- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

QuickBooks Financial Statements: A Complete Guide

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How to prepare QuickBooks financial statements

1. quickbooks profit and loss statement, 2. quickbooks balance sheet, 3. quickbooks cash flow statement, summary of quickbooks financial statements.

With accounting software options like QuickBooks' small-business products , detailed financial information about your business is always at your fingertips. Financial statements — such as a profit and loss statement, balance sheet or statement of cash flows — are a window into the health of your business and help you spot problems and opportunities.

You can use QuickBooks financial statements when opening a business bank account, applying for a business credit card or loan or when planning for the following year. If you can’t quite figure out how to make something work in QuickBooks, or what reports you should be looking at, read on. We’ll tell you what types of financial statements are available on QuickBooks, what they’ll tell you about your business and the instructions you need to follow to access them.

» MORE: NerdWallet's best small-business apps

advertisement

QuickBooks Online

The beauty of QuickBooks is that you can create dozens of custom reports to help you better run your business. Beyond the basic three financial statements — profit and loss, balance sheet and cash flow statement — you can also customize reports by product, vendor, employee, bank or customer.

QuickBooks gives you flexibility as to how the statements are used and shared. You can view them in QuickBooks, email them to yourself or another member of the business or export them for later viewing. QuickBooks even lets you schedule financial reporting, so you can automatically receive and share updated financial statements on a periodic basis.

Here are the three main types of QuickBooks financial statements you can create:

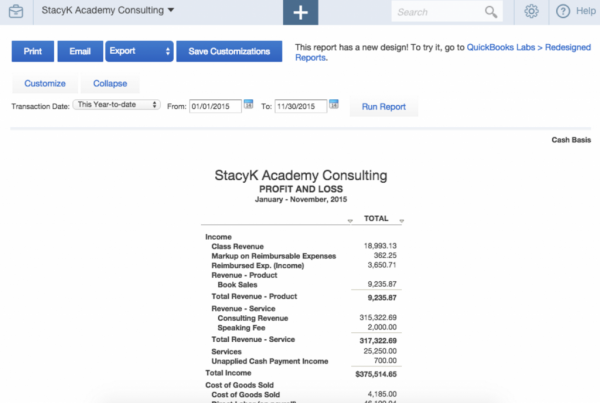

Your profit and loss statement, also called an income statement, summarizes your business’s financial performance over a period of time — daily, weekly, monthly, quarterly or annually. It is an important document because it tells you the company’s biggest areas of expenditures and revenues.

The profit and loss statement lets you take advantage of opportunities that increase sales and trim back on expenses. You’ll want to review this statement more than once a year, and definitely before filing your small business taxes. You can run a standard profit and loss statement in QuickBooks or a profit and loss detail which shows year-to-date transactions for each income and expense account.

Here’s how to prepare your QuickBooks profit and loss statement:

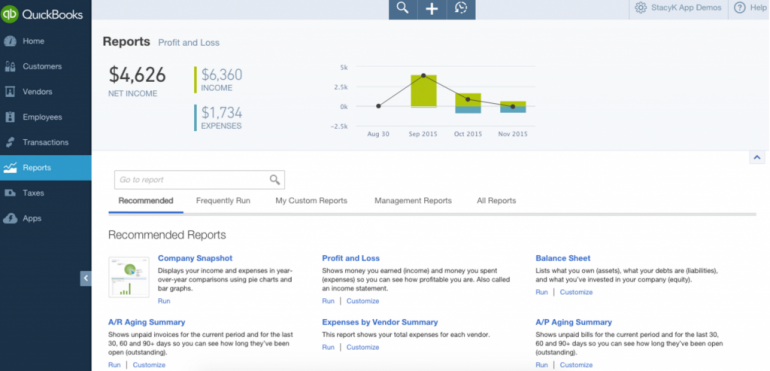

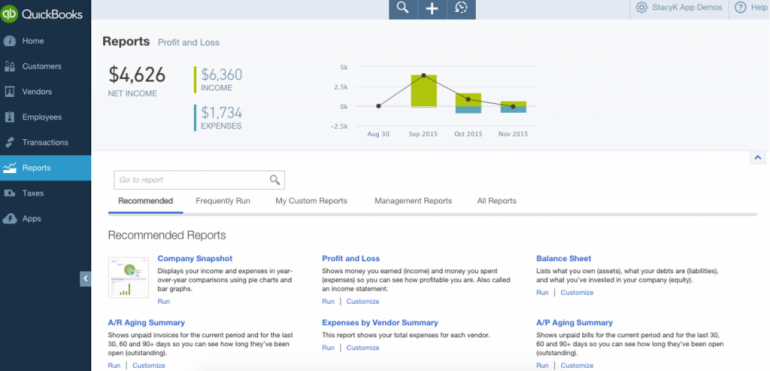

From the home dashboard, select Reports on the left navigation bar:

From the Report Center, you can either go to the Recommended tab or to All Reports > Business Overview, then choose Profit and Loss. (The Recommended tab is faster, but you’ll need to go to All Reports to get the Profit and Loss Detail). Just click on the report name or the link that says “Run” to open it.

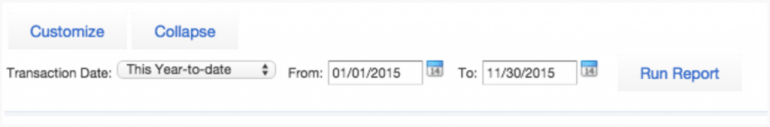

Once it’s open, you can edit the date range or click Customize to make other changes to the report. For example, this where you can see the amount and percentage of profits coming from a specific product or customer. You can also customize the reporting time period here. If you just change the date directly without clicking the customize button, make sure you click the Run Report button to view the report for the new dates. Keep in mind that you can view the report in QuickBooks, email the report to yourself or someone else or export it as a new file.

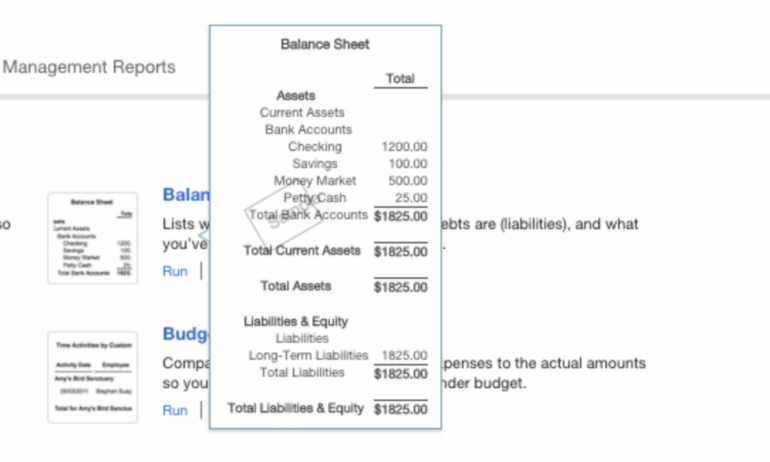

A balance sheet is a statement of the assets, liabilities and equity of a business — essentially a snapshot of your business value at a specific point in time. Balance sheet items are calculated by subtracting your liabilities — what you owe — from your assets, cash or property — what you’re own or is owed to you. The result is equity, or what your company is worth.

» MORE: NerdWallet's best accounting software

Balance sheets are useful for accountants to see your financial health and for banks when you are applying for loans. It’s also essential for the small business owner to get a true sense of how their business is doing.

Just as with a profit and loss, the standard balance sheet is fine, but I recommend pulling the balance sheet detail in QuickBooks to send to your tax preparer. As you can guess, this is a more detailed version of the standard balance sheet, showing the starting balances at the beginning of last month, transactions entered in for the month and ending balances.

To create your QuickBooks balance sheet, follow these instructions:

1. In the left navigation bar, click Reports:

2. From the Report Center, you can either go to the Recommended tab or to All Reports > Business Overview, then choose Balance Sheet. Recommended is faster for a standard Balance Sheet, but you’ll need to to All Reports to get the Balance Sheet Detail. Just click on the report name or the link that says “Run” to open it. If you hover over it, you’ll get a preview — this works for the P&L and other reports, too:

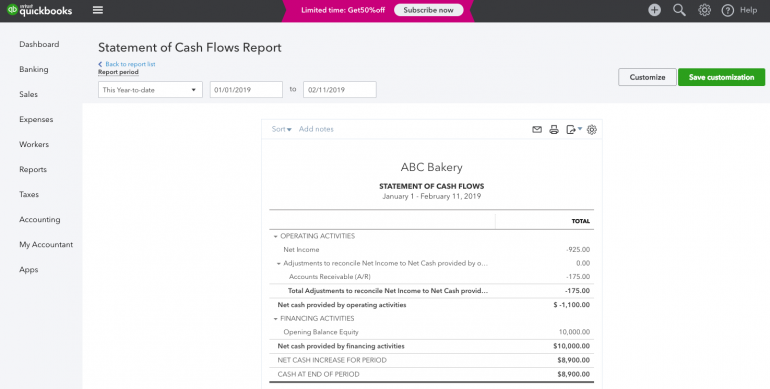

A cash flow statement, or statement of cash flows, shows the amount of cash that flows into your business from a variety of sources and flows out of your business in a given period of time. Statement of cash flows is important because it shows your company’s actual cash position to fund operating expenses and debt obligations. The liquidity of your company will be illustrated in a statement of cash flows.

