Books of Accounts

Previous Lesson: Correcting Entries

Next Lesson: Types of Journal

There are two main books of accounts, Journal and Ledger . Journal used to record the economic transaction chronologically. Ledger used to classifying economic activities according to nature.

Types of Journals

Special Journals are used in large business organizations, where it is found inconvenient to journalize every transaction in one journal. Therefore, the journal is sub-divided into different journals known as the subsidiary books. The journal is divided in such a way that a separate book is used for each class of transactions The important books of accounts used in modern business world are the following:

- Purchase Day Book

Sales Day Book

Return inward book, return outward book.

- General Journal

>> Practical Multiple Choice Questions Books of Accounts MCQs .

Video Lecture: Books of Accounts in Urdu & Hindi-Workbook Practice

Purchases Day Book

Purchases book or purchases day book is a book of original entry maintained to record credit purchases. You must note that cash purchases will not be entered in purchases day book because entries in respect of cash purchases must have been entered in the Cash Book . At the end of each month, the purchases book is totaled. The total shows the total amount of goods purchased on credit. Purchases book is written up daily from the invoices received. The invoices are consecutively numbered. The invoice of each number is noted in the purchases book.

Purchase Day Book Format

Example # 1:

From the following transactions of a trader prepare the Purchases day book:

2014

Jan 5 Purchased goods from Qurat Ul Ain & Co Rs. 2,400

” 15 Purchased goods from Saba Sajjad 6,000

” 25 Purchased goods from Omer Nawaz & Co 1,500

” 30 Purchased goods from Maqbool & Co 3,000

A sales book is also known as sales day book in which are recorded the details of credit sales made by a businessman. Total of sales book shows the total credit sales of goods during the period concerned. Usually the sales book is totaled every month. The sales day book is written up daily from the copies of invoices sent out.

Sales Day Book Format

Example # 2:

From the following transactions of a trader prepare the sales day book of M. Amin:

March 5 Sold goods to Ideal College Rs. 200

” 10 Sold goods to Ahmad & Co 100

” 20 Credit sales to Ayesha Bibi 400

” 31 Sold goods to Gulbaz Khan 100

Sales returns book is also called returns inwards book. It is used for recording goods returned to us by our customers. Customers who return goods should be sent a credit note. It is a statement sent by a business to customer showing the amount credited to the account.

Return Inward Book Format

Example # 3:

From the following transactions of a trader prepare the sales returns book:

June 8 Goods returned by Sana Khalid & Co Rs. 40

” 20 Goods returned by Ideal Traders 52

Purchases returns book is a book in which the goods returned to suppliers are recorded. It is also called returns outward book or purchases returns day book. Goods may be returned because they are of the wrong kind or not up to sample or because they are damaged etc.When the goods are returned to the suppliers, intimation is sent to them through what is known as a debit note. These debit notes serve as vouchers for these entries. A debit note is a statement sent by a businessman to vendor, showing the amount debited to the account.

Return Outward Book Format

Example # 4:

From the following transactions of a trader prepare the purchases returns day book:

July 14 Karim & Sons Rs. 135

” 27 Maria Waheed & Co 150

” 31 Saeed Bros 25

>> Download and Practice Books of Accounts Problems PDF

Proper General or General Journal

Journal proper is book of original entry (simple journal) in which miscellaneous credit transactions which do not fit in any other books. It is also called miscellaneous journal or General Journal. For example purchase assets on credit, Correcting Entries , Adjusting Entries and Closing Entries etc.

Example # 5:

Record the following transactions in the appropriate journal?

March 3 Purchased goods from Ali & Co for Rs. 4,500

“ 8 Sold merchandise to Naeem & Sons worth of Rs. 6,000

“ 12 Purchase merchandise from B & Brothers Rs. 3,000

“ 14 Credit sales of goods to Z & Co for Rs. 2,500

“ 15 Naeem & Sons returned goods Rs. 1,000

“ 18 Return merchandise to Ali & Co Rs. 500

“ 22 Purchase Furniture from Mr. Saeed of Rs. 3,200

“ 24 Returned goods to B & Brothers of Rs. 200

“ 27 Purchase Machinery on account from MMM Machines Rs. 7,000

“ 29 Z & Co returned merchandise of Rs. 300

>>> Practice Books of Accounts Quiz 1 and Quiz 2 .

Related Topics

Books of Accounts MCQs

Single Column Cash book

Cash Book MCQs (I)

Single Cash Book Problems

More Interest

Double Column Cash Book

Three Column Cash Book

Cash Book MCQs (II)

Cash Book Problems

Books of Accounts Problems

Further Readings

Principles of Accounting

Accounting Examples

Accounting MCQs

Accounting Formats

Mukharji, A., & Hanif, M. (2003). Financial Accounting (Vol. 1). New Delhi: Tata McGraw-Hill Publishing Co.

Narayanswami, R. (2008). Financial Accounting: A Managerial Perspective. (3rd, Ed.) New Delhi: Prentice Hall of India.

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

25 Comments

I always was interested in this topic.

Please explane the ledger

was soo helpful… thank you and keep up the good work

Helful to me and my learning

Thanks for your personal marvelous posting! I definitely enjoyed reading it, you may be a great author.I will ensure that I bookmark your blog and will often come back in the foreseeable future. I want to encourage you to definitely continue your great work, have a nice holiday weekend!

I am very happy to read this. This is the kind of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this best doc.

A very well written article.

One small addition that would make the concept holistic would be to give an introduction of the scenario preceding Books of Original Entry i.e. Source Document.

A Source Document is also known as a prime book, or subsidiary books or daybook or journal. It usually contains the raw and unprocessed information. This information is then transferred to books of original entry in a summarized manner.

How can l get this notes

It is very informative and you are obviously very knowledgeable in this area. Nice read. I enjoyed your post. Thank you. I enjoyed your post. Thank you.

I truly appreciate this post. You are obviously very knowledgeable. Thanks for writing this. This information is magnificent.

You are a very persuasive writer. I enjoyed your post. Thank you. I enjoyed your post. Thank you. This will be useful to everyone who reads it, including me.

it is real helpful, thank you so much

This information is magnificent. Hit me up! I’ll be sure to bookmark your website because I will definitely come back all of the time. Thumbs up!

This article has actually been really satisfying to check out. Your viewpoints as well as thoughts on this topic are intriguing. We view things differently, yet you created in such a manner in which I may have changed my own opinions. Thanks for giving this information as well as giving me a brand-new perspective on it. Will read more in the future.

When someone writes an piece of writing he/she retains the image of a user in his/her mind that how a user can know it. So that’s why this paragraph is outstanding. Thanks!

I like it when individuals come together and share ideas.

Great website, keep it up!

