Our work is reader-supported, meaning that we may earn a commission from the products and services mentioned.

How To File A Massachusetts Annual Report

- Last Updated: April 26, 2024

- By: Greg Bouhl

Advertising Disclosure

One requirement for keeping a Massachusetts corporation or Limited Liability Company (LLC) in compliance is filing an Annual Report. The Report confirms and updates the company’s information each year with the Massachusetts Secretary of the Commonwealth, such as the name and address of the registered agent and the name and address of members, directors, or officers.

Related: How to form an LLC in Massachusetts

Who Needs to File an Annual Report?

Domestic and foreign corporations and LLCs are required to file an annual report each year after the year the company was formed.

What is Needed to File a Massachusetts Annual Report

You have the option of filing your Massachusetts LLC or Corporation Annual Report online or by mail. To file online, visit the Massachusetts Secretary of the Commonwealth’s website . Otherwise, you can fill out the Annual Report – Form D by downloading and filling out an Annual Report.

The report asks for information such as:

- Business name

- Principal office address

- Federal Employer Identification Number (FEIN)

- Business activities of the entity

- Name and street address of the Massachusetts Resident Agent

- Name and address of the officers, directors, members, and/or managers

Filing is usually done in 3-4 business days.

Massachusetts Annual Report Cost

The Annual Report filing fee for both the Corporation is $125, and the LLC is $500.

Annual Report Due Date

The State of Massachusetts has different deadlines depending on the business entity.

Corporations: The Annual Report is due 2.5 months after the end of the entity’s fiscal year. Most entities use a calendar year which means December 31 st is the end of their fiscal year. In this example, an Annual Report for a Corporation would be due March 15 th of each year.

LLC: An LLC’s Annual Report is due on its anniversary date each year. For example, if your LLC or Corporation was formed on January 1 st , 2024, the deadline for the first Annual Report will be January 1 st, 2025.

The Secretary of the Commonwealth’s office emails a reminder in advance of the Annual Report due date. Even though a reminder is sent, it’s important to make an additional reminder for yourself should you not receive it.

Massachusetts Annual Report FAQs

My business made little or no money. do i still have to file the annual report.

Even if your Corporation or LLC received no income or had no business activity, the Annual Report is still required to be filed.

What happens if you don’t file the Annual Report on time?

If the Annual Report isn’t filed on time, a late penalty will be assessed, and the business entity will lose its status of good standing with the state. If the report is delinquent for over two years, the entity may be subject to administrative dissolution by the Massachusetts Secretary of the Commonwealth.

How do you change a Massachusetts Registered Agent?

While the Massachusetts Annual Report form asks for the name and address of the Registered Agent, the Registered Agent can’t be updated on this form.

To update the Registered Agent’s information, fill out a Statement of Change of Registered Agent/Registered Office .

Massachusetts Secretary of the Commonwealth Contact Information

The mailing address for the Massachusetts Annual Report is:

Massachusetts Secretary of the Commonwealth One Ashburton Place, Room 1717 Boston, MA 02108-1512 If you have questions, they can be contacted at (617)727-9640.

How To Start A Business In Massachusetts

How To Fill Out The Massachusetts LLC Certificate of Organization

Beginners Guide To Start A Massachusetts LLC

How To Do A Massachusetts Business Name Search

Massachusetts DBA / Business Certificate In 5 Easy Steps

Should You Use A Massachusetts Resident Agent Service?

How To Register For A Massachusetts Sales Tax Permit

How To Get A Massachusetts Resale Certificate

Guide To Hiring Employees In Massachusetts

Popular Questions

See more start-up questions

Popular Business Ideas

See more business ideas

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Form An LLC

Business ideas, common start-up questions, get in touch.

Contact Form

Mailing Address: PO Box 2571 Carbondale, IL 62901

Rules and regulations for starting a business change frequently. While we do our best to keep this information fully up-to-date, its very difficult to stay on top of the changes for every state. Also, this site is for informational purposes only and does not provide legal or tax advice.

Additionally, Startup101 may earn a small commission from products or services mentioned on this site.

Disclaimer | Privacy

© 2017 – 2024 StartUp101 LLC – All Rights Reserved.

Some (but not all) of the links on StartUp101.com are affiliate links. This means that a special tracking code is used and that we may make a small commission on the sale of an item if you purchase through one of these links. The price of the item is the same for you whether it is an affiliate link or not, and using affiliate links helps us to maintain this website.

StartUp101.com is also a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com .

Our mission is to help businesses start and promoting inferior products and services doesn’t serve that mission. We keep the opinions fair and balanced and not let the commissions influence our opinions.

What Is an LLC Annual Report?

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on June 4, 2024

What Is an Annual Report?

How to file annual report for your llc, how to renew your llc annual report, multi-state businesses.

As the owner of an LLC, one major responsibility you have is filing an annual report. Annual reports are necessary for most states to keep your business up to date and in compliance. However, filing them each year also commonly includes a fee, which must be paid along with your submission.

Whether you’re tackling your very first annual report or just need to brush up on the basics, this guide contains all you need to know about annual reports and how to file.

Annual reports provide basic information about your LLC, including the names and addresses of members, managers, and your registered agent. They also offer a comprehensive report of all business activities throughout the year and capture financial performance.

States require annual reports to be publicly available and updated with the latest information. Some states also use annual reports to determine the amount of taxes owed.

As the owner of an LLC, you’re responsible for keeping your business up to date and fully compliant with federal, state, and local regulations, including taxes and annual reports. Failure to comply could result in massive fines or even the revocation of your company’s registration.

Pick your state from the table below to see the requirements for filing an annual report. Arizona , Ohio , Missouri, and New Mexico don’t require an LLC to file an annual report.

Choose Your State

- connecticut

- massachusetts

- mississippi

- new hampshire

- north carolina

- north dakota

- pennsylvania

- rhode island

- south carolina

- south dakota

- west virginia

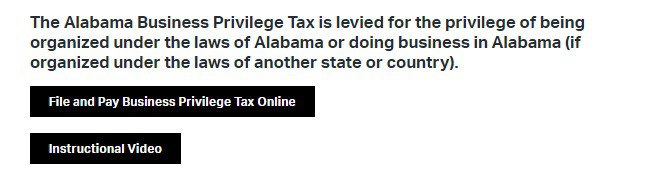

How to File an LLC Annual Report in Alabama

To file your annual report in Alabama, visit the Department of Revenue and select “file and pay business privilege tax online.”

You’ll need to log in to your account to file.

Then you’ll fill out the business privilege tax and annual report form. The form includes a calculation of the business privilege taxes your company owes.

The fee for filing your annual report is $10, in addition to your business privilege tax.

Reports and returns are due on the 15th day of the 3rd month after the start of the taxable year. There is a $50 fee for filing late, plus accrued interest.

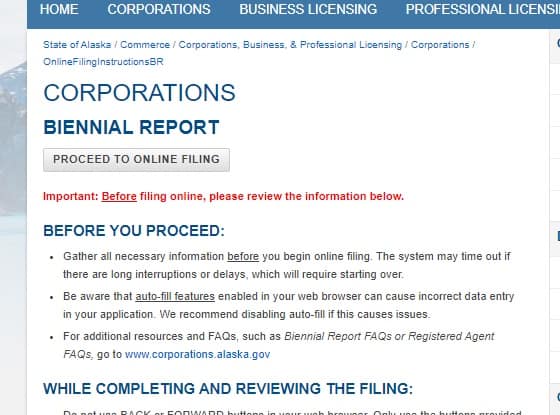

How to File an LLC Biennial Report in Alaska

To file your biennial report in Alaska, you must visit the Division of Corporations, Business, and Professional Licensing website .

Select “Proceed to online filing.”

Fill out all the required information.

The fee for filing your biennial report is $100, and reports are due every two years on January 2 nd . In addition, there is a late fee of $37.50.

How to File an LLC Annual Franchise Tax Report in Arkansas

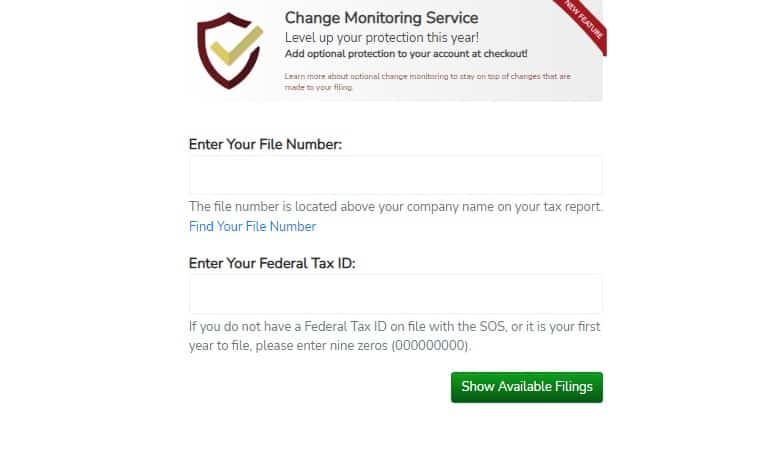

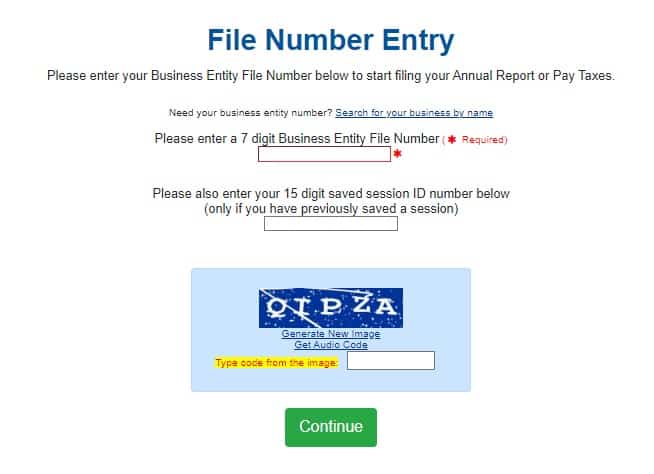

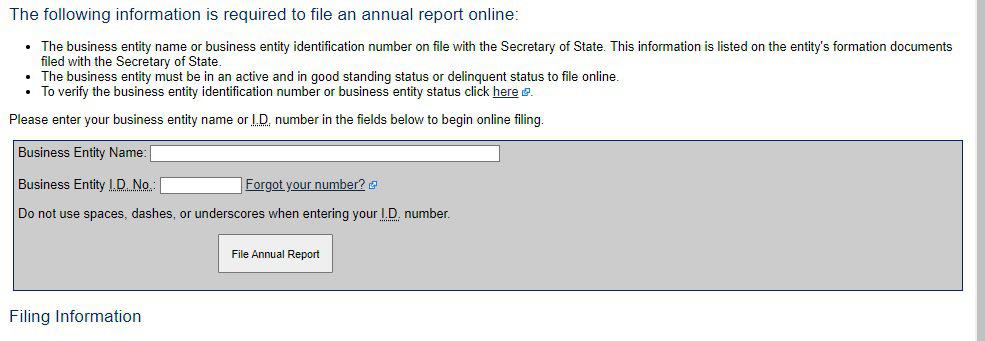

To file your annual franchise tax report in Arkansas, visit the Secretary of State’s website and enter your file number and EIN.

Fill in the required information.

The annual franchise tax is $150, and reports are due May 1.

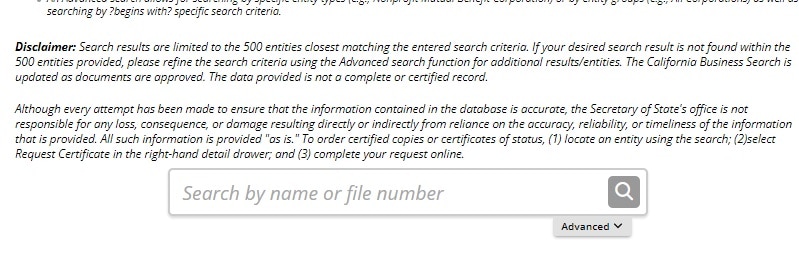

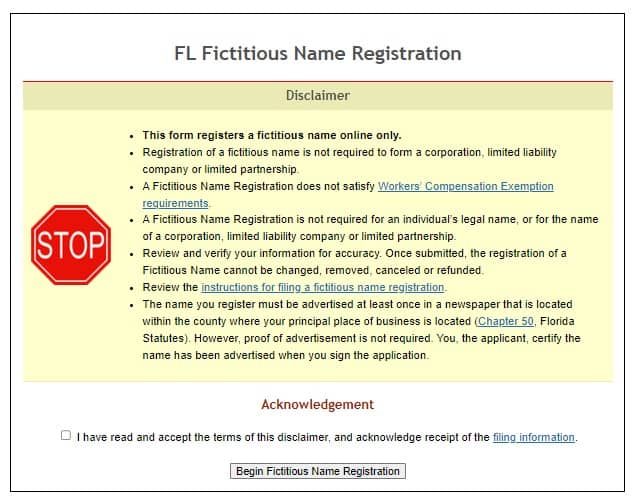

How to File an LLC Statement of Information in California

To file your statement of information in California, visit the Secretary of State’s website and enter your business entity number.