Depending on your accounting method, you might record revenue at the time of a sale or when your customer actually pays. You can specify your accounting method in QuickBooks, making it easy to get a handle on your cash flow.

Here’s how to access your QuickBooks cash flow statement:

In the left navigation bar, click Reports:

Type Statement of Cash Flows in the search field and select it to open the report.

Choose Customize to change any report settings. For instance, you can change the reporting time period or filter by customer, employee, vendor or product. Once you’re finished with customizations, click Run Report.

For most small businesses, the three basic financial statements are all you’ll need to get a good understanding of your business’s financial performance. However, these just scratch the surface of what’s possible with QuickBooks.

Here’s a summary of available QuickBooks financial statements:

Profit and loss statement: View income and expense summaries for your company or detailed numbers for each account.

Balance sheet: Understand your company’s debts, liabilities and assets.

Cash flow statement: Learn how well your business’s cash flow can support its debts and obligations.

General ledger report: Shows you the beginning balance, transactions and totals for each account in your chart of accounts.

Customer, job and sales reports: Keep track of what’s impacting your accounts receivable.

Item reports: Manage your inventory with insightful merchandise and product reports.

Vendor reports: Get a handle on your business expenses and accounts payable.

Banking reports: Reconcile all your bank accounts and credit card statements and analyze where all your money lives.

List reports: These help you quickly pull up lists of information, such as customer lists or product lists.

Payroll and employee reports: Understand how personnel costs are impacting your business (most insightful if you have QuickBooks payroll)

Accountant and tax reports: These reports are only for accountants and tax preparers for use with their clients.

Budgeting and forecasting reports: Use these to plan ahead for your company and ensure that you’re staying within organizational budgets.

Along with periodically running each of these reports, you can also use them for other evaluations, like a common size analysis, as well as get nice visual representations and graphs in QuickBooks of how your company is performing. These are useful for general financial analysis and for planning with your bookkeeper, tax preparer or business consultant.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

QuickBooks Online resources

Read more about how QuickBooks Online works.

How to create a stellar QuickBooks Online budget.

How to import bank transactions into QuickBooks Online.

How to process credit card payments in QuickBooks Online.

How to create a purchase order in QuickBooks Online.

How to write and print checks in QuickBooks Online.

How to adjust prices and price levels in QuickBooks Online.

How to create a QuickBooks income statement.

How to create an invoice in QuickBooks.

How to write off an invoice in QuickBooks.

How to print pay stubs in QuickBooks Online.

Progress invoicing in QuickBooks Online: Step-by-step instructions.

Best POS systems that integrate with QuickBooks.

QuickBooks financial statements: A complete guide.

QuickBooks definitions: The top 22 you need to know.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

Accounting | Versus

QuickBooks Online vs Self-Employed: Features & Differences

Since QuickBooks Self-Employed is no longer offered to new subscribers, this QuickBooks Online vs Self-Employed comparison is focused on whether current QuickBooks Self-Employed subscribers should convert to QuickBooks Online.

Published April 3, 2024

Published Apr 3, 2024

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Danielle Bauter

This article is part of a larger series on Accounting Software .

- 1 Quick Comparison

- 2 Use Cases

- 3 User Reviews: Tie

- 4 Pricing: Tie

- 5 Features: QuickBooks Online Wins

- 6 Ease of Use: Tie

- 7 Assisted Bookkeeping: QuickBooks Online Wins

- 8 Integrations: QuickBooks Online Wins

- 9 Mobile App: QuickBooks Online Wins

- 10 Customer Support: Tie

- 12 Bottom Line

QuickBooks Online and QuickBooks Self-Employed are both accounting software solutions offered by Intuit, but they serve different types of users and have different feature sets. While QuickBooks Online is a full-featured double-entry bookkeeping system capable of tracking assets, liabilities, income, and expenses of Small and midsize businesses (SMBs) small and midsize businesses , QuickBooks Self Employed is a simple-to-use way for microbusinesses with no employees to track income and expenses.

- QuickBooks Online : Best for small businesses requiring payroll, inventory tracking, job costing, budgeting, or scalability

- QuickBooks Self-Employed: Best for freelancers and self-employed individuals seeking basic bookkeeping and federal tax support

Intuit now offers QuickBooks Solopreneur, which is part of the QuickBooks Online product lineup and builds on the success of QuickBooks Self-Employed. You can learn more in our QuickBooks Solopreneur review . If you currently have QuickBooks Self-Employed, you can continue your subscription, but Intuit no longer offers new ones.

Why You Can Trust Fit Small Business

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting platform for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface. We immerse ourselves in every system we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing QuickBooks products, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study , helps us understand how the different QuickBooks products compare with each other and how they work in real-world scenarios.

QuickBooks Online vs Self-Employed At a Glance

Use cases and pros & cons.

- QuickBooks Online

- QuickBooks Self-Employed

- An Alternative

- Small businesses that invoice customers frequently: While QuickBooks Self-Employed allows you to invoice customers, its process is not nearly as refined as the excellent invoicing in QuickBooks Online. For instance, the creation and collection of an invoice are not recorded automatically as income in QuickBooks Self-Employed. Also, the invoice descriptions in QuickBooks Self-Employed are difficult to manage and edit, meaning you often must create unique descriptions for each invoice line item. QuickBooks Online has exceptional invoicing features, such as its ability to calculate sales tax based on the customer’s location, which is why we selected it as the best invoicing software .

- Retail businesses tracking inventory: QuickBooks Online has excellent inventory tracking and accounting features for retailers. It calculates the cost of goods sold (COGS), tracks inventory levels, and determines the cost of ending inventory.

- Small businesses tracking time and assigning project costs: If you want to invoice customers for billable hours accurately, QuickBooks Online can help you track hours worked and bill them to customer invoices. You can also track time and assign them to projects.

- Businesses with multiple classes of products or services: QuickBooks Online’s class and location tracking features allow businesses to separate net profit by type of product or service

- Businesses with multiple locations: QuickBooks Online is also a good fit for businesses with multiple locations because its class and location tracking is beneficial for tracking the profitability of each. Its robust reporting capabilities also allow you to customize reports to compare data by location and project future cash flow.

- Businesses with employees: QuickBooks Self-Employed does not have a payroll feature while QuickBooks Online has it built in with QuickBooks Payroll. This streamlines the payroll process and lets you manage everything on one platform.

- Offers scalable plans, priced based on number of users and features needed

- Has a wide network of QuickBooks Online ProAdvisors for expert assistance

- Comes with powerful inventory management features

- Is unable to track the value of your investments automatically

- Has a mobile app, but can’t record time worked

- Is unable to compare estimated to actual project costs

- Freelancers working remotely often: QuickBooks Self-Employed has its own mobile app that lets you create and send invoices, track business mileage, and scan receipts from your mobile device. QuickBooks Online can also do this—but at a higher price. For other recommendations, refer to our guide on the best mobile accounting apps .

- Freelancers who pay personal and business expenses from the same bank account: If you use your bank account for both personal and business, QuickBooks Self-Employed allows you to designate payments from your bank account as “personal,” so you can ensure that your income statement reflects accurate information. This is one area where QuickBooks Self-Employed truly beats QuickBooks Online regardless of price.

- Freelancers who need to track profit and expenses and file federal tax returns: With QuickBooks Self-Employed, you can categorize income and expenses and transfer the information to your tax return in TurboTax.

- Freelancers who track mileage: QuickBooks Self-Employed allows you to track your mileage using your smartphone’s GPS. You can also classify business and personal trips within the mobile app.

- Calculates quarterly estimated tax payments

- Transfers Schedule C tax information to TurboTax

- Captures and organizes receipts

- Has limited invoicing functionality

- Is unable to accommodate multiple businesses

- Can’t track unpaid bills

- Small businesses seeking free accounting software: If you’re willing to sacrifice some features in exchange for free accounting software, we recommend Wave. Not only is it free, but it is also one of our leading QuickBooks alternatives . Read our Wave Accounting review for more information about its features.

- Small businesses that need fixed asset management tools: Neither QuickBooks Online nor QuickBooks Self-Employed track nor calculate the book value of your fixed assets. If this is a feature you’re looking for, we suggest Xero, which is unique among accounting programs because it can track and calculate depreciation for fixed assets like vehicles, machinery, and equipment. Read our review of Xero to learn more.

- Project managers who need to compare estimated and actual costs: If you want to compare budgeted costs to actual time and expenses, we recommend FreshBooks. Our FreshBooks review has more information about what the solution offers.