I am regular visitor, how are you everybody? This post posted at this web site is in fact good.|

Nice replies in return of this difficulty with real arguments and telling all about that.|

Thanks for sharing my students will surely benefits from the knowledge

It’s amazing to visit this web page and reading the views of all friends regarding this piece of writing, while I am also zealous of getting know-how.

So much help me your page. Thank you and my blessings with you.

Thanks very much

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

Bookkeeping

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Bookkeeping: definition.

Bookkeeping is the art of recording business transactions in a systematic manner. However, bookkeeping has been defined in various ways by different authors. Some of the major definitions are given below:

- Bookkeeping is an activity concerned with recording financial data related to business operations in a significant and orderly manner

- The part of accounting that is concerned with recording data is often known as bookkeeping (Frank Wood)

- Bookkeeping is the daily operation of an accounting system, which involves recording and classifying routine transactions (Meigs & Meigs)

In simplified words, bookkeeping is the art of recording business transactions comprehensively and in a prescribed, careful way in the books of accounts.

Bookkeeping: Explanation

What is bookkeeping.

This is an important question that deserves a basic but important answer. Bookkeeping is the process of correctly recording cash, credit , and other transactions in the books of account.

What Are Books of Account?

The primary book of account is called the ledger . It is known as the ledger because all transactions, after first being recorded in subsidiary books , are afterward grouped or summarized in the form of accounts in the ledger.

Why Are Goods/Services Bought or Sold on Credit?

Almost all business dealings are conducted on a credit basis to avoid the inconvenience and danger of carrying large amounts of cash .

The supplier of goods or services is usually satisfied to receive payment at some further date. The main exception is the real trade for a private individual.

Why Record These Transactions?

Even in the smallest business, the proprietor or manager will want to have accurate and up-to-date information about how much has been brought and sold, how much money has been received for sales , and how much has been paid away for purchases .

Private individuals often find it convenient to have the same information for their cash receipts and payments . You can imagine that with a very large business, chaos would quickly result without this information.

Does Bookkeeping Really Involve Analyzing Transactions?

It is reasonable to say that bookkeeping involves recording transactions so as to permit analysis in a systematic fashion, in a way that can be applied to all businesses of whatever kind, and that is intelligible not only now but at any future time.

How Has Bookkeeping Changed?

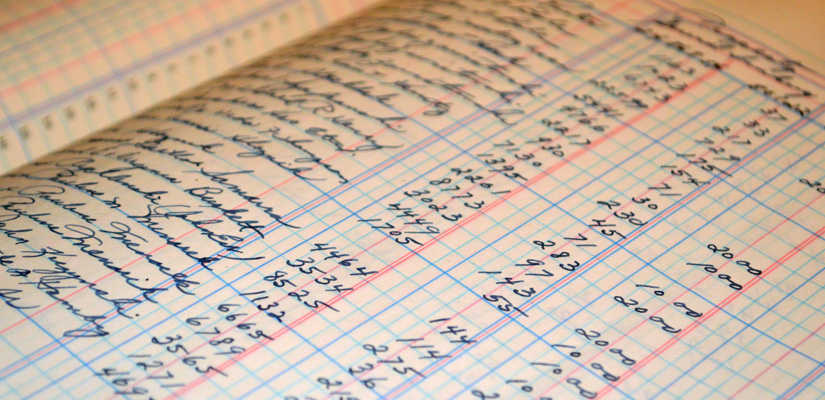

The term "books of account" has a distinctly old-fashioned sound. It perhaps makes you think of a Charles Dickens novel set in early Victorian England, with rows of clerks perched on high stools writing in large books.

Bookkeeping today is likely to be done with the aid of a computer rather than with handwritten books, and this is a virtual certainty in a business of any size or significance.

Nevertheless, modern bookkeepers are doing exactly the same as the clerks were in the novels of Charles Dickens.

Today we are doing it faster and more accurately, but the Victorian clerks achieved very high standards. Whether or not they were any happier is a question for another book!

Importance of Bookkeeping

All businesses, without exception, need to keep accurate and readily accessible records of their financial transactions.

As a child, I had a neighbor who died at the age of 75, leaving records that accounted for every penny of their income and expenditures since their 21st birthday.

Surprisingly, he was a charming, generous man and in no way a miser. Perhaps you too have a personal bookkeeping system to record your own financial affairs, though I would not recommend taking it to these extreme lengths.

The benefits of dependable financial records in business are probably self-evident. They include:

The law requires all companies, as well as many other organizations, to prepare accounts satisfying certain criteria. This can only be done if the basic, supporting financial records are in place.

- The tax authorities require it. If you don't believe me, try telling Her Majesty's Revenue and Customs that you can't complete a VAT return because you haven't kept proper records.

- It's necessary to manage bank accounts, cash, and borrowing. Otherwise, checks might bounce and an unproductive surplus may build up.

- When intelligently used, accounting records warn of impending financial difficulties or even insolvency .

- Financial records provide the basis for efficiency savings and profitable business decisions.

- Without proper bookkeeping, the owners cannot know the worth of the business.

- It is, in many instances, essential to engage in bookkeeping in order to comply with money laundering regulations.

Bookkeeping FAQs

Why record these transactions.

It is reasonable to say that Bookkeeping involves recording transactions so as to permit analysis in a systematic fashion, in a way that can be applied to all businesses of whatever kind, and that is intelligible not only now but at any future time.

Does bookkeeping really involve analyzing transactions?

The term “books of account” has a distinctly old-fashioned sound. It perhaps makes you think of a charles dickens novel set in early victorian england, with rows of clerks perched on high stools writing in large books.

How has bookkeeping changed?

Today we are doing it faster and more accurately, but the victorian clerks achieved very high standards. Whether or not they were any happier is a question for another book!

What is the importance of bookkeeping?

How can we maintain accurate accounts.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

Learn more...

What is a Book of Accounts?

A book of accounts contains transaction records for commercial accounts. Double entry accounting systems used by commercial organizations involve numerous ledgers or books, including the general ledger and general journal. Collectively, these ledgers are referred to as books, a shortened term for books of account. A single book of accounts can refer to any one of the numerous books used in the accounting process.

Primarily, the most common use of the term "book of accounts" references the general ledger used in double entry accounting systems. The general ledger contains all accounts used by an organization, along with the current balances of those accounts. Changes to these accounts require entries to note the transactions, creating an ongoing record of the organization's financial history. Other types of ledger and account books include the general journal, cost ledger, and subsidiary ledger , depending on the specific accounting system chosen. Each book fits the definition of book of accounts, although the term is used for these books less often.

