preparation

Corporate Training

Project Management Training

Agile Training

Read Our Blog

Press Release

Connect With Us

PMI, PMBOK, PMP, CAPM, PMI-ACP, PMI-RMP, PMI-SP, PMI-PBA, The PMI TALENT TRIANGLE and the PMI Talent Triangle logo, and the PMI Authorized Training Partner logo are registered marks of the Project Management Institute, Inc. | PMI ATP Provider ID #3348 | ITIL ® is a registered trademark of AXELOS Limited. The Swirl logo™ is a trademark of AXELOS Limited | IIBA ® , BABOK ® Guide and Business Analysis Body of Knowledge ® are registered trademarks owned by International Institute of Business Analysis. CBAP ® , CCBA ® , IIBA ® -AAC, IIBA ® -CBDA, and ECBA™ are registered certification marks owned by International Institute of Business Analysis. | BRMP ® is a registered trademark of Business Relationship Management Institute.

The Project Management Guide

No nonsense Project Management tips, tricks, strategies and shortcuts

How To Write A Good Risk Statement

Risks should be written down as a Risk Statement and logged in the Risk Log. They should be reviewed regularly to ensure they are being managed and communicated effectively.

It is essential to write clear risk statements in order to understand them, assess their importance, and communicate them to stakeholders and people working on the project.

The Risk Statement helps everyone understand and prioritise the risks on the project. The Project Manager will focus on communicating and managing the highest priority risks.

Risk Statement is a communication tool

The Risk Statement is used to communicate the risk to the relevant stakeholders, if it is of sufficient importance. It should state clearly:

- What the risk is

- What the trigger is for the risk ie what will cause it to happen

- What the impact of the risk is if it happens

In addition to this each risk should be:

- One single risk

- Understandable to the audience intended ie it should be jargon free or non-technical if targeted at executives

The key point is that if people understand what the risk is they can then help to mitigate it.

Risk Statement format

Using a standard format for writing Risk Statements helps to ensure all of the essential elements are covered. For example:

“If <event X> happens then there is a risk <consequence> that the project could be impacted in <Y way> ”

Example 1: If the new servers are not delivered by 10 th February, then there is a risk that the commissioning engineers will not be able to start on the 11 th and so there could be a delay to the project timeline.

Broken down: If [EVENT] the new servers are not delivered by 10 th February, then there is a risk that the [CONSEQUENCE] commissioning engineers will not be able to start on the 11 th and so there could be a [IMPACT] delay to the project timeline

Example 2: If the new HR software is not delivered by 1 st May, then we may have to extend the contracts for the HR software testing team meaning there would be an increase in budget required.

Broken down: If [EVENT] the new HR software is not delivered by 1 st May, then we may have to [CONSEQUENCE] extend the contracts for the HR software testing team meaning there would be an [IMPACT] increase in budget required.

Prioritising Risks

Once the Risk Statement has been completed then its likelihood and impact can be assessed and scored. The Project Manager can then decide how important the risk is and who needs to know about it and assist with its mitigation.

See the article: How to rate project risks for likelihood and impact .

Back to Help with starting and running projects

Become A Better Project Manager

Get expert Project Management tips directly to your InBox by subscribing to The Project Management Guide blog.

- How it works

- Case studies

How to create standout risk reports that demonstrate the real value of Risk

Risk management - and the risk team itself - can gain greater traction with senior leaders and the board if risk reports centre around a few key principles; know your audience, make it relevant, hone the narrative, visualise your risk, and provide a future outlook. From examples contributed by our membership, we've aggregated the core components that make up effective risk reporting.

%20(800%20%C3%97%20800px).png?width=800&height=800&name=Untitled%20(1910%20%C3%97%201000px)%20(800%20%C3%97%20800px).png)

As risk leaders look for a way to advance their risk reporting frameworks and better engage the business on risk, the next step for many risk teams is finding a way to add demonstrable value to the business through reporting.

With this in mind, we have distilled key insights shared by risk leaders in our membership to produce this article. It provides a high-level overview as to why risk reporting is important, how risk teams can effectively report risk to senior leaders, and how businesses report risks to the wider world.

It also underlines the importance of evolving your risk reporting process so that it remains relevant and continues to meet the needs of business leaders, as well as the wider pool of external stakeholders who keep a watchful eye over how the organisation is managing its risks.

1. What is risk reporting and why is it important?

A. risk reporting definition.

It is not enough for the risk team to identify threats and opportunities to the business and monitor them in a silo. Ultimately, the purpose of the risk management function is to support the rest of the business to manage its risks better. This is where risk reporting comes in.

Through the risk reporting line, risk teams typically feed information up to the audit and risk committee and/or the executive board to raise awareness of any new risks to the business, provide updates on the status of existing risks, and potentially get senior leaders' buy-in for risk projects (read more on common risk reporting lines ).

With this information, senior leaders (especially risk owners) can cascade responsibility for the steps that need to be taken to the relevant parts of the business. For instance, if the risk team had determined that health and safety risks have become more probable based on indicators, the risk owner (with the support of the risk function) can work with parts of the business to strengthen controls and mitigate the potential risk.

b. What's the difference between internal and external risk reporting?

Reporting to who?

- Internal risk reporting is delivered by the risk team to their direct report - which in some cases is the board itself.

