- International

- Schools directory

- Resources Jobs Schools directory News Search

Simple and Compound Interest Problems Banking

Subject: Mathematics

Age range: 16+

Resource type: Lesson (complete)

Last updated

8 March 2024

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

As part of our Economics curriculum, The Teacher Lab has created this set of simple and compound interest mathematics problems. This set of word problems will complement the topics of banking and finance.

What’s included (24 questions altogether!)

10 Simple Interest Problems

4 questions to calculate interest earned

2 questions to calculate the principal amount

2 questions to calculate the time taken

2 questions to calculate the interest rate

10 Compound Interest Problems

4 questions to compare the interest collected based on simple and compound interest rates

These 24 word problems are packaged in the following formats:

Printable PDF file

PDF form filling file for students to fill up digitally

Google Slides

Tes paid licence How can I reuse this?

Get this resource as part of a bundle and save up to 38%

A bundle is a package of resources grouped together to teach a particular topic, or a series of lessons, in one place.

Personal Finance Insurance Credit Card Saving Accounts Loans

Need to teach the life skill of personal finance to your students? In this resource bundle, we will provide you with teaching slides and activities to teach your students about insurance, credit & debit cards, checking and savings accounts, loans and simple and compound interest. What's included **Insurance** A ready-made deck of Google Slides to teach the definition of insurance, different types of insurance and commonly used insurance jargon 2 crossword puzzles to test your students on their understanding of the different types of insurance and the insurance terms commonly used A set of printable gamecards to calculate the payout made when an insurance claim is made **Loans** A ready-made deck of Google Slides to teach the definition of a loan and the different types of loans 5 worksheets that can be printed or used digitally (crossword puzzle, loan sorting, budgeting, comparing loan periods and interest rates, calculating total interest, payment and monthly repayment) A set of 6 printable gamecards to calculate the interest incurred from borrowing a loan and the monthly repayment amount **Credit and Debit Cards** A ready-made deck of Google Slides to teach the features, advantages, disadvantages, similarities and differences between a credit and debit card. (You will receive a link to the Google slides.) Ready-made multiple choice questions to assess your students' learning on the topic of credit and debit cards. 3 different printable worksheets (identifying different features of a debit card, comparing advantages and disadvantages of credit vs debit card, a worksheet to conduct market research and decide on the most suitable credit card) **Checking and Savings Accounts** A ready-made deck of Google Slides to teach the features, advantages and disadvantages of a checking account and a savings account. (You will receive a link to the Google slides.) Ready-made multiple choice questions to assess your students' learning on the topic of checking and savings accounts 3 different printable worksheets A worksheet to help identify the best bank or financial institution to open a checking account A worksheet to help identify the best bank or financial institution to open a savings account A worksheet to practice writing checks **Simple and Compound Interest Problems** 24 questions on simple and compound interest This is a teaching package filled with a bumper crop of teaching ideas and activities for you to choose from, and one that will save you lots of preparation time. Say goodbye to all those late nights trying to come up with new lesson ideas. We've done the work for you! This is an absolute classroom time saver! Download your copy today and see the difference it makes in your classroom.

Checking and Savings Account with Simple and Compound Interest Activities

Introducing our comprehensive banking package! This package will empower you with the resources needed to teach the topic of checking and savings accounts, as well as the art of calculating simple and compound interest. If you would like your students to learn more about the features of checking and savings accounts as well as how the interest on these accounts is calculated, you've come to the right place. What's included **Checking and Savings Account** A ready-made deck of Google Slides to teach the features, advantages and disadvantages of a checking account and a savings account. (You will receive a link to the Google slides.) Ready-made multiple choice questions to assess your students' learning on the topic of checking and savings accounts 3 different printable worksheets A worksheet to help identify the best bank or financial institution to open a checking account A worksheet to help identify the best bank or financial institution to open a savings account A worksheet to practice writing checks **Simple and Compound Interest** **10 Simple Interest Problems** 4 questions to calculate interest earned 2 questions to calculate the principal amount 2 questions to calculate the time taken 2 questions to calculate the interest rate **10 Compound Interest Problems** 4 questions to calculate interest earned 2 questions to calculate the principal amount 2 questions to calculate the time taken 2 questions to calculate the interest rate 4 questions to compare the interest collected based on simple and compound interest rates These 24 word problems are packaged in the following formats: - Printable PDF file - PDF form filling file for students to fill up digitally - Google Slides

Banking and Finance Lesson Slides and Activities

In this bundle, you will be equipped with the resources to teach your students about checking accounts, saving accounts, credit cards, debit cards, simple interest & compound interest. **What's included:** **Credit and Debit Cards** A ready-made deck of Google Slides to teach the features, advantages, disadvantages, similarities and differences between a credit and debit card. (You will receive a link to the Google slides.) Ready-made multiple choice questions to assess your students' learning on the topic of credit and debit cards. 3 different printable worksheets A worksheet to identify the different features of a debit card A worksheet to state the advantages, disadvantages, similarities and differences between a credit and debit card. (An answer key is provided) A worksheet to conduct research and make a decision on the most suitable type of credit card based on one's needs. **Checking and Savings Accounts** A ready-made deck of Google Slides to teach the features, advantages and disadvantages of a checking account and a savings account. (You will receive a link to the Google slides.) Ready-made multiple choice questions to assess your students' learning on the topic of checking and savings accounts 3 different printable worksheets A worksheet to help identify the best bank or financial institution to open a checking account A worksheet to help identify the best bank or financial institution to open a savings account A worksheet to practice writing checks **Simple and Compound Interest** **10 Simple Interest Problems** 4 questions to calculate interest earned 2 questions to calculate the principal amount 2 questions to calculate the time taken 2 questions to calculate the interest rate **10 Compound Interest Problems** 4 questions to calculate interest earned 2 questions to calculate the principal amount 2 questions to calculate the time taken 2 questions to calculate the interest rate 4 questions to compare the interest collected based on simple and compound interest rates This is a teaching package filled with a bumper crop of teaching ideas and activities for you to choose from, one that will save you lots of preparation time. Say goodbye to all those late nights trying to come up with new lesson ideas. We've done the work for you! This is an absolute classroom time saver! Download your copy today and see the difference it makes in your classroom.

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

Compound Interest Textbook Exercise

Click here for questions, gcse revision cards.

5-a-day Workbooks

Primary Study Cards

Privacy Policy

Terms and Conditions

Corbettmaths © 2012 – 2024

Compound Interest Formula

Compound interest is interest that is calculated on both the money deposited and the interest earned from that deposit.

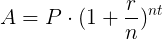

The formula for compound interest is \(A=P(1+\frac{r}{n})^{nt}\), where \(A\) represents the final balance after the interest has been calculated for the time, \(t\), in years, on a principal amount, \(P\), at an annual interest rate, \(r\). The number of times in the year that the interest is compounded is \(n\).

Jasmine deposits $520 into a savings account that has a 3.5% interest rate compounded monthly. What will be the balance of Jasmine’s savings account after two years?

To find the balance after two years, \(A\), we need to use the formula, \(A=P(1+\frac{r}{n})^{nt}\). The principal, \(P\), in this situation is the amount Jasmine used to start her account, $520. The rate, \(r\), as stated in the problem, is 3.5% (or 0.35 as a decimal) and compounded monthly, so \(n=12\). Since we are looking for the balance of the account after two years, 2, is the time, \(t\).

\(A=520(1+\frac{0.035}{12})^{12(2)}\) \(A=557.65\)

The balance of Jasmine’s account after 2 years is $557.65.

Lex has $1,780.80 in his savings account that he opened 6 years ago. His account has an annual interest rate of 6.8% compounded annually. How much money did Lex use to open his savings account?

To find the principal, \(P\) we can use the same formula, \(A=P(1+\frac{r}{n})^{nt}\). We have the balance of the account, \(A\), after 6 years, which is $1,780.80. The interest rate, \(r\), is 6.8% (or 0.68 as a decimal) and is compounded annually, so \(n=1\). The time, \(t\), is 6, since we know he opened his account 6 years ago. Plug in the known values into the formula and solve for the missing variable, \(P\).

\(1{,}780.80=P(1+\frac{0.068}{1})^{1(6)}\) \(1{,}780.80=1.484P\) \(1{,}200=P\)

The principal amount Lex used to open his account 6 years ago is $1,200.