In double entry accounting, the general ledger is one of numerous record-keeping components used in tandem with other books in the commercial accounting system. Information from the general ledger carries over to the financial statements for the organization at the end of the accounting period. Transactions are recorded as they relate to account balances in the general ledger, but these records merely reflect credit or debits to the accounts listed. Detailed information on specific transactions are recorded in via journal entries in the general journal.

Books of account house records showing changes to various commercial accounts used by an organization. These accounts show changes in balances for assets, liabilities, and expenses. For double entry accounting, the general journal records specific transactions involving at least two affected accounts, one with a credit and one with a debit. The new account balance drawn from the general journal information transfers to the general ledger as a summary entry.

An example can help to explain how a book of accounts is used. The purchase of office equipment creates a reduction in cash and an increase in the asset account for office equipment. The specific transaction, affected accounts, and notation about the transaction each warrant an entry on separate lines in the general journal. The increase or decrease to each account then transfers to the primary book of accounts, the general ledger. At the end of the accounting period, the general ledger balances transfer to financial statements such as the balance sheet , income statement, and statement of owner's equity.

You might also Like

Recommended, as featured on:.

Related Articles

- What Are the Different Types of Ledger Books?

- How Do I Get the Best Accounting a-Level Results?

- What are Subsidiary Accounts?

- What is a Ledger of Accounting?

- What is a Book Balance?

- What is a General Ledger: Your Comprehensive Guide to Financial Recordkeeping

Discussion Comments

Post your comments.

- By: robert cabrera A general ledger contains all accounts used by an organization, along with current balances of those accounts.

What is "Books of Accounts"

What is Books of Accounts becomes evident when viewing them as the financial diary of a business. They capture all monetary movements, such as income, expenses, assets, and liabilities. This organized documentation facilitates the preparation of financial statements and ensures transparency in financial reporting.

- Atton Accounting & Consulting

- Books of Accounts

Chief Client Relationships Manager

Have a question?

Books of Accounts Definition

Books of Accounts encompass the systematic and chronological records of financial transactions maintained by a business entity. These encompass ledgers, journals, and other accounting documents providing a comprehensive overview of a company's financial activities.

Books of Accounts Meaning

The meaning of Books of Accounts is rooted in their role as the foundation of accounting. These records enable businesses to track and organize their financial transactions, offering a clear and accurate representation of the company's financial health. Books of Accounts are vital for compliance, decision-making, and financial analysis.

Books of Accounts in Detail

Delving into the details, books of accounts comprise various components.

- Ledgers: Recording transactions by accounts.

- Journals: Documenting transactions in chronological order.

- Trial Balance: Verifying the accuracy of recorded transactions.

- Financial Statements: Summarizing the financial position and performance.

"In the intricate world of finance, Books of Accounts are the silent narrators, chronicling the financial journey of a business with precision and clarity."

Efficient management of Books of Accounts is not just a legal requirement; it is a strategic imperative for businesses aiming for financial success and stability.

Applying Books of Accounts in the UAE

In the vibrant business landscape of the United Arab Emirates (UAE), accurate Books of Accounts are indispensable. For instance, in the thriving retail sector of Dubai, businesses meticulously maintain their Books of Accounts to monitor sales, track inventory, and manage expenses, ensuring financial stability and compliance with local regulations.

In the UAE's dynamic construction industry, companies utilize detailed Books of Accounts to manage project costs, track expenditures, and ensure that financial resources are allocated efficiently. This practice is essential for adherence to local regulations and international accounting standards.

In conclusion, our glossary unravels the significance of Books of Accounts, providing clarity on its definition, meaning, and detailed aspects. Whether you're a business owner, aspiring accountant, or simply curious about financial processes, this guide equips you with essential knowledge for navigating the world of financial management.

Sign up for our monthly newsletter

News and information on starting and doing business in the UAE, tax regulations updates and other useful information. We will send you the most relevant info from our blog maximum once a month only.

We are very thankful to everyone who participates in our survey

Page version from: 2024-03-15 11:30:04

Content Author: Atton Accounting & Consulting Editorial Department

- Cambridge Dictionary +Plus

Meaning of books of account in English

Your browser doesn't support HTML5 audio

Examples of books of account

Word of the Day

call centre

a large office in which a company's employees provide information to its customers, or sell or advertise its goods or services, by phone

Varied and diverse (Talking about differences, Part 1)

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- Business Noun

- All translations

To add books of account to a word list please sign up or log in.

Add books of account to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

Principles of Accounting Volume 1 Financial Accounting

(11 reviews)

Contributing Authors

Copyright Year: 2019

ISBN 13: 9781947172678

Publisher: OpenStax

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Richard Hale, Associate Professor, Berea College on 12/1/23

The authors do a fine job of proceeding through the expected topics at a manageable pace while giving sufficient depth for an introductory course. read more

Comprehensiveness rating: 5 see less

The authors do a fine job of proceeding through the expected topics at a manageable pace while giving sufficient depth for an introductory course.

Content Accuracy rating: 5

Coverage of content is accurate. Basic principles are introduced in the proper sequence, and the authors clearly present the topics in the expected manner.

Relevance/Longevity rating: 5

Examples are current and relevant.

Clarity rating: 5

Accounting is often referred to as "the language of business." Accordingly, the text does a fine job of relating the terminology to introductory students to topics and concepts they may not have encountered in prior dealings.

Consistency rating: 5

No unexpected jumps in difficulty nor lapses in topic coverage.

Modularity rating: 5

As with all other OpenStax offerings, modularity is an area in which this textbook shines. It would be easily possible to assemble a survey course combining topics from this book and the second offering (Principles of Managerial Accounting) to create a one-semester offering.

Organization/Structure/Flow rating: 5

Principles of Accounting has a certain flow to it which this book replicates.

Interface rating: 5

The textbook reads as well online as it does in print.

Grammatical Errors rating: 5

No editorial or grammatical errors noted.

Cultural Relevance rating: 5

OpenStax has traditionally been inclusive in its examples.

An issue that may arise when adopting this textbook...there is an appalling lack of publisher-provided ancillaries. Yes, there are PowerPoint slides. No, there are not quizzes, homework assignments, or in-class work available. Supposedly, these materials exist in the user community, yet I was unable to locate or obtain them. This remains a stumbling block (in my mind) to adoption.

Reviewed by JiangBo Huangfu, Assistant Professor of Accounting, Berea College on 11/30/23

I'm pleasantly surprised by the book's comprehensiveness. For instance, my classes use a textbook from a major publisher, and upon comparison, I observe no significant difference in the breadth and depth of the content they cover read more

I'm pleasantly surprised by the book's comprehensiveness. For instance, my classes use a textbook from a major publisher, and upon comparison, I observe no significant difference in the breadth and depth of the content they cover

I incorporated some exercises from this book into my current classes, and they proved to be highly effective. I did an intensive reading of one chapter for class preparation, I did not identify any errors.