- One-person businesses that want one platform to manage bookkeeping and taxes: QuickBooks Solopreneur is ideal for one-person businesses that want to be able to run their business seamlessly. Users can separate business and personal expenses, get expert tax prep assistance, set and track growth goals, track mileage, and more.

User Reviews: Tie

Although QuickBooks Self-Employed technically scored higher, the user reviews were too close to call one clear winner. We analyzed the reviews for each below.

QuickBooks Online Reviews

Many users find QuickBooks Online user-friendly, especially for basic tasks like invoicing and expense tracking. They also appreciated its wide range of features including bank reconciliation, reporting, and its integration with other apps.

Some reviewers also mentioned that while it is competitively priced, many found that the costs added up as they needed more features. Also, while it’s generally considered easy to use, some mentioned a learning curve, especially for users coming from the desktop version.

QuickBooks Online earned the following average scores on popular review sites:

- Capterra [ 1 ] : 4.3 out of 5 based on nearly 6,450 reviews

- G2.com [ 2 ] : 4.0 out of 5 based on more than 3,250 reviews

QuickBooks Self-Employed Reviews

QuickBooks Self-Employed is generally well-regarded among freelancers and sole proprietors, but some limitations are worth noting. Features like mileage tracking and income/expense categorization resonate with self-employed users. They also appreciate features like estimated tax tracking and reports for tax time.

However, while it is good for basic needs, it likely won’t scale with growing businesses. Features like double-entry accounting are absent, and compared to free alternatives, some find the subscription fee a turnoff, especially for those with simple needs.

QuickBooks Self-Employed earned the following average scores on popular review sites:

- Software Advice [ 3 ] : 3.9 out of 5 based on about 100 reviews

- TrustRadius [ 4 ] : 9.0 out of 10 based on over 50 reviews

Pricing: Tie

It is difficult to compare QuickBooks Online vs Self-Employed across the board. This is because QuickBooks Online offers a range of subscription plans based on the number of users and features needed while QuickBooks Self-Employed offers plans that are bundled with or without tax filing options. Therefore, we call this category a tie.

QuickBooks Online Pricing

QuickBooks Online has four pricing plans to choose from, each with its own set of features and allowed users. See below for more information about the features included with each plan.

- Simple Start: $30 per month for one user

- Essentials: $60 per month for up to three users

- Plus: $90 per month for up to five users

- Advanced: $200 per month for up to 25 users

In addition to the allowed users, the QuickBooks Online plans vary in the features included. Check out our QuickBooks Online plans comparison to learn about the features of each.

QuickBooks Self-Employed Pricing

- Self-Employed: $15 per month for one user

- Self-Employed Tax Bundle: $25 per month, includes one federal and one state tax return filing through TurboTax plus the ability to pay quarterly estimated taxes online

- Self-Employed Live Tax Bundle: $35 per month, includes everything in the Self-Employed Tax Bundle plus access to a certified public accountant (CPA) who will do a final review of your tax return.

Features: QuickBooks Online Wins

Many of the same features can be found in both QuickBooks Online and QuickBooks Self-Employed, but the major difference between QuickBooks Online and Self-Employed is that the latter doesn’t track assets and liabilities, so you can’t reconcile your bank accounts or manage and track unpaid bills. Because of that, QuickBooks Online takes the lead in this category.

Accounts Payable (A/P): QuickBooks Online Wins

QuickBooks Self-Employed does not track unpaid bills, usually referred to as A/P. With QuickBooks Online, you can track bills, manage vendor credits, and set up recurring payments. Therefore, QuickBooks Online is the clear winner in this category.

It even lets you pay bills directly from the software with QuickBooks Bill Pay, using automated clearing house (ACH) or check while you can only record payments made outside the software with QuickBooks Self-Employed. You can also track A/P aging with QuickBooks Online, so you can see which bills are outstanding and how much you owe each vendor.

Accounts Receivable (A/R): QuickBooks Online Wins

QuickBooks Online also aces this category. While both platforms allow you to create and send invoices, the invoice customization options are limited with QuickBooks Self-Employed. QuickBooks Online allows you to send invoice reminders and create recurring invoices as well as create estimates and turn them into invoices once they are accepted by the customer—all features that QuickBooks Self-Employed lacks. You can also track A/R aging with QuickBooks Online, which is unavailable with QuickBooks Self-Employed.

There are a couple of major problems with the invoicing features of QuickBooks Self-Employed. First, creating and even receiving payment for an invoice does not record any income in your books. This means that it’s possible to properly record the receipt of an invoice payment, but not record the payment received as income.

The second problem is how the line-item descriptions, called product or service items, are managed. Once created, you can’t edit a product or service item when adding it to another invoice. The practical implication of this is that you’ll end up typing custom descriptions for every invoice you issue.

Reporting: QuickBooks Online Wins

QuickBooks Online offers a wide variety of customizable reports, including a Balance Sheet. Since QuickBooks Self-Employed doesn’t track assets and liabilities, it cannot create a complete set of financial statements, which must include a Balance Sheet. This is one of the reasons why QuickBooks Online leads in this category.

QuickBooks Self-Employed’s available reports are limited to a profit and loss statement, mileage log, and general ledger. It also offers two reports that are unavailable with QuickBooks Online—a Schedule C worksheet and Quarterly Estimated Taxes.

Sales & Income Tax: QuickBooks Online Wins

Both allow you to add sales tax to invoices and track independent contractors. But the difference between QuickBooks Online and Self-Employed is that QuickBooks Online offers a robust set of sales and income tax features, including a sales tax center and tax forms that cater to the needs of large businesses, so we selected it as the winner. On the other hand, QuickBooks Self-Employed offers an efficient set of features focused on helping self-employed individuals manage their sales and income tax operations.

Ease of Use: Tie

QuickBooks Online is more complex than QuickBooks Self-Employed and offers more features, which can make it more difficult for some users to learn and use the platform. However, it provides more flexibility and customization options.

QuickBooks Self-Employed is simpler and easier to use, making it the better choice for self-employed individuals and freelancers requiring basic accounting software that can handle their expense tracking, and tax management needs. We called this category a tie because each plan is specific to the needs of its intended users.

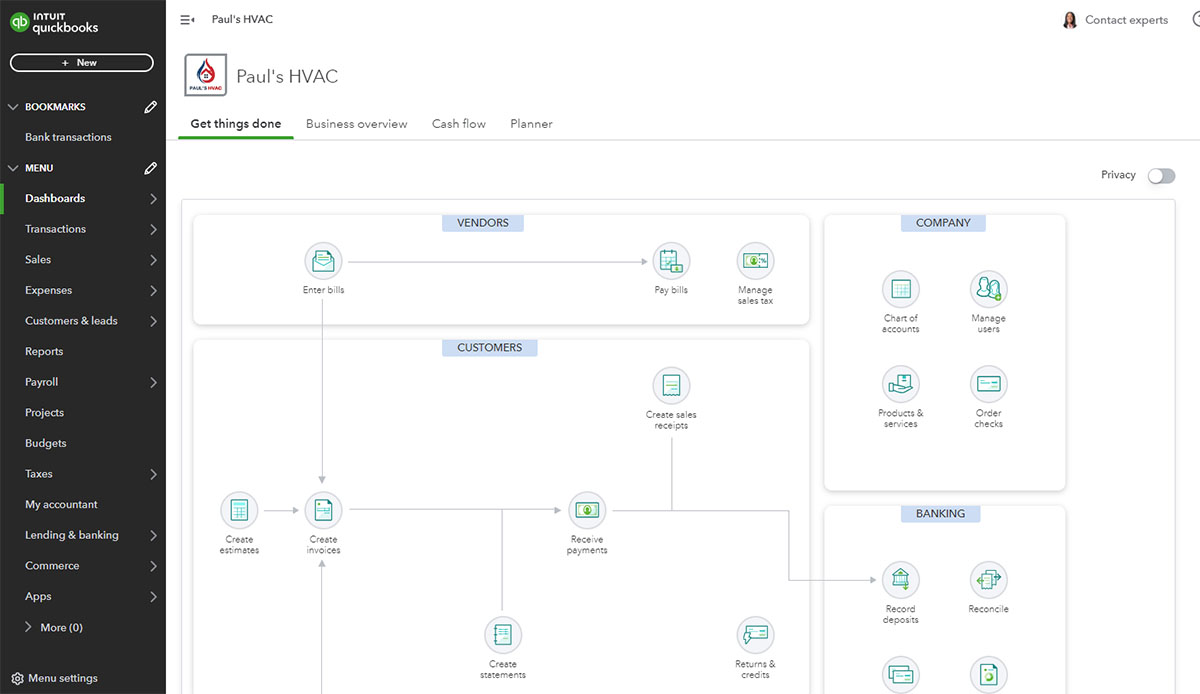

QuickBooks Online Ease of Use

QuickBooks Online is a more comprehensive accounting software designed for SMBs. It has a more complex user interface than QuickBooks Self-Employed, but it offers more customization options and integrations with third-party apps.

