What is an expense report?

In any organization, employees might incur business expenses that they end up paying for out of their own pockets. This ranges from travel-related expenses and client luncheons to office supplies or tech devices. Because these expenses are incurred on behalf of the firm, employees will request reimbursement for any amount they paid by submitting an expense report.

An expense report contains a categorized and itemized list of expenses that were made on behalf of the organization. This report helps the employer or finance team determine what money was spent, what was purchased, and how much of the expenditure is approved for reimbursement. Having said that, the merits of expense reports are not restricted to reimbursement claims. They also make it easier for businesses to file tax returns, claim tax deductions, and complete audits.

In this guide, you will learn all about expense reports—what they contain, why they are important, and most importantly, how to create them.

When an employee requests reimbursement for business expenses they paid for with their own money, these expenses are outlined on a paper or digital document called an expense report. Typically, these expenses are organized by categories, such as office supplies, meals, or mileage. They are also itemized so that multiple entities are listed along with their individual costs. This allows for more detailed auditing during the approval process than only listing the total amount of expenses incurred. Usually, an expense report is also submitted with the corresponding receipts for each itemized purchase.

Expense reports help track business spending and are usually generated on a monthly, quarterly, or yearly basis.

Monthly and quarterly expense reports are essential to track all the purchases a firm has made within that period. These reports are used to check if the spending is within the organization’s budget and to identify areas where costs can be cut to maximize profits.

Yearly expense reports are used to deduct expenses on the firm’s tax returns.

Expense reporting process

Once an employee or department has submitted their expense report, their line manager or department head reviews the report for legitimacy and accuracy. Based on this validation, they can either approve the report and forward it to the finance team for reimbursement or reject it in case of a policy violation. After reimbursement, the finance team records the reimbursed amount as a business expense that impacts the accounting profits and taxable profits of the firm. Receipts and records of expense claims are then stored securely for external audits.

At times, employees are provided a certain amount in advance to cover business expenses. In those cases, expense reports are used to tally expenditures made against an advance payment. The finance department would still record the reimbursed amount as a business expense, but there would be no reimbursement and the finance team would simply deduct the total cost incurred from the employee’s advance.

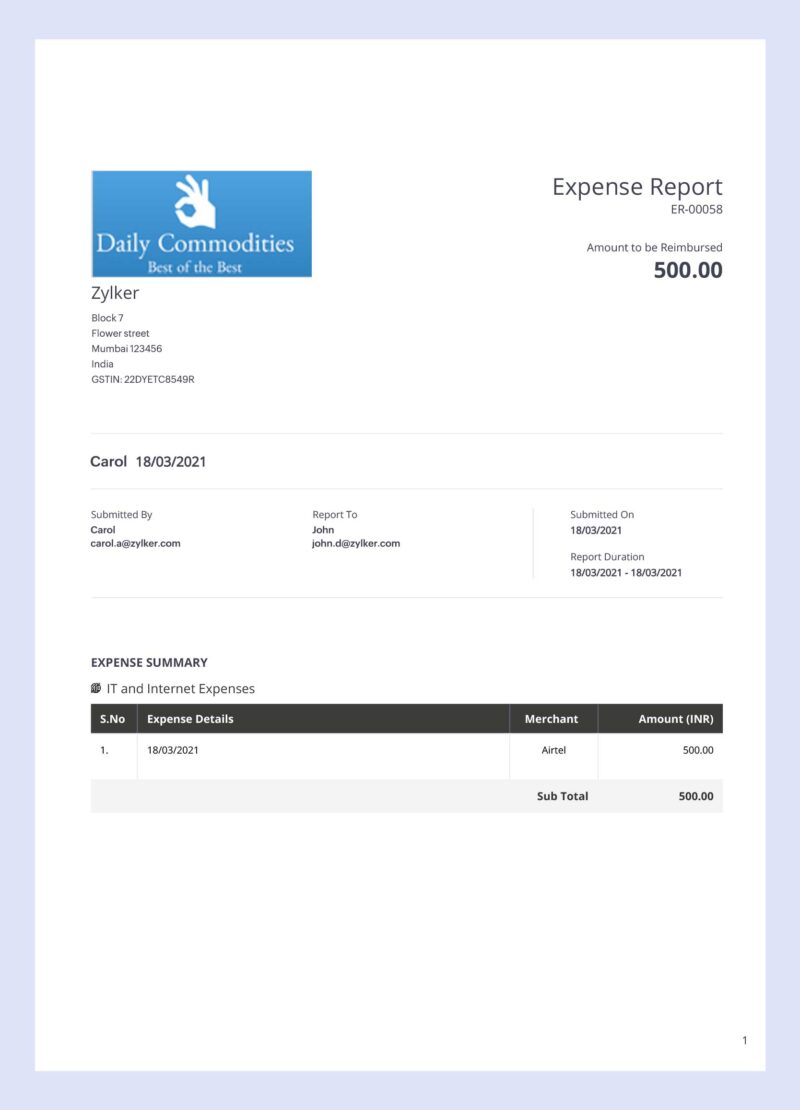

Contents of an expense report

Information about the employee submitting the report (name, department, designation, contact details, etc.)

A date and amount for each expense (correlating to the date and amount on the attached receipt)

Type of expense (meals, mileage, internet, etc.)

The merchant or vendor from whom the item was purchased

The client or project it was purchased for (if applicable)

The account to which the expense is to be charged from your firm’s chart of accounts

Additional descriptions about each expense

A subtotal for each type of expense and the total cost of the expenses, including tax

A subtraction for prior advances paid to the employee (if applicable)

Why do we need expense reports?

Here are a few benefits of generating expense reports:

Facilitates efficient expense tracking and cost control

Cost control ideally begins with reviewing expense report data. This helps in tracking your firm’s spending over time by giving you a clearer picture of how much money is being spent and what it’s being spent on. You can also decipher how much your employees are spending with respect to different expense categories, check which categories are driving the costs up, and strategize on how to reduce or eliminate these costs. Analyzing these reports also helps you identify loopholes in expense policies that lead to increased expenditure and decide which vendors to prioritize and which ones to let go.

Helps with budgeting

Budgets are absolutely key to running a business smoothly. Detailed and accurate expense reports help with structuring a strong and informed financial plan for your organization’s future. This allows more appropriate budgets to be allocated for various projects and departments. With consistent expense reporting, you can verify if the different departments or projects are adhering to their budget thresholds in order to keep your business financially secure in the long run.

Makes for accurate reimbursements

If an employee has paid for business expenses out of their pocket, they would want a reimbursement that is accurate and fair. Luckily, you also want to make sure the request is fair so you aren’t paying more than you owe. Expense reporting puts a standardized process in place where employees are made aware of what can and can’t be expensed, and it also gives organizations a faster way to determine if a claim is legitimate. An itemised expense report with receipts attached acts as solid evidence about when, where, and how any expenses were incurred, and whether they are compliant with your organization’s expense policy.

Simplifies tax deductions

Many business expenses incurred by your employees while at work are tax-deductible. However, you cannot claim deductions for expenses unless you have them properly recorded with proof that they were actually incurred. Some business owners use their bank account or corporate card statements as a source to list all their deductible expenses. However it’s important to note that these statements may not reflect all expenses. Expense reports, on the other hand, simplify the entire process of keeping track of deductible expenses and writing them off during tax season. All the finance team has to do is add up all the expenses that can be written off and input them into the appropriate tax forms.

From receipt to reimbursement: The expense reporting process

Most firms choose between spreadsheets, templates, and expense reporting software to generate and track expense reports. In this section, we’ll learn how expense reports are created in two different ways—manually and using expense reporting software.

Manual expense reporting with custom templates

Since creating an expense report from scratch each time is a tedious task, some organizations equip their employees with customizable, ready-made templates to prepare reports in a spreadsheet or PDF format. Here are the steps involved in this type of expense reporting:

The employee documents their name, contact information, designation, the date range covered, and the business purpose of the report.

Next, they establish the right number of rows and columns to report the expenses. Certain firms have mandatory columns and categories to match the columns and expense categories in tax return forms.

Each expense is entered in chronological order with a brief description, where the most recent expense is listed last on the report.