I'm currently using the latest edition of a textbook from a major publisher. I think the content of this textbook is up-to-date content because it aligns well with the one I am using. Nonetheless, it would be beneficial if the textbook included relevant case problems.

I read a couple of chapters in greater depth and find the textbook offers remarkable clarity, making complex concepts easily understandable for readers.

I find a coherent and connected learning experience when I scanned the whole book and when I intensively read a few of the chapters.

I feel that the chapters in this textbook are effectively structured with well-defined subsections. Each chapter is thoughtfully organized into digestible segments, allowing readers to navigate through the material with ease. This breakdown into subsections enhances comprehension by presenting information in manageable portions.

I think the organization of this textbook is both logical and systematic. Each chapter unfolds in a coherent manner, with a clear progression of ideas and concepts. The content is well structured, often beginning with an introduction with a case to set the stage, followed by a systematic breakdown into sections or subsections. This organization facilitates a smooth flow of information, helping readers understand the material progressively. Key concepts are appropriately highlighted, and the inclusion of relevant examples and illustrations further enhances clarity.

The online version is easy to navigate.

Upon careful review, I found no apparent or obvious errors were detected in the content. I quite enjoy reading the book and feel the information presented is thoroughly checked and consistently reliable.

I appreciate the textbook's focus on accounting and business principles. The content is tailored to provide comprehensive insights into accounting practices and their applications in the business world without perpetuating cultural insensitivity.

Reviewed by Dave Jordan, Instructor, Northeastern Illinois University on 4/29/23

Principles of Accounting Volume 1 is comprehensive and covers all elements of a typical introductory accounting course. The text goes deep into certain areas and only touches the surface on others. The text sometimes takes a multi-pass approach... read more

Comprehensiveness rating: 4 see less

Principles of Accounting Volume 1 is comprehensive and covers all elements of a typical introductory accounting course. The text goes deep into certain areas and only touches the surface on others. The text sometimes takes a multi-pass approach to explain a topic. In Chapter 2 - the text provides an introduction to the financial statements and then builds on it in Chapter 3. I have seen this in other textbooks. My desired approach is show an income statement with operating income / other / tax / EPS; show a statement of owners equity with dividends. Chapter 3 is great. I love that expenses are explained using the house of GAAP. Nice touch. I would have introduced a compare and contrast of expenses to assets in Chapter 3. In recording JEs in Chapter 3; I would have preferred less transactions and the T-Account to be illustrated earlier. JE, A=L+E; T-account, then end with TB and F/S.

So as it relates to comprehensiveness - It's there; sometimes over-explained with words (like trying to show both perpetual and periodic inventory methods simultaneously (why??)) / underexplained (like in Chapter 2) / but mostly topics are explained, and are sufficiently covered

Some chapters are not organized naturally (e.g. AIS.) The student is learning about inventory and then immediately accounting information systems in the next chapter. I like the content in the chapter but either early on as a basis for understanding tools that accountants use or at the end. In teaching from this book - I would be forced to skip chapters and introduce chapters out of order. There are too many chapters (provides options for instruction who emphasize certain chapters over others) but a concern is the way the text is constructed.

In Summary - the book is comprehensive. I rate it a 4 out of 5 as in very good.

Content Accuracy rating: 4

Principles of Accounting Volume 1 is highly accurate. I do think there are some issues with immaterial items like re-naming titles of sections (e.g. 1.3 Describes Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities to "Types of Organizations: as it appears to me as this section is mis-titled), but more importantly when the text defines elements of revenues and expenses it defines these elements over multiple chapters; and the earlier chapters (Chapter 2) is actually materially incomplete. The text provides an introductory definition and then provides a better definition in later chapters. Just define it correctly, once? When the text simplifies a definition - the text approaches misleading the student into an understanding of an element that is incorrect. Another example of this is the first pass (introduction) of the statement of cash flows. It is not wrong but it does not show a statement of cash flows, it's elements, or its purpose. I would show a more complete statement and let the instructor simplify the illustration.

The text is accurate and comprehensive. I gave it a 4/5 as in very accurate. Many items, I can teach directly from the text by only using the text. Accurate and clearly presented.

Principles of Accounting Volume 1 is mostly an outline of accounting rules that have been around for a long time; won't change; and will be relevant for the foreseeable future. There are some changes (e.g. analytics) that changing the way accountants work. The text does have material in Chapter 7 (e.g. 7.1 storing data) that may need to be addressed as technology changes and/or might make it obsolete, but I don't see a way around this. AIS is an important topic and is a basic tool. It needs to be explain now even though the tools are evolving quickly to be cloud based and app based.

Overall the relevance of this text is up to date that will not quickly become obsolete (depending in part on technology changes in the near future).

Clarity rating: 3

Principles of Accounting Volume 1 could be presented much more concisely, more simply; and with better clarity. Certain chapters could be explained with less words, although I love the picture selections (e.g. Capone); certain chapters could be partially eliminated (i.e. Chapter 2 and explanation of periodic and perpetual inventory methods at the same time; certain chapters break continuity (e.g.AIS); and certain chapters could be completely eliminated (e.g. Chapter 14 accounting for corporations, which is outlined in each chapter before). These suggestions would improve clarity from the student learning perspective and process.

The text could provide a general introduction to accounting (tasks, profession, and regulation) in a more clear approach.

I gave the text 3/5 as being both accessible prose and inaccessible (confusing) prose, adequate content and inadequate content. It is a sold text book that would require significant modification and adaptation to work for me.

Consistency rating: 4

The text is consistent in terms of terminology and framework. The approach used by the authors through each chapter is consistent.

Modularity rating: 3

The text is divisible into smaller reading sections but not easily. Some content as presented is confusion so my approach would be to reframe it and not use it. Some content is too wordy but that is easily remedied by paraphrasing and summarizing (making it fine for modularity)

Overall the text is fine (3/5) but not great.

Organization/Structure/Flow rating: 4

The chapters could be more progressive building off of each other better. As a storyboard - the profession / the users / the systems (AIS) / The tasks (journal entries from start to finish (adjusting and closing) /Trial Balance / Financial Statements.

The text, however, took a curvy approach to the explanation of the topic, but not unlike other textbooks. Overall it wasn't great but it was typical and above average. I could use this textbook with modifications and content selectiveness (some content needs expounding / some needs modification / some needs elimination) and chapters don't work as presented for me.

The text navigation was straight forward. The chapters might be distracting or require modification but the interface was straight-forward. The pictures (images and graphs) were great! Really brings the student into the objective of the chapter/unit.

I am not the best judge - but to me the book was overly wordy in some sections - did not have any grammatical issues.