The learning curve for QuickBooks Online can be steep for new users, but it provides plenty of resources, such as tutorials, forums, and customer support, to help you get started. Once you’re familiar with the software, it can be easy to use, especially for businesses with complex accounting needs.

QuickBooks Online Dashboard

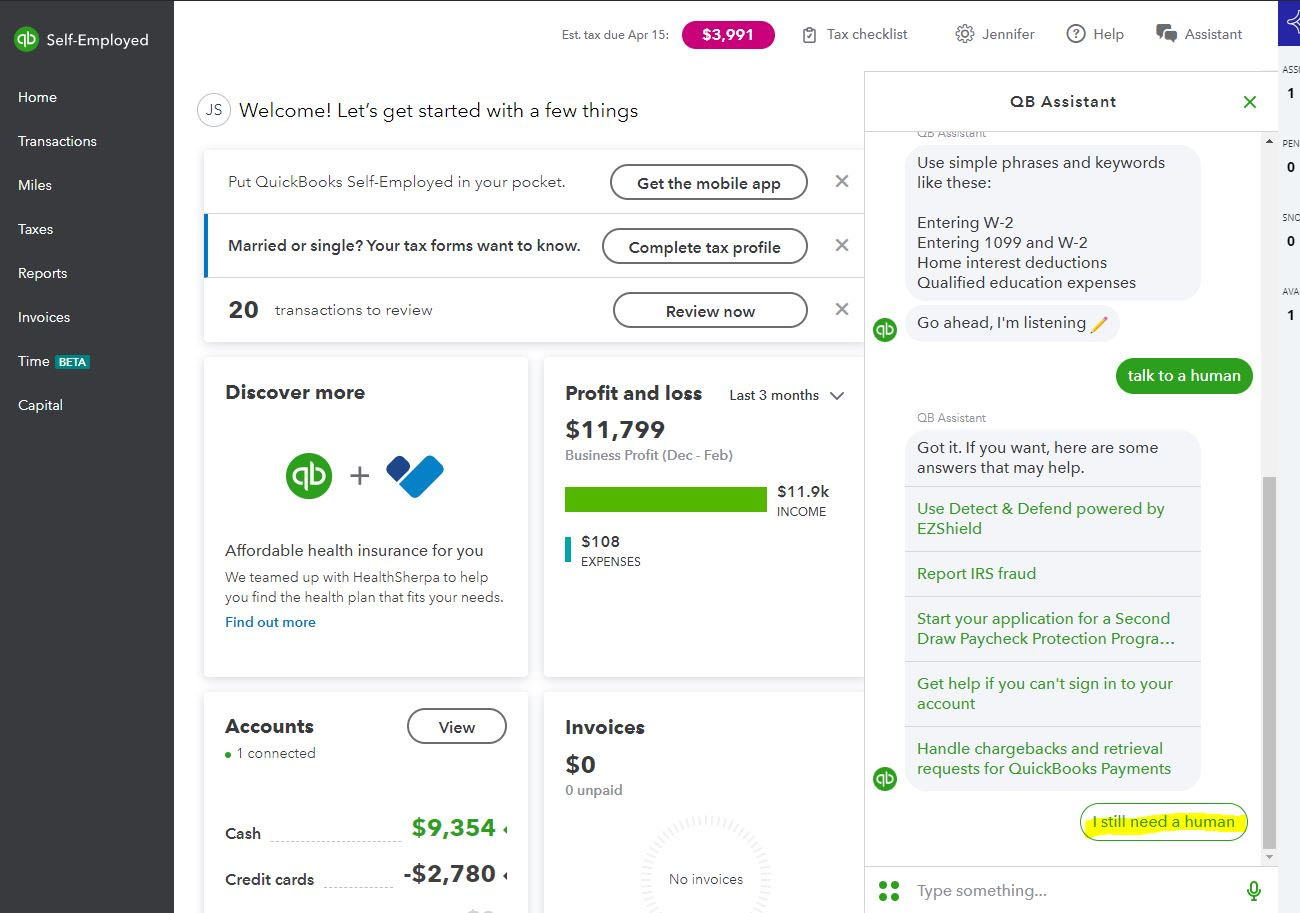

QuickBooks Self-Employed Ease of Use

QuickBooks Self-Employed is designed specifically for self-employed individuals, freelancers, and independent contractors. It has a more streamlined feature set, focused primarily on invoicing, expense tracking, and tax management.

It has a simpler user interface than QuickBooks Online, with fewer options and features, and an intuitive navigation. It provides step-by-step guides and in-app prompts to help users navigate the software and complete tasks.

QuickBooks Self-Employed Dashboard

Assisted Bookkeeping: QuickBooks Online Wins

For QuickBooks Online users, assisted bookkeeping is available in the form of QuickBooks Live, which is why it is the winner in this category. Starting at $200 per month, the service matches you with a certified QuickBooks ProAdvisor, who will help you connect your bank and credit card accounts, categorize your transactions, and reconcile your bank accounts. They are also available for telephone or one-way video calls, to answer questions and troubleshoot any bookkeeping issues.

However, QuickBooks Live bookkeepers cannot assist with 1099 reporting and preparation or payroll. It is unavailable to QuickBooks Self-Employed users—but they do have access to a network of QuickBooks ProAdvisors.

Read our review of QuickBooks Live to learn more about the service.

Integrations: QuickBooks Online Wins

QuickBooks Online integrates with a wide range of third-party software, with more than 700 apps across various categories, such as customer relationship management (CRM), ecommerce, time tracking, and project management. Some popular integrations include PayPal, Shopify, TSheets, Salesforce, HubSpot, Square, and Stripe. It also connects with thousands of apps through Zapier. Visit the QuickBooks Integrations page to learn more.

QuickBooks Self-Employed has fewer integrations than QuickBooks Online. However, it still offers a good selection that are relevant to self-employed individuals, such as TurboTax, PayPal, MileIQ, Etsy, and Stripe.

Mobile App: QuickBooks Online Wins

QuickBooks Online and QuickBooks Self-Employed have separate mobile apps. While the QuickBooks Online mobile app allows you to perform many of the same activities as the web-based version, the QuickBooks Self-Employed mobile app limits you to creating and sending invoices, categorizing expenses from the bank feed, tracking mileage and expense receipts, and viewing reports. Therefore, QuickBooks Online is a clear winner here.

Customer Support: Tie

Both QuickBooks Online and QuickBooks Self-Employed offer phone, chat, and email support options to their users, but QuickBooks Online offers a VIP service called QuickBooks Priority Circle to users with an Advanced plan. This service connects you with a dedicated account team, provides in-depth training, and 24/7 premium technical support. Although this is a valuable service, we still ruled this category a tie since the service is only available to Advanced users.

Meanwhile, QuickBooks Self-Employed offers phone support to all subscribers, and if you sign up for the Live Tax Bundle you’ll also receive access to a CPA for assistance with filing your income tax returns. Both platforms also provide online help centers with extensive resources and a community forum where users can connect and share knowledge.

Frequently Asked Questions (FAQs)

Do i have to pay extra for quickbooks mobile apps.

No, QuickBooks mobile apps are included with the software.

Can I enter and pay bills with QuickBooks Self-Employed?

No, QuickBooks Self-Employed doesn’t allow you to manage bill payments. If this is an important feature, we suggest checking out QuickBooks Online.

How much does QuickBooks Online cost?

QuickBooks Online ranges in price from $30 to $200 per month, depending on the subscription plan. These plans are priced based on the features and number of users included.

How do I move from QuickBooks Self-Employed to QuickBooks Solopreneur?

It is currently impossible to migrate data from QuickBooks Self-Employed to QuickBooks Solopreneur, but QuickBooks Solopreneur does have features to import data in spreadsheet format.

Bottom Line

QuickBooks Online is designed for small to mid-sized businesses and offers a powerful suite of accounting features, including invoicing, bill management, inventory tracking, payroll, and advanced reporting. QuickBooks Self-Employed is designed for microbusinesses that have more basic accounting needs. The best software for you depends on the size of your business and the features you’re seeking.

User review references: [1] Capterra | QuickBooks Online [2] G2.com | QuickBooks Online [3] Software Advice | QuickBooks Self-Employed [4] TrustRadius | QuickBooks Self-Employed

About the Author

Find Danielle On LinkedIn

Danielle Bauter

Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor's degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about business for various consumer publications.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- QuickBooks Hosting

- QuickBooks Pro Hosting

- QuickBooks Premier Hosting

- QuickBooks Enterprise Hosting

- QuickBooks POS Hosting

- QuickBooks Add-ons Hosting

- Buy QuickBooks

- Sage Hosting

- Sage 50 Hosting

- Sage 100 ERP Hosting

- Sage 300 ERP Hosting

- Sage 500 ERP Hosting

- Tax Software Hosting

- Drake Tax Software Hosting

- UltraTax CS Hosting

- Lacerte Hosting

- ProSeries Tax Software Hosting

- TaxWise Hosting

- Small Business

- Law Firm Hosting

- Virtual Desktop

- Status Page

Join over 150,000 readers community who get our new posts by email.