Once all the expenses have been reported, the employee must calculate the subtotals of all the expense categories followed by the grand total. The subtotals help the finance team analyze how much is being spent on each expense category.

Finally, the employee must attach corresponding receipts for all the expenses mentioned above. They can either provide scanned copies of the receipts or photocopies, depending upon whether they are submitting the report digitally or not.

The report is submitted to the line manager or department manager, who will validate the report and check for policy violations or fraudulent claims.

On securing their approval, the report is forwarded to the finance team for reimbursement.

Automated expense reporting

Using expense report templates is a quick way to track expenses for small businesses. However, as your firm expands, it can become too time-consuming. With multiple departments processing several expense reports a day, you will want to switch to an automated expense reporting solution to track and manage these reports more effectively.

With an expense management system, your employees can generate expense reports on the go with just a few clicks. They only need to fill in the mandated fields on the form within the application or capture their receipts digitally. With the latter option, the expense data is extracted from these receipts, and itemized claims are created automatically.

Once this is done, all the expense claims can be grouped into a report and submitted with the tap of a button. Some applications are robust enough to gather unsubmitted expense claims from a date range automatically, group them, and submit them to the designated approver.

As an alternative, your employees can connect their bank account, credit/debit card, or corporate card to the expense reporting software. Statements can then be imported automatically, or card transactions can be fetched directly from the card provider. This makes it easier for your employees to convert these transactions to expense claims.

The line manager or department manager will review the reports submitted to them and check for warnings or notifications regarding policy violations, fraud, or duplicate expenses. Approvers can set up auto-approval for reports with no warnings and auto-reject for reports that don’t meet the criteria.

Upon review, the approved report is forwarded to the finance team so reimbursements can be distributed.

Switching to expense reporting software

Filing expense reports covers the first half of the expense management process. Staying on top of your business expenses also involves maintaining policy compliance, timely reimbursements, successful expense audits, and more. This is where an expense management solution like Zoho Expense can help. It removes the need for manual data entry and paperwork by providing multiple ways to record expenses on the go. Zoho Expense:

Automates report generation and submission

Supports multiple expense policies

Weeds out policy violations and fraudulent expenses

Increases spend visibility with intuitive dashboards and analytical reports

All of these features help save you a great deal of time and money, all while keeping your employees productive and satisfied. Try Zoho Expense for free today to streamline your expense management process.

Related Posts

- 15 essential features to look for in a travel expense management system

- What is expense management software?

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

You might also like

Make your expense reporting effortless. try zoho expense today.

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is An Expense Report?

Expense reports help you understand where your money goes.

Table of Contents

To manage your business’s financial health effectively, it’s essential to have a clear picture of where your money goes. Expense reports are central to this understanding. These reports offer a detailed view of your business’s expenditures. For precise financial record-keeping, it’s crucial to understand expense reports, their usage, their components and their significance.

What is an expense report?

An expense report serves as a comprehensive record of a business’s expenses and may cover a particular department, specific project or individual employee. An expense report meticulously organizes expenditures and categorizes them by various criteria, such as the payee and the nature of the expense.

Expense reports are vital tools for managing small business finances . They help business owners and managers monitor financial outflows to gain pivotal information to evaluate the company’s financial standing, pinpoint cost-saving opportunities and enhance profitability. They simplify the process of filing tax returns, claiming tax deductions and ensuring a smooth auditing process.

What does an expense report include?

Expense reports vary in structure. While some provide a comprehensive overview of spending for a specific duration (like a month or quarter), others focus on itemized expenses tied to a particular employee or project.

Expense reports typically contain the following elements:

- The date of the expense transaction

- The recipient or vendor of the payment

- A paper receipt or digital record of the payment

- Linkage of the expense to a specific client or project

- The complete payment amount, including taxes and other associated charges

- The designated category or nature of the expense

Beyond these primary details, expense reports might also feature annotations regarding individual expenses or the overall amount, elucidating the reason for the expense or any forthcoming costs tied to the same project or client.

How do you create and fill out an expense report?

When constructing an expense report, the primary goal is identifying the expenses to be included. Expenses can be based on the payee, spending category (type of spending) or a particular project or client to which the expense was related. It can also be based on the employee who paid the cost.

The process for building an expense report is straightforward:

- Determine what expenses you want to include in your report.

- List the expenses that meet your criteria, including the details listed above.

- Total the expenses included in your report.

- Add notes about expenses incurred or total paid.

- Give your report a date, number and title based on what it includes.

Why are expense reports important?

Expense reports are crucial because they empower managers to oversee the financial activities of a department, team or organization ― particularly expenses associated with specific clients or projects. Besides aiding managerial oversight, expense reports ensure employees receive reimbursements for business-related expenses they’ve borne, such as business travel or client entertainment.

Expense reports are essential because they do the following:

- Monitor departmental spending and overall cash flow

- Determine profit margins by offsetting expenses against total revenue

- Facilitate employee reimbursements for valid business expenditures

- Keep tabs on costs linked to specific projects, products or clients

Expense report categories and associated expenses

You can run expense reports for various categories depending on your industry and the business expenses you’re tracking . For example, consultants might log client-specific expenses while manufacturers might track product-related costs. Sales representatives often record and claim travel and entertainment expenses.

Here are some examples of typical expense report categories and what they include:

The best accounting software for tracking expenses and creating expense reports

Among our picks for the best accounting software , we recommend the following platforms for expense management and reporting:

- Intuit QuickBooks: The gold standard in accounting software goes beyond tracking your expenses automatically. It also categorizes all your expense transactions automatically, saving you substantial work when it’s time to claim tax deductions . Explore this platform’s other features via our Intuit QuickBooks accounting software review .

- FreshBooks: With the FreshBooks mobile app, you can snap photos of physical receipts easily to document your expenses. FreshBooks also reconciles your spending records with your bank data automatically to ensure you’ve captured all your expense transactions. Learn more via our FreshBooks review .

- Xero: You can view your current and projected expenses from the Xero dashboard. The mobile app also powers immediate reimbursements for any expenses your team has filed. Check out our Xero review to learn what else this vendor offers.

- Zoho Books: This accounting software platform includes tools for automating your expense tracking. You can also view your top expenses as well as the projects for which you’ve incurred billable expenses, directly from the Zoho Books dashboard. Read our Zoho Books review to learn about this platform’s additional features.

- Wave Financial: Connect Wave to your financial institutions ― it offers 10,000 such connections ― and you’ll make it easy to download and import expense records. The Wave mobile app is also great for converting paper receipts to digital expense records. Our Wave Financial review details the extensive functionality of this entirely free accounting software.

Expense report FAQs

Who can submit an expense report, what is expense report software, what is considered an expense, what is a monthly expense report, saving records of your spending.

There should be clear records of all money flowing in and out of your business. Expense reports create this documentation, whether for expenses being reimbursed to employees or those being compared against revenue in general reports. They’re how you get a handle on your company’s spending and make smarter decisions moving forward. Track your expenses now and you might have less costly ― or fewer ― ones before you know it.

Max Freedman contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Search Search Please fill out this field.

- Building Your Business

What Is an Expense Report?

Expense Report Explained

Sakshi Udavant covers small business finance, entrepreneurship, and startup topics for The Balance. For over a decade, she has been a freelance journalist and marketing writer specializing in covering business, finance, technology. Her work has also been featured in scores of publications and media outlets including Business Insider, Chicago Tribune, The Independent, and Digital Privacy News.

:max_bytes(150000):strip_icc():format(webp)/hhhhhhh-e68e8c1f946f4a039c61fe374be94242.jpg)

Definition and Example of an Expense Report

How an expense report works, what an expense report should include, types of expense reports, templates for expense reports.

Klaus Vedfelt / Getty Images

An expense report is a document used to track business expenditures.

An expense report is a formal document used by employees and contractors to receive reimbursements for business expenses from their employers. For example, a contractor may include the price of meals eaten on the job, cost of the gas filled in the vehicle used for work, and internet bills incurred on a work phone on their expense report.

- Alternate name : Travel and entertainment report, T&E report

Imagine an employee traveling for a business conference. They would use some means of transport, eat something on the way to/at the conference, entertain clients at a restaurant or a co-working space, and incur many such expenses to complete the assigned task. All of these may be included in an expense report. Depending on the company policies, the employer fully or partially reimburses these expenses based on a predetermined arrangement (contract).

