Solving The Money Problem Net Worth

What is solving the money problem's net worth.

Solving The Money Problem is an American YouTube channel with over 274.00K subscribers. It started 4 years ago and has 1554 uploaded videos.

The net worth of Solving The Money Problem's channel through 13 May 2024

Videos on the channel are categorized into Knowledge.

How much money does Solving The Money Problem make from YouTube?

Below is an estimated average earnings from advertising on the channel, depending on language, price and current audience.

This income is valid for channel visits till May 13 and must be updated when channel data changes. The channel may have additional revenue streams, such as sponsored content and product sales, that are not reflected in these figures.

Solving The Money Problem channel's current stats and earnings

Here are the stats for the last two weeks, separated by days.

- The lowest daily views during this period are 0.00

- The highest daily views are 169.94K

Forecast of next month's revenue

Solving The Money Problem net worth for June 2024 - $16,894

Official Social Media Channels

- Top Youtubers in United States

- Best in category "Knowledge"

To forecast the value of Tesla stock might seems out of place on this website dedicated to value investing , but I've had so many people ask me about my views on Tesla (TSLA), and I have had several heated discussions with my uncles and my dad, who all believe that Tesla does not stand a chance against the big, established car companies (they're wrong!), that I felt compelled to write this article.

In this article, I explain why I, as a hardcore value investor, invested a large part of my portfolio in Tesla stock, and why I believe the company will be worth TRILLIONS by 2030.

But first, let me briefly tell you how I accidentally ended up owning Tesla shares...

In August of 2015 I purchased shares in SolarCity, then still managed by Elon Musk's cousins, Peter and Lyndon Rive.

Their unique offering was to allow clients to rent solar panels so they could start making money from day 1, instead of having to splurge a couple of thousand dollars and only seeing any real returns after several years.

After running the numbers, it seemed like a great value stock, and so I invested.

Just one year later it was announced that Tesla and SolarCity would combine, in a rather controversial deal.

This transformed my SolarCity shares into Tesla shares, and I wasn't super happy about that back then...

Still, I kept the shares in my portfolio and watched them hover around the $300 mark for years.

Nothing spectacular happened.

Then, the #1 investor in the private investment club I'm in started talking about his research into Tesla, and he made some very intriguing points.

According to his research, Tesla seemed to have an unassailable talent and technology lead, and the stock should be worth a lot more than $300.

I listened closely, but did not act on it.

Then, at the end of 2019, the audacious Tesla Cybertruck was unveiled and pre-ordered en masse.

I searched YouTube for some footage of the unveiling, and stumbled upon a video from Solving the Money Problem , and was taken by the guy's knowledge about Tesla and investing.

Since then, I watched every single one of his videos, which taken together paint a very clear and nearly inevitable path to extreme profitability for Tesla in the coming decade.

On top of that, I started reading the in-depth research done by ARK Invest , who are long term investors in disruptive innovation, and whose largest holding is Tesla stock.

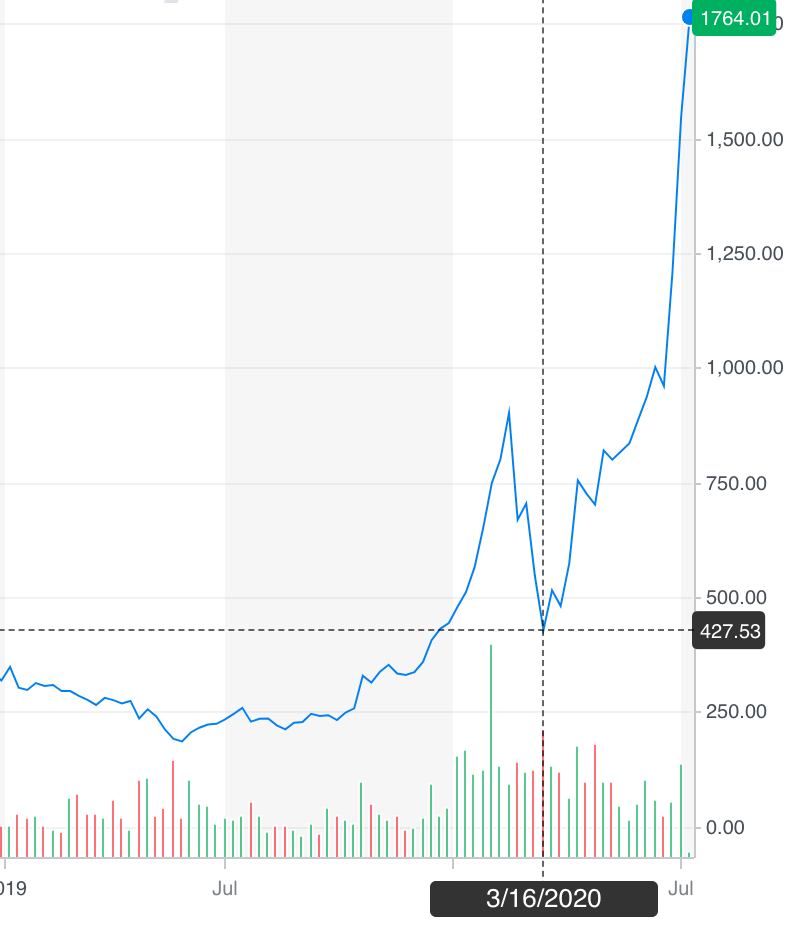

All of this information led me to purchase more TSLA shares during the COVID downturn in March, even though I normally only buy stocks from companies that have shown years of above average profitability.

So why did I make this exception?

Why did I stray from my otherwise ultra-logical investment strategy?

Had I gone mad?

I honestly feel Tesla is an incredible company with huge competitive advantages, and will be worth several Trillion dollars within a decade.

But before we can peer into the future, we have to establish where Tesla as a company is today .

Tesla today

Today, in 2020, Tesla has achieved all of the milestones it set in its 2006 Master Plan :

- Build sports car (Tesla Roadster)

- Use that money to build an affordable car (Tesla Model S)

- Use that money to build an even more affordable car (Tesla Model 3)

- While doing above, also provide zero emission electric power generation options (Solar Roof)

They are also well on their way to achieve their goals set in Elon Musk's Master Plan, Part Deux :

- Create stunning solar roofs with seamlessly integrated battery storage

- Expand the electric vehicle product line to address all major forms of terrestrial transport

- Develop a self-driving capability that is 10X safer than manual via massive fleet learning

- Enable your car to make money for you when you aren't using it

Let's dive a bit deeper into these.

Tesla Energy

It is worth noting that the first item on Musk's latest Master Plan is not about cars.

It is about solar roofs and battery storage.

When you hear people say things like "Tesla is valued much higher than other car companies", is because Tesla is not just a car company .

A lot of their focus is in fact on energy products, which Elon Musk expects will be worth as much, if not more, than their entire car division at some point.

Tesla is currently producing about 1000 solar roofs per week in their GigaFactory.

Giga New York built 4MW of Solar Roof last week, enough for up to 1000 homes! — Tesla (@Tesla) March 15, 2020

40% of the people who purchase a solar roof, also purchase at least 1 Powerwall, which further increases Customer Lifetime Value.

They've also been granted an electrical utility license in the UK , and have successfully implemented their grid-scale Megapack battery storage solution in several huge projects worldwide.

According to Musk:

At the site level, Megapack requires 40% less space and 10x fewer parts than current systems on the market. As a result, this high-density, modular system can be installed 10x faster than current systems.

All of this is managed by their revolutionary Autobidder software , which automatically optimizes energy storage and delivery, maximizing the revenues earned from Tesla battery solutions.

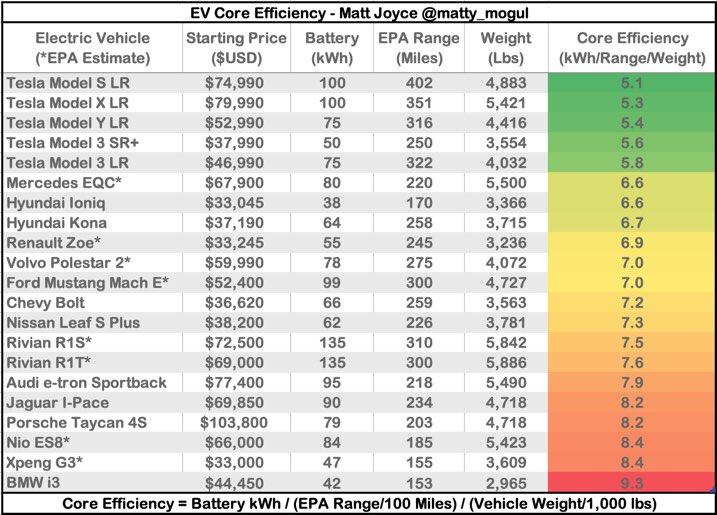

And these batteries, which are also used in their cars, are not just any batteries, they are the most efficient batteries in the world at the moment:

Notice those first 5 rows?

Tesla is dominating when it comes to battery tech, and there are more improvements coming now that they are building their own battery R&D labs and production lines.

Tesla Vehicles

In 2016, when the second Master Plan was written, Tesla had only launched the Model S sedan and Model X mid-size SUV.

They vowed to cover "all forms of terrestrial transport", leaving the terrestrial transport up to Musk's other highly successful company, SpaceX.

Since then, the more affordable Model 3, and recently also the Model Y crossover, have started rolling off the production line.