- External risk reporting is conducted by the business on a yearly basis via the organisation's annual report. This lets external stakeholders, such as investors, know what risks the business is monitoring and how they are being managed.

What frequency?

- Internal risk reporting tends to happen on a more frequent basis for the business to be agile enough to anticipate and respond to risks.

- External risk reporting is less frequent, as it's produced for the company annual report.

How does the content differ?

- Internal risk reporting has greater depth than what is covered in a typical risk section of a company annual report. With more detail and no mandated requirements, the report is tailored to the needs of the business, focusing on action points.

- External risk reporting is a more brief, high-level overview of the risks the business is focusing on. The contents is often dictated by the mandates of the jurisdiction the company is in. These require listed businesses to include certain information in their reports (e.g. since April 2022, the UK has required listed businesses to report on their climate-related financial disclosures).

c. When and how often should companies generate risk reports?

According to two benchmark studies we've conducted recently:

- It is most common for risk reports to be generated quarterly, regardless of the company's risk operating model . This is because, for most companies, the CRO or direct report of the risk team (for example, the chief financial officer) reports to the audit and risk committee (ARC) or the board once a quarter. This places a requirement on the centralised or decentralised group risk function to review their risk registers, indicators and other data sources and prepare their report on a regular basis.

- When risk teams report directly to the board, 48% of businesses generate and deliver risk reports on a biannual basis.

- 69% of companies report quarterly into the audit and risk committee.

d. How can risk reporting add value to a business?

It is one thing to improve the quality of different aspects of your risk reporting, but the key question risk leaders are asking themselves is, how can risk reporting add value to the business? Having the answer to this question is what will get you noticed by senior stakeholders and business decision-makers.

2. How do risk teams report on risk to the business?

A. most common risk reporting lines used by businesses.

A typical risk reporting structure at most businesses will see the risk team report information up to senior management and the board. However, the risk reporting lines that sit beneath this broad structure tend to differ from company to company.

Based on research we have conducted with a range of practising risk managers across multiple sectors in our global benchmark on risk operating models , two risk reporting lines stand out:

- For companies with a 'head of risk' the most common reporting line is to the organisation's chief financial officer (CFO), who would be responsible for providing feedback on risk at board-level management committees.

- For companies that have a chief risk officer (CRO), approximately half of them have a direct reporting line into the CEO and the board on risk. This is a particular trend amongst heavily regulated organisations, such as financial institutions.

While these two reporting lines stand out from the rest, the graphic below highlights the diversity of risk reporting lines currently being used by organisations - many heads of risk report into general counsel, while the number of risk teams who report into a chief strategy officer is on the rise, indicating a movement towards integrating risk with strategy at many organisations.

There are many variables at play that may influence the risk reporting lines certain cohorts of businesses have in place. Companies within particular sectors may be more likely to have a specific type of risk reporting line, while geography is also a factor - for instance, European-based companies tend to have a CRO who reports into the board. Download the benchmark for more trends and analysis.

b. Create an effective risk reporting template

In order to standardise risk reporting and ensure consistency, most risk teams use a template to structure their risk reporting. When preparing their risk reporting template, risk leaders should consider who the audience will be and factor this in when deciding what details (and how much) to include.

If the answer is a member (or members) of the executive committee, several of whom may be risk owners, you may want to include more practical information to help them understand how to manage these risks better. However, if the report is going to the board, it may be better to keep information high level so that they are not overwhelmed with the specifics and are more likely to engage.

Our Risk reporting to the ARC and board benchmark highlights divergences between the reports delivered to these two entities - for example:

- 55% of those contributing to the benchmark agree that ARC and board reports required different content.

- 30% of companies comment that their board reports are more strategic, while 20% note that ARC reports focus more on the short-term impact of risks.

What almost all risk leaders agree on is that risk reporting should be used to anticipate and answer questions before the audience asks them - this is a key part of building trust with the board. How do you get buy-in from the board and ARC ?

So, what might you include in your risk reporting template?

Risk reporting models for the ARC and board

This analysis takes a deep-dive into the key reporting models used by over 50 multinational organisations using data from our benchmark. Download here .

c. Source information by using the right indicators

According to risk leaders, the main challenge when it comes to sourcing data for your risk report is identifying a single source of truth, especially if there are multiple legacy systems to combine and different processes across the business for collecting risk information. The latter is a particular obstacle for large, multinational organisations with a decentralised governance structure.

Ultimately, to have confidence in your risk reporting, you need to have confidence in your key risk indicators (KRIs). Many risk leaders define a set of relevant and manageable KRIs by adopting a quality-over-quantity mindset, focusing on indicators that i) actually matter to the organisation and ii) are not too complex to monitor and update regularly.

To make these KRIs reliable, it is important to establish clear ownership for gathering and inputting information. In most cases, this will mean risk owners taking responsibility for their risk registers and checking that tasks have been completed consistently and at the right time. Many risk teams also remain on hand to support risk owners and challenge the data provided when necessary.

In addition, indicators are most useful when they have a dual purpose: to monitor an increase (or decrease) in the likelihood of any given risk, and provide an insight into the potential impact and appetite of the risk.