Most companies don’t reimburse leisure activities like sightseeing with your family when you are traveling for work. It’s important to read your contract properly before submitting your expense report.

Companies typically have a fixed reimbursement policy, which is clearly stated in the contract employees and contractors receive before commencing work.

The contract will include specifics like what is the per diem (daily expense allowance), which expenses will and won’t be reimbursed , and how the expense report should be submitted. When it is time to file a reimbursement for business expenditure, the employee or the contractor will submit an expense report to the manager, employer, or the accounting department, depending on the size and type of company.

An expense report should include the following details for a hassle-free reimbursement process:

- Date : When the business expense was incurred.

- Expense details : Type of expense incurred (meals, tickets, fuel, etc.).

- Employee/contractor details : Name, department, business information, contact details, type of work arrangement, etc.

- Receipts : Proof of expense ( invoices and bills ).

If an employee plans to include an unspecified expenditure (one not agreed to in the contract) in the expense report, it’s helpful to provide an explanation for why the expense should be reimbursed by the employer.

Different companies have different reimbursement policies, so employees have to adjust their expense reports accordingly.

Below are two types of expenses reports used frequently by small-to-medium-sized businesses.

Recurring Business Expense Report

Regular employees who frequently incur a lot of business expenses follow a fixed template to submit business expense reports every month or weekly, depending on the company’s policy. These may include a daily fee or specific expenses such as travel and meals.

One-Time Business Expense Report

If an employee, or most likely a contractor, is filing for reimbursement in a single instance (not frequently), they use a one-time business expense report. The format for a one-time expense report isn’t fixed, as different contractors may incur different types of expenses. Such reports offer more flexibility but may require receipts for proof.

Using a neat template with clearly demarcated sections for each piece of information can make the reimbursement process easier. Here are some websites and apps to access free templates for submitting expense reports:

While templates can be a good place to start, make sure they include all the details necessary for reimbursement before submitting the document to avoid delayed or stuck payments.

Key Takeaways

- A business expense report is a form of document used by employees to track expenditure for reimbursement

- Expense reports are based on rules mutually agreed on by the employer-employee or contractor/contractee.

- One-time expense reports are used for reimbursement of the occasional business expense, while recurring reports are used by regular employees.

U.S. General Services Administration. " Per Diem Rates ."

Carroll University. " Expense Report ." Accessed Sept. 15, 2021.

What is an Expense Report? (Excel Templates Included)

Nick Zaryzcki

Reviewed by

December 18, 2019

This article is Tax Professional approved

An expense report is a form that captures all of the most important information about a business expense. It lets you do two things:

Determine how much you’ll reimburse an employee for a business expense they made using their own money.

Document that expense in enough detail that you can write it off on your business tax return.

I am the text that will be copied.

If your employees make business expenses—when travelling for a conference, entertaining clients, or using their personal vehicle for work, for example—you need to track those expenses using an expense report.

An expense report will usually ask you to itemize (break down into as much detail as possible) all of the expenses included on the report, and to attach any receipts associated with those expenses. It will also usually organize each expense by category , so that it’s easy to plug into your company’s bookkeeping system.

What should an expense report include?

At minimum, an expense report should include all of the following information:

- Information identifying the person submitting the report (department, position, contact info, SSN, etc.)

- A date and dollar amount for each expense, matching the date and dollar amount on the receipt provided for that expense

- A brief description of each expense

- Which account in your company’s chart of accounts the expense will be billed to

Most expense reports also contain information like:

- Subtotals for each expense type, to make it easier for a bookkeeper to input that data into your accounting system

- The total reimbursement figure being requested by the employee submitting the report

- Room to explain certain expenditures that don’t fit clearly into one category

Expense report templates

Google “expense report” and you’ll find an endless variety of templates, all of which seem slightly different. Which one is right for you?

We’ve come up with three templates that we think should cover most use cases.

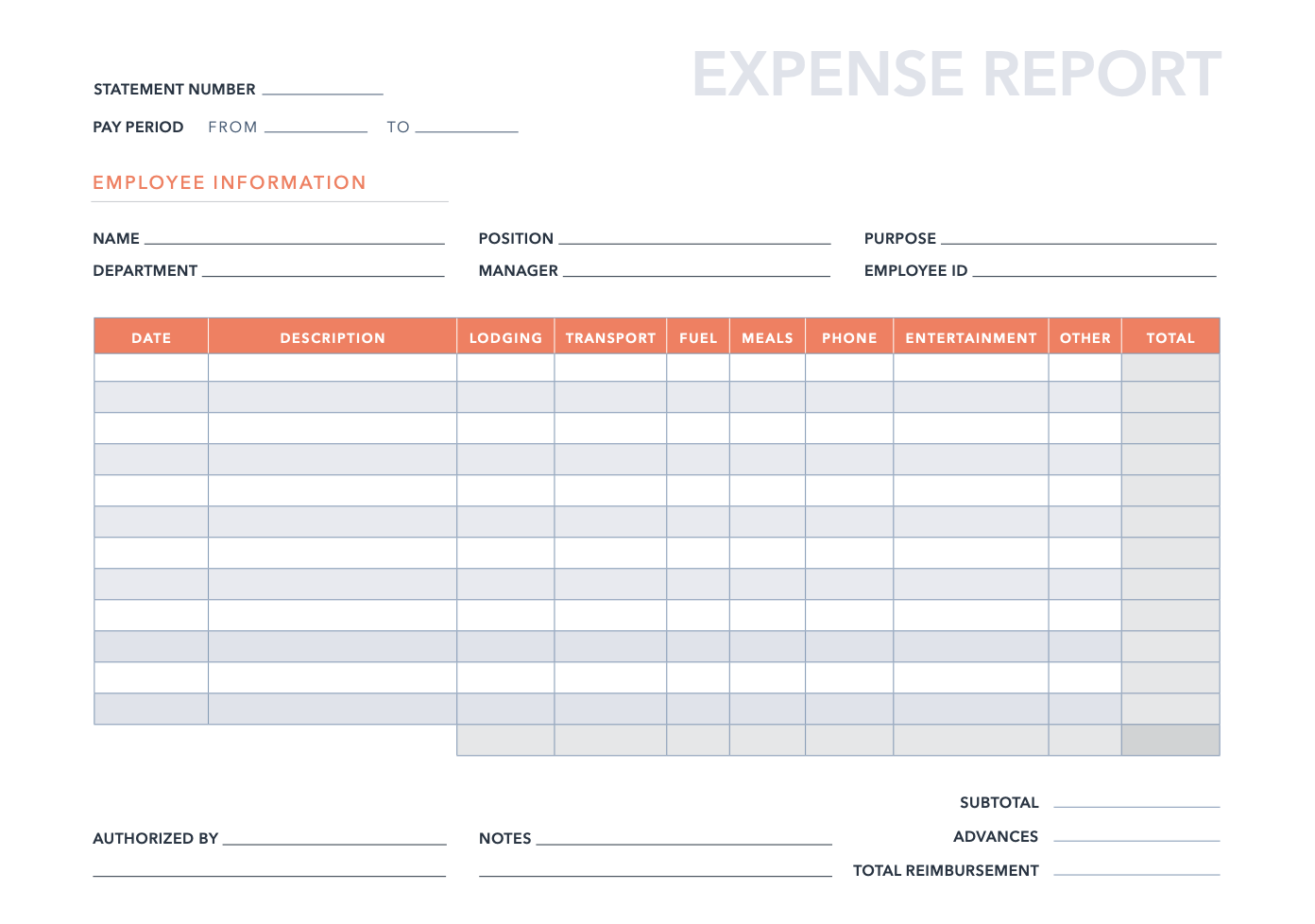

A one-time expense report

If your employees don’t make many regular business expenses and you just need a form to capture the odd travel or project expense, a simple one-time expense report might work.

This form is dead simple. In addition to the employee’s personal information and the relevant pay period for which the report is being submitted, all it asks for is a one-line description of each business expense. Each line asks for the date the expense was made, a brief description of the expense, the expense type and the expense amount. Pretty straightforward!

