Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

11 Real Financial Analyst Resume Examples That Worked in 2024

Financial Analyst

Best for senior and mid-level candidates.

There’s plenty of room in our elegant resume template to add your professional experience while impressing recruiters with a sleek design.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

- Financial Analyst Resume

- Financial Analyst Resumes by Experience

- Financial Analyst Resumes by Role

Writing Your Financial Analyst Resume

Financial analysts have different duties and responsibilities based on seniority level and business sector, making it hard to decide what to include on your financial analyst resume when applying for that dream finance job.

You must also know how to format your resume , what information to include, and what projects to highlight to attract the attention of a hiring manager or recruiter.

We’ve meticulously researched and analyzed countless financial analyst resume samples from all career stages in different industries, resulting in the creation of 11 resume samples to set you on your way to building a professional resume and land more interviews in 2024 . Plus, our writing guide will give you plenty of resume tips so you hit the right note every time!

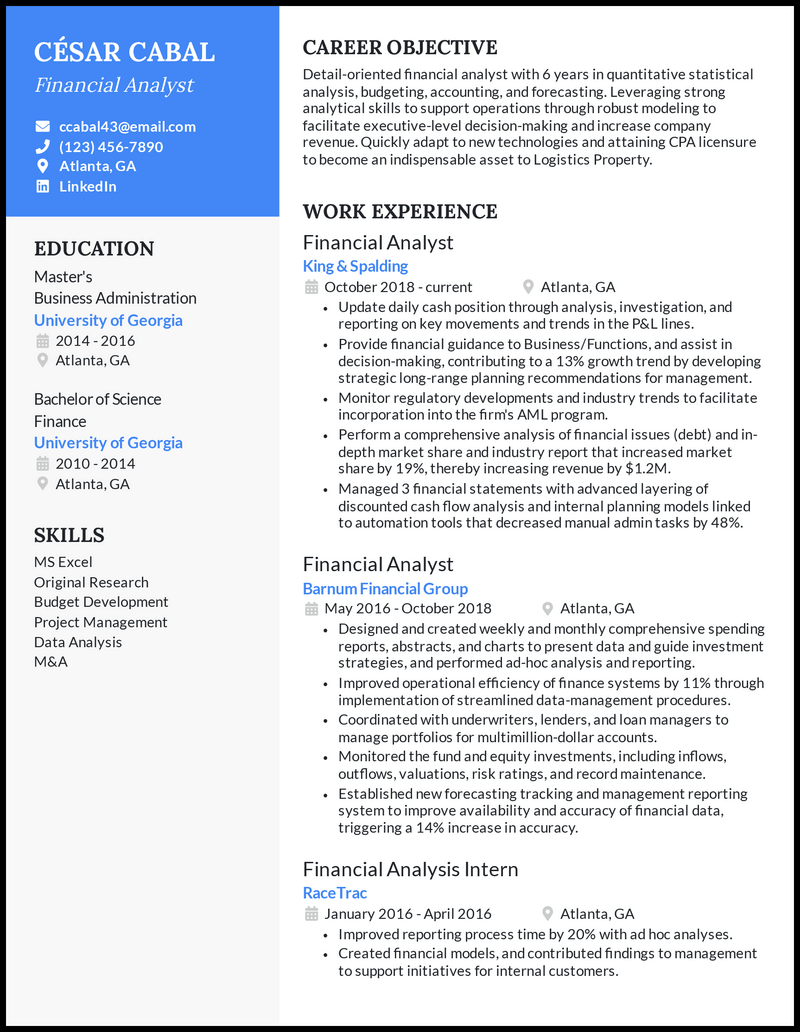

Financial Analyst Resume Example

or download as PDF

Why this resume works

- Run your resume through a resume checker to ensure you include enough stats and don’t have grammar or punctuation errors, but don’t forget to check it yourself!

- Don’t forget to include your projections and forecasts! Focus your financial analyst resume experience on how close your projections and forecasts were for the company and “how” those accurate projections and forecasts helped the business.

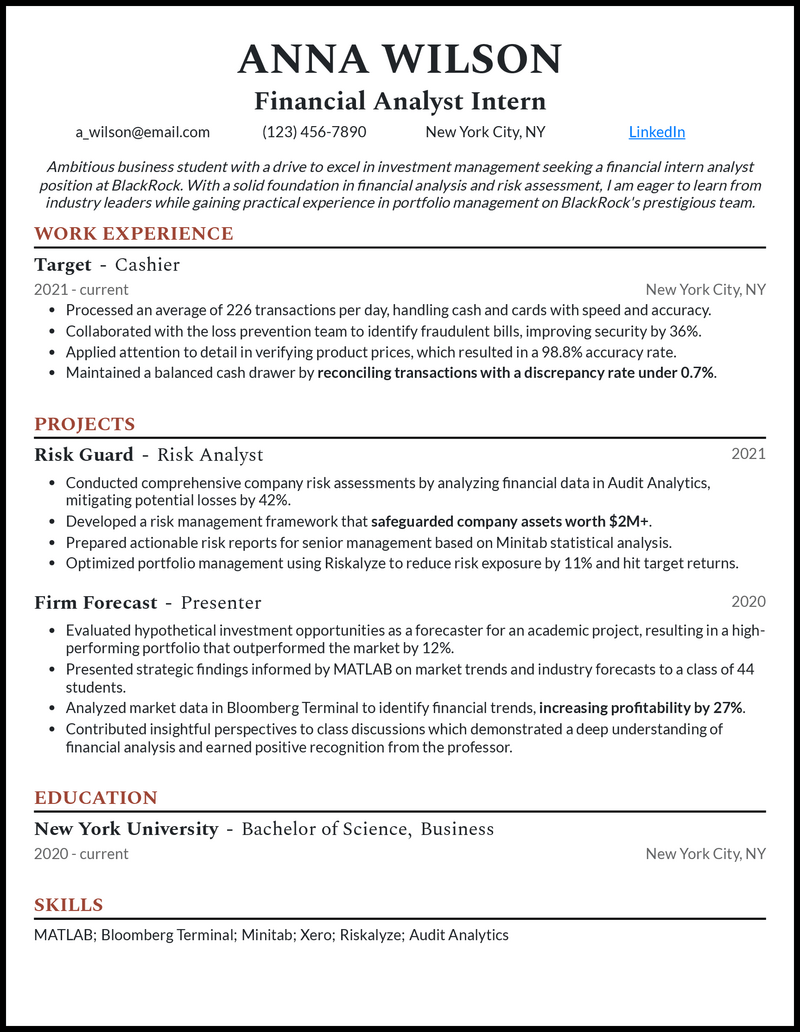

Financial Analyst Intern Resume

- Detail your academic projects in risk analysis and forecasting to demonstrate well-rounded experience on your financial analyst intern resume.

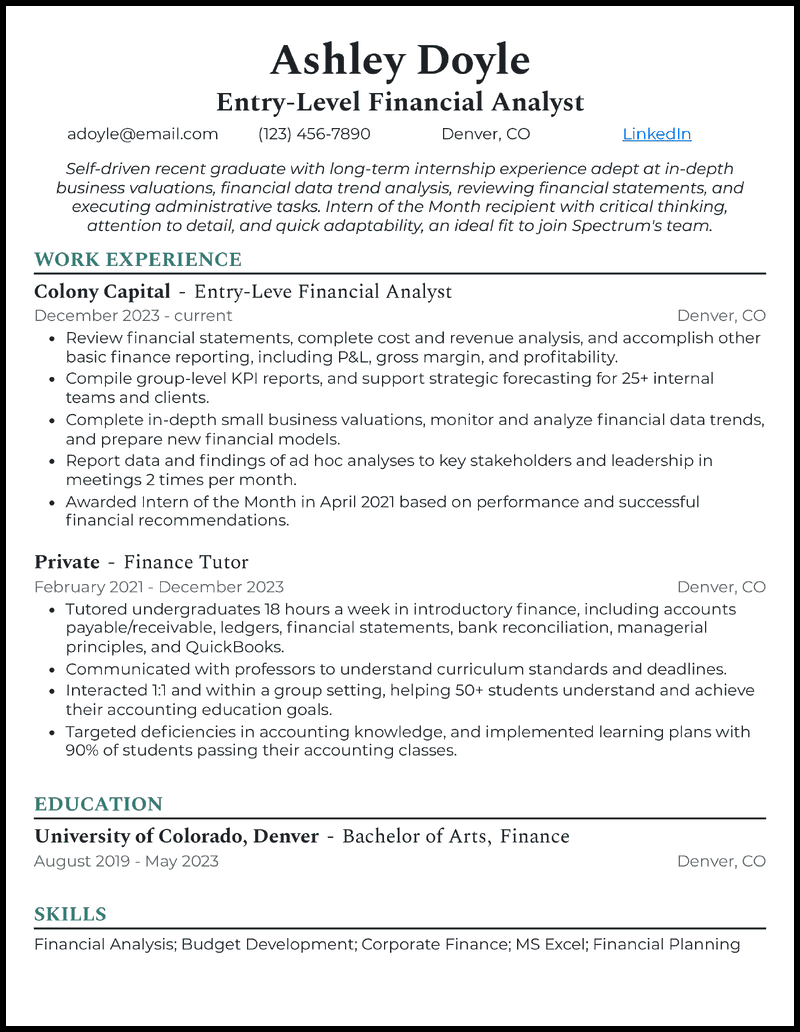

Entry-Level Financial Analyst Resume

- Even if you don’t have the technical skills required, skills like communication, data reporting, and scheduling show employers you’re organized, detail-oriented, and able to work together in a team.

- Be proud of your experience; hiring managers understand (and want to see) that we all started someplace.

- Always tailor this section to each job to which you apply. Include the name of the company, the job title you’re applying for, and skills mentioned in the job description.

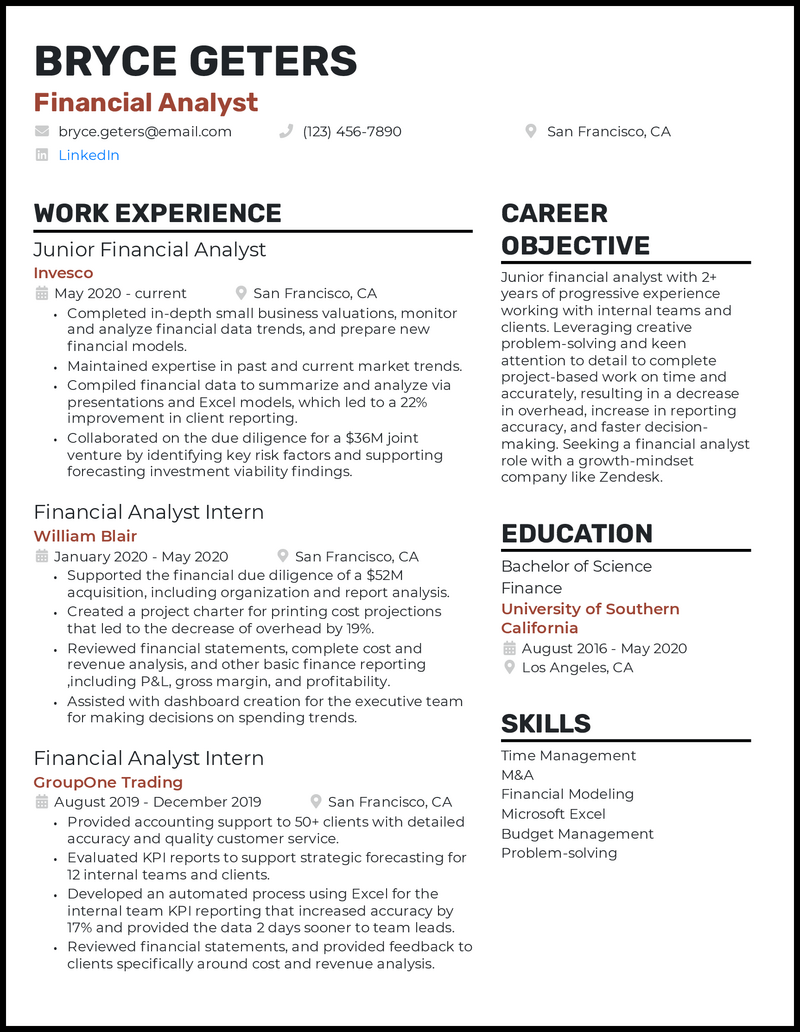

Junior Financial Analyst Resume

- Yes, yes, we know it’s tedious, but it’s vital. You don’t have to spend hours on it, either; simply do some research on the company and scan the financial analyst job description , then include relevant keywords on your junior financial analyst resume.

- Be sure to include the type of reports you created and the impact of your work (that’s where you can include metrics).

Senior Financial Analyst Resume

- Don’t be afraid to brag about your team’s size, your project’s budget, the number of projects you completed on time.

- And if you can, list how those projects have directly impacted the team, the company, and its clients.

- Skills like “financial modeling,” “budget management,” and “SQL,” are all fantastic additions to your resume!

Chartered Financial Analyst Resume

- Reiterate your professional value on your chartered financial analyst resume by going beyond your best investments and drawing attention to your track record with clients.

- Try employing story-telling techniques in your financial analyst cover letter to demonstrate your success with clients.

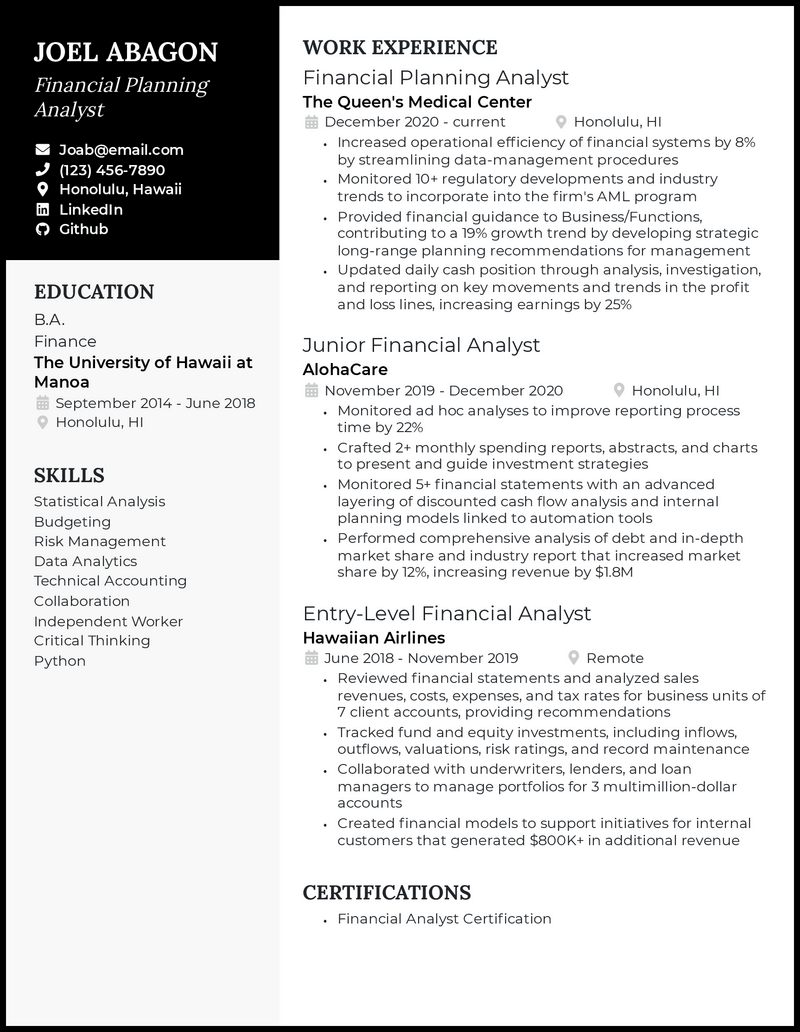

Financial Planning Analyst Resume Example

- It may be difficult to include specific bullet points for all your areas of aptitude, so pick and choose your skills based on the job description.

- This format lets hiring managers see your most recent (and probably most relevant) work experience first.