The text is professional and inclusive.

Overall the text is usable, informative, and complete. I would rate it a 3.8/5 rounding to a 4 as better than average but the text could use some work for my preferences. Accounting is difficult enough on its own - and no book is a complete instruction manual; so my preference would be to create an environment that outlines in a clear simple approach the profession / tasks (recording and reporting) / and the governance (regulations) of the profession.

Reviewed by Jennifer Sherman, Associate Professor, Bunker Hill Community College on 3/15/23

The book covers all the basics and starts with the foundations, what is accounting, the steps of accounting and thru the various parts of the balance sheet. Each chapter includes a section with the appropriate ratio, an important part of linking... read more

The book covers all the basics and starts with the foundations, what is accounting, the steps of accounting and thru the various parts of the balance sheet. Each chapter includes a section with the appropriate ratio, an important part of linking financial accounting to managerial accounting to finance

I did not find any glaring errors

The accounting field changes almost annually so it's difficult to say all content is 'up to date'. It is current up to it's publishing date (2019) so it will need to be updated soon

Clarity rating: 4

It flows as much as possible given that many of the terms are so particular to the industry

Very consistent!

Modularity rating: 4

As it's laid out, it can be subdivided. I do think the first 2 chapters could be combined but overall it looks easy to divide up

It flows well - or at least how I organize my classes.

Interface rating: 1

There seems to be no interface with Moodle or any online homework/testing that competitors (e.g. McGraw Hill) has. Also seems limited in student resources (e.g. videos) and the instructor resources are pathetic compared to other cometitors

I didn't see any grammar issues but I'm also not an English teacher!

Given the topic, there is little cultural impact/sensitivity. Given that this is for US based accounting for business, including international perspectives in any kind of great detail would just add to confusion and dilute the learning. Mention it yes, go into detail , no.

While I think this book is quite adequate, the lack of instructor and student resources makes it less desirable. The lack of an online homework/testing component would also prevent me from using the book.

Reviewed by Michael Griffin, Associate Teaching Professor, University of Massachusetts Dartmouth on 11/8/22

This book covers all the same topics that I would cover in an Accounting I course. read more

This book covers all the same topics that I would cover in an Accounting I course.

As an OpenStax book, it has gone through QA procedures and reviews and it also appears to me to be accurate and error-free.

Relevance/Longevity rating: 4

It has a 2019 copyright and is up-to-date with current financial accounting fundamentals. I do think that in its next update, some consideration should be given to the evolution of the CPA exam and the emphasis on data analytics. Also, some problem-solving with MS Excel would be a nice addition to the text.

The writing is clear and concise. Accounting does have a lot of specialize language/vocabulary and the book does a nice job with that.

The book is consistent throughout.

The sections of the text make it possible to assign various modules and to stop and lecture and problem solve based on those sections.

The topics are organized along the same lines as best-selling financial accounting textbooks.

This interface is effective, navigation of the ebook is easy and intuitive, and all tables and figures seem to load correctly and make sense.

I see now grammatical errors in the text.

OpenStax does a good job of working an editorial process that eliminates any culturally insensitive content.

One concern that I have with any accounting textbook is whether there will be a homework system that the students can benefit from and that makes grading homework an easy process. With the books that I use in my courses (McGraw-Hill, Wiley, and Pearson), I rely heavily on the LMS platforms that the publisher provides. I could be wrong, but I did not see evidence of that in this text. Of course, I could create such a homework system with our university's blackboard system but it would be a great deal of work, especially if a robust and comprehensive (content) system was created. Again, if I missed that type of technology and content, I apologize. I do know that Blackboard cartridges are available but those do not usually offer the same kind of homework that I am looking for whereby students complete worksheets, journal entries, ledgers, financial statements, and even MS Excel-like work and it is all graded by the system. Students in a financial course need lots of hands-on work - learning by doing and grading all that manually, is an impossible task because of other demands on faculty time.

Reviewed by Sayan Sarkar, Assistant Professor, University of Mary Washington on 7/8/22

With respect to comprehensiveness- the text book is very comprehensive. It also includes a section on Time value of Money which is a very important section in financial accounting. read more

With respect to comprehensiveness- the text book is very comprehensive. It also includes a section on Time value of Money which is a very important section in financial accounting.

The text-book is accurate and I did not find any error. As per my understanding, I did not find any bias.

The test is consistent. Updating the book should not be a difficult. Just by revising the examples, the book can be easily updated. I do see the book to be relevant for a long time.

For the most most part the book is clear. Though combining a few chapters can really help. This is a one semester class and covering 16 chapters can be a lot. Combing chapter 1 and 2 and combining chapter 12 and 13 can reduce the number of chapters from 16 to 14. Also financial statement analysis is an integral part of financial accounting, I suggest introducing ratios to respective chapter where they are more relevant. For examples introduce inventory management ratios in the chapters that deals with inventory.

The textbook is consistent with respect to terminology.

Overall the chapters can be easily divided into smaller parts.

Organization/Structure/Flow rating: 3

For the most part the text are presented in a logical, clear fashion. Though I suggest, moving Chapter 10 Inventory after Chapter 6 Merchandising Transactions makes more sense. Chapter 6 and Chapter 10 are both related to inventory management and moving chapter 10 to chapter 7 makes the flow much better.

Interface rating: 3

This is a place where the book can use some some help. For examples creating some more images/charts to explain the accounting equation and transactional analysis can really help with the understanding,

Grammatical Errors rating: 1

I did not find any grammatical errors.

Cultural Relevance rating: 1

As this is mostly a quantitative subject, issue of culture is not really relevant. But the examples that are used seemed very inclusive and there is no cultural in-sensitiveness.

Reviewed by Cheryl Kline, Online Faculty/Instructor, Trine University on 6/23/22

This textbook covers all areas that I would expect to see in an Accounting 1 course. There are many examples presented that make the material easier for accounting and non-accounting students to understand. The book contains an index. There are... read more

This textbook covers all areas that I would expect to see in an Accounting 1 course. There are many examples presented that make the material easier for accounting and non-accounting students to understand. The book contains an index. There are also PowerPoint slides that include selected graphics from the text, key concepts and definitions, examples, and discussion questions. The index is an in-depth glossary of terms used throughout the book,, and also states which chapter and subsection the term is used.

The book is accurate, error-free and unbiased. The book complies with the current accounting rules and regulations. OpenStax updates these textbooks on a regular basis, so there is no worry about using an outdated textbook for your classes. The principles of GAAP which pertain to accounting consistency, transparency and ethics are followed. There were no errors found during my review. I did not note or sense any bias throughout the book.