Download Template

A recurring expense report

If your employees continuously make lots of business expenses over the course of their work (i.e. frequent travel, regular driving, etc.), giving every single individual expense its own line on the report might take up too much room. You might be better off using the following template, which combines all of the expenses you make in one day on one line.

This template provides room for “Hotel,” “Transport,” “Fuel,” “Meals,” “Phone,” “Entertainment” and “Miscellaneous” expenses, although you should customize these labels to fit a typical day of spending for your business. If your employees spend a lot of money on airfare or supplies, those each might deserve their own column in the form.

A long-term (quarterly or yearly) expense report

Companies use quarterly and yearly expense reports to get a snapshot of long-term spending for a particular individual, project, department or product line.

This template is similar to the template above, except for one difference: each month now gets its own row. To complete this form, you’ll have to come up with monthly totals for each spending category.

Why do we need expense reports?

If you run a small business that already does bookkeeping and produces financial statements, it might not be clear why you need expense reports. So why do it?

They let you reimburse employees properly

If an employee pays for something out of pocket and asks for a reimbursement, you need some way of making sure the expenses they’re claiming are accurate. An itemized expense report (with receipts attached) lets you do exactly that.

They let you track expenses over time

Expense reports also let you track spending over time and see whether any particular expense category is driving costs.

They let you do your taxes properly

Many of the expenses your employees make when working for your business are deductible, but you can’t deduct those expenses until you record them somewhere and have proof that they happened.

Generating an expense report helps you keep track of deductible expenses that your business bank account/credit card history might not be catching, and make it a whole lot easier to write those expenses off around tax time.

This is also why it helps to use the IRS’s categories when designing your expense reports.

For example, if you run a sole proprietorship and you use Schedule C (Form 1040) to record your business expenses, make sure to use the expense categories from Schedule C (which you can find in Part II of the form) on your expense reports.

When recording expenses or designing your own reports, make sure to use IRS terminology like:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract labor

- Legal and professional services

- Office expense

- Rent or lease

- Vehicles, machinery, and equipment

- Repairs and maintenance

- Travel and meals

- Deductible meals

Use a bookkeeping service like Bench to stay on top of expenses

Although filing expense reports will get you part way there, staying on top of your business expenses is a year-long struggle. Thankfully, a bookkeeping service like Bench can help.

In addition to running America’s largest bookkeeping service for small businesses, Bench also offers a full suite of expense tracking tools, including a dashboard that lets you monitor your finances in real-time. If you’ve got a pile of expense reports sitting around and have no idea what to do with them next, our bookkeepers can help.

Related Posts

How to Pay Off Your Business Debt, Fast

Buried in small business debt? Follow this plan to dig yourself out.

Liquidity: A Simple Guide for Businesses

Having trouble paying your bills? You might have problems with liquidity. Here’s everything you need to know.

.png)

Overhead Costs (Definition and Examples)

Overhead is the cost of staying in business—learn how to track how much you’re really earning and build rock-solid profit projections.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Travel and Expense

How to do an expense report: steps and solutions for effective expense reporting.

There's nothing like face-to-face communication, but travel can be one of the biggest costs associated with doing business. Detailed and accurate expense reports help you keep your finger on where money is going, while employees get reimbursed for expenses promptly.

Travel-related expenses at small and medium businesses increased 178% in 2022. Everyone who travels for your business should know how to do expense reports. Employees who pay out of pocket want to have their expenses reimbursed. When tax time comes, you need to be able to accurately document legitimate business expenses. And, the business intelligence associated with travel costs means understanding your expenses better.

Setting up a consistent system means that you’re always on top of all costs and using your travel funds effectively.

Why a Well-Structured Expense Report Matters

A business expense report has to be set up in a way that’s easy to understand, comprehensive, and consistent across departments and personnel.

A good report gives the business a better idea where travel-related money is going and can help with planning. For example, you can see whether you need to budget more toward international airfare in the coming year or decide whether travel-related subscriptions are paying for themselves and being used to their fullest potential. You can also identify places where you can save money.

Business travel expenses are typically tax-deductible. With the right expense report setup, you can document those expenses quickly and easily, saving headaches at tax time.

A Step-by-Step Guide to Expense Reporting

An expense report is a document that brings together all the relevant expenses from a business trip or event. This will include information like the date of a purchase, the amount spent, the expense category, and any relevant receipts.

Start by collecting receipts during travel. Physical receipts should be either scanned or photographed so the information is available to anyone who needs it later on for documentation.

Capture all the relevant information in the business expense template or system used. This will include:

- Date of the expense

- Vendor purchased from

- Expense category (common categories include meals, transportation, and lodging)

- any tax or VAT assessed)

- Any additional notes

- A PDF, PNG, or JPEG of the receipt of invoice

This data is sent to the person in charge of managing expenses. Then, expenses that need to be reimbursed are tallied up and paid. When it's time to make reports for tax and other purposes, all the data is there and available in one place.

How Templates Can Help

If everyone's working with the same framework, expense reports get a lot easier for everyone involved. Your traveling employees have a better handle on what expenses are reimbursable. You are better able to categorize expenses, so you can see where your money is going.

Exploring Tools for Expense Reports

There are a few different tools you can use to do your expense reports. Each has their own benefits and drawbacks.

At the most informal end, you can simply have traveling employees email a list of expenses and attach images of receipts. However, this can be a hard system to standardize and it creates opportunities for risk. You'll likely end up with people formatting their reports differently from one another, such as using different wording for the same expenses. It can be easy to miss legitimate expenses. Plus, parsing the list can use huge amounts of your finance team's time that could be better spent on other tasks.

You can learn how to do an expense report in Excel, but this has limitations. Using an incorrect formula in one cell can populate an error throughout your sheet. And, the spreadsheet is what's known as a "closed" system. You can't automatically export data from it into another system.

Specialized, purpose-built tools like the ones from SAP Concur can cut the confusion and make travel expense reporting easy and accurate. Traveling employees can start by collecting receipts in the ExpenseIt mobile app. Then they upload images to Concur Expense , which creates and categorizes expenses automatically. If you are using Concur Drive , it will seamlessly capture mileage to ensure expenses are documented accurately and fairly.

Common Challenges in Expense Reports

While expense reports are necessary for transparent operation of your business, they can also be challenging for both traveling employees and the people coordinating back in the office.

Fraud is, unfortunately, a persistent risk associated with business travel. Studies show that around 5% of a typical organization's annual revenue is lost to fraud. Employees may deliberately or unintentionally request reimbursement for expenses that are not legitimate parts of business travel. A well-organized system with clear categories can help eliminate misunderstandings and ensure reimbursement requests are accurate.

Many employees do not want to spend the time associated with paperwork after business trips. A system like SAP Concur solutions, however, captures and categorizes most expenses automatically . All the employee needs to do is review the inputs to ensure accuracy and it's good to go.

Speed and Simplify Your Expense Report Process

Travel expense reports provide essential insights into where your travel-related funds are being spent. They provide the business intelligence you need to keep your travel cost-effective and to get the most out of every travel dollar spent.

Want a one-stop solution that makes everything easier? Our self-guided demo shows you how to capture expenses from any device, submit an expense report to a manager, and see how to approve reports you receive.

What's an Expense Report? [Why It Matters + Template]

Published: March 30, 2022

If you travel for business – or use a personal vehicle for work — chances are you're incurring some business expenses.

In order to be fairly reimbursed, you need to keep track of expenses in an expense report. On the flip side, employers need expense reports to know how much the business is spending and where.

Here, we'll cover the basics of an expense report, how to fill it in, and see an example in action.

What Is An Expense Report?

An expense report tracks items and services that you purchase while working. These are often — but not exclusively — used for business travel.

Although an expense report is necessary for any employee who wants to be reimbursed for a business expense — like travel, gas, or meals — they're equally important for the employer. Here's why:

1. Accurate reimbursements.

Here's the rub — employees want reimbursement for the expenses they've paid out-of-pocket. But, on the flip side, employers want assurance that these expenses are fair and legitimate. An expense report provides a standardized process that addresses both these concerns.

2. Cost control

Expense reports allow you to track spending over time and identify whether any particular expense category (such as transportation or hotels) is driving costs excessively. Then, you can strategize how to reduce or eliminate these costs.