Connecting your suite of indicators to risk appetite will help to keep the threat and opportunity aspects of risk in balance. While it is vital to wave the red flag to executives and the board when too much risk is being taken, not taking enough risk should also be highlighted in risk reports.

d. Engage stakeholders with visual risk reporting

When preparing a risk report, risk teams have to consider what will engage senior leaders - an overabundance of narrative and text, or visuals that communicate ideas simply and efficiently .

For most companies, a visual representation of how the business' principal/material risks are developing - most commonly displayed in the form of a heatmap - is the preferred method. But risk leaders at organisations in our network are taking their risk reporting to the next level with their visualisations.

e. Get buy-in from the board and ARC

While using visuals is one effective method to boost engagement from senior leaders during the risk reporting process, there are many other ways to get buy-in from the board and ARC that risk leaders in our membership are implementing.

Firstly, it's crucial to tell a story during risk reporting and provide context to your audience: don't just tell them what is happening, but why it is happening. For instance, one risk leader in the network uses a visual moodboard of risks to tie the business' principal/material risks to events developing in the organisation's external environment:

Some risk teams are working with guest contributors to add credibility and weight to their risk reporting. Using a subject matter expert voice from within the business to add credence to your argument - whether it be a quote in a risk report or attending a meeting with the board in person - can get senior leaders to take notice and place more importance on suggested actions.

Moreover, deviating from the status quo every so often can prove effective so that the content of your risk reporting doesn't become stale or boring - if business leaders feel like risk reporting is a repetitive process that rarely develops or changes, this may cause certain risks to be overlooked.

Ultimately, engaging with executives and the board requires you to know your audience: what concerns them, and how can risk management impact this in a positive way. If the board cares about the long-term success and viability of the business, framing risk through a strategic lens is a good way to get their attention.

f. Link risk to strategy and objectives

Risk leaders in the network have shared, from experience, that compiling a risk report from the default position of "what could go wrong" can leave you with a list of risks that feels disconnected from the business itself. Instead, asking first "what matters to the business" can help you to achieve greater stakeholder engagement from the outset.

In order to focus on what matters to the business, it can help to overlay risks onto the company's strategic objectives - in other words, how will risks impact, for better or worse, the ability of the business to achieve its goals? An easy way to visualise this relationship is employing a Venn diagram:

Where there are overlaps between risks and objectives, you can signal to business leaders that threats or opportunities should be prioritised. Furthermore, drawing a clear link between strategy in your reporting can help to embed risk within the strategic mindset of the business and get Risk a regular role in strategy conversations. While it is useful for the risk team to highlight areas where risks may affect the business' existing strategy, the next evolution of this is for Risk to guide the development of new goals and strategies. Once again, this will allow risk management to add value.

g. Create a radar of risks for emerging risk reporting

Outer layer

Emerging threats and opportunities the business should be aware of, even if no actions are required at this point.

Middle ring

Contains what some risk leaders refer to as 'Tier 2 risks' - those risks that the executive leadership team (including risk owners) should be monitoring.

Innermost circle

'Tier 1 risks' - the priority risks that need to be escalated to the board.

a. What are the key features of a risk section in an annual report?

Most businesses, especially listed companies in jurisdictions where there are specific reporting requirements, will include a risk section in their annual report, although the content of these sections, as well as the amount of detail given, varies between companies.

Using data from the Risk Reporting Comparison Tool , there are some clear trends around the risk section of an annual report:

- On average the risk section of a company's annual report takes up about 5% of the overall document , highlighting that it is not an insignificant part of the overall reporting process.

- Rounded to the nearest whole number, the average number of principal / material risks shared by businesses is 12; usually, a company's list of principal or material risks only varies slightly year-on-year.

- Most risk sections will include reference to the trend of individual risks (65%) - in other words, is the risk increasing, stable or decreasing - and how each risk links to strategy (56%).

- Although the majority of companies do not categorise principal/material risks as part of their annual report, a significant number of businesses (43%) do organise their risks under a few key headings (e.g. financial, operational, strategic etc.).

- Just 16% of companies mention their appetite for each risk in their annual reporting and even fewer (5%) refer to opportunities in the risk section.

- In terms of emerging risks, 35% of companies list these specifically in the risk section of their annual report, although a much larger proportion will acknowledge that they conduct horizon scanning for threats and opportunities to the business.

These figures are based on data in the Risk Reporting Comparison Tool, as of February 2023.

b. What are the top principal and emerging risks companies currently report?

Unsurprisingly, the leading principal/material risks reported by companies vary by sector. For example, while Cyber Security and Digital Transformation are top risks for computer software companies, businesses in other industries are focusing more on other kinds of threats and opportunities.

Here are a few trends based on a cross-sector analysis of companies across all industries based on data from our Risk Reporting Comparison Tool :

- Talent was the most reported risk category in 2022 and 2023, with the number of mentions increasing year on year.

- Climate Change and Environment and Sustainability account for over 7% of principal/material risks reported in company annual reports.

- Cyber Security is the second-most reported risk category, accounting for 6.49% of principal/material risks reported in 2023 (compared to 6.13% in 2022).

As for emerging risks, Regulation remains the most mentioned emerging risk , accounting for almost 9% of the emerging risks mentioned in external reports.

Going into 2024, we've noticed a significant rise in geopolitical emerging risks, with trade disputes, East-West divide, Russia-Ukraine war, East-West divide being cited by companies as examples of those risks.

c. What do companies include in TCFD disclosures?

