Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Trending Topics

- Look Forward: Multidimensional Transition

- Look Forward: Supply Chain 2024

- AI in Banking: AI Will Be An Incremental Game Changer

- The Return of Energy Security

- The AI Governance Challenge

- India's Future: The Quest for High and Stable Growth

Offerings by Division

- S&P Global Market Intelligence

- S&P Global Ratings

- S&P Global Commodity Insights

- S&P Dow Jones Indices

- S&P Global Mobility

- S&P Global Sustainable1

S&P Global Offerings

Featured Topics

Featured Products

- Market Intelligence

- Commodity Insights

- Sustainable1

S&P Capital IQ Pro

Platts Connect

S&P Global ESG Scores

AutoCreditInsight

SPICE: The Index Source for ESG Data

- S&P Global Home

- Explore S&P Global

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

- Our Experts

- Research and insights

Tesla Motors: A case study in disruptive innovation

Senior Director, Cost Benchmarking Services, IHS Markit

Tesla Motors broke the mold. Then reinvented it. Not only did Tesla Chief Executive and Chief Product Architect Elon Musk demonstrate that convention could be defied, he did it in an industry with 100-year-old traditions, norms, and processes. Of course, the auto industry has innovated in the past, but Tesla, which was founded in 2003, has pushed the envelope beyond what most automakers thought possible. The company's Silicon Valley-style "techpreneurship" enabled it to move faster, work more efficiently, and create groundbreaking new ideas around sustainable mobility and automotive technology.

After all, this is Musk's modus operandi. In 1998, he disrupted e-commerce by creating a widely deployable and secure payment platform called PayPal. And in 2002, he launched SpaceX, a company that designs, manufactures, and launches rockets and spacecraft. The company's goal is to enable people to live on other planets. Musk, himself, wants to "die on Mars" and wholeheartedly believes it will be possible.

He is also a lightning rod in the debate around mass transit with an idea some critics refer to as vaporware. Dubbed Hyperloop, Musk's idea is to create a high-speed transportation system that is immune to weather, impossible to crash, uses little energy and recaptures most of what it uses, and travels twice the speed of today's commercial aircraft. He believes the concept could move people from Los Angeles to San Francisco in just 35 minutes. Oddly, he has no interest in making the Hyperloop a reality but, rather, is putting his ideas out there for others to take and improve the human experience.

With Tesla, Musk is focused on disrupting mobility. As of mid-June 2014, the company has released all of its patent holdings, claiming that open-source innovation is more powerful than anything one company could do individually. While IP lawyers cringed, Wall Street applauded, sending Tesla's stock price up 14% to $231 a share. This radical approach to innovation runs deep, as evidenced in the technology and design approach of the company's flagship Model S, its $69,900 luxury car.

In August 2014, the IHS Technology Teardown Team purchased a used 2013 Model S and took it apart to see what made it tick. The team dismantled 12 systems and cataloged every part within each system. The teardown included both the electronics systems inside the car's interior and the drivetrain (see sidebar "What's inside the Model S?").

Technical differences

The teardown confirmed that the Tesla Model S is unlike anything else on the road. A massive plot of real estate in the center stack is dedicated to a 17-inch touch screen infotainment system, which became—since its production launch in 2011—an instant industry benchmark for automotive display integration. There is room left for only two physical buttons on the console—one for the hazard lights and one for the glove compartment release (see sidebar below).

The technical specifications are impressive. The 17-inch screen is a Chi Mei Optoelectronics display with 1920 x 1200 WVGA resolution that includes a projected capacitive touch screen—the same technology employed in many smartphones and tablets. The system runs on a Linux-based operating system, offers Garmin navigation with Google Earth overlays, and computes at speeds still besting most other systems available today with its NVIDIA Tegra 3 processor combined with 2 GB of DDR3 SDRAM.

The system includes an embedded 3G modem from Sierra Wireless that runs broadband data off AT&T's network. It can receive software updates over the air and controls all of the functions of infotainment, audio, navigation, Bluetooth phone, HVAC, and even vehicle settings like windows, door locks, sunroof, trunk release, traction control, headlights, steering, and suspension settings.

In addition, a 12.3-inch fully digital instrument cluster sits directly in front of the driver with its own NVIDIA Tegra 2 processor, which it uses to handle the diverse array of graphics, content, and redundant outputs for the driver. About the only "familiar" driver components are the steering wheel, pedals, and transmission shifter—the latter actually borrowed from the Mercedes-Benz parts bin.

Manufacturing differences

The system is clearly in a class of its own. However, with all of these high-end specifications, how can Tesla sell this as a standard feature in every Model S? More disruption.

The company chose to change up the supply chain and borrow from the electronic manufacturing services (EMS) model of production that is standard practice in the consumer electronics industry. In this respect, Tesla is closer to being a technology company than a traditional automobile maker. Much like how Apple designs the iPhone and then employs Foxconn to build it, Tesla contracted with a leading EMS provider to build its center infotainment system, instrument cluster, and several other systems in the Model S. This model required Tesla to internalize much of the hardware and software development, as well as the systems integration work. Given that Tesla has hired its engineers from all over Silicon Valley and beyond, this was not a problem.

The Silicon Valley culture and the EMS approach to manufacturing were a clear advantage for Tesla at one time but no longer make it unique. The EMS model is expanding in the automotive industry, and the likes of Compal, Flextronics, Foxconn, and Jabil are working with brands including Chrysler, Daimler, Ford, General Motors (GM), Jaguar, and Volkswagen.

However, the transition to the EMS model can be problematic. Ford outsourced the entire infotainment architecture for the development and deployment of MyFord Touch in 2011 to an EMS provider. The initial system had technical software problems that required Ford to issue several software upgrades. This cost tens of millions of dollars, contributed to a poor customer experience, and caused perception problems for Ford, from which the company has only recently recovered.

Development differences

In the last decade, virtually every automaker has relocated portions of vehicle and vehicle technology development to new R&D facilities in the San Francisco-to-San Jose tech corridor. In fact, some early innovators predate Tesla: BMW, Daimler, and Volkswagen set up shop in the Valley in the mid-1990s, and Honda opened its first office in 2003, the same year Tesla was founded.

The reasons for doing so now go beyond manufacturing. Automotive OEMs are co-locating with the likes of Apple, Cisco, Facebook, Google, HP, Intel, NVIDIA, and Oracle to help speed the pace of innovation. This involves accelerating the pace of hardware, software, services, and applications development but also rethinking the process of design.

The development speed of a typical mobile device is often six months or less. Compare that with the design-to-production timing for a new vehicle of approximately four years and it's no wonder car-buying consumers have been underwhelmed by standard in-vehicle electronics. Even today, consumers can find navigation and infotainment systems designed in 2008 for sale in model-year (MY) 2014 vehicles. To give an idea of how ancient that is in "tech-years," BlackBerry held more than 50% market share among smartphone users in 2008. Remember BlackBerry?

Tesla has had a competitive advantage over auto industry rivals in design innovation since day one. Located in arguably the center of the world for technological innovation, Tesla was able not only to construct its vision of mobility in Silicon Valley, but also recruit its employees from many of the leading technology companies to design and build the car there as well. All other OEMs grasping for automotive technology leadership had to learn the culture of Silicon Valley, figure out how to adapt to it, and dissolve the century-old "way of doing things." Tesla was born into it.

Service differences

With Tesla's technology come some very important services. Perhaps at the top of the list is the convenience of over-the-air (OTA) software updates for vehicle recalls, which Tesla has made free and standard for Model S owners. This functionality has, in turn, created plenty of positive press for the company.

It all starts with the connection. The 3G connection in the Tesla infotainment system is already providing this solution via relatively old wireless technology. Since the modular and flexible hardware architecture of its infotainment system allows for mid-cycle technology enhancements, IHS expects Tesla will soon debut true 4G LTE connectivity in its vehicles. The added bandwidth will further enhance the OTA update service, as well as the rest of the services the Model S offers.

IHS forecasts a 60% global penetration rate on embedded cellular connections in cars by 2022, with 4G LTE bandwidth comprising roughly 60% of that market. GM and Audi have actually beaten Tesla to market on this specification as both OEMs already have 4G LTE cars on the road now.

One central purpose of this mass-market vehicle broadband adoption is to accommodate FOTA (firmware over the air) and SOTA (software over the air). Tesla has already deployed this function in part because it allows the company to provide vehicle service without needing to charge (or possibly pay) for service bay labor.

Consider Tesla's recall of the Model S for overheating charger plugs in January 2014. The day the recall notice came out, Tesla had all 29,222 Model S vehicles updated wirelessly and running the new safer version of the software. Ironically, around the same time, GM had a similar fire-related safety recall issued that also required a software update. Despite all of its vehicles having standard OnStar telematics, owners were required to take their cars into a dealership for the software update, costing GM a warranty labor expense on all 370,000 recall service appointments.