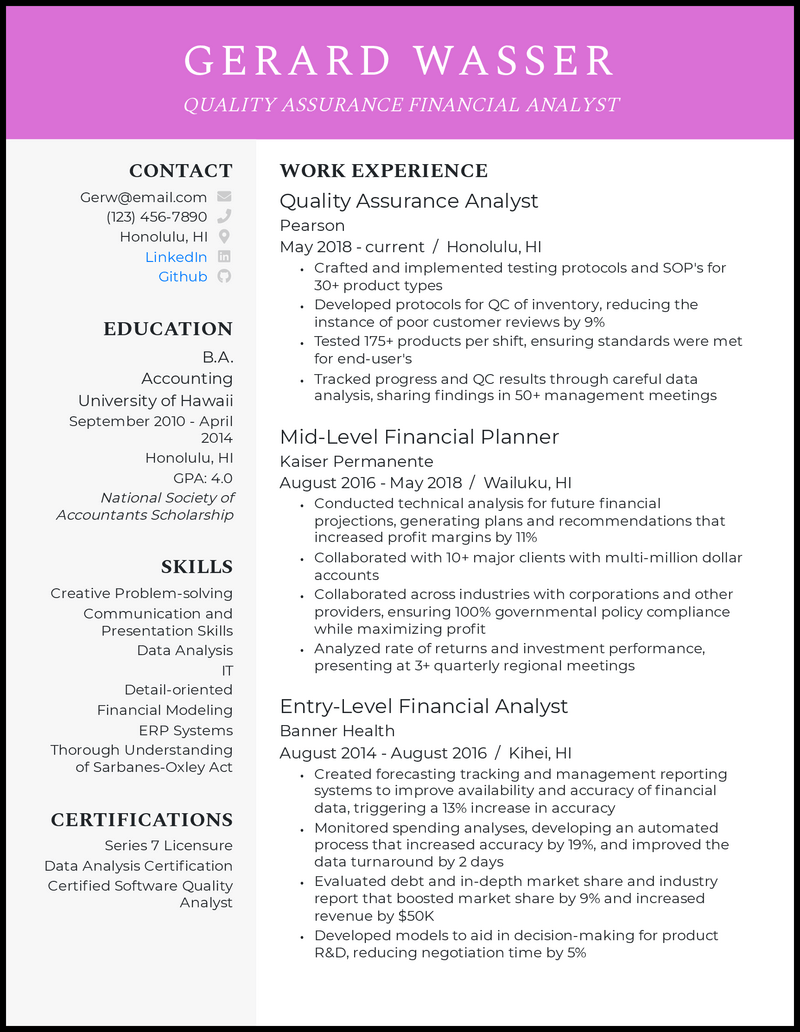

Quality Assurance Financial Analyst Resume

- If you don’t have certifications, you can add awards instead. If the certificate or award isn’t well known, you should add the organization that issues the certification.

- Each templates come with their own pros and cons, especially when it comes to length. Some formats allow for longer content while others focus more on other sections, so try out a couple to see what works.

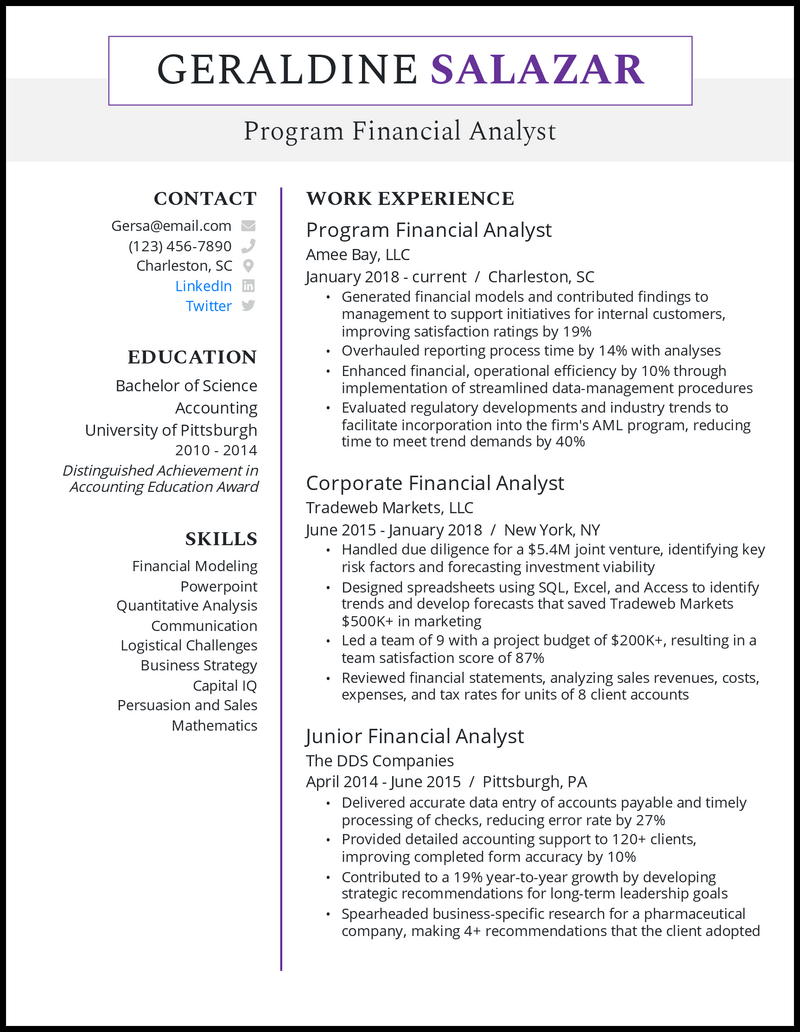

Program Financial Analyst Resume

- If you target your bullet points for each job to which you apply, hiring managers are more likely to give you an interview over a generalist resume.

- When it comes to tailoring, look at the financial analyst job description ; does it focus on data analysis, modeling, and presentations, or is there more emphasis on team leadership, ROI, and accounts payable?

- You can categorize your bullet points by necessary skills so when the job application focuses more on one skill over another, you’re ready!

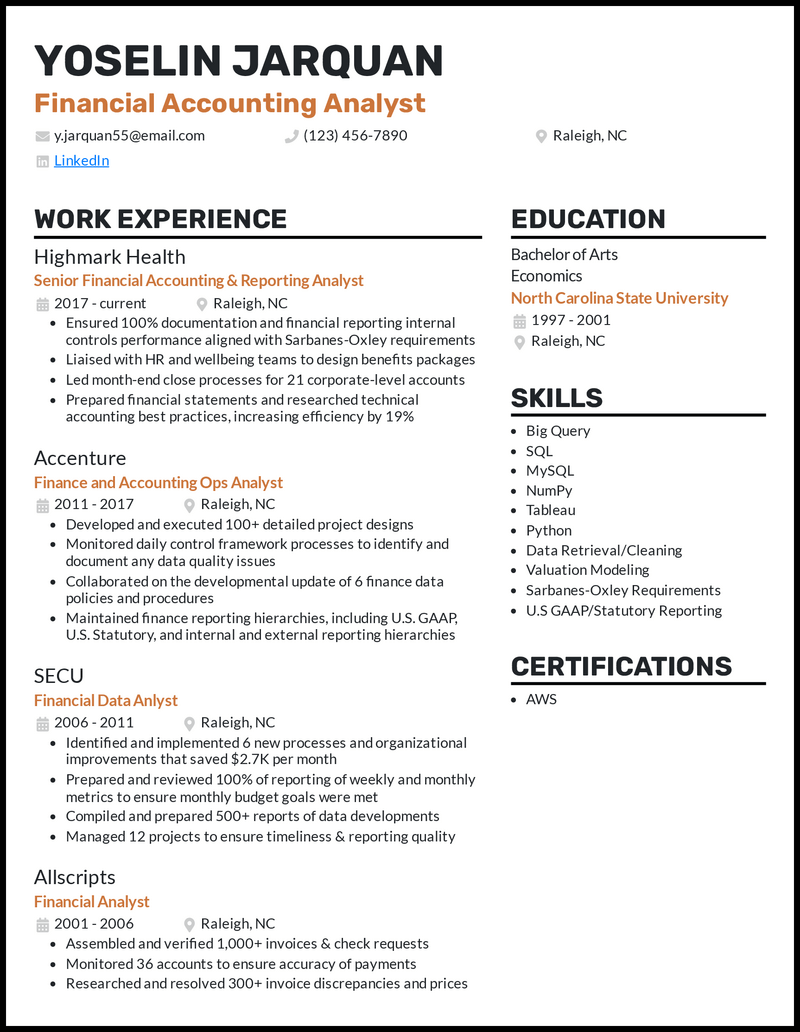

Financial Accounting Analyst Resume

- Since financial accounting analysts use their expertise to assess current situations and give financial advice, use clear metrics like project and initiative quantities, improvement percentages, and company savings.

- Even using a simple pop of color in some of your headers can make your resume more memorable (and easier to read, too).

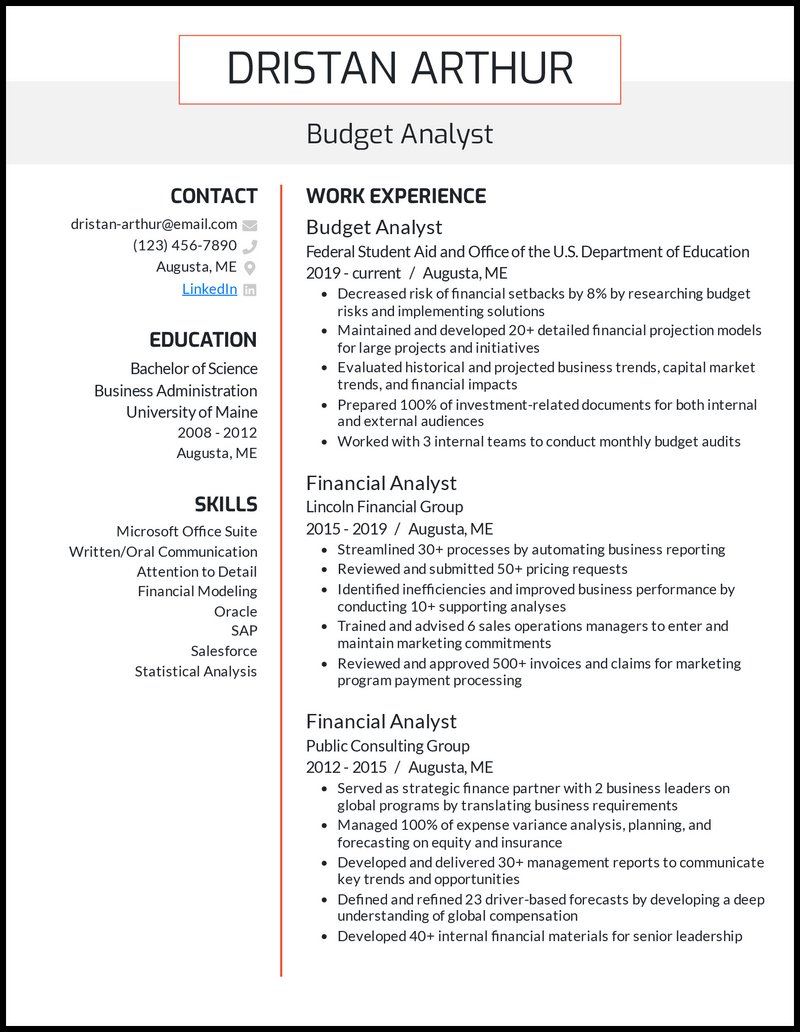

Budget Analyst Resume

- Limiting your work experience roles lets you include details like the number and type of projects that you handled like a champ.

- Don’t worry if you have too many jobs to list on your budget analyst resume . You only need to show three to four of your most relevant roles.

- When you provide quantifiable achievements in your experience section, think of which programs or skills you used and highlight those.

Related resume guides

- Investment Banking

You might be tempted to think that the only thing that matters on your resume is the content, but proper resume formatting is almost as important. Even if you have decades of impressive financial analyst experience, it’ll be hard for a hiring manager to look past poor formatting. A well-formatted resume will be readable for ATS and logical for hiring managers who only have a few moments in their day to look at your resume.

Let’s review some of the most important aspects of resume formatting, including:

- Resume formatting choices

How to include your contact information

Outwit the ats, resume format choices.

Each of the following formats performs a particular function, highlighting your work experience, skills, or both.

Three resume format favorites among successful job applicants in 2024.

- Reverse-chronological format: This format is exactly what you think: it orders your work experience starting from the most recent. This format will help hiring managers see your most relevant (and likely most impressive job title) first.

- Functional format: Unlike the reverse-chronological format, the functional formats place the most emphasis on skills. If you have employment gaps, you may want to consider this format, but be aware that hiring managers may be confused or wonder if you’re being forthcoming.

- Combination/hybrid format: This format weights work experience and skills equally by combining functional and reverse-chronological formats.

For financial analysts, we almost always recommend reverse-chronological formatting. Hiring managers love that it’s easy to read and skim, and you’ll love that it showcases your most senior position.

When a hiring manager wants to reach out for an interview, it’s important to make your name, phone number, and email easy for them to find. Ensure your contact information is highly visible by placing it at the very top of your financial analyst resume.

Use a large font for your name and a large (but slightly smaller) font for your job title. Both your name and your job title should be centered in the header.

If you want to try using color in your resume we suggest using the color as the backdrop for your contact information header. Professional colors for financial analysts include navy, amber, or dark green.

Below your header, you’ll need to include contact information, which should include:

- Phone number

- Your city and state (optional but recommended if it’s a local business)

- Professional links, such as LinkedIn (optional)

Like the example below, you can do a lot with your header to showcase your creativity while remaining professional.

If you’re applying to an online job posting, the chances are high that the hiring manager is using applicant tracking system software (ATS) to pre-filter applicants.

The ATS works by picking up on words used throughout your resume and matching them to keywords selected by recruiters (usually keywords in the financial analyst job description ). If you don’t have enough keyword matches, your resume may be thrown out before anyone can read it. That’s why your resume must be ATS-friendly.

Be careful to adhere to the following formatting guidelines:

- Margins: Use standard one inch margins, or at the very least half an inch, if needed to save space.

- Font type: Keep it basic by using Times New Roman, Arial, Cambria, or Garamond.

- Font sizes: The body of your resume should be a 12-14-point font, but you can make it slightly smaller (but only slightly) if needed. Your job title should be larger, around 20-point font, and your name should be about 24-point font.

- Header names: Use colors, bolding, or complementary fonts to help your subheaders stand out throughout your resume. Just make sure your font is readable.

- Skills: Customize your skills section for every job to which you apply. Carefully read the job descriptions to determine what keywords the recruiters will be scanning for while avoiding plagiarizing their job posting!

- Logical order: As we mentioned earlier, reverse-chronological order is the best for your financial analyst resume, and ATS operates under the assumption that your resume is formatted this way.

- Page count: Do everything you can (adjust font and margin, within reason) to fit the page perfectly. Your resume will look unprofessional and burdensome to read if it’s over a page. If your resume is a little short, recruiters will wonder if you’re inexperienced.

Formatting your resume isn’t easy at first, but once you’ve built your resume for the first time, all you need to do is minor tweaks for each job application.

Write your financial analyst resume

Writing your perfect financial analyst resume can be difficult especially with a job at stake. We know that writing an effective resume may feel overwhelming, but if you take it one section at a time, the process shouldn’t be too stressful.

