Netflix vs Blockbuster – 3 Key Takeaways

It’s the ultimate example of technology disrupting a marketplace…

Or is it really the story of a leadership shakeup that toppled an empire?

Or is it a story about the extreme hatred people have for late fees?

The Netflix vs. Blockbuster saga has been told a dozen different ways, with a dozen different lenses applied.

And what I’ve come to realize (and this likely won’t come as a huge surprise)is that there’s no single explanation for why Netflix succeeded where Blockbuster failed.

As is the case with most things in life, it was a nuanced situation. There was a perfect storm of poor decisions and technological advances and other contributing factors that led to Netflix’s staggering growth…and Blockbuster’s equally staggering decline (when Blockbuster filed for bankruptcy in 2010, Netflix’s annual net income was $161 million .)

My goal with this post is to distill everything I’ve learned about these two companies down into a few actionable takeaways for marketers – sort of like this post on Zoom’s success story .

But first, for those who aren’t familiar with how the Blockbuster vs. Netflix story unfolded, here’s a short summary:

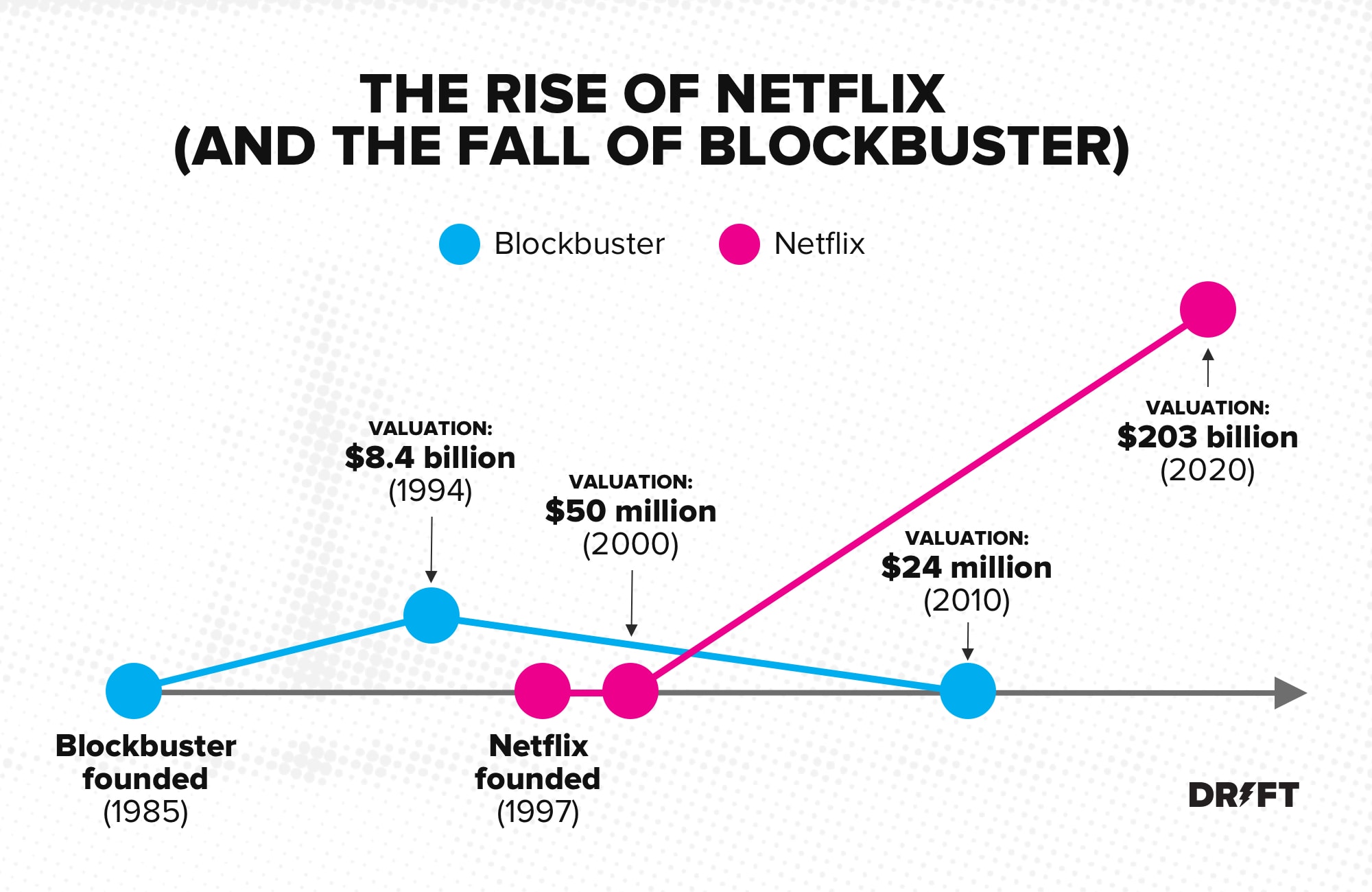

The Rise of Netflix (and the Fall of Blockbuster)

When Netflix launched in 1997, Blockbuster was the undisputed champion of the video rental industry.

Between 1985 and 1992, the brick-and-mortar rental chain grew from its first location (in Dallas, Texas) to more than 2,800 locations around the world.

Two years later, Viacom paid $8.4 billion to acquire Blockbuster .

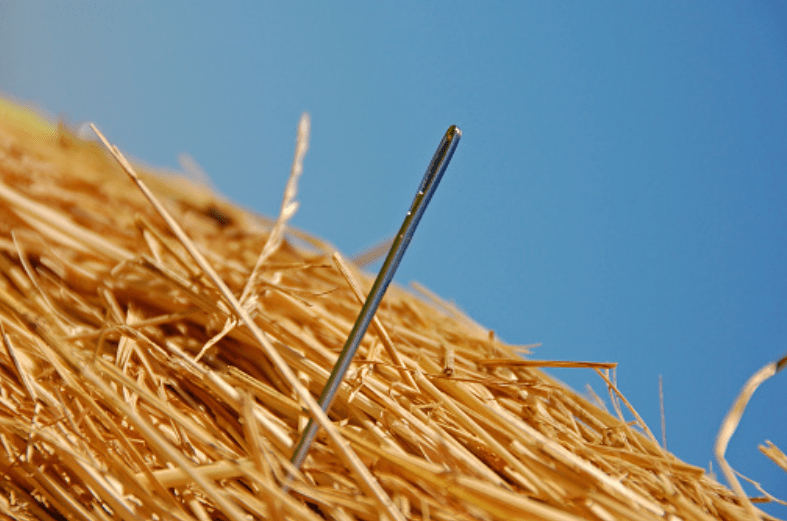

So by the time Netflix showed up on the scene with its video rental-by-mail service, it appeared to be a classic case of David vs. Goliath.

In fact, in the year 2000 –perhaps realizing that it’d be easier to fight alongside Blockbuster than against them – Netflix co-founder and CEO Reed Hastings approached Blockbuster’s then CEO, John Antioco, with a merger proposal:

Hastings wanted $50 million for Netflix. And as part of the deal, the Netflix team would run Blockbuster’s online brand.

Of course, that deal never materialized. Partly because Blockbuster laughed in Netflix’s face when they met to discuss the deal.

“It was tiny, involuntary, and vanished almost immediately. But as soon as I saw it, I knew what was happening: John Antioco was struggling not to laugh,” Netflix’s Marc Randolph remembers of the encounter.

At the time, Antioco considered Netflix to be small potatoes, and would come to realize only too late that having an online platform would be the way of the future.

In 1999, Netflix received backing from Groupe Arnault, giving them a $30 million cash injection that helped launch its subscription-based service.

In 2004, Blockbuster did launch a Netflix-like online DVD rental platform , and even abandoned their unpopular (but lucrative) late fees for overdue rentals.

By 2006, subscribers for Blockbuster’s online services had grown to more than 2 million. (Meanwhile, in that same year, the number of Netflix subscribers reached 6.3 million.)

Then in 2007, Antioco left Blockbuster, late fees were reinstated, and Blockbuster’s online efforts were put on the back burner.

In 2008, Netflix signed a deal with Starz to stream around 1,000 blockbuster movies and shows on its service.

Blockbuster’s fate was all but sealed.

In 2010, Netflix was signing deals with names like Sony, Paramount, Lionsgate, and Disney to help them grab a 20% market share of North American viewing traffic. On July 1st of the same year, Blockbuster was de-listed from the New York Stock Exchange and filed for bankruptcy having incurred nearly $1 billion in losses.