While far from a sure thing, nanotechnology offers significant business opportunities for companies willing and able to take the long view. One avenue is to identify a sizable opportunity in an existing market where a nanotech product can displace an existing inferior solution, e.g., a coating for an automobile that keeps itself clean, clears mist from side mirrors, or self-repairs scratches in the automotive paint.

Volume aside, Tesla paid much less on a per-vehicle basis than GM, simply by providing a software update procedure that has been on personal computers for more than two decades and mobile phones since before the BlackBerry.

IHS sees the OTA software trend continuing strongly. With vehicles like the new Mercedes-Benz S-Class claimed to have over 65 million lines of code—10 times that of the Boeing 767 Dreamliner—the automotive industry stands at a crossroads. Software recalls are about to become a major problem, one that will be expensive if this type of technology is not broadly deployed.

As of February 2014, over 530 software-related recalls had been reported since 1994 (see figure below). Among these, 75, or 14%, were issued for MY 2007 alone, with over 2.4 million vehicles affected. Numerous questions arise from the variation in volume by model year—not the least of which is, why have recalls for MY 2007 been so numerous? There are likely several reasons for this spike:

MY 2007 had the last large-sales volume before the economic recession plunged US car purchases from approximately 16 million to 10 million in 2010.

Many new electronics systems were added in MY 2007 for infotainment, advanced driver assistance systems, and core auto control systems, which increased the amount of software in the typical car.

MY 2007 involved recalls of 75 vehicles, the most of any model year. Many automotive OEMs had multiple model recalls with software updates. Toyota had especially high recall rates that included software updates.

It is in this context that IHS expects FOTA and SOTA to be enabled in over 22 million vehicles sold worldwide in 2020 alone, growing from approximately 200,000 vehicles in 2015. Major deployment will begin in 2017. In the meantime, Tesla will continue to leverage its first-to-market status with FOTA and SOTA to help lower overall costs to the end user and improve unit margins on each additional Model S sold.

Powertrain differences

The heart of Tesla's Model S is its electric propulsion system, which includes a battery, motor, drive inverter, and gearbox. The battery is a microprocessor-controlled lithium-ion unit available in two sizes; spending more buys more range and more power. The induction motor is a three-phase, four-pole AC unit with copper rotor. The drive inverter has variable-frequency drive and regenerative braking system, while the gearbox is a single-speed fixed gear with a 9.73:1 reduction ratio. The battery of each Model S is charged with a high-current power inlet, and each vehicle comes with a single 10kW charger and mobile connector with adapters for 110-volt and 240-volt outlets as well as a public charging station adapter.

This powertrain package allows Tesla to deliver a longer driving range than any other EV maker—about 200 miles versus just under 100—plus acceleration and driving performance similar to or better than a traditional gasoline-powered vehicle. While several automakers offer EV powertrains—Nissan's Leaf and Chevrolet's Volt, for example—none matches Tesla's commitment to EV development. And as a clean slate company, Tesla has had the advantage of developing an entirely new powertrain and supply chain without the hindrance of existing dealerships, physical plants, or inventory.

Other EV products use lithium-ion batteries, but in lower kWh and using fewer, but larger, battery cells. For example, the Nissan Leaf uses a 24kWh battery, with 192 cells and EPA-estimated range of 84 miles. The Model S' 85kWh battery has more than 7,100 cells, allowing it to move greater weight faster and with longer range.

To address range anxiety, Tesla has made a significant investment developing charging stations in the US (112 to date, according to the Tesla website), Europe (63), and Asia (17). These supercharger stations can swap out the battery in less time than it takes to fill a tank of gas. Owners must come back and swap again for their original battery. Nonetheless, this helps alleviate drivers' worries about becoming stranded on long trips.

Tesla is working to drive battery costs down in anticipation of the launch of its mass-market, $35,000 Model 3 EV sedan, which is slated to debut in 2017. To that end, the company recently announced a new $5 billion "gigafactory" battery plant in Nevada in partnership with Panasonic. It will reportedly handle all elements of battery cell production, from raw material to battery pack, rather than only battery pack assembly. And Tesla intends to sell its OEM batteries for non-automotive applications, which will enable it to increase production volume and reduce unit cost.

What does the future hold?

- Created a fun-to-drive electric roadster. Check.

- Leveraged the lessons to scale-up to a full-luxury sedan. Check.

- Disrupted the luxury car market and, according to IHS Automotive data, attracted "conquest" buyers from the likes of BMW, Mercedes, and Lexus, not to mention Toyota and other volume brands. Check.

- Diverged from entrenched supply chains to develop technology in-house and lowered per-unit development costs for an industry-leading infotainment platform. Check.

- Addressed a software-related vehicle safety recall in one day for almost 30,000 cars. Check

- Created a company destined to influence the industry as a whole and did so while pleasing Wall Street. Check.

Tesla has established benchmarks for infotainment system hardware, software flexibility, and manufacturing supply chain. The company innovated powertrain design, which has proven both robust and viable for everyday use. And it has received plenty of accolades for aesthetic design from the automotive media. The result is that "made in Silicon Valley" is no longer roundly dismissed as an option for an automotive OEM.

So what's next for Tesla? How does it maintain its leadership in technology development? Has it created a sustainable competitive advantage? Can it deliver on promises of a new luxury crossover with the Model X and a new high-volume EV competitor with the Model 3? Will Tesla be able to steal market share from not only luxury marques, but also from higher-volume brands?

Going forward, Tesla faces five distinct challenges:

Consumer demand. Perhaps the most significant is consumer acceptance of electric vehicles. In the first eight months of 2014, EVs accounted for only 0.7% of the 11.2 million light-vehicle sales in the US. Even Renault-Nissan CEO Carlos Ghosn, a staunch supporter of EVs, last year acknowledged Renault-Nissan would miss its original 2016 target of selling 1.5 million EVs by four to five years.

Dealerships and service. Today, Tesla's direct-sales model is illegal in most US states. As Tesla attempts to go mainstream, it will need the legal restrictions lifted or be forced to adjust its model. Further, as vehicles age and the numbers sold increase, there will be maintenance issues that cannot be handled by OTA software updates. Tesla will need to build out an after-sales service network that is robust enough to handle the demand.

Marketing. To date, demand for the Model S exceeds supply. But as the company targets the mass market with the Model 3 and aims for 500,000 units sold in 2020, it will need to beef up its marketing. Tesla's Apple Genius-bar-inspired dealership model has worked for the affluent early adopters, but can it be scaled up to meet its sales targets?

According to IHS registration data, 51.8% of all Tesla buyers have annual household incomes over $150,000. By comparison, the percentage of Chevrolet Malibu buyers with a household income higher than $150,000 is only 6.5%. Tesla will need to create a marketing strategy that targets economy-car consumers, who are notably different than those who buy the $80,000 to $100,000 Model S.

Production Boosting output will likely mean growing pains for Tesla as it transitions to a high-volume production model. How the company manages the transition will determine Tesla's near-term future. Of course, many automakers have had difficulties ramping up new plants or launches and yet overcome the challenges in the longer term. While growing pains are to be expected, there is no reason to believe Tesla does not have the capacity to become a volume manufacturer.

Innovation. Tesla has already made a name for itself around technology adoption and innovation. But it will be challenged, as all first movers are, to maintain that lead and continue to push the boundaries with future products. Assuming the gigafactory and its supply chain allow Tesla to make a mass-market offering and keep its infotainment stack as an industry benchmark, the company's next move will be automated driving. Musk has already stated that Tesla will "hit the market" by 2017 with a partially self-driving vehicle. With many other OEMs targeting this time frame as well, Tesla might not be as disruptive in automated driving as it has been in infotainment design and sustainable mobility

But then again, it might surprise the market and break loose another game-changing product or technology before the rest of the automotive industry is ready—because that's how Silicon Valley works.

Tesla's user-experience focus sets it apart

We live in an era of smartphone ubiquity. So we are routinely disappointed when we get into our cars and are forced to make do with resistive touch screens (if we are lucky) or LEDs and vacuum fluorescent displays controlled by dials and buttons (if we are not). Tesla understands the importance of smartphone ubiquity to modern life, so it's no accident the transition is seamless when one climbs into a Model S

That is not the case with the majority of comparably priced vehicles from other auto manufacturers. Indeed, many of the recent automotive infotainment systems that the IHS Teardown Team has analyzed feature relatively small displays (typically 7-inch diagonal size or less) and low resolution (typically 800 x 480 WVGA or less).

Then there's the touch technology. Many of the touch screens IHS tears down in automotive head units are using resistive technology. Combine these legacy technologies with often underpowered processing chips and proprietary software and you often end up with a user experience that is unfamiliar, not intuitive, and has a lot of "latency" issues (meaning it's slow).