Without further ado, let’s dig into the content of your financial analyst resume. Here’s what we’ll cover:

- Using a resume objective or summary statement

- Writing about your work history

- Key skills for financial analysts

- Education and optional sections

- Customizations

- Flawless editing

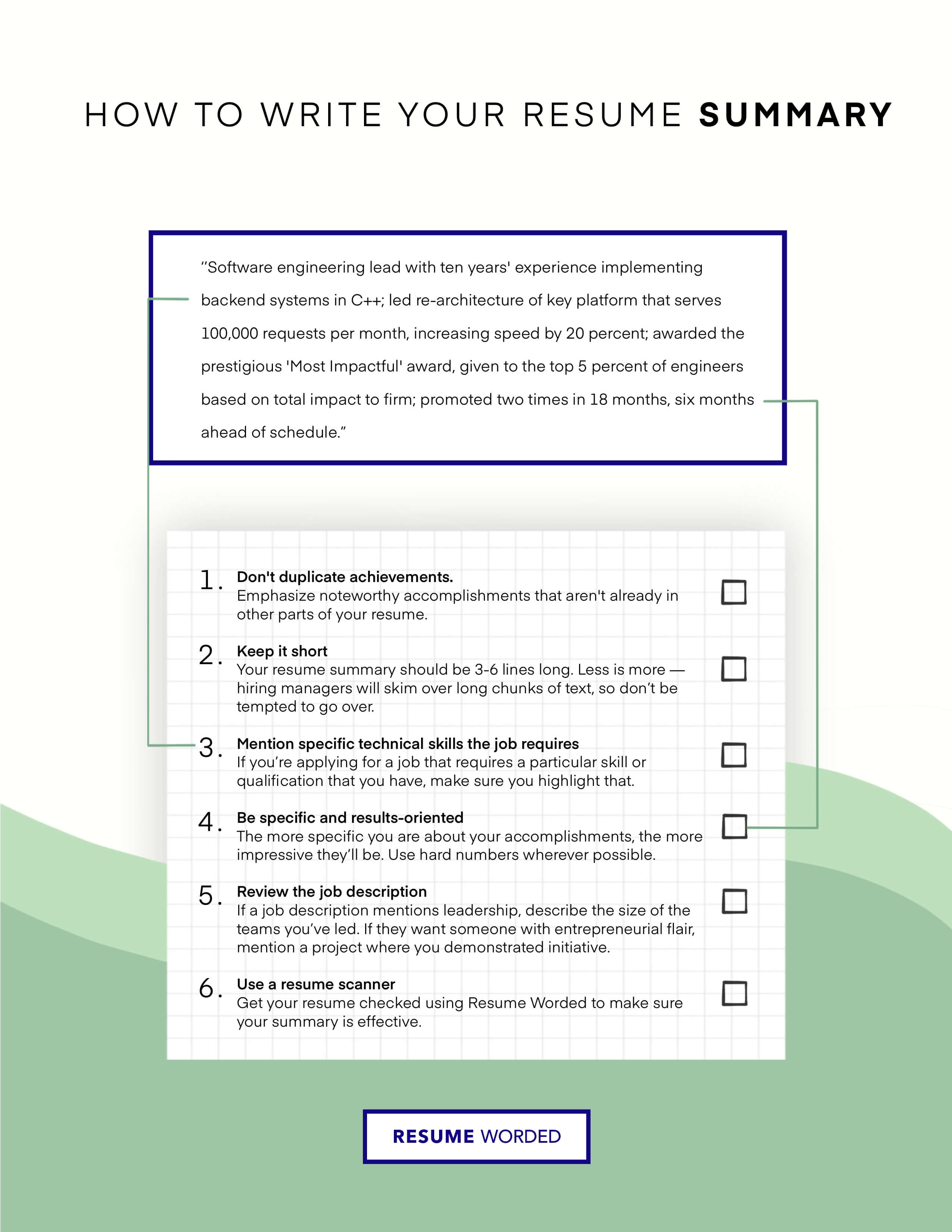

Understand the elusive objective/summary statement

Objectives and summaries are some of the most commonly misunderstood sections on a resume, but they can be useful. However, choosing between a resume objective or a resume summary is difficult because there are only a few circumstances in which you’ll use either one.

Both are highly job-specific, two to three-sentence paragraphs used near the top of your resume (often under your job title). An objective is for entry-level candidates or job seekers who have recently changed fields. An objective will tell hiring managers why you want the job.

On the other hand, a summary is for professionals with over 10 years of experience in a specific field. It highlights skills you’ve developed and biggest achievements.

Neither the objective nor the summary is a mandatory inclusion on your resume, but these statements can enhance your resume and boost your chances of getting hired. Let’s go over a few examples:

Example 1: Young professional seeking a job at your office to continue advancing my career in finance.

What could be improved: This is a poorly written resume objective. You should mention the specific job title you’re applying to, the company name, and one to three highly-specific skills you possess that will improve or contribute to the company’s operations.

Example 2: Working in finance with experience in organizing and communicating.

What could be improved: This summary is too bare-bones. It contains no meaningful information and just takes up space.

Example 3: Financial analyst with 7+ years of experience specializing in informative and persuasive professional presentations, seeking a role to utilize my depth of ROI and client relations skills as a team player at Spectrum.

What we like: This objective and the example below mention a specific job title, the company name, and the skills they bring to the table. It’s short and effective.

Example 4: Data-driven financial analyst with 23 years of business valuation and trend analysis under 3 major Fortune 500 corporations. With skills across many areas of data analysis and presentation, trend forecasting, and financial advisement, I provide a wealth of knowledge and business know-how to companies with which I’ve worked. I am eager for an opportunity to improve ROI in several key areas to optimize growth at BetterMent.

What we like: This summary (and the example below) are specific and contain information that makes this candidate an obvious choice. The applicant above also points directly to an area they know they can improve business operations. You want a hiring manager to read your summary and think, “we need this person.”

How to include your financial analyst work history

It should come as no surprise to you that the most important section of your financial analyst resume is your work history. It can be tempting to cram every job title you’ve held onto the page, but hiring managers prefer applicants who focus on the most relevant and recent work experience they’ve had. You can share information about older jobs and internships during your interview! You’ll want to include two to four job experiences.

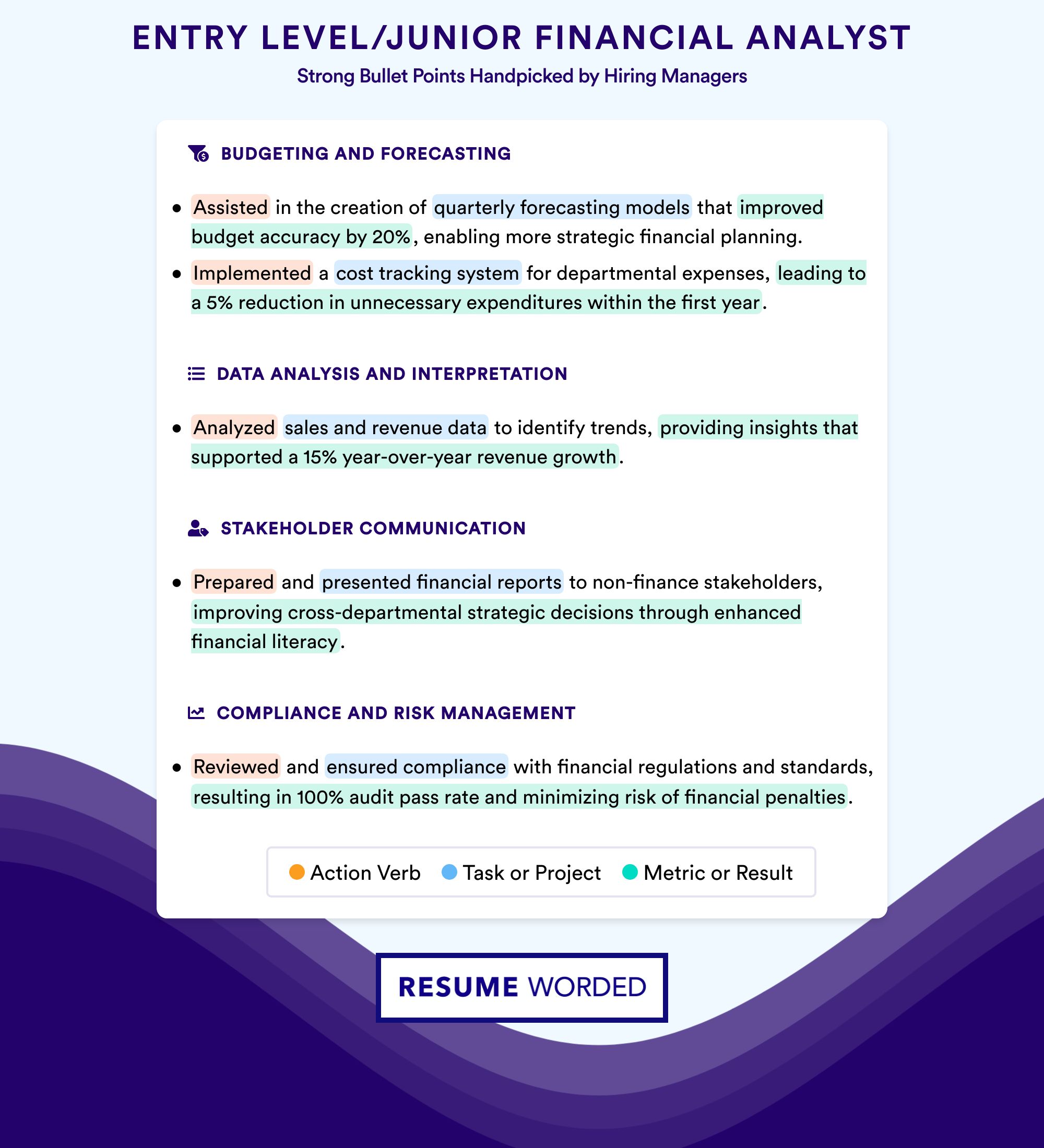

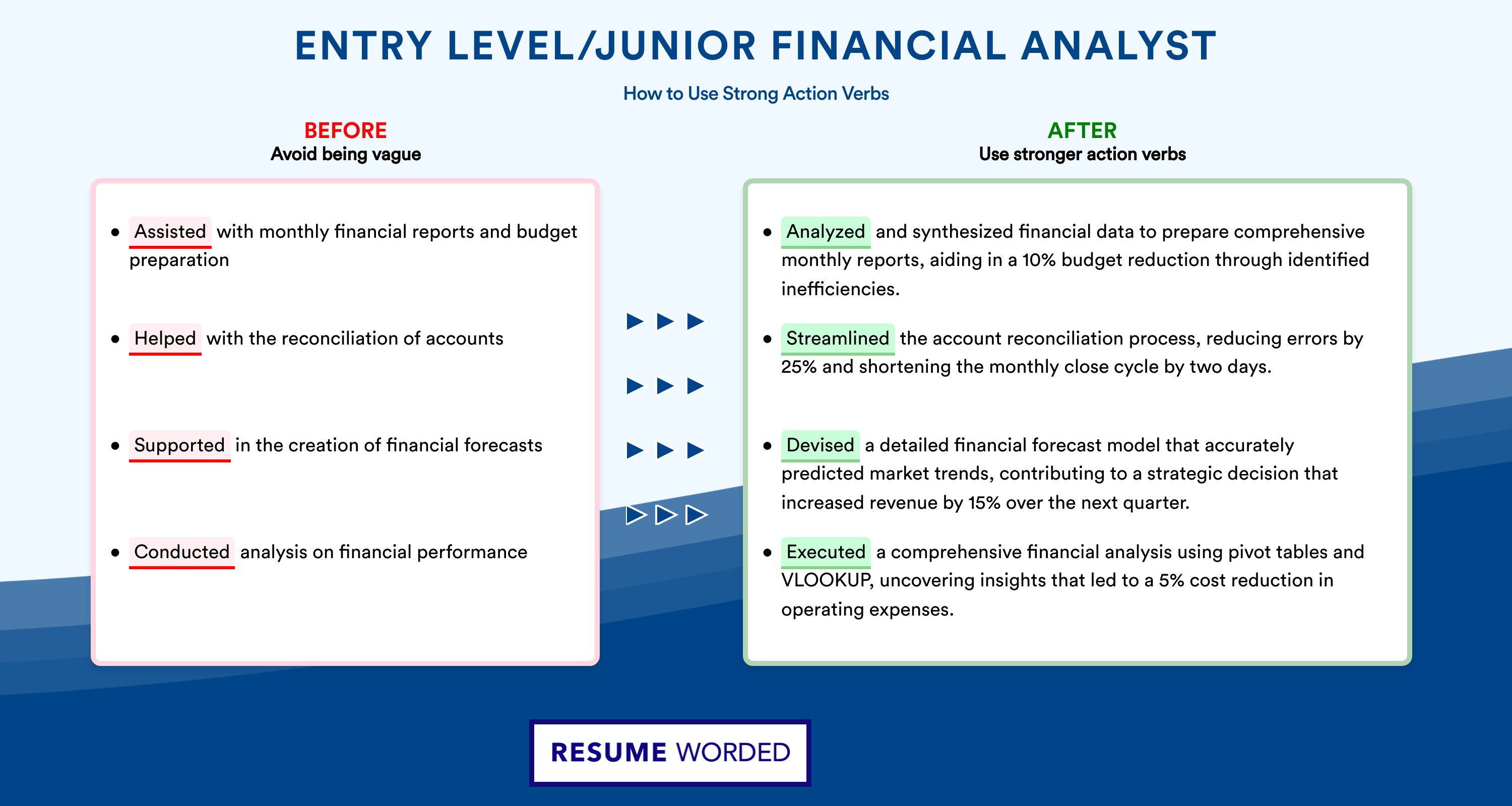

Write descriptive bullet points

Your work experience should be broken down into bullet points, which make your resume look more organized and easier for hiring managers to read.

- Throughout your bullet points, you’ll want to avoid passive voice, which can make text boring to read and unengaging. Instead, use active voice, which exudes confidence and ownership of your work. Adding action words to start each bullet point, like “operated,” “spearheaded,” and “orchestrated,” will further engage readers and break up your text.

- You’ll also want to be careful to avoid personal pronouns, like “I” or “my.” Employers already know you’re writing about yourself, and personal pronouns sound unprofessional.

- You can choose to end all of your bullet points with or without periods. Consistency is key.

- Finally, you’ll want to consider verb tense. You can leave your current work experience in the present or past tense, but all of your former work experience must be in the past tense.

Here are a few examples of good bullet points that incorporate these tips:

- Oversaw the financial due diligence of a $52M acquisition, including organization and report analysis

- Developed an automated process using Excel for the internal team KPI reporting that increased accuracy by 17% and provided data 2 days faster to team leads

- Monitored 10+ regulatory developments and industry trends to incorporate into the firm’s AML program

These bullet points are perfect for a financial analyst resume. They’re written in active voice, using action verbs, avoiding personal pronouns; they’re all written in the past tense, with consistent punctuation.

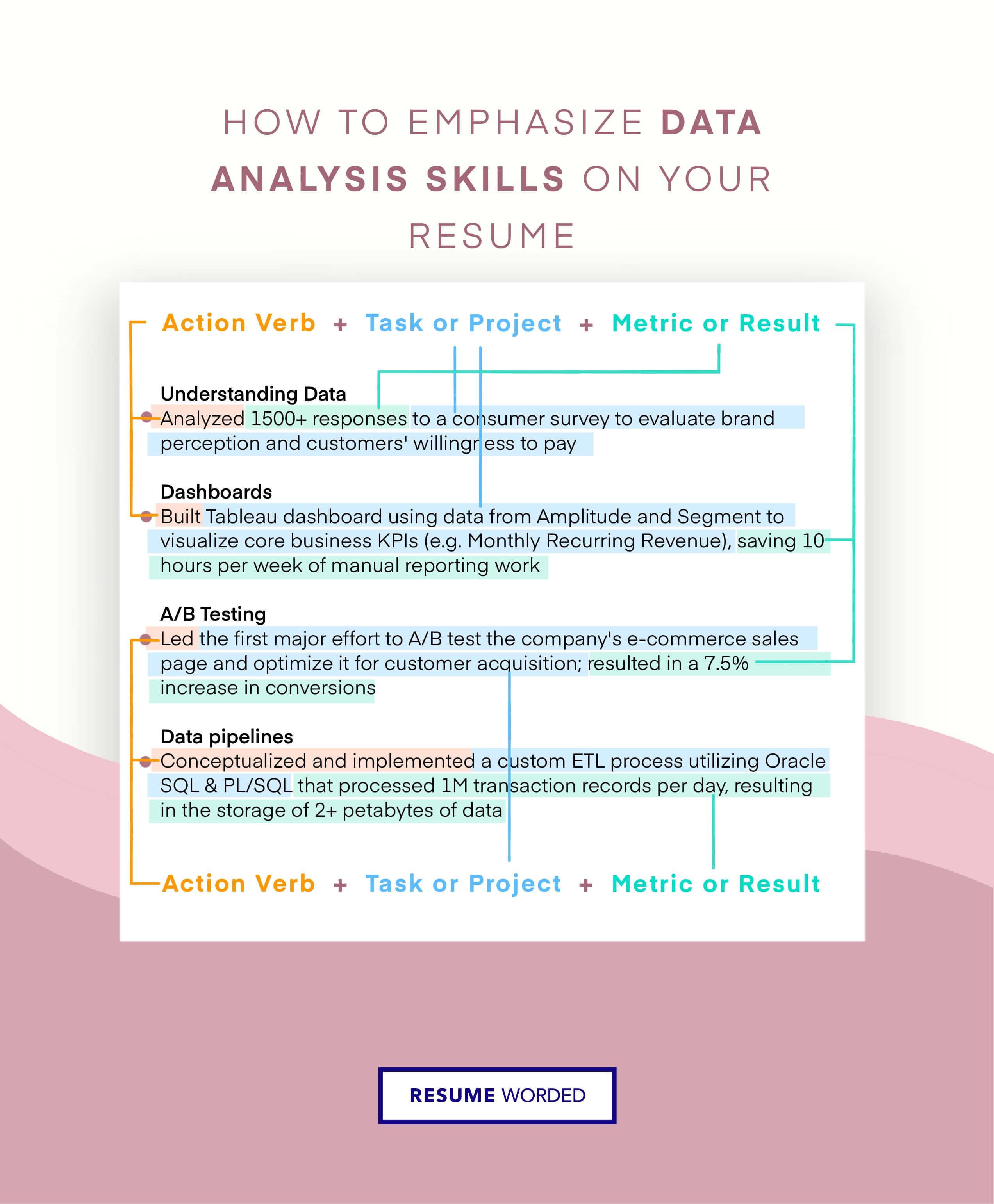

Leverage numbers

Numbers demonstrate your value to the company, unlike words alone. We’ve interviewed countless hiring managers to ask them what they consider the most important element of a successful resume; almost unanimously, they’ve reported that metrics made applicants much more likely to get interviews. For the best results, aim to include quantifiable metrics on at least 50 percent of your bullet points.