Image Source

Netflix’s valuation at the time?

$24 million.

For comparison, today, Netflix is valued at around $203 billion – a 4,060% increase from its valuation back in 2000.

3 Takeaways from the Netflix vs. Blockbuster Battle

1. never forget what you’re really selling..

For years, Blockbuster dominated the video rental space. But at some point, they lost sight of what business they were really in.

Instead of focusing on delivering incredible (and affordable) entertainment to their customers – something Netflix definitely has down – Blockbuster put more stock in the model they were comfortable using.

And hey, who can blame them? Back before the internet became integrated into nearly every facet of our lives, it was hard to imagine brick-and-mortar Blockbuster stores disappearing.

Blockbuster initially succeeded because they did one core job better than anyone else: delivering entertainment to people’s homes.

But as we all know, technologies change. And instead of investing all of their efforts into finding a new way to deliver on their true purpose (more on that in the next section), Blockbuster’s innovation stagnated. That reality hit Netflix founder Marc Randolph when the business was pivoting from a Mail-order DVD service to online streaming.

He wrote in his book, That Will Never Work: The Birth of Netflix and the Amazing Life of an Idea :

“We’d finally figured out a way to make our original idea of DVDs by mail work, and here we were, looking ahead to a future without either DVDs or mail.”

The way Netflix overcame its challenges? Keep reading 👇

2. You need to be willing to adapt. (And half measures won’t cut it.)

1997 era Netflix–before the company embraced streaming

When you dig into the Netflix vs. Blockbuster story, it becomes clear that Blockbuster did (eventually) realize that the Netflix model was the future. And they did make changes to address it.

But in the end, it was too little, too late.

Blockbuster could never fully evolve into the modern business it needed to be in order to compete with Netflix. Once owning 9,000 stores in the US, Blockbuster now has a single brick-and-mortar presence – a lone store in Bend, Oregon .

Sandi Harding, the owner of the single remaining Blockbuster store in the world. Source .

As Forbes reported:

“The irony is that Blockbuster failed because its leadership had built a well-oiled operational machine. It was a very tight network that could execute with extreme efficiency, but poorly suited to let in new information.”

Technologies improve. Industries change. In order to grow, you need to keep a pulse on the ever-evolving needs and preferences of your customers so you can make changes to your model accordingly.

London-based Video Producer Andy Ash says this was Blockbuster’s downfall. The company was too busy making money in their video stores to imagine a time when people would no longer want or need them.

“In a bid to rescue their business, their answer at the time was to fight fire with fire. At one point they even opened up rental kiosks, a little bit like a vending machine, but all of these attempts were based on either outdated technology or outdated business models, whereas Netflix at the time, they did the opposite; they streamlined, they were able to see the future of video rentals and then innovate for that future.”

This applies to products and services as well as to marketing strategies. Believe it or not, marketing channels have a shelf life.

So even if you learn how to dominate a specific channel , you need to remember that all channels, no matter how popular they are today, could someday fade into oblivion…just like brick-and-mortar Blockbuster locations did.

The key to surviving, and thriving?

Embrace change.

Blockbuster didn’t. Even in 2008, the company’s CEO, Jim Keyes , was perplexed by (or refused to accept) Netflix’s appeal to customers:

“I’ve been frankly confused by this fascination that everybody has with Netflix…Netflix doesn’t really have or do anything that we can’t or don’t already do ourselves.”

As Square2Marketing’s Mike Lieberman explains :

“Blockbuster didn’t believe a month-to-month subscription service would ever actually work. And it certainly wasn’t planning on going digital. Even when the company was offered a buyout deal early on, it declined, believing that its previous business revenue model would work just as well in the new wave of movie watching as it had in the past.”

3. The customer-driven approach always wins.

Customer-driven sales & marketing from drift.

As we’ve already established, there were several factors that contributed to the company’s downfall, including not understanding what business they were really in – entertainment, not retail – and not being flexible enough to adapt.

But another key piece of the puzzle was Blockbuster’s unwillingness to put their customers first. The company’s revenue relied (massively) on charging late fees. As David Reiss explains:

“Blockbuster’s profit had to be sufficient to sustain their worldwide stores and staffing levels. As well as their pricing structure reflecting this, their profit also relied on something their customers hated – late fees. A significant portion of the revenue that Blockbuster needed to stay in business was a revenue stream that Netflix didn’t even charge for, as you could keep their movies as long as you wanted. Whereas Netflix developed a business model that simplified the video-renting process, making it more enjoyable for customers, Blockbuster only thought about maximizing their own returns.”

Forbes described Blockbuster’s reliance on penalizing its patrons in the form of a late fee as the company’s “Achilles heel.” When Blockbuster did finally address the issue, the cost of dropping late fees from their model amounted to a loss of $200 million.

“Any time you can get rid of the No. 1 customer dissatisfaction factor and in the process generate higher customer traffic, for me, as a retailer, that spells a good answer,” CEO John Antioco said of the move at the time.

Narrator: it didn’t work.

At the same time, the company cut its late-fee revenue stream, it was building out its online platform cost another $200 million. If you add up these two costs, Blockbuster paid $400 million in an effort to modernize and remain competitive with Netflix.

We’ll never know if this plan would have succeeded. Shortly after this modernization effort, Antioco was ousted by the board after the changes were made.

Blockbuster then returned to their company-driven ways…and went bankrupt a few years later.

Final Thought: Change Is Inevitable

When I was a kid, getting to pick my own movie at Blockbuster was a rite of passage.

Every weekend, my siblings and I would pile into my dad’s car and make two stops. First, we marched into Blockbuster. Then it was over to the supermarket next door for snacks, soda, and frozen pizza. It was our little ritual.

But these days, the idea of going to a brick-and-mortar store to rent a video seems kind of crazy.

With the rise of Netflix, home entertainment became just a few clicks away. It’s become its own kind of ritual – for over 182 million paying members .

So the next time you think to yourself, “The way we do things now will never change,” remember the Netflix vs. Blockbuster saga and how an entire industry can become upended in just a few years.

Editor’s Note: This article was published in July 2017 and has been updated to reflect new information.

Want to drive Netflix-level growth for your business? Start here .

Related Stories

- THE STRATEGY JOURNEY Book

- Videos & Tutorials

- Strategy Journey Analyzer [QUIZ + WORKBOOK]

- COMMUNITY FORUMS

- Transforming Operating Models with Service Design (TOMS) Program

- ABOUT STRATABILITY ACADEMY

Winning the Customer Journey Battle: Netflix vs Blockbuster Case Study

By Stratability Academy

Published: April 25, 2019

Last Update: May 4, 2020

TOPICS: Gameplans & Roadmaps , Operating Model , Service Design , Transformation

We know a brand has established a strong position in customers’ mind when its name becomes a verb, like Google, Uber, Skype. And one such brand that cannot be ignored in this digital age is Netflix. Netflix has come a long way, starting from an online DVD rental service to the world leader in the streaming industry. The company completely changed how people watched movies and, consequently, destroyed the throne of Blockbuster, once the giant brick and mortar video rental store in the U.S. Interestingly, in 2000, Blockbuster turned down the $50M offer to purchase Netflix, just to find itself decease under the reign of Netflix 10 years later. How did Netflix flip the table and nail the customer journey as of today? How did it master the art and science of digital transformation on its strategy journey?

Let’s explore what happened based on the pains and gains in the customer journey.

Blockbuster’s Customer J ourney

Before Netflix, the age of Blockbuster…

Back to the late 20th century, when Netflix was just a small start-up, Blockbuster dominated the video rental industry with over 9,000 stores around the globe. With the emergence of DVDs as the new video medium, Blockbuster managed to get exclusive deals with big Hollywood studios to rent new DVD releases after cinema showings ended. At that time, almost every household had a videocassette recorder (VCR) for the purpose of video watching, and Blockbuster rental stores were people’s frequent destination for movie selections.

Then, at one point, people realized they went to Blockbuster stores not because they enjoyed the experience but just because it was the only choice for them to watch new movie releases. With that being said, Blockbuster store visits were far from convenience. Imagine one Sunday afternoon, your kids were home and you wanted to watch a movie with them. Then you would probably spend the next few hours driving them to a nearby Blockbuster store, going through hundreds, if not thousands, of DVDs on the shelves without a catalog or any recommendations from store attendants, except for the new releases which were charged out at a premium, getting eyestrain from reading the titles, and arguing with your kids what to watch. By the time you got home, you realized you had not cleaned up the VCR machine’s video head after the last watch, so you do that first, before sitting down on the couch to play the DVD you brought home earlier. How much enjoyment was left then? But it was not the whole story. After some days of watching the movie, you were too caught up in your work and forgot to return the DVD on time, thus you had to pay the store an exceptionally high late fee. In fact, late fees comprised of a large pie of Blockbuster profits. It was an unpleasant experience that actually drove people away from the business.