The fee for filing your statement of information is $20, and a $5 disclosure fee. Reports are due every two years within 90 days of the anniversary of your LLC formation.

How to File an LLC Periodic Report in Colorado

To file your periodic report in Colorado, visit the Secretary of State’s website and enter your business I.D. number.

Then select “periodic report” and fill out all the required information.

The filing fee is $10, and reports are due yearly on your LLC’s formation anniversary.

How to File an LLC Annual Report in Connecticut

To file your annual report in Connecticut, visit the business division website and log in to your account.

Then you’ll select “file annual report” and fill in all the information.

The filing fee is $80, and reports are due March 31st.

How to File and Pay LLC Annual Tax in Delaware

To file and pay your annual tax in Delaware, visit the Division of Corporations website and enter your business entity number.

Select “pay tax” and enter the required information, including your billing information.

The tax is $300, and reports are due March 1. The penalty for late filing is $200.

How to File an LLC Annual Report in Florida

To file your annual report in Florida, visit the Division of Corporation’s website and enter your business document number.

Fill out the required information.

The fee for filing your annual report is $138.75, and reports are due by May 1. If you file after May 1, the late fee is $400.

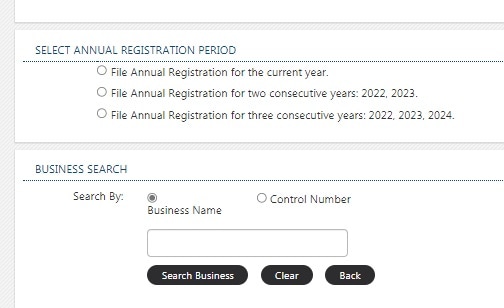

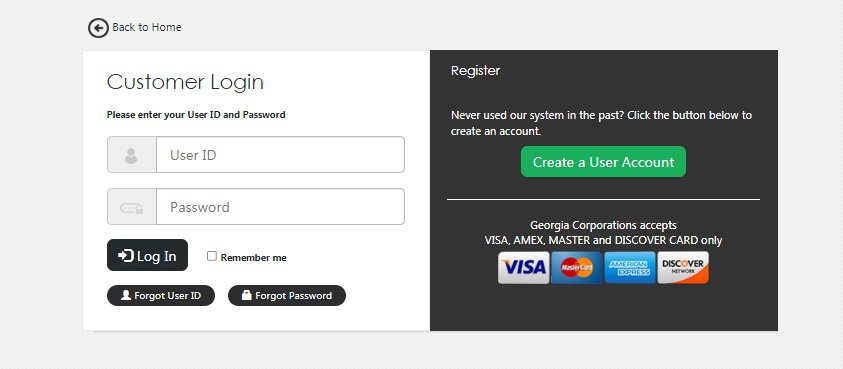

How to File LLC Annual Registration in Georgia

To file your annual registration with no changes in Georgia, visit the Corporation’s Division website , select the year for which you’re filing, and enter your business name or control number.

Follow the prompts to complete the registration.

You’ll need to sign in on the Corporation Division’s website to complete the registration if you’re making changes to your business information.

The fee for filing your annual registration is $50, and registrations are due April 1. If you file after April 1, there is a $25 late fee.

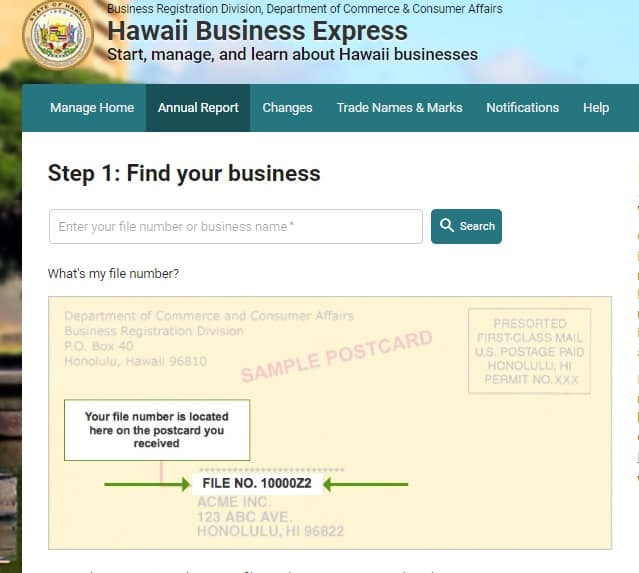

How to File an LLC Annual Report in Hawaii

To file your annual report in Hawaii, visit the Business Express website and enter your file number or business name.

Then simply fill in the required information and submit your report.

The fee for filing your annual report is $15 , and reports are due depending on the registration date of the business as follows. If the registration is between:

- Jan. 1 and March 31, the annual report is due March 31 of each year

- April 1 and June 30, the annual report is due June 30 of each year

- July 1 and Sept. 30, the annual report is due Sept. 30 of each year

- Oct. 1 and Dec. 31, the annual report is due Dec. 31 of each year

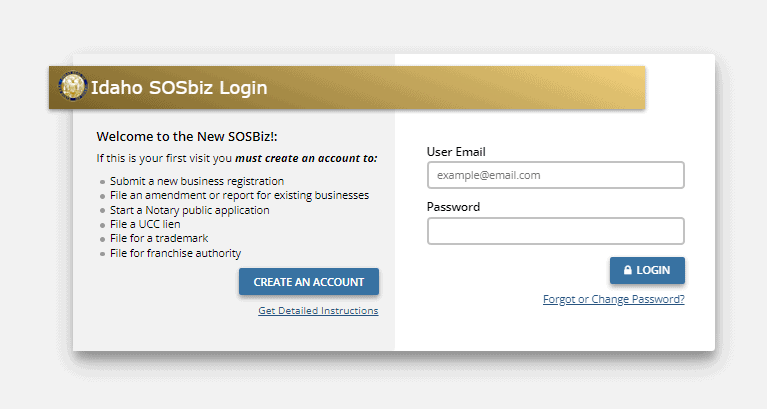

How to File an LLC Annual Report in Idaho

To file your annual report in Idaho, visit the Secretary of State’s website and log in to your account.

Then select “annual report” and fill in the required information.

Filing the report is free, and reports are due by the end of the anniversary month of LLC formation.

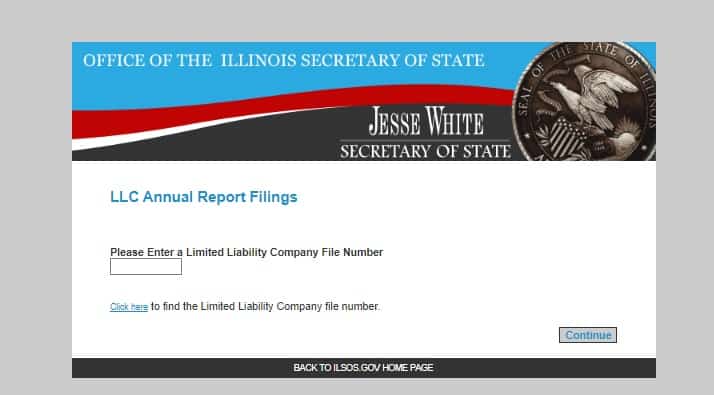

How to File an LLC Annual Report in Illinois

To file your annual report in Illinois, visit the Secretary of State’s website and enter your file number.

The fee for filing your annual report is $75, and reports are due by the end of the month before your LLC’s formation anniversary.

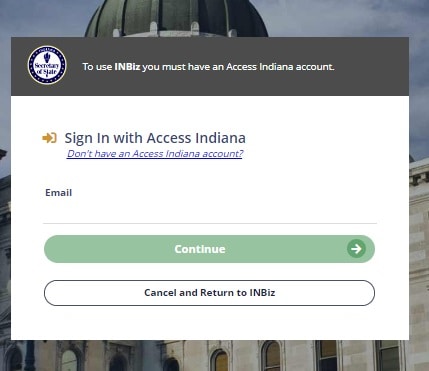

How to File an LLC Business Entity Report in Indiana

To file your business entity report in Indiana, visit the Access Indiana website and log in to your account.

Simply select “business entity report” and fill in the required information.

The fee for filing your business entity report is $50, and reports are due every other year by the end of the anniversary month of your LLC’s formation.

How to File an LLC Biennial Report in Iowa

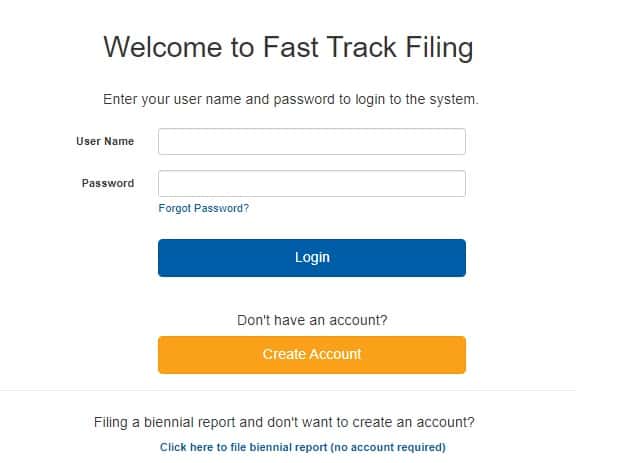

To file your biennial report in Iowa, visit the Fast Track Filing System website and log in to your account.

Select “file biennial report,” enter your business ID number, and fill out the required information.

The filing fee is $30, and reports are due April 1 every other year.

How to File an LLC Annual Report in Kansas

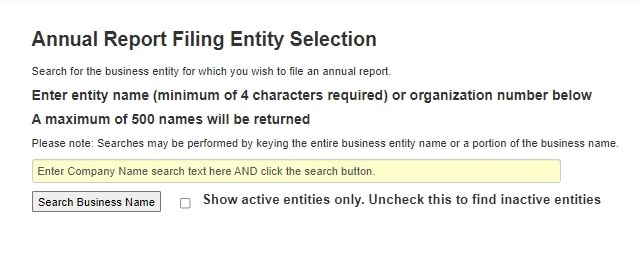

To file your annual report in Kansas, visit the Secretary of State’s website and enter your business name and entity number.

Then simply fill in the required information.

The filing fee is $55, and reports are due April 15.

How to File an LLC Annual Report in Kentucky

To file your annual report in Kentucky, visit the Secretary of State’s website and enter your entity name.

The fee for filing your annual report is $15, and reports are due June 30.

How to File an LLC Annual Report in Louisiana

To file your annual report in Louisiana, visit the geauxBIZ website and log in to your account.

Select “File an amendment or annual report,” then enter your Louisiana charter number. Next, select “File annual report” and fill in the required information.

The fee for filing your annual report is $30 plus a $5 credit card fee, and reports are due on the anniversary date of your LLC’s formation.

How to File an LLC Annual Report in Maine

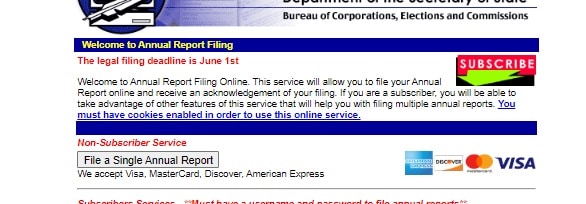

To file your annual report in Maine, visit the Secretary of State’s website and select “File a single annual report.”

Fill in the required information and submit your report.

The fee for filing your annual report is $85, and reports are due June 1st. Reports filed after June 1 st will be subject to a $50 late fee.

How to File an LLC Annual Report in Maryland

To file your annual report in Maryland, visit the Business Express website and log in to your account.

Select “File annual report” and fill in the required information.

The fee for filing your annual report is $300, and reports are due April 15. Fees for filing late depend on the number of days past due, with a minimum of $30 and a maximum of $500.