Compound Interest Sample Questions

A teacher wants to invest $30,000 into an account that compounds annually. The interest rate at this bank is 1.8%. How much money will be in the account after 6 years?

Use the compound interest formula to solve this problem.

\(A=P(1+\frac{r}{n})^{nt}\) From here, simply plug in each value and simplify in order to isolate the variable \(A\).

\(A=30{,}000(1+\frac{0.018}{1})^{1×6}\) \(A=30{,}000(1.018)^6\) \(A=$33{,}389.35\)

An investment earns 3% each year and is compounded monthly. Calculate the total value after 6 years from an initial investment of $5,000.

Once again, use the compound interest formula to solve this problem.

\(A=5,000(1+\frac{0.03}{12}^{12×6}\) \(A=5,000(1.36)^{72}\) \(A=$5{,}984.74\)

Kristen wants to have $2,000,000 for retirement in 45 years. She invests in a mutual fund and pays 8.5% each year, compounded quarterly. How much should she deposit into the mutual fund initially?

\(A=P(1+\frac{r}{n}^{nt}\) From here, simply plug in each value and simplify in order to isolate the variable \(P\).

\(2,000,000=P(1+\frac{0.085}{4})^{4×45}\) \(2,000,000=P(1.02125)^{180}\) \(P=$45{,}421.08\)

Sean invests $50,000 into an index annuity that averages 6.5% per year, compounded semi-annually. After 9 years how much will be in his account?

\(A=50{,}000(1+\frac{0.065}{2})^{2×9}\) \(A=50{,}000(1.0325)^{18}\) \(A=$88{,}918.29\)

Calculate the interest rate for an account that started with $5,000 and now has $13,000 and has been compounded annually for the past 12 years.

\(A=P(1+\frac{r}{n})^{nt}\) From here, simply plug in each value and simplify in order to isolate the variable \(r\).

\(13{,}000=5{,}000(1+\frac{r}{1})^{1×12}\) \(13{,}000=5{,}000(1+\frac{r}{1})^{12}\) \(2.6=(1+\frac{r}{1})^{12}\)

To get rid of the exponent 12, find the 12th root of both sides. This means raising both sides of the equation to the power of 112.

\(2.6^{\frac{1}{12}}=((1+\frac{r}{1})^{12})^{\frac{1}{12}}\) \(1.08288=1+r\)

Subtract 1 from both sides.

\(r=0.08288\) (as a decimal) \(r=8.288\%\) (as a percent)

Return to Math Sample Questions

by Mometrix Test Preparation | This Page Last Updated: February 16, 2024

- + ACCUPLACER Mathematics

- + ACT Mathematics

- + AFOQT Mathematics

- + ALEKS Tests

- + ASVAB Mathematics

- + ATI TEAS Math Tests

- + Common Core Math

- + DAT Math Tests

- + FSA Tests

- + FTCE Math

- + GED Mathematics

- + Georgia Milestones Assessment

- + GRE Quantitative Reasoning

- + HiSET Math Exam

- + HSPT Math

- + ISEE Mathematics

- + PARCC Tests

- + Praxis Math

- + PSAT Math Tests

- + PSSA Tests

- + SAT Math Tests

- + SBAC Tests

- + SIFT Math

- + SSAT Math Tests

- + STAAR Tests

- + TABE Tests

- + TASC Math

- + TSI Mathematics

- + ACT Math Worksheets

- + Accuplacer Math Worksheets

- + AFOQT Math Worksheets

- + ALEKS Math Worksheets

- + ASVAB Math Worksheets

- + ATI TEAS 6 Math Worksheets

- + FTCE General Math Worksheets

- + GED Math Worksheets

- + 3rd Grade Mathematics Worksheets

- + 4th Grade Mathematics Worksheets

- + 5th Grade Mathematics Worksheets

- + 6th Grade Math Worksheets

- + 7th Grade Mathematics Worksheets

- + 8th Grade Mathematics Worksheets

- + 9th Grade Math Worksheets

- + HiSET Math Worksheets

- + HSPT Math Worksheets

- + ISEE Middle-Level Math Worksheets

- + PERT Math Worksheets

- + Praxis Math Worksheets

- + PSAT Math Worksheets

- + SAT Math Worksheets

- + SIFT Math Worksheets

- + SSAT Middle Level Math Worksheets

- + 7th Grade STAAR Math Worksheets

- + 8th Grade STAAR Math Worksheets

- + THEA Math Worksheets

- + TABE Math Worksheets

- + TASC Math Worksheets

- + TSI Math Worksheets

- + AFOQT Math Course

- + ALEKS Math Course

- + ASVAB Math Course

- + ATI TEAS 6 Math Course

- + CHSPE Math Course

- + FTCE General Knowledge Course

- + GED Math Course

- + HiSET Math Course

- + HSPT Math Course

- + ISEE Upper Level Math Course

- + SHSAT Math Course

- + SSAT Upper-Level Math Course

- + PERT Math Course

- + Praxis Core Math Course

- + SIFT Math Course

- + 8th Grade STAAR Math Course

- + TABE Math Course

- + TASC Math Course

- + TSI Math Course

- + Number Properties Puzzles

- + Algebra Puzzles

- + Geometry Puzzles

- + Intelligent Math Puzzles

- + Ratio, Proportion & Percentages Puzzles

- + Other Math Puzzles

How to Solve Compound Interest Problems?

Compound interest is an interest that is accumulated on the principal and interest together over a given time. In this article, let's familiarize ourselves with solving compound interest problems.

Simple interest is interest that is paid only on the principal of money, while compound interest is interest that is paid on principal and compound interest at regular intervals.

Related Topics

- How to Solve Simple Interest Problems

A step-by-step guide to solving compound interest problems

Compound interest is the interest paid on principal and interest that is combined at regular intervals. At regular intervals, the interest so far accumulated is added to the existing principal amount and then the interest is calculated for the new principal. The new principal is equal to the sum of the Initial principal, and the interest accumulated so far.

Compound interest \(=\) interest on principal \(+\) compounded interest at regular intervals

The compound interest is calculated at regular intervals like annually( yearly), semi-annually, quarterly, monthly, etc.

Compound interest formula

The compound interest is calculated after calculating the total amount over some time, based on the interest rate and the initial principle. For an initial principal of \(P\), rate of interest per annum of \(r\), period \(t\) in years, frequency of the number of times the interest is compounded annually \(n\), the formula for calculation of amount is as follows.

\(\color{blue}{A=P\left(1+\frac{r}{n}\right)^{nt}}\)

The above formula represents the total amount at the end of the period and includes compound interest and principal. In addition, we can calculate the compound interest by subtracting the principal from this amount. The formula for calculating compound interest is as follows:

\(\color{blue}{CI=P\left(1+\frac{r}{n}\right)^{nt}-P}\)

In the above expression:

- \(P\) is the principal amount

- \(r\) is the rate of interest (decimal)

- \(n\) is the frequency or no. of times the interest is compounded annually

- \(t\) is the overall tenure.

It should be noted that the above formula is a general formula when the principal is compounded \(n\) several times in a year. If the given principal is compounded annually, the amount after the period at the percent rate of interest, \(r\), is given as:

\(\color{blue}{A=P\left(1+\frac{r}{100}\right)^t}\)

\(\color{blue}{C.I.=P\left(1+\frac{r}{100}\right)^t-P}\)

Compound interest formula for different periods

The compound interest for a given principle can be calculated for different periods using different formulas.

Compound interest formula – quarterly

If the period for calculating the interest is quarterly, the profit is calculated every three months and the amount is combined \(4\) times a year. The formula to calculate the compound interest when the principal is compounded quarterly is given:

\(\color{blue}{C.I.=P\left(1+\frac{\frac{r}{4}}{100}\right)^{4t}-P}\)

Here the compound interest is calculated for the quarterly period, so the interest rate r is divided by \(4\) and the period is quadrupled. The formula to calculate the amount when the principal is compounded quarterly is given:

\(\color{blue}{A=P\left(1+\frac{\frac{r}{4}}{100}\right)^{4t}}\)

In the above expression,

- \(A\) is the amount at the end of the period

- \(P\) is the initial principal value, \(r\) is the rate of interest per annum

- \(t\) is the period

- \(C.I.\) is the compound interest.