Netflix’s Digital Transformation Customer Journey

Then Came Netflix – a Market Disruptor

As a former Blockbuster customer, Netflix CEO Reed Hastings thoroughly understood the issues with that customer journey, and he initially started Netflix as a mail-order DVD subscription service to eliminate the lengthy in-store visits and annoying late fees. To make up for the lack of physical customer interaction, Netflix offered lower prices (monthly subscription fees for unlimited rentals) and implemented efficient order-processing computer systems. After just a few years, from a small business, Netflix steadily grew its revenues and got Blockbuster on guard.

Nevertheless, it was when Netflix launched its video streaming service that saw the end of Blockbuster. Netflix, again, took a deep dive into the consumer journey and foresaw the future demands for instant-access entertainment at the convenience of Internet devices. With the new streaming service, Netflix customers could browse a detailed digital movie catalog and press play in a second with no need for a physical DVD. The streaming service of Netflix is so successful that it accounts for one-third of downstream Internet traffic during peak hours in the U.S.

In 2013, upon discovering the potential hype of binge-watching, Netflix started to produce in-house content, known at Netflix Originals, and released all the episodes at one time. Its first original series House of Cards still remains one of the best dramas on Netflix. Besides, Netflix took on customers’ desire for personalization and came up with the smart content recommendation system which was backed by machine learning. Each customer now has a customized experience on Netflix based on their personal habits and preferences. This is where Netflix built up its sticky service to get customers addicted and keep them coming back for more.

Netflix’s popularity can be exposed by impressive numbers: circa. 150M users, almost double the runner-up Amazon Prime; two-thirds of Netflix users share their accounts with others, increasing the actual viewers by 2.5 times; 10 hours spent on Netflix weekly by average U.S. users; 23 languages used and 57% of international users; etc… Considering the recent increase in the share of users outside the U.S., Netflix is drastically growing its international content in the library.

And it gets that the customer journey doesn’t stop changing either. Netflix has been extending the customer journey via cross-platform partnerships. It has teamed with telecommunications and media companies like Vodafone, BT, and Sky in the UK, who all offer Netflix as part of their mobile or cell phone packages, or TV packages, and you can now control your Netflix accounts with voice-activated home automation IoT apps like Amazon Alexa, and Google Home. All of these customer journey extensions are there to save customers time and to provide convenience, and continue to provide better customer experiences.

Hasting could not have applied all of these digital transformation changes to the Netflix business model so successfully without closely following and predicting the customer journey and even testing with customers via co-creation. For a service company like Netflix, customer experience is king, thus the importance of the customer journey mapping process when it comes to lifting a business or an organization to another level, and changing the ‘game’.

Digital Transformation success through the customer journey

Netflix’s success results from the continuous effort of understanding the customer journey and delivering value driven; customer co-created; and network connected services; three digital transformation approaches introduced in THE STRATEGY JOURNEY Framework . The customer journey mapping process and digital transformation approaches, go hand in hand with each other, which explains the failure of Blockbuster to digitally transform due to its customer experience blind spot.

So when it comes to innovation and defining any new service, don’t forget to ‘map the customer journey ‘ as Reed Hastings and Netflix did.

Stratability Academy

About the author

Stratability Academy is a provider of strategic management, innovation and digital transformation learning materials based on the THE STRATEGY JOURNEY Framework , and is the publisher of THE STRATEGY JOURNEY book (2019) by Julie Choo and Graham Christison.

You might also like

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Strategy Journey Fundamentals , Transformation

The Impact of Co Creation in Modern Business

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Transformation

4 steps to create a Winning Game Plan

Service Design

9 Steps to your Winning Customer Journey Strategy

- Marketplace

- Marketplace Morning Report

- Marketplace Tech

- Make Me Smart

- This is Uncomfortable

- The Uncertain Hour

- How We Survive

- Financially Inclined

- Million Bazillion

- Marketplace Minute®

- Corner Office from Marketplace

- Latest Stories

- Collections

- Smart Speaker Skills

- Corrections

- Ethics Policy

- Submissions

- Individuals

- Corporate Sponsorship

- Foundations

CEO Reed Hastings on how Netflix beat Blockbuster

Share now on:.

- https://www.marketplace.org/2020/09/08/ceo-reed-hastings-on-how-netflix-beat-blockbuster/ COPY THE LINK

Get the Podcast

- Amazon Music

In early 2000, Netflix founders Reed Hastings and Marc Randolph offered to sell the company to Blockbuster for $50 million. Blockbuster turned them down. Eventually, Netflix triumphed over Blockbuster, popularized streaming, and forced the entertainment industry to adapt. Hastings credits much of this success to the company’s internal culture. For Hastings’ interview with “Marketplace’s” Kai Ryssdal, click here . The following is an excerpt from a new book Hastings co-wrote called “ No Rules Rules: Netflix and the Culture of Reinvention. ”

Reed Hastings: “Blockbuster is a thousand times our size,” I whispered to Marc Randolph as we stepped into a cavernous meeting room on the twenty-seventh floor of the Renaissance Tower in Dallas, Texas, early in 2000. These were the headquarters of Blockbuster, then a $6 billion giant that dominated the home entertainment business with almost nine thousand rental stores around the world.

The CEO of Blockbuster, John Antioco, who was reputed to be a skilled strategist aware that a ubiquitous, super-fast internet would upend the in- dustry, welcomed us graciously. Sporting a salt-and-pepper goatee and an expensive suit, he seemed completely relaxed.

By contrast, I was a nervous wreck. Marc and I had cofounded and now ran a tiny two-year-old start-up, which let people order DVDs on a website and receive them through the US Postal Service. We had one hundred employees and a mere three hundred thousand subscribers and were off to a rocky start. That year alone, our losses would total $57 million. Eager to make a deal, we’d worked for months just to get Antioco to respond to our calls.

We all sat down around a massive glass table, and after a few minutes of small talk, Marc and I made our pitch. We suggested that Blockbuster purchase Netflix, and then we would develop and run Blockbuster.com as their online video rental arm. Antioco listened carefully, nodded his head frequently, and then asked, “How much would Blockbuster need to pay for Netflix?” When he heard our response—$50 million—he flatly declined. Marc and I left, crestfallen.

That night, when I got into bed and closed my eyes, I had this image of all sixty thousand Blockbuster employees erupting in laughter at the ridiculousness of our proposal. Of course, Antioco wasn’t interested. Why would a powerhouse like Blockbuster, with millions of customers, massive revenues, a talented CEO, and a brand synonymous with home movies, be interested in a flailing wannabe like Netflix? What did we possibly have to offer that they couldn’t do more effectively themselves?

But, little by little, the world changed and our business stayed on its feet and grew. In 2002, two years after that meeting, we took Netflix public. De- spite our growth, Blockbuster was still a hundred times larger than we were ($5 billion versus $50 million). Moreover, Blockbuster was owned by Viacom, which at that time was the most valuable media company in the world. Yet, by 2010, Blockbuster had declared bankruptcy. By 2019, only a single Blockbuster video store remained, in Bend, Oregon. Blockbuster had been unable to adapt from DVD rental to streaming.

The year 2019 was also noteworthy for Netflix. Our film Roma was nominated for best picture and won three Oscars, a great achievement for the director Alfonso Cuarón, which underscored the transformation of Netflix into a full-fledged entertainment company. Long ago, we had pivoted from our DVD-by-mail business to become not just an internet streaming service, with over 167 million subscribers in 190 countries, but a major producer of our own TV shows and movies around the world. We had the privilege of working with some of the world’s most talented creators, including Shonda Rhimes, Joel and Ethan Coen, and Martin Scorsese. We had introduced a new way for people to watch and enjoy great stories, which, in its best moments, broke down barriers and enriched lives.

I am often asked, “How did this happen? Why could Netflix repeatedly adapt but Blockbuster could not?” That day we went to Dallas, Blockbuster held all the aces. They had the brand, the power, the resources, and the vi- sion. Blockbuster had us beat hands down.

It was not obvious at the time, even to me, but we had one thing that Blockbuster did not: a culture that valued people over process, emphasized innovation over efficiency, and had very few controls. Our culture, which focused on achieving top performance with talent density and leading employees with context, not control, has allowed us to continually grow and change as the world, and our members’ needs, have likewise morphed around us.