At the center of the dashboard in the 2013 Model S is the Tesla Premium Media Control Unit, which blows away all of the head units we have seen in specs, not to mention sheer size. The 17-inch diagonal display with touch screen makes for a very large assembly when removed from the dash. Inside the unit are many subassemblies, which are all modular, giving Tesla numerous design options for future models.

Several of the printed circuit board (PCB) assemblies, including the main assembly, feature Tesla Motors logos and copyrights, meaning that they are all designed and controlled by Tesla. In and of itself, this is unusual, as we find that most automotive OEMs entrust and outsource the bulk of their head unit designs to third parties such as Harman

Automotive, Panasonic, Alpine, Denso, Pioneer, and others. Tesla is thus designing and controlling the bill of materials down to the component level. This is closer to Apple's design-and-build model than it is to other automakers.

Such an approach affords Tesla leverage in the supply chain, more direct control over the finished product, and ultimately more control over the user experience. It also gives Tesla a potential performance and technology edge that others might find difficult to quickly emulate, as so much of the design is done in-house at Tesla rather than by the head unit suppliers.

Many other PCB assemblies are modular and come from third parties, such as the processing PCB, which is a turnkey solution from NVIDIA, and the air interface module, which is from Sierra Wireless.

All told, there are 10 PCB assemblies in Tesla's media control unit. The modularity of this design is not unusual for automotive electronic systems and allows Tesla many options. If Tesla wants to upgrade the processing power or change the air interface module, it may be possible to achieve this more easily and with less redesign than if all of the functions were integrated into fewer PCB assemblies. In this sense, modularity of design, rather than aggressive integration, has always been an automotive electronic standard. Not only does modularity give automotive designers many upgrade options, it improves reparability.

The center console of the Tesla Model S is dominated by a 17-inch touch screen infotainment system, which is an industry benchmark for automotive display integration.

What's inside the Model S?

In August 2014, IHS bought a second-hand 2013 Tesla Model S. The Los Angeles-based IHS Technology Teardown Team set to work pulling it apart to examine all primary systems inside the car. The team has cataloged every component and developed a detailed bill of materials for each system that includes the technical specifications, cost, and manufacturers of the components. In addition, the team estimated the labor and manufacturing cost of each system.

The 12 systems analyzed by the IHS Teardown Team comprised the following:

- Premium Media Control Unit

- Instrument Cluster

- EV Inlet Assembly

- High-Voltage Junction Box

- Battery Charger

- Thermal Controller

- Liftgate Left Hand Taillight

- Power Liftgate Module

- Body Control Unit

- Sunroof Control Unit

- Passive Safety Restraints Control Module

Mark Boyadjis, Senior Analyst, Infotainment and Human-machine Interface, IHS Automotive Andrew Rassweiler, Senior Director, Teardown Services, IHS Technology Stephanie Brinley, Senior Analyst, Americas, IHS Automotive Posted 7 October 2014

Keep yourself updated with the latest news of automotive and mobility industry featured on our Mobility News and Assets Community page to stay ahead of your competition.

Strong electric motor growth and eAxle development will power the next decade of EVs

BriefCASE: Can data privacy concerns spoil the connected-car party?

BriefCASE: Software-defined vehicles - An identity crisis for the industry?

- Our Purpose

- Our History

- Investor Relations

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Customer Care & Sales

- Support by Division

- Report an Ethics Concern

- Office Locations

- Our Organization

- Corporate Responsibility

- IOSCO ESG Rating & Data Product Statements

- Terms of Use

- Cookie Notice

- Privacy Policy

- Client Privacy Portal

- Do Not Sell or Share My Personal Information

© 2024 S&P Global

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

Use imagination to make the most of generative AI

Lending standards can be too tight for too long, research finds

US voters exhibit ‘flexible morals’ when confronting misinformation

Credit: iStock.com / JasonDoiy

Ideas Made to Matter

New case study takes up Tesla’s entry into the auto industry

Dylan Walsh

May 13, 2019

Within three years of Tesla’s founding in 2003, Elon Musk had invested $55 million of his own money in the company. And yet things were not going as planned. CEOs were leaving after short tenures. The company’s first model, the Roadster, was experiencing cost overruns. In response, in October of 2008, Musk appointed himself CEO. “I have so many chips on the table,” he explained. “I need to steer the boat completely.”

How has he done at the helm? A new case study on MIT Sloan’s LearningEdge website considers the question with in-depth context about the U.S. automobile market and Tesla’s position within it.

“Prior to Tesla, no domestic manufacturer had entered the U.S. automotive market at scale since the Second World War,” said Donald Sull , a senior lecturer in innovation and entrepreneurship at MIT Sloan and one of the case study’s co-authors. “This case, which includes rich data on the industry, customers’ willingness to pay for electric vehicles, and Tesla’s financial situation, explores whether Tesla’s strategy of establishing a beachhead in the luxury segment and out-innovating its competitors can trump the challenging fundamentals of the auto industry.”

Tesla went public in June 2010 at a price of $17 per share. Eight years later, the stock was trading at $335, making Tesla the most valuable car manufacturer in the U.S. But the company had only posted two profitable quarters by that point. Investors were skeptical of its long-term viability, and media coverage wasn’t helping: the mass-market Model 3 was woefully behind schedule, lost in “production hell,” while a series of errant tweets by Musk brought SEC scrutiny and an eventual fine. The company has continued along a bumpy road, with a record $312 million of profit between July and September of 2018, followed by a plunge in stock prices, followed by a slump in sales, followed by promises of a driverless taxi fleet by 2020.

Given this wild variability in Tesla’s performance — sometimes a shining example of Silicon Valley potential, sometimes appearing to be on the brink of collapse — investors and industry experts are split on the company’s future. Where does the company stand? What are its prospects in a broader car market experiencing seismic changes?The case study explores these questions, beginning with a broad overview of how automakers, their suppliers, and their customers define one of America’s most fundamental industries. It then provides detailed background on four modern and connected forces powerfully reshaping this market:

Electrification. In 2017, 200,000 electric vehicles were sold in the United States, a 25% increase over 2016 sales. The trend is continuing, and new business opportunities are emerging.

- Autonomous driving. Self-driving cars are drawing investment from many giant companies, and the implications are striking. As one industry observer put it: “In the past, cars were primarily about driving and secondarily about content consumption. With autonomous cars, that prioritization will be reversed. Fully automatic cars will be battery-powered living rooms on wheels.”

- Connectivity. As cars increasingly connect to the internet, old automotive business models are coming into question. The CEO of one Chinese conglomerate suggested that he would eventually be able to offer his company’s electric car for free, earning money instead from services the company sold to customers.

- Alternatives to car ownership. A 2017 transportation study out of Stanford University predicts that by 2030, 95% of U.S. passenger miles will be served by on-demand autonomous electric vehicles and there will be an 80% drop in private car ownership in the United States.

Against this backdrop, the case study positions the emergence of Tesla — how the company has both driven and responded to these radical evolutions in the automobile market.

According to Sull: “This case is perfect for analyzing an industry in flux, the financial and operational risks of a disruptive strategy, and how to create value by driving up willingness to pay in an industry with limited product differentiation.”

Related Articles

- Original Article

- Open access

- Published: 30 December 2020

Sustainability in the automotive industry, importance of and impact on automobile interior – insights from an empirical survey

- Wanja Wellbrock 1 ,

- Daniela Ludin 1 ,

- Linda Röhrle 1 &

- Wolfgang Gerstlberger 2

International Journal of Corporate Social Responsibility volume 5 , Article number: 10 ( 2020 ) Cite this article

77k Accesses

12 Citations

32 Altmetric

Metrics details

Sustainability is currently one of the main issues in all media and in society as a whole and is increasingly discussed in science from different sides and areas. Especially for the automotive industry, sustainability becomes more and more important due to corporate scandals in the past and topics such as electric motors, lightweight construction and CO2 emission reduction are key issues. Although the focus is primarily on other components, the interior cannot be neglected either in terms of sustainability. Interior is the most frequently seen part of the car by the driver. Therefore, e.g. the use of natural fibres especially for premium brands can only be considered in connection with highest standards regarding practical and aesthetical aspects. Consequently, the following research question arises: How do the three pillars of sustainability (economical, ecological and social issues) influence interior development at premium brand manufacturers and how do customers accept sustainable solutions? The focus of the paper is exclusively on premium brands due to the higher spread of sustainability effects compared to volume brands. A quantitative study is carried out to determine the expectations on the customer side regarding more sustainability in the automotive industry in general and in the interior sector in particular and to derive corresponding challenges and potentials for original equipment manufacturers.