Compound interest formula – half-yearly

Profit for compound interest varies based on the calculation period. If the profit calculation period is half-yearly, the profit is calculated once every six months and is combined twice a year. The formula for calculating compound interest if the principal is compounded semi-annually or half-yearly is given as:

\(\color{blue}{C.I.=P\left(1+\frac{\frac{r}{2}}{100}\right)^{2t}-P}\)

Here the compound interest is calculated for six months, so the interest rate \(r\) is divided by \(2\) and the period is doubled. The formula to calculate the amount when the principal is compounded semi-annually or half-yearly is given:

\(\color{blue}{A=P\left(1+\frac{\frac{r}{2}}{100}\right)^{2t}}\)

Compound Interest – Example 1:

Davide lends \($3,000\) to John at an interest rate of \(10%\) per annum, compounded half-yearly for \(2\) years. Can you help him find out how much amount he gets after \(2\) years from John?

The principal amount \(P\) is \($3,000\). The rate of interest \(r\) is \(10%\) per annum. Conversion period \(=\) Half-year, Rate of interest per half-year \(= \frac{10%}{2}= 5%\). The time period \(t\) is \(2\) years. The compounding frequency \(n\) is \(2\).

Now, substitute the given data in the compound interest formula: \(A\:=\:P\left(1+\frac{\frac{r}{2}}{100}\right)^{2n}\)

\(A=3,000\left(1+\frac{\frac{10}{2}}{100}\right)^{2\times 2}\)

\(=3646.51\)

Exercises for Solving Compound Interest Problems

- What interest rate do you need to turn \($1,000\) into \($5,000\) in \(20\) Years?

- If you deposit \($5,000\) into an account paying \(6%\) annual interest compounded monthly, how long until there is \($8,000\) in the account?

- \(\color{blue}{8.38%}\)

- \(\color{blue}{7.9}\)

by: Effortless Math Team about 2 years ago (category: Articles )

Effortless Math Team

Related to this article, more math articles.

- 5 Best Laptops for Math Teachers

- 5th Grade OST Math FREE Sample Practice Questions

- How to Solve Word Problems of Budgeting a Weekly Allowance

- What to Consider when Retaking the ACT or SAT?

- How to Get Better at Math: 7 Comprehensive Tips for Parents with Kids Struggling

- 8th Grade MAP Math FREE Sample Practice Questions

- FREE ATI TEAS 7 Math Practice Test

- Top Proven Strategies To Increase Your SAT Math Score

- 5 Best Desks for Online Math Teachers in 2024

- Descending into Numbers: A Deep Dive into the Floor Value

What people say about "How to Solve Compound Interest Problems? - Effortless Math: We Help Students Learn to LOVE Mathematics"?

No one replied yet.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Mastering Grade 6 Math Word Problems The Ultimate Guide to Tackling 6th Grade Math Word Problems

Mastering grade 5 math word problems the ultimate guide to tackling 5th grade math word problems, mastering grade 7 math word problems the ultimate guide to tackling 7th grade math word problems, mastering grade 2 math word problems the ultimate guide to tackling 2nd grade math word problems, mastering grade 8 math word problems the ultimate guide to tackling 8th grade math word problems, mastering grade 4 math word problems the ultimate guide to tackling 4th grade math word problems, mastering grade 3 math word problems the ultimate guide to tackling 3rd grade math word problems.

- ATI TEAS 6 Math

- ISEE Upper Level Math

- SSAT Upper-Level Math

- Praxis Core Math

- 8th Grade STAAR Math

Limited time only!

Save Over 45 %

It was $89.99 now it is $49.99

Login and use all of our services.

Effortless Math services are waiting for you. login faster!

Register Fast!

Password will be generated automatically and sent to your email.

After registration you can change your password if you want.

- Math Worksheets

- Math Courses

- Math Topics

- Math Puzzles

- Math eBooks

- GED Math Books

- HiSET Math Books

- ACT Math Books

- ISEE Math Books

- ACCUPLACER Books

- Premium Membership

- Youtube Videos

Effortless Math provides unofficial test prep products for a variety of tests and exams. All trademarks are property of their respective trademark owners.

- Bulk Orders

- Refund Policy

Free Mathematics Tutorials

- Math Problems

- Algebra Questions and Problems

- Graphs of Functions, Equations, and Algebra

- Free Math Worksheets to Download

- Analytical Tutorials

- Solving Equation and Inequalities

- Online Math Calculators and Solvers

- Free Graph Paper

- Math Software

- The Applications of Mathematics in Physics and Engineering

- Exercises de Mathematiques Utilisant les Applets

- Calculus Tutorials and Problems

- Calculus Questions With Answers

- Free Calculus Worksheets to Download

- Geometry Tutorials and Problems

- Online Geometry Calculators and Solvers

- Free Geometry Worksheets to Download

- Trigonometry Tutorials and Problems for Self Tests

- Free Trigonometry Questions with Answers

- Free Trigonometry Worksheets to Download

- Elementary Statistics and Probability Tutorials and Problems

- Mathematics pages in French

- About the author

- Primary Math

- Middle School Math

- High School Math

- Free Practice for SAT, ACT and Compass Math tests

Compound Interest Problems with Detailed Solutions

Compound interest problems with answers and solutions are presented.

Free Practice for SAT, ACT and Compass Maths tests

- A principal of $2000 is placed in a savings account at 3% per annum compounded annually. How much is in the account after one year, two years and three years?

- What would $1000 become in a saving account at 3% per year for 3 years when the interest is not compounded (simple interest)? What would the same amount become after 3 years with the same rate but compounded annually?

- $100 is the principal deposited in a 5% saving account not compounded (simple interest). The same amount of $100 is placed in a 5% saving account compounded annually. Find the total amount A after t years in each saving plan and graph both of them in the same system of rectangular axes. Use the graphs to approximate the time it takes each saving plan to double the initial amount.

- If $3000 is placed in an account at 5% and is compounded quarterly for 5 years. How much is in the account at the end of 5 years?

- $1200 is placed in an account at 4% compounded annually for 2 years. It is then withdrawn at the end of the two years and placed in another bank at the rate of 5% compounded annually for 4 years. What is the balance in the second account after the 4 years.

- $1,200 is placed in an account at 4% compounded daily for 2 years. It is then withdrawn and placed in another bank at the rate of 5% compounded daily for 4 years. What is the balance in the second account after the 4 years. (compare with the previous problem)

- $1200 is placed in an account at 4% compounded continuously for 2 years. It is then withdrawn and placed in another bank at the rate of 5% compounded continuously for 4 years. What is the balance in the second account after the 4 years. (compare with the two previous problem)

- What principal you have to deposit in a 4.5% saving account compounded monthly in order to have a total of $10,000 after 8 years?

- A principal of $120 is deposited in a 7% account and compounded continuously. At the same time a principal of $150 is deposited in a 5% account and compounded annually. How long does it take for the amounts in the two accounts to be equal?

- A first saving account pays 5% compounded annually. A second saving account pays 5% compounded continuously. Which of the two investments is better in the long term?

- What interest rate, compounded annually, is needed for a principal of $4,000 to increase to $4,500 in 10 year?

- A person deposited $1,000 in a 2% account compounded continuously. In a second account, he deposited $500 in a 8% account compounded continuously. When will the total amounts in both accounts be equal? When will the total amount in the second accounts be 50% more than the total amount in the second account?

- A bank saving account offers 4% compounded on a quarterly basis. A customer deposit $200, in this type of account, at the start of each quarter starting with the first deposit on the first of January and the fourth deposit on the first of October. What is the total amount in his account at the end of the year?

- An amount of $1,500 is invested for 5 years at the rates of 2% for the first two years, 5% for the third year and 6% for the fourth and fifth years all compounded continuously. What is the total amount at the end of the 5 years?

Solutions to the Above Questions

- Solution When interest is compounded annually, total amount A after t years is given by: A = P(1 + r) t , where P is the initial amount (principal), r is the rate and t is time in years. 1 year: A = 2000(1 + 0.03) 1 = $2060 2 years: A = 2000(1 + 0.03) 2 = $2121.80 3 years: A = 2000(1 + 0.03) 3 = $2185.45

- Solution Not compounded: A = P + P(1 + r t) = 1000 + 1000(1 + 0.03 · 3) = $1090 Compounded: A = P(1 + r) t = 1000(1 + 0.03) 3 = $1092.73 Higher return when compounded.