Netflix is different. We have a culture where No Rules Rules.

Excerpted from “No Rules Rules: Netflix and the Culture of Reinvention” by Reed Hastings and Erin Meyer, reprinted courtesy of Penguin Press.

Stories You Might Like

Netflix CEO Reed Hastings on culture, competition and what keeps him up at night

David Brancaccio reacts to “The Last Blockbuster”

Netflix tests feature to crack down on password sharing

Everybody’s watching: Netflix sees subscriber surge of 16 million with COVID-19 lockdowns

Netflix raises more debt. Is it sustainable?

“the last blockbuster”: previewing our may documentary film selection.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on . For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.

Also Included in

Latest episodes from our shows.

American capitalism isn't working for everyone

Does Texas need its own stock exchange?

Coworking spaces are trying to put a new lease on the WeWork business model

Share your wedding spending regrets!

ChatableApps

Netflix vs Blockbuster – A Comparative Analysis of Streaming Giants’ Success and Failures

Netflix vs blockbuster: the rise and fall of two entertainment giants.

When it comes to home entertainment, the names Netflix and Blockbuster are inseparable from the collective memory of millions of people worldwide. However, while Netflix has ascended to the pinnacle of the streaming industry, Blockbuster met its demise. In this blog post, we will delve into the intriguing story of these two giants and examine the factors that led to their contrasting destinies.

Rise of Netflix

Netflix’s Early Beginnings as a DVD Rental Service

Netflix initially emerged on the scene as a DVD rental-by-mail service in 1997, offering customers the convenience of renting movies without setting foot outside their homes. This innovative approach quickly gained traction, enabling the company to capture a significant share of the video rental market.

Transformation into a Streaming Service

Recognizing the growing potential of digital media, Netflix made a bold move in 2007 by introducing streaming as an alternative to physical DVD rentals. This shift marked a turning point for the company, setting the stage for its future dominance in the entertainment industry.

Successful Strategy Shifts and Innovations

Netflix’s success can be attributed to several strategic decisions and innovations that have kept it ahead of its competition.

Introduction of Original Content

One of the factors that contributed significantly to Netflix’s rise was its decision to produce original content. With popular shows like “House of Cards” and “Stranger Things,” the streaming giant assured its subscribers that it could deliver exclusive and high-quality content that couldn’t be found anywhere else.

Expansion into Global Markets

Netflix’s appetite for growth wasn’t confined to the domestic market. The company realized the immense potential in expanding internationally and successfully launched its streaming services in various countries, leveraging its already considerable brand recognition.

Embracing the Subscription Model

Building upon its rental-by-mail foundation, Netflix embraced a subscription model that allowed users to enjoy unlimited access to its vast collection of movies and TV shows for a monthly fee. This approach offered both convenience and affordability, forging a strong bond between the company and its subscribers.

User-friendly Interface and Personalization

Netflix revolutionized the user experience by developing a user-friendly interface that showcased personalized recommendations based on individual preferences and viewing history. By tailoring content suggestions to each user, Netflix succeeded in keeping viewers engaged and coming back for more.

Downfall of Blockbuster

Blockbuster’s Dominance in the Rental Market

Before the advent of digital media, Blockbuster was the undisputed king of the rental market. With its chain of physical stores spread across the nation, Blockbuster boasted a vast selection of movies and games that kept customers coming back.

Failure to Adapt to Changing Consumer Preferences

Underestimating the shift to digital media

Blockbuster’s greatest downfall was its inability to foresee the rapid adoption of digital media and streaming. As customers increasingly turned to Netflix and other streaming services, Blockbuster clung to its brick-and-mortar stores, failing to recognize the impending revolution that would reshape the industry.

Slow response to the emergence of streaming services

Even after digital media started gaining momentum, Blockbuster was slow to respond. Instead of developing or partnering with a streaming service, Blockbuster focused on its in-store experience, which eventually became a liability.

Missed Opportunities and Strategic Errors

Ignoring the Importance of Technology

Blockbuster’s reluctance to embrace technology was a significant factor in its downfall. While Netflix invested heavily in developing streaming technology and expanding its digital infrastructure, Blockbuster failed to recognize the potential of this new era and instead stuck to its traditional model.

Poor Decision-making Regarding Partnerships

Blockbuster also made critical missteps in its choice of partnerships. For example, it passed up on an opportunity to acquire Netflix in its early days, a decision that would come back to haunt the company as Netflix rose to prominence.

Comparison of Success Factors

Differentiation through Content Offerings

Netflix’s success can be partially attributed to its ability to offer exclusive original content, giving subscribers a unique and compelling reason to choose Netflix over other streaming services. Blockbuster, on the other hand, relied primarily on licensing existing content, failing to capture the attention and loyalty of its audience.

User Experience and Convenience

Netflix’s user-friendly interface and personalized recommendations provided a superior viewing experience, eliminating the hassle of browsing through physical copies and improving customer satisfaction. Blockbuster’s reliance on physical stores and limited browsing options paled in comparison and failed to address changing consumer expectations.

Pricing and Subscription Models

Netflix’s subscription model offered tremendous value for money, allowing customers to access unlimited content at a fixed monthly fee. In contrast, Blockbuster’s pay-per-transaction model became less appealing as streaming emerged as a more convenient and cost-effective solution.

Expansion into International Markets

While Netflix expanded its services to various countries, Blockbuster’s physical store presence limited its ability to penetrate global markets effectively. This international expansion allowed Netflix to tap into new audiences and diversify its revenue streams.

In the battle between Netflix and Blockbuster, it is evident that the former’s rise to success and the latter’s downfall hinged on factors such as adaptability, embracing technological advancements, and understanding consumer behavior. The story of these two entertainment giants serves as a valuable lesson for industry competitors, illustrating the importance of staying ahead of the curve and constantly evolving to meet the changing needs and preferences of consumers.

The future of streaming services remains promising, but not without its challenges. As the industry becomes increasingly competitive, companies will need to continue innovating and delivering exceptional content and experiences to stay relevant. Only by learning from past mistakes and understanding the evolving landscape can streaming services hope to thrive in an ever-evolving entertainment ecosystem.

Related articles:

- The Ultimate Guide to Avoiding Blockbuster Late Fees – Tips and Tricks for a Stress-Free Movie Rental Experience

- Is ‘London Bridge Is Falling Down’ Available on Netflix? Exploring the Classic Nursery Rhyme in Streaming

- From Success to Obscurity – Unmasking the Reasons Why Blockbuster Failed

- Exploring the Top Product Management Models – A Comprehensive Guide

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Art Ocain: Leader

a disruptor, innovator, mentor, technologist, author, and consultant.

Decision-Making Processes and Failures: Netflix vs Blockbuster

Back in the year 2000, Reed Hastings, founder of Netflix, flew to Dallas to meet with the Blockbuster CEO, John Antico (Tyler, 2017). Interestingly, Reed Hastings chartered a private jet to Dallas because no commercial flights were available on short notice (Randolph, 2019). Reed and the Netflix team presented their business to Blockbuster (who was turning $6 billion in revenue) for a mere $50 million. Antico and Blockbuster turned them down, with a lot of arguments showing that Blockbuster did not believe that the Internet craze was a serious threat, so Netflix resolved to bury Blockbuster (Randolph, 2019). In 2010, Blockbuster declared bankruptcy (Satell, 2014).

The idea of Aikido is to turn someone’s strength into their weakness. In a model for business strategy , Aikido is when a company offers a product that is “diametrically opposed” to the image and mindset of the competition (BMI Lab, n.d.). Unlike most other terms discussed here, Aikido is a strategy, not a forecasting or goal-setting technique. It is most similar to STAR in that it is an approach to a problem.

In the case of Blockbuster, who excelled in brick-and-mortar video rentals with late fees and was very profitable with a $6 billion revenue, there was so much momentum in their way of doing things. Blockbuster had the market and had established the level of service for video rental. Netflix, in true Aikido fashion, entered the market with the exact opposite of what Blockbuster offered. Instead of a brick-and-mortar presence, Netflix allowed customers to rent movies online. Instead of late fees, Netflix allowed customers to return without late fees. Netflix was able to offer the market an opposite solution which was enough to trip Blockbuster and make it die under its own weight.