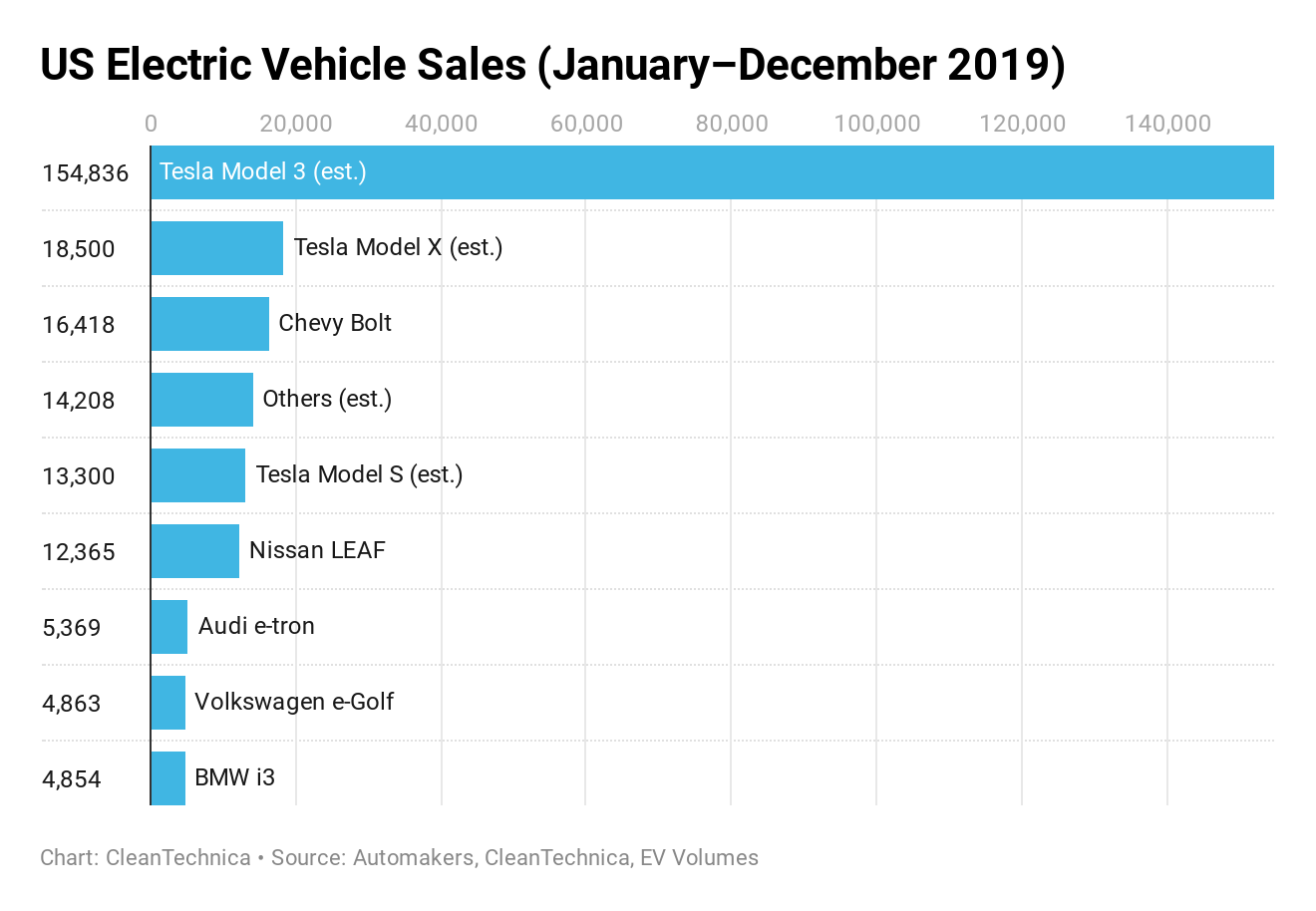

The Model 3 has been a smashing success.

It sold over 10 times more than the second most popular electric vehicle (which was the Model X...)

It won the Car of the Year award.

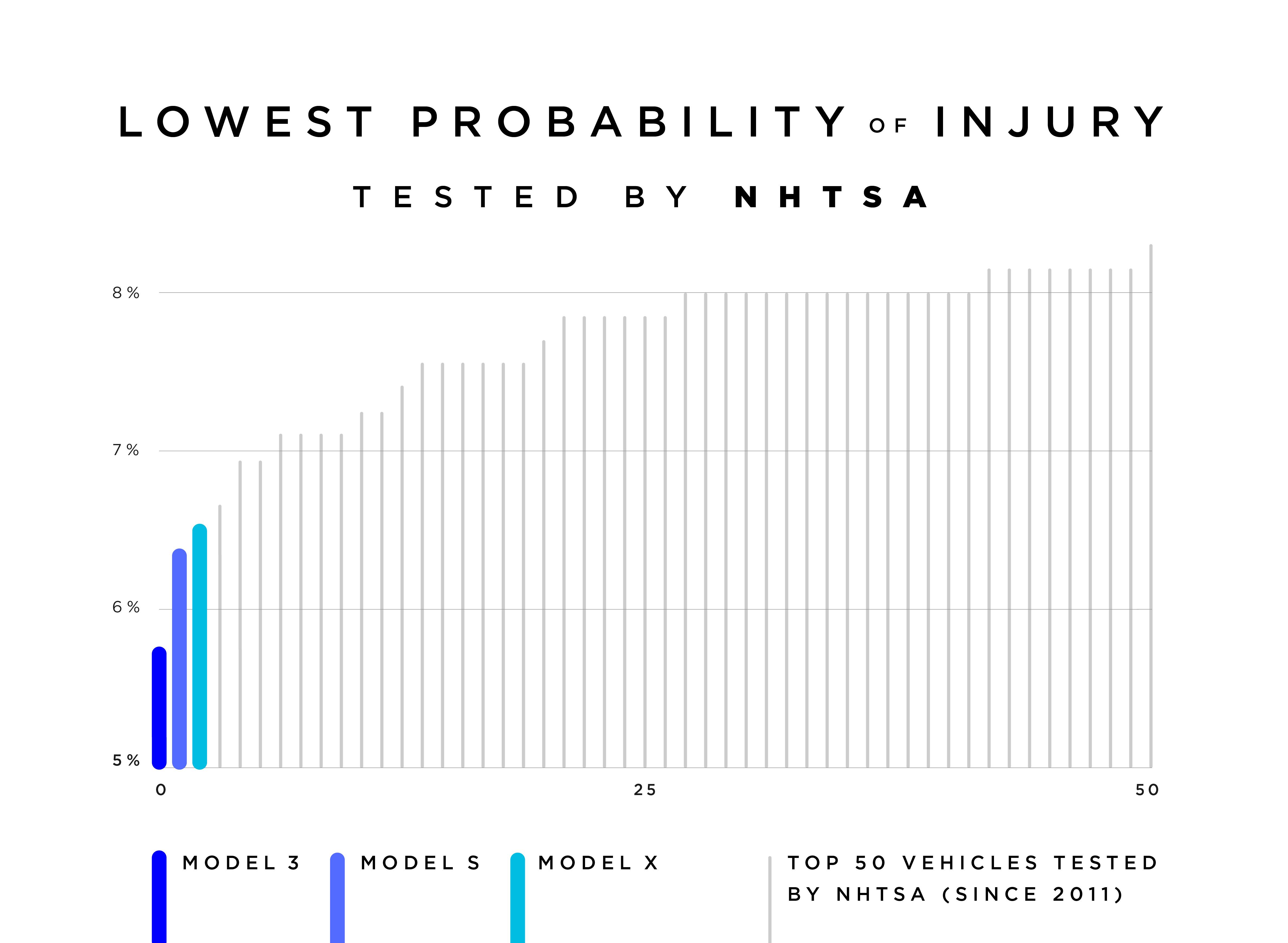

It was the safest car EVER TESTED (followed by the Model S and Model X...)

And Elon Musk expects demand for the Model Y to be more than that of the S, X, and 3... combined!!

And then there are of course the controversial Cybertruck, which received a couple hundred thousand pre-orders the day it was announced, as well as the Tesla Semi truck, and the new record-breaking Tesla Roadster, which all still have to enter production.

The rumor mill also hints at a potential Tesla van and compact car.

While at first glance this lineup looks pretty decent, the thing that is really impressive are the incredible efficiencies Tesla is able to achieve with each new iteration.

For example, the Model Y shares 75% of its parts with the Model 3, creating massive economies of scale.

The Cybertruck might look weird to many, but the reason for the stainless steel body is that it doesn't need a paint job , creating enormous savings in production time and costs.

Same for the right angles of the body; much easier to produce than smooth curves.

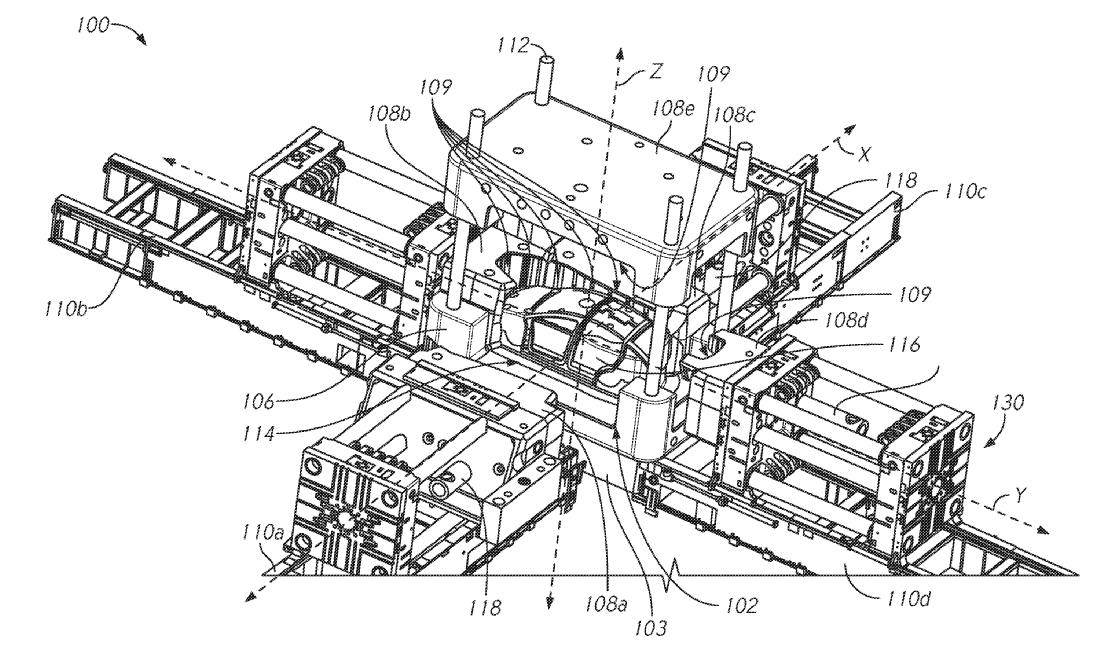

Then there is the gigantic die-casting machine Tesla patented in 2018, which today allows them to create a car body out of just 2 parts (eventually just 1), whereas the body of a traditional car consists of no less than 75 individual parts!!

This greatly reduces complexity and production costs.

So yes, Tesla makes cars, and they are being smart about it too, but their most important "product" might be "the machine that builds the machine": their Gigafactories.

While they were in "production hell" during the Model 3 production ramp a few years ago, their China Gigafactory was built and fully ramped within just a year after breaking ground.

And the best part: the China factory was 65% cheaper per unit of capacity, leading to much higher profit margins for cars coming from that factory.

Giga Berlin is following a similar path.

Today, Tesla is not able to produce enough cars to meet demand, but they will build Gigafactories as fast as they can make them the next few years to close this gap.

And the best part: other car companies are effectively funding these factories by purchasing billions of $ worth of ZEV credits from Tesla , just to meet emission standards and avoid massive fines.

Full Self-Driving

Autonomous vehicles, also referred to as full self-driving or level 5 autonomy, will revolutionize transport as we know it.

And it's a matter of when , not if .