- Solution Compounded n times a year and after t years, the total amount is given by: A = P(1 + r/n) n t quarterly n = 4: Hence A = P(1 + r/4) 4 t = 3000(1 + 0.05/4) 4 × 5 = $3846.11

- Solution Annual compounding First two years: A = P(1 + r) t = 1200(1 + 0.04) 2 = $1297.92 Last four years : A = P(1 + r) t = 1297.92(1 + 0.05) 4 = $1577.63

- Solution Daily compounding (assuming 365 days per year) First two years: A = P(1 + r / 365) 365 t = 1200(1 + 0.04 / 365) 365 × 2 = $1299.94 Last four years : A = P(1 + r / 365) 365 t = 1299.94 (1 + 0.05 / 365) 365 ×4 = $1587.73 Higher final balances compared to annual compounding in last problem.

- Solution In continuous compounding, final balance after t years is given by: A = P e r t . First two years: A = P e r t = 1200 e 0.04 × 2 = $1299.94 Last four years : A = P e r t = $1299.94 e 0.05 × 4 = $1587.75 Same balances compared to daily compounding in last problem.

- Solution P initial balance to find and final balance A known and equal to $10,000. A = P(1 + 0.045 / 12) 12 × 8 = 10,000 P = 10,000 / ( (1 + 0.045 / 12) 12 × 8 ) = $6981.46

- Solution P initial balance is equal to $4,000 and final balance is equal to $4,500. A = P(1 + r) t = 4,500 4000(1 + r) 10 = 4,500 (1 + r) 10 = 4500 / 4000 Take ln of both sides. 10 ln(1 + r) = ln(4500 / 4000) ln(1 + r) = ln(4500 / 4000) / 10 1 + r = e 0.1 ln(4500 / 4000) r = e 0.1 ln(4500 / 4000) - 1 ≅ 0.012

- Solution A 1 = 1000 e 0.02 t A 2 = 500 e 0.08 t A 1 = A 2 gives 1000 e 0.02 t = 500 e 0.08 t Divide both sides by 500 e 0.02 t and simplify 100 / 500 = e 0.08 t - 0.02 t 2 = e 0.06 t Take ln of both sides. 0.06 t = ln 2 t = ln 2 / 0.06 ≅ 11.5 years A 2 is 50% more than A 1 gives the equation: A 2 = 1.5 A 1 500 e 0.08 t = 1.5 × 1000 e 0.02 t e 0.08 t - 0.02 t = 3 0.06 t = ln 3 t ≅ 18.5 years

- Solution A = P(1 + r/n) n t First quarter deposit, t = 1 year: A 1 = 200 (1 + 0.04 / 4) e 4 × 1 = $208.12 Second quarter deposit, t = 3/4 of 1 year : A 2 = 200 (1 + 0.04 / 4) e 4 × 3/4 = $206.06 Third quarter deposit , t = 1/2 of 1 year : A 3 = 200 (1 + 0.04 / 4) e 4 × 1/2 = $204.02 Fourth quarter deposit, t = 1/4 of 1 year : A 4 = 200 (1 + 0.04 / 4)e 4 × 1/4 = $202 Total amount = $208.12 + $206.06 + $204.02 + $202 = $820.2

- Solution A = P e r t End of first two years: A 1 = 1500 e 0.02 × 2 End of third year: A 2 = A 1 e 0.05 × 1 End of fifth year (last two years): A 3 = A 2 e 0.06 × 2 = 1500 e 0.02 × 2 + 0.05 × 1 + 0.06 × 2 = $1850.51

More References and Links

- Monthly Savings Calculator

- Compound Interest Calculator

- Currency Converter

POPULAR PAGES

privacy policy

One to one maths interventions built for KS4 success

Weekly online one to one GCSE maths revision lessons now available

In order to access this I need to be confident with:

This topic is relevant for:

Compound Interest

Here is everything you need to know about compound interest for GCSE maths (Edexcel, AQA and OCR). You’ll learn how to calculate compound interest for increasing and decreasing values, and set-up, solve and interpret growth and decay problems.

Look out for the compound interest worksheet and exam questions at the end.

What is compound interest?

Compound interest means that every time interest is paid on an amount the added interest will also receive interest thereafter.

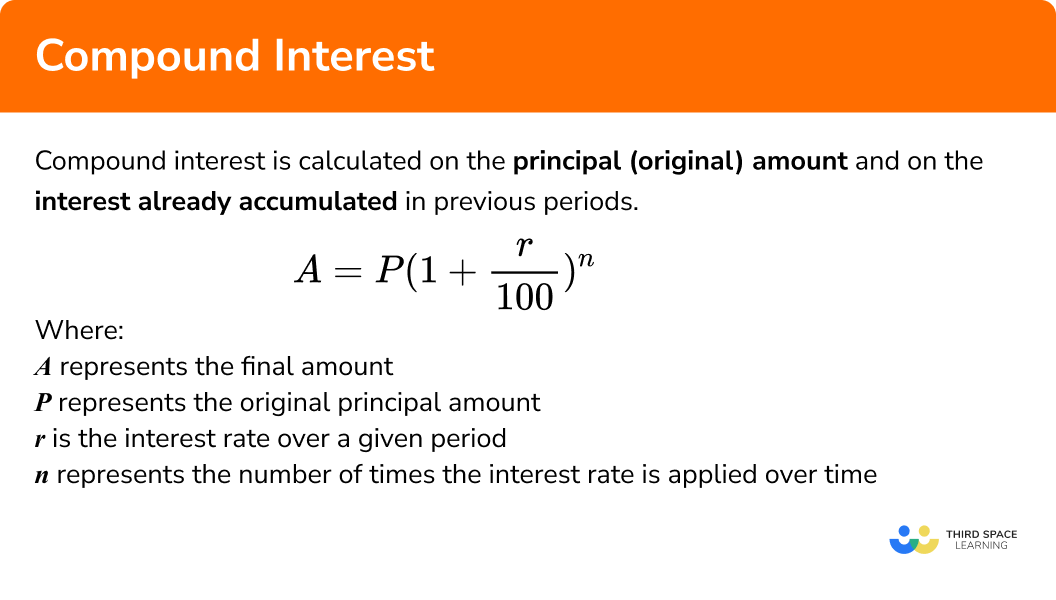

Compound interest is calculated on the principal (original) amount and the interest already accumulated on previous periods.

For example, take the amount of money in a savings account.

If you put £100 in an account with an annual interest rate of 10%, the value of the money in the account will increase by 10% in year one.

The new amount of money in the account will be £110 or 110% of the original.

In year two the value of the money in the account will increase by 10% again.

The new amount would be £121 or 121% of the original. This because we have increased £110 by 10%.

Compound interest formula

Compound interest is interest calculated on top of the original amount including any interest accumulated so far. The compound interest formula is:

- A represents the final amount

- P represents the original principal amount

- r is the interest rate over a given period

- n represents the number of times the interest rate is applied

Let’s calculate a 3% increase (per year) on an amount P using compound interest over 4 years.

If we were to calculate the amount after each year, we could just use the a multiplier of 1.03 to find each amount.

This P\times 1.03 gives the value after the first year.

The second year’s amount is this amount, multiplied by a further 1.03 and so on for the amount of years. This can be expressed using a table.

After n years, the principal amount P is multiplied by the percentage change multiplier n times. This is why the power is expressed as n .

So for this example, multiplying P by 1.03 n would calculate an increase of 3% compound interest for 4 years.

Compound Depreciation is when the value of something decreases by a percentage rate compoundly. Here we can use the same formula but the interest rate will be negative .

Compound interest formula worksheet

Get your free compound interest formula worksheet of 20+ questions and answers. Includes reasoning and applied questions.