The students love not having to purchase a book. Instructors can rely on up-to-date accounting information, but unlike purchased publisher textbooks, these are not replaced every other year. Any significant accounting changes will be updated and the examples will not be outdated.

This book is specifically designed for both accounting and non-accounting majors, explaining the core concepts of accounting in familiar ways to students. Each chapter opens with a relatable real-life scenario for today’s college student to build a strong foundation that is applicable across many aspects of business.

Consistency in the terminology and framework was prevalent throughout the textbook. The accounting framework is used consistently to measure, recognize, present, and disclose the information appearing in financial statements.

The modularity is consistent throughout the book. Each chapter is divided into subsections that may be individually assigned if that is more appropriate for a class than assigning the entire chapter. For example, a chapter on Fraud, Internal Controls, and Cash has seven subsections; one on Petty Cash and another one on Bank Reconciliations. If you want to concentrate on one or more of these topics rather than the entire chapter, it is very easy to do. This also makes the reading more comprehensive and easier for the students who cannot finish the reading assignment at one time.

The topics are presented in a logical and clear fashion. The chapters build on one another and flow from one to the other effortlessly.

Interface rating: 4

The book's is basically free of interface issues. The book has a detailed chapter of contents and an index with an alphabetized glossary. The images and charts are simple and easy to read and understand. There didn't seem to be any display features that would distract the normal reader. There was an issue with the embedded charts and graphs. These are not acceptable for the reading impaired, and it was necessary to retype them when using them for assignments. It would also be great to have page numbers included for students using the online version of the book. Page numbers are sometimes used in OER classes to direct students to the correct assignment.

There were no grammatical errors found in my review.

There were no culturally insensitive or offensive words, phrases, or references observed. It would be advisable to include examples for races, ethnicities', and inclusive backgrounds.

I would recommend this book for use in accounting classrooms. There is also a second book, Principles of Accounting 2, which concentrates on management accounting.

Reviewed by Dianne Poulos, Adjunct Professor, Bunker Hill Community College on 6/30/20

The textbook provides a thorough overview of the accounting system. It delves quite a bit into the "why" of accounting which is sometimes glossed over in favor of mechanics in other texts. read more

The textbook provides a thorough overview of the accounting system. It delves quite a bit into the "why" of accounting which is sometimes glossed over in favor of mechanics in other texts.

No errors were encountered in my review.

The life examples are drawn from companies which are relevant and understandable to students today.

Looking at this from the context of a non-native English speaker, some of the language or vocabulary would be difficult to comprehend. Words such as ancillary even though explained later, might turn off a reader who already struggles with the language.

There is much consistency between the chapters in terms of how they are structured. Terminology is consistent as well.

Each chapter is broken into smaller, easily digested sections. Although chapters 1-5 must be presented in sequential order since we are discussing a sequence of events in an accounting cycle, the others can easily be moved around in terms of order presented.

The illustrations are particularly helpful. Also, really liked how debits and credits are brought into the discussion of the accounting equation early. Other texts have the instructor teaching to the equation and then introducing the concept of debits and credits. This creates a lot of confusion in some of the students.

Interface was great.

No grammatical errors detected.

I did not detect any. However, as a straight, white woman, I might not be as sensitive to the issues.

This is a good, solid textbook. There are many exercises and problems for students to use in the application of the material. The "Think it Through" sections in the chapter will provide some good fodder for discussion. I'm always looking for a way to not be lecturing but discussing. These open framework hypotheticals do the trick. Real life examples are presented in a way that most students have encountered in their life. This has been the way I've been teaching and this book will be a good resource to further enhance my lectures.

Reviewed by William Holmes, Instructor, LSUE on 4/15/20

The text covers all the important aspects that should be covered in the introduction to financial accounting. The text covers an overview of accounting information systems which I have not seen in textbooks I've used. It looks like the content... read more

The text covers all the important aspects that should be covered in the introduction to financial accounting. The text covers an overview of accounting information systems which I have not seen in textbooks I've used. It looks like the content is solid and comprehensive.

The information contained in the book is accurate and inline with what would be expected from an introduction to financial accounting textbook.

The topics covered in the book are relevant. I've used two textbooks for my course in the last five years and the information is comparable.

The book is clearly written.

The book is consistent.

The book is split into appropriate parts. This book did introduce financial statements and how to prepare them early than other books I've reviewed; however, I see how this can assist the student in understanding how financial statements are useful in business and how they can be used before getting into the weeds of details on analyzing accounts. As noted, I like the fact they are introducing accounting information systems which is an important topic.

Please refer to the previous comment, the book is well organized and consistent with other books that I have reviewed on the subject matter.

The book interfaced well. There did not appear to be any problem with navigation or other displays such as charts and graphs.

No grammatical errors were noted.

This text is straight forward and focused on the subject of financial accounting. It was no insensitive in any way.

After reviewing the book, and the accompanying resources I will consider adopting it for use in my classes. If not as a primary resource, I will recommend the source as an additional reading option for my students.

Reviewed by Darin Bell, Business Instructor, Treasure Valley Community College on 1/4/20

This textbook has all of the content that I cover with the publisher textbook that I have used for the past 6 years. read more

This textbook has all of the content that I cover with the publisher textbook that I have used for the past 6 years.

I have not used this test yet for an actual course but in my initial review I did not find any errors in the text.

This text includes some very relevant information about careers in accounting. I did not see a tie-in with data analysis which would have been nice but there are other ways to integrate this in to a course.

This textbook uses of T-accounts and diagrams to make the concepts become clearer for students. For a fee there are also videos through the OpenStax app.

This text is written in a single voice and allows for consistency through out the entire textbook. The types of graphics and the language that provides structure is also the same throughout the entire book.

Each chapter has subunits and it would be possible to remove or skip some of the units and there learning objectives because they are all numbered and ordered.

This text lays out the basic accounting foundation in the first five chapters. The publisher book I have used does it in 4 chapters. Having more chapters is a plus especially if your student struggle with the basic concepts. I wish that the chapters on merchandising and inventory were back-to-back. I will flip these when I use the book in my class to provide more continuity for these concepts. All of the other chapters are in a logical order.

There are many format options that are common to OpenStax textbooks that make this book a very accessible and usable book.

In my limited review I did not find any grammatical errors. I have not used this text yet in a course. Upon using it in a course I suspect any errors will surface.

I did not find any culturally insensitive or offensive content in this textbook.

I am excited to use this textbook in my courses this next year. I plan on creating my own videos and exam problems to expand the course. I will also create a Canvas course that I am will to share.