Introduction

Sustainability is regarded as the keyword of the twenty-first century and the importance of the topic is not yet sufficiently widespread (Mittelstaedt, Shultz II, Kilbourne, & Peterson, 2014 ). The associated topic of resource conservation, which has been important since the eighteenth century, is now more relevant than ever. Above all, the automotive industry, which is the most important branch of industry in terms of turnover and the growth engine for Germany, has to deal more intensively with sustainable development and the associated effects and challenges. Automotive manufacturers are under pressure to comply with both political guidelines and internal specifications, as well as with constantly changing individual customer wishes (Thun & Hoenig, 2011 ; Wallentowitz & Leyers, 2014 ).

For the automotive industry, topics such as electric motors and the associated optimization areas, lightweight construction and CO 2 emission reduction are key issues. Nevertheless, the car’s interior cannot be ignored. After all, the interior is the part of a car most frequently seen by the driver and must therefore be practical, aesthetically pleasing and at the same time weight saving. The use of natural fibres as alternative materials in the interior plays an important role and is a further step towards greater sustainability (Pischinger & Seiffert, 2016 ).

Consequently, the following central research question arises: How is the new development of the interior by premium brand manufacturers influenced by the three pillars of sustainability (economical, ecological and social issues) and what are the challenges for original equipment manufacturers (OEMs) and suppliers? The contribution focuses exclusively on the German premium manufacturers Audi, BMW, Mercedes-Benz and Porsche, since sustainability at these companies is already more integrated into the manufacturing process.

Based on a literature review on sustainability in the automotive industry, previous efforts to increase sustainability in the interior sector will be elaborated on. Subsequently, an empirical study is used to determine the expectations on the customer side regarding more sustainability in the automotive industry in general and in the interior sector in particular and to derive corresponding challenges and potentials for OEMs and suppliers.

Sustainability in the automotive industry

Long-term success in the automotive industry is primarily achieved through consistent innovation strategies, strong branding, global efficiency in the value chain and qualified and motivated employees. Research and development can be argued as the key to long-term success - after all, no other industry invests more than the automotive industry in this area. Currently, the automotive industry is arguably witnessing the greatest phase of upheaval in its history. Mega trends such as emission reduction, lightweight construction, automated driving, connectivity and mobility services have changed the landscape for good. In line with these trends, the supplier industry is also adapting and undergoing fundamental changes (Dannenberg, 2017 ; Koers, 2014 ; Pischinger & Seiffert, 2016 ).

The topic of sustainability in the automotive industry is also gaining more momentum in the scientific community. Nunes and Bennett, for example, carry out a fundamental comparison of environmental initiatives of automobile manufacturers, conclude that these are often still very vague, and require further concretization. Another criticism is that the focus is primarily on the ecological dimension (Nunes & Benett, 2010 ). Azevedo et al. develop a theoretical framework for analysing the influence of green and lean SCM practices on the sustainable development of automobile manufacturers. Ecological (e.g. CO 2 emissions), social (e.g. supplier screening) and economic (e.g. operating costs) aspects are considered as performance indicators (Avezedo, Carvaho, Duarte, & Cruz-Machado, 2012 ). Azevedo and Barros complement this with an analysis of a sustainable business model for the automotive industry that integrates all three dimensions of sustainability. This contribution also shows that there has been a clear improvement in sustainability performance in the automotive supply chain over the last decade (Avezedo & Barros, 2017 ). Sinha et al. emphasize that sustainability management in the automotive industry is only possible through a holistic process approach starting with the conception and continuing right up to the series production of the product. In addition to these rather conceptual contributions, several authors consider concrete materials about their sustainability potential for the automotive industry (Sinha et al., 2015 ). Kumar and Das consider, for example, the suitability of bio composites especially in the field of dashboards (Kumar & Das, 2016 ), whereas Dunne et al. focus primarily on the suitability of natural fibres (Dunne, Desai, Sadiku, & Jayaramudu, 2016 ). Hetterich et al. consider the specific attitude of motorists towards sustainable materials in the interior sector. The focus here is on the willingness of customers to actually pay more for renewable raw materials (Hetterich, Bonnemeier, Pritzke, & Georgiadis, 2012 ).

In sum, the issue of sustainability in the automotive industry may well be gathering momentum and scientific focus, but the interior design sector in particular has been largely neglected. A few papers focus on the topic of sustainable interior, but mostly with a strict technological view (e.g. Bergenwall, Chen, & White, 2012 ; Jasiński, James, & Kerry, 2016 ; Mayyas, Qattawi, Omar, & Shan, 2012 ; Mcauley, 2003 ; Sopher, 2008 ; You, Ryu, Oh, Yun, & Kim, 2006 ). Some others analyse the potential of sustainability as a customer requirement, but misses the focus on automotive interior (e.g. Biju, Shalij, & Prabhushankar, 2015 ; Hetterich et al., 2012 ; Moisescu, 2018 ; Panuju, Ambarwati, & Susila, 2020 ). The article attempts to close this gap.

Sustainability in the interior of automobiles

The widespread innovation efforts in the field of electric mobility and autonomous driving also offer the potential to rethink and redesign the car’s interior. The vehicle interior has to be transformed into an increasingly attractive living space. This can be achieved, for example, through attractive surfaces made of sustainable materials. The interior plays an increasingly important role in purchasing decisions. It arouses emotions, offers comfort, safety and functionality and radiates brand identity as a fusion (Laukart & Vorberg, 2016 ; Pein, Laukart, Feldmann, & Krause, 2006 ).

The interior of a vehicle can be divided into six assemblies: the cockpit, the seats, the door and side trim, the headliner, the luggage compartment and the floor trim. The developments in this area is a balancing act between the pressure to innovate and the need to keep costs down. (Dölle, 2013 ).

Characteristics of natural fibre materials

Already in 2005, more than 30,000 tons of natural fibres were used in the automotive industry in Europe (Sullins, 2013 ). In 2015, the figure was already 50,000 tons, of which ten to 20% were European hemp fibres. Hemp belongs to the category of baste fibres, which are most frequently used in automotive components. Hemp, kenaf and flax are suitable alternatives to glass fibres because they are less expensive, have a lower density, a high strength and are more environmentally friendly. The use of natural fibres can result in cost savings of ten to 30% compared to glass fibers. Due to its strength, it can be used as a reinforcement for vehicle interior parts such as door panels. In addition, kenaf, which is cultivated mainly in China and Thailand, has one of the best CO 2 absorption rates in the plant world (Adekomaya, Jamiru, & Sadiku, 2016 ; Dunne et al., 2016 ; Suddell, 2008 ; Sullins, 2013 ; Verma, Gope, & Shandilya, 2012 ).

Another advantage is that the natural fibre-reinforced plastic does not splinter and can break without creating sharp edges. Its low weight and high load-bearing capacity are an advantage for lightweight construction and safety requirements and have a positive influence on crash management. Due to the positive cost performance ratio and the other advantages described, composite materials based on natural fibres have been used for several years for thermoplastics, thermosets and elastomers in automotive interiors. Well-known examples of this are doors made of flax or sisal fibres and polymeric binders such as polypropylene (thermoplastic) or polyurethane (Bjurenstedt & Lärneklint, 2004 ; Hull & Clyne, 1996 ; Laukart & Vorberg, 2016 ).

When selecting alternative materials, great care should be taken. For one, fibres from natural sources are not always more environmentally friendly than conventional fibres. Large amounts of water, pesticides, chemicals and energy are needed to prepare and dye the fabric during cotton degradation and processing. In addition, natural fibre reinforced plastics are neither as strong nor durable as metal or synthetic fibres, so they need to be replaced more frequently, resulting in increased energy consumption in the long term.

Whereas natural fibres were previously concealed behind a thick film lamination, they are now becoming more and more visually perceptible and are increasingly finding their way into the premium interior as a design element. At the same time, suppliers and vehicle manufacturers are in equal demand to conduct even more intensive research in the field of natural fibre-reinforced plastics and to bring technologies to series maturity that make it possible to further increase the proportion of natural fibres in vehicle interiors (Dunne et al., 2016 ).

Sustainability measures in the interior

The new hybrid materials and vehicle concepts pose a challenge for manufacturers and suppliers. The lightweight construction required for this should continue to offer the best surfaces in the interior since the appearance conveys a direct impression of quality, which is especially important for premium brands (Dunne et al., 2016 ; Hassan, Zulkifli, Ghazali, & Azhari, 2017 ; Karus & Kaup, 2002 ; Puglia, Biagiotti, & Kenny, 2005 ). Therefore, corresponding solutions with bio-composite materials are of great importance, as, for example, the supplier Dräxlmaier shows with his Kenaf door trim for the BMW i3 electric vehicle. The component is made exclusively of natural fibre-reinforced polypropylene with functional elements (Bröker & Ostner, 2017 ; Gelowicz, Günnel, Hammer, & Otto, 2017 ).

