Simple Interest Calculator

The Simple Interest Calculator calculates the interest and end balance based on the simple interest formula. Click the tabs to calculate the different parameters of the simple interest formula. In real life, most interest calculations involve compound Interest. To calculate compound interest, use the Interest Calculator .

| End balance |

| Principal |

| Interest rate |

| Term |

| Total Interest = | $20000 × 3% × 10 |

| = | $6,000.00 |

| End Balance = | $20000 + $6,000.00 |

| = | $26,000.00 |

| Year | Interest | Balance |

| 1 | $600.00 | $20,600.00 |

| 2 | $600.00 | $21,200.00 |

| 3 | $600.00 | $21,800.00 |

| 4 | $600.00 | $22,400.00 |

| 5 | $600.00 | $23,000.00 |

| 6 | $600.00 | $23,600.00 |

| 7 | $600.00 | $24,200.00 |

| 8 | $600.00 | $24,800.00 |

| 9 | $600.00 | $25,400.00 |

| 10 | $600.00 | $26,000.00 |

Related Interest Calculator | Compound Interest Calculator

What is Simple Interest?

Interest is the cost you pay to borrow money or the compensation you receive for lending money. You might pay interest on an auto loan or credit card, or receive interest on cash deposits in interest-bearing accounts, like savings accounts or certificates of deposit (CDs).

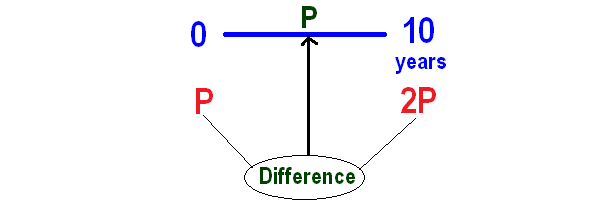

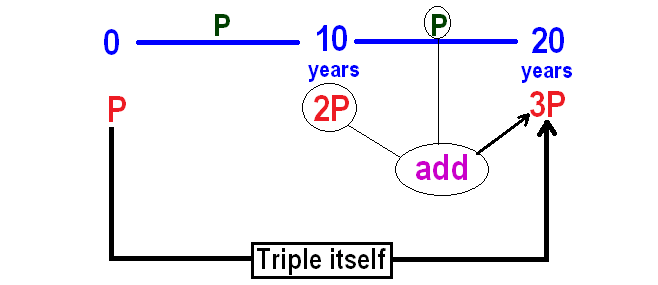

Simple interest is interest that is only calculated on the initial sum (the "principal") borrowed or deposited. Generally, simple interest is set as a fixed percentage for the duration of a loan. No matter how often simple interest is calculated, it only applies to this original principal amount. In other words, future interest payments won't be affected by previously accrued interest.

Simple Interest Formula

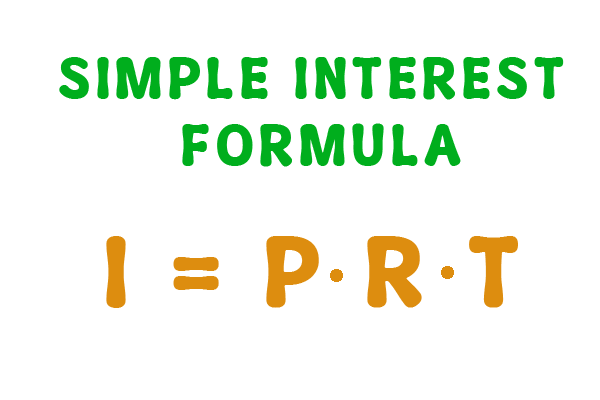

The basic simple interest formula looks like this:

Simple Interest = Principal Amount × Interest Rate × Time

Our calculator will compute any of these variables given the other inputs.

Simple Interest Calculated Using Years

You may also see the simple interest formula written as:

In this formula:

- I = Total simple interest

- P = Principal amount or the original balance

- r = Annual interest rate

- t = Loan term in years

Under this formula, you can manipulate "t" to calculate interest according to the actual period. For instance, if you wanted to calculate interest over six months, your "t" value would equal 0.5.

Simple Interest for Different Frequencies

- I = total interest

- P = Principal amount

- r = interest rate per period

- n = number of periods

Under this formula, you can calculate simple interest taken over different frequencies, like daily or monthly. For instance, if you wanted to calculate monthly interest taken on a monthly basis, then you would input the monthly interest rate as "r" and multiply by the "n" number of periods.

Simple Interest Examples

Let's review a quick example of both I=Prt and I=Prn.

For example, let's say you take out a $10,000 loan at 5% annual simple interest to repay over five years. You want to know your total interest payment for the entire loan.

To start, you'd multiply your principal by your annual interest rate, or $10,000 × 0.05 = $500.

Then, you'd multiply this value by the number of years on the loan, or $500 × 5 = $2,500.

Now that you know your total interest, you can use this value to determine your total loan repayment required. ($10,000 + $2,500 = $12,500.) You can also divide the value to determine how much interest you'd pay daily or monthly.

Alternatively, you can use the simple interest formula I=Prn if you have the interest rate per month.

If you had a monthly rate of 5% and you'd like to calculate the interest for one year, your total interest would be $10,000 × 0.05 × 12 = $6,000. The total loan repayment required would be $10,000 + $6,000 = $16,000.

What Financial Instruments Use Simple Interest?

Simple interest works in your favor as a borrower, since you're only paying interest on the original balance. That contrasts with compound interest, where you also pay interest on any accumulated interest. You may see simple interest on short-term loans.

For this same reason, simple interest does not work in your favor as a lender or investor. Investing in assets that don't offer compound growth means you may miss out on potential growth.

However, some assets use simple interest for simplicity — for example bonds that pay an interest coupon. Investments may also offer a simple interest return as a dividend. To take advantage of compounding you would need to reinvest the dividends as added principal.

By contrast, most checking and savings accounts, as well as credit cards, operate using compound interest.

Simple Interest Versus Compound Interest

Compound interest is another method of assessing interest. Unlike simple interest, compound interest accrues interest on both an initial sum as well as any interest that accumulates and adds onto the loan. (In other words, on a compounding schedule, you pay interest not just on the original balance, but on interest, too.)

Over the long run, compound interest can cost you more as a borrower (or earn you more as an investor). Most credit cards and loans use compound interest. Savings accounts also offer compounding interest schedules. You can check with your bank on the compounding frequency of your accounts.

Compound Interest Formula

The basic formula for compound interest is:

| A = P × (1 + |

Note that interest can compound on different schedules – most commonly monthly or annually. The more often interest compounds, the more interest you pay (or earn). If your interest compounds daily, you'd enter 365 for the number of time interest compounds annually. If it compounds monthly, you'd input 12 instead. Learn More About Compound InterestCompound interest calculations can get complex quickly because it requires recalculating the starting balance every compounding period. For more information on how compound interest works, we recommend visiting our compound interest calculator . Which is Better for You: Simple or Compound Interest?As a borrower, paying simple interest works in your favor, as you'll pay less over time. Conversely, earning compound interest means you'll net larger returns over time, be it on a loan, investment, or your regular savings account. For a quick example, consider a $10,000 loan at 5% interest repaid over five years. As established above, a loan this size would total $12,500 after five years. That's $10,000 on the original principal plus $2,500 in interest payments. Now consider the same loan compounded monthly. Over five years, you'd repay a total of $12,833.59. That's $10,000 of your original principal, plus $2,833.59 in interest. Over time, the difference between a simple interest and compound interest loan builds up exponentially.

Calculator Simple Interest

Simple Interest CalculatorEnter the values you know. The value left out will be automatically calculated and displayed. Simple Interest Formula

No results found We can’t find anything with that term at the moment, try searching something else. Simple Interest CalculatorThe simple interest calculator can be used to provide a quick and accurate calculation of interest assessed on a loan or investment. Principal (P) Total P+I (A) Related Calculators PRINCIPAL + INTEREST (A) A = $6,250.00 PRINCIPAL (P) P = $5,000.00 R = 2.5 %/year T = 10 years There was an error with your calculation. Table of ContentsSimple interest plus principal calculator, the information you need to use the simple interest calculator, the specifics of simple interest, differences between simple interest and compound interest, the applications of simple interest, check your data.