3. Simplifies tax deductions

Many business expenses are tax-deductible. However, you need to accurately record them (with receipts) before claiming a deduction. This is where expense reports can come in handy — providing solid evidence about when, where, and how expenses were incurred.

Now let's cover what to include in an expense report and popular business categories.

What to Include in an Expense Report

An expense report contains a variety of information — however, there are several details you must include, such as the:

- Identifying information of the person filling out the report — this could be your name, designation, or contact info.

- Date - the date on which you incurred the expense.

- Amount - the total cost of an expense incurred, including taxes.

- Description – a brief account of each business expense.

- Category - the type of expense incurred (e.g. parking, office supplies, or gas).

A report may also include nice-to-have information, like whether an expense belongs to a specific client or project, or space to explain certain expenditures that don’t fit clearly into a category.

Next, you must calculate (and record) the subtotal for each expense category and the grand total of all expenses.

Expense Report Template

Download this template

Common Expense Report Categories

With expense categories, you will better understand what expenses can and cannot be reimbursed. Plus, you’ll also alleviate future headaches for your bookkeeper or tax preparer.

Speaking of taxes, it's a good idea to use the IRS' categories in your expense report. Here's a list of the most common types:

- Car and truck expenses

- Commissions

- Legal and professional services

- Membership fees

- Office supplies

- Postage and shipping

- Repairs and maintenance

- Transportation

- Travel expenses (hotels, meals, parking, etc.)

- Vehicles, machinery, and equipment

Choosing the right categories will depend on your type of business. For example, a drop-shipping company will dedicate categories for shipping, printing, and storage, whereas an advertising firm may have categories for digital services.

How to Fill Out an Expense Report

An expense report can either be filled manually or electronically using accounting software or apps.

Let's first discuss how to fill out an expense report manually:

- Start by filling out the mandatory information in the report — such as your name and designation.

- In chronological order, list each expense under the appropriate category.

- Along with each expense, include the date it was incurred, the total amount, and a brief description of it.

- Calculate the subtotal for each category and the grand total of all expenses.

- Finally, attach corresponding receipts to the report. The receipts should clearly show the date and total amount.

- Submit the report to your line or department manager who will check it for illegitimate claims or policy violations.

Many small businesses can benefit from using a standard expense report template. However, depending on your size or industry, it could make sense to use accounting software — like Xero , QuickBooks , or FreshBooks — to keep track of expenses.

Further, bookkeeping apps like Sunrise , ZoHo Books , GoDaddy Bookkeeping make it easy for employees to capture receipts, car mileage, and other expenses on the go. Or for businesses looking for complete control expense management software such as ExpenseOnDemand .

Final Thoughts

Expense reports take the guesswork out of how much money your business is spending and where it's going. Done correctly, you can accurately reimburse employees, simplify your taxes, and even make financial projections for the coming year.

Don't forget to share this post!

Related articles.

Accounting 101: Accounting Basics for Beginners to Learn

How To Conduct a Small-Business Valuation

A Guide to Managerial Accounting

What Is Goodwill in Accounting: An Explainer

A Quick Guide to GAAP Accounting for Your Business

How To Do Accounting for Your Startup: Steps, Tips, and Tools

Gross Revenue vs. Net Revenue: An Explainer

![meaning of expense report The Plain-English Guide to Revenue Run Rate [Infographic]](https://blog.hubspot.com/hubfs/run-rate.jpg)

The Plain-English Guide to Revenue Run Rate [Infographic]

The Beginner's Guide to Balance Sheets

What Is a Profit and Loss Statement?

Track your work expenditures to get reimbursed appropriately.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make an expense report: 6 easy steps.

A new small business may not have many expenses to track. But as you grow, your expenses will multiply. You’ll need to track how much you’re spending via an expense report form.

An expense report will also make sure you’re prepared come tax time. Many expenses can be deducted from the total amount owed, according to The Balance.

Creating your own expense report doesn’t need to be daunting. Follow the steps below to learn how to make your own expense report quickly and easily.

Not sure what an expense report is? This article includes a straightforward definition and discusses why expense reports are important for small businesses .

In this article, we’ll cover:

6 Steps To Create An Expense Report

What is on an expense report, how do you create an expense sheet.

- How Do I Manage My Expenses in Excel?

1. Choose a Template (or Software)

To make an expense report, you should use either a template or expense-tracking software. Making an expense report from scratch can be time consuming.

To create an expense report in Excel, PDF, Word or other popular programs, you need to download a template. We also offer an expense report template for free .

Customize the template with your company name, the date range you’re reporting on and your name.

To save time as your business (and number of expenses) grows, you’ll want to upgrade to expense-tracking software . Link your business bank account so that expenses are added as you go. Or use the corresponding app to photograph paper receipts as you get them.

Here is expense report sample generated with FreshBooks:

Source: FreshBooks

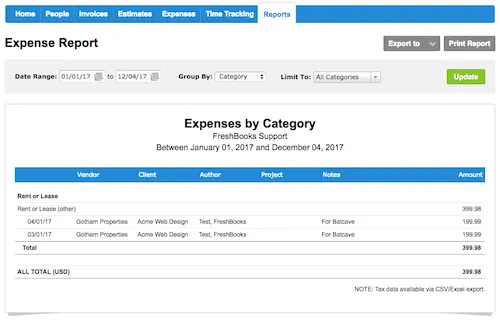

2. Edit the Columns

FreshBooks’ expense reports has standard columns you can use to adapt your expense report template, if needed. The columns are:

- Date: when the item was bought

- Vendor: where the item was bought

- Client: what client the item was bought for

- Project: what project the item was bought for

- Account: to indicate a client or project

- Author: who bought the item

- Notes: notes to explain the expense

- Amount: cost of the expense

Your columns should reflect common expenses in your business. If you regularly take out clients for coffee or dinner, you need a “travel and meals” column. If you drive a vehicle for business purposes, you need a “car and truck expenses” column, according to The Balance.

Expense reports can separate out expenses by tax category, like rent. This is because the IRS allows businesses to claim some expenses as deductions and asks them to break out the totals by category.

These categories include:

- Advertising

- Car and truck expenses

- Employee benefit programs

- Office expenses

- Pensions and profit-sharing plans

- Rent or lease

- Repairs and maintenance

- Taxes and licenses

- Travel and meals

3. Add Itemized Expenses

Add each expense on a new line, being sure to fill out as much information as possible. Be sure to indicate what client and project the expense is for to ensure accurate tracking.

Enter your expenses in chronological order so the most recent expense is at the end. Add the amount of each expense, tax included.

4. Add up the Total

Each category has a subtotal on an expense report and then a grand total of all expenses. You can add this feature to your expense report template, if you like, so you can better see how you’re spending in each category.

Then find the total. Account for any previous over or under payments, if you’re reimbursing an employee.

5. Attach Receipts, If Necessary

Employees submitting expense reports for reimbursement will absolutely need to attach receipts to justify their claims. If printing the expense report, tape the receipts onto a piece of printer paper and photocopy them so you can keep the originals.

If submitting the expense report electronically, scan the receipts using the receipt scanner app and attach them as files. Only then can an employee be reimbursed.

Even if you’re a business owner generating an expense report to track spending, it’s essential to keep your corresponding receipts or invoices. If you’re deducting expenses on your taxes, having a backup is necessary in case of an audit, as advised by The Balance. For small business owners, understanding how to invoice as a sole proprietor is crucial; it aids in ensuring proper documentation of your expenses, facilitates tax deductions, and maintains financial transparency.

6. Print or Send the Report

Now your expense report is ready. First, double check your work, especially the figures and the total.

Expense-tracking software can export your report to Excel so you can print or share it more easily.

An expense report is typically a spreadsheet. The following items can typically be found on an expenses spreadsheet:

- The name of the company

- Date range or time period

- Columns such as date, description or explanation, code, category columns such as “fuel or mileage”

- A list of expenses

- An area for the manager to sign off on the expenses

An expense sheet is the same as an expense report. To create an expense sheet, follow the steps above.

In short, the steps to create an expense sheet are:

- Choose a template or expense-tracking software

- Edit the columns and categories (such as rent or mileage) as needed

- Add itemized expenses with costs

- Add up the total

- Attach or save your corresponding receipts

- Print or email the report

How Do I Manage My Expenses in Excel

Creating an expense report spreadsheet in Excel is a simple way to manage your expenses.