Here are a few ways you might consider adding metrics about your past roles in financial analysis:

- Hard numbers: Discuss the details of your work. What percentage have you increased ROI? What percent have gross earnings increased for the company during your time of employment?

- Sales: Discuss the rate of potential clients converted from your presentations, the number of presentations you provided, and the success of your sales strategies.

- Reports: Have you successfully forecasted trends? Have your abstracts and internal presentations resulted in financial gain for the company?

- Collaboration: Financial analysts need to collaborate across departments frequently. Let employers know you collaborate well with others by detailing the number of people or departments with which you’ve worked.

If you’re having trouble visualizing how you’d use these questions to come up with numbers, don’t worry. Here are a few examples:

- Provided financial guidance to Business/Functions, contributing to a 19% growth trend by developing strategic long-range planning recommendations for management

- Collaborated with 10+ major clients with multi-million dollar accounts

- Created forecasting tracking and management reporting systems to improve the availability and accuracy of financial data, triggering a 13% increase in accuracy

- Evaluated regulatory developments and industry trends to facilitate incorporation into the firm’s AML program, reducing time to meet trend demands by 40%

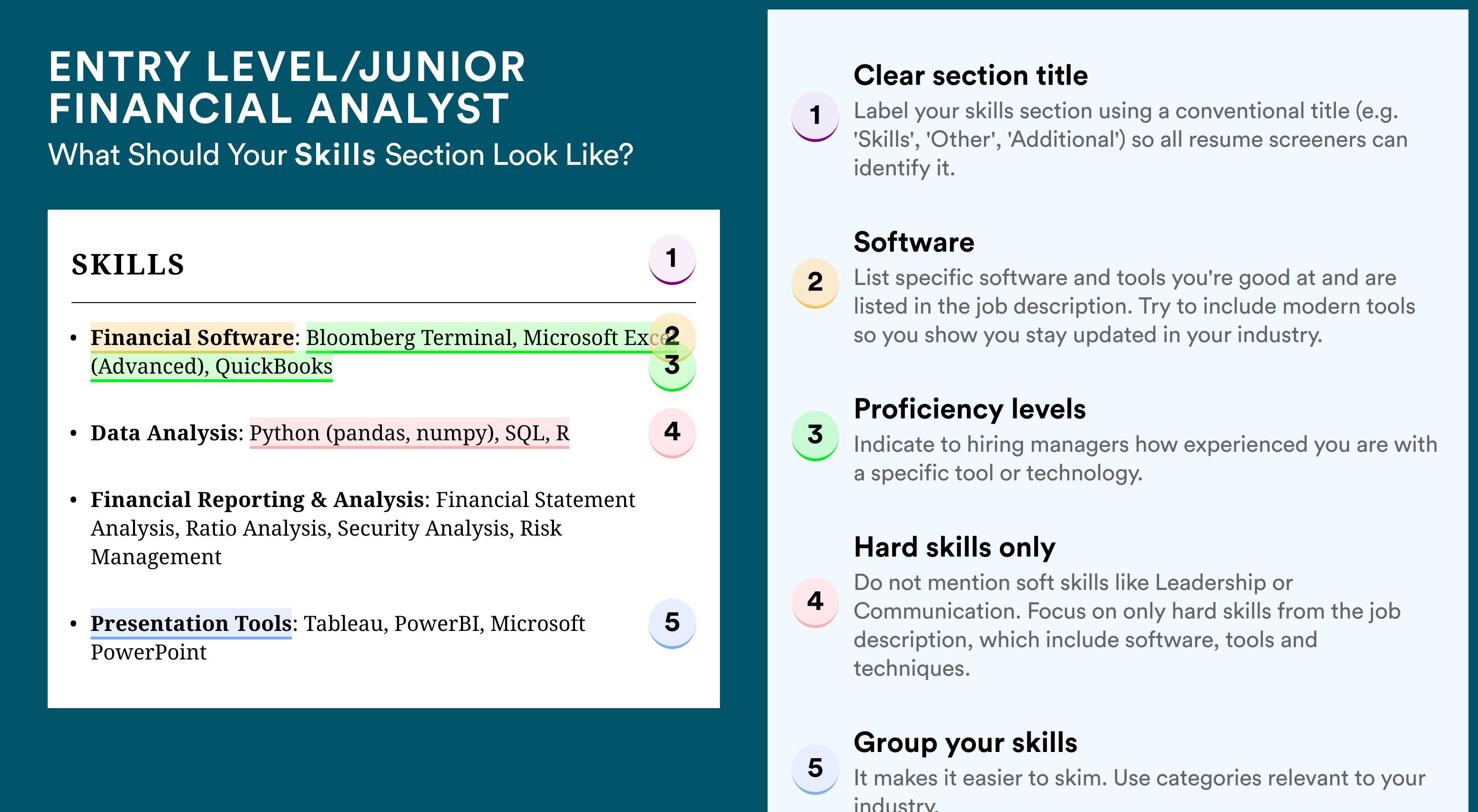

Financial analyst skills to include in your resume

The skills section is an important place to demonstrate your value to potential employers, not to mention it’s one of the best places to include keywords for ATS. Unfortunately, many hopeful applicants don’t emphasize the right skills. The right skills for your financial analyst resume will depend on the specific job to which you’re applying.

Generally, we recommend including a mix of soft and hard skills, with the majority being hard skills because they’re easier to measure and more job-specific. Aim to include six to ten highly relevant skills on your resume.

Use the following financial analyst skills as examples to get you started:

- Financial Modeling

- Cash Flow Management

- Financial Reporting

- Quantitative Finance on Python

- Electronic Trading Systems Development

- Data Consolidation

- Predictive Analysis

Why are these resume skills appropriate? We’ve included a mix of hard and soft skills specific, measurable, and highly desired by most employers. When looking for your next financial analyst job, be sure to read the job description carefully. Often, you’ll be able to pick up on which skills are the most important to your hopeful employers.

But, a word of caution: avoid overselling your skills. If you don’t know how to do something or are inexperienced, leave it off your resume. Hiring managers want honesty above all.

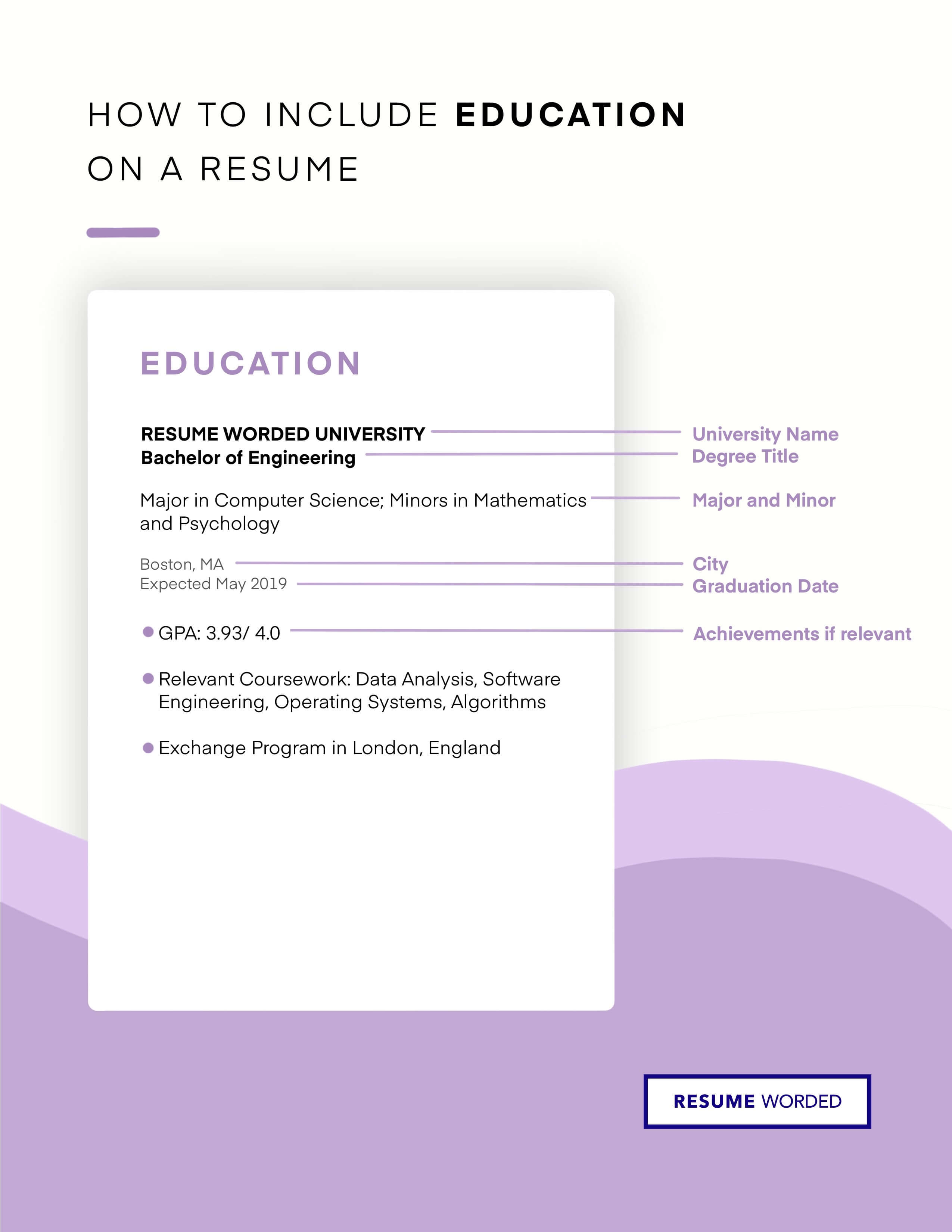

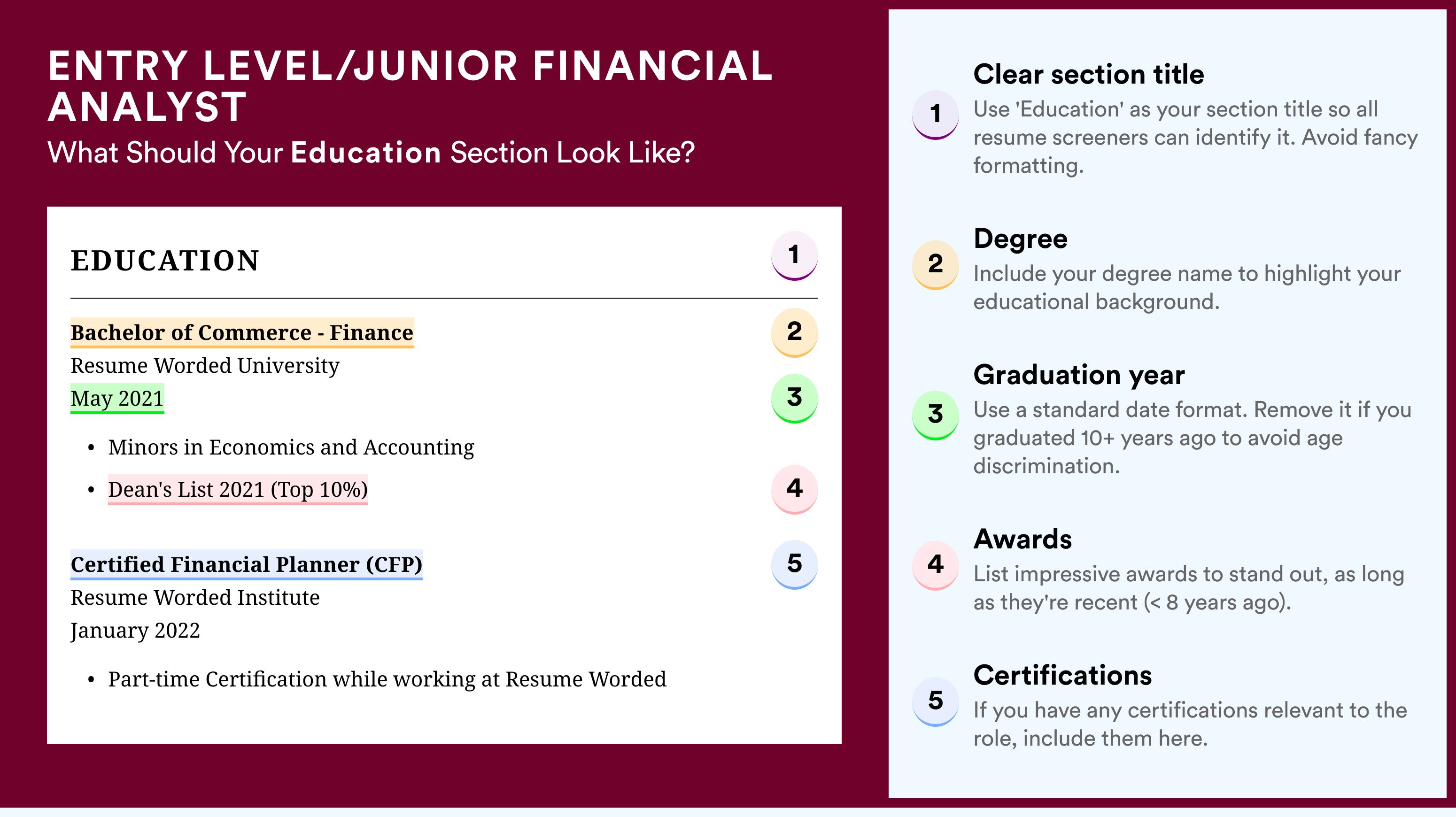

Education + optional resume sections

ou probably already know that the financial analyst world can be a tough place in which to get your career started. Though there are no formal educational requirements, most employers will seek applicants with at least a bachelor’s degree in a relevant field.

Include the highest education level on your resume, but avoid including too much detail unless you’re a recent graduate with limited work experience. If you have minimal experience, you can utilize your education to demonstrate your working potential. Still, if you’re a more experienced applicant, you only need to provide your school name, graduation year, and degree.

There aren’t any formal requirements for certifications for financial analysts, but you should mention any specialized training you’ve received, such as a Financial Analyst Certification, Data Analysis Certification, or Certified Software Quality Analyst.

Finally, you may be wondering whether you should include any interests and hobbies to your resume . Generally, we don’t recommend including them, but there are a few instances where they’re appropriate additions to your resume:

- If you don’t have a great deal of work experience, it may be helpful to highlight some interesting hobbies or volunteer activities in which you’ve taken part. These can be great talking points during interviews if used appropriately!

- If you’re a recent graduate seeking your first finance job, you likely lack a lengthy work history to share on your resume. In this case, you can use interests and hobbies to convey to employers that you’re a hard worker and someone who thrives under pressure.