The simple interest calculator allows you to determine the amount of interest you can receive or pay over the life of your loan. This calculator comes in handy for analyzing different types of loans when determining the projected interest you get from lending money. You can use the simple interest calculator to calculate the principal, the interest rate, or the time of interest accrual. You will need a few different inputs to use the simple interest formula. First, you will need the principal amount of the loan. Then you will need to know or determine the interest rate and term of the loan. This results in the interest formula A=P(1+rt) . The formula includes the following components:

You need three of the four variables to use the calculator, so if you have A, P, and r, you can solve for t. Simple interest is the amount paid by a borrower for the use of borrowed money over a fixed period. It is interest only on the principal amount as a percentage of the principal amount. No interest is charged on the interest. The simple interest rate does not increase over time, so you will always know exactly how much you will pay. Borrowers benefit from simple interest because they only have to pay interest on the loans they take out. But investors can lose out on simple interest if their investments are based on it. When making a payment on a simple interest loan, you pay the interest for that month first. The rest of the payment goes to repay the principal amount of the loan. For example, you have a credit card with a 5% Annual Percentage Rate and you make $2,000 worth of purchases during that year. You would end up paying back the $2,000 you borrowed from the credit card company plus 5% interest on that $2,000. So, paying off the balance will cost you $2,100. Simple interest is calculated only on the balance of the principal debt. And compound interest is calculated based on the principal balance and accumulated interest from previous periods. With compound interest, the amount owed will grow much faster than with simple interest. Sometimes compound interest is called "interest on interest payments." The growth of compound interest is affected by such a factor as the frequency of compounding, that is, the frequency of compounding. The greater the number of compound interest periods, that is, compounding periods, the higher the interest rate. The compounding periods are a crucial element that distinguishes between simple and compound interest. The main difference between simple and compound interest is that the amount owed on compound interest grows much faster. Simple interest applies to credit card balances. Most personal loans, including student loans and home mortgages, use simple interest. Most coupon bonds use simple interest. Consumer loans and auto loans use simple interest when calculating interest payments. Certificates of deposit use simple interest to calculate investment income. Simple interest is usually applied to short-term loans, and some mortgages use this calculation method. In the U.S., most mortgages with amortization schedules are simple interest loans. Compound interest is often used to enhance long-term investment returns, such as 401(k)s and other investments. Another everyday use of compound interest is in bank accounts, especially savings accounts. Student loans, mortgages, and credit cards can also use compound interest, so keep an eye on the interest rate when making these important financial decisions. There are no hard rules about using simple or compound interest. So you need to ask your lender what type of interest they use. Jesse is considering taking out a loan to buy a car. The loan amount will be $5,000, with the bank charging 3% interest each year for five years. What total amount of interest he can expect to pay? Calculating the interest yields the following equation: A = $5,000 × (1 + 0.03 × 5) = $5,750 Subtracting $5,000 from the loan amount gives Jesse a total interest expense of $750. Anna is a student who took a simple interest loan to pay for one year of college tuition, which costs $20,000. The annual interest rate on loan is 5%. Anna repaid the loan over four years. The amount of simple interest paid is: $20,000 × 0.05 × 4 = $4,000 and the total repayments are: $20,000 + $4,000 = $24,000 Solutions for different factorsWe can break down the simple interest rate formula into four different formulas. Each of these formulas solves the problem for a different variable. Calculate the total amount of interest (standard calculation) $$A=P(1+rt)$$ Calculate the principal amount owed $$P = \frac{A}{1 + rt}$$ Calculate the interest in decimal form $$r = (\frac{1}{t}) × (\frac{A}{P} - 1)$$ Calculate the interest as a percentage $$R = r × 100$$ Calculate the lending time $$t = (\frac{1}{r}) × (\frac{A}{P} - 1)$$ Let's try a reverse calculation to find the loan time. Sarah takes out a $10,000 loan with an interest rate of 5%. The calculated principal and interest amount are $13,500. What is the duration of the loan? Using the inverse calculation above, we get the formula: $$t = \frac{1}{0.05} × \frac{13,500}{10,000} - 1$$ After solving for t, you get the loan for seven years. Top tips to keep in mind when calculating simple interestCheck the terms of your potential contract to make sure you enter the correct information. The simple interest calculator explains the results in detail, familiarizing you with the factors that affect the calculation. Don't assume that interest will accrue unambiguouslyThe simple interest plus principal calculator gives you a general idea of the interest you can reasonably expect on your loan. Don't automatically assume that this is the exact amount that lenders will charge you. Some factors can change from the time you get the loan until you sign it. Some contracts charge interest based on market factors, meaning the interest rate can change over the life of the loan. Understanding how to calculate simple interest is important for individuals and businesses. Not all loans have a simple interest rate. Many loans accrue compound interest. When these situations arise, use our compound interest calculator designed to identify the compound interest on your loans or investments. Simple Interest Calculator & FormulaSimple Interest means earning or paying interest only the Principal [1]. The Principal is the amount borrowed, the original amount invested, or the face value of a bond [2]. On this page, I explain the simple interest formula and provide a simple interest calculator that you can use to solve some basic problems. For information about how simple interest applies to amortization , or if you are looking for a so-called "Simple Interest Mortgage" calculator, try our Simple Interest Loan Calculator . Simple Interest FormulaSimple Interest is earned or paid on the Principal only . "Simple Interest" is different than "Compound Interest". You don't earn interest on interest, and you don't pay interest on interest. The formula is indeed simple because it only involves multiplication: Formula #1 I = Prn Interest ( I ) = Principal ( P ) times Rate Per Period ( r ) times Number of Periods ( n ) Divide an annual rate by 12 to get (r) if the Period is a month. You'll often find the formula written using an annual interest rate where the number of periods is specified in years or a fraction of a year. Formula #2 I = Prt Interest ( I ) = Principal ( P ) times Annual Rate ( r ) times Time in Years ( t ) The time can be specified as a fraction of a year (e.g. 5 months would be 5/12 years). Simple Interest CalculatorNow that you have the formula, you can use the calculator below to solve your homework problems. Try using it solve the example problems listed below. The calculator uses Formula #2 . You need a javascript-enabled browser to use the calculator. Simple Interest Calculator, I=Prt

This calculator was designed based to make it easy to use for both monthly and daily accrual calculations. The Days in Year only matter if you enter a value in the Days field. Normally, you'd enter only the days or only the months or only the years, but if you enter values in all 3 fields, the time is calculated as Years + Months/12 + Days/DaysInYear. Simple Interest Example ProblemsTry using the above calculator to solve the example problems listed below. Example 1 : You take out a loan of $10,000 that charges a annual rate of 6%. Using formula #1, the interest you pay on your first monthly payment is $10000*(6/100)/12*1=$50. Using formula #2 and the calculator, enter P=10000, r=6, and 1 month. Example 2 : You have a savings account that earns Simple Interest. Unlikely . Most savings accounts earn compound interest. Example 3 : My father loans me $2,000 to buy a used car and tells me I need to pay it off in one big chunk (a balloon loan ). To be easy on me he will charge me simple interest based on an annual rate of 3%. I work really hard in the summer (using my car to deliver pizza), and am able to pay off the car in just 4 months. Using formula #2, the interest I owe my dad is $2,000*(3/100)*4/12=$20. Using formula #1, it would be $2,000*(3/100)/12*4=$20 (very basic algebra). Example 4 : Using the assumption that a year has 360 days (a common banking assumption sometimes used for prorating the interest between the close date of a loan and the date of the first payment), how much interest accrues over 20 days if the current Principal balance is $100,000 and the annual interest rate is 7.2%? Using simple interest formula #2, the total interest accrued would be $100,000*(7.2/100)*20/360=$400.

How to Cite This Article- Wittwer, J.W., " Simple Interest ", on Vertex42.com, Nov 11, 2008, https://www.vertex42.com/Calculators/simple-interest.html Follow Us On ... Finance ArticlesSponsored listings , financial calculators, mortgage calculators, loan calculators, amortization, retirement & savings, debt calculators, business tools. Simple Interest CalculatorTable of contents Our simple interest calculator calculates monthly payments on an interest-only loan . Just provide the interest percentage, and you'll know how much that loan costs. The difference between "just" interest and mortgage payment is simple — with the mortgage calculator, every month you repay a part of the principal and your loan balance gets lower and lower. With the simple interest calculator, only the interest is paid. The loan amount stays the same forever. Nothing changes with time, so we didn't include a field that would specify your loan's duration. Simple interest can be used both when you borrow or lend money. In the former case, the interest is added to a separate pile of money each month (and is not subject to extra interest next month). What is interest?The interest is one of the most often used words in finance. Students of the economy become familiar with this term during their very first lectures. Financial advisors, financial officers, stockbrokers, bankers, investment managers, and other financial experts use this term hundreds of times during their everyday activities. So, at the beginning of this article, we will try to answer the question “What is interest?” . Later on, you will find the answers to the following questions:

In the next sections, we will also show you some examples of simple interest calculations. But everything in its own time. Let's start with the definition of interest. Generally, interest is the cost of borrowing money. It is a price that the borrower pays to the lender for using his money . The interest is customarily expressed as a percentage ( % ) of the original amount (principal amount, balance). Interest can be either simple or compounded. Simple interest is based on the original amount, while compound interest is based on the original amount and the interest that accumulates on it in every period (for further explanations of simple and compound interest, see the section Simple and compound interest ). Interest rate definitionIn finance, interest rate is defined as the amount that is charged by a lender to a borrower for the use of assets . Thus, we can say that for the borrower, the interest rate is the cost of debt, and for the lender, it is the rate of return. Note here that if you make a deposit in a bank (e.g., put money in your savings account), from a financial perspective, it means that you lend money to the bank. In such a case, the interest rate reflects your profit. The interest rate is commonly expressed as a percentage of the principal amount (loan outstanding or value of deposit). Usually, it is presented on an annual basis. In that case, it is called the annual percentage yield (APY) or the effective annual rate (EAR). Simple and compound interestSimple interest is used to estimate the interest earned or paid on a certain balance (original amount) during a particular period. Simple interest does not take into account the effects of compounding . Compounding means calculating interest on interest. In other words, with compounding, you earn the interest not only on the principal amount but also on the interest that was earned over the previous periods. It is essential information to know, as with compound interest you actually earn or pay more over the considered period. If you want to assume that interest from the previous periods influences the original amount, you should apply compound interest. Here, we only mention its most basic definition, which states that compound interest is the interest calculated on the initial principal and the interest that has been accumulated during consecutive periods as well. Note that since simple interest is calculated only on the original amount, it's much easier to determine than compound interest. However, with our calculators, you won't feel the difference. Simple interest definition and simple interest formulaAccording to the widely accepted definition, simple interest is an interest that is paid or computed on the original amount of a loan or the amount of a deposit. The simple interest formula is: interest = amount × interest_rate Did you know that the term simple interest was used for the first time in 1798? (That year, the words rentier and working capital appeared in the English language for the first time, too). How to calculate simple interest?Are you wondering how to calculate simple interest? Here is an example that should help you understand it. Let's assume that you put $1,000 in your savings account. It is the so-called original amount. (Note that you can also treat this $1,000 as the initial value of your loan with simple interest). First of all, take the interest rate and divide it by one hundred. 5% = 0.05 . Then multiply the original amount by the interest rate. $1,000 × 0.05 = $50 . That's it. You have just calculated your annual interest! To get a monthly interest, divide this value by the number of months in a year ( 12 ). $50 / 12 = $4.17 . So, your monthly interest is $4.17. If the initial $1,000 is a deposit, this is your monthly profit. If this $1,000 is a loan, this value represents your monthly payments. Now, let's try to make some further calculations. If you want to compute the sum of the interest paid over a specified period, all you need to do is multiply the monthly interest by the adequate number of months or years: expand the "total interest" section of our calculator to do so! For example, you may want to calculate the total interest you will receive during the next two and a half years. To do so, you need to multiply $4.17 by 30 (2 years = 24 months, half a year = 6 months): $4.17 × 30 = $125.10 Obviously, all of the above calculations might be done quickly and painlessly with our smart calculator! An example of simple interest in practiceYou inherit $1,000,000 and intend to use it to provide a steady income - you don't want to spend it, nor invest it. You put it into a bank account with a 5% annual interest rate. Every year, you get $50,000 (5% of $1 million). Every month, you'll receive $4,166.67 (1/12 of $50,000). No matter how much time passes, you'll still have $1 million on that account. An alternative — compound interestBut what if you were to leave that extra cash in the account? Then that interest would keep working for you, and every month, the balance on the account would increase (and the whole thing would become an investment. To make it simple, let's assume that the interest compounds annually (is added once per year).

Now that's something, isn't it? You wouldn't get your $4,166 every month, but you'd have 131 times more in the bank after 100 years. The real-life examples of simple interest loansWell, not everyone will inherit $1,000,000 (although we sincerely wish you that). However, it doesn't mean that you will not come across simple interest in your everyday life. The common examples of the use of simple interest are:

Assume that you take out a simple interest car loan . If the car costs $5,000 and you don't have any savings, to finance it, you would need to borrow $5,000. It is the principal amount of your car loan. Knowing that the annual interest rate is 3% and the loan must be paid back in one year, you can compute the simple interest on that loan as follows: $5,000 × 3% = $150 In total, you will have to pay back the principal amount plus the interest. So: $5,000 + $150 = $5,150 Assume that you have a credit card with a $2,500 limit and a 15% interest rate that is not compounded . In the previous month, you bought goods for $1,800, and at the beginning of this month, you paid only the minimum amount, which was $100. It means that you have a $1,700 balance remaining. The interest that will accrue on your credit card this month is: $1,700 × 15% / 12 = $21.25 However, be aware that credit cards usually have compounded interest rate. Simple interest on credit cards is nowadays rather something extraordinary (Well, try to guess why…) Discounts on early payments are used mainly in business. A seller may offer a discount for his contractor in order to prompt him to pay for the invoice in cash or earlier than its maturity. For example, the issuer of the invoice for $30,000 may offer a 0.2% discount for payment within the week after purchase. It means that the amount of discount is: $30,000 × 0.2% = $60 So the buyer will have to pay: $30,000 − $60 = $29,940 Simple interest rate and perpetuityTo explain what is perpetuity, we have to start with the term annuity . In the most intuitive sense, an annuity is a series of payments that are made during a specified period at equal intervals. A perpetuity is a specific type of an annuity that has no end. In other words, we could say that perpetuity is a stream of payments that continues forever (indefinitely). Assuming that payments begin at the end of the first period, the monthly payment from perpetuity is calculated with the following formula: monthly payment = principal amount × interest_rate Note that it is not a coincidence that the above formula is very similar to the simple interest formula presented in the section Simple interest definition and simple interest formula ( interest = amount × interest_rate ). In fact, we calculate the same value; only the names of the variables have changed. Are you curious about the value of the principal amount that guarantees you won't have to work anymore? Let's assume that to do so, you need a yearly income equal to $100,000. We also need to assume that, the interest rate is 4% and is constant over time. Thus: $100,000 = principal amount × 4% principal amount = $100,000 / 4% = $2,500,000 Hmm… quite a lot, isn't it? Unfortunately, even if you had such an amount, currently, there are only a few existing financial products that are based on the concept of perpetuities. However, in the past, they were issued by many financial institutions (insurers and banks) and even the governments. For example, the so-called consols were issued by the British government and were finally redeemed in 2015. Further interest rate calculationsNow you know what is simple interest and how to calculate its value. So it's high time you become familiar with more complex concepts of financial mathematics. Undoubtedly, the term that is the most associated with simple interest is compound interest. We have already described this idea in one of the previous sections. But did you know that calculations based on compound interest may be used to compute the future value of your investment or savings? All you need to do is use one of our smart calculators. You may also be curious how to compare several bank deposit (or loan) offers if they have different compounding periods and different interest rates. To do so, you need to compute the Annual Percentage Yield, which is also known as the Effective Annual Rate (EAR). This value tells you what is the interest rate on a yearly basis and thus helps you make the best (i.e., the most reasonable) financial decision. However, you can also do it on your own. If you are not sure how to do this, read the APY calculator description, where everything is explained in detail. Another fascinating thing you can do when going deeper into interest calculations is to compute how long it would take to increase your investment by n%. Are you curious how much time you need to double your initial investment? Triple it? We suggest you use our smart rule of 72 calculator . Interest rate calculators in everyday lifeIf you want to apply the concept of interest rate to everyday life situations, you can try the following tools designed by the Omni team: The credit card payoff calculator allows you to estimate how long it will take until you are completely debt-free. The mortgage calculator helps you estimate the cost of your mortgage (monthly installments) for different payback periods and mortgage rates. You can also compute the remaining balance of your loan with the loan balance calculator . The cap rate calculator helps you determine the rate of return on your real estate property purchase. The dream come true calculator provides an answer to the question: how long do you have to save to afford your dream? The lease calculator helps you compute the monthly and total payments for a lease. Interest rate in business calculationsThe concept of interest rate is also widely applied to various business calculations. Here you have a few examples of our business calculators in which the interest rate plays an important role. The present value calculator estimates the current value of a future payment given a certain rate of return (note that here, the rate of return is the same as the interest rate!). The NPV calculator gives you information about the expected profitability of a planned investment project. The discounted cash flow calculator (DCF) uses the concept of interest rate (here – discount rate) in estimating how much a company is worth. What is the difference between simple and compound interest?The difference between simple and compound interest is that simple interest is paid on the initial principal (loan or deposit) , while compound interest is calculated using the initial loan or deposit and any earned interest on top of that . How do you find the future value of simple interest?To find the future value, F , of simple interest, follow these steps:

What is principal in simple interest?The principal, or principal amount, is the initial amount of money lent or invested. The letter P denotes the principal, and it's the value on which interest is calculated. What is 6% interest on a $30,000 loan?6% interest on a $30,000 loan is $1,800 per year or $150 per month . You can quickly calculate simple interest by finding the 6% of 30000: 6 × 30000 / 100 = 1800 Loan amount Annual interest rate. How much interest you are charged per month/year. .css-17jgrqx.css-17jgrqx{color:#2B3148;background-color:transparent;font-family:"Roboto","Helvetica","Arial",sans-serif;font-size:20px;line-height:24px;overflow:visible;padding-top:0px;position:relative;}.css-17jgrqx.css-17jgrqx:after{content:'';-webkit-transform:scale(0);-moz-transform:scale(0);-ms-transform:scale(0);transform:scale(0);position:absolute;border:2px solid #EA9430;border-radius:2px;inset:-8px;z-index:1;}.css-17jgrqx .js-external-link-button.link-like,.css-17jgrqx .js-external-link-anchor{color:inherit;border-radius:1px;-webkit-text-decoration:underline;text-decoration:underline;}.css-17jgrqx .js-external-link-button.link-like:hover,.css-17jgrqx .js-external-link-anchor:hover,.css-17jgrqx .js-external-link-button.link-like:active,.css-17jgrqx .js-external-link-anchor:active{text-decoration-thickness:2px;text-shadow:1px 0 0;}.css-17jgrqx .js-external-link-button.link-like:focus-visible,.css-17jgrqx .js-external-link-anchor:focus-visible{outline:transparent 2px dotted;box-shadow:0 0 0 2px #6314E6;}.css-17jgrqx p,.css-17jgrqx div{margin:0;display:block;}.css-17jgrqx pre{margin:0;display:block;}.css-17jgrqx pre code{display:block;width:-webkit-fit-content;width:-moz-fit-content;width:fit-content;}.css-17jgrqx pre:not(:first-child){padding-top:8px;}.css-17jgrqx ul,.css-17jgrqx ol{display:block margin:0;padding-left:20px;}.css-17jgrqx ul li,.css-17jgrqx ol li{padding-top:8px;}.css-17jgrqx ul ul,.css-17jgrqx ol ul,.css-17jgrqx ul ol,.css-17jgrqx ol ol{padding-top:0;}.css-17jgrqx ul:not(:first-child),.css-17jgrqx ol:not(:first-child){padding-top:4px;} .css-jdoljy{margin:auto;background-color:white;overflow:auto;overflow-wrap:break-word;word-break:break-word;}.css-jdoljy code,.css-jdoljy kbd,.css-jdoljy pre,.css-jdoljy samp{font-family:monospace;}.css-jdoljy code{padding:2px 4px;color:#444;background:#ddd;border-radius:4px;}.css-jdoljy figcaption,.css-jdoljy caption{text-align:center;}.css-jdoljy figcaption{font-size:12px;font-style:italic;overflow:hidden;}.css-jdoljy h3{font-size:1.75rem;}.css-jdoljy h4{font-size:1.5rem;}.css-jdoljy .mathBlock{font-size:24px;-webkit-padding-start:4px;padding-inline-start:4px;}.css-jdoljy .mathBlock .katex{font-size:24px;text-align:left;}.css-jdoljy .math-inline{background-color:#f0f0f0;display:inline-block;font-size:inherit;padding:0 3px;}.css-jdoljy .videoBlock,.css-jdoljy .imageBlock{margin-bottom:16px;}.css-jdoljy .imageBlock__image-align--left,.css-jdoljy .videoBlock__video-align--left{float:left;}.css-jdoljy .imageBlock__image-align--right,.css-jdoljy .videoBlock__video-align--right{float:right;}.css-jdoljy .imageBlock__image-align--center,.css-jdoljy .videoBlock__video-align--center{display:block;margin-left:auto;margin-right:auto;clear:both;}.css-jdoljy .imageBlock__image-align--none,.css-jdoljy .videoBlock__video-align--none{clear:both;margin-left:0;margin-right:0;}.css-jdoljy .videoBlock__video--wrapper{position:relative;padding-bottom:56.25%;height:0;}.css-jdoljy .videoBlock__video--wrapper iframe{position:absolute;top:0;left:0;width:100%;height:100%;}.css-jdoljy .videoBlock__caption{text-align:left;}@font-face{font-family:'KaTeX_AMS';src:url(/katex-fonts/KaTeX_AMS-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_AMS-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_AMS-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Caligraphic';src:url(/katex-fonts/KaTeX_Caligraphic-Bold.woff2) format('woff2'),url(/katex-fonts/KaTeX_Caligraphic-Bold.woff) format('woff'),url(/katex-fonts/KaTeX_Caligraphic-Bold.ttf) format('truetype');font-weight:bold;font-style:normal;}@font-face{font-family:'KaTeX_Caligraphic';src:url(/katex-fonts/KaTeX_Caligraphic-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Caligraphic-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Caligraphic-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Fraktur';src:url(/katex-fonts/KaTeX_Fraktur-Bold.woff2) format('woff2'),url(/katex-fonts/KaTeX_Fraktur-Bold.woff) format('woff'),url(/katex-fonts/KaTeX_Fraktur-Bold.ttf) format('truetype');font-weight:bold;font-style:normal;}@font-face{font-family:'KaTeX_Fraktur';src:url(/katex-fonts/KaTeX_Fraktur-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Fraktur-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Fraktur-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Main';src:url(/katex-fonts/KaTeX_Main-Bold.woff2) format('woff2'),url(/katex-fonts/KaTeX_Main-Bold.woff) format('woff'),url(/katex-fonts/KaTeX_Main-Bold.ttf) format('truetype');font-weight:bold;font-style:normal;}@font-face{font-family:'KaTeX_Main';src:url(/katex-fonts/KaTeX_Main-BoldItalic.woff2) format('woff2'),url(/katex-fonts/KaTeX_Main-BoldItalic.woff) format('woff'),url(/katex-fonts/KaTeX_Main-BoldItalic.ttf) format('truetype');font-weight:bold;font-style:italic;}@font-face{font-family:'KaTeX_Main';src:url(/katex-fonts/KaTeX_Main-Italic.woff2) format('woff2'),url(/katex-fonts/KaTeX_Main-Italic.woff) format('woff'),url(/katex-fonts/KaTeX_Main-Italic.ttf) format('truetype');font-weight:normal;font-style:italic;}@font-face{font-family:'KaTeX_Main';src:url(/katex-fonts/KaTeX_Main-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Main-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Main-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Math';src:url(/katex-fonts/KaTeX_Math-BoldItalic.woff2) format('woff2'),url(/katex-fonts/KaTeX_Math-BoldItalic.woff) format('woff'),url(/katex-fonts/KaTeX_Math-BoldItalic.ttf) format('truetype');font-weight:bold;font-style:italic;}@font-face{font-family:'KaTeX_Math';src:url(/katex-fonts/KaTeX_Math-Italic.woff2) format('woff2'),url(/katex-fonts/KaTeX_Math-Italic.woff) format('woff'),url(/katex-fonts/KaTeX_Math-Italic.ttf) format('truetype');font-weight:normal;font-style:italic;}@font-face{font-family:'KaTeX_SansSerif';src:url(/katex-fonts/KaTeX_SansSerif-Bold.woff2) format('woff2'),url(/katex-fonts/KaTeX_SansSerif-Bold.woff) format('woff'),url(/katex-fonts/KaTeX_SansSerif-Bold.ttf) format('truetype');font-weight:bold;font-style:normal;}@font-face{font-family:'KaTeX_SansSerif';src:url(/katex-fonts/KaTeX_SansSerif-Italic.woff2) format('woff2'),url(/katex-fonts/KaTeX_SansSerif-Italic.woff) format('woff'),url(/katex-fonts/KaTeX_SansSerif-Italic.ttf) format('truetype');font-weight:normal;font-style:italic;}@font-face{font-family:'KaTeX_SansSerif';src:url(/katex-fonts/KaTeX_SansSerif-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_SansSerif-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_SansSerif-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Script';src:url(/katex-fonts/KaTeX_Script-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Script-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Script-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Size1';src:url(/katex-fonts/KaTeX_Size1-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Size1-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Size1-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Size2';src:url(/katex-fonts/KaTeX_Size2-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Size2-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Size2-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Size3';src:url(/katex-fonts/KaTeX_Size3-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Size3-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Size3-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Size4';src:url(/katex-fonts/KaTeX_Size4-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Size4-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Size4-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}@font-face{font-family:'KaTeX_Typewriter';src:url(/katex-fonts/KaTeX_Typewriter-Regular.woff2) format('woff2'),url(/katex-fonts/KaTeX_Typewriter-Regular.woff) format('woff'),url(/katex-fonts/KaTeX_Typewriter-Regular.ttf) format('truetype');font-weight:normal;font-style:normal;}.css-jdoljy .katex{font:normal 1.21em KaTeX_Main,Times New Roman,serif;line-height:1.2;text-indent:0;text-rendering:auto;}.css-jdoljy .katex *{-ms-high-contrast-adjust:none!important;border-color:currentColor;}.css-jdoljy .katex .katex-version::after{content:'0.13.13';}.css-jdoljy .katex .katex-mathml{position:absolute;clip:rect(1px, 1px, 1px, 1px);padding:0;border:0;height:1px;width:1px;overflow:hidden;}.css-jdoljy .katex .katex-html>.newline{display:block;}.css-jdoljy .katex .base{position:relative;display:inline-block;white-space:nowrap;width:-webkit-min-content;width:-moz-min-content;width:-webkit-min-content;width:-moz-min-content;width:min-content;}.css-jdoljy .katex .strut{display:inline-block;}.css-jdoljy .katex .textbf{font-weight:bold;}.css-jdoljy .katex .textit{font-style:italic;}.css-jdoljy .katex .textrm{font-family:KaTeX_Main;}.css-jdoljy .katex .textsf{font-family:KaTeX_SansSerif;}.css-jdoljy .katex .texttt{font-family:KaTeX_Typewriter;}.css-jdoljy .katex .mathnormal{font-family:KaTeX_Math;font-style:italic;}.css-jdoljy .katex .mathit{font-family:KaTeX_Main;font-style:italic;}.css-jdoljy .katex .mathrm{font-style:normal;}.css-jdoljy .katex .mathbf{font-family:KaTeX_Main;font-weight:bold;}.css-jdoljy .katex .boldsymbol{font-family:KaTeX_Math;font-weight:bold;font-style:italic;}.css-jdoljy .katex .amsrm{font-family:KaTeX_AMS;}.css-jdoljy .katex .mathbb,.css-jdoljy .katex .textbb{font-family:KaTeX_AMS;}.css-jdoljy .katex .mathcal{font-family:KaTeX_Caligraphic;}.css-jdoljy .katex .mathfrak,.css-jdoljy .katex .textfrak{font-family:KaTeX_Fraktur;}.css-jdoljy .katex .mathtt{font-family:KaTeX_Typewriter;}.css-jdoljy .katex .mathscr,.css-jdoljy .katex .textscr{font-family:KaTeX_Script;}.css-jdoljy .katex .mathsf,.css-jdoljy .katex .textsf{font-family:KaTeX_SansSerif;}.css-jdoljy .katex .mathboldsf,.css-jdoljy .katex .textboldsf{font-family:KaTeX_SansSerif;font-weight:bold;}.css-jdoljy .katex .mathitsf,.css-jdoljy .katex .textitsf{font-family:KaTeX_SansSerif;font-style:italic;}.css-jdoljy .katex .mainrm{font-family:KaTeX_Main;font-style:normal;}.css-jdoljy .katex .vlist-t{display:inline-table;table-layout:fixed;border-collapse:collapse;}.css-jdoljy .katex .vlist-r{display:table-row;}.css-jdoljy .katex .vlist{display:table-cell;vertical-align:bottom;position:relative;}.css-jdoljy .katex .vlist>span{display:block;height:0;position:relative;}.css-jdoljy .katex .vlist>span>span{display:inline-block;}.css-jdoljy .katex .vlist>span>.pstrut{overflow:hidden;width:0;}.css-jdoljy .katex .vlist-t2{margin-right:-2px;}.css-jdoljy .katex .vlist-s{display:table-cell;vertical-align:bottom;font-size:1px;width:2px;min-width:2px;}.css-jdoljy .katex .vbox{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex-direction:column;-ms-flex-direction:column;flex-direction:column;-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;}.css-jdoljy .katex .hbox{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;width:100%;}.css-jdoljy .katex .thinbox{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;width:0;max-width:0;}.css-jdoljy .katex .msupsub{text-align:left;}.css-jdoljy .katex .mfrac>span>span{text-align:center;}.css-jdoljy .katex .mfrac .frac-line{display:inline-block;width:100%;border-bottom-style:solid;}.css-jdoljy .katex .mfrac .frac-line,.css-jdoljy .katex .overline .overline-line,.css-jdoljy .katex .underline .underline-line,.css-jdoljy .katex .hline,.css-jdoljy .katex .hdashline,.css-jdoljy .katex .rule{min-height:1px;}.css-jdoljy .katex .mspace{display:inline-block;}.css-jdoljy .katex .llap,.css-jdoljy .katex .rlap,.css-jdoljy .katex .clap{width:0;position:relative;}.css-jdoljy .katex .llap>.inner,.css-jdoljy .katex .rlap>.inner,.css-jdoljy .katex .clap>.inner{position:absolute;}.css-jdoljy .katex .llap>.fix,.css-jdoljy .katex .rlap>.fix,.css-jdoljy .katex .clap>.fix{display:inline-block;}.css-jdoljy .katex .llap>.inner{right:0;}.css-jdoljy .katex .rlap>.inner,.css-jdoljy .katex .clap>.inner{left:0;}.css-jdoljy .katex .clap>.inner>span{margin-left:-50%;margin-right:50%;}.css-jdoljy .katex .rule{display:inline-block;border:solid 0;position:relative;}.css-jdoljy .katex .overline .overline-line,.css-jdoljy .katex .underline .underline-line,.css-jdoljy .katex .hline{display:inline-block;width:100%;border-bottom-style:solid;}.css-jdoljy .katex .hdashline{display:inline-block;width:100%;border-bottom-style:dashed;}.css-jdoljy .katex .sqrt>.root{margin-left:0.27777778em;margin-right:-0.55555556em;}.css-jdoljy .katex .sizing.reset-size1.