The use of natural fibre materials as a design element that underlines the sustainable character of a vehicle was not an option until now. They had not previously met the requirements of OEMs for a high-quality appearance and the technical process conditions of the manufacturers made it difficult to use the materials. After a long development period, the supplier Dräxlmaier and the manufacturer BMW have now joined forces to bring the innovation of visible natural fibres in the interior to series maturity. Requirements for design elements and weight reduction have been met and, at the same time, the materials are ecologically compatible. The “Fast Fibre Forming” developed by Dräxlmaier makes it possible to implement the “Visible Nature”. Panels are made of kenaf fibres and coated with a wafer-thin transparent plastic film. The purity of the plant material used ensures a particularly high-quality surface appearance compared to other natural raw material sources such as hemp or flax (Bröker & Ostner, 2017 ).

In the BMW i3, the visible door beams and the instrument panel cover are also made of the fibres of the tropical mallow plant Kenaf. The reasons for the selection are that Kenaf has a high degree of fineness and purity of the fibres compared to flax and hemp, which is essential for a high-quality surface. This is an elementary prerequisite because the design philosophy of BMW i vehicles combines a consistent focus on sustainability, which becomes visible and tangible in the interior, with simultaneous fulfilment of the OEM’s premium claim (Schmiedel, Barfuss, Nickel, & Pfeufer, 2014 ).

A further example is presented by Johnson Controls for the new BMW 3 Series with wood fibre components that not only relieve the burden on the environment but also reduce weight by 20% compared to solutions previously used (Focus, 2012 ).

The use of renewable and natural raw materials as a sustainable alternative to plastics is in direct harmony with the needs of the young generation. Yanfeng Automotive Interiors, for example, deliberately presents the recyclable, artistically designed natural fibre middle parts of the door panel in a natural look. According to Han Hendriks, Chief Technology Officer at Yanfeng, there is currently a shift towards more personalisation and individualisation. Drivers want to be sustainable and at the same time be safe and in touch with the spirit of the times (Yanfeng, 2017 ).

The supplier International Automotive Components (IAC) optimizes component designs for OEMs. A new product is the “Fibre Frame” technology. The natural fibre semi-finished product “EcoMatHot” replaces the classic material sheet steel in the mounting frame of the vehicle roof lining with panoramic or sliding roofs. The material consists of 70% renewable raw materials. A weight reduction of up to 50% is possible (Industrie, 2017 ).

In the future, it is expected that the use of renewable raw materials and recycled materials will continue to gain in importance. Visible components made of renewable materials will be found more frequently in the interior of the cars of tomorrow. In this context, the natural materials must be designed haptically and optically so that they can no longer appear only in laminated or mixed form with plastics (Focus, 2012 ).

Empirical study on customer expectations regarding sustainability aspects in interior design of cars

Based on the information from the previous chapters an empirical large-volume study is conducted to investigate the expectations and potentials that customers see in sustainability elements, particularly in the interior sector. The empirical survey focuses exclusively on customers of premium brands (Audi, BWM, Mercedes-Benz and Porsche), since sustainability measures are already more widespread in this area and customers have even higher expectations with regard to design and equipment (Skala-Gast, 2012 ).

Structure of the empirical study

The empirical study is based on an online survey with purposively selected persons from the Heilbronn University of Applied Sciences, the University of Stuttgart and the company Valeo Schalter und Sensoren in Bietigheim-Bissingen. The survey was conducted via Survey monkey. All persons with a minimum age of 18 years were contacted through the official university or company mailing lists and send on to the questionnaire’s homepage. Therefore, the participants were mainly students and employees of the above mentioned Universities and companies. The age limit has been set the minimum age to drive a car in Germany. One hundred forty-one participants fulfilled the desired characteristics, which can be divided in 100 male and 41 female test persons. With regard to premium brands, Audi and Mercedes-Benz each dominated with 34%, BMW followed with 25% and Porsche with almost 7 % of the participants.

The questionnaire consists of 23 questions developed by the authors, divided into three sections: “general sustainability”, “specific sustainability in the automotive industry and the interior” and “future expectations”.

Empirical results

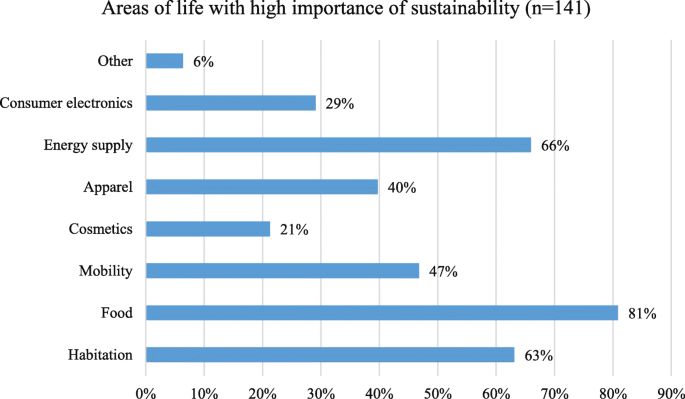

The participants of the study recognize the fundamental importance of sustainability. With the exception of two persons, all respondents attach fundamental importance to sustainability in different areas of life. For 81% the focus is on nutrition, followed by energy supply (66%) and living (63%). The area of mobility follows a little behind with 47% (see Fig. 1 ). This shows that a fundamental need for sustainability exists, but mobility is not the most important area.

Areas of life with high importance of sustainability. Source: Own illustration

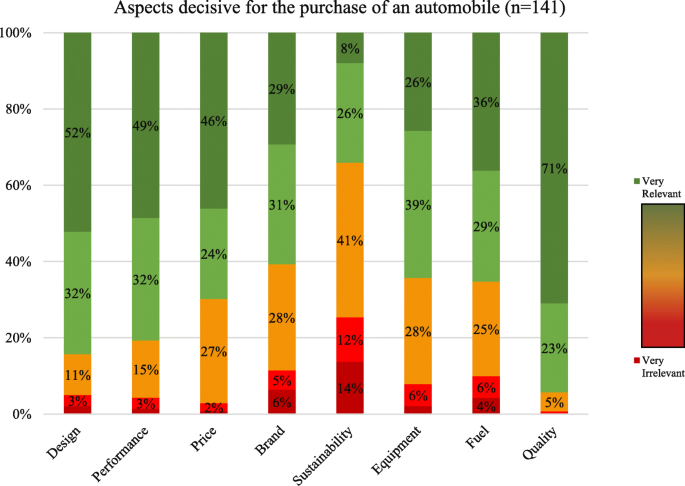

Regarding the question of which factors are decisive when buying a car, quality, price, performance and design are on the first ranks. Sustainability plays an important or even very important role for only 34% of the respondents, which is the lowest value of all factors (see Fig. 2 ). This result shows that sustainability is discussed regularly in the automotive industry, but at the same time, it has only a limited influence on customers’ purchasing decisions, especially in the premium segment.

Aspects decisive for the purchase of a passenger car. Source: Own illustration

The willingness to accept additional costs for sustainable materials in the car is also very indifferent. Almost half of the respondents (47.5%) are not prepared to accept higher costs for sustainability aspects in the car. This is quite a high number and shows the problem of automotive manufacturers to transfer additional costs to the customers.

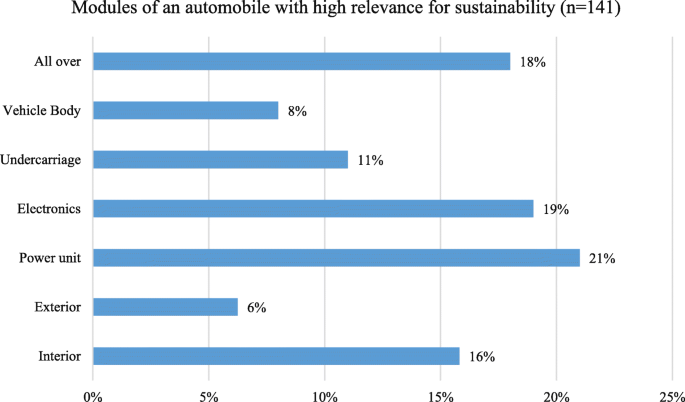

Looking at the single modules of an automobile, power unit (41%) and electronics (38%) receive the highest relevance for sustainability from the customer’s point of view. For almost 35%, sustainability is important in all areas of the automobile, whereas 30% highlight especially the interior sector (see Fig. 3 ). This result demonstrates that although the customer focuses on the sustainability of the interior, at first glance the drive system and electronics in particular have a higher sustainability potential from the customer’s point of view. The further investigations now relate exclusively to the interior.