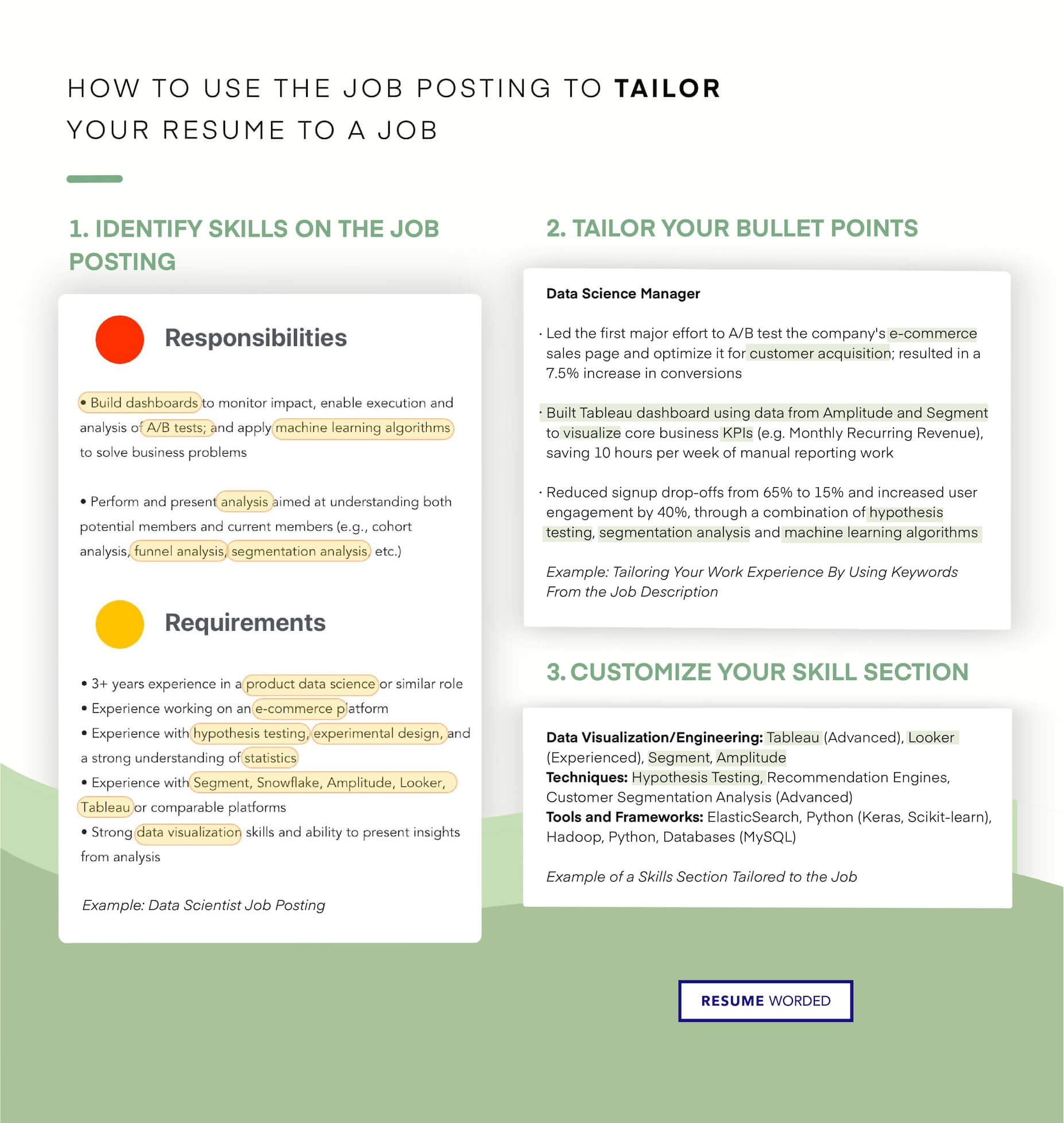

Tailor your financial analyst resume to the job ad

We’ve mentioned it a few times, but it’s important enough to reiterate. You need to tailor your financial analyst resume for every job to which you apply. Specifically, if used, your resume objective or summary statement needs to be customized with specific job titles and company names. Your skills section should be tailor-made to the job, too. You can do this by referencing skills mentioned in the job description (without ever copying anything from the job posting verbatim). Finally, your bullet points should be tailored to fit the specific needs of each company.

Don’t submit a sloppy financial analyst resume

We know it’s difficult to take a step back after you’ve finished working on your financial analyst resume. However, we strongly recommend that financial analysts, and all job seekers, take a step back. Put your resume away for a day or two, and then look it over again for typos. Have friends or family proofread it, and take advantage of our free resume checker .

One step closer to your next job

Congratulations! The first step to writing your professional financial analyst resume is research. If your resume is complete, you can upload it to see what AI-powered tips our resume checker has for you before making a cover letter .

If you haven’t started yet, or if you want to start your resume from scratch, use our resume builder . Both our resume checker and builder will analyze your resume and provide specific tips on how you can make improvements.

Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Financial Analyst Resume Guide & Examples

Entry Level/Junior Financial Analyst Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Entry Level/Junior Financial Analyst

- Entry Level/Finance Associate

- Entry Level/Credit Analyst

- Entry Level/Business Analyst

- Entry Level/Investment Analyst

Get advice on each section of your resume:

Jump to a resource:

- Entry Level/Junior Financial Analyst Resume Tips

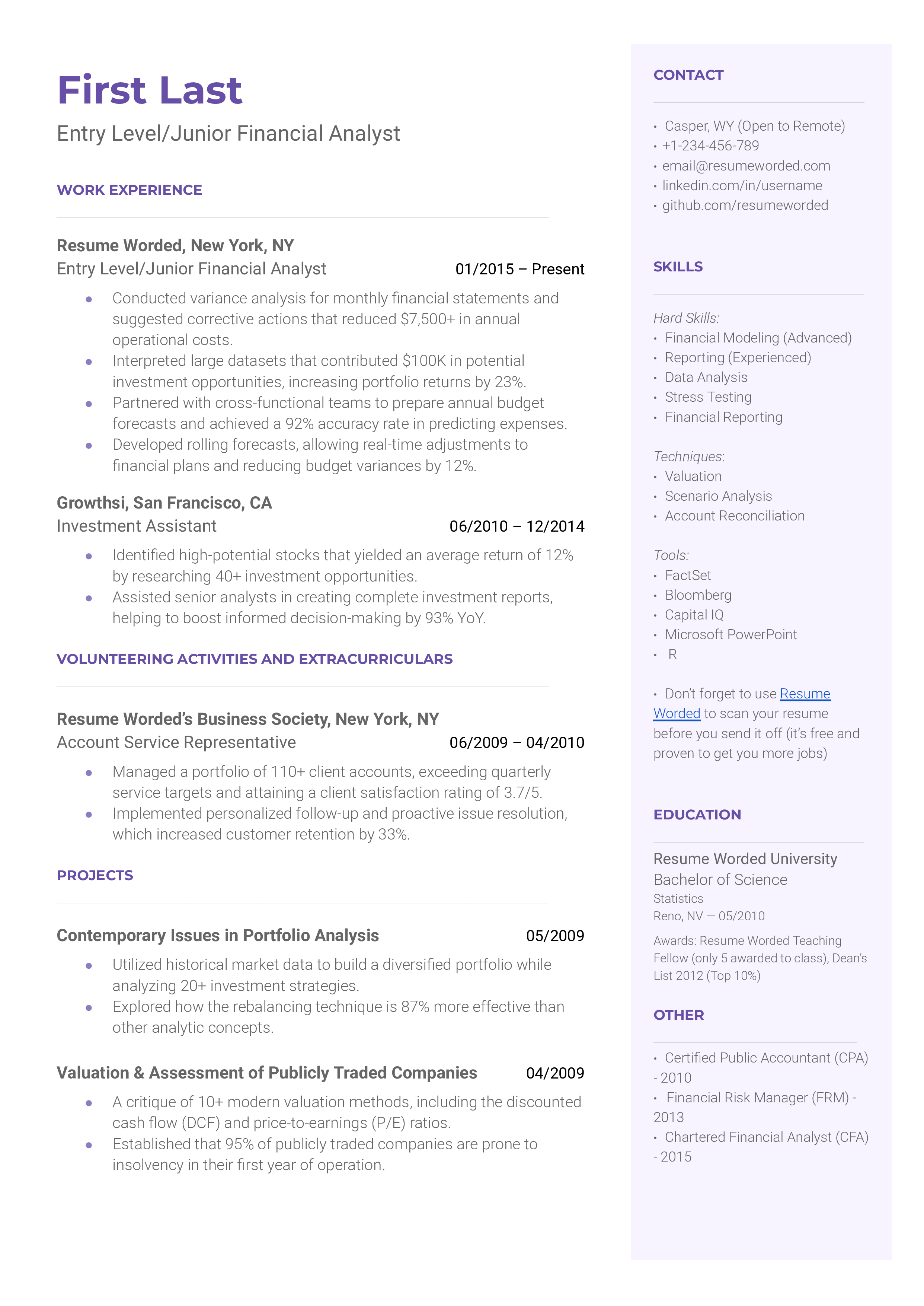

Entry Level/Junior Financial Analyst Resume Template

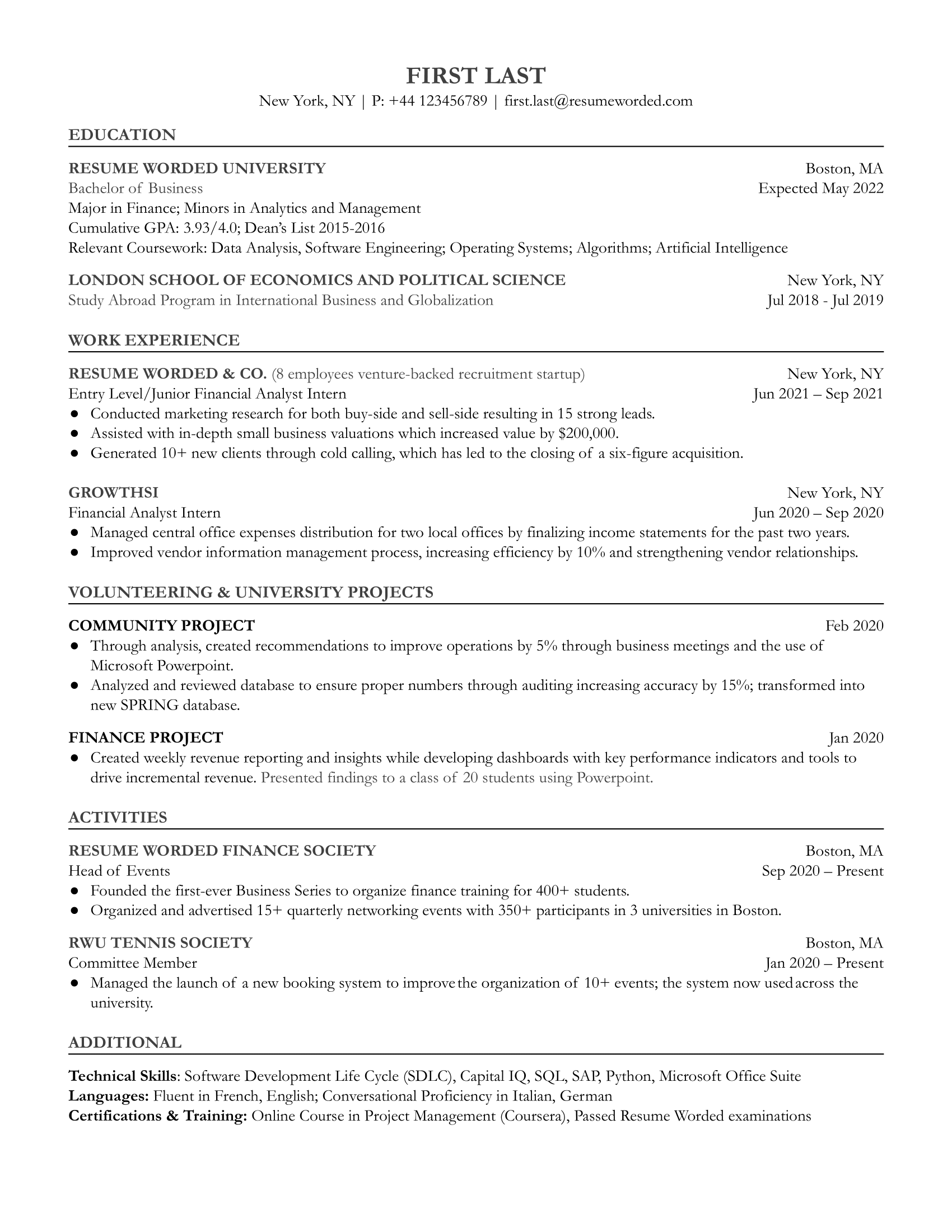

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., entry level/junior financial analyst resume sample.

As an Entry Level/Junior Financial Analyst, you're at the beginning of an exciting journey in a dynamic field. The finance industry is currently experiencing a significant shift towards digitalization and data-driven decision making. In this space, being tech-savvy and having a solid grounding in data analysis are increasingly valuable. On your resume, it's pivotal to showcase not only your financial acumen but also your adaptability and forward-thinking mindset. Exude passion for the finance sector, because employers are keen on candidates who are genuinely interested in their line of work. Be sure to highlight any coursework or projects you've completed that are relevant to the job, and don't shy away from showcasing your soft skills, such as critical thinking or teamwork. These assets can set you apart from other applicants.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your entry level/junior financial analyst resume in 2024, highlight data analysis skills.

As this role is often centered around interpreting financial data, it's essential to emphasize any experience you have with data analysis. Have you worked on a project or took a course that involved analyzing data sets? Highlight that on your resume and demonstrate your competency in this area.

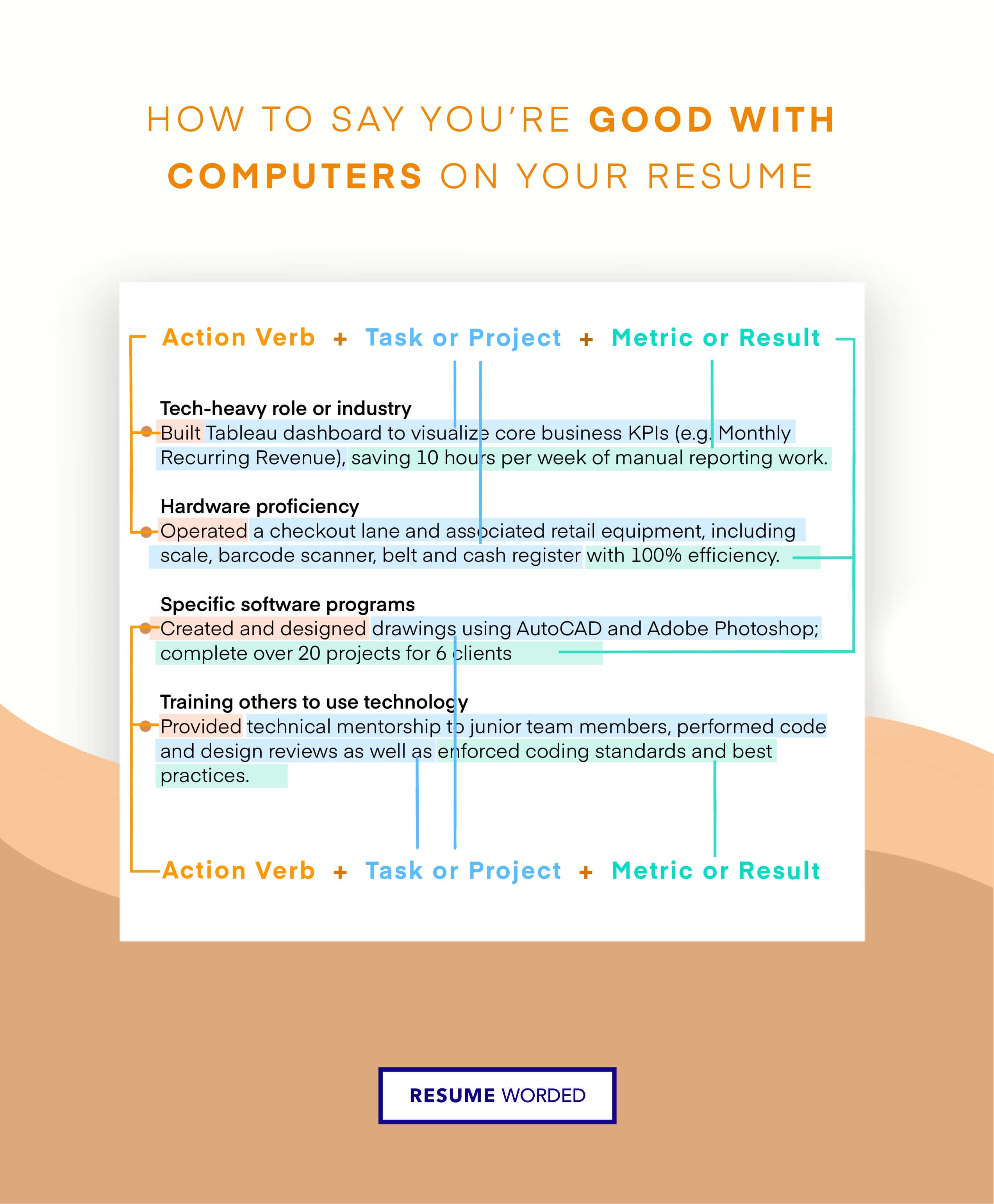

Showcase Technological Proficiency

With the finance industry's ongoing digital transformation, being comfortable with technology is a critical skill. If you've used financial analysis software or other technical tools in school or a previous job, definitely include those details. This could be as simple as being an Excel whizz or as complex as knowing how to use specific finance software.

Junior financial analysts typically collect and analyze data, create reports, and make policy recommendations based on their findings. While you can get this entry-level job with little to no prior work experience, you’ll be a more competitive candidate if you’ve studied business, finance, economics, or a related field in school. Use your resume to emphasize your educational background, and don’t forget to also list any relevant internships you’ve done.