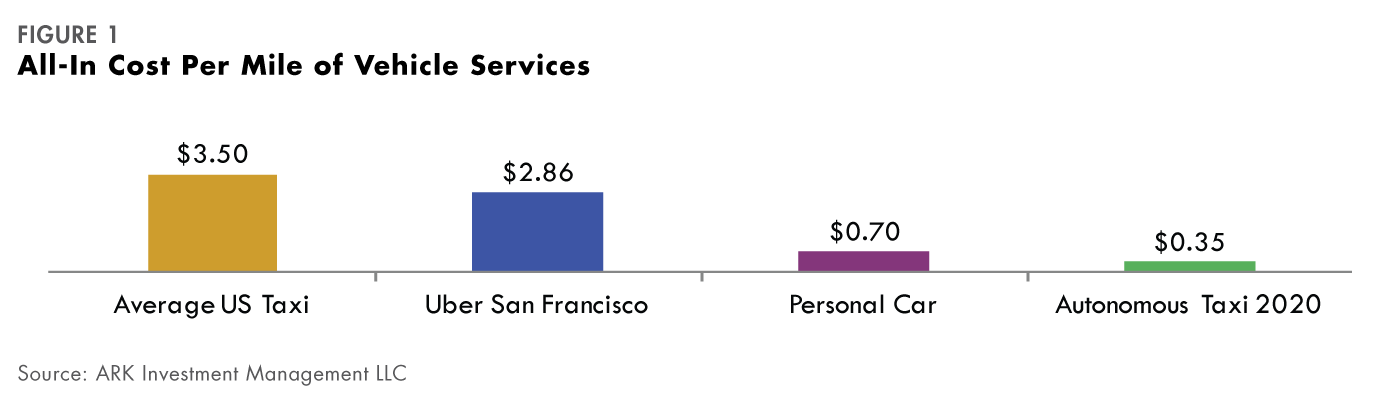

The promise is that once cars can drive themselves, a fleet of so-called robotaxis will become one of the main modes of transportation, because this will be much cheaper than either owning a car or taking a regular taxi with a human driver.

ARK Invest estimates that a robotaxi will cost around $0.35 per mile, compared to $0.70 per mile for owning a car yourself, thanks to higher utilization rates.

Instead of you driving your car only a few hours a day, your car could be used as a robotaxi while you weren't using it and earn you money while you sleep!

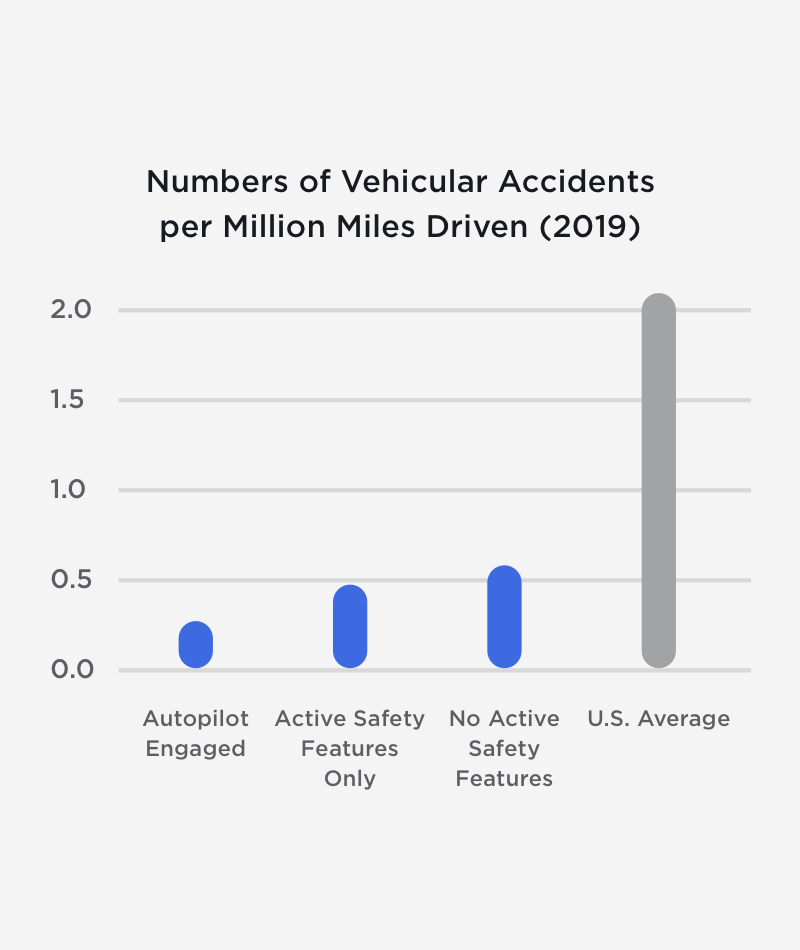

However, besides you being able to watch Netflix while your car drives you places, or your car earning you money, the main benefit of self-driving is that it is MUCH MUCH safer than having flawed humans drive.

Today, Tesla cars that have Autopilot enabled are already about 10 times less likely to get into an accident than the US national average!

ARK expects car accidents to eventually decline by a whopping 80% as more cars on the road become autonomous.

This will save millions of lives!

But while this dream sounds amazing, we're not fully there.

Level 5 autonomy has not been completely solved yet, but Musk recently said they are close (he has been saying this for a while now, though).

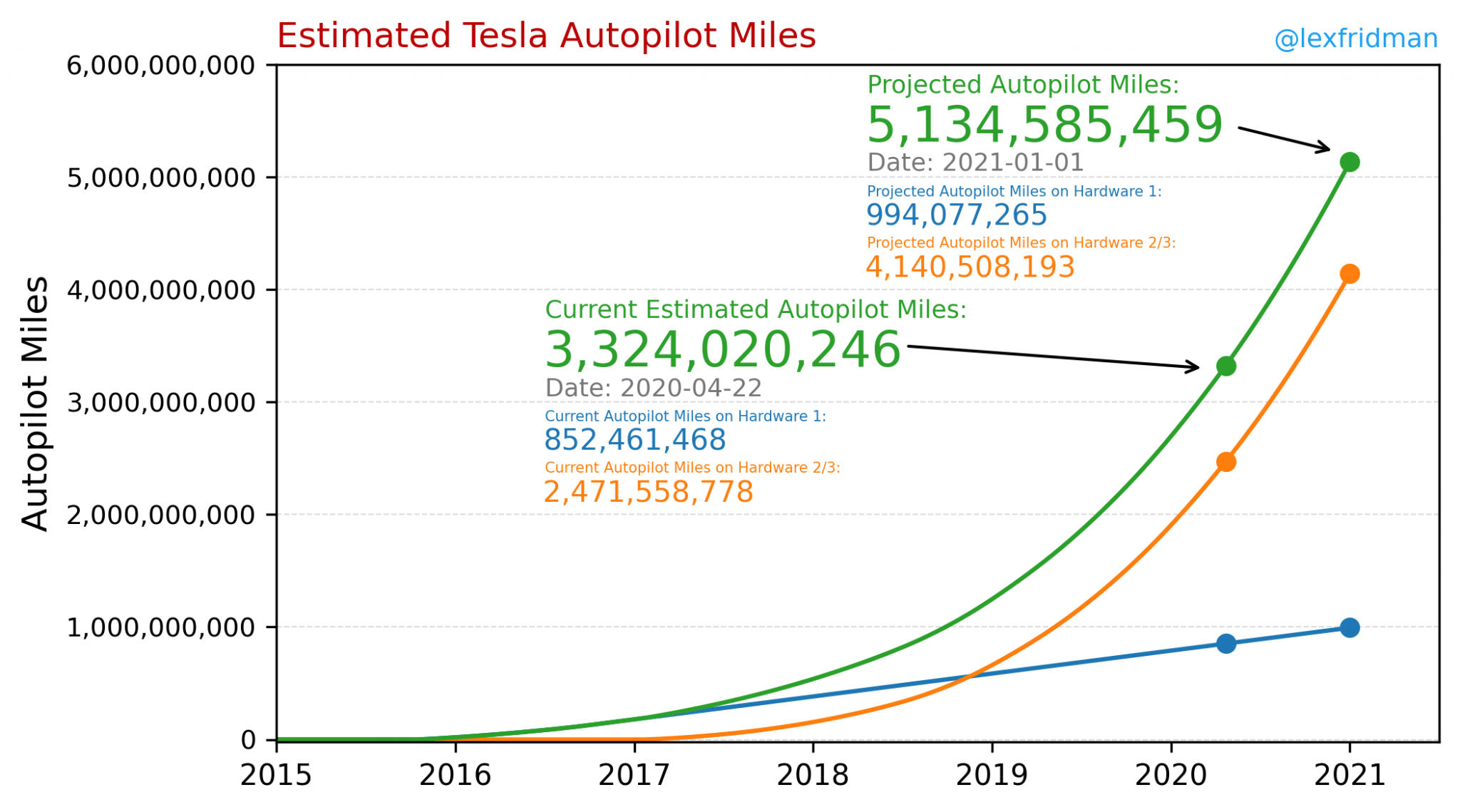

But if anyone is going to solve it, it is Tesla, as they have a humongous data lead by having over 1 million cars on the road that are collecting real-world data, every single day.

This data is then used to train a deep neural network, and each data points improves its performance and reliability.

There is no company in the world that comes even close to having this amount of real-world data, and so many are using computer simulations to train their AI, which is just not going to cut it.

Besides, all competitors are using LIDAR technology, which is bulky, and cannot distinguish a rock from cotton candy.

Tesla chose the route of computer vision, which is much harder to perfect, but ultimately superior for this particular application.

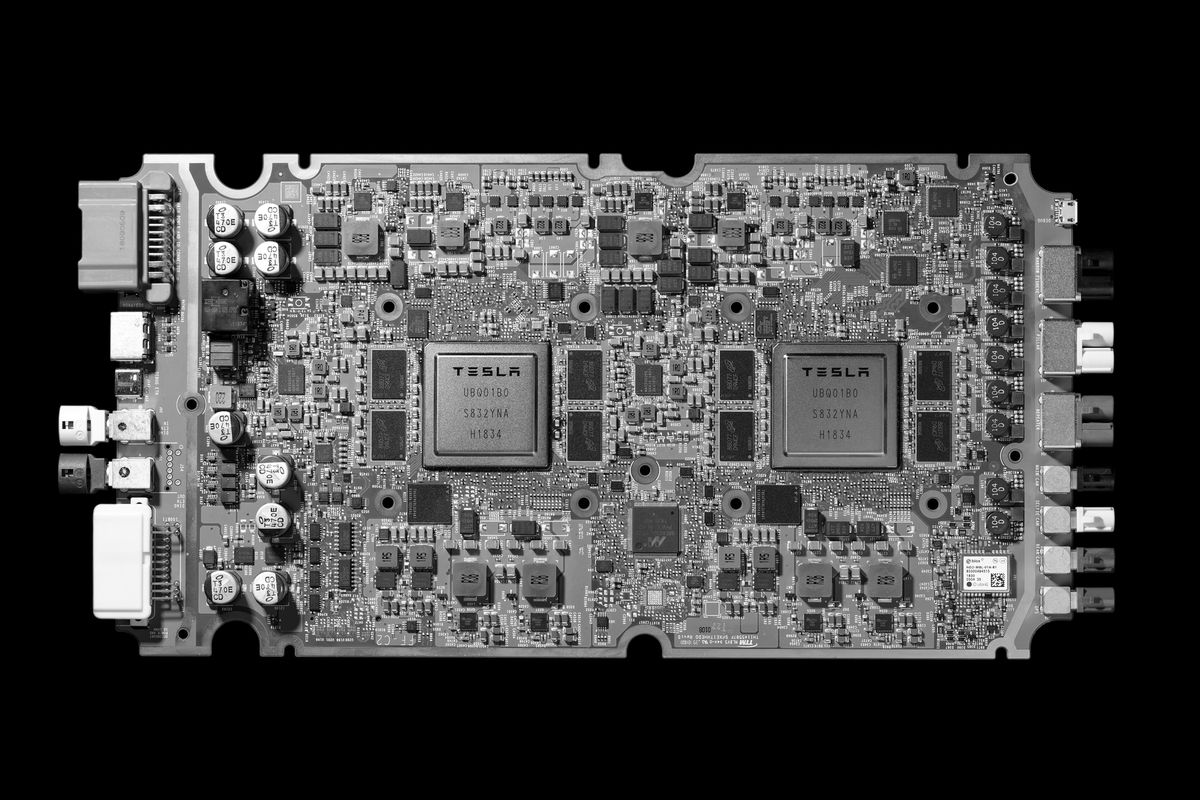

All of this is made possible thanks to Tesla's in-house developed Full Self-Driving Computer, also called Hardware 3.