The purpose and content of annual reports continue to evolve as companies adapt to changing regulations and investor demands.

In April 2022, it became a requirement for FTSE-listed businesses in the UK to include a TCFD disclosure in their annual report. It seems likely that the requirement will soon be imposed on listed businesses in other markets, which raises the question: what should you include in your TCFD disclosure?

Based on data from our TCFD Reporting Comparison Tool , trends are starting to emerge:

- The most common aspects of a TCFD disclosure are risks (and opportunities), targets and scenarios, all of which are covered in over 75% of the reports we have analysed.

- While the different climate-related risks are essentially split into two categories - physical and transition - there is a wide variety of scenarios and targets that businesses are reporting against. For example, many companies have a short-term emissions target to 2025, though some organisations also have set goals (e.g. net-zero emissions) up to 2030, 2040 and even 2050.

4. How do you maintain relevant and effective risk reporting?

A. ensure the risk reporting process is fit for purpose.

In order to validate your risk reporting approach and identify areas for improvement, it's worth considering how (and where) you can build in opportunities for feedback into your risk report. This is especially important when it comes to engaging the board - is there a communication channel in place for them to ask the risk team questions if they are confused, or provide a healthy amount of challenge if they disagree with aspects of the risk report?

Ultimately, the only way you can be sure that your risk reporting process is fit for purpose is to understand business leaders' response to it. Below we have highlighted some key questions a risk team may want to ask themselves before delivering their latest risk report.

b. Monitor the effectiveness of risk reports

Given the process-driven nature of risk reporting, it's easy to understand how this activity can become a repetitive exercise that disengages people around the business - especially leaders to whom risk reports are presented. For this reason, it's important to observe how effective your latest risk report is, in terms of provoking action and contributing to decision making.

The simplest way to test whether your risk report is actually having a meaningful impact on the business is to include key follow-on actions and monitor whether the organisation is putting these into motion from the top-down. If not, and in the absence of any communication as to why, it's evident that risk reporting has become a token exercise that senior leaders are all too willing to ignore.”

.png?width=1080&height=1080&name=Untitled%20design%20(2).png)

Risk Leadership Network member

Of course, these actions may be a result of disengagement, lack of awareness or lack of motivation at the business unit level - in this case, it's important for the risk team to work together with risk owners and champions to cultivate the right kind of culture.

One way to gauge how risk reports resonate with senior leads is to push for a more active role in presenting this information . While handing an executive and/or member of the board a document might not get much of a response, presenting your risk report in person will enable you to engage directly with the intended audience and discover what does, and does not, resonate with them.

This is a popular option: according to our Risk reporting to the ARC and board benchmark, 80% of businesses state that their most senior risk resources presents both the board and ARC report entirely face-to-face or with some element of face-to-face interaction.

%20(800%20%C3%97%20800px)%20(2).png?width=800&height=800&name=Untitled%20(1910%20%C3%97%201000px)%20(800%20%C3%97%20800px)%20(2).png)

c. Update your risk reporting template

If you want the board, ARC and other leaders around the business to continue engaging with your risk reports, it's vital to keep reporting fresh and add new layers of insight over time. You don't want to overwhelm the business by presenting a vastly expanded risk report with too much detail - however, incremental shifts in reporting may be greeted with a warmer response.

Risk leaders across the network are taking steps to update and advance their risk reporting process by incorporating elements such as appetite and culture if these are not already being reported on separately.

Interestingly, less than 50% of the companies in our Risk reporting to the ARC and board benchmark have risk appetite as a standalone section or agenda item in their report, suggesting that there is an opportunity for companies to add this particular lens to their risk reporting process.

According to one of our members who does include appetite in their report, they feature a colour-coded dashboard that links risk appetite to the business' key risk indicators.

If parts of this dashboard have turned red, this means that certain risks are starting to push either the upper or lower limit of risk appetite, constituting a threat to the business that must be addressed. This is designed to trigger action from senior leaders.

On the matter of culture, risk leaders note that persistent reporting on risk culture provides a record of an organisation's work in this area, signalling how the business has already evolved and ways for it to develop further. By at least including a reference to culture in your risk reporting, you may be able to prompt better discussion about the topic with the wider business.

More on risk reporting at Risk Leadership Network

Risk Leadership Network empowers risk leaders to implement better risk practice by facilitating practical knowledge sharing between peers. Through bespoke and tailored network assistance, we facilitate the specific collaborations that enable our members to solve challenges quickly.

This guide is an overview of some of the key lessons shared by risk leaders in our network on risk reporting. There are far more case studies, templates, tools and bespoke opportunities to collaborate with practising risk leaders with membership to Risk Leadership Network . Meanwhile, here are all the resources and opportunities to get involved mentioned in this article.

General resources/opportunities to get involved:

Internal risk reporting:

.png?width=1080&height=1080&name=HST_Societal%20Trends%20(5).png)

External risk reporting:

Related posts you may be interested in

Reporting risks in smarter ways - our Risk Reporting Comparison Tool

Communicating the status of material risks: three common approaches and three alternatives

Reporting risk in a smart way: risk reporting comparison tool, get new posts by email.

Risk Management Report Template

Identify and describe the risks involved, estimate the impact of each risk, categorize the risks.