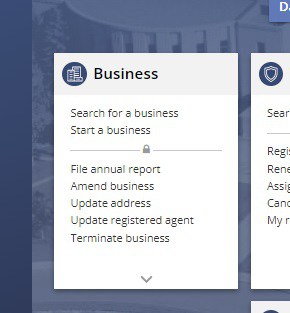

How to File an LLC Annual Report in Massachusetts

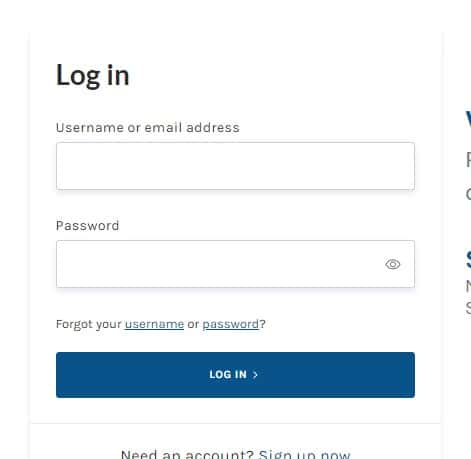

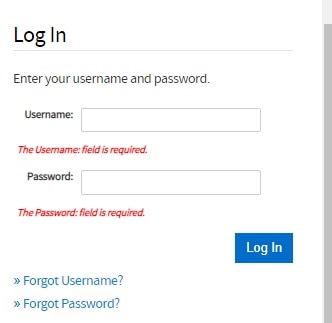

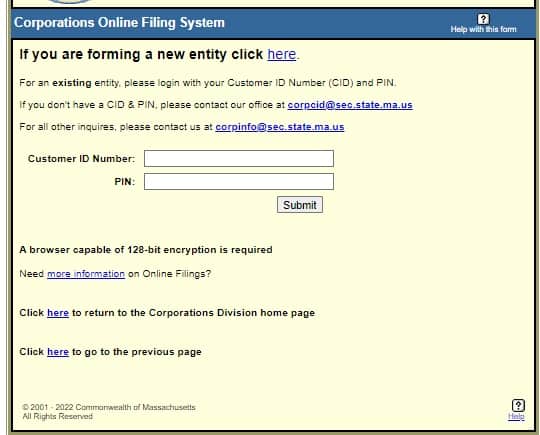

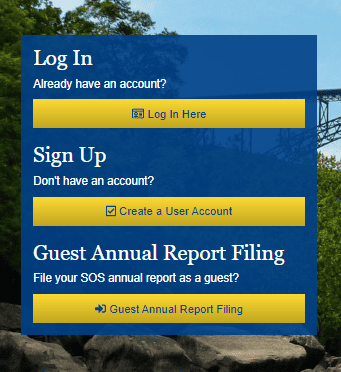

To file your annual report in Massachusetts, visit the Secretary of the Commonwealth’s website and log in to your account.

You’ll select “file annual report” and fill in all the required information.

The fee for filing your annual report is $500, and reports are due on the anniversary date of your LLC’s formation.

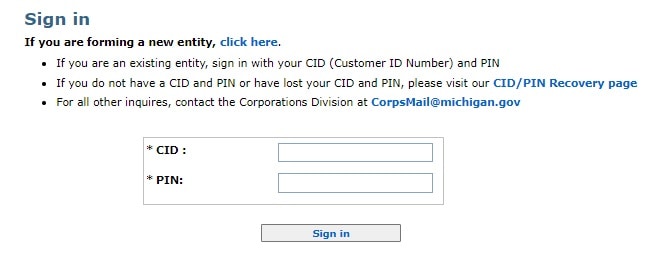

How to File an LLC Annual Statement in Michigan

To file your annual statement in Michigan, visit the corporation’s online filing system website through the Department of Licensing and Regulatory Affairs and log in to your account.

Select “file annual statement” and fill in all the required information.

The fee for filing your annual statement is $25, and reports are due February 15.

How to File an LLC Annual Renewal in Minnesota

To file your annual renewal in Minnesota, visit the Secretary of State’s website and enter your business name or entity number.

Select “annual renewal” and fill in all the required information.

Filing is free, and reports are due December 31.

How to File an LLC Annual Report in Mississippi

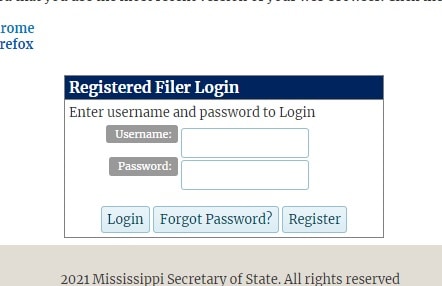

To file your annual report in Mississippi, visit the Secretary of State’s website and log in to your account.

Then select “file annual report” and fill in the required information.

Filing is free, and reports are due April 15.

How to File an LLC Annual Report in Montana

To file your annual report in Montana, visit the Secretary of State’s business services website and select “file annual report.”

Enter your business name or filing number, then fill in the required information.

The filing fee is $20, and reports are due April 15. The fee for filing late is $15.

How to File an LLC Biennial Report in Nebraska

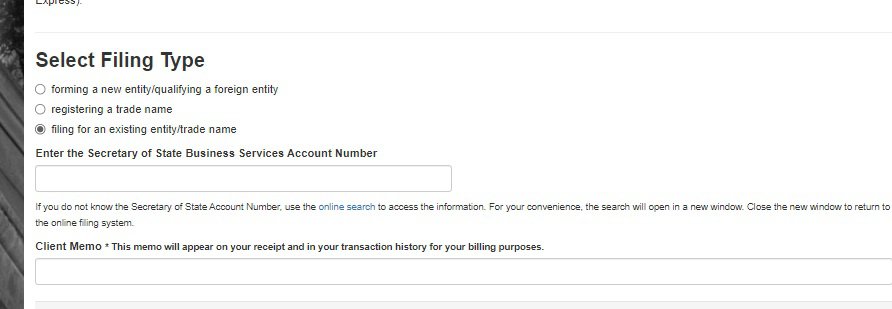

To file your biennial report in Nebraska, visit the Secretary of State’s website , select “filing for an existing entity,” and enter your business services account number.

Then you’ll select “file online” and fill in the required information.

The fee for filing your biennial report is $10. Reports are due by April 1 or every odd-numbered year.

How to File an LLC Annual List in Nevada

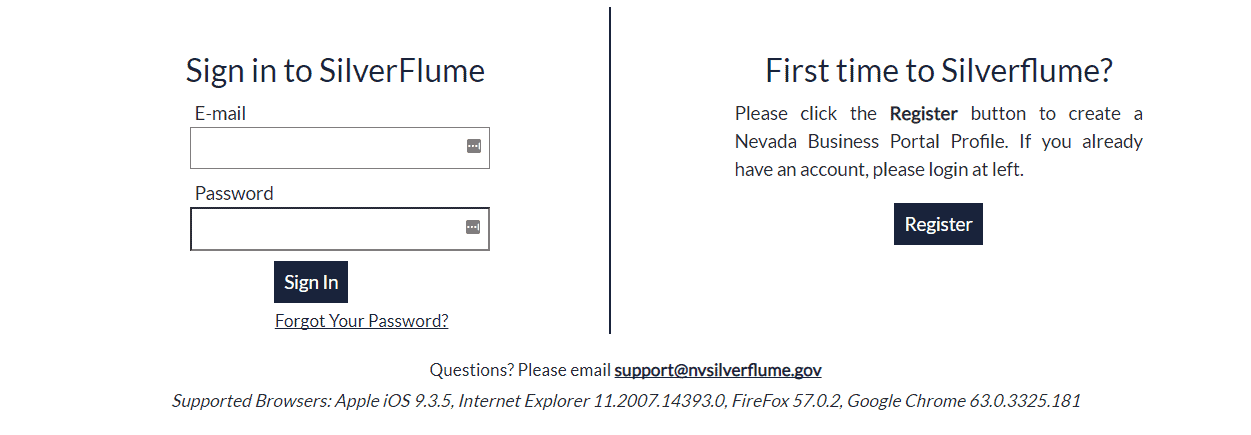

To file your annual list in Nevada, visit the business portal website and log in to your account.

Then select “file annual list” and fill in all the required information.

The fee for filing your annual list is $150, and reports are due by the end of the anniversary month of your LLC’s formation. The fee for late filing is $75.

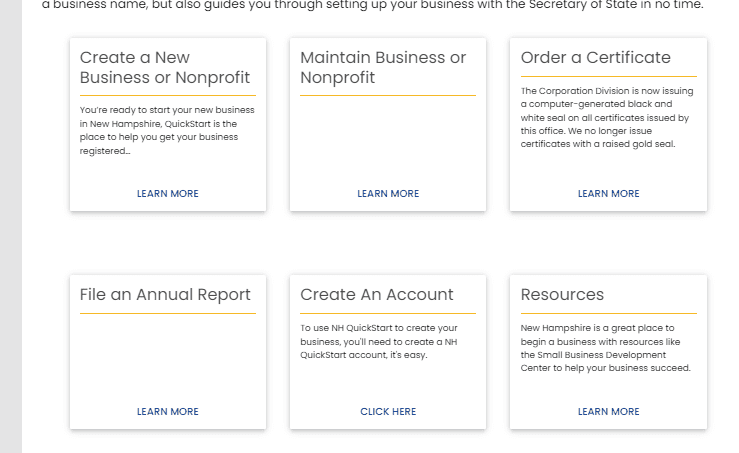

How to File an LLC Annual Report in New Hampshire

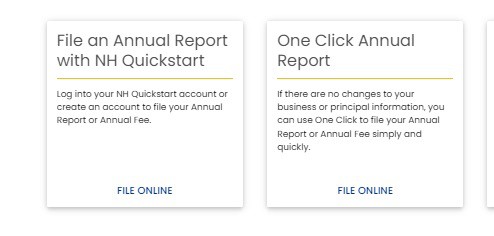

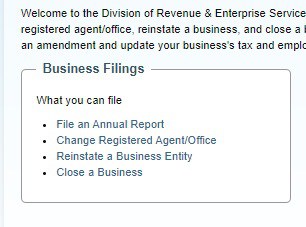

To file your annual report in New Hampshire, visit the Secretary of State’s website and select “file an annual report.”

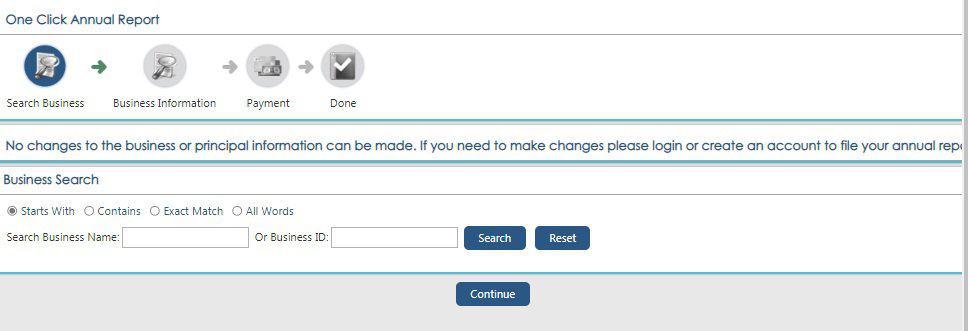

You can log in to your account to file your report on the next page. You can choose a “one-click” filing option if there are no changes. You’ll have to log in to your account if you make changes.

You’ll then search for your business by name or business ID number and file your report.

The fee for filing your annual report is $100 plus a $2 online filing fee, and reports are due by April 1. The fee for filing late is $50.

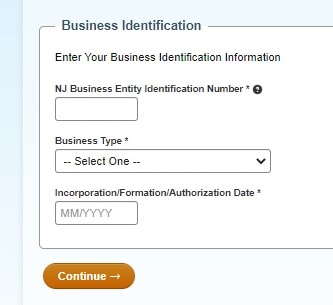

How to File an LLC Annual Report in New Jersey

To file your annual report in New Jersey, visit the Division of Revenue and Enterprise Services website and select “file annual report.”

Then you’ll enter your business ID number, select the type of business, and the date of your LLC’s formation.

Follow the prompts to complete the filing of your report.

The fee for filing your annual report is $75, and reports are due by the end of the anniversary month of your LLC’s formation.

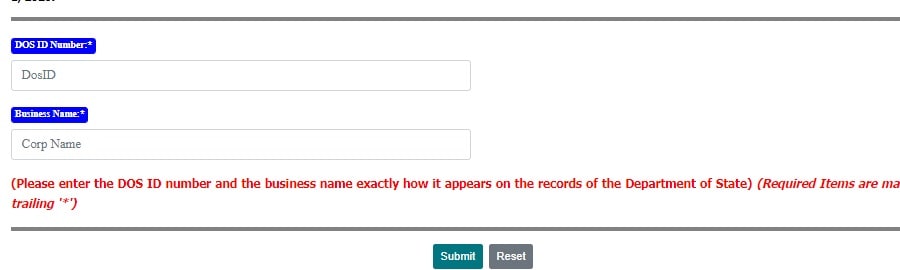

How to File an LLC Biennial Statement in New York

To file your biennial statement in New York, visit the Department of State’s website and enter your business ID number and name.

Then simply follow the prompts to complete the statement and submit it.

The filing fee is $9, and statements are due by the end of the anniversary month of your LLC’s formation.

How to File an LLC Annual Report in North Carolina

To file your annual report in North Carolina, visit the Secretary of State’s website and select “annual file report.”

Enter your business name in the search box and when the result comes up, select “annual report.” Then simply verify the required information or make changes as necessary.

The fee for filing your annual report is $202 online, and reports are due April 15.

How to File an LLC Annual Report in North Dakota

To file your annual report in North Dakota, visit the Secretary of State’s website and select “file annual report.”

Enter your business name or ID number in the business search box. When your business appears, click on the “file annual report” icon, fill in the required information, and submit the form.