Related lessons on simple and compound interest

Compound interest is part of our series of lessons to support revision on simple interest and compound interest . You may find it helpful to start with the main simple interest and compound interest lesson for a summary of what to expect, or use the step by step guides below for further detail on individual topics. Other lessons in this series include:

- Simple interest and compound interest

- Simple interest

- Depreciation

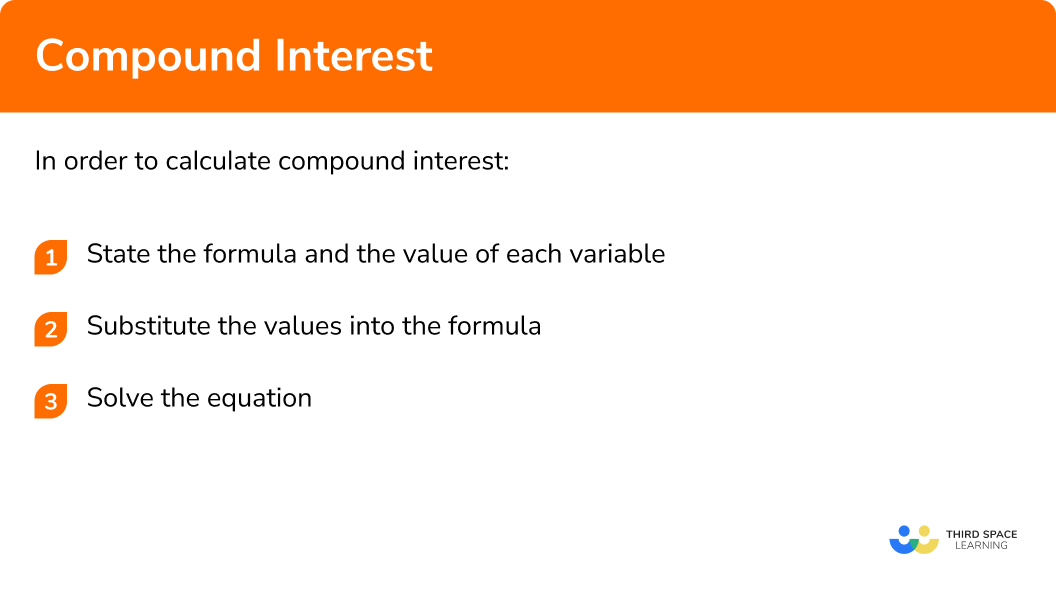

How to calculate compound interest

In order to calculate compound interest:

- State the formula and the value of each variable.

- Substitute the values into the formula.

- Solve the equation.

Explain how to calculate compound interest in 3 steps

Compound interest formula examples

Example 1: compound interest (percentage increase).

£8500 is invested for 5 years at 0.3% per year compound interest. What is the value of the investment after this time?

State the formula and the value of each variable .

Here we use the formula

2 Substitute the values into the formula .

Substituting these values into the compound interest formula

3 Solve the equation .

Example 2: compound depreciation (percentage decrease)

A vacuum cleaner is bought for £399 and loses 22% of its value per year compound depreciation. What is the value of the vacuum cleaner after 2 years?

Substitute the values into the formula .

Solve the equation .

Example 3: compound interest (compounding periods)

A house is valued at £150 000. On average, the house price increases by 0.24% monthly compounding over 2.5 years. What is the future value of the house after this time?

This time the interest rate in monthly so we need to convert the time into months.

2.5 year is the same as 2.5\times 12 = 30 months.

Example 4: compound increase (writing an answer in standard form)

Bacteria reproduce at a rate of 3% per hour. If there are 1.2 x 10 7 bacteria in a petri dish at hour 0, how many bacteria are in the petri dish after 4 hours?

- P = 1.2 × 10 7

Example 5: compound interest (best buy)

Two offers exist for the same car.

A car has a value of £7999. Which offers a better value over the period of time stated?

Here we are calculating compound interest with the formula

twice as we are comparing each offer:

Substituting these values into the simple interest formula

Offer A \\A=7999(1+0.06)^{3}\\

Offer B \\A=7999(1+0.03)^{5}\\

Offer A \\A=7999\times{1.06}^{3}\\ \\A=\pounds{9526.94}\\

Offer B \\A=7999\times{1.03}^{5}\\ \\A=\pounds{9273.03}\\

The best offer is Offer B (remember to state your conclusion).

Common misconceptions

- Applying the incorrect formula to the question

This is a very common mistake where simple interest is calculated instead of using compound interest.

- Incorrect percentage change due to different time scales

Here is example 3 with this misconception:

A house is valued at £150,000. On average, the house price increases by 0.24% per month over a period of 2.5 years compound interest. What is the value of the house after this time?

Although the answer here looks reasonable, the 0.24% interest is per month not per year, which is what has been calculated.

- Using the incorrect value for the percentage change

Not dividing the percentage rate by 100 is a common error. For example when using compound interest to increase £100 by 2% for 5 years, this calculation is made:

This is clearly wrong. We need to instead divide 2 by 100 to give 0.02. This gives a sensible final answer of £101.41.

- Using a positive value for r when it should be negative

If a value is depreciating (going down), the value of r is negative whereas it is incorrectly used as a positive and so the answer will be larger than the original amount.

Practice compound interest formula questions

1. The amount of water in a pond changes throughout the year. For 6 months of the year, the water level increases by an average of 1\% . For the other 6 months of the year, the water level drops by 0.7\% . If the pond contains 400L at the beginning of the year, how much water is in the pond at the end of the first year?

The pond starts with 400L of water. We are dealing with two 6 month time periods with a different multiplier for each one.

The amount of water is given by 400\times(1+0.01)^{6}\times(1-0.007)^{6} .

2. A bar of soap decreases in weight every time it is used by 3\% compound interest. If the bar of soap weighs 50g at the start of the week, and it is used 45 times, how much does it now weigh?

Using the compound interest formula results in the following calculation: 50\times(1-0.03)^{45}=12.7 \quad (3sf) .

3. The Amazon rainforest covers an area of 5.5 million km ^2 in 2021 . If the rate of deforestation is 0.2\% , what is the expected area of the rainforest in 2030 ?

Using the compound interest formula results in the following calculation, with the answer rounded to the nearest integer: 5500000\times(1-0.002)^{9}=5401788 .

4. Account A has an annual percentage yield of 2.5\% compound interest. Account B has an interest rate of 0.2\% per month compound interest. If the initial investment is £3000 , how much more money has Account B accumulated than Account A in interest after 40 months?

After 40 months Account A has accumulated £230.67 in interest as 3 years interest has been accrued.

After 40 months Account B has accumulated £249.60 in interest as 40 months interest has been accrued.

The difference is £18.93 .

5. A bucket is leaking water at a rate of 17\% per hour, compound depreciation. How many hours would it take for the bucket to be under half full?

After 1 hour the bucket is 83\% full.

After 2 hours the bucket is 68.89\% full.

After 3 hours the bucket is 57.18\% full.

After 4 hours the bucket is 47.46\% full.

6. A battery loses its charge at a rate of 5\% every 2 hours, compound depreciation. If a battery starts fully charged, what percentage charge is left after 8 hours? Write your answer to 2 decimal places.

We could use the compound interest formula, or look at how the battery changes over time.

After 2 hours the battery is 95\% full.

After 4 hours the battery is 90.25\% full.

After 6 hours the battery is 85.74\% full.

After 8 hours the battery is 81.45\% full.

Compound interest formula GCSE questions

1. (a) An initial deposit of £1400 is invested for 3 years. The interest payments occur annually at 6\% compound interest. Work out the amount of interest earned after this time.

(b) After the first 3 years, the interest rate falls to 2\% . How much would the investment be worth after a further 4 years?

1400 × (1.06)^{3}

£1667.42-1400 = £267.42

1667.42 × (1.02)^{4}

2. (a) A car is bought for £15 000 . The car loses 10\% of its value every year, compound interest. Which calculation works out the total value after 5 years? Circle your answer.

- 15000 − 10 × 5

- (15000 10) × 5

- 1.1^{5} × 15000

15000 × 0.9^{5}

(b) The car is paid for using a credit card. Every month, £1500 of the bill is paid off, but 0.2\% of the remaining bill is added after. Calculate the balance on the credit card after 3 months.

13500 × 1.002 = £13527 (month 1)

12027 × 1.002 = £12051.05 (month 2)

10551.05 × 1.002 = £10572.16 (month 3)

3. (a) Kieran invests in multiple financial institutions using the stock market. After the first 3 years, he has made an average of 3\% interest per year, compound interest. For the next two years, his stock prices fall by a compound interest rate of 4\% each year. If the original investment was worth £13,000 , calculate the future value of the investment after 5 years.

(b) Harry invested in the same stock, with his investment after 5 years having the present value of £7500 . What was his original investment worth?

13000 × (1.03)^{3}

14205.45 × (0.96)^{2}

7500 / (0.96)^{2}

8138.02 / (1.03)^{3}

Learning checklist

You have now learned how to:

- Solve problems involving percentage change, including: percentage increase, decrease and original value problems and simple interest in financial mathematics

- Set up, solve and interpret the answers in growth and decay problems, including compound interest (and work with general iterative processes)

The next lessons are

- Types of numbers

- Standard form

Still stuck?