- 1 Technical Risks

- 2 Financial Risks

- 3 Operational Risks

- 4 Legal Risks

- 5 Market Risks

Approval: Categorization of Risks

- Categorize the risks Will be submitted

Determine the likelihood of occurrence of each risk

- 1 Very High

Conduct a risk assessment

Develop risk mitigation strategies, implementation of risk mitigation strategies, approval: risk mitigation strategies.

- Develop risk mitigation strategies Will be submitted

- Implementation of risk mitigation strategies Will be submitted

Monitor and control risks on a regular basis

Update the risk register, conduct a risk review meeting, approval: risk review meeting.

- Conduct a risk review meeting Will be submitted

Prepare a draft of the risk management report

Review the draft, approval: draft review.

- Review the draft Will be submitted

Finalize the risk management report

Approval: final risk management report.

- Finalize the risk management report Will be submitted

Distribute the finalized report to all stakeholders

Schedule a meeting to discuss the report, take control of your workflows today., more templates like this.

The Essentials of Effective Project Risk Assessments

By Kate Eby | September 19, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Performing risk assessments is vital to a project’s success. We’ve gathered tips from experts on doing effective risk assessments and compiled a free, downloadable risk assessment starter kit.

Included on this page, you’ll find details on the five primary elements of risk , a comprehensive step-by-step process for assessing risk , tips on creating a risk assessment report , and editable templates and checklists to help you perform your own risk assessments.

What Is a Project Risk Assessment?

A project risk assessment is a formal effort to identify and analyze risks that a project faces. First, teams identify all possible project risks. Next, they determine the likelihood and potential impact of each risk.

During a project risk assessment, teams analyze both positive and negative risks. Negative risks are events that can derail a project or significantly hurt its chances of success. Negative risks become more dangerous when teams haven’t identified them or created a plan to deal with them.

A project risk assessment also looks at positive risks. Also called opportunities, positive risks are events that stand to benefit the project or organization. Your project team should assess those risks so they can seize on opportunities when they arise.

Your team will want to perform a project risk assessment before the project begins. They should also continually monitor for risks and update the assessment throughout the life of the project.

Some experts use the term project risk analysis to describe a project risk assessment. However, a risk analysis typically refers to the more detailed analysis of a single risk within your broader risk assessment. For expert tips and information, see this comprehensive guide to performing a project risk analysis.

Project risk assessments are an important part of project risk management. Learn more from experts about best practices in this article on project risk management . For even more tips and resources, see this guide to creating a project risk management plan .

How Do You Assess Risk in a Project?

Teams begin project risk assessments by brainstorming possible project risks. Avoid missing important risks by reviewing events from similar past projects. Finally, analyze each risk to understand its time frame, probability, factors, and impact.

Your team should also gather input from stakeholders and others who might have thoughts on possible risks.

In general terms, consider these five important elements when analyzing risks:

- Risk Event: Identify circumstances or events that might have an impact on your project.

- Risk Time Frame: Determine when these events are most likely to happen. This might mean when they happen in the lifecycle of a project or during a sales season or calendar year.

- Probability: Estimate the likelihood of an event happening.

- Impact: Determine the impact on the project and your organization if the event happens.

- Factors: Determine the events that might happen before a risk event or that might trigger the event.

Project Risk Assessment Tools

Project leaders can use various tools and methodologies to help measure risks. One option is a failure mode and effects analysis. Other options include a finite element analysis or a factor analysis and information risk.

These are some common risk assessment tools:

- Process Steps: Identify all steps in a process.

- Potential Problems: Identify what could go wrong with each step.

- Problem Sources: Identify the causes of the problem.

- Potential Consequences: Identify the consequences of the problem or failure.

- Solutions: Identify ways to prevent the problem from happening.

- Finite Element Analysis (FEA): This is a computerized method for simulating and analyzing the forces on a structure and the ways that a structure could break. The method can account for many, sometimes thousands, of elements. Computer analysis then determines how each of those elements works and how often the elements won’t work. The analysis for each element is then added together to determine all possible failures and the rate of failure for the entire product.

- Factor Analysis of Information Risk (FAIR): This framework helps teams analyze risks to information data or cybersecurity risk.

How to Conduct a Project Risk Assessment

The project manager and team members will want to continually perform risk assessments for a project. Doing good risk assessments involves a number of steps. These steps include identifying all possible risks and assessing the probability of each.

Most importantly, team members must fully explore and assess all possible risks, including risks that at first might not be obvious.

“The best thing that a risk assessment process can do for any project, over time, is to be a way of bringing unrecognized assumptions to light,” says Mike Wills , a certified mentor and coach and an assistant professor at Embry-Riddle Aeronautical University’s College of Business. “We carry so many assumptions without realizing how they constrain our thinking.”

Steps in a Project Risk Assessment

Experts recommend several important steps in an effective project risk assessment. These steps include identifying potential risks, assessing their possible impact, and formulating a plan to prevent or respond to those risks.

Here are 10 important steps in a project risk assessment:

Step 1: Identify Potential Risks

Bring your team together to identify all potential risks to your project. Here are some common ways to help identify risks, with tips from experts:

- Review Documents: Review all documents associated with the project.

- Consider Industry-Specific Risks: Use risk prompt lists for your industry. Risk prompt lists are broad categories of risks, such as environmental or legal, that can occur in a project.

- Revisit Previous Projects: Use checklists from similar projects your organization has done in the past.