Modules of an automobile with high relevance for sustainability. Source: Own illustration

A majority of 74% of the respondents agree that the OEM should place more emphasis on the selection of sustainable and natural materials in the interior. Only 7 % reject this, which represents a clear message to the OEM.

In order to control the customers’ design perception of natural materials in the interior, a picture of an untreated door panel was shown to the participants (see Fig. 4 ). The reaction to whether the test persons could imagine this in their automobile was very positive. 71% of the respondents could imagine such a door, if properties as haptics, appearance and economy are retained. Only 9 % of the respondents could not imagine such a door.

Untreated door panel with natural materials. Source: Dräxlmaier, 2018

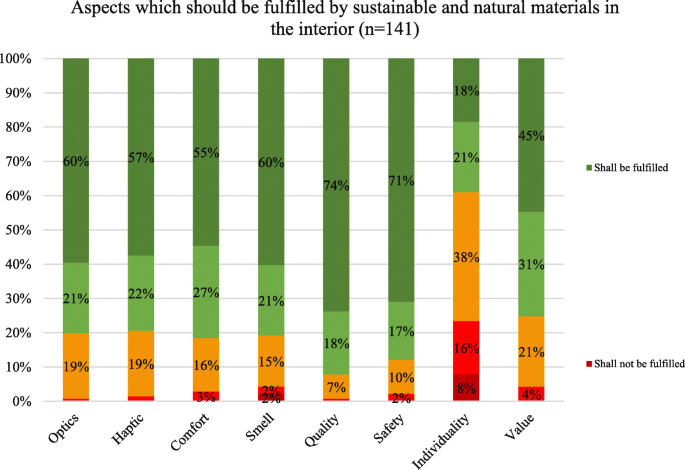

Looking at additional aspects, which should be fulfilled by sustainable and natural materials in the interior, quality (74%) and safety (71%) receive the highest percentages, followed by smell and optics (60%), haptics (57%) and comfort (55%). At the end of the scale, individuality only receives 18%, which is surprisingly low compared to the wide variety of variants in the automotive industry (see Fig. 5 ).

Aspects that should be fulfilled by sustainable and natural materials in the interior. Source: Own illustration

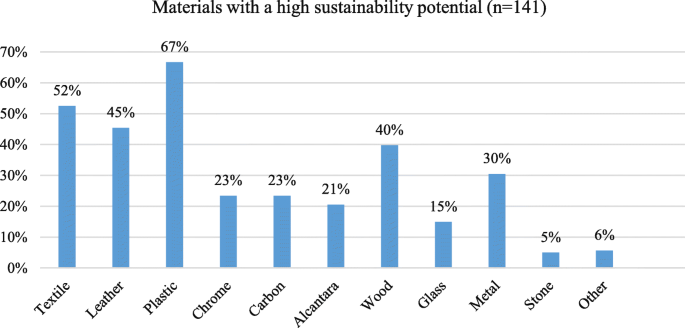

Looking at the individual types of material, it turns out that customers would like to see more sustainable implementations in the interior, particularly for plastics (67%), textiles (52%), leather (45%) and wood (40%) (see Fig. 6 ). Especially for the first three materials, sustainable solutions are already available, as described in the previous chapter.

Materials with a high sustainability potential. Source: Own illustration

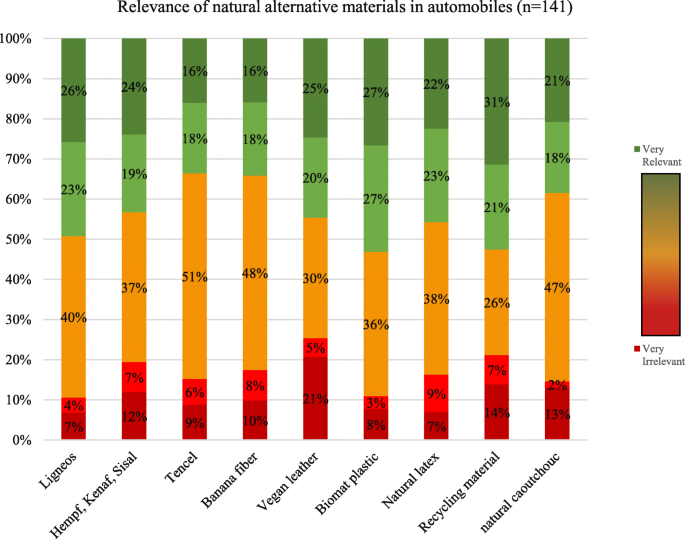

Regarding the variety of natural alternative materials, biomat-plastic (54%) and recycled material (52%) receive the highest percentages of people evaluating it as relevant or even very relevant for the interior sector. Overall, all known alternative materials such as ligneous, hemp, kenaf or sisal are well accepted by customers and the percentages for irrelevance are usually much lower for all materials (see Fig. 7 ).

Relevance of natural alternative materials in automobiles. Source: Own illustration

As an optional question, the participants were asked to decide which material they prefer for which interior component. The blue words are the result of the majority customer decision (see Fig. 8 ). The results show that the materials selected for the centre console, door trim and decorative elements are already sustainable. Other natural materials such as recycled material or natural rubber also achieve a high level of approval for individual interior components, although they do not yet represent a majority opinion.

Interior components with corresponding materials. Source: Barnes-Clay, 2012

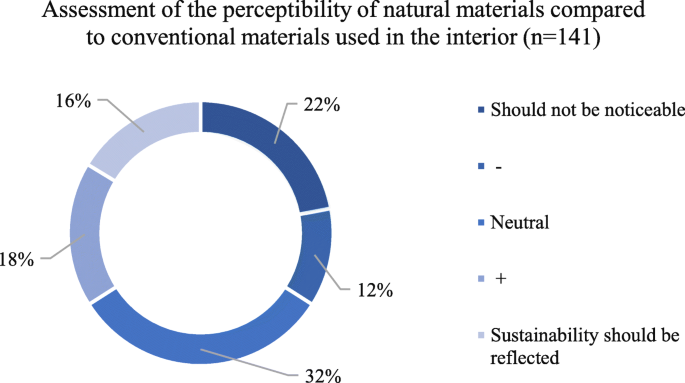

The question whether natural materials should be more noticeable in interior design compared to conventional materials also produced a mixed response. 34% of all participants highlight that natural materials should be noticeable, whereas the same percentage disagree with this statement (see Fig. 9 ). Therefore, a meaningful picture cannot be derived.

Assessment of the perceptibility of natural materials in the interior. Source: Own illustration

The participants also answered the question whether the usage of natural materials in the interior is a long-term mega trend or only a short-term fashion trend. Only 51% of the respondents assume it a long-term mega trend, whereas the other half expect only a short fashion trend without long-lasting influence on the automotive industry. Therefore, this question can also be said to paint a much-divided picture.

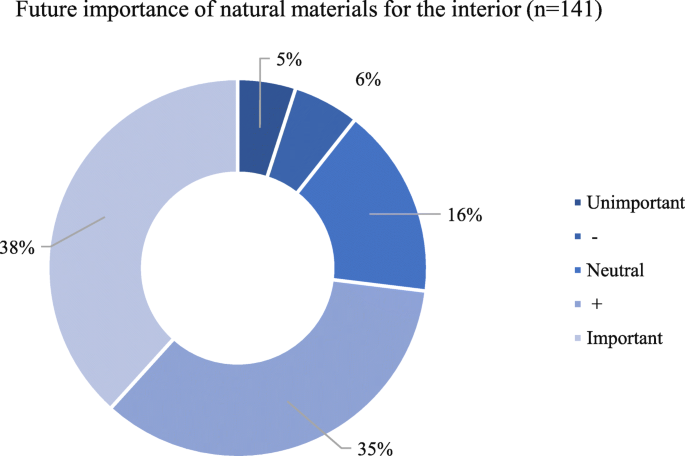

The final topic is the future relevance of sustainable materials in the interior. Nearly 75% of the respondents rate the future relevance as very high or at least high, thus prophesizing an increase in meaning and relevance in the coming years (see Fig. 10 ).

Future importance of natural materials for the interior ( n = 141). Source: Own illustration

Overall, it can certainly be seen that the issue of sustainability is present in people’s awareness. A tendency towards greater openness for new, more sustainable materials among customers of premium automobiles is recognizable. The priority for customers is that sustainability is taken into account in manufacturing and production, but not to the detriment of appearance, feel, comfort or price.

Discussion of the results

While there is an agreement in business practice that sustainability is not just a short-term fashion trend, but also a permanent indicator, this is not fully backed up by the empirical results. Only 50% of the respondents agree with this statement. The cost factor, which, according to the OEM, would have to be compensated, is an obstacle for approximately 50% of the customers. This means that for every second respondent a conflict of objectives with the OEM exists.