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size1{font-size:1em;}.css-jdoljy .katex .sizing.reset-size1.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size2{font-size:1.2em;}.css-jdoljy .katex .sizing.reset-size1.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size3{font-size:1.4em;}.css-jdoljy .katex .sizing.reset-size1.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size4{font-size:1.6em;}.css-jdoljy .katex .sizing.reset-size1.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size5{font-size:1.8em;}.css-jdoljy .katex .sizing.reset-size1.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size6{font-size:2em;}.css-jdoljy .katex .sizing.reset-size1.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size7{font-size:2.4em;}.css-jdoljy .katex .sizing.reset-size1.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size8{font-size:2.88em;}.css-jdoljy .katex .sizing.reset-size1.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size9{font-size:3.456em;}.css-jdoljy .katex .sizing.reset-size1.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size10{font-size:4.148em;}.css-jdoljy .katex .sizing.reset-size1.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size1.size11{font-size:4.976em;}.css-jdoljy .katex .sizing.reset-size2.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size1{font-size:0.83333333em;}.css-jdoljy .katex .sizing.reset-size2.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size2{font-size:1em;}.css-jdoljy .katex .sizing.reset-size2.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size3{font-size:1.16666667em;}.css-jdoljy .katex .sizing.reset-size2.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size4{font-size:1.33333333em;}.css-jdoljy .katex .sizing.reset-size2.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size5{font-size:1.5em;}.css-jdoljy .katex .sizing.reset-size2.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size6{font-size:1.66666667em;}.css-jdoljy .katex .sizing.reset-size2.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size7{font-size:2em;}.css-jdoljy .katex .sizing.reset-size2.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size8{font-size:2.4em;}.css-jdoljy .katex .sizing.reset-size2.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size9{font-size:2.88em;}.css-jdoljy .katex .sizing.reset-size2.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size10{font-size:3.45666667em;}.css-jdoljy .katex .sizing.reset-size2.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size2.size11{font-size:4.14666667em;}.css-jdoljy .katex .sizing.reset-size3.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size1{font-size:0.71428571em;}.css-jdoljy .katex .sizing.reset-size3.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size2{font-size:0.85714286em;}.css-jdoljy .katex .sizing.reset-size3.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size3{font-size:1em;}.css-jdoljy .katex .sizing.reset-size3.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size4{font-size:1.14285714em;}.css-jdoljy .katex .sizing.reset-size3.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size5{font-size:1.28571429em;}.css-jdoljy .katex .sizing.reset-size3.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size6{font-size:1.42857143em;}.css-jdoljy .katex .sizing.reset-size3.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size7{font-size:1.71428571em;}.css-jdoljy .katex .sizing.reset-size3.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size8{font-size:2.05714286em;}.css-jdoljy .katex .sizing.reset-size3.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size9{font-size:2.46857143em;}.css-jdoljy .katex .sizing.reset-size3.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size10{font-size:2.96285714em;}.css-jdoljy .katex .sizing.reset-size3.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size3.size11{font-size:3.55428571em;}.css-jdoljy .katex .sizing.reset-size4.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size1{font-size:0.625em;}.css-jdoljy .katex .sizing.reset-size4.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size2{font-size:0.75em;}.css-jdoljy .katex .sizing.reset-size4.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size3{font-size:0.875em;}.css-jdoljy .katex .sizing.reset-size4.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size4{font-size:1em;}.css-jdoljy .katex .sizing.reset-size4.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size5{font-size:1.125em;}.css-jdoljy .katex .sizing.reset-size4.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size6{font-size:1.25em;}.css-jdoljy .katex .sizing.reset-size4.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size7{font-size:1.5em;}.css-jdoljy .katex .sizing.reset-size4.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size8{font-size:1.8em;}.css-jdoljy .katex .sizing.reset-size4.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size9{font-size:2.16em;}.css-jdoljy .katex .sizing.reset-size4.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size10{font-size:2.5925em;}.css-jdoljy .katex .sizing.reset-size4.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size4.size11{font-size:3.11em;}.css-jdoljy .katex .sizing.reset-size5.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size1{font-size:0.55555556em;}.css-jdoljy .katex .sizing.reset-size5.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size2{font-size:0.66666667em;}.css-jdoljy .katex .sizing.reset-size5.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size3{font-size:0.77777778em;}.css-jdoljy .katex .sizing.reset-size5.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size4{font-size:0.88888889em;}.css-jdoljy .katex .sizing.reset-size5.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size5{font-size:1em;}.css-jdoljy .katex .sizing.reset-size5.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size6{font-size:1.11111111em;}.css-jdoljy .katex .sizing.reset-size5.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size7{font-size:1.33333333em;}.css-jdoljy .katex .sizing.reset-size5.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size8{font-size:1.6em;}.css-jdoljy .katex .sizing.reset-size5.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size9{font-size:1.92em;}.css-jdoljy .katex .sizing.reset-size5.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size10{font-size:2.30444444em;}.css-jdoljy .katex .sizing.reset-size5.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size5.size11{font-size:2.76444444em;}.css-jdoljy .katex .sizing.reset-size6.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size1{font-size:0.5em;}.css-jdoljy .katex .sizing.reset-size6.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size2{font-size:0.6em;}.css-jdoljy .katex .sizing.reset-size6.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size3{font-size:0.7em;}.css-jdoljy .katex .sizing.reset-size6.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size4{font-size:0.8em;}.css-jdoljy .katex .sizing.reset-size6.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size5{font-size:0.9em;}.css-jdoljy .katex .sizing.reset-size6.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size6{font-size:1em;}.css-jdoljy .katex .sizing.reset-size6.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size7{font-size:1.2em;}.css-jdoljy .katex .sizing.reset-size6.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size8{font-size:1.44em;}.css-jdoljy .katex .sizing.reset-size6.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size9{font-size:1.728em;}.css-jdoljy .katex .sizing.reset-size6.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size10{font-size:2.074em;}.css-jdoljy .katex .sizing.reset-size6.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size6.size11{font-size:2.488em;}.css-jdoljy .katex .sizing.reset-size7.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size1{font-size:0.41666667em;}.css-jdoljy .katex .sizing.reset-size7.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size2{font-size:0.5em;}.css-jdoljy .katex .sizing.reset-size7.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size3{font-size:0.58333333em;}.css-jdoljy .katex .sizing.reset-size7.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size4{font-size:0.66666667em;}.css-jdoljy .katex .sizing.reset-size7.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size5{font-size:0.75em;}.css-jdoljy .katex .sizing.reset-size7.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size6{font-size:0.83333333em;}.css-jdoljy .katex .sizing.reset-size7.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size7{font-size:1em;}.css-jdoljy .katex .sizing.reset-size7.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size8{font-size:1.2em;}.css-jdoljy .katex .sizing.reset-size7.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size9{font-size:1.44em;}.css-jdoljy .katex .sizing.reset-size7.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size10{font-size:1.72833333em;}.css-jdoljy .katex .sizing.reset-size7.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size7.size11{font-size:2.07333333em;}.css-jdoljy .katex .sizing.reset-size8.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size1{font-size:0.34722222em;}.css-jdoljy .katex .sizing.reset-size8.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size2{font-size:0.41666667em;}.css-jdoljy .katex .sizing.reset-size8.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size3{font-size:0.48611111em;}.css-jdoljy .katex .sizing.reset-size8.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size4{font-size:0.55555556em;}.css-jdoljy .katex .sizing.reset-size8.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size5{font-size:0.625em;}.css-jdoljy .katex .sizing.reset-size8.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size6{font-size:0.69444444em;}.css-jdoljy .katex .sizing.reset-size8.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size7{font-size:0.83333333em;}.css-jdoljy .katex .sizing.reset-size8.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size8{font-size:1em;}.css-jdoljy .katex .sizing.reset-size8.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size9{font-size:1.2em;}.css-jdoljy .katex .sizing.reset-size8.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size10{font-size:1.44027778em;}.css-jdoljy .katex .sizing.reset-size8.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size8.size11{font-size:1.72777778em;}.css-jdoljy .katex .sizing.reset-size9.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size1{font-size:0.28935185em;}.css-jdoljy .katex .sizing.reset-size9.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size2{font-size:0.34722222em;}.css-jdoljy .katex .sizing.reset-size9.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size3{font-size:0.40509259em;}.css-jdoljy .katex .sizing.reset-size9.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size4{font-size:0.46296296em;}.css-jdoljy .katex .sizing.reset-size9.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size5{font-size:0.52083333em;}.css-jdoljy .katex .sizing.reset-size9.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size6{font-size:0.5787037em;}.css-jdoljy .katex .sizing.reset-size9.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size7{font-size:0.69444444em;}.css-jdoljy .katex .sizing.reset-size9.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size8{font-size:0.83333333em;}.css-jdoljy .katex .sizing.reset-size9.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size9{font-size:1em;}.css-jdoljy .katex .sizing.reset-size9.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size10{font-size:1.20023148em;}.css-jdoljy .katex .sizing.reset-size9.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size9.size11{font-size:1.43981481em;}.css-jdoljy .katex .sizing.reset-size10.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size1{font-size:0.24108004em;}.css-jdoljy .katex .sizing.reset-size10.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size2{font-size:0.28929605em;}.css-jdoljy .katex .sizing.reset-size10.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size3{font-size:0.33751205em;}.css-jdoljy .katex .sizing.reset-size10.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size4{font-size:0.38572806em;}.css-jdoljy .katex .sizing.reset-size10.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size5{font-size:0.43394407em;}.css-jdoljy .katex .sizing.reset-size10.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size6{font-size:0.48216008em;}.css-jdoljy .katex .sizing.reset-size10.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size7{font-size:0.57859209em;}.css-jdoljy .katex .sizing.reset-size10.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size8{font-size:0.69431051em;}.css-jdoljy .katex .sizing.reset-size10.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size9{font-size:0.83317261em;}.css-jdoljy .katex .sizing.reset-size10.