S.M.A.R.T. goals are specific, measurable, achievable, relevant, and time bound. SMART is a goal-setting method from Peter Druckers’s Management by Objectives which is used to make objectives clear and achievable (Mindtools: SMART Goals , n.d.). SMART goals are often used to make a goal meaningful and motivating, and the tool is usable by most people and organizations. Netflix, as well as most dot-com companies, users key performance indicators (KPIs) heavily, which are based off of SMART goals (Marino, 2019). KPIs measure the “measurable” part of goals. Sara Marino indicates that Blockbuster’s lack of appropriate SMART goals and KPIs for the dot-com era were a factor in their demise (Marino, 2019).

Since Blockbuster’s online strategy was non-existent and their business model was faulty and unable to compete with nimble competitors like Netflix, setting goals around launching a Netflix-like project never occurred to Blockbuster. They never set a goal around it because they did not see Netflix as a threat.

DELPHI Analysis

Unlike SMART, which is for goal-setting, DELPHI Analysis is about forecasting. Abhishek Syal, from MIT Sloan and Senior Analyst for Dell/EMC, performed a Delphi Method example on Blockbuster and Netflix, showing that it could be forecasted that the market would follow the dot-com trend (Syal, 2018). The Delphi Method, developed by RAND Corporation in the 1950s to analyze technology and warfare, has become a statistical forecasting tool to come to a consensus about a future prediction (RAND Corporation, n.d.). Abhishek Syal’s Delphi Method example shows a clear handoff of market from Blockbuster to Netflix (Syal, 2018).

SWOT Analysis

SWOT analysis is a planning tool that stands for the terms strengths, weaknesses, opportunities, and strengths. It is a tool that analyses a business’s internal abilities and hinderances as well as external factors that affect the business (Parsons, 2018). With investment of time and energy, team involvement, and open collaboration using the tool, a team can honestly assess where it needs to improve, defend, or grow.

In the SWOT analysis performed by Adam on Free SWOT Analysis , Blockbuster has several strengths as well as weaknesses. Strengths ( internal ) include their large market control and low prices, while weaknesses ( internal ) include lack of planning in global markets and expensive shipping arrangements. Opportunities (ex ternal ) include quality improvement and online product development, while threats ( external ) include problems with movie failures, piracy, and the amount of competition (Adam, 2011).

STAR stands for situation, task, action, and result, and is used for dealing with a situation. STAR is commonly used in behavioral interviews to provide a comprehensive response to a problem (Doyle, 2020). It is often used to build an answer to a question in a way that is comprehensive. STAR, like Aikido, is a strategy rather than forecasting like Delphi or planning like SMART.

Reading the story of Netflix’s meeting at the Blockbuster headquarters in Dallas, the Netflix team did a great job of answering the questions asked of them in a STAR way, although the meeting was largely unsuccessful.

Much like SMART, GROW is a planning tool, although it is commonly used in coaching. GROW is made up of goal, current reality, options, and will to commit (Mindtools: GROW , n.d.) GROW is meant to determine the tactical path from current state, through evaluating options, to reaching the goal through a way forward.

Blockbuster, during their demise, had opportunities to acquire or develop business in the online space, rather than firmly holding onto their anchor business model. Re-evaluation of their goals, a new SWOT analysis, and building a new tactical path through GROW would have helped them plan their way out of failure. The concept of Aikido, which is a mindset or strategy, allowed Netflix to go up against Blockbuster, seizing the market, by offering exactly the opposite approach to Blockbuster. Stubbornness, lack of planning, lack of adaptability, and poor decision making led to their failure, rather than seeking out the right solution for their brand and their corporation.

Adam. (2011). SWOT Analysis of Blockbuster. Retrieved from https://www.freeswotanalysis.com/entertainment/245-swot-analysis-of-blockbuster.html

BMI Lab. (n.d.). Aikido . Retrieved from https://businessmodelnavigator.com/pattern?id=3

Doyle, Alison. (2020). How to Use the STAR Interview Response Method. Retrieved from https://www.thebalancecareers.com/what-is-the-star-interview-response-technique-2061629

Marino, Sara. (2019). KPIs and Netflix. Retrieved from https://medium.com/@saramarino_31225/kpis-and-netflix-155e8189469b

Mindtools. (n.d.). SMART Goals: How to Make Your Goals Achievable . Retrieved from https://www.mindtools.com/pages/article/smart-goals.htm

Mindtools. (n.d.). The GROW Model of Coaching and Mentoring . Retrieved from https://www.mindtools.com/pages/article/newLDR_89.htm

Parsons, Noah. (2018). What is a SWOT Analysis, and How to Do It Right (with examples) . Retrieved from https://www.liveplan.com/blog/what-is-a-swot-analysis-and-how-to-do-it-right-with-examples/

RAND Corporation. (n.d.). Delphi Method. Retrieved from https://www.rand.org/topics/delphi-method.html

Randolph, Marc. (2019). He “Was Struggling Not to Laugh”: Inside Neflix’s Crazy, Doomed Meeting with Blockbuster . Retrieved from https://www.vanityfair.com/news/2019/09/netflixs-crazy-doomed-meeting-with-blockbuster

Share this:

Published by art ocain.

I am a DevOps advocate, not because I am a developer (I’m not), but because of the cultural shift it represents and the agility it gains. I am also a fan of the theory of constraints and applying constraint management to all areas of business: sales, finance, planning, billing, and all areas of operations. My speaking: I have done a lot of public speaking in my various roles over the years, including presentations at SBDC (Small Business Development Center) and Central PA Chamber of Commerce events as well as events that I have organized at MePush. My writing: I write a lot. Blog articles on the MePush site, press-releases for upcoming events to media contracts, posts on LinkedIn (https://www.linkedin.com/in/artocain/), presentations on Slideshare (https://www.slideshare.net/ArtOcain), posts on the Microsoft Tech Community, articles on Medium (https://medium.com/@artocain/), and posts on Quora (https://www.quora.com/profile/Art-Ocain-1). I am always looking for new places to write, as well. My certifications: ISACA Certified Information Security Manager (CISM), Certified Web Application Security Professional (CWASP), Certified Data Privacy Practitioner (CDPP), Cisco Certified Network Associate (CCNA), VMware Certified Professional (VCP-DCV), Microsoft Certified System Engineer (MCSE), Veeam Certified Engineer (VMCE), Microsoft 365 Security Administrator, Microsoft 365 Enterprise Administrator, Azure Administrator, Azure Security Administrator, Azure Architect, CompTIA Network+, CompTIA Security+, ITIL v4 Foundations, Certified ScrumMaster, Certified Scrum Product Owner, AWS Certified Cloud Practitioner See certification badges on Acclaim here: https://www.youracclaim.com/users/art-ocain/badges My experience: I have a lot of experience from developing a great company with great people and culture to spinning up an impressive DevOps practice and designing impressive solutions. I have been a project manager, a President, a COO, a CTO, and an incident response coordinator. From architecting cloud solutions down to the nitty-gritty of replacing hardware, I have done it all. When it comes to technical leadership, I am the go-to for many companies. I have grown businesses and built brands. I have been a coach and a mentor, developing the skills and careers of those in my company. I have formed and managed teams, and developed strong leaders and replaced myself within the company time and again as I evolved. See my experience on LinkedIn here: https://www.linkedin.com/in/artocain/ View more posts

Leave a Reply Cancel reply

Discover more from art ocain: leader.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Netflix & Blockbuster – Case Study Of Disruptive Innovation

Written By:

Post Date – Update:

It’s rare for a week without me tuning into Netflix to watch something or at least browse its offerings to find my next binge-worthy series. I know I’m not alone in this habit; countless others probably engage in the same routine.

That’s why examining the Netflix and Blockbuster case study is so enlightening. It offers a riveting look at how disruptive innovation can permanently alter the digital landscape. One company survived and flourished, while the other faded into business irrelevance. As we delve into key learnings from this case study, we also discuss what contemporary companies can do to avoid meeting the same fate as Blockbuster.

Table of Contents

Understanding disruptive innovation, netflix’s early challenges, low-end footholds, new market footholds, blockbuster’s missed opportunities, the importance of transformation in business, 1. adapt or perish, 2. recognize low-end footholds, 3. embrace technology early, 4. customer-centric approach, 5. stay ahead through innovation, 6. use data intelligently, 7. anticipate future trends, 8. understand market signals, 9. transformation is continuous, listen to our podcast about streaming wars chronicles: the netflix & blockbuster case study of disruptive innovation below or by clicking here., 5 questions to ask when considering a solid wood furniture manufacturer, what is solid wood vs. engineered wood, hardwood solids furniture, what does the term mean, netflix & blockbuster: a case study in disruptive innovation.