All participants principally agree that sustainability should play an overall role in the automobile and should not be restricted to individual areas. Although the majority of respondents chose the modules power unit and electronics, the category “everywhere” follows close behind in terms of importance. Therefore, the interior as a single module has to be integrated into the overall automotive design.

The customers also highlight that all traditional criteria connected to automobiles – especially appearance, haptics, comfort, smell, quality, safety and value – must also be fulfilled in a sustainable interior. At this point, manufacturers often see a problem. Natural materials fulfil certain properties, but others sometimes not. Consequently, manufacturers need to look more closely at this issue in order to satisfy the wishes of their customers.

As seen in the empirical study, the majority of participants can imagine a centre console made of ligneous wood or a door panel made of natural fibres such as hemp or kenaf. In addition, the topic of recycling is important for the customers. Therefore, the manufacturers should begin to work on innovative solutions regarding this topic.

The majority of customers also see an increase in the importance of sustainability for the interior on the horizon. It is therefore crucial for manufacturers to be innovative, show initiative, take advantage of emerging market opportunities and to act proactively. The focus should be on achieving first mover advantages, and it is crucial for OEMs to maintain their position as technology leaders and premium manufacturers, both in Germany and beyond. Therefore, it is imperative that premium manufacturers concentrate on the existing mega-trend of sustainability (Gelowicz et al., 2017 ; Schade, Zanker, Kühn, & Hettesheimer, 2014 ; Skala-Gast, 2012 ) and especially take more efforts on sustainable automotive interior solutions. However, all against the background that costumers accept compromises in comfort, practicality and price only to a very limit extend.

Referring to previous research in this area, the paper adds new insights to the topic of customer requirements regarding automotive sustainability in general and sustainable automotive interior in detail. The main result of the paper is to provide further details on the connection between sustainability and customer comfort in the automobile industry and to confront the needs of the customers with the challenges of the companies. This made an important contribution to the research field sustainability in the automotive industry.

The automotive industry is a prime example of small steps bringing change and contributing to a more environmentally friendly world. Suppliers are working with manufacturers to find solutions for a more sustainable interior and the importance of implementing sustainability along the entire supply chain is also well known to those involved. As a result, technological progress and the refinement of processes for the development of natural fibre products make it possible to replace products that currently pollute the environment more simply and cost-effectively with more environmentally friendly products, and at the same time to produce them in a more environmentally friendly way (Dunne et al., 2016 ; Hetterich et al., 2012 ).

This article focuses exclusively on premium manufacturers and their customers. The further research project will analyse whether there are significant differences when it comes to volume manufacturers. Furthermore, no distinction has been made between age, gender and automotive brand. Another limitation is the purposive sample of the study. The participants were mainly students, which cannot be taken as an average of the population. All of these will be explored in further research activities.

Availability of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

Original Equipment Manufacturers

International Automotive Manufacturers

Adekomaya, O., Jamiru, T., & Sadiku, R. (2016). A review on the sustainability of natural fiber in matrix reinforcement – A practical perspective. Journal of Reinforced Plastics and Composites , 35 (1), 3–7.

Article Google Scholar

Avezedo, S., & Barros, M. (2017). The application of the triple bottom line approach to sustainability assessment. The case study of the UK automotive supply chain. Journal of Industrial Engineering and Management , 10 (2), 286–322.

Avezedo, S., Carvaho, H., Duarte, S., & Cruz-Machado, V. (2012). Influence of green and lean upstream supply chain management practices on business sustainability. IEEE Transaction on Engineering Management , 59 (4), 753–765.

Barnes-Clay, T. (2012). Review: Lexus GS 450H hybrid. http://bloodsweatandfashion.com/lexus-gs-450h/ . Accessed 29 Aug 2018.

Google Scholar

Bergenwall, A. L., Chen, C., & White, R. E. (2012). TPS's process design in American automotive plants and its effects on the triple bottom line and sustainability. International Journal of Production Economics , 140 (1), 374–384.

Biju, P. L., Shalij, P. R., & Prabhushankar, G. V. (2015). Evaluation of customer requirements and sustainability requirements through the application of fuzzy analytic hierarchy process. Journal of Cleaner Production , 108 , 808–817.

Bjurenstedt, A., & Lärneklint, F. (2004). 3D biocomposite for automotive interior parts . Lulea: Lulea University of Technology.

Bröker, T., & Ostner, D. (2017). Innere Leichtigkeit. Automobil Industrie , 62 (8), 94–95.

Dannenberg, J. (2017). Auf Einkaufstour. Automobil Industrie , 62 (6), 8–12.

Dölle, J. E. (2013). Lieferantenmanagement in der Automobilindustrie. Struktur und Entwicklung der Lieferantenbeziehungen von Automobilherstellern . Wiesbaden: Springer.

Book Google Scholar

Dräxlmaier (2018). Türverkleidungen. Innovativ und nachhaltig. https://www.draexlmaier.com/produkte/interieur/tuerverkleidungen/ . Accessed 29 Aug 2018.

Dunne, R., Desai, D., Sadiku, R., & Jayaramudu, J. (2016). A review of natural fibres, their sustainability and automotive applications. Journal of Reinforced Plastic & Composites , 35 (13), 1041–1050.

Focus (2012). Natürliche Sache. https://www.focus.de/auto/news/oeko-materialien-im-auto-innenraum-natuerliche-sache-aid-758345.html . Accessed 29 Aug 2018.

Gelowicz, S., Günnel, T., Hammer, H., & Otto, C. (2017). Mehr als Werkstoffe. Automobil Industrie , 62 (5), 34–37.

Hassan, F., Zulkifli, R., Ghazali, M. J., & Azhari, C. H. (2017). Kenaf fiber composite in automotive industry: An overview. International Journal on Advanced Science, Engineering and Information Technology , 7 (1), 315–321.

Hetterich, J., Bonnemeier, S., Pritzke, M., & Georgiadis, A. (2012). Ecological sustainability. A customer requirement? Evidence from the automotive industry Journal of Environmental Planning and Management , 55 (9), 1111–1133.

Hull, D., & Clyne, T. W. (1996). An introduction to composite materials , (2nd. ed., ). Great Britain: Cambridge solid state science series.

Industrie, A. (2017). Optimierte, leichtere Komponenten. Automobil Industrie , 62 (5), 52.

Jasiński, D., James, M., & Kerry, K. (2016). A comprehensive framework for automotive sustainability assessment. Journal of Cleaner Production , 135 , 1034–1044.

Karus, M., & Kaup, M. (2002). Natural fibres in the European automotive industry. Journal of Industrial Hemp , 7 (1), 119–131.

Koers, M. (2014). Industrie und Politik. Zusammenspiel als Basis profitablen Wachstums in der Automobilindustrie. In B. Ebel, & M. B. Hofer (Eds.), Automotive Management. Strategie und Marketing in der Automobilwirtschaft , (2nd ed., pp. 177–188). Berlin et al.: Springer.

Kumar, N., & Das, D. (2016). Fibrous biocomposites from nettle (Giardinia diversifolia) and poly (lactic acid) fibers for automotive dashboard panel application. Composites Part B Engineering , 130 (1), 54–63.

Laukart, G., & Vorberg, T. (2016). Fahrzeuginnenausstattung. In S. Pischinger, & U. Seiffert (Eds.), Vieweg Handbuch Kraftfahrzeugtechnik , (8th ed., pp. 714–727). Wiesbaden: Springer.

Mayyas, A., Qattawi, A., Omar, M., & Shan, D. (2012). Design for sustainability in automotive industry: A comprehensive review. Renewable and Sustainable Energy Reviews , 16 (4), 1845–1862.

Mcauley, J. W. (2003). Global sustainability and key needs in future automotive design. Environmental Science & Technology , 37 (23), 5414–5416.

Mittelstaedt, J. D., Shultz II, C. J., Kilbourne, W. E., & Peterson, M. (2014). Sustainability as megatrend. Two schools of macromarketing thought. Journal of Macromarketing , 34 (3), 253–264.

Moisescu, O. I. (2018). From perceptual corporate sustainability to customer loyalty: A multi-sectorial investigation in a developing country. Economic Research-Ekonomska Istraživanja , 31 (1), 55–72.

Nunes, B., & Benett, D. (2010). Green operations inititiatives in the automotive inudstry. Benchmarking An International Journal , 17 (3), 396–420.

Panuju, A. Y. T., Ambarwati, D. A. S., & Susila, M. D. (2020, May). Implications of automotive product sustainability on young customers’ purchase intention in developing countries: An experimental approach. IOP Conference Series: Materials Science and Engineering , 857 (1), 012024.

Pein, M., Laukart, V., Feldmann, D. G., & Krause, D. (2006). Concepts for energy absorbing support structures and appropriate materials. In Proceedings of the 22nd International Congress of Aeronautical Sciences .