- “What I like to do for specific types of projects is put together a checklist, a taxonomy of old risks that you've identified in other projects from lessons learned,” says Wendy Romeu, President and CEO of Alluvionic . “Say you have a software development program. You would pull up your template that includes all the risks that you realized in other projects and go through that list of questions. Then you would ask: ‘Do these risks apply to our project?’ That's kind of a starting point.” “You do that with your core project team,” Romeu says, “and it gets their juices flowing.” Learn more about properly assessing lessons learned at the end of a project in this comprehensive guide to project management lessons learned .

- Consult Experts: Conduct interviews with experts within and, in some cases, outside your organization.

- Brainstorm: Brainstorm ideas with your team. “The best scenario, which doesn't usually happen, is the whole team comes together and identifies the risks,” says Romeu.

- Stick to Major Risks: Don’t try to identify an unrealistic or unwieldy number of risks. “You want to identify possible risks, but you want to keep the numbers manageable,” says Wills. “The more risks you identify, the longer you spend analyzing them. And the longer you’re in analysis, the fewer decisions you make.”

- Look for Positive Risks: Identify both positive risks and negative ones. It’s easy to forget that risks aren’t all negative. There can be unexpected positive events as well. Some people call these opportunities , but in a risk assessment, experts call them positive risks.

- “A risk is a future event that has a likelihood of occurrence and an impact,” says Alan Zucker, founding principal of Project Management Essentials , who has more than two decades of experience managing projects in Fortune 100 companies. “Risks can both be opportunities — good things — and threats. Most people, when they think about risk assessment, they always think about the negatives. I really try to stress on people to think about the opportunities as well.” Opportunities, or positive risks, might include your team doing great work on a project and a client wanting the team to do more work. Positive risks might include a project moving forward more quickly than planned or costing less money than planned. You’ll want to know how to respond in those situations, Zucker says. Learn more about project risk identification and find more tips from experts in this guide to project risk identification .

Step 2: Determine the Probability of Each Risk

After your team has identified possible risks, you will want to determine the probability of each risk happening. Your team can make educated guesses using some of the same methods it used to identify those risks.

Determine the probability of each identified risk with these tactics:

- Brainstorm with your team.

- Interview experts.

- Review similar past projects.

- Review other projects in the same industry.

Step 3: Determine the Impact of Each Risk

Your team will then determine the impact of each risk should it occur. Would the risk stop the project entirely or stop the development of a product? Or would the risk occurring have a relatively minor impact?

Assessing impact is important because if it’s a positive risk, Romeu says, “You want to make sure you’re doing the things to make it happen. Whereas if it's a high risk and a negative situation, you want to do the things to make sure it doesn't happen.”

There are two ways to measure impact: qualitative and quantitative. “Are we going to do just a qualitative risk assessment, where we're talking about the likelihood and the probability or the urgency of that risk?” asks Zucker. “Or are we going to do a quantitative risk assessment, where we're putting a dollar figure or a time figure to those risks?”

Most often, a team will analyze and measure risk based on qualitative impact. The team will analyze risk based on a qualitative description of what could happen, such as a project being delayed or failing. The team may judge that impact as significant but won’t put a dollar figure on it.

A quantitative risk assessment, on the other hand, estimates the impact in numbers, often measured in dollars or profits lost, should a risk happen. “Typically, for most projects, we don’t do a quantitative risk assessment,” Zucker says. “It’s usually when we’re doing engineering projects or big, federal projects. That’s where we're doing the quantitative.”

Step 4: Determine the Risk Score of Each Event

Once your team assesses possible risks, along with the risk probability and impact, it’s time to determine a risk score for each potential event. This score allows your organization to understand the risks that need the most attention.

Often, teams will use a simple risk matrix to determine that risk score. Your team will assign a score based on the probability of each risk event. It will then assign a second score based on the impact that event would have on the organization. Those two figures multiplied will give you each event or risk a risk score.

Zucker says he prefers to assign the numbers 1, 5, and 10 — for low, medium, and high — to both the likelihood of an event happening and its impact. In that scenario, an event with a low likelihood of happening (level of 1) and low impact (level of 1) would have a total risk score of 1 (1 multiplied by 1). An event with a high likelihood of happening (level of 10) and a large impact (level of 10) would have a total risk score of 100.

Zucker says he prefers using those numbers because a scale as small as one to three doesn't convey the importance of high-probability and high-impact risks. “A nine doesn't feel that bad,” he says. “But if it's 100, it's like, ‘Whoa, I really need to worry about that thing.’”

While these risk matrices use numbers, they are not really quantitative. Your teams are making qualitative judgments on events and assigning a rough score. In some cases, however, teams can determine a quantitative risk score.

Your team might determine, based on past projects or other information, that an event has a 10 percent chance of happening. For example, if that event will diminish your manufacturing plant’s production capacity by 50 percent for one month, your team might determine that it will cost your company $400,000. In that case, the risk would have a risk score of $40,000.

At the same time, another event might have a 40 percent chance of happening. Your team might determine the cost to the business would be $10,000. In that case, the risk score is $4,000.

“Just simple counts start to give you a quantifiable way of looking at risk,” says Wills. “A risk that is going to delay 10 percent of your production capacity is a different kind of risk than one that will delay 50 percent of it. Because you have a number, you can gather real operational data for a week or two and see how things support the argument. You can start to compare apples to apples, not apples to fish.”