You have a couple of options. You can download an Excel expense report template. It has typical business and travel expense categories and automatically calculates the total for you.

You can also create your own Excel spreadsheet from scratch:

- Open a new Excel spreadsheet

- Write the name of your company, time period being tracked and your name in the upper left hand fields

- Leave one row black. Make columns to categorize your expense information. Standard columns, from left to right, include Expense, Type, Date and Amount.

- Itemize your expenses, from the least recent to most recent

- Add up all the expenses and include the amount at the bottom. Write “Total” beside it.

- Print out or email the expense report

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "indirect spend guide", to learn:.

- Where the best opportunities for savings are in indirect spend.

- How to gain visibility and control of your indirect spend.

- How to report and analyze indirect spend to identify savings opportunities.

- How strategic sourcing, cost management, and cost avoidance strategies can be applied to indirect spend.

Expense Reporting: What Is It, Templates, and How To Fill A Report

- Written by Keith Murphy

- 15 min read

KEY TAKEAWAYS

Expense reporting is the process of documenting and submitting expenses incurred by an individual or an organization during business operations.

- Expense reporting has many benefits for businesses (including taxes and compliance.)

- Manual paper-based processes can work when you’re small but often become impractical.

- Software can help automate and streamline your processes.

What Is Expense Reporting?

It involves keeping track of all expenses, such as travel expenses, office supplies, meals, and other expenses related to business operations, and then submitting a report to the appropriate party for reimbursement or accounting purposes.

Expense reporting is an important process for businesses as it helps to ensure that expenses are properly accounted for and that employees are reimbursed for legitimate business expenses promptly.

Additionally, expense reports can provide valuable insights into how much money is being spent on different categories of expenses, which can help organizations identify areas where they may be able to cut costs or optimize their spending.

Reasons to Use Expense Reports

Employee Expense Reimbursement

One of the primary reasons for expense reports is to reimburse employees for business-related expenses they have incurred on behalf of the company. This could include travel expenses, meals, accommodations, and other costs.

More Accurate Budgeting

Expense reports can provide valuable data for budgeting purposes. By tracking expenses over time, companies can gain insights into where they are spending money and identify areas where they may need to cut costs or adjust their budget.

Compliance With Internal Controls

Expense reports can help you ensure compliance with internal policies and external regulations. Companies can reduce the risk of fraud, errors, and noncompliance by requiring employees to document their expenses and obtain proper approvals.

Tax Requirements

Expense reports are also used for tax purposes. By tracking business expenses, companies can deduct them from their taxable income and reduce their tax liability.

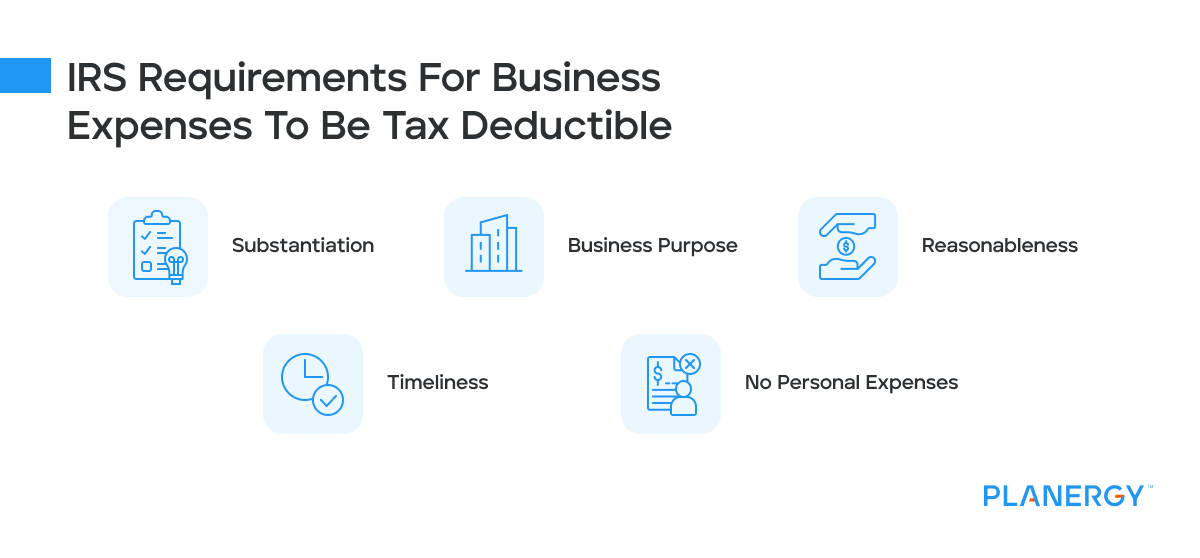

IRS Requirements for Expense Tracking and Reporting

The Internal Revenue Service (IRS) has specific rules and requirements for business expenses that can be deducted from taxable income.

To be deductible, expenses must be ordinary and necessary expenses incurred during business operations. Here are some of the key requirements that the IRS has for expense reports:

Substantiation

The IRS requires that adequate records, such as receipts, bills, and invoices substantiate expenses. These records must show the expense’s amount, date, place, and business purpose.

Business Purpose

Expenses must have a business purpose. This means that they must be directly related to business operations, such as travel expenses for a business trip or office supplies for use in the office.

Reasonableness

Expenses must be reasonable in amount. This means that they should not be excessive or unnecessary for the business purpose. For example, a coach flight instead of a first-class seat, or a basic hotel room instead of a suite.

Expenses must be reported in a timely manner. The IRS requires that expenses be reported on a regular basis, typically within 60 days of the expense being incurred.

No Personal Expenses

Personal expenses cannot be deducted as business expenses. The IRS requires that expenses be exclusively for business purposes and not for personal benefit.

Spend Management Analysis

Expense reports can provide valuable insights into how employees are using company resources.

By analyzing the spend data , companies can identify trends and patterns in employee spending , which can help them make informed decisions about budgeting, procurement, and other business processes.

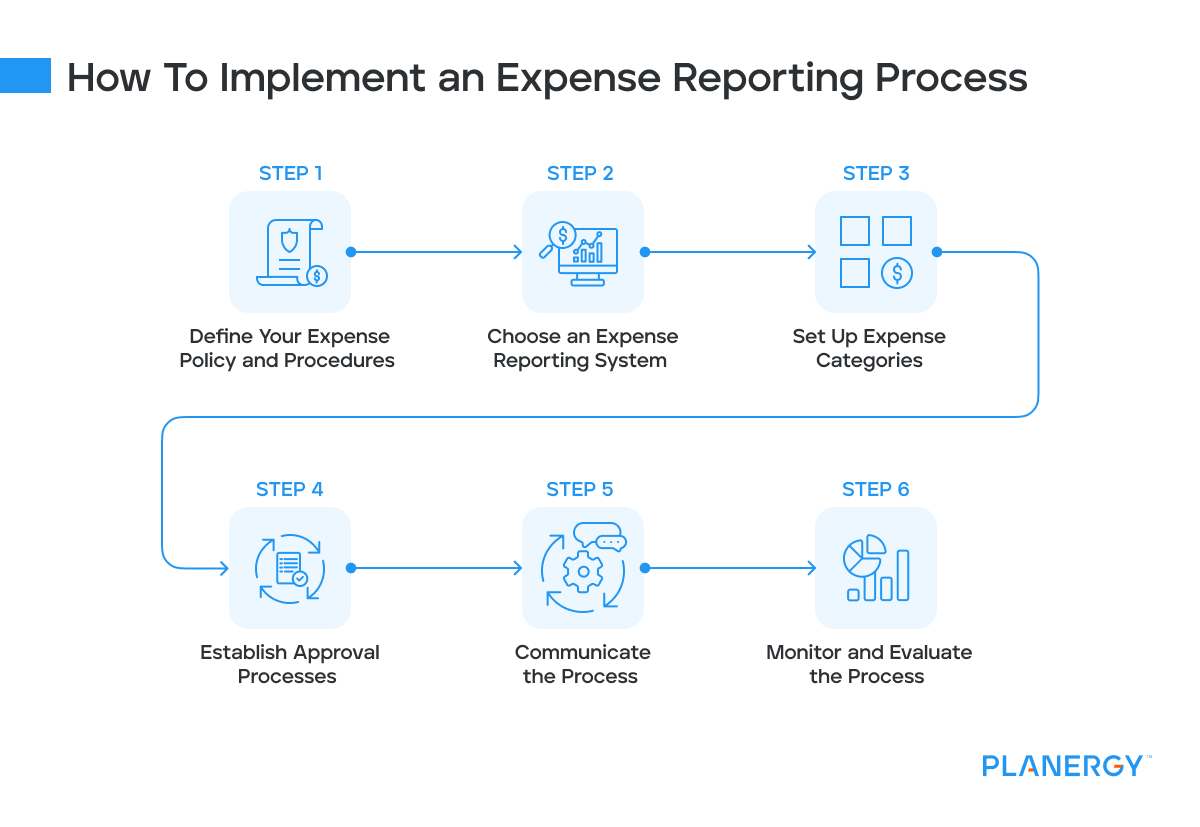

How To Implement an Expense Reporting Process

It’s up to your organization to define the expense reporting process in a way that makes sense for you and your industry.