An engineer from a Japanese car company said " we cannot do this ", and car manufacturing experts said this chip is about 6 years ahead of GM and the like.

Tesla saw the need to develop this chip themselves, as off-the-shelf products like Nvidia's AI chips used way too much power, and were not optimized for computer vision tasks.

So Tesla today has the most powerful self-driving chip in the world, as well as a gigantic data lead, making it very likely that they will be the first company to solve level 5 autonomy.

So why is Tesla able to innovate so rapidly?

One word: talent.

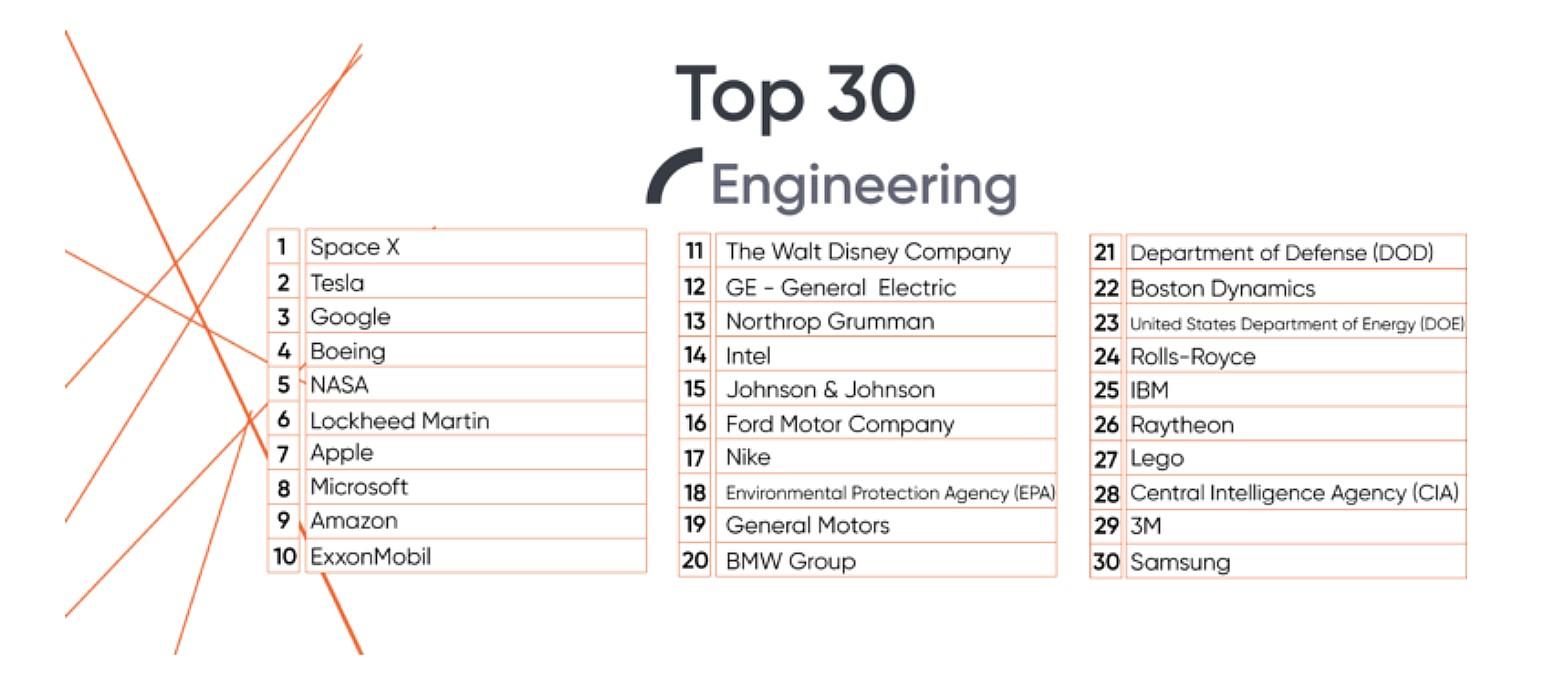

Tesla is the #2 most popular company to work for, as voted by engineers (#1 being Musk's other company, SpaceX, who regularly move engineers between them when needed).

So Tesla has its pick of the very best engineering talent in the world.

This matters!

Alan Eustace from Google said:

One top-notch engineer is worth "300 times or more than the average," explains Alan Eustace, a Google vice president of engineering. He says he would rather lose an entire incoming class of engineering graduates than one exceptional technologist. Many Google services, such as Gmail and Google News, were started by a single person, he says.

Finally, let's look at Tesla's current financial position, as all the things mentioned above will be useless if the company goes bankrupt before it is able to implement all of its bold plans.

In Q1 2020, Tesla had a cosy $8 billion in cash (enough to build 4 Gigafactories), although there is also a significant amount of debt on their balance sheet .

They also generated about $1 billion in free cash flow over the last 12 months, even after paying for operating expenses and new Gigafactories, which means money is coming in faster than they can spend it.

It is 100% true that Tesla's financials are not what I normally look for as a value investor.

They have a negative return on equity , while I normally look for > 15%

They have a 1.27 debt-to-equity ratio, while I normally look for < 0.5

They have a 1.24 current ratio , while I normally look for > 2

Yet it is clear that they are on a path of exponential growth.

I consider this a special situation that is too good to pass up, and so I made an exception for Tesla.

Tesla in 2030

Now that we established where Tesla is today , let us pull out our crystal ball and make some educated guesses about the future.

If we assume that Musk's second Master Plan will become a reality, we should see:

- Bigger energy business

- A vehicle for every market segment

- Full self-driving

- Customers earning money with their Tesla products

To accommodate these dreams, many more Gigafactories are needed.

Luckily, costs per factory are declining rapidly, and construction + ramping only takes about a year now, so in 10 years we can reasonably expect a minimum of 10 extra Gigafactories.

Likely even more than that, as Musk plans to 50X the current output from its Gigafactories.

Future profit margins on car sales should continue to increase significantly as production processes are further optimized.

Even software-like margins seem possible once full self-driving is released, from robotaxi fees, Autobidder fees, as well as an in-car app store for entertainment purposes, since the driver no longer has to pay attention to the road and has this big, beautiful screen in front of him.

While VW is finally taking electric vehicles seriously, many other car makers are still sleeping, and even VW is too late to the party to catch up with Tesla.

Yes, they have more money and more people to throw at the problem, but in technology the following saying holds true:

"Even if you get 9 women pregnant, you won't be able to make a baby in 1 month."

Tesla has a head start of a few years, and this cannot simply be undone by throwing money at it.

Sooo, it seems likely that once the sleeping giants realize they are too late to the party and are not able to catch up in time, they will seek to license Tesla's battery, drivetrain, and self-driving technology.

And licensing fees are ultra-high margin.

Tesla has only just started building out its own battery production line and R&D lab, and yet they've already developed a battery that will only degrade 10% in 1 million miles, after which it can still be used in grid storage solutions, until it is finally recycled .

It further seems possible that Tesla's energy business will have reached a size comparable to that of their car division by 2030, as Musk expects.

Now for the trillion dollar question:

How much will Tesla stock be worth in 10 years?

Normally , when we value investors try to determine the value of a company, we use something like a Discounted Cash Flow model .

However, this only really gives a reasonably accurate result if a company has stable, predictable earnings.

This is not the case with Tesla.

This is also why Aswath Damodaran 's valuation of $650 per share based on today's numbers seems reasonable, but using his approach to extrapolate to 2030 would severely underestimate Tesla's potential.

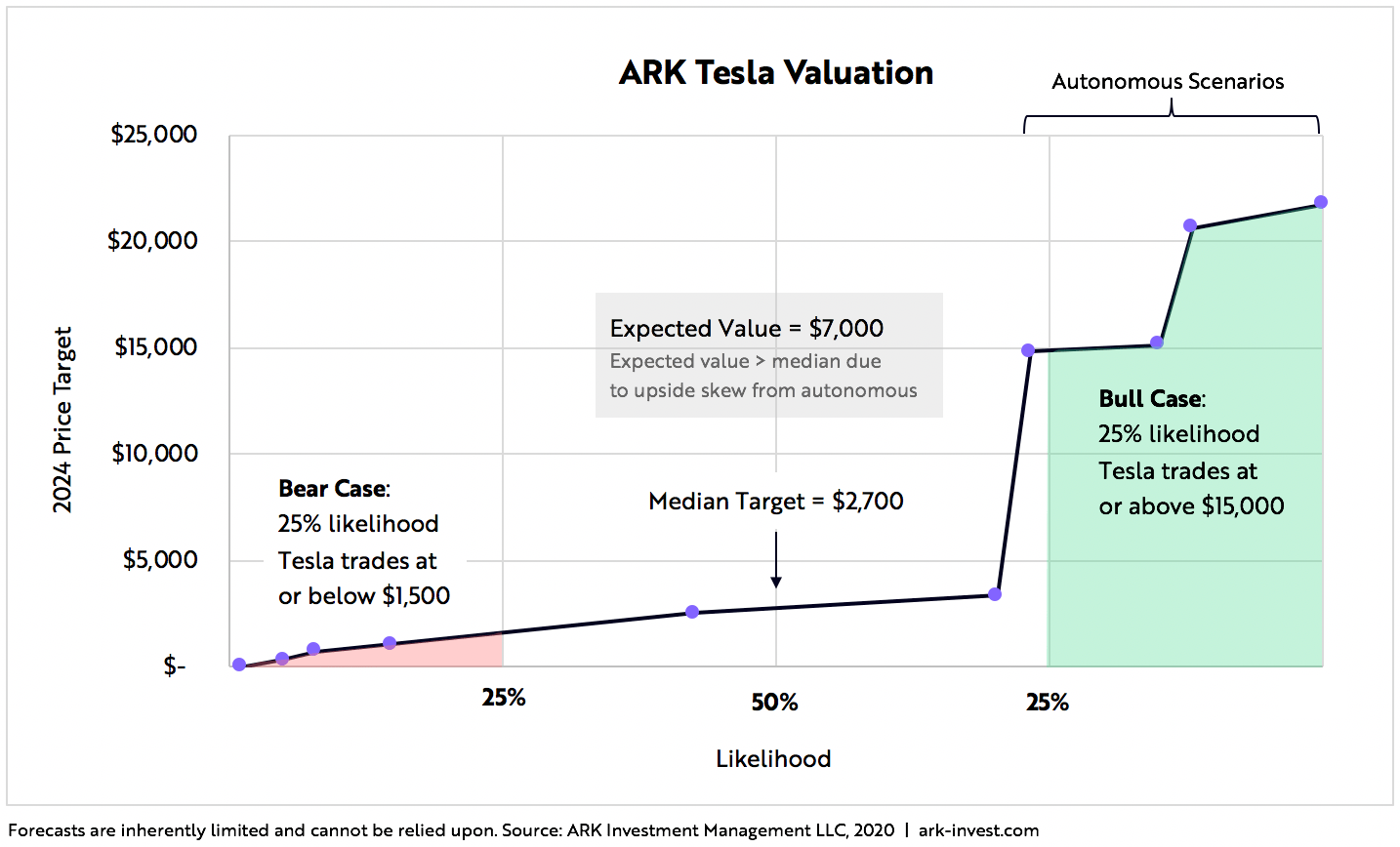

The investor from my investment club, who has a 5000% return since 2009, sees a potential $500 billion market cap for Tesla in 2024, or $2700 per share.