One of the most compelling case studies in disruptive innovation is the saga of Netflix and Blockbuster. This story provides valuable insights into how Netflix managed to upend the industry, positioning itself as a dominant force in today’s digital landscape.

Continue reading as we delve deeper into the disruptive journey of Netflix and Blockbuster.

Digital disruption has been a game-changer in entrepreneurial strategies since the late 20th Century. Contrary to popular belief, disruptive innovation is not the same as mere creativity.

While creating a fuel-efficient engine might draw a new consumer base, the minor variations from standard engines do not categorize it as disruptive. True disruption focuses on targeting sectors that established companies overlook or revolutionizing an existing system.

This case study delves into how Netflix applied disruptive innovation to dethrone Blockbuster in the home entertainment industry.

Brief History Of Netflix

Understanding its history is crucial to grasp the scale of Netflix’s disruption fully. Netflix was founded in 1998 by Reed Hastings and Marc Randolph in Scott’s Valley, California, with an initial investment of $2.5 million from Hastings.

Opting to distribute DVDs rather than bulky and fragile VHS tapes, Netflix started with 30 employees and 925 available titles. Over time, the company introduced a monthly subscription model, eliminating the single rental system. It positioned itself as a consumer-friendly alternative to Blockbuster’s model, often including late fees and hidden charges.

Netflix wasn’t always the giant we know today. In 2000, the company even offered to sell itself to Blockbuster for $50 million—an offer that Blockbuster refused.

Following the dot-com bubble burst and the 9/11 attacks, Netflix was forced to lay off two-thirds of its staff. However, the proliferation of affordable DVD players and an IPO in 2002 helped the company regain its footing.

Disruptive Strategies Used By Netflix

Netflix employed various disruptive approaches to outmaneuver Blockbuster in the market. Continue reading to uncover two of these critical, innovative strategies.

Netflix initially targeted lower-end markets that Blockbuster ignored. It presented itself as a hassle-free alternative to Blockbuster by eliminating late fees. This allowed Netflix to grow its customer base steadily.

The company focused on improving service speed and video quality, gradually becoming a preferred choice over Blockbuster for many consumers.

Netflix further disrupted the industry by introducing DVDs and streaming services. Their easy-to-use online interface and innovative recommendation algorithm provided an experience Blockbuster couldn’t match.

They also invested in creating original content, widening their market appeal, and keeping audiences engaged.

Blockbuster’s business model worked well for a time, but their complacency in innovation left them vulnerable to disruption. They continued to rely on an aging model that included late fees and did not adapt quickly enough to new technologies.

When they finally attempted to catch up, it was too late, and they were already in decline.

While disruptive innovation is crucial for capturing market share, continual transformation is essential. Netflix’s willingness to adapt allowed it to evolve from a DVD rental service to a streaming giant.

Conversely, Blockbuster’s resistance to change led to its downfall. The case of Netflix vs. Blockbuster is a compelling example of how disruptive innovation can reshape industries and why companies must adapt to survive.

Lessons From The Netflix & Blockbuster Case Study On Disruptive Innovation

The evolution of Netflix and the decline of Blockbuster serve as an epic tale of disruptive innovation in the business landscape. This case study provides insights into strategic decision-making and offers lessons on how to deal with market transformation.

Here are ten key lessons companies can learn from this saga.

The inability of Blockbuster to adapt to emerging technologies and new consumer preferences, especially around the convenience of movie rentals, was a critical downfall. Companies must be agile and willing to adapt their business models to remain relevant.

Netflix capitalized on the aspects of the market that Blockbuster ignored, primarily around consumer annoyance with late fees. Companies should be cautious not to ignore market segments that might seem less profitable or secondary, as they may become entry points for disruptive competitors.

Netflix took a risk by betting on DVDs and online streaming. Companies should look towards emerging technologies as opportunities for future growth and be willing to invest early, even if the technology hasn’t yet reached mass adoption.

Netflix’s recommendation algorithm, easy-to-use interface, and concern for customer experience made them a consumer favorite. Companies should place the customer at the center of their business model and continually strive to improve the user experience.

Netflix invested in original content to differentiate itself further from Blockbuster and new competitors. Companies must continuously innovate and expand their offerings to keep customers engaged and deter potential entrants.

Netflix has been a pioneer in utilizing big data to understand customer behavior and preferences. Companies should leverage data analytics to make more informed decisions and to tailor their services/products to individual customer needs.

While Blockbuster remained committed to physical stores, Netflix anticipated the shift toward digital consumption. Forecasting and acting upon trends can differentiate between leading the market or becoming obsolete.

Blockbuster missed the signals when Netflix offered to sell itself for $50 million, and consumers began to show dissatisfaction with late fees. Recognizing and acting upon market signals, even subtle ones, can impact a company’s trajectory.

Even after establishing itself as a leader in streaming, Netflix continues to evolve and adapt. Understanding that transformation is an ongoing process rather than a one-time event is crucial for long-term success.

10. Learn From Failures

Both Netflix and Blockbuster had their share of mistakes. However, Netflix has shown an ability to learn from its failures, pivot, and recover. Companies should not only celebrate successes but also see failures as learning opportunities.

The tale of Netflix and Blockbuster is a masterclass in understanding disruptive innovation and market transformation mechanics. By recognizing early signs of disruption, staying adaptable, and being committed to continuous improvement and innovation, companies can remain competitive and relevant in their respective markets.

Find out more about how Mondoro can help you create, develop, and manufacture excellent home decor and home furniture products – don’t hesitate to contact me , Anita . Check out my email by clicking here , or become a part of our community and join our newsletter by clicking here .

Mondoro gives out a FREE Lookbook to anyone interested . You can receive a copy of our latest Lookbook by clicking here.

Listen to our Podcast called Global Trade Gal . You can find it on all major podcast platforms. Try out to listen to one of our podcasts by clicking here.

Subscribe to our Mondoro Company Limited YouTube Channel with great videos and information by clicking here.

Related Questions

One of the things we look at when we go into a new solid wood furniture manufacturer is in-house kiln wood drying. We also want to know if they understand how to join the wood properly and have the equipment. Also, if the manufacturer is in a hot and tropical climate if they have a dry room to help control the wood moisture levels. We like to work with factories that cut and shape all the wood and have in-house finishing facilities.

You can discover more by reading our blog 5 Questions To Ask When Considering A Solid Wood Furniture Manufacturer ; read more by clicking here.

Solid wood is cut down from the tree , cut into wood boards, and then used for manufacturing. On the other hand, engineered wood is considered manmade as it is usually manufactured with wood chips, wood shavings, and an adhesive. Today the manufacturing of engineered wood is extremely technical.

You can discover more by reading our blog All About Teak Wood And Outdod? by clicking here.

Hardwood solids can include non-solid woods such as engineered woods. Hardwood solids are used in furniture and other industries to classify what wood is used in a product. The terms usually do not classify what type of wood is used.

You can discover more by reading our blog Hardwood Solids Furniture, What Does The Term Mean? by clicking here .

- Latest Posts

- Navigating Waves: Understanding Fluctuations In Global Container Shipping Rates – April 29, 2024

- Timeless Charm Of Ceramic Table Lamps: A Deep Dive Into Elegance And Functionality – April 16, 2024

- Shapr3D And Procreate: Perspective On Home Decor And Furniture Design – April 11, 2024

Share Our Post On:

Anita Hummel

Brought to you by:

Netflix Inc.: The Disruptor Faces Disruption

By: Chris F. Kemerer, Brian Kimball Dunn

Netflix Inc. (Netflix) had surpassed Blockbuster, the previous movie rental leader, before making the successful transition to digital delivery of video content. But despite Netflix's success, in…

- Length: 12 page(s)

- Publication Date: Nov 27, 2017

- Discipline: Information Technology

- Product #: W17722-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Netflix Inc. (Netflix) had surpassed Blockbuster, the previous movie rental leader, before making the successful transition to digital delivery of video content. But despite Netflix's success, in 2017, numerous competitors, including both established, mainstream content producers and digital upstarts, were making it difficult for Netflix to recreate its earlier dominance. Critics pointed to Netflix's slowing acquisition of subscribers and accelerating debt levels. Netflix's chief executive officer was confronted with disruption from a variety of digital rivals. How should he respond? Should Netflix continue to try to be a content producer, competing with Hollywood's industry leaders? Should it form a partnership with other media companies to align everyone's incentives? Perhaps it could move into other media content areas outside of traditional entertainment. Further, there remained the question of how to treat its legacy DVD-by-mail business. As the incumbent firm, Netflix needed to respond to competitors and avoid a fate similar to that of Blockbuster.