Wills adds, “Humans, being very optimistic and terrible at predicting the future, will say, ‘Oh, I don't think it'll happen very often.’ Quantitative techniques help to get you away from this gambler fallacy kind of approach. They can make or break your argument to a stakeholder that says, ‘I've looked at this, and I can explain mechanically, count by the numbers like an accountant, what's going on and what might go wrong.’”

Step 5: Understand Your Risk Tolerance

As your team considers risks, it must understand the organization’s risk tolerance. Your team should know what kinds of risks that organizational leaders and stakeholders are willing to take to see a project through.

Understanding that tolerance will also help your team decide how and where to invest time and resources in order to prevent certain negative events.

Step 6: Decide How to Prioritize Risks

Once your team has determined the risk score for each risk, it will see which potential risks need the most attention. These are risks that are high impact and that your organization will want to work hard to prevent.

“You want to attack the ones that are high impact and high likelihood first,” says Romeu.

“Some projects are just so vital to what you do and how you do it that you cannot tolerate the risk of derailment or major failure,” says Wills. “So you're willing to spend money, time, and effort to contain that risk. On other projects, you're taking a flier. You're willing to lose a little money, lose a little effort.”

“You have to decide, based on your project, based on your organization, the markets you're in, is that an ‘oh my gosh, it's gonna keep me up every night’ kind of strategic risk? Or is it one you can deal with?” he says.

Step 7: Develop Risk Response Strategies

Once your team has assessed all possible risks and ranked them by importance, you will want to dive deeper into risk response strategies. That plan should include ways to respond to both positive and negative risks.

These are the main strategies for responding to threats or negative risks:

- Mitigate: These are actions you will take to reduce the likelihood of a risk event happening or that will reduce the impact if it does happen. “For example, if you’re building a datacenter, we might have backup power generators to mitigate the likelihood or the impact of a power loss,” says Zucker. You can learn more, including more tips from experts, about project risk mitigation .

- Avoid: If a certain action, new product, or new service carries an unacceptably high risk, you might want to avoid it entirely.

- Transfer: The most common way that organizations transfer risk is by buying insurance. A common example is fire insurance for a building. Another is cybersecurity insurance that would cover your company in the event of a data breach. An additional option is to transfer certain risks to other companies that can do the work and assume its risks for your company. “It could be if you didn't want to have the risk of running a datacenter anymore, you transfer that risk to Jeff Bezos (Amazon Web Services) or to Google or whoever,” Zucker says.

These are the main strategies for responding to opportunities or positive risks:

- Share: Your company might partner with another company to work together on achieving an opportunity, and then share in the benefits.

- Exploit: Your company and team work hard to make sure an event happens because it will benefit your company.

- Enhance: Your company works to improve the likelihood of something happening, with the understanding that it might not happen.

These are the main strategies for responding to both threats and opportunities, or negative and positive risks:

- Accept: Your company simply accepts that a risk might happen but continues on because the benefits of the action are significant. “You're not ignoring the risks, but you're saying, ‘I can't do anything practical about them,’” says Wills. “So they're there. But I'm not going to spend gray matter driving myself crazy thinking about them.”

- Escalate: This is when a project manager sees a risk as exceptionally high, impactful, and beyond their purview. The project manager should then escalate information about the risk to company leaders. They can then help decide what needs to happen. “Some project managers seem almost fearful about communicating risks to organization leaders,” Romeu says. “It drives me nuts. It's about communicating at the right level to the right people. At the executive level, it’s about communicating what risks are happening and what the impact of those risks are. If they happen, everybody knows what the plan is. And people aren't taken by surprise.”

Step 8: Monitor Your Risk Plans

Your team will want to understand how viable your organization’s risk plans are. That means you might want to monitor how they might work or how to test them.

A common example might be all-hands desktop exercises on a disaster plan. For example, how will a hospital respond to a power failure or earthquake? It’s like a fire drill, Zucker says. “Did we have a plan? Do people know what to do when the risk event occurs?”

Step 9: Perform Risk Assessments Continually

Your team will want to continually assess risks to the project. This step should happen throughout your project, from project planning to execution to closeout.

Zucker explains that the biggest mistake teams tend to make with project risk assessment: “People think it's a one-and-done event. They say, ‘I’ve put together my risk register, we’ve filed it into the documents that we needed to file, and I'm not worrying about it.’ I think that is probably the most common issue: that people don't keep it up. They don't think about it.”

Not thinking about how risks change and evolve throughout a project means project leaders won’t be ready for something when it happens. That’s why doing continual risk assessment as a primary part of risk management is vital, says Wills.

“Risk management is a process that should start before you start doing that activity. As you have that second dream about doing that project, start thinking about risk management,” he says. “And when you have completely retired that thing — you've shut down the business, you've pensioned everybody off, you’re clipping your coupons and working on your backstroke — that's when you're done with risk management. It's just a living, breathing, ongoing thing.”

Experts say project managers must learn to develop a sense for always assessing and monitoring risk. “As a PM, you should, in every single meeting you have, listen for risks,” Romeu says. “A technical person might say, ‘Well, this is going to be difficult because of X or Y or Z.’ That's a risk. They don't understand that's a risk, but as a PM, you should be aware of that.”