Billionaire investor Ron Baron believes Tesla could be worth $1.5 trillion by 2030.

We’re going to make 10 times our money from here... Tesla could be worth $1.5 trillion, ultimately putting it among the largest and most valuable companies in the world.

ARK Invest, who have several people from different specialties working on this one evaluation, expect Tesla stock will be worth $7000 by 2024 already.

That implies a market cap of $1.3 TRILLION by 2024, 6 years before we reach 2030!

Self-made millionaire Steven Mark Ryan, from the Solving the Money Problem YouTube channel I mentioned earlier, has been researching Tesla in-depth since 2016, and with some back-of-the-napkin math, he roughly estimates a $5 trillion market cap by 2030 is possible.

So what do I think?

I think that, based on the thorough research from some very smart people, as well as my own research, a $2 trillion dollar market cap by 2030 seems plausible.

This means the stock could be worth ~$10.000 in 10 years time ($2000 after the recent 5:1 stock split).

I don't know of any other company with competitive advantages and technology leads similar to those of Tesla, and with so much room left to grow.

That is why my $450 average purchase price seemed very reasonable to me, even if only a fraction of that future valuation is ever reached.

Let's finish with a quote from Charlie Munger when asked about Musk:

I would never buy [Tesla], and I would never sell it short. And I have a third comment; Never underestimate the man who overestimates himself. I think Elon Musk is peculiar and he may overestimate himself, but he may not be wrong all the time.

Found this article insightful? Then click one of the share buttons now to help me spread this information.

NEXT: This Is How I Analyze Stocks In SECONDS

P.S. This is not investment advice, just my thoughts on TSLA stock. Want my thoughts on the metaverse? Then check out this article .

Nick Kraakman

I'm a value investing expert, serial entrepreneur, and educator. For over 10 years I've been studying the strategies of the world's best investors, and in 2013 I started this website to help other investors consistently grow their wealth. I've already trained 20.000+ people through my best-selling investing course. Read my full story...

Don't leave without your free gifts !

Join 32.659+ fellow investors and receive 2 investment spreadsheets and an ebook for free!

I'M NICK KRAAKMAN

I’m here to teach you about Value Investing. I create tools and resources to make investing more accessible. Learn from my successes (and failures) to become a better investor.

FREE SPREADSHEETS & EBOOK

Get three powerful automated spreadsheets, including an intrinsic value spreadsheet + my ebook "The 10 Best Investors in the World", for free!

Claim Your Free Spreadsheets & eBook NOW!

No Spam. Ever. Promise!

Popular Posts

- How to Calculate Intrinsic Value (DCF & More)

- How to Find Undervalued Stocks in 3 Simple Steps

- Lessons from Rich Dad, Poor Dad (summary)

- How to Determine a Realistic Growth Rate for a Company

- The 20 Funniest Goldman Sachs Elevator Gossips

Quick start video

Solving The Money Problem net worth

Solving the money problem income, solving the money problem estimated earnings by months, solving the money problem net worth (revenue, salary), solving the money problem frequently asked questions, how many uploads on youtube solving the money problem has, when solving the money problem started youtube channel, what is the monthly income of solving the money problem, how many subs does solving the money problem have, what is net worth of solving the money problem, how many video views does solving the money problem have, how much does solving the money problem make per 1000 views, similar youtubers to solving the money problem.

Solving The Money Problem trending videos

Solving The Money Problem

With steven mark ryan and friends.

Solving The Money Problem With Steven Mark Ryan

Fan Club With Friends

Welcome to the Solving The Money Problems Fan Club ! This site was started as a fun YouTube post. I asked Steven can I make him a Fan Boy website and he said yes. So here it is. It's 99 Cents a year. Kind of like Facebook. a place to shit post at your own risk. All memberships are non-refundable. We have set up a dummy account for steven, sent him his login credentials but he has not officially logged in yet or acknowledged this site as of yet. I'm currently pulling all the videos over from youtube. Members can comment on posts and have fun in some of the forums. You are responsible for anything you say.

So if you're a Steven Mark Ryan fanboy welcome, if you're not you will be. If your Elon Musk, Munroe, Rob, and you guys are reading this Hello Also! BIG FAN.

Solving The Money Problem's Fan Club!

PS IF YOU'RE NOT A PATRON OF STEVEN'S OFFICIAL PATREON ACCOUNT IT CAN BE FOUND HERE

THIS IS JUST A FANSITE

Are you trying to reach Steven? Do you have a big green bag for him? O.K Good Carry on. This form goes directly to Stevens Gmail.

We have recieved your message WE HOPE IT'S Smokable

Latest Activity

Welcome to the site I will ad live chat to it today. What would you like to see? be able to do?

5 Simple Steps to Resolve Money Problems

Money problems can take many forms..

Posted April 23, 2019

Money problems can take many forms. You might be swamped with debt, struggling to save or pay for college for your kids or worried about outliving your resources in retirement . (Retirement? What retirement?)

Maybe you’re confused by a bewildering array of options and so you do nothing, which just adds to your stress and deepens the hole you find yourself in.

But money problems are just itching for solutions, if you have the foundation, courage and focus to make changes.

By foundation, I mean the basic knowledge you need to understand how to make financial decisions that move you toward the life you value.

If your first reaction is, "Whoa—I don’t know much about the fine points of money," you’re not alone. Here’s a quiz to give you a quick idea of how firm your financial foundation is right now.

Answer each with either TRUE or FALSE:

- Spending more than I can afford (adding to debt) reduces my financial well-being. ___

- The more debt I carry, the more difficult it is to save. _____

- Spending on things I do not truly value is likely to lead me into trouble. ___

- Having a liquid emergency fund is prudent for unexpected expenses or situations, like a major home repair or losing my job. _____

- Investing in risky assets is a dangerous strategy for money I’ll need in the short-term. ___

- Protecting my most valuable assets (health, family, property) is important. ____

- I should have a Will and Powers of Attorney in case I die or become incapacitated. ____

- Filing my taxes on time is important. _____

- My portfolio should support my situation and future plans as well as my risk tolerance and time horizon. ____

If you answered TRUE to these questions, your foundation is on its way. If you answered FALSE to any of these questions, send me an email with your thoughts.

You can hire someone to help you with the foundation ( here’s a list of fee only financial planners), or you can educate yourself on the fundamentals. But once you have that firm foundation, you can follow these five steps to work your way out of money problems.

Define the problem—you can’t solve what you don’t acknowledge. What’s happening that’s causing you financial difficulties, stress and worry? Writing it down will help bring clarity (and stop that endless loop going on in your head).

Know what you don’t know. Identify and sort through what you know from what you don’t. For example, you might know that you’ve got $10,000 in credit card debt, but you’re not sure the best way to dig yourself out.

Explore resources. Whether you hire a professional to help you or commit to learning from books, courses and articles from trusted sources, find the answers and/or solutions to what you don’t know.

Create an action plan. Write it down and put it where you can’t avoid seeing it every day. If you don’t act on your goals and plan, nothing changes.

Track your progress. Measure your headway, celebrate your wins, and make adjustments or course corrections, as you need them.

These steps aren’t complicated, but they require your personal resolve, courage, to keep on track. Missteps and challenges are not fatal. They test your desire to reach your goals—the best thing you can do with a mistake is learn from it.

Your resilience and support from your personal and professional team will get you through those moments of doubt or mistakes.

Given how complicated life is, keeping your focus on a simple, direct and clear action plan is your best ally to success.

Michael F. Kay is a Certified Financial Planner, practitioner and CPA. He is the president of the firm Financial Life Focus.

- Find a Therapist

- Find a Treatment Center

- Find a Psychiatrist

- Find a Support Group

- Find Online Therapy

- International

- New Zealand

- South Africa

- Switzerland

- Asperger's

- Bipolar Disorder

- Chronic Pain

- Eating Disorders

- Passive Aggression

- Personality

- Goal Setting

- Positive Psychology

- Stopping Smoking

- Low Sexual Desire

- Relationships

- Child Development

- Therapy Center NEW

- Diagnosis Dictionary

- Types of Therapy

At any moment, someone’s aggravating behavior or our own bad luck can set us off on an emotional spiral that threatens to derail our entire day. Here’s how we can face our triggers with less reactivity so that we can get on with our lives.

- Emotional Intelligence

- Gaslighting

- Affective Forecasting

- Neuroscience

7.3 Methods for Solving Time Value of Money Problems

Learning outcomes.

By the end of this section, you will be able to:

- Explain how future dollar amounts are calculated.

- Explain how present dollar amounts are calculated.

- Describe how discount rates are calculated.

- Describe how growth rates are calculated.

- Illustrate how periods of time for specified growth are calculated.

- Use a financial calculator and Excel to solve TVM problems.

We can determine future value by using any of four methods: (1) mathematical equations, (2) calculators with financial functions, (3) spreadsheets, and (4) FVIF tables. With the advent and wide acceptance and use of financial calculators and spreadsheet software, FVIF (and other such time value of money tables and factors) have become obsolete, and we will not discuss them in this text. Nevertheless, they are often still published in other finance textbooks and are also available on the internet to use if you so choose.

Using Timelines to Organize TVM Information

A useful tool for conceptualizing present value and future value problems is a timeline. A timeline is a visual, linear representation of periods and cash flows over a set amount of time. Each timeline shows today at the left and a desired ending, or future point (maturity date), at the right.

Now, let us take an example of a future value problem that has a time frame of five years. Before we begin to solve for any answers, it would be a good approach to lay out a timeline like that shown in Table 7.1 :

The timeline provides a visual reference for us and puts the problem into perspective.

Now, let’s say that we are interested in knowing what today’s balance of $100 in our saving account, earning 5% annually, will be worth at the end of each of the next five years. Using the future value formula

that we covered earlier, we would arrive at the following values: $105 at the end of year one, $110.25 at the end of year two, $115.76 at the end of year three, $121.55 at the end of year four, and $127.63 at the end of year five.

With the numerical information, the timeline (at a 5% interest or growth rate) would look like Table 7.2 :

Using timelines to lay out TVM problems becomes more and more valuable as problems become more complex. You should get into the habit of using a timeline to set up these problems prior to using the equation, a calculator, or a spreadsheet to help minimize input errors. Now we will move on to the different methods available that will help you solve specific TVM problems. These are the financial calculator and the Excel spreadsheet.

Using a Financial Calculator to Solve TVM Problems

An extremely popular method of solving TVM problems is through the use of a financial calculator. Financial calculators such as the Texas Instruments BAII Plus™ Professional will typically have five keys that represent the critical variables used in most common TVM problems: N , I/Y , PV , FV , and PMT . These represent the following:

These are the only keys on a financial calculator that are necessary to solve TVM problems involving a single payment or lump sum .