The filing fee is $50, and reports are due November 15th. The fee for late filing is $50.

How to File an LLC Annual Certificate in Oklahoma

To file your annual certificate in Oklahoma, visit the Secretary of State’s website and select “annual certificate.”

Then follow the prompts to enter all the required information.

The filing fee is $25, and reports are due on the anniversary date of your LLC’s formation.

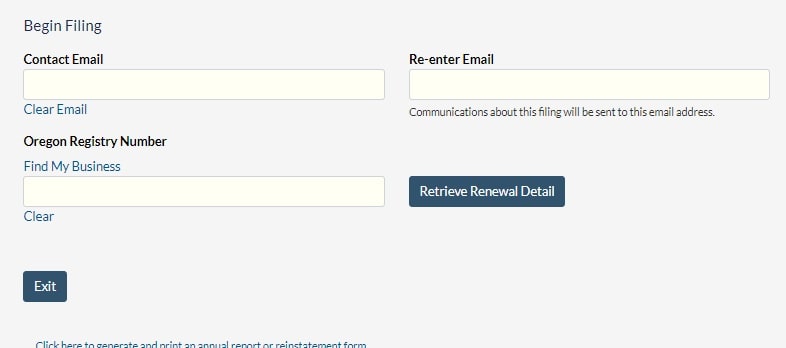

How to File an LLC Annual Report in Oregon

To file your annual report in Oregon, visit the Secretary of State’s website and enter your name, email, and Oregon registry number.

Your business information will appear for you to verify or change, then you’ll submit the report.

The filing fee is $100, and reports are due on the anniversary date of your LLC’s formation.

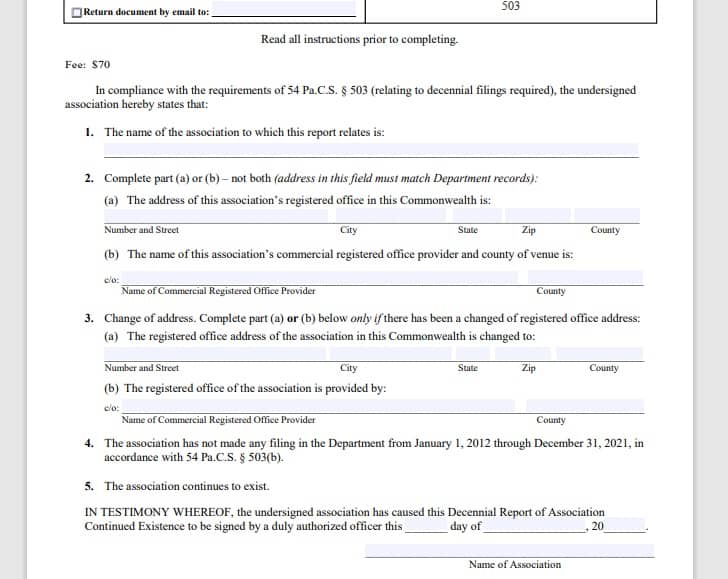

How to File an LLC Decennial Report in Pennsylvania

To file your decennial report in Pennsylvania, visit the Department of State’s website to download the form. Unfortunately, you cannot file online, only by mail.

Your LLC needs to file a decennial report if your business has had no new or amended filings processed with Pennsylvania’s Bureau of Corporations and Charitable Organizations in the last ten years . Review your LLC’s filings within that period to determine whether your business needs to file.

Every business in the state follows the same ten-year filing schedule. The filing years end with the number one, and decennial reports can be filed at any time during the year.

The filing fee is $70, and you’ll mail the report and the fee to:

Pennsylvania Department of State Bureau of Corporations and Charitable Organizations P.O. Box 8722 Harrisburg, PA 17105

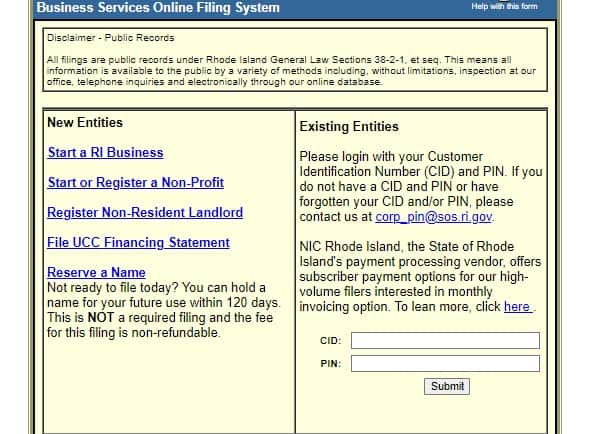

How to File an LLC Annual Report in Rhode Island

To file your annual report in Rhode Island, visit the Secretary of State’s website and log in to your account.

You’ll simply select “File Annual Report” and fill in the required information.

The fee for filing your annual report is $50, with reports due May 1. The fee for late filing is $25.

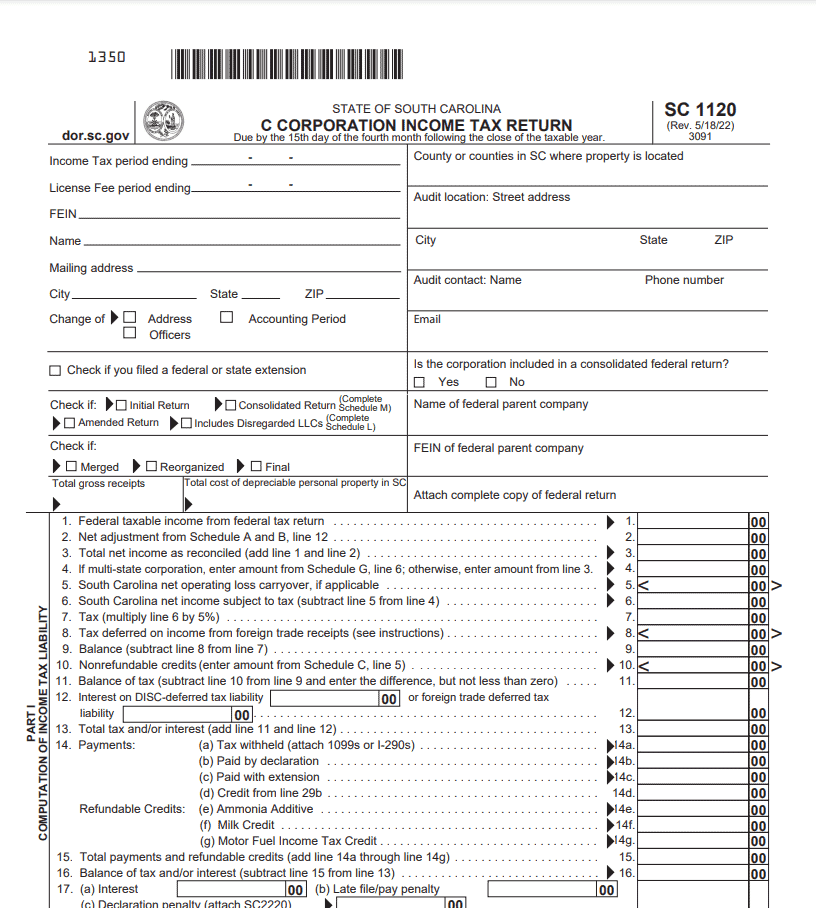

How to File an LLC Annual Report in South Carolina

In South Carolina, your annual report is filed as part of your state corporate tax return. To file online, you have to use approved tax software. In addition, you must file online if your tax liability is more than $15,000.

Approved software providers for South Carolina Corporate eFile (as of January 2022) are:

- Advanced Tax Solutions

- ATX – Universal

- CCH ProSystemFx

- Drake Software

- GoSystems/OneSource

- Intuit ProSeries

- Intuit Tax Online

- Online Taxes Inc

- RCS TaxSlayer

- UltraTax CS (Creative Solutions)

- UTS – TaxWise

If you’re eligible and you wish to file by mail, you can download the form and mail it as follows:

Mail Balance Due returns to :

SCDOR Corporate Taxable PO Box 100151 Columbia, SC 29202

Mail Refund or Zero Tax returns to :

SCDOR Corporate Refund PO Box 125 Columbia, SC 29214-0032

South Carolina doesn’t charge a fee for filing your annual report besides the tax owed. Reports are due on or before the 15th day of the fourth month after the close of the taxable year.

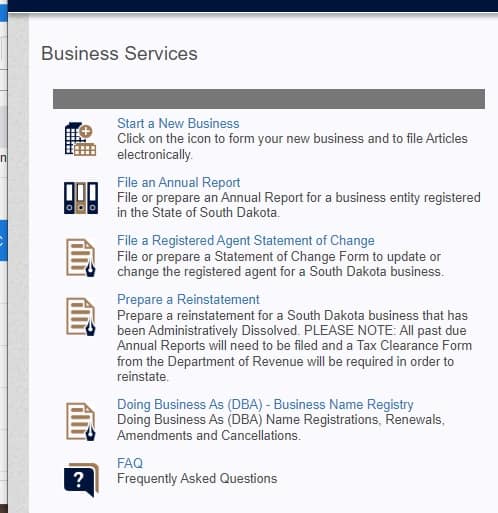

How to File an LLC Annual Report in South Dakota

To file your annual report in South Dakota, visit the Secretary of State’s website and select “File an Annual Report.”

On the next page, select “File Annual Report” again. Then you’ll enter your business ID number and follow the prompts to enter the required information.

The fee for filing your annual report is $50 if you file online and $65 if you file by mail.

Reports are due on the first day of the anniversary month

How to File an LLC Annual Report in Tennessee

To file your annual report in Tennessee, visit the Secretary of State’s yearly report website and click “Start Now.”

Then fill in the required information and submit your report.

The fee for filing your annual report is $50 per each LLC member, with a minimum of $300 and a maximum of $3,000.

Reports are due by the first day of the fourth month after the end of your LLC’s fiscal year.

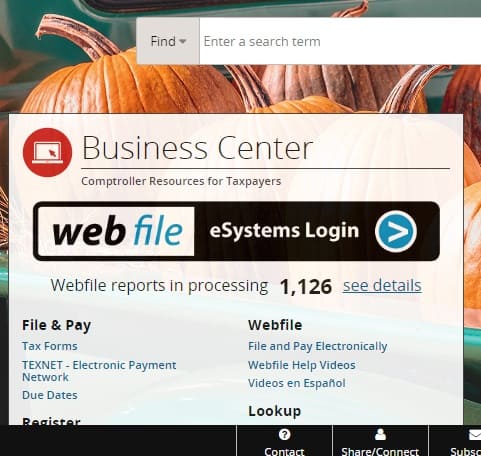

How to File an LLC Annual Report in Texas

In Texas, your annual report is filed with your annual franchise tax return. To file your annual report and franchise tax return in Texas, visit the Comptroller’s website and follow the link to the eSystems login.

Log in to your account and select “assign taxes/fees.” Next, enter your Texas tax ID number, follow the prompts to enter the required information, and pay your franchise tax.

Your tax due will depend on the amount of your revenue, and reports are due May 15th. Find instructions on calculating your tax due here .

How to File an LLC Annual Report in Utah

To file your annual report in Utah, visit the Division of Corporations and Commercial Code website and click “renew a business.”

Enter your business entity number and follow the prompts to enter the required information.

The filing fee is $18, and reports are due on the anniversary date of the LLC formation. The fee for late filing is $10.

How to File an LLC Annual Report in Vermont

To file your annual report in Vermont, visit the Secretary of State’s website and select “business services.”

Then select “reports and renewals” and then “annual reports.”

Follow the prompts and log in to your account to enter the required information and submit the report.

The fee for filing your annual report is $35, and reports are due within three months of the end of your latest fiscal year.