Chris Kemerer is affiliated with University of Pittsburgh.

Learning Objectives

This case was written for undergraduate and post-graduate courses in information systems and technology strategy. It offers a vehicle for students to thoroughly explore Clayton Christensen's disruptive innovation concept. In particular, it offers the opportunity to see two disruption examples in one case. Through the case, students will understand both demand-side and supply-side disruption; analyze multi-objective management of a portfolio of both mature, cash-cow lines of business and emerging, less certain business delivery innovations; understand the economics of digital goods and platform businesses, including high-fixed-cost and low-marginal-cost production functions and the cross-side network effects inherent in platforms; and discuss new technology risk management, particularly with respect to rapidly changing and uncertain information technologies.

Nov 27, 2017

Discipline:

Information Technology

Ivey Publishing

W17722-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Harvard Business School →

- Faculty & Research →

- May 2007 (Revised April 2009)

- HBS Case Collection

- Format: Print

- | Pages: 15

About The Author

Willy C. Shih

Related work.

- August 2014

- Faculty Research

Netflix in 2011

- Netflix in 2011 By: Willy Shih and Stephen Kaufman

insights and consulting for change

- Change (31)

- Communication (16)

- Government (6)

- Initiatives (2)

- Leadership (19)

- Measurement (11)

- Organizational Behavior (13)

- Organizational Culture (6)

- Politics (10)

- Reporting (8)

- Strategy (29)

- Strategy Map Design (7)

- Strategy-Focused IT (12)

- Tenacious Tortoise (6)

- Workforce (7)

- Atul Gawande audiences balanced scorecard Blockbuster British Petroleum BSC capacity for change Carolyn Aiken cascade case study cause and effect change agents channels charisma Charles M. Blow Chris Brogan Chrysler common sense company size competency competition conditions for change consulting contribution defensive dental floss discretionary spending DVD earthquake Economist enterprise activity expectations experienced facilitation facilitation Flaw of Averages focus group Frederick Herzberg fuel economy GM Government hare HBR health care health care spending hierarchy hunkering down hypotheses hypothesis indicator information capital information technology Iridium irrational IT IT Organization IT spending John Kotter Key West leadership leading indicators Lord Browne Malcolm Gladwell McKinsey messages motivation Motivation-Hygiene Theory Netflix New York Times New Yorker perception perspectives and themes precision public relations reality red yellow green Redbox regulated monopoly research design sabotage safety Sam L. Savage Scott Keller SFITO statistics strategy map survey teachable moment technology technology management Tenacious Blog tenacity Terry Gross time reporting Tom Peters Tom Wolfe value proposition vertical and horizontal Virginia Apgar vocabulary Wordpress

Blockbuster vs. Netflix: A Case of Technology-Driven Strategy

For a few years now, I’ve been doing a riff on Blockbuster and Netflix in some of my speaking engagements. It’s been a useful case for sharing many of my insights about strategic management and the role of technology in strategy (disclaimer: neither of these firms has been a client of mine, and my impressions have been formed only from publicly-available information).

The essence of the riff is this: Blockbuster built a very successful business model and then had its lunch eaten by Netflix. The key lessons we can learn from this case are:

- Don’t underestimate the power of technology to change your competitive environment.

- Constantly be looking for ways to challenge and reinvent your value proposition, or your competitors will do it for you.

- Recognize and overcome the forces that will resist change in your own organization.

Let’s look at the history. Blockbuster opened its first store in Dallas in 1985. It grew rapidly through franchising, company-owned stores, and acquisition and consolidation of the thousands of independent “mom and pop” video rental retailers around the country. The value proposition was easy to see: convenient, economical, and reliable rental access to video and game entertainment, in a clean and family-safe (with no X-rated movies) environment. Viacom acquired Blockbuster in 1994 for $8.4 billion.

But Blockbuster’s fortunes have been on a long decline. Viacom floated shares in Blockbuster with plans for a full divestiture. The separation was completed in 2004, with Viacom taking a $1.3 billion charge for its trouble. Blockbuster stock, which traded above $29 a share in 2002, has recently been trading below $1.00 per share. Blockbuster’s market capitalization is less than $150 million , and trading was halted briefly in March 2009 on rumors of bankruptcy.

Billions of dollars in shareholder value lost. What happened? Netflix happened (although other, less significant forces contributed). Netflix was established in 1997 and has its headquarters in Los Gatos, California. Although it started with a conventional pay-per-rental model, it introduced its monthly subscription concept in 1999, and dropped pay-per rental soon after. Capitalizing on the shift from tape to disk media for video, Netflix’s business model exists entirely without a bricks and mortar retail presence.

The basic value proposition of Netflix has been to capture its customers’ DVD choices on its website (heavily driven by customized recommendations), and ship the chosen DVD to and from customers via U.S. Mail. Compared with bricks and mortar video rental stores, Netflix offers the convenience of website ordering and door to door service at the sacrifice of same-day service. In most cases, DVDs arrive in the mail the day after an order is initiated (either by request on the website or returning a previously rented DVD). Netflix’s success has certainly been due in part to reliable execution of its order capture and delivery processes. Netflix went public in 2002 selling over 5 million shares at a (split-adjusted) $7.50. After having incurred losses for a few years, it posted its first profit of $6.5 million on $272 million in revenue in 2003. Netflix recently traded around $40 per share, and has a market capitalization over $2.2 billion .

Don’t underestimate the power of technology to change your competitive environment

Netflix’s business strategy was entirely built on the basis of then-available technology. Environmental changes, such as higher penetration of internet access and broad availability of DVD players changed the landscape, and created opportunity. Of course, the technology was available to Blockbuster, which was certainly aware of environmental change. But Blockbuster was slow to respond.

Compared with Blockbuster’s retail video rental model, Netflix offered the value proposition of convenience, choice, essentially unlimited inventory, and of course low cost; all because the consumer interacts with Netflix using her computer, rather than having to physically visit a Blockbuster. Think about the layout of a typical Blockbuster store; nearly all the space is occupied by air. This air creates aisles that allows consumers to walk and see (often with some difficulty) the cover art and titles of perspective DVD rentals. The actual space necessary to store the DVDs is a small fraction of the space needed for an effective browsing environment. So Blockbuster incurs a huge overhead in real estate, as well as the relatively modest salaries of the clerks and store manager who probably aren’t offering you a lot of advice about what movie to see.

Although Blockbuster finally entered the online market in 2004, it hasn’t enjoyed the same success as Netflix. It was sued by Netflix in 2006 for patent infringement on the design of its online rental program (the case was settled with undisclosed terms). Recent measures of online traffic show that Netflix.com outdraws Blockbuster.com by a factor of about 5 to 1.

Constantly be looking for ways to challenge and reinvent your value proposition, or your competitors will do it for you

Despite competition from self-service rental kiosks from such firms as Redbox , Netflix seems unlikely to be overtaken soon by a competitor. Despite its current success, Netflix is in the process of reinventing itself. Netflix has added a “Watch Instantly” feature to its web site. At no additional cost, eligible subscribers are able to stream near-DVD quality movies and recorded television shows instantly over the internet. While the number of titles available now is limited, the inventory of Watch Instantly titles is growing rapidly. Netflix is now forming partnerships with electronics manufacturers to instantly stream movies directly to their devices. In May 2008 they released a set-top-box to stream Netflix’s Watch Instantly movies. While Blockbuster may have been competing with Netflix, Netflix today seems to be gearing up to compete with cable and satellite video distributors, as well as such studio-sponsored streaming sites as Hulu .

Recognize and overcome the forces that will resist change in your own organization

Without insider knowledge, we can only imagine what kinds of leadership meetings took place at Blockbuster when rentals began to decline in favor of Netflix and other competitors. What seems clear is that Blockbuster was unable to muster the courage and the tenacity to reinvent itself in the face of technology and environmental change. Netflix seems to be embracing the inevitability of change in its future.

Comments are closed.

- COSA FACCIAMO

- IL NOSTRO APPROCCIO

- COSA CERCHIAMO

Case Study: Netflix vs. Blockbuster

There are many relevant, and certainly constructive, case studies that shed light on the challenges faced in digital transformation and the pitfalls in underestimating its importance to how we do business and engage customers. One of the more famous stories of digital disruption and the battle for market leadership involves Netflix and Blockbuster. It was a classic battle of old versus new technology, of flexibility versus rigidity of business models, and, ultimately, of corporate culture. Blockbuster, once the largest video rental company in the US with a hefty international presence and worldwide revenues of $6 billion, lost big and a major reason was due to Netflix’s visionary digital strategy.