Example 1: Future Value of a Single Payment or Lump Sum

Let’s start with a simple example that will provide you with most of the skills needed to perform TVM functions involving a single lump sum payment with a financial calculator.

Suppose that you have $1,000 and that you deposit this in a savings account earning 3% annually for a period of four years. You will naturally be interested in knowing how much money you will have in your account at the end of this four-year time period (assuming you make no other deposits and withdraw no cash).

To answer this question, you will need to work with factors of $1,000, the present value ( PV ); four periods or years, represented by N ; and the 3% interest rate, or I/Y . Make sure that the calculator register information is cleared, or you may end up with numbers from previous uses that will interfere with the solution. The register-clearing process will depend on what type of calculator you are using, but for the TI BA II Plus™ Professional calculator, clearing can be accomplished by pressing the keys 2ND and FV [ CLR TVM ].

Once you have cleared any old data, you can enter the values in the appropriate key areas: 4 for N , 3 for I/Y , and 1000 for PV . Now you have entered enough information to calculate the future value. Continue by pressing the CPT (compute) key, followed by the FV key. The answer you end up with should be displayed as 1,125.51 (see Table 7.3 ).

Important Notes for Using a Calculator and the Cash Flow Sign Convention

Please note that the PV was entered as negative $1,000 (or -$1000). This is because most financial calculators (and spreadsheets) follow something called the cash flow sign convention, which is a way for calculators and spreadsheets to keep the relative direction of the cash flow straight. Positive numbers are used to represent cash inflows, and negative numbers should always be used for cash outflows.

In this example, the $1,000 is an investment that requires a cash outflow. For this reason, -1000 is entered as the present value, as you will be essentially handing this $1,000 to a bank or to someone else to initiate the transaction. Conversely, the future value represents a cash inflow in four years’ time. This is why the calculator generates a positive 1,125.51 as the end result of this calculation.

Had you entered the present value of $1,000 as a positive number, there would have been no real concern, but the ending future value answer would have been returned expressed as a negative number. This would be correct had you borrowed $1,000 today (cash inflow) and agreed to repay $1,125.51 (cash outflow) four years from now. Also, it is important that you do not change the sign of any input value by using the - (minus) key). For example, on the TI BA II Plus™ Professional, you must use the +|- key instead of the minus key. If you enter 1000 and then hit the +|- key, you will get a negative 1,000 amount showing in the calculator display.

An important feature of most financial calculators is that it is possible to change any of the variables in a problem without needing to reenter all of the other data. For example, suppose that we wanted to find out the future value in our bank account if we left the money from our previous example invested for 20 years instead of 4. Before clearing any of the data, simply enter 20 for N and then press the CPT key and then the FV key. After this is done, all other inputs will remain the same, and you will arrive at an answer of $1,806.11.

Think It Through

How to determine future value when other variables are known.

Here’s an example of using a financial calculator to solve a common time value of money problem. You have $2,000 invested in a money market account that is expected to earn 4% annually. What will be the total value in the account after five years?

Follow the recommended financial calculator steps in Table 7.4 .

The result of this future value calculation of the invested money is $2,433.31.

Example 2: Present Value of Lump Sums

Solving for the present value (discounted value) of a lump sum is the exact opposite of solving for a future value. Once again, if we enter a negative value for the FV, then the calculated PV will be a positive amount.

Taking the reverse of what we did in our example of future value above, we can enter -1,125.51 for FV , 3 for I/Y , and 4 for N . Hit the CPT and PV keys in succession, and you should arrive at a displayed answer of 1,000.

An important constant within the time value of money framework is that the present value will always be less than the future value unless the interest rate is negative. It is important to keep this in mind because it can help you spot incorrect answers that may arise from errors with your input.

How to Determine Present Value When Other Variables Are Known

Here is another example of using a financial calculator to solve a common time value of money problem. You have just won a second-prize lottery jackpot that will pay a single total lump sum of $50,000 five years from now. How much value would this have in today’s dollars, assuming a 5% interest rate?

Follow the recommended financial calculator steps in Table 7.5 .

The present value of the lottery jackpot is $39,176.31.

Example 3: Calculating the Number of Periods

There will be times when you will know both the value of the money you have now and how much money you will need to have at some unknown point in the future. If you also know the interest rate your money will be earning for the foreseeable future, then you can solve for N, or the exact amount of time periods that it will take for the present value of your money to grow into the future value that you will require for your eventual use.

Now, suppose that you have $100 today and you would like to know how long it will take for you to be able to purchase a product that costs $133.82.

After making sure your calculator is clear, you will enter 5 for I/Y , -100 for PV , and 133.82 for FV . Now press CPT N , and you will see that it will take 5.97 years for your money to grow to the desired amount of $133.82.

Again, an important thing to note when using a financial calculator to solve TVM problems is that you must enter your numbers according to the cash flow sign convention discussed above. If you do not make either the PV or the FV a negative number (with the other being a positive number), then you will end up getting an error message on the screen instead of the answer to the problem. The reason for this is that if both numbers you enter for the PV and FV are positive, the calculator will operate under the assumption that you are receiving a financial benefit without making any cash outlay as an initial investment. If you get such an error message in your calculations, you can simply press the CE/C key. This will clear the error, and you can reenter your data correctly by changing the sign of either PV or FV (but not both of these, of course).

Determining Periods of Time

Here is an additional example of using a financial calculator to solve a common time value of money problem. You want to be able to contribute $25,000 to your child’s first year of college tuition and related expenses. You currently have $15,000 in a tuition savings account that is earning 6% interest every year. How long will it take for this account grow into the targeted amount of $25,000, assuming no additional deposits or withdrawals will be made?

Table 7.6 shows the steps you will take.

The result of this calculation is a time period of 8.7667 years for the account to reach the targeted amount.

Example 4: Solving for the Interest Rate

Solving for an interest rate is a common TVM problem that can be easily addressed with a financial calculator. Let’s return to our earlier example, but in this case, we know that we have $1,000 at the present time and that we will need to have a total of $1,125.51 four years from now. Let’s also say that the only way we can add to the current value of our savings is through interest income. We will not be able to make any further deposits in addition to our initial $1,000 account balance.

What interest rate should we be sure to get on our savings account in order to have a total savings account value of $1,125.51 four years from now?

Once again, clear the calculator, and then enter 4 for N , -1,000 for PV , and 1,125.51 for FV . Then, press the CPT and I/Y keys and you will find that you need to earn an average 3% interest per year in order to grow your savings balance to the desired amount of $1,125.51. Again, if you end up with an error message, you probably failed to follow the sign convention relating to cash inflow and outflow that we discussed earlier. To correct this, you will need to clear the calculator and reenter the information correctly.

After you believe you are done and have arrived at a final answer, always make sure you give it a quick review. You can ask yourself questions such as “Does this make any sense?” “How does this compare to other answers I have arrived at?” or “Is this logical based on everything I know about the scenario?” Knowing how to go about such a review will require you to understand the concepts you are attempting to apply and what you are trying to make the calculator do. Further, it is critical to understand the relationships among the different inputs and variables of the problem. If you do not fully understand these relationships, you may end up with an incorrect answer. In the end, it is important to realize that any calculator is simply a tool. It will only do what you direct it to do and has no idea what your objective is or what it is that you really wish to accomplish.

Determining Interest or Growth Rate

Here is another example of using a financial calculator to solve a common time value of money problem. Let’s use a similar example to the one we used when calculating periods of time to determine an interest or growth rate. You still want to help your child with their first year of college tuition and related expenses. You also still have a starting amount of $15,000, but you have not yet decided on a savings plan to use.

Instead, the information you now have is that your child is just under 10 years old and will begin college at age 18. For simplicity’s sake, let’s say that you have eight and a half years before you will need to meet your total savings target of $25,000. What rate of interest will you need to grow your saved money from $15,000 to $25,000 in this time period, again with no other deposits or withdrawals?

Follow the steps shown in Table 7.7 .

The result of this calculation is a necessary interest rate of 6.194%.

Using Excel to Solve TVM Problems

Excel spreadsheets can be excellent tools to use when solving time value of money problems. There are dozens of financial functions available in Excel, but a student who can use a few of these functions can solve almost any TVM problem. Special functions that relate to TVM calculations are as follows:

Excel also includes a function called Payment (PMT) that is used in calculations involving multiple payments or deposits (annuities). These will be covered in Time Value of Money II: Equal Multiple Payments .

Future Value (FV)

The Future Value function in Excel is also referred to as FV and can be used to calculate the value of a single lump sum amount carried to any point in the future. The FV function syntax is similar to that of the other four basic time-value functions and has the following inputs (referred to as arguments), similar to the functions listed above:

Lump sum problems do not involve payments, so the value of Pmt in such calculations is 0. Another argument, Type, refers to the timing of a payment and carries a default value of the end of the period, which is the most common timing (as opposed to the beginning of a period). This may be ignored in our current example, which means the default value of the end of the period will be used.

The spreadsheet in Figure 7.3 shows two examples of using the FV function in Excel to calculate the future value of $100 in five years at 5% interest.

In cell E1, the FV function references the values in cells B1 through B4 for each of the arguments. When a user begins to type a function into a spreadsheet, Excel provides helpful information in the form of on-screen tips showing the argument inputs that are required to complete the function. In our spreadsheet example, as the FV formula is being typed into cell E2, a banner showing the arguments necessary to complete the function appears directly below, hovering over cell E3.

Cells E1 and E2 show how the FV function appears in the spreadsheet as it is typed in with the required arguments. Cell E4 shows the calculated answer for cell E1 after hitting the enter key. Once the enter key is pressed, the hint banner hovering over cell E3 will disappear. The second example of the FV function in our example spreadsheet is in cell E6. Here, the actual numerical values are used in the FV function equation rather than cell references. The method in cell E8 is referred to as hard coding . In general, it is preferable to use the cell reference method, as this allows for copying formulas and provides the user with increased flexibility in accounting for changes to input data. This ability to accept cell references in formulas is one of the greatest strengths of Excel as a spreadsheet tool.

Download the spreadsheet file containing key Chapter 7 Excel exhibits.

Determining Future Value When Other Variables Are Known . You have $2,000 invested in a money market account that is expected to earn 4% annually. What will be the total value in the account in five years?

Note: Be sure to follow the sign conventions. In this case, the PV should be entered as a negative value.

Note: In Excel, interest and growth rates must be entered as percentages, not as whole integers. So, 4 percent must be entered as 4% or 0.04—not 4, as you would enter in a financial calculator.

Note: It is always assumed that if not specifically stated, the compounding period of any given interest rate is annual, or based on years.

Note: The Excel command used to calculate future value is as follows:

You may simply type the values for the arguments in the above formula. Another option is to use the Excel insert function option. If you decide on this second method, below are several screenshots of dialog boxes you will encounter and will be required to complete.

This dialog box allows you to either search for a function or select a function that has been used recently. In this example, you can search for FV by typing this in the search box and selecting Go, or you can simply choose FV from the list of most recently used functions (as shown here with the highlighted FV option).