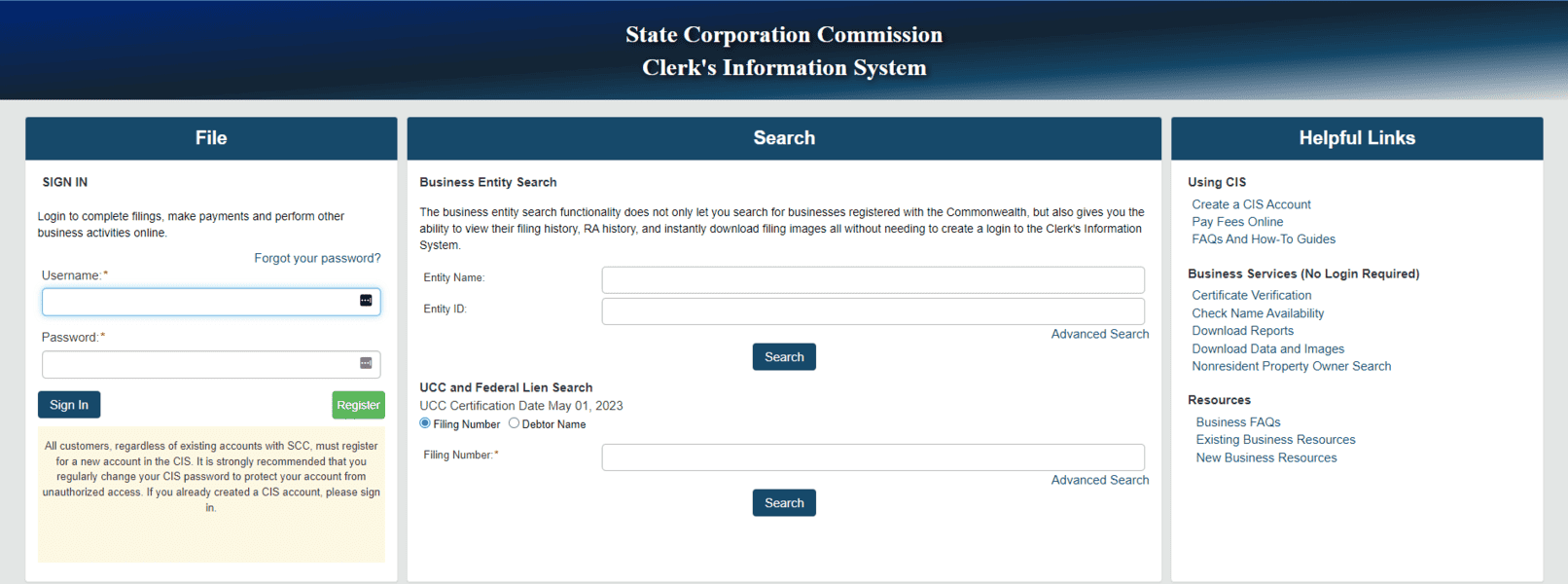

How to File an LLC Annual Report in Virginia

To file your annual report in Virginia, visit the State Corporation Commission’s website and log in to your account.

Click on “online services,” then click on the annual report link, search for your business, and enter all the required information.

The filing fee is $50, and reports are due on the last business day of the anniversary month of your LLC’s formation.

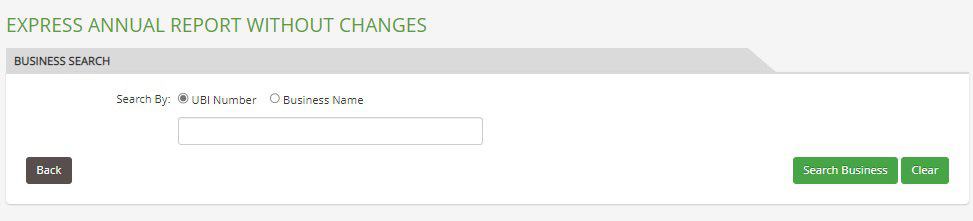

How to File an LLC Annual Report in Washington

To file your annual report in Washington, visit the Express Annual Report website and enter your business name or UBI number.

Once you’ve located your business record, fill in the required information and submit your report.

The filing fee is $60, and reports are due on the last day of the anniversary month of your LLC’s formation.

How to File an LLC Annual Report in West Virginia

To file your annual report in West Virginia, visit the WV One Stop Business Portal website and either log in to your account or click “Guest Annual Report Filing.”

Then select “SOS annual report” and search for your business on the next page.

Simply fill in the required information and submit your report.

The filing fee is $25, and reports are due July 1. The fee for late filing is $50.

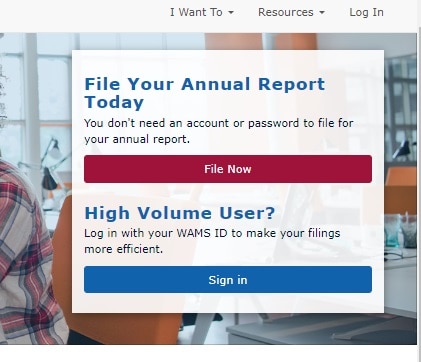

How to File an LLC Annual Report in Wisconsin

To file your annual report in Wisconsin, visit the One Stop Business Portal and click “File Now.”

Then search for your business record and complete the required information.

The filing fee is $25, and reports are due by the end of the quarter in which your LLC was initially formed.

How to File an LLC Annual Report in Wyoming

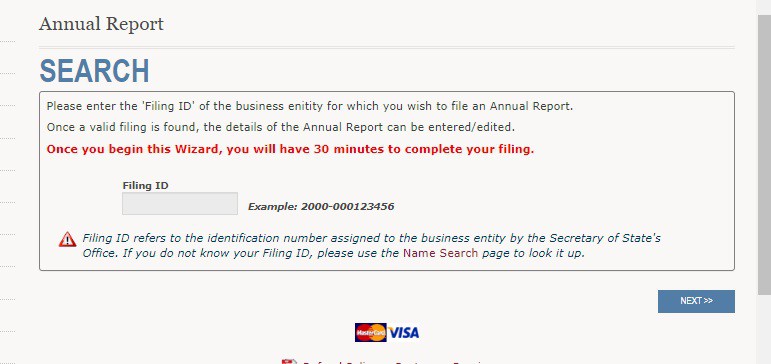

To file your annual report in Wyoming, visit the Business Center website and enter your filing I.D. number.

The filing fee is an annual report license tax, which is $60 or $0.00002 for every dollar of your assets, whichever is greater. You must file by mail if your tax is more than $500.

Reports are due on the first anniversary month of your LLC’s formation.

Annual renewal fees and filing requirements vary from state to state. Arizona has no annual reporting requirement for LLCs, for instance, while New York requires LLCs to file biennial statements. So make sure you’re aware of your state’s requirements and deadlines.

Renewal fees range from $50 to $750, and the filing process varies. Some states use different names for regular reports. Your state might call it a periodic report, a biennial statement, or a franchise tax report. Regardless, the purpose is the same.

Remember that you’ll have to abide by your state’s guidelines whether or not your business made a profit. Failure to comply could result in hefty fines or the dissolution of your business. Fortunately, in most states, annual filings can be completed online.

It’s important to pay close attention to filing due dates. In some states, annual reports are due on the anniversary of your business formation. In others, all businesses have exact due yearly dates.

LLCs that do business in multiple states must register as foreign LLCs in some states and comply with each state’s filing requirements. A foreign LLC is an LLC doing business in a state other than the one in which it initially registered.

For example, if your LLC is registered in Pennsylvania and you start doing business in New Jersey, you must register as a foreign LLC in New Jersey.

If you fit any of the following criteria, your LLC may be considered a foreign business:

- You have a physical presence of any kind in that state

- You have employees in that state

- You regularly meet with clients, managers, or investors in that state

- You are licensed to do business in that state

You may also need to register as a foreign LLC if your business has a bank account or property in that state. However, if you’re an online business registered in one state that makes sales in other states, you’re most likely not a foreign business.

Filing annual reports takes considerable time and effort, but they are necessary for running your business. Take the time to familiarize yourself with your state’s rules and regulations on filing. Make sure to file your LLC annual report on time and pay any associated fees to keep your business in good standing.

Featured Resources

How to Transfer Rental Property to an LLC

Carolyn Young

Published on June 6, 2023

If you own a rental property, you can transfer it to a limited liability company (LLC). You may already have an LLC or need to start one, but either ...

How to Protect Your Assets as an LLC Owner

Many entrepreneurs form a limited liability company (LLC) for their new business because of its many benefits, such as liability protection. An LLCi ...

What is an L3C (Low-Profit Limited Liability Company)?

A low-profit limited liability company, known as an L3C, is essentially a combination of a limited liability company (LLC) and a non-profit. Thegoal ...

- Business Formation Guide

- Start an LLC

- Annual Report

Massachusetts LLC Annual Report

Last Updated: May 13, 2024, 8:32 am by TRUiC Team

Once you have formed your Massachusetts LLC , you must stay on top of your state’s filing deadlines ( annual report ) in order to stay in good standing and avoid unnecessary fines or penalties.

This article answers the following questions for a Massachusetts LLC:

- What is an annual report?

- How do I file an annual report?

- Should I use a registered agent service?

What Is an Annual Report?

In Massachusetts, an annual report is a regular filing that your limited liability company must complete every year to update your business information, including:

- Business name and street address

- General character of the business

- Registered agent name and address

- Names and addresses of LLC officials (i.e., members, managers, directors, or officers)

The purpose of this report is to keep your business records up to date with the State of Massachusetts. This allows creditors and other interested parties to look up your business address in case they need to contact you. The government uses this information to track the payment of your LLC state taxes .

Ready to form a Massachusetts LLC? Read our top LLC services review to find the right formation service for you.

How Do I File an Annual Report?

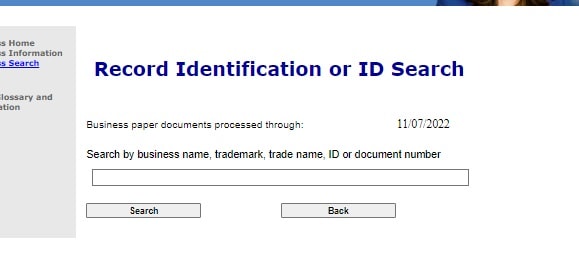

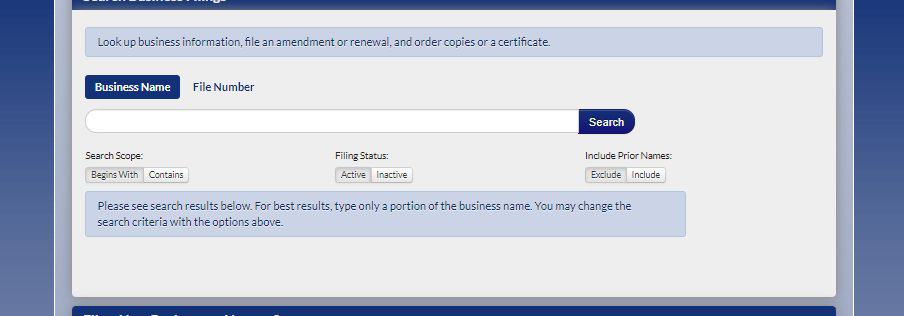

You can file your Massachusetts LLC annual report with the Secretary of the Commonwealth. You must know your state identification number prior to filing, which can be found through a business entity search .

File Your Massachusetts Annual Report

OPTION 1: File Online With the Massachusetts Secretary of the Commonwealth

OPTION 2: File by Mail, by Fax, or in Person

Fee: $520 online, $500 via hard copy

Filing Address: Secretary of the Commonwealth One Ashburton Place, Room 1717 Boston, MA 02108-1512

Fax: (617) 624-3891

Note: Fax filings must include a cover sheet .

Due Date: Massachusetts LLC annual reports are due every year by the LLC’s anniversary date (i.e., the date when you initially registered your LLC with the state).

Late Filings: Any annual report received after the due date will cause your LLC to become delinquent. Further failure to file an annual report could result in the dissolution of your Massachusetts LLC.

Should I Use a Registered Agent Service?

A registered agent , known in Massachusetts as a resident agent , is a person or business nominated by your company to officially receive and send papers on your behalf. By using a registered agent service, you can ensure that your LLC's reports are always filed on time to the appropriate government agency. Here are the three main advantages to using a registered agent service for your LLC:

- Avoid late filing penalties: The Secretary of the Commonwealth can dissolve a Massachusetts LLC if it does not file an annual report. A registered agent service will notify you when reports are due, and they can also submit the filing for you for an additional fee.

- Gain flexibility: A registered agent service can receive and send documents for your LLC during regular business hours so that you don’t have to be on the job from 9 a.m. to 5 p.m. every week. You can also use a registered agent service to form an LLC in other states where you don't already have an established business presence.

- Maintain privacy: Using a registered agent service allows you to keep your personal address off of public records, ensuring your privacy. Additionally, if someone sues your LLC, the lawsuit will be served to the registered agent’s address rather than your place of business.

Learn more about getting a Massachusetts resident agent by reading our guide.

Recommended: Northwest provides free registered agent service for the first year as part of their LLC packages.

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

- Industries Accounting Firms Architecture Construction Engineering Law Firms Nonprofit

- Partner Partner With Us HCA Partner Marketplace

- Information Center

- Software Overview

- Entity Manager

- License Manager

- Records Manager

- Tax Manager

- Dynamic Disclosures®

- Registered Agent Service

- Services Overview

- Most Popular

- Annual Report

- Business License

- Charitable Registration

- Foreign Qualification

- Incorporation

- LLC Formation

- Nonprofit Formation

- Registered Agent

- Beneficial Ownership Information (BOI)

- Certificate of Good Standing

- Certified Copies

- Dissolution and Withdrawal

- Doing Business As (DBA)

- Drop-off Filing

- Employer Identification Number (EIN)

- Initial Report

- Name Reservation

- Payroll Tax Registration

- Reinstatement

- Sales and Use Tax Registration

- Accounting Firms

- Architecture

- Construction

- Engineering

- Partner With Us

- HCA Partner Marketplace

Massachusetts Annual Report

Stay compliant with managed annual report service.