Typically, employees will be given specific guidelines on what expenses are eligible for reimbursement, what documentation is required, and how to submit their expense reports. This might be covered by a corporate travel policy and employee expense reimbursement policy.

This can vary depending on the organization, but the process generally involves keeping receipts, filling out a form, or using an online tool to document expenses and then submitting the report to the appropriate person or department for review and approval.

Developing an expense reporting process for a company typically involves several steps.

Define Your Expense Policy and Procedures

Start by establishing clear policies and procedures that define what expenses are eligible for reimbursement, what documentation is required, and how expense reports should be submitted and processed.

This should be communicated clearly to all employees and stakeholders involved.

As you define your company policies, consider the following:

- What type of expenses will you cover?

- What expenses are not eligible for employee reimbursement?

- Will you allow employees to use a corporate card or purchasing card?

- Will you allow employees to book their own business travel or have someone book it for them? What pricing limits will you enforce?

- What should employees do during a business travel emergency? For example, the flight is overbooked, only first-class is available on another airline, etc.

- Will you require paper receipts for all expenditures or allow employees to submit photos of receipts through a mobile app?

Choose an Expense Reporting System

Next, determine the expense reporting system you’ll use. This could be a paper-based system, a Microsoft Excel spreadsheet, or a cloud-based expense management software.

As you evaluate options, consider ease of use, functionality, security, cost, and integration with other systems, such as your ERP or accounting software .

The ideal expense management solution will work with your accounting software and allow you to establish automated workflows for data entry and accounts payable.

Set Up Expense Categories

Define and set up expense categories, such as travel, meals, entertainment, and office supplies. This will help ensure expenses are properly tracked and allocated in your general ledger.

Establish Approval Processes

Next, establish an approval process for expense reports, which may involve multiple levels of approval depending on the expense amount or the employee’s position. This helps ensure that expenses are properly reviewed and authorized.

A simple process looks like this:

Employee Submits Expense Report

The employee submits an expense report to the appropriate person or department, typically the employee’s supervisor or the finance department.

Review of Expense Report

The approver reviews the expense report to ensure all expenses are legitimate, necessary, and comply with company policies and procedures.

Approval or Rejection of Expense Report

The approver either approves the expense report, indicating that the expenses are acceptable and can be reimbursed, or rejects the report, indicating that some or all expenses are unacceptable.

Corrections and Resubmission

If the expense report is rejected, the employee may need to make corrections and resubmit the report for approval.

Processing of Approved Expense Report

Once the expense report is approved, the finance department will process the report and arrange for reimbursement of the approved expenses.

Communicate the Process

After establishing the approval process for employee expenses, you must communicate the expense reporting process to all employees, including how to submit expenses and what to expect in terms of reimbursement.

This should be done through employee handbooks, training sessions, and other communication channels.

Monitor and Evaluate the Process

You should regularly monitor and evaluate the expense reporting process to ensure it works effectively and efficiently.

This could involve tracking metrics such as expense report turnaround time, the accuracy of submissions, and the amount of reimbursement. Based on this feedback, the process can be refined and improved over time.

For example, tracking everything in a spreadsheet may be the quickest and easiest way to handle things when you’re a small company. But as you scale, it will lose efficiency because it relies on manual data entry.

Investing in expense reporting software makes more sense to streamline and automate the expense management process.

No matter which method you choose, having an expense reporting process in place helps keep operations running smoothly.

Basic Expense Report Template

[Company Logo]

Expense Report

Employee information.

- Department:

- Employee ID:

- Date of Expense Report:

Expense Details

Sub-Total: [Total amount of expenses]

Receipts Attached: [Yes/No]

Notes/Comments:

[Add any notes or comments regarding the expenses or the report]

This is just a basic template that is customizable to fit your company’s specific needs. The expense report should include all relevant information, such as the date, expense description, category, amount, and whether or not a receipt is attached.

It should also have spaces for the employee and manager’s signatures to certify the information as accurate and additional notes or comments to aid approval.

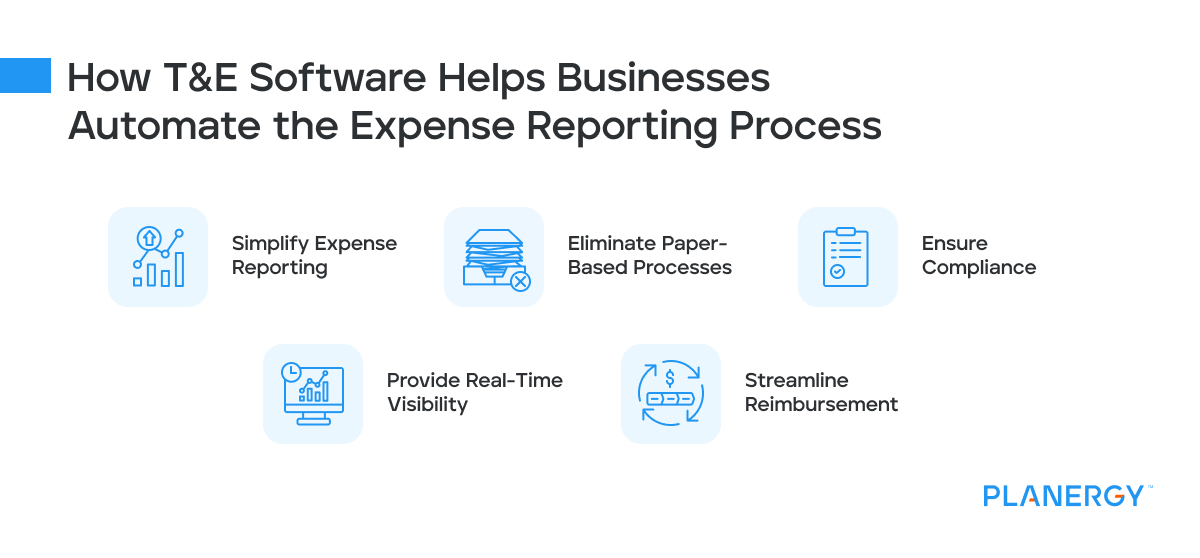

How Travel and Expense (T&E) Software Solutions Can Help

Travel and expense management can be difficult if you are using manual processes. Travel and expense (T&E) software can help businesses automate and streamline their expense reporting process.

Simplify Expense Reporting

T&E software can make it easy for employees to submit expenses by providing a user-friendly interface for capturing and categorizing expenses.

This can reduce the time and effort required to complete expense reports and ensure that all required information is included.

You can also automate expense reporting, streamlining reimbursement approval and cutting down on the manual tasks in the process.

Eliminate Paper-based Processes

T&E software can eliminate the need for paper-based expense reports and receipts, which can be time-consuming and error-prone. It is very easy to lose a receipt.

Instead, employees can use mobile devices or web-based portals to submit expenses and attach electronic receipts. This can be done as soon as receipt is received, reducing the possibility of missing documents.

Ensure Compliance

T&E software can help businesses ensure compliance with internal policies and external regulations by providing automated approval workflows, audit trails, and built-in compliance checks.

Provide Real-time Visibility

T&E software can provide real-time visibility into expenses, allowing businesses to track spending and identify areas where costs can be reduced or optimized. This can help businesses make informed decisions about budgeting and procurement.