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size10{font-size:1em;}.css-jdoljy .katex .sizing.reset-size10.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size10.size11{font-size:1.19961427em;}.css-jdoljy .katex .sizing.reset-size11.size1,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size1{font-size:0.20096463em;}.css-jdoljy .katex .sizing.reset-size11.size2,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size2{font-size:0.24115756em;}.css-jdoljy .katex .sizing.reset-size11.size3,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size3{font-size:0.28135048em;}.css-jdoljy .katex .sizing.reset-size11.size4,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size4{font-size:0.32154341em;}.css-jdoljy .katex .sizing.reset-size11.size5,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size5{font-size:0.36173633em;}.css-jdoljy .katex .sizing.reset-size11.size6,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size6{font-size:0.40192926em;}.css-jdoljy .katex .sizing.reset-size11.size7,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size7{font-size:0.48231511em;}.css-jdoljy .katex .sizing.reset-size11.size8,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size8{font-size:0.57877814em;}.css-jdoljy .katex .sizing.reset-size11.size9,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size9{font-size:0.69453376em;}.css-jdoljy .katex .sizing.reset-size11.size10,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size10{font-size:0.83360129em;}.css-jdoljy .katex .sizing.reset-size11.size11,.css-jdoljy .katex .fontsize-ensurer.reset-size11.size11{font-size:1em;}.css-jdoljy .katex .delimsizing.size1{font-family:KaTeX_Size1;}.css-jdoljy .katex .delimsizing.size2{font-family:KaTeX_Size2;}.css-jdoljy .katex .delimsizing.size3{font-family:KaTeX_Size3;}.css-jdoljy .katex .delimsizing.size4{font-family:KaTeX_Size4;}.css-jdoljy .katex .delimsizing.mult .delim-size1>span{font-family:KaTeX_Size1;}.css-jdoljy .katex .delimsizing.mult .delim-size4>span{font-family:KaTeX_Size4;}.css-jdoljy .katex .nulldelimiter{display:inline-block;width:0.12em;}.css-jdoljy .katex .delimcenter{position:relative;}.css-jdoljy .katex .op-symbol{position:relative;}.css-jdoljy .katex .op-symbol.small-op{font-family:KaTeX_Size1;}.css-jdoljy .katex .op-symbol.large-op{font-family:KaTeX_Size2;}.css-jdoljy .katex .op-limits>.vlist-t{text-align:center;}.css-jdoljy .katex .accent>.vlist-t{text-align:center;}.css-jdoljy .katex .accent .accent-body{position:relative;}.css-jdoljy .katex .accent .accent-body:not(.accent-full){width:0;}.css-jdoljy .katex .overlay{display:block;}.css-jdoljy .katex .mtable .vertical-separator{display:inline-block;min-width:1px;}.css-jdoljy .katex .mtable .arraycolsep{display:inline-block;}.css-jdoljy .katex .mtable .col-align-c>.vlist-t{text-align:center;}.css-jdoljy .katex .mtable .col-align-l>.vlist-t{text-align:left;}.css-jdoljy .katex .mtable .col-align-r>.vlist-t{text-align:right;}.css-jdoljy .katex .svg-align{text-align:left;}.css-jdoljy .katex svg{display:block;position:absolute;width:100%;height:inherit;fill:currentColor;stroke:currentColor;fill-rule:nonzero;fill-opacity:1;stroke-width:1;stroke-linecap:butt;stroke-linejoin:miter;stroke-miterlimit:4;stroke-dasharray:none;stroke-dashoffset:0;stroke-opacity:1;}.css-jdoljy .katex svg path{stroke:none;}.css-jdoljy .katex img{border-style:none;min-width:0;min-height:0;max-width:none;max-height:none;}.css-jdoljy .katex .stretchy{width:100%;display:block;position:relative;overflow:hidden;}.css-jdoljy .katex .stretchy::before,.css-jdoljy .katex .stretchy::after{content:'';}.css-jdoljy .katex .hide-tail{width:100%;position:relative;overflow:hidden;}.css-jdoljy .katex .halfarrow-left{position:absolute;left:0;width:50.2%;overflow:hidden;}.css-jdoljy .katex .halfarrow-right{position:absolute;right:0;width:50.2%;overflow:hidden;}.css-jdoljy .katex .brace-left{position:absolute;left:0;width:25.1%;overflow:hidden;}.css-jdoljy .katex .brace-center{position:absolute;left:25%;width:50%;overflow:hidden;}.css-jdoljy .katex .brace-right{position:absolute;right:0;width:25.1%;overflow:hidden;}.css-jdoljy .katex .x-arrow-pad{padding:0 0.5em;}.css-jdoljy .katex .cd-arrow-pad{padding:0 0.55556em 0 0.27778em;}.css-jdoljy .katex .x-arrow,.css-jdoljy .katex .mover,.css-jdoljy .katex .munder{text-align:center;}.css-jdoljy .katex .boxpad{padding:0 0.3em 0 0.3em;}.css-jdoljy .katex .fbox,.css-jdoljy .katex .fcolorbox{box-sizing:border-box;border:0.04em solid;}.css-jdoljy .katex .cancel-pad{padding:0 0.2em 0 0.2em;}.css-jdoljy .katex .cancel-lap{margin-left:-0.2em;margin-right:-0.2em;}.css-jdoljy .katex .sout{border-bottom-style:solid;border-bottom-width:0.08em;}.css-jdoljy .katex .angl{box-sizing:border-box;border-top:0.049em solid;border-right:0.049em solid;margin-right:0.03889em;}.css-jdoljy .katex .anglpad{padding:0 0.03889em 0 0.03889em;}.css-jdoljy .katex .eqn-num::before{counter-increment:katexEqnNo;content:'(' counter(katexEqnNo) ')';}.css-jdoljy .katex .mml-eqn-num::before{counter-increment:mmlEqnNo;content:'(' counter(mmlEqnNo) ')';}.css-jdoljy .katex .mtr-glue{width:50%;}.css-jdoljy .katex .cd-vert-arrow{display:inline-block;position:relative;}.css-jdoljy .katex .cd-label-left{display:inline-block;position:absolute;right:calc(50% + 0.3em);text-align:left;}.css-jdoljy .katex .cd-label-right{display:inline-block;position:absolute;left:calc(50% + 0.3em);text-align:right;}.css-jdoljy .katex-display{display:block;margin:1em 0;text-align:center;}.css-jdoljy .katex-display>.katex{display:block;white-space:nowrap;}.css-jdoljy .katex-display>.katex>.katex-html{display:block;position:relative;}.css-jdoljy .katex-display>.katex>.katex-html>.tag{position:absolute;right:0;}.css-jdoljy .katex-display.leqno>.katex>.katex-html>.tag{left:0;right:auto;}.css-jdoljy .katex-display.fleqn>.katex{text-align:left;padding-left:2em;}.css-jdoljy body{counter-reset:katexEqnNo mmlEqnNo;}.css-jdoljy table{width:-webkit-max-content;width:-moz-max-content;width:max-content;}.css-jdoljy .tableBlock{max-width:100%;margin-bottom:1rem;overflow-y:scroll;}.css-jdoljy .tableBlock thead,.css-jdoljy .tableBlock thead th{border-bottom:1px solid #333!important;}.css-jdoljy .tableBlock th,.css-jdoljy .tableBlock td{padding:10px;text-align:left;}.css-jdoljy .tableBlock th{font-weight:bold!important;}.css-jdoljy .tableBlock caption{caption-side:bottom;color:#555;font-size:12px;font-style:italic;text-align:center;}.css-jdoljy .tableBlock caption>p{margin:0;}.css-jdoljy .tableBlock th>p,.css-jdoljy .tableBlock td>p{margin:0;}.css-jdoljy .tableBlock [data-background-color='aliceblue']{background-color:#f0f8ff;color:#000;}.css-jdoljy .tableBlock [data-background-color='black']{background-color:#000;color:#fff;}.css-jdoljy .tableBlock [data-background-color='chocolate']{background-color:#d2691e;color:#fff;}.css-jdoljy .tableBlock [data-background-color='cornflowerblue']{background-color:#6495ed;color:#fff;}.css-jdoljy .tableBlock [data-background-color='crimson']{background-color:#dc143c;color:#fff;}.css-jdoljy .tableBlock [data-background-color='darkblue']{background-color:#00008b;color:#fff;}.css-jdoljy .tableBlock [data-background-color='darkseagreen']{background-color:#8fbc8f;color:#000;}.css-jdoljy .tableBlock [data-background-color='deepskyblue']{background-color:#00bfff;color:#000;}.css-jdoljy .tableBlock [data-background-color='gainsboro']{background-color:#dcdcdc;color:#000;}.css-jdoljy .tableBlock [data-background-color='grey']{background-color:#808080;color:#fff;}.css-jdoljy .tableBlock [data-background-color='lemonchiffon']{background-color:#fffacd;color:#000;}.css-jdoljy .tableBlock [data-background-color='lightpink']{background-color:#ffb6c1;color:#000;}.css-jdoljy .tableBlock [data-background-color='lightsalmon']{background-color:#ffa07a;color:#000;}.css-jdoljy .tableBlock [data-background-color='lightskyblue']{background-color:#87cefa;color:#000;}.css-jdoljy .tableBlock [data-background-color='mediumblue']{background-color:#0000cd;color:#fff;}.css-jdoljy .tableBlock [data-background-color='omnigrey']{background-color:#f0f0f0;color:#000;}.css-jdoljy .tableBlock [data-background-color='white']{background-color:#fff;color:#000;}.css-jdoljy .tableBlock [data-text-align='center']{text-align:center;}.css-jdoljy .tableBlock [data-text-align='left']{text-align:left;}.css-jdoljy .tableBlock [data-text-align='right']{text-align:right;}.css-jdoljy .tableBlock [data-vertical-align='bottom']{vertical-align:bottom;}.css-jdoljy .tableBlock [data-vertical-align='middle']{vertical-align:middle;}.css-jdoljy .tableBlock [data-vertical-align='top']{vertical-align:top;}.css-jdoljy .tableBlock__font-size--xxsmall{font-size:10px;}.css-jdoljy .tableBlock__font-size--xsmall{font-size:12px;}.css-jdoljy .tableBlock__font-size--small{font-size:14px;}.css-jdoljy .tableBlock__font-size--large{font-size:18px;}.css-jdoljy .tableBlock__border--some tbody tr:not(:last-child){border-bottom:1px solid #e2e5e7;}.css-jdoljy .tableBlock__border--bordered td,.css-jdoljy .tableBlock__border--bordered th{border:1px solid #e2e5e7;}.css-jdoljy .tableBlock__border--borderless tbody+tbody,.css-jdoljy .tableBlock__border--borderless td,.css-jdoljy .tableBlock__border--borderless th,.css-jdoljy .tableBlock__border--borderless tr,.css-jdoljy .tableBlock__border--borderless thead,.css-jdoljy .tableBlock__border--borderless thead th{border:0!important;}.css-jdoljy .tableBlock:not(.tableBlock__table-striped) tbody tr{background-color:unset!important;}.css-jdoljy .tableBlock__table-striped tbody tr:nth-of-type(odd){background-color:#f9fafc!important;}.css-jdoljy .tableBlock__table-compactl th,.css-jdoljy .tableBlock__table-compact td{padding:3px!important;}.css-jdoljy .tableBlock__full-size{width:100%;}.css-jdoljy .textBlock{margin-bottom:16px;}.css-jdoljy .textBlock__text-formatting--finePrint{font-size:12px;}.css-jdoljy .textBlock__text-infoBox{padding:0.75rem 1.25rem;margin-bottom:1rem;border:1px solid transparent;border-radius:0.25rem;}.css-jdoljy .textBlock__text-infoBox p{margin:0;}.css-jdoljy .textBlock__text-infoBox--primary{background-color:#cce5ff;border-color:#b8daff;color:#004085;}.css-jdoljy .textBlock__text-infoBox--secondary{background-color:#e2e3e5;border-color:#d6d8db;color:#383d41;}.css-jdoljy .textBlock__text-infoBox--success{background-color:#d4edda;border-color:#c3e6cb;color:#155724;}.css-jdoljy .textBlock__text-infoBox--danger{background-color:#f8d7da;border-color:#f5c6cb;color:#721c24;}.css-jdoljy .textBlock__text-infoBox--warning{background-color:#fff3cd;border-color:#ffeeba;color:#856404;}.css-jdoljy .textBlock__text-infoBox--info{background-color:#d1ecf1;border-color:#bee5eb;color:#0c5460;}.css-jdoljy .textBlock__text-infoBox--dark{background-color:#d6d8d9;border-color:#c6c8ca;color:#1b1e21;}.css-jdoljy .text-overline{-webkit-text-decoration:overline;text-decoration:overline;}.css-jdoljy.css-jdoljy{color:#2B3148;background-color:transparent;font-family:"Roboto","Helvetica","Arial",sans-serif;font-size:20px;line-height:24px;overflow:visible;padding-top:0px;position:relative;}.css-jdoljy.css-jdoljy:after{content:'';-webkit-transform:scale(0);-moz-transform:scale(0);-ms-transform:scale(0);transform:scale(0);position:absolute;border:2px solid #EA9430;border-radius:2px;inset:-8px;z-index:1;}.css-jdoljy .js-external-link-button.link-like,.css-jdoljy .js-external-link-anchor{color:inherit;border-radius:1px;-webkit-text-decoration:underline;text-decoration:underline;}.css-jdoljy .js-external-link-button.link-like:hover,.css-jdoljy .js-external-link-anchor:hover,.css-jdoljy .js-external-link-button.link-like:active,.css-jdoljy .js-external-link-anchor:active{text-decoration-thickness:2px;text-shadow:1px 0 0;}.css-jdoljy .js-external-link-button.link-like:focus-visible,.css-jdoljy .js-external-link-anchor:focus-visible{outline:transparent 2px dotted;box-shadow:0 0 0 2px #6314E6;}.css-jdoljy p,.css-jdoljy div{margin:0;display:block;}.css-jdoljy pre{margin:0;display:block;}.css-jdoljy pre code{display:block;width:-webkit-fit-content;width:-moz-fit-content;width:fit-content;}.css-jdoljy pre:not(:first-child){padding-top:8px;}.css-jdoljy ul,.css-jdoljy ol{display:block margin:0;padding-left:20px;}.css-jdoljy ul li,.css-jdoljy ol li{padding-top:8px;}.css-jdoljy ul ul,.css-jdoljy ol ul,.css-jdoljy ul ol,.css-jdoljy ol ol{padding-top:0;}.css-jdoljy ul:not(:first-child),.css-jdoljy ol:not(:first-child){padding-top:4px;} Total interest calculationsTime the loan is for. Total interest You are using an outdated browser. Please upgrade your browser to improve your experience.   Simple Interest CalculatorAbout this calculator. This is an online simple interest calculator. This calculator not only gives you the answer but also the sample solution to find the answer. This calculator uses the following simple interest formula, I :