- Save time! Maintain a single online company profile that we use to file annual reports nationwide.

- Ensure on-time filing. Our software tracks due dates and files reports on time to maintain good standing and avoid late fees.

- Enjoy total visibility. See due dates, filing status, approved documents, and more in Entity Manager.

Annual fees from $100 to $175 per state plus filing fees.

- Massachusetts Annual Report Information

Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

State agencies do not provide consistent reminders when annual reports are due. As a result, you may be tracking your company’s annual report due dates on your own. Perhaps you received a letter from the state telling you an annual report is coming due, or worse, overdue.

This page provides information about how to file a Massachusetts annual report. Our handy reference table will provide you with the Massachusetts annual report due dates and filing fees for each entity type. We also offer Managed Annual Report Service to offload your annual reports entirely. We track your due dates and file on time, every time.

What Is an Annual Report?

Why is a massachusetts annual report required, how do i file a massachusetts annual report, where do i file a massachusetts annual report, when is a massachusetts annual report due, what is the massachusetts annual report filing fee, who can file a massachusetts annual report, massachusetts annual report requirements by entity type, annual report requirements by state.

Annual reports are required business filings, typically made with the secretary of state. In most states, companies submit any changes to their address, ownership and officers, and registered agent. Some states require additional information about revenue, assets, stock, and paid-in capital.

Tracking due dates in multiple states and filing on time is often challenging. A company that registers in multiple states will have due dates at different times throughout the year. In some states, they may be required to file every two years (biennially).

Companies spend countless resources managing annual reports on their own. Tracking deadlines, gathering information, navigating forms and online filing portals, and submitting reports on time requires constant attention throughout the year. The complexity only increases for companies with multiple entities or that register in multiple states. Furthermore, most companies rely on spreadsheets, calendar reminders, and file folders to manage their annual reports.

With Harbor Compliance’s Managed Annual Report Service, we provide cloud-based software to view entity data, store corporate records, and ensure business continuity in a virtual world.

Annual reports are required by statute in nearly every state. They provide state agencies with updated information on the entities registered in their state. Your company is required to file annual reports to maintain good standing and continue operating.

Failure to file annual reports on time can result in late fees. Most states enforce additional penalties on lapsed entities. These include the loss of naming rights, loss of access to the courts, and administrative dissolution. Many banks, licensing agencies, and even prospective clients require evidence that a business is in good standing. By filing annual reports each year on time, companies avoid the costly and potentially embarrassing consequences of noncompliance.

There are two ways to file a Massachusetts annual report.

- If you plan to file your Massachusetts Annual Report on your own, view the table below for the available filing methods for your type of legal entity. We also provide links to forms and agency filing portals.

- Sign up for Managed Annual Report Service . Simply provide your information one time and update it with us when it changes. Our software tracks your due dates and automatically files your annual reports throughout the year.

Annual Reports are filed with the Massachusetts Secretary of the Commonwealth - Corporations Division. To view your entity registration and confirm your due date, use the corporation filing authority's business search feature and search for your entity.

Annual report due dates depends on the type of entity you have and whether your business is domestic or foreign to Massachusetts. In many cases, the annual report deadline is based on the date you form or register with the state. View the table below to find the due dates for your state.

Harbor Compliance’s software directly integrates with secretary of state databases. With our Managed Annual Report Service, we use your entity data to track your annual report due dates accurately and file on time, every time.

Annual report filing fees depend on the type of entity you have and whether your business is domestic or foreign to Massachusetts. View the table below to find the filing fees for your state.

With our Managed Annual Report Service, you no longer have to calculate your fee or remit payment to multiple agencies. Our software calculates your exact filing fee. We simply invoice your filing fee 90 days before your report due date directly within your Client Portal.

Anyone with authority to prepare and submit business filings can file a Massachusetts Annual Report. However, ensuring compliance across entities and jurisdictions creates complexity.

Harbor Compliance simplifies your annual report compliance. Our Managed Annual Report Service replaces legacy systems for tracking due dates and filing annual reports. We eliminate your need to research requirements, create due date reminders, and navigate government forms and filing portals.

Our service maximizes your time savings and ensures accuracy in filing. When you sign up, we conduct an initial review of your entity registrations to identify noncompliance. We offer additional services to prepare and file overdue reports, register entities, and reinstate them into good standing.

We minimize the amount of information you provide to us. Simply enter your company data into a secure, web-based form, and update it only when it changes. We use that information to file your reports automatically throughout the year. Entity Manager Software tracks annual report due dates and calculates filing fees across all states and entities. Enjoy immediate visibility into registration data, entity statuses, and upcoming due dates.

See the table below for information on filing an annual report in Massachusetts. Select your entity type to view your Massachusetts annual report filing fee and due date.

Massachusetts Corporation Annual Report Requirements:

Domestic massachusetts limited liability company annual report requirements:, foreign massachusetts limited liability company annual report requirements:, domestic massachusetts nonprofit corporation annual report requirements:, foreign massachusetts nonprofit corporation annual report requirements:, massachusetts professional corporation annual report requirements:, domestic massachusetts professional llc annual report requirements:, foreign massachusetts professional llc annual report requirements:, domestic massachusetts limited partnership annual report requirements:, foreign massachusetts limited partnership annual report requirements:, massachusetts limited liability partnership annual report requirements:, massachusetts trust annual report requirements:, related resources.

- Help Center

- Testimonials

- Developers & API

© 2012 - 2024 Harbor Compliance. All rights reserved.

Harbor Compliance does not provide tax, financial, or legal advice. Use of our services does not create an attorney-client relationship. Harbor Compliance is not acting as your attorney and does not review information you provide to us for legal accuracy or sufficiency. Access to our website is subject to our Terms of Use and Service Agreement.

Filing Fees

Filing fees depend on your individual situation. We do our best to calculate your filing fees upfront and collect those fees today so we can get started. Your specialist will determine your exact filing fees and invoice additional fees if required.

MA LLC Annual Report: Everything You Need to Know

An MA LLC annual report is one of several documents required to do business in the state. This document and several others are key to keeping your Massachusetts enterprise in good standing. 3 min read updated on February 01, 2023

An MA LLC annual report is one of several documents required to do business in the state. This document and several others are key to keeping your Massachusetts enterprise in good standing.

Annual Reports

All LLCs in Massachusetts must file an annual report with the Corporations Division. This document is due by the anniversary of when you filed the certificate of organization.

The report must list information shared in its certificate of organization. Filing your annual report is required, and failing to do so will affect your LLC's good standing in the state. You can file by mail in Massachusetts for a $500 fee, and you can file online for a $520 fee. It takes 24 to 36 hours to process your annual report.

Check your Certificate of Organization to find the original filing date and determine when you need to submit your annual report. If you don't have a copy of this document, go online to search for your LLC . The information you need should be listed as the Date of Organization in Massachusetts for your enterprise. Businesses that miss the deadline are considered delinquent, and the state dissolves LLCs that fail to file an annual report.

Note that you should receive a reminder when your due date is approaching. Don't count on receiving a reminder every year, however. It's better to find your original filing date and mail your annual report on time each year.

You can submit the annual report online. You just need your customer ID number and PIN, which is listed on the state's reminder. You can also get this information from the Corporations Division via email . Simply submit your business name , and the state will reply within half an hour.

In addition to the annual report, there are a few other documents you may file to help you manage your LLC.

Statement of Change of Resident Agent/Office

LLCs must appoint a registered agent when they set up their companies. If the registered agent changes addresses, you can file a Certificate of Statement of Change of Resident Agent/Resident Office.

You can submit this form by mail along with a $25 filing fee. It's free to fill out and submit this form online.

Statement of Change of Resident Office Address by Resident Agent

You can also change your LLC's address. Simply file a Statement of Change of Resident Office Address. There's also a $25 filing fee for this form if you submit it by mail. Filing online, however, is free.

Statement of Resignation of Resident Agent

File a Statement of Resignation with the Corporations Division if you want to resign from the LLC. Note that you must also submit this form to your LLC. Filing by mail costs $25, but you can change your office address with this form online for free.

Application for Reinstatement Following Administrative Dissolution

If you dissolve your LLC or the state dissolves the LLC because the members failed to file an annual report, you can file a form to reinstate your business. Submit your Application for Reinstatement Following Administrative Dissolution along with a $100 filing fee to re-establish your business. You must also submit any annual reports you missed.

Restated Certificates

An LLC that makes changes to its certificate of organization, also known as the articles of organization , can submit a restated certificate to make those changes official and replace the old copy. A restated certificate of organization simply restates the rules outlined in the articles of organization. An amended and restated certificate of organization includes changes to the articles of organization.

Regardless of which type of restated certificate you apply for, you'll need to provide:

- Your LLC's federal identification number

- Your LLC's name

- The original certificate of organization's filing date

- The information included in the original certificate of organization

- The information included in any amendments to the restated certificate

- If no amendments will be included, a statement indicating that no changes are being made

- A statement clarifying that the restatement is duly executed and is being filed appropriately

The rules outlined in the restated certificate go into effect as soon as the form is filed. However, you can also specify a future date when the changes will apply. It costs $100 to file a restated certificate of organization. The restated certificate replaces the initial certificate of organization once approved or upon the indicated date.

If you need help with an MA LLC annual report, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Massachusetts Secretary of State LLC

- LLC Lookup Massachusetts

- Massachusetts LLC Annual Report

- Certificate of LLC

- Massachusetts Corporate Annual Report: Everything to Know

- Florida Annual Report LLC

- Certificate of Organization LLC

- Florida LLC Annual Fees

- Oregon LLC Annual Report

- LLC In Massachusetts

- Professional Corporation

- Apply for an EIN

- File a DBA Online

- Foreign Qualifications

- Dissolution

- Reinstatement

- Certificate of Good Standing

- Conversions

- Certified Copies

- Corporate Bylaws & Minutes

- LLC Operating Agreement Filing

- Annual Report Filing Services

- Create & File Timely Initial Reports

- Corporate Seals & Embossers

- BOI Reporting

- Appoint a Registered Agent

- What is a Registered Agent?

- Find a New Registered Agent

- Registered Agent Faqs

- Learning Center

- Recent Articles

- DoMyLLC.com

- Massachusetts

File a Massachusetts Annual Report

If you conduct business in the state of Massachusetts, be sure to declare to the state that you are still operational by filing an annual report with the Corporations Division every year.

Speak to an Expert today about our annual report service at 888-366-9552

Reports as low as $49 with our Total Compliance Package

No matter what type of business you own, if you conduct business in the state of Massachusetts, it’s important that you file an annual report each year. The deadlines and cost to do so vary based on what type of company you own. But, it’s important that you file because the state considers annual reports to be compliance documents.

Annual reports allow the state of Massachusetts to keep track of any changes that have occurred to your business during the past year, such as changes to your corporate structure or agent registered to conduct business on your behalf. Failure to file on time could jeopardize your business’ standing in the state.

Let Us File Your Massachusetts Annual Report

Worried about filing your annual report to the State of Massachusetts? Let us do it for you. Our convenient filing services come with the following benefits:

- Experienced preparation

- Guaranteed on-time filing with the Massachusetts Secretary of State

- Keep your Massachusetts business operating legally

- Avoid late fees and penalties or the right to do business in the state

We Protect Your Privacy

Your privacy is of utmost importance to us and we go to great lengths to keep your personal information from falling into the wrong hands. As part of our promise, we:

- Monitor your Massachusetts state business records

- Update your records for you

- Allow you to use our address when filing instead of yours

We don’t sell your information to anyone. We only provide it to government entities when required and keep it on file so we can help you with your future annual registration needs.

Massachusetts Annual Report Filing Fees & Instructions

The cost to file an annual report with the Corporations Division varies based on what type of business you own. Profit corporations, both foreign and domestic, must pay $109 to file their annual report. The reports are due 2.5 months after the fiscal year has come to a close. Nonprofit corporations must pay $18.50 to file an annual report, and they must file by November 1.

LLCs have the most expensive annual reports in the state of Massachusetts. These companies must pay $520 to file with the Corporations Division. An LLC's annual report is due on the company's anniversary date.

Massachusetts Corporations (Domestic & Foreign)

Massachusetts limited liability companies (domestic & foreign), massachusetts nonprofit corporations (domestic & foreign), massachusetts professional corporations (domestic & foreign), massachusetts limited partnerships (domestic & foreign), massachusetts limited liability partnerships, massachusetts limited liability limited partnerships, how to file your massachusetts secretary of state annual report.

In order to file a Massachusetts annual report, companies have three basic options in order to complete the process. These include:

- Filling out the paper report that can be downloaded from the Corporations Division’s website, then mailing in the completed report in its entirety.

- Reports can also be completed and faxed to 617-624-3891 along with the Fax Voucher Coversheet found at the website.

- Finally, you can use the online service to complete the process online. This requires your customer ID and PIN, which can be emailed to you from the Corporations Division. Online filing is generally preferred since it is faster and more reliable.