-New articles from industry leaders

-Free downloads and other offers

-Tips, tricks and more!

Your personal space to feed your curiosity and stay up-to-date with accounting, tax, the cloud, and everything that comes with it!

- QuickBooks Software

- Guide To Quickbooks Self Employed

QuickBooks Self-Employed 2024: Simplify Your Employment Journey

QuickBooks Software , Small Business | Updated On May 30th, 2024

The QuickBooks Self Employed user base has surged, experiencing a remarkable twofold increase to reach 360,000 users. This growth is notably higher than the preceding quarter’s count of 180,000, and it marks a substantial leap from the count of 75,000 merely a year ago. It can be attributed to an innovative integration between QuickBooks Self-Employed and TurboTax that has resulted in almost 4 million self-employed individuals utilizing the service for tax filing purposes.

What is QuickBooks Self Employed

QuickBooks Self-Employed is a cloud-based accounting software tailored for freelancers, sole proprietors, and individual contractors.

It’s empowers self-employed individuals to take control of their finances with its powerful accounting tool. Entrepreneurs can easily manage their income and expenses, track mileage, send invoices, and pay taxes online using this software. It also categorizes expenses and tracks deductions to help them stay organized.

The software’s advanced analytics provide insights into future cash flow and tax liability, enabling business owners to make informed decisions quickly and accurately. Additionally, users can access all their financial information from any device at any time, making QuickBooks Self-Employed the ideal choice for those who need to manage their businesses efficiently while constantly on the move.

Key Features or Benefits of QuickBooks Self-Employed

- Bank Connectivity : QuickBooks Self-Employed allows users to connect their bank accounts directly to the software, so they can quickly and easily manage their financial transactions in one place.

- Mileage Tracking : Users can track their mileage for tax purposes with just a few clicks using this feature. They can also categorize trips as business or personal for better tracking accuracy.

- Automated Tax Calculations : QuickBooks Self Employed includes tax calculations so that users can see how much they owe in taxes at any given time throughout the year. This helps them stay organized and compliant with the IRS at all times.

- Invoicing : Users can easily create professional invoices on the go from their phone or laptop using this feature, then send them out directly from QuickBooks Self Employed via email or text message in just a few minutes.

- Financial Reporting : With the reporting feature, users can easily generate reports on their income and expenses over any period of time.

How to Get Started With QuickBooks Self-Employed

- Start by setting up your QuickBooks Self-Employed account . You can do this by visiting the QuickBooks website “ https://quickbooks.intuit.com/self-employed/ ” and signing up for a new account.

- Once your account is set up, connect your bank accounts and credit cards to QuickBooks Self-Employed . This will allow the software to automatically import your financial transactions.

- Categorize your expenses and income: QuickBooks Self Employed offers pre-set categories, but you can also create your own custom categories. Make sure to accurately categorize your transactions for accurate reporting and tax purposes.

- Use the invoicing feature to create and send professional invoices to your clients: You can customize the invoice template with your logo and branding, and easily track when payments are due.

- Track your mileage using QuickBooks Self Employed mileage tracking feature: This is especially useful for self-employed individuals who need to deduct their business mileage for tax purposes.

- Generate reports and analyze your business’s financial health: QuickBooks Self Employed offers a variety of reports, including profit and loss statements, expense reports, and tax reports.

- Utilize the tax features in QuickBooks Self-Employed: The software can help you estimate your quarterly tax payments and track your deductible expenses, making tax time a breeze.

- QuickBooks Self-Employed mobile app: QuickBooks Self Employed has a desktop version as well as mobile application (app) that allows you to manage your finances on the go.

- Integrating QuickBooks Self-Employed with other tools and software you use: QuickBooks Self Employed offers integrations with popular platforms like Shopify, PayPal, and Square , allowing you to streamline your business processes.

Advantages and Disadvantages of QuickBooks Self Employed

Quickbooks self employed vs online.

QuickBooks Self-Employed is designed for freelancers and independent contractors, while QuickBooks Online is a comprehensive accounting solution for small businesses.

Gain Access to Manage Your Finances and Hassle-free Tax Filing

QuickBooks Self Employed Vs Simple Start

QuickBooks Self-Employed is tailored for freelancers and self-employed individuals seeking simple expense tracking, invoicing, and tax preparation tools.

On the other hand, QuickBooks Simple Start is suitable for small businesses requiring more advanced features, including comprehensive expense management, invoicing, tax reporting, and scalability as the business expands.

Take control of your finances today with QuickBooks Self-Employed

Top 7 Alternatives for QuickBooks Self Employed

Self-employed individuals and freelancers seeking an alternative to QuickBooks Self-Employed have a variety of alternatives available. Some popular choices include

- FreshBooks : Designed with the needs of freelancers and small business owners in mind, FreshBooks is an accounting software that offers features such as invoicing, expense tracking, time tracking, and basic financial reporting.

- Wave : A free accounting software, Wave provides essential features like invoicing, expense tracking, and basic accounting functions. It is particularly suitable for small businesses and freelancers who need a simple yet cost-effective solution.

- Zoho Books : Zoho Books offers a comprehensive suite of tools, including invoicing, expense tracking, time tracking, and basic accounting features. It seamlessly integrates with other Zoho business software products.

- HoneyBook : Creative freelancers and service-based businesses use HoneyBook, which offers tools for client communication, project management, invoicing, and payment processing.

- AND.CO : Freelancers and small businesses rely on AND.CO for its invoicing, expense tracking, time tracking, and contract management capabilities. It is renowned for its streamlined interface and user-friendly nature.

- Sage Business Cloud Accounting : Freelancers and small businesses can access invoicing, expense tracking, and basic accounting features through Sage Business Cloud Accounting, previously known as Sage One.

- Bonsai : Freelancers benefit from Bonsai, a platform that provides tools for contracts, proposals, invoicing, time tracking, and expense management.

Also Read: Complete Guide to Sage Accounting Software

QuickBooks Self Employed Accounting Software Review 2024

Before you finally decide which software to use for your accounting purposes, see the reviews provided by various trusted websites:

Reviews by TrustRadius

Reviews by Software Advice

Steps to Migrate and Upgrade from QuickBooks Self-employed to QuickBooks Online

Step 1: save your financial reports.

Download all your work from QuickBooks Self-Employed so you have an extra copy for safekeeping.

- Go to Reports .

- From the Tax Details section, select a tax year.

- Select Download .

- Download a report for each year you have in QuickBooks.

- Repeat these steps for your Profit and Loss, Mileage Log, and Receipts.

Step 2: Copy your data to QuickBooks Online

If you copy your data to QuickBooks Online, there’s no way to return to QuickBooks Self-Employed. If you still want to copy it, follow these steps on a computer.

- Go to Settings , then from the Profile column, select Upgrade .

- Select Choose a plan on the one that you prefer.

- Review the changes in features, then select Sounds Good .

Note: If you choose to bring your data, follow the steps to categorize open transactions and mark the paid invoices.

- Review the summary of data that you’ll move to QuickBooks Online.

- Select Continue , then To QuickBooks Online!

- Double-check your payment method, then select Change plan . If you need to change your payment method, select Edit .

- Answer or confirm a few details about your business to start using QuickBooks Online.

QuickBooks Self-Employed is a dependable partner throughout your journey as a self-employed individual. It not only provides efficient financial management but also brings peace of mind.

When venturing into the world of entrepreneurship, it is wise to embrace QuickBooks Self-Employed as your trusted ally in streamlining and enriching your self-employment experience.

Frequently Asked Questions

Can i have more than one business on quickbooks self-employed.

No, One QuickBooks Self-Employed/QuickBooks Online account is for one company file. You must sign up for a new QBSE account with another email address to proceed.

How does QuickBooks Self Employed differ from other QuickBooks versions?

QuickBooks Self-Employed is specifically designed for individual use and can only be accessed by one user. On the other hand, QuickBooks allows for multiple users, which makes it more suitable for small businesses that operate as a team.

Can I add my Bookkeeper, Accountant, or tax professional?

Certainly! It is possible to extend a complimentary invitation to an accountant for collaboration. Upon accepting the invitation, they will have the ability to work on your account. You retain the option to revoke their access at any given time.

How much does QuickBooks for self-employed cost?