Lead with your educational history

If your work history is fairly short, it’s best to lead your resume with your educational history, especially if you majored in a relevant subject area. If you have a bachelor’s degree in business with a minor in analytics and management, mention that up-front to show hiring managers that you’re starting with at least some background in the field.

Discuss any relevant internship experience (or tailor non-relevant experience to the role)

You may not have held many jobs at this stage in your career, but if you’ve interned in financial analytics, make sure to highlight your internships on your resume. Treat them as you would treat any work experience, adding bullet points to explain what you achieved (such as “generated 10+ new clients through cold calling”).

Entry Level/Finance Associate Resume Sample

Entry level/credit analyst resume sample, entry level/business analyst resume sample, entry level/investment analyst resume sample.

As a hiring manager who has recruited for top companies like Goldman Sachs, JPMorgan Chase, and Citi, I've reviewed hundreds of resumes for entry-level financial analyst positions. Based on my experience, I've compiled a list of essential tips to help you create a standout resume that will catch the attention of potential employers in the finance industry.

Highlight your analytical skills

Employers are looking for candidates who can demonstrate strong analytical skills. Showcase your ability to analyze financial data and provide insights by including specific examples in your resume.

- Analyzed financial statements of 10+ companies and identified cost-saving opportunities, resulting in a 15% reduction in expenses

- Conducted market research and competitor analysis to support investment decisions, leading to a 20% increase in portfolio returns

Avoid generic statements that don't provide concrete evidence of your skills:

- Familiar with financial analysis

- Experienced in market research

Emphasize your proficiency in financial software

Proficiency in financial software is a must-have skill for entry-level financial analysts. Highlight your experience with tools like:

- Microsoft Excel (including advanced functions like VBA and pivot tables)

- Bloomberg Terminal

Provide specific examples of how you've used these tools to analyze data and make informed decisions:

- Used Bloomberg Terminal to monitor market trends and identify investment opportunities, resulting in a 25% increase in portfolio value

- Created financial models using Excel to forecast revenue growth and assess risk, leading to a successful $5M capital raise

Include relevant coursework and certifications

As an entry-level candidate, your relevant coursework and certifications can help you stand out from other applicants. Include courses like:

- Financial Accounting

- Corporate Finance

- Investment Analysis

- Quantitative Methods

Also, highlight any certifications you've earned or are working towards, such as:

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Financial Planner (CFP)

These certifications demonstrate your commitment to the field and can give you a competitive edge in the job market.

Showcase your communication skills

Financial analysts must be able to effectively communicate complex financial information to both technical and non-technical audiences. Demonstrate your communication skills by including examples of:

- Presentations you've given to senior management or clients

- Reports or analyses you've written

- Collaborations with cross-functional teams

Prepared and delivered quarterly financial reports to executive team, highlighting key performance indicators and providing actionable insights for strategic decision-making

Avoid using vague or generic statements that don't showcase your specific communication abilities:

- Strong communication skills

- Experienced in presenting financial information

Quantify your achievements

Whenever possible, quantify your achievements using numbers, percentages, and dollar amounts. This helps employers understand the impact you've made in previous roles or projects.

- Analyzed financial data for a $10M portfolio, identifying opportunities that led to a 15% increase in returns

- Created financial models that helped secure $5M in funding for a startup venture

- Conducted market research that informed a new product launch, resulting in $2M in sales within the first quarter

Avoid using vague or unquantified statements:

- Assisted with financial analysis

- Helped with market research

- Supported new product launches

By quantifying your achievements, you provide concrete evidence of your skills and the value you can bring to a potential employer.

Tailor your resume to the job description

Customize your resume for each job application to highlight the skills and experiences that are most relevant to the specific position. This shows employers that you've taken the time to understand their needs and how you can contribute to their organization.

For example, if a job description emphasizes financial modeling skills, make sure to include examples of your experience creating and using financial models:

- Developed a comprehensive financial model to assess the viability of a $20M acquisition opportunity, considering various scenarios and risk factors

- Created a DCF model to value a publicly-traded company, resulting in a buy recommendation that generated a 25% return over 6 months

Avoid using a generic, one-size-fits-all resume that doesn't address the specific requirements of the job:

Financial analyst with experience in data analysis and market research. Skilled in Excel and Bloomberg Terminal. Strong communication and collaboration skills.

By tailoring your resume to the job description, you demonstrate your fit for the role and increase your chances of landing an interview.

Writing Your Entry Level/Junior Financial Analyst Resume: Section By Section

summary.

A summary is an optional section at the top of your resume that provides a quick overview of your professional background, skills, and achievements. While a summary is not required, it can be a useful way to provide context for your experience and highlight your most relevant qualifications for the Entry Level/Junior Financial Analyst role you are targeting.

Keep in mind that a summary should not simply repeat information that is already included elsewhere in your resume. Instead, it should add value by providing additional details or context that may not be immediately apparent from the rest of your application. It's also important to avoid using an objective statement, as these are generally considered outdated and ineffective.

To learn how to write an effective resume summary for your Entry Level/Junior Financial Analyst resume, or figure out if you need one, please read Entry Level/Junior Financial Analyst Resume Summary Examples , or Entry Level/Junior Financial Analyst Resume Objective Examples .

1. Tailor your summary to the financial analyst role

When writing your summary for an Entry Level/Junior Financial Analyst position, it's crucial to tailor the content to the specific role and company you are applying to. This means highlighting the skills, experience, and achievements that are most relevant to the job requirements.

For example, if the job description emphasizes financial modeling and data analysis skills, your summary should focus on your experience with these specific areas:

- Recent finance graduate with strong skills in financial modeling, data analysis, and forecasting, seeking an Entry Level Financial Analyst role at XYZ Company

- Entry-level professional with a Bachelor's in Finance and experience in financial statement analysis and data visualization, looking to contribute to ABC Corporation's financial planning and analysis team

Avoid generic or irrelevant statements that could apply to any job or industry, such as:

- Hardworking individual with strong communication skills and attention to detail

- Recent graduate seeking an entry-level position in a dynamic company

2. Highlight your relevant education and certifications

As an Entry Level/Junior Financial Analyst, your education and certifications are likely to be a key focus for employers. Make sure to prominently feature your relevant degrees, majors, and any professional certifications you have earned or are pursuing in your summary.

Recent graduate with a Bachelor's in Finance and a minor in Accounting from XYZ University. Currently preparing for the CFA Level 1 exam. Seeking an Entry Level Financial Analyst position to apply my strong analytical skills and passion for financial markets.

If you have completed relevant coursework, projects, or internships, you can also briefly mention these experiences to demonstrate your hands-on knowledge and skills. However, avoid simply listing courses or projects without context, as this information may be better suited for other sections of your resume.

- Completed courses in Corporate Finance, Financial Accounting, and Investment Analysis

- Participated in a group project analyzing the financial statements of a publicly-traded company

Experience

The work experience section is the heart of your resume as an entry level financial analyst. It's where you prove to employers that you have the skills and experience to excel in the role. In this section, list your work history in reverse-chronological order, with your most recent experience first.

For each role, include the company name, your job title, dates of employment, and a few bullet points highlighting your key accomplishments and responsibilities. Remember to tailor your work experience to the specific financial analyst role you're applying for.

1. Use strong financial analysis verbs

When describing your work experience, use strong action verbs that demonstrate your financial analysis skills. This helps recruiters quickly understand your capabilities and imagine you in the role. For example:

- Analyzed financial data to identify trends and opportunities for cost savings

- Forecasted revenue and expenses using statistical modeling techniques

- Collaborated with cross-functional teams to develop and monitor budgets

- Presented financial reports and recommendations to senior management

Avoid weak or passive language that downplays your contributions, like:

- Helped with financial analysis projects

- Responsible for creating reports

2. Highlight relevant financial analysis tools

Employers want to know that you're proficient in the tools and technologies commonly used in financial analysis. In your work experience, mention any relevant tools you've used, such as:

- Microsoft Excel (advanced functions, VBA, etc.)

- Financial modeling software (e.g. Oracle Hyperion)

- Data visualization tools (e.g. Tableau, QlikView)

- ERP systems (e.g. SAP, Oracle)

For example:

- Created financial models in Excel to forecast revenue under various scenarios

- Used Tableau to build interactive dashboards for tracking key financial metrics

Tailoring your resume to the job is crucial. Our Targeted Resume tool analyzes your resume against a job description and identifies missing skills and keywords. It's a great way to ensure your work experience section is optimized for each application.

3. Quantify your impact with metrics

To really make your work experience stand out, use metrics to quantify your impact whenever possible. This helps employers understand the scope and significance of your contributions. For example:

- Reduced operating expenses by 15% through identifying and eliminating inefficiencies

- Managed a budget of $500K and consistently came in under budget

- Automated monthly reporting process, saving 20+ hours per month

If you don't have exact metrics, you can still provide context for your accomplishments:

- Analyzed large datasets with 100,000+ rows to identify trends

- Created financial models used by senior management to make strategic decisions

4. Show progression and leadership

Employers love to see growth and progression in your work experience. If you've been promoted, taken on additional responsibilities, or led projects, make sure to highlight that in your resume. For example:

Financial Analyst, XYZ Company Promoted from Junior Financial Analyst after one year due to strong performance and leadership skills Led a team of 3 analysts to streamline the budgeting process, reducing time to complete by 25% Mentored and trained 2 junior analysts in financial modeling and data analysis best practices

Even if your title hasn't changed, you can still show progression by highlighting how your role has evolved and how you've taken on more responsibility over time.

Education

The education section of your entry level financial analyst resume should be concise yet impactful. It's a chance to showcase your relevant academic background and any specialized coursework or certifications that make you a strong candidate. Here are some key tips to follow when writing your education section:

1. Put education at the top if you're a recent grad

If you graduated within the past 1-2 years, your education is likely your strongest qualification for an entry level financial analyst role. In this case, place the education section above your work experience.

Include the following details for each degree:

- Name of the institution

- Degree earned (e.g., Bachelor of Science in Finance)

- Graduation date or expected graduation date

- GPA, if above 3.5

New York University, Stern School of Business Bachelor of Science in Finance Expected Graduation: May 2023 GPA: 3.8

2. Highlight relevant coursework and academic projects

As an entry level candidate, you may not have extensive work experience in finance. However, you can bolster your qualifications by showcasing relevant coursework, capstone projects, or academic achievements in your education section.

Example of how to list relevant coursework:

- Relevant Coursework: Financial Accounting, Corporate Finance, Investment Analysis, Econometrics

Avoid listing basic or introductory courses that don't directly relate to financial analysis, like this:

- Coursework: Intro to Psychology, World History, English Composition

3. Include finance-related certifications

Certifications can give you a competitive edge, especially if you don't have a finance degree. If you've earned any relevant certifications, include them in your education section or in a separate 'Certifications' section.

Some common certifications for entry level financial analysts include:

- Chartered Financial Analyst (CFA) Level I Candidate

- Financial Modeling & Valuation Analyst (FMVA)

- Bloomberg Market Concepts (BMC)

Certifications Chartered Financial Analyst (CFA) Level I Candidate, June 2023 Bloomberg Market Concepts (BMC), 2022

4. Keep the education section brief if you have 5+ years of experience

If you're a senior financial analyst with several years of work experience, your education becomes less important than your professional accomplishments. In this case, keep your education section short and to the point.

Good example for a senior candidate:

University of Pennsylvania Bachelor of Science in Economics

Bad example that includes too many details:

University of Pennsylvania, The Wharton School Bachelor of Science in Economics Graduation Date: May 2013 GPA: 3.6 Relevant Coursework: Financial Accounting, Corporate Finance, Investment Analysis, Econometrics Honors: Dean's List (Fall 2011, Spring 2012)

Skills

The skills section is one of the most important parts of your resume. It's where you show employers that you have the specific abilities and knowledge they're looking for in a financial analyst. A well-crafted skills section can help you stand out from other candidates and increase your chances of getting an interview.

Here are some tips to help you create a strong skills section on your resume:

1. Highlight your technical skills

As an entry level financial analyst, it's important to showcase your technical skills. This includes proficiency in financial software, such as:

- Microsoft Excel

You should also highlight any programming languages or data analysis tools you know, such as:

Be specific about your level of proficiency with each skill. For example:

Advanced proficiency in Microsoft Excel, including pivot tables and VBA Intermediate knowledge of SQL and Python for data analysis Familiarity with Tableau for data visualization

2. Include relevant financial skills

In addition to technical skills, you should also highlight any relevant financial skills you have. This could include:

- Financial modeling

- Budgeting and forecasting

- Financial reporting

- Risk analysis

Be sure to tie these skills back to the specific requirements of the job you're applying for. For example, if the job description mentions experience with financial modeling, you could say:

Experience building financial models in Excel to forecast revenue and expenses

Avoid listing generic or irrelevant financial skills, such as:

Basic accounting Bookkeeping Invoicing

3. Categorize your skills

To make your skills section easy to read and navigate, consider grouping your skills into categories. For example:

Technical Skills : Microsoft Excel (Advanced), SQL (Intermediate), Python (Intermediate), Tableau (Beginner) Financial Skills : Financial Modeling, Budgeting and Forecasting, Financial Reporting, Risk Analysis

This helps hiring managers quickly see the range of your abilities and how they relate to the job. Avoid a long, unorganized list of skills like this:

Microsoft Excel Financial modeling SQL Budgeting Python Financial reporting Tableau Risk analysis

4. Tailor your skills to the job

One of the biggest mistakes job seekers make is using the same generic skills section for every application. Instead, you should tailor your skills to the specific job you're applying for.

Start by carefully reading the job description and noting any skills or qualifications that are mentioned. Then, make sure to include those skills in your resume if you have them. For example, if the job description says:

Required Skills: Proficiency in Microsoft Excel, including pivot tables and VLOOKUP Experience with financial modeling and forecasting Knowledge of SQL for data analysis

Your skills section might look like this:

Advanced proficiency in Microsoft Excel, including pivot tables and VLOOKUP Extensive experience building financial models to forecast revenue and expenses Intermediate knowledge of SQL for data analysis and reporting

Skills For Entry Level/Junior Financial Analyst Resumes

Here are examples of popular skills from Entry Level/Junior Financial Analyst job descriptions that you can include on your resume.

- Account Reconciliation

- Business Analysis

- Internal Controls

- Management Accounting

- Data Analysis

- Forecasting

Skills Word Cloud For Entry Level/Junior Financial Analyst Resumes

This word cloud highlights the important keywords that appear on Entry Level/Junior Financial Analyst job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