Using this CalculatorHow to use this calculator.

The sample answer and solution will be shown below the calculator.  I want to calculateInterest (i), principal ( p ), interest rate ( r ), duration ( t ), sample solution & answer. The following are the sample solution and answer for your reference. Ways to UseUsing this calculator. You can use this calculator in many ways. Here are some ideas:

We are shortlisting 200 people to be the first in the world to most awesome mathematical adventure of your life. If you are chosen, you will be entitled to full app and content worth $99 for free Join our FB group to download ZapZapMath Free today! Fill in your email below and stay tune! Click on the orange button to visit our Facebook Group and Join our Facebook Group No Thanks. My Kids Don't Need To Learn Math Everyday CalculationFree calculators and unit converters for general and everyday use. Calculators » Finance » Simple Interest Calculator Simple Interest CalculatorOur online tools will provide quick answers to your calculation and conversion needs. On this page, you can calculate simple interest (SI) given principal, interest rate and time duration in days, months or years. We have made it easy for you to enter daily, weekly, monthly or annually charged interest rates. e.g., 2% interest per month, 5% per week, 10% per year SOLVE FOR: Simple Interest Principal Interest Rate Time Period Interest amount: Interest Rate (%): Daily Weekly Monthly Yearly Time Period: Days Months Years To find time period between two dates, use date duration calculator. Download: Use this interest calculator offline with our all-in-one calculator app for Android and iOS . Simple Interest FormulaSI = P×r×t A = P+SI A = P(1+rt) Where, A = Final amount SI = Simple interest P = Principal amount (Initial Investment) r = Annual interest rate in percentage t = Time period in years When calculating simple interest by days, use the number of days for t and divide the interest rate by 365. Likewise, to calculate simple interest month-wise, use the number of months for t and divide the interest rate by 12. Simple interest calculationsThe following examples will show you how to solve different variables involved in simple interest calculation. Example 1. What is the simple interest on a loan of $300 for 4 months at 12% per year? Ans. SI = P×r×t = 300×(12/100/12)×4 = $12 Example 2. Simple interest on $5000 over 4 years is $1800, what is the interest rate? Ans. r = SI/(P×t) = 1800/(5000×4) = 0.09 = 9% Example 3. If you borrow $1200 at a 5% annual interest rate, how long will it take for the total amount owed to reach $1300? Ans. SI = 1300-1200 = 100 t = SI/(P×r) = 100/(1200*(5/100)) = 1.67 years or 20 months Example 4. Find the principal if the simple interest in 14 days at 25% per annum is 100. Ans. P = SI/(r×t) = 100/((25/100/365)*14) = 10428.57 More Interest Calculators