Pischinger, S., & Seiffert, U. (2016). Ausblick. Wo geht es hin. In S. Pischinger, & U. Seiffert (Eds.), Vieweg Handbuch Kraftfahrzeugtechnik , (8th ed., pp. 1391–1393). Wiesbaden: Springer.

Chapter Google Scholar

Puglia, D., Biagiotti, J., & Kenny, J. M. (2005). A review on natural fibre-based composites—Part II: Application of natural reinforcements in composite materials for automotive industry. Journal of Natural Fibers , 1 (3), 23–65.

Schade, W., Zanker, C., Kühn, A., & Hettesheimer, T. (2014). Sieben Herausforderungen für die deutsche Automobilindustrie. Strategische Antworten im Spannungsfeld von Globalisierung, Produkt- und Dienstleistungsinnovationen bis 2030 . Baden-Baden: Edition sigma.

Schmiedel, I., Barfuss, G. S., Nickel, T., & Pfeufer, L. (2014). Einsatz sichtbarer Naturfasern im Fahrzeuginterieur. Automobiltechnische Zeitschrift , 116 (6), 34–37.

Sinha, P., Muthu, S. S., Taylor, I., Schulze, R., Beverley, K., Day, C., & Tipi, N. (2015). Systems thinking in designing automotive textiles. Textiles and Clothing Sustainability , 1 (6), 1–13.

Skala-Gast, D. (2012). Zusammenhang zwischen Kundenzufriedenheit und Kundenloyalität. Eine empirische Analyse am Beispiel der deutschen Automobilindustrie . Wiesbaden: Springer.

Sopher, S. R. (2008). Automotive interior material recycling and design optimization for sustainability and end of life requirements. Society of plastics engineers (SPE)-global plastic and environment conference (GPEC). 2008.

Suddell, B. (2008). Industrial fibres: Recent and current developments. In Proceedings of the symposium on natural fibres, Rome, Italy, 20 October 2008 , (pp. 71–82).

Sullins, T. L. (2013). Biocomposite material evaluation and processing for automotive interior components . Birmingham: University of Alabama.

Thun, J.-H., & Hoenig, D. (2011). An empirical analysis of supply chain risk management in the German automotive industry. International Journal of Production Economics , 131 (1), 242–249.

Verma, D., Gope, P. C., & Shandilya, A. (2012). Coir fibre reinforcement and application in polymer composites: A review. Journal of Materials and Environmental Science , 4 (2), 263–276.

Wallentowitz, H., & Leyers, J. (2014). Technologietrends in der Fahrzeugtechnik. Dimensionen, Verläufe und Interaktionen. In B. Ebel, & M. B. Hofer (Eds.), Automotive Management. Strategie und Marketing in der Automobilwirtschaft , (2nd ed., pp. 29–56). Berlin et al.: Springer.

Yanfeng (2017). Naturfasertechnologie von Yanfeng Automotive Interiors trifft den Zeitgeist. https://www.yfai.com/de/naturfasertechnologie-von-yanfeng-automotive-interiors-trifft-den-zeitgeist . Accessed 29 Aug 2018.

You, H., Ryu, T., Oh, K., Yun, M. H., & Kim, K. J. (2006). Development of customer satisfaction models for automotive interior materials. International Journal of Industrial Ergonomics , 36 (4), 323–330.

Download references

Acknowledgements

Not applicable.

Authors‘information

Prof. Dr. Wanja Wellbrock is a professor for procurement management at Heilbronn University. His main research areas are supply chain management, strategic procurement management, sustainability and big data applications in cross-company value chains. He is the author of various English- and German-language publications and project manager of several practice-oriented research projects in these areas. Prof. Dr. Wanja Wellbrock gained practical experience in management positions in the automotive and aviation industries as well as in management consulting.

Since 2015, Prof. Dr. Daniela Ludin holds the professorship for general business administration at the Heilbronn University of Applied Sciences in the Faculty of Management and Sales on the Schwäbisch Hall campus. To anchor the principle of sustainability as a central moment in her courses is one of her main targets. Since 2017, Prof. Dr. Daniela Ludin is responsible for the Bachelor’s degree programm Management & Procurement Management (B.A. MBW); since 2019 also fort he Bachelor‘s degree programm Sustainable Procurement Management (B.A. NBW). Since 2015, Prof. Dr. Daniela Ludin is also a member of the Council for Sustainable Development at Heilbronn University, which she has also chaired as Sustainability Officer at Heilbronn University since 2019. Before her time at Heilbronn University, Prof. Dr. Daniela Ludin worked from 2009 to 2015 at the Rottenburg University of Applied Sciences with a professorship for law, environmental and forest policy. Her main research areas are sustainable procurement management, sustainable mobility, sustainable consumption, sustainable financial products and sustainable data management.

Prof. Dr. Wolfgang Gerstlberger is currently Professor of Operations Management at the Tallinn University of Technology (Estonia). Previously, he was Associate Professor for Innovation Management at the University of Southern Denmark in Odense and Endowed Professor for Innovation Management and SME Research at the International University Institute of the Technical University of Dresden. Professor Gerstlberger completed his doctorate and habilitation in the field of general business administration at the University of Kassel. In addition, he has led and carried out numerous innovation and sustainability projects for companies, the EU, associations and public administration organizations as a freelancer. His current research interests are in the areas of sustainable innovation and operations management, digitization and sustainable logistics.

Linda Röhrle finished her Bachelor degree in Management and Procurement Management at the Heilbronn University of Applied Sciences.

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and affiliations.

Heilbronn University of Applied Sciences, Campus Schwäbisch Hall, Faculty of Management and Sales, Heilbronn, Germany

Wanja Wellbrock, Daniela Ludin & Linda Röhrle

Department of Business Administration, Tallinn University of Technology, School of Business and Governance, Tallinn, Estonia

Wolfgang Gerstlberger

You can also search for this author in PubMed Google Scholar

Contributions

Wanja Wellbrock and Linda Röhrle analyzed and interpreted the survey data. Daniela Ludin performed the general sustainability background and Wolfgang Gerstlberger the sustainability aspects regarding automotive interior. All authors were major contributors in writing the manuscript. All authors read approved the final manuscript.

Corresponding author

Correspondence to Wanja Wellbrock .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Wellbrock, W., Ludin, D., Röhrle, L. et al. Sustainability in the automotive industry, importance of and impact on automobile interior – insights from an empirical survey. Int J Corporate Soc Responsibility 5 , 10 (2020). https://doi.org/10.1186/s40991-020-00057-z

Download citation

Received : 10 September 2020

Accepted : 13 December 2020

Published : 30 December 2020

DOI : https://doi.org/10.1186/s40991-020-00057-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Sustainability

- Automotive industry

Case Study: How Technology is Helping Automotive Manufacturers Achieve Sustainable Goals

- April 28, 2022

A digital transformation in car production is supporting manufacturers as they transit towards sustainable manufacturing.

Car manufacturers face a range of challenges globally as they strive to move towards sustainable manufacturing. Central to this is ensuring production processes remain as clean and efficient as possible while maintaining product quality and reducing wastage. Digital transformation is underpinning this as cloud-based technology such as artificial intelligence (AI) and machine learning (ML) play pivotal roles.

Accuracy and timeliness

One area where ML is supporting car manufacturers is in reducing production line interruptions . Automotive industry specialist Richard Felton explains that ML systems can help avoid unplanned maintenance by analysing data to improve predictive maintenance schedules. “If you avoid unnecessary maintenance, you reduce costs, increase productivity, and do not have unplanned downtime,” he said. “ML not only handles the sheer scale, breadth and accuracy of the data, but also the timeliness.” The technology can also help manufacturers navigate current global component shortages. “Manufacturers are using ML to anticipate shortages and how to handle those shortages in components more efficiently ,” he added.

Efficient component inspections

Additionally, ML supports component quality inspections using data from camera inspections to check assembly processes and sequences in terms of complexity, speed and accuracy. “The machine learning can spot anomalies that human operators might miss across millions of data points,” he added. This digital transformation is supported by companies such as Amazon Web Services (AWS) , which as a cloud service provider, enables customers to access and manage data, scale globally and make data driven decisions in real-time using AI, ML and other advanced services. AWS services help with sustainability, digital manufacturing and supply chains and improves the overall equipment effectiveness by capturing, analysing and visualising plant floor data. The services brings all this together as a holistic solution to support the automotive industry. Felton, who is the senior practice manager, AWS for Automotive , said the platform has purpose-built capabilities, drawing on expertise from across the automotive industry and offers the “broadest partner eco-system of any cloud specifically for automotive customers to help them transform their businesses.” We helped VW tackle that very complex operation with the digital production platform, with analytics in the cloud to help them achieve efficiency, quality and sustainability.

Automating processes with AI