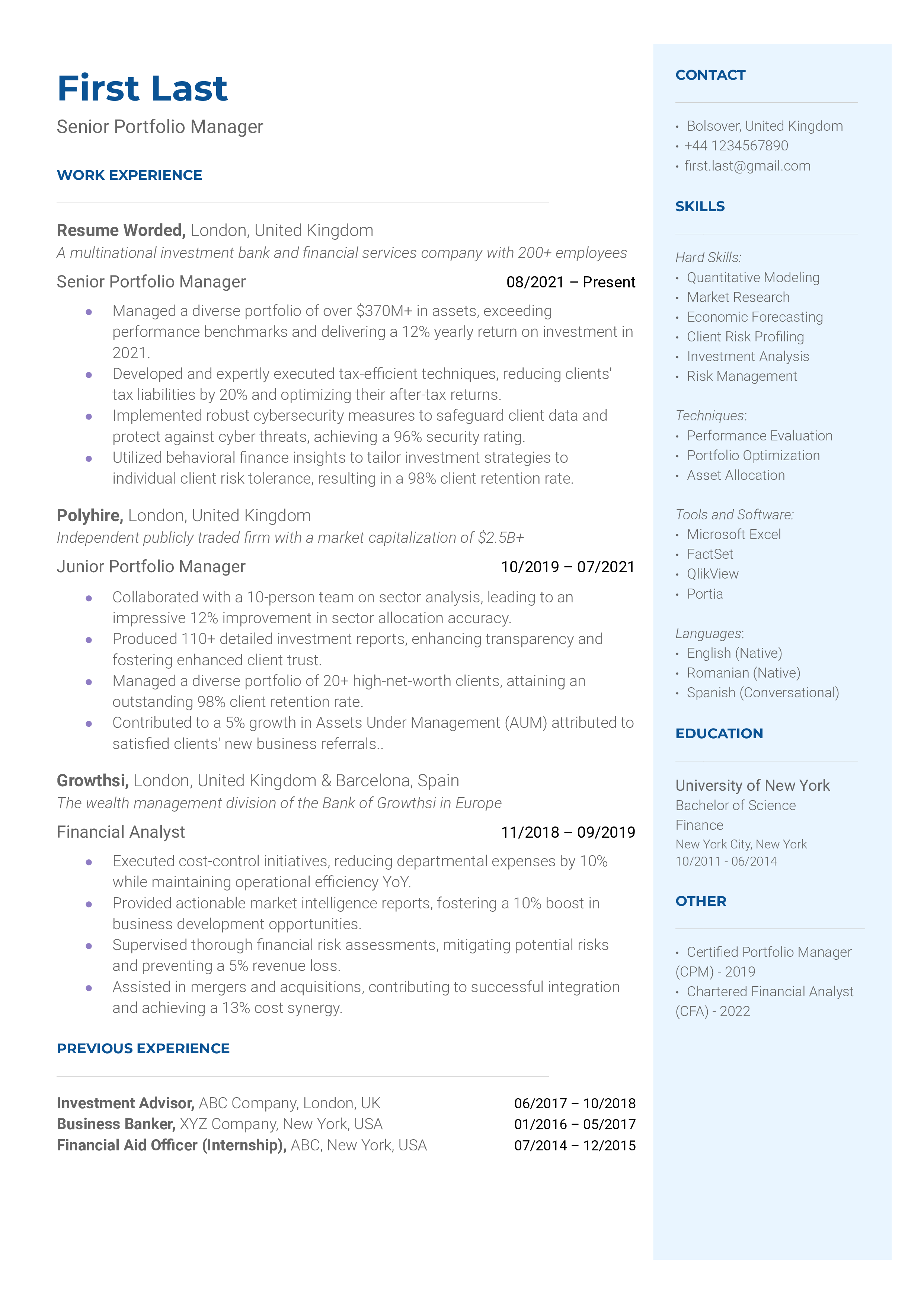

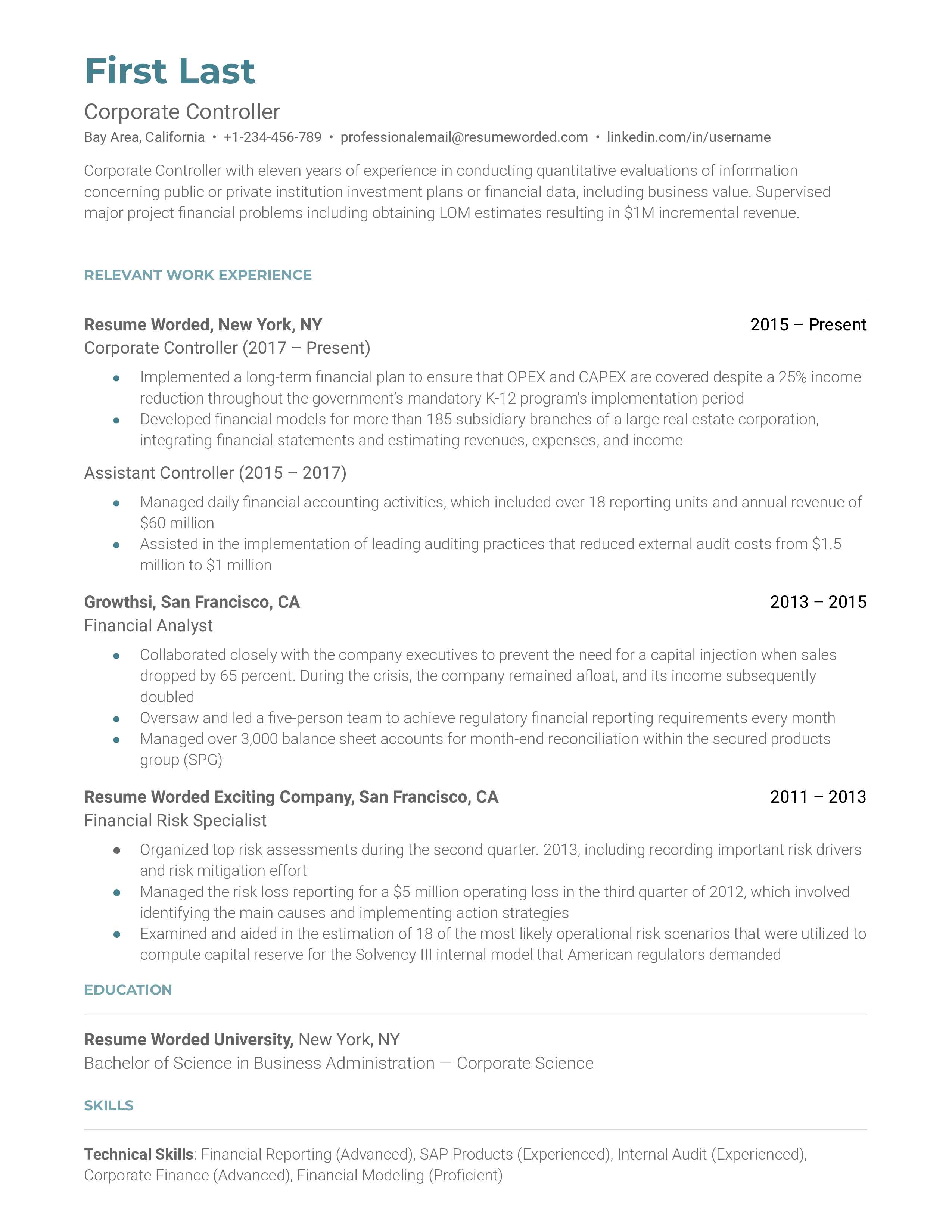

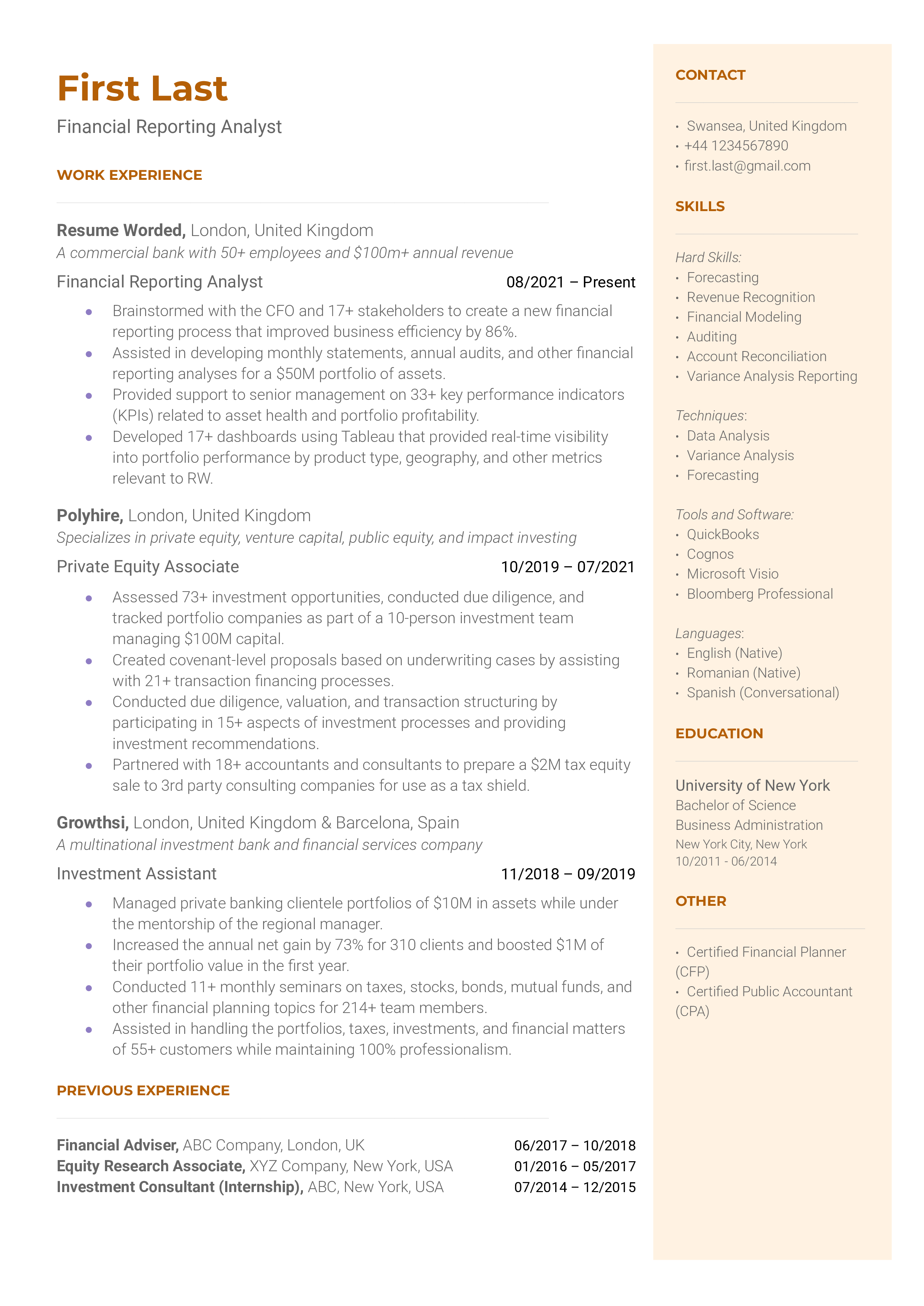

Similar resume templates, financial analyst.

Financial Controller

Reporting Analyst

- Internal Audit Resume Guide

- VP of Finance Resume Guide

- Credit Analyst Resume Guide

- Financial Analyst Resume Guide

- Purchasing Manager Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Financial Analyst Resume Guide & Examples for 2022

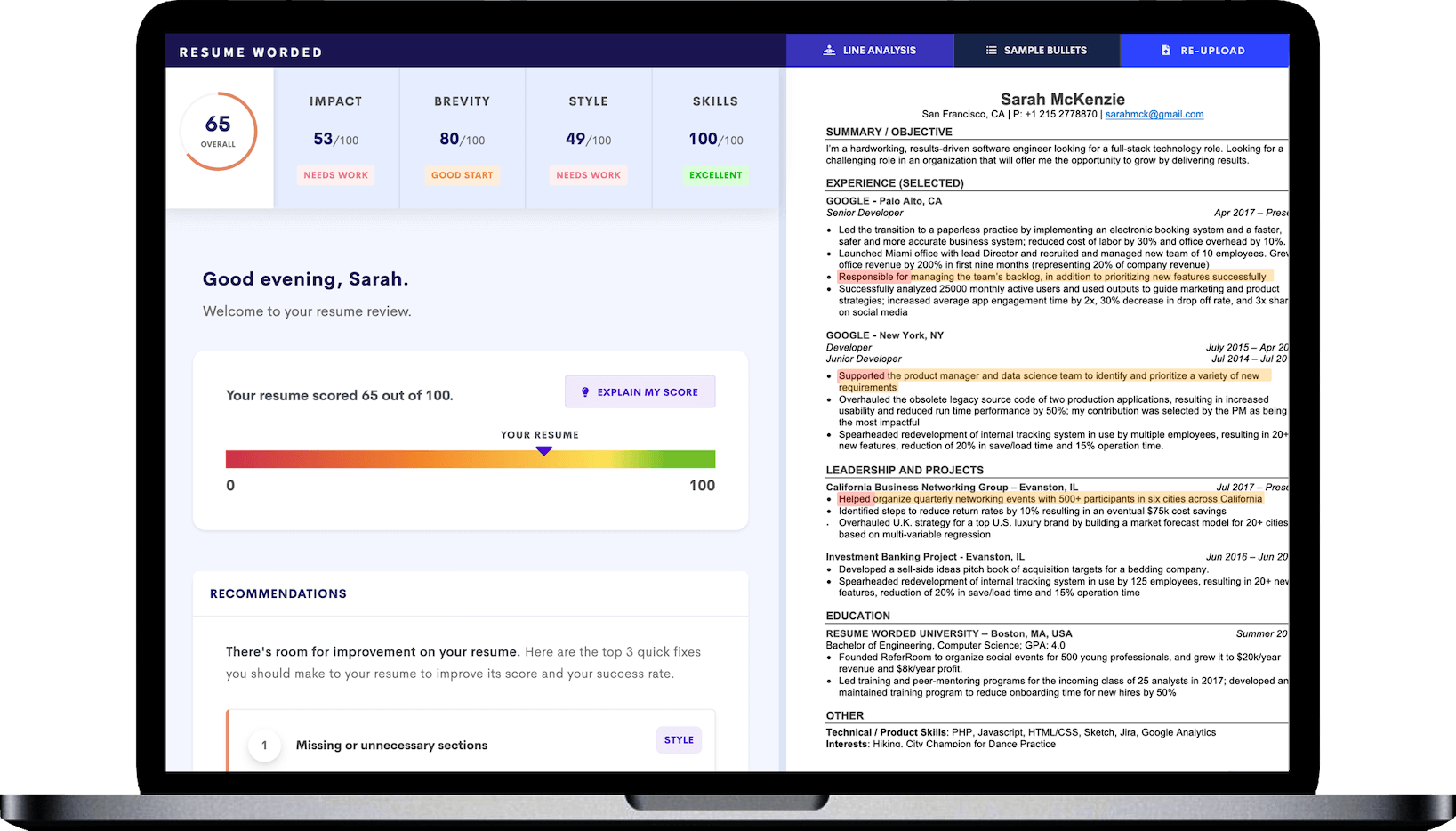

Improve your Entry Level/Junior Financial Analyst resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Entry Level/Junior Financial Analyst resumes in your industry.

• Fix all your resume's mistakes.

• Find the Entry Level/Junior Financial Analyst skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Entry Level/Junior Financial Analyst Resumes

- Template #1: Entry Level/Junior Financial Analyst

- Template #2: Entry Level/Junior Financial Analyst

- Template #3: Entry Level/Junior Financial Analyst

- Template #4: Entry Level/Finance Associate

- Template #5: Entry Level/Credit Analyst

- Template #6: Entry Level/Business Analyst

- Template #7: Entry Level/Investment Analyst

- Skills for Entry Level/Junior Financial Analyst Resumes

- Free Entry Level/Junior Financial Analyst Resume Review

- Other Finance Resumes

- Entry Level/Junior Financial Analyst Interview Guide

- Entry Level/Junior Financial Analyst Sample Cover Letters

- Alternative Careers to a Financial Analyst

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 14 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 14 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Financial Analyst Resume [The Ultimate 2024 Guide]

Looking to land your next job in finance?

You’ll need a compelling financial analyst resume to stand out from the competition.

At the end of the day, it doesn’t matter how good you are at analyzing financial data if you can’t prove it to the hiring manager at your dream company.

Luckily, that’s exactly what this article is here for.

We’re about to teach you all you need to know about how to write a financial analyst resume, including:

Job-Winning Financial Analyst Resume Example

How to write a financial analyst resume (step-by-step).

- Free Financial Analyst Resume Template

And more! Let’s dive right in, starting with:

What’s a better way to get started with your resume than to get inspired by a compelling financial analyst resume example, right?

The above resume does a lot of things right, such as:

- Follows the chronological resume format. While there are other resume formats out there, the chronological one is both the most popular, and the best one for the job.

- Lists contact information the right way. It includes a phone number, a professional email address, a LinkedIn URL, and a location.

- Catches the recruiter’s attention with a resume summary. This financial analyst resume summary shows the recruiter the candidate is relevant at a glance.

- Convinces the recruiter that they’re the right person for the job with an achievement-oriented work experience section. Achievements help show the recruiter how you stand out from the rest of the candidates.

- Uses bullets to make the financial analyst resume easy to follow. The recruiter has hundreds of other resumes to review. By using bullets, you make it easier for them to read your resume and understand your background.

- Includes a concise education section. Since the candidate has a lot of work experience, they don’t focus as much on their educational history.

- Lists the right hard and soft skills. A strong financial analyst should possess both types of skills (and show them off on their resume).

- Includes optional resume sections to fill up the space and make the resume even more compelling.

Found the financial analyst resume example interesting?

Awesome - time to start working on yours!

In this section, we’re going to walk you through 8 essential steps for creating a compelling financial analyst resume, starting with:

#1. Format Your Financial Analyst Resume Right

While there are 3 types of resumes formats you can use, the best option is the reverse-chronological format , which looks as follows:

The format starts off with the most recent work experiences and then goes backward in time.

Once you’ve decided on the format, you need to work on the style and layout of your resume. Here’s what that involves:

- Don’t go over the 1-page limit . Unless you’re a professional with 15+ years of experience, chances are, you don’t need more than a single page.

- Pick a professional font. Some of our favorites are Ubuntu, Times New Roman, and Roboto.

- Use 11-12 pt font size for the body text in your resume.

Free Financial Analyst Resume Template

Want to create a compelling resume without all the hassle of working on the formatting, style, layout, and the like?

Well, it’s possible!

All you have to do is pick one of our 8 free resume templates .