Prepare your KS4 students for maths GCSEs success with Third Space Learning. Weekly online one to one GCSE maths revision lessons delivered by expert maths tutors.

Find out more about our GCSE maths tuition programme.

Privacy Overview

Compound Interest Word Problems Practice Test

About compound interest word problems:.

In this lesson, we will learn how to solve a compound interest formula word problem. The compound interest formula is given as: A = P(1 + r/n) (tn) , where A is the future value, P is the present value or principal amount, r is the rate as a decimal, n is the number of compounding periods in a year, and t is the number of years.

- Demonstrate an understanding of how to solve a word problem

- Demonstrate the ability to solve a compound interest word problem

Instructions: Solve each word problem. Round your answer to the nearest hundredth.

a) Larry invested $27,000 in a savings account that pays an annual interest rate of 1.8%. The savings account is set to compound quarterly (4 times per year). How much is in Larry’s account after 5 years?

Watch the Step by Step Video Solution | View the Written Solution

a) Becky invested $19,800 in a CD that pays an annual interest rate of 5.3%. The CD is set to compound daily (365 times per year). How much is in Becky’s account after 9 years? Note: Ignore the extra day from leap years.

a) Jake invests in an annuity with an annual fixed interest rate of 6.2%. The annuity compounds monthly (12 times per year). If after 10 years, the account balance is $27,839.45 how much was the beginning investment?

a) Jennifer is saving up for a house and wants a 20% down payment. She will invest a lump sum into a savings account for 5 years that pays 4.3% annual interest and compounds monthly (12 times per year). After some calculations, she figures her ideal house will cost $140,000. How much should she put in the savings account?

a) Melissa visits two competing banks. National Bank and Trust is offering a 5-year CD with an annual interest rate of 3.75%. This account will compound monthly (12 times per year). Jones Town Bank is offering a 5-year CD with an annual interest rate of 3%. This account will also compound monthly (12 times per year). The Jones Town Bank is offering a $300 bonus to all new customers. This bonus money will be deposited in Melissa’s account on the first day of her account being opened. Assuming Melissa has $10,000 to invest, which bank should she choose? If her investment amount changed to $5000, how would this impact her decision?

a) $29,536.74

Watch the Step by Step Video Solution

a) $31,901.32

a) $22,591.84

a) Investment of $10,000 - National Bank and Trust, Investment of $5000 - Jones Town Bank

Compound Interest Worksheet and Answer Key

Compound Interest Calc Compound Interest Lesson

Students will practice solving for Amount, Principal and interest rate in the compound interest formula .

Note: this is the easier worksheet and does not require the use of logarithms . Try our harder compound interest worksheet for that .

Example Questions

Other Details

This is a part worksheet:

- Part I Model Problems

- Part II Practice

- Part II Answer Key

- Compound Interest Formula

- Compound Interest Calculator (Solves for any variable, types as you go)

- Continuously Compounded Interest

- Continuously Compounded Interest Calculator

- Exponential Growth

Ultimate Math Solver (Free) Free Algebra Solver ... type anything in there!

Popular pages @ mathwarehouse.com.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

6.2.1: Compound Interest (Exercises)

- Last updated

- Save as PDF

- Page ID 37883

- Rupinder Sekhon and Roberta Bloom

- De Anza College

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

SECTION 6.2 PROBLEM SET: COMPOUND INTEREST

Do the following compound interest problems involving a lump-sum amount.

Do the following compound interest problems.

Compound Interest Questions

Compound interest questions are provided here to help the students understand the applications of compound interest in our daily existence. As we know, compound interest is one of the important mathematical concepts that can be applied in many financial transactions.

Below are some situations where we can use the formula of CI to calculate the required results.

- Increase or decrease in population

- The growth of a bacteria (when the rate of growth is known)

- The value of an item, if its price increases or decreases in the intermediate years

What is Compound Interest?

Interest is the additional money paid by organisations like banks or post offices on money deposited (kept) with them. Interest is also paid by people when they borrow money. When the interest is calculated on the previous year’s amount, the interest is called compounded or Compound Interest (C.I.).

The formula for finding the amount on compound interest is given by:

A = P[1 +(R/100)] n

This is the amount when interest is compounded annually.

Compound interest (CI) = A – P

Read more: Compound interest

Compound Interest Questions and Answers

1. Find the compound interest (CI) on Rs. 12,600 for 2 years at 10% per annum compounded annually.

Principal (P) = Rs. 12,600

Rate (R) = 10

Number of years (n) = 2

= 12600[1 + (10/100)] 2

= 12600[1 + (1/10)] 2

= 12600 [(10 + 1)/10] 2

= 12600 × (11/10) × (11/10)

= 126 × 121

Total amount, A = Rs. 15,246

= Rs. 15,246 – Rs. 12,600

2. At what rate of compound interest per annum, a sum of Rs. 1200 becomes Rs. 1348.32 in 2 years?

Let R% be the rate of interest per annum.

Principal (P) = Rs. 1200

Total amount after 2 years (A) = Rs. 1348.32

We know that,

A = P[1 + (R/100)] n

Rs. 1348.32 = Rs. 1200[1 + (R/100)] 2

1348.32/1200 = [1 + (R/100)] 2

1 + (R/100) = 53/50

R/100 = (53/50) – 1

R/100 = (53 – 50)/50

Hence, the rate of interest is 6%.

3. A TV was bought for Rs. 21,000. The value of the TV was depreciated by 5% per annum. Find the value of the TV after 3 years. (Depreciation means the reduction of value due to use and age of the item)

Principal (P) = Rs. 21,000

Rate of depreciation (R) = 5%

Using the formula of CI for depreciation,

A = P[1 – (R/100)] n

A = Rs. 21,000[1 (5/100)] 3

= Rs. 21,000[1 – (1/20)] 3

= Rs. 21,000[(20 – 1)/20] 3

= Rs. 21,000 × (19/20) × (19/20) × (19/20)

= Rs. 18,004.875

Therefore, the value of the TV after 3 years = Rs. 18,004.875.

4. Find the compound interest on Rs 48,000 for one year at 8% per annum when compounded half-yearly.

Principal (P) = Rs 48,000

Rate (R) = 8% p.a.

Time (n) = 1 year

Also, the interest is compounded half-yearly.

So, A = P[1 + (R/200)] 2n

= Rs. 48000[1 + (8/200)] 2(1)

= Rs. 48000[1 + (1/25)] 2

= Rs. 48000[(25 + 1)/25] 2

= Rs. 48,000 × (26/25) × (26/25)

= Rs. 76.8 × 26 × 26

= Rs 51,916.80

Therefore, the compound interest = A – P

= Rs (519,16.80 – 48,000)

= Rs 3,916.80

5. Find the compound interest on Rs. 8000 at 15% per annum for 2 years 4 months, compounded annually.

Principal (P) = Rs. 8000

Rate of interest (R) = 15% p.a

Time (n) = 2 years 4 months

4 months = 4/12 years = 1/3 years

= Rs. 8000 × (23/20) × (23/20) × (21/20)

= Rs. 11,109

Therefore, the compound interest = A – P = Rs. 11,109 – Rs. 8000 = Rs. 3109

6. If principal = Rs 1,00,000. rate of interest = 10% compounded half-yearly. Find

(i) Interest for 6 months.

(ii) Amount after 6 months.

(iii) Interest for the next 6 months.

(iv) Amount after one year.

P = Rs 1,00,000

(i) A = P[1 + (R/200)] 2n

Here, 2n is the number of half years.

Let us find the interest compounded half-yearly for 6 months, i.e., one half year.

So, A = Rs. 1,00,000 [1 + (10/200)] 1

= Rs. 1,00,000 × 21/20

= Rs. 1,05,000

Compounded interest for 6 months = Rs. 1,05,000 – Rs. 1,00,000 = Rs. 5000

(ii) Amount after 6 months = Rs. 1,05,000

(iii) To find the interest for the next 6 months, we should consider the principal amount as Rs. 1,05,000.

Thus, A = Rs. 1,05,000 [1 + (10/200)] 1

= Rs. 1,05,000 × (21/20)

= Rs. 1,10,250

Compound interest for next 6 months = Rs. 1,10,250 – Rs. 1,05,000 = Rs. 5250

(iv) Amount after one year = Rs. 1,10,250

7. The population of a place increased to 54,000 in 2003 at a rate of 5% per annum.

(i) Find the population in 2001.