Reviewed by Andrew Hartzler, Professor of Accounting, Goshen College on 7/15/19

This book is perhaps the most comprehensive text I have seen for financial accounting. For those who are familiar with Financial Accounting, the index and glossary are sufficiently detailed. The fact that the text is so comprehensive is both a... read more

This book is perhaps the most comprehensive text I have seen for financial accounting. For those who are familiar with Financial Accounting, the index and glossary are sufficiently detailed. The fact that the text is so comprehensive is both a positive and a negative. It is positive in the sense that it has essentially every topic that you may want to cover in an introductory course. For newer instructors however it may be a bit daunting to distill the content down to what is most essential to cover in an introductory course. The text has some content that is more relevant to courses such as Accounting Information Systems, Financial Management, and Intermediate Accounting. An experienced instructor can recognize this and use the necessary elements for a principles course whereas for a new instructor the content is too extensive to cover in a single semester long course and would potentially overwhelm them. If an instructor's principles course contained only students who quickly and easily understood accounting concepts, then it would be possible to touch on such a wide variety of concepts in an introductory course. However, most principles courses contain business majors and other non-accounting majors who would struggle with the pace required to cover so much material.

I noticed a few typo-graphical errors but overall the text is well-written and accurate. I noticed no specific bias in the writing or examples.

Basic accounting concepts have not changed for a long time. For that reason, open source texts such as this one should be more widely used. The small incremental changes made in the basic structure of accounting do not warrant the frequent new editions that publishers try to push through. The only elements that would need to be updated may be the dates after a period of time so that they are more current and perhaps a few of the examples. The basic accounting elements however will not become obsolete and will remain relevant for the foreseeable future.

This text is very well-written. It contains excellent explanations of concepts such as the differences/similarities between revenue and gains. The primary issue I see with the text (as with other financial accounting texts) is how quickly it assumes students understand concepts of revenues/expenses, the function of accounts, and cash vs. accrual accounting. For those very familiar with accounting, the ordering of the concepts in financial accounting textbooks seems to make sense. However, if one takes a step back and thinks about what students might be struggling with, one can quickly see how fast these texts expect students to make leaps in their understanding. An example of this (which is common to most financial accounting texts) is the introduction of financial statements in chapter two before students fully grasp what the elements reflected on the financial statements represent. It is critical to spend enough time with students making sure that they understand how the basic accounting system works (revenues, expenses, accounts, cash and accrual basis) before they can make full use of the subsequent accounting concepts that are presented.

The structure of the book is consistent throughout.

The text is sufficiently modular in format to be easily reorganized and realigned.

The topics follow a clear, logical order. The only exceptions are chapters 1 and 2. Chapter 1 presents a broad overview of accounting which is common in financial accounting texts. What is included is fairly logical, but I find that topics such as retail businesses vs. service businesses and the difference between lenders/creditors/stockholders are more meaningfully included later in the text when the instructor is dealing directly with the accounting elements that illustrate the differences between these topics. As I mentioned previously, chapter 2 makes the assumption that students already grasp at this early stage what revenues and expenses are and the differences between cash and accrual accounting.

The interface is clean and easy to follow.

I noticed a few typo-graphical errors but overall the text is well-written grammatically.

I did not notice any cultural insensitivity. I noted a variety of inclusive examples.

Table of Contents

- 1. Role of Accounting in Society

- 2. Introduction to Financial Statements

- 3. Analyzing and Recording Transactions

- 4. The Adjustment Process

- 5. Completing the Accounting Cycle

- 6. Merchandising Transactions

- 7. Accounting Information Systems

- 8. Fraud, Internal Controls, and Cash

- 9. Accounting for Receivables

- 10. Inventory

- 11. Long-Term Assets

- 12. Current Liabilities

- 13. Long-Term Liabilities

- 14. Corporation Accounting

- 15. Partnership Accounting

- 16. Statement of Cash Flows

- 17. Answer Key

Ancillary Material

About the book.

Principles of Accounting is designed to meet the scope and sequence requirements of a two-semester accounting course that covers the fundamentals of financial and managerial accounting. Due to the comprehensive nature of the material, we are offering the book in two volumes. This book is specifically designed to appeal to both accounting and non-accounting majors, exposing students to the core concepts of accounting in familiar ways to build a strong foundation that can be applied across business fields. Each chapter opens with a relatable real-life scenario for today’s college student. Thoughtfully designed examples are presented throughout each chapter, allowing students to build on emerging accounting knowledge. Concepts are further reinforced through applicable connections to more detailed business processes. Students are immersed in the “why” as well as the “how” aspects of accounting in order to reinforce concepts and promote comprehension over rote memorization.

About the Contributors

Senior Contributing Authors Mitchell Franklin, LeMoyne College (Financial Accounting) Patty Graybeal, University of Michigan-Dearborn (Managerial Accounting) Dixon Cooper, Ouachita Baptist University

Contribute to this Page

Here are the basic Books that every taxpayer like you should keep in mind.

1️⃣ General Journal This book is referred to as the original entry book. It records the transactions of the business in the order of the date using the principle of “debit and credit”.

2️⃣ General Ledger This book is referred to as the final entry book. This is where you will see the summarized journal entries of an account to get the reconciled balances. This book tracks your Assets, Liabilities, Owner’s capital, Revenues, and Expenses.

3️⃣ Cash Receipt Journal This is a special journal used to record all cash payments for expenses and/or collections of receivables. Entries can be in the form of cash sales; the sale of an asset for cash; collections from customers; a collection of interest, dividends, rent, etc.

4️⃣ Cash Disbursement Journal This book is an internal record kept by accountants to record and track the business’s outflow of cash. This helps keep the General Ledger up-to-date.

5️⃣ Sales Journal

This is a special journal used to record sales on credit (received from customers).

6️⃣ Purchase Journal This is a special journal used to record credit purchases (payable to the supplier).

To download JuanTax's Books of Accounts templates, click on this link: https://bit.ly/JuanTax_BOA

Do you know that you can manage your books of accounts in JuanTax in just a couple of minutes? Want to learn more? Reach out to our Support Team on weekdays from 9 AM to 6 PM or view this demo .

Books of Accounts: What Is The Best Fit For Your Business?

Posted on february 20, 2019, 3 mins read.

What are books of accounts? Why are they so important for a company? What type of books must you have? Who is going to check? In short, every business in the Philippines (and the world!) should have and maintain up-to-date books of accounts. They are an essential element of a successful business for many reasons. We have outlined below the types of accounting books that companies in the Philippines must maintain. We have also provided guidance on which books are likely to be the best fit for your business.

Make sure to visit www.cloudcfo.ph/blog on a regular basis for updates and information on innovative and progressive accounting and bookkeeping services in the Philippines.

No matter how big or small your business is or what kind of industry you operate in, you need to prepare and maintain books of accounts. Books of accounts are the place in which all of the financial transactions and operations of a company are recorded. The books enable business owners and managers to understand what money is coming in and out of the business. They are also important for preparing cashflow forecasts and financial reports. It would be almost impossible to run a company successfully without books of accounts.