Figure 7.6 shows the completed data input for the variables, referred to here as “function arguments.” Note that cell addresses are used in this example. This allows the spreadsheet to still be useful if you decide to change any of the variables. You may also type values directly into the Function Arguments dialog box, but if you do this and you have to change any of your inputs later, you will have to reenter the new information. Using cell addresses is always a preferable method of entering the function argument data.

Additional notes:

- The Pmt argument or variable can be ignored in this instance, or you can enter a placeholder value of zero. This example shows a blank or ignored entry, but either option may be used in problems such as this where the information is not relevant.

- The Type argument does not apply to this problem. Type refers to the timing of cash flows and is usually used in multiple payment or annuity problems to indicate whether payments or deposits are made at the beginning of periods or at the end. In single lump sum problems, this is not relevant information, and the Type argument box is left empty.

- When you use cell addresses as function argument inputs, the numerical values within the cells are displayed off to the right. This helps you ensure that you are identifying the correct cells in your function. The final answer generated by the function is also displayed for your preliminary review.

Once you are satisfied with the result, hit the OK button, and the dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function.

The FV of this present value has been calculated as approximately $2,433.31.

Present Value (PV)

We have covered the idea that present value is the opposite of future value. As an example, in the spreadsheet shown in Figure 7.3 , we calculated that the future value of $100 five years from now at a 5% interest rate would be $127.63. By reversing this process, we can safely state that $127.63 received five years from now with a 5% interest (or discount) rate would have a value of just $100 today. Thus, $100 is its present value. In Excel, the PV function is used to determine present value (see Figure 7.7 ).

The formula in cell E1 uses cell references in a similar fashion to our FV example spreadsheet above. Also similar to our earlier example is the hard-coded formula for this calculation, which is shown in cell E6. In both cases, the answers we arrive at using the PV function are identical, but once again, using cell references is preferred over hard coding if possible.

Determining Present Value When Other Variables Are Known

You have just won a second-prize lottery jackpot that will pay a single total lump sum of $50,000 five years from now. You are interested in knowing how much value this would have in today’s dollars, assuming a 5% interest rate.

- If you wish for the present value amount to be positive, the future value you enter here should be a negative value.

- In Excel, interest and growth rates must be entered as percentages, not as whole integers. So, 5 percent must be entered as 5% or 0.05—not 5, as you would enter in a financial calculator.

- It is always assumed that if not specifically stated, the compounding period of any given interest rate is annual, or based on years.

- The Excel command used to calculate present value is as shown here:

As with the FV formula covered in the first tab of this workbook, you may simply type the values for the arguments in the above formula. Another option is to again use the Insert Function option in Excel. Figure 7.8 , Figure 7.9 , and Figure 7.10 provide several screenshots that demonstrate the steps you’ll need to follow if you decide to enter the PV function from the Insert Function menu.

As discussed in the FV function example above, this dialog box allows you to either search for a function or select a function that has been used recently. In this example, you can search for PV by typing this into the search box and selecting Go, or you can simply choose PV from the list of the most recently used functions.

Figure 7.10 shows the completed data input for the function arguments. Note that once again, cell addresses are used in this example. This allows the spreadsheet to still be useful if you decide to change any of the variables. As in the FV function example, you may also type values directly in the Function Arguments dialog box, but if you do this and you have to change any of your input later, you will have to reenter the new information. Remember that using cell addresses is always a preferable method of entering the function argument data.

Again, similar to our FV function example, the Function Arguments dialog box shows values off to the right of the data entry area, including our final answer. The Pmt and Type boxes are again not relevant to this single lump sum example, for reasons we covered in the FV example.

Review your answer. Once you are satisfied with the result, click the OK button, and the dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function. The PV of this future value has been calculated as approximately $39,176.31.

Periods of Time

The following discussion will show you how to use Excel to determine the amount of time a given present value will need to grow into a specified future value when the interest or growth rate is known.

You want to be able to contribute $25,000 to your child’s first year of college tuition and related expenses. You currently have $15,000 in a tuition savings account that is earning 6% interest every year. How long will it take for this account grow into the targeted amount of $25,000, assuming no additional deposits or withdrawals are made?

- As with our other examples, interest and growth rates must be entered as percentages, not as whole integers. So, 6 percent must be entered as 6% or 0.06—not 6, as you would enter in a financial calculator.

- The present value needs to be entered as a negative value in accordance with the sign convention covered earlier.

- The Excel command used to calculate the amount of time, or number of periods, is this:

As with our FV and PV examples, you may simply type the values of the arguments in the above formula, or we can again use the Insert Function option in Excel. If you do so, you will need to work with the various dialog boxes after you select Insert Function.

As discussed in our previous examples on FV and PV, this menu allows you to either search for a function or select a function that has been used recently. In this example, you can search for NPER by typing this into the search box and selecting Go, or you can simply choose NPER from the list of most recently used functions.

- Once you have highlighted NPER, click the OK button, and a new dialog box will appear for you to enter the necessary details. As in our previous examples, it will look like Figure 7.12 .

Figure 7.13 shows the completed Function Arguments dialog box. Note that once again, we are using cell addresses in this example.

As in the previous function examples, values are shown off to the right of the data input area, and our final answer of approximately 8.77 is displayed at the bottom. Also, once again, the Pmt and Type boxes are not relevant to this single lump sum example.

Review your answer, and once you are satisfied with the result, click the OK button. The dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function.

The amount of time required for the desired growth to occur is calculated as approximately 8.77 years.

Interest or Growth Rate

You can also use Excel to determine the required growth rate when the present value, future value, and total number of required periods are known.

Let’s discuss a similar example to the one we used to calculate periods of time. You still want to help your child with their first year of college tuition and related expenses, and you still have a starting amount of $15,000, but you have not yet decided which savings plan to use.

Instead, the information you now have is that your child is just under 10 years old and will begin college at age 18. For simplicity’s sake, let’s say that you have eight and a half years until you will need to meet your total savings target of $25,000. What rate of interest will you need to grow your saved money from $15,000 to $25,000 in this time, again with no other deposits or withdrawals?

Note: The present value needs to be entered as a negative value.

Note: The Excel command used to calculate interest or growth rate is as follows:

As with our other TVM function examples, you may simply type the values for the arguments into the above formula. We also again have the same alternative to use the Insert Function option in Excel. If you choose this option, you will again see the Insert Function dialog box after you click the Insert Function button.

Once we complete the input, again using cell addresses for the required argument values, we will see what is shown in Figure 7.16 .

As in our other examples, cell values are shown as numerical values off to the right, and our answer of approximately 0.0619, or 6.19%, is shown at the bottom of the dialog box.

This answer also can be checked from a logic point of view because of the similar example we worked through when calculating periods of time. Our present value and future value are the same as in that example, and our time period is now 8.5 years, which is just under the result we arrived at (8.77 years) in the periods example.

So, if we are now working with a slightly shorter time frame for the savings to grow from $15,000 into $25,000, then we would expect to have a slightly greater growth rate. That is exactly how the answer turns out, as the calculated required interest rate of approximately 6.19% is just slightly greater than the growth rate of 6% used in the previous example. So, based on this, it looks like our answer here passes a simple “sanity check” review.

- 1 The specific financial calculator in these examples is the Texas Instruments BA II Plus™ Professional model, but you can use other financial calculators for these types of calculations.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/7-3-methods-for-solving-time-value-of-money-problems

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Solving the problem of money

Financial services should put happiness at the heart of how they serve customers.

When it comes to money, what does ‘good’ look like? What does success mean when we think about our relationship to our finances?

One typical response will hinge upon the word ‘more’. Accumulating wealth, buying a bigger house, winning a promotion and a higher salary. Another response could be based around ‘less’. Lower bills, lower charges on financial products, less time spent thinking about personal finances.

But what if we applied a completely different success criteria? What if we judged our relationship with money by whether it makes us happy? To approach that question from a business perspective: what is the problem of money that the financial services industry is solving? Are products and services focused on more, or less – or on happy?

Financial wellbeing

Many financial services companies attempt to help their customers manage their money through financial education. The term financial wellbeing is often used in this context, as a concept that includes being better at managing finances and debt (which I would argue is better described as financial resilience). It also covers many other aspects of money, including our money beliefs, our behavioural biases, and money distractions.

Only when we understand the sources of happiness (short-term) and wellbeing (longer-term) can we really understand the role that money plays in helping to achieve these. We also begin to realize how financial education often starts in the wrong place. A wealth of research about human happiness helps us to better understand the problem of money, and the shortcomings of the financial services industry in helping to solve it.

Money barriers to wellbeing

Making great financial decisions is not something humans are built to do. In many ways, we have only needed to think about our financial futures for the last 40 years or so. In many parts of the world, life expectancy has boomed – but all those extra years are when we are not earning. Families have stopped living together all their lives, so income is needed beyond working age. We now need to make financial plans for the future that we are not equipped to make.

That goes to the very heart of how we think about money. Neuroscience research shows that money decisions are fearful decisions. We make them with our gut (so-called ‘System 1’ thinking ) while knowing those decisions will have long-term ramifications. Other research shows that we find it difficult to think about our future selves, and therefore to plan for the future.

We can therefore see that the first part of the problem of money is that we are not equipped to solve it ourselves.

Self worth, not net worth

The second part of the problem relates to the role that money plays as a generator of joy. Of course, money can have a direct part to play in generating wellbeing. Being able to afford a holiday or to spend time with loved ones requires money. Improving financial resilience can reduce money worries. But research also tells us that the extent to which more money makes us happier gets smaller as we have more of it.

The sources of long-term wellbeing are relatively simple, it seems, including living a life with meaning and purpose, and social interactions. Similarly, short-term happiness comes from things that don’t cost money. Being kind to others, being outside, cuddles: none of these require wealth. And yet, one look at magazines, social media and advertising tells us that ‘more’ remains the mantra.

If the first part of our problem with money is that we are not built to make good financial decisions, the second part is that our approach to money is often focused on its accumulation, not on using it to generate wellbeing.

Financial wellbeing education

We need help when it comes to our relationship with money. The help that financial services firms offer, however, tends to come in the form of information, not insight. This might be wealth managers who only talk about investments, or banks who provide education only on being ‘in control of your money’, or on how to take out loans. This is not solving the problem of money.

To help customers to be happier, not just wealthier, financial services need to address issues that relate to the sources of joy. Education on what those sources are would be a great start. Financial wellbeing – defined in the broadest terms – should be the starting point of financial education, not an add-on.

It is widely accepted that if we teach people about nutrition and its effect on health and energy levels, there is an increased chance that they will eat healthier. It’s not a huge leap to think that a similar approach could work for our relationship to money. If we teach people that buying endless stuff only gives very short-term hits of joy, and that there are better sources of long-term wellbeing, they might manage their money better.

Similarly, if we help people to better connect with their future selves, they are surely more likely to put money into savings products. And if we help people to recognize that some of their money beliefs are not working in their best interests, they may make better financial decisions.

In this way, we could both equip people to make better financial decisions, and help them to understand that a better financial decision is one that is focused on their wellbeing.

If we make achieving wellbeing the success criteria for our relationship with money, we solve the problem of money, and the world will become a happier place. But it is a task that should not be left to us to tackle alone as individual consumers. We should have the full support of the financial services business that serve us.