QuickBooks for Self-Employed has three pricing plans:

- Basic Self-Employed: $15 per month

- Self-Employed Tax Bundle: $25 per month

- Self-Employed Live Tax Bundle: $35 per month

Know the author

Mark Calatrava

Mark Calatrava is an experienced content writer with a passion for delivering informative and engaging content. With an impressive 9+ years of experience in the field, Mark has honed his skills in various writing styles and formats. As a certified QuickBooks ProAdvisor, Mark has an extensive understanding of the QuickBooks platform, where he possesses in-depth knowledge and a deep understanding of the software. Mark Calatrava Linkedin , Mark Calatrava Facebook

Similar Articles

What is QuickBooks Retail Management How Its Benefits for Business

Fishbowl Inventory Management Software: Types, Features, Pricing and More

Managed IT Services Providers Benefits, How It Works and Why You Need It

Popular posts.

What are the Top 10 Emerging Cybersecurity Challenges?

How to Solve QuickBooks Multi-User Mode Not Working

Accounting Trends: Predicting Business Future in 2024

Top 10 Technology Trends Transforming Data Centers 2024

Which QuickBooks Edition Is Best For

Newsletter subscription, our headquarters.

Sagenext Infotech LLC 3540 Wheeler RD STE 109 Wheeler Executive Center Augusta GA 30909 (USA)

Join Our Newsletter

Partner With Us

- Sage 100 Hosting

- Sage 300 Hosting

- Sage 500 Hosting

Tax & Accounting

- Drake Hosting

- UltraTax Hosting

- Data Security

- User Acceptance Policy

- Privacy Policy

- Cookie Policy

- Data Centers

- Service Level Agreement

Get to know us

- HIPAA Compliance

- Vision and mission

- Sagenext Infotech vs Group Sage

Copyright © 2023 Sagenext Infotech LLC. All Rights Reserved.

Home > Finance > Accounting

QuickBooks Self-Employed vs. QuickBooks Small Business 2023

Data as of 12/12/22. Offers and availability may vary by location and are subject to change.

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

The bottom line: In spite of their names, QuickBooks Online is actually best for most business owners, including self-employed freelancers. QuickBooks Self-Employed is too bare-bones for all but the smallest of businesses, but it can work well for tax-conscious freelancers who rely on end-of-year deductions.

QuickBooks Self-Employed is Intuit’s accounting solution for freelancers, while QuickBooks Online is Intuit’s more fully featured small-business accounting software. QuickBooks Self-Employed could work for freelancers who want a stellar interface and easy integration with Intuit’s tax software, TurboTax. Meanwhile, QuickBooks Online’s high-value accounting features, third-party integrations, and additional users set it apart.

- Top feature comparison

- QuickBooks' strengths and weaknesses

- Best for basics : QuickBooks Self-Employed

- Best features : QuickBooks Online

- Best value for price : QuickBooks Online

- Best third-party integration : QuickBooks Online

The takeaway

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

QuickBooks Self-Employed vs. QuickBooks Simple Start for small businesses

Overall intuit quickbooks strengths and weaknesses.

Before deep-diving into how QuickBooks Self-Employed differs from QuickBooks Online for small businesses, let’s talk about what we like and don’t like about QuickBooks' online products in general.

Shared QuickBooks strengths

All QuickBooks accounting products (with the exception of some QuickBooks Desktop plans) have incredible mobile accounting apps that are user-friendly and straightforward for on-the-go freelancers and employers alike.

Second, QuickBooks’ cloud-based accounting solution is ridiculously easy to use and was made for small-business owners first . While FreshBooks and Xero rival QuickBooks’ ease of use, QuickBooks’ sleek interface and user-first approach keep it ahead of the curve (at least for now).

Shared QuickBooks weaknesses

As is typical of Intuit products, both QuickBooks Self-Employed and QuickBooks Online have higher starting prices than most other freelance and small-business accounting plans on the market.

If you want to collaborate or add users to a growing business, QuickBooks’ small-business user limit maxes out at 25. A product like Xero, which has unlimited users, or FreshBooks , which lets you add users as your business grows for a monthly fee, might work better for you than a QuickBooks product.

By signing up I agree to the Terms of Use and Privacy Policy .

Best basic bookkeeping features: QuickBooks Self-Employed

If you’re a freelancer who works just a few small jobs a month, QuickBooks Online for small businesses might be too complex for your needs. In that case, you’ll want QuickBooks Self-Employed, which sticks to bookkeeping basics:

- Business expense tracking

- Receipt scanning and organization

- Basic annual reports (like profit and loss statements )

- Automatic mileage tracking

- Quarterly tax estimation

- Basic invoice creation

- Basic payment acceptance (via invoice)

These features can help you track basic income, get paid on time, and make the most of your end-of-year tax deductions . They’re also ideal for helping you separate business expenses from personal expenses—which is a crucial financial step for every small-business owner, including freelancers working just a few jobs a year.

What they can’t do is help you grow your business. You can’t track your cash flow at less than an annual level, turn estimates into invoices, or look at big-picture financial reports to trim losses and up profits—and for many freelancers, that’s perfectly fine.

If you want basic help tracking your side gig’s income separately from your personal finances, QuickBooks Self-Employed fits the bill. But if you want to eventually grow your business from a smaller venture into a larger company, potentially one with partners and employees, QuickBooks Online Simple Start will work better.

At $15 a month, QuickBooks Self-Employed is at the higher end of freelance accounting software. Most of QuickBooks’ main competitors charge less: Zoho Books is free for businesses with less than $50K in annual revenue, Xero starts at $12 a month, and Wave Accounting is completely free. (Like QuickBooks Self-Employed, FreshBooks also starts at $15 a month, but its invoicing is notably better than QuickBooks Self-Employed.)

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike.

- Track time and expenses

- Create custom invoices

- Accept online payments

Best accounting features for growing businesses: QuickBooks Online

Whether you’re a freelancer hoping to expand your client base or small-business owner with employees, QuickBooks Online for small businesses has more of the tools you need to actively grow your business.

For ten dollars more than QuickBooks Self-Employed, QuickBooks Simple Start (the most basic QuickBooks small business plan) does everything QuickBooks Self-Employed does, and then some:

- In-depth cash flow tracking, including cash flow forecasting

- Customized estimates with mobile signature acceptance and invoice conversion

- Automatic sales tax calculation and tracking

- End-of-year 1099 tax form preparation

- Integration with ecommerce tools like Shopify

Pay particular attention to QuickBooks Simple Start’s ecommerce integration. If you sell physical products, you can’t use QuickBooks Self-Employed —at least, not if you want to integrate your bookkeeping software with your sales apps. (The lack of ecommerce integration helps explain why QuickBooks Self-Employed lacks a sales tax tracking feature, but it’s still annoying.)

Bookkeeping usually refers to the process of keeping your financial records in order, while accounting refers to using that financial information to make informed business decisions. Software like QuickBooks Self-Employed can help you keep accurate financial records , but it doesn’t offer many analytic tools. In contrast, QuickBooks for small businesses includes bookkeeping and accounting features, like profit and loss tracking and management.

Pricier QuickBooks Online plans add even more analytics and more thorough accounting and bookkeeping features:

- Additional users (up to 25 with QuickBooks Online Advanced)

- Bill management, including scheduled payments and fee-free online bill pay

- Time, project, and inventory tracking

- Batched recurring invoices and bill payments

These more extensive accounting tools are best suited to growing businesses with plenty of bills to manage and projects to track. And since QuickBooks’ small business plans allow for multiple users, they also work best for businesses in which multiple people have eyes on the books, like multi-partner LLCs or large corporations with a full accounting department. (Both QuickBooks Simple Start and QuickBooks Self-Employed allow for only one user.)

Sole proprietors, on the other hand, should do well with either QuickBooks Online Simple Start or QuickBooks Self-Employed. QuickBooks Online still includes quarterly estimated taxes and tax deduction optimization—its plans just offer more accounting help alongside the basic QuickBooks Self-Employed features.

Best value for price: QuickBooks Online

QuickBooks Self-Employed is cheaper than QuickBooks Online—so shouldn’t it have the best value for the price? You’d think so, but frankly, QuickBooks Self-Employed doesn’t have enough features to justify its high cost. And that’s just talking about the basic Self-Employed plan, not the higher-priced tax bundles, which—for most businesses, anyway—aren’t worth the price.

QuickBooks Self-Employed plans and pricing 2023

Unless you’re already planning to use TurboTax to file during tax season , we don’t recommend either of the QuickBooks Self-Employed tax bundles. The extra tax features aren’t worth an entire $25 a month—especially when you don’t get any extra accounting and bookkeeping features along with the increased price. If you want more features at a cheaper price, we recommend Wave (which is free) or Xero (which is $12 a month).

To learn more about filing your self-employment taxes, read this article .

QuickBooks Online has one of the higher starting prices of most popular accounting tools. In fairness, though, it also has more (and better) features than a lot of top competitors.

For instance, with QuickBooks’ built-in time tracking, project tracking, and inventory management, you don’t have to pay extra for a third-party solution (unless you want to). Unlike Xero , QuickBooks includes business expense management with every plan QuickBooks Self-Employed is cheaper than QuickBooks Online—so shouldn’t it have the best value for the price? You’d think so, but frankly, QuickBooks Self-Employed doesn’t have enough features to justify its high cost. And that’s just talking about the basic Self-Employed plan, not the higher-priced tax bundles, which—for most businesses, anyway—aren’t worth the price.