© everydaycalculation.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IMAGES

VIDEO

COMMENTS

Alternatively, you can use the simple interest formula I=Prn if you have the interest rate per month. If you had a monthly rate of 5% and you'd like to calculate the interest for one year, your total interest would be $10,000 × 0.05 × 12 = $6,000. The total loan repayment required would be $10,000 + $6,000 = $16,000.

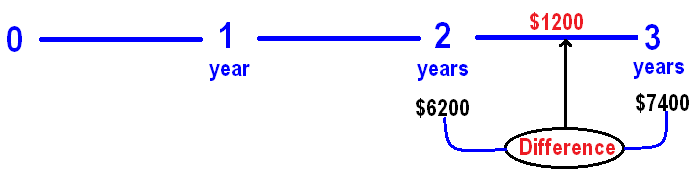

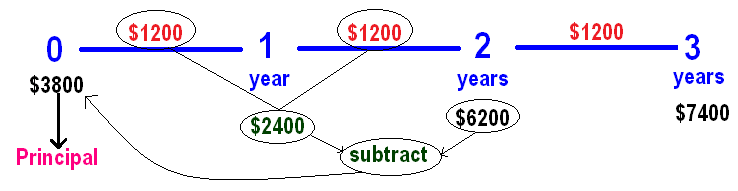

Simple interest. Simple interest is based only on the principal amount, unlike compound interest, where we use previously earned interest to calculate the next interest. For example if we invest \$100 for 3 years at an interest rate of 10% than we earn $10 each year. This calculator uses the following formula to solve simple interest problems:

This calculator for simple interest-only finds I, the simple interest where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods. Where r is in decimal form; r=R/100. r and t are in the same units of time. Calculate Interest, solve for I. I = Prt. Calculate Principal Amount, solve for P.

Simple Interest Calculator - calculate simple interest step by step. Solutions Graphing Calculators; New Geometry; Practice ... Math notebooks have been around for hundreds of years. You write down problems, solutions and notes to go back...

Simple Interest Calculator. Enter the values you know. The value left out will be automatically calculated and displayed. Principal (P) Total principal amount if known. Rate (R) Interest Rate % per year. Period. Time (t)

We can break down the simple interest rate formula into four different formulas. Each of these formulas solves the problem for a different variable. Calculate the total amount of interest (standard calculation) A=P (1+rt) A = P (1+ rt) Calculate the principal amount owed. P = \frac {A} {1 + rt} P = 1+ rtA.

Compound Interest Calculator. Graphing. Plot and analyze functions and equations with detailed steps. Study Tools AI Math Solver Popular Problems Worksheets Study Guides Practice Cheat Sheets Calculators Graphing Calculator Geometry Calculator. Company About Symbolab Blog Help Contact Us.

Simple Interest means earning or paying interest only the Principal [1]. The Principal is the amount borrowed, the original amount invested, or the face value of a bond [2]. On this page, I explain the simple interest formula and provide a simple interest calculator that you can use to solve some basic problems.

First of all, take the interest rate and divide it by one hundred. 5% = 0.05. Then multiply the original amount by the interest rate. $1,000 × 0.05 = $50. That's it. You have just calculated your annual interest! To get a monthly interest, divide this value by the number of months in a year ( 12 ). $50 / 12 = $4.17.

This is an online simple interest calculator. This calculator not only gives you the answer but also the sample solution to find the answer. This calculator uses the following simple interest formula, I: Where: P is the principal. r is the interest rate (per year or per annum) t is the loan duration/period in years.

Simple Interest Calculator. Our online tools will provide quick answers to your calculation and conversion needs. On this page, you can calculate simple interest (SI) given principal, interest rate and time duration in days, months or years. We have made it easy for you to enter daily, weekly, monthly or annually charged interest rates. e.g., 2% interest per month, 5% per week, 10% per year

Simple Interest calculator - SI=(P*R*T)/100 where P=Principal amount, R=Rate of interest, T=Time; using Simple Interest, step-by-step online ... Learn more Support us (New) All problem can be solved using search box: I want to sell my website www.AtoZmath.com with complete code: Home: What's new: College Algebra: Games: Feedback: About us ...

Compound Interest. Compound Interest is calculated on the principal amount and also on the interest of previous periods. The following formula can be used to find out the compound interest: A = P× (1 + r/n) nt. Where, A = final amount including interest, P = principal amount, r = annual interest rate (as decimal), n = number of compounds per ...

Solved Example Problem. The below solved example problem may used to understand how the principal, rate of interest & time period are being used in the SI formula Example Problem Calculate the yearly & monthly simple interest payable for the principal sum 1000 USD borrowed at 6% of interest rate for the time period of 1 year. Solution simple interest payable for 1 year SI = (P x R x T)/100 ...

Based on Principal Amount of $1000, at an interest rate of 7.5%, over 10 year(s): Total Value = $1750 Total Interest = $750

Simple Interest Formulas and Calculations: Use this simple interest calculator to find A, the Final Investment Value, using the simple interest formula: A = P(1 + rt) where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods.

Now, use the above simple interest calculator to find the simple interest for the following problems: Rate= 10% p.a., Principal= $40000 and Time= 4 years; Rate= 3.5% p.a., Principal= $4800 and Time= 3 years ☛ Related Articles: Simple Interest; Interest Rate Formula ☛ Math Calculators:

The simple interest calculator computes the interest amount and ending balance for savings. Calculate simple interest by using the formula I = Prt.In this formula, "I" equals the interest ...

Examples of finding the interest earned with the simple interest formula. In many simple interest problems, you will be finding the total interest earned over a set period, which is represented as \(I\). The formula for this is: Let's use an example to see how this formula works. Remember that in the formula, the principal \(P\) is the ...