You’ll need to also submit payment regardless of the method you use to complete your filing process, and submit the forms by the due date. This is 2 and a half months after the end of the fiscal year for your company if you are profit corporation or 4 and a half months after the end of the fiscal year for charities. LLCs are required to file by their anniversary date each year.

Failure to file can lead to noncompliance and create numerous potential risks for your business.

Our Massachusetts Annual Report Service

We offer secure, professional annual report preparation and filing services with the Massachusetts Secretary of State. Hire us and you’ll never need to worry about missing a report deadline or paying hidden fees or penalties. We’ll make sure your business is in good legal standing so you don’t face the threat of administrative dissolution by the state.

Massachusetts Annual Report Filing Service Benefits

Our annual report filing services can benefit you in the following ways:

- Hassle-free compliance with the state of Massachusetts’ business reporting requirements

- No missed deadlines or late fees

- Professionally prepared and submitted filing service

Have questions about our annual report services or business compliance solutions? Contact us or fill out our convenient online price quote form .

Massachusetts Business Annual Report FAQS

What is the deadline to file the massachusetts annual report.

- LLCs, LPs, and PLLCs must file by the anniversary date of their business’ creation each year.

- Corporations and PCs must file by 2.5 months after the end of their fiscal year. Generally this falls on March 15th.

- LLPs must file by the last day of February each year

- Nonprofits must file by November 1

- Charities must file by 4.5 months after the fiscal year end, which usually ends up falling on May 15 of each year.

What is the Cost to File the Annual Report in Massachusetts?

- Corporations – $125 mailed in, $109 online or by fax.

- LLCs – $500 by mail, $520 online or by fax

- Charities – Varies based on yearly revenue. Between $35 and $2000

- Nonprofits – $15 by mail, $18.50 fax or online

Will I Be Notified by the State of Massachusetts?

No. Massachusetts does not send out reminders for the annual report. It is up to you to remember to file each year.

Is There a Penalty for Filing the Annual Report Late?

Yes, there is a $25 late penalty if you miss the due date. However, this does not include any potential noncompliance penalties such as dissolution of your corporation or revocation of license, which can lead to even more potential costs for a company.

Who Can File the Massachusetts Annual Report for My Business?

Anyone with authority can file the Massachusetts annual report on your company’s behalf.

Massachusetts Business Resources

Massachusetts Office of Secretary of State Phone Number: (617) 727-9640

Address: Massachusetts Secretary of State One Ashburton Place, 17th floor Boston, MA 02108

HELP FILE MY MASSACHUSETTS ANNUAL REPORT

There is a lot to remember when running a business and making sure the annual report or biennial report is filed on time is the last thing a business owner needs to worry about. At DoMyLLC we have an entire department that is dedicated to ensuring annual report filing are complete in a timely manner. Take one less task off your plate and feel confident your annual report will be filed on time to avoid late penalties and falling into bad standing with the state.

Official websites use .boston.gov

A .boston.gov website belongs to an official government organization in the City of Boston.

Secure .gov websites use HTTPS

) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

Building Emissions Reduction and Disclosure

Boston’s Building Emissions Reduction and Disclosure Ordinance (BERDO) sets requirements for large existing buildings to reduce their greenhouse gas emissions over time.

Email or call Mon - Fri, 9 a.m. - 5 p.m.

↗ RETROFIT Resource HuB

↗ berdo review board , ↗ berdo regulations website, ↗ berdo fund website, announcements.

Building owners must report their energy and water data for the 2023 calendar year. Learn how to complete reporting here.

We are offering data reporting and verification services to building owners who need extra assistance.

The first application cycle of the Equitable Emissions Investment Fund is now open for nonprofit organizations.

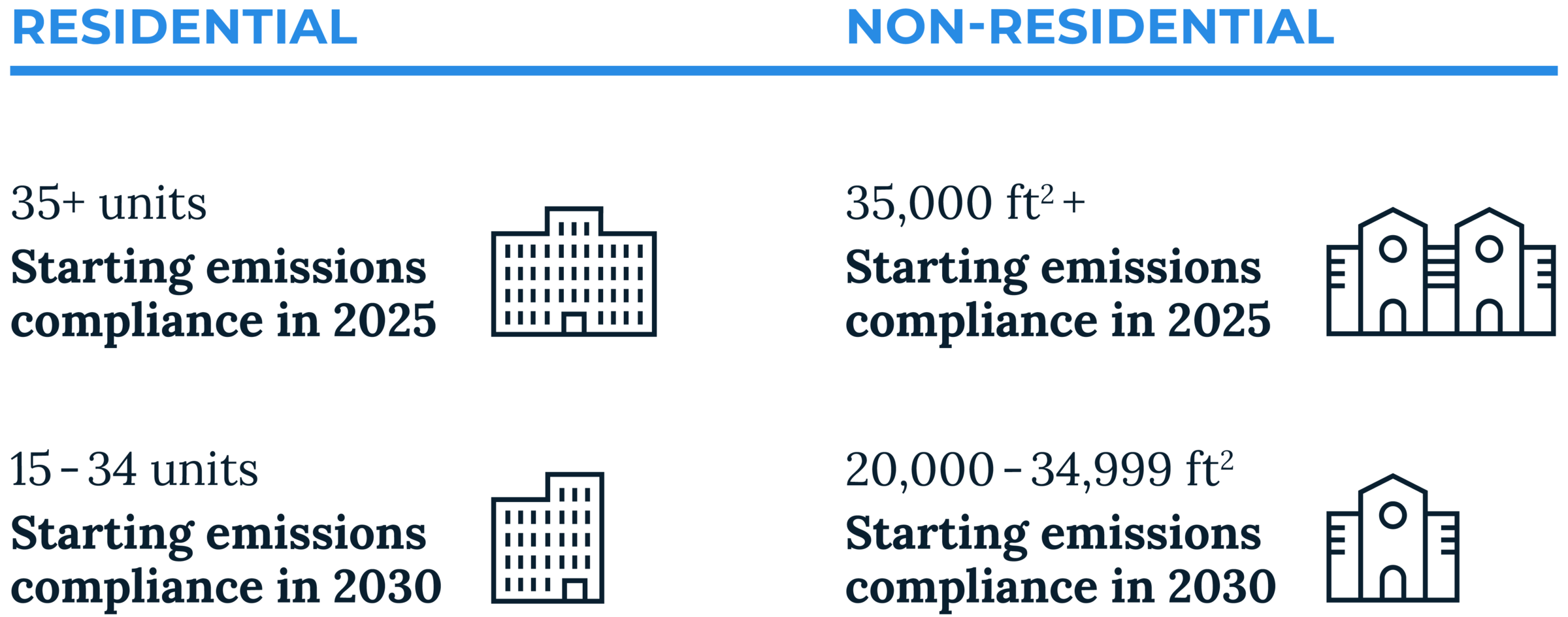

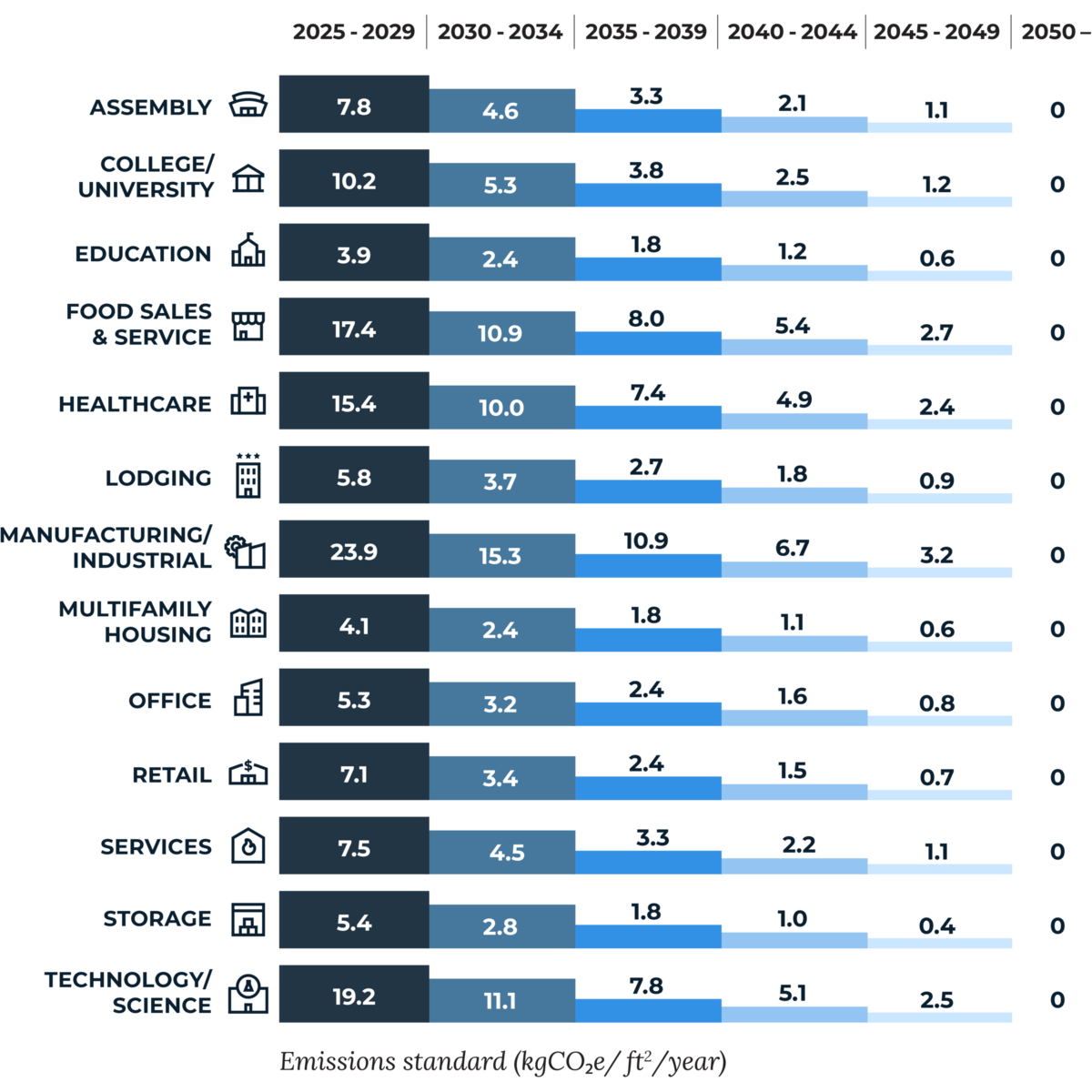

WHAT IS BERDO?

BERDO is a local law that aims to reduce air pollution and greenhouse gas emissions generated by large buildings in Boston. Owners of buildings subject to BERDO are required to report their buildings’ annual energy and water consumption. Starting in either 2025 or 2030, they will also need to comply with building emissions standards (i.e., emissions limits). The emissions standards set by BERDO decrease over time, with all buildings expected to reach net-zero emissions by 2050.

To learn more about BERDO

↗ berdo 101 quick guide, ↗ ordinance, ↗ regulations, ↗ policies and procedures, who is covered.

BERDO applies to the following buildings:

↗ BERDO COVERED BUILDINGS LIST

↗ administrative guidance.

Please note that a mixed-use building is considered residential if 50% or more of its Gross Floor Area, excluding parking, has a residential use.

WHAT ARE MY OBLIGATIONS UNDER BERDO?

Annual reporting of total energy and water use from the previous calendar year.

Learn how to report to BERDO

Third-party verification

Third-party verify reported data on the first year of reporting and every "Verification Year" thereafter.

Learn how to complete third-party verification

ㅤEmissions reductions

Reduce annual emissions below an emissions standard (emissions limit) corresponding to your building use type.

Learn how to comply with emissions standards

HOW DO I REPORT TO BERDO?

There are main parts to reporting:

- Report key building characteristics and your annual energy and water use through ENERGY Star Portfolio Manager

- Complete the BERDO Reporting Form to provide key data related to emissions compliance

- Complete third-party verification

- Video: How to report through Energy Star Portfolio Manager

- Video: How to request data from Eversource

↗ How to Report Guide

↗ request data from eversource , ↗ request data from national grid , ↗ tenant data authorization form , ↗ designate tenant as owner letter, ↗ portfolio manager helpdesk, how do i comply with third-party verification.

You must hire a third-party qualified energy professional to verify your reported data.

T hird-party verification is required for the first year of reporting and every " Verification Year" thereafter. Verification Years include:

↗ LIST OF THIRD-PARTY VERIFIERS (REQUEST FOR INFORMATION RESPONSEs)

↗ how to guide for third-party verifiers, how do i get started with emissions compliance, 1. determine your first year of emissions compliance.

- Buildings must begin complying with emissions standards in 2025 or 2030, depending on their size:

2. identify your emissions standard

- Use the chart on the right to identify the emissions standard that applies to your building.

- As a default, buildings are required to comply with the emissions standard that matches its largest primary use type .