And while it’s frustrating that QuickBooks limits user numbers by plan, we like that the user pricing is built into the overall cost. (In contrast, each FreshBooks plan has unlimited users—but you’ll pay an extra $10 a month for each one, which quickly inflates the overall price.)

QuickBooks Online plans and pricing 2023

Data as of 11/9/22. Offers and availability may vary by location and are subject to change.

Best third-party integration: QuickBooks Online

Since QuickBooks Online and QuickBooks Desktop are two of the most popular accounting software in the world, they integrate with just about any third-party app you can think of. Along with other QuickBooks and Intuit programs like TurboTax and QuickBooks Payroll, they sync with dozens of third-party apps for inventory management , time tracking, project management, payroll —and virtually anything else you can think of.

In contrast, QuickBooks Self-Employed doesn’t sync with much beyond TurboTax. Most importantly, it doesn’t sync with popular payment acceptance and ecommerce apps, including Square and Shopify . So if you sell a service (like landscaping or editing), you can use QuickBooks Self-Employed. But if you sell on Amazon, Etsy, or eBay, you’ll likely get more out of an accounting solution that syncs with ecommerce apps .

Even though QuickBooks Self-Employed is geared towards freelancers, we still recommend QuickBooks Online over Self-Employed for most freelancers, contractors, sole proprietors, and other small-business owners. It has more accounting features that help you track your profit and loss, find new ways to grow your business, and collaborate with extra users.

However, if you’re looking for a streamlined bookkeeping solution with excellent quarterly tax estimation features and mileage tracking, QuickBooks Self-Employed is a good option. It’s not the cheapest freelance software out there, but its user-friendly interface and exceptional mobile app help justify its above-average price.

Not interested in either QuickBooks product? Read through our list of QuickBooks alternatives , most of which have a cheaper starting price and can work for freelancers and midsize business owners alike.

Related content

- Accounting 101: A Guide for Small-Business Owners

- What Are Generally Accepted Accounting Principles?

- Check Out Business Owners’ Top QuickBooks Tips, Tricks, and Integrations

- 7 Reasons Business Owners Prefer QuickBooks Payroll

QuickBooks Self-Employed vs. QuickBooks Online FAQ

QuickBooks Small Business is a general term for the QuickBooks’ small business plans: QuickBooks Simple Start, Essentials, Plus, and Advanced. All four QuickBooks Online plans cater to small businesses, from sole proprietorships to large corporations. You can use QuickBooks Online to manage bill payments, send invoices, manage 1099 contractors, and much more depending on the plan you choose.

In contrast, QuickBooks Self-Employed is focused on basic bookkeeping for freelancers and others who file their taxes as sole proprietors. Since it was built for people who attach Schedule C forms to their income tax forms, its quarterly tax estimation, mileage tracking, and built-in tax optimization are incredibly thorough. QuickBooks Self-Employed also gives you basic financial tracking tools, such as simple income tracking and end-of-year profit and loss assessments.

No. QuickBooks Online has four plans for small businesses. QuickBooks Self-Employed is a separate, standalone bookkeeping solution for freelancers. Our in-depth reviews of each product can give you a more thorough look at QuickBooks Self-Employed vs. Simple Start .

Can I use QuickBooks Self-Employed for an LLC?

If you file a Schedule C form as part of your end-of-year taxes, you can likely use QuickBooks Self-Employed. Typically, that includes sole proprietors and single-member LLCs.

Other types of business owners—including multi-member LLCs, partnerships, S Corps, and C Corps—should not use QuickBooks Self-Employed to track finances or file taxes. Additionally, you shouldn’t use QuickBooks Self-Employed if you have employees (even just one). These types of businesses should all use QuickBooks Online or QuickBooks Desktop Premier, not QuickBooks Self-Employed.

Is QuickBooks Self-Employed worth it, or do I need QuickBooks for small businesses?

QuickBooks Self-Employed is more expensive than some other self-employed accounting options, but it might be worth it for freelancers who rely heavily on tax deductions (a.k.a. tax write-offs) to save money at the end of the year. Its quarterly tax estimation is helpful and accurate, as is its app-based mileage tracking. Its basic invoices and receipt-scanning features help you charge clients and keep your finances in order.

However, if you want features other than basic reports, bookkeeping, and tax assistance, we recommend QuickBooks Online or another accounting software program. QuickBooks Self-Employed has a higher starting price than many other freelance and contractor bookkeeping options, and it doesn’t have as many features as cheaper accounting companies like Wave Accounting .

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

We review products independently , but we may earn affiliate commissions from buying links on this page. Terms of use .

Intuit QuickBooks Self-Employed

Powerful pricey tools for freelancers and independent contractors.

Bottom Line

- Exceptional user interface and navigation

- Easily tracks expenses and income

- Automatic mileage tracking

- Can assign business transactions to Schedule C categories

- Estimates quarterly income taxes

- New time tracking tools

- Can assign tags to transactions

- Good support resources

- No contact or product records, advanced time tracking, project tracking, or recurring transactions

- Invoices not customizable or thorough

- No templates for estimates or quotes

- Manual sales tax management

- Mobile apps not updated with new features

Intuit QuickBooks Self-Employed is a simple small business accounting tool that offers an exceptional user experience. Designed for freelancers, independent contractors, and sole proprietors, the software connects to your financial accounts and imports transactions, tracks mileage, creates and sends invoices, and estimates quarterly taxes. New features since our last review include a specialized setup tool (Tax Timeline), simple time tracking, and tags. However, despite these strengths, the site isn't as capable as other accounting websites aimed at similar markets. Our Editors' Choice pick for smaller-scale accounting is FreshBooks, which costs less and offers a more robust set of features.

How Much Does QuickBooks Self-Employed Cost?

Intuit QuickBooks Self-Employed costs $15 per month. The current promotion prices it at $7.50 per month for three months (plus the free trial), but $15 per month is more than FreshBooks charges for its first-tier service ($13.50 per month). Wave and Sunrise are free, and GoDaddy Bookkeeping starts at $4.99 per month. That makes Intuit QuickBooks Self-Employed one of the most expensive services in this group.

Intuit is also the developer and publisher of TurboTax , so it offers two bundled deals with that service. For $25 per month ($12 per month for the first three months), you get the Self-Employed Tax Bundle. Because Intuit QuickBooks Self-Employed and TurboTax Self-Employed are integrated, you can transfer your income and expense data directly into TurboTax Self-Employed and pay your estimated taxes online. The package includes one free federal and one free state return filing. Self-Employed Live Tax Bundle ($35 per month; $17 per month for the first three months) adds unlimited help and advice from a CPA year-round and a final review of your return from that professional.

Intuit QuickBooks Self-Employed doesn't offer true double-entry accounting like Wave and FreshBooks do, but that's not as important to many workers in the gig economy as it is to larger companies who might share their bookkeeping tasks with an accountant. In addition, the site's excellent companion apps could serve many of today's mobile entrepreneurs—who tend to live on their phones—well. Like other Intuit financial applications, Intuit QuickBooks Self-Employed uses an easily understandable navigation system and offers an exceptional user experience. It's almost fun to use. The interface is consistent across desktop and mobile platforms too, so it's an attractive choice if you want this kind of interoperability.

Getting Started With QuickBooks Self-Employed

QuickBooks Self-Employed has changed its setup process since I last reviewed it. The site opens to your Dashboard, with a new tool displayed at the top: the Tax Timeline. This will appear whether or not you signed up for the Self-Employed Tax Bundle, and it’s optional. The Timeline walks you through a series of setup steps that prepare you for sending your data to TurboTax. Even if you’re not planning to do so, it’s a good setup tool. It asks for basic information about your company, then about your tax situation (like dependents and withholding), your vehicle, your home office, and your healthcare. Next, you enter login credentials for your online bank accounts so the site can import transactions. Finally, it helps you categorize your expenses and track your business miles driven so you take every deduction possible.

The Tax Timeline really serves as QuickBooks Self-Employed’s setup tool, since when you close it, the site’s Dashboard appears with no further setup instructions. It’s a good idea to go through the steps and stop when you hit the TurboTax import step. If you don’t, you can click the gear icon in the upper right to find the links to those steps

This first step can take some time if your finances are very active, since you are encouraged to categorize all of your transactions, but it's time well-spent. Once you go through the process with data from the previous 90 days (or more), you'll not only be caught up, but you'll get meaningful feedback when you head to the Dashboard and look at the charts. Intuit QuickBooks Self-Employed didn’t guess at the categorization for hardly any of my transactions, as some sites do, but it asked me a question about one and offered to create a rule that would automatically categorize transactions from that vendor the same way.