Streamline Reimbursement

By automating the expense reimbursement process , T&E software can make it easy for businesses to reimburse employees for expenses. This can reduce the time and effort required to process reimbursements and ensure that employees are paid accurately and on time.

Overall, T&E software can help businesses reduce the administrative burden of expense reporting and ensure that expenses are properly documented and compliant with internal policies and external regulations.

What’s your goal today?

1. use planergy to manage purchasing and accounts payable.

- Read our case studies, client success stories, and testimonials.

- Visit our Spend Analysis Software page to see how Planergy can empower you to get more value from your spend.

- Learn about us, and our long history of helping companies just like yours.

2. Download our “Indirect Spend Guide”

3. learn best practices for purchasing, finance, and more.

Browse hundreds of articles , containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

Related Posts

- Travel & Expense

Corporate Travel Program: How To Create a Program for Employer and Employee Needs

- 16 min read

The Top 8 Business Travel Management Tools

- 18 min read

Expense Reimbursement: What Is It, How To Manage, and What Should You Cover

Procurement.

- Purchasing Software

- Purchase Order Software

- Procurement Solutions

- Procure-to-Pay Software

- E-Procurement Software

- PO System For Small Business

- Spend Analysis Software

- Vendor Management Software

- Inventory Management Software

AP & FINANCE

- Accounts Payable Software

- AP Automation Software

- Compliance Management Software

- Business Budgeting Software

- Workflow Automation Software

- Integrations

- Reseller Partner Program

Business is Our Business

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog

This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here .

What is an Expense Report and Why It’s Important for Small Businesses

By Hannah Donor • Nov 26, 2023

The path to small business success is smoother when you are in control of your spending. As you work through the everyday challenges that are a part of running a business, it’s important to avoid slowing your momentum as a result of wasting resources. Efficient spending gives you more breathing room to operate your business and achieve healthy growth sooner.

And establishing proper spend management is only possible with effective expense tracking, which is why it is so important to become familiar with expense reports.

What is an Expense Report?

An expense report is a financial document that provides a record of business expenditures over a defined period of time. Unlike a profit and loss statement , which shows the expenses and income of a business, an expense report focuses solely on business expenses. Expense reports can be produced for varying periods of time, i.e. monthly, quarterly, or annually. and can be used to track expenditures for a specific project, employee, or department, as well as for the business as a whole. For example, an expense report for a specific project may include materials and contractor fees. An expense report for an employee’s work trip may include flights or mileage, meals, and lodging.

Why are Expense Reports Important?

An expense report is a crucial element of tracking business expenditures and assessing where financial resources are being allocated. Expense reports have a variety of uses, but here are some of the most common ones:

Reimbursement request

In order to be reimbursed for business expenses, it is common practice for an employee to be required to fill out an expense report showing work-related expenses. This is especially common when it comes to business trips that require flights, lodging, meals, and any other travel expenses that are eligible to be covered by their employer.

Tax deductions

It’s a best practice for small business owners to use expense reports on an ongoing basis to record and organize their business expenses in order to be able to easily write them off on their taxes , rather than having to scramble during tax season and track down each individual transaction and receipt.

Logging mileage

If you drive as part of your job, whether you’re a truck driver or a business consultant commuting to your clients, you’ll want to claim your mileage as a tax deduction . This requires you to keep accurate, detailed records of your mileage and vehicle expenses so you can write them off on your tax return, which is made easier by using expense reports.

Managing cash flow

Part of managing your business’s cash flow means keeping on top of all business-related expenses and being able to determine if each one is necessary for to your business. An expense report provides a clear, organized view of your expenses, so you can assess your spending efficiency and make budgetary decisions that are beneficial for your cash flow.

What is Included in an Expense Report?

Not all expense reports require the same level of detailed information, especially those that aren’t used for reimbursement requests or tracking costs for a particular project. But even if you are using an expense report simply to organize all of your business expenses for the year as part of an annual review, it’s helpful to include all details that could prove necessary down the road. Expense reports should include the following:

- The transaction date (when the expense was paid)

- The payee (who the money was paid to)

- The subtotal for each expense (including taxes, fees, and commissions)

- The expense category (e.g. travel, training, marketing, etc.)

This basic information is relevant for any type of expense report. Additional information may be required depending on the purpose of the report, including a reporting employee’s information for a reimbursement request, an indication about the client or project the report is related to, or longer descriptions about certain expenses for the sake of context.

Expense Reporting Process

Regardless of the specific purpose of an expense report, you need to know how to fill it out properly. Below is a step-by-step guide that you should follow when filling out an expense report:

1. Determine the scope

This helps you understand which transactions should be included in the report. Is the report for a specific project, an individual, or a department? Include only those expenses that are relevant to that particular category. Once you’ve established the scope of the report, collect all invoices, receipts, or other transaction records that include the information required to fill out your report.

2. Title and date

Give your expense report a title that clearly conveys the purpose of the report. For instance, the report title should specify whether the included expenses are related to an employee reimbursement request or expense tracking for a specific project. The date refers to the time period being covered by the report, whether the expenses are from the current month, a fiscal quarter, the preceding year, or the duration of a project or business trip.

3. List expenses

Based on the collected receipts and invoices, begin filling out the report by recording the specific expense data for each item. Be sure to include the all relevant details mentioned previously, as well as any additional information that may be useful when reviewing the expense report.

4. Calculate the total expenses

Sum up all of the individual expenses listed on the report to determine the total expenditure. To avoid the possibility of manual error, it can be helpful to use an expense report template that includes built-in formulas, so the subtotal is automatically tallied once the raw data is added to the report. And, using an expense report template means you start filling out your report without delay rather than spending time creating one from scratch.

5. Include additional notes

If necessary, add notes to transactions explaining their inclusion in the report. For example, a team may need to explain their reasoning for purchasing a specific piece of equipment and how it helped them complete their project in order to be granted full reimbursement.

How often you create an expense report depends on the purpose of the report. If you are creating expense reports as part of your regular business financial reporting, you should create an expense report for each fiscal quarter as well as an annual expense report (which can also be used when filing business taxes).

If expense reports are being used as part of the process of employee reimbursement, they may be generated monthly or at the conclusion of a project that required the employee to spend money (e.g. on travel expenses).

While you should provide receipts with an expense report as proof that the amount indicated on the report is accurate, the receipt does not necessarily need to be the original. For example, if you’re using Lili’s Accounting Software you can simply take a picture of the receipt and attach it to the transaction.

To ensure you that an expense report is accurate, it’s important to double-check each figure against the original receipt or invoice of the transaction. To ensure the calculation is correct, it is best practice to create a report using a spreadsheet that has built-in formulas that will auto-calculate the total. Any calculated total should be manually verified, as well.

A more alternative to manually creating and verifying the accuracy of expense reports is using accounting software that automatically generates expense reports and calculates the total on your behalf, saving you prep time and avoiding the possibility of manual error.

Bottom Line: Expense Reports and Lili

Manually generating and filling out an expense report can be a time-consuming, error-filled process. Our Accounting Software automatically generates expense reports on a monthly, quarterly, and annual basis. All you need to do is categorize business expenses with a quick swipe or tap in the Lili platform. Expense reports are automatically generated based on your expense categorization, and available in your account whenever you need them!

Hannah Donor is a freelance copywriter and social media strategist with 5+ years of experience helping small businesses authentically curate the written word to reach and inspire their target market.

By Hannah Donor • Aug 22, 2023

By Hannah Donor • Feb 26, 2023

By Hannah Donor • Apr 4, 2023

Don’t take our word for it, open a Lili account today and enjoy a 30 day trial of Lili Pro, Smart, or Premium!

Fill in some basic personal information.

Share a few details including business type, EIN and industry.

Choose the account plan that best fits your business.

Email Our Support Team or Call Us

Mon – Friday, 9am – 7pm EST

Lili is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC. The Lili Visa® Debit Card is issued by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc. Please see the back of your Card for its issuing bank. The Card may be used everywhere Visa debit cards are accepted.

Wire Transfer service provided by Column Bank N.A., Member FDIC. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. or Lili App Inc.

1 Available to Lili Pro, Lili Smart, and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.