Recommended Articles

Cracking corporate

Leaders have a vital role to play in nurturing young talent – especially where unequal societies mean that…

Adventures in finance

Extraordinary life experiences can shape financial decisions. I’ve always worked in finance, and I’ve always been an adventurer….

The human catalyst

A strong Human Capital Factor ignites growth. “I only want to invest in fundamentals.” Such is a common…

Duke CE is the lead partner in Dialogue , a global journal for managers and leaders. The magazine brings you the best in business thinking with fresh thought leadership from around the world.

Sign up for our Leadership Insights

- Terms of Use

- Privacy Policy

6 Tips for Solving the Money Problem

by GeorgeG | Aug 4, 2022

We are struggling with money.

Almost two-thirds of Americans are living paycheck-to-paycheck. Half have less than $500 in savings. The average credit card debt is over $6,000.

I share that because if you’ve got money problems, you’re in good company.

Knowing that others are also struggling may provide some comfort, but I’m more interested in helping to do more than that. It’s my goal to give you some actionable things for solving the money problem you’re experiencing.

Have you ever said or thought, “Everything happens for a reason?” Well, perhaps the reason for your problems is to help you get better by overcoming them. You’re fully capable of becoming financially successful.

I’ve been helping people solve money problems for 20+ years as a financial advisor. I’m honored to be named to Investopedia’s list of the top 100 financial advisors many years running. I share that to let you know I’ve helped others to do what you want to do.

And, I’ve got personal experience with money problems. I spent much of my 20s living paycheck-to-paycheck, in and out of credit card debt, and not paying close attention to my finances. So I can certainly identify with others who are struggling financially.

I’m going to share six tips for solving the money problem you’ve got:

Recognize the time value of money

Detox your spending

Start paying attention

Become the CEO of your financial life

Spend less than you make

Maximize your income

Let’s get started.

The best time to plant a tree was 30 years ago. The next best time is today.

Money has a time value. Simply put, the longer you wait to begin pursuing your financial goals, the harder it becomes to reach them. The flip side of that coin is, the earlier you start, the easier it is.

But wherever you are on your journey, the time to get started is today. If you don’t already have a sense of urgency around your finances, it’s time to get one. It’s also time to set your intention.

What are you going to do? Pay off your credit card debt? Start saving money? Become an investor? Whatever you desire, write it down.

For example, write “I will be debt-free.” It sounds like a simple step (and it is), but making a commitment to yourself is really important.

I’ve never taken a vow of poverty, and I don’t expect you to either. But at some point, you have got to take a hard look at what you’re spending your money on if you want to change your financial future.

How long could you go without buying something online? Could you go for a week? Two weeks?

I’m not asking you to stop buying food for yourself and your family. My tip is for you to cut out all your non-essential spending for a specific time period. And I realize it won’t be easy.

We all have patterns and habits we follow. Ask yourself this, “Are my current spending habits getting me where I want to go?” If the answer is no, stop doing things the way you’ve been doing them for a week.

Depending on how that goes, extend it another week. See if there are minor changes you can make that will save you money. That’s the idea with this tip.

What gets measured, gets managed.

We need to pay attention to our finances. Too often, when we find ourselves in a tough spot, we ignore it. We brush it under the rug, or put our heads in the sand. But that doesn’t work.

What happens to little problems when you leave them alone? Do they go away? No. They get bigger. Here’s how you pay attention to your money:

- Track your cash flow on a monthly basis. Open every account you have and review all the transactions.

- Keep a household budget. A budget is a plan for your money that helps you to know if you’re on track to meet your goals. You need to review this on a monthly basis.

- Pay attention to your credit. Review your credit report and score at least once a year.

- Know your net worth. Everyone has a net worth, even you. It’s your assets minus your liabilities.

Paying attention to your financial situation is the first step to taking personal responsibility and ownership of it.

This is a simple shift in mindset.

Imagine you’re the CEO of a large company. Would you have a good understanding of the financial affairs of your organization? Of course you would.

I want you to act like you’re the CEO of you. Fundamentally, there will never be anyone who’s more interested in your financial success than you are. While you don’t need to personally do everything related to your finances, you need to take an active interest.

For example, you may hire someone to do your taxes and file your returns. But you still need to pay attention to what they’re doing to ensure accuracy and completion. With every aspect of your finances, make sure you’re taking an interest, and that things are getting done.

This is both a tip and a financial truth; you need to spend less money than you make.

When we live paycheck-to-paycheck, we spend all of our money every month. In order to get out of debt, and to start putting money away for ourselves, we need to be able to spend less than we earn.

I’ve discovered that not many people know exactly how much they earn, and how much they spend every month. This goes back to the importance of paying attention to your cash flow and budget. Once you know how much you earn and how much you spend, it’s time to figure out how to spend less than you earn.

I don’t enjoy being told to spend less, and I don’t like telling others to spend less. So, if you’re not interested in spending less, you’ll need to figure out how to earn more money. What can you do to maximize your income?

Are you in the right career? If yes, what can you do to make yourself more valuable? Can you learn new skills or get a certification?

If you’re in the wrong career, what can you do to get into the right one? What’s standing in the way of you doing the kind of work and earning the kind of money you want?

Check out How to Find a Career You Love with Kathy Caprino .

A third option is to start a side hustle. The internet has made earning additional income a lot easier than it was in the past. If this is a viable option, check out SideHusl.com for ideas on where to focus your energy.

You’re someone who can be financially successful. Set your intention and get to work.

To help you on your journey to solving your money problem, it’s important to get as clear as possible about what you want your future to look like. In service of that, you can access our Goals course for free.

You can also access our Values course , and our Get Out of Debt course for free.

If you’re ready to take control of your financial life, check out our DIY Financial Plan course.

Connect with one of our Certified Partners to get any question answered.

Stay up to date by getting our monthly updates .

Check out the LifeBlood podcast .

LifeBlood is supported by our audience. If you purchase through links on our site, we may earn an affiliate commission. Learn more.

A self-made millionaire who studied 1,200 wealthy people found they're willing to admit an uncomfortable fact about money

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate products and services to help you make smart decisions with your money.

Contrary to popular belief, "everyone has the same opportunity to acquire wealth," says self-made millionaire Steve Siebold , who has also studied more than 1,200 of the world's wealthiest people over the past 30 years.

In his research, he found that rich people are willing to admit something about money that makes many of us uncomfortable: It can solve most problems.

It can be uncomfortable to accept that money, rather than being the corrupting force it is often portrayed, can serve as a useful tool that creates opportunities, options, and happiness, but that's what the wealthiest people do on a daily basis — and it allows them to generate more wealth.

"If you want to start attracting money, stop seeing it as your enemy and think of it as one of your greatest allies," Siebold writes .

"It's a friend that has the power to end sleepless nights of worry and physical pain, and can even save your life ... Start telling yourself on a daily basis that money is your friend and a positive force in your life, and your mind will go to work to help you acquire more."

While average people see money as a necessary evil and let it stress them out, rich people find wealth reassuring, says Siebold : "The world class sees money as the great liberator, and with enough of it, they are able to purchase financial peace of mind."

Watch: Meet the 26 year old jeweler making it big hawking custom bling to celebrities on Instagram

- Main content

- Entrepreneurs

- Entrepreneurship

- entrepreneurs

- United States

Connect with us

- Privacy Policy

- Cookies Policy

- Terms of Service

- Copyright Policy

Weekly Must-Reads View All

Ultimate guide to understand casino withdrawal and deposit .

Online casinos are very popular and have a lot of users

How to Start Your Own Gaming Company

Ready for an exciting new chapter with a gaming company?

Fawn Weaver: How Her Unique Thinking Has Made Her Net Worth Skyrocket.

Fawn Weaver is an entrepreneur, best-selling author, and philanthropist with a

Explore How Sumner Stroh Has Shaped Human Thinking.

Sumner Stroh is a successful entrepreneur and investor with an estimated net

Popular Topics

- zoom meeting

- zoom company

- zoetis stock

- zoetic stock

- Zhao Weiguo

- Zach Bryan Net Worth

Trending Now View All

Solving the Money Problem: A Journey to Financial Freedom

Problems with one’s finances are a typical challenge that many people and households must surmount. People may experience worry and anxiety as a result of it, and it may also impede them from enjoying the life they want. But what if we told you that finding a solution to the problem with money is actually possible? That it is possible for you, too, to attain financial freedom and lead a life free of anxieties about money, provided you have the correct tactics, skills, and frame of mind. In this piece, we will investigate a comprehensive approach to resolving the issue of money and obtaining freedom from one’s monetary responsibilities.

Table of Contents

Acquiring knowledge of one’s own financial situation, effectively managing one’s financial resources, increasing one’s wealth, being independent of one’s finances.

Understanding personal finance is the first thing that has to be done in order to fix the money problem. The term “personal finance” refers to the management of one’s own money and encompasses activities such as creating a budget, saving money, investing, and paying off debt. Acquiring a foundational knowledge of personal finance will provide you with the knowledge and tools necessary to make educated decisions regarding your finances and work toward achieving your financial objectives. Among the most important ideas to grasp are the following:

- Budgeting: The first step toward achieving freedom from your financial situation is to gain an understanding of how much money you make, how much money you spend, and how to create a budget.

- The ability to save money is essential to obtaining a level of financial independence. It enables you to put together a fund for unexpected needs, save money for upcoming costs, and invest in your future.

- Putting your money into assets that have the potential to increase in value over a period of time is what we mean when we talk about investing . It is essential to one’s pursuit of financial independence to have a solid understanding of the various forms of investments available, such as stocks, bonds, and real estate.

- Managing debt: The ability to handle debt effectively is absolutely necessary for finding a solution to the money problem. It is important to know about the different kinds of debt, like credit card debt, student loan debt, and mortgage debt, as well as how to pay them off.

The next stage, after gaining a solid understanding of personal finance, is to efficiently manage the money you have available to you. This involves coming up with a budget, deciding on some financial goals, and searching for different ways to save costs. Putting together a budget is a tool that enables you to keep track of both your income and your expenses. Putting together a budget You will be able to see exactly where your money is going if you create a budget and then use that information to make modifications to lower your costs and boost your savings.

Establishing monetary objectives:

Establishing monetary objectives is a crucial step on the path to gaining monetary independence. It is critical to have a plan in place to reach one’s short-term as well as one’s long-term monetary objectives after they have been established.

Bringing down the costs

Increasing your savings and giving yourself more financial independence can be accomplished more quickly and easily if you cut back on your spending. Look for places in your budget where you may make cuts, such as in areas like eating out, going to the movies, and other forms of leisure.

Increasing one’s fortune is the next phase in the process of fixing the problem with money. Building wealth takes a multi-pronged approach that includes paying down debt , saving money, and investing.

- Putting money aside: If you want to build wealth, saving is a need. Even if you can only put away a few dollars each week, it’s still crucial to make it a habit to save on a regular basis.

- Investing is essential to the process of accumulating money and should be viewed as such. Invest your money in things that have the potential to increase in value over time, like stocks, bonds, or property.

- Paying down debt: Paying off debt is essential to the process of accumulating wealth. Paying off debts with high-interest rates, like credit card debt, should be your number one priority.

To be financially independent means to be able to do anything you want, whenever you want, without being concerned about how you will pay for it. It is essential to living within your means, build up a robust emergency fund, and devise a strategy for the future if one wishes to reach the goal of achieving financial independence.