(ii) What would be its population in 2005?

(i) Let P be the population in the year 2001.

Thus, population in the year 2003 = A = 54000 (given)

Also, n = 2

54000 = P[1 + (5/100)] 2

54000 = P[1 + (1/20)] 2

54000 = P × [(20 + 1)/20] 2

54000 = P × (21/20) × (21/20)

P = 54000 × (20/21) × (20/21)

P = 48979.6

The population in 2001 = 48980 (approx.)

(ii) Given that the population in the year 2003 = P = 54000

= 54000[1 + (5/100)] 2

= 54000[1 + (1/20)] 2

= 54000 × [(20 + 1)/20] 2

= 54000 × (21/20) × (21/20)

Therefore, the population in 2005 = 59535

8. What is the difference between the compound interests on Rs. 5000 for 1 ½ year at 4% per annum compounded yearly and half-yearly?

P = Rs. 5000

Time (n) = 1 ½ years

When the interest is compounded yearly,

= Rs. 5000 × (26/25) × (51/50)

CI = A – P = Rs. 5304 – Rs. 5000 = Rs. 304

When the interest is compounded half-yearly,

n = 1 ½ years = 3 half-years

A = P[1 + (R/200)] 2n

Here, 2n = 3

A = Rs. 5000 [1 + (4/200)] 3

= Rs. 5000 [1 + (1/50)] 3

= Rs. 5000 [(50 + 1)/50] 3

= Rs. 5000 × (51/50) × (51/50) × (51/50)

= Rs. 5306.04

CI = A – P = Rs. 5306.04 – Rs. 5000 = Rs. 306.04

Difference between compound interest = Rs. 306.04 – Rs. 304 = Rs. 2.04

9. The population of a town decreased every year due to migration, poverty and unemployment. The present population of the town is 6,31,680. Last year the migration was 4%, and the year before last, it was 6%. What was the population two years ago?

The present population of the town (A) = 631680

Last year migration rate was 4%, and the year before, the previous migration rate was 6%.

Let P be the population of a town, two years ago.

Thus, R 1 = 4%

According to the given situation, the total population is:

631680 = P × (24/25) × (47/50)

P = 631680 × (25/24) × (50/47)

Therefore, the population of the town, two years ago = 700000

10. Find the amount and the compound interest on Rs. 1,00,000 compounded quarterly for 9 months at the rate of 4% per annum.

P = Rs. 1,00,000

Time = 9 months

A = P[1 + (R/400)] 4n

Here, R/400 is the quarterly interest rate.

4n = 9 months = 3 quarters

So, A = Rs. 1,00,000 [1 + (4/400)] 3

= Rs. 1,00,000 [1 + (1/100)] 3

= Rs. 1,00,000 [(100 + 1)/100] 3

= Rs. 1,00,000 × (101/100) × (101/100) × (101/100)

= Rs. 103030.10

Practice Questions on Compound Interest

- The population of a city was 20,000 in the year 1997. It increased at the rate of 5% p.a. Find the population at the end of the year 2000.

- Find the compound interest on Rs. 16,000 at 20% per annum for 9 months, compounded quarterly.

- Vasudevan invested Rs. 60,000 at an interest rate of 12% per annum, compounded half-yearly. What amount would he get- (i) after 6 months? (ii) after 1 year?

- Kamala borrowed Rs. 26,400 from a bank to buy a scooter at a rate of 15% p.a., compounded yearly. What amount will she pay at the end of 2 years and 4 months to clear the loan?

- Find CI paid when a sum of Rs. 10,000 is invested for 1 year and 3 months at 8 1/2 % per annum, compounded annually.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Get expert advice delivered straight to your inbox.

5 Fun Ways to Teach Compound Interest

8 Min Read | Jan 11, 2023

Ah, compound interest. It’s one of the most important money lessons that students can learn while they’re young—but it’s also one of the trickiest topics to teach. And if we had to guess, your class list is a mixed bag of personalities and learning styles. What works for one student might not work for another! So let’s walk through a few different ways to break it all down.

What Is Compound Interest?

Before we jump in, let’s do a quick rundown of compound interest. When you put money into a savings account at a bank, it grows. This is because the bank pays you a fee so they can use your money to do business (with lots of rules and regulations to make sure you don’t lose your money). This extra growth is called interest!

After a period of time, with the principal (the original chunk of money you put in) and the interest that your money earned, you end up with a larger total amount than you started with. And if you leave the money alone, you’ll earn interest based on that new, larger total—that’s called compound interest. This process keeps rolling, and slowly over time your money really grows, without any work on your end. Compound interest is essentially free money!

But there’s a catch. Compound interest works in your favor when you’re saving or investing money, but it can also work against you. For example, if you were to borrow money by using a credit card or taking out a car loan (of course, we know you’d never do that!), you’re required to pay interest on that money. So you’ll end up paying much more than you originally borrowed! Not cool.

The Magic of Compound Interest

So, what’s the secret weapon that gives compound interest its power? Time! It won’t work if you quit early, so fight the urge to withdraw your savings or investments before they have time to grow. And if students can just learn to delay gratification and flex those patience muscles, they’ll find that their money will ultimately do the work for them.

Ways to Explain Compound Interest:

How can you help this lesson hit home for your class? Well, you know your students, and we know personal finance. So here are five possible ways we recommend explaining compound interest so it sticks with your students for life!

1. Tell a story.

People are hardwired to remember stories. They can make a big impact when it comes to teaching complicated topics.

In his book Good to Great , author Jim Collins uses a flywheel metaphor that illustrates compound interest in action. He says to picture a massive metal flywheel—a heavy disk mounted on an axle. To get the flywheel spinning, you give it your best push forward, but it doesn’t move much. You can barely even notice that it moved! It takes you three whole hours to get the flywheel to do just one complete turn. But as you keep pushing, you start building up a little momentum. You move it around a second rotation, and then a third.

You keep pushing in a consistent direction, and eventually—it’s going! It has picked up enough speed that its own weight continues hurling it forward, without you needing to push. Each turn of the flywheel compounds on the one before it and creates unstoppable momentum.

So, which push caused the flywheel to go so fast? The first? The fifth? Actually, it wasn’t one push but all of them together that got the flywheel moving. This is what happens when you invest consistently over time . The accumulation of your efforts will create momentum that you can hardly keep up with!

2. Do an activity.

Compound interest is all about delayed gratification and patience, as your students will see in this activity. Start by asking your students, “Would you rather start with a penny and double your money daily for 30 days or have $1 million?” They might be tempted to take the $1 million right off the bat, but challenge them to figure out which option will make them wealthier in the end. Have them pull out a pencil and paper and do the math!

Are you a teacher? Help your students win with money today!

Have each student start at 1 cent and double it 30 times. At first, things aren’t looking impressive. They’ve only just made it past $1 at Day 8. Even halfway through the month, they’re still only at $163! At Day 25, they might be wishing they had taken the $1 million, since they’re still just at $167,772 and the month is almost over. But if they keep going, this is when the magic starts to happen. (Remember, our secret weapon is time .)

Suddenly, the small progressions made throughout the month start to pay off. On Day 28, they’ve surpassed $1 million with a whopping $1,342,177. Keep going and watch your students be amazed at how much they end up with after 30 days! Their results will look something like this:

Day 1: $.01

Day 2: $.02

Day 3: $.04

Day 4: $.08

Day 5: $.16

Day 6: $.32

Day 7: $.64

Day 8: $1.28

Day 9: $2.56

Day 10: $5.12

Day 11: $10.24

Day 12: $20.48

Day 13: $40.96

Day 14: $81.92

Day 15: $163.84

Day 16: $327.68

Day 17: $655.36

Day 18: $1,310.72

Day 19: $2,621.44

Day 20: $5,242.88

Day 21: $10,485.76

Day 22: $20,971.52

Day 23: $41,943.04

Day 24: $83,886.08

Day 25: $167,772.16

Day 26: $335,544.32

Day 27: $671,088.64

Day 28: $1,342,177.28

Day 29: $2,684,354.56

Day 30: $5,368,709.12

Try using our compound interest calculator that will do the calculations for you.