Founded in 1997, Netflix began operations by offering DVD rentals and sales. At the time, DVDs were a new format. Rather than establishing brick and mortar retail locations with VHS tapes, Netflix delivered movies by mail, which was both a disrupting idea and well-suited to the new, sturdy and slim DVD format. To deliver its DVDs into the hands of its customers, Netflix invested in warehousing and distribution. By early 2000, Netflix’s traditional pay-per-rent business model, the same model used by rival Blockbuster, was replaced by a monthly subscription-based revenue model where you placed movie titles in a queue, receiving unlimited DVDs throughout the month with the sole limit on the number of DVDs you could borrow at any one time. Netflix allowed you to keep the discs for as long as you wanted. Their revolutionary idea was that customers received new movies when the old ones were returned – with no due dates or late fees. This further cemented Netflix’s reputation as an industry disrupter, breaking with the industry’s way of doing business on a pay-per-rental basis, effectively taking on the home video sales and rental industry. In one fell swoop, by eliminating due dates and late fees, Netflix found a way to give customers what they truly longed for, setting the stage for future growth and dominance of the entire industry.

In 2000, the founder of Netflix flew to meet Blockbuster’s CEO and team. During the meeting, Netflix proposed that it be acquired by Blockbuster for $50 million [1] , recommending the companies join forces. Netflix would manage Blockbuster’s online brand and Blockbuster would promote Netflix in stores. At the time, Blockbuster was at the top of the video rental industry and the company balked at the idea of partnering with an upstart. They refused to move away from physical retail stores (in the years that followed they doubled down on their retail store strategy) and they rejected the idea of eliminating their late fees. Perhaps more tellingly, they rebuffed the idea of moving toward a digital platform. The company hadn’t yet understood how vital the digital platform would be to its survival. [2]

Just a few years later in 2004, Blockbuster’s CEO at the time, John Antioco, finally recognized that Netflix and others had altered the movie rental landscape and decided to invest heavily in the digital platform, planning to spend $200 million to launch Blockbuster Online. Under Antioco, Blockbuster likewise planned to eliminate late fees, at another $200 million investment. [3] Up until this point in time, even though late fees were a major customer irritant, Blockbuster, with its thousands of retail locations, millions of customers and massive marketing budget, had until then relied on these fees as a key source of revenue. It’s easy to see how these planned investments would have negatively impacted Blockbuster’s bottom line in the short term. The company’s board moved against Antioco. He lost their confidence and left the company by July 2007. The new CEO reversed Antioco’s changes, in an unsuccessful attempt to increase profitability, but Blockbuster, the once unbeatable company, declared bankruptcy in 2010.

Netflix, in contrast, continued to invest in digital technology, eventually moving to video on demand via the internet, betting big on broadband adoption and customer appetite for streaming digital content. Netflix’s streaming business was such a success that it rebranded itself around video on demand. Today, Netflix, worth $71B in market cap [4] , is “the world’s leading internet television network with over 100 million members in over 190 countries enjoying more than 125 million hours of TV shows and movies per day… Members can watch as much as they want, anytime, anywhere, on nearly any internet-connected screen.” [5]

Lessons Learned

Much has been written on Blockbuster’s demise and there are certainly several important lessons to be learned. We see Blockbuster’s biggest failure to be its initial refusal to see how digital transformation would impact its future. That, coupled with the company’s failure to identify and provide what its customers truly wanted (a better experience with no late fees), paved the way for its nimble opponent, Netflix to disrupt the industry and become the market leader. Digital transformation of an entire industry can happen quickly, and Blockbuster’s misreading of the trend for video rentals to go digital was fatal. Once Blockbuster missed the mark, it was unable to recover.

It’s easy to understand how Blockbuster was overly entrenched in its traditional business model to see that the future was not in a strong store network, but rather in bypassing the retail store experience and in delivering movies to its customers directly in their homes. With its market leadership and billions in revenues sourced from a soon-to-be obsolete strategy, Blockbuster was unable to assess correctly the new opportunities and threats that Netflix presented. As a globally successful brand and video rental incumbent, Blockbuster additionally overestimated its ability to compete with Netflix once it did decide to go digital. Having a strong brand does not ensure that your company will be able to compete effectively against digital transformers, no matter what their size – and yours. [6]

So, create a roadmap for your company’s future survival. Changes are swift and unforgiving in the digital age. Be aware how changing technology can meet your customers’ needs better and faster and plan accordingly. Know that some of today’s niche opportunities might become vastly more attractive, even disruptive. In this information age, new ideas can go viral before you have time to react. Be a visionary. Revisit your brand’s strategy regularly. And, don’t let current success blind your ability to assess market opportunities and threats posed by new entrants.

[1] http://www.businessinsider.com/blockbuster-ceo-passed-up-chance-to-buy-netflix-for-50-million-2015-7?IR=T

[2] https://www.forbes.com/sites/gregsatell/2014/09/05/a-look-back-at-why-blockbuster-really-failed-and-why-it-didnt-have-to/#71157d61d64a

[3] https://hbr.org/2011/04/how-i-did-it-blockbusters-former-ceo-on-sparring-with-an-activist-shareholder

[4] As of June 5, 2017. https://www.bloomberg.com/quote/NFLX:US

[5] https://media.netflix.com/en/about-netflix

[6] https://digit.hbs.org/submission/blockbuster-its-failure-and-lessons-to-digital-transformers/

Why go Digital?

Myth: We invest in digital already, so we don’t need to go through the pain of a Digital Transformation

MBA Knowledge Base

Business • Management • Technology

Home » Management Case Studies » Case Study: How Netflix Took Down Blockbuster

Case Study: How Netflix Took Down Blockbuster

Blockbuster and Netflix are two big business within the domestic videocassette rent payment market place that skilled very much distinctive products. Netflix extremely multiplied its firm estimate even as Blockbuster dropped its leading market position and fallen into bankruptcy. Back to the late 20th century, whilst Netflix was just a small newly established business, Blockbuster ruled the video cassette rental business with over 9,000 shops all around the world. With the emergence of DVDs as the brand new video medium, Blockbuster be able to get special deals with massive Hollywood studios to rent new DVD releases after cinema showings ended. At that point in time, nearly every family had a videocassette recorder (VCR) for the reason of video watching, and Blockbuster rental shops were people’s familiar starting point for film selections. Technology and innovation performed a significant task inside the improvement of the apprehensive business. Today’s dynamic domain is completely centered on progression of technology and every area requires to carry out new intervention of technology to obtain success . The on-line video package providers companies are those who design a new to look at preferred programs. The business idea of Blockbuster change into related to serving the DVDs on a rental basis. Netflix become also using the equal idea however after a period of time, it changed to the online streaming video. This advertising approach of Netflix offers with the phases that Netflix used to promote its commercial enterprise businesses.

History of Blockbuster

Blockbuster turned into one in every of the biggest video companies all over in the globe. Blockbuster became the primary organization, which commenced to offer DVDs on condominium basis. David Cook set up the company in the year 1985. David in Dallas based the primary store of Blockbuster. The primary video market of Blockbuster turned into an extensive success on global horizontal. The retailer became opened with 8000 tapes which consist of 6500 titles. Afterward they had been opened three more but, the company face challenges 3.2 million dollars in 1986. Therefore Cook sold 1/3rd share beginning of 1987. The business was managing 133 stores in 1987. Within 1919, the full number of shops reached as much as 1000. During 2000, the Blockbuster is the pinnacle DVD carrier company. But, within the year 2006, Blockbuster disconnected from Viacom.

History of Netflix

In 1997 Netflix turned into established in California, founded by Reed Hasting. At the preliminary level of this blockbuster advertising method the videos were offered on a hire charge base by the organization. But, in 1999, the business changed into commencing the delivery of obtained videos via postal facility of the United State. After a few year of its setting up order, in 2009, the business had a large and improved database system. In 2009, business was began delivering DVD such as distinctive titles. It can be referred that the business nearly contained a focus of 4.5 million customers. Within the same year, company had completed an affiliation with a digital company named as consumer electronics. This partnership made easy to get entry to the internet on specific appliances. In 2010, Blockbuster business turned into bankrupt. As in line with the facts collected, after this affiliation, people can easily get entry to internet over iPad, computer, mobile phone, laptop, and exclusive net devices. But, currently the company has 23 million contributors from different international location those make use of Netflix subscription.

How Netflix beat Blockbuster