Compliance is another important reason for a company to have books of accounts. The Bureau of Internal Revenue (BIR) requires that all corporations, companies, partnerships and individuals who pay taxes in the Philippines must maintain books of accounts. The BIR can then monitor companies and ensure the correct amount of tax is being paid. So between financials, governance and compliance, make sure your books of accounts are in order!

Types of accounts

There are three main types of books of accounts approved by the BIR for use – manual, loose-leaf and computerized books. The company itself can decide which one of the three they wish to use. In each case, the books will generally have to include at a minimum, the following information: the general ledger, sales, purchases, accounts receivables and payable, inventory and payroll ledgers. Companies must register their books of accounts with the BIR upon incorporation and also on an annual basis. With this in mind, it is important to identify which books of accounts are the best fit for your business!

Manual Books of Accounts

This is where a business maintains physical books, journals and ledgers. There are no computer or automated processes used for these books. Daily transactions are recorded entirely by hand. This is the most popular system for accounting books across the Philippines. It is most commonly used by freelancers, sole traders and smaller companies as they will usually have a lower volume of transactions and less complex processes.

It is cost efficient as it only requires the purchase of hard copy journals and ledgers but it can be time consuming, more prone to manual errors and fairly inefficient. While companies don’t have to apply for a BIR permit to use the manual books system (as required for other types of accounting books – see below), manual books of accounts do have to be registered with the BIR.

Loose Leaf Books of Accounts

Loose-leaf books of accounts are a somewhat hybrid system between manual books and computerised books. Transactions are recorded into a computer or cloud-based system. When it is time to register or submit the loose-leaf books to the BIR, the company must printout the computer files, bind them together and then submit them to the BIR in hard-copy. If a company wants to use loose-leaf books of account, it must first apply to the BIR for a permit enabling the company to do so.

Cloud based accounting is commonly used in conjunction with the loose-leaf books as they achieve more efficient processes and generates real value-added information for the company without the effort and expenditure required for the registration of the computerized books of account. QuickBooks and Xero are just some of the accounting software that CloudCfo uses.

Computerized Books of Accounts

These books of accounts are “systems generated”. This means recording transactions and generating reports and documents through a computerized accounting system. Computerised books are generally used by bigger organisations that deal with a large volume of transactions and have more complex accounting processes. Capital investment is required as companies must invest in computer hardware, accounting software programmes and data storage.

The company must submit the books of account to the BIR in soft copy (i.e. CD-ROM). The BIR must first approve the company’s use of the computerized books of accounts, including the particular computerised system that the company is operating. Sometimes, the BIR will notify larger companies in the Philippines that they must use computerized books.

Each year, many companies in the Philippines are required to have their books of accounts audited and submit an Audited Financial Statement (AFS) to the BIR. For many companies in the Philippines, the deadline for submitting the AFS is 15 April– just around the corner! Check out our recent article which outlines what you need to know this audit season .

CloudCfo – Online Accounting and Bookkeeping Services in the Philippines

CloudCfo is an outsourced accounting and finance service provider for companies in the Philippines.

We put efficient processes in place so that our clients’ books of accounts are always in order and ensure that our clients can extract real-time value-added information about the financial status of their business.

We provide all our bookkeeping services online via cloud accounting and we are fully enabled by smart technology.

Let us show you the most efficient system for managing your books of accounts – tailored services to fit your specific business model!

Visit us at www.cloudcfo.ph or contact us at [email protected] .

DISCLAIMER: This article is strictly for general information purposes only. Nothing in this article constitutes or intends to constitute financial, accounting, regulatory or legal advice and must not be used as a substitute for professional advice. It is still necessary to consult your relevant professional adviser regarding any specific matter referenced above.

Related Articles

May 2024 Tax Calendar

Download our May Tax Calendar for a hassle-free guide to all the crucial dates and deadlines this month. Simplify tax compliance today with CloudCFO.

Uncategorized

Top 5 accounting tools ph accountants should know for 2024.

In the fast-paced world of business, keeping pace with the latest accounting tools is essential for effective financial management. For Philippine business owners and accountants, embracing modern software solutions can streamline operations, boost productivity, and ensure adherence to regulatory requirements.

Accounting Corporate News Taxes

Strategic insights: an exploration of the ease of paying taxes law and its impact on businesses.

In a recent milestone on Philippine taxation, President Ferdinand Marcos Jr. signed the new Ease of Paying Taxes Law by President Ferdinand Marcos Jr. This landmark legislation marks a significant paradigm shift, bringing about a reclassification of taxpayers based on gross sales. Micro, Small, Medium, and Large enterprises now navigate a more nuanced framework tailored to their scale.

Get In Touch

If you want to know more about our tailored services and processes, drop us a line to discuss how we can help you to grow your business. We will respond to you within 24 hours.

Subscribe to our monthly Newsletter for access to key insights, regular updates and quality business know-how for the Philippines.

Subscribe to our Newsletter

Why do we use cookies, privacy overview.

- April 29, 2021

Books of Accounts: What you need to know, and all that needs to be accounted for

Every corporation, partnership, and tax-paying individual (sole-proprietor or professional) is required to have records of their daily transactions. As a business owner, you need to log your daily operations. Knowing the exact numbers allow you to make informed decisions and projections. Most of all, you need to properly record the amounts of your transactions for tax filing purposes. It is this set of records that are called “books of account”.

The Details of These “Books”

In general, each transaction a business entity makes falls under a certain account. If you buy inventory with cash, you will see a decrease in your cash account, and you will log an increase of an equal amount to your inventory account. These accounts have to be registered with the Bureau of Internal Revenue and can be registered as one of the following types :

- Manual Books of Accounts (handwritten)

- Loose-leaf Books of Accounts (typewritten and printed)

- Computerized Books of Accounts (specialized accounting software).

These above-mentioned books assure transparency that all transactions are duly credited and all income and expenses rendered are accurate. If you don’t maintain your accounts accurately, you may be subject to Oplan Kandado or Tax Mapping.

The Books of Accounts

Below is the list of books of accounts that are the minimum requirement for any business entity , may it be sole-proprietorship, corporation, partnership, or professional category.

1. General Journal

This is the most basic book of accounts and is also called the book of original entry. This is because all transactions are first encoded herein in order of occurrence, using the double-bookkeeping method that utilizes debit and credit.

2. General Ledger

The General ledger summarizes the transactions of the general journal under each account to get their ending balances. For example, the general ledger of cash would compile all transactions under cash, both debit and credit, listed in the general journal. This process is done for all accounts under assets, liabilities, and equity.

3. Cash Receipt Journal