3. Make it practical.

Sometimes it takes real-life application for a concept to click. Try comparing compound interest to a personal habit that your students will connect with (like reading 10 pages of a book a day or saving $50 a month) to show how small actions seem insignificant in the moment, but they really add up over time. They’re easy to do but also very easy not to do. Let’s use working out as an example.

We’ve all been there: It’s January 1 and you commit to getting fit in the new year. You start out super motivated, working out for an hour and a half every single day. It’s going great for two weeks until you realize you’re not seeing any results. You get discouraged, stop exercising altogether, and pretty soon are back where you started. You need a new plan!

With compound interest, slow and steady wins the race. So instead of sprinting out of the gate, imagine you start to exercise for just 30 minutes a day and eat healthier. At first, you don’t see any results (and you’re always sore!), but you decide not to give up. After a few weeks, you still don’t see much progress, but you suddenly have more energy. So you keep it up. As your clothes slowly start to fit better and you notice more muscle tone, you’re excited about the small changes you see.

This fuels your motivation. Your short workouts, newfound energy, internal motivation and healthier diet all add up ( slowly over time) until one day you look in the mirror and realize you’re stronger and healthier than ever. The key? You didn’t quit! It was only a little bit of effort every day, but consistency and time brought you amazing results. Much like compound interest, getting physically fit is a marathon, not a sprint.

4. Play a game.

One surefire way to guarantee student attention is to involve food! This marshmallow game can be played throughout the duration of your class period to illustrate compound interest. It’s easy, and all you need is a bag of mini marshmallows (you can also use M&M’s, Skittles or any other small candy). Here’s how to play:

Give each student one marshmallow. Throughout the class period, compound that marshmallow every 10 minutes by giving double the previous amount to everyone who hasn’t eaten theirs yet. For example, after 10 minutes, whoever hasn’t eaten their one marshmallow gets one more (if they already ate it, they don’t get another). In 10 more minutes, give two additional marshmallows to everyone who hasn’t eaten theirs yet (now they should have four).

In 10 more minutes, give them four more, then eight more, then 16 more, and so on. One marshmallow didn’t seem like much at first, but if they can resist the urge to eat them, they should have 32 marshmallows to devour at the end of one hour-long class period. (Just make sure you have enough marshmallows to give out!)

5. Work a real-life problem.

Avoid the question every student loves to ask: “When will I need this in the real world?” Have your students solve this everyday math problem to see compound interest in action.

Bobby made a one-time deposit of $500 in a savings account with a 10% interest rate. Using the formula FV=PV(1+ r/m) mt , figure out how much Bobby will have in his savings after 20 years if he leaves his money in the account and lets it grow. Have your students pull up the activity in Chapter 3, Lesson 6 to help them solve this problem! (Answer: He would have $3,363.74.)

See? Compound interest doesn’t have to be confusing! Our hope here at Ramsey Education is that these creative explanations and activities will help make this concept easier for you to teach and for your students to understand. If you’d like more resources on teaching topics like investing and building wealth, check out our Foundations in Personal Finance curriculum.

Life-Changing Personal Finance Curriculum

Teach your high school students the money skills they’ll use now and for the rest of their lives with Foundations in Personal Finance. And this month, Foundations will be available in Spanish for the first time ever!

Did you find this article helpful? Share it!

About the author

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

31 Teacher Appreciation Gifts That Won’t Break Your Budget

t’s hard to pick out a teacher appreciation gift for someone you only know through your kid. We get it. Check out these gifts ideas (all under $30) for some inspiration!

Compound Interest Calculator

Calculate compound interest step by step.

- Simple Interest

- Compound Interest

- Present Value

- Future Value

compound-interest-calculator

Related Symbolab blog posts

Please add a message.

Message received. Thanks for the feedback.

IMAGES

VIDEO

COMMENTS

Maths KS4: Compound Interest. Contains a whole lesson. 1. Lottery starter. 2. Activity 1: Simple and compound interest card sort. 3. Activity 2: Compound interest problem solving questions (check answers before lesson)

Practice Questions. Previous: Increasing/Decreasing by a Percentage Practice Questions. Next: Percentages of an Amount (Calculator) Practice Questions. The Corbettmaths Practice Questions on Compound Interest.

Do you want to learn how to solve compound interest problems using the formula A = P(1 + r/n)^(nt)? Watch this video from Khan Academy, a free online learning platform that offers courses in math, science, and more. You will see a step-by-step explanation of the concept and an example problem with solution.

Compound/Simple Interest. A series of lessons (2-3) on using the multiplier to calculate compound and simple interest. The lesson recaps using the multiplier to calculate percentage increase and decrease. It move onto using this for interest problems aswell are reverse problems. It has best buy style questions where pupils must choose which ...

As part of our Economics curriculum, The Teacher Lab has created this set of simple and compound interest mathematics problems. This set of word problems will complement the topics of banking and finance. What's included (24 questions altogether!) 10 Simple Interest Problems. 4 questions to calculate interest earned.

How much interest has accrued if calculated as compound interest? What is the new total balance? Interest: Total balance: Solution Compound Interest: Total Balance = P(1 + R) T P = principle = starting balance = $105 R = interest rate = 4% T = time = 11 years Total balance = principle × (1 + interest rate) time = 105 × (1 + (4 / 100)) 11 = $162

Find the total amount and total interest after one year if the interest is compounded half yearly. Principal ₹ = ₹. 4000. Rate of interest = 10 % per annum. Total amount = ₹. Total interest = ₹. Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more.

Next: Expressing as a Percentage Textbook Exercise GCSE Revision Cards. 5-a-day Workbooks

The formula for compound interest is A = P(1 + r n)nt A = P ( 1 + r n) n t, where A A represents the final balance after the interest has been calculated for the time, t t, in years, on a principal amount, P P, at an annual interest rate, r r. The number of times in the year that the interest is compounded is n n.

A step-by-step guide to solving compound interest problems. Compound interest is the interest paid on principal and interest that is combined at regular intervals. At regular intervals, the interest so far accumulated is added to the existing principal amount and then the interest is calculated for the new principal. The new principal is equal ...

The compounded interest doubles in about 14 years while the non compounded (simple) interest doubles in about 20 about years. Solution Compounded n times a year and after t years, the total amount is given by: A = P(1 + r/n) n t quarterly n = 4: Hence A = P(1 + r/4) 4 t = 3000(1 + 0.05/4) 4 × 5 = $3846.11

Here is everything you need to know about compound interest for GCSE maths (Edexcel, AQA and OCR). You'll learn how to calculate compound interest for increasing and decreasing values, and set-up, solve and interpret growth and decay problems. Look out for the compound interest worksheet and exam questions at the end.

In this lesson, we will learn how to solve a compound interest formula word problem. The compound interest formula is given as: A = P (1 + r/n) (tn), where A is the future value, P is the present value or principal amount, r is the rate as a decimal, n is the number of compounding periods in a year, and t is the number of years. Test Objectives.

Free worksheet(pdf) and answer key on Compound interest. 20 scaffolded questions that start relatively easy and end with some real challenges. Plus model problems explained step by step ... Students will practice solving for Amount, Principal and interest rate in the compound interest formula. ... Part I Model Problems; Part II Practice; Part ...

SECTION 6.2 PROBLEM SET: COMPOUND INTEREST. Do the following compound interest problems involving a lump-sum amount. 1) What will the final amount be in 4 years if $8,000 is invested at 9.2% compounded monthly.? 2) How much should be invested at 10.3% for it to amount to $10,000 in 6 years? 3) Lydia's aunt Rose left her $5,000.

The formula for finding the amount on compound interest is given by: A = P[1 +(R/100)] n. This is the amount when interest is compounded annually. Compound interest (CI) = A - P. Read more: Compound interest. Compound Interest Questions and Answers. 1. Find the compound interest (CI) on Rs. 12,600 for 2 years at 10% per annum compounded ...

5. Work a real-life problem. Avoid the question every student loves to ask: "When will I need this in the real world?" Have your students solve this everyday math problem to see compound interest in action. Bobby made a one-time deposit of $500 in a savings account with a 10% interest rate.

Cite this content, page or calculator as: Last updated: November 10, 2023. Compound interest calculator finds compound interest earned on an investment or paid on a loan. Use compound interest formula A=P (1 + r/n)^nt to find interest, principal, rate, time and total investment value. Continuous compounding A = Pe^rt.

Calculate compound interest step by step. Simple Interest. Compound Interest. Present Value. Future Value. What I want to Find. Compound Interest. Please pick an option first.