Step 10: Identify Lessons Learned

After your project is finished, your team should come together to identify the lessons learned during the project. Create a lessons learned document for future use. Include information about project risks in the discussion and the final document.

By keeping track of risks in a lessons learned document, you allow future leaders of similar projects to learn from your successes and failures. As a result, they can better understand the risks that could affect their project.

“Those lessons learned should feed back into the system — back into that original risk checklist,” Romeu says. “So the next software development project knows to look at these risks that you found.”

How to Write a Project Risk Assessment Report

Teams will often track risks in an online document that is accessible to all team members and organization leaders. Sometimes, a project manager will also create a separate project risk assessment report for top leaders or stakeholders.

Here are some tips for creating that report:

- Find an Appropriate Template for Your Organization, Industry, and Project: You can find a number of templates that will help guide you in creating a risk assessment report. Find a project risk assessment report template in our project risk assessment starter kit.

- Consider Your Audience: As you create the report, remember your audience. For example, a report for a technical team will be more detailed than a report for the CEO of your company. Some more detailed reports for project team members might include a full list of risks, which would be 100 or more. “But don't show executives that list; they will lose their mind,” says Romeu.

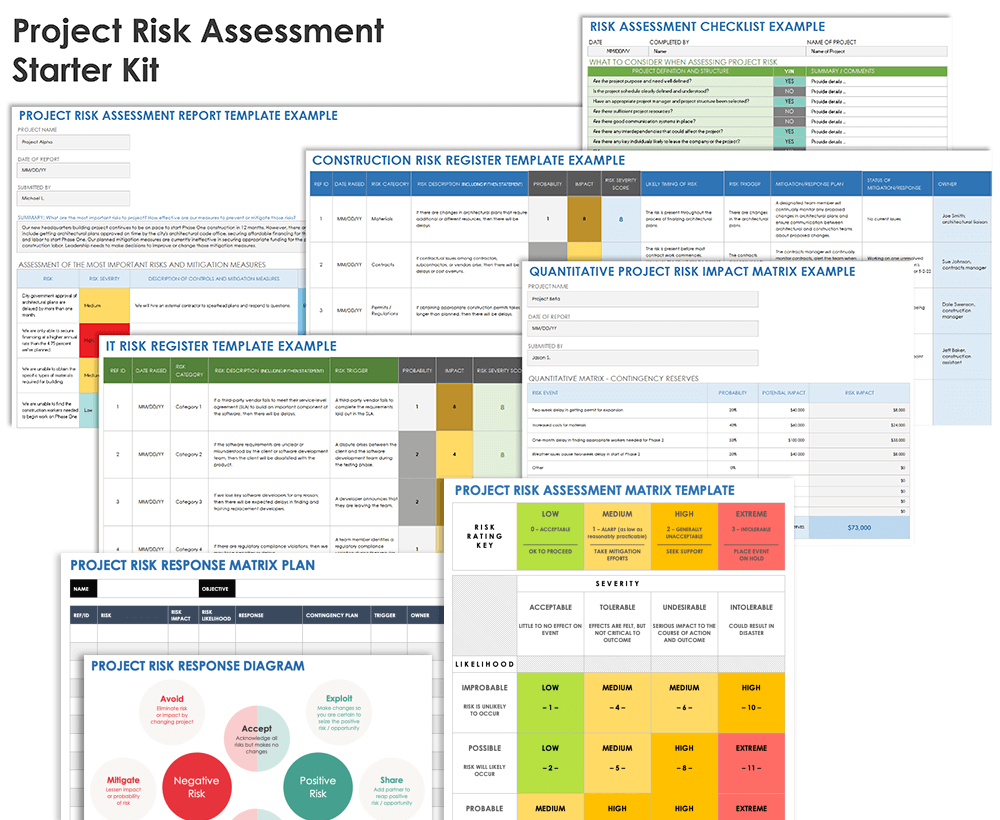

Project Risk Assessment Starter Kit

Download Project Risk Assessment Starter Kit

This starter kit includes a checklist on assessing possible project risks, a risk register template, a template for a risk impact matrix, a quantitative risk impact matrix, a project risk assessment report template, and a project risk response table. The kit will help your team better understand how to assess and continually monitor risks to a project.

In this kit, you’ll find:

- A risk assessment checklist PDF document and Microsoft Word to help you identify potential risks for your project. The checklist included in the starter kit is based on a document from Alluvionic Project Management Services.

- A project risk register template for Microsoft Excel to help you identify, analyze, and track project risks.

- A project risk impact assessment matrix for Microsoft Excel to assess the probability and impact of various risks.

- A quantitative project risk impact matrix for Microsoft Excel to quantify the probability and impact of various risks.

- A project risk assessment report template for Microsoft Excel to help you communicate your risk assessment findings and risk mitigation plans to company leadership.

- A project risk response diagram PDF document and Microsoft Word to better understand how to respond to various positive and negative risks.

Expertly Assess and Manage Project Risks with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Unito home /

- Risk Reporting: A Definition, Tips, and Free Templates

From negotiating on salary to investing in the stock market, risk is an inherent part of the business world. You know that risk. You’ve dealt with it. But did you know you can easily communicate that to everyone? When dealing with risks that affect an entire company, you’ll need to share information about them with people in charge. Risk reports are a tool for doing that — and if you need a little support, you’ve come to the right place.