Popular Pages

Intuit QuickBooks Self-Employed's Dashboard showcases the data it tracks with proficiency. It displays six graphs that provide an overview of your most important numbers: Profit and Loss, Expenses, Accounts, Invoices, Mileage, and Estimated Tax. Click on any active area of the graph to drill down to original recordkeeping. Links to outstanding tasks and the most frequent transactions to review appear above these charts.

A vertical toolbar to the left contains navigation links to Home, Transactions, Miles, Taxes, Reports, Invoices, Time (new; technically in beta), and Capital. Clicking the gear icon in the upper right opens the site's settings, and a help link sits to the right of it. To the left of these, the site displays the amount in estimated tax you owe as of the current time (this number, of course, changes as more transactions come in and are categorized).

Intuit QuickBooks Self-Employed is simple and intuitive enough that you're unlikely to need assistance. If you do, you can search for topics or start a conversation with the QB Assistant -- an interactive support tool that provides possible answers to your questions and helps you drill down if the question was too broad. If the QB assistant cannot answer your question, then you can get help via chat, email, a callback, or Intuit's online community of users.

The Transactions page is the heart of the Intuit QuickBooks Self-Employed experience. There's a chart at the top of this screen that displays your business income, spending, and profit for the past three months. Below that are filtering tools that allow you to see only a subset of your transactions (like business, personal, or unreviewed and uncategorized). You can also sort by account, date range, or tags (new). To the right of those filters is a search tool. The rest of the page consists of a register-type display of the transactions you've downloaded and entered manually.

Here's how it works: Let's say one of your downloaded transactions is a monthly subscription fee for a web service. The name of the vendor appears first, after the date. The amount appears in the next column. To the right of that are three buttons marked Business, Personal, and Split. Since it's a business expense charged by one vendor, you'd click Business. The Category column then displays the one guessed at by Intuit QuickBooks Self-Employed. If that is incorrect, you click it, and a box opens containing your most often used categories. If it's not there, you click Show all categories and select the correct one from that list.

A small link marked Add Rule appears once you select a category. Click it, and a small window opens, helping you to easily teach the site how to categorize similar transactions whenever they appear. You can even have the rule apply to past transactions, which is unusual in this class of applications. New since last year is the ability to create your own Tags and assign them to transactions. These allow you to set up filters like clients or projects, and group related transactions.

You can also attach a receipt from a file on your computer, add a note, or exclude transactions (if, for example, it’s a duplicate). Intuit QuickBooks Self-Employed uses OCR technology to extract the data from photos of receipts you've snapped on your smartphone. It then enters the relevant details in the correct fields on the site. Intuit has implemented this technology well, but it's not always 100 percent successful.

Mobile Miles, Mobile Apps

If you drive for work and can deduct the mileage, you can enter that specific expense by clicking the Miles link in the left vertical toolbar. You provide a few details about your vehicle(s), then about each trip. Each entry, of course, will need a date and purpose. You can enter start and end addresses and let Intuit QuickBooks Self-Employed calculate the miles or simply enter the miles driven yourself. If you've logged trips in either MileIQ or Google, the site can import that data. The site keeps a running tally of the business miles you’ve driven and calculates your mileage deduction for tax purposes.

If you’re using the Intuit QuickBooks Self-Employed mobile app, you can let it track your mileage automatically by turning on Location Services. FreshBooks is the only other accounting service I've reviewed that offers this, and it's a great tool for rideshare and meal-delivery drivers, as well as professionals who simply track business miles for client visits, for example.

Intuit QuickBooks Self-Employed's mobile app lacks little—if anything—found on the browser-based version. It's the best companion app I found in this group of accounting websites designed for freelancers. From invoices to mileage tracking to estimated taxes to reports to interactive help, the vast majority of features are here. Unfortunately, time tracking and tags have not yet been added to the apps. Like other Intuit applications, the user experience is exceptional. There's an Intuit QuickBooks Self-Employed app for both Android and iOS, so no matter which platform you're on, you can do your books on the go.

Both work similarly, though there are some minor differences in their navigation tools. The iOS version displays five icons along the bottom of the screen that open the Dashboard, Transactions, Mileage, Invoices, and Taxes sections. You access the app's settings and other housekeeping tasks from an icon in the upper-left corner. The Android version opens a menu with the same functions when you click a link in the lower-left corner of the screen. There are also some minor user interface and navigation differences once you get into the working screens themselves. Both apps, though, are quite attractive and intuitive.

Calculating Estimated Taxes

If you didn't set up your Tax Profile initially, click the gear icon, then Tax profile to do so. In this window, you provide some important personal details (marital status, dependents, and so on) so the service calculates your estimated taxes correctly.

Once you've been working with Intuit QuickBooks Self-Employed for a while, your categorization and data entry work begins to pay off, since the site uses the income and expenses you've entered to estimate the quarterly taxes you're required to pay as a self-employed individual. Click the Taxes navigation button to the left, then on Annual. Intuit QuickBooks Self-Employed displays your taxable business profit for the current tax year to date, breaking it down into income and Schedule C deductions. Below that is a more detailed breakdown of those deductions, divided into Business, Vehicle, Home office, and Healthcare sections. Click the Email tax details link, and you can download Excel spreadsheets containing both summary and detail views of your taxes.

When you click on Quarterly, you see your quarterly tax schedule for the current year, with figures for both recommended payments and what you have already paid. If you have used Intuit QuickBooks Self-Employed in previous years, then you can view your historical data on this same page. The site also projects your annual profit based on your actual income and deductions to date. And, you can click a link to fill in your 1040-ES payment voucher that you can submit with your payment.

Intuit QuickBooks Self-Employed provides four reports in addition to the comprehensive summary and detailed versions. One is an accounting of all the receipts you've entered. You can't simply view this report; you must download it. There’s also a mileage log and a profit and loss statement and, new since last year, a report showing income and expenses by tag. These six seem sufficient considering the scope of the site, though GoDaddy Bookkeeping offers more reports beyond taxes, as well as a Schedule C Worksheet.

Basic Invoices and Time Tracking

Intuit QuickBooks Self-Employed doesn't offer much invoicing functionality, but you can send very simple invoices to customers and receive their payments online. There are no customization options for the lone invoice format except for the addition of a logo. Invoice forms contain fields for the name, address, phone number, and email address of both your business and the customer. You can select the client from a drop-down list if you've already entered it on another invoice. GoDaddy Bookkeeping offers more robust templates and automation. There's no way to build product or service records, but the site remembers descriptions you've typed in on earlier invoices and displays them in a drop-down list.

Intuit QuickBooks Self-Employed also doesn't handle sales taxes. You can't prespecify a variety of tax rates, and there's no integration with a sales tax service such as Avalara. You have to manually calculate any sales taxes due and, worse, include them as line items. There’s also no report for your sales tax items. However, your payment processing service may add sales tax and report back to you on how much you’ve collected.

The site now allows you to do very simple time tracking . You can add a new client record or select one you’ve already created, then build a simple project. This is not a true project management solution. Intuit QuickBooks Self-Employed uses this term to describe services, and you can only provide a name, description, and hourly rate. Both the client and project fields are optional. Whether you’re simply tracking time for your own purposes or assigning it to a client and project, you can either start and stop a timer or enter your hours manually. Once you’ve saved a time entry, the site displays it and any others you create in a table below the time entry tool. You can view these by date, client, or project. You can’t yet convert time entries into invoices, but you can mark them as paid. Intuit QuickBooks Self-Employed has a ways to go before its time tracking abilities catch up to those found in FreshBooks.

A Simple, Pricey Service

Intuit QuickBooks Self-Employed lacks many of the features that competitors offer, like project management and robust time tracking, item and contact records, sales data exchanges with sites like eBay, and recurring transactions. Still, the service has carved out a niche for itself as an easy-to-use set of tools for a growing market: freelancers or independent contractors who work for themselves full-time or have side hustles. Those individuals need to watch their finances carefully and get assistance preparing for estimated taxes four times a year.

The service provides a user experience rivaled only by that of FreshBooks, and its automatic mileage tracking may appeal to frequent business travelers. Beyond that and the income tax help, though, there's really no compelling reason to go with Intuit QuickBooks Self-Employed. Many sole proprietors could get by with FreshBooks' $13.50-per-month level, which is less than Intuit QuickBooks Self-Employed's regular price. And FreshBooks does so much more in every possible area, including customizable invoicing, time tracking, and income/expense management. It's our Editors’ Choice winner for smaller-scale accounting this year.

One advantage of using an Intuit solution, though, is that you can upgrade to an application that's more sophisticated while staying in the same product family. The next step up from Intuit QuickBooks Self-Employed is Intuit QuickBooks Online , which is our Editors’ Choice winner for small business accounting again this year. It offers much more in every possible way, while maintaining the same exceptional user experience found in its more junior version.

While you're thinking about your money, you should also check out our stories on the best personal finance services and the best tax prep software .

More Inside PCMag.com

- Sage 50 Accounting

- Intuit QuickBooks Online

About Kathy Yakal