The formatting work is done for you, all you have to do is fill in your contents, and you’re ready to land your dream job!

And the best part? Our resume templates look absolutely slick compared to the typical black-and-white templates:

#2. Include a Contact Information Section

Once you’re done formatting your resume (or you’ve picked one of our free resume templates ), it’s time to start working on your resume contents.

The first step here is to include your contact information, which includes:

- Name and surname.

- Professional title . Your title should match the one mentioned in the job description.

- Phone number.

- Professional email address. E.g. [name] + [last name] @gmail.com.

- Location. The city, state, and country are enough, no need to mention your home address.

- (Optional) LinkedIn URL. If your LinkedIn profile is up-to-date, you can include a URL in your contact information section.

Here’s what your contact information section should look like once you’re done with it:

Financial Analyst

123-123-1234

linkedin.com/in/johnd

#3. Write an Attention-Grabbing Financial Analyst Resume Summary (or Objective)

The next section in your financial analyst resume is the resume summary.

A resume summary , in a nutshell, is a “preview” of your resume. It helps the recruiter understand whether you’re qualified without having to read your resume in its entirety.

Done right, a financial analyst resume summary should include:

- Your job title ( “Financial Analyst” )

- Your years of experience ( “With 6+ years of experience in the field” )

- Your top 1-2 achievements ( “Experienced in identifying wasteful processes and cutting spend by over 12% at Company X” )

- Your top skills ( “Skilled in risk management, data validation techniques, and data visualization” ).

Here’s a practical example of what this looks like on a resume:

- Senior financial analyst with 6 years of experience seeking a role at Company X. Past achievements include helping drive costs down by over 12% at Company Y by eliminating wasteful processes. Skilled in risk management, data validation techniques, and more. CPA-certified.

Don’t have a lot of work experience? You might want to use a resume objective instead. Read our guide to learn more.

#4. Focus on Achievements to Stand Out from Other Applicants

The next section on your financial analyst resume is the work experience section.

First things first, start by formatting the section as follows:

- List your work experiences reverse-chronologically. Start with your latest/current experience and go back in time from there.

- For each of your roles, include the following information: title, company name, dates employed, and 3-5 responsibilities and achievements.

- For older roles (think, jobs from 5-10+ years ago), you can include less than 3 responsibilities/achievements.

And here’s how that would look on your resume:

07/2015 - Current

- Collected, analyzed, and managed quantitative data.

- Created in-depth financial reports that lead to over 12% cost reductions in 2020.

- Prepared weekly reports and led presentations for training new staff.

- Reported directly to the CFO.

Now, if you want your work experience section to truly stand out from your competitors, here are some tips on how to make that happen:

- Focus on achievements when possible. The recruiter knows what your responsibilities were - they want to know how you excelled at the role instead. So, if possible, include achievements instead of responsibilities.

- Quantify your achievements. Saying “cut expenses” is one thing, saying “cut expenses by 12% in 2020 by identifying and eliminating wasteful processes” is something else entirely. Including information on results, timeframe, and actions taken helps give the hiring manager a better idea of your work history and skills level.

- Skip on irrelevant work experience. The hiring manager doesn’t care about your job waiting tables 12 years back during university, so you can safely skip it.

Applying for an entry-level financial analyst role? Check out our article on how to create a no-experience resume .

#5. Include Your Educational Background

On to the next section - education .

This one’s relatively straightforward, just include your educational history as such:

- Include your latest degree on top of the section. Start off with the degree name (e.g. B.A. in Finance), institution name, and years attended.

- If you have a second degree, include that too. Follow the same format.

- If you have a B.A. or an associate’s degree, feel free to skip including your high school information.

Here’s how the education section should look like on your financial analyst resume:

B.A. in Finance

Chicago University

08/2013 - 05/2017

If you’re a recent university graduate lacking in work experience, you can also add information about the courses you’ve attended in university to give the recruiter an idea of your knowledge:

Courses Attended:

- Corporate Finance

- Asset Management

- Risk Management

#6. List the Right Skills for the Job

The next step to perfecting your financial analyst resume is including the right skills.

And by “right skills,” we don’t mean listing out every single skill you’ve learned.

Rather, you need to specifically include the skills that are going to help you do your job as a financial analyst right.

Some of the most in-demand financial analyst skills in 2024 are:

15 Essential Financial Analyst Skills

- Financial Modeling

- Financial Accounting

- Managerial Accounting

- Financial Reporting

- Statistical Analysis

- Data Validation Techniques

- Communication

- Process Improvement

- Attention to Detail

#7. Use The Optional Resume Sections (to Make Your Resume Even More Compelling)

Do you still have some space on your financial analyst resume? You can use some of these optional resume sections to fill up your resume to cover the entire page.

While these sections won't land you the job on their own, they can help you stand out from applicants with the same level of experience and skills.

The optional sections are:

- Certifications. As a financial analyst, there are a lot of certifications you can get to help attest to your skill set. E.g. CFA , CPA , FMVA, and others.

- Languages. In 2024, knowing an extra language or two is always an asset, regardless of what job you’re applying for.

- Hobbies & Interests . This section can help show the hiring manager who you are as an individual (as opposed to a professional) and (potentially) allow you to build rapport with your interviewer.

Here’s how these optional sections would look like on your financial analyst resume:

- German - Native

- English - Fluent

- Spanish - Intermediate

Certifications

- Chartered Financial Analyst (CFA) Certification (4). 02/2015 - 02/2016

- Financial Modeling and Valuation Analyst (FMVA). 03/2012 - 08/2012

Hobbies & Interests

- Artificial Intelligence

- Mindfulness

#8. Make Sure Your Financial Analyst Cover Letter is as Compelling as Your Resume

At this point, your resume probably already looks very compelling…

But we’re not done just yet!

You need to create a financial analyst cover letter that’s just as good as your resume.

Here are some tips on how you can do this:

- Start the cover letter by addressing the hiring manager with their full name or title. E.g. “Dear Margaret.” Sure, you could do the traditional “Dear Sir or Madam,” but including a name or position shows the recruiter that you did your research.

- In the introduction of your cover letter, include your job title, years of experience, top 1-2 achievements, industry experiences, and any of your other top selling points.

- In the body section of your cover letter, you can include things like more detailed skills, responsibilities, work history, and optionally, information on why you’d like to work at the company you’re applying for.

- Finish up the cover letter with a call to action. E.g. “Would be more than happy to discuss my work history more in-depth over an interview.”

Struggling with your cover letter? Check out some of our best resources on the topic:

- Guide on Writing a Cover Letter

- 21 Best Cover Letter Tips

- Most Common Cover Letter Mistakes

Key Takeaways

And that’s the gist of it!

That’s all you need to know in order to create a compelling financial analyst resume and land the job.

Before you go, let’s do a quick recap of the most important learning points we covered in this article:

- Use a resume summary to grab the hiring manager’s attention from the get-go.

- In your work experience section, focus on achievements over responsibilities. Quantify your achievements when possible.

- Include both hard and soft skills in your skills section.

- Include any certifications that you might have. E.g. CPA, CFA, etc.

- If you have some extra space in your resume, you can also include extra sections such as languages or hobbies.

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Financial Services

Entry Level Financial Analyst Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the entry level financial analyst job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Culture that fosters development

- Exposure to meaningful work in an innovative environment

- Customized development plans

- Use analysis to influence and drive action within finance and our business partners by using fact-based, holistic and forward-looking perspectives

- The candidate will construct forecasting models to optimize and identify the strategic financial direction for the regional office

- Isolate key drivers, quantify impacts, and forecast implications to the business

- Industry and competitor company analysis and research

- Quick learner with aptitude for various systems and processes

- Develop effective presentations for small groups

- Assist in the review, set-ups and processing of claim and capitation payments within the Pegasys system

- Assist with forecasting and planning of corporation’s results

- Assist in client regulatory/monthly reporting processes

- Collaborate with business partners to identify emerging issues and assist in implementation of strategies

- Collaborate with business partners to identify emerging issues and assist in implementation of strategies

- Knowledge in SQL a plus

- Provide accurate, timely reports with financial insight to allow business partners to improve performance

- Provide accurate, timely reports with financial insight to allow business partners to improve performance

- Assist in preparation of monthly reporting packages for senior management/Allstate Corporation Board meeting presentations

- Working knowledge of PeopleSoft Financial Systems and/or IBM Cognos TM1 is a plus

- Develop effective presentations for small groups

- Other Administrative work as assigned to support the Finance Department

- Basic Skills - able to perform mathematical calculations and understands basic accounting functions

- Advanced Excel skills; ability to develop and use pivot tables and databases to obtain data and develop reports; database (Access or equivalent) creation experience

- Working knowledge of US GAAP highly desirable

- The successful candidate will have general knowledge of business area processes, including best practices in order to support the area's projects, products and services

- This candidate will have effective communication in working with others in everyday situations and have the ability to interact effectively and lead change with internal and external customers

- Working knowledge of SAP Financials is highly desirable

- Customer Orientation ‐ establishes and maintains long‐term customer relationships, building trust and respect by consistently meeting and exceeding expectations

- Knowledge of consulting companies is highly desirable

- Working knowledge of Excel and good knowledge of MS Windows based software packages: Word, Outlook, etc

- Financial analysis skills ‐ knowledge of research techniques sufficient to collect and interpret data Knowledge of descriptive statistics to analyze statistical data and prepare projections

6 Entry Level Financial Analyst resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, entry level financial analyst resume examples & samples.

- Bachelor’s degree in Finance, Math, or Economics required

- 5 GPA or higher

- Internship as an analyst or up to 1 year of corporate financial analysis experience

- Must be detail oriented and be able to deliver accurate information in a timely manner

- Prepare and help build storyline for financial updates

- Use analysis to influence and drive action within finance and our business partners by using fact-based, holistic and forward-looking perspectives

- Bachelor's degree in Finance, Business, Accounting or related field

- GPA of 3.2 and above

- This individual will have exceptional written skills and the ability to understand and report on all forms of business statistical information

- The ideal candidate will create models to measure financial data, prepare written narratives and/or presentations to explain outcomes of the data to management and peers

- This individual will have the ability to apply standardized mathematical concepts to solve problems and prepare reports for analysis

- He/she will also have the ability to leverage technical skills in support of team objectives

- The ideal candidate will be responsible for quality and quantity of sound decisions around processes and issues within the scope of daily responsibilities

- The successful candidate will have general knowledge of business area processes, including best practices in order to support the area's projects, products and services

- Isolate key drivers, quantify impacts, and forecast implications to the business

- Use analysis and reporting to influence and drive action within finance and our business partners by using fact-based, holistic and forward-looking perspectives

- Working knowledge of financial and accounting concepts

- Analytical skills to compile information requiring combinations of data from multiple sources, the ability to work with numbers and formulas

- Solid work ethic, including ability to follow-up, focus on details and take initiative

- Oral and written communication skills, able to work effectively with employees both internal and external to the finance function

- Effective time management and organization skills with a proven ability to multi-task

- Bachelor’s degree in Accounting, Finance or other related degree

- Fully proficient in PC tools (Microsoft Office)

- Minimum GPA of 3.00 strongly desired

Entry Level / Financial Analyst Resume Examples & Samples

- Degree emphasis in Finance, Business Administration, or related discipline

- Self-starter with excellent communication and organizational skills

- Knowledgeable in Intermediate level Excel including working knowledge of Pivot tables, V-lookups, graphics

- Work effectively as an individual contributor and as part of a team

- Positive attitude and strong interpersonal skills

- Knowledgeable in Cobra and SAP tools, Earned Value Management (EVM) principles and their application to the program including Earned Value Management's (EVMS) metrics & reporting familiarity

- Education and experience consistent with job responsibilities

- Understanding of accounting concepts and familiarity with U.S. GAAP

- Work experience in the professional environment

- Experience with presentations to management

- Knowledge of or familiarity with FAR and CAS

- Cost center controlling and budget management reporting

- P&L reporting for actuals and forecasts

- Cost reduction program reporting to drive gross margin expansion

- Inventory reporting, valuation & analysis

- Ad-hoc projects as defined

- BS in Business Administration, Finance, or Accounting. Advanced degree/CPA is a plus

- Less than 5 years of experience, preferably within the semiconductor industry

- Self-starter who can work independently

- Strong Problem-Solving skills

- Proficient with MS Office with advanced Excel knowledge

- Detailed oriented, hands-on team member ready to be part of the regional finance team

- Highly organized with excellent analytical skills

- Self-starter with a curiosity to learn new processes

- Ability to manage independent work effort

- May monitor department budgets by reviewing data in the financial system and communicating with the managers/chiefs

- Prepares advanced financial trend and data analysis reports

- Participates in the development of regional, departmental and/or functional budgets

- Minimum two (2) years of related experience in financial analysis and budgeting

- Bachelor’s Degree in Finance/Accounting or Business-related field

- Education and experience consistent with job responsibilities, strong analytical skills, finance/accounting acumen

- Self-starter with strong communication skills

- Advanced proficiency with Microsoft Office Suite Products with emphasis on Excel and Power Point

- Familiarity and understanding of Earned Value Management System (EVMS) concepts and applications

- Strong financial / analytical orientation

- Experience with financial data submittals; accounting skills

- Familiarity with SAP, Cobra, Hyperion, wInsight, E-WAD

- Advanced Excel skills; ability to develop and use pivot tables and databases to obtain data and develop reports; database (Access or equivalent) creation experience a plus

- Bachelor’s degree in finance, accounting, business or related field

- Minimum of 0-2 years of related experience

- Advanced knowledge and experience using Microsoft Excel

- Strong Modeling & Analysis

- Excellent verbal & written communication

- Ability to execute and follow-through to completion of tasks

- Bachelor’s degree in Accounting, Finance, Math, or a related field preferred

- Strong excel skills are required (pivot tables, allocations, formulas, etc.)

- Work experience or educational background in Finance or Accounting

- SAP and/or Hyperion knowledge/experience

- COBRA, Open Plan experience

- Assist in the monthly financial statement closing process, including preparation of Journal Entries, completion of account analyses and Accounts Payable

- Completion of the monthly Bank Reconciliation process

- Responsible for reviewing and manipulating data

- Ensure accuracy of data

- Build monthly P&L reporting and profitability analysis

- Provide revenue and Gross Margin analysis

- Preparation of unit costs

- Capital spending requests

- Ad hoc financial analysis for business unit and the Power Mosfet Division Controller & Power Solutions Group Controller, as necessary

- Undergraduate degree in Finance, Accounting, or Business/Data Analytics Degree

- Less than 10% travel required

- Oracle EBS and BI experience preferred

- Hyperion Planning/Reporting experience preferred

- Tableau, Qlikview, or other reporting tools preferred

- Bachelor’s degree in Accounting is preferred

- 2 + years of related accounting experience

- Working knowledge of life insurance and retirement products a plus

- FINRA Series 6 & 63 license to be obtained within 90 days of filling the role

- Ability to assemble and communicate findings to areas requesting analytical information

- Intermediate PC skills in Microsoft Office, SAP accounting system a plus

- Attention to detail when preparing work papers and process documentation

- Expense analysis, actual and planning

- Assist with forecasting and planning of corporation’s results

- Bachelor’s degree in Finance, Business, or related field with GPA of 3.5 and above

- Financial Analyst or similar internship strongly preferred or 1-2 years of related experience (insurance industry and financial analysis experience)

- Microsoft products (Excel, Word, PowerPoint), SAP knowledge a plus

- Analytical skills including ability to reconcile, manipulate and analyze data to produce information and develop and/or evaluate financial scenarios

- Written and verbal communication skills required to draft memos and presentations and interact with internal customers

- Planning and organizing skills including ability to multi-task and exhibit effective time management and organizational skills

- Personal interest in learning a wide variety of corporate finance related work, ability to pay close attention to detail and the ability to work on teams as well as independently

- General insurance industry understanding including metrics, common structures (mutual vs. stock), ratings importance, preferred

Entry Level Financial Analyst for Established Global PE Firm Resume Examples & Samples

- 1-3 years of financial analysis experience

- Bachelor's Degree in Finance, Accounting or Business is required

- Prior experience in database applications

- Strong Excel skills w/ VBA

- Skill in interpreting and analyzing data

- Skill in examining documents and quantitative metrics for correctness and accuracy

- Ability to apply business intelligence strategies to convert business cases into solutions

- Knowledge of legal and fiscal requirements and regulations

- Interpersonal Skills ‐ able to work effectively with others

- PC Skills ‐ demonstrates advanced proficiency in Microsoft Excel, Microsoft Office suite, and in other applications as required. Demonstrate knowledge of relational databases, including SQL queries

- Policies & Procedures ‐ demonstrates knowledge and understanding of organizational policies, procedures and systems