- Mixed-use buildings may adopt a Blended Emissions Standard based on the square footage of each of the building's primary uses.

3. start planning for emissions compliance

- Buildings can decrease their emissions by reducing energy use and transitioning away from fossil fuels, using or buying renewable energy, or investing in environmental justice communities through Alternative Compliance Payments.

- All building owners are encouraged to start planning early to utilize equipment turnover and capital improvements as opportunities to reduce energy use and emissions.

- Our Retrofit Hub provides a step-by-step guide for BERDO compliance.

follow the step-by-step emissions compliance guide in our RETROFIT RESOURCE HUB:

Retrofitting berdo buildings, get in touch, ↗ schedule a building consultation .

If you have already reported your data to BERDO, you can schedule a free one-on-one virtual building emissions consultation with us to help you understand your current emissions and compliance options.

↗ REGISTER FOR OFFICE HOURS ON EMISSIONS COMPLIANCE

The BERDO team hosts weekly virtual office hours focused on emissions compliance. Office hours are held weekly on Fridays at 10 a.m. on Zoom.

Data Disclosure

The City of Boston is required to annually disclose BERDO reported data from the previous year.

Future data disclosures will report on metrics related to environmental justice and the equitable implementation of BERDO. Staff, in collaboration with community members, are identifying appropriate metrics to track and report on over time. Initial research has been conducted to evaluate options for the development of environmental justice metrics for BERDO and has been summarized in a memo.

↗ 2023 Data DisclosurE

↗ search prior data disclosures, ↗ berdo equity metrics memo, upcoming events, previous webinars, renewable energy webinar (march 27, 2024).

- Slides / Recording

HARDSHIP COMPLIANCE PLANS WEBINAR (FEBRUARY 14, 2024)

- Slides / Recording

INDIVIDUAL COMPLIANCE SCHEDULES WEBINAR (JANUARY 31, 2024)

Building portfolios webinar (january 17, 2024).

- Slides / Recording

EMISSIONS COMPLIANCE WEBINAR (JANUARY 3, 2024)

- Slides / Recording

- BERDO Regulations Listening Session (July 19, 2022)

- BERDO Regulations Listening Session Notes (July 19, 2022)

- How to Make a Zero-Over-Time Plan Slides (June 29, 2022)

- How to Make a Zero-Over-Time Plan Recording (June 29, 2022)

- BERDO Technical Training Slides (June 23, 2022)

- BERDO Technical Training Recording (June 23, 2022)

- BERDO 2.0 101 Slides (May 24, 2022)

- BERDO 2.0 101 Recording (May 24, 2022)

- How to Report for BERDO through Energy Star Portfolio Manager Slides (May 2, 2022)

- How to Report for BERDO through Energy Star Portfolio Manager Recording (May 2, 2022)

- Mass Save Multifamily Programs Slides (April 26, 2022 )

- Mass Save Multifamily Programs Recording (April 26, 2022)

- Mass Save Commercial Programs Slides (April 12, 2022)

- Mass Save Commercial Programs Recording (April 12, 2022)

- BERDO 2.0 101 Slides (April 4, 2022)

- BERDO 2.0 101 Recording (April 4, 2022)

- Multifamily Building Electrification Slides (March 29, 2022 )

- Multifamily Building Electrification Recording (March 29, 2022)

Sign up to receive updates on BERDO from the Environment Department.

Who's Involved:

Nearly 2 Million Adults in Massachusetts are Food Insecure Including 45% of Adults in Four Counties, According to The Greater Boston Food Bank’s Fourth Annual Statewide Study

Home » News » Press Releases » Nearly 2 Million Adults in Massachusetts are Food Insecure Including 45% of Adults in Four Counties, According to The Greater Boston Food Bank’s Fourth Annual Statewide Study

FOR IMMEDIATE RELEASE

- Study finds 34% of state households report food insecurity, reveals stark racial disparities; eight out of 10 receiving SNAP benefits still seek additional food assistance

- Food-insecure families report needing average of only $60 more per week to achieve food security

Boston, MA (May 29, 2024 ) – With exorbitant costs of living, increased grocery prices and the end of pandemic-era supports in 2023, 1 in 3 Massachusetts adults reported household food insecurity, according to the latest annual statewide study from The Greater Boston Food Bank (GBFB), with the overall number increasing to nearly two million food insecure adults in the Commonwealth. The report, Food Equity and Access in Massachusetts: Voices and Solutions from Lived Experience , is a collaboration between GBFB and Mass General Brigham (MGB).

The study estimates approximately 1.9 million adults in Massachusetts are food insecure, an increase from last year’s estimated 1.8 million adults. Hunger exists in every county across the Commonwealth, with Western Massachusetts and the Boston area seeing the highest levels of food insecurity – Berkshire, Bristol, Hampden and Suffolk Counties report over 45% of adults experiencing food insecurity in 2023.

Although many households experiencing food insecurity utilize federally funded programs like the Supplemental Nutrition Assistance Program (SNAP), Women, Infants, & Children Nutrition Program (WIC) and School and Summer meals, as well as Community Food Assistance Programs (food pantries, community meal programs or mobile markets), the study shows these programs remain inadequate at the current funding level to alleviate food insecurity in Massachusetts. Seventy-nine percent of households using SNAP reported seeking additional food assistance. Additionally, three-quarters of people who used two or more food assistance programs still reported some level of food insecurity.

The households experiencing food insecurity reported on average needing approximately $60 more per week for food — a difference of about $2,000 a year. Statewide, the estimated amount needed among all households facing hunger in 2023 was around $1.7 billion to meet their annual food needs.

“Far too many Massachusetts residents suffer from food insecurity, which has significant negative impacts on their health, wellbeing and security. Our administration has partnered with The Greater Boston Food Bank to increase access to nutritious food across the state, and we’ll keep working hard to combat hunger,” said Governor Maura Healey.

GBFB has been conducting annual research since the end of 2020 to examine the prevalence of food insecurity and barriers to accessing food assistance programs. New to this year’s study is data about the free Universal School Meals program, food insecurity among seniors and college students, barriers and facilitators to WIC participation, more detailed race and ethnicity categories, and county-level food insecurity data.

This year’s study, conducted in collaboration with Mass General Brigham, is funded by the Department of Elementary and Secondary Education (DESE) through a U.S Department of Agriculture (USDA) grant. The Greater Boston Food Bank also collaborates with MGB on several research community projects. One of The Greater Boston Food Bank’s 600 partner agencies that supplies free and healthy food to is MGH Revere Food Pantry, a center that serves 80 families each week with nutritious plant-based food that promotes health. The pantry treats food insecurity and aims to curb nutrition-related chronic diseases such as high blood pressure, diabetes and obesity. Due to overwhelming demand, MGB is slated to expand its offerings by 50% in the upcoming weeks with support from GBFB.

“Food insecurity is closely linked to cardiometabolic diseases—including hypertension and diabetes—which are major contributors to premature mortality and reduced life expectancy across the Commonwealth and in the communities served by Mass General Brigham,” said Elsie Taveras , MD, MPH, Chief Community Health & Health Equity Officer at Mass General Brigham. “Lack of access to healthy, nutritious food continues to disproportionately impact communities of color and other traditionally marginalized groups. With nearly two million adults reporting food insecurity across the state, we are committed to partnering with The Greater Boston Food Bank and others to find equity-based solutions to this public health crisis.”

The research, led by Lauren Fiechtner , MD, MPH, GBFB’s senior health and research advisor and director of pediatric nutrition at Mass General for Children, was developed with input from state, community, and healthcare partners, including GBFB’s Health and Research Advisory Council. From November 2023 to March 2024, GBFB conducted an online survey of more than 3,000 adults in Massachusetts, collecting data from every income, gender, race/ethnicity, age, education, and region to ensure representation of historically unheard voices.

“Lived expertise is the foundation of this report,” said Dr. Fiechtner. “When we asked folks facing hunger what needs to change, the responses overwhelmingly attributed food insecurity to high inflation and cost of living, low-paying jobs, and limited public transportation options. This study allows us to make data-driven, community-based investments and advance priorities that will have a real impact on the lives of our most vulnerable neighbors who are facing food insecurity every day.”

Through this report, GBFB aims to elevate voices of those with food insecurity and their lived expertise, highlighting their solutions for solving hunger; decrease inequities in food access by improving experiences for those receiving services from hunger-relief organizations and federal nutrition programs that meet dietary and cultural preferences; and continue addressing the elevated need and increase awareness of, support for, and enrollment in nutrition assistance programs for families across the Commonwealth.

“The fact that 1 in 3 people remain food insecure is an unacceptable day to day reality for far too many in our state, one of the wealthiest in the nation,” said Catherine D’Amato, president & CEO of GBFB. “Food insecurity is political, economic, and personal. Massachusetts may be doing all the right things, but without proper funding, benefits like SNAP and WIC are simply not enough to keep families fed, and many of them continue to make significant tradeoffs to put food on the table. As a state, we can fix this. We have the power to solve hunger here in Massachusetts.”

Of the 3,000 individuals who participated in the study, those who experienced food insecurity reported having to choose between paying for food or paying for utilities (69%), transportation (69%), mortgage or rent (62%), medical care (55%) or school tuition (39%).

GBFB provides several public policy recommendations to challenge disparities and the current state of food insecurity in Massachusetts which are available in the report.

SUMMARY OF KEY FINDINGS

- Bristol, Hampden and Suffolk Counties have over 45% of adults reporting food insecurity in 2023.

- Overall Food insecurity continues to inch up with approximately 1.9 million adults or 34% of the state’s households reporting food insecurity.

- Stark racial disparities exist with American Indian/Alaska Native (62%), Hispanic (56%) and Black (51%) households experiencing the highest levels of food insecurity.

- Over half of LGBTQ+ households report food insecurity (56%) in 2023.

- Almost 1 in 2 college students at public and community colleges in Massachusetts live in a food insecure household (44%).

- 1 in 5 seniors reported food insecurity in 2023

- Participation in child nutrition programs among food insecure households with children continues to go up.

- 60% of food insecure households with children under 5 participate in the WIC program.

- 74% of food insecure households with children in school are now receiving free school meals thanks to the now permanently funded Universal School Meals legislation in Massachusetts.

- Experience with Universal School Meals is overwhelmingly positive as shown through qualitative data.

- 86% of food insecure households said they were forced to buy the cheapest food available (which also tends to be the least healthy).

- More than 60% of people said they had to make tradeoffs between food, and utilities, transportation or housing

- 75% of those utilizing two or more food assistance programs continue to report food insecurity.

- Of households receiving SNAP benefits, 59% also report going to a food pantry.

- Of those experiencing food insecurity and self-reported as eligible, 18% did not participate in SNAP in 2023. This difference is often referred to as the “SNAP gap.”

- The overall number of households going to food pantries did not change significantly, but these households did report relying on food pantries more often in 2023.

- Statewide, the estimated amount needed among all households facing hunger in 2023 was around $1.7 billion to meet their food needs.

- The leading chronic health conditions diagnosed in food insecure households are hypertension (35%), obesity (29%), and diabetes (27%).

- People living in a food insecure household were twice as likely to screen positive for anxiety or depression.

- Advanced MassHealth 1115 waiver program which piloted several reimbursable nutrition interventions with MassHealth patients and success has led to enhanced programming and increased funding coming in 2025.

- Expanding infrastructure and strengthening the food system through significant physical expansions to the Massachusetts Food Banks, food bank capacity-building grants to their community food assistance programs, and the Food Security Infrastructure Grant program.

- Passing permanent legislation for Universal School Meals in Massachusetts

- Increasing funding for MEFAP, HIP, and SNAP access for immigrant families

- Leading statewide diversity, equity, inclusion, and belonging trainings for food pantry staff and volunteers to decrease stigma and discrimination in food pantries, facilitated by the Food Bank Coalition of Massachusetts, DESE, and Promoting Good

- Implementing college hunger programs across 27 public and community college campuses because of Hunger Free Campus grants through the Department of Higher Education

- Hiring a Director of Food Security within the Department of Agricultural Resources and coordinate programs and funding throughout the state

- Launching the Make Hunger History Coalition, an ambitious statewide initiative that aims to craft a comprehensive plan to eradicate hunger for good and mobilize a powerful movement to drive change

Methodology

- From November 2023 – March 2024, using an online survey company, GBFB surveyed more than 3,000 MA adults. Food insecurity is measured using the full 18-item USDA Household Food Security Survey Module (Household level). The survey included quotas for income, gender, race/ethnicity, age, education and region to ensure we included representation of voices that are historically overlooked. Weighting methods were used to create estimates representative of the Massachusetts population. New this year: surveys available in Chinese, Portuguese, Haitian creole in addition to English and Spanish. Also lived expertise solutions to food insecurity, how much additional money would be required to support food needs, food insecurity among seniors and college students, experiences with universal school meals, barriers and facilitators to participation in WIC and county-level data.

For more information on the survey’s methodology please visit: www.gbfb.org/what-we-do/data-research

About The